Southern California would be the second most populated state in America and half of all home sales in July were distressed properties. Worst July in four years and every county is down year-over-year in price.

The Southern California housing market is still in deep trouble. Southern California is home to over 22,000,000 Americans and if SoCal were to become a state all by itself, it would be the second largest state behind Texas. In other words, this is one people filled region. The housing figures for July came out on Monday and show an abysmal market in spite of the Federal Reserve artificially slamming mortgage rates to the historical limbo floor. July is typically one of the hottest months for home sales yet the figures are bad in light of every piece of financial spaghetti being thrown at banks and housing. The shadow inventory is still epic in Southern California as banks try to control the market but there is little that can be done because one main ingredient is missing. The recipe is failing because household incomes are in the dumps! Why do you think most of the demand and sales are occurring with lower priced homes? You still have your poser crew in Southern California looking for zip code and area code pride yet their incomes are built for a beer budget yet their tastes are looking for wine. Only a few years ago, the bartender was serving up option ARMs without checking IDs. That is no longer the case. Let us look at the data for the region.

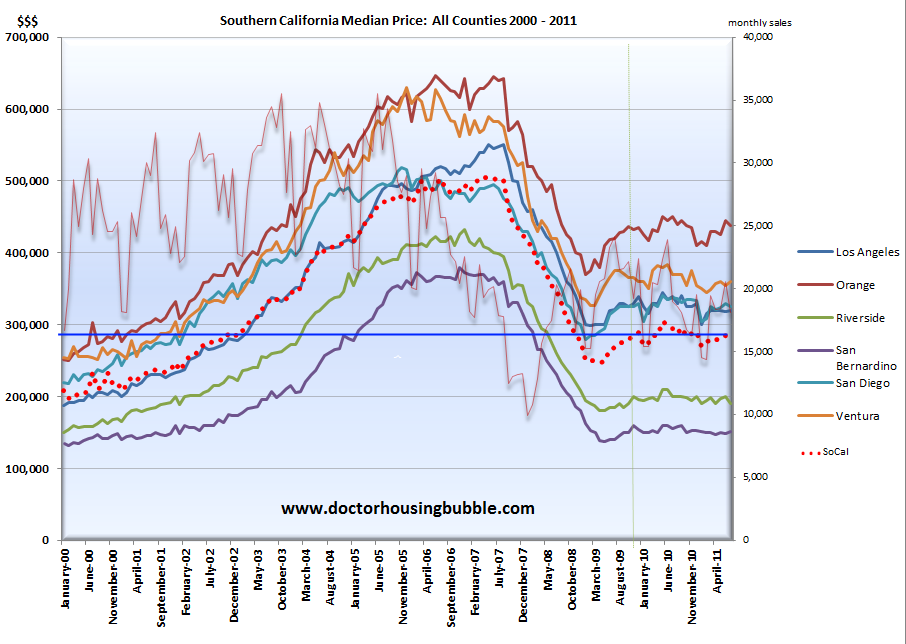

Southern California has poorest performing July in four years

Every county in Southern California is now negative year over year when it comes to drops in the median home price. Even more disturbing is the reality that every single county is down year over year with sales as well. Part of this has to do with banks hoarding up shadow inventory and not releasing what the market is demanding. The market right now is demanding lower priced homes to go with crushed household incomes. Of course the mission of the Federal Reserve is to keep this charade going for as long as possible and pretend that somehow banks are solvent with 6 million homes lingering in the shadow inventory. This has been the problem with our “solutions†thus far. The entire focus has been on the housing bubble and banking when the focus should have been on jobs and household incomes. Let us not even pretend that the last decade was some kind of economic miracle instead of a drunken credit spending orgy. To make up for lost incomes exotic poser financing like option ARMs and Alt-A products were designed to allow people to live way beyond their means. Now, on a weekly basis I see folks driving around in leased BMWs or Jaguars going to recycle massive bags of aluminum and plastic. I’m not talking about folks doing their part for the environment (if they cared about the environment they would opt for a different car, but I digress) yet are looking for an additional stream of income.

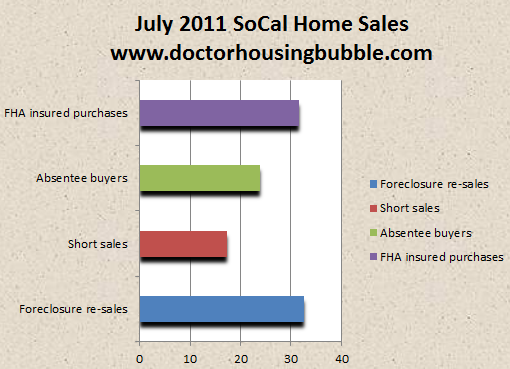

Half of sales in Southern California distressed

There is nothing normal about the current Southern California housing market. Look at the makeup of current sales:

This is a not a normal market! You have nearly 50 percent of home sales coming from the distressed category. Over 32 percent of the sales were foreclosure re-sales (aka cheaper homes) and over 17 percent were from the short sale pile (aka cheaper homes). Then, you have over 23 percent of the sales coming from absentee buyers (aka potential investors) and these folks are not buying your massive bubble properties in bubble cities. Many of the absentee buyers come from the all cash pile and they are paying a median price of $212,000 for their purchases. And finally, you have FHA insured loans dominating the financing game. 31 percent of all homes purchased last month were financed with FHA insured loans which only requires a minimum of 3.5 percent as a down payment and this is what the vast majority are putting down (or all they can afford). Where is the big money here? There isn’t any large deep pocket cohort and this is why banks are hoping (praying) that somehow inflation starts to pick-up so they can off load the giants of the shadow inventory. Many of these are in areas like Culver City, Pasadena, Cerritos, Santa Monica, and other areas you might not associate with collapsing housing markets. Folks are still delusional at this point.

What is the problem? The current policy is actually keeping home prices inflated and that is why the backlog is so massive. The banks have an enormous amount of shadow inventory and we are finishing up year four of this crisis. What did all those bailouts accomplish? The only thing they did was keep the connected banks from going under at the expense of the entire nation. What service are banks doing aside from artificially keeping the market altered for their own benefit? Isn’t this some kind of command control economy that many on Wall Street investment banks despise? If the market is demanding lower prices so be it. It makes complete sense. Why should folks be forced to go into debt servitude even with FHA insured loans just to keep bank balance sheets “healthy†so they can doll out massive bonuses to a system that has failed the country? We do live in an odd sort of world. Unlike the rhetoric from politicians or those from the financial industry, let us run some numbers to highlight this point:

Total SoCal MLS non-distressed inventory:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 121,356

Total SoCal distressed inventory:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 114,343

Total SoCal distressed inventory for sale:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 36,488

This is the problem here. First, you have nearly the same amount of troubled inventory as you do with the natural inventory pipeline. The sales figures are showing that people are opting to go with the distressed properties because these typically sell for lower prices. Yet look at the amount of distressed inventory making it to the public eye. Of the 114,343 distressed properties in SoCal (this is from what we can gather and places that have NODS, there are many more that simply do not fall here) only 36,488 make it to the MLS. In other words the public is only seeing about 30 percent of the homes in the foreclosure process. There is also another pool of distressed inventory where people have stopped making payments yet no foreclosure process has started (and this pool is rather large as well).

We have two ways to go and the one we are taking is similar to Japan. The banks would love nothing more than to drag this thing out for years. Why? They keep getting a paycheck along the way! Yet this is horrible for the economy because resources are being displaced into a sinkhole here. So what if home prices go down if this is all that households can sensibly afford? In regions where home prices have collapsed sales are picking up solid steam. It is important to get to a normal level quickly and liquidate inventory fast so we can get on to the bigger task at hand which is fixing the overall economy and putting Americans back to work. Yet the Wall Street obsessed politicians have focused way too much on housing. Ironically these policies have kept prices inflated and even with those trillions of dollars wasted, SoCal home prices are back to 2002 levels! So what was really solved aside from keeping failed institutions floating and more banks able to pay themselves at the taxpayers’ expense? Horrible financial policy and bad politics now seem to dominate the economy. The SoCal housing market is anything but normal. You’ll know it is a normal market when non-distressed sales dominate and FHA insured loans are a tiny piece of the financing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

47 Responses to “Southern California would be the second most populated state in America and half of all home sales in July were distressed properties. Worst July in four years and every county is down year-over-year in price.”

Yup, the only way the member banks, members of the Fed, can survive is to dribble out the bad debt a little bit at a time. Not having to mark the homes to market price saved them from death in 2009. They run our country. So look for this to go on for years to come.

Sad but true. Reinstate Mark To Market, and there would be much more pain to the idiots who got us into this mess, but we’d get a true and functioning market back in the forseeable future. As opposed to this.

Unfortunately for the bankster cabal, they’re run out of time…

I don’t know if there is a precise definition for ‘shadow inventory’. However, as it is used here at the housing bubble blog it would appear to be something like ‘those houses in the foreclosure pipeline that haven’t made to the MLS yet’, or similar.

In addition to that huge block of housing inventory, I suspect there is a similar sized block of housing inventory lurking in the shadows as well. What about all the people that would love to sell if house prices would just go up a few percent so they could get out even, or with only a small loss? Or people that would love to move to another city, but dread the thought of their house languishing on the market for months. Retired people that would like to downsize, but don’t want to sell their primary asset into price weakness.

When house prices catch a bid and start to move up, these people will be selling, killing any and all house price rallies for years to come, I’m guessing.

Or people who would love to leave the state and buy a really nice house for a decent price but don’t dare because they might not be able to get health insurance elsewhere.

…or find employment!

There are a growing number of homes that were foreclosed with renters in them. All renters are afforded 60 days after notice… Also, the banks have to honor any leases in place before foreclosure so a one year or even longer lease has to be honored. This makes the home an investment property in the eyes of a lender, and will not garner as much in the market as SFR.

Since the Fed Govt and Banks are in bed together I’m not sure if this problem will ever resolve itself in a sane manner.

L.A. Mayor Calls for $8B Property Tax Hike

http://www.bloomberg.com/news/2011-08-16/l-a-mayor-calls-for-8b-property-tax-hike.html

Los Angeles Mayor Antonio Villaraigosa, the chief of California’s largest city, called for sweeping changes in Proposition 13, the nucleus of the nation’s anti-tax movement.

(more at link)

Yes, please!

HUH? LA isn’t on the list of cities where it is cheaper to rent than buy?

See:

Low Home Prices Mean It’s Cheaper To Buy Than To Rent In Many Cities

http://www.huffingtonpost.com/2011/08/16/home-prices_n_928767.html

As the national real estate slump deepens, home prices in many cities have crossed a worrisome milestone.

It’s cheaper to buy a home than to rent onein 74 percent of the country’s largest 50 cities, according to the real estate site Trulia — findings that confirm the national epidemic of depressed housing prices remains in full swing.

Trulia’s research, which compared the median list price and median rent for two-bedroom apartments, condos and townhomes in America’s 50 largest cities, found that renting is more expensive than buying in dozens of markets, particularly in Miami and Las Vegas, as well as Mesa, New Mexico, and Arlington, Texas.

(more at link)

Remember, historically that renting is a premium to buying. There are so many drawbacks to buying that it was often left to people that wanted to be in the landlord investment.

It’s not cheaper to buy than rent because the home buying public knows prices are going down for the foreseeable future and they are calculating in the forward depreciation cost of the home whereas if you rent there is no forward depreciation expense. Also, selling the home will cost you 8 percent 6 (com) +2 (closing). If the house isn’t appreciating you’re locked into an 8% exit fee, at least and when rates eventually rise, the full doc loan environment will drive prices down via debt ratio limits.

The media tries to give it to everyone backwards when they broadcast that rates are going up and people are jumping in to buy now. If rates go to 7 percent it will decimate home values. These stories do not take any of this into consideration.

We live in Orwellian times. Doublespeak and stuff…

The banks have a lot of influence on the politicians, so we will go on as before for many years to come, like Japan. Nobody has the courage to go against Wall Street and the banks. Obama has shown that. We serfs just have to accept our lot in life and continue to serve big capital. Time to go out to dinner with my BFF Jack Daniels and Jim Beam.

“Nobody has the courage to go against Wall Street and the banks.”

This guy seems to have some courage. Here’s Ron Paul taking on Bernanke…

http://www.youtube.com/watch?v=-Ey07aRKc8o

Paul has my vote.

Ron Paul had my vote in 2008…too bad I had to WRITE his name in.

Yes, Ron Paul had courage to go against his party, under Bush, to be against the wars. He is also a co-sponsor on the bill to audit the Fed. Rick Perry, being an opportunist, saw how well Congressman Paul’s message was playing(just about tied in Iowa for first place) and picked up Paul’s message against the Fed(in the Perry style) in an attempt to steal Ron Paul voters over to his side. IT will not work. Ron Paul voters are not the type to vote for somebody like Perry who is an Aggie and got his degree in cows(animal husbandry). I don’t want an Aggie to rule over me.

Ron Paul is scary…

http://www.huffingtonpost.com/earl-ofari-hutchinson/ron-paul-is-scary-but-tho_b_79495.html

I’m sorry, Rhiannon, but the idea that Ron Paul is ‘scary’, just doesn’t pass the smell test. The only Republican, and one of only a few in the entire Congress, that has been consistently anti-war and against a blank check for the Pentagon, is a horrible, scary fascist? That is absurd on its face.

I disagree with Paul’s laissez faire attitude toward civil rights, but that doesn’t make him a fascist. He has more faith in the free market than I do to correct discrimination and other wrongs. Perhaps in the internet age, it would be easier to organize boycotts against discriminatory employers than in the past? Who knows.

To bring this on topic, the reason your Huffington Post friends don’t like Paul is that he wants to abolish the Federal Reserve Bank. You know, the Federal Reserve Bank that has been a serial asset bubble blower these last many decades, including the housing bubble.

Educate yourselves…

http://www.alternet.org/rss/breaking_news/589574/ron_paul%27s_15_most_extreme_positions/

Not unrelated to the theme of the government does for the banks, not the people, and if a bank could lose money, the government supports it and as to austerity and sound practices finally forced on banks, well: the government “chickens out”. The government decided today, the paper says, to buy up chicken thus to support continued much higher chicken prices, and to prevent price declines (price declines which, of course, will encourage consumers to start consuming more chicken, thus clearing the market). This was paid for with tens of millions of YOUR TAX MONEY to support the chicken growers, it says (read: their banks who overlent (WSJ article recently) to create too many brand new expanded chicken farms, count on it). That means the government a) runs up chicken prices to consumers b) supports overleveraged speculating weak growers/banks especially and c) they send the bill for the chicken they buy to the taxpayers, the same consumers they want to now be forced to spend more for chicken!!!! Do you think that high chicken prices forced up unnaturally by this in the short run, will cause consumers to buy more chicken, or will this only make things worse, of course? What else is telling: the govt is then giving the chicken to low income consumers and so on, thus sating THEIR part of the demand curve for chicken anyway. Is this always the same story? Incidentally, supporting chicken price always helps support those bank loans to other overleveraged meat producers (beef and pork). Are you offended by this at some level?

This is an investor market! Listening to NPR Monday on real-estate. They had a guy from Bankrate, and a Realetard (never better time to buy speak). A caller said he was consistently getting outbid by all cash investors. They are gonna flip all the way down this long death spiral. Even the Realetard conceded that all cash investors were gonna win the bid. Seen this in Burbank. Houses changing hand over a couple months. They are so brazen they don’t even care about cosmetics. Buy and flip. Anyway

It just

(sorry) plain sucks….

I heard that very NPR radio show.

Does anyone have stats on who these cash investors really are?

What really bothers me is that I think a “normal” indivdual cash investor is a lot smarter and wouldn’t be making these purchases.

Are the investors REIT’s? FCB’s?.. Has some TARP money leaked into the cash only

market as a yet another sneaky way to keep R/E prices artifically elevated?

Cash does not win out simply because it is cash. If your financed offer is over a cash offer, you have a very good chance of getting it, since cash is not always…..CASH in the end. Many fall out of escrow when an investor changes their mind or has three homes in escrow and chooses one dropping another. Banks know this but for a home that needs rehab, it is sometimes the only buyer.

It is true there are some individual as well as groups of investors buying to hold and rent in anticipation of higher rents. They will get financing at some point in most cases. The highest dollar goes to an owner occupied usually FHA buyer for SFR in move in condition. Anything after that is a risk and requires cash, and priced to accomodate that.

Burbank is a great neighborhood near a lot of well paid employment opportunities. It’s hard to get in the door unless you have a lot to offer a bank for a house there. And most of the homes are pretty small.

The maket will ultimately win over the banksters, schiesters, crooks, politicians and the real estate industry. The longer it drags out the BIGGER the price drops will be. Those looking to buy and flip now will end up in foreclosure, as they are catching a falling knife. As long as renting is cheaper than buying, save the extra money or invest it somewhere else. Buying real estate now is a losing proposition for most.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Great article Doc! Here in the Santa Clarita Valley 80% of homes on the MLS Status reads “Back offers only” I love the area where I rent and would love to purchase a home soon but all homes in this area have Mello-Roos, These homes sold for almost half of mill back in 2006 but now they are going in the high 200’s to mid 300’s, They range between 1900 SF up to over 3000 SF, I just keep thinking, damn if I buy and damn if I don’t! This house market is so darn confusing!

Three years ago I got a steal on my current home, all cash, just as the pre-recession/depression kicked off. My home had been vacant 400 days. Ever since that time, I’ve had my eye on another home down the street. It’s a BofA home and sure they have recycled through several realtors trying to peddle the overpriced home. Over 1000 days, empty. What’s the problem? The bankster still wants a 2007 (bubble) price.

BofA may only be the servicer. The investor who holds the note is the final decision maker.

It’s clear to me now that there’s no way the federal government is going to do anything but what the banks tell them to. This mess could easily drag on another 5-10 years with banks slowly leaking out distressed properties and keeping prices as high as possible. Unless you’re an all-cash buyer or connected (corrupt) realtor you won’t have much luck finding a good yet cheap distressed property. And many of those boomers we’ve been waiting on to downsize will just decide to stay in their giant homes. I’ll keep on renting indefinitely and carefully invest my savings elsewhere rather than fall for all the low interest rate “it’s a great time to buy” propaganda.

That wonderful graphic–the rainbow Sierra–should be all that rational people need to make a sound decision about buying a house.

Sadly, for every person who can’t see that graphic for what it means, there are two who can, and still make the wrong decision.

I trust many of you know the work of Dan Ariely.

http://www.ted.com/talks/dan_ariely_asks_are_we_in_control_of_our_own_decisions.html

I’m not convinced that cognitive and perceptual illusion are isomeric realms of brain activity. But still, it’s worth considering how it is that some people do, and others don’t, grow the ability to say, “What’s the length of the two tables? I’m not sure. Let me measure it.” (Referring to the video above.)

Which is basically all that DHB has been trying to teach these past five years in my view. It doesn’t help that in the portrait of the Housing Last Supper, you and I are on the blank side of the table, with all the banksters, speculator, RealTorz, and assorted scamsters on the other, arrayed around the savior figure of a mortgage.

I have a friend who was paying rent of $3700 mo. for his home in Brentwood (next to Santa Monica). Rents have been going up, and he was just given notice of a rise to $4500 mo. Another friend pays $3600 rent for her home in Pasadena and worries the unfettered rent increase may come any day. People who are self employed and do not qualify (W2) or those who lost or strategically defaulted on their high end homes, have to rent. If those folks living in their high end defaults were to be foreclosed, they too would be looking to rent and the increase in rents would follow, even as the price of their foreclosed home fell…. The more foreclosures pushed through while the credit is tight… (W2’s qualify while 1099 with heavy deductions, maynot…. making a smaller buyers pool). I am not defending or attacking any position here… just trying to keep the discussion relevant.

Hi Jen Wow, those are some high rents your friends are paying. They must make tons of money to toss +/- $4k per month ($48K/yr) just for a roof over their head…

Daniel, Those prices are not high for good areas in LA, especially the westside. Even rents for a downtown loft often run around 4k a month. The condo I wanted to rent in Studio City ran 4,500/month for about 1800 sq ft.

People want to live here and a lot of people make serious money.

If I could buy an investment property in a good part of LA, I would do it in a heartbeat. This city is not going to disappear anytime soon.

This is typical. Those renters are probably making 200K gross annual, minimum. We have renters in our Malibu house paying 5900 per month. Stunning. But what is worst is that the market value STILL isn’t justified. It is said (although I have a hard time believing it) that our house is “worth” 1,7 million.” But I don’t know who would be stupid enough frankly to pay 1.7million for a house that rents out for 5900 a month. That is a 4% return not taking into consideration any expenses of any kind, and assuming no vacancy . . . ever. Mailbu is a trange place.

Can someone tell me???

In the first chart in DHB post, it appears as if San Bernardino has seasonal price fluctuations of 100K or more. If this is true I would think that it would breed a large flipping community. Is this true? Am I reading the chart correctly?

San Bernardino has become a target for buy and hold cash flow investors due to the rent to purchase price ratio, although I hear that the quality of tenants can be tricky depending on the location. Investors have also been targeting the area for quite a while because of the % price drop that, in theory, reduces further downside risk. But the buy and hold focus has become more popular in this area vs the flips due to the ratio that I mentioned. I do not invest in SFR in CA so I don’t know the area as well as others. I hope this helps.

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

I think I understand the % drop issue in that area, but the chart seems to suggest that it would make sense to buy in December and sell in July in perpetuity. It’s as if one would have to be stupid to every buy in July in this region. Additionally, it appears as if the flip environment would be pervasive due to this.

Maybe this area is just prone to large swings in market desirability. Your cash flow suggestion of the area seems to suggest that the chart isn’t quite as “swingy” or volatile as it suggests.

I’d be curious to see any data prior to the 2000 upswing start of the bubble.

Obama “conceded that it will take at least a year for housing prices and sales to start rising, a key marker of an improved economy”. This is great news coming form the President. I wonder where he got this information from?

His housing comments were in response to a grilling from a real estate company owner who said she had begun to see a turnaround in late spring but that her phones stopped ringing after last month’s “debt ceiling fiasco,” when a government default seemed possible.

Obama said”It will probably take this year and next year for us to see a slow appreciation again in the housing market,” he added, offering no backup for the prediction.

I like Obama personally, but comments like those tell me he has too many well heeled banksters and wallstreeters whispering in his ear and cannot hear the cries of the middle class. Has he completely lost touch with those of us who gave him the job to look out for us. I guess it’s politics as usuall. Talk for the middle class, and act for the rich.

How can you ‘like’ someone who repeatedly lies, and breaks his word? He is not trustworthy. No federal politician is, or they wouldn’t get that far. Yup, that means Bachman, Perry, Romney etc.

I will except Paul Ryan, until proven otherwise, mostly on the basis that he appears to have a hard time making his ideals fit into a relatively smooth debate. I’m not saying he is not a liar, merely that I have no proof of it.

Financial industry lobbying interests largely funded Obama’s 2008 campaign, so it’s no wonder that Wall Street has received hundreds of billions of direct support from both the federal government, and the Federal Reserve. Obama is great at making speaches, bu this policies are little different than every other precedessor, save on the margin, which is where he hopes to gain marketing fodder for the 2012 campaign.

Is there any hope any of the smaller houses in the area bounded by La Cienega/Pico/LaBrea/Venice will fall to 400k? I see some short sales that haven’t moved around there- not sure if it’s the process itself or no one plain wants them. I just want a modest house in a modest area that is safe-ish and central to jobs (I am a freelancer).

And I am afraid of investors scooping up properties to flip them at higher prices. This one stands out: http://www.redfin.com/CA/Los-Angeles/1636-Ellsmere-Ave-90019/home/6904445.

I see some well kept craftsmen houses that are affordable in the areas bounded by La Cienega/Adams/MLK and Vermont. But the LA Times crime map of that area scares me a bit. I wonder why with the housing bubble/boom in LA this area did not improve as people were priced out of anything above the 10 fwy. And why with USC nearby, it hasn’t attracted alumni to buy or invest and improve the area…

Just some thoughts. Keep up the good work on this blog…

I just saw today that David Stockman has predicted that there will be a HUGE recession in 2013, due to the stimulas money coming to a halt, and IIRC, the lower tax rates ending. If so, 2013 could be the time to buy.

2013 is the time to buy, if we all have jobs by then!

I’ve followed your blog with great interest, and have sat on the sidelines as a renter. I’m now in a situation that I hope you’ll address–I know it isn’t unique to me. I’m in a position that makes me highly motivated–almost mandated by circumstance–to buy now (I’ll spare you the details, but there are professional, emotional and financial incentives to do so.) I’m looking the Pasadena/Altadena area, possibly Eagle Rock/Highland Park (probably in the $450,000 price area), and expect to live ten years or more in the place. For those of us who are taking the plunge even in the face of potential further weakness, how do you advise we best address the situation?

Leave a Reply to Daniel