Shadow inventory grows in Southern California – Huntington Beach foreclosure with $1.4 million in loans and no payments made in a year. Auction scheduled for end of March in a mid-tier Southern California beach city.

The big story surrounding American housing has to do with distressed inventory that is not reported in any meaningful way. It is amazing that even after the National Association of Realtors had to revise home sales lower and was blasted by those who track the housing industry, little has been done to reform the system. Keep in mind this is the data that is quoted line by line on a monthly basis by the mainstream media as if it were gospel. It is hard for average folks to understand what is really going on with the housing market because much of it is hidden in the dark netherworld of bank balance sheets. Thankfully there are methods of shining a light on the true nature of the housing market but it takes time and using multiple sources. The shadow inventory is enormous and Bank of America is hinting at going forward with a “bad bank†model which is likely to make it even harder to track the true health of the U.S. housing market. The mid-tier market in California is much worse than what the surface shows. Today we’ll examine Huntington Beach.

Mid-tier beach homes feeling the pinch

Bedrooms:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,700

Year built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1969

Don’t bother searching for the above home in the MLS because it isn’t listed. This home is scheduled for auction on March 24, 2011. This is definitely a mid-tier home in a mid-tier beach city. Huntington Beach falls in the same place that Culver City does in that it is a target for young working professionals. Yet the current market is saturated with shadow inventory and the problems are profound in these markets.

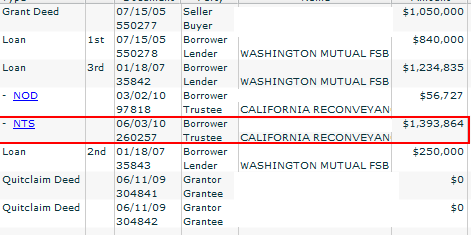

The last public sale on this place appears to have occurred sometime in 2005:

Sales History (07/15/2005):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,050,000

Does the above home look like a million dollar home to you? Maybe it does after a decade of insane bubble prices for California. After this purchase at a seemingly high price Washington Mutual went ahead and allowed a few refinances pushing the price of the place even higher. Let us take a look at the mortgage action here:

By January of 2007, it looks like this home had $1,484,835 in loans. Just look at the above home and think that right now, JP Morgan Chase is claiming this as an asset at an inflated value. Want to take a wild guess how much they are valuing this place at? Of course we don’t know even though these banks wouldn’t even be standing without taxpayer bailouts. The shadow inventory gets even more distorted. Transparency? More like the banks and the government took a page out of the NAR playbook:

“(UPI) The “most popular measure” of existing home sales, the National Association of Realtors’ Existing Home Sales, has increasingly overstated home sales for ten years as measured by five other sources, and reached a level in 2010 that is 15 to 20 percent higher than actual sales, according to CoreLogic, which made the charges in its US Housing and Market Trends Report.

CoreLogic reported sales totaled only 3.6 million in 2010, down 12 percent from 2009. By comparison, NAR reported sales fell only 5 percent in 2010 after rising in 2009, and were flat relative to 2008. CoreLogic said sales did not actually rise in 2009.â€

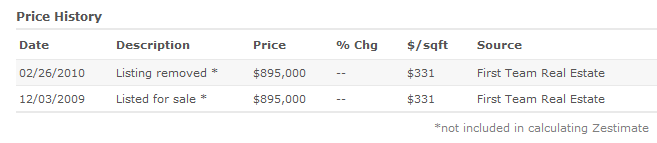

Clearly this Huntington Beach home is overpriced. It was listed on the market briefly in 2009 but was pulled back:

Source:Â Zillow

So do the numbers here. This place has close to $1.5 million in loans in 2007 and suddenly two years later is listed at $895,000. Pulling it back did nothing as the above data shows. In March these owners already owed a tidy sum:

Notice of Default (03/02/2010):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $56,727

There is little to do when you are this underwater. How many months went by before this first NOD? Let us just use the $1.23 million first mortgage and try to estimate payments here:

Loan amount:Â $1.23 million

Loan term:Â Â Â Â Â 30 years

Interest rate:Â Â 7 percent (being generous for a jumbo loan)

Monthly PI payment:Â $8,209

I’m guessing the NOD was filed for the first only. So run the numbers:

$56,727 Â Â Â Â Â Â Â Â Â / Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $8,209Â =Â ~7 months no payment before NOD

Now this is a rough estimate because it can be that they had an option ARM with WaMu which would mean they went even longer without a payment here. Bottom line is you have a major foreclosure in process here. How many more of these exist in Huntington Beach?

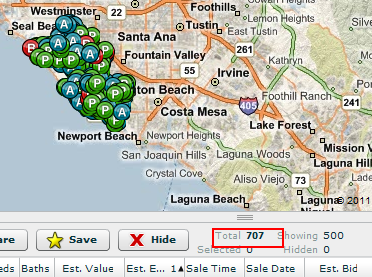

According to the MLS only 20 foreclosures are listed. But if we take a look at the foreclosure in process map it is much more than that:

20 foreclosures listed on the MLS while 707 homes have a notice of default filed, are scheduled for auction (the above home), or are bank owned. Still think everything is fine with the current market? Huntington Beach is going to have a significant correction and homes like this will lead the way.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “Shadow inventory grows in Southern California – Huntington Beach foreclosure with $1.4 million in loans and no payments made in a year. Auction scheduled for end of March in a mid-tier Southern California beach city.”

Hey! At least it’s not a condo!

/sarc

HAHAHAHA, nope you’re right ToraBora. It’s just a shitbox that looks like any old Florida swamp/floodland hurricane special. Close to a million and a half in loans on that dump, wow!

Why no address? I’d love to be able to check out all the neighboring homes that probably sold for $200,000 in the mid 90’s.

I’d be willing to bet that there are also a TON of people who don’t show up at all yet still aren’t paying their mortgages.

It’s like the old saying about a tree falling in the forest. If nobody is there to hear it, does it make a sound? If a bank doesn’t file an NOD on a delinquent homedebtor…well…you get the idea.

OK Folks…here’s the subject house…

http://www.redfin.com/CA/Huntington-Beach/19732-Quiet-Bay-Ln-92648/home/3132485

From the zillow listing, it appears that it was “remodeled and expanded” adding about 840 sf and a bathroom. Whether that was done before or after the bubble purchase it unknown. I suspect it was done before judging by the property taxes paid as an expansion would have triggered a reassessment.

Here is the neighbors home bought in 1997 for $405,000 (I was low with my initial $200K estimate but didn’t realize it was in a “golf course” community. Whoop tee doo. They both back to a BUSY street.

http://www.redfin.com/CA/Huntington-Beach/19722-Quiet-Bay-Ln-92648/home/3132488

Here’s a home a few more doors down that’s a little smaller, purchased in 1999 for $347,000. It also backs to Goldenwest and the feeder sidestreet.

What’s that you say? Location discounts (backing to Goldenwest) should command a discount?

OK.

Here’s a home on the other side of the street that backs to the golf course purchased in 1996 for $440,000.

http://www.redfin.com/CA/Huntington-Beach/19751-Quiet-Bay-Ln-92648/home/3132448

You can tell when 19751 Quiet Bay did their remodel (2005/2006) as the property taxes took a HUGE jump from just under $5,000 per year to over $11,000.

http://www.zillow.com/homedetails/19751-Quiet-Bay-Ln-Huntington-Beach-CA-92648/25110350_zpid/

So…what have we learned today?

We’ve learned once again that homes tripled in price during the bubble and need to fall a TON more.

Let the silly foreign cash buyers be the bagholders folks!

Ooops…forgot to give you the link to that $347,000 house…

http://www.redfin.com/CA/Huntington-Beach/19692-Quiet-Bay-Ln-92648/home/3132495

Good work EconE (and DrHB)! Even with the “innanet”, doing the homework still takes time. Appreciate it.

PS: Here in FL, with the SOH (Save Our Homes) tax rise limitation, you see the quantum jumps in taxes paid when a long-time owner with SOH discount sells the prop to buyer (speculator) who has no transferrable SOH status. In So-Fla anyway, additions and re-mods which only fractionally increase the sq. footage don’t cause a 100% leap in taxes due.

Enzo…

I think that the jump wouldn’t be so large if the owner didn’t have the prop 13 deal that was keeping the taxes lower before the reassessment.

It’s amazing how blinded people get by greed. The housing casino is dead and all were left with are some ugly houses, supposedly worth a million bucks. It’s no wonder people are walking away in droves. When banks are taking 2 years to foreclose, whywould anyone keep throwing money down a rat hole.

I wonder how these beach cities feel now that a possible tsunami is something to think about. Perhaps, we should be factoring in earthquakes and tsunamis when it comes to picking out a home.

http://www.westsideremeltdown.blogspot.com

I had asked a question about foreclosures earlier, and someone was kind enough to explain that foreclosures need to appear on the MLS for a couple of weeks before being sold, according to Bank rules.

I’m here to say that this is NOT being followed. What I’m seeing are properties being sold very suspiciously. First, advertisements on Craigslist touting “Not on MLS”. And then appearing suddenly on the MLS as “Contigent, Sold”. No other advertisement. And no chance for a competitive bigging situation.

I have to say, I think the Banks are being taken for a ride. Unless the Bank personnel are in on the scam, too.

It seems to me that there’s more here than meets the eye, and the crooks are all up and down the chain.

YEP, good catch… chaps my @ss too. You can try calling the FBI and your state AG, but don’t expect a lot of enthusiasm out of the .gov employees “responsible” for prosecuting this graft… remember, at the end of the day, .gov employees are really BANK employees! 😡

I’ve been monitoring Huntington for two years now, it is astonishing to see how long their peak lasted, well into 2009, almost 2010! Even today prices per square foot are still in the $400+ range. And it is rare to see a sale that isn’t still above the 2003/2004 sale prices.

Last May we checked out an open house in that same Seacliff golf course community, on Cloverwood. They were asking $625/sf for a 1998 house, okay on a nice sized lot with pool and spa and nicely remodeled. To my disbelief some idiot actually did pay $2.25 Million only weeks later, that’s in July 2010!!!

You can check out the property yourself here:

http://www.redfin.com/CA/Huntington-Beach/19596-Cloverwood-Cir-92648/home/3547767

If you look at the sale history, the house sold for $850k in 1998, then for $1.7 Million in 2002. Even with the remodel there’s no way to justify the $2.25 Million – but obviously not for the buyer. Must have been the house of their dreams…

Now all the neighbors in that community are drooling after that sale price, hoping to find a similar fool. Only in recent months did I see that they’ve started accepting reality and lowering prices. But they still have a long and painful fall ahead of them.

I’ll keep renting for a few more years to wait out this mess…

Dave – I laughed like hell at your comment “Now all the neighbors in that community are drooling after that sale price, hoping to find a similar fool.” Yeah, I bet. Foolio? Are you there? Just kidding, Foolio.

It’s a beautiful house, but yes, they found a sucker who paid $2.25 Million. Poor fool. He will end up losing a lot of money.

When I looked at the pictures of the kitchen, it looks like they used the cheap, particle board, tract-home cabinets. Too bad. If a place sells for $2.25 Million, it should have quality, custom cabinets which will last for years. Do you guys remember the cabinets of yesteryear that would last forever – well – for a very long time, at least? These new cabinets are sooo cheap, and are lucky to last for 5 years before they start falling apart.

The idea of paying $2.25 million and getting only 10,000 and change square feet of lot out in the suburbs, in 2010, is just amazing to me.

HB is not the “suburbs” – it’s a beach community, and that $2M house is very near the beach. Just trying to clarify and not allow mistaken perceptions to mislead you.

Questor, you are right on both counts.

-Banks are being taken for a ride(though I’m pretty sure they don’t really care).

-Kickbacks are being paid to bank personel in order to get them to push through sales not justified by comps.

This scene is being played out all up and down CA coastal. We moved to OC in ’07 from out-of-state, and looked at buying a house in Dana Point or San Clemente. Ended up not buying anything, and we are still renting (thankfully!).

We made offers on 6 houses and almost bought one place in Dana Point (Monarch Beach) for about 920K. That place never sold (despite our “agent” telling us that “you aren’t overpaying by a long shot, prices will go back up” etc. – -anything to get her commission). It is now back on the market at 695K!!! Another house in the “Bible Belt” streets in Dana Point on Jeremiah I believe last sold in ’07 for 1.1 mil. and is now on the market at 500K!!! That’s 600K in 4 years folks, more than half off the peak bubble!!!

OCRent, thanks much for your “on the ground” reports. Eye openers. Please chime in often with actual props you are tracking. The “Doc” who hosts this blog does an outstanding job covering So-Cal, but he can’t “be everywhere”.

OC renter – thanks for that good info. Question: what are the bible streets renting for now? Is there a regular renter community there so that you can figure out a reliable rental ratio? The key to true valuation is rent – it is impossible to say what a house is “really worth” until we know what the income stream could be.

Dr. H is right on with this one. I regularly check homes for sale in my local area and find it interesting that a good number of abandoned homes are not on the mls. They are just sitting there, some with signs do not enter. I have found out the scoop on a couple of my neighbors and they have definitely let their homes go back to the bank–for many months. I am wondering when they will be flooding our already depressed IE market.

Thanks!

What I don’t understand is how can a house in Dana Point, once “valued” at $1.1MM now have an asking of $500K (I get that) but yet a decent home in the Valley of NoHo or Van Nuys (not the gangland territories) stillo go for $350K low-end. In my assumptions, these Valley homes – in good hoods, should be more in line with $200k-$250K. Sure you can get that price but you going north of Victory blvd and looking at graffiti as your landscape.

I know that most on here are looking west-side, etc but some are also looing in the Valley. Anyone, Dr. HB – shed some light please.

thanks

I’m in So-Fla, not So-Cal, but I’m going to venture a guess that since the bankSters have gone “medieval” on our asses, that they have also gone medieval by carving up the Bubble Zones into “fiefdoms”, and “granted title” to “cooperative” (crooked) NAR brokers who will “play ball”.

In short, part of extend, pretend, pump, then dump, is deflating only one small fiefdom (zip code) at a time, to prevent the dreaded MARKET-WIDE COLLAPSE. Easier to label a big price drop as a “fluke” if it only happens to 4 homes at a time, instead of 400. The majority of sheeple are still pathetically dependent on Duh Usual Cheerleaders (NAR, CNBC, etc.) for their highly skewed information, and are eager to “get off the fence”. 🙄

Every day I have to bite my tongue as fairly high net worth individuals I know–folks with significant RE holdings who should know better–tell me the market “has definitely bottomed”. In every case, they have reached this wishful conclusion based on the tiny data sets and short timelines which worked for them during the flat market of the 1990s… lawdy, lawdy, how the macro-economics have shifted since those Clinton Daze…

I have to say that I’m impressed. I never would’ve thought of the scam of deflating different zip codes at a time, in order to scew the statistics. I am familiar with some of the scams, but it’s just not in my normal thinking to come up with clever scams.

That’s definitely something to keep an eye out for. Thanks.

When you look as closely as we (the bubble blog readers) do, it’s easy to see the scams that the banks pull. They’re gaming the system so much that every new homeowner is an instant bagholder. If the bank sells a 2 star house to one knifecatcher, you can rest assured that they’ll come up with a 2.5 star house nearby to sell immediately afterwards and bury the previous buyer.

This is related to another trick of only letting the ‘dud’ properties go in the better areas i.e. on major streets, something wrong with the area, weird house/lot. This way you eliminate any real comparables.

Notwithstanding the other comments to your post pointing out bank shenanigans (yup I’m Irish) one thing affecting these different homes may be jumbo loans. Less people will ever qualify for jumbo so the bank caught holding the bag needs to let it drop more than the $250,000 house which given the availability of govt 3.5% loans and low interest rates any working stiff with an average calif income can afford the payments on the lower prices house. These folks would never consider looking at more expensive homes to see what quality is and haven’t the market skills to see what 250K really buys in non-Cal bubble fly over states so they buy the over priced SF Valley property. Tough Ta Ta’s for you and me as a cousin used to say when we were kids. If DHB and his wise followers are right are time is coming.

Sorry for all of the typos – I’m at home with a cold today and I hate when I’m “that person” that can’t type or spell

LOL, that Huntington Beach house pictured above is HIGH-larious, not just financially, but architecturally as well. I mean I *know* So-Cal is a “car-dominated” culture, but this place really points it up–it’s a parody, actually. A THREE-car garage and WIDE driveway accounts for 90% of your street “presentation”, while a tiny sidewalk and entryway for the actual people is kind of squeezed in as an afterthought… a “real steal” for “only” 1.05+M… 🙄

Those NAR shills, they slay me. :tongue:

PS: That said, I do appreciate that the driveway is white concrete, instead of black asphalt w/ petrochemical sealer.

Hey, those flyover states may have asphalt drive ways but they don’t sell Zirconia like it’s blood diamonds. Your post is the perfect spot for my response from reading the article since I had your same reaction. Drop this puppy in a flyover and its $125K at best. Barnum was right eh?

“It is amazing that even after the National Association of Realtors had to revise home sales lower and was blasted by those who track the housing industry, little has been done to reform the system.”

Really? What’s so “amazing” about it? The U.S. economy has suffered MASSIVE financial FRAUD and NOTHING has been done to reform it. The judicial system is rampantly corrupt and NOTHING is being done to reform it. Our legislators -from BOTH parties- are openly subservient to corporate interests and routinely disregard the will of the people they claim to ‘represent’, yet NOTHING has been done to reform that either.

The only TRULY ‘amazing’thing is that most of you HAVE NOT FIGURED OUT that the United States suffers from institutionalized fraud and is FUCKED UP beyond all repair.

Hey Al- You took the words right out of my mouth. I get they powers that be are banking on people being more concerned about American Idle and Charlie Sheen to spend a minute trying to figure out why they have no money.

oops- that was supposed to be; ” I guess the “powers that be” are banking on our population being more concerned about American Idle and Charlie Sheen than the fact that they personally have no savings/retirement.”

“American Idle” That’s too rich on so many levels given the state of things. Kudos

Thanks EconE for the links and the investigative works. I put the address you provided into google maps, and up comes this:

******************************************************************

http://maps.google.com/maps?

f=q&source=s_q&hl=en&geocode=&q=19732+Quiet+Bay+Lane,+Huntington+Beach,+CA&aq=0&sll=37.0625,-95.677068&sspn=34.861942,78.837891&ie=UTF8&hq=&hnear=19732+Quiet+Bay+Ln,+Huntington+Beach,+Orange,+California+92648&ll=33.675961,-118.010588&spn=0,0.019248&z=16&layer=c&cbll=33.676009,-118.010476&panoid=OfO2yNR-PQ4jaVeBZbmusw&cbp=12,180.23,,1,5.33

******************************************************************

The house to the right of it is beautiful! But I agree w/ Foolio that the house under scrutiny is a schitt box – ugly, and dated. It appears to be a $250,000 home, as a maximum. To bad the guy to the right of him built such a beautiful home. It’s surrounded by a bunch of blah, ordinary, 1970’s style schitt boxes.

Sorry – here is the street view:

http://maps.google.com/maps?f=q&source=s_q&hl=en&geocode=&q=19732+Quiet+Bay+Ln,+Huntington+Beach,+CA+92648&aq=&sll=37.0625,-95.677068&sspn=34.861942,78.837891&ie=UTF8&hq=&hnear=19732+Quiet+Bay+Ln,+Huntington+Beach,+Orange,+California+92648&ll=33.675426,-118.009322&spn=0,0.019248&z=16&iwloc=A&layer=c&cbll=33.676053,-118.010378&panoid=pgckB-lGVho43eENLAtatg&cbp=12,143.52,,0,5

Now’s the time to get your realtor license and cozy up to any of your friends in that industry. Reason being, the only deals to be had are to connected people with inside knowledge. The banks will make sure that every actual transaction stays as opaque as possible. 🙂

All bets are off now.

Within 2 months wealthy japanese will cross the Pacific with their bags of gold and cash to buy CA real estate.

Tokyo is becoming radioactive , and – 25 million Tokyo dwellers must go somewhere.

Realtards will really use anything to push house buying won’t they?

Tell me, even if Japanese relocated, why would they go to the most earthquake prone state in the U.S. after they have just suffered a devastating earthquake? Ha, don’t tell me they also want beachfront property!

@JRS: This is exactly my thoughts. Why in the world would you go from such a dramatic event and come to the most earthquake prone state in the U.S.? Do these people forget that some of the biggest fault lines run through L.A. and the OC? I doubt they want to live in San Bernardino or out in Palm Desert.

Did people forget about Northridge? The comment from CalAsian is so narrow and devoid of any analysis and even basic logic. The Nikkei got slammed last night by close to 11 percent. This person probably doesn’t even realize that Japan has been in a low-grade recession for two decades (lost decades?). Plus, you think these people are open to going from one housing bubble to another?

The above comment is basically someone following closely to an area like San Marino and has seen a few wealthy foreigners buy up a few choice homes. Big deal. Southern California has over 22 million people but again, a handful of homes selling in a totally prime market suddenly makes the entire state for sale to foreigners. Please, right now people are not likely to be jumping into another earthquake prone area.

Many Asian investors are already flying into John Wayne airport in Orange County and snapping-up RE in Irvine right off the plane. They pay asking price and are even willing to settle separately any 2nd mortgage loan debt if it exists. Meanwhile, the exact same thing is happening in Florida, except it’s the central & south American latino community buying everything there. Over in NYC, again we have the asian and europeans buying RE, although the european tide has slowed to an ebb due to their having their own economic problems.

Stick a fork in America ..it’s DONE.

Please show me some property records that support this. Your claims are highly doubtful and appear to be sensationalistic.

Haven’t you heard, they pretty much took over Hawaii already.

And who is going to sponsor them for citizenship? You, CalAsian? And why should we permit them to enter even if they wanted to? Cheaper to send them rice, water and tents than bring them here and put all the old people on SSI.

First of all, the Japanese will bring money, so getting sponsorship won’t be hard.

Second, it will be like the Vietnamese refugees who helped USA during the war and ended up in North America. Special laws will be passed to accept the wealthy japanese , who will trade their $1 million , 1000 square feet flats at Tokyo with a 5000 sq feet house for a lower price at Cal.

“And why should we permit them to enter even if they wanted to?”

Because THEY OWN the United States! They own the factories, the businesses and the entertainment venues. The own the land. In fact, if Goldman Sachs hadn’t beaten them to it, the Asians would ALSO own the presidency, the legislature and the judiciary.

Which is why you’re lucky that the Asians decided to still let YOU enter the U.S.

The Japanse don’t HAVE any money anymore, you laughable troll. Just ignore this moron CalAsian, he’s either a bear trying to rally other bears with statements that are simply so far out of whack with reality, or a delusional moron who’s sniffed one too many fumes from his dry cleaning business.

Slightly offtopic but even this won’t help when bubble bursts.

“Tokyo is becoming radioactive , and – 25 million Tokyo dwellers must go somewhere.”

Currently the environment in the power plant is as dangerous as X-rays or flying in 3 miles altitude. Move 6 miles and radioactivity drops to background level. So far no hysteria is justified: Tsunami killed >20 thousands people and people are worried of very low radiation in small area? So far none is killed in these accidents, which should give you the scale of them. So I really don’t get it.

Also: It doesn’t look like any major city would get radioactive. But power plant owners have done some big mistakes and that explains that low radiation, not the reactor blowing up. (Like many “news” channels tells us.) “A building” in “a nuclear power plant” blew, yes, but the reactor is something else. Sensationalism brings the money in and nuclear plants are good target for that.

Local tabloids aren’t any better, so can’t blame US media here. Vultures and the carcass.

I was worried when Chernobyl blew up, it was quite near here and much, much worse: You could photograph Cherenkov radiation from exposed core and that’s something no living people have seen in that scale: All died very shortly afterwards.

HAHAHA, that’s hilarious CalAsian. Japanese with bags of gold, huh, just like the late 80’s? Except since then, their equities and investments have lost trillions of dollars (what was the peak of the Nikkei? 37,000? Something around that? And now well under 9,000), their banks and bonds paid next to nothing for 2+ decades, and their properties are still down anywhere from 50-90% since peak also 2+ decades ago (and have lost even more value in the past week…I can’t imagine much demand for land now underwater and in the ocean, or covered with smashed debris, or glowing from radioactive fallout).

The author of this article asks the question, “At what value is the bank carring this mortgage loan?”. The answer to this question is the key to the slow foreclosure issue and the significant and growing shadow inventory. If you care to explore the answer to the question further I suggest you do a key word search for: Congress Helped Banks Defang Key Rule” by Susan Pulliam and Tom McGinty the Wall Street Journal 6/3/09. The banks are playing the game of extend and pretend hoping to write off losses against future earnings and at the same time praying for a housing recovery (which cannot happen under the current economic condtions. (Also, look-up U.S. Senate Banking Committee testimony of Professor Adam Levitin on youtube) .

CALL YOUR LOCAL DRE, WRITE A LETTER TO THE HEAD OF REO AT THE BANK INVOLVED BUT BEST OF ALL, SEARCH OUT THE REALTOR’S REO COMPETITOR IN THE SAME AREA AND RAT HIM OUT, HE WILL KNOW JUST WHO TO CALL.

QUESTOR:

I had asked a question about foreclosures earlier, and someone was kind enough to explain that foreclosures need to appear on the MLS for a couple of weeks before being sold, according to Bank rules.

I’m here to say that this is NOT being followed. What I’m seeing are properties being sold very suspiciously. First, advertisements on Craigslist touting “Not on MLSâ€. And then appearing suddenly on the MLS as “Contigent, Soldâ€. No other advertisement. And no chance for a competitive bigging situation.

I have to say, I think the Banks are being taken for a ride. Unless the Bank personnel are in on the scam, too.

It seems to me that there’s more here than meets the eye, and the crooks are all up and down the chain.

Reply

Enzo MiMo

March 14, 2011 at 11:32 amYEP, good catch… chaps my @ss too. You can try calling the FBI and your state AG, but don’t expect a lot of enthusiasm out of the .gov employees “responsible†for prosecuting this graft… remember, at the end of the day, .gov employees are really BANK employees!

I love your blog, Doctor HB! Here is an international perspective – Spain.

http://www.guardian.co.uk/world/2011/mar/28/residents-trapped-spanish-ghost-towns

Leave a Reply to EconE