Shadow Inventory Proof and Banks Delaying Losses for another Day. Banks Employing the Stick Your Head in the Sand Solution for the Financial Crisis.

Apparently acknowledging shadow inventory is like holding onto childhood superstitions like believing in Santa Clause or the financial Easter Bunny. Over the last week, many of you have sent me articles where many authors both amateur and professional have started attacking shadow inventory and started proclaiming that it was a myth. Shadow inventory does not exist according to these new articles. Some of these authors went ahead and made up their own definitions of shadow inventory which in itself is curious since this inventory supposedly does not exist. The problem of course is that there are many definitions of what shadow inventory is so I will try to reiterate what I have been talking about for months.

Here is how I define this category of inventory:

“(Doctor Housing Bubble) What is shadow inventory? First, shadow inventory is housing units that are not making it onto the public market for one reason or another. There is speculation surrounding why this is happening. Lenders are overwhelmed and simply do not have the human capital to handle the glut so goes one theory. Others speculate that lenders are simply too incompetent to have a system in place to handle the mess they created.”

This is rather clear and many people when referring to shadow inventory are discussing it by this definition. Essentially shadow inventory encompasses housing inventory that isn’t viewable by the public or measured in more historical standards. Calculated Risk does an excellent job breaking down some of the categories:

“(Calculated Risk) There are several categories of shadow inventory:

REOs. There are bank owned properties that have not been put on the market yet. Several sources have told me the number is growing – no one knows why except possibly for accounting reasons (the banks might have to take an addition write down when they sell the property).

Foreclosures in process. The delinquency rate has continued to rise, and this will probably lead to many more foreclosures later this year. The number of foreclosures depends somewhat on the success of the modification programs. Last year many delinquent homeowners listed their homes as “short sales” – so those homes were not shadow inventory, however fewer delinquent homeowners are listing their homes now as they try to work with their lenders on a modification. Some percentage of these homes are shadow inventory.

New high rise condos. These properties are not included in the new home inventory report from the Census Bureau, and do not show up anywhere unless they are listed.

Homeowners waiting for a better market. This was the group mentioned in the Reuters story (the article also mentioned foreclosures). These are homeowners waiting for better market conditions to sell.

Inventory is usually the best metric to follow for the housing market – and according to recent releases inventory is declining for both new and existing homes – however shadow inventory clouds this picture.”

I would also add homeowners that have stopped paying but banks are simply not contacting them. In fact, according to Amherst Securities Group LP the foreclosure process now takes 18 months to 2 years, up from 15 months only a year ago. 2 years! I have had many e-mails from people telling me they have been in their homes without making a payment for 12 months. Amazing. Others have stopped making payments and the banks have yet to contact them. The bottom line, there is shadow inventory. These are homes that in every other time in history would have been on the market as additional inventory. I am open to debating the amount of shadow inventory but to say it is a myth is non-sense. In fact, to think there is no shadow inventory is to believe in banking data and give the crony capitalist the benefit of the doubt that they are handling things correctly.

In addition, the crux of the argument for those stating the non-existence of shadow inventory is narrow in focus. What they are arguing is basically one angle of the story. Their point is that banks are not hoarding REOs and there will be no flood of inventory in the next few months. On this point, they are correct. That however does not mean there is no shadow inventory or that somehow it is a myth.

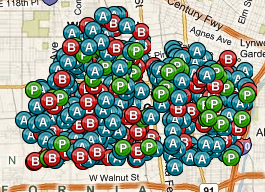

Let us run a quick little experiment shall we? Let us look at an area facing tough times right now here in Southern California, Compton:

MLS Inventory:Â Â Â Â Â Â Â Â Â Â Â 465

Of this, 114 are listed as short sales and 48 are listed as foreclosures

So this is the public data. But let us look at what is going on in the shadow inventory:

So how many properties show signs of distress?

This is exactly what I am talking about. The public can see 465 homes with 114 short sales and 48 foreclosures. But the reality is, there are some 1,639 properties either in pre-foreclosure, default, or bank owned. Now, if we remove the public listings that would leave us with 1,477 homes not showing up. Given the entire MLS inventory is 465 I would say that is a rather significant number. Most of these homes will default. This is something we already know. This is in fact shadow inventory. Banks are simply self-serving and are holding off on foreclosing on homes because to do so, would implode their business. That is, they would need to take an immediate and gigantic write-down.

And banks are getting their hands slapped but nothing is being done. Timothy Ward who is the deputy director of the Office of Thrift and Supervision even acknowledged the shady practices currently going on at banks:

“(OTS Letter) The following practices are considered weak and do not appear to be in accordance with GAAP and/or supervisory guidance.

1)Â Institutions charge-off losses only at foreclosure or when deemed uncollectible. A sound practice is to establish charge-off policies in accordance with the Uniform Retail Credit Classification and Account Management Policy (CEO Memo #128, July 27, 2000). Institutions should assess the current value of the collateral and selling costs when a loan is no more than 180 days past due. Any loan balance in excess of that assessment should be classified Loss.”

180 days past due? You mean 6 months? Well we just found out the foreclosure process is taking 18 months to 2 years (assuming banks even start the process which we now know in many cases they are not). What we need is a heavy crack down but with suspension to mark to market, banks are playing fast and loose with their data. If you recall, the public private investment program (PPIP) was set to move forward in July. It is still having the kinks worked out apparently. I guess they still haven’t figured out how to fleece the public enough. Many banks were assuming they were going to dump all their toxic waste onto taxpayers. And to acknowledge toxic waste while the stock market is rallying like it just took some speed might throw a wrench into the party.

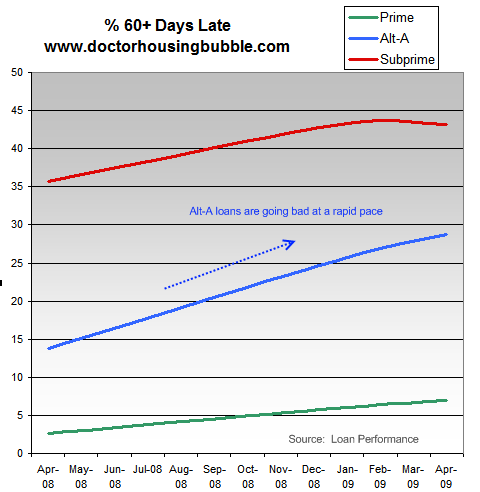

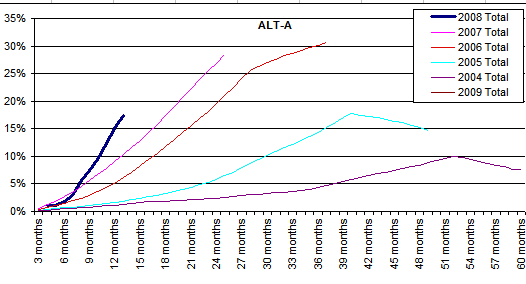

Also, I think some confusion came from the Alt-A and option ARM tsunami that I have talked about for nearly a year. This is not a myth and the tsunami is already here:

These loans are going into distress as expected. This is happening in California and also nationwide:

The question whether banks are foreclosing on these homes is another thing entirely. In fact, the way things are playing out not paying your mortgage seems to be an actual solution to the crisis for banks. Most are betting their cronies will come through and they can suddenly dump the waste onto the public. At a certain point however, you have to get to price discovery. To think that loan modifications or sales are fixing the imbalance is naïve and misses the entire scope of the problem. Currently, the market still has $1.1 trillion in active Alt-A and subprime loans. That is an enormous number. Let us not even talk about the rising number of prime defaults which is another major issue in itself. And to clarify, pay option ARMs can also be Alt-A loans. Not all pay option ARMs are Alt-A loans and vice versa. Alt-A is simply a category called Alternative A-paper meaning banks played fast and easy with the underwriting. There are a few general reasons a loan would fall into the Alt-A category:

>Less than full documentation

>Lower credit scores

>Higher loan-to-value ratios

>More investment properties

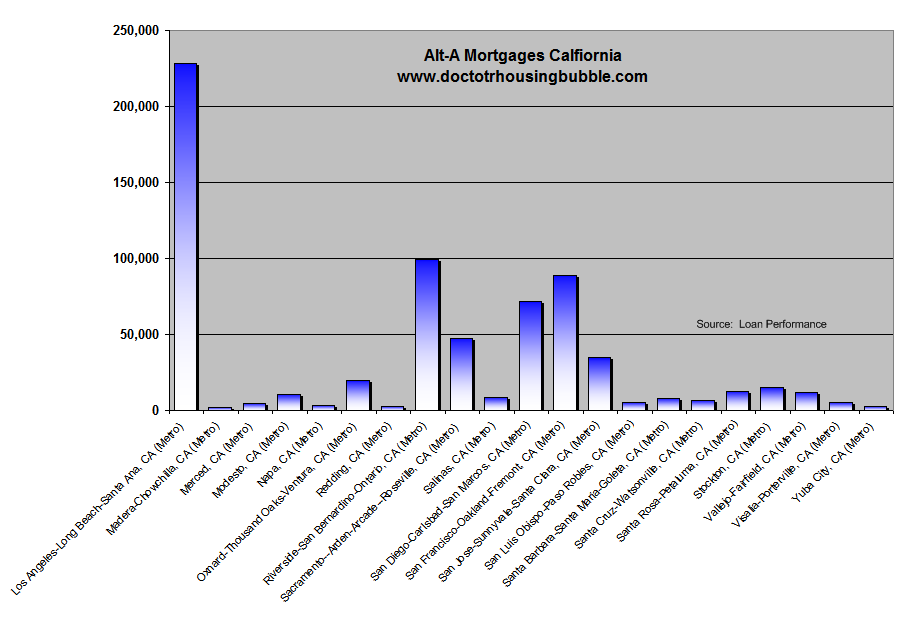

So you can technically have a high credit owner with an option ARM that isn’t an Alt-A product. Or you can have a low credit owner with an option ARM that is an Alt-A product. This is rather clear. Option ARMs are a small part of the toxic mortgage world. The bottom line is we have some $1.1 trillion of extremely toxic mortgages floating in the market and most of the Alt-A loans are here in California:

So the flood of problems are already starting. Banks are simply operating under incompetent rules and mixed standards where one bank might foreclose on a regular timeline while another bank might be doing absolutely nothing. In fact, I have gotten a few e-mails from those in the industry stating that banks are simply waiting to “see where the market goes” in the next few months. This confirms what was said in a recent American Banker article, Postponing the Day of Reckoning (August 26, 2009 – subscription required):

“Deferring foreclosures could have bottom-line benefits experts say. With fewer foreclosed properties hitting the market, housing prices have rebounded slightly. Moreover, properties might recover more of their value later on, so by waiting, banks may be able to cut their ultimate losses.

“Everybody is waiting to see what the market is going to do from a property perspective,” Volez said, “At some point, they have to liquidate these assets.”

That is the main issue right there. Here in California, many of those Alt-A loans will never recover. A property that sold for $400,000 in the Inland Empire that is now going for $150,000 is going to cause the bank a loss no matter what. At a certain point, having so many borrowers not paying is going to cause massive cash flow problems. This will drain your capital as well. Some think that by delaying foreclosure that banks are being creative and smart. They are basically trading a sudden punch to the head with death by a thousand mortgage payments. That isn’t a solution. That is praying the government and the taxpayer bail you out once again. And then what? The government owns these toxic mortgages? At a certain point the home has to be valued at non-bubble prices. In places like California with an 11.9 percent unemployment rate, prices may not recover for a decade.

Let us look at another prime location to see some more shadow inventory if you still have some doubts. Many are itching to buy in Culver City so we’ll use that as an example:

Culver City MLS listings:Â Â Â Â Â Â Â Â Â Â 101

2 listed as a foreclosure and 12 listed as short sales

Now let us look at properties in distress:

How many properties are we looking at above?

170 properties. Keep in mind that only 14 of these are on the MLS. Take out the 2 foreclosed homes and 11 short sales and you have 157 properties not viewable by the public. Given there are only 101 properties on the MLS, there are more properties in the shadows than in the public view. 22 homes sold in Culver City last month. This is the difference between 4.5 months of inventory (low) and 12 months of inventory (high). Big difference and the shadow inventory does exist. I know it was painful to hear as a child that there was no Santa Clause but you can feel comforted that shadow inventory is the real deal.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

44 Responses to “Shadow Inventory Proof and Banks Delaying Losses for another Day. Banks Employing the Stick Your Head in the Sand Solution for the Financial Crisis.”

There was a belief that the banks are holding onto a number of foreclosed homes.. That is the part of shadow inventory which is a myth as it makes little sense for banks to foreclose and then not market a property.

“Shadow inventory” of homes in default is massive. But until and unless that supply comes on market we have a stagnant market of low sales , insolvent borrower sitting in homes they are paying for and ready, willing and able buyers not buying because those defaulted borrowers are occupying homes they can no longer afford.

I don’t see a scenario where the tax payer doesn’t foot the bill to bail out the banks once again. All the too big to fail institutions during the first round of bailouts are even bigger today.

Sounds like the banks are into speculating. And based on information from previous posts, they are also into renting. This makes sense. Since banks were obviously not good at banking, they might as well try their hand at being landlords and speculators. They cannot do any worse, and they still have the taxpayer safety net.

Thank you for another enlightening post DHB. All the news recently says we are headed out of the resession into better times. The media keeps us focused on side shows.

Keep up the good work please!

Numbers and maps and evidence and logic can only get you so far with the dedicated skeptic. But Dr. HB – you already know the best way to demonstrate the reality of the shadow inventory! It’s to add something along the lines of the great “Real Homes of Genius”, maybe “Real Homes in the Shadows”? 1234 Somewhere Drive, Bubbleston, California. First NOD October 2007, Foreclosed Feb 2009, still vacant and unlisted.

Shadow inventory certainly does exist, but if the banks can let them leak out a few at a time, they can keep prices propped up pretty well.

A good place to look as an example of where prices probably can not be proped up ,is Portland, Oregon.

Oregon has the fourth highest unemployment rate in the country, and a not very diversified economic base. A few years ago, it was “the place” for Californians to move. Now, many of those recent immigrants are losing their jobs(low seniority).

As winter sets in, they will find it is not too wonderful being unemployed, in an area where it rains 28 days a month in the winter, and where a six inch snow fall in late December can shut the airports, and the entire city down.

Even though Portland did not suffer the massive overbuilding of Southern Calif.

keeping property values up is not possible, as the recent migrants move back to where they can still find a job.

People who consider shadow inventory a myth, remind me of the birther movement… DOC, no matter how much evidence to the contrary you have, there is no convincing these people. You might say that the sky is blue, but it will always be green for them.

Changing the topic.

http://www.nhsie.org/downpaymentassistance.html

I have a sibling trying to use the program listed above. It seems good for getting individuals into a house, but it has a 45 year term attached to it. Bank of America is endorsing this program to my sibling. I see this as self serving on BofA’s part. What do you think? Is it good for someone that wants to live in a house, or is it best to just wait it out?

I think most people are not denying shadow or stealth inventory. They are, as you touched upon, of the belief that all the inventory is not going to be flooding the market.

This is what I’ve been hearing: Many loans will be modified; many will go through short sale; banks will rent them back to owners, PPIP – investors buying bulk (not listed in MLS); China/foreigners buying the inventory before going to market (How? I’d like to know. Really. I’ll do it) kicking the can until inflation will hit and prices will go up.

I have come across MANY places that were investment properties, people owning multiple properties. Most of those do eventually make it to the MLS. I have seen places receive NODs and not make it to the MLS for over a year.

As so whether the above reasons are sufficient to absorb the shadow inventory, I have my doubts about some of them (Ok. Many of them)

The criteria requirements for loan modification are pretty rigid and many don’t qualify.

Some are going through the short sale process. We see those handful of contingent properties languishing on the market.

Banks renting to owners? Yeah. I can see some of them doing that. Will people be stupid enough to do it? Yeah. They were dumb enough to go in over their head in the first place. They are the ones believing in Santa Claus. Their house will go up in value any time now.

Investors buying bulk. Enough to absorb the trillion you mentioned? Uh. I have to say, I just don’t see that kind of jack. Some will get absorbed.

China buying. It’s about time we sell them our overpriced crap. I hope it’s true. They can hold on to an eroding property and maintain it, paint, termite, etc.

Inflation. People warn it’s coming. I say the money needs to be flowing out there for inflation to happen. We already had inflation. It was called the housing bubble/HELOC. But say inflation happens. What about unemployment? What about the low incomes? We not only have unemployment, we have furloughs, pay cuts, etc. We really need to look at U6 figures.

Incomes have not really gone up. People had the illusion of higher income b/c of the HELOC phenomena. Take that out of the equation. You have to rely on salary and businessess have to rely on you spending your salary. GOOD LUCK. Unless unemployment turns around AND salaries increase, I just don’t know who will have the wherewithal to buy a house at inflated prices, even if they wanted to, they would now have to qualify and prove they can make the payments.

Really, the only way I see this turning around is if banks sell to the kid w/the lemonade stand again – or dead people.

Where do you see inland prices going? Have you ever taken a drive around some of the newer neighborhoods out here? I know many believe prices have bottomed out here, but I see droves of houses that are clearly abandoned(dead lawn with no cars around). Then on top of that a good portion of the houses that are not already abandoned are in some form of foreclosure. I don’t see how this won’t keep pretty seroius downward pressure on prices. Then again you can rent these places out for far more than the price of a mortgage assuming you can find renters. Hard to say what will happen out here, but its still a complete mess.

I have recently noticed signs appearing in front of houses that are not listed as being for sale. These say “bank repo open house”. They appear only on Sunday and gone during the week. The houses do not have normal for “sale signs” in front and no one would know they are for sale if it were not for the

bank repo open house.

Doc,

Great work and thanks so much for this blog. You’re doing a fantastic service here. I do not think for one moment that the people who argue against shadow inventory have anything but guile up their sleeves. In other words, the bottom calling REIC scum will be the first to tell us that prices are on the way up and we’d better buy now or be priced out forever. If I wish to God that the folks who caused this mess would just die and allow honest people to live their lives with decency.

I live in Chicago, IL. In Chicago a person can not make a mortgage payment for two full years before they are kicked out. The banks are simply speculating that prices will stabilize and then they can start the foreclosure proceedings.

Also, on the other side, buyers are eager to “snap up bargain basement priced properties before prices inevitably go up”. Those were the words of a local news segment. Foolish buyers are actually “snapping up bargains” just because it is labeled a foreclosure or bank owned.

Sure prices have come down (as much as 30% to 50%). But those prices have come down from an artificial bubble high. When an average 1800 square foot, 3 bedrooms, two baths and two car garage was selling from 450K to 650K!

Those buyers who purchased “bargain priced properties” are going to kick themselves in 2012 to 2015.

The idea that the Banks and powers that be are so organized and cunning as to be able to artificially prop up this mess for the long term is absurd. Lets face it if they were that smart or organized we would not be in this mess in the first place. The moves they are making now, which make things look good in the short term are moves of desperation and panic. At some point the dam will tip over and these institutions will scramble for survival. When that happens all bets are off. Lets not forget what motivates many investors and first time buyers is GOOD NEWS. The numbers will slow down most likely this fall, the news will jump on that that, (anything to get viewers). People will panic, stop buying. Investors will panic stop buying start selling. 2007 anyone? Memories are short.

With Congress soon looking for ways to increase revenue, we may be in for a perfect storm for housing. We’re already getting stories like the following from the CBO (Congressional Budget Office):

http://www.bostonherald.com/business/real_estate/view.bg?articleid=1194151&srvc=business&position=4

Now, I don’t think it has a chance of passing in the near term, but even rumors of Congress removing the deduction for mortgage interest and realestate taxes will harm things. If this sort of story gets traction, however unlikely it is to actually occur, the shockwaves that will go through the housing industry will be immense.

StargazerA5

Can you share where you were able to generate the maps of distressed homes? Is that available on some website? Thanks!

ARM indexes

I was also hoping to find out where you obtained information as to which homes/ the number of homes in a specific area were distressed.

I think everybody who refuses to acknowledge the shadow inventory is big bird with head in the sand. Try this exercise in 2 parts to verify DHB numbers.

1. Go to realtor.com and make search for both cities with SFR and condo/townhouse checked. Result for inventories as of today is like this:

Culver city 101

Compton 461

Only few of them (around 10%) are stated to be REO, foreclosure or short sale, so mostly potential generic sales, non-disteresed.

2. Go to foreclosureradar.com (where you get distressed property) and make search for same 2 cities. It pops up “actionâ€, “pre foreclosure†and “REO†for

Culver city 9 pages x 20 properties – around 160

Compton 84 pages x 20 properties – around 1700

(I counted in pages because the free service doesn’t give you total number)

There was a time I was thinking, “the subprime mess is overâ€, but when I see this number for Compton 1700! (I guess it is very similar in other slum areas) I think again.

Clearly there is something wrong going on with these numbers and I don’t believe in the “smart banks†myth. Banks are hoping for miracle or the right moment to upload all this toxic financial waste onto the government, the only 2 ways to go with positive outcome for them. There is more emotions coming, but if I only knew why is this uptick of good news of today?

First I need to point out how bad calculated risks 4 categories are. The only way to truely gain an understanding if there is shadow inventory or not is through REOs. And compton? Come on, lets choose a little bit better area. I talk all day long in blogs and forums about the supposed shadow inventory bank conspiracy theory. I didn’t/don’t believe it so I recently decided to run an experiment to see where those foreclosure numbers were actually coming from.

Shadow Inventory – Myth or Reality?

http://occoastalnews.com/?p=609

The experiment involved Aliso Viejo, CA 92656. What I found was exactly what I had predicted – Foreclosure Radar numbers are false and there is no huge backlog of REOs.

Yes, I agree, you don’t state your source for these distressed inventory maps, they just appear out of nowhere.

What absolute a**holes!

Yeah, no doubt the good Dr. is simply making up numbers out of his head.

So, realtors, go forth and tell more lies!

Everybody has a vested interest. Ever hear anyone talk down a stock they own? Of course not. Ever heard a used car salesman tell you to “avoid his cars”? “Bad time to buy a house” from a reeltur? “Military might be dangerous” from a recruiter?

You gotta dig for the truth–too valuable to just throw out there. Unless of course it’s Fux Gnews: Fair and Balanced, just like the boss wants it….

I’ve been Renting in SoCal.. Hollywood specifically for 7 years… I currently rent a 1 bedroom apartment for $1225 a month near Runyon Canyon in Hollywood. It’s a tiny 650 sq foot 1 bedroom. I think tons of homes are over-priced still… But RENTS are over-priced also… You have to factor that into the equation. Renting in desireable areas is very expensive and keeps going up… My rent was raised again this past month. 4 years ago the same apartment cost $1025… Now it’s $200 more a month for the same apt with a much dirtier carpet and aging applicances… and currently a broken air conditioning unit.

I pay $15K a year for cramped space with no yard and little privacy… Sure i could probably move to a better apartment… But at this point my fiancee and I just want to wait until we find a home at the right price. A 3 bedroom/2bath with 1800 sq feet/ a yard and a pool… (if it’s in the valley). We want a good school district where we don’t have to pay for Private school and would like to pay $400K…. Would even stretch to $450K if we loved the place. Is that too greedy for SoCal in the Valley?

I calculate we pay $15K a year to rent a tiny 1 bedroom in Hollywood… x 30 years = $450K… So a $450K for a 3 bedroom/2bath seems fair… Sure i know i pay property taxes and interest… But i also calculated I’ll get $6-10K back every year in tax refunds… helping to offset that some. Right now as a renter… I end up owing or breaking even come tax time….

Then again.. I don’t want to buy a shack for $450K… I’ve been seeing some beautiful homes for $550K… waiting for that last $100K drop… Just getting impatient waiting…

I have been posting NODs on SDL for over a year. This year I started a couple of threads on ZIPs in San Diego (nice and ok areas). The only areas that seems to have lower NODs right now is 92106, 92107 and 92110. I can tell you there’s plenty that’s not listed and that just are in limbo for a very long time. The numbers of NODs do not match to inventory, much less foreclosures. Some easily for a year. I’ve seen some surface to market a year later.

92126

92106

92107

92110

92130

92071

92128

92117

About the only places where there seems to be activity are some condo conversion complexes in UTC:

Villa Vicenza

Lucera

Verano

@ Robert Larson

We know you are an idiot but are you a Realtor also?

If you don’t believe there is inventory being held back by banks read this article.

http://www.bankinvestmentconsultant.com/news/postponing-reckoning-foreclosure-2663681-1.html

The accountants and auditors openly explain why the banks are not foreclosing.

Tom Booker, a senior vice president in the default information unit at First American Corp. in Santa Ana, Calif., concurred. “There are borrowers who are six or eight months in default; they may have exhausted their workout options; but they’re put on a forbearance plan because it’s an interim to a final resolution, which is foreclosure,” he said. “Banks don’t want to take the losses now.”

Here’s one way to keep the “unemployment” rate in check: let unemployment benefits expire thus subtracting them from the calculation. http://www.msnbc.msn.com/id/32555445/ns/us_news-the_elkhart_project

Desperation and misery looking more like the Great Depression. Throw in a little H1N1 and you’ve got a dreadful winter ahead.

Please consider the needy in your holiday gift-giving plans this coming holiday season. Be brave Comrades!

To the requests for distressed housing maps, you can go to http://www.google.com and select maps. Then click on “show more options” and on the drop down menu which appears, select “real estate”. Type in the zip code you are interested in and the maps will seem to get a terrible case of chicken pox. Some of the homes shown are foreclosed, some have received a NOD, and some are in pre-foreclosure (as least one missed payment). I am sure that the list is not all-inclusive and probably not up to the minute but I believe that it does indicate a current trend in each market, if nothing else.

@ Renting is Expensive

“Sure i could probably move to a better apartment”

If you’re unhappy, it really sounds to me like you should look scan craigslist for someplace nice nearby while you and your wife wait out the crash over the next year or so. I rent a bit east of you and was surprised what I was able to find once I was put into a situation where I needed to move and am now much happier I am with my new place.

To summarize, I got married earlier this year and subsequently moved from a slightly overpriced one-bedroom bachelor pad apartment to a great two-bedroom house for only a $400/month more, but not before my former landlord offered me a two-bedroom for the same price I was paying for my one-bedroom.

We also are friends with a couple renting in a nice area of Pasadena who recently renewed their lease at a $175/month discount after pointing out to their landlord that nearby units were being listed a $200/month less than they were a year ago.

Nice areas are coming down too, added to the fact that there are a lot of underwater folks are sitting on houses that need to rent to someone.

I dunno how accurate google is. I haven’t made a payment since Dec 1st and my home doesn’t even show up in pre-foreclosure.

How nice for Chicago’s delinquent homedebtors that they can live rent-free for 2 years before the lenders move on them.

Chicago landlords don’t forebear so much from their tenants. Don’t pay your rent, and you will be out and on the front lawn of your apt. building in three months.

The sheer weight of all the foreclosures is buying lots of time for buried borrowers. How nice to be able to live rent free in a $500K condo for 2 years.

“Moreover, properties might recover more of their value later on, so by waiting, banks may be able to cut their ultimate losses.”

I appreciate the reasonableness of your statements, but from what I see, the banks are paralyzed. They are in such bad shape that if their true financial situation were laid bare…they would be insolvent. Therefore, they have NO choice but to hold on as long as possible, until hopefully, some “real estate fairy” will come along and cure their problems.

Comment by Renting is Expensive…

August 31st, 2009 at 5:22 pm

I’ve been Renting in SoCal.. Hollywood specifically for 7 years… I currently rent a 1 bedroom apartment for $1225 a month near Runyon Canyon in Hollywood. It’s a tiny 650 sq foot 1 bedroom. ……I pay $15K a year for cramped space with no yard and little privacy… Sure i could probably move to a better apartment… But at this point my fiancee and I just want to wait until we find a home at the right price. A 3 bedroom/2bath with 1800 sq feet/ a yard and a pool… (if it’s in the valley). We want a good school district where we don’t have to pay for Private school and would like to pay $400K…. Would even stretch to $450K if we loved the place. Is that too greedy for SoCal in the Valley? …….I calculate we pay $15K a year to rent a tiny 1 bedroom in Hollywood… x 30 years = $450K… So a $450K for a 3 bedroom/2bath seems fair… Sure i know i pay property taxes and interest… But i also calculated I’ll get $6-10K back every year in tax refunds… helping to offset that some. Right now as a renter… I end up owing or breaking even come tax time….

__

Umm lets go back to basic math.

>>>

$400,000 with 20% down is a $320,000 mortgage. National average rate for a 30 year mortgage this week is 5.27%.

>>

Payment (principal and interest) = $1771 per month

>

Add on insurance (call it $200 a month) and property taxes (call it $30 per $1000 of assessed value which is ½ of market value or $500 a month.) BTW, that is MY tax rate here on the shores of Lake Michigan so it has a reasonable basis.

>>

Principal and interest $1771 + insurance $200 + $500 taxes = $2471 a month.

>>

Over a 30 year mortgage you will pay $320000 in principal and PLUS — sit down now – $317,566 in interest. That is a GRAND total of $637,566 for the purchase of the house – not including taxes (another $6000 or so a year or $180000 over 30 years), insurance (at least another $2400 a year or $72000.) And in the insurance and taxes, and that house over 30 years – not including maintenance – will cost you $889,566.

>>

Almost forgot! Have to add in the ‘lost opportunity earnings’ from the downpayment of $80,000. If the $80000 had been put into tax-free muni bonds paying 4-5%, it would earn another $3600 a year or $108000 over 30 years; and if you had just reinvested that $3600 in munis, at the end of 30 years with compounding, you would have around.$299,000.

>>

So the FINAL grand total for that house for 30 years is downpayment and lost earnings ($299,000) + principal $320000 + interest $317566 + taxes $180000 + insurance $72000. The real total is $1,188,566!!!! OUCH!!! That is a far cry from $400,000!

>>

Okay will subtract the $15000 a year rent for 30 years from that $1,188,556. Feel better that the house will ‘only’ cost you an additional $738,556 + repairs and maintenance?

>>

Renting may be expensive but owning can break the piggy bank.

>>

Pray tell how you think that tax deduction for interest paid will make up the difference between $400,000 (your 30 year price) and the real 30 year price of $889,000? Note: you ONLY get a tax deduction for INTEREST payments – not principal payments.

>>

Or how the ‘tax deduction’ (deduction, not credit) will pay for the difference between $15000 in rent for 30 years ($450,000) and that $889,000 actual price for the house? That is a difference of over $14,633 a year!

>>

The interest deduction (DEDUCTION – NOT ‘TAX CREDIT) is highly over-rated. On a $320,000 mortgage, the amount of interest paid in the 1st year is $16,756. Lets assume you are in the very top Federal income tax bracket which means your AGI (income after exemptions and deductions) is at OVER $357,000 for a married couple filing jointly and your top marginal tax rate is 35%. Home mortgage interest is an ITEMIZED deduction which means you have to come up with at least $10,300+ of itemized deductions for a married couple filing jointly. (BTW, ‘itemized deductions’ replace the standard deduction of $10,300 – you don’t get both.) Anyway, the value of that home interest deduction is the amount of interest paid x (times) the tax rate. The most – the very most – you could hope to save on the amount of federal taxes which you PAY is $16756 x .35 = $5864.

>>

I would tend to think that your combined taxable income is NOT $357,000 so you won’t get to that amount. I would guess maybe in the 25-28% top marginal bracket for the 2 of you. Wow! $4440 saved on the amount you pay in Federal Income taxes. Congratulations. That plus another $4000 –5000 might pay to reshingle the roof or replace the furnace/AC.

>>

You most assuredly will be coming up very short (like $10000) short if you think the tax deduction (Gross income – deduction) will make up the difference between the cost of the house and the cost of the apartment.

>>

And speaking from several decades of experience, repairs and maintenance are expensive. Seems like no tradesman ever quotes any price that is less than $2000 to repair water lines, replace a water heater, replace a garage door opener, fix a bad electrical circuit, reroof the house (an every 15 or so year project), paint the house…….and then you want to maintain a pool to boot…..

>>

SO if you really only want to spend $15,000 a year, then you can only afford around a $154,000 PITI (principal, interest, taxes and insurance.) Any tax savings will be eaten up from replacing the refrigerator, fixing plumbing leaks…….and in any event a once a year tax savings doesn’t do squat for the monthly cash flow to pay that mortgage unless you adjust your withholding so that you don’t pay the money in the first place and thus don’t get a refund.

I talked to a well-connected guy who says that Wachovia is hiring asset managers locally to tend to the foreclosed properties and they are definitely waiting for prices to rebound to release them onto the market. It’s not just a theory, it’s their business plan.

I can only imagine in the backs of their minds they are thinking that if things don’t pan out so well with this strategy that the gov will step in to sop up the losses. Moral hazard at work here folks. Don’t expect Benanke, Geithner, Summers, Dodd, Frank, et al to let the banks down.

Where can I find the maps which show distressed properties? I’d like to show them to some naysayers that I know.

Now the banks are moonwalking away from properties, or at least the cnnfn story claims that. When the MSM stops cheerleading and points out something bad, that’s worth a pause to ponder…

New strategy for SoCal shadow inventory–massive wildfire to destroy thousands of homes…maybe some strip malls too…

Here in Florida, all you’ve got to do is get on your bike and look for unmowed lawns, green pools, and disconnected meters to get a good idea of what’s happening. Oh yeah, no for sale signs either. They’ve given up.

Think of the banks as similar to an oil cartel, why flood an already saturated market with something that won’t sell anyway? Kind of an REOPEC. Hell, just wait a bit longer and the fed will backstop a doghouse.

I read the following on a blog: “California started its 90 day foreclosure moratorium on June 16th which means that it will end mid Sept.

Free rent is over folks!”

Could someone explain what that means?

Dr,

Good post…. who do you recommend for foreclosure information? foreclosureradar ?

DG,

I agree that the google display of distressed homes is not extremely accurate. It does however give some sort of idea as to how many homes are distressed. And the kicker is that the extraordinary amount of red dots is an understatement of the problem. It’s not a great search tool if someone is looking to buy a foreclosure but it does paint a picture.

Looks like a catch 22.

The banks own the homes and need or want top dollar.

The banks can’t lend you too much money to buy their overpriced house because they know you can’t afford to pay it back.

The market’s locked up because the price most folks can afford to pay is less than what banks and most sellers need. Maybe we are now entering the ugly sticky stage most expected; except the lenders are the main sellers and they have more options than the average seller.

They will have to develop a few new tricks and I think that’s exactly what they are trying to do on our dime, and keep their bonus to boot.

I know two families who have not paid in about a year and one who walked 6 months ago and have had very little contact with their lender although one is now in talks and say’s he may get a modification after his 3 month trial. (after not paying a dime in a year, however now owes back taxes and has been sued by his HOA).

Another person I know did get foreclosed on and said she has to pay taxes on the loss (anybody hear anything about that)

I may do the same except I didn’t get in over my head, still upside down a tad but not crying just paying down my debt.

Where do those maps come from?

“Here in Florida, all you’ve got to do is get on your bike and look for unmowed lawns, green pools, and disconnected meters to get a good idea of what’s happening. Oh yeah, no for sale signs either. They’ve given up.”

Pretty much. The bad thing is in my area of Florida the number of empty homes is worse than last year. Much worse. I have tracked about 100 homes over the last couple of years…

Less than 30 are currently with new owners. It seems the average time between the NOD and a new owner is running between 2.5-3 YEARS.

I work with people who have not paid in 2 years and have yet to recieve the first NOD.

Hang on because the ride is just getting interesting…

I believe the FASB’s delay in the implementation of mark-to-market accounting of mortgage assets has incentivized banks and other mortgage lenders not to foreclose on significant numbers of borrowers / residents in default. If one works through the logic of the reasons mortgage lenders are not completing foreclosure proceedings, I believe the shadow inventory becomes much less of a mythical boogy man and should be regarded as a real and significant threat. See WSJ article, “Congress Helped Banks Defang Key Rule” June 3, 2009 ~ Susan Pulliam / Thomas McGinty. Do mortgage lenders want to become the owner-of-record of empty houses? (Think of the cost of maintenace, security, property taxes, municipal fees, etc.) Under the present economic conditions there aren’t enough borrowers who can qualify for mortgages to sop-up the excess supplyof houses. Thank you Freddie, Fannie and Countrywide. In Japan they called it the lost decade.

There is much being made about the alleged “shadow inventory†of homes being held by banks that are in some stage of foreclosure. Advocates of the “the shadow inventory is ‘out-there-lurking-and-ready-to-dump-new-inventory-on-the-market’ obviously have no idea about the disincentives for banks to do that. It’s all about an accounting issue.

In addition to the mistake of perhaps selling too soon into a rising market, banks have a very important reason not to sell their property at a loss. If a bank sells a property at a loss, they must immediately show that loss on their books and every loss affects their stock, their loss ratio and their P&L sheets. Analysts of banks look very carefully at loan loss coverage ratios and it has a major effect on the market reputation of the bank as well as how the investor community sees that bank.

This issue was seen during the financial crisis of 2008/09 when many securities held on banks’ balance sheets could not be valued efficiently as the markets had disappeared from them. In April of 2009, however, the Financial Accounting Standards Board (FASB) voted on and approved new guidelines that would allow for the valuation to be based on a price that would be received in an orderly market rather than a forced liquidation. Starting in the first quarter of 2009, banks were allowed to not “mark-to-marketâ€. This ruling fixed an accounting problem which had been causing many banks to appear undercapitalized when in fact they were not.

When a bank has to write down an asset on its books, it not only has to take the loss, but also has to beef up its reserve of cash to cover its declining asset base. The net result is a black eye and less money to lend— even if the bank plans to hold the asset until indefinitely or until maturity. So basically, there is no incentive whatsoever for a bank to rush onto the market any properties subject to foreclosure. Those who fail to understand the internal workings of banks are still believing the myth of “shadow inventory†rather than the fact that the FASB accounting rules allow banks to hold troubled real estate assets without having to write down their value. Maybe these “believers†should come out of their own shadows and see the light of day.

Leave a Reply to Effective Demand