5 reasons why the California real estate market will weaken from August to December of 2010: California budget delay, inventory growth, and three other important factors.

The party is largely over for California real estate. Lost in the mix of all the economic news is the grim reality that we still don’t have a budget for the state. We are facing another five weeks delay and days closer to issuing IOUs yet again. Yet this information is still flying underneath the media radar. It is relegated to page nine if you can even find it. The Federal Reserve and government have taken the advice from banks in virtually every policy move; suspend mark to market, inject trillions of dollars into the banking sector, provide loan modification options, purchase mortgage backed securities, and more tax credits and all this combined merely served as a stop-gap for the real estate price adjustment. Why? Home prices in many areas are still too expensive because incomes are weak and employment (especially good paying jobs) are hard to come by. The major budget deficit we face (like many other states) is a reflection of a weak economy.

Not much has changed in 2010 at least for California real estate. In fact, from August to December of 2010 California real estate is going to face much tougher waters ahead. Let us list five important reasons why.

Reason #1 – California budget delayed yet again

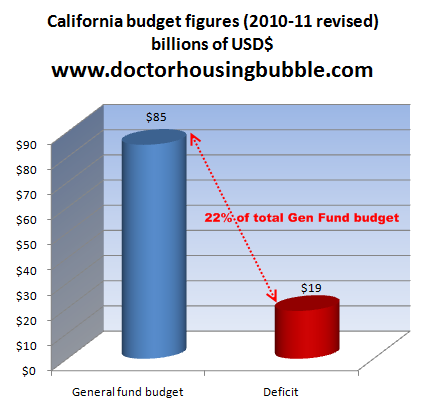

We currently face a $19 billion budget deficit which comes out to 22 percent of the current general fund budget. This is a massive amount of money. The buck stops in Sacramento and virtually no one has a clear direction of where we are heading. In fact with an election year our amazing representatives are planning their election campaigns for November instead of dealing with the pressing issue at hand. We can blame the tactics on an election year but the budget has been in the red for over three years now. This crisis did not come on as a shock.

Now why would the budget crisis be an issue on real estate? First, there are only a couple of ways to plug the gap. You either raise revenues through higher taxes or simply having a better economy and collecting more. Clearly the fact that we are in a massive hole tells us that revenues are not coming in. The temptation for elected officials will be to tax even more although California is already massively taxed. In L.A. County many are already paying close to 10 percent in sales taxes! Need we mention city officials making $800,000 for tiny working class areas like Bell?

The other option you have is to cut. And this is an option the Governor is taking:

“(Business Spectator) Schwarzenegger has proposed slashing spending to balance the state’s books, an approach rejected by Democratic lawmakers. Their leaders in the state Senate and Assembly are trying to draft a joint plan likely to include proposals for tax increases to rival the governor’s budget plan.

By ordering furloughs, which he also did last year, Schwarzenegger is bringing pressure on state employee unions allied with Democratic lawmakers on the heels of losing a courtroom battle to cut state employees’ pay to the federal minimum wage to bolster the state’s finances.

Schwarzenegger’s new furlough order was instantly condemned by labor officials as a political ploy.â€

I’m surprised that some of the better coverage on the California economy is coming from out of the country. Either way, you can see where the line is being drawn in the sand. Both of the above outcomes are not positive for California housing. More layoffs equates to less people able to afford homes. Higher taxes and people have less to spend on housing. The problem stems from the California economy relying on real estate for both jobs and spending and all this happened in a once in a lifetime bubble. That bubble has now burst yet the state budget structure is still relying on bubble revenue figures.

Reason #2 – Inventory growing

Source:Â MLS

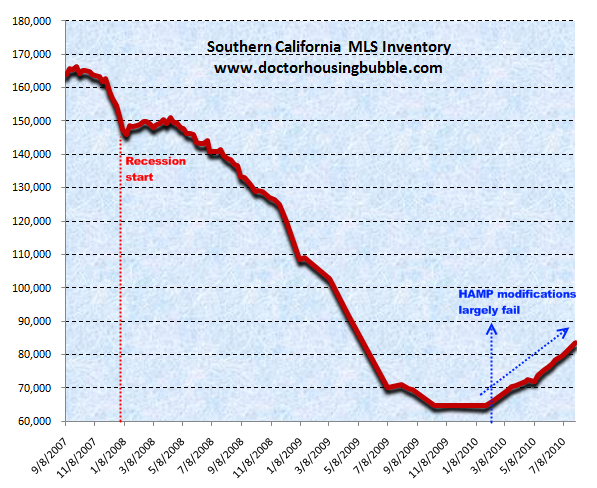

The amount of inventory in Southern California has been growing steadily. In fact, we can pinpoint the actual growth to roughly March when we started to realize that programs like HAMP were merely smoke and mirrors operations to make the numbers appear better than they actually were. Now we are seeing more and more distressed property hitting the market. Keep in mind that the above chart is based on MLS data and this heavily understates the actual shadow inventory of problematic real estate. Not much has changed the calculus of toxic mortgages:

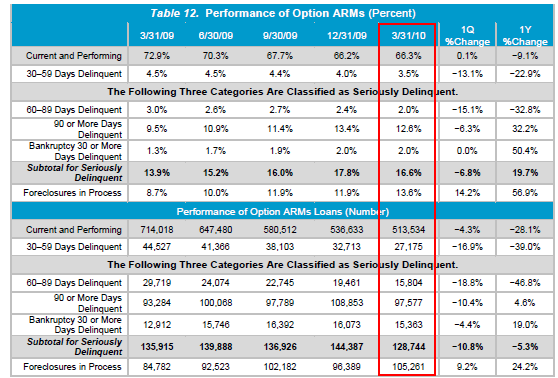

I’ve annotated the above chart to give a clearer view of where we are. Keep in mind that some banks have reworked option ARM loan products (50% of option ARMs are here in California) yet problems are still extremely high:

Now the above data is fascinating. California is home to half of these loans so it will be worth our time to look at this closely. From March of 2009 to March of 2010 we went from having 714,018 performing option ARMs in the U.S. to 513,000 option ARMs in March of this year. As of today, roughly 34 percent of all option ARMs are not even current. These are toxic waste products. Why the big drop? Many of these ended up as foreclosures but many got pushed into interest only loans that buy a few more months (maybe a year or two) but these will default as well.

So inventory keeps growing because of problems in the system. I’ve kept meticulous data on the MLS for Southern California for close to four years. Let us examine the shift in makeup over the last few years:

September 2007

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 166,514

Short sales + foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 9,711

Distressed inventory as percent of total MLS:Â Â Â Â 5.53%

September 2008

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 133,388

Short sales + foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 48,951

Distressed inventory as percent of total MLS:Â Â Â Â 36.44%

September 2009

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 69,936

Short sales + foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 19,702

Distressed inventory as percent of total MLS:Â Â Â Â 28.33%

August 2010

MLS listings:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 83,677

Short sales + foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 25,562

Distressed inventory as percent of total MLS:Â Â Â Â 30.54%

So if we look at the above, from September of 2009 to August of 2010 you can see that distressed MLS inventory has jumped. But overall inventory has also increased. The earlier chart shows a steady increase at a time when typically inventory is depleted because of the spring and summer selling season. With tax credits finished and big MBS purchasing programs over, where do we go from here?

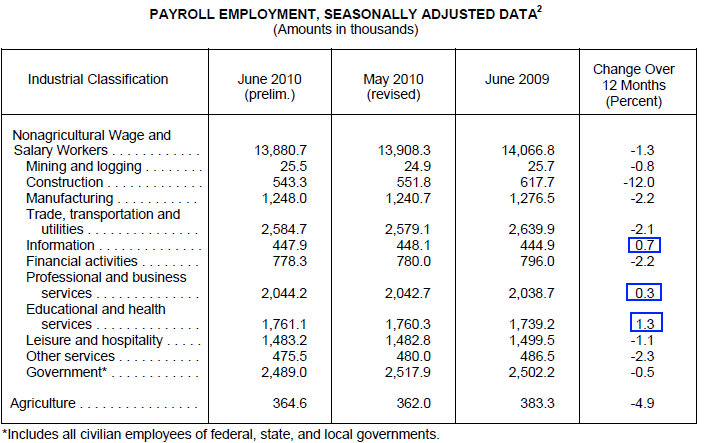

Reason #3 – California employment growth anemic

California unemployment still stands at 12.3 percent. What this means, is that the equivalent underemployment rate for the state is closer to 23 percent. If you look above, only three sectors actually experienced any jobs added over a 12 month period. How can overpriced areas in California maintain high prices without having a solid employment base? We know how we did it last time and it was through high leverage products like Alt-A and option ARMs. What do we have in our arsenal this time? Sure you can purchase a home with a 3.5% down payment via FHA insured loan products but you need to have verifiable income. And just because you can buy with government metrics, this doesn’t mean that it is a good reason to do so. The exponential growth in FHA insured loan defaults should explain why low down payments are not a good enough reason to purchase a home.

California employment growth is weak. And as we mentioned, the government is actually looking at slashing payrolls. The last decade had a massive amount of jobs that were built around the housing bubble and real estate consumption. Those are largely gone and won’t be coming back. What industry will step in? For these reasons betting on housing in California for the next few months is a losing bet.

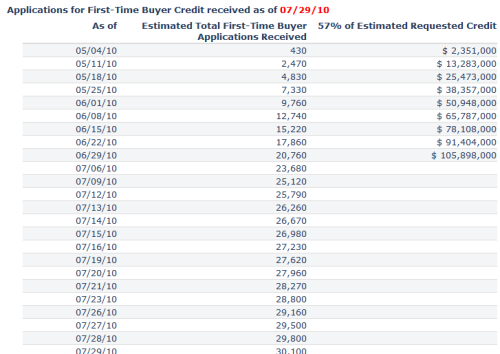

Reason #4 – Government incentives burning out

In the time honored tradition of pandering, the California government pushed an incentive for new and first time home buyers in California. As would be expected, the money was eaten up quickly. This is $200 million that the state clearly does not have to spend (did we mention the $19 billion budget gap). So now, the state has combined the Fed tax credit with the state tax credit and low money down payment FHA insured loans for the maximum effect. The only next step available is to give away homes to anyone that would want one. Clearly this momentum is burning out because there is no such thing as a free lunch (or home in this case).

There are only so many ways you can juice the market without having a healthy economy.  At least during the housing bubble, people could get jobs in virtually any industry because credit was flowing like beer at a frat party. Anyone and everyone could get whatever they wanted. It reminded me of the dot come craze and any company with a webpage and dot com after their name would get a few million dollars in seed money. Those days are over. People now have a better understanding of real estate simply because they have been forced to pay attention instead of believing the “real estate always goes up†mantra.

Reason #5 – California buyer psychology

The fact that people have to pay full price on a mortgage is stunning to many. Those teaser rates created a big class of people that believed in the 5 or 7 and move up crowd. You know what I’m talking about here; these people believed that you buy a starter home, stay put for 5 to 7 years, let the magical David Blaine like effects of real estate appreciation work, and then you can sell and move into your McMansion. It was a clear path (at least it seemed that way). So five year option ARMs weren’t such a bad idea in their mind. Who cares that the loan exploded on the first day of year five because some other schmuck would be in the home with a new loan. The home buyer won. The mortgage broker and agent made out like bandits with giant commissions. The state made out like a champ by taxing those commissions. It seemed to be the perfect shell game. Those days are over and now the only game in town is the 30 year fixed mortgage (or the 15 year fixed but that is rare in California).

Given current prices in niche markets like the Westside, many people are simply vying to rent. Or the more realistic reason, they simply don’t qualify for a $600,000 loan on a tiny place in a prime location. There is no guarantee prices will go up. We did a comparative analysis between Japan and the U.S. and Japan had [has] weak prices for over two decades. Don’t take my word for it; listen to the Fed chief of St. Louis:

“(Barron’s) IN WHAT MAY BE PREPARATORY STEP for a major shift in the U.S. monetary policy, St. Louis Federal Reserve Bank President James Bullard warned the U.S. is closer to succumbing to a Japanese-style deflation than any recent time, which he urged be countered with “quantitative easing.”

Quantitative easing, or QE, is economists’ jargon to describe the Fed’s massive purchases of $1.7 trillion in Treasury, agency and mortgage-backed securities, a program that started in March 2009 and ended a year later. The purchases were part of the doubling of the size of the central bank’s balance sheet as the key component of the Fed’s efforts to prevent the meltdown of the financial system in late 2008 and early 2009.â€

In other words, there is little reason to believe home prices in California will go up. With so much uncertainty with interest rates, jobs, and the budget why would people buy when we are entering the typically weak fall and winter seasons? Yet I’m sure there are many itching to dump their money into the real estate game; after all, this is California and the gold rush mentality will always be here even after the money is gone.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “5 reasons why the California real estate market will weaken from August to December of 2010: California budget delay, inventory growth, and three other important factors.”

Another wonderful article from Dr. We have stopped looking for months. I noticed there are a lot more houses on MLS in 500 to 700K range than there are in 300 to 500K. Sellers are still unrealistic. I don’t know if that will change any time soon. I think we have to wait until 2012 and see.

“Our problem basically is that we have a very distorted economy,†Greenspan

said today . Any recovery has mostly been limited to large banks, large businesses and “high-income individuals who have just had $800 billion added to their 401(k)s, and are spending it and are carrying what consumption there is.†“The rest of the economy, small business, small banks, and a very significant amount of the labor force, which is in tragic unemployment, long term unemployment — that is pulling the economy apart,†Greenspan said.

ASKED IF ANOTHER ECONOMIC CONTRACTION, A SO CALLED DOUBLE DID, WAS POSSIBLE, GREENSPAN SAID, “IT IS POSSIBLE IF HOME PRICES GO DOWN. Home prices, as best we can judge, have really flattened out in the last year.â€

Slowing economic growth, and a decline in housing activity following the

expiration of a government tax credit, have raised fears that the economy could

return to a recession before completing its recovery from the worst downturn

since the 1930s.

“If home prices stay stable, then I think we will skirt the worst of the housing

problem,†Greenspan said. “But right under this current price level, mainly 5, 7

or 8 percent below, is a very large block of mortgages, which are under water,

so to speak, or could be under water. And that would induce a major increase in

foreclosures, foreclosures would feed on the weakness in prices, and it would

create a problem.†Ben S. Bernanke, told Congress last month that the economic outlook is “unusually uncertain.â€

http://noir.bloomberg.com/apps/news?pid=20601068&sid=aUb4ukA88agU

There has to be an external event to jolt us out of this. Either we raise import taxes or stop offshoring or some natural/manmade disaster tilts the balance back in our favour. Until then, w ehave a long hard slog ahead of us.

Unlike Japan , China and India have 2 billion people combined-so while they use us as an export market, they can and are developing their own internal markets. When that happens, I doubt they will be for free trade-if it does not benefit them.

I agree prices won’t go up, but sometimes I’m starting to think that prices aren’t going to come down either. Seems like we are at a standstill… many people like me are still on the sidelines waiting for more squatter inventory from banks and equity sellers to lower their asking prices 10-15%. Hope prices go down, but I just don’t know… I’m very confused.

Here on east coast, sales tax last year, giant property tax this year. Just like the last depression: economy fails, raise taxes, economy fails worse. This will take billions out of the economy cuz it’s happening everywhere. There will be protectionism, bond failures, bank failures, auction failures. Hang on folks, this barrel is going over the falls. Doing the same think and expecting a different outcome is what?

Our RHINO governor could have vetoed every single budget during the boom years. He lied to everyone that voted for him when he said he would cut the credit cards. He fell into the easy spend like crazy mantra, budgets with double digit increases year over year and now he wants to fight with the Democrats.

I’ve been reading the good Dr. now for the last 6 months or so. I’ve also been one of those investors the Dr. discusses. The specific type, I mean the 5-7 year purchase and move up. I made a ton of cash for 20 years. Guys like the good Dr. were not around during that time, and everyone, I MEAN EVERYONE, I spoke to during those years all said the same thing; Buy and Sell Real Estate. I didn’t consider myself a speculator, nor did I bend anyone’s arm to buy anything. I never sold anyone a loan. I simply bought, lived and sold every, actually, 4-5 years. This formula worked for every single person I knew. In the year 2000, I had moved up to an $850,000 purchase with a wopping $450,000 down payment. It was a full doc loan and I qualified easily. In 2005, I sold that same property for $1,620,000.00. That was what the market was doing at the time. It was at this stage that I purchased 2 properties with the proceeds. Since that time, both properties have tanked so bad that one recently short sold for $300,000.00, after I paid $665,000.00 in 2005 (the bank accepted a 50% loss). It took 14 months to close that deal. The other property has lost $200,000.00 in value since 2005 also, but still have it. Bottom line, many people I know, including myself were in this game for years and have all lost almost everything. For all you readers that think you had a crystal ball, from say, 1996-2006. I would encourage you to tell us what that mighty ball of yours is saying now? Not everyone involved is, or was, sub-prime. Not all of us are dumb-a**”s that took out more than we could handle or had 3% or no down-payments. A lot of us were caught in bad-market timing. Want to know where? Bet you never would have guessed Orange County, CA. The market is a lot more mysterious and down-right ugly than anything I have seen, or my investor parents have seen in 60+ years. Don’t think there is a “shadow enventory”? The short sale guy from my bank, called an “Asset Manager”, told me 2 months ago, they are processing 1000’s of short sales a month and the number is climbing every week since 2009. His words was it’s a snow ball gaining momentum. How much have I lost? Since 2005, I have lost so far, $900,000.00 in asset value and cash. My investor brother has lost $3.5 millon so far, since 05, and two other investors we know have lost a combined $10 millon combined. I can tell you more. Properties are changing hands without every being on the MLS or in the shadow inventory estimates. How do I know? That is how we are doing it these days, I know of only one guy making a fortune in real estate these days, he is a large contractor that was hired to rehab 200 FHA houses a month. Figure that one out in your statistics. What my consenses is, what you see in the MLS is either garbage or way over priced. The MLS is useless because that is not where the deals are these days.

You are wrong. I was telling my friends in CA about housing prices dropping in the early 2000’s. It doesn’t take a crystal ball. It takes knowledge of basic economic concepts and a rudimentary knowledge of the history of real estate prices in CA. You say your parents have invested for 60+ years in CA? If that’s true then why haven’t they figured out that CA real estate has historically experienced drastic swings in market value? They can’t be that intelligent if they’ve been investing for that long and did not understand housing was at one of the high points price wise in the early 2000’s.

You’re just making excuses for your $$ loss by saying it was market timing and no one could have known.

The only unusual thing is how high prices continued to climb in the mid 2000’s until the crash, and that should have just been a further warning to you.

The govt has thrown $trillions at the economy and all it’s done is to cause a flattening of the housing market. This intervention cant go on forever and as the punch bowl is being pulled away, the economy is once again on a weakening trajectory. Housing will start to head south from this slump.

Great write up Doctor. It’s funny that I haven’t heard a peep regarding the CA state deficit. I would imagine that the 19 B number grows everyday if nothing has changed. I think that idiot Schwarenegger just doesn’t want to deal with it and will leave the steaming pile of shit for the next governor to clean up. Either way, CA will probably be the last state to recover. There are just too many problems here…too many to even list.

~

I think what was said about a housing price stalemate could be correct. Some desirable areas just didn’t get affected much at all. What will it take to get another 15 to 20% drop? And if prices do not drop from here, I think you will forever see a change in demographics. Young, college educated people who grew up in CA will be leaving this state in great numbers. It’s just too hard to get ahead here and for many it’s almost impossible to keep your head above water. What will this do to businesses and state revenue…it can’t be good.

@soCal-n

Thanks for the brutal honesty and I’m truly sorry. I think I’ve been reading here about 4 years and you are right–nobody knows when the bottom falls out, but we know it’s coming now and we’re scared as hell, although some are just waiting for a smooth drop so they can jump in. I’m sure they don’t care if you move to first class if the plane is going down…

Here in sleepy Susanville I saw a foreclosure go for $135k. Needs a roof bad, has single pane windows, minor plumbling/electrical issues, the boiler was stolen. Upside is valley/mountain view, decent structure, trees, turn through driveway, downstairs apartment, 2000sq/ft, 2 & 1/2 baths. This is far less than the $300000 it would have cost just a few years ago. $40000 would make this place dance.

Re: unrealistic sellers. I don’t know if its that as much as they are on the hook for 500-700K and HAVE to sell their home at that rate to break even. Most of these people are going to stay put if they can’t sell, and will only cave in due to lack of employment, or a rising tax base. “Realistic” is like having your own reality, its the state of mind at the moment, with the facts at hand. I doubt wether these sellers are looking to gouge anyone but are simply reflecting the facts. They owe more than the house is worth, so they have to sell it as that, they don’t have the cash to settle the loan out after the sale.

The other alternatives are either walk from the note, or declare bankruptcy, neither which will benefit a buyer. Sad state of affairs!

Socal native, I read your post and agree with the comments regarding everybody was making money moving up properties every 5 years. My old boss was the posterchild of this. He started off in the early 1980s by buying a condo in Irvine…I think he said he put 15K down at the time. After a few years of price appreciation, he sold and moved up to a SFR (he didn’t make that much money on the second house), then he moved up again and made several hundred thousand. Finally he bought a really nice place in an exclusive gated south OC community in 2000 and he still lives there today. His current residense is probably worth double what he paid for it. Other than his initial 15K downpayment…he made his money by selling every few years and rolling over equity and getting insane price appreciation. I doubt we will ever see this again…some people truly won the lottery here in CA. Unfortunately none of today’s buyers will ever have this type of opportunity!

I am a realtor, Back in 1988-2004 prices dropped in CA. I remember people would say that prices would never go up again as they were too high before 1988. In 1996 prices of homes started to climb non stop until 2006. Yes, the prices are down at this time because of the economy but History always repeats itself. Once the economy gets better and the invontory drops the prices will go up again. If I had to invest on anything, I will always invest on Real Estate as long as it makes sense. You want to buy when it is low and sell when is high. This is the time to buy! prices will not be this low again.

CA. is screwed any way you look at it. People will definitely leave for a lower cost of living elsewhere.

@ Socal native –

Thanks for sharing your story. It’s fascinating to see the boom/bust from the eyes of someone who was “doing all the right things,” yet forgot that it that what “investing” had become was a “game,” as you write.

I love the way everybody on this blog blames the governor for these problems! I’m no fan of Arnold, but he had nothing to do with the bubble, he had nothing to do with the huge influx of illegals in sanctuary cities, and he had nothing to do with the huge entitlements that CA. shells out.

The comments here reflect out of touch liberals looking to blame the other party for their own misguided policies.

We’ve given up looking, too. When we were looking several months ago the realtor said it was rare for them to have buyers like us with cash. We were discouraged by the lack of quality you could get in the $400-500k range —in a small town with very high unemployment. After looking for a few months we decided we were perfectly happy staying where we are and saving our money for another couple years.

Sometimes I think all the paper appreciation over the last two (maybe 3) decades will be erased. SoCal-Native and wheresthebeef’s stories are common and telling.

–

People used to buy houses and eventually “moved up” because their earnings made that possible. Houses were bought with the intention of paying for them.

–

There’s currently a generation of people (especially in CA) who owe their entire lifestyles to the appreciation of thier homes. This has been going on for 20-30 years.

–

The next generation could very well see a reversion back to idea of building equity by making payments. And according to some on this blog, the move backward might come a lot faster than the move up. Scary…

Robin Thomas, we all realize that Arnold is not the only one to blame. I am a huge Republican and think he has done a lousy job. When he first came to office, he said he would clean up Sacramento…he failed in a big way and has basically thrown in the towel and admitted defeat. Look at Gov. Christy in New Jersey, that is the type of person needed to clean house. Someone who will make all the unpopular decisions that are desperately needed. Here in CA, we need to take a massive dose of medicine to fix the problems. No matter how bad it tastes, we need the whole bottle rammed down our throat. The politicians only have the cajones to feed us one teaspoon at a time.

So is there any positive news for California? Jesus Christ!

There doesn’t appear to be any more juice left to feed the RE industry. Politicians in Washington and Sacramento don’t realize just how tapped out the US taxpayer is. But once the elections are done and public officials have their cushy jobs secured once more, they’re probably not going to spend more to feed housing industry since there’s no risk that people will vote them out for 4 years, and PACs and lobbyists don’t have the same piles of cash they had even one year ago. Interestingly, illegal immigration seems to be getting more coverage as the top political issue than general economic well-being.

Can banks can keep holding on to these homes and controlling California SF home prices? I question this because not all banks are the same size nor do they have identical business interests. Some will eventually step out of line and try to flog as many REOs as they can, especially when prices start to sink in a choppy manner over the next 6 months. The ramification of selling off REOs might be lower for banks with fewer units and when being the first bank to do so may mean losing less money?

But I do agree that the charts you display are goddamned scary and it’s unfortunate that the media has neglected to report the truth of a potential second crash in values.

Robin, this is not Texas. Not everybody blames the Governor. He tried with his propositions a while back, but then people voted them down. To get a budget, it takes the Democrats and the Republicans to come up with an agreement. The “Terminator” tries to intimidate the members of the Legislature, but in the end, there is only so much that he can do. Former Governor Davis had the same problems with the Legislature. As Kinky Friedman(former candidate for TX Governor) said, “How can you look at the Texas(also CA) legislature and still believe in intelligent design? “

“He tried with his propositions a while back, but then people voted them down.”

~

Bingo. State workers make up more than 50% of the working public in this state and were just able to go to the polls and vote everything down. It doesn’t matter who’s governor.

What strikes me is that so many people fell for the Regean-populist-feel-good-to-be-American bullshit and like all of our systemic problems suddenly vanished because RR said so. This helped fuel this attitude the US can do no wrong and that stocks and housing can go up indefinately. Just proves how bad we as a nation are at math, and how good we are at Peter Pan make believe and it’s so.

As Einstein said, “No problem can be solved from the same level of consciousness that created it.”

I’m sure Bernanke and Greenspan are much more intelligent than I am, so how could they be so stupid to think all the problems that cause a Kondradief Winter can be solved with printing more money. Since they are not stupid, they must be complicit. Or please help me with a third alternative.

@ Native, while I’m truly sorry, I got out of high school in the 74 recession followed by the famous double-dip 76 recession. then the 79 gas crunch, the 82 recession that was very bad. I studied the depression and was all too familiar with real estate bubbles. So the information was there–just everyone always thinks this time it’s different. Another Einstein fits perfectly here:

“Few people are capable of expressing with equanimity opinions which differ from the prejudices of their social environment. Most people are even incapable of forming such opinions.”

I’ll listen to even average scientists and engineers before I’ll listen to ‘brilliant’ economists, TV pundits, or Realtors…there’s really nothing new under the sun.

…

You’re exactly right. The information was there and people ignored it. Everyone always thinks it’s different this time.

@Dark Ages; There are still many people I know scared as hell too. I’m one of those that was scared sh@tless about 18 months ago and finally landed where I am today. My issue is not with what has happened, per se, I believe a lot of this was engineered post the dot com bubble burst to keep money flowing. My issue is with those that think they knew what was happening, when it was happening. That’s armchair quarterbacking thinking they have some super power to see the future. Investing is a risk regardless if it is real estate, stock market, anywhere you place your money. But when the sky falls I love it when people say “I knew it”.

@Dfresh; It is a whole lot easier for me to take the comment of yours “a game” (on the chin) than it is to lose nearly a million. The term “game” is a word used commonely used by all sorts of industries to suggest you’re either in it or not. We can all paint this as some sort of shell game or ponzi scheme that many were doing, but that’s just not true. Real estate is still a legitimate investment, as well as anything else. In reality, however, when the bottom falls out, we all somehow blame those involved as some type of player. I can assure you that my tiny loss is considered bottom feeder level compared to multiple millions lost by legitimate businesses in US Real Estate. It is not a game (a game as you suggest) anyway. Many of us were not buying soccer Mom SUV’s every year and everything that goes along with that. We are, and still, hard working Americans providing for our families so our wives can work hard taking care of children and handle the nasty business of taking care of home responsibilities. The stigma that everyone was gaming and fleecing home buyers is what makes headlines, but not reality by a long shot. Investing hard earned money has forever changed in the minds and hearts of folks in my circle. What I know to be true is that those in their 40’s and upward, who were moving money around to keep some of this moving, has stopped. This is valid at least in my investor circle. What this will do, long term, and I suspect has perpetuated more of this, is that we are not moving money and that will prevent any reasonable increase in prices for homes in CA.

@Karen; the house that I eventually short sold (for a 50% discount) was purchased by Chinese immigrants with a suitcase full of cash. We had a line a mile long of foreign immigrants, ALL WITH CASH. There is an enormous network of these folks scooping up deals.

“Properties are changing hands without every being on the MLS or in the shadow inventory estimates. How do I know? That is how we are doing it these days… What my consenses is, what you see in the MLS is either garbage or way over priced. The MLS is useless because that is not where the deals are these days.”

SoCal Native, so where and how are these deals taking place? Just gotta have the right contacts and connections at banks and mortgage holders? I agree the MLS is bullshit, and all listings I’m looking at are VASTLY overpriced, but then how to play the game? Any “asset managers” I talk to basically tell me to piss off – “oh I can’t help you, you have to talk to the RE agent/broker assigned to the property”. What a joke. There must still be records of these deals you mention taking place as the properties exchange hands. Got any addresses with examples you’d care to share?

And finally, all these Chinese immigrants with suitcases full of cash with a line a mile long, and you still took a 50% haircut? Best offer was half off with THAT much interest?

“the house that I eventually short sold (for a 50% discount) was purchased by Chinese immigrants with a suitcase full of cash. We had a line a mile long of foreign immigrants, ALL WITH CASH. There is an enormous network of these folks scooping up deals.”

~

But those houses are actually only worth 50% of the full selling price. In other words, those people are buying these houses at pre-bubble prices, and that will drive down housing prices.

@SoCal-Native – for what it’s worth the way I always looked at California was that people out there were trading built up housing equity between themselves basically playing mark to market where the market was facilitated by the banks and people trading housing between themselves. Bottom line, incomes out there simply don’t equate with perceived pricing. Kind of a sick momentum where gradually the market gets smaller and smaller. Super low interest rates and the government housing initiatives really helped from the late 1990s on as you were able to increase demand through a group of new home buyers who traditionally would not have been lent to (good job politicians). Hence everyone at the bottom rung or starter homes was able to move up another notch and continue this, some several times in that period if they kept turnover fast. At the end of the day though, for a $1m home most figure you had better take home at least $300K per year with 20% down. There just aren’t that many people out there doing that (or couples doing $150K each) and $1m homes in CA are nothing special at all. Hence…the game is over due to 1) sputtered out momentum 2) much tighter financing 3) loss of wealth at risk in real estate equity positions 4) oversupply 5) very difficult economic conditions 6) likely increasing taxes and cost of living. It will probably continue for a while or some neighborhoods will seem totally insulated but that’s really just some people continuing to believe in the game and setting apparent pricing. Eventually markets normalize and big disparities are weeded out. Not saying you are moving to beachfront Malibu making $80K or something stupid but the weirdness and lack of sense will eventually go (time period is the only question).

I think the thing in CA was that it lasted so long unabated, aside of LA in the early 1990s it pretty much just ran as financing got cheaper and looser (figure 1980s 18% rates to today’s 6% given a booming economy, perfect demographics, migration, Asia trade). In FL there have been numerous real estate cycles so a number of people were familiar with things blowing up, developers going under and people renting out their houses as they had to move and couldn’t get out for a time. Granted this time was way worse but people who spent much time there in the 70s-80s through early 1990s had seen the game before whereas few others have. I watched FL throughout this starting in 2001 economy had a bunch of 20-45K jobs, no one had any savings or discretionary income, salaries didn’t increase and yet real estate was rising year after year. How? Financing and very poor financial decision making upon buyers. Fundamentals stunk though and now reality is here.

One thing that is important to realize is that real estate is a heavily leveraged asset so downside risk is commensurate with upside risk. Like any investment program you need to rebalance and take some money off the table in the good times because using leverage and given illiquidity it can really hammer you in a big drop. Most people simply assumed it couldn’t drop so they effectively doubled down the whole way up and had everything they ever made at risk and heavily leveraged. Well, leverage works both ways and as nice as it is to make huge money on the way up – it’s brutal the other way and people had too much risk which made it catastrophic.

Pretty much my view anyway. Not sure that really helps. I don’t pretend to have a crystal ball but things that generally keep people out of trouble is 1) independent thinking 2) healthy skepticism 3) gathering data 4) take measured risk and take money off the table so that you can’t get carried out in the event of a major loss or the unexpected (there is optionality in being alive). Actually I think #1 sums it all up. If people did that, the rest comes naturally from it. Everything works better with #1 from financial decisions to democracy.

“the house that I eventually short sold (for a 50% discount) was purchased by Chinese immigrants with a suitcase full of cash. We had a line a mile long of foreign immigrants, ALL WITH CASH. There is an enormous network of these folks scooping up deals.”

1980’s-90’s — Japanese with suitcases full of cash

1990’s-2000’s — Californians with suitcases full of cash

Now — Chinese with suitcases full of cash

Doesn’t take a crystal ball to see how this ends… 😉

So SoCal-Native,

Where did these Chinese with suitcases full of cash find out about your house for sale? If an off-the-MLS transaction, is there some pipeline direct from the banks to offshore investors? Not trying to be paranoid here, but your comments about property changing hands without ever making it onto the books struck a nerve…

@native

I didn’t know when, but reading here in 2006,7 corroborated my concern that something was terribly wrong. I was the idiot because I knew this was a classic bubble and I sent an email to everyone I knew when Asian markets were dropping 900 points a day and told them to get their household in order because something terrible is happening right now. Everyone of course thought I was an idiot, even though I was an honors EE grad. My brother even got me a book to explain why I was being hoodwinked by folks trying to scare me.

My years of training won’t let me believe econo-speak. Just as all sound can be described as salient single frequency notes of various frequencies, ampilitudes and phase, economic math must follow some rules, without regard to the CNBC cheerleader bullshit. Think of all the rules that were violated:

1) It’s not different this time–there is nothing new under the sun

2) There’s no free lunch

3) The price of commodities is a function of the ability of people to pay for it–regardless of how much they want it. If rates go down, prices go up so that the ability to pay does not go change.

4) Whatever goes up must come down.

5) Housing over the long run appreaciates at the rate of inflation.

6) When the music stops somebody won’t have a chair.

the thing is some folks think things will correct in a few months or so and it will be fine. What happened last depression? It went up and down for years until WWII. It may go down and not come up for a generation. US may go down and not ever regain anything of our former self. Risk? You bet, because all this went down and no one even went to jail. The criminals are in charge. Their is honor among theives–and we the just will pay unjustly.

BTW, the chinese ‘miracle’ was a 4 trillion juan:dollar stimulous package in 2008. Yes there are thousands of Chinese with barges of cash–and they all want to be here…Don’t doubt that for a minute. If you had money would you stay in China? Of course not. Not that our bogus economy is anything better. Where did they find out? Money talks. Nobody wants your 20% down FHA loan when they can make a cash deal. I don’t know, but I sure don’t doubt it. Everything SCNative said makes sense. sounds like good advice to me, but it will fall on deaf ears because it takes a paradigm shift to hear, which most of us are incapable of.

Dark Ages- how dare you attack President Ronald Reagan? President Reagan took a nation that was on the brink of defeat and brought it back full circle to victory. President Reagan helped more people around the world gain freedom by defeating the evil that was Communism.

If only we didn’t have term limits for the Presidency of the U.S. things could have got a lot better. If we implement the policies of President Reagan America will prosper. Follow the policies of Mr. Obama (I refuse to call him my President because he was not even born in America) and we will become a third world nation.

Homefinder.com lists 30 pages of properties for sale in Santa Rosa (about 600) and 67 pages (around 1300) foreclosures. While this is extreme, Santa Maria has many more properties listed for sale with about 1/3 foreclosures.

I have more to say, especially about the Central Coast, but my comments have not been making it through–this is a test comment.

Robin Thomas

You are a perfect example of an out of touch reader. No one says Arnold is responsible for the bubble, NO ONE.

Comment by Eli

Ronald Regan spit in the eye of the idea you need a balance budget. Carter was worried about deficits and Republicans let him know DEFICITS MATTERED! When Regan came into office not only did deficits no longer matter but Regan through a 1 trillion dollar party!

Was it Regan or was it just money flying around that would have had the same result weather Republican or Democrat? Of course when Clinton came to town deficits mattered once again. And yes, when Bush #2 came to town deficits no longer mattered………and then there is the famous Cheney quote ” Deficits don’t matter, Ronald Regan proved that”. Now that Obama is in town no Republican can recall the Cheney quote or the Bush left Obama a 1.2 trillion deficit.

Many Presidents were one generation from being immigrants yet the first time a President is vehemently accused of being an illegal, he happens to be black. Makes you wonder……. Makes you wonder why if he is not legal to be President why a conservative Supreme Court Justice swore him in? Doesn’t that make the conservative Supreme Court guilty? A Conservative leaning Supreme Court surely must be able to enforce the law?

You Birthers are little more than racists. Call him a bad President for his Politics if you want but for Obama to not be a Citizen would mean that his Mother hatched this plan way back when Obama was a child! The only reason to hatch such a plan would be to show he was a natural born citizen versus an immigrant and the only reason for that would be if the Mother so desperately was sure her son would be President some day she needed to falsify records from the day his birth was announced in the Honolulu newspaper decades ago.

There is no other reason in the Nation for a person to want to appear natural born versus naturalized.

I can’t believe I am wasting my time arguing with a bone head.

@so cal native- you really have to think about your “investing” experience like the nineties tech bubble. They really are more alike than they are different. Both had their mainia phase where everybody was making money and you couldn’t lose. Tech had its investor clubs, housing had its tv shows. But housing is very different than stocks or commodities in one important respect. Housing cycles are very very long involving multigenerational time frames. The current bubble really began in the seventies with the baby boom coming of age. Before that housing was quite affordable- even for lower income folk. The last major downturn in housing was during the great depression- 80 years ago. Consider all the ups and downs since then up to about 2002 as market “noise.”

Think about all those investors buying right now to flip. The whole idea is to sell to the next willing sucker. Isn’t that what stock market speculators did with the tech bubble? In a falling market that is knife catching. Trying to call a bottom is a devistating game if you’re wrong. And in a bubble bust it can be catastrophic. All these flippers hope to sell to an end buyer- a homeowner resident. But what if there aren’t enough around to qualify to be end buyers for all the flipper owned home. Think of it as real estate musical chairs. I think in a few years there are going to be a lot less chairs.

LOL…

Eli, take off the tinfoil hat please and sit down.

It was hardly an attack – it was an …brace yourself – opinion.

That’s what preople do on blogs.

And as far as Presdient Obama’s legitimacy, unless you are a Creek, Cherokee or other Native American, you aren’t legitimately entittled to be here either.

But I doubt we wil lhave to worry about seeing your name on a ballot for POTUS and having to make that tough decision.

SoCal-Native, dont forget that there was also the tax free gain on the sale of the house after 24 months. $250K/person. I sold my homes every two years from1999 to 2007. What a deal and incentive to play the game! But like every highly leveraged play, you cant stay in the party too long because when it caves in, it caves in hard.

I remember the good Dr stating that the bottom will be in after all the Alt-A and Option ARMs reset and sentiment shifts to where everyone doesn’t think of housing as a good investment. Then it’ll be a good time to look at housing, but even then it’ll be an L shaped recovery so there will be no rush.

@Foolio – Take a close look at properties, such as zillow, and compare listing prices compared to sell prices the last 12 months. Then look at the estimated value. All three numbers are off by a lot in some cases. As far as doing business with Chinese immigrants, it’s something I’m glad I experienced it. It seemed like there were groups of people that looked up public records, and or last sales, as comparisons and cut the number in half and made the offers. I would get groups of offers at a time, all Chinese, and all of them hit the 300k number. It was a matter of time before the bank succumbed to the pressure that the property must be worth only that. The bank held out for 14 months as the market went up and down the last few quarters. The mind of Chinese investors are armed with a lot of data, comparisons, and have no problem walking away if the profit margin isn’t what they want. I ran a comparison of all the potential buyers, met many of them, and it was a drastic change from what I was used to seeing 2-3 years ago (99% Asian, I only met on Caucasian, and the other few were European).

I only make this comment because most of them were cash buyers and many of them I met were buying multiple properties in various areas. Look at places like Corona, Riverside, San Bernardino as well. You will see a demographic shift of buyers in these areas gombling up houses from various sources. I met a Chinese woman that has her own insurance company in San Gabriel Valley. I spoke to her last week and she picked up two more houses in Corona, one off the books, the other an REO at between 50-60% below 2007 sales prices for the area. She paid cash for both. When I asked her what her plan was, she suggested one was going to be a rental for a family immigrating later this year and that her rental price was well below rents for the area. The other one she said is undecided because she might move in because she never thought she could ever own a house that nice. When you start putting thoughts like these together, you begin to realize there is more happening than you can imagine.

@Apolitical Scientist – You’ll have to ask someone else where all these buyers came from, I have no idea. When I say they were Chinese immigrants, I’m saying most of them didn’t speak a word of english, and most of them had a Chinese realtor with them that spoke english. This was not some walk in the park and occassional passerby, they showed up by the dozen before it hit the MLS. The only people that new about the transaction was the bank, me and the agent I used… and that is because the banks require that. Don’t underestimate the power of public records. It’s the new MLS.

@Eli

I liked RR too, but unfotunately he set in motion an entire paradigm shift that people don’t understand helped lead us to this point, and it took me years to change my point of view. We began to feel that words and feeling good are more important than action and deeds. We’re losing the Bretton-Woods advantage we had over other nations after WW II, so our economy is based on unsustainable models now. Carter worried about our systemic problems so everyone thought he was an idiot. RR says no problem–just unload the treasury and the wealth will just tinkle down from Wall Street and make everyone happy–especially the defense contractors. It’s this mindset that made the bubble so bad. The math only works in the short term.

California real estate IMHO is nothing more than a smoke and mirrors game. Who in their right mind pays 500K or more for a shack? Even 350K? Even 250K? It took 35 years to get to this point of breaking finally real estate in California is OVER.

@Rayme,

I believe it was more like it won’t happen BEFORE the alt-a unwind. Nobody can call a bottom because it always can get worse.

Since there hasn’t been any response, I’m going to have to take SoCal-Native’s anecdotes about armies of Chinese with suitcases full of cash, as well as the “real deals taking place behind the scenes” with a substantial grain of salt.

I’d love for him to throw some actual evidence/proof of his comments out there though. Of course he has the perfect excuse not to provide any factual evidence of these insider deals – “I don’t want to share my wealth building secrets, but trust me me and my investor posse have insider deals going galore”

I rent in Tarzana, south of Ventura Blvd.

Lots of little tract homes built in 1950, 2bed/1bath (800 sq ft) or expanded to 3bed/2bath (1000 sq ft). During the peak, these houses were selling in the $700K range. But now, because of the HUGE CRASH in real estate that everybody has heard about for the past 3 years…

…owners are only asking for prices in the $600K range.

Crash, my a**.

People are still delusional.

I just sold a house back in April in a very upscale NorCal town. I listed it very aggresively. But very accurately comped. I got 14 offers the first week. 3 were for all cash. All 3 were caucasion US citizens. All offers were over $1.2M. There were 3 Chinese families that didnt have all cash and their offers were too low. I sold it for all cash to an extremely wealthy investor who scraped the lot and is building $3M house. This person was not Chinese.

Gone,

I totally agree. Even at 250K it’s hard for me to justify buying some crappy little shack that I could buy in Ohio for 40K.

I’ve grown to hate CA., I’ve grown to hate the U.S. government.

@Foolio Says –

“Since there hasn’t been any response, I’m going to have to take SoCal-Native’s anecdotes about armies of Chinese with suitcases full of cash, as well as the “real deals taking place behind the scenes†with a substantial grain of salt.

I’d love for him to throw some actual evidence/proof of his comments out there though. Of course he has the perfect excuse not to provide any factual evidence of these insider deals – “I don’t want to share my wealth building secrets, but trust me me and my investor posse have insider deals going galoreâ€

Geeze dude! I’d like to hold your hand an all, but I have replied quite a few times. There are mountains of data out there! Off the book deals take form in a variety of ways. There are equity trades, AITD takeovers, builders going out of buisiness and handing the keys over to buyers that never list. I know an investor that just traded 2 condos in the desert (not far from Palm Springs) for a $150k MotorHome, none of that was in the MLS. There is a growing list of properties being traded on websites, some for cash, some for trade, but are never listed using “traditional” methods. How come banks sell REO’s to private investors in bulk, all off the books, so to speak? It’s easy for them to liquidate a lot quickly. I know that happens because I know a contractor that rehabs FHA housing. The equation is simple – Banks group together houses, sells them to private investors for a discount, investors rehab, then do whatever they want. Some of these are international investors. How do the banks learn about private investors? First you need a lot of cash and you need to know someone that can make decisions at banks. Sorry you don’t want to believe it. I read the Dr’s perspective here and have made comments related to myself and how it applied to a short sale, fall in prices, etc. I’d rather not debate with you or anyone else here, how and why the variety of forms of transfers are taking place.

I’ve grown to hate the greed, Robin.

On Obama being a foreign-born national. That’s OK, he just can’t be that when he’s president. The fact he can’t/won’t produce a valid birth certificate means he is hiding something and we all know what that means if indeed, he is not native-born. I’m not exclusively a birther – I want to see the “real” document which every other president was not afraid to show. If you are an elected official, you should by HONOR show your birth certificate, especially if its created such a division in the country as it has.

Obama shows no indication he really cares what people think, he is just in it for the glory of “Hope and Change”.

Until this type of behavior ends, and we all get real about what the future holds (at best a major Depression, at worst a 10-20 year winddown with the US being unable to rise to former powers) then we are all lost.

Housing prices are a function of income and perception.

@CAE – Great Story. Although, one property, heavily advertised on the MLS, upscale NorCal area. It appears that some folks take what others say as it must apply in all cases. I’m not saying that at all. Reading all my posts and replies, explains things much more clearly. Of course buyers come in all flavors, I was simply stating something that I had not seen in previous years. That is, groups of foreign investors buying property for discounted prices. I mis-judged some folks here as “show me the facts, or you’re a liar.”

I’m out… got much better things to do.

I’m not a fan of Obama, but for what it’s worth, I couldn’t produce MY “real” birth certificate on demand…. even though I’m an “old stock” American whose forebears on both sides of my family settled in this country well over 200 years ago. I would have to go to the state of MO and get a copy, because the one given my parents at my birth was lost many moves and family upheavals ago.

The “birther” nonsense is just that… nonsense. There are ample grounds to criticize Obama with no reference to this. As it happens, there IS on file with the appropriate authorities in Hawaii a birth certificate for him, showing him born in Ouhu, Hawaii, to a mother who is a native born citizen, born in Kansas. If your mother is a native born citizen, it doesn’t matter where the father was born.

@ all of the Birthers,

Please give it up. You lost. Its over. This is a real estate/economic blog and not the drudge report. Economic policy can be something that we intelligently debate and discuss, as noted on this blog many ,many times. But to bring up the birthing issue here is simply inane.

As for the issue of most real estate transaction occurring outside of the MLS, that is true. We have been looking for a house for 3 years (studying the market and saving money), but we have not seen the deals on the MLS that we expected. The best deals are bank offered properties but only if you have tons of cash and can purchase multiple properties. Otherwise, you are SOL.

Ok, I hear ya. So how, as a possible first time home buyer do I purchase a home NOT listed on the MLS? Where do I go looking?

I rent in Thousand Oaks/Agoura Hills area. The rent is cheaper then if we were to buy one of these homes right now. We go to several open houses on weekends, and I’m sorry, but they are still way overpriced. 1 million for a 2000 square foot home is ridiculous. Our rent is only 2600 per month, and if we bought the same house, which was on the market, our mortgage payment would be over 4000.00 or more per month. Its a no brainer, to rent until prices come down to realistic non bubble mentality in Southern CA.

What industry will step in?

In November CA will legalize pot. There will be forces that try to stop the legalization, but it will ultimately be good for the CA economy. It won’t replace Real Estate or equal the boom days of Silicon Valley, but it will add to the tax revenue collected by the state.

Oh, so now paying taxes help the economy? Last I checked, I do not do drugs and am motivated to work and uh, keep that money for something productive… not paying income redistributers in their Ivory Towers.

SoCal-Native, your experience and insights are much appreciated, sorry some chose to get pissy. There’s a lot of frustration out there and we all know what happens when people get frustrated. I haven’t read too many folks commenting on DHB who are aware of the bigger investor end of the market and I’m curious for anymore insights you or anyone else have. Don’t shoot the messenger folks.

@SoCal-Native… It’s fascinating to hear from someone who actually rode the wave for a while. I agree it’s always easier to look back and see the signs, and that’s how it was during the dot com era. Everyone knew in the back of their minds that the companies didn’t make sense (AOL and Time Warner? Pets.com? kudzu.com?) but nobody wants to be the lone person sitting out as everyone dives into tubs full of cash.

Sure, we should all remember that businesses and investments need to make sense and be sustainable, but if we can just bail out before the crash… that’s like telling a gambler to quit while he’s ahead. It’s too hard.

One more thing- yes let’s all keep on renting. Sellers, realtors, banks, all of em are still smoking major amounts of weed. Sanity will prevail- people are throwing away $100,000 here, $200,000 there these days, maybe more, and they don’t even know it (or want to know it). A friend recently bought something for 1.3 mil on an interest only 15 year loan! Gee I’m going to rent from a bank for 15 years so I can pay for plumbing issues and knock down a wall or something. Duh… He thinks he’s going to inflate out of the loss in that time frame…Hey maybe he’s right, but it’s a bit too casino for me (not to mention waaayyy out of my budget) and many people don’t want to hear otherwise. I love LA, but not that much, and it’s not a great place to raise kids. Sure big investors can deal in blocks, but no one wants to deal with biz like that on a small scale- thus we’re stuck on MLS. I say chill for 2-3 years and see where the chips fall.

I’m beginning to think that there’s a serious game being set up against the buyer. Every time I find a house I like, there’s always “multiple offers”. This last one was on the market for 9 months, and had sat at the same price for over 90 days. The agent confirmed there weren’t any other offers pending that morning. As my agent put my offer together that afternoon, suddenly they had another offer and accepted it (without even bothering to see how much money I was offering, which is very strange for a foreclosure). It’s sketchy.

I’ve come to the conclusion that in order to actually buy a house, I am first going to have to lobby against all of the bullshit non-regulation of the banks. Probably the best place to start is with the “mark to market” suspension, though I am open to suggestions and am creating a list. They really shouldn’t have messed with me, because I was perfectly happy to ignore it otherwise. But if they want to start something, that’s fine. I double-dog guarantee them the double-dip recession they’re afraid of, and this time around, there ain’t gonna be no stimulus package.

It’s a game they are playing in CA as well. A house sits for sale for nine months and tries to get multiple offers. Never buy a house if you must bid against others. It’s a scam. They are deliberately playing buyers off and jerking prices unnecessarily up.

No it’s the real estate agent with the 100 foreclosure listings given to them by the banks that are scamming everything.

@Robin

the hope for our nation was that if folks were unleashed from the shakles of serfdom that we would be prosperous and we could build a great nation, which I feel we did. There are always the alphas trying to dominate and enslave the betas, so we just need to be aware that is what Wall Street does. They got into health care and it has destroyed the country almost by itself. They got into housing, disaster. They got into the college loan system and we are so lost it seems hopeless. When they get cap and trade going, run for the mountains.

http://en.wikipedia.org/wiki/National_debt_by_U.S._presidential_terms

RR was a pretty good president in some regards. In others, not so.

Since you seem like a true believer in Reganomics, and probably believe that the Repubs are the party of fiscal responsibility, you can check your beliefs with the second graph/chart on this linked page. Additionally, Regan levied the highest taxes we had seen in over 10 years directly onto business. Pretty amazing for being a Republican isn’t it.

The truth is the current state of the US economy would not be handled very differently by either party. Additionally, communist forms of government are alive and very well today. One of them happens to be a rising world power: China.

Sorry SoCal – when I posted that this morning, it was before your response was put up. Thanks for giving the follow up, and again I apologize for finding your earlier posts suspect.

I’m not seeing any such activity in west LA, and my intuition tells me those hordes of Chinese are hitting the San Gabriel valley and further east, as you noted. I don’t think they even had to hit the public records – rather just use realty trac or some other online service and find the properties that are in default.

As for transactions off the books/behind the scenes, obviously every sale where a property changes hands would have the deed recorded so there would be some record at the very least, and these comps do show up on redfin and elsewhere. Zillow estimates are garbage, but also in the areas I’m looking at there are no properties closing at 50% discount over last year or even from peak. Still only 33% at best.

Funny, I can produce a notorized copy of mine by calling my county records office and paying a $25 fee to get one reproduced. All that is necessary is to be there in person to confirm identity. Obama has been back to Hawaii more than once in the last couple of years. He had ample opportunity.

You know, Obama’s policies (or lack thereof) are contributing to this housing mess by injecting a sense of fear. Fear of the future. I do not blame buyers for sitting on the fence when they know in the back of their minds that their income might be double-taxed to pay for all the entitlement programs being voted in.

I still stand by what I say – there IS something to hide, otherwise he’d have dealt with it long ago. He does a disservice to ALL of us by being a coward. And this is regardless of whether he is by birth qualified to be president.

I agree with the comment regarding “a whole generation of people in California owe their lifestyle to insane house price appreciation.” It will be very painful for the current generation to realize that equity from now on will be built by paying off mortgage principle…there will be no more free lunchs. See my post above regarding my former boss, in a 25 year span he turned his 15K initial downpayment into well over 1M equity in his current residense. This was all done by trading houses every 5 years and surfing the CA housing appreciation wave. Sooner or later, any speculative investment is tapped and there is no potential for any price appreciation (we saw that with tech stocks in 2000, we are seeing that with CA real estate today). If we are lucky, prices will stay flat for the next decade or so. The free lunch program is over!

One thing I rarely hear raised in the Birther furor is Hillary. If there was any substance to the accusations, does anyone believe Hillary and Co. wouldn’t have taken full advantage? (As it is, some believe the whole thing started with her campaign in the first place.) There were plenty of good reasons for Obama not to be elected. Many documented by his own hand in his books. But the fix was in and the adoring media chose not to give much attention to these disturbing issues. That so many of those so-called journalists are now out of work or soon will be is but cold comfort.

Those of us who originally voted for Arnold were hoping for metaphorical heads on pikes outside the statehouse. We wanted someone who couldn’t be bought, didn’t care who he offended by exposing their offenses in government, and didn’t care if he got re-elected so long as he made his mark. Arnold turned out to be incapable of backing up this promise due to his need to be loved. In real life, the Terminator was a wimp who backed down from confrontation and the great hope of real reform was lost. We needed a burnt earth attack from the Governor’s office and didn’t get it. Instead, Conan the Barbarian got his ass kicked by a 60-something schoolteacher turned union boss who would go on TV and lie her ass off unchallenged.

Everyone buying a house in California is signing up for paying for oversized government pensions. No way Prop 13 survives the increasing responsibility of California’s taxpayers for the promises our politicians made.

They found a way around Prop. 13. City of L.A. just tripled everone’s DWP Bill and is now trying to triple the water bills to pay for city pensions. DWP/City L.A. in cahoots!

Slim, JBR, SoCal Native,

~

Great posts, thank you.

~

Emma,

~

I agree. If we’re willing to elect a guy named “BHO,” what does it matter what’s on his birth certificate?

~

Snowman,

I have a similar fear myself – that those stuck in place because of their homes will be seen as a collective piggy bank for cash-starved municipalities and Sacramento together.

@Snowman,

“I have a similar fear myself – that those stuck in place because of their homes will be seen as a collective piggy bank for cash-starved municipalities and Sacramento together.”

Great point. I remember a few years back about someone saying he could still pay the PI I but the T threw him into foreclosure. That is one of the saddest cases and I’m sure there are many. but just like all the other depressions, lower revenues force higher taxes force banks to pay the taxes instead of homeowners. What a grevious, unintended consequence. Renters don’t pay property tax, now do they? At least not directly, and rent is still a function of supply and demand.

As another smart feller here once told me, you never truly own a house because of the taxes and assessments.

When the collapse is over, people will be able to own homes that no longer own them. Hopefully for a long time in the future people will remember that a house is to live in. Invest in businesses, commercial property, for your speculative money, even if you loose that money you will still have a home. This also will end the speculators in the market for homes, and that will be the best part going forward for all of us.

I used to rent a small house in that area (it is called Encino Park) during the peak of the bubble. Most houses were listed under $200K, many in the

$175K range. Suddenly everone went crazy and they jumped to $500K!!!

No kidding. My enighbor bought his mother a house before the peak for

$169K, a small 2 bed run down shack, later sold it for close to $400.

The house we rented sold for $500, it has since been sold twice, the last

time for $365K!

I would like to buy in Encino/Tarzana/Woodland Hills area but prices haven’t

come down enough but they will.

We knew it was going to come to this… I don’t mean to bragg but we really did. I came across an old book on how to calculate how much a person

could afford housewise and it gave the following advice:

Mortgage companies “used” to lend no more than 3.5 times your annual income max i.e., you made $50K a year you could not afford a house

that cost more than $175K. Also, you should have min 10% down and

no more than 28% of your gross income should go towards the mortgage,

taxes, insurance and repairs!!!

A friend of mone told me the homes in that area would jump to a million

dollars. The people who lived in that area were nurses, super market

clerks and so forth and their pay didn’t go up it was very easy to figure

out how this was going to end.

The worst is yet to come.

Ok, well, I have read many, many comments over the last few days, on this blog and I’ve even posted a few. That generated some debate and comments in return. While I agree there is a lot of anxiety, frustration, unknows and fear in real estate, etc., my perspective doesn’t always line up with fear mongers and nay sayers, or those blindingly hoping that some magic wand will guide them to the one perfectly underpriced property that nobody has seen yet. There is so much going on, that is impossible for everyone to find perfect deals. But first, so we can get my experience level out of the way, and this is probably a one time shot, because I’m home feeling like crap with a summer head cold. So I have had time to sit idle and read and reply here. I’m 50, born and raised in SoCal. Born actually in Compton when it was one right on place to live. But that began to change 48 years ago. My family is comprised of 5 males and our parents. All of us picked up the property rehab bug when we were barely out of diapers because our parents, parents were too. I was changing light bulbs in rentals when I wasn’t even able to say door knob. The short story is we all owned property by the time we were 18. It was a right of passage in our home, much like a car at 16. My Mom, who have never lifted as much as a screwdriver to hand it to one of us, knows more about real estate in SoCal than any realtor I have ever met. She reads and she talks. Us guys hit the streets and bought, fixed and sold, for most of our lives. There you have the basic story. Fast forward 40 years and an untold number of properties transfered later. I’m not going to sit here and say all is well. But because I have some of the concerns as others, I think there is much more to consider than gloom and doom. After 18 months of a holocaust for many in my own family, we are by no means broke, and we didn’t bet the farm on investments. There is a reason the “bet the farm” term is used. It means don’t leverage where your family lives. I have read comments to my posts and some have assumed as much. That is their problem, not mine. I have merely stated simple facts to events that have happened to me personally, but it in no way reflects a much larger overall picture of my real estate experience or postition at the moment. First, I don’t subscribe to the notion or peoples “feelngs” about property values continuing to drop, just because someone thinks or feels that they should. Real Estate investing in places like CA, is a much larger market than you are aware, just because you were born here, or want to live here. Free market capitalism is very much alive and well here. Basically put, if the real estate market was a deck of cards, the events of the last 2-3 years has merely “shuffled the deck.” But guess what? The cards are still present and accounted for, just your hand looks different. The methods that made people tons of cash the last 20 years has pretty much gotten blown in that shuffle. What it did, however, because of other world events, has opened up avenues for buyers that would not have otherwise bought, are now on the prowl and they are serious, and quick about it. Posters that think there is something sinister going on in the market and that some personal attack on them is rediculous. The basic principle of real estate remains a fact; money talks and the faster you shove cash into someones face, that’s the beginning of a deal. Times are real tough for a lot of people, I see it everywhere. I see people depressed, scared, single mothers, with BS loans, I see it. If you want my personal opinion of what I think, because that’s all it is, an opinion, I will give it. I don’t talk politics, elections, religion, stock market, or don’t get pulled into people’s personal drama. Let’s talk real estate. I will offer my experience of a property transfer we did for my nephew the last couple of months, and how many of my ealier comments apply. My nephew fell on tough times and lost his job, lost him home, and moved into an apartment. We had a hard time as a family to watch this happen, so we discussed some options with him and his wife to get them going again. His credit tanked, and his new job, a good one, but hasn’t been there for a year yet. We put the word out some personal collegues to keep an eye out for certain types of sellers. I need to gloss over that point for now. In late 2009, a friend of a friend of a friend, you get the point, called my brother and I about a property that was built in 2007. Not the best time trying to market new houses. This custom built 4000sq ft house had never been lived in, nicely maintained by the builder for 2 years. It had been on the MLS off and on both years for $1.2m. The person that called us was the builder discussing a discounted price for the house. His company had a loan of $450k on the property. By March, we had negotiated the price down to $590k, a carry back of 50k, no interest, for 3 years, and wrapping his loan into an AITD for 5 years. My nephew gave up some of his priced posessions, he had the cash difference and he closed escrow June 2nd, 2010. BTW, this property had been on the MLS but dropped off for about 9 months just sitting there because the sellers/owners had no luck getting what they wanted. In the end, their bleeding stopped and they will write off the loss… the moral is, we did not use the MLS, didn’t use a realtor, but we did use an escrow company, for closing and to write the AITD. Everything else we did ourselves. I realize this is not for everyone, but if you want deals, there are only two types of people in real estate: “those that make things happen, and those that wonder what happened.” More later if you can digest this.

SoCal-Native,

I certainly appreciate your perspective as someone actively involved in what real estate has mutated into here in SoCal. My comments weren’t so much a xenophobic rant about Chinese with suitcases full of money, but more a question about what sources of information these buyer/investors had available.

As you’ve probably realized, this blog is largely a support group for frustrated home buyers waiting for RE to tank to a level we feel is fair, endlessly complaining about the reasons it hasn’t happened yet, but encouraging each other to wait because it surely will. While I share this conviction it seems that you have some data from the trenches that many of the rest of us lack. If there is a mechanism in place that will siphon off all desirable low priced real estate before it is ever listed then this could easily distort the data the rest of us see.

So I’m asking directly: What information sources do you believe the investors you encounter use? Many of us here follow the standard internet foreclosure listing services and read the county assessor’s data, but I don’t see how those could have made one aware of an upcoming short sale when only the seller, the bank and RE agent knew of it – unless you’re talking about investors cold calling everyone with a NOD or delinquent tax lien.

Or does one have to be so networked into the RE game that a “friend of a friend of a friend” like your bother’s just calls out of the blue with 50% off property offers?

Appreciate any info you’d care to provide.

@ So Cal –

You were playing a game and you were speculating. Buying every 4-5 years and selling for the appreciation is SPECULATING. Just because you were doing it for a long time doesn’t make it any less so. It was a long bubble. Bubbles are speculative. Speculative = unsustainable or highly risky. What you were doing was unsustaniable. That you admit yourself.

There’s no problem with speculating. It’s a free country. But, please, call a spade a spade.

“Investing” in res RE means buying properties where the rent pays for the PMI plus expenses. The appreciation is an added bonus.

@Dfresh – Had a bad 18 months of losing asset value, no doubt, agreed. The good thing, is like many other industries have had to do, we retool, and go right back to work.