The leverage based economy: $1,000,000 home for $2,000 a month even with higher rates. The addition of Goldman Sachs and Visa to the DOW reflect our leverage based economy.

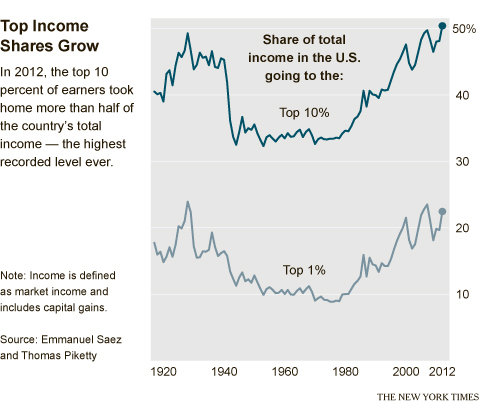

It was interesting to see Goldman Sachs and Visa being added to the DOW 30 Index. The importance of this highlights the massive amount of leverage in our economy. Those benefitting from low rates are large investors with the ability to use financial arbitrage and have the ability to keep ahead of inflation. For the last few years, that pathway has come through hedge funds and Wall Street picking up loads of investment properties scattered in the wreckage of the bursting housing bubble. Another interesting piece of data came out regarding wealth distribution in the United States. The top 10 percent of earners took in half of the country’s total income, a new record that goes back to the early 1920s, pre-Great Depression.  Those with the ability to access high leverage products, like many clients of Goldman Sachs, have done extremely well since the recession ended in 2009. For others, not so much. In fact, you can still purchase a $1,000,000 home today for $2,000 a month. Find out how via the wonderful world of leverage.

Higher rates put a minor dent into high income leverage

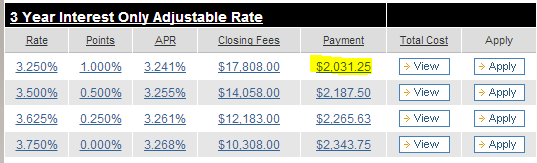

A few months ago we discussed how it was feasible to purchase a $1,000,000 home for a payment of $1,900 a month. Since rates have shot up overall since then, I thought it would be interesting to see how the higher rate market impacted the interest only segment:

Assuming you purchase a $1,000,000 home with $250,000 down, you can get your monthly principal and interest payment down to $2,031. Not bad for grabbing onto a million dollar property. Taxes and insurance will add on another $1,000 or so per month so your total PITI will be in the $3,000 to $3,200 range. In these low rate environments, a buyer at this level can offset a large portion of their tax burden by leveraging this debt and writing off interest and taxes for example. This can be a big windfall for higher income families. A high mortgage is beneficial if your income is above $200,000. Why? The IRS maximum for mortgage interest debt is $1,000,000. In the mortgage above, you are paying $24,372 in interest alone which is a nice deduction to have especially at a higher marginal tax rate. Ultimately wealthier families are going to have access to better tax planning and methods of sheltering income. Real estate provides some of the largest government subsidies in our economy especially in California (i.e., mortgage interest, taxes, Prop 13, non-recourse state, etc).

Cash investors are chasing lower priced properties for renting them out but a good portion of cash buyers are buying to live in the property. Last year, all-cash purchases in California above the $500,000 mark rose 35 percent from 2011. This year it is up as well. This figure is important because these are unlikely to be investment properties since the higher the price, the harder (and smaller) the pool of potential renters you can find.

Make no mistake though, the bulk of buying is going to investors looking for rentals or flips and this market is frothy like a rabid squirrel. For example, last month in SoCal 29.4 percent of all sales went to cash buyers. Of those, 27.4 percent were “absentee†meaning these people were not slated to live in the property. That is a large portion of the market. Cash buyers paid a median $328,000 so they are definitely chasing lower priced properties to flip or rent out.

The gains flow to the top

We’ve talked about the shrinking middle class in California and how wealth disparity is growing dramatically. This week, we have additional data confirming this massive change:

Source:Â NY Times

The top 10 percent of income earners captured half of all income in the country, the highest amount ever. Keep in mind that some areas are becoming targeted locations for wealth. It is interesting to see neighborhoods where new residents that just bought are working professionals with high incomes yet are moving into areas where people would not have the ability to buy their own home today if they had to. I’ve seen this in Pasadena where you have someone that bought for $200,000 many years ago all of a sudden having a neighbor in a similar model home paying $1,000,000. The above chart highlights that the middle ground is becoming much smaller.

So it is interesting that we now have Goldman Sachs and Visa in the DOW. Probably an accurate depiction of our leverage based economy. Max it out via credit cards, auto loans, college debt, or a giant mortgage. If you are a big bank and can get your hands on cheap debt from the Fed, then you can plow that money into real tangible assets in real estate.

What is interesting is that in the last bubble, leverage was offered out to anyone with a pulse. Today, it is only a select few that can leverage this playing field and they are doing it. This is how we get massive investor money flowing into real estate.

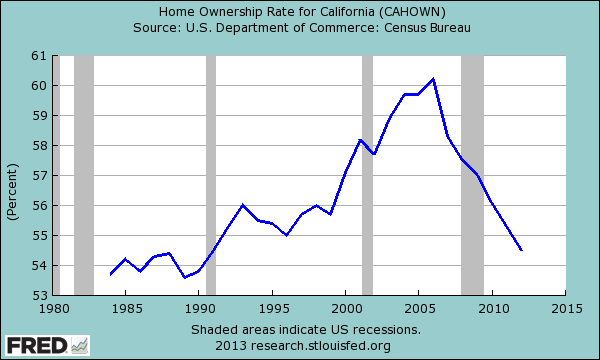

What impact has this had on California home ownership?

There is little need to guess what is happening here. Just follow the money. This is more evidence that the middle class is being constrained in the US, especially in high cost areas of California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “The leverage based economy: $1,000,000 home for $2,000 a month even with higher rates. The addition of Goldman Sachs and Visa to the DOW reflect our leverage based economy.”

This housing bubblet is being enjoyed by a far smaller group of people-those “eligible” to take advantage of low rates. It will make some rich people richer but will do nothing to lower home affordability, increase home ownership rates or help the overall economy.

Indeed on my site I am calling the end of the economic recovery as we head into thte fall

Fortune telling is for fools. That’s why I make financial decisions which make sense no matter what happens.

@Joseph wrote “…If the economy weakens, hard to think interest rates rising…”

Obviously you are not familiar with Portual, Italy, Ireland, Greece and Spain, aka the PIIGS.

Familiarize yourself with them and your hypothesis falls apart.

Ernst Blofeld: “Obviously you are not familiar with Portual, Italy, Ireland, Greece and Spain, aka the PIIGS. Familiarize yourself with them and your hypothesis falls apart.”

Really? Ok, please explain how is the situation with the PIIGS interest rates similar to the US.

Do any of those countries print their own money? Is the US in danger of defaulting on its debt?

Even better, explain what the interest rate situation is currently like in Portugal, Italy, Ireland, and Spain. How have they done since the euro debt crisis?

I’ve read a lot of doom and gloom about it the last couple years, but now that things have leveled off, I haven’t heard much about them lately. Perhaps you’d be kind enough to explain why we should be fearful of what’s happening to the PIIGS.

MB, I will tell you why you should be afraid of the PIGS. I speak French and German and know much about both nations and how the people think.

There is no guarantee that the world will indefinitely decide to enslave and destroy itself by accepting the dollar as the world reserve currency. We are not fooling anyone with our talk of a “recovery” and everyone knows this country is economically dying, drowning in debt. The reason they haven’t dropped us already, is that they own much of our debt, and are probably hoping against hope to get paid back some of it. The longer they wait, though, the harder the eventual fall will be.

The bureaucrat politicians in Europe actually do the bidding of America, and of the current, destructive system, not their own people. Go read, using Google Translate if necessary, the reader comments on Le Figaro in France, or Faz.net in Germany, and see how satisfied people are with their politicians and EU bureaucrats… They know what is going on, and that they are being steadily impoverished by the totally untenable and absurd European Union, where Germany is in the position of having to bail out everyone to sustain its profitable export business. And even Germany is in horrible shape. The people in Germany are poor, just like here, not to mention they are having few babies; only the rich get richer. As for the people in other European nations, just do some research and you’ll see how miserable their situation is. France is being deindustrialized, Spain has enormous youth unemployment, their future is being frittered away.

As long as these politician-placeholders are there, the dollar is safe. However, how long do you think the lid can be kept on the pressure-cooker? When the nations descend further into poverty, there will be massive revolutions. There is NO WAY, do you understand, that this will not happen — except the Antichrist coming and selling people on a world government, but we won’t get into that — because as long as the European Union is there to serve the needs of the few, the many will get poorer and poorer, and angrier and angrier.

Once the riots happen, the EU will collapse, and Europe will go back to having nations as it always did — France, Spain, Germany, independent of each other. Also, they will get rid of the dollar as the world reserve currency. They will take a hit due to this action, but the hit is coming anyway; they have nothing left to lose. As for the U.S., it will not just take a hit, it will probably be utterly destroyed. Without having the world reserve currency, this country will be stripped of all its spurious might instantly.

Some people think it will be wars, others think it’s something else, but I believe the “black swan” event that will end the world as we know it — by ending modern America — are riots and revolutions in Europe, and the dismanteling of the EU. At any rate, the dollar could not be more fragile. The reason that we became so powerful was due to World War II and its aftermath, but political decisions that came afterwards, such as globalizing and outsourcing, squandered all of that. The fiat money system would have only worked if we had endless wars to fight, because it is war that made us what we were, and that enabled us to convince all these other nations we were an impregnable superpower. That was the “confidence” we sold to get them to buy our debt; the confidence that we would always be a superpower. But now we are a welfare state propped up by China. This is the humbling of American arrogance, and it’s not over yet.

OutofCalifornia:

Hast du einen vogel?

I’ll ignore some of your more outlandish long-range predictions, and just address the one item that is within the realm of reality.

Currently only the euro is the only real alternative. Should the EU and the Euro be dissolved, the US dollar would gain an even stronger foothold as the world’s reserve currency. What else would take it’s place? GBP and CHF are both located in Europe and would be affected by any crisis there. Japan has more debt than the US.

Here is an LA Times article from 9/12/13 that reports Southern California August house prices are flat again, following higher mortgage interest rates and fewer cash/investor purchases —

http://www.latimes.com/business/money/la-fi-mo-home-prices-august-20130912,0,3622979.story

Let’s see what happens as interest rates continue to rise; as more low-paying jobs are created; and wage growth stagnates.

Another fortune teller. So sad! Sure, interest rates could continue to rise. But, also could stay abt the same. Going up probably just means the economy improving and jobs most important factor for home buying. If the economy weakens, hard to think interest rates rising. Sure, stagflation possible, but no indications yet. Yes, speculation has hit some parts of RE and stocks, but that means nothing, just as always be cautious. Due for corrections in both, but even if big bubbles, no way to tell when eventual top.

Interest rates will rise because the Fed will start to taper their bond purchases later this month. That will put downward pressure on house prices. The jobs that are being created are not high-paying jobs, but low-paying jobs in retail, hospitality and healthcare. Baby boomers are retiring, college graduates leave school with $30,000 in debt and the Millennial generation isn’t as interested in buying homes as other generations, after watching what happened to their parents.

At first, I was going to say that the days of getting tax deductions on a $1M+ mortgage are numbered…But then, I realized that those are the very people who donate (heavily) to political campaigns…So on 2nd thought, never mind.

Credit based society is all about the payments. This has been the US for quite some time now.

This is true but what happens when people can’t afford to make those payments and scale tips? Without strong underlying economic principles that lines they keys of the people producing the goods and/or services so that they can become the consumers and investors, the eventually what they end up with is a pile of worthless paper that cannot be repaid. Then they steal all the real wealth. the assets that backed all that paper. That is what is happening currently. This decade will be not fondly remembered as the decade of the great transfer of wealth. Money never disappears, it only transfers. This was so obvious that this was coming to me anyway, that I wrote extensively about it since 2009. Once people understand the game it’s clear to see what was coming. It was done purposefully and intentionally. Get your assets and out of paper. Remember it isn’t yours till its paid for. If the assets price drops, which it willmina manipulated casino market, if you owe more than its worth you lose. If you pay cash for more than its worth, you also lose. Vegas sports betting is more honest. Lol

You owe more than it’s worth, quit making payments. Then your costs go to zero.

I think that’s well understood at this stage of the game.

Don’t ask me why my iPad thought that I said scale tips? What I said was stop paying. Sorry about that speech to text

I was wondering why your comments were so difficult to read… The ipad does have a keyboard onscreen and external versions are also available. I use an external keyboard when using my ipad and entering text.

Goldman Sachs became a “Bank Holding Company” during the financial crisis. This distinction gave them access to the Federal Reserve’s Discount Window. Hence, they could borrow money for next to nothing, use it for their investment strategies, and pass it on to their clients. I remember that day in 2008 and thought to myself “This is insane!”

Bingo! Rigged casino! I use your Money to place bets, if I win you Gee! I did great that’s mine! If the bet loses, gosh darn that was your bet so sorry you lost. it’s the Bankster’s bash

Crony capitalism at its finest. Thanks Paulsen and the rest of the investment bank alma mater for opening up the coffers to greater leveraged risk. Smashing that Chinese wall’s big result has been the economic cancer of overvaluation based on easy money in equities and real estate. Saving GS and protecting the TBTF institutions from the structural economic collapse in 2008 has led to a greater structural problem of overvaluation.

Forget the credit swaps and such derivatives of mass destruction of 2007-2008, the markets in 2013 are overvalued in equities and real estate. Analysis of financial statements for P/E and other ratios show they are overpriced.

What ammo will the government use to prop up the banks and bail out the top .01% investor class risk takers when the next exogenous shock crushes the markets?

Liquidity always seems good until you need it, as market wags say.

It’s interesting to note how, even among the well-off, inequality is increasing. Look at the 2nd chart above showing the income of the top 10 and top 1%. Now subtract the two curves. This is the income of the top 1-10% (excluding the top 1% percent) and it is almost flat! Specifically the income in this segment goes from about 23% to 27% of the total over the last 30 years, while that flowing to the top 1% more than doubles from 10 to 22% of the total.

So it’s not only class warfare between the haves and the have nots. It’s the haves vs. the have-a-lots, and the have-a-lots are eating the haves for breakfast…

This might actually be a good thing since the 1-10% still have some political influence in this country. If they recognize how they are being shafted right along with the poor then perhaps they can provide some counterweight to the outsized influence of the plutocrat (or is it kleptocrat) elite.

Great observation!

Interesting that home ownership was at it’s peak when prices were at their peak. Just shows that available easy money ie: sub prime and no doc loans drove the market not asking prices. Now that it is more difficult to actually qualify and buyers need save up a down payment owning a home seems to be going to those who can really afford to buy, what a concept.

You are missing the game entirely. Asking prices don’t drive sales. What drove the prices up was demand for the paper. The houses were just the tool used to make the paper more enticing to investors so banks could gamble with OPM and if they win yippee, if they lose, the suckers pay. Please take the time to learn about money. You have been fed the lie that the busboys and waitresses of the world caused the financial collapse. Americans did not suddenly wake up one day and decide to stop paying for their biggest investment they will make in their lifetimes. They did not suddenly by the millions decide to turn deadbeat overnight. Think about it. Look further. Pull back the curtain and find the truth.

Another conspiracy theorist!

A lot of people of people got caught up with the idea of flipping homes. Take these links as an example.

https://en.wikipedia.org/wiki/Casey_Serin

http://iamfacingforeclosure.com/history.html

A sixth grader could look at those charts and see that we are in 1929 mode. The supposed crash of 2008 was just an hors d’oeuvre. It was just reported that over 20% of Americans in the last year had difficulty feeding themselves and their family. That was where is was in 2008. This is not a recovery. It is a prelude.

Yeah, if you have more children than you can afford, have a 100 dollar/month T.V./Internet bill and a 50 dollar/month iPhone bill it probably is ‘difficult’ to feed the family.

According to CNN, the foreclosure crisis is drawing to a close (umm, yeah):

http://money.cnn.com/2013/09/12/real_estate/foreclosure-crisis/index.html

i enjoy your articles. this one appears to be a little lite on re taxes and insurance cost for a 1 M home @ 1K monthly….

Another pinprick for Housing Bubble 2.0: “Loan limits for popular mortgages are scheduled to drop in January, according to a Wall Street Journal report this week. The Federal Housing Finance Agency is planning to slash the maximum size of mortgages eligible to be backed by Fannie Mae and Freddie Mac, which currently run as high as $417,000 in most parts of the country and up to $625,500 in pricier cities, including New York and San Francisco.”

http://www.marketwatch.com/story/its-about-to-get-harder-to-buy-a-home-2013-09-11

I really never understood the reason why govt needs to subsidize home loans larger than $200k. If you can’t afford the down payment on any home loan above that, then DO NOT BUY.

I think the real interesting thing is that the home ownership chart drops around 1987 and then starts its epic growth around 1990. This coincides with the Savings and Loan crisis where the Fed started its economic interest rate experiment. Remember the “end of the economic cycle†with Greenspan on the cover of time magazine. We had strong Fed influence ever since which created growth in debt and a home is the largest debt for the average consumer. I wonder what a chart would look like if you overlay student loan “ownership rate†chart on top of the home ownership rate chart…

Classic statement Fulano – “The supposed crash of 2008 was just an hors d’oeuvre.” You are probably right. I think the housing market is headed for disaster – like a snowball rolling downhill toward hell. It will not be pretty. Home prices will fall like a rock. What amazes me is how the powers that be were able to reinflate the housing bubble during a frigging depression!

This housing situation is going to end so badly! There is extreme manipulation of the housing market going on. I met a person the other day who overpaid for an older house in a decent neighborhood. The manipulation going on is a desperate measure to save the banks and to falsly inflate GDP numbers. The sad thing is

disproportionate amount of people’s income is going to housing. It ends up being the same as robbery. People are being ROBBED of their income by buying homes at artificially inflated prices. Some poor fools just can’t see the light at the end of the tunnel and resign themselves to thinking high home prices are here to stay and greatly overpay for a place to live. This is all going to end very badly. It will be something like this:

http://www.thedailysheeple.com/wp-content/uploads/2012/09/nuclear-bomb-explosion2.jpg

>> People are being ROBBED of their income by buying homes at artificially inflated prices.<<

Even if housing prices are inflated, it might make sense to buy a house if you have the cash. The coming hyperinflation will eat away your cash faster than if you bought a house at an inflated price.

You’re boring. Good luck holding onto anything you think you own in a hyperinflation. Everything is up for grabs in that situation landlord-boy. We’ll see if you can hang on to what you think you ‘own. Holding up a mortgage document won’t save you.

Makes even more sense to buy if you don’t have cash. No better hedge to inflation then low interest debt.

Hamburger, you say people are being “robbed” of their income to buy houses at artificially inflated prices. The alternative is people being “forced” to rent at nosebleed high prices? Housing on a national level is still very cheap. You are focusing on desirable parts of coastal California…that hasn’t been cheap for decades.

It’s over folks. This just in:

http://theeconomiccollapseblog.com/archives/prepare-for-tough-times-if-your-job-has-anything-to-do-with-real-estate-or-mortgages

The economiccollapseblogspot has been crying wolf for many years now… just like InfoWars.com or Gerald Celente, their predictions are based on fear and tend to attract readers who feed on fear based predictions.

Need a separate page to dump news-stories which may be of interest to DrHousingBubble. How can these types still be creaming the big money? They earn top dollar pushing debt and HPI. Stupid system. Poncey debt pushers who for over a decade pricing skilled hard-working people out the market (even who’ve achieved fairly senior positions into their early-mid age of 30s), in their ponzi no-value-for-money market.

>>Bexil is offering adjustable rate mortgages and allowing down payments as low as 3 percent.

Robbins remains committed to the mortgage industry.

“I love this business, helping to provide the American dream to our customers and getting paid well to do it,†he told Mortgage Banking magazine last year. He said he wanted back in at the bottom of the market — what he called “the fun and exciting time in our business.â€<<<

In full: Executives From Biggest Subprime Lenders Are Peddling Risky Mortgages Again

09/11/2013. http://www.huffingtonpost.com/2013/09/11/subprime-loans_n_3903290.html

$1mil house for $2K monthly payment; if prices go up, buyer a genius, live a leveraged dream; if RE tanks, buyer squat until bank forecloses, save $ w/no payments, buy another house in a few years w Fresh Start mortgage program. Lather rinse repeat.

No solid economic recovery generating plentiful well paying jobs; stock market rallies on bad news, QE “hopes”. Thanks to FED massive wealth transfer to rich continues while massive QE allowed Mom/Pop to celebrate that their 401K is back and their SoCal 70’s era tract house bought for $200K when Seinfeld was a primetime network show is back to 2005 prices. Mom/Pop, 80% of the neighbors couldn’t buy their houses at today’s pricing, don’t know anyone who could afford to buy their houses, and worry about their heavily in debt adult kids who lack secure jobs…but truly do believe SoCal will never have a shortage of wealthy DINKS, investors eager to buy in ‘hoods filled with age 50+ folks who love to talk about SoCal weather, how could anyone live anywhere else, chuckle, snort!

Even with rates at what they are now, affordability is at about 36% in CA right now. Getting HELOCs and mortgages in general are still quite stringent on qualifications. This has the look of a slowly recovering price structure. So, I give it another year, and maybe two.

the big mistake of economist is the preasumption that the rich people when become richer are investing and creating jobs and welfare for everybody but the truth is the opposite because today the rich invest only in speculative ways and not in industry as they did in the past. This “new speculative and leveraged capitalism”” is more dangerous than anything else for the economy

At the bank where I work, we add 2% to the start rate for 3/1 and 5/1 loans to compute the qualifying payment, so as to prevent some payment shock in the future.. So, it works out that the 7/1 is the easiest loan for qualifying payment. For $1,000,000 loan, the best rate for with no points for a 3/1 is 2.500% (qualifying payment based on 4.500%) , 5/1 is 3.375% (qualifying payment based on 5.375%) and the 7/1 is 3.625% (rate and qualifying rate). The 7/1 has been the second most popular loan this year after 30 year fixed for my customers. The 10/1 is 4.125%, about 0.500% lower than a Jumbo 30. If rates keep climbing, these will be more popular in the Jumbo range.

Leave a Reply