What can we gather from analyzing all sales data for an entire block of housing? Examining one street in Torrance with homes built in 1953 and 1954.

People may think there is an elaborate system when it comes to pricing real estate. For many companies, we can look at earnings, potential for growth, management, and also dive into the balance sheet to examine the nuts and bolts of the operation. Even with all of this data, markets fluctuate. But with real estate, the appraisal data is as rudimentary as it gets especially for single family homes. Basically most systems use the comp method of pricing homes. That is, an appraiser will use three homes in the nearby vicinity that have recently sold and that will be the basis for price. It doesn’t matter that the home would rent for $2,400 but end up costing you $600,000. Crap shacks all across the Southland exhibit this behavior. More to the point, you have many older owners living in homes that they would have no chance of affording today. Does it make sense that only a handful of sales determine the price of current listings? Maybe it does but few bother to examine this assumption. After all, you can’t fault a seller for trying to get as much as they can. I’m surprised I haven’t seen this analysis conducted but why not examine all home sales for a block of housing? Today we’ll dig deep into the data for an entire block of homes built in 1953 and 1954 in Torrance.

One sale does not come close to representing a neighborhood

Torrance has some nice areas but most of the city is basic post-World War II housing. Housing built for basic functionality and affordability, at least when it was designed in the 1950s for many sections of the city. You would think that some of these places have full upgrades but most have the same bones from when they were built back in 1953 and 1954.

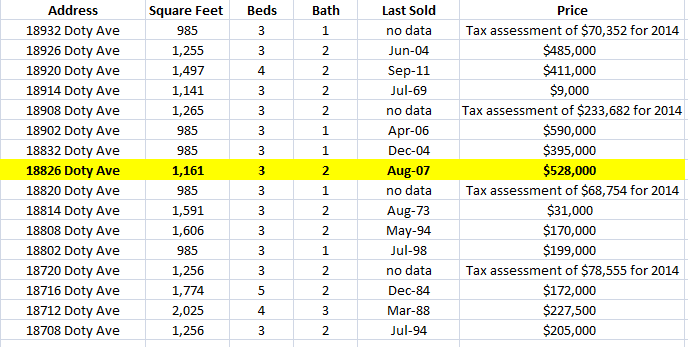

I wanted to examine data for a block with at least 10 homes. This block has 16 homes. What is useful is we have standard sizes as well to compare. Let us look at our block:

Nothing special here. The average home on this block is 1,297 square feet. 5 of the homes are listed at 985 square feet. Most have 3 bedrooms. 5 of the 16 homes have purchase prices of $400,000 or higher (2 with $500,000+ sales prices). The rest have sales prices under $227,500 and many were bought for much lower many decades ago. You will also notice that many are old school owners based on tax assessment data. Take a look at the above city block broken down by sales data:

The ability to pull data like this really puts knowledge into the hands of buyers. Not too long ago, if you really wanted to find sales data like this, you would spend an entire day at the county clerk office. Not worth it so most just went with the simple comp method of pricing a home. But just take a look at the data above. How many of these current owners would be able to afford to buy their home once again? Or would they even have the ability to afford the market rent of their current home? You can see one sale of a 985 square foot home going for $590,000 back in April 2006.   The neighbor 1.5 years prior paid $395,000 (nearly $200,000 less) for the same build of a 985 square foot home.

It is also important to look at tax assessment data. Someone is paying taxes as if the home was valued at $68,754 thanks to Prop 13. Yet the other person that paid $590,000 is paying nearly 9 times the amount in annual taxes for basically living on the same street and utilizing the same level of government services. We are looking at the same street here and homes built very similar to one another.

There is one home for sale on the street currently:

18826 Doty Ave, Torrance, CA 90504

3 beds, 2 baths, 1,161 square feet

Take a look at the ad:

“Coming soon. Beautiful 3 bedroom, 2 bath home, almost completely remodeled. Great family neighborhood, shopping, El Camino College, frwy’s, and Mall. This is a must see home.â€

I hope people realize that community colleges are within a close distance to all areas in California given there are 112 across the state. You can also “shop†in most cities from what I have read on the inter-webs. The size of this home is below average compared to the average square footage of the other homes on the street. Someone bought this place at the last peak in August 2007 for $528,000. The home is listed for $609,000. This would be the most expensive sale on this block ever and there are larger homes as well. Zillow has its own algorithm of pricing homes. Hard to tell if it uses a comp model but it has to use some derivative of this to give Zestimates for all homes in the country. Just like the basic appraisal method, it will fail to catch booms and bust (similar to what we saw in 2007 through 2009). Zestimates and appraisals are great for steady housing markets. Not boom and bust prone areas.

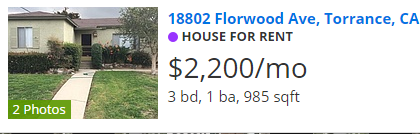

The list price of $609,000 is not even remotely close to the Zestimate of $505,000. Looking at the entire sales data of the block, it is hard to say how they are arriving at this price point. We can look at a rental a couple of streets over:

The rental is slightly smaller with one less bathroom. So we can assume this place would rent for $2,400 to $2,500. Is any investor really going to pay $609,000 for a rental stream of $2,500 per month? 20 percent down here would mean throwing down $121,800. This is where those trying to use rent comparisons miss the mark and why sales volume is pathetic. The average adjusted gross income for a household in this zip code is $56,486. How long will it take for someone to save $121,800 with that income level? Very long. So supposedly, you are looking at higher income folks as your pool of potential buyers. But look at this place. Even after the $121,800 is put down you have a hefty mortgage for years to come.

The data should be sobering. Take the example again of the two neighbors with the 985 square foot homes. One paid $395,000 in 2004 and one paid $590,000 in 2006. Close to a $200,000 difference for basically the same structure, size, and build of a home. Boom and bust baby. Now someone is looking to set the record for this block. But seeing the history of the block puts it all into context. The recent sales history shows a history of market mania in California. And with this home listed at $609,000 someone might set a price record on a fairly nondescript street in Torrance.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “What can we gather from analyzing all sales data for an entire block of housing? Examining one street in Torrance with homes built in 1953 and 1954.”

If this shitbox really rents for 2400 or 2500 per month, then selling for around 600K seems in the ballpark. Why do shitboxes in Torrance rent for 2500 dollars per month? This is a good question I would like to know the answers to.

Well the comp at $2200 is an asking rent. Who says they’ll get it? Either way everything is full retard until the FED raise and REIT/flipper capitulation. I thought last year was our 2007 redux, looks like I was a year early. Looks like we’ll be waiting until late this year or 2016 for the larger drops. Patience in all things 🙂 as an aside I spent some time in Yucaipa this weekend. 400k to live 20 mins from San Berdu. Hilarious…

I compare Torrance to Culver City in some ways. The overflow of people (with a good amount of money) but who cannot afford Santa Monica, Venice, West LA, Marina Del Rey have overflowed into Culver City. The overflow of people (with a good amount of money) but who cannot afford Manhattan Beach, Redondo Beach, Hermosa Beach, Palos Verdes have overflowed into Torrance.

So can I ask a really basic question? Why are there more and more affluent people in LA who keep pushing into various neighborhoods? Remember 20 years ago when you could get shot in Venice after dark? Remember when there was no Santa Monica Promenade, no Old Town Pasadena? Remember when there was never a line in front of Pink’s? Now an overflow of people with money has gone from Los Feliz to Silverlake and on into Echo Park, Highland Park, Glassel Park, Cyprus Park … and on into Boyle Heights.

Stupid question: From whence do ALL these “affluent” folks come???

tamales, the jobs to be had are becoming more elite. Basic manufacturing jobs are moving, and what’s coming in are engineers, tech’s, CEO’s, high level management, etc.

Not sure how you can compare CC to Torance. CC has a major Hwood studio in its center, is 10 min from two other studios, 10 min from Venice, Santa Monica, Westood and central to most of the rest of LA. The money flowing into CC property values comes from studio folks and the booming Internet industy, priced out of SM, Cheviot Hills and Castle Heights and desperate for great schools. Torrance is central to nothing but refineries and nicer beach towns. This home would sadly be selling for 800k in CC.

@bjk you are correct. I grew up on the westside, and recall when Venice Canals was bikers, drug dealers and canals full of car batteries, trash and old bicycles. And the Pico corridor in Santa Monica was old ramshackle bungalows with frequent gang shootings. Venice Canals are now multimillion dollar homes and those with money continue to push into the Oakwood section of Venice and the Pico Corridor. The next part of the westside where you will see a push is Baldwin Vista. Homes in the $600K range just east of Culver City and South of West Adams. For more to your answer, see ‘leftover tamales’ post below for an answer to your question.

> “Where do ALL these “affluent†folks come???”

Say hello to the ever-widening income gap. Particularly noticeable in big cities with millions of inhabitants, hundreds of thousands will by definition be in the top 10% and doing very well indeed these last few years. All of these folks want, and can afford, a piece of the LA-Good-Life. So long as the money train keeps rolling (i.e. until the total economic collapse the constantly hyped by our favorite doomer Cassandras) these folks will keep finding new neighborhoods to gentrify.

@leftover tamales, affluent folks or highly indebted spenders?

The personal savings rate is fast approaching zero in SoCal.

@Stupid question: From whence do ALL these “affluent†folks come???

It’s not like more and more and more and more affluent people are being made. It just shifts. Places like downtown used to be for the elite. The area around USC used to be for elites. Whole swaths of the city were upscale and nice, which are now decrepit and dangerous. Marina del Rey was the hippest hottest best place on earth in the 70s. It’s been through a whole couple of decades of run down. Now it’s picking back up again.

Also it’s very true that people are living extremely over extended lives with no savings, credit card bills, and debts. People do have to live within their means anymore – and don’t.

Leftover Tamales … there is a relatively large segment of people who are called ‘hand-to-mouth-rich’! By some accounts almost 40 million households. These people are relatively high income earners, but live paycheck to paycheck. Everything goes to the mortgage, the fancy car, private schools, expensive gyms, etc. These people never learned the value of money or frugality, thus are all about material wealth and have no real liquid assets. There are certainly more millionaires in a place like So. Cal. but likely those you observe aren’t in the group … they are just taking on a mountain of debt. The typical ‘millionaire next door’ usually lives a bit more modestly, and probably wouldn’t be buying at those prices … that is how most amass wealth!

Thank you Maurice for understanding that yeah, it seems like more and more rich people are being made. I remember when Marina del Rey was hot. I also remember when everyone was high tailing it to the Valley and then Orange County. Now everyone (the affluent) seems to be moving inwards.

Interesting comment, Realist, about the shift in the economy. The prosperous do seem uberprosperous and it does seem like there are more of them. I don’t know enough about the growth in certain fields to understand how there could be such a huge shift.

Poli Sci – The gap is indeed widening …. But the question is then – are there more affluent people as Realist suggests, or is it just a geographic shift as Maurice says?

sorry tamales…you misread me. I said the opposite. What you have is access to amounts of credit and debt that was not available before. Whether this was for school, cars, consumer junk, homes etc. This kind of credit was not available. Now any idiot with a temp job can lease a BMW.

That’s what’s different. There are comparatively a lot of really rich people and then there are a bunch of paycheck to paycheck people who like to pretend they are rich. As for education, the housing market rises are driven by access to cheap credit and other schemes to get people to hock their asses to quote un quote ‘own.’

Thanks, JN. I’ve tried to avoid using terms like “hipster” or “gentrifiers” or, heaven forbid, “white people” because I know it gets people all riled up. At the end of the day color doesn’t matter, the hipster look is a fad that’s out of control but will eventually pass, and gentrification just means money …. in this case crazy money. It used to be that the model for gentrification was that true artists moved into a neighborhood. Followed by artsy people. And then the monied bohemian types. Now it’s just money. Thanks for the hand to mouth insight.

@SomePeople CallmeMaurice wrote: “…people are living extremely over extended lives with no savings, credit card bills, and debts…”

You just described most of the people I work with. No savings, no retirement accounts, weekend trips to Mammoth or concerts at Staples Center, two or three vacation trips per year (to Europe, Asia or Australia), brand new leased BMW/Mercedes in the driveway, eating at 4 star restaurants 2 to 4 times a week on worker bee salaries.

@ernst blofeld

I employed these people and knew EXACTLY how much money they were making and how much they counted on the bonus at the end of the year. Hey, if you want to live like today is your last day – more power to you, you can’t take it with you.

But as regards this conversation…why does it seem like there are so many affluent people as compared to yesteryear? Like I said…access to credit and cheap debt. In the past, it was hard to get a giant loan. Not every college kid could get a credit card. You couldn’t just lease a luxury car with barely a job to show.

I think America is becoming more and more like a Los Angeles actor economy. 1 million people come out to become rich and famous. 10 will actually make it and the rest of the suckers will be waiting tables, living in a shitty N. Hollywood apts, paying for acting lessons, head shots, and ‘coaching’ and maxing out their cards trying to look like they’re making it big.

I know people with good jobs who live in super prime areas who are second mortgaged, refi’ed, and HELOCed out the ass. Even with the insane market they would only be able to sell the $2m house (bought for $1m) and walk away with $300k. Where to live then? He told me the guy down the street in a $2m home is on an interest only loan. You think all those people who are showing off are ‘affluent’? Or are they all just shucking and jiving to keep from sinking?

Hi Again,

I think the insight into people’s debt and income is very interesting and probably right on.

However…. I knew people in the 90’s who maxed out their credit cards and declared bankruptcy. I knew people in the early 2000’s who got huge SUV’s with no evidence of income. I knew people in 2010 who lost the homes they had recently purchased.

So I’m still curious about the steady trend of more “rich peeps” over the last 20 years. Remember when the Promenade had Midnight Special bookstore, that bookstore on nothing but architecture, and that vintage clothing store, Muskrat. All of those are long gone, replaced by high end clothing stores Remember the Denny’s on Sunset in West Hollywood where all the big haired heavy metal rockers hung out? Now it’s been converted into a fancy restaurant. La Brea went from being a funky street selling used clothes to being high end. Ha! I remember when The Abbey was just a little coffee shop where you could read or write. And struggling actors live in West Hollywood. Now they live in North Hollywood. In 10 years where will they live? Southgate?

It does seem to me that LA has been getting “richer” …. I’m sure that easy credit may be the explanation. But the steady expansion and “affluent-cation” has been phenomenal. Who would have thought, 20 years ago, that there would be a NoHo? With restaurants etc.? Who would have thought a one story, 2 bedroom craftsman on Gardner would be worth over a million? Credit cards run out. People lose their jobs. But the enrichment of LA continues….

@ Some People Callme Maurice

“You think all those people who are showing off are ‘affluent’? ”

Ask Realist. According to unRealist, they are. He is one of those who belives everything he sees. He confuses the “popcorn” milionaires he sees around LA, who live paycheck to paycheck, with the real milionaires.

@tamales I think what you are talking about is development not affluence. Couldn’t you say the same about any city anywhere. “I remember when these were just farms and empty fields” “I remember when there was a store here instead of a big chain store” I remember when there was a taco stand at the corner of La Brea and Santa Monica. it’s now a target. Does that mean there are more affluent people. I’m not sure…I think that’s just development isn’t it? I’m really asking more than stating.

As a kid I spent some time growing up in Kansas city. We moved to the newest nicest suburbs which were just at the southern edge of developed civilization. It was farms and fields from there. There were brand new shopping centers and schools. Now that edge of development has extended very far to the south. The former great suburb is now the not-as-great suburb and the brand new great shopping mall of my childhood is this…http://deadmalls.com/malls/metcalf_south_shopping_center.html

So I wonder if development with passing time doesn’t necessarily mean affluence…just development.

I used to pay those prices for a Torrance box. There are lots of professional families in the South Bay who work in aerospace, etc who have household incomes around $100K. They want a good school district, and can afford that rent, but don’t make enough to buy. Outside of Torrance, you are looking at an hour commute inland before you get to a comparable school district. That was my situation, and the situation of many of my old coworkers.

So much for Torrance – Explosion reported at ExxonMobil refinery in California

http://www.businessinsider.com/exxon-california-refinery-explosion-2015-2

Because California is a rat hole, as southern Florida is super expensive and crowded. Who with any common sense, would want to live in these hell holes. As for Sacramento, why would anyone want to live there? the city has levees (ditto New Orleans) and could be under water if and when they get lots of rain and the levees collapse. Calif. and Fla. and living on/near the gulf coast is for losers. I left the gulf coast 33 years ago, moved inland 100 miles in Ala.

Going rate in the Southbay (including Torrance) for rentals of a 1500 sq ft home is far higher than $2500/mo. In my zip code the going rate for that home is $3800-$4300. For a crappy, neglected, paint on paint, no AC, crappy heater and old kitchen rental.

Why? Supply and demand, beach, good schools, low crime, some areas have a nice sense of community unlike most areas of LA.

You can rent ocean front in long beach (not far away) for the same price. I don’t get it.

My guess is a Torrance landlord may not care how many people occupy a rental as long as the rent is paid. Long beach Oceanfront landlord, might be another story…

I have a lot of friends in Redondo and Hermosa, who have landlords that wont update their apartments. The exact replies by the landlords are always the same. “I have a stack of applications of people waiting to live here. Why should I upgrade for you when someone else will live here and pay me as it sits?”

it’s the school district …. plain and simple

Interesting item in the worthless local rag — Phoenix “Arizona Republic” — that Scottsdale, has issued building permits for 4000 rental units the last two years, which is the same amount as the total nine years prior. Doing the math, that is 2000/year versus 440/year.

Btw, disappointed the Torrance block was not the 4000-4500 block of Scott St., since that is where I used to live. And we weren’t across the street from a refinery …

I must move now. I have only for 10% down. I could do 20% but that would leave me pretty broke. Got a steady income of about 130K to 150K. Am in my early 60’s. Lost a ton on last home owned. I pay 2700/mo. in rent. I can afford up to about 450K which would put me at about $3500/month mortgage. Pickings are real slim unless I want to live in West Adams. Been waiting since 2013 for prices to come down. They have not. I know this is not an exact science but would appreciate opinions. Should I buy or rent?

i wouldn’t want a mortgage during my retirement years

Good point. Thanks Ben. On top of that income can swing greatly. I’m performance based. Who knows how many years I can perform?

“I wouldn’t want a mortgage in my retirement years.”

Is there a secret to not paying rent if you don’t outright own a home that I don’t know about?

If you can have a mortgage payment lower than paying rent… it makes complete financial sense to have a mortgage payment no matter how old you are.

Rent. In the mean time, build up your savings even more, then when you retire, move to another state or area were you can buy a home in cash.

Thanks Strykker. That’s good advice.

I think Joe Dirt his logic is that if one doesn’t own the house outright and if one must pay monthly for living space then one is better off renting if something catastrophic happens. For example, let’s say a person has a stroke and can’t work. 30 days notice and that person can be moved to a cheaper living space or to a relatives home. Whereas getting out of a house as you know if much harder.

@Strykker, @tolucatom

There’s always Bakersfield. Mediterranean weather!!!! For the price of a brand new Toyota Prius, here’s a $30K crap shack in Bakersfield.

http://www.realtor.com/realestateandhomes-detail/1300-Virginia-Ave_Bakersfield_CA_93307_M13426-72576?row=10

You don’t need to leave California to find affordable housing.

I can rent a house about 1000 sq. ft. in Santa Monica, WLA, Toluca Lake, Hollywood Hills, West Hollywood, and Studio City for about $500 – $1100 a month less that I’d pay for a mortgage on a smaller condo in same area or a house in 90016. Rough numbers comparing Westside Rentals and Listings I’m getting.

YOu want a new mortgage in your 60’s? Are you crazy?

A new type mortgage that is simply magic…

“All with no down payment, no closing costs and no mortgage insurance. The Ongs’ real estate agent, Jill Medley, called it “the best loan in the history of real estate.”

The Ongs already lost a home to foreclosure

http://www.latimes.com/business/realestate/la-fi-equity-building-mortgage-20150103-story.html#page=1

I’d like to compliment our Doctor for providing a great case study.

I could be wrong, but I don’t think anybody would be crazy enough to lend money to someone to buy a house on Doty Ave at current prices, if there was a mechanism to make the person liable for any losses. That would probably mean going to a hard money only lending system.

No disrespect but, you are wrong.

House in LA near ocean is the sort of thing that’s pretty much guaranteed to appreciate. We’re entering a global mobility phase of the elites, and any person with money – from Russia or China or Mexico or Brazil – is buying property in the prime locations. Elite real estate is bought and sold much more like fine art than like the rental income producing asset that it is. OK, this block in Torrance might not compare with Santa Monica or Paris or London, but it is in LA and it is in proximity to the water. In 20 years there’s little doubt it will be worth over $1M and the square footage of the structures will double.

That’s simply ridiculous. You are either a realtor, loan broker, or other type of huckster. No ‘elite’ person anywhere in the world would buy this kind of property…that’s just stupid.

Maybe not but those people have been bidding up the more prime areas for years, which has forced other less-elites into areas like Torrance, which in turn bids up prices there.

If it took 20 years for my $600k to appreciate to $1mil, I would be very sad!

From $600 to $1M in twenty years is 3% per year. My point was that the housing bears can growl all they want, these houses are going to appreciate at above inflation. Buyers aren’t as stupid as they look.

Brilliant. Thanks Doc, ver interesting.

That situation is why we left Torrance last year. Worked in the South Bay, so it was the best nearby school district that we could afford. Loved Torrance, loved Socal, but realized it just wasn’t going to work financially long term. Rented a smallish 1100 sqft house for $2400, even that amount isn’t easy with two working parents. Buying was out of the question. Next door neighbors on either side had multiple adults sharing the houses, with 4-5 vehicles each. House was still in good condition because it was single owner, with a Boomer landlord who inherited it free and clear. She sold for $650K after we moved out.

There are a TON of middle class Boomer owners in Torrance who could never afford today’s prices. These are neighborhoods that the wealthy just won’t be interested in, and the Japanese demand will also take a hit with Toyota’s future departure. I think prices will eventually drop, but I just wasn’t willing to wait a decade for that to happen. I only have so many working years! We have an amazing home now in the Southeast for a fraction of the price. Will definitely visit Socal again in the future but will never move back.

Humidity? Hurricanes? What are the entertainment options in the Southeast?

Humidity and Hurricanes are easier to plan for than a major earthquake. $250K gets you a MUCH nicer house anywhere from North Carolina down to Florida and with all of the savings, entertainment options mean being able to travel.

My Aunt & Uncle sold their crapshack in San Jose (bought it in the 70’s) last year and bought a much nicer place on 50 acres in Texas for a fraction of the price AND an RV nicer than any of the homes listed in this article. Now retired and RV’ing all over the country on their retirement income.

Are the entertainment options in CA really that great if you are 50+?

Absolutely not…

The Realist: Humidity? Hurricanes? What are the entertainment options in the Southeast?

US is not just SE. NW doesn’t have humidity east of Cascades, no tornados, no huricanes and more entertainment than time available. For the amount of a downpayment for a crapshack in SoCal you can have a nice house, new, in the fastest growing city in US – Kennewick or Yakima with lots of good paying jobs. Instead of one season you have 4 with very mild winters – these days 50-60 degrees.

@The Realist, as bizarre as it may sound, the entertainment options in SoCal are not that great. Ticket brokers (aka legalized scalpers) get all the good seats at the concerts. One cannot think that paying $600K for a crap shack justifies the entertainment options in SoCal.

How many people use the many “entertainment options” in places like L.A. or NY?

I grew up in NYC. I never attended an opera. Never went to Carnegie Hall. Been to the Museum of Modern Art only once.

I’ve lived in L.A. since 1987. Been once to the La Brea tar pits. Once to Staples Center.

Most people spend the bulk of their lives at home, at work, or on the commute. What’s the good of living within driving distance of museums and concerts if you spend most of your time in a crapshack amid crappy neighbors?

I don’t think that is the point! If you live in So. Cal. you live with the threat of earthquakes, and wildfires! The real point is that talking about how much your home is worth is just talk, and saying that the prices will just go up, is dumb, since we just came out of a housing bust! Perhaps smart money is cashing out all that equity, finding a cheaper house somewhere else, having money left over to enjoy retirement, travel, or simply to reduce the stress, and not being house poor!

We found in Socal that entertainment options do zero good if half your take home pay is going towards rent.

As someone alluded, for two working parents, 90% of the days are spent going to work, going home, cooking dinner, getting kids situated, then going to bed. That routine is exactly the same anywhere.

For entertainment, New Orleans, Memphis, Birmingham, Gulf Coast are all within an easy days drive. We spent New Years at Miami Beach. Its nice now having the budget to actually be able to do things.

Not having an exploding refinery within 2 miles of our house, and better air quality is nice now as well.

North Torrance is not the better part of the city. $609,000.00 for 1161 square feet? I’m guessing the lot is around 5500 square feet. This is not a good time to buy.

Had a conversation with my landlord this weekend when he came over to fix something.

He was saying how housing prices are going to GO WAY UP next year, and the current die-down is just the “winter lull”.

I said really? What makes you think that? He said “demand”.

No reasoning to how people are going to pay for it.

What is happening … the highly educated high income are moving to trendy coastal cities like NYC, LA, SF, DC, and Boston. This is the money driving prices higher. At the same time, people who can’t pull down the big money are leaving NYC, LA, SF, DC, and Boston for inland cities. That does not mean the elite coastal cities are any more fun than the inland cities. In fact, some of the inland cities are quite desirable. However, this is the money train driving prices higher in the elite coastal cities.

I do not see a “current die-down”. Actually, I am seeing a lot of places going pending. I think the recent drop in interest rates are causing the current mini boom.

I have the money to live in the elite coastal cities since I bought in during the 90s when I was in my 20s, so I will stay. However, if I was not in, I would not be willing to pay the substantial prices in today’s market. I would relocated to somewhere else … there are lots of great places that are much cheaper. For example, Scottsdale is very nice. So is the gulf coast of Texas. If I was starting out today, that is where I would be. The elite coastal cities are just way too expensive, and it appears they are headed higher … clearly not worth it if you are not already in.

North Scottsdale is, no doubt. South Scottsdale, on the other hand, is iffy …

I would have loved to have taken a counterpoint to what he told you. I’m not sure what city you live in but here in the city of Glendora there are at least 5 sites where new building is occurring. The link here (which does not count as one of the 5 sites) shows some new units which were finished a couple of years ago, of which, there are still some for sale. http://www.southlandproperties.net/idx/mls-cv15021677-425_south_glendora_avenue_glendora_ca_91741

Not shown is the beautiful south view of the railroad tracks and that of the back of an Albertsons along with some other stores in the shopping center. The north view is of the post office. I know there is similar building also happening in some neighboring cities.

If the building does complete (the last time the rate of building was like this was around 2008) there will be at least 400 plus new homes (not including the current inventory) in a city that usually has between 150 and 200 homes for sale at any given time. There are also lots of more for sale signs popping up and it is very evident that many of these are flippers (multiple trucks out front and work going on but no one actually moving in).

I was at lunch about a month ago and one of the people at the table was talking about all the ‘equity’ that he had in his house. He was trying to convince another friend at the table that now is a great time to buy and if he doesn’t he will miss out. What is more amazing was the hubris toward (what now seems to be the tautology once again) the value of his home and homes in general as to how home values will never decrease. He did admitted that there could be a dip in prices but it wouldn’t be very much.

Simply put, it’s amazing as to how short our memory is in regards to past events. I remember having similar conversations back in 2007 – 2008 and yet, here we are again. With the fed no longer purchasing 40B a month in MBS from the big banks and the bond purchasing program supposedly coming to an end, how much longer can this farce continue? I have had my own doubts since the advent of Q.E., but with home values continually increasing and the S&P 500 at an all time high, maybe those in the camp of “deficits don’t matter because we owe it to ourselves…” are right. My hunch is that they will eventually be proven wrong but I am starting to wonder if that will actually happen.

I’m in Eastern suburbs of Sacramento – hardly prime coastal city 🙂 It is one of the nicest areas in Sacramento though, with excellent school districts – but still – It’s Sacramento – cow town State workers for the most part.

Most of the buyers in my zip are Bay Area transplants – the locals can’t afford to buy here anymore. We have a decent amount of building going on too. Half of the new homes are bought by Baby Boomers (I can never figure out why people who can hardly walk buy 2 story 4000 sq ft mansions) and the other half seem to be either Bay Area young couples BUT I notice those homes have 4-6 cars parked out front which I suspect = more than 2 adults living there to cover the mortgage.

It’s just a weird market all around.

My old office was around the corner from the Glendora development you speak of. I’m still in the area quite a bit and Glendora is a funny place. This “Little OC” of the San Gabriel Valley is full of older conservatives who think RE appreciation is a God given right. Much like you I had the EXACT same conversations with these types in 2007. They don’t get that the stupid .goc policies they supported since Regan have created a generation COMPLETELY unable to support the housing ponzi. And the myth is that most of these guys have houses nearly paid off. Just like in the OC they have the burning need to “Keep up with the Jones”.

The last crash was brought on by a very short period of flat prices followed by a small pullback. It was that pullback that led the banks to kill the NINJA loans and from there it was look out below. Same thing is happening now accept swap out NINJA loans with specuvestor cash momentum purchases. We can have a precipitous drop even on low inventory/volume. If the banks aren’t lending to all but the most credit worthy and documentable and there is no momentum for specuvestors to buy into, we’ll be back at 2011 prices soon enough.

“Does it make sense that only a handful of sales determine the price of current listings? Maybe it does but few bother to examine this assumption. After all, you can’t fault a seller for trying to get as much as they can. I’m surprised I haven’t seen this analysis conducted but why not examine all home sales for a block of housing?”

Time Value of Money. $170,000 in 1994 was worth more than $170,000 today so using old sales are worthless. Now… if you took that $170,000 sale from 1994 and calculated what it’s purchasing power is worth today based on a 3% to 5% inflation rate, you might be on to something interesting. Compounded at 4% for 21 years = $393,232 in today’s dollars. (Homes are more of an inflation hedge for the long term.)

Regardless… I always use Rent vs. Buy calculations and ROE calculations when determining if it makes financial sense to buy or rent.

The $609,000 listing with 20% down at 4% interest is coming in around $2892 PITI so before any tax deductions (depreciation if it applies), there will be a negative cash flow. (Depends what your tax rate is.)

There’s certainly no one size fits all when it comes to real estate…. and it is more complicated in buying right to begin with then just an appraisal.

My analysis — NO WAY I would buy 18826 Doty Ave for anything more than $500K with 20% down.

I’m looking at a house in northern Huntington Beach. LP is 600K for 1200sqft for a house built in the 60’s. Despite the age, the house appears to be in good condition. This house sold for $462K in 2009. In terms of the comps, this house doesn’t appear to be unreasonably priced. What do guys think? Does a house such as this qualify as a “crap shack?”

execute…Please understand comps are overrated in such a bad housing market that is occurring. No matter what anybody tells you the Re market overall is not good so throw comps out the window many folks need to sell and sell now.

Getting back to a good buy look, 1200 ft home $500 a sq. ft. do you need any of us to tell you that you should run from such a house???

robert,

thanks for your response. I’m not surprised by your overall answer although it does lead to another question: What do you think a reasonable price is?

Looking at the LA Case-Shiller metric: http://us.spindices.com/indices/real-estate/sp-case-shiller-ca-los-angeles-home-price-index, it would appear the slope of the curve has leveled out… indicating the possibility that prices may decrease in the months ahead. But even in the event of a negative price correction, how far could things fall? Using the last bubble as a reference, the peak to trough was 273 -> 159, or about a 40% drop. It’s worth noting that the bottom of the last bubble had prices still well above anything that preceded it. Since the magnitude of the current bubble doesn’t appear to be as extreme as the mid 2000’s one, maybe the correct will be even smaller?

@execute,

Many firmly that the “last bubble” never ended and that it merely was reflated into where we are now by extraordinary Fed and government actions at all levels. Thus, the fall in prices would have been much more severe if those agencies did not step in to backstop prices and restore buyer confidence. If prices resume falling despite all-time low interest rates, banks cooking their books, and record buying of overpriced MBS, what other actions could these same agents of manipulations could desperately resort to? I think that the RE market is trying to correct itself despite the magnitude of institutionalized manipulation.

Zestimate of $505,000? Never ever make a housing purchase on Zillow or really any RE site. Like pictures that agents show of sellers homes, till you actually see the property and what it has to offer a estimate based on comps that are mostly outdated and in many cases not even within 5 miles of the subject property is not only a big mistake but a miss justice to true RE values.

Paying for example the Zillow estimate price of $505k would be overpaying let alone the listed price?

The article below is a good one for what is “trending” in RE, prime areas included (not to the same extent as IE).

February 17, 2015

The End of the Global Debt System Approaches

The 2008 Crisis was not THE Crisis.

The 2008 Crisis was largely a banking crisis focused on securities. The REAL Crisis will hit when the bond bubble collapses.

The current global monetary system is based on debt. Governments issue sovereign bonds, which a select group of large banks and financial institutions (e.g. Primary Dealers in the US) buy/sell/ and control via auctions.

These financial institutions list the bonds on their balance sheets as “assets,†indeed, the senior-most assets that the banks own.

The banks then issue their own debt-based money via inter-bank loans, mortgages, credit cards, auto loans, and the like into the system. Thus, “money†enters the economy through loans or debt. In this sense, money is not actually capital but legal debt contracts.

Because of this, the system is inherently leveraged (uses borrowed money).

Consider the following:

1) Total currency (actual cash in the form of bills and coins) in the US financial system is little over $1.2 trillion.

2) If you want to include money sitting in short-term accounts and long-term accounts the amount of “Money†in the system is about $10 trillion.

3) In contrast, the US bond market is well over $38 trillion.

4) If you include derivatives based on these bonds, the financial system is north of $191 trillion.

Bear in mind, this is just for the US.

Globally the bond bubble is north of $100 trillion. And this $100 trillion has been used as collateral for a derivative market that is well north of $555 TRILLION.

Again, debt is money. And at the top of the debt pyramid are sovereign bonds: US Treasuries, German Bunds, Japanese Government Bonds, etc. These are the senior most assets used as collateral for interbank loans and derivative trades. THEY ARE THE CRÈME DE LA CRÈME of our current financial system.

So, this time around, when the bubble bursts, it won’t simply affect a particular sector or asset class or country… it will affect the entire system.

The coming crisis will not be another 2008. It will be something much much worse. The 2008 Crisis was caused by an implosion of the Credit Default Swap market. At that time, the entire CDS market was roughly $50-60 trillion in size.

The interest rate based derivatives market is TEN TIMES larger in size: north of $555 trillion.

Best Regards

Graham Summers

Phoenix Capital Research

Summers missed the BIGGER picture: the derivatives market is INSANELY concentrated — with less than FIVE players holding the ‘OTHER SIDE’ of ALL of the interest rate ‘hedges.’

And, naturally enough, these are the exact same institutions that are To Big To Fail/ essential hubs on the SWIFT backbone for international trade.

JP Morgan Chase is the biggest gorilla of them all.

It’s not the size of this market — it’s that it’s FOUR mega-players — backed by the US Government (defacto) against the entire rest of the world. YIIIKES!!!

When the term derivatives is brought up — remember that they are virtually all of one character: insurance against debt fiascos:

Interest rate jumps

Roll over crisis

Sovereign repudiations

They are, by definition, entirely concentrated against the debts of MAJOR issuers, ONLY.

It’s impossible to buy (at a rational price) a CDS on corporate (high yield) debt, or dinky municipal bond issues.

The CDS market is massively concentrated towards sovereigns and rate hedges.

What this means is that political-economic crisis must rocket through the SWIFT system into international trade repercussions at lightning speed… almost like the dockyard slow-down currently underway along the entire West Coast.

TPTB have backed themselves deep into a corner. ANY attempt to normalize the interest rate curve MUST implode the biggest players. They can’t unload their risk/ reverse their positions.

This is what doomed AIG. (American International Group) Right up until the implosion, AIG was under-writing virtually the ENTIRE CDS default ‘book.’

Notably, the top book-maker/ bookie for AIG in London was taking ALL of the premium income to his ‘bottom line’ and walking out the door with astonishing paychecks — for himself and everyone in the office.

NO PREMIUM proceeds were being held back for claims!

The alternate term for this is “Control Fraud.”

The top four mega-banks are engaged in hyper- Control Fraud. Hence the insane figures cited by Summers here.

Like the South Seas bubble the end will surely come… because the players are not for turning.

It’s the financial equivalent of Adolf in his bunker.

I wouldn’t call it the bunker by analogy. Stalin was outside the door with a lot of things that go “BANG”, these guys have made sure they are untouchable. There is no storming of the Bastile to take their heads off this time. Sure they talk up that Putin can come knocking on The City door (London) and bash heads but not likely this time. putin et tu porte is a boogeyman tale today. They own the judge juries and executioners this time. They will blame the scapegoat, I will let you guess who that is this time around. This time it is just a game of chicken to see what fiat remains standing. The odds for USD are better than EU, GBP, Yen or any of the other useless pieces of paper. Fiat is only real if you think it will still be there when you wake up again.

“… derivative market that is well north of $555 TRILLION…”

What’s after a TRILLION? A Gazillion? Jusk Askin’

Hey Doc,

its been a while since we saw a ‘real homes of genius’, here is one in mid-chitty LA.

Purchased Summer of 214 for $371K now listed for $649K with some home depot lipstick of course.

http://www.trulia.com/property/3134237120-2334-S-Redondo-Blvd-Los-Angeles-CA-90016

in a unsavory area and plenty of freeway noise 24/7

This would be a cute house for, say, $200K or so. Maybe $250K.

Too bad the sleek kitchen reno is completely out of character with the house. Something more traditional and “Spanish” in character would have been better.

Still, it’s a nice, livable house. At some point, we will have another 2008-style bust, and many HDTV rehabs just like this one will become available to some nice moderate-income family at a reasonable price.

Here’s a bizarre news story: A buyer was outbid for a San Diego house, and turned into a crazed stalker, harassing the couple who outbid her: http://www.dailymail.co.uk/news/article-2956508/Woman-53-ordered-stay-away-young-family-outbid-dream-home-moves-just-ONE-MILE-road.html

I read about this demented woman. What a case- a prematurely aged hag, 53 yrs old- going-on-82 by her appearance, is so obsessed with a particular house that she threatens and harasses an innocent young couple. Damned demented old bat needs to be put away- she is a menace to anyone who gets near here and will, given time, go right over the edge to outright physical violence.

So much for Hollywood Hills – Pipe bursts, sending 100,000 gallons into Hollywood Hills neighborhood

http://www.latimes.com/local/lanow/la-me-ln-water-main-break-floods-hollywood-hills-neighborhood-submerges-vehicles-20150218-story.html

No matter how much you polish it a turd is still a turd. Homes in and around LA are old. Many date back to the 20’s & 30’s. Homes this old will require a lot of extra maintenance. On top of that you most likely have all kinds of different mickey-mouse repairs done over the years by previous owners. Many 1st time home-buyers are not prepared for this especially after leveraging themselves to the hilt to make the purchase. Most people hemorrhage money for the 1st 6-12 months after purchasing a home. Home inspections don’t reveal many of the day to day issues you discover when living there.

My sister hired Magoo to perform a home inspection on her 1962 era purchase.

Five-years on, the wiring — and more — was still being corrected.

Never buy a house that’s been ‘fixed’ by Larry Klink.

If you want a REAL home inspection — hire an electrician, a plumber, … et. al. each in turn to eyeball their own field.

The home inspectors (of ill repute) actually have NO IDEA of what constitutes code infractions — and need for immediate remediation.

Decades ago, my college buddy’s father — a life long BANKER — with ZERO field experience got in on the ground floor of the HI ‘craft’ — yes that was two-score years ago.

He’d waltz around a property and bag hundreds of dollars… personally.

Then as a home loan officer, he’d sign off on his ‘inspected’ property as collateral against a mortgage. (World Savings, btw) [ long dead, too]

World Savings ultimately became the wealth vehicle for the Meyers clan [harpooned by SNL back when] [threatened Meyers lawsuits had SNL edit them out of all subsequent re-broadcasts of that opening skit] — who — if you recall — unloaded their turd right at the top of the mania — and now send their big bucks off to hyper-liberal causes. [The couple is second only to Soros for seed money for hyper Leftist causes. … The other hyper Leftist sugar daddy is in the Federal pen: Bernard Madoff.]

Does that tale sound familiar?

[ hint, hint: Countrywide ]

The housing will remain in stagnant state for a long time, at lease for few more years… The FED will be patient indefinitely. They will never again raise rates substantially. They will do anything, including directly buying stocks, to prevent this bubble from popping.They are all in and betting against them is at least unwise. Don’t be surprised if the FED owns the same percentage of US stocks as they do treasury debt at some point. Economic survival depends on it and they know it. I wish it were not true, but I strongly believe it is. I would call it the the prolonged plateau in housing and stock prices. The demand will keep stagnant, the supply will keep stagnant, the prices will neither rise, nor fall. I’ve given my prediction earlier on 2016 housing tank and now I am in doubt it will happen even then, I am now thinking more of 2020… Don’t expect the flood in the new inventory in spring – summer of 2015 season, not going to happen. The rents are still hot. The investors will keep the rentals, the flippers would not flip and also keep the properties as rentals. Most people stay put…

Correct! Call it peak prosperity, plateau, eternal stagnation. Like you, in many of the things I said I wished I would be wrong but I am not.

In the Sacramento Bee today: “Sacramento home sales fall 29% in January”.

The Sacbee is usually singing a different tune, just last month it reported on hos “robust” and “unstoppable” the Sacramento real estate market is!

Leave a Reply to robert