The fallacy of cheap home prices and the two income trap – dual income households underscore massive housing inflation. Nationwide home prices overvalued by 25 percent.

Housing inflation has run at an elevated pace since the 1970s and ramped up starting in the 1990s. Yet what masked much of the pain was access to easy credit but also the rise of the two income household. The housing bubble is worse than many expect and probably for the wrong reasons. Many readers make the wrong assumption that because we are largely a two income household nation that home values had to rise simply because of this transition. It was a simple 2 plus 2 calculation. This is wrong and it is more likely that home values grew in the last decade more on the introduction of exotic mortgage products that didn’t rely on income measures. There is little debate that many cities in California are still in major housing bubbles. Yet nationwide home values are still overpriced by 25 percent. Let us examine why.

Dual income households

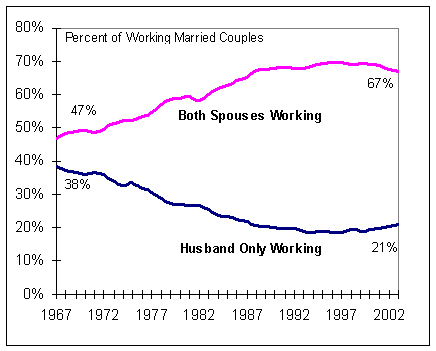

Since the late 1960s there has been a steady rise in dual income households:

Source:Â Tax Foundation

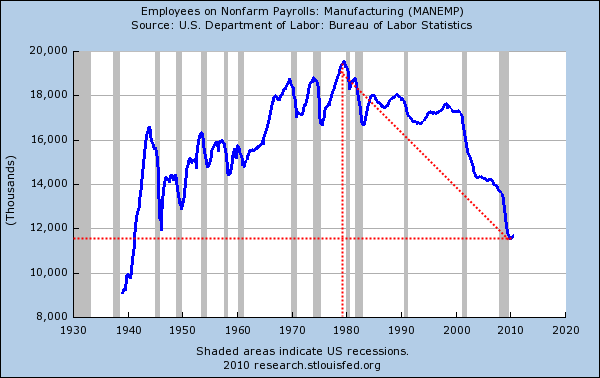

The above is a dramatic shift in the way we organize our household budgets. Yet we also need to remember what caused the above shift. In the 1950s and 1960s it was very doable for one blue collar job to support one household. That is, purchasing a home with a 30 year fixed rate with one blue collar income was not an extraordinary accomplishment. But what pushed the rate from 47% in 1967 to 67% today? Of course the obvious part is the rise of women in the workforce but the more sinister reality is that households now need two incomes just to stay within the middle class. It was more out of necessity. You need only look at the data on manufacturing jobs to see the trend:

We have the same raw number of people working in manufacturing as we did in the 1940s! Of course our population has expanded dramatically over that time. It is amazing that 4 out of 10 Americans work in the low paying service sector (i.e., McDonalds, Wal-Mart, cashiers, etc). That is why the median household income of Americans is roughly $50,000 (in California it is roughly $60,000). Now given the large amount of dual income households, you can do the math on individual wages. The housing market inflation has been underplayed because you have dual income households working lower paying jobs. So yes, income has gone up but the per capita wage for each individual has gone down. Even with two incomes, the current price of housing in the U.S. is too high. That is why the Federal Reserve has done everything imaginable to keep rates artificially low. But guess what? Unless they can throw in a third income to the household people won’t be buying.

Historical housing prices

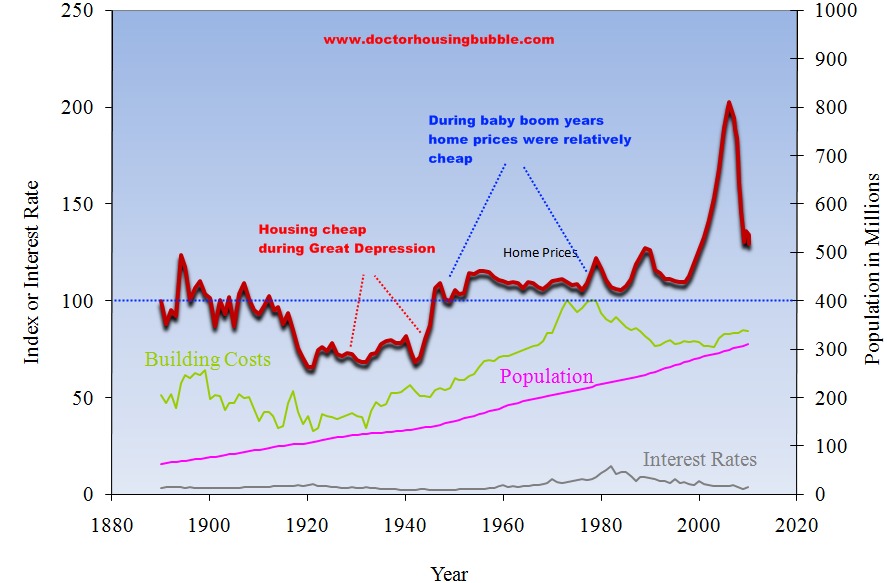

When you tell people that housing prices are still too high, they looked shocked. How can this be with such a dramatic correction? They might agree on the merits of a handful of California areas but certainly not nationwide. The reality is, nationwide home prices are overvalued by at least 25 percent:

Now this is data going back to the 1880s. For over 100 years home prices hovered around the 100 base point. During the Great Depression, home prices were extremely affordable (but then again it was the Great Depression). But even after that terrible economic time, home prices remained relatively affordable for nearly 50 years from 1940 to 1990. All of sudden you begin to see spikes in this market. What exactly happened here? You have the S&L crisis but also the de-regulation of the financial markets. In other words, we suddenly allowed toxic junk mortgages to enter into the system and turned the housing market into a wild casino.

Even after the dramatic spike and peak reached in the 2000s and subsequent slide, home prices still need to fall another 25 percent to be in line with historical data. If this is the deepest crisis since the Great Depression you would expect that home values would at least make their way back to the 100 base point. The mainstream media only relies on banking and housing pundits that have a vested interest in keeping home values inflated. They don’t have any sense of what is going on in Main Street USA. Just last week I saw someone (yet again) selling loads of cans and plastic bottles at the recycling center from their leased Jaguar! Or another person was buying loads of items at a dollar store and had a Prada purse. Sure these are anecdotes but things are changing. And Americans have little faith in the stock market as they should:

“(MSNBC) Renewed economic uncertainty is testing Americans’ generation-long love affair with the stock market.

Investors withdrew a staggering $33.12 billion from domestic stock market mutual funds in the first seven months of this year, according to the Investment Company Institute, the mutual fund industry trade group. Now many are choosing investments they deem safer, like bonds.â€

Why keep money in a stock market with no reform, flash crashes, and I-bankers fleecing the American people in their glorified casino? The reason home sales have collapsed is the fact that the employment market is so weak and fragile. People are shifting their spending habits to “needs†from “wants†and this has cratered many industries (no more Prada bags but $1 tooth brushes will work). A giant McMansion has many substitutes. You can lease a smaller home or condo. In other words the demand for buying homes is highly elastic.

Income data

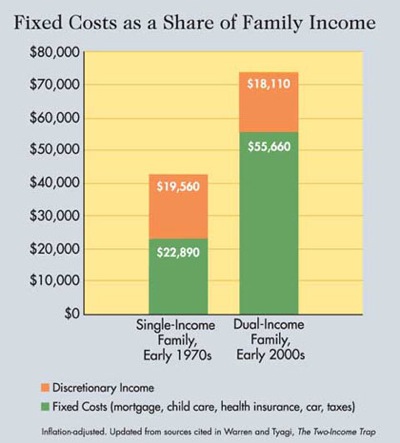

Elizabeth Warren, Professor of Law at Harvard has been a fantastic advocate for the middle class. Her book on the two income trap is fantastic and highlights the slow erosion of the U.S. middle class. Her data below shows that two incomes are not necessarily better than one given the current erosion of individual purchasing power:

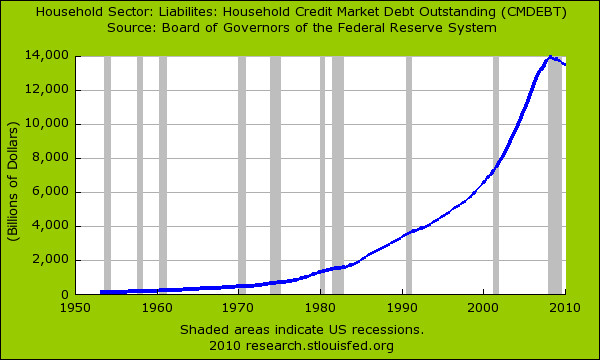

Now run the above numbers carefully. The single-income family of 1970 had more discretionary income than the dual-income family of the early 2000s. To keep pace, the recent trend has been for households to take on more and more debt to make up for this real short-fall:

Now this is an interesting point. The balance sheet of Americans has taken a major hit since the recession started. In fact, residential real estate values (the place where most have their net worth) have cratered by $6 trillion. But look at the above. The debt hasn’t adjusted. This has to do with banks not realizing the actual losses (i.e., shadow inventory, etc). Yet the reality is losses have occurred. And when you even run hypothetical scenarios you can understand why having two incomes isn’t a big win:

Source: CNN

This is an interesting perspective. If you run through nearly each line item above, everything has gone up in price over this time. Don’t even start with healthcare or college costs because the chart would tilt right over. But even looking at mortgage payments and taxes, things have shifted. Also, with the single income household you didn’t need two cars or needed to pay for daycare/babysitting. These are added costs that come when per capita incomes have shrunk.

Now with many households becoming one income households yet again because of this recession, we see the tide rolling out and how bad things really are. Combine this with a tightening of credit access and the reality is revealed. Home values are still extremely expensive and have been covered up by dual income households and massive amounts of debt. Remove both of those and you get a very ugly economic picture.

So what does this mean? It means home values need to drop lower. It also means we need to focus on figuring out what is needed to get our employment base on the right track. We don’t need any more agents, brokers, or Wall Street i-bankers so we need to ask what industries we want to see flourish in this country. The only pundits we hear from on national TV usually want the old order to come back. Looking at the above data, that looks highly unlikely.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “The fallacy of cheap home prices and the two income trap – dual income households underscore massive housing inflation. Nationwide home prices overvalued by 25 percent.”

The US started abdicating production off-shore in earnest back in the early 1990’s. It’s now at a such a level that very few things are made here anymore. And now many services are going off-shore as well….The govt sector is the only employer that is holding up the mirage. Now it too seems to be faltering. If it cant successfully issue greater debt in the future…..the wheels will come off the system quickly.

The family income (purchasing power) has gone down over the years. Our standard of living has really gone down.

The quality of life has tumbled down. Because both parents have to work, the little kids are basically raised by strangers at the day care center. We eat out more because no one is home to cook. Most of people trying to save money will opt for the cheap fast food which is bad for the human body. Then the health condition goes down. The health cost goes up for everybody including the stay-healthy ones. The globalization is supposed to lower the cost of living. Instead, the rich got richer by exploiting the cheap labor overseas. The people here lose their jobs forever. The super rich bought the government. When the crisis strikes, they got bailed out. The corruption has kept the quality of education down, which keeps our future generations down from effectively competing globally. We separately need drastic changes.

Excellent post, Doctor.

I had a conversation with someone a while back on jobs and efficiencies. With continued efficiencies in manufacturing and even in service, do we have enough jobs in the USA for everyone that wants one? And with moving jobs overseas, it creates an even bigger problem. This imbalance needs to be corrected; until then, we are approaching a new “normal”.

Yes, we must smash the machines to get the jobs back!!! Then we can run around busting windows – that will create more jobs! Then we build giant pyramids – that will create lots of jobs.

Jobs for everyone – wealth and value for no one.

True, we must smash the machines to get the jobs back.

The machines are:

1) Greedy Wall Street Bankers, who create no new products or services for the average middle class Americans, only products or services for the UltraRich 1%.

2) Media owned by Greedy Players who lie for profits.

3) Greedy CEOs who are waging “class warfare” against the average working Americans by outsourcing and off shoring American jobs.

4) Corrupt GOP politicians who work for the interests of the UltraRich 1% and who vote against every single bill that benefits Middle Class or working Americans.

Basically, the uneducated Bubbas have been fooled into thinking that the interests of Hate, Racism, Anti-Imigration and Religious Bigotry represent THEIR interests and these same people vote against their economic interests EVERY SINGLE TIME.

What’s The Matter with Kansas, Bubba?

http://whatsthematterwithkansas.com/

I’ve had a nearly infalible investment strategy over the years. I discovered that whenever in life I feel like I am being screwed, find out who is screwing me and buy stock in that company. The trick is knowing who is screwing you.

In my depressed opinion, we are screwed. What does America make (not just design) that consumers want? I don’t see any reason for a resurgence in anything.

And, unfortunately, people are being mad at the wrong things.

Movies. 🙂

I feel really hopeful that people will start to see what is really important in life. Part of this will be co operation within one’s community and buying and bartering locally. Show the big guys that we don’t need to buy from them. Learn from communities that work together. Like the Amish.

I’ve lived in the San Francisco Bay Area since 1968, when I was 18. In this area (not the rest of the country, I’m just speaking of the effect I observed here) home prices began skyrocketing in the mid-70’s and kept on going up from there, with pauses during recessions. But in the initial phase of skyrocketing prices — 1975 – 1990 — people were still using traditional, 10% – 20%-down mortgages (though in the final years of that period people began referring to things like “creative financing”, “balloon payments”, which were probably the primordial ooze out of which the whole sub-prime mess evolved.

But in the beginning of the housing price inflation, it was clear that prices were being affected by what people could afford: microprocessor-stimulated Silicon Valley was creating jobs with higher and higher incomes, and dual-income baby boomer families were becoming the norm.

Dual income family trends in the rest of the nation might not have had as much impact because, due to the geographical confines of the Bay Area, it was not possible to meet demand by building lots of new housing developments, unlike other booming areas like Chicago-land.

The most ABSURD real estate bubbles have been going on in India and China for the past 20-30 years, where homes have appreciated about a THOUSAND times. A one thousand US dollar investment in India’s metro real estate in the 1970s is now worth more than a million US dollars. Home owners in India and China are unbelievably rich and are far more wealthy than their Western counterparts. Despite the ABSURD appreciation in the past 30 years, the mentality in India and China is that real estate is the easiest and best form of investment, with values doubling every 2-3 years. Note that these so called homes in India and China are small, with little features, very low quality, have no good infrastructure and so filthy that no sensible person would spend even a 100 bucks on, yet are being sold and bought for millions of dollars each in the greatest PONZI game ever played. This PONZI game has created inflation, which then fuels the PONZI game even more and you get the idea. Compare all of this to the United States. Homes have hardly even tripled in value in the last 30 years, and yet, we are quick to point this out as a bubble. We are playing the reverse PONZI here, where we want to destroy absolutely fabulous homes to complete worthlessness. A regular 2000 sqft 4-BR American home would cost several million dollars everywhere in the world except in the USA, where it costs a measly USD 200000. Yep, Americans want everything for free. If it is not free, it has to be a bubble.

“A regular 2000 sqft 4-BR American home would cost several million dollars everywhere in the world except in the USA”

It’s not, that’s crap.

I’m talking from EU, I should know. EU is way more expensive place to live than US, here in north we need such things as half foot of insulation and a roof which stands three foot of snow. 2000 sq ft is quite normal house here too (on the bigger end, though) and it will cost a lot to build, but not several millions or no-one could buy those. I have a budget of about 200 000 euros and that should be enough to have a house built for me with some luxuries thrown in.

Considering technical differences your house (essentially a plasterboard box with roof and plumbing) is very expensive even at 200 grand.

You can’t compare a $200k US suburb home to a home in the city elsewhere. The same home in a village or remote suburb in India will cost $50k or less.

Thomas,

I live in MN and we know something about cold and snow here. The climate in most of Europe is much milder than here in the Midwest USA. Our building codes require roofs that withstand more than 1 meter snow load and walls with insulation values equivalent to yours. The average price of a home here in the Midwest is less than 200K euros too.

//The most ABSURD real estate bubbles have been going on in India and China for the past 20-30 years, where homes have appreciated about a THOUSAND times.//

Rob , I wonder how exactly did you come to the figure “about a THOUSAND times”?

wow! pretty awesome data there.

I have a family in India, AND I have bought a property in one the metropolitan city as recent as 2009 and close to heart of the city. I would call the prices are up by FOUR times from where it was in 1996 to 2002/2003.

Like every other RE market, INDIA has the same kind of price fluctuations based the location, infrastructure(which is bad most of the places) and especially based on neighborhood.

Talk about quality dont even start it. In India a all the buildings (if they constructed with a city/municipal permit) have to be concrete roofed. Do you even know what that is? care to find out ever?

What you are pointing out is the quality of infrastructure , if you take as whole community/ies. By that i mean, the road, electricity (is a big mess)shops avaialble, quality of foods (when compared to USA).

Until we see manufactoring increase in this country the decline will continue. We do not produce enough engineers in this country to hold a candle to the tens of thousands coming out of Chine and India, just by shear numbers of people thinking of new inventions and new ideas coming out of foreign countries it is simplay a matter of time when a significant new technology will eminate from the minds of all these foreign competiors and that will be the final blow to the US. Our young people are more interested reality shows and music than inventing something as a whole. My parents lived through the Great Depression and it changed them into hard working productive citizens, this new generation may need to see how hard life can be when you are uneducated in useful terms or just have a im entitled attitude. The world delivers the school of hard knocks without reserve and we are no exception.

Your tax burden goes down significantly on one income and you become eligible for government subsidies (*hint). http://mises.org/daily/3822

~

Re: manufacturing. Manufacturing output has actually been increasing in this country even as manufacturing employment has plummeted. The reason is automatation. Ultimately, manufacturing workers will be replaced by robots, even in BRIC. In fact, this is already happening.

This begs the question, “What will the rest of us do for work?” I don’t know.

I agree, automation will take most jobs eventually. People will have to see benefits trickle down from this or the world will just implode—we’re already in the depths of privation, any more and it’ll be chaos and martial law. We could potentially transition into an era of post-scarcity innovation if the means of production can be brought to people in a tangible, sustainable fashion—along with education. Instead of treating people like vapid cattle on an abusive ranch we could empower them to help us out of this mess. Yet, intellectual property rights have crippled us by locking off info and ideas behind golden legal gates—punishable by an Armageddon of litigation. Open Source Ecology—polish fusion physicist Marvin Jakubowski—has created a distributive enterprise business model for their endeavor, which is brining the open source software movement to physical reality via free, educated collaboration. They are building out a list of 50 machines needed to take a person from “mud hut to singularity” and making those blueprints/video tutorials available at zero cost. They built a completely operational emulation of a $44,000 John Deere 5075M Utility Tractor for $6,000 in three months—obviously access to materials and market fluctuations will affect price, but the idea is incredibly inspiring. I suggest checking it out, and if you’re good at DIY, build one of the machines to advance the data for the cause.

Doctor

I read everyone of your posts and I must say … this one here … simply one of your best.

Rob, Rob,Rob…

Not to detract from the beauty of your screed, but you might want to take a look at Goleta, CA. 1500 sq. ft. homes built in 1960 and sold for $10,000 were fetching a cool million at the height of the bubble in 2006. This for a 46 year-old house (need I say in need of a new roof? Need I say 46 year-old plumbing running under the slab? Need I say settling, cracking and tilting slabs? Need I say 46 year-old wiring throughout the walls?).

Yes, indeed, no bubble in the good old US of A. Why, the rest of the world all live in mud huts with only cow dung for fuel,you know.

Instead of shoveling at least $5 Trillion into sustaining the bankrupt old economy that was based on the expansion of debt and suburban sprawl, we could have applied this money to our national debt, or at least put it toward essential infrastructure repairs, especially the frayed and inadequate electrical grid and essential repair-replace for our 8,000 dangerously decrepit bridges and 3,500 large hydro dams in danger of catastrophic failure.

Now we have no money left to do these things, because we’ve funneled it all into things that have to be considered sunk money that we will never recover, which is our fantastic suburban sprawl and the tower of mortgage debt that can never be repayed.

We have it all wrong. We grew rich and powerful by manufacturing and innovation. But heavy industry and technological innovation require massive capital commitments for extended time frames. which won’t happen in a fake economy that keeps adding to the level of risk inherent in running on debt and fumes. We need savings and investment for these things, long term investment; and Keynesian economic policy with its emphasis on spending beyond our means and driving consumption in the absence of real production, or the resources that are needed for production, militates against the behaviors and investment we need to capitalize the industries we badly need, such as electrified rapid rail, both freight and passenger, serving every city and major town, and power generation capable of providing the amounts of power that will take, let alone to keep even with current needs.

Laura, your last sentence is too long. Way too long.

And to make matters even worse, according to the latest census figures, 43% of adults over 18 are single. Now if the other 57% are living as couples, that means that for every 43 single households, there are only around 28.5 two-adult households. Of course, some of the single people live with their parents, etc. But even if we were to assume that 1/4 of that 43% lived with their parents, that would still leave just 28.5 two-adult households for every 32 single person households.

And with just 67% of two-person households having double incomes, that means that there are only 19 dual income houses for every 41 single income households – or in other words, less than a third of all households currently have two incomes.

As much as I like the Doc, and Elizabeth Warren, the charts and article do little more than to verifiy what is already common knowledge to anyone who has kids, and a spouse working.

The spouces salary mostly goes to cover the “extra” expense of the car and related car expenses including gasoline, child care, clothing, lunches, and any other work related incidentals.

There is only an incremental increase in disposable income.

It’s not a linear relationship, nor would any sane math competent person expect it to be, unless A – you don’t have kids, and B – can somehow get by without the extra car.

This would remove a considerable overhead expense associated with the second income.

But that is not in any way new news.

There is nothing inherently wrong or evil about a two-income family.

Truth is, it really is a different world.

Some women want to work, have a career and an individual identity.

The only trap door in the trap is for a family that spends exactly as much as they make, ergo, relies on the second income to make the ends meet.

However those ends are defined.

And one of them loses the job.

It, like this housing madneess, also tend to add to the stickiness of the labor market and labor mobility, in that if the other member has a job, it inhibits the ability to relocate for greener pastures.

I think we have a long road ahead of us. Whatever solution the democrats or the republicans have , do not fit the problem. The republicans just want more of the same and the democrats have no clue. I think this malaise will work itself through our society until we can’t take it anymore and then I am afraid we might go in the oither extreme-full on protectionism. Then we might come back to a balance.

Very interesting post Doc.

One solution is to start building things here in the U.S. Andy Grove wrote an interesting article on Bloomberg on July 1, 2010 titled “How to Make an American Job Before It’s Too Late: Andy Grove”. (http://www.bloomberg.com/news/2010-07-01/how-to-make-an-american-job-before-it-s-too-late-andy-grove.html). I don’t know if it will work, but I would be willing to try something different than the current strategy of bailing out the “too big to fail” and trying to artificially keep real estate inflated. Not only did the big institutions get bailed out, after this last economic chaos they appear to have gotten even bigger!!! But I digress. I think if we “rebuild our industrial commons” we have a better chance of increasing household incomes in real terms.

I just read the article. I think Andy Grove or anyone who argues that we need to create more manufacturing jobs should consider the hurdle of the unions. Look at Wal-Mart. They are killing the traditional supermarket chains by opening super-centers and hiring non-union workers. Without the unions, Wal-Mart is able to maintain competitiveness domestically. Look at the state unions. Because of them, the state is broke.

However, if the essentials like housing, food, education, and health care are much cheaper, maybe the union workers will not ask for as much as salaries and benefits and live with a much lower paycheck. Break down the essentials. On the monthly basis, rent or mortgage is a much larger portion of expense for most of people. If this part is lowered significantly, 1) people will have more money spending on other things like education; 2) because of lower labor cost, maybe the US companies can afford to hire their own people in US; 3) less stress will lead to lower health costs. That’s why we are here. We want lower housing costs.

Graet post. This thesis is not new but good in that it needs to be said. Thanks DHB. The expense chart is probably much worse as stated b/c of extra clothes, cell phones, work related expenses. Net gain = zero or worse (maybe), ie, it is a cost to have that second job. There are plus benefits in regard to added value to society but these are hard to quantify.

Yes media has not adequately delivered this picture on affordabilty but I would like to see a thesis about how the “tradition and culture” influence this self delusion of home ownership as a necessity. I mean there are other life “experiences” worthly of income outlay and committment (I don’t want to say investment since I have not defined what the outlay is). There is strong and and huge bias towards home ownership even if the economic paradegim has shifted. What if the parents instead said, “ok screw the house, we will rent, but we are going to do everything in order to send the kids (or themselves) to medical school (or professional school or technical school, etc)

The “Taxes” item are what screams out to me. Our government is the family’s ENEMY pure and simple. Having gone to one income 23 years ago we always have recalculated the two income fallacy for raising a family numerous times and stuck with our plan.

Two more huge expenses since the 80’s:1) added medical and pharmaceutical bills for “stress” disorders accompanying the two income life. 2) Divorce costs when the whole family breaks apart.

I hope people read and take heart what you and Elizabeth Warren are trying to enlighten people with.

I’m not sure what the “correct” housing prices ought to be. However, I do know that people are living, day to day, measured by the quantity of goods being produced and consumed today, far better than they did in 1970. Drive on any freeway in SCAL and you will see cars that are so much better than they were in 1970. My 96 Camry has 250,000 miles on it and is still going strong. In 1970 I don’t think anyone would think of driving a car for more that 100,000 miles. Look at what the kids are consuming today. Shoes, texting, laptop computers, face book, skiiing trips, graduation parties, going abroad, going to Vegas, $200 jeans, digital cameras in their phones. Inside homes, a bedroom for every kid, their own private phone, food on demand, I’m sure all of you could add more.

What is the point? As an economic historian I learned years ago that it is better to look at “real” goods rather than looking at prices and measured incomes when trying to determine what is happening to income. Looking at values of goods measured by prices is like a veil that is covering up what is really being consumed and produced. We don’t have a good “yardstick” when we use prices as the method of valuation, particularly when much technical change is going on. If Elizabeth Warren was looking at families consumption by the quantities of goods i.e., shoes, potatoes, telephone calls, miles driven,etc. she would have a much different picture of what families were consuming and how much “better off” families are today compared to in the past.

“In 1970 I don’t think anyone would think of driving a car for more that 100,000 miles. ”

Maybe not in 70s (quality was going to drain already then) but most cars made in 60s are still running if maintained and there’s no reason why wouldn”t they run almost for ever: Very reliable machines. Gas guzzlers of course but that’s another matter, nobody cared at that time.

The idea of planned obsolence is ensuring that none of modern cars will be moving in 50 years, 20 years is hard job for most.

Recently sold my 1976 MGB. (Used to be my mothers but I drove it for 15 years.) Sweet car with way over 200,000 miles on it. Did I think it would last that long? No, nobody did. 🙂

Hey, read her book. She did compare those things and guess what? We aren’t better off despite fancy new technology. She very clearly and methodically shows that families today spend far more on essentials and much less on discretionary spending than they did thirty years ago. That’s more for housing, education, food and health care. You might think that because people have a fancy iPhone we’re better off but that simply is not the case.

Ofcourse, I do love my iPhone…..

Excellent perspective Doug. The amount of goods available, and the access to those goods, is incredible when compared with the past. It’s amazing to think about what even “poor” families have these days.

At the same time the quality of those goods (except electronics perhaps) has gone downhill. Things are not built to last. Even the quality of our food has gone downhill.

Joe Average – yes, the poor families have cell phones and sattelite dishes today, but they are forced to eat some of the worst quality food in the world since an apple tends to cost more than a fast food hamburger these days and soda is cheaper than milk, which itself is stuffed with hormones that make their daughters enter puberty at 8 years. Living a healthy live is only affordable to the elite.

She did. In great and agnoizing detail. Those graphs are jsut a tiny tiny part of the book. Pages and pages on comparing % of income spent on clothes in 1970 vs now, food etc. Tyr READING it before making criticisms. Shouldn’t be hard to find – try your library since it was published more than 2-3 years ago.

My father (since passed away and one who lived through the last GD) had been saying this for years: You get what you pay for. We are now getting what we (the American public who is so in love with “rebates” “sales” and “discounts”) paid for, cheap goods and cheap houses make for no jobs and no income in the long run. I’m going to join the team of “we’re screwed” because we have to now build a completely new infrastructure for jobs that does NOT include high union wages and benefits in order to compete with the rest of the world. I’d hazard to say that before its over and done with, the majority of homes are going to fall below the 100% line and we will be happy to have a roof over our heads. And happy to eat.

We do need to focus on how to survive the next 10 years, the heck with what houses will eventually cost. Its all relative if you are living on the street.

Rob,

Just because other countries may have bubbles which are even more absurd than the US doesn’t mean that we don’t have them here. It almost sounds like you are saying the US economy is great since there are others which are worse. It doesn’t work that way. Less bad does not equal good.

Take the laziest freeloading person you know (we all know one). If they can show you someone who is a bigger deadbeat does it make this person a hard worker? Of course not. I think your conclusions are way off base.

The question is when will the banks actually start taking these houses back and selling them? I’m at 20 months of non-payment and I have begged, pleaded and tried to do a short sale with the bank and they refuse to take my house. I moved out and told them the house is vacant and I’m not longer taking care of it and still no dice. We got an offer for a short sale that was above what the same floor plan went for in the neighborhood within the past few months and they still refused. I really think the banks can’t take the losses on all these properties without needing another bailout. They probably have my loan along with millions of others on the books at 425k when its only worth 160k. Excellent analysis as usual by the way.

That’s amazing. So, you’ve begged them to follow through on your contractual agreement with them by way of your mortgage and they won’t. Wow. Next time someone wants to castigate anyone behind on their loan as some sort of deadbeat, especially if they so much as consider strategic default, remember DG’s story. The bank doesn’t want to follow through on the contract!

DG, be careful. If you (a) don’t take care of the house and (b) don’t transfer responsibility to the bank properly, you can get stuck with significant losses.

Talk to a lawyer regarding the best way to mitigate damages and turn over legal responsibility for the house properly.

It may require nothing more than a few letters sent via registered mail. But you need to legally establish (and be able to prove in later legal proceedings against you) that the bank is now the responsible party and cannot come after you for more money.

This could happen if they delay selling the house and its value drops further, or if they don’t maintain it and it must be torn down.

I have no idea where we as a nation are headed. But the haves and have nots are widening, I moved to Texas from Cali. due to cheap living. ‘I’d rather be there’. I was poor as a mouse there , here w/ the snakes and bugs, I live average. If u have a fancy taste bud, You have to pay. ‘You get what you pay for’. We as a nation have to say enough, I’m full and back away from the dinner table. Your not going to change the banks policy and the direction of this slide. I agree with Dr. House all the time and if you stick your head in the sand, you’ll end up w/ sand. Stop watching TV, there is no batman and hommer, to bail us out.

DG, did you have to move from the area? One of my friends lives in N california. She bought her house way back in the 60s and almost payed off. But then she took some out to put her kids through college and then it was so easy-she bought cars for them, paid their downpayments, went on vacations and just spent like crazy. She lost her job that she had been in for 32 years. So she quit paying for almost 17 months now-she almost has 800k in loans and I think she bought the house for 20-30k or something. Nobody has asked her to move out and she is happy and content !

I just don’t think this state of affairs can hold on for long. Obama might have had good intentions, but we have to let this go to its bottom.

DG- You should be aware that even though you moved out of the house, as the legal owner, you still can be on the hook for property taxes. If the county so chooses, they can garnish your wages in order to pay those taxes.

Check with an attorney and or tax person.

jesus…if we go back to a one household income i will have to spend more time with my spouse and children….!

Something has to change as Cronies can’t squeeze any more out of the Middle Class. There hardly is any Middle Class left. Housing prices will come down as there is less and less demand at bubble prices.

As prices usualy overcorrect on the downside, home prices should bottom out around 60% off peak pricing. Taking an averageof 3% inflation and house appreciation annually, since 1997, home prices should have risen about 57%. That’s quite a ways off from what we currently have on the Westside of LA. Still a good 30- 40% overpriced.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

@Rob

“USA, where it costs a measly USD 200000. Yep, Americans want everything for free.”

The measly 200,000 you refer to is a lot of money for some people and that is all

they can afford. If houses that cost that will go up to millions of dollars, who can

pay for them?

Three things we need to address:

1- Dump the cronyism and put in tight laws to make it safe for everyday people to invest in the US economy.

2-Offer tax breaks to our businesses that make it more profitable to keep manufacturing jobs in our country and giving jobs to our own blue-collar level citizens (No amount of over-priced vocational school will make everyone computer engineers we need living wage jobs for our large, working schmo population.)

3- Take pressure off companies and families by making health care and higher education affordable.

Health care: Start actually going after insurance companies for illegal denial of care tactics and pass laws that require ALL insurance companies to provide a basic health care package to all citizens on a sliding scale (and each company in each state must take on a proportion of the population with high risk/ore-existing conditions.

Universities: First off, offer more and better personal finance, business classes and vocational tracks sooner. Start in 6th grade. Not everyone needs to go to university, and we need more small businessmen than we need professors.

Then, start a shake-down of the state universities. Stop giving school regents boards the right to vote themselves and administration buddies raises. Also start pass laws linking chancellor/administrator’s salaries to only 10x that of the lowest paid tenured faculty (that alone would save millions!). THEN require universities to have 75% funding for all new buildings, labs etc. in an escrow account before beginning construction, and forbid passing the cost of any non-vital or deluxe updates on to student tuition (like luxury single-occupant dorms, restaurant-style food courts, luxe new gymnasiums). I worked in the financial department for a major state university and was appalled at the way flash corporate MBA’s (old buddies hired through the chancellor’s past life as a defense/oil exec.) demanded and got luxury corporate perks (new car, expensive condo in elite area, private-sector level salary) while racking up expenses in kick-backs, buddy deals and “Re-branding”, passing o these non-academic unnecessary costs to our students as tuition spiraled out of reach of our state’s median population.

Once it’s possible to trust banks and the market again for investing, find a job to support a family, cover health costs without going broke, and work your way through college without crippling debt, our economy can start to stabilize.

Susan, think about all the structural changes that are required. Health care is 1/5 of our economy, education is also got unsustainable costs with faculties and facilities that require major changes. On top of this add on the real estate fiasco, and we have major changes to undergo as society. Unfortunately, I think the young people are more likely to play video games than to actually solve issues as the old have robbed them of actually having a decent life. None of them can afford a house in these areas, and the people that took advantage are counting on it for retirement. How can you save and invest when wealth has been made in this unproductive way….

Hi Dr HB, do you still stand by your earlier estimate that housing will bottom in May 2011?

This thread is more interesting than the article. We created this problem ourselves with our own desire for more, more and more.

I am 63, my wife and I live debt free and have for many years. I drive a 15 year old pickup some people won’t ride in that I purchased at an auction, we have a 10 year old car, paid off the house in 15 years, have 1 income and put almost 1/3 of my net income in savings or investments. We don’t own a large house, go out a lot to eat, have rolex watches or live to the max. What do we have? a large amount of security and sleep well at night. Who is impressed by that? Our friends who live in larger houses and drive nicer newer cars.

It is very impressive what you did with one income…. but it is just not possible anymore. I have a very nice job as an aerospace engineer… considerably higher than the reported median household income in my area, but I can’t make the mortgage payments on a 900 sq ft house… much less pay it off in 15 years! I am forced to try and raise a family in a 2 bedroom apartment… and rent still takes up most of my income. We live within our means, but the middle class as my parents lived is a thing of the past.

Yea really, it’s one thing to be 63 and have paid your house off in 15 years, but who can do that anymore with current housing prices in Los Angeles, much less on one income? Yes, the baby boomers had it good but what about everyone after? The Dr is right, way over priced housing is an enemy of the middle class.

My dad started a business 35 years ago in CA that is still doing well. After buying out his partners, 2 of my brothers are working there. The business hasn’t changed much, but my brothers’ lifestyles are definitely less than what my parents managed with one comparable income years ago.

Their basic costs for living expenses are frugal but substantially more than my dad’s ever were. Dad had the advantage of having been able to buy a nice piece of land and build on it years ago. My brothers are stuck in pre-bubble bought houses with no yards that are too small for their families. Their wives have had to start working as the last of the kids have started preschool. Not for extras or luxury items, but just to make ends meet with a little bit of savings left over.

No, this isn’t Silicon Valley. It’s just a smallish town in Central Cali.

The solid middle class lifestyle that my parents enjoyed has eroded away for their children.

Thanks for a great post DHB.

Ken,

If you don’t mind me asking, what is your location, what income bracket are you in, and how many kids do you have?

The problem we have out in CA is that rents are high relative to the rest of the country which requires you to make more money which puts you in a higher federal income tax bracket. It’s tough to save money out here even doing all the things you say.

But, in general, I agree. 1500 ft^2 sounds like a mansion to me.

PR Cal,

My wife and I live in the burbs of Dallas, we raised 1 daughter and 1 granddaugher, one is a college graduate and we will be paying for most of our grandaughers education as well, starting this year. My income is in the very high 5 figures but this income is not how my situation came to be.

In the late 1980’s the Texas economy went down and I owned a company that technically went bankrupt but I refused to file bankruptcy. We had a 2 year old home and a lot of business debt. We paid off what we could as we could, reducing every dollar of business debt we could. We learned how to live on almost nothing.

We went months without going out to eat and only with a buy one get one free coupon and drinking water. I repaired the cars, wife cut my hair, etc. while the debt slowly went away and I was able to get another job while still paying off business debt. My office was moved into our home. It took years, but we spent as little as possible refinancing the house twice to lower rates and shortening the mortgage.

Eventually the debt was gone, I kept the remainder of the business which was making about 10K a year to put my daughter through college then sold it and financed it.

When all the smoke was clear, we had cash in savings and decided to pay off the house. We still eat meals buy one get one free and drink water. My wife still cuts my hair. I still close the AC vents to the now empty bedrooms and turn off the pilot light to the gas heater for the summer months. Those things add up.

Today I do financial counseling through Crown Ministries for people in serious debt.

Don’t waste a good recession, learn from it and grow.

Ken

Ihaaa, lowest sales ever measured, 27% down from june. I don’t think this will destroy only housing it all goes down in flames. If this is what it takes to get the prices to afordable levels so be it! I am getting the champaine!

teh single greatest problem is noted in the above taxes: the two-income family that “thinks” they are getting ahead are actually paying for the giant welfare class to live better than they live, and without having to do that silly “work” thing.

by having babies they can’t afford, the welfare class blackmails america into being “compassionate” for their stupidity. and then, they go and have another baby, cause after all, ya can’t not feed a baby, ya can’t not give free money to a mother with five kids at her skirts….

or can ya? until this country decides that allowing women (and the men who donate the sperm and who know exactly that the gubbermint will pick up the tab for their wayward ways…) to have babies they can’t afford and be rewarded for it with lifetime health care for free, lifetime food stamps for free, and lifetime daycare (these women work just enough…sometimes, if they are not having to take care of their “disabled” child, and they’ve all got a disabled child).

ah yes, it’s goooooood living to be on the disability welfare gravy train. after all, we are constantly hounded that we must take care of the “poor”. but who says we have to? until americans are willing to cut off welfare once and for all, completely and absolutely and say no rewards for having babies you can’t afford, then those who work are just the slaves to those who dont.

and those who don’t work are sitting on the couch, with a bag of cheetos in one hand, and a pregnancy test in the other….ah yes, is it the first of the month yet?

disability welfare gravy train

WOW! Didn’t know such people who have those with physical and mental disabilties still lived under the rocks.

Why don’t you try having MS or been an accident and end up with traumatic brain injury and memory loss or get some other god awful and chronic condition.

FYI Social Security Disability pays an average of $900 a month – and they have to pay all Medicare costs out of that (Part B, Medigap if they can get one and 20% of all services if they can’t and PArt D prescriptions)

FYI SSI is the safety net for those who have no income, less than $2000 in assets for an individual and who are disabled and were unable to work enough to qualify for SSD. It pays around $675 a month. Yeah— that is where all those kids born with muscular dystrophy, autism or whatever end up.

Would you rather we just gassed those who are or became disabled?

Ken,

Did you know Larry Burkett before he passed away? We have his book. We also have “America’s Cheapest Family.” The authors of the latter work benefited greatly from Larry Burkett’s tutelage.

Sounds like you and I are pretty similar financially.

I did not know him personally. I’ve seen multiple training films that he made. He made some of them when he was in pain with cancer. He sat to one side with one shoulder drooped down.

Dude. The welfare mothers are statistically insignificant distraction designed to get you mad and voting in line with the interests of some seriously wealthy people, who are very much unlike most of us.

The reason the the taxes went up is that the two income couple is earning more money. The two income family has an extra $33k of income, of which they pay about $13k in taxes. That’s about 40% tax rate, which is about right at that income level once social security and medicare are added to the usual income tax bracket for that range of income. The “trap” here is that due to our progressive tax code, the second income is taxed at a much higher rate than the first, up until the first $160k or so of first-earner income. After that it levels off a bit.

DHB can easily correct for this by looking at what a 2-income family in 1973 would be paying. I imagine the numbers would be substantially similar to today, with some fluctuations for insurance and stuff. I believe taxes have actually gone down since 1980. See for example:

http://www.stanford.edu/class/polisci120a/immigration/Federal%20Tax%20Brackets.pdf

It appears that a 73k annual income for a dual income family would put you at the 65% tax bracket and so would be expected to have paid much more.

(Oops, need to correct for Y2k vs. 1973 dollars to read that chart. It would also help to read the 1970 column rather than the 1960 column! 🙂

Americans, you are so thoroughly screwed, and the fact that you fail to realize that your two-party governmental crime syndicate has repeatedly raped you across the span of multiple decades is astonishing. Your crime syndicate politicians don’t give a rat’s ass about you, your families, or your problems, and you’re too stupid to see through their never ending stream of lies. Flushing all incumbents out of office is the only chance you have, but it’s not likely to happen because Americans are too easily duped by the “blame the Republicans” and “blame the Democrats” mindset to understand that both political parties have repeatedly enabled the plunder of the middle class. Example: Cambridge02140 stating that “the uneducated Bubbas have been fooled” by corrupt GOP politicians “into thinking that the interests of Hate, Racism, Anti-Imigration and Religious Bigotry represent THEIR interests and these same people vote against their economic interests EVERY SINGLE TIME.” Of course they have. However, the so-called “educated” (i.e., indoctrinated, and self-indoctrinated at that) American “intellectuals” like Cambridge02140 don’t have the slightest amount of common sense to realize that voting for the Democorp party, which supported passage of health “care” legislation “to see what’s in the bill” a-la Pelosi, where “what’s in the bill” was directly written by corporate interests, further plunders the middle classes. Get a clue: Republicorp politicians = Democorp politicians = crime syndicate. Americans on both prefabricated sides of the political “spectrum” are basically a bunch of easily duped, easily divided suckers that the crime syndicate politicians toy with at will. Americans had better wake up, fast, otherwise it’s game over for them.

you hit the nail on the head! I just don’t know what’s ahead, do you? All I really know is big goverment is failng the citizens and I wish I could be in DC on 8/28/10, you? I also know that a country who continues to kill babies is doomed to failure. Just take a look at Obama’s Czars Bio’s and you’ll figure it out, where these people want the country to be.

Yes, we are screwed. But don’t forget that American’s are resourceful and enterprising people, we just have to get really P****D first before we take action. The scales are coming off our eyes, and when we see that millions of votes can be invalidated by ONE JUDGE, and that the will of the people is no longer the Rule of Law, then hell will be paid. Just wait and see what happens. The people who don’t work, better get an idea on how they are going to work, or they will be starving.

As I said, housing is going to take a big back seat to the bigger issues like taxes, and jobs because no one is dealing with those issues that hobble us the most.

I’m not a Tea Party member, but there is some sense in what it being said. Get the gov’t OUT of propping up all these industries and let them stand on their own 2 feet and survive like the rest of us are doing.

So, if a state held an election, and decided to take away a woman’s right to vote, you think that should be upheld? You don’t think ONE judge has the right to stop one group of people from taking away the civil rights of another group of people?

What if the state you’re living in voted, and decided that the marriages of people over XX years of age (fill YOUR age in the blank), are null and void. You OK with that? After all, the people voted, it must be legal!

We are a nation built on laws. But the majority cannot pass laws to take away the rights of the minority. I’m sure you’d look at this issue very differently if YOUR rights were being violated.

I think Andy Grove is a hypocrite. Intel is one of the biggest outsourcers of jobs to other countries. What he’s not saying, bring back manufacturing jobs here, well, except for microprocessor production.

You did an excellent job of explaining the symptoms of a sick economic system. But the root cause of the disease is the fiat currency. It is a ponzi scheme of enormous proportions which make working class Americans poorer and poorer as you clearly point out. Even today the Fed is doing EVERYTHING in their power to hide their ponzi scheme. Look at what the Fed is doing in the court system even today as we read your blog…

http://ttbth.blogspot.com/2010/08/fed-refuses-to-reveal-truth-behind.html

You got my vote Doc. I’ve talked about this for years. I try to talk about my wife not working so hard the rest of her life and with one in college now it just doesn’t seem feasible (neither of us is a Walmart greeter–we’re talking middle-class earning power). I just don’t see how most people are doing it untile they talk about how much debt they are carrying. It’s a sham and the tide is going out. We are in serious trouble by the millions.

It breaks down to this.

1. Jobs that require very high language and other skills.

2. Jobs that do not.

3. Jobs that cannot be done elsewhere

4. Jobs that can be done in other countries.

When you import literally millions of low skill, low-language-capacity workers in the form of a broken immigration policy, and combine that with the double-whammy of globalization and outsourcing of many jobs, it’s not a big surprise that there are not enough jobs for American workers. Here’s what happens.

1. Jobs that can be done elsewhere will eventually be sent there for the lower costs involved. They have to. Companies will not be able to compete otherwise.

2. Jobs that can be done here that do not require high language skills will be done by the cheaper immigrants. They have to. Companies cannot compete if they try to hire American workers at higher wages.

3 That leaves only jobs that cannot be sent elsewhere (teachers, govn’t workers) and cannot be given to a new immigrant (clerks, laborers, service industry stuff) for what was previously the “middle class”.

That means a a game of musical chairs for the rest of us who don’t happen to be in a “safe” line of work. Unless you have some skill that is immune to the globalization/immigration combo (politician, uber-skilled genius, talk radio personality, etc) you will find your wages plunging as the supply of workers exceeds the demand. Asia and India have a nearly unlimited supply of workers able to do the job. The capital will flow there to set up shop.

Globalism. Great if you have a lot of capital to invest or want a cheaper 55″ TV set. Not so great if you’re trying to make a living and aren’t highly educated AND in a field that can’t be outsourced.

We had a good thing going here for a couple hundred years. Especially post WWII. We blew it for the myth of Globalism as a good thing. It sure benefits the 3rd world, though, I must admit.

Leave a Reply to Laura Louzader