When was the last time California had a sensible housing market? You might be surprised at the answer. Inland Empire deals versus overpriced Orange County. Analyzing the delusion of the starter home in Culver City.

California is an odd sort of duck when it comes to the housing market. The market has dramatically collapsed in the Inland Empire and Central Valley with very little news coverage and many of these areas run similarities closer to what we are seeing in Las Vegas and Arizona. Take for example Riverside County. Home prices peaked in June of 2006 with the median home price selling for $422,000. Today the median price is $200,000 down a jaw dropping 52 percent from the peak. Let us now take Orange County. Orange County peaked in August of 2007 with a median price of $642,250 and today the median price is $445,000, a drop of 30 percent. The argument I have made for California housing is not that every area is in a bubble (this was a case at the peak) but many specific markets still carry inflated values today in the summer of 2011. The only reason these prices remain this way is because of lax lending, Federal Reserve intervention, and banks holding large amounts of homes in what is known as the shadow inventory. We hear rumblings about the soon to expire conforming loan limits. This expiration will have little impact on say the county of Riverside but will be a significant change to Orange County. Let examine what a more “normal†market would look like.

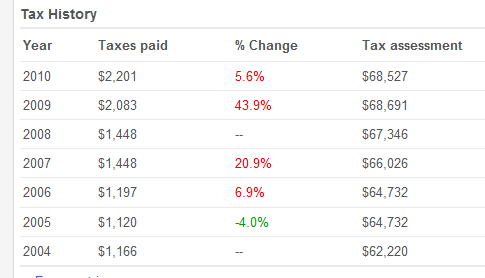

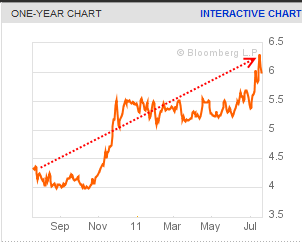

Don’t get used to mortgage rates being this low

For over forty years the average 30 year fixed rate mortgage carried an interest rate of approximately 8 percent. Today that rate is down below 5 percent. There is only one reason for this; the Federal Reserve has bought trillions of dollars in mortgage backed securities shunned by the market and the global meltdown. There is an incredible underpricing of risk going on right now. The U.S. is still a flight to safety harbor but for how long given how our banks and politicians run things? The above chart reflects an unsustainable housing system for the United States. Mortgage rates are at rock bottom levels. I hear the argument going like, “rates have never been this low so you should buy!â€Â Of course when home prices were going up it was, “don’t be priced out of the market!â€Â Yet this mentality will only work if you think rates will remain low for a very long duration of time moving forward. Because what many potential California buyers will not tell you is that they are only buying their home as a starter home. There is no desire to stay put for 30 years. The name of the game is buy, build bubble equity, sell, and move into another bigger inflated place. Of course this model has severely imploded but the psychology is painfully resistant to adjust lower. Call it the Duesenberry demonstration effect.

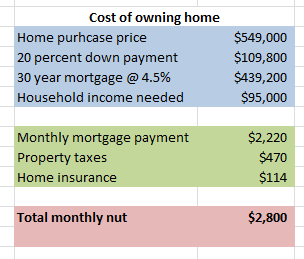

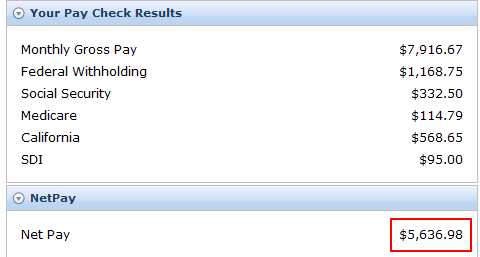

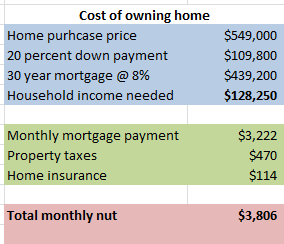

First, let us run a scenario on a $549,000 home:

Many “starter†homes in places like Culver City will still cost this amount which is still insane. First, we will go with a 20 percent down payment of $109,800. This is only covering the down payment and not the additional closing costs to close out escrow but let us keep this simple. You would be financing a mortgage four times the size of a household income that would qualify for this property. You can buy a home at this price point if your household income pulls in $95,000. First, that income does not support a $549,000 home adequately and provides little buffer for mistakes but these are the kinds of transactions taking place today. After we factor in the monthly payment, $2,800 is coming out to pay your housing expenses each month. Now how much is a household making $95,000 a year taking in per month?

So basically for a starter home 50 percent of net pay is going to pay for housing expenses. This is insanity but you can actually qualify for this loan today if you went for it. But let us make a simple rational assumption. What if mortgage rates track back up to their historical four decade average? Let us run those numbers:

Now, you will notice that a household will magically need $30,000 more a year just to qualify. Plus, the monthly home payment jumps by $1,000 to $3,806. This is why the Federal Reserve is doing everything it can to keep mortgage rates artificially low even if it means imploding our economy with debt only a few years down the road. You have to ask why doesn’t the government just focus on increasing incomes since this will clearly push home values higher? After all, if the government is working with banks to artificially keep home prices up why not aim at artificially inflating incomes?   Well first, the system is setup to hide shadow inventory and allow banks to push maximum leverage onto buyers and move them into over priced homes even though incomes have remained stagnant for over a decade! The only incomes that are not stagnant come from the financial industry. This is the madness here. Interest rates should go up with more true risk. Just look at Spain for example:

The Spanish 10 year bond has gone up by 50 percent only since September of 2010. This is the same kind of move we can see in the U.S. It can happen as quickly as a few months or a couple of years. The FHA insured loan market is going to change starting next month in California because of the conforming loan limit changes. This is a good thing. Incomes are not moving up so more affordable housing makes sense. Our society is obsessed with the “monthly nut†like a squirrel running out onto the highway to get food only to miss the big rig barreling down on it. We’ve seen this with families financing $2,000 televisions when they barely have enough for food. They just slap it on the credit card. From contacts in the housing industry many have told me that most that come to the table have very little saved up. They are barely qualifying for these mortgages and that is why the housing lobbyist are fighting tooth and nail trying to extend conforming loan limits even though they only impact maybe three or four states but are paid by all 50 state taxpayers.

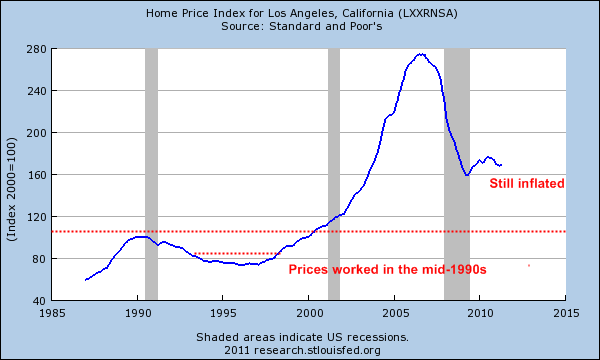

When times were more normal

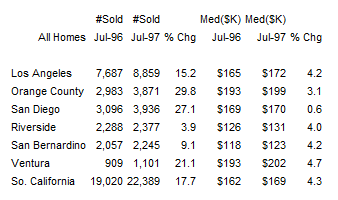

Even the boom and bust Los Angeles County market has seen more reasonable days not too long ago. In the mid-1990s home prices in the county were more reasonable:

This occurred after the late 1980s and early 1990s bubble burst. Why did this work? First, home prices had a reasonable ratio in relation to household incomes. Take a look at the below:

Source:Â Data Quick

The median home price for Los Angeles County was $165,000 in July of 1996. The median household income in 1996 was $43,500 putting the ratio at 3.7 which is still a bit high but definitely more reasonable. Today the median household income is $67,000 but the median L.A. County home is still selling for $318,000 (a ratio of 4.7). Even to get back to the more modest 3.7 figure of 1996, prices would need to fall down to $247,900 (an additional 20+ percent drop).

Keep in mind that throughout the 1990s the 30 year fixed rate mortgage had an average rate of roughly 7.5 percent (closer to the 8 percent historical long-term average). Today we are down to 4.5 percent but this is absolutely artificial and we are risking much larger things on a global scale than simply housing. It isn’t a question of whether rates will rise, but when. Will a Greece default trigger it? What about Spain? What about real estate bubbles in Canada or China popping? Risk is incredibly underpriced around the world at the moment and ironically the “riskless†investment seems to be with mortgages in the U.S. according to current mortgage rates. Hah! The mortgage backed securities that imploded markets in Iceland and all over the world are now seen as safe as U.S. Treasuries! In fact, the Fed has been making this exchange for years now with the bailouts.

What happens next?

The banking system is working through its shadow inventory but at a painfully slow pace. It is a race between market perception and the inevitable debt blowups around the world. Can banks off load more junk to the government (aka taxpayers) before the severe next correction hits? So far it has been working for banks but not for the American public. So what can we get for our example $549,000 figure? Let us see what we have in Culver City:

3944 TILDEN AVE, Culver City, CA 90232

Listed   06/17/11

Beds     2

Full Baths            1

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,029

$/Sq. Ft.              $531

Lot Size 6,991 Sq. Ft.

Year Built            1941

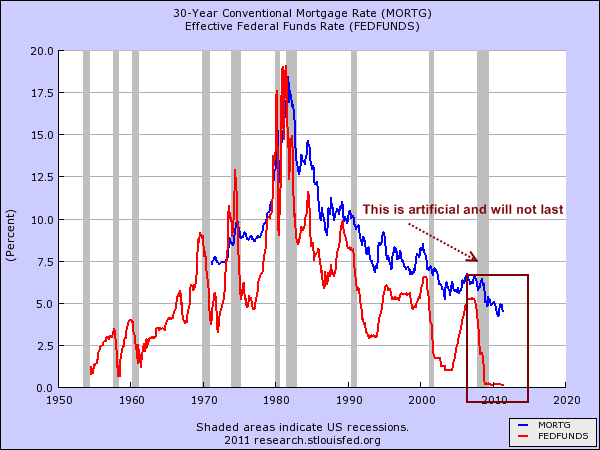

This is your starter home. 2 bedrooms and 1 bath listed at 1,029 square feet. The listing price on this home is $545,900. Looking at tax assessment records this place was purchased in more sensible times:

God bless Prop 13. The home is listed for $545,000 but is paying taxes at an assessed rate of $68,000. Let us look at the backyard here:

Now keep in mind what the logic would have been in the past to buy this home:

A-Â Okay, we buy this place and stick it out for two or three years.

B-Â By that time, we will find $100,000 to $150,000 in appreciation and we move to home #2

C- Three years pass and buy $700,000 to $750,000 home and if things go well, rinse and repeat

This is seriously how people think in Southern California in many of these bubble markets. Yet rates will go up and are you willing to stay put in the above place for 10, 20, or even 30 years? That is the reality but that is now what is being pitched by those in the housing industry. Either way, there is absolutely no evidence suggesting we will see solid appreciation in these markets for years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “When was the last time California had a sensible housing market? You might be surprised at the answer. Inland Empire deals versus overpriced Orange County. Analyzing the delusion of the starter home in Culver City.”

Why doesn’t the doctor ever take into consideration the mortgage interest tax deduction in his hypotheticals?

Leaving that tax break out of the equation removes a net credit worth over $10,000 per year to each hypothetical family presented.

Sure, it may be scaled back or eliminated by future legislation (not likely), but that is neither here nor there.

He probably leaves out the “$10K” credit because it doesn’t exist unless Kallyfornia allows thousands of dollars of deductions for home “owners”.

To itemize, you to have deductions above the standard deduction. In the example, the property taxes, and state/local taxes get you there.

The balance of interest ($16K first year) is your net gain on itemizing.

With a $95K income, your top marginal rate maxs at 25% with effective rate of around 16-17% for the $16K “deducted. Add a few if Kallyfornia allows some deduction.

Based on that, you MIGHT get $4-5K deduction.

So the Dr.’s “monthly nut” figures are too high by about 20% at least. If your tax bracket is any higher than 25%, then his “monthly nut” figures are too high by even more.

Have you ever owned a house?

Reread my post. Based on taxes, you might get a $4-5K per year savings.

The average homeowner will easily spend an additional $4-5K per year on the house. Add in the expected replacement of windowa, roofs, appliances, driveways, and the lifetime figure goes north.

Jay,

I just ran the numbers, in the first scenario (4.5%) , first year interest payments will be $19,619. A married couple will have a refund of $7,319 vs $3,381 if the didn’t buy the house, for a gain of $3,938. For a single person the advantage is $6,376 . In the second scenario (8%, higher income, $35,003 interest paid), the married couple gain $10,156, while a single person gains $11,062. So effectively, a married couple pays a mortgage of $1,897 a month @4.5%, and $2,376 per month @8%.

The important point to note in the “savings” is that this has to be compared to house expenditures beyond the mortgage/insurance/taxes.

$531/sq. ft for a wooden shack with paper-thin roof shingles… OK. LOVE the lame incongruous semi-circular “architectural” foyer thingy over the front door. Apparently the MLS agents read your blog, because they actually hid the garbage can… this time.

I’m in FL, but I take it that under Prop13 a new buyer would be paying 5-8 times higher taxes on that Culver City shack?

Keep up the good work, but the banksters seem to be staying ahead of the sheeple with their rolling brownouts of shadow inventory. I note how the local media in Miami-Ft.Laud pounces on every little OUT OF CONTEXT up-blip in the local RE scene.

PS: Doc, by focusing only on what a return to the norm in interest rates will do to the monthly nut, you’re inadvertantly making the case to “buy now”. In many previous postings you DID point out–quite correctly–that rising interest rates will LOWER market prices, and thus equity, going forward, by an amount roughly PROPORTIONAL to the monthly nut.

OMG!… just zoomed in via sattelite & Google Street… this dump is like the only SFR left in the ‘hood, surrounded and towered over by downscale apts… wow, talk about ZONING… talk about MISleading cropping by MLS/Realtards!

Looks like they missed their chance to sell out to developers. I mean dang, when your street goes from R1 to R3+ (probably not in one jump), it’s time to boo-galoo, ’cause you’re going to be “marooned” in a different ‘hood than you bought into.

What say ye who look at comps in this ‘hood, are sellers now deluding themselves? What’s the current vacant lot comp on this?

Why do you think the house has bars on the two backdoors? This is absolute insanity. In the Dallas area this house be worth about $50,000, maybe. People in California are going to be very, very sad.

I have lived in that neighborhood for ten years. Median household income there is at least $70K per year. Unemployment is below 5%. In that neighborhood, one bedroom apts typically rent for $1500/month. Two bedroom apts typically rent for $2000/month. There are very few empty apartments or houses there. That being said, a more realistic price for that home would be $300K since at 4.5% interest, the monthly payments would be more in line with the income levels in the neighborhood.

“This is absolute insanity. In the Dallas area this house be worth about $50,000, maybe. People in California are going to be very, very sad.”

Actually, peeps in So-Cal (and Manhattan, NYC) have been very, very sad, for a long, long time, BUT… they’re trapped in the “hype-the-lemon-matrix”, and thus have to PRETEND they’re happy. i.e. they’ve sacrificed so much $$ to be in what they were told/sold as being the “Center of Chic/Center of Duh Universe”, that even when reality prybars their backdoor and steals their Sharper Image shyt, they can’t admit they “bought a lemon”. Similar to Jaguar owners during the decades when that marque was stylish-looking caca.

@misterwho: Sometimes you have to step back and reflect on if what you’re doing is worth it. Sure, you can be proud that you’re living in an area that stats show average $70k a year but what is that amount of money buying you? The equivalent of a salary $2k year in Mogadishu? I used to be like you but then I woke up. Now, I live in an area that most people live in brand new 3500sq ft brand new homes, one of the top 10 safest cities in America, great education , low stress levels and average income is somewhere around retail employment salary. It’s hilarious.

@HiThere: In what state/city do you live?

@TrailRider: Murrieta, CA. 1 hour from SD, LA, Irvine. Fortunately, I work from home so I don’t have a commute issue. That’d probably be the only concern for someone who wants to move out here, but at the prices so low, you literally could work retail (as a lot of people out here seem to do) and get by.

Nothing like a few little white lies a real estate agent will tell you. ANYTHING to make a sale. Especially, in this market.

Check out some of the best white lies ever…

http://www.westsideremeltdown.blogspot.com

And today’s horrible sales figures for June prove that you are correct, DHB. I have a friend who refuses to believe that her condo in El Monte has dropped in price from 2007. Still believes there’s a buyer that will pay her price because it’s “worth it”.

I’d live in a small RV before I’d EVER pay more than $60000 for that thing. sheesh.

Someone who bought a 1 ounce gold coin in 2000 at $250 would be worth today $1600. Our government is destroying the Dollar by purchasing our own debt and keeping interest rates very low.

The talking heads keep telling us inflation isn’t going to happen – it’s DEFLATION. Inflation is already in our face and they are denying it.

Either by accident or design, the Fed is pulling off a remarkable balancing act. On the deflation side of the see saw you have falling housing prices, and other money/equity destroying enterprises like foreclosures, bankruptcies, etc.

On the inflation side you have ferocious money printing by the Fed, and monster sized budget deficits by the Congress.

Congress says they want a balanced budget, which would mean cutting federal spending by $1.5 trillion over the next 12 months, which would be a 10% decline in our GDP (from $15 trillion down to $13.5 trillion). Obviously, this is just posturing, since a cut of one third that size would push this recession were in into a deflationary crash, like 1929.

None of them have the slightest clue what to do, other than to keep playing this balancing act. Got gold and silver, lol?

Actually, if you price things in terms of gold, prices are decreasing, not increasing. Sure, that won’t help you buy your next Big Mac. But it might make you wonder about it.

@Questor: except USD. If you priced USD in price of gold, since just 7 years ago it was @ $250 now it’s at over $1500.

Most people seem to want to define inflation and deflation in terms of consumer prices but things make a little more sense when inflation and deflation are defined in strict economic terms. That is to say, if we speak about the money supply, then the credit crunch and the bursting of the housing bubble were both large deflationary event events. Net worths and credit were significantly diminished due to both, and the end result would have been a smaller money supply for the economy at large. Without delving into the wisdom or lack thereof or its debatable track record, quantitative easing is a massively inflationary policy designed in an attempt to prevent a price spiral in response to these deflationary events. Price effects are secondary and trailing to the actual macroeconomic events of inflation and deflation.

There are still young fools every day that believe that 1998 was a hundred years ago, thinks are different now, and that the government will fix the whole thing. I agree Doc–they still think when this bump in the road is over it’s back to flip city. No Realtor ever went broke underestimating the intelligence of the American public…I was young and foolish once too. Now I’m just older.

The reason that young fools will pay that, is they are not old enough to remember prices of 13 years ago. A young couple who are age 30, were in high school back then, and did not know, or care, about house prices.

That’s my demographic exactly. In my early 30’s and I was still in high school 13 years ago, and did not care or know about housing prices. But I’ve looked at enough historical sale prices to know that prices were relatively affordable 13 years ago. Most of the time when I look at houses the first thing I look for is the pre-bubble price, generally that is right around what I would pay.

Heh. That place really is the iconic Westside starter home. It has a sibling on S. Bundy currently on the market for $499,000. One quibble with the Doc’s analysis: while interest rates are apparently abnormally low, isn’t it much harder to qualify for a loan these days? My impression is that lenders are overcompensating for their Bubble bacchanalia by tightening up loan requirements to the point where only people with 20% down, scores of 700-plus, and federal gov’t jobs can qualify. The rate is moot if you can’t get the loan.

Yup. What a joke on S. Bundy. I live right near it. For a real laugh, check out 1625 Wellesley nearby. Roof is caving, but it’s only $850K. DOM of 200 days and counting…

OMG! In January it was listed just over $1M! Effing crazy.

You have to ask why doesn’t the government just focus on increasing incomes since this will clearly push home values higher?

When the bankers buy politicians, they’re buying manipulations to make the *banks* richer, not the general population.

When was the last time we had a sensible market? Well, our local elected representatives in desirable So. Cal. areas are doing everything they can to keep the time machine RE bubble fully functional. Just listened to NPR today a segment about the looming debt ceiling deadline and the gang of 6 solution, which includes elimination of certain tax breaks like mortgage interest and RE taxes. The D representative in the SF Valley said he’d never go for elminating these tax breaks because too many of his constituents need them to keep equity in their homes. He said outright that Californians only get marginally higher wages but we spend all our money on our homes. The elimination of these tax breaks woudl cause a “recession or worse” as home owners would lose more equity in their homes and cause a real and psychological hit on the local economy.

Yep, the mortgage interest deduction won’t go away until the Boomers move into nursing homes and we need a spike in tax revenue to cover their end of life care. Then we’ll finally hear how irresponsible it is to subsidize housing on the backs of renters, while old people can’t get the healthcare they need. When everyone on this board has a mortgage to pay off, of course.

Excellent point!

Lived the first 45 years of my life in this Hell Hole and left for CO. If you ever want a sensible RE market you leave this hole. Culver City is Compton on a good day and get real average income for a local gang banger is not $70K. Move while you can before it is too late

But, if rates go north of 7%…the prices will drop even farther since no one will qualify…and then it’s an 8% loan on 80% of the principal (and 80% of the downpayment) or a 10% loan on 50% of the principal.

WABC-TV here in New York reported yesterday 7-20 that the credit score you see may not be the same as the one the banks get when you apply for a loan. I always thaught the credit score was a scam & this sort of proves it.

Here’s a home here in So. Pasadena similar to the Culver City one…

http://www.redfin.com/CA/South-Pasadena/602-Meridian-Ave-91030/home/7005414

Shit, this is a complete dump. If the bank and you are dumb enough to buy garbage like this then sink like an anchor.

Keeping up with the Joneses has wrought many to neighbors of Red Fox. It it still going on all over the country with retirees building their trophy homes and waking up on completion that their IRA homes ‘skeem of things’ disintigrated. It is called living beyond your means despite documented declining family incomes. And people have found out that the Joneses don’t pitch in on the mortgage payment.

Cali peeps: am I correct that a buyer of this close-to-the-freeway shack would lose the Prop13 tax cap, and end up paying taxes proportional to the current “appraised” value, probably 5-8 times higher than the $60k valuation? That’s a selling point… 🙄

Yes. Taxes run around 1-1.5% of sale price. Prop 13 only caps the annual increase in property taxes to no more than 2% (with exceptions). Prop 13 is sort of like rent control – it always “resets” at fair market value when there is a new renter.

Unless this homeowner exercises their one-time-only Prop 13 “exemption-transfer” by selling that property to their adult child. Yeah, like that’s going to happen…..

Taxes in CA. run about 1 1/2 % of value. On a $500,000. home, that is $7,500. a year in taxes.

(Some cities it is close to 2% of value- even worse.)

Hey! It’s CC, land where dreams are manufactured just down the street at Sony. Catch some surf, all beit garbage laden. Don’t ya know that the shit don’t stink in Culver City!

One quibble – Interest rates are not abnormally low because if interest rates are raised that means prices will deflate even more/faster meaning more people will be unemployed because of bankruptcies.

The Fed’s mandate is low inflation and low unemployment.

Inflation is not that high at all. Raising interest rates will guarantee deflation and perhaps Bankruptcy of States and Cities. Do you really want California to be Greece?

China’s rating agency has all ready implied we have default by debasing the USD. We borrow 1/1 ratio and payback 1/.5 ratio. that will last untill investor want payment in other forms of assets and/or dump the USD holdings. Inflation is here in every product! you may not know it by the cost as volumes have been decrased rather than price incrase, creative packaging……

Inflation not HIGH? Oh yeah, I forgot they don’t count food and energy……. or anything else that might make it look like there is inflation. Steak goes up in price substitute hamburger, keeps the number low. Go the the supermarket and then tell me there is no inflation or just try http://www.shadowstats.com

I think that your Federal and State tax costs are overstated. First, mortgage interest and property taxes are deductible on the state return. The Federal return also allows you to deduct the state income taxes. Pedro and Maria who both bought the home(Pedro is a gardener and Maria is a maid) have 4 little darlings(Maria’s mother, Carmen who gets SSI and Medical takes care of the little darlings) that each get their child credit and dependent deduction. By the time Uncle Jesus gets done doing their tax return and putting down 9 on the W-4, they owe very little in taxes.

The above is typical of many buyers.

I think a big reason that the Inland Empire had such a dramatic 52% drop is that so many subprime buyers were able to buy in the area that could not afford Orange County. I suspect that homes/condos and apts in Orange County, particularly the beach cities and nearby, have, as a whole, been owned substantially longer than the inland empire and the owners still have substantial equity. Lastly, subprime buyers were probably much fewer, percentage-wise, in o.c.

I’m sorry, so so sorry, but a person would absolutely have to have schitt 4 brains to buy this house for $545,900. Insanity, Insanity!!! Dog Doo for half a million $ ??? Go hump yourself.

zillow has the value at 476k with a range of 352-585k. Rental value at 2300 mo. Check out 3654 TILDEN Ave which is similar for sale at 579k.

Dr. H.,

Nice breakdown of cost of owning a home at ~550K. But, you must be using Prop 13 tax rates. Typical residential real estate tax in CA is 1.1%; it’s what we pay on our home and we are not Prop 13.

So, I think most new buyers, unless they are eligible for Prop 13, would pay a little over $6000 on a $550K if my math is correct. Making this example even less affordable. Anyone like ot comment?

John

Look at the price this one recently sold at!

http://www.redfin.com/CA/Santa-Monica/1105-Centinela-Ave-90403/home/6760549

@enzo – The term is “Cognitive Dissonance”

http://en.wikipedia.org/wiki/Cognitive_dissonance

It describes so much of otherwise irrational human behavior. We cannot change the poor decisions we have made, so we change our feelings about the decision instead. e.g. I must really like living here….

In the world according to JAY there is no problem. DHB site is useless, the stats are all lies, people have not bee kick out of houses and unemployment at at %1.

OR….. maybe JAY should get his head out of his …

Adam2 said: “Do you really want California to be Greece?”

You are optimistic. California, and the U.S., ARE going to be Greece. The basic theme of this crisis is that you can’t pay off excessive debt using more debt. California’s pension debt alone is at $600 Billion, according to the best independent estimate to date.

It’s only a matter of time before California is faced with having to default on its debts, just like Greece is starting to do now. The people who have saved cash, and are out of debt, will be the ones best off.

This board has helped me so much over the last several years. I finally just purchased my first home after waiting almost ten years; it has been an extremely frustrating process. I’m purchasing the house with no expectations of appreciation in the next five years. I do think that there will be better deals in the future, but I have reached an age where I need some stability of owning my own home.

I have been researching the neighborhood in Long Beach for about two years. Prices were stubbornly high there until about the last several months. I purchased a 1,700 square foot home that is totally turn-key home in a great neighborhood for $540K. I’m putting down $230K with 4.5%, 30 year loan for the balance.

Good luck to all and thanks to this board for keeping me sane over the last several years.

Wow… OVER 40% down! Did the lender require that, or just your preference, or…?

Just my preference. My plan is to pay the loan down in 15-20 years with extra payments.

Kodus on an excellent question and analysis. During the bubble many never heard that prices fell after the boom of the 80s. Recent bubble post 1998 was much higher than the inflated prices back in the 80s. More like a ant hill back than vs the past 10 years.

http://www.housingbubblebust.com/OFHEO/Major/NorCal.html

Explains it all, we certainly will see further declines to get back to normal.

This is absurdly insane, Commiefornia!$549,000 in FRN paper/computer dots for this dump? Come to daddy in Utah..lots of room…lots of wives…I’ll take your silver coin.Its good here.

I moved to orange county in 1983 from the midwest. It took me 18 months to realize Southern California was a fantasy, a dump with palm trees. I moved to the south, bought a house for 60 grand and paid it off.

I can’t believe the number of people holding onto these over priced houses, I’d rather have 500 grand than a cracker box in a ghetto full of apartments. 500 grand will buy you a house in the mountains of Georgia or N. Carolina and a condo in Florida near the beach, with enough left over to buy a car and take a nice vacation.

Of course 500k will buy a whole lot of gold and silver and a nice little crackerbox on some land in the country.

Southern California is insane, get out while you can. I’m real glad I did. My home is paid for, my car is paid for, I got money in the bank and I only work when I feel like it. Enjoy the rat race.

Leave a Reply