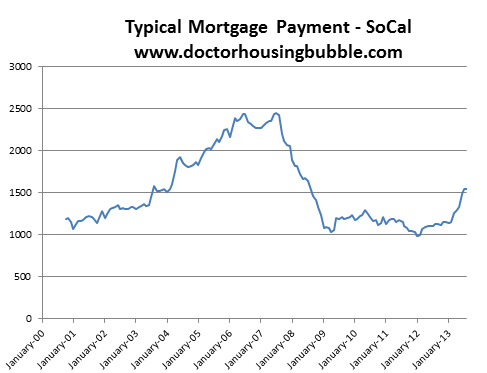

The next move for the SoCal housing market: Investors slowly pulling back from peak. Foreclosure resales now only 7 percent of sales with the typical mortgage payment at $1,500.

Last month only 7 percent of homes sold in SoCal fell in the foreclosure resale category, a 7 year low. This is a big trend change in the market as investors continue to be a big player in the real estate market while distress sales drop dramatically. What is interesting from the data is that the typical mortgage payment for those buying with a mortgage is still very low signifying income pressures. There is little doubt that SoCal is in a real estate fever. That fever may be drawing back a bit with inventory rising and prices getting out of reach for many but the investor play is still sucking up a lot of new inventory that hits the market. It might be useful to compare current housing data to figures reached during the peak of the market. How far have we come and where do we go from here?

The current state of SoCal housing

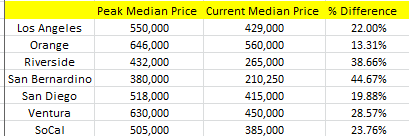

The amount of foreclosures on the market is no longer a pressing issue. Los Angeles County has about 13,000 active foreclosures while the market has 18,697 properties for sale. Remember that there were times when the ratio was higher than 1:1 on the negative side so this has definitely dropped. So it is no surprise that last month, foreclosure resales made up 7 percent of all sales (down from the peak of 58 percent). Let us take a look at current price changes:

While prices are up dramatically, the Inland Empire is a long way from reaching their previous peaks. Orange County is only 13 percent from reaching its previous peak. A couple of reasons for these differences. First, big money is targeting sought after areas in L.A. and Orange County.  All cash buyers for example from China may choose to put money into Irvine or San Marino but not so much into Riverside. Flippers seem to be attracted to county location (older homes or outdated homes provide more upside potential). Those buying in the Inland Empire as investors may be looking for cash flow properties and may be more sensitive to price.

This is why prices in Riverside and San Bernardino although up, are nowhere close near their peaks while L.A. and OC inch closer to their previous highs. We can see that many households that buy with a mortgage are still unable to afford a large jump in home prices:

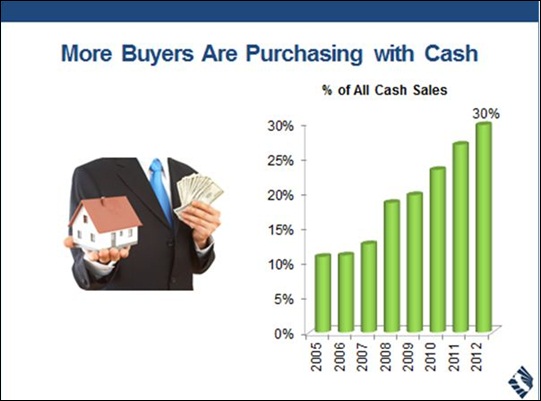

Those buying with a mortgage committed to a typical mortgage payment of $1,545. I know many that read this blog are interested in prime areas and would do an end-zone dance if they ever got a mortgage at this payment level. However, this is for the entire SoCal market. It would be interesting if we had investor data for each respective county (and city) but that data is hard to come by. What we do know is that 26.3 percent of all sales last month in SoCal went to investors (down from 31 percent at the peak). This aligns with the trend for the state overall:

Source:Â CAR

Even in the hot days of 2005, cash buying was closer to 10 percent. Today it is at 30 percent for the state. With inventory being so low, this is a big factor in the current rise of real estate prices. As the market has heated up, flipping has increased once again in California.

Pushing out the marginal buyer

The marginal buyer is going to have a tough time in this market. That is why the renting option has ballooned since the housing market first crashed. Take a look at FHA loans as a percent of all sales:

SoCal FHA loans

Peak:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40% of all sales

Today:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 19% of all sales

The big gap has been filled by cash investors. Prices are going up at the rate they did during the last bubble but sales volumes are nowhere close to what they were in the peak because simply put, volume and inventory is still low:

SoCal Monthly Sales

Peak:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 35,522

Today:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 23,057

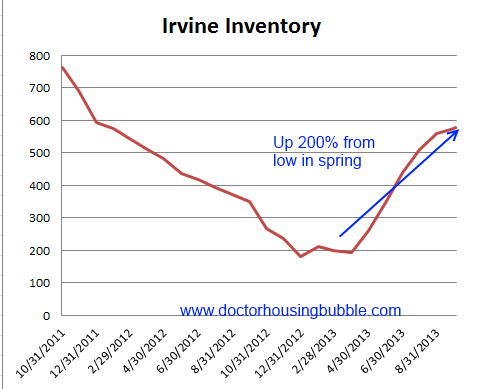

Even with the incredibly hot market of today, monthly home sales are still down 35 percent from the hot days of the last run. This is definitely not a case of people holding back. If the inventory was out there, people would be diving in because the mania is in full swing. Investors especially with rentals are overplaying what they think they can yield. This has become extremely apparent in 2013. This is a large reason why we are seeing inventory increase even in more select markets:

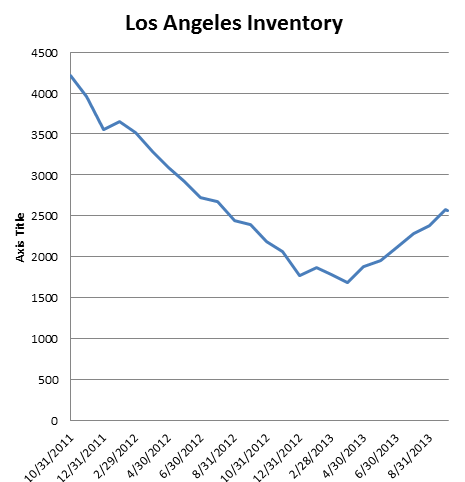

It is useful to track prime areas because we are now seeing homes having price reductions where a year ago, this was not the case. This isn’t limited to a smaller niche area. Look at the city of Los Angeles:

Inventory is definitely increasing. Also, the government shutdown will have some impact on the market (depends on how long it goes). Take a look at this perspective from someone in the industry:

“(Calculated Risk) We are still taking applications, locking rates, processing our little hearts out, and closing. Our principal problem: in the post-Bubble spasm authorities decided that ALL borrowers should produce two years’ tax returns (not just the few self-employed, or owners of rental property, or those needing investment income to qualify). And authorities decided that neither the borrowers nor their CPAs could be trusted to give us true copies, so we must pull transcripts from the IRS (the dreaded 4506T).

The IRS is shut. When it re-opens it will have to process a backlog growing by the hour. Are the authorities helping by waiving the transcript, or granting good faith safe harbor? NooOOOooo. Many lenders — to their great credit — seem willing to defer the risk to post-closing. However, home sales and closings will suffer soon, if only by expired rate locks.â€

You can already see the seeds of making lending easier once again. Why get two years of tax returns? How about we just go stated income again because we can’t wait a couple of days.  That turned out well last time right? Of course those with access to alternative financing (i.e., cash, etc) are having no trouble buying.

Where do we go from here? It looks like the market is frothy but if lending goes back to what it was in the last cycle, and we are already seeing more interest only loans, then the current run still has more gas. However, if investors start seeing marginal or negative returns and flips start losing money, then you might see a big part of the market slowly exit the game and this corner of the market has been the foundation of the run for the last couple of years. Although inventory is up from the lows in the spring, it is still only having a marginal impact on investor buying (with little help for average Joe and Jane buyers).

What is your prediction for SoCal housing as we enter the fall and winter seasons?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The next move for the SoCal housing market: Investors slowly pulling back from peak. Foreclosure resales now only 7 percent of sales with the typical mortgage payment at $1,500.”

Bernanke was right that the babies in DC need their sitter awhile longer. This will delay tapering and might even cause a real dent in the economy, which may even drive rates lower, spurring demand. However, with inverters clearly pausing activity due to reduced cap rates, this will limit the upside. Will this pause provide enough time for incomes to increase? Nope. We’ll be at this plateau through at least Winter.

From American Banker website:

“The nation’s four largest banks are holding $57 billion of seriously delinquent loans that they’ve been slow to move into foreclosure over concerns that the Federal Housing Administration, the government mortgage insurer, will refuse to cover the losses and hit them with damages, according to industry sources.

…the FHA’s guarantee does not apply if lenders are found to have violated underwriting or servicing standards, or to have engaged in misconduct. Banks can also be held liable for treble damages under the False Claims Act if they are found to have “falsely certified” that mortgages met all FHA requirements.

As a result, the banks face hefty losses if the loans go into foreclosure…”

The Fed is bailing out the banks by keeping interest rates low while forcing bank depositors into the stock market and investment real estate. This is part of their master plan, suck in good clean money…cash buyers to take over their bad loans. They know this market is going to crash again, that’s why they only loan to the cream of the crop now. They don’t want to be stuck with bad loans on their books. Look for rules/laws to change on forclosures…home buyers won’t be able to walk away like they did last time. There will be new loan programs once investor/cash buyers dies down and they will pump up the volume with new looser loan programs. Meanwhile new rules will be in-effect protecting the banks.

30% of all sales are 100% cash?!!. 10 years ago with this would have been HUGE news. What’s this telling us? Money is now nervous about any investment on the planet and real estate is one of the safest places to hide if you think a real storm is coming. Especially in highly desirable areas.

That’s correct. We live in a world where the true value of any asset can change dramatically overnight. I would rather be left “holding the bag” on a desirable piece of coastal California RE rather than some questionable paper or metal asset. As the old saying goes, “You gotta live somewhere.” I think more and more people catch on to this everyday…

You wouldn’t be left holding a bag if said bag were desirable enough.

You gotta live somewhere in this context is a cheap meme that attempts to oversimplify an inherently complex and dynamic set of individual circumstances. Seems that a lot of potential bag holders tell themselves this in order to feel better about their position. Why else would they be on here attempting to convince us instead of using that time to enjoy their desirable piece of coastal California RE?

@ Please, my reference to “holding the bag” by owning a desirable piece of coastal CA RE was in jest. Even you agree that owning in some of these desirable areas will never end up in the “bag holder” category. That land will always be desirable and command a premium, the same can’t be said for other asset classes. This year’s big winners in stocks or metals could be big time losers next year…the same can’t be said for premium coastal RE. As we have witnessed, there is lots of money sloshing around out there and it’s finding its way into RE.

No doubt all investments these days are questionable, but real estate no better. If we keep moving in the same direction…

-The state will try to tax more of your ever shrinking income

-The local moochers will try to tax more of the property they let you live on

-Your “allowance” of water and electricity will shrink and the fees rise

-The coastal commission won’t even let you paint your porch without the moochers permission

That “safe” coastal CA real estate becomes nearly worthless….quickly. As a matter of fact, it might be worthwhile to pay someone to take it off your hands.

But it probably won’t come to that.

Joe Average, move to flyover country and buy there if you think there is any chance of what you described will ever happen. Taxes as they are in CA right now are high, is that keeping people from coming here? I guess I’ll be content living in a worthless house located near the beach with near perfect weather…you can’t have everything in life. 🙂

Lord, I may have overdone it a little 😉

But the point being: Investment-No. Fun way to spend money and live near the beach-yes.

The major reason investors (mom & pops, small timers, hedge funds, et al) are piling into real estate is that the yield on CDs, money market funds and bonds are abysmally low courtesy of the Federal Reserve.

If these investors could get 5% interest on 2 year money market funds, they would not touch real estate (coastal or non-coastal) with a twenty foot pole. Before the Federal Reserve and Greenspan/Bernanke went wild with the printing presses, i.e. the year 2000, 6% interest on a 5 year CD was in the ball park.

No such thing as a safe place to hide, if as you suggest, a “storm” is coming. Land title is ultimately backed by a government, and government can levy what it may on land “owners” in dire times.

At any rate, there’s another dynamic at play that deserves mention. Money is chasing yield in a low rate environment. No one can claim with complete certainty what the higher rate of “cash” plays on RE in the current environment is being driven by.

“…and government can levy what it may on land “owners†in dire times…”

Another factor that is often overlooked are holding costs, ie, property taxes, HOA dues,

insurance and maintenance. Not insignificant numbers especially when considering coastal properties.

If one isn’t careful, real returns could go negative faster than a melting snowcone during the Santa Ana Winds.

People have to make decisions. Perfection is rarely an option. So, they decide on what’s the least problematic choice. Real estate has proven a decent choice in many disturbing environments. As the world becomes a more unstable place in which to invest, real estate in desirable areas will increase in price….because scared money will not want to have investments sitting in govt debt nor cash in a bank or brokerage house. Too easy to take it from you if it’s in liquid form.

Tangible assets will start to look better as things hit the fan and govt starts to grab anything that’s in liquid form. Sure, they’ll raise taxes as well, but I bet pension grabs and bail-ins are the first victims as they’re an easy grab for the one’s in power.

CAE, they will go with the choice that has the best ROI, period. RE is more “problematic” than equities. Have you ever been a landlord? For Christ’s sake, spare us a little more credit than that.

I’m hoping the shutdown will push things over the inflection point as more potential borrowers cannot get approved and inventory increases. I think high inventory is the main thing that will start to begin price correction. Interestingly, student loans still get processed as normal with the shutdown. I am about 25% of the way to buying with cash in Nevada (can’t afford CA). I look at it as an “investment” into not having to pay rent (in truth it’s rent savings minus all the costs of running a house, but still a net savings) – that in itself when the prices are right is a sort of ROI. Beyond that, I want to own at least one 3-4 unit property, which is probably enough income to live comfortably. It will take some time to reach that goal, and some time for the market cycle to match what I want.

High inventory coming from lack of qualified buyers? Not a strong correlation, IMO. CA is hamstrung with inventory moving forward due to:

1) Prop 13

2) Boomers have paltry retirement and need their house as asset to do a reverse mortgage, rent out rooms, etc

3) Lack of empty dirt to build on (desirable areas)

4) fog-a-mirror types have been wiped out…who remain are stronger hands

5) global economy means lots of demand for so cal, which still is just slightly more desire able than TX

6) LA very hospitable to different races (Middle East, Asian, Latino/Hispanic)

7) etc

@Maximum wrote: “…as more potential borrowers cannot get approved and inventory increases…”

That probably won’t happen.

Currently, banks control inventory. As long as the Federal Reserve keeps the overnight rates at close to 0%, banks can borrow from the Fed at 0% and use these funds to make the scheduled payments to bond holders (aka holders of mortgage backed securities). This is how banks are able to keep foreclosures off of the market.

If the Fed’s overnight rates were to go above the “official” rate of inflation, i.e. 2% (the unofficial inflation rate is closer to 5%), banks would be forced to unload inventory. However, since the Federal Reserve controls the overnight rates, this is unlikely to happen unless “official” inflation starts pushing 4%. If the Federal Reserve were to set the overnight rates at true market rates, i.e. 4% to 5%, this would kill off about 1/2 of the Fed’s member banks.

The problem with holding any printed $ or even stocks is that ALL currency values are dropping fast, thanks to the $ printing games all major governments are playing around the world. If you look at all choices, REAL properties are better than any IOU’s (printed monies).

I agree with you, I’m taking my share and getting a house in a cheaper area, once some market correction comes. In the long run, prices will reach this high again due to inflation and value changes, the issue is having no real other alternative for ‘store of value’. I do hope in a few years when I have enough to buy a house in cash the price hasn’t exploded due to USD losing significant value, but I do think we are nearing a top phase in the current cycle and it will take some years for the game to explode.

I will just keep taking classes and borrowing until my savings intersects market prices and it seem to be near the bottom portion of a cycle. Owning a house with solar panels to cover all electricity I believe will have operational costs savings which is much more than the pitiful 3% yield that people are chasing on rentals now – considering I am coming from a $1500/mo. rent situation. I think perhaps it costs about $500/mo. if you don’t have to worry about electrical, to own a house in NV. I guess that depends on repair costs/maintenance.

Maximus, regarding expected benefits from going solar, be sure to look before you leap. Hoping for more efficient and cheaper solutions, every few years I check out what savings I would get from putting up solar panels on my tract house in Irvine. Most recently, I attended a session hosted by SoCalEdison and half a dozen solar contractors. The SCE presentation included examples that were marginal AT BEST. You need a pretty big electric bill year round to get close to making sense.

When I had 3 different companies assess the gain for me, not a single one could honestly recommend that I proceed. Their calculations all came out around a 40-42 year payback on equipment warranted for 20-25 years. (Of course this presumed a modest rise in utility rates – nothing catastrophic.) But why would I buy (the cheapest route) by frontending my out-of-pocket (time value of money), or lease where my monthly rental fee exceeded my actual SCE bill? I don’t know how long I’ll live in my house, so I would be assuming a burden where I may never seen the upside to. Anyway – caveat emptor

If you have a mortgage on that REAL PROPERTY and the value plummets guess what, you owe more than the house is worth. A house is an illiquid asset to sell in times of crisis or when you are in need of cash fast. Also, I do not consider a house i live in as an investment, You buy a house to live in it and that is it. If you take away all these government subsidies like the tax deduction, FHA and every other program that is out there, a home would be a depreciating asset. If you know what your doing in the stock market, and your a savoy investor you should be fine. Stocks have returned 13.4% on average annual since 1978. There is no safe investment out there, everything has risks including the idiots who bought real estate in the last bubble and were crying about how they lost equity and wanted the government to make them whole because the big bad banks lied to them.

You are referring to leveraged purchases. ALL the cash purchases are NOT leveraged. Leveraging in itself IS gambling. When anyone puts down say ONLY 20%, he’she is gambling 500%. My comment is mainly for the cash purchases which is REAL investment without ANY gambling.

“If you know what your doing in the stock market, and your a savoy investor you should be fine.”

I got a good chuckle at reading that. Do you honestly think your average Joe or Jane will put time aside to research investments. They have more important things to do like sit on the couch and stuff their face with all sorts of unhealthy food. The concept of buying a property in a desirable area takes very little intellect. You live in a great area and will likely make money over time. It’s really not that hard!

In regard to ‘coastal properties’ I never took that to mean properties so close to the beach that the Coastal Commission would be involved… I take it to mean anywhere within a few miles of the ocean – in terms of LA, that could be Brentwood, WLA, Westchester, Culver City, etc. Very desirable places (where prices are bouyed by their proximity to the coast) but not within eyeshot of the waves breaking. Furthermore, half of these things that people complain about – state tax, local tax, utilities….renters will feel this also, right? as these costs increase the landlord passes on whatever he possibly can in higher rents. Purchasing a home may be questionable as of now, but it looks like those who purchased an affordable home in 2010 and 2011 have little downside now if prices crash (if prices drop suddenly 20% they still paid less than that and have not lost 2 yrs of rent in the meantime).

QE- Renters don’t feel the full effects of all those things. Some, but not all. There’s a limit to what you can get in rent…no limit on the potential costs of being a landlord.

Regarding California Coastal Real Estate that only goes up in price:

“Lone Cypress said today that it had a signed letter of intent to buy Pebble Beach from companies controlled by Minoru Isutani, a Japanese business executive. Mr. Isutani acquired the 5,300-acre resort in Monterey County, Calif., and its operator, the Pebble Beach Company, in September 1990. The terms of the deal announced today were not disclosed, but sources close to negotiations said the price was about $500 million. If so, that would be about 40 percent less than the $841 million Mr. Isutani paid.”

I would suggest that there is no more iconic coastal property than Pebble Beach. If you are interested in factual information, you call also look up the what has happened to Hawaii real estate in recent times. But do go ahead and believe “axiomatic” realtor bullshit.

That’s a little misleading, comparing a mega resort to SFRs is never an apples to apples comparison. Anybody who bought in the desirable beach cities back in 1990 is looking pretty good today. There is no refuting this!

First of to the average investor response, there are many average joes and janes who out there including myself who take the time to research and pick good solid companies to invest in. If researching is not your thing or you dont have time, there is something called ETFs or index funds with very low fees you can buy that invest in a basket of different types of blue chip stocks that actually pay dividends.

Second, Your assumption that it doesnt take much brains to buy a home in a desirable area is just plan false because we can revisit all of the people who bought back in 2004-2007 who lost their homes in these very desirable coastal areas. Thirdly, I dont get your point when it comes to buying a home in a desirable place. ex. I bought a house in malibu in 1990 for 500k and now its worth 3 million. The only way i am going to enjoy those gains is by selling the home and downgrading my standard of living(going to a less desirable area, smaller home, more cirme etc.) to enjoy the gains i made. Like i said earlier, a home is not an investment its a place to live. Enjoy your home, however dont look at it as a investment because you said it before your always going to need a place to life and all that cash is always going to tied up in some type of property.

Bubblicious, nice cherry picking data. I’ll do the same. How did that investment turn out when buying at Nasdaq 5000? The S&P 500 is barely above its high from year 2000. That’s 13 long years with little or no gain. These are all the big indexed funds you are talking about.

You in addition to many people on this blog viewing owning a house simply as a number. There are many intangible benefits to owning that you can’t put a price on. Stocks, bonds, metals are all liquid assets. However, you get ZERO useful benefits while sitting on these assets. You get lots of real benefits from owning a house. You have to live somewhere, tax benefits, stability for family/kids, access to good public schools, ability to rent it out, ability to borrow from it, Prop 13 protection, etc, etc, etc.

Keep renting and HOPE for the big crash. You obviously didn’t learn anything from the last few years.

LOL… Your comical When i talked about stock investments i talked about S&P 500, no one is cherry picking data. Like I said if you invested lets say 500K in the S&P500 and someone else invested 500K in housing in the last 50 years guess wat S&P500 would be ahead by a mile, it wouldnt be close. No one is cherry picking data my friend. S&P 500 is back to all time highs while housing has only gone up only 10-20% these last couple of years.

Now to your so called in tangible benefits. This one just cracks me up. While i sit on my stocks bonds and metals, i don’t have to pay taxes on them(until i sell), i don’t have to pay maintenance, i just sit there and collect my dividends check every month. Does your house pay you a monthly dividend to own it? When you pay for an overpriced house, guess what, you use more of your income to pay for that house. While i rent my 3d 2bth house for 1500 a month (same house is around 3K a month mortgage). I can use that extra 1500 in savings to investment more for retirement, travel the world, go out to nice places on friday and saturday night, oh yea and enjoy my life. I don’t need to be home all the time because i am using more of my income on a property that probably is overpriced. That my friend is the intangible benefit of renting. Also, some of those same so called benefits a home owner has I as a renter have. Such as going to the same good public schools, maxing out my 401k which has its own tax benefits, and having more disposable income. I am not waiting for a crash in housing, if it comes that’s great, if not i am more than happy renting and saving for retirement. While I “wait” I will continue traveling and taking multiple vacations around the world every year and enjoy going out with my wife and friend. That my friend is priceless, the memories you make by traveling the world. Not sitting in a home on Friday night watching TV cause you don’t have much of a disposable income left to do anything after paying your mortgage.

Bubblish said ” I bought a house in malibu in 1990 for 500k and now its worth 3 million. The only way i am going to enjoy those gains is by selling the home and downgrading my standard of living.” “Does your house pay you a monthly dividend to own it?”

If you bought a property that has gone up 6x in 30 years, the gains you are enjoying are your reduced cost of living, and you are enjoying those gains year after year. Instead of paying $15k/mo in rent for the privilege of living in a $3m house in Malibu, you’re probably paying $3k/mo (that is if you haven’t paid it off already) That difference increases YOY as rents rise.

An investment property produces a dividend called rent, and a home produces a dividend called “rent-free living”

I have no idea where you live, but the line between renting/owning costs crossed in intersected in many parts of Los Angeles a couple years ago and is slowly diverging again.

If you’re confident that you are renting a home for less than the cost of buying, that’s certainly a wise decision. However, for the sake of retirement you’d better be sure you’re not squandering the savings and are investing wisely if you’re planning to continue renting even after retirement.

Bubblish, I don’t even know why I waste time responding to clowns like yourself.

“While i rent my 3d 2bth house for 1500 a month (same house is around 3K a month mortgage). I can use that extra 1500 in savings to investment more for retirement, travel the world, go out to nice places on friday and saturday night, oh yea and enjoy my life.”

You are 100% full of crap. A 3K per month mortgage equates to homes that are valued over 600K today. NOWHERE in this city will you find a property like this that you can rent for $1500/month. Keep dreaming friend or should I say keep renting my friend!

Lloyd the only clown here is you. I dont need to bring BS numbers to prove my point to you. I live in Glendale, and houses here range from 650-700K. I have been renting my place for about 10 years. TO some landlords a very good tenant is worth more then jacking up the rent on the place. In the last 10 years my landlord has taken the rent up twice. So again CLOWN, i dont need to make up numbers to prove my point to you.

To MB:

There is still property tax and maintenance on the home. If you bought that house in malibu in 1990, guaranteed a major remodeling has been done by now or its going to be done very soon. My plan for retirement is to move to a tax friendly state to retire. I only live in socal mainly because all of my family is here. I have grown up in socal, and i just dont see the lure of the state. For the amount of taxes somoene pays and the amount of traffic one endures, i just dont think its worth it. Before you jump on me about moving, my plan in the next few years is to move after finishing up my MBA, and move into a better industry than the one I am in(currently in defense). As long as i continue to max out my 401K, and ROTH IRA, and invest in stocks i think ill be fine when i retire. I never said i wasnt going to buy property, just not in socal, to overpirced for what you get. Ill probably buy a retirement home when i reach my mid to late 30s in a tax friendly state.

Bubblish:

Prop Taxes should still be very low based on Prop 13. My estimate of 3k/mo on a 500k home is generous enough to include ample ins/maintenance/prop tax.

Of course remodeling is a great unknown, but it’s unlikely the renter would have had their property remodeled by their landlord. For example in the 10 years you’ve lived in your rental has the landlord remodeled the home extensively? Apples to apples. It’s a moot point anyhow, the owner’s of the hypothetical 1990s Malibu are saving 100k/year in market rent, enough for a nice reno every few years.

If you’re planning to move anyway, you probably should NOT buy and renting is probably the smart decision. However, there are many other people that will be forced to move because rents have outpaced their incomes.

Bubblish, I apologize for my comments. I had no idea a landlord could possibly be that stupid. Market rate rent for your house is likely $2500/month MINIMUM. I get the whole concept of giving a good tenant a break on the rent; however, giving almost 50% discount relative to market rate rent is asinine. Your landlord is not in charity business. Consider yourself extremely fortunate but your situation is almost unheard of…go buy some lottery tickets.

For the rest of the world, paying market rate rent is the standard. This option for your house would be to pay 650K or pay $2500/month rent. If you have a 20% downpayment, buying would likely make sense.

California real estate needs to come back down ti earth and 50% price adjustment to the downside is not a question of IF but WHEN.

People are INSANE paying these inflated priced today, insane!!!

When interest rates rise over 10% but they will have to go over 20% just like under Volcker, house prices will be cut in half and still no one will want to buy them.

Stay away from overpriced housing in California or most of the US.

If you pay $400,000 and up for a DEPRESSION STYLE home build in 1920 there is something wrong with you.

@Wisdom there will surely be a correction when the next financial crisis hits and/or the banks start unloading inventory on the market, but 50%? –not likely. Too much Asian money pouring into Ca RE which will put a floor on the downside.

Investors have shown what ROI they’re willing to accept and pay full-cash for real estate. After prices went up 15% we’re seeing fewer investors buy properties as the ROI decreases.

Given what we’ve seen, what do you think would happen if properties fell 25% overnight. Do you think it’s more likely that they would fall another 25% or that investors would start jumping in again?

Most people don’t think clearly that when you buy a property, you pay for 2 things: 1. the land/location and 2. the building on it. There’s not much difference between, say Pasadena and Palo Alto building a 2000 sq ft house on similar “land”. Hence the $/sq.ft. number is actually meaningless. Another basic reference point is “reset” cost. Building a new house today in most cities is about $200 per sq ft and up. (actual building cost plus city fees/utilities, etc.) without the cost of the land/lot. That puts BASIC house price tag at $300 to 400K PLUS land cost– to about $500/600K and up. With that in mind, as long as we see growing population trend in California, the housing prices CAN NOT come down long term.

I disagree. I have owned property in many. many other states and California is NOT doing well nor is it NORMAL to expect to pay 400-500 for a house, new or not.

In the nicest and most growing areas of the United States it does not cost 200 $ a square foot on average.

But the it’s impossible to tell people in California that the state just is not as great as it once was. I Do think that the young folks will be moving away and the state of California will fall even further.

Unless you are Asian or Hispanic California is not a nice place to live anymore.

Cal has it ills, but folks coming from overseas are still fascinated it. International property is ridiculous overpriced, they still see Cal as a bargain and always will.

What you describe is the cost approach to the appraising of property. It is a very poor indicator; not completely irrelevant, but not very important. The market approach is more important in appraising; that is why the banks always use the market approach for SFH and for commercial they use mainly the market approach but give some weight to the cost approach.

What you spent for building the house is irrelevant to the buyer – it is sunk cost – if you spent more or less than other builders is irrelevant. What is important for the buyer is his job pay, interest and credit availability.

Otherwise, what you say is true.

In highly desirable areas, most of you pay is the cost of land – they can not produce more of it. If it is a house from depression era it is actually a liability: for a small one it is cheaper to bulldoze it and build new. Then you have to add the demolition cost.

Yoddie, that $ per sq ft number is ridiculous. I am having a duplex built in Montana right now. lot was $34k. Structure, city fees, landscaping (i.e everything else) will be $300 k for 3700 square feet.

I just got a bid on construction for my own home. If you don’t include an unfinished basement in the calculation, it’s $125 per square foot.

Montana is not particularly cheap for new construction. The labor force are local Americans…

In California, here in San Francisco Bay Area, the prior to construction fees cost about $100K per house – electricity, water, sewage and “City Environment Impact” fees ( which could go as high as $50K or higher for some city.

The actual construction cost is about $150 per sq ft. One can build a house as cheap as $130/sq ft. to over $200 sq/ft for luxury homes.

Everything here is more expensive. minimum wage is going up to $10/hr and generally construction workers get $160-$200 for a day’s work. It’s the major metropolitan prices, NYC, San Francisco, Seattle, LA. Everything is just more expensive.

I have been reading this forum for years. This is my first post.

After living in Palos Verdes Estates I am ready to leave. Why? Because buying a 1500 square foot house that was built in 1970 is outdated and has very little yard for over 2 million dollars is nuts now.

Even though SOCAL is very welcoming to everyone, many of those people buying in this area do not take care of their property. Most are slumlords (yes even the wealthy rent homes) who don’t live in the area.

I think it’s telling that the only people left in this area are those retired who are living on a reverse mortgage and couldn’t care less what happens to SoCal. I don’t think many people will be willing to pay millions for an outdated home in an area where if you want to shop or visit a restaurant you have to go into areas where there is a lot of crime and dirtiness. (Del Amo Mall anyone?)

The entire coast is way overpriced, falling apart and is quite dumpy and run down in many areas. Case in point is Newport Beach. Gorgeous yes, except when you drive a half mile from the coast. There are lots of areas in Newport that are disgusting.

If you can afford Malibu more power to you, but even in Malibu there are gross areas. Which is just going to get worse. The desirable areas are shrinking and in 20 years there will be big beautiful mansions along the coast but many of the less expensive homes on the coast (like those in Rancho Palos Verdes, Palos Verdes Estates, Hermosa, Redondo, Manhattan Beach, Newport, Dana Point, Laguna, etc.) are just falling apart and being rented out to less and less desirable people all the time. Slow but sure those crappy areas are creeping closer and closer to the ones I named (and many I did not, but you get the gist.) making it more and more uncomfortable for those who can afford the coast to live there.

We are moving because I don’t enjoy living in an expensive home where I have to risk my life everyday just to go to the mall. Even South Coast Plaza is sketchy on days.

Lucky for us we have lived in many other areas of the United States and have found areas we like where things are clean, safe, inexpensive, new, great schools, roads, scenery and such. (Even progressive!) California is in too much trouble to be worth it anymore. There are too many other options in the US now that are fantastic places to live.

I don’t blame retirees for staying or doing a reverse mortgage, who wants to move when your old? But I do believe that they are the last generation to be able to do so in California.

Yes, we left CAL 17 years ago never regret one day of it. That said, Cal still holds a mystique about it. Many people still dream that it is the ultimate life for them. The sheer size of CAL will always make it a player in the world of RE.

God forbid of course, only a catastrophic earthquake will end the dreaming.

Leaving Palos Verdes said: ” Most are slumlords (yes even the wealthy rent homes) who don’t live in the area … are just falling apart and being rented out to less and less desirable people all the time”

Where are you moving to that has fewer renters than PVE? PVE is 90% owner occupied, Rolling Hills is 95% owner-occupied and RHE is 90% owner occupied.

If a renter is paying $10k/mo to rent a $2m house, I’m not sure I’d automatically denigrate them as being “less desirable”

Not sure why you think SCP is sketchy these days. I go there all the time and it is safe, clean, and has high end stores/customers.

Also, care to give some examples of these great areas/cities throughout the US that are new, clean, great schools, nice, etc……?

Investors are going to find out pretty soon that being a landlord isn’t as easy as made out in books, seminars and info-mercials. If it’s a small time investor they will find out that it requires a lot of work. Do the math and they are going for a yield of 5% to 8%. In our current interest rate environment that is good. But in a normal interest rate environment one can obtain that sort of a yield with little to minimum risk on the table.

The large investors like hedge funds, reits, etc…. will find out that the landlord business is really tough. For them, the yield will be even lower because they will have huge over head costs. A small time investor can be better at controlling the bottom line than a very large company. For example, with a large company, the upper and mid level manages will want fancy cars, fancy meeting rooms. At the bottom the guy who fixes the light bulb and paint brushes will figure out a way “to get his share”.

I don’t expect investors either the small time or the big time one’s to stay in the real estate game for long.

Unless you are Asian or Hispanic California is not a nice place to live anymore. – See more at: http://www.doctorhousingbubble.com/socal-real-estate-prices-trends-southern-california-housing-market-next-move/#comments

Believe it or not, Mexicans and Central Americans do the best in St Louis on income not household income at 35,000, better than both California and Texas. Lots of young Hispanics headed for the mid west and south. Also some parts of Upper state New York, Hispanics make more money.

We are moving because I don’t enjoy living in an expensive home where I have to risk my life everyday just to go to the mall. Even South Coast Plaza is sketchy on days. – See more at: http://www.doctorhousingbubble.com/socal-real-estate-prices-trends-southern-california-housing-market-next-move/#comment-402731

Actually, Orange County still has less crime than Harris County Texas unless your in the nice suburban parts of Harris. Crime is worst back east.

“back east”? There isn’t one big swath of geography like that – certainly not one that includes a city in Texas.

First, the terrible news: Two Houston communities are ranked among the nation’s 25 most dangerous neighborhoods, according a new study by NeighborhoodScout.com.

The website analyzed FBI data from 17,000 local law enforcement agencies to find specific neighborhoods in America with the highest predicted rates of crime, MSN Money reports.

Coming in at No. 15 in the U.S. is a Houston neighborhood centered at the intersection of Dowling and McGowen Streets, located in Houston’s historic Third Ward – a broad geographical area that includes stately mansions, the University of Houston and Texas Southern University.

The community “stands out to NeighborhoodScout partly because it has more sales and service workers than nearly any other neighborhood in the country,” according to MSN Money. “The area also has a very high concentration of studio apartments and other small living areas.”

The violent crime rate (per 1,000) is reported as 75.89, and residents there have a 1 in 13 chance of becoming a victim of crime in one year.

Neither Anaheim or Santa Ana made the listing but Houston did for some bad places.

What does all this Texas talk have to do with California?

My prediction for the fall and winter season? Home prices will slowly, but surely drop. Investors over estimated how many people can actually afford to buy or even rent! Now that investors are pulling back on purchasing, the people left to buy or rent are “millennials.” If you are the average Joe from an older generation, you probably already bought into the last bubble and are stuck or are already renting. I am a millennial and most of my friends are flat broke, living pay check to pay check, mooching off their parents, or living with their parents. These are general scenarios and I understand that not everyone fits into these descriptions, but as a whole, this is what is going on. I have been watching the housing market in my area like a hawk these past 2 years and I already see the stand still and prices dropping. It’s very entertaining.

My house is still a bit underwater and I’d love to sell it to one of these cash buyers you are talking about. I hate being a slave to all this debt. Of course, when I look at the cost to rent a home, I see most rents are more than my mortgage payment! WTF?

Sorry to hear that you’re underwater, Jim.

If it is true that rents are higher than your mortgage payment at least you’re saving money every month while accumulating principal.

For anybody surprised that inventory is still low, this is why. Sellers (especially if they’ve refi’d) and reluctant to sell and rent since their monthly outlay would likely increase. They’re also reluctant to sell and trade up with interest rates rising since they’d pay substantially more for the upgrade.

Here is my question for anybody who can answer:

How the heck are middle income families able to rent a home for $2,500 a month in North Orange County?

I just don’t see how this is possible. Rent in some of the areas I’ve looked (Brea, Placentia, Orange) are all around that price, so people must be paying it. I just don’t know how.

I purchased a home last year in Culver City adjacent after some number crunching with the intangibles of owning a home (stability, equity, neighborhood, etc).

My PITI (Principal, Interest, Taxes, Insurance) + maintenance (est. at $1 per sqft per year) Minus Fed withholding = about $400 per month MORE than if I was a renter. The question I asked myself if I am $400 over parity on rent, do I want to OWN the home for an extra $100 per week. The answer was ‘yes’. Then the wife and I pared down our disposable money (cable tv, dinners out, widgets, but still having good vacations). In this way, we felt it was worth it to cut back on frivolous expenses in order to be a homeowner within our means. Lots to consider, but just looking at the numbers, I would be stuck as a renter for life OR living in Inland Empire which was untenable. Another key factor was finding a neighborhood that we can live the rest of our lives (we are both self employed) and odds of needing to relocate for career are slim. Another was a house large enough not to need to rent office space (not included in my financial calculation). good luck to all.

I forgot to add – not sure how inflation enters the picture. In 10 or 20 years, I am reasonably sure of having equity and my 3.5% fixed interest rate, hedges against inflation which as a renter I cannot avoid. Unless I played my cards smart (with that extra $400 per month) no telling where I would be as a renter except for sure no equity in a home.

QE A, I’m right there with you. I crunched the numbers myself and ended up buying last year. As I mentioned above, there are lots of intangible benefits from owning a home in addition to all the tangible ones. Locking in a 3.5% rate was just icing on the cake and definitely protects me from future inflation.

2010-2012 will likely be looked back on as one of the best times to buy in recent memory in socal. Nominal prices were still high, but the monthly payments were absurdly low and many areas were at or below rental parity.

The confirmation bias echo chamber the two of you exist in is really something to behold. You could end up being proven right or wrong because no one really knows.

The act of commenting on this blog attempting to convince the rest of us what a great decision you made sure is a peculiar bit of psychology. If you’re so confident, wouldn’t you instead be spending this time enjoying your new home?

Yeah, I’m definitely enjoying my new home. The last I checked, this is not just a blog for angry renters. I used to be one before I finally accepted reality that housing will NOT have epic collapse in desirable areas of coastal California. There is lots of good information from both camps, what fun would it be if this was just an angry bear blog?

Lord, while your intentions seem to be sincere, I feel you miss the point.

If commenting to the rest of us about the confidence of your played position helps you in some way, then that’s great–for you. It just seems to me that subconsciously it’s more about convincing yourself because why else bring your personal situation into the debate? It’s simply not useful to the audience.

I think a lot of us would admit that we are not confident about the future prospects for housing (even coastal California) that portends the entire point of this blog and why we’re debating the subject.

By the way, I don’t consider this an “angry bear” blog any more than I would agree that we’re all “angry renters”. I think many of us have varied circumstances and vantage points from where we view the housing bubble concern.

Yeah, and:

++++++++!!!!!!!!

Leave a Reply to bmd