The three faces of the California housing correction – a Burbank condo, a single family home in Hacienda Heights, and an investment property in Burbank.

Low interest rates must seem enticing to many but even after a few days rates have trickled back up. The Federal Reserve has pushed mortgage rates to an almost unsustainable low. The government for the past few years has virtually originated every single mortgage as banks contend with their unwieldy shadow inventory properties. One thing that has been a significant change on the ground is the willingness of banks to sell properties via short sales and working with sellers on pushing out properties. This is still a small part of the market but there is a turning point this year. Banks in 2011 started getting serious about reducing prices and agreeing to short sales and selling REOs. Now why would banks agree to haircuts if they believed the housing market was on the verge of an upswing? They don’t believe this and realize they need to get a handle on their inventory or face and even larger backlog of properties. Today we’ll examine three properties that exemplify the price cutting that is going on in the current market.

Burbank condos in the $100,000 range?

A few years ago if you would have told someone that you would be able to purchase a condo in Burbank in the $100,000 range they would have laughed. Well those days are now here:

1620 NORTH SAN FERNANDO BOULEVARD #25, Burbank, CA 91504

Est. Payment    $909

HOA Dues          $242 (MONTHLY)

Listed   06/14/11

Beds     2

Full Baths            1

Partial Baths      0

Property Type  CONDO

Sq. Ft.  860

Year Built            1964

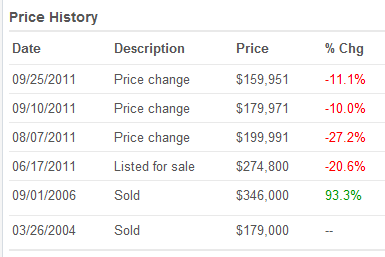

Now if 860 square feet is appealing to you this might be a place to purchase. Here is a clear example of the bubble massively correcting. The current list price is $159,951. The condo is listed as a short sale and we can see that some serious price cutting is going on:

Someone actually paid $346,000 for this 860 square foot condo in Burbank! There is no other way to describe this kind of action without using the word bubble. We are looking at over a 50 percent price cut here since 2006. Is this a good deal?

You’ll also notice that it was initially listed in June of this year for $274,800 and no one was biting. Something tells me they are trying to move this property. More shadow inventory being cleared out.

Hacienda Heights price cuts

Maybe you are in the mood for a single family home. Let us look at Hacienda Heights:

16535 OLD FOREST RD, Hacienda Heights, CA 91745

Listed   08/01/11

Beds     3

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,405

Year Built            1972

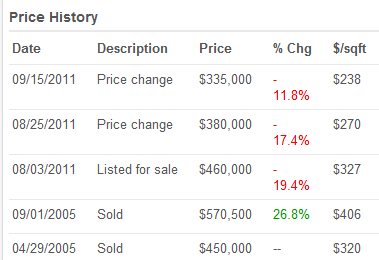

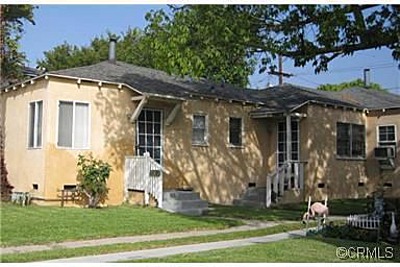

Here we have a 3 bedrooms and 2 baths home with 1,405 square feet. This home would fall in the Southern California starter home category. The current list price is $335,000. As you can see from the above photo it must have been garbage pickup day yet again. Let us look at the price cuts here:

2005 was a manic year for this property. Today the home is selling for $235,000 less than the 2005 price. How low of an interest rate do you need to eat a $235,000 price cut and feel good about it? Same thing happened here as it did with the Burbank condo. It was initially listed in August for $460,000 thinking that some sucker would bite with low rates and the summer selling season. The price is now lower by $125,000 in two months! $125,000 is the price of a starter home in many states in the U.S. People have forgotten the value of money in many areas and are much too comfortable with debt. Imagine if you bought this place in August and knew it would only fetch $335,000 a few months later. So many delusional people are being suckered in by low rates.

Burbank property misses the bubble

I’ve argued that some of the most interesting pricing has come from non-distressed properties. Let us head on back to Burbank:

1219 WEST BURBANK BOULEVARD, Burbank, CA 91506

Listed   04/12/11

Beds     0

Full Baths            0

Partial Baths      0

Property Type  MFR

Sq. Ft.  1,726

$/Sq. Ft.              $266

Lot Size 4,996 Sq. Ft.

Year Built            1943

This place is more of an investment property. Let us look at the ad:

“Great 3 unit building in Burbank with garage parking. Each unit has its own washer and dryer hookups, large side yards, hardwood floors, some plumbing and window upgrades. Centrally located near AMC theaters, restaurants, shopping, Flappers comedy club, etc.. Great street visibility in a high demand area. A great property for the first time investor or owner occupant. Burbank is an ideal city for income property ownership with strong rental demand, and and an excellent employment base. Burbank is a self incorporated city with its own fire, police, and water & power service. The city of Burbank has no rent control.â€

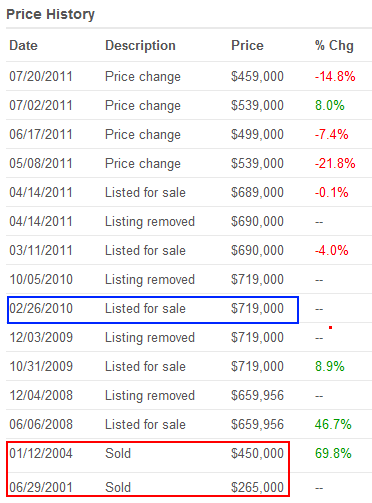

Now some of this might not strike you as interesting given the insanity of Southern California real estate. The property is listed at $459,000. But let us look at the pricing history here:

Someone was trying to sell this place for $719,000 only one year ago! Today someone is chasing prices back down to the last sale price of $450,000 back in 2004. Now think about it, if rents were solid there would be absolutely no reason to sell. Keep in mind aspiring landlords that you have maintenance, taxes, insurance, and vacancies to contend with in any investment property. It is rare when someone is selling a cash flow property especially if it isn’t distressed.

The shadow inventory is leaking out. Potential sellers will need to contend with some serious price cuts. Welcome to phase two of the correction.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

39 Responses to “The three faces of the California housing correction – a Burbank condo, a single family home in Hacienda Heights, and an investment property in Burbank.”

Nice article. You just don’t see this type of coverage in our Corporate Controlled Media, as that would be bad for their business.

Thanks Dr Housing Bubble for another real homes of genius.

Burbank is Bubblicios

you gave me the idea to start my own blog on mainly the San Diego housing Mess

http://www.caliscreaming.com

That first one looks like the apartment from David Lynch’s Mulholland Drive.

I feel bad for all of the suckers that lost their life savings buying last year . . .

A lot of the suckers buying last year didn’t put a whole lot down. All those poor people who got conned into buying for the tax credit and 3.5% FHA down must be sweating bullets now. Their 3.5% is long gone and they are probably another 5 to 10% underwater with their property losing value every day. If they need to sell in the near future for whatever reason, it’s offically game over.

What scares me the most is that the general consensus from everybody I talk to says housing will keep going lower. This is going to be a long, cold winter for loan owners!

Tres interesting!

“People have forgotten the value of money in many areas and are much too comfortable with debt.”

A friend of mine just sold her place in Colorado by undercutting her neighborhood by about $18K, which sold for $120K. The place on her block that is listed at $138K has been sitting like a dead duck for over a year now. Brighton, CO. I thought it was astounding that the CO market is sensitive to an 18K difference. Maybe it’s just a percentage thing though.

I think the typical California home buyer is still a bit delusional when it comes to home debt. I’m guessing it may take awhile still, but I’m constantly looking for signs of mental shifts when I speak to new people I meet. Hopefully, something during the second correction will happen to help snap people out of this mental state.

Thanks Dr. for highlighting my bubble bound city of Burbank. I keep enjoying renting here and watching prices fall, albeit slowly, very slowly. The major price drop after the crash was followed with bubble propping by the gov. and by banks holding back inventory to prop up demand thereby keeping prices up. If my wife and I can’t afford a starter home in Burbank than who can? In a normal market we are prime buyers, but, in this market you have to make into the 200K range to afford a decent Burbank home. I hope enough of these flipping investors lose money to get the hell out of Burbank. This seems to be the new Ponzi scheme in Burbank. They snap up any decent property, slap on some paint and bubble it up. When knuckleheads stop biting the bait, maybe we will get back to Earth but in he meantime there gonna flip all the way down.

In my area as well housing seems to be correcting to 2003/2004 pricing which is still too high. Once we hit 2000 or earlier pricing it MAY be time to step in, but buyer beware……

Y2K isn’t far enough back. The bubble started inflating in 1997, & the economy didn’t stink back then like it does now, so waiting for prices to hit pre-1997 levels before jumping in might be wise.

Bakersfield has already lost a full 10-12 years in equity gains. I’d not be surprised to see that investor property in Burbank drop down to the $265,000 price from 2001.

Total slam dunkies from Doc!!!!!

The condo–my goodness, let’s see, $900/month, plus $242 HOA, plus tax, insurance…. That comes out to…what, about $1,600 a month for 860 s.f. built 50 years ago. I’ll bet you could find far sweeter rental deals…without the constant threat of condo association liabilities, or burst water pipes.

And the third property–the Burbank “investment” listing that screams “NO RENT CONTROL.”

Yeah, that’s great…but say the buyer puts down $100K. At 5% over 30 years, that leaves a monthly nut of at least $2,400. Not counting insurance, repairs, et ceteras.

Hard to see how this place would generate any income.

That’s OK, Doc, coz we’re in the post-income economy. “Investments” for us small fry means we put our money somewhere, preferably taking on more debt, and watch it all shrink.

The two Burbank properties are close to the 2004 prices, which is typical of the area according to Zillow. Glendale and Burbank have an immigrant population that comes from countries that don’t have a culture of a self assessed income tax system. Many of these people take our taxpayer paid benefits of Medi-Cal, and SSI and other forms of welfare at the same time that they have business income that is not reported on their income tax returns. They really think that America is the promised land. They can buy overpriced homes with cash. In fact, they look for property to invest their cash.

Amen

I loved living in Burbank. That being said, I rented there rather than trying to buy. Now, I’m in the bay area and I wonder if it would have made more sense to stay in Burbank. My San Francisco realtor has tried to help, but prices are even higher here than I would have imagined. At any rate, I’m pleased to see pricing like this, even for fixer-upper properties. Maybe I should come back to LA…

Three properties – three rip offs! The middle house looks like a dump and at $335 K a person would be nuts to buy it at that price. The condo – also overpriced. Did you notice the $242/month homeowner’s association fee on the condo? What an absolute rip off!!! And sorry, but only a fool would buy the last house at $459 K.

Homeowner’s associations should be outlawed. They are communistic, blood sucking leeches that take your money and give you nothing in return.

I’m not fond of associations myself, but to say they “give you nothing in return” for your association dues makes no sense. Somebody has to pay for the new roof, the exterior upkeep. Quite often the association dues cover water-sewer-trash.

The middle property is in Mexican gang land, Hacienda Heights. http://www.justice.gov/usao/cac/pressroom/pr2010/091.html

Burbank does not have a gang problem due to aggressive policing which brought down a DOJ investigation of the Departments methods.

I have a co-worker that bought a condo back in 2005 similar to the one shown in this article for $300k with no money down. I couldn’t believe what he was paying monthly not including the $250/month HOA fee. He kept trying to get me to buy houses with him because the trend was only going to continue. From my understanding (as I do not work with him anymore), he was forclosed on in 2010 (after living for free for two years) and the current asking for the condo is now $125k which is about the price that the person who he bought it from paid around the year 2000.

I looked at dozens of houses (I am interested in buying but I currently rent) in the area all summer and could not believe what people were asking. I looked up every one on redfin and was astounded to find out that some people were actually asking what they paid for the house in 2005 – 2008 time frame.

What’s even more astonishing are the number of home builders still building condos and townhomes in this area. I love when I see a condo or townhome listed at 350k+ and has been on the market for 300+ days. The flippers are also not helping the market.

The California housing market will continue to suffer for many years. Although I still have no children of my own, I am a firm believer that my grandkids will get a great deal on a house.

I would love to see doctorhousing bubble to something similar to Real Homes of Genius such as Real Home Builders of Genius or Real Home Flippers of Genius.

Keep up the good work!

Sheez….whooda thunk it….I’ll soon be able to buy a house for the price of a full size pickup. Not a very big house, though.

Yes, most Californians are deilusional when in the real estate world. Most sellers are angry still because they did not sell when the long overdue market correction began. When my parents bought our house for about $20k in 1965 in North Holloywood (now called NoHo), people bought a home to live, to raise a family, not as a investment. Those days are long gone, so are the days in Los Angeles when it was a wonderful place to live. Now, most people in Los Angeles are not from here, and they’re always obvious.

I started looking at houses in the SFV 3 years ago, getting ready to move here from the east coast ’cause my job was being moved here.

Sale prices for 4bdr 3 bath, 2500 sq ft SFH in the desirable areas of Studio City, Sherman Oaks and Encino, south of Ventura, were averaging around $1.2m.

That was out of our price range and more than what you would pay for something equivalent in NYC metro area, so we rent instead.

Cut to 2011. Some of those same properties have been re-listed and are in the $699,000 range.

I’m waiting this out. We haven’t hit bottom yet.

Every time I get the urge to scan the listings on Redfin, I first read Dr. Housing Bubble and say, “Nah, why bother?” Thanks Dr. HB for reminding me to hang on to my money.

same here – i figure the good doc has saved me at least a couple hundred thou – i am a happy renter in sierra madre and i’ve just stopped looking to buy (for a while anyway . . . )

Wow, 2001 prices which look low were after a massive boom. I think fundamentals have lost their allure. Lets hope things swing back. My friend lives in Phoenix and they have 4plexes under 100k. Las Vegas is quite down. CA is still holding up to bubble prices. 2011 economy is much , much worse than 2001 and the prices should reflect that.

speaking of HOA dues, I have heard that in many condo projects the vacancies have caused the remaining condo owners to pay higher HOA to take up the slack of the vacancies. Is this true…. just curious if the HOA contract would allow for upping dues during sustained vacancies…?

Danny, in a practical sense, the HOA can do about anything that the Board wants. But the problem many have, is that if the HOA fees go higher, they don’t get paid because in many units the owners are upside down and they are not paying their mortgage and they can just walk. The Board can also be replaced. The Board members are like any other politician. Being a HOA Board member is a thankless job and it is hard to get a sucker to take the job. On some HOA boards, there are a number of vacancies because it is hard to get suckers to take the job. I know some HOAs who don’t have the money to do necessary repairs so people bail on them by selling their units.

HOAs are only recently waking up to the fact that they can foreclose to recover lost dues or fees.That ought to help keep the fees down.

But it is one of the downsides of HOAs. You piss off the HOA, and they will make life very difficult for you. So much so, that some people have had their homes foreclosed on by the HOA, when they didn’t pay the silly fines against them.

Beats me why anyone would want to live with an HOA. But there are all kinds out there.

Questor, replace the Board. It is self defeating to foreclose. Foreclosed properties do not pay the HOA fees. Foreclosed properties and fire sells bring down the prices of all units in the project. Most projects already have a few foreclosed units that can’t sell. If the Board adds to the list, they will be voted out. Most Boards do not want the hassle of owning units and dealing with the banks. In fact, most Board members are as lazy as government workers.

@John:

You might want to check some of the articles which have surfaced over the past year about this. It seems that there are more HOA’s waking up to the fact that this is a viable option for them. In particular with Banks and the shadow inventory that they never sell, nor pay the dues upon.

A normal foreclosure process can wipe the HOA fees off the books, stiffing the HOA. But if the HOA has a claim on the property itself, that’s a different story.

My favourite article appeared about a year ago about some poor sap in Seattle who bought a house in an HOA. He pissed off the Board, and they levied fines against him, which pissed him off even more. He fought against it, the fines increased to the point where he couldn’t pay (IIRC, he was already a debt-junkie, and was having trouble keeping up with just the mortgage payments). So the HOA foreclosed and took his house away. That’s one way to kick someone out of the neighbourhood. A Google search should turn it up, if you’re interested.

Just wait until we’re back into a full-blown recession again. (Like we ever really got out of the last one)

Without good paying jobs, CA real estate is going to keep headed south.

Here in Sacramento, there are new builds (2000 or later) that are now selling at 2001 prices and should be at 2000 prices by this winter/spring. DQnews.com keeps showing the steady decline in prices. I expect prices to decline to at least 1996-7 levels and if it over corrects, maybe much less.

Sacramento has tons of homes in shadow inventory even though the volume tha IS for sale on the market has been decreasing, price per sqft is still sinking. Imagine if the banks flooded the market and released all the shadow inventory at the same time.

That would be great! Houses would be selling for the price of a car!

Waiting and watching…. I’m not buying until I know we have hit the bottom. Personally, I love renting!

Condo hoa’s are good from the perspective of maintaining a prudent reserve for large semi predictables, like roofs and the like. Also for maintaining order in larger buildings with high renter occ. I’ve owned two in smaller complex 18 units each, they were great. Hoa also can negotiate better cable rates and provide some insurance etc. Just a matter of taste. But if you’ve ever seen a condo with loads of crap on everyone balcony and general filth, that was the weak one.

Yep. And all three examples are still is denial price-wise: I’d expect to pay no more than $115,000 for the condo in this market (another 30% to go down yet), another 10-12% off the single family unit (@ $295,000 sounds more like it..if that)…and another whopping 40% drop to foist that $459,000 multi-unit onto a buyer…$265,000 even sounds high..and that was the 2001 selling price….

Be interested to know when these sell…and how predictions go….but unless I am mistaken…we ain’t seen nuttin’ yet.

And with all this: California is still the best place in US to live. But first comes JOBS….then resolution of DEBT…then a healthy market can emerge. I see no jobs on the horizon…

I mean…at $459,000, and three tiny rental units…how the heck can cash flow cover even 60%-70% of the ownership costs? What would these units rent for?

No….I hate to say it, because I am sure many are still hopeful THEIR home is “different” and marketable…..but the crash, the real one, is yet to come.

I live in an apartment in the Hollywood Hills that is under the rent stabilization board rules. My landlord raises my rent 3-4% a year and I now pay about $1000 a month for an apartment with a downtown LA view & the complex has a pool with a nice view of the hills. I’ve been looking in my neighborhood and in Santa Monica for a while now and everything is still very high in both areas. The forclosures are all well above $500k.

Here’s one in my neighborhood:

http://www.redfin.com/CA/Los-Angeles/6015-Graciosa-Dr-90068/home/7129333

They’re asking over 700k for it. Here’s another in the same range:

http://www.redfin.com/CA/Los-Angeles/2145-Beachwood-Ter-90068/home/7131168

Here’s a real estate owned town house in Santa Monica for under $550k!

http://www.redfin.com/CA/Santa-Monica/2502-Arizona-Ave-90404/unit-2/home/6768327

With REO homes at such high prices, I don’t see prices going to pre 2001 levels for a long, long time – probably not ever unless we have a full blown depression that lasts a long time. I will probably just stay a renter until I move out of the area.

LA area is in a depression. 12% UE or so and if we go into a double dip recession you can bet that will increase.

Most of these houses will drop like crazy in a year or two. LA is a nice place to live but without good jobs, these prices just aren’t sustainable.

I have this bank-owned one near me, it’s been sale pending for a while now…

http://www.redfin.com/CA/South-Pasadena/1928-Fletcher-Ave-91030/home/7009350

Wonder what the selling price will be?

It appears that the housing downturn has accelerated these past several months. I sincerely believe we will see carnage to house prices, and I mean down to pre-1997 level prices. It will shock many people on what prices houses finally settle down as a popping of a bubble always overshoots and the realization that we lived through the most massive bubble in human history.

That West Burbank triplex is HIGH-larious! Instead of the garbage can, they have the dreaded PLASTIC LAWN FLAMINGO, lol! 😀 I thought that particular piece of kitsch was limited to here in So-Fla!

Add in the cheapie asphalt roof shingles, wall-banger A/C units, shabby shack-like construction–and lack of hard rental revenue data–and this “prize” is going nowhere fast.

Call me when the GOOD rental props hit mid-90s prices… and Duh State.gov clears its deficit. 🙄

Leave a Reply