Lies, Damned Lies, and Shadow Inventory. Shadow inventory may be improving on a nationwide scale but not for California – Notice of defaults rise approximately 70 percent in latest month of data. Beverly Hills shadow inventory nine times the size of MLS public foreclosures.

You have an interesting dynamic unfolding in the United States. Recent data shows that the shadow inventory figure is starting to decline nationwide. However in high priced markets particularly in California there is little movement in the shadow inventory. To the contrary, notice of defaults for California raged up nearly 70 percent in the last month of data. In other words while the pipeline nationwide for shadow inventory may be declining at a slow turtle like pace, little of this is happening in high priced markets with absurd levels of hidden inventory like in Beverly Hills or Culver City for example. Adding fuel to the fire, the incredibly high mortgage limits are set to expire which will keep the faux-bourgeoisie from buying their $1 million shack in a preferred zip code simply by going into massive debt. They will now need to come to the table with some solid cash and a respectable income. Realtors are bemoaning this and trying to fight tooth and nail to keep it in place because they realize how phony some of these buyers are in terms of their actual net worth.

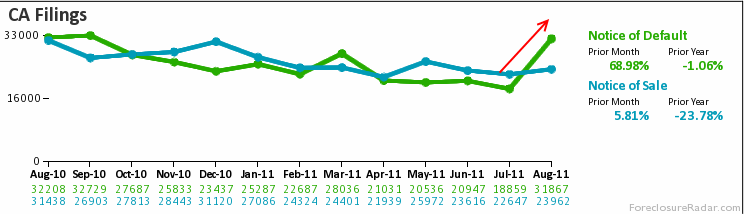

The surge in California shadow inventory

While the case can be made that shadow inventory on a nationwide basis is falling, here in California the pipeline might be filling up again:

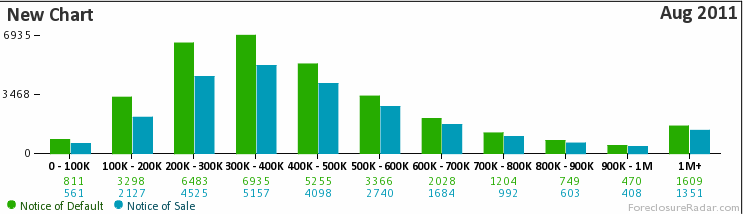

This is not a pretty picture. Some might think that only low income and cheap homes fall into the foreclosure process. That is not the case. Just take a look at the notice of default pipeline by mortgage balance:

In August alone you had 1,609 households with a mortgage of $1 million or more receive a notice of default in California! In other words, some people aren’t making their mortgage payment and probably have a Lamborghini parked in the driveway. This is certainly the case for places like Beverly Hills. Since the nation isn’t exactly flush with cash and there is little sympathy for California jumbo home owners especially when the median home price nationwide is closer to $170,000 the odds of any help coming are slim at least at the Federal level. We’ve seen dumber things so we can’t rule out anything.

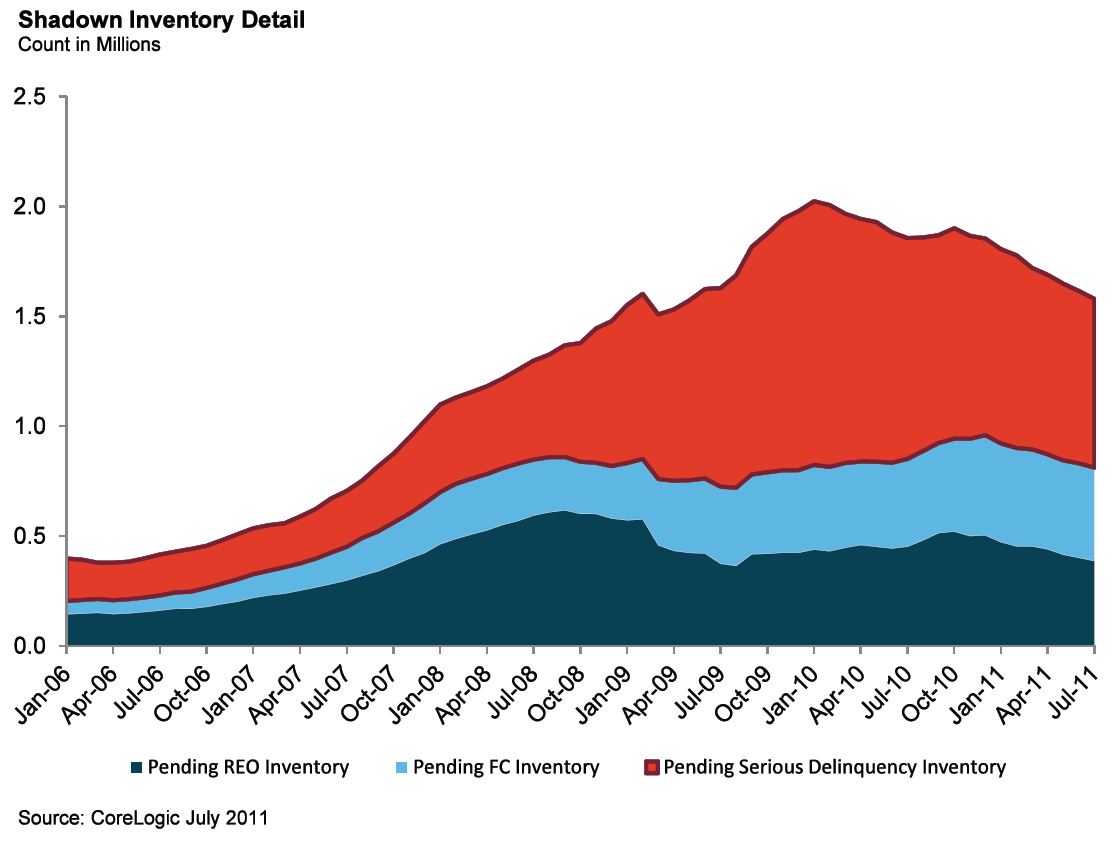

It is true however, that nationwide the shadow inventory has been declining:

Source:Â CoreLogic

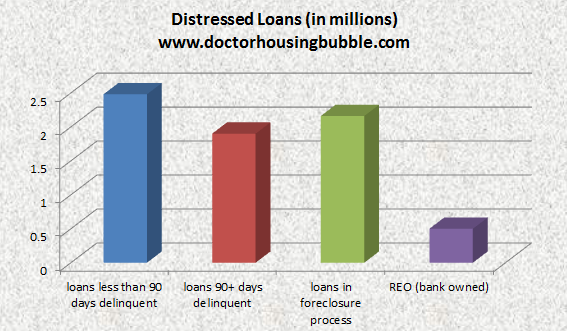

The above data is the “purest†form of shadow inventory. That is, properties not on the MLS but 90+ days delinquent and/or in the process of foreclosure. Yet the distressed pipeline is much bigger. In fact, the overall distressed pipeline is much larger and runs over 6 million:

So a large piece of the picture is missing especially those early notice of defaults (that surge in California for example). That in my book constitutes shadow inventory since 90 percent of these properties will end up in foreclosure anyway. Nationwide this pipeline alone is over 2 million homes and recent movements from Bank of America for example show that banks are starting to foreclose on many more homes. That is, these homes are brought out of the shadows like the surge in the chart above.

So you want an example of this. Let us look at Beverly Hills once again for example:

Est. Payment    $3,976

HOA Dues          $502

Listed   08/24/11

Beds     3

Full Baths            2

Partial Baths      1

Property Type  CONDO

Sq. Ft.  2,123

$/Sq. Ft.              $329

Lot Size N/A

Year Built            1974

The MLS lists 11 foreclosures in Beverly Hills including the above condo. This place last sold in 2003 for $725,000. Welcome to a lost decade for Beverly Hills! The current list price is $699,000. Here is the ad:

“Prime beverly hills foreclosure opportunity to fix and save! This spacious 3 bedroom + den and formal dining room front end unit features closets galore, balcony, and fireplace, and double door entry. Quality wood flooring and crown and base moldings throughout most of unit. Unit is an as-is fixer (kitchen cabinets and appliances are removed, misc repairs needed, and may not qualify for conventional financing–check with your lender) and is in landmark building that has a beautiful and elegant lobby, pool, gym, and sauna, is close to the best entertainment venues and is in beverly hills unified school district. Please see private remarks to show, or for any questions regarding this property.â€

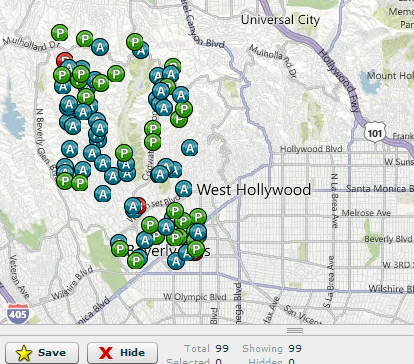

Yet the shadow inventory for this “prime†market is 9 times as large:

99 properties are in the shadow inventory here. I don’t doubt that places like Las Vegas or Florida that are selling foreclosures in bulk are helping lower the shadow inventory figure. But who in the world is buying the properties in bulk in California? The data seems to show an opposite scenario. Too bad they don’t break out the shadow inventory trends by loan balances. Beverly Hills has 99 problems and a healthy housing market is not one of them.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

37 Responses to “Lies, Damned Lies, and Shadow Inventory. Shadow inventory may be improving on a nationwide scale but not for California – Notice of defaults rise approximately 70 percent in latest month of data. Beverly Hills shadow inventory nine times the size of MLS public foreclosures.”

I figure shadow inventory in Raleigh-Durham is going down at about 3% per month, but I’m not sure that rate is statistically significant. (Assuming shadow inventory is unmarketed REO. Who knows what the deep shadow inventory (non-paying, non-foreclosed) is.)

Here’s one estimate which the Corporation controlled media didn’t cover too well:

http://finance.yahoo.com/blogs/daily-ticker/shiller-house-prices-probably-won-t-hit-bottom-162755874.html

“House prices won’t necessarily plunge from here in nominal terms, but in real terms–after adjusting for inflation–they could still drop significantly, Professor Shiller says. And the bottom might not arrive for years.”

I do take exception,though. He doesn’t seem to be accounting for a blow up in European debt over those years, which will impact our Banks. Nor does he seem to account for our Banking system dealing with our own debt destruction either.

A 10-15% drop in prices will only make the latter worse. I’d say that a 10-15% drop in prices is only the next leg downwards.

the estimated payment of $3,976 plus $500 in HOA does not include any up-front costs, to install kitchen cabinets and appliances, misc repairs.

Precisely. Built in the 70’s and the kitchen is stripped. I suspect it needs carpeting, blinds, drapes, perhaps new doors and windows, new baths, fixtures, et al. Seems like they are trying to get quite a bit more than the 03 price given the condition.

You are missing the most important part. The place is not in a state to be financed. It will go for $500,000 cash

yep. to what jacked said.

Down and Out in Beverly Hills

Dave is a hard working business man, his wife is only interested in yoga, aerobics and other meditation classes, and he sleeps with the house maid. Their teenage son is confused about his sexuality and their daughter is suffering from eating disorders…

Looking at the map, it is interesting to see that the majority of those dots on the map appear to be in the area of the hills and canyons of Heavily Bills (Beverly Hills) such as North of Wilshire Blvd. I woulda thunk that the ‘flats’ area which has a lower median price and income would have been the majority. Perhaps due to the jumbo loans.

For the snoopy folks (like me)… here is more info on this property:

http://www.realtor.com/realestateandhomes-detail/441-N-Oakhurst-Dr-Unit-205_Beverly-Hills_CA_90210_M16479-23748

Thanks, ChrisNLongBeach. I was curious.

why show a 750,000 dollar “unit” when units can be had elsewhere for 25,000..? why show high income needs when workers must compete worldwide with 20 other workers for the same job and who are willing to work at a 20th the wage and who do very well at it……/////

Do these stats include data from Private Lenders?

For example, I have nothing to do with the R/E industry or the banking cartel, but I hold an interest in a 1TD on a house in Huntington Beach. Payments are current, but if my client fell behind how on earth would the data collection bureaus know?

Thus, if it were somehow possible to collect distressed property info funded by private individuals like myself, the stats could be only higher. How much higher? Who knows.

To coin a term perhaps properties on nobodies radar could be called “Shadows in the Shadow Inventory” <;)

It’s a good point, and calls to mind all the private “hard money” loans out there as well, but… I would imagine that you and most of those private “Mom & Pop” lenders–once they realized “the money’s not comin'”–would very quickly move to foreclosure/repo actions, which in most states puts the property very much on the radar… yes/no?

Also, most 1stTDs and other collateralized loans on RE would be recorded by the county, if not by law, then per lender’s demand terms. This is another searchable trail. Not sure if CoreLogic, RealtyTrac, etc. dig that deep… but I’d certainly find out before I ponied up for a subscription… (which I may do soon).

e.g. even for my straight-up rental props, my tenants’ pay history IS reported to the major credit bureaus, via atenantscreen.com. Yes, they know this up front… scares off the slackers in droves. 😀 (OTOH, those who sincerely wish to INcrease their FICO, can do so by paying their rent EARLY and CONSISTENTLY.)

Classic. The $1Million foreclosure. Reminds me of a trip through a treeless HB tract (1500-1800sq) single story hood a year and a half ago. Houses worth $300K were still listed at $550K. There were a ton of cars parked on the street and many vacancies. One of the tract shanties had been HELOC remodeled in the ever trendy Tuscan cum Moreno Valley mediterranean style. I noticed that this Tuscan HB villa in treeless shanty tract suburbia had a Lambo and an H1 Hummer in the driveway. Would that qualify as bourgeous or just conspicuous Cali? I am sure they paid big for their slice of heaven. It is amazing the prices still being asked in hideous working class and lower middle class hoods. The risk embracing super debtors (i.e. squatters) have certainly paupered their risk averse conservative neighbors (i.e. renters)

Nice Jay-Z reference at the end 🙂

And the R/E industry analysts Talking Heads on CNBC are very enthusiastic because home prices are up 0.2% month over month in August, but down 3.5% compared to last August nationally. YEAH!

I observe that the higher the mortage, the more the likelyhood of the default turing into a sale.

I know of someone who was not paying her mortgage on the Westside for many months and the bank told her not to worry and just pay when she can. Assuming that the bank does not file a non-payment notice, does this show up in the statistics? I would assume that the bank was not singling her out and that there are many others in this category. I would think that this would be an “Unknown Unknown” if this is the case…

If it’s not reported or filed, then it’s not a statistic. It’s a true shadow that will most likely become part of the inventory.

Condo introduced was missing a kitchen and a funny co-incidence: A kitchen renovation company lives in same addess.

http://www.kitchenrenovationbeverlyhills.com/

Interestingly enough HG-TV will air Selling L. A. beginning October 3. If the New York version was anoying, the L. A. episodes should really be way over the top on the anoyence scale.

Television being what it is they will probably re-run episodes from 09 to make the houses look more costly than they are in reality. I hope you pick up the irony in that sentence.

Shadow inventory does not include ones that have not paid their mortgage and a default notice has NOT been filed, therefore, the actual number of houses that are in distress is much much higher. The Banksters are so overwhelmed with distress properties that still thousands of homes fall behind on mortgage payment. The Banksters have a large amount of inventory to purge for the years to come. However, our media keeps talking about Greece daily to divert our attention away from the real problems here at home.

I think there is a revolving door between investors and banksters that is chasing the market all the way down and these stats don’t show up on MLS. They are swooping in on property in Burbank, doing a quick refurbish and selling. It’s hard to believe in this market that it is possible to flip and make money, but I guess there are plenty of junior entertaient moguls in Burbank to snap up these properties. I posted a Trulia recently sold ad that showed a 350K sale being flipped for 550K, in 4 months. Sad thing is that the planes land in your backyard, and it’s 900 sqft. 2/1. Ugh.

For those who are not from or live in Beverly Hills, perhaps you need to know it’s not what it used to be. Farsi is the first language, even the mayor is Persian. Since building requirements have changed (cannot build big columns on property), many have moved farther West. And yes, the buildings are old. For example, 211 Spaulding has several beautiful units, about 2200sf in the high $7’s and then you should be aware the HOA’s are $2,300 a month. Foreclosures are abundant in BH. There you have it.

@CC hard to believe but true. I love Redfin as it sometimes reveals the previous sold price and date. Its not uncommon to see distressed homes sold cheap, refurbished then marked up 150-300k 6 months later.

Everyone appears to be rooting for the fall of housing and the crippling collapse of America along with it. Shouldn’t we all be rooting for wage inflation instead? Why root for deflation.. when rooting for a raise seems more practical.

Housing has effectively gone nowhere for over a decade in most of America? There are 30 year old families who bought a home in their early 20s that have seen no appreciation in 10 years… Are you actually rooting for a generation of Americans to see no rise in their largest investment over the next 30 years?

Why don’t we concentrate on distributing money back to the middle class instead of the few at the top…. Then things will repair themselves and we can go back to 1-3% per year home appreciation of norm… trending with inflation.

Brad, I don’t know how long you’ve been reading this blog but that’s not really the message here or what most people want. This blog is geared to pointing out the idiocy of overpriced housing and how everyone has ‘bought into it’. The blog has followed the saga the entire way and the message here is that in many areas housing is still far out of line with incomes and thus unsustainable (i.e. the bottom is not in and you can’t hold it up because supply/demand imbalance is overwhelming and eventually it MUST balance in reality).

It’s unfortunate that many people are underwater. Tragic for many. There is an issue though, many paid far too much for far too little, overextended themselves financially to ‘get in before being priced out’ or keep up with the Jones family, or felt that they needed to own because renting made you inferior in some way [my opinion having grown up not wealthy but around very substantial wealth is that this is a middle class inferiority complex/hang up that realtors play to]. Now some were just plain unfortunate but that’s happened all the time to people when industry moves from a town or a breadwinner/family member gets ill or dies – which is just horrible but people do lose houses for good reasons and some people just don’t make money in them. Certainly as an investment the worst thing one can do is pay too much for any investment and that’s the issue now. Wages remain in the late 1990s levels, uncertainty is sky high, and lending is tight so there’s really no reason for housing to be above 1998-99 pricing. There should have never been a bubble or run up, if was all bull**** credit games, media hype, and VERY bad financial decision making on home purchasers, lenders, and investors providing capital.

Same thing happened in the tech bubble, you bought the S&P 500 or God forbid the NASDAQ in 2000, you got crushed for a decade. Why people commit substantial capital (especially with mega leverage in the case of a house) without checking pricing reality first, I don’t know. I’m willing to take something of a leap if I can easily handle a loss, but housing for most people is HUGELY outsized relative to their income and even more so their real discretionary income.

What we need is not wage inflation right away but more jobs, wages don’t move when there’s slack in the labor market and not only is slack high but many people who are listed as employed were making $80K and took a job for $40K. Jobs lead to wage growth which leads to confidence and stability. These are required by most people to take out 30 years of debt (scary but then again what do I know) on an illiquid asset with high transaction costs.

You know, people used to avoid debt like the plague. They had a memory of the depression and the last major credit crisis/contraction. Those people are largely dead now and their offspring (Gen 2/3) were profligate spenders and squanders with no qualms about leveraging up. This is what drove pricing to unsustainable levels and honestly sustainable pricing is significantly lower than we are now, and given the love affair of house/leverage is almost entirely broken (and younger generations are having trouble finding jobs and loaded with debt) I don’t think people will be as crazy as they were the last time so you need MUCH higher wages to get pricing back to 2005-2007 levels. We have 3-5 years of inventory to work through and figure another 10 years to see those levels again baring hyperinflation (which assumes jobs are still plentiful, it may not be good for housing if only a few can afford that pricing from the mega-stock we have on hand).

Hope that helps a bit. Not a happy thing but maybe gives you some color on the blog and how people really feel here. This is simple reality for most and many here have been more hurt that the 20-30 year olds who just haven’t gotten appreciation and are still waiting for it.

What you said is all good except this: “Those people are largely dead now and their offspring (Gen 2/3) were profligate spenders and squanders with no qualms about leveraging up. This is what drove pricing to unsustainable levels….” I’m in that prior generation and many of us were and are well aware of prudent financial behavior learned when our parents had to put up 20% and pay a mortgage or lose the property. Additionally no one financed cars at over 100% of retail but at only 80%. The rules were that you had to owe less than the assets value to cover for unforeseen crises. What drove prices up was increasing demand due to population growth, limited space and regulation (environmental which is not a bad thing). What put prices through the roof was a manipulation of the “game” by members of my generation in financial power who rigged it for their greed. Thank you Mr Gecko. Is that M. Douglass’ character name?

Brad, I think slim hit the nail on the head with his response. Barring hyperinflation, we will not see wage inflation for a LOOOOOONG time. So that means one thing for still inflated RE prices…they need to come down to reflect local incomes. The government, banks and other special interests have been doing everything in their power to delay the inevitable, this can not be refuted.

Most Americans need to grasp the idea that there will be NO home appreciation for many years to come, the housing bubble pulled ahead 15 to 20 years of appreciation…we are now unwinding from this. A home is a shelter and a place to live, it is not an investment vehicle like it was viewed for previous decades. Gen X and Y will bear the brunt of this bubble, many of these people had their financial lives wiped out. Gen Y can’t find jobs and are postponing marriage, having kids, homeownership, etc.

As painful as it may be, homeprices in still inflated areas need to come down to realistic levels. This will ensure a healthy market to build a foundation on. If things don’t correct, we will drag this mess on for the entire decade or longer.

@Brad:

I’d echo what Slim said. No one is rooting for it. It is simply unavoidable at this point. And the only way to get back to rebuilding America is to get completely through the massive debt destruction which is going on. There is no other option. And I really, really wish that wasn’t the case.

Housing historically tracked just about 2% above inflation, and was thought of as a “home” to raise a family and such, not as an investment. It wasn’t till recent years when people were saying houses are ATM’s and that one should never expect to pay off their mortgage. This has been the poison that was capitalized on by Wall Street. So this notion of great home appreciation is a false argument based on misconceptions.

Just talking to a travel RN who showed me a picture of a gorgeous home in North Carolina that she bought for 86K. My jaw dropped. I can’t buy a shoebox here for that.

Brad,

You are right, of course. What you are seeing is a bunch of people DEEPLY frustrated with a market that has been delusional for decades. We would like to see the market get so hammered by reality, that it will never forget the lessons learned!

This goes far beyond shadenfreud. It is personal. This market has abused younger Cailfornians for a very long time, forcing egregious transfers of wealth from young to old. Families with children live in tiny apartments in low rent school districts while older childless couples reap massive unearned paper capital capital gains and sit on better housing in better school districts long after their children have left home, all while enjoying tremendous tax breaks thanks to prop 13.

It isn’t fair.

Some folks are also looking to buy a house, sitting on not quite a big enough downpayment. Inflation / wage inflation would just devalue their down payment and push the houses further out of reach.

You are spouting nonsense. Sure some older folks are living the way you say but I am alive in this culture and move about from Diego, the Inland Empire and LA. I also have children who have children. They are in good neighborhoods with good homes. They are surrounded by their peers with kids not old people. Please, not withstanding prop 13s flaws, stop spouting Fox propaganda. If you truly know otherwise show us the facts as Dr HB does.

originally posted on Patrick.net (but since the DOC was mentioned I thought it was appropriate and figured he may get a kick out of it)

WHATTA BARGAIN!!!!!! 180k, DOWN FROM 2.3M!!!!!!!! LOOK OUT FOR THE STAMPEDE!!!!!!!!!!!!!!!!!!!!!!

Okay, after reading one of today’s acticles (New York City: Escape Your Housing Bubble and Move to Reno!) I decided to check out some properties in Reno on Zillow and came across this gem. Now at first I thought I was having a flashback from my street roaming days in the Bronx back in eighties, so I hastily looked around me and saw that all objects remained inanimate so I had to conclude that this was real. (If I’m wrong, please tell me. And please help make it stop.)

So whaddaya think? Would this qualify for one of the doc’s “Real Homes of Genius?” (Doctor Housing Bubble, of course, as if I had to say it)

What say you?

http://www.zillow.com/homedetails/2745-W-Lake-Ridge-Shrs-Reno-NV-89519/7300878_zpid/#{scid=hdp-site-map-list-address}

$180K for the lot? Not that bad. You just need to allocate some funds to knock down the wreck that is there and build something good. If that is where I think it is (my brother lives in the Reno area) it’s a fairly expensive neighborhood.

If they were trying to sell it immediately after construction was halted, the shell might have been rescued and completed. But the market was in the grip of madness and this was no exception. They needed to go low, move it fast and save what was there from being a complete waste.

My sister and her husband had a similar situation in Newhall, CA. Architect was building dream home for himself and wife when their marriage failed. Put house in two-thirds finished condition on market and my sister and brother-in-law (who is a successful landscape designer) grabbed it and customized it to their liking. The twist is that the architect lives next store in the house he planned to flip after moving into the dream home. He and wife got back together and they’re still next door.

I’m sure the 180K price tag for the lot may not seem too bad; my point was the drastic drop in the asking price and the notion that a price tag of 2.3M could be commanded for something that looks like a crackhouse. One listing source by the name of, get this, Luxury Real Estate (oh, boy) has the property listed for 754K. Does anything in those photos exemplify “luxury” to you? Please keep in mind that the photos showcase not the lot itself, but the structure.

Leave a Reply