Long live the rally in California home prices: How much momentum does the current real estate run have? A market where heartfelt letters are required begging sellers to offer you a Great Depression built home for an outrageous price.

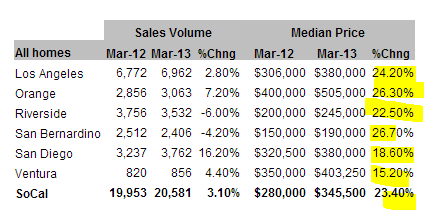

However you want to slice it, median or repeat same home sale prices the price of a home in California went into the stratosphere over the last year. The psychology has now shifted to full fledge mania where people think they are going to be priced out but some are oblivious to the reality that they are competing with a massive amount of investors. The median home price of a SoCal home in March of 2012 was $280,000. For March of 2013 it jumped to $345,500. What justifies such a big move? The only true justification is the artificially low interest rates being provided by the Fed, low inventory, and investors (the trifecta of the current market) but this pace is completely unsustainable and you will see this trending out towards the end of the year. Why? Because there is no way you are going to have 20+ percent annual gains on the median price and the media is running with this feeding into the frenzy. A stunning 34 percent of all SoCal purchases in March came from all cash buyers. How much momentum does this trend have?

The rise in home values

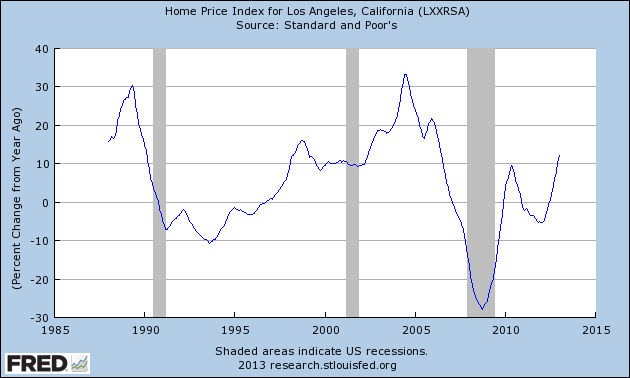

The annual rise in home values is now above 10 percent for the LA-OC region (same home repeat sales):

The last time we had such a strong pace upwards was during the peak years of the bubble. Of course we are nowhere close to the 30 percent gains from the bubble but 10+ percent is significant especially when much of the growth is coming from hot money and incredibly low inventory. The name of the current game right now is capitulation. We saw similar things in 2004 and 2005 when it was becoming clear a bubble was in place but people to get into the game took on toxic mortgages to finance their play in the housing market.

Just because people are verifying their income does not mean they can handle a mortgage when other debt items are factored in (i.e., student debt, auto debt, etc). The rally in the housing market is incredible given all the weak employment reports that are coming out. A large portion of job growth is coming from low wage jobs and we are hearing from the Census that the last few months of labor “improvements†have flat out come from people exiting the work force.

So you have to take the gains in context. We also have the Fed mentioning that part of the recovery is because of housing causing a snake eating its own tail effect:

“(WSJ) Federal Reserve stimulus aimed at spurring growth will likely grow more powerful as the housing market recovers further, but the trends that have fueled income inequality aren’t likely to change much, a U.S. central bank official said Thursday.

“The accommodative policies of the [Federal Open Market Committee] and the concerted effort we have made to ease conditions in the mortgage markets will help the economy continue to gain traction,†Fed governor Sarah Bloom Raskin said.

“As house prices rise, more and more households have enough home equity to gain renewed access to mortgage credit and the ability to refinance their homes at lower rates,†she said.

“I think it is possible that accommodative monetary policy could be increasingly potent†as the housing market picks up, Ms. Raskin said.â€

So basically investors and large hedge funds will continue to buy up properties while more and more Americans will be given the boot form the middle class. It is naïve to think that having artificially low rates comes at no cost. We are already seeing the hit being taken across the board. So you have banks, many that caused bubble 1.0, kicking people out, buying these places up with Fed artificial QE and then jacking rents up or flipping them to new buyers. Sounds like a fantastic gig and that is why Wall Street suddenly has butterflies in their stomach when they think of residential real estate.

Look at the median price changes in SoCal:

The repeat index has prices up above 10 percent and the median price is up 20+ percent. Yet overall household economic gains are weak. In other words, jump on the housing bubble bandwagon for round two. Looking to buy in the city of Los Angeles?

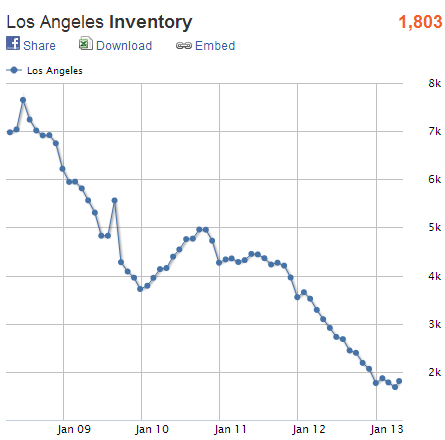

Inventory is down nearly 80 percent over the last few years. You want to own a home? Gear up since you’ll be entering a shark tank with very little inventory being fought over by all cash investors, foreign money, FHA buyers, and your regular conventional mortgage buyers. And we’ve only started the spring and summer selling season! So how much momentum does this rally have? Hard to tell but the psychology now is fully in a mania stage “I need to offer $50,000 over ask or I’ll be outbid†or “forget about any inspection, let us just clear all contingencies.â€Â Or the heartfelt letters to sellers begging them to sell you a Great Depression cookie cutter home for $800,000.

“(Daily Breeze) A little sincerity goes a long way today. Agents are increasingly pushing their buyers to submit more than a purchase agreement when making an offer to buy a home, reports a recent article by the New York Times.

Personal letters and even baked goods can win-over a hesitant seller, giving the buyer just enough of a competitive edge to garner the seller’s acceptance when multiple offers have been submitted. It seems that cash is nice, but love letters sweeten the deal.â€

Long live the California housing rally! On the bright side, the state budget needs those higher property tax bills so it is win-win all around. Right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “Long live the rally in California home prices: How much momentum does the current real estate run have? A market where heartfelt letters are required begging sellers to offer you a Great Depression built home for an outrageous price.”

Doc,

same story here in Portland and even more so in Seattle…minimal inventory, prices jumping so fast that ’07 highs are coming back into view. Be it right or very wrong matters not to the average buyer. They simply want in. Very bubbly up here and it’s come on very quickly this spring.

Of course, Oregon has some much more interesting variables than California. Last July forclosures stopped because of the Oregon Court of Appeals decision in Niday. The decision required all MERS recorded delinquent mortgages to be foreclosed via the courts rather than through the normal Oregon process of non-judicial forclosures. The non-judicial forclosures took about six months, the judicial take about 18 months on average. The new forclosure filings are now up to what they were in the peak of the forclosure process. There is a second waive of forclosure set to hit the market late fall 2013. The peak of the second waive won’t be until a least fall of 2014, if not later. The filings from March 2013 will represent a doubling of incoming inventory in fall of 2014. When ne factors in a significant number of new housing starts and the increased FHA requirments it seems likely that bubble2.0 in Oregon will peak late summer 2013 and prices will stagnate or decline at least into 2015.

Thank you for a much better explanation of what I’ve posted previously regarding the situation in Portland. Once they passed that law the supply of foreclosures dwindled to next to nothing in a matter of months.

Yeah, it’s interesting because it APPEARS like we don’t have any foreclosures, but instead they have just been delayed. The Oregon Supreme Court opinion in Niday should be published within a few months. In the meantime, have a look at the initial foreclosure filings for the last three months.

http://gorillacapital.com/news/2013/04/15/oregon-foreclosures-climb-in-march/#more-362

I’ve heard there’s talk of Oregon raising it’s property taxes.

There is talk about raising property taxes (once again), but a lot of folks are tapped out at this point, for a such a progressive city there’s still some pushback on yet more additional taxes. They recently passed something called an “arts tax” in Portland, which averaged out to $35 per person per household. Most of it’s not going to the many smaller non – profits here, but to the usual politically – connected large charities.

They (our gov.) just need things to look good long enough for them to ease out of the picture and then the blame can be redirected.

I need prices to go up about another $90k, before I can sell and after paying the realtor I would have approx. $60k. If that took 2 years in 2015 I could sell for $634k and move up, (but to what).

If rates were at 5.2% and I put $75K down 10% on a $734k house I would be looking at $4700/$5000 a month, no way we could handle this.

If rates were at 5.2% and someone put 10% down or $65K on my $634k house they would be looking at over $4000k a month, no way we could even pay that much. (so, like so many, we are stuck for a while).

I know my neighbor’s, nobody makes that kind of money or has staying power.

If rates went higher and consumers were forced to spend too much of their income on housing/rents, this would be a negative for housing and the economy. Add in Obama care, new taxes etc…no problem.

We just kicked the can far enough down the road to re-elect and re-direct blame once again. I see a recession or worse forming in late 2015/2016 just look at the cycle. And so it starts all over, let’s just hope we can do it one more time.

Only in America.

We are starting to see a lot more (800%) inventory hit the peninsula (Bay Area) including a many “coming soon” signs. I’d say the second top is here or close and down the economy goes by the fall (no pun intended).

“Give me control over a nations currency, and I care not who makes its laws.â€

Baron M.A. Rothschild

Brilliant Observations, as always Dr.

There is a famous phrase, the reason history repeat itself is that we don’t listen, or learn from past. Such is a case here. Feeding frenzy is on, the hell with economic fundamentals.

Thanks to your Blog, some of us have the benefit of intelligent and objective analysis, we can take it to heart.

Thank you for your public service, Doc!

Pushpinder

unfortunately underlying economic principles no longer apply the market is completely controlled and manipulated so the best we can do is guess when the roulette wheel will stop. or gess where the elevator is at, the top or the bottom, or the middle, only the actual Sims gamers know the answer to that and we’re all just The Sims. We can guess and try to catch a wave. Or watch on the sidelines as fortunes are made and lost at break neck speed. It’s crazy. Some people arguably just want a home. Imagine that! Times they are a changin’.

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

that is such an awesome quote wasn’t that President Kennedy in his last speech before the banksters had him assassinated?

If people fully underStood why we are all in this situation right now there would be full on rights at GS and JP Morgan and BOA, WELLS ET AL.

@Lynn Chase wrote: “…that is such an awesome quote wasn’t that..”

Nobody knows where this quotation comes from. The term “deflation” came about during the Great Depression.

The quote: “…If the American people ever allow private banks to control the issue of their currency…”

Means this would have come on or before 1913 when the Federal Reserve was created by an act of Congress. The Federal Reserve, a private bank, has controlled the issuance of U.S. currency for a hundred years.

Sorry I am using text to speech and it should read “riots at GS….. et al”. Not “rights”. amazing one word can make such a difference in the meaning.

How about “rites (last)”? Wishful thinking, perhaps.

Wall Street Equity Firms have billions of dollars and will keep investing in houses to rent even when the returns go from around 10% ROI to 4% ROI. Where else are they going to put their diversified money, and government bonds at 1% are for fools. This is the new baseline for real estate, Wall Street competing against private home buyers. The results for Wall Street has been just what they predicted, why would they quit now

“Wall Street Equity Firms have billions of dollars and will keep investing in houses to rent even when the returns go from around 10% ROI to 4% ROI.” You obviously know little about property management…

Cap rates have gotten so low that it’s a losing venture for anyone getting in now after you factor in management costs and maintenance. not to mention a terminally unemployed populace that means missed rents, vacancies and people treating your property like shit by piling in to many people. There’s a reason nobody has ever rented SFHs en masse. The market fundamentals don’t work. This is another case of the FED trying to fight gravity/clear the banks toxic balance sheets. They may succeed in the latter, but will yet again fail spectacularly in the first.

You are absolutely correct about the cap rates. Keep in mind that the hedge funds DO NOT use their own money, it is investor money and borrowed money from the banks themselves. Anyone who buys for cash at this point in this low interest rate market is crazy or only concerned about the fees they are making and not the market risk.

I fully agree David it makes one speculate as to how long good ROI can be sustained once the over saturation of rental properties are on the market it can only cause rents to go down. couple that with the fact that the large hedge funds are certainly hedging there bets on monetized leases through credit default swaps and here we go again round and round and round.

I fully agree David it makes one speculate as to how long good ROI can be sustained once the over saturation of rental properties are on the market it can only cause rents to go down. couple that with the fact that the large hedge funds are certainly hedging there bets on monetized leases through credit default swaps and here we go again round and round and round. Who will end up without a chair when the music stops this time?

I doubt they can even get 4%. A lot of hedge funds didn’t really buy at the bottom – they just bought at a lower than bubble price. Their upfront negative is high relative to rental income.

You can get corporate bonds yielding 5%. Hedge funds know this – they are seeking alpha returns on this housing thing.

I am starting to see that home prices in my area are at the break even level of rents vs. mortgage. And it looks like the momentum is slowing down. Investors only want places the yield 5% or more. But the general public is looking at rent parity. The rise was so fast and high this year that it looks like we may already be starting to peak. This may be over in a year.

there are micro markets all over the country, and here in Los Angeles we have many micro markets. From the San Gabriel Valley where all cash foreign buyers are snapping up properties left and right, to hipster neighborhoods where we’ve seen almost 20% increase in median price since last year. How long will this sustain???? We really don’t know. But as long as interests rates stay low and inventory remains low, there will be a frenzy. I am seriously considering selling my house as prices are near and close to 2006-2007 bubble prices. Which poses the “bubble” question. Are we approaching a bubble? Certainly this is an artificially inflated market given the demand and low inventory. When are jobs and the overall economy going to rebound with 20% appreciation numbers? Likely never. So this concerns me as to another run up in prices and having the real estate market carry the economy. I’m kinda rambling on, but nonetheless, it’s a great to time sell right now if you have any equity or are finally out from underwater. Sell your house and go rent for awhile. Let the masses duel it out and overbid while we wait on the sidelines waiting for the so called bubble to burst again.

Going to look for an apartment for rent today… :…-(

Cheaper that a mortgage but $4K to move in and got to buy my own fridge and washer/dryer. Will start looking for a home in a year or 2 again…or will the investors just keep pricing us out?

Here are the numbers in Oakland, CA, per Redfin, for March 2013:

# of homes for sale (SFRs only): -56.6 percent vs last year

Median sold price per square foot: + 47.7 percent vs last year

http://www.redfin.com/city/13654/CA/Oakland

Inventory has been decreasing for over two and a half years. Redfin says there are 266 SFRs on the market now.

There are about 1,100 REOs being held off market, and another 1,100 or so houses in earlier stages of foreclosure (and, presumably, many more squatters who are in default but who the banks are ignoring).

Truly outrageous.

Just because a situation is morally wrong doesn’t mean we should deny facts. The Fed has shown that it will continue ZIRP and other easing measures for the foreseeable future. The only thing that will stop this is a significant drop in unemployment or a significant rise in inflation – neither of which seems to be on the horizon. While I don’t like it this suggests to me that the housing reflation could go on for a lot longer than most folks here would like to admit.

Every dollar that we lend to China eventually has to make its way back to the US in the form of purchases. If we’re giving out dollars for cheap why shouldn’t the Chinese (or substitute whatever other cash rich institution you despise) continue indefinitely to buy up real property at low real cost?

So the median price is up. But is there data on the change in home values broken down in, say, $100k increments? ($500k-600k, $400-500k etc..)

From what I can see, it looks like the $500k+ homes have recovered to 2006-2007 bubble levels. But I’m looking at homes in Valencia/Santa Clarita under $300k that are nowhere near back to bubble levels.

Good posts from CAE and LA. I too am guessing at the rise will level off sometime this year. We’re involved in a transaction where we bought a house first for cash, and then our Daughter will sell the town home and cash us out. So far the plan is working. I’m amazed, though, that they have already had a couple of offers to rent the town home from people who heard of the move and knew that the T.H. wasn’t yet on the market. The T.H. won’t be ready to sell until May, when the new house is fixed up and all the furniture is moved. My motto is “Sell in May and go away!”

What if Tamerlan Tsarnaev was forced to work as a contact with the FBI and the operation got away from them? something similar to this:

http://www.thisamericanlife.org/radio-archives/episode/471/the-convert

My last listing in Ventura County in Oxnard list price $574K sale price $611K all cash from supposed owner occupant moving from Oklahoma. If you believe that this is a real owner occupant and not a straw buyer I can also sell you a nice bridge in Brooklyn. Hedge funds and investors are playing dirty once again and have now learned to put on an owner occupant face.

Everything is getting a little harder for Ben Bernanke. Since 2008, his goal has been to keep asset bubbles from breaking, keep asset prices from sliding. A continuing slide in housing prices would render US banks insolvent. His plan has been to weaken the US Dollar. He knows that a weaker Dollar causes anything traded in dollars to rise in price. To preserve the prices of risk assets (housing, stocks, commodities) he needed to wound the US Dollar. Between 2000 and today, the Dollar’s value is down some 20%.

Of course, his policies of QE, ZIRP, ITBB (infinite Treasury Bond Buying) are Dollar-negative. His ‘printing’ (this is a metaphor) new money to buy toxic assets — essentially have the taxpayer buy the toxic assets — that no sane investor would touch — is also Dollar-negative and requires his own tilting of the playing field toward zero interest rates or his $3+ trillion balance sheet would turn to dust.

Ben wants the Dollar to go down. He spends billions a week to make this happen.

If the Dollar rises, stocks will housing prices fall, and commodity prices, and inflation. Why is that so bad? Why is more affordable housing, natural resources, and food being fought so voraciously by Mister Bernanke?

QE is running out of room, out of time. Bernanke is hitting the wall. His suppression of interest rates to weaken the Dollar to support asset bubbles and the appearance of prosperity returning…CANNOT WIN —

No wonder the Fed Board was boiling at their last meeting. Even those Fed members who do not support Bernanke’s policies have tried to put a good face on all of this, fearing a meltdown in global markets.

Is the punchbowl going away? And if it goes away, what then? How low might housing prices go? Ben Bernanke has painted himself into a corner; and now things are getting hard for him.

Watch the Dollar. If it continues to rally, Ben Bernanke is losing his power.

Good Luck!

@Wizard of Oz wrote: “…Why is more affordable housing, natural resources, and food being fought so voraciously by Mister Bernanke?…”

Because the Federal Reserve is a privately owned corporation that is controlled by its stock holders: i.e. Goldman Sachs, Wells Fargo, Bank of America, Citi Group, U.S. Bank, etc.

For readers of this web site not familiar with the Federal Reserve, the Fed requires all nationally chartered banks to buy non-transferable shares in one of the regional Federal Reserve banks. For regional/state banks, if they wish to borrow money from the Federal Reserve (to get their hands on those ZIRP funds), they too must buy stocks from one of the regional Federal Reserve banks, and become shareholders (equity owners) in the Fed as well.

So everything the Fed does, is in the interest of the banks who hold stocks in the Fed.

BINGO!

Bernanke uses the rational of “get unemployment below 6%”, which he knows is complete and utter BS! His job is to keep the member banks afloat.

You want to know what Bernanke will be buying next? Just look at the member banks balance sheets and see what “asset” is deep underwater, and that’s what he’ll be buying next. With the rally in the USD, I would not be surprised if his next buying spree was muni bonds.

@CAE, that is correct. QE3 is all about unloading MBS’s from member banks so that the Federal Reserve can monetize the toxic debt.

I was under the impression that most of the toxic housing assets were bought by foreign pension funds, and have all been written off. I also thought that the banks didn’t hold onto any or got bailed out with TARP/AIG Bailout. Is it known if QE is buying these housing assets or are these other assets?

I don’t think most of these MBS have been written off yet. The scale of it was so massive globally that it would totally sink investment returns across the world. Missing a bond payment or paying a tenth of a percent lower than expected yield gets you murdered in the bond market. I don’t even think any principal got paid off on these assets at all. Something’s being hidden.

@LAer, your assumptions are valid.

The really toxic mortgages were issued in 2004, 2005, 2006, 2007 and 2008. The mortgages started going bad in 2006. By October 2008, the credit markets had completely frozen. MBS’ were supposedly being sold (if they could find a buyer) for 40 cents on the dollar in 2008. So these wound up staying on the balance sheets of the banks since almost no one would touch them.

30 year mortgages are typically chopped up into 10 year securities that are sold to investors. Fanny Mae, Freddie Mac and pretty much everyone does it this way. These 10 year securities compete with the U.S. 10 year note (aka the USA 10-year Government Benchmark note).

Since the bulk of the garbage mortgages were underwritten beginning around 2004, the principal on these MBS’ will be due to creditors starting in 2014 (i.e. 10 year maturity date on the security). The QE3 $40 billion per month MBS purchase program started in Q3 2012. Coincidence? You decide…

Allow me to revisit this subject again.

Some of us understand that there is a Deflation Season that MUST be honored, no matter how painful for the status-quo — and that QE was the immoral transfer of wealth from the (relatively) poor taxpayers to the rich (the bankers mostly), in essence rewarding them for their stupidity and failure. The Debt Bubble was encouraged by bankers everywhere, including the two chiefs of the Bank in America, Greenspan and Bernanke. QE was a visionless denial of the truth: bad debt taken on in huge amounts at the end of the Business Cycle NEEDS TO BE DESTROYED.

This does not mean that such an honoring of deflation will be painless. Taking on massive amounts of debt is stupid and shows a total lack of leadership, and a lack of philosophical understanding, a misguided naivety that expansions last for ever. Expansions do not last for ever. They last for certain amount of years; then the deflation also lasts for certain amount of years.

Nothing in nature grows for ever. There is growth; and then there is rest.

The Deflation Season is about;

1) destruction of Bad Debt (toxic matter)

2) growth in savings and in currency strength

3) preparation for the next growth cycle.

Every new growth cycle is symbolized and characterized by a new technology that makes the growth possible.

If you undertand business cycle then you would know that we are currently at the age of decline, decay, downsizing, Nature triumphing over man.

No matter what FED does at the end DEFLATION is going to win.

We can’t grow again until we destroy all the bad debt we have accumulated for the past 30 years. We can buy some time, like FED is doing now, but then the FALL is going to be even bigger.

Good Luck!

We have a problem with a lack of good supply. Many people are underwater and making their payments. They want to move, but they can’t . The ones not making their payments and qualify for foreclosure, the banks don’t want to foreclose on all of them at once. Hence, we have a problem with a lack of sufficient supply and the prices go up. Eventually, the prices will go so high that a new equilibrium will be reached. Income is not going up, so there is a limit to how high prices can go.

In a few years, when the Fed unwinds, interest rates will go up and then the music stops. Party on!

DHB, I love your blog. Always so insightful. Thanks! I’ve been trying to buy a house for several years now, but keep losing out to cash buyers or people bidding well over asking. Its terribly frustrating. I feel like if the system weren’t broken, I’d be able to buy a small house in my preferred areas of Sacramento, and not commute many miles to work. I have a good job, making in the mid $70’s, have excellent credit, and a solid down payment of 10-15% (depending on condition of house). I am 40years old, have a doctoral degree, and about $40k of outstanding student loans. I’m starting to think I’ll never be able to buy a house, not unless I get married so we have a duel income. How is it possible that this American dream of home ownership has turned into a pipe-dream? I did everything right, and yet its still not enough!

“duel income” – you mean you would marry a professional duellist? I thought that had been outlawed.

I think he meant “dual income”.

Hahaha! You are right. I meant dual, not duel. Hopefully my romantic partnership won’t be so contentious. Although I’ve heard one way to ruin a relationship is to buy a house together.

See George Carlin on the American Dream myth…

Well, you are not alone. I have my own small business and earn over $300,000/yr, have zero debt (none whatsoever), pay credit cards each month completely, my spouse and I have FICO scores in the 800’s, we have about $200,000 for a down payment, and we only wanted a house somewhere between $250,000 and $350,000.

Although we could get approval for a loan, we refuse to overpay for a house. Period. And houses in our area are overpriced.

So we rent….

I feel the same. I can get a loan, but I do not want to pay half a million for a starter home, built in the 60’s, that needs a ton of work. In the past few years, there has only been one house sorta worth it in my area. It was a 1500 sf 3 br/2ba SFR on 1/4 acre, kept well, built in the 1980’s for $450K.

Okay, there’s being prudent with money, and then there is being cheap.

With your financials, you’re just being cheap. Nobody on this board wants to overpay. But I suspect you are the kind of person that thinks everything is overpriced, no matter how low the price is.

With your income and downpayment, you could easily buy a nice house and not have it affect your lifestyle, but you refuse to do so out of some theoretical conviction that the house *ought* to be much cheaper.

I don’t care how many degrees you have, you must be thinking DUAL income rather than DUEL income. But being married is likely to be a DUEL so it’s kind of a cute play on words anyway.

So i hear everyone’s talking about investors buying up properties. Is that happening in the west side? I understand investors could be targeting areas such as Inland Empire, but people aren’t being priced out of IE. They’re being price out of desirable areas such as the west side. One popular city that Dr. HB often brings up is Culver City.

So i go on Redfin, filter for Culver City, only on property type “House”, and sale record of “Last 3 months”. There are more than 40 houses sold. I’d expect to see some of these for rent on realtor.com, but none of those properties are showing up. In fact, on realtor.com, if i search for “House/Condos/Townhomes” for Culver City, only 11 rentals show up, with the most current sold unit in 2006. Investors would not just buy and hold real estate property due to 6% transaction cost.

So where’s the evidence that investors are buying up properties (particularly SFR’s) in the west side and renting them out? I sure don’t see any, and therefore i don’t see investor activity as an explanation for disparity between median household income and medium house price in cities such as Culver City.

Would anyone like to argue against my point?

Question for the readers and the Dr. Would you sell now and rent for awhile or hold off and watch prices continue to rise and try to time the market and list your home later in say 6 months to a year? Thanks for your replies.

LA, by all means, wait. I assume that you do not want to buy another home, if you do, it will go up as well. Also, there is much to choose from. Now is not a good time to buy. Why do you want to sell?

LA, what is your motivation for selling? If it is purely financial and you are trying to time the market, you might want to think twice if this is the reason. As we all know, rents are high and going higher. Nobody has any idea how long the limited inventory will last. So if do sell, you might be stuck in your rental for longer than you anticipate. Add up all the costs of selling a place, securing a rental, moving and then buying and moving again…that’s a significant amount of money and hassle.

Nobody knows how this will play out but this all needs to be included in the equation.

My motivation for selling is based on amount owed on home. I have finally reached positive valuation and have a high payment. I can’t refi due to amount owed on home. It would be a huge burden off my chest to get rid of high payment and rent at half the cost for start rebuilding. Saving money on overall expenses and then saving for future down payment is the goal. Plus we want to downsize a bit and kind of start over. With the market this hot, I think we can actually make some money on the house and feel good that we no longer are living month to month on high mortgage and expenses. Yes renting costs are higher, you have moving costs and deposit etc, but it’s time for a change and this market seems ripe…

LA, sounds like you have no intention of keeping your house for the long term. This is definitely the time to sell it, I highly doubt we will see much more appreciation from this little bounce. This actually might be the easiest time in history to sell a house, take advantage of it. Remember, just year and a half ago nobody wanted anything to do with housing. I remember looking at places that were literally sitting there for months on end. Good luck.

@LA

Things that come to mind are: temporary pain in moving, finding a good rental, and not knowing how this will turn out (will you be able to buy for less in a few years or be happy renting for many years?). I think the chances are high that you will be able to buy for less in a few years. I struggle with this. If I knew it meant $100 to 200K less in the next 5 years, I would sell now. Problem is we don’t know. So it is a risk. Sometimes I think the risk is bigger to stay in your home when you can get out of it, unless you really like it.

Also, I like being settled, yet the property I am in now is not the one I would like to be in. I go back and forth trying to love where I’m at and wanting to get out of this and move.

@LA

Another problem in my situation is that I’m not sure if I’d can sell without having to put money out or do a short sale. It’s too close in my situation. I am pretty sure that if I could walk away in the positive, I would do it and rent for awhile. Worst case, housing in your desired areas keeps increasing and may have to consider another area, perhaps in another state.

I think many people tacitly sense a shoe of some sort is going to drop. Economic collapse; we’re due, pandemic; we’re due, environmental disaster; we’re due. All out war; due again. How soon? I think soon enough…

I am continually amazed that the shoe hasn’t dropped yet. Makes no sense. The more time that goes by without the shoe dropping, the more polarized I become. That is I waffle back and forth between “the drop will be a doozy” and “all will be propped up for the rest of my lifetime”. And, not having a real clue the sector(s) that will drop is the most disconcerting.

+1 Sadie. Its exhausting using logic because of the course the shoe, the socks, the pants and undies should have dropped by now, but logic (or in our relevant discussion, proper asset pricing today and predictability in the future) is officially gone, and as many have said, its a rigged game for the banks by the fed/govt. Its now angrier than ever if you’re a saver/renter as you get the double whammy of cash (down payment) turning to crap (Yellen is Bernacke, Jr.) and no inventory/overpriced homes, especially in So Cal. Its like the tsunami of shtstorms….but for the low rates.

These super low rates should make any renter at least “consider” buying. Then you need to look at your own finances, the local houses on the market and ask yourself what else will you do with your down payment you I rent for 2 or 3 or more years. Cash sucks and will likely (although I know some want deflation but the Fed has already said its their biggest fear so they will fight it like crazy) be worth another 20% less in a few years. If you dont believe in the asset bubble of homes, will you really love the asset bubble of stocks? Many people talk gold, but are you really going to buy physical gold and hope its up in 3 years or when you want to buy? And there’s the rub and the crime in it all and why despite not believing in the market, people still go in. The fed forcing risk averse savers to choose between cash turning to crap due to QE or bubbly assets. So just roll the dice and enjoy the gamble; its fun!

FTB, good post. The policies of the Fed/government has forced many people’s hands into buying (myself included). Rent kept going higher every year, my cash downpayment was getting eroded away and I was unwilling to gamble it all in the market or go all in with gold. When the opportunity came to buy at or below rental parity, I finally gave in. Unlike others, I am not expecting any appreciation for the next decade…it’s just gravy if it happens. With that low fixed rate monthly payment, I’m protected from inflation and own part of an asset class that the government will protect “till the end.” A house is a shelter but comes with many fringe benefits too. Good luck with whatever you decide to do.

According to Calculated Risk, the heavy investor activity may bouy home prices for another couple years.

http://www.calculatedriskblog.com/2013/04/housing-some-thoughts-on-investor.html

Up here in Marin, we have real estate agents calling us, leaving notes on our door (one left a little bag of super cheap charm bracelet charms with random designs on them, and two of them were in the shape of a piano – really, who would want them? If you have a nice charm bracelet, these look cheap and aren’t silver…and what’s with the charms – -what is the purpose/connection to selling houses?), and generally shaking down the ‘hood, hoping to find a house they can sell. I mean really, driving door to door asking people if they want to sell? Get the hell away, I’m renting, you idiots! I hope the tulip mania ends soon, I can’t take the turkey buzzard agents constantly circling, hoping to make a buck…

Regarding investors. They will have limited impact. This is for one simple reason: Home occupants are not created out of thin air. Every time a family rents, that’s one potential buyer off the market. Everytime a family buys, that’s one potential renter off the market. Housing ultimatley follows income and inflation, neither of which are high right now!

I would monitor the conditions that have contributed to the price run up. Those being lack of inventory and low interest rates. As long as those two conditions continue, hang on. However, once either moves significantly and more importantly, that looks like the new trend, be ready to list your house on the low side of the market value to sell fast.

Just my 2 cents and worth what you paid for it.

A good quote from the movie Airplane! sums this up

“They bought their tickets, they knew what they were getting into- I say -LET THEM CRASH!

AK,

Very good point regarding investors. If 35% of the current purchases are being made by cash, we should see a flood of inventory on the rental markets in the immediate future. Either that, or the properties get retrofitted with cheap finishes and granite countertops and put right back on the market.

Either way, something has to give. You are correct, there are only so many people looking for places to live.

So if the Fed and banks manipulate upwards the price of homes, but there is not a significant contribution of liars loans and NINJA loans, but predominately loans to folks who can pay their mortgages, why would there be a crash? I could see the market leveling off, but crash, I don’t know.

Armageddon is now guaranteed. It all depends upon which time scale we favor. The honest approach will bring Armageddon sooner. The lying, trickery, taking on more debt, devaluing the currency, propping up stocks and housing prices, propping up bonds when the market turns its back on them….this is an attempt to defer Armageddon until…the next administration I guess.

If the economy were to magically grow enough, we would escape Armageddon. But the economy CAN’T grow until it unloads all of its bad debt, which will trigger Armageddon. Taking on more debt is pretending this isn’t so. Fantasy. Maybe we can grow our way out of this…dilemma. GDP, GDP, GDP. It aint working.

I was looking for a file on a shared computer in my university’s grad student computer lab. This machine is connected to a scanner and fellow students unknowingly leave all sorts of personal documents on the machine without deleting them.

I noticed one was an offer to buy a house, and curiosity got the better of me. The offer was for over $330,000 and the down payment was $4000. There was something about another loan for $12K+.

This person would have to be a grad student because no one else can get in that room. I didn’t know this person by name but they probably make no more than the typical stipend for being a teaching or research assistant, which I believe is in the $20s. Few students work full time and I don’t recall seeing more than one name on the document.

Of course I don’t know what the outcome was, but it’s just mind-boggling that after all we’ve been through, people (and their real estate agents) can even think of buying a house for 1/3 of a million dollars with 4 grand down.

Does anybody remember my thesis from last year (or a few years ago) on here that if investor penetration in a market became large enough, it would reduce inventory turnover and therefore put upward pressure on housing prices? It was under my old user name, which was something like ‘afez’ or ‘andrewfez’ or some variant on that. I think the last time I mentioned it was on the article about how Vegas was oversupplied with investors and it was pushing down rents there. When was that?

One of the more enthusiastic commenters belittled me on that one with a reply that went something like, ‘OmgomgomgNeverBeenABettlerTimeToBuyOmgomg’ or some variation of that.

Well, here’s a few more thoughts:

1) Once hedge funds saturate a local market, that doesn’t mean all other markets are also saturated. America is a pretty big place. And outside the coastal regions and big cities the smaller markets are a bit more healthy (where income and prices are in line with each other). There are places whose prices are intimately coupled with interest rates that saw little bubble….

2) It could be the hedge funds like the short term volatility of Los Angeles or Vegas or wherever they’re at presently. But if things get bad – really bad – like corrections back to fundamentals and loss of faith in the dollar bad, I still think the best position to be in for a rich person is that of a land baron, and now that the big guys have dipped their toes in the water here and there and have all their connections built and in place to easily buy real estate, this could be a long term trend in the making.

Welp, I had a point, but I’m tired from working all day, and can’t remember what it was……

I wonder if the “funds” buying housing are funds that are tied to employee 401(k)s. I mean it would make sense. A smart investor wouldn’t buy a bundled housing fund, but 401(k) fund managers just might. Anyone know either way if my hypothesis has any merit?

There’s one security choice in my 401k (I don’t have a position on it) called the Pimco Total Return Instl. whose got things like ‘Fannie Mae Single Family TBA 4% 2042-01-01’ and Treasury Notes in their top 10 holdings. In fact treasury notes at different rates are all over the place in that one.

“(Daily Breeze) Personal letters and even baked goods can win-over a hesitant seller”

How crazy is that? Things have changed. Cash certainly is part of every deal, but in the old days we used drugs, alcohol and prostitutes to increase our competitive edge. If your an Urban La shopper in the market for a depression era breeder box, use Tea and Skittles and Booty. That is my suggestion for frustrated first time home buyers.

After further reflection maybe I’m showing my age here. Is the phrase “Baked Goods ” the modern urban lingo for drugs alcohol and prostitutes ?

JP Morgan has been using the baked goods technique for months now.

If everything is so rosey, why is it that when I drove down the coast this afternoon from Ventura/Oxnard, through Malibu, to Santa Monica, all I saw were for sale signs on these gourgeous houses. PCH is lined with foresale signs. There getting out while the getting is good.

Deja Doh,

Agreed, From Thousand Oaks (Renting) I take the PCH from Kanan into Century city daily and have noticed recently the increase number of property for sale signs along the way. As a motivated buyer, and not a sucker the wife and I are in a holding pattern until next year as we cannot stomach the rejection of cash offers and over asking prices. Granted its not the mid-west but i know what a home is worth, and needless to say these homes are $HIT comparatively speaking. Few questions… Why isn’t there more new home construction?? Why are people so willing to pay over asking? Is the local government also in bed with Bernake and the big banks?

Those in Sacramento and their local government stooges have attempted to micromanage the State’s economy for 30 plus years since their cash cow (doubling of property taxes every year in the early 70’s) was curtailed with Prop 13. It’s all misdirection. They can’t say “let’s limit development”, but they can camouflage it in the name of preserving the environment. The real estate industry is right there in bed with them as well. If this was Major League Baseball, it would be collusion. It is collusion.

It’s a lot of bank, government, and investor manipulated smoke and mirrors. Ashes, ashes we all fall down. The bubble will burst. SHORT LIVE THIS GREEDY BS market, NOT long live. Let some nice folks buy a freakin house!

Leave a Reply