The recipe for another SoCal housing mania – Irvine MLS inventory below three months. Maxing out on leverage and low interest rates.

The California housing market is back to being a flipper’s paradise. A combination of low mortgage rates and incredibly low inventory is providing a very fertile ground for current sellers. I was having a talk with someone about the Irvine housing market and how quickly homes are selling. Irvine is a very interesting market in that a large portion of sales come from the condo segment. You also have a good amount of international demand for the area. The current demand for housing in Irvine is very reminiscent of the days of the housing bubble. I’m reminded of some of the international buyers coming to new developments with cash in hand to buy places before they were even up. Bidding wars are common and buyers are now offering bids even over the asking price. Why? Inventory is very low and sales are increasing. So if you are looking to buy in this market expect insanity and gear up. Let us take a look at the market more in depth.

Irvine housing market

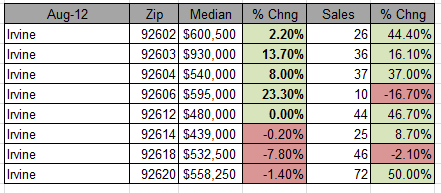

Irvine is a mid-tier city in Southern California located in Orange County. When we look at the recent trends we realize why most of the action is actually occurring:

Nearly every zip code in Irvine has seen a massive jump in sales over the last year. Prices for most areas are up as well thanks to low mortgage rates and constrained inventory. With the amount of sales that took place in the last dataset and the current MLS inventory available, you have less than 3 months of inventory. Whenever you have inventory dropping below 4 or 5 months you start seeing pressure hitting the market on the buyer side (i.e., it begins looking favorable for sellers).

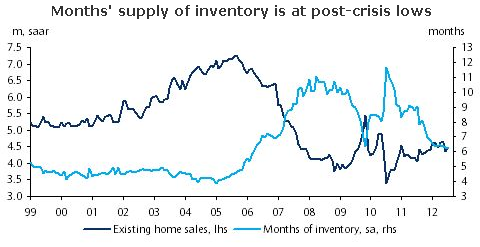

Interestingly enough this is not only a prime market trend, this is hitting nationwide:

At the peak, we had nearly one year of inventory on the market nationwide. Today it is back down around 6 months, being cut in half. Sales have also picked up but nowhere close to the bubble heyday. So we have to boil down the recent price increases to:

-Low interest rates increasing leverage (it isn’t coming from income growth)

-Constrained inventory

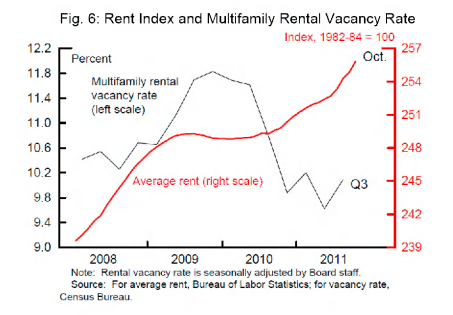

The Federal Reserve and banks are carefully managing the distressed inventory and ironically this is causing rents to rise putting pressure on working class families even though they talk about helping “average†Americans with all this action:

The volatility of the current housing market is incredible and what was once a very bland segment of the economy, has become a market in which boom and bust is built into the system. The Fed is engineering higher prices here with rents going up (through bulk sales or properties and constrained inventory) and also keeping home prices inflated as mortgage rates hit record lows (as they shift trillions of dollars onto their balance sheet. The only thing that isn’t occurring is household incomes going up.

Even in high priced markets like Irvine, incomes are stretched for current home prices:

Average adjusted gross income (92602)

2005:Â Â Â Â $91,138

2006:Â Â Â Â $98,138

2007:Â Â Â Â $95,577

2008:Â Â Â Â $98,656

2009:Â Â Â Â $88,555

Even looking at average housing income which tends to skew households income higher, you realize that the $600,000 median priced home will stretch a budget significantly. It is a fascinating trend but I notice that many people are throwing in the towel and just diving into the mania. Right now the market has shifted to a seller’s market in Southern California and places like Irvine. But keep in mind that unless the overall economy picks up steam or households actually see real income growth, this burst of energy from low rates and constrained inventory is only going to go so far. Since nearly 30 percent of California mortgage holders are underwater, you might have many more people deciding to sell now that they are reading the tea leaves.

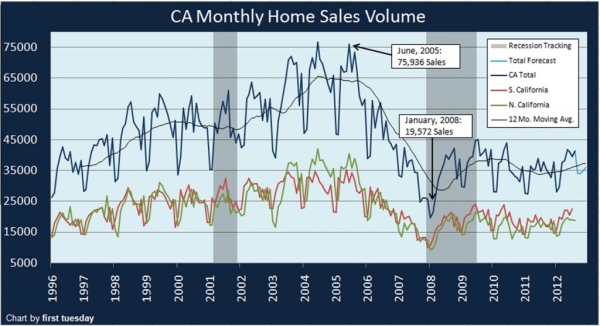

Even though it may feel like a mania, home sales in California are still nowhere close to what we saw in the bubble days:

In fact, we are trending at levels seen in the 1990s. Where we highlight places in Los Angeles with a hipster vibe, you also have places like Irvine drawing in a different crowd. The big condo market in Irvine is interesting because you might have people paying more in mortgage insurance, HOA fees, and other non-principal and interest related items. Some places can have HOAs that begin nearing four figures per month.

Flippers, bidding wars, and panicked buyers. It is beginning to feel like the 2000s again. What other examples of a mania are you seeing in the current market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “The recipe for another SoCal housing mania – Irvine MLS inventory below three months. Maxing out on leverage and low interest rates.”

It’s “all-in” baby!!!

With interest rates as low as they are, this timeline represents the only chance many people will ever have to buy a home.

Smart buyers are jumping in. The timid Timmy’s are going to be kicking themselves in 5 years.

LOL! The Return of the Housing Trolls 🙂

I remember reading quite a few of these posts in 2005-6. The “Smart Buyers” of that period were none to happy with their decisions 5 years later. This time will be different why?

My family just bought and I’m not a troll. I bought because I’m 34, have two small children and want a house to raise my family. I also hate landlords, I’m what’s considered an ideal tenant, always get my deposit back, but I still hate them, the idea of them, their authority over me. If I stop making payments they will come in less then 30-days, how long will the bank man take? It’s a no brainer, we are all marching toward death, we can only wait so long, if you can afford the payment then do it.

Lol very true! Then again, go back to the early days of the chat rooms, and you find lots of people in the 1996 timperiod that California housing is “Nowhere close to the bottom”…

Anybody who bought in 2005-6 wasn’t anywhere close to rental parity (rates were in the 5-6% range, nominal home prices were higher than today and rents were defiinitely lower than today). Many places are at or below rental parity today, this is one reason people are getting off the fence. Another reason is that the Fed won’t let the housing market find a natural bottom, this is clear as day. I highly doubt this will change after the election. It looks very likely Obama will get re-elected, that means 4 more years of the Bernanke freight train crushing all savers and renters who dare to stay in its path. This isn’t rocket science here!

REPOST;

Math doesn’t mean squat when the FED says 2+2 is whatever they say it is.

It comes down to this equation.

Rent vs. Buy

Buyer + Buyer ability to pay mortgage (Renting “$$†from FED) + middleman (Servicer) + FED.

Renter + Renter ability to pay rent (Paying for Landlord meals, loans on $$ he rented from the FED + all of his middlemen (Tax Acct. Tax Lawyer, Managmnt Co., Etc Etc Etc + REIT middleman + FED

Improved chances of survival depends on shortest link to the taskmaster FED.

I just bought a house in the IE from a flipper. Now I only have to worry about me coming up with money to pay mortgage which for me is same amount as rent and what the FED will do.

Renter has to lay awake at night when the SHTF in the not too distant future and worry about his source of income, his landlords sources of income, and what the fed will do. (Don’t bother replying that a renter can get up and leave. Where too? everyone is in the same mess WTHSTF.)

YOU don’t own your house & you don’t own your apartment, all of it is rented from the government. Cut out all the middlemen you can. It is you versus the FED.

Candace,

Could your family not be raised in a rented house? Is the mentality that we’ve created with low money down loans and low interest rates that it’s a better gamble than renting since if anything goes wrong it will take longer for the bank to kick you out than a landlord. You also mention that, “if you can afford the payment…” this is the large problem that low money down creates, it makes people think about these things only in terms of monthly payments, and not in the long term. We have allowed policy to distort the markets

POTUS,

Congrats on buying a house. I think now maybe good time for some to purchase a home. However, I would argue that renting is way more flexible than a mortgage. There are many different types of entities that will rent you a place to live. Section 8 for example is the gov’t housing. If you shop carefully, you can find very nice place to live at half the price. At least that’s the case with us. As we pay half of what our mortgage would be here on the Westside of LA, in a 2×2 beach front apt. Not to mention that we are rent controlled. In the state of CA, renters are very well protected. Whatever happens to the landlord, the renter is protected by law and cannot be easily removed. Meaning if your landlord is being foreclose upon, the bank cannot simply remove you from the property if you have a lease. There was an eviction at our building that took one year to execute. This type of things are not uncommon in CA. Not to say that one should not buy a home, but if you need flexibility renting certainly is the way to go.

….and with price to earnings ratios so low, this might be the only time people can get in on the equity markets.

….and with all this money printing going on this might be the only time people can get in on treasury notes.

….and natural gas will always be super low unto to the end of time. America is a Gastopia. There’s never been a better time to go ultra long on a cheap gas play.

In fact, if we would just drill more in American territories, we wouldn’t need anymore gas or oil from other countries. Silly America, for getting into expensive wars, and all they really needed to do was just drill more on their own land.

….and there’s never been a better time to get a PhD in art history.

….and there’s never been a better time to cash out home equity on a 500k, 900sqft house and buy a new Mercedes.

….Ok, back to swimming in my gold coin collection….

There are a lot of transactions everyday. Apparently someone is out there buying at this level. Actually many people have bought in the past 3 years.

If you read the same thing over and over since 2006, to what point do you change your view about housing?

Housing in Los Angeles especially in trendy areas like Silverlake and Hollywood are still way overpriced.

The sheep will be slaughtered once again. Free money is abundant – ask Obama and his attempt to buy all those mortgage backed securities. Why would they do such a thing? Watch, next year winter time we will hit another new low.

The housing market is still being kept up by rampant speculation in the form of free money – a house with a 30 year mortgage at 2.7% fixed is about $1800.

Not too long ago, a 5% rate was considered attractive and according to historical norms is a great rate. Payments are $2230 per month.

What does this mean?

A mortgage with an interest rate of 5% that sells for $360,000 is as affordable as a house that sells for $446,000 at a 2.7% rate.

It is not hard to see why housing prices have climbed. But have they climbed the mathmatical equivilent of 24%? I guess to some they have…but remember, this is due to massive governmental intervention.

Once rates go slightly up, party is over…in a hurry. It has to end soon, or else we end up with more than 1 in 6 on welfare because they cant afford $5 loaves of bread or $6 gas…the see-saw will go back the other way and people who are caught up in the mania today will pay the second bubble price.

Kicking the can down the road is all we are doing.

The mania has already re-started – hide the women and children…the next low is going to be a blood bath – remember, even a dead cat bounces when dropped from a rooftop.

You said “A mortgage with an interest rate of 5% that sells for $360,000 is as affordable as a house that sells for $446,000 at a 2.7% rate.”

Just the mortgage yes, but the overall cost? No way! You have higher property taxes and higher insurance, as well as a higher down payment – i.e. you need more of your own hard-earned money upfront to get this low monthly payment…

But yes, to the financially challenged things are looking great right now!

So it’s safe to buy in non-trendy areas that are down 40-50%? Like say the San Fernando Valley?

Safettobuy, where in the San Fernando Valley are you looking ? We live on the Westside and prices in areas in the Valley are just as high. Look on the MLS, a house just came on the market today in Studio City on Ben Street at $792 a SF ! The seller is dreaming ! Sellers think it is 2006. What idiot sheep are buying ? Another bubble.

Buying a home should make financial sense first, not being a “proud” home owner.

I mean , at some point interest rates are going to have to keep up somewhat with inflation – and when that day comes…the charade will be over

You ought to consider/factor that the international crowd in Irvine have the capability of bringing international funds ( in addition to US income) towards home purchase. Plus the controlled residential development by the Irvine Company makes it the most minutely managed/controlled market.

98% of the apartment complex in Irvine are owned and managed by the Irvine Company. That should be a good hint.

Take two.

Irvine Company’s Powerful Market

http://www.shoppingcenterbusiness.com/index.php?…irvine-companys-po…Cached

This was quite timely.

as quoted in the article

“Additionally, since Irvine Company began developing the ranch property in the 1960s, it has been very careful to locate properties only where they made sense.”

You said it clear….this manipulated market will not last. It is a Herculean effort to reinflate the bubble so that we can feel wealthier. After the election, we will begin to see it slowly fall apart. High unemployment, static incomes, massive student loan debt…there is no foundation to this bubble to sustain itself.

I live in Toronto, Canada and from my vantage point, California real estate is a bargain. In my opinion, all residential real estate here – from detached homes to condominiums are grossly overvalued. If I was an American, it seems like a no-brainer to buy residential real estate. Housing prices are reasonable, interest rates are at generational lows, banks are willing to lend (especially now that they can sell their mortgages to the Fed), and the iceing on the cake is that you can deduct the already low interest rates from your income!! We don’t have that luxury in Canada. I don’t know why any employed American with a decent downpayment, would be renting vs. purchasing thier own home right now.

Elizabeth, given the interest rates and prices, you could argue that a majority of counties in California are affordable. A handful are just obscenely overpriced for what it is, but I’d say most other places have somewhat hit the mark in terms of monthly expenses. The main issue that I see in this situation is not so much whether or not homes are overpriced, but where you see interest rates going in both the near and long term future. While it may be a ‘good’ time to buy if you are renting and paying similar in rent, if inflation and interest rates don’t play in your favor, it’s just going to be a lot of equity lost.

I think this, then, ultimately boils down to whether you are looking for a home for more emotional/personal value than financial. I don’t see a home as a financial investment unless you are renting it out, especially in this economic environment. People say it’s a good time to buy, while some others say it’s not. IMHO, it depends on what you’re looking for, and based on your motive, it could be a good time to buy in.

no downpayment.

Very simple, many families don’t have stability, thus do not want to be trapped with a mortgage. People forget that unless you pay cash, the bank actually owns your home. There are so many variables in play right now that it’s best to stay flexible and plan ahead. This is why I won’t buy, let alone that we are no where near rent parity here on the westside of LA.

Most of the San Fernando Valley is at or better than rental parity.. Some prime central areas like Studio City are still expensive… But there’s a lot of good prices on homes the westside of san fernando valley.

Unemployment is a risk for many of us right now. We don’t want to be trapped in a 30-yr mortgage.

Ah Yezzzzz, it’s back. Low fixed interest rates and not much down. The system is nurturing the bank inventories now. More entitlements to a narrow group while the basic market fundamentals are ignored. Where else to start than Orange County, home of the free market corn-servative thinkers and tea party fundamentalists

The fact remains that this is an election year. Whether it is right or wrong for what the fed is doing is not my concern.

But for every action, there is a reaction. The result of the feds buying of mortgage backed securities is an artificial net. It will sustain (barely) with all the help of free money (low interest rates) and QE policies.

Once gas commodities prices go through the roof, there will be a backlash. Heck, lets face it, most of America is NOT in a position to own or even be considering to own a house.

1 in 6 are on welfare…17%!!! That number will only rise with these QE policies. However, in an election year the fed wants to keep the housing market up and the dow up. How the heck do you think the down went from 14000+ down to 6500 in such a short period? Then back up to 13500? WTH? As if it were a fart in the wind. As if the free money scandal never existed. As if…well, you get the point

Yes, interest rates are at an all time low…where do you think this free money is coming from?

I can’t wait til Jan 1 when the Bush tax cuts expire and the average household is forced shell out as much as $5,700 more a year.

The government wants their money – what you give to one in free money (ie lower interest rates) cannot be given without first taking from another – this is pure logic. So where is the money coming from? YOU!, US! ME! HIM! THEM!

Higher taxes, higher inflation, all with raising housing prices, and lower wages. Remember, there is only a finite number of Americans who now qualify for a 30 year loan – the money is free (or near free with low interest rates), but not for everyone. The low interest rates just apease the current homeowners to feel like their housing values are no longer falling off a cliff. To win votes. Now I’m not saying that it is right or wrong, every president does “stuff” for the economy right before election time.

What I am saying is that there is going to be an aggregate effect. Higher consumer prices rampent inflation, and lower wages lead to drastically reduced spending, even much higher unemployment and eventually people will not have enough to spend on buying that new house.

You think the fed is going to loan money out at a true negative interest rate? I mean, in all honesty it is negative now, but they are not going to loan $100000 out at -1%…lol. Once the forces push and push to try and keep this economy artificially afloat, there will be no more places to push.

Remember people, wages are not going up…where is all this free money coming from?

How can you have hyperinflation and lower wages? It doesn’t work that way. Companies can’t raise prices if the consumer doesn’t have the money.

Interest rates go up in response to accelerated inflation, and inflation shows up in everything (including wages and housing). In deflationary times home prices and wages deflate (lower), in inflationary times prices and wages inflate (increase). In the last five years we’ve been in a deflationary or flat time, but times are changing.

The price of gold, energy and food is a different animal entirely, thus Core CPI.

You have no idea what you’re talking about, do you?

Sounds like you don’t understand what is hyperinflation

It’s not like iPad will be sold at 10x so that apple employees all get wages increased

It’s about necessities, food and maybe gas, less money will go to other private sectors so there won’t be wage inflation for those jobs. it’s definitely not a proportional scaling up.

Remember the money printed don’t directly go to consumers pockets.

Let’s not forget that The FED took housing prices out of the CPI equation long ago, it is rents they calculate, not prices.

Of course, now that house prices have fallen the last few years, the FED shouts “DEFLATION” from the mountain tops so that they can Q and E us to death.

You can’t have it both ways…….. Housing inflation is not really inflation but housing deflation really is deflation!

Well, actually, the FED can have it both ways and is having it both ways but after witnessing 49 revolutions around the sun, I know one day Mr. Market will stand up to the FED and in a big way.

Understand inflation just fine. How funny that inflation equals housing deflation…must be the dolt on that one.

At the rate the BernanQE is going, he may get mortgage interest rates in the low 2% range some time next year. Just think what that will do to the housing market!

Japan has had a 1.5% mortgage interest rate for a while, so it’s not out of the realm of possibility. If this happens, anyone who tells me we are going to see hyperinflation better be buying a freakin house when they say this.

People who bought 2006 or so and on will rue that day. Housing is way overpriced for what it is – shelter. But some people would rather have no disposable income, no savings, and no retirement money and buy a house, to feel like they are “somebody.” The sheeple in that category will pay dearly in the years to come for that foolishness. I have no crystal ball of course but some things are hidden in plain sight to many people. This fake economy can’t last, and a major correction is coming, for many years to come. It won’t be a simple crisis and then move on. The lack of saving for retirement is going to wreck many people’s finances unless they wake up and get rid of the albatross (house)!

FIRSTLY, Most people that couldn’t afford to buy in 2006.. Already foreclosed. The rest probably should just take the credit hit and walk away unless they put a sizeable downpayment into it and don’t mind owing a over-priced asset.

This fake economy is gonna take down everyone though… Not just homeowners. If i would sell my home and go rent now, I would end up paying more to rent in my area than my mortgage currently is. Even factoring in maintenance ect. Unless you want everyone to move into studio apartments in expensive cities. But there are a finite number of those available and in LA they still rent for $1000 a month.

“Most people that couldn’t afford to buy in 2006.. Already foreclosed”

not necessarily, i just learned a friend hasn’t paid their mortgage in 48 months, this isn’t something anyone brags about so i’ll bet their are millions just like them and that party is coming to an end pretty soon….then what?

I have a one sentence answer for all the smart guys who think house prices are protection from inflation and cannot possibly fall again. Assets propped up by cheap artificial credit will be devastated when interest rates jump. Hint, interest rates are in a bubble.

not to be a jerk…but interest rates are down…way way down. Bubbles float up and go pop. What’s the reverse of a bubble? A pit? Sinkhole?

Interest rates are down and bond PRICES are up. There is your upside bubble. I assume you understand how the bond market works.

Listen to Jeff folks…

People today think home interest rates are too high at even 7 %. I was in my early 20’s in the early 1980’s and remember my sister convincing her husband to buy a home (in west Texas) and rates were 16%… Yes, they took a bath on that, lost their down payment and went bankrupt by 1986. The Savings & Loan’s were not bailed out…the consumer paid the piper back then.

Like Jeff Beckman just said above…Hint, interest rates are in a bubble.

Today’s bubble is the interest rates.

Buy a home for 200K today at even 4%

OK, so,7 years down the road you have to move or relocate. Put your current home on the market for what you paid for it but the interest rates are now 9 %…

Who can afford your home at these rates, no one, YOU then have to come down on your price…There goes your entire investment…

INTEREST RATES WILL GO UP…COUNT ON IT…Wake up people, when you buy, you need to know you are going to be living there for way more than 20 years to not take a hit in your wallet… I’m betting the banks are already hiring staff to property manage all the REAL inventory on the banks books. They are done with the losses. This is a renters market, not a buyers market, and unless you are paying with cash, this is our new normal in the good ole USA….just sayin

Tell that to Japan… 20+ years of low rates and counting… Where we are headed. Housing will keep up with inflation from here on out.

What on Earth makes you think interest rates will ever go up? You’re basically casting a vote for an economic recovery here in the United States in the next 20 years. Not going to happen. Stagnation for the next several decades is clearly what lies ahead.

If interest do not go up that is means the economy is still in a depresion. Take a look at Japan, they have had decades of low interest rates and real estate continued to fall, more than 50%. The long and the short of it is that house prices will fall with higher rates or with continued low rates. Income is going down for sure. Defense spending HAS to be cut and those are the best jobs in Southern California. And, we have another .com bust coming up in Silicon Valley with Face Book, Yahoo, Znga, etc. HP is on its way to bankruptcy now. Wait until after the election and see what happens.

By the way, have you checked the price of gasoline today? How will that affect people who drive a 150 miles a day?

I’m lookin into purchasing a 2 bed/2 bath town home in north OC about 1100sq ft for $329k. This is usually way out of my price range (around $200k) but the city has this home buyer assistance program. Without it, I wouldn’t even be pondering purchasing. Basically with the assistance, it brings my monthly payment to $1300 including tax and HOA fees, more than $200 less than I’m paying right now for my 750 sq ft apt that I’ve been at for 4 years. I keep hearing rates may go even lower or housing prices may drop even further but I’m also hearing this is a great time to buy…should I continue to sit on the sidelines? Renting’s cool but…what do you all think?

I’d say if the terms work, you like the property as a place to live and your income and job stability pencil out buy it. Man if you pay 200 a month less, with no more than 28% of gross income and don’t put a pile of cash in it buy it.

I say buy if it beats renting. Rates aren’t going anywhere for the rest of most of our lives. Everyone seems to be panicking a little…buy-now-or-be-priced-out-forever-noise…I wouldn’t buy into that, but renting doesn’t really have the strategic benefits it used to have.

I keep hearing about low inventories, multiple offers, and rising prices. So I took some time to look at what is really happening in my target market – Yorba Linda. This is what I found:

1. There have been 98 regular SFR sales, and 13 SFR short sales in the last 3 months, for an average of $796k/$599k, respectively.

2. Of these 98 regular sales, 8 sold at list, 12 sold above list, and 78 sold below list price. The average sales price above list for the 12 that sold over list price was $11k, but this was skewed higher by a couple of sales. The median was only $3k over list price for the homes that sold above list. For the 78 regular sales that sold below list price, the average sales price was $39k below the original list price.

3. 29 of the 98 had the list price reduced, while only 2 had a list price increase. The two that increased their list price sold for an average of only $7k over original list after raising the list price by an average of $43k over the original list price. The 29 regular sales that reduced their list price reduced it by an average of $79k.

4. For short sales: 2 were sold at original list price, 6 sold below the list price, and 4 sold above list price. For the four that sold above list, they sold for an average of $112k above list price with a median of $83k above list. For the six that sold below list price, they sold for an average of $36k below list price.

5. Eight shorts sales had their original list price reduced by an average of $67k, while 3 had the list price increased by an average of $146k (sold for an average of $142k above original list). Two short sales were sold at list price.

Observations and Conclusions:

a) A large majority of regular sales are selling at or below list (86 of 98).

b) The regular sales selling above list are selling very close to the list price (+11k avg, +$3k median).

c) The regular sales which are selling below list are selling for substantially less than the original list price (-$39k average).

d) Regular list prices are being reduced much more often than they are being increased (29 decreased, 2 increased).

e) Many short sales are still being listed way below market price. This is evidenced by the increase in list prices for 3 ss (+$145k avg increase, with +$142k avg sale price). And also evidenced by 4 short sales that sold above list price without a price increase ($111k avg, and $83k median).

f) Many short sales are listed above market price evidence by 8 ss dropping their prices by an average of $68k.

g) Conclusions: low inventory and low rates are affecting sales prices. But these market forces are only slightly increasing sales prices on only a small number of sales. Regular sellers are having to reduce their asking prices to generate offers and also reduce final sales prices to close sales. Short sellers are all over the map. Some are asking far too much and some are asking far too little. This is still a buyer’s market despite all the spin to the contrary!

Wow good work. Thanks for sharing.

Well, actually OC may be the big loser, if the Inland Empire picks up it will attract all ethinc groups because the housing is cheaper. OC outside of Santa Ana and West Anaheim and the barrio areas is pretty surbubian and expensive. There are cheaper suburbs in the Inland Empire or out of state. In fact the OC has lost its white population to other counties in the State or to other states. And also Orange County is thought uncool and will not attract the hip market of La either. Mainly its the foreign market in Irvine and some oher people buying property which might be involved in flipping as well.

Leave a Reply to Gerhardt R.