Pitching tiny homes to aspiring hipsters: Glassell Park and 869 square feet of HGTV renovations. When the down payment becomes an issue.

There was another article showing that the LA/OC metro area is the most unaffordable housing market based on incomes of those living in the area. People point to rising prices or rents as somehow a condition of economic resurgence but all it means is that more money is funneled into real estate. And speculation again is rampant. Just look at the number of rental households we have added. If voting with money is a true indication of “want†people are going towards rental housing. Even for a $700,000 crap shack the numbers start to pencil out with a 20 percent down payment ($140,000). But even a couple making six-figures will have a long journey to save this much even with low interest rates. And this is what has changed over time. The down payment strike point was easier to save in the past versus today where people are diving into more expensive mortgages with down payments in the 10, 5, and even 3.5 percent range. Of course lower mortgage rates allow for an underlying inflated value to emerge. From 2006 to 2013 LA saw an increase in the rental population by 11 percent. Today we look at a Glassell Park HGTV home to see how marketing is done to the hipster crowd.

Chasing the Glass-ell dream

People mistake correlation with causation. For example, we look at wealthier US households and yes, most own real estate. But did the wealth come from owning housing? For the truly wealthy, their primary residence is a small part of their portfolio. We are not talking about your Purina Dog Chow eating boomer shopping at the 99 Cents Store while holding onto their million dollar home without cashing in on the equity. Do you think it is a prerequisite to buy a sub-1,000 square foot crap shack to be on your way to millions? What about the 7,000,000+ foreclosures that occurred since the crisis hit? Of course as Nassim Taleb would argue, this subset of people are erased from the history books only to look at the winners (we don’t see Enron or WorldCom trading on the stock market). You might have a home that went through one, two, or even more foreclosures yet overall the price rose over this volatile period.

You then get this simplified argument that high income households represents a good portion of the targeted buying population. What people forget to mention is that a large number already own. So who is left to buy? You think high income households are going to buy in a toxic neighborhood and be the guinea pig for gentrification? Take one for the team? Apparently not. That is why big investors and foreign money has been a big play in the California housing market and why people continue to run the numbers. It isn’t a simple buy or rent argument.

Let us take a look at this home in Glassell Park:

2456 Sundown Dr, Los Angeles, CA 90065

2 beds, 1 bath, 869 square feet

This picture makes the home look epic.  2 beds and 1 bath is a tiny place. Let us look at the ad which clearly caters to the hipster crowd:

“Picture a view worth a 1000 words, wrap around deck & patio for morning coffee, intimate dinners & grand affairs. Kitchen to impress guests, chefs & gourmets alike. Master bedroom opens to morning sunrises & evening stargazing. Nurture your inner artist, musician, yogi or even CEO in your studio with doors opening out to a vacation like feel of bliss. Architectual style and remodel so hip and clean, par excellence.â€

Damn straight those will be intimate dinners in 869 square feet. You can take your Whole Foods kale salad and entertain the two people that will fit in your kitchen. Nurture your inner artist? Musician? Yogi? Or even CEO? Why not just say “come one, come all hipsters!â€Â The place is listed at $715,000:

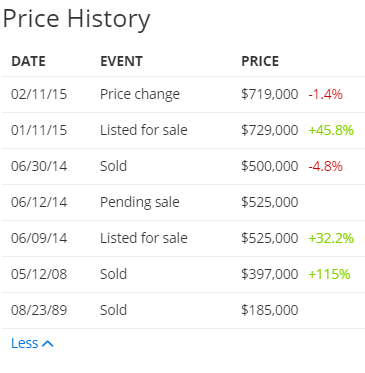

This place sold last June for $500,000. So it looks like someone feels that they added $215,000 (50% in value) over the last few months. Here is the Google Streetview:

Better enjoy hilly living. Also, take the 2008 price of $397,000. For this zip code, the AGI tax data for 2008 was $46,741 for a household. Today, it is roughly $50,000 but somehow this place is now worth $715,000? Basically the price from 2008 is up 80 percent while incomes are stagnant. A 20 percent down payment in 2008 was $79,400. Today it is $143,000. A household that can save that chunk of change is unlikely to live here. What you will have is people leveraging their brains out to live here.

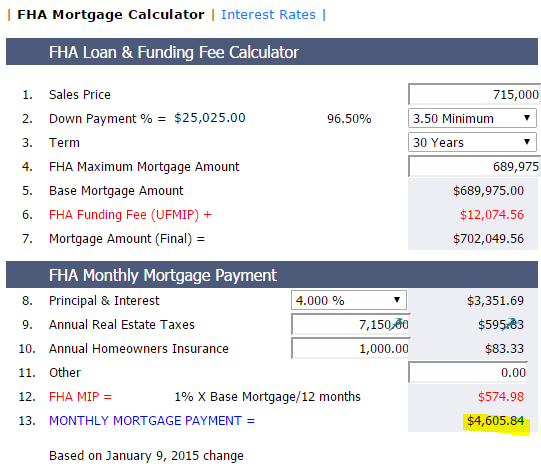

So how much will it cost you per month if you buy this place with 3.5 percent down ($25,025 down)?

$4,605 per month if you go with FHA. For this Glassell Park place. The reason first time buyers are smacked out of the market and largely becoming renters is because the down payment is too much for their budgets AND the monthly payment. No investor is going to buy this as a rental. So the ad is targeting the hipster crowd.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “Pitching tiny homes to aspiring hipsters: Glassell Park and 869 square feet of HGTV renovations. When the down payment becomes an issue.”

Things are about to get interesting 🙂

I think you called the top…. Plateau or crash… Anyone’s guess

Yup, $4.6K a month for a tiny piece of the American Dream!

In a premium global city, with the weather and entertainment capital of the world, that’s not bad. You will pay more in SF or NYC.

Trollo-lo-lo-lo-lo 🙂 🙂 🙂

People will still buy. Many people have money from the parents. Especially asian parents. They always help their kids with downpay. Besides, there should many people making over 200k in LA area. Those ones in finally industries makes bank.

Financial industry I mean

those ones. nice!

Check the Google Street View on this house. (I wonder how they managed to get the Google Car in there?) https://www.redfin.com/CA/Woodland-Hills/22141-Costanso-St-91364/home/4185407

Go from Isabel St, turn on Roseview, then take it to San Rafael Ave. You end up at the corner of San Rafael and Moon, and that’s the steep curvy hilly street that has an absolute gorgeous view of the Eagle Rock area, and you will realize that is the street that is easily viewable from the 134 as you are heading west. People probably ask “what is that street”, well that’s it.

Keep going down, you end up on Ave 50, then hang a right to Eldred St. The steepest in Los Angeles and the 4th steepest in the WORLD! Aweomesauce!

Holy Crap! I live right around the corner from Eldred, drive past it all the time, and never realized how steep it was back there. I “drove” up it using Google Maps, and thought, “This doesn’t seem that steep.” And it doesn’t…until you turn the view around and look DOWN the hill. Wow!

“…& grand affairs”

A party of 5 considered grand these days?

I think the endgame of the government bond bubble is obvious. There won’t be any defaults, and they won’t try to inflate away the debts. Everyone wants growth and debts inhibit growth. Eventually, they’ll just print debt-free money to pay down the debts. Economist Steve Keen will be all over the media with his debt jubilee idea. I think Bill Still has also been proposing similar ideas.

If the rich keep getting richer and squeezing the poor so much, it will lead directly to Keen’s idea of QE for the people. I believe this is going to be the moment when inflation takes off, so it would be wise to go long tangible assets and maybe TIPS before then.

It’s going to make a few people upset that loading up on debts gets rewarded with forgiveness, but they will be a minority. Flyover mentioned that 1 trillion dollar annual government deficits aren’t sustainable. But didn’t the Fed effectively retire $1 trillion of government debt through QE? So in other words, there will never be a funding problem.

Two important forms of debts that the Fed hasn’t been able to retire are household and corporate debts. That’s where the debt jubilee will come in.

The major bubble we have today is the full employment bubble. Everyone seems to firmly believe that jobs are the key to economic prosperity. Of course, this is nonsense. If we worked 70% less, then we’d have more free time and a much higher quality of life. That is true prosperity.

We are already at a point where more than half of people are single. That’s in large part because we are too busy working to find a significant other. Isn’t that crazy? But this is great for the economy because single people spend more money, boosting GDP. You think that’s a coincidence or have we become economic slaves to the point where the choices we make in life are mere illusion?

@Vegas Landlord wrote: “…Two important forms of debts that the Fed hasn’t been able to retire are household and corporate debts. That’s where the debt jubilee will come in…”

Au contraire. There’s about $24 trillion dollars in retirement funds that are invested in debt (aka bonds). Any debt jubilee means there’s many Baby Boomers out there who will be eating cat food, shopping at the 99 cent store and getting a job at Wal*Mart or McDonalds at the ripe old age of 70 if that debt jubilee happens.

The $24 trillion in retirement funds dwarfs the $2.5 trillion the Fed printed out of thin air.

Less work and more technology is definitely appealing and a nice dream, but the reality is we are global now and there are people out there willing to go 10+ hours a day, 7 days a week. If you want to be in the game, that’s what it takes. Listen to people on Shark Tank or guys like Donald Trump, they got where they are sleeping 4 hours a day.

Here we are, again, looking at another collapse. The problem today is we are on a global dollar standard. A paper money standard can work, but only if you maintain confidence in the money . . . and you do that by running a good economy and having a good business environment . . . we’re doing the opposite. We are printing a lot of money. We have a lousy business environment. Taxes are too high. Growth is too low. So, a lot of things are combining to undermine confidence in the dollar. The last time the system collapsed in 2008, the Fed rescued it. How did they do that? Well, we know the Fed printed over $3.5 trillion in new money in the last 5 years. The Fed’s balance sheet went from $800 billion to over $4 trillion. People understand that. What’s less well known is the swap lines with Europe . . . European banks had dollar liabilities because they borrowed money in dollars. . . . Where did the European Central Bank get the dollars they needed to bail out their own banks? They got them from the Fed. They gave us euros and we gave them dollars. So, these dollar/euro swaps were in the tens of trillions of dollars. . . . In addition to that, the Fed guaranteed every money market fund in the United States . . . and they guaranteed every bank deposit in the United States. Here you have a massive $60-$100 trillion bailout, not the $4 trillion you were told. Fast forward to today. When the next collapse comes, it is going to be bigger than the last one. It’s going to be exponentially bigger. The five biggest banks that were too big to fail in 2008, today they are bigger. They own a larger percentage of the total banking assets. . . . When you double or triple the scale of the system, you don’t double or triple the risk. You increase the risk by an exponent that could be 10 times or 100 times.

Thanks for reminding us again that runaway inflation is just around the corner. The same corner it has been hiding behind for 6 years? 7? I lose count.

Good point about the EU swaps. From the previous comment, the FED will just buy everything comment, I say what happens to the dollar then. I say it will become way less valuable, maybe lose reserve currency status. Other countries won’t just sit there. China and Russia among others are preparing for this.

Already in the second week of February and the asking price reductions still coming in across the board. More organic sellers are dropping asks below what they paid five or more years ago. Getting down to the wire for a rebound from last year’s trend of price reductions. I understand that one of the housing gospel choir members has been singing tunes recently about what’s trending.

“But didn’t the Fed effectively retire $1 trillion of government debt through QE?”

NO it didn’t. Today, the national debt is more than double from 6 years ago and growing super fast. If you want to go long, and anticipate the year of “jubilee” be my guest. Buy the houses the Doc is presenting above and you’ll be rich ….:-)))

I promise no competition – at least from my part.

Are you saying that you believe the Fed is going to reduce its balance sheet in the future? If the Fed balance sheet only grows in size, then for all intents and purposes, the bonds they’ve purchased have been retired.

I remain long US treasuries.

California housing is more of a bet on jobs. Nevada housing is more of a bet on leisure, welfare, and retirement. I don’t see any imminent threat to the jobs bubble, but I don’t like jobs. I think we should all be retired by now.

US foreclosures hit a 15-month high in January

Read more: http://www.businessinsider.com/r-us-foreclosure-activity-rises-5-percent-in-january-realtytrac-2015-2#ixzz3RXQYwSOQ

I don’t know if you’ve ever been to Glassell Park but it’s a cool place to live. King Taco and Super A Foods are neat places to live next to, and you are literally minutes from York Blvd and all the action over there. You can be at the Glendale Galleria and Americana in 15 minutes on a weekend afternoon. Hop on the 2, and it’s Old Town Pasadena or a day at Echo Park and all the delicious street vendors there. I have wonderful memories taking my children there a few years ago every Sunday. This is actually a very, very cool property and location as the Eastside (reference Eastsider L.A. website) is heavily trending. Silverlake started it all.

Ha! Being a musician, I spent the last 15 years all over the East side, and my friends still live in Echo Park, Glassel Park, Frogtown, Atwater Village, Highland Park, etc. Outside of Silver Lake, it’s still pretty dirty and awful, and it’s only the kind of place you’d want to live if you’re a broke musician. Maybe it’ll finally gentrify, and maybe it’ll be a good investment in the future, but it’s currently a pretty low quality place to live.

Yes. living near a taco joint is definitely worth 700K. It’s statements like this that prove how ignorant and delusional current buyers are. After spending 700K on this 1952 hipster crapshack, all you will be able to afford is tacos.

You hear this kind of justification a lot from this poster.

Yes, but where else can you eat Tacos if you move out of CA. It is worth paying 700k for a crapshack for the priviledge of eating Tacos…sarc.

@Hunan, for $700K, a person could buy 10 of these taco stands and start their own business franchise instead of buying a single $700K money-pit crap shack.

“Trending” is just neckbearded hipster talk for “massive housing bubble”.

If the LA Times is any indication, last week it was all about the Grammy’s, this week, who will be presenting at the Oscar’s, and there is always a piece on which celebrity is buying or selling. So. Cal. is about pretense, living in a dream world! It is taboo to discuss affordability, housing bubbles, rampant gang problems, a crumbling infrastructure, public pension liabilities, dockworker strikes, or anything else that would spoil that mid-morning latte in places like the now chic Manhattan Beach, or Newport Beach!

I remember when the Japanese had extra dollars and they dumped it on L.A. real estate and later lost because they paid too much. The same thing is happening to the Chinese. Wait, they will lose too when things turn around.

People are not forced to live in L.A. They are free to leave. Apparently the benefits are greater than the costs, or people would leave and go to that fabled land of Texas.

I moved to Texas and moved back to California… Also tried Florida. Both states offer lower cost of living and low taxes but you definitely get what you pay for it. I’m in Coastal South Orange County, and the quality of life here surpasses anything either state can offer. In Texas, it is very uncomfortable unless you are socially conservative (better yet, Southern Baptist) and Florida is home to the biggest population of White Trash imaginable. We think we have problems? Where I live (south OC) is tidy, orderly, extremely low crime and has amazing weather.

Thanks for your perspective! That’s pretty much what I know would happen with me if I moved to Florida, Texas or almost any other state. Although, South County is pretty conservative/religious, too, from what I’ve gathered. Probably nowhere near Texas, though. I’m slightly conservative, but definitely not religious.

I live in central OC now, but the one place I’d like to try is the Bay Area. My significant says she is too grounded here, though, and RE prices there are more ridiculous there than OC. OC seems to get hotter every year (warmer summers, warmer winters), and the Bay area would seem to be a nice reprieve from the heat while still offering a lot to do.

You have a point Chris, the best counties of Texas like Collin also have poor latino areas just like South Orange County. I saw one school in plano that had over 80 percent of the students on free and reduce and most where latino and Afo-american. Texas has a much higher afro-american population than Orange County. Texas has two In fact Arizona and Colorado are also cheaper than OC but don’t have as many afro-americans as the big Texas metro areas along with Latinos. Also, the oil glut may or may not layoff about 50,000 workers in Texas and other industries like restaurants and hotels that relied upon California from Clinton to Obama kept interest low which encourage the high price here. They wanted to get reelected and didn’t want a downturn at leas Clinton and Bush but it drag the economy longer by keeping interest rates low.

Too bad that traffic in South Orange County is horrendous and you all have to drink recycled toilet water because there is not enough water! We used to live in Laguna Niguel before before it become built up with wall to wall housing. We cashed out and got the hell out of SoCal that looks more and more like Tijuana.

I think you’re broadly over-generalizing Texas and Florida.

Southern Baptist? “White trash”? Both Texas and Florida have plenty of Catholics and Latinos, and even black areas. Many Haitians and other islanders in Florida, as well as Jews.

It’s been many years since I was in Miami, but I recall a nice, modern city, with a lively nightlife, at least near the beaches. Very diverse ethnically. Yes, it has its share of ghetto neighborhoods, as does any large urban area, Los Angeles and Orange counties included.

Austin is liberal, and has a lively music and indie film scene.

Orange County has plenty of trashy areas. It’s been a while since I’ve passed through Santa Ana or Anaheim. Both those cities have crappy areas.

calinomore – could you please elaborate how Irvine compares to Tijuana?

@calinomore, you’re a racist moron. Laguna Niguel has a white population of 80%, and the hispanic population is 13%! Hardly Tijuana. Guess that 13% is a little too “colorful” for you.

@ Abe My recollection was the Japanese lost their money in commercial (office towers, strip malls, etc) real estate not SFH.

I am a Ventura native who moved to the Nashville area 10 years ago, and am been longing to move back home. I’ve saved a good chunk of change, I work from home so don’t have to commute and I make over six figures. Of course going from no state income tax to 9.3%, plus double health insurance costs (I’m self employed), and topping it off with insane prices for tiny, old, unrennovated junk is making me wary. But, my lifelong friends and some family are there, and I miss the outdoor lifestyle (and the Mexican food!).

I’ve been watching the market and keeping up with blogs like this, and I’m wondering if someone can say, in layman’s terms, if the so Cal market is due for a big reduction, or if it looks like prices will rise or stay the same for the unforeseeable future.

Don’t want to come back and end up in a tiny rental in an unsafe neighborHOOD. Thanks for any feedback.

Ha, good luck with getting any reliable prediction on real estate. People can guess, some better than others, but the reality is that no one knows. General consensus seems to be that prices may deflate a bit at some point, but when and by how much is a crap shoot.

We rent a 1,400+ sf townhome built in 1994 in central OC for $1900/mo with two master bedrooms + an office (we also own a separate place, long story). The complex is very nice, though the surrounding neighborhood is marginal. We’re just biding our time here until we can (hopefully) move to Newport Beach when prices (hopefully) adjust a bit. So that’s what you might expect to pay for rent in OC for something livable.

“I’m wondering if someone can say, in layman’s terms, if the so Cal market is due for a big reduction, or if it looks like prices will rise or stay the same for the unforeseeable future.”

People have been trying to predict this for eight years now and every single person has been wrong. Every single person. Every time. Especially Jim Taylor.

If hanging with childhood friends, “outdoor lifestyle” and eating Mexican food are major life priorities, moving back to CA could be wonderful…seems there are lots of like minded folks in CA with plenty of spare time to hang outdoors and eat Mexican cuisine since many are retired, UE, working PT, and/or living back at Mom/Dad’s crib for good. Good luck!

@Homesick, if you are truly making 6 figures and living in Nashville, the difference in cost of living between Tennessee and SoCal means that you can fly back to SoCal once a month without impacting your finances. Move back to SoCal permanently, you’ll be busted financially in short order.

A house on my block just hit the market (in SF). The realtor is Chinese and the people I see looking at it are mostly Chinese. I think there is a huge market out there for foreigners who want to park money in the US. I don’t know if they want something this small but they are certainly driving up the prices here. The house is being offered at 30% more than I paid less than four years ago and it’s one of those places that has been owned by one family since the 1960’s. It would have languished on the market four years ago but I bet it goes within the week for over asking. If this is a bubble like the Japanese bubble I think it still has a way to go before it bursts.

@mtampoon says “If this is a bubble like the Japanese bubble I think it still has a way to go before it bursts.”

I know it’s just a figure of speech and just your opinion, but when you say things like “still has a long way to go…” I have to wonder just how much you know about the Chinese economy or the factors that are contributing to this so called phenomenon. I mean is “I think” really based on anything or is it just pure idle wondering aloud?

I’m not giving you a hard time, but I’m trying to separate opinion that comes from some analysis and research from just “I think”.

F word and A word are back in Real estate.

Foreclosures and Auctions?

Ship is now in sinking man the lifeboats, hope there is enough boats to go around?

What, we hit an iceberg, and you did not tell me. Don’t you dare go into those lifeboats until they are full. Now, this time around, I have my AK47 to shoot any crew member that is a coward. I have my gun on Francesco Schettino, there he goes, falling into a lifeboat,(sounds of gun shots) .

I live in Phoenix. 3/2/1700 down a half block just listed for 360 (!), while a place with the same stats one block over, in the same HOA, just lopped off 20 to 220. My 5/4/2700 with something resembling a view (slightly uphill) is worth maybe 400. 360. She’s nuts. And that does not include the likely cleanup from the strip club manager who she previously rented to (eww). Obviously, not LA/OC prices — my old home in Torrance is now well north of 1 mill — but at scale, still overly optimistic …

What’s funny is this house is priced $175,00 more than the comps in the area and basically they are looking fro a 50% return in 6 months. Unrealistic? Probably, but if they can get some Chinese sucker to overpay for this sardine can, more power to them.

It wont be a Chinese investor, it will be a young couple that doesn’t want to commute to the I.E.

San Fernando Valley Update:

Inventory is UP

Listing Prices are UP

Sold Prices are DOWN.

example: 2400sq ft house Reseda

Original Listing: $550K

Reduced to: $535K

Sold @ $527K

This is very typical and as you can see it isn’t a huge leap from the original asking price but it is substantial. I think it’ll be more of the same for 2015. Inventory is up but houses are still selling within what people are perceiving to be a reasonable drop in price.

But is the median still up from last year?

The inventory is WAY down in Seattle area compared to the same period last year…

I don’t know what is funnier: the price of this place, or the fact that the words “par excellence” were used in a RE listing. Wow. Just…wow.

Did it occur to you the neighborhood is on track to be the next hot spot? Silverlake and Echo Park are full, Atwater is pricey, Eagle Rock in pricey and Highland Park is filling up. I told this board that Cypress Park and Glassell Park are next, after that is Sun Valley and Tujunga.

That’s until the next earthquake or until the water shipped in from up north stops flowing. Glassell Park is full of small old run-down houses, the lots are tiny, the streets are narrow, and there is not enough water!

I am waiting for the market to crash….it must.

The markets are crashing:

The Baltic Dry shipping index closed at the lowest level ever (going back to 1985).

The commodities market is crashing:

Oil, down 40% year-over-year

lumber, down 15% year-over-year

natural gas, down 40% year-over-year

platinum, down 15% year-over-year

copper, down 20% year-over-year

sugar, down 15% year-over-year

rice, down 25% year-over-year

wheat, down 15% year-over-year

corn, down 18% year-over-year

The only thing that has gone up is the housing index. Home sales are backwards looking. It’s based on economic activity, employment and earnings history from the prior 1 to 3 years.

The Baltic Dry shipping index and commodities indexes are future looking indexes that reflect a time period 3 to 12 months going forward. When these go negative, recession usually follows, and eventually housing crashes.

Yes, the cargo ship captains and owners complain, it is the cruise lines where there is still good demand, especially with the northern artic route opening up due to global warming. I was assigned to the Mediterranean(but had an altercation with Francesco), but they just assigned again to the northern route. The band is playing, the party is going strong, when will it end, nobody knows. But they do tell me that there are icebergs out there, but then again the ship’s owners tell me not to worry and keep the party going, but I feel very uneasy. I have my AK47 at the ready.

I know a guy whose brother walked out of a liquor store in Cypress Park, not 1.5 miles from this house, and had his head split open so bad, he now has a scare from the base of his neck to the top of his forehead. It’s a miracle he lived. I know of another guy that was jumped outside a very popular taco joint in Cypress Park. 700k+ to fear for your life. No thanks.

My Brother got transferred to Loreto St School in C.P. due to his mental disabilities and behavior problems back in the late ’50s. It was a shabby area back then, too. Glassell Park and Mt Washington are definitely a cut above Cypress Park. But that’s not saying much. My old neighborhood now is known as Hermon, although we called it Highland Park back in the day. Cutting up the NE side into Microneighborhoods to fool the unwary?

Austin has a latino barrio area too. I wold take OC over the Latino-black lower class of Texas and Florida. Miami has a lot of barrios too Austin, Houston and Dallas have low income latinos and blacks, Miami also has low income latinos and blacks. OC looks great except for Anaheim and Santa Ana Texas outside of the nice burbs like Lakeshore or Plano looks more like Mexico And a black ghetto with just as much foreigners.

The first column is for Harris County Texas, home of Houston. Texas actually has real areas that looked like Mexico its the Rio Grande areas of Brownsville where about 90 percent of the population is Latino just like Imperial County in California.

White alone, percent, 2013 (a) 77.8% 78.1%

Black or African American alone, percent definition and source info Black or African American alone, percent, 2013 (a) 19.0% 16.7%

American Indian and Alaska Native alone, percent definition and source info American Indian and Alaska Native alone, percent, 2013 (a) 0.3% 0.5%

Asian alone, percent definition and source info Asian alone, percent, 2013 (a) 1.7% 2.7%

Native Hawaiian and Other Pacific Islander alone, percent definition and source info Native Hawaiian and Other Pacific Islander alone, percent, 2013 (a) Z 0.1%

Two or More Races, percent definition and source info Two or More Races, percent, 2013 1.2% 1.9%

Hispanic or Latino, percent definition and source info Hispanic or Latino, percent, 2013 (b) 65.6% 23.6%

White alone, not Hispanic or Latino, percent definition and source info White alone, not Hispanic or Latino, percent, 2013 Miami-Dade lots of low income Hispanic and black areas along with higher income areas. I suggest to folks to go to Arizona and Colorado minorities but less of them. Maricopia is affordable more so than King County Was.

Cynthia, why so obsessed with race? Most people I know could care less about the race/religion/personal lives of their neighbors; their major concern is they want to live around normal, considerate people who keep up yards/property, keep noise levels down, and are respectful and considerate of their neighbors. Sheesh!

I dont know about goods or bads or any of that, but on the subject of race I know a lot of people do care about it. They just do. Some don’t, some do, either way it’s within their rights. As long as they are not acting illegal about it but opinion is freedom.

I also couldn’t care less about the race/religion/personal lives of my neighbors. Except that by and large, Hispanic neighbors have been more of a problem than other races (and I’m part Hispanic). Barking dogs, frequent fiestas with loud music, many kids running around unsupervised, 6+ cars parked in the yard for their over-occupied house, frequent use of illegal fireworks. These are some of the issues you can expect to encounter when living near Hispanic people in middle to lower income areas, at least from my experience- generally not what most people would describe as considerate and respectful. These have just been my observations- your experience may differ.

For die hard SoCal cheerleaders, being uncomfortable with “Hispanic culture” could prove quite the paradox in the future. Hispanic population has exploded, and will continue growing. There’s far more Hispanics in SoCal than wealthy Hipsters and Silver Surfers with 6 figure incomes/pensions/fat down payments. Simple math.

Unless one lives in a multimillion dollar enclave, I think most SoCal hoods will see much larger Hispanic populations down the road. Of course, most think their ‘hood is “special” or “different”. Won’t happen here! I paid 700K for this vintage charmer! We’re behind gates! There’s a dog bakery and a fluten free pizza place down the street with a bird mural! Those Hispanics will surely stay in their ‘hoods with their tacos, fiestas, molcajetes, minivans and yapping pit bulls. Yessir!

Another thing the bad areas of Texas are more like Watts than Santa Ana or Anaheim unless its the all Latino southern part of Texas like El Paso, Anaheim and Santa Ana all have murder rates lower than Austin, Houston and Dallas. Anaheim is just high in thief compared to LA but a much lower murder rate. So, almost all Latino is better than Latino/Afro-American in crime rates.

Another thing Space X and Virgin Galactic are now both in the LA area. Granted, Musk does things in Texas, Florida, Washington and Nevada but so far he has not mention about moving the headquarters of space x and Branson just moved some of his operations from Mojave to Long Beach which is really more profitable than the space tourism since its small satellites and housing even in South Orange County will probably dropped since lots of nice condos and tract houses are not be sold. I preidct that a lot of the latino and minority ppoulation of LA/ORnage will moved as the ecnomy changes more atuomation making it harder for low skilled workers in the future to afford the places and many will moved to the inland empire and to states like Texas. So, people trashing LA/Orange and not the big metro areas of Texas or Nevda will be into a shocked in the 2020’s.

When it comes to high income staying in LA/OC, you and I are on the same page. I agree the worker bee’s will continue to move to AZ, TX, and FL as they will have no choice. CA is simply to expensive and the jobs are too high level for an Average Joe.

Vegas Landlord,

Below is an article which explains better than I can why you see the increase in debt as a source of higher prices while I see it as a source of deflation. Although more debt means increase in debt money supply, the way I see it it is that it works up to a point when too much debt becomes deflationary (creates instability in the system) especially for purchases financed with debt. You look at the upward part of the curve, while I look at the downward slope of the bell curve (a liitle more to the right on the curve). The picture is a bell curve. You look from the left and I look from the right. We are both correct. Where we disagree is where we are relative to the inflextion point. I think we past that while you extrapolate the upward line to infinity. I think this why so many people disagree on the outcome. Some look at the past and extrapolate it to the future. I believe that we passed an inflexion point where so much debt becomes deflationary. This has consequences for RE prices. Given millions of factors NOBODY can predict the timing. However, the direction is clear.

Here there are few paragraphs:

“For me, the massive amount of debt we have accumulated in our own planetary confines is the ecoomic equivalent of a black hole, and we are approaching the point at which that debt will implode if it is not resolved. As with Greece, the ability of players large and small to pay debt off in a global deflationary environment has been greatly compromised. I’m not certain how this will end. Maybe everyone will sit down and hammer out something like a Plaza Accord to resolve the debt, by which I mean dilute it, destroy it, make it go away, restructure it – whatever it takes. Of course, history suggests that we will do such a thing only in the middle of or immediately following a crisis.

Today’s Outside the Box is from our old friend Dr. Lacy Hunt of Hoisington Asset Management. He muses on the effects of debt and takes us back to the ’20s and ’30s, when there were similar problems with debt in countries that had engaged in currency wars for over a decade.

Clearly the policies of yesteryear and the present are forms of “beggar-my-neighbor†policies, which the MIT Dictionary of Modern Economics explains as follows: “Economic measures taken by one country to improve its domestic economic conditions … have adverse effects on other economies. A country may increase domestic employment by increasing exports or reducing imports by … devaluing its currency or applying tariffs, quotas, or export subsidies. The benefit which it attains is at the expense of some other country which experiences lower exports or increased imports.… Such a country may then be forced to retaliate by a similar type of measure.â€

The existence of over-indebtedness, and its resulting restraint on growth and inflation, has forced governments today, as in the past, to attempt to escape these poor economic conditions by spurring their exports or taking market share from other economies. As shown above, it is a fruitless exercise with harmful side effects.”

For full article you may read here

http://www.mauldineconomics.com/editorial/outside-the-box-hoisington-quarterly-review-and-outlook-fourth-quarter-2014

DAMN STRAIGHT THE DINNER WILL BE INTIMATE. gwaharharharharharhaaaaa!!!! 🙂

Glassell Park has horrible schools.

All kids get the same curriculum, from common core. Whether it’s Manhattan Beach or Glassell Park, it no longer matters. What matters is parent involvement. As long as you work with your kids, and they get A’s at those schools, everything will be fine. In fact, they will have a better shot at scholarships. It’s sad but true, the better performing schools have more competition and few scholarships for the best students. Now if you get straight A’s in Glassell Park, you’re a superstar and offered a full ride at UCLA.

Use the system to your advantage.

“All kids get the same curriculum, from common core. Whether it’s Manhattan Beach or Glassell Park, it no longer matters.”

Are you seriously comparing schools in Manhattan Beach with borderline hoods like Glassell Park or Highland Park? No, parent involvement is not the most important thing. Spend a couple of seconds and you will find out peers are the biggest influencing factor on future success especially once middle school hits.

According to The Realist, you might as well send your kids to Johnny Cochran Middle School or some other substandard school in South Central. After all, according to him, all schools are providing the same education. Wow, this guy is really out of his mind or a real estate agent.

Conservatives here act like Texas doesn’t have poor latinos or black areas that why i bring. up race. Conservatives lie about how great Texas is its humid and has just as many poor minorites and some poor whites like California.Why not try Colorado here instead In fact Houston grew about 50 percent in Latinos while OC which the conservatives say is crappy here only grew 22 percent because Houston is cheaper.

They better get the menial labor robots up and running quick. When all that’s left in LA is the people who can afford today’s housing prices (rent or own), I’d like to know where the $6 mani/pedi is going to come from, or the cut-rate gardening services, or the under-the-table household labor? All the things that make living in California so grand. Your two-income high-earning couple is going to have a nervous breakdown when they realize all the poor people have left the state.

They will continue living 6 to a bedroom, in the barrio, like they do now. That is bullish for rent prices too – multi incomes.

Why aren’t people HAPPY that L.A. is now on par with the global elite? Are you not proud to be a part of that? It’s 85 degrees out right now, sheesh. There is 4 foot of snow in Boston, no thanks.

You’re better than other people and that’s something that should be celebrated.

It’s not even close to being part of the global elite. We have no real urban scape. It’s just one big hill billy suburb. Even on the super elite, coast west side. Drive down Lincoln. World class? More like Green Acres. Drive down Wilshire. Ma and Pa Kettle. Drive down Aviation, PCH in the South Bay – Chico and the Man. Yes there are some enclaves that are splendid. I live in one. The weather is great. It’s a nice place to live, but there is SO much untapped, dilapidated, converted Smog Shop, shitty stucco construction everywhere that is still un-upgraded that you could go on for decades and still not be out of stock. This is not a mature, limited inventory place like Monte Carlo, London, Rome, Paris or New York. LA was born out of real estate hucksterism for midwest rubes. It’s still that way. Sure there are great places to live and sure there are great jobs and opportunity here, but it’s all ups and downs, ups and downs in LA. Remember when Japan was going to own all of LA? Buy now or priced out forever? Yeah…that….only all over again. I live in perhaps the most prime of prime neighbor hoods in LA outside of a street of $40m mansions in Beverly Hills and still there are probably 40% of houses that are old tear downs. And this despite every possible trick to juice the real estate market. All it takes is one thing (interest rates, earthquake, further economic downturn) to reset things. I’m not saying there isn’t value in some properties. Make smart decisions. But it’s far from “get in now or you’ll never buy again” bull shit that hucksters and boosters are touting. One other thing that seems to be bandied about that is pure and total bullshit: “neighborhoods are bullet proof” That just isn’t true…if West LA or Miracle Mile or Culver or Palms crater….the you can bet your ass that Santa Monica, Palisades etc. will slide. There are no contagion walls.

The poor will NEVER leave CA. In fact CA is a magnet for the poor. CA pays out more in welfare then ALL other states combined. There welfare programs here that don’t exist anywhere else in the country. In fact poor people from all over the country and Mexico dream about coming to CA and getting handouts.

I kid you not, I truly miss NY winters: http://nypost.com/2015/02/14/city-braces-for-coldest-day-in-two-decades/

In the meantime, I’m suffering through a February heat wave. No, the temps are not great in SoCal. February is no time for a heat wave. It’s unnatural. It’s one of the factors inspiring me to move to the Pacific Northwest. Not as cold as NY, but still, they have normal seasons.

I’ve been in Portland since December, and I love the weather here. You get a mix of cold’ish (45 degrees) and rainy mixed with nicer days with sun. It’s been 62 degrees and sunny for days. Our folks just told us how hot it is back in LA, and I don’t miss it at all. Over 80 and I’m miserable. Jacket weather is my favorite, and the weather in the Northwest pales in comparison to where I grew up in the Midwest.

Why do people think it is cool to live where the minority is the majority? It may seem in theory to be cool and hip, but the reality is much different. I am speaking from experience.

It boggles my mind when I hear people gushing over Echo Park, Highland Park, Glassell Park, etc. I have a business acquaintance who lives in Echo Park and I dread going there. Traffic is hell. Driving up Alvarado is like driving in Tijuana. When did it become OK to throw some dirty clothes and used shoes on a public sidewalk and open your own sidewalk store? Without fail every time I get to the intersection of Alvarado & Glendale Blvd there are people walking between the cars in traffic panhandling. On top of all that I get to admire whatever new graffiti went up recently, or I can look at all the laundry drying off balconies in what looks like sub-standard housing along Alvarado. If I’m lucky I may see a couple hookers on Gendale Blvd. Yes, this is the American Dream. Buy a 700K crapshack in New-Tijuana near the taco stand. I better brush up on my Spanish.

I agree with your sentiment 100%. Areas like Glassell Park and Echo Park are definitely better than 15 years ago, but the home prices are quite out of line. Sure, you’ve got some flippers really sprucing up some of these older homes, but it doesn’t detract from the fact that it seems like you’re driving through a third world country in some parts. I just don’t get the mindset of anyone who would buy properties at exorbitant prices like the one listed in this article. A property going for over $800/sq. ft. in an area that still has a gang presence is beyond me.

No doubt Doc is aware, but a flick through 4 real estate portals, and I found 3 of them now list this place at $699,000 / cut below the mental thick end of 700 grand.

Leave a Reply