What the TARP? Cutting Back to the Necessities: 3 Emerging Trends in this Economic Crisis. The Mighty are Falling, Consumers Forced to Save, and Job Protectionism.

In Los Angeles and other big cities many people get lost in the concrete jungle of urbanism. In fact, hundreds of people die alone each year without any human contact with the outside universe. It is as if they have disconnected from the actual grid of social interaction. Every year a service in Los Angeles is done with cremated remains of those who have passed away and city workers, with all their abilities try to find ties with potential family members. You would think that in a technologically advanced age that everyone would have at least one connection to another human in this world. That is not the case.

The reason I bring up this point is how disconnected we have gotten from one another and how this is simply one additional facet to this economic calamity. A few years ago I was getting a loan for an investment property. Nice little place that was out of the state and met my criteria for a good buy and hold rental. I shopped around for the best mortgage rate and found a place online in Arizona. The broker I worked with was a good salesman and all the paperwork was done via the phone and e-mail. Never met the guy. Got an excellent rate and didn’t even have to show one W-2 form. In fact, I could have gotten a loan 5 times as big if my heart desired and that was a scary prospect because it made me realize how little oversight was in the system.

I remember at the time that the broker was trying to push me into an option ARM but I had to explain to him that I strictly dealt with 30 year fixed mortgages. He was sincere in that he believed what he was trying to sell was truly the best product. It was more a case of ignorance and lack of future planning. I think of the $500 billion in option ARMs that will be striking down upon this nation in 2009 and 2010 during the worst economic crisis of our lives. The broker worked for a company that has long ago imploded. Not sure what he is doing today.

That is the ease in which a decentralized economy has allowed people to eliminate any face to face contact. Loans were made across the country to people who could have claimed anything on paper. No one really cared. Everything was front loaded and long-term planning didn’t matter. Like the person that passes away alone, usually the city workers find years and years of unpaid bills, QVC bought items that remain unopened, and observations that may seem incredible to the general public. Yet this is what we have on our hands at the moment. A decade of hidden bets, horrible investments, and toxic waste is now coming to the surface.

The Mighty are not Immune

Warren Buffet who once stated derivatives were “financial weapons of mass destruction” is now facing the wrath of the derivatives market. It is incredible that the cost to protect against Berkshire being unable to meet its debt payments based on credit-default swaps has more than tripled in two months. The swaps jumped over 475 basis points from 129 only two months ago. Berkshire is now down a stunning 43 percent for the year when the previous worst year in its 40 year record was a drop of 6.2 percent in 2001. Seeing this massive conglomerate take a near 50% hit is stunning and a blow to confidence. If the Oracle of Omaha can’t get it right in this market, who can?

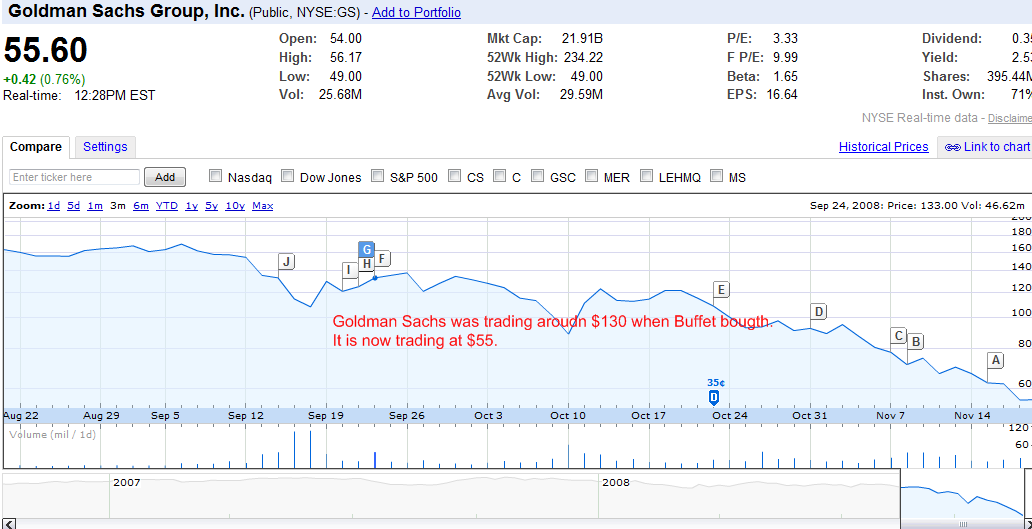

Now, it isn’t that the [once] wealthiest man in the world is feeling the pain of the markets but what investments he made to feel the pain. He holds large stakes in American Express and Wells Fargo who haven’t done well in the current market. Berkshire’s income stream largely from insurance holdings is down 77%. His public buy of Goldman Sachs led many sheep to the slaughter thinking he saw value in the once Golden boy of Wall Street. Since that time, Goldman has been cut in half:

We also see the massive banking giant Citi taking a major pummeling in this current market. It is now trading well in the single digits even after announcing a major job cut of 52,000 for the upcoming months. It was the second biggest mass job layoff announcement in history. Take a look at Citi:

This market has no mercy for anyone. It would appear that the only safe place to be right now is in cash.

Consumers Forced to Save

There is a silent depression hitting the nation that is finally coming to the surface. That is the life of living on the edge of financial ruin with only one paycheck keeping you liquid. With unemployment sky rocketing, many people are being forced off that edge in a wave of insolvency. I think a story that highlights this is how a colleague thought that his home equity line and his credit cards were his “emergency savings” and this was his buffer. If he ever needed cash desperately, he had access to a $50,000 home equity line and $20,000 in credit cards. Well guess what? WaMu which was the home equity line provider  closed his line down here in California since he was now in a negative equity position and his credit cards have been chopped down to $5,000. In his mind, he has had $65,000 in his savings wiped away. How many others are in this kind of mindset?

You also don’t want to count or trust the government completely. Remember that $700 billion TARP plan that was supposedly going to buy toxic assets? As it turns out, that never happened. Much of the funds went as capital injections to banks. This wasn’t the essence of the plan but these people are making it up as they go along. Ironically, since the bailout bill was passed the market has tanked even further:

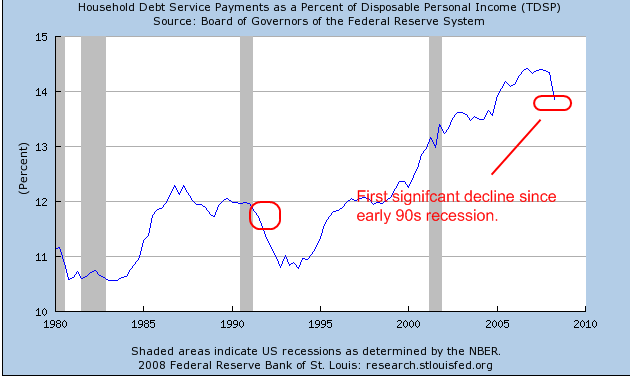

A near 3,000 point drop in less than 2 months is a crash. Wasn’t the bailout suppose to stop a crash? Are you meaning to tell me that if the bailout didn’t go through the market would be 5,000 points down? Consumers unlike the government have to operate in a world of money reality. They have no access to bailouts. And people are actually focusing more on servicing current debts:

If you look at the above chart, this is the first significant decline since the early 90s recession. This may on the surface look like a good sign but all it is showing is the massive contraction in debt but also all the debt destruction via bankruptcies and foreclosures where debt is literally evaporating. Think of it this way. You lose your home and go bankrupt and that is all your debt. You technically have no debt at least on paper. But would you really claim this person is in good shape? Many Real Homes of Genius are hitting the market here in California, in fact every 30 seconds to 1 minute a home is being foreclosed on here in the state.

Job Protectionism

The few remaining doubters keep saying this won’t be that bad because we won’t see the Great Depression soup lines. Well what about job fair lines?

Source:Â Gawker

Someone sent me the above picture taken from a Monster job fair in New York on Wednesday November 12. Normally you would see a sizable line but this time the line curves around the entire avenue block. People are doing all they can to look for work. This is merely a reflection of the poor economic landscape. Maybe it isn’t as powerful as a soup line but you can rest assured many people in that line are distressed.

The climate is such where everyone is on pins and needles worrying about their jobs. Some rightfully so. October was horrible but just look at November. November is already on pace to being the worst month on record this year for the markets and we still have a few days left. What good news is going to come out? Unemployment insurance claims are at 16 year highs which only mean the next job report is going to be brutal.

In addition, many states are cutting budgets back with hiring freezes and also cutting pay for employees. They are not in good shape. California is currently in a special session which seems to be going nowhere. It also doesn’t solve next year’s budget which will be horrific. Things are grim.

Being protective of your job is a natural and human instinct. But even many places are seeing over qualified employees vying for retail jobs (those that are still open). Times are tough and all the data is pointing to tougher times. Gear up and now you know why people are saying, “what the TARP just happened?” What just happened is the crony capitalist on Wall Street with their idiotic politicians just suckered you for a nice chunk of change.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “What the TARP? Cutting Back to the Necessities: 3 Emerging Trends in this Economic Crisis. The Mighty are Falling, Consumers Forced to Save, and Job Protectionism.”

Formerly Chris in Cali here… moved to the other bubble state with beaches…. Doc, your post (once again) is right on the money! Everywhere you look, people are being hit with the reality of living beyond their means. Now value of “things to sell on Craigs list” like used cars, used electronics or jewelry is dropping like a stone. We are facing a long time before the “good” times come back. You almost need to change the blog name to reflect the wider issues you are covering. I know your reader have hunkered down (or are at least cognizant of the situation) but the vast majority of people continue to be consumerist zombies completely caught off guard by this situation.

dr. bubble, your post is as incisive as always. good god, are we in for it. too bad the wise will be soaked to pay for the sins of the moronic.

I’m visiting Boise Idaho right now. Hospital cafeterias cutting back on the food choices-the former big lunch spread now closer to bare bones, cutting back employee hours. according to the TV news unemployment in the state has doubled. Not just what we think of as the bubble areas being affected, but Middle America too.

Hours and pay are being cut. Chicago unemployment at 7.3% and local CEOs warn Mayor Daley that there will be “thousands” of layoffs in early 2009. Empty subdivisions allover the suburbs. Chicago is very dependent upon the FIRE economy since we lost so much of our manufacturing in the 70s and 80s.

I’d just like to criticise your use of the log or semi log vertical scale on the CITI, Dow and Goldman graphs. Semilog maps are only appropriate when you’re dealing with exponential growth or decay. Not when you are trying to convey a sense of scale. I feel they exaggerate movements downwards when honestly you don’t need to exaggerate.

Thanks

It’s the income, stupid. Reaganomics eviscerated the ranks of workers who got healthy paychecks (with frozen real dollar value since the mid-1970s) and a solid social safety net for their (pooled) efforts. Wages for the bottom 90 percent of workers were emptied out while the top 1 percent skyrocketed. Our economy was systematically turned into an bottom-seeking one.

~

In exchange for a sustainable share of a sustainable production and prosperity, Americans were given easy debt for shiny things made cheap in China. And in the process a new lucrative banking industry–revolving unsecured credit–was created.

~

Meanwhile people call for more starving of the workers. Which is like saying that the cure for cachexis is more fasting.

~

Stephen Colbert had a nice piece the other night:

http://www.colbertnation.com/the-colbert-report-videos/210798/november-19-2008/the-word—mad-men

~

Yeah. Blame the barnacles.

~

rose

And today the state unemployment numbers came out..Ca. is the third highest behind Rhode Island and ,(no surprise here), Michigan. At 8.2% that’s a 1/2 % increase over last month’s. Translated: 1. 5 million people at least out of work in the Golden State. Ouch.

@compass rose:

Yeah, punishing workers further is not going to help anyone. Read an article recently which stated that deflation would never happen here and that the talk of it was overblown. Also stated that we will see inflation of perhaps 10 to 15 percent but with no pesky wage inflation pressure…..lemme see….I think this is it:

http://seekingalpha.com/article/106776-7-key-points-about-deflation

If people were defaulting before all this unemployment and reduction in hours how is beating down the worker further gonna help?

I think this guy is way off with his predictions, but would love to hear other’s reaction and opinions.

Awesome article Dr HB, as always.

I thought you are studnet who just finsihed yoru Phd.

Dr. Looks like you have been in the real estae market and made your move when it was bad also.

Idiocracy at its finest. If real estate and the stock market show anything, it is that you have to look forward. You can’t just assume that tomorrow will be like yesterday. You can, however, know that winter will follow autumn. The mother of all Kontradieff winters is coming. We’re just raking leaves right now.

I’ve said this before…I no longer have any faith whatsoever in the U.S. government. The bailout/theft had me so angry that I could not sleep at night. To brazenly steal our money in the light of day, and get away with it…the whole thing just makes me sick. I have never felt this sort of hatred ever before in my entire life. I fear that it is over for the U.S., that the scumbag moneymen have sucked the life out of the country, and have now run off with the loot.

I am truly amazed that public outrage is so muted. If a sniper were to start picking off some of the bastards who got us into this mess, I would laugh and cheer.

We need to have bodies swinging from lamp posts.

Bravo senior! Just because you can does not mean you should. You should look that RE guy up and follow-up. I bet he’s in deep trouble…

Leave a Reply to gael