Shadow Housing Inventory: The Deception of the Foreclosure Numbers and the real REO Picture. A Case Study of Southern California Real Estate. How 40,000 Homes are Hidden From Public View by Banks.

The much anticipated bottom in real estate is here! It is time to rejoice people. Let us for a second forget about the 336,000 foreclosure filings last month and the 26,000,000 unemployed and underemployed Americans. The time to buy real estate is now. If you didn’t buy a home yesterday do it now! Grab your phone, call up your agent with the glossy business card, line up your carefully saved down payment, and buy up that 900 square foot home in Culver City for $500,000 because this is it. We can also disregard the analysis from Moody’s that California’s unemployment rate will top 13 percent in 2010. Another estimate places the unemployment rate at 14 percent (we are at 11.6 percent today) so things will get worse before they get better but who cares! Real estate prices will go up on pure hype. The cash for clunkers Real Homes of Genius program.

In 2006, when I talked about the absolute shady underbelly of the housing industry including no-doc loans, forgeries, mortgage broker corruption, agent shenanigans, bought off appraisers, crony Wall Street, there was a sizable contingent that believed it was a tiny group of bad apples. I argued the vast majority of the industry was polluted and as we are now painfully finding out, that is the case. Last year, I started discussing the shadow inventory data and we had another group that simply did not believe this. They thought for the most part, only one or two homes were off the books and shadow inventory was basically a misguided assertion. Today, I am going to prove to you with Southern California data that there is a gigantic shadow inventory building. The Alt-A and option ARM tsunami will be the match that sets this housing tinder box off in 2010 (with the peaking unemployment rate). Keep in mind, we may have a national economic recovery but California housing is done for many years.

What is shadow inventory? First, shadow inventory is housing units that are not making it onto the public market for one reason or another. There is speculation surrounding why this is happening. Lenders are overwhelmed and simply do not have the human capital to handle the glut so goes one theory. Others speculate that lenders are simply too incompetent to have a system in place to handle the mess they created. There is truth in both of these scenarios. What I am starting to believe is the massive glut of housing is being caused by the inability of banks to sell homes for losses and take write-down’s to their already weak balance sheet. Think of all those notice of defaults for example. Technically, the bank can value the price at an overly optimistic point because mark to market has been suspended and the bank technically hasn’t sold the home. So this may be more of a practical survival mechanism for the banks. However, with such a crony capitalist system then why would we continue to hand money out to these institutions? We are back to the hype based economy. This is like a person saying “yes, I own $2 million in real estate” except they have $3 million in debt which they don’t openly talk about.

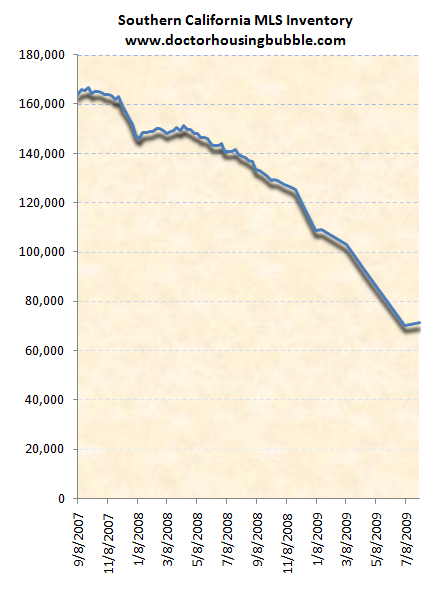

Let us put the numbers together since no one has attempted to get an actual hard figure on shadow inventory. Since we can’t do this for the entire United States, we can try to recreate our own little figures for Southern California. First, I’ve been tracking MLS data since 2007 when it peaked:

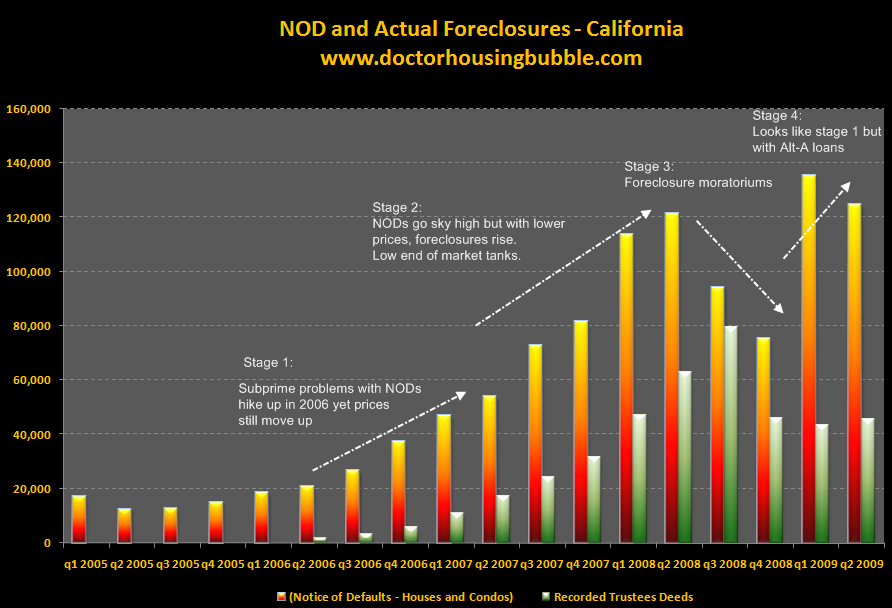

The peak was reached in late 2007 when over 160,000 units of housing were on the market in Southern California. Since that time, the drop in MLS housing units has continued on a steady pace. Now some would say this occurred because during this time, prices fell by half and thus spurred sales. Yes and no. For the last year or so, nearly 50 percent of all Southern California homes sold were foreclosure re-sales. A bulk of the homes sold happened in more depressed lower cost markets. Many of those homes did not even make the MLS in the first place. So the drop has to be explained by other reasons. Another reason is people pulling off “non-distress” home sales from the list. That is, homes being sold that are not in any form of distress but simply because a seller wants to offload the property. So that might explain a few homes being yanked off the MLS but certainly not as many as the current list is showing. What we can safely predict, is what occurred with the glut of subprime homes back in 2007. Let us look at the notice of default charts for that trend:

In 2006 notice of defaults shot up through the roof. Much of this was in lower priced areas loaded with subprime toxic waste. The trend was simple, NODs spiked and then once prices stalled, foreclosures slammed the market. Now, the pattern is repeating itself except this time we have the Alt-A toxic mortgages that will start recasting in mass in 2010. The pattern is extremely clear. But these are things that we already know. As of today, there are some 71,000 homes on the MLS for all 6 counties in Southern California. This is a far cry from the over 160,000 homes near the peak in 2007. Keep in mind this was the ultimate bubble point. During the crazy days of the bubble we would have one or two months of inventory on the market in some areas!

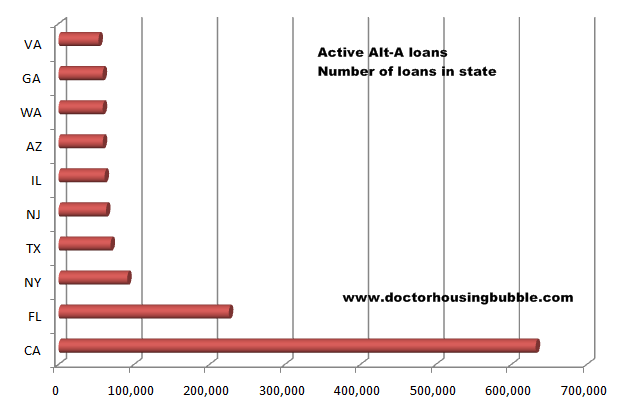

So let us run the quick numbers which are sucking people back in. Last month some 23,262 homes sold in Southern California.  With 71,000 homes on public inventory that is 3 months of inventory at the current sales rate. Not bad right? A normal market will have about 5 to 6 months of inventory. But this is the ultimate head fake. Those subprime loans are still toxic and there are some $400 billion outstanding and there are some $660 billion in Alt-A loans most of it calling California home:

Bottom line many of these loans will default. But let us look at 2009 and count our home sales:

For the first six months of the year 114,495 homes sold in Southern California. Keep in mind that in any given month, Southern California makes up over half of the sales for the entire state so this is a good indicator of the overall market. We have prime, near prime, subprime, and every mortgage product ever created in this market. For example 44,167 homes sold statewide in June with 23,262 (52%) coming from Southern California.

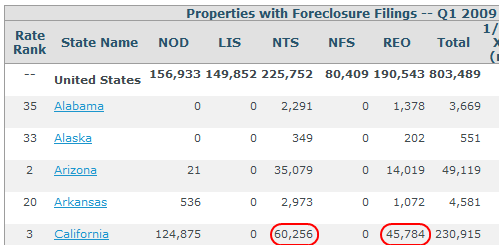

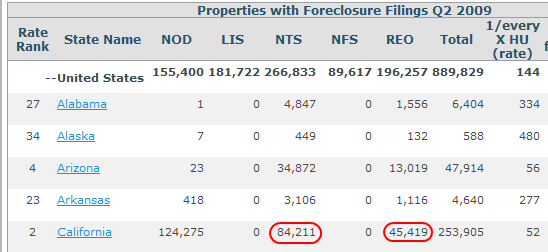

The MLS figure from the start of the year to the current number has dropped from 110,000 to 71,000 a drop of 39,000 homes. But there can be no bigger deception than this number. Let us look at first quarter and second quarter foreclosures for the state:

Statewide some 235,670 homes entered into foreclosure (NTS and REO). The NOD number of course is off the charts and this is inventory that will hit later this year and into 2010. But set that figure aside for the moment. Let us assume the same proportion of 52% for foreclosures in SoCal. That would mean roughly 122,000 homes were added via the NTS and REO process. We only had 114,495 home sales recorded during this time! So we are missing some 40,000+/- homes from the MLS! That is an enormous number and sure is bigger than a one or two home anomaly. With the Alt-A and option ARM junk still being booked at peak values in most cases, banks are kicking the can down the road as far as they can. That is why I get so many e-mails and comments from people saying:

“Hey doc. I haven’t made a payment in 4, 5, 6, or even 7 months and still have no notice of default from the bank.”

Those lame loan modifications are basically self serving for the bank because the principal isn’t touched and the bank can still claim it has an “asset” that is valued at $500,000 when the real market value is more like $250,000. Pure insanity.

So that drop in the MLS is pure hocus pocus. What is happening is this. Homes are selling from a second wave of bubble dream buyers. These people say they are comfortable staying in the home for 5 to 7 years but deep down, they believe in the trading up myth created during the bubble. What about staying in your home for 10, 15, or 20 years? Many have sat on the fence and simply cannot wait any longer. They are jumping into a shark tank lured by tax incentives and more housing Kool-Aid. Did they not notice the $26 billion budget deficit for the state? So as these homes sell, they are removed from the MLS. Most people that can sell without distress, are holding back because many suffer from California housing delusion and are licking their chops because they think they can reclaim that 2007 price point. They won’t and they are in for a stunner. But these are the people removing their home from the MLS. The few homes that do make it to the list in distress are selected and aren’t priced competitively in mid to upper priced areas. The lower range is being sold at a rapid pace at rock bottom prices like homes in Compton going for five-figures.

How do we know something is fishy? On the MLS there are only 5,800 homes labeled as foreclosures for all of Southern California! Bwahahahaha! This is madness. Those loan mods are basically to keep banks afloat and pad their current balance sheet until they can tweak the public-private investment program to unload this crap to the public. They have nothing to do with keeping the homeowner afloat. Here is a loan mod for you. How about you foreclose, list the home, and let the market decide the price without government subsidies to prop up the banks? This is like being shocked that the cash for clunkers program is working. Well no crap! You are giving money away! I’ve never heard someone in my life say, “gee, thanks for that free money but no thanks.”

It is pure madness. The data is rather clear. And don’t think this is some tinfoil hat conspiracy. Even the MSM is going with this but there is no way to look into the REO books of banks since they are cooking their data like Julia Child:

“(Reuters) Shadow inventory has the potential to give us another leg down on home prices during the second half of the year,” said Steven Wood, chief economist at Insight Economics in Danville, California.

“It appears that there is a significant amount of shadow inventory in the form of bank owned properties, which will continue to grow with the rising in delinquencies,” he said. It can take about 4-6 months for a house for be out of foreclosure and ready for sale.

Torsten Slok, senior economist at Deutsche Bank in New York, said about 1.8 million homes are currently in foreclosure and they will continue to weigh on home prices at least for the rest of this year.”

No doubt. And with those toxic Alt-A mortgages how many homeowners are going to opt for the ridiculous modifications that basically make them lifelong renters with zero mobility? Get ready for round two. This wave is coming and nothing is going to stop this. Summer selling season is nearing the end and we are now going into the slow selling season with shadow inventory coming into the light.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

53 Responses to “Shadow Housing Inventory: The Deception of the Foreclosure Numbers and the real REO Picture. A Case Study of Southern California Real Estate. How 40,000 Homes are Hidden From Public View by Banks.”

NAR was not mentioned but is a co-conspirator in this cover-up. As a reminder, they are an industry trade group in the business of getting you to buy a home. I’ve mentioned this many times but their press releases are often just re-released in the mainstream media without any journalistic verification. We all know that accurate numbers can be used to create misleading and sometimes outright deceptive conclusions. That’s why we have the good Doctor!

Right now, NAR (along with their co-conspirators) has created what’s called “momentum buying” in marketing terms by creating a motivational environment. One should never underestimate the power of good marketing, especially in a country where wishful thinking and lack of healthy skepticism/intellectual curiosity have led us into the bubble in the first place. We are in a sucker rally so don’t be fooled.

Be brave Comrades!

Thank you DHB. They have eyes but do not see. They flock like Lemmings to buy the deals of the century. Wonders are how many of these $8K home buyers will be foreclosed upon in yet another wave.

Keep up the good work.

Need more convincing, go here:

http://www.businessinsider.com/henry-blodget-state-of-the-real-estate-market-july-6-2010-plenty-more-downside-2009-7

I trust you Doc… Although it’s hard to sit on the sidelines and watch the housing prices go up (over the last 4 months) in the Woodland Hills neighborhoods we are looking to buy in eventually. I lean very hard on the data you reveal and because of it know we are headed for another downward housing spiral soon. My spouse keeps fretting that we’re missing our opportunity to buy and that housing prices will only continue going up, despite your articles that I regularly share. Thanks for the constant reality check to hold on to our hard earned cash awhile longer!

Thank you Dr. Bubble. I think shadow inventory is key to understanding why there will be no real estate price recovery in the near future. It’s physically impossible for home prices to increase or even stabilize with funding for cash strapped potential home buyers tightening coupled with the foreclosures and potential foreclosures banks are refusing to recognize.

I happened to watch “This Week” and caught the Maestro in a conversation with George (it’s still available). Clearly this is the issue which has him worried. He knows exactly the kind of toxic garbage that’s out there, having had a hand in it’s production.

http://abcnews.go.com/ThisWeek/

In our area (San Francisco Bay Area) one of my neighbors put her house on the market this spring (now widowed). Listed at $850,000, built in 1978, no upgrades, needs a paint job. After 2 months,(no offers) , lowered price to $780,000. After 3 months, no offers, so pulled the house off the market until next spring, “when prices should go up again’.

Despite all evidence to the contrary, people will just not believe that things are not going to “bounce back”, and everything will be ok in 2010.

The massive round of layoffs of public employees has not even hit yet(just hand wringing about “possible” cuts.)

When THAT wave of enempolyment hits, a large group of very well paid potential buyers, with stable jobs, will be GONE. That can not possiblly prop up current home price levels.

The number of abandoned homes not on the market in my neighborhood is staggering. Take a look at any neighborhood that was heavily built during the boom years and I am guessing they are all similar. My whole street was sold in 2005 and 2006 and currently looks like a bomb went off sometime in the past few months. I notice you didn’t give an option 3) bank intentionally keeping a massive amount of shadow inventory so they don’t continue crashing the market with the true number of foreclosures. It is also probably the same reason after 8 months of non-payment I still have no NOD. I figured my house would be sold and I’d be a renter by now, but I am beginning to believe I will still be living in this house next summer. The banks are delaying the recovery in some ways because the longer they wait on all these foreclosures the longer it will take for people to get decent credit again.

Wake up and smell the coffee folks! No amount of govt manipulation will save the RE market from doing what it ultimately has to do. Clear out all the garbage loans that are a figments of home-debtors imagination. As prices drop in the mid to high-end levels, smart buyers will wait until there is a hint of upside. That won’t be for years. Banks will take on more homes in hopes of dumping them on taxpayers (Ex PPIP). Bubble pricing is over for the next 10 years or so. With no rush to buy, buyers are now in the driver seat. In a couple years they will be able to pick and choose as high paying jobs keep shrinking.

The Westside of Los Angeles is in for a rude awakening. Dr. HB has been ahead of the curve and continues to be so. Numbers don’t lie, but salespeople do.

http://www.westsideremeltdown.blogspot.com

Great insight Dr. The media spin is working. Friends and family are affraid for us. Trying to get us to buy now so we don’t get priced out. Articulating facts to them is futile.

Regarding shadow inventory. We are considering signing up for a free trial on one of the foreclosure websites, tracking the reo’s, then driving the neighborhood we want to buy in (Ladera Ranch) to see what the status is (listed, occupied, etc.).

Though un-scientific, it may give us a feel how banks are dealing with that community.

Has anyone else done this?

Any thoughts on which foreclosure websites are best?

Doc – this is great and all, but what you are missing/not telling us is when/if this is all going to change.

We know the banks are artifically restricting supply – we have known this for some time now – at least a year or so. We keep being told, just wait, the floodgates are opening – any day now.

One year later and we are still waiting. Further, the banks have no so restricted supply that the prices in some areas have stabilized and even gone up. If thats the case, why will they quit doing what they have been doing for the past year and simply dump them out?

So again, thanks for reaffirming what we all know. We all assume some day they will be dumped, but if the banks have been able to control supply long enough to tame prices, I see no way they are going to reverse course now.

The good Dr. has presented a pretty clear case for not buying any real estate until at least 2013. Based on his Alt-A reset chart which peaks in Sept. 2011, then you have the typical NOD to Foreclosure to Eviction process which can take up to a 12 months to complete, plus the 4-6 months for the foreclosure to time to market time, you get January 2013 when the market will be flooded with REOs. This will not be a fast correction in the market especially for the mid to high end. Be patient, wait another 3.5 years, and you can have your dream home for a great price.

Cengiz, you make an interesting point. If the banks have continued this long in holding back their inventory, what would keep them from continuing that practice for the next 5 years?

Thanks for the facts Dr. H, it keeps us sane during the emotional turmoil.

Hey Dr –

Can you do a real homes of genius on some of these foreclosure prices? I’ve been looking at and touring some foreclosures, and the prices are astronomical for the work some of these houses need.

For example, I went to look at 5228 Satsuma in zip 91601 – 300K for a house that was going to have to be entirely remodeled inside and out, was originally built in 1918, and had an apartment building spring up next to it recently!

Something seems fishy here.

I don’t know Doc, I’ve been a reader of your blog since the beginning and appreciate your points, but I’m starting to think the worst is behind us for now. Despite all your charts and data, the Banks have been successful at disguising their losses through the cooperation of the FAS board and the change in accounting of those assets. They can now show those assets on their books at their purchase price, so they don’t need to put up any more capital AND they pass the Geithner stress tests.

While they buy time in this way, they keep raising money in the secondary market and waiting for the market to recover. It might not hide the problem forever, but it will cushion it over time. Meanwhile their stocks keep rallying–Bank of America went from $2.50 per share to over $16 per share!! The banks seems to be doing great, and are at their old game again.

Never forget that Madoff got away with his ponzi scheme for decades.

The Banks can do the same and have no less than the US government on their side. You can’t win. They pocketed all those profits for years, and now that the bubble they helped cause is deflating they are going to be able to manipulate their way out of bankruptcy or even having to take stock losses.

How does this new inane “owner to renter” bill just voice-vote-passed in the house, affect the equation? Can now banks decide that their balance sheets are better off by pretending that the value of their houses is higher than it really is, and covering up the truth by allowing the “owners” to stay in the houses as renters at an nice, affordable price? Then (the banks think) in five years or so, they can try to sell the house back to the so-called owner, at a higher price, or just take it away and sell it to some other suckers who are well-heeled or desperate enough to pay the still-inflated price.

Banks are clever, and they have the government behind them, bailing them out of any risk, every step of the way. I would feel more heartened if I understood what is going to prevent them from continuing to play these games of restricting supply the way monopolists and cartels do. Even worse is the spectre of all these deadbeat homeowners, most of whom are underwater only because they refinanced a bunch of times and took the money out for fancy cars and vacations, being able to accumulate more capital by not paying their mortgage, or now being able to rent the house they bought at less than the mortgage price, due to this most recent travesty of legislation.

Its a sad commentary on the state of journalism in the US when a blogger is able to do what the mainstream media can’t do. You are the best source of the truth in this housing market.

As for the shadow inventory I have to admit that I didn’t believe it at first. I am a very succesful REO agent. http://www.jamesegallagher.com This time last year I had over 75 listings. Today I have 3 even though the NOD’s have gone up.

I don’t think there’s any doubt that while the banks are clearly overwhelmed by the need to process a huge and growing number of defaults with a smaller (due to layoffs) workforce – that most of the shadow inventory is the purposeful withholding of supply from the overall market.

There are plenty of reasons for this, economic and political. I think one of the most interesting may be related to the fact that, due to the large numbers of zero-equity defaults – a small number of large financial institutions are now in effective control of a large fraction of the potential supply of houses on the market.

Economically – the strength of this position means they have a very strong incentive to operate as a quantity-constraining (price-controlling) cartel. You don’t have to be a monopoly to have dominant-player power in a market.

So this would mean the banks can indeed maximize profit if they behave like an OPEC of real estate – a strategy that is viable since they are supported by 0% bailout loans and government capital infusions.

Now that I think about it – that term is probably the best to use to explain the issue to people “BANKS AND SHADOW REOS – THE OPEC OF OUR HOUSING MARKET”

“If the banks have continued this long in holding back their inventory, what would keep them from continuing that practice for the next 5 years?”

Precisely! I pointed this out a year ago, and was told, “it wont happen – banks will open the floodgates long before they reach price stability” – well guess what folks, that happened – the banks did what the bloggers told me they could not do.

Even worse, now that they have achieved stability, there is no reason not to maintain it – as long as it takes. Diamond Co. DeBeers is a great example. If they sold all the diamonds they held, prices would be about 10% of what they are now. 50 years ago, as they rose to power, many said, they couldnt manipulate the market forever – well maybe not forever, but 50 years and still going strong!

Unfortunately I think Indy hit the nail on the head. For those of you who do not have a background in economics google “cartel theory” and you can see what he and I are talking about. As much as I would like to think the banks are going to release that shadow inventory soon – everything I see suggests they will act as a cartel indefinitely.

In our area (Sacramento) you see only a few of the many foreclosures actually put up for sale and when they are some cash paying investment buyers swoop in and bids way high to get the property. The agents claim the appraisal will “protect” you and urges you to bid high. So either it is a really stupid game of bidding ridiculously high to get the place only to have the price reduced after appraisal or they are still up to the normal dirty tricks business. So you are left to short sales and waiting endlessly for the bank to get back to you, which apparently they have no good reason to sell so they don’t.

With all these comments, one must not forget that unemployment keeps increasing, gas prices going higher, and banks are lending money to a few people. No matter how hard Banks try to delay, cover it up, and get bailed out, it comes down to what the buyer can afford. Today, most buyers can afford a little to buy a house, and you will see house prices continuing to go down. Yes, there are some that are buying now, but I bet mostly they have no choice due to job relocation, or just moving up.

What I worry most about it when interest rates begin to skyrocket as cash becomes king in a few years. The Feds will not even be able to borrow as foreigners and investors begin to run out of cash and the ones that do have cash will charge higher interest rates. Housing prices will severely go down.

DR you the foremost authority on housing forecasting in So Cal that I have found. You are like a Harry Dent Jr focused on a mirco level.

Great comment by Matt. I love the good Doctor, he does a great job of reporting. MSM sucks. Some people think that the banks can hide this shadow inventory forever. They need to read some other independent bloggers. The factual reserve banking system that we have today is a major fraud that cannot survive another Great Depression, which is what we are in the beginning of. Treasury cannot sell the number of bonds to foreigners already in order to pay for the Obama Budget. The Federal Reserve is printing money now to finance Federal Government Debt. A Depression doesn’t just get transfer wealth from the poor to the rich, it also gets rid of a lot of bad ideas and behaviors. The truth will come out and it will not be pretty. Our Quasi Fascist economy is a bad idea,

Hey, Cengiz Khan

As to your diamond cartel theory, it’s not that the American people

are waiting breathlessly on ever house the banks release at the

prices they put them on the market for.

The banks won’t loan to many would be buyers at the gross

income multiples required to buy these properties. People

can’t buy the houses because they can’t get the level of

financing to buy them. The banks are just making sure they

service (read swindle) all the eager (read greedy), cash-fat buyers

first. Then they will lower the price to get the next available level

of less gullible sucker until the market finally reaches its

true bottom. Of course, by then it’s 2014, and the people who

bought, today, have lost half the value in their too early purchase.

Yes, the banks have a plan… but unsold houses rott,

diamonds don’t.

Dr., Indy, Cengiz, Matt, Rayme:

When would you try to get into the west LA starter home market? Looking at places that are around 650-700k 3bed/1 bath.

What I don’t fully understand is how the banks can sit idly by and lose billions a month.

By some accounts the number of REO properties is nearly a 1,000,000. If the average loan balance on those loans is say 200K, you are looking at 200B just sitting there and assuming a 5% return, you are looking at additional 10B per year (nearly 1 B per month).

Now if we just look at defaults (not REO or NTS) and assume an additional 100,000 loans at the same 200K balance, the non-performing assets are growing at 20B per month and banks are losing an additional 100M per month, I assume chump change.

Now I understand mark to market allows them to sit from an accounting perspective. However, the banks “service” these loans–typically for other banks and affiliates. The service banks need to pay the asset owning banks (whether those be interest income or principal asset owners). From a cash flow perspective, I understand the banks are borrowing from the Fed at nearly 0% to offset the cash flow and pay the asset owners versus foreclosure their other option. But when you are borrowing just to service debt obligations, you only increase your total amount of debt (kind of like the US government).

To Rayme’s point above, at some point in time Treasury needs to put that on hold and at that point in time the growing debt really has to bust.

Now going back to my simplistic assumption of banks losing 100M a month because of new defaults. AltA, Option Arm loans in mass at likely much higher balances than 200K are likely going to take that 100M number up to closer to a Billion. I’ve seen numerous accounts by Dr. HB about loan amounts closer to the 400K number and if the rate of default doubles–you are looking at close to a billion. Add in a massive commercial real estate bubble, massive unemployment, California budget deficits (which are only going to increase for 2010), couple those with economic realities that at some time interest rates will rise, food and energy will rise and the government will become forced to tax everyone except those on wall street more and you got big problems

“Some people think that the banks can hide this shadow inventory forever. They need to read some other independent bloggers”

You mean like Mr. Mortgage who breathlessly told us about the imminent dump of REO last year which he ominously entitled “the quickening”

http://www.youtube.com/watch?v=tMpCB9Ckk-o

These bloggers were wrong then and they are wrong now. They said the banks would dump, they didnt. They said the banks cannot stabilize the market, they did. How many more times are we going to listen to “its coming” “its coming” before we doubt the message? The cange of MTM rules allowed the banks to hide this stuff forever.

Sorry, you can tell me all day about how much is accumulating, but until you can see it on the market, its merely another story confirming what we already know.

For the banks, holding a bunch of non-paying NODs become a balancing act between their balance sheet and their income statement.

Without mark-to-market, the notes they hold are still shown as assets on their balance sheets. By not taking a write-down, they preserve their reserve margins required by the Fed so can they stay in business as banks.

On the income sheet side, they are foregoing debt service pass-through and hence have to eat their cost of money – essentially zero thanks to the Fed’s very low interest rates. They are not making money on the loans but they ain’t losing much either, mostly the amount of principal in the payments. Money is cheap for banks – look at money market rates and savings account rates.

Therefore it cost them little or nothing to have a deliquent owner sitting in the house and maintaining it. Yet if they go to foreclosure they take a haircut on their assets and their reserve margins are challenged. The government sure doesn’t want more banks becoming insolvent so will keep money cheap. That leads, inevitably to inflation, stealing from all savers and producers.

So for a bank – foreeclosures risk going out of business while holding NODs cost next to nothing.

The banks will have to face up to the cramdowns when interest rates rise. That will change the balance and foreclosures will hit the market.

The US government, the Federal Reserve, and the banks are all waiting for inflation to save them – and screw us.

Tell me where I’m wrong.

Whitehall – precisely. This is why so many homes sit there with someone living there without paying the mortgage, keeping it in (respectable) shape from squatters, etc. Even worse, the deals they are striking allowing people to “rent” the homes helps their balance sheet til they decide the time is right to sell that particular house.

Bottom line, whatever incentive the banks had to “dump” assets has now been significantly lessened.

The financial institutions are delusional much like the rest of this country (United States of Delusion- USD). They believe this is you garden variety recession and that home prices will bounce back just like they did in previous recessions and then they won’t have to write down anything. As the readers of this blog know, it just ain’t so. There is much more pain to come: http://www.marketwatch.com/story/nearly-half-of-mortgages-seen-underwater-by-2011-2009-08-06?siteid=yahoomy

Remember, mark to market suspension makes this shell game totally legal. Despite the gov shenanigans, you can’t sustain the unsustainable and therefore the question is when, not if the losses get exposed and its game over. The Lost Decade, USD-style is coming. Boy, will we show those Japanese how to screw an economy the right way!

Be brave Comrades!

@ Whitehall: “They are not making money on the loans but they ain’t losing much either, mostly the amount of principal in the payments.” I fall into the bucket of frustrated renter waiting for things to happen.

My opinion of why banks WILL release the shadow inventory sooner than later is a clear reflection of your statement above. The banks aren’t loosing but they also are not making money. Banks are in business to make money, otherwise it’s like playing a game of Monopoly where all you do is roll the dice, move around the board and collect $200 for passing GO. No fun and no profit. Banks are not stupid. Greedy and calculating, yes but not stupid. They know that they need to cut their losses in order to move on and that is the only way they will again begin to make money. The Gov has their backs as far as not letting them go under – the big ones at least. Also banks know they need to do it quickly – by 4th Q, because they too are aware of the Tsunami a-comin’

Hello Doc. I am a big fan, but I don’t follow your argument regarding MLS inventory. Maybe you can clarify for me.

NTS = Notice of trustee sale. This is the second stage, and it is recorded 30-90 days after the NOD. This is posted in a newspaper, like the Irvine World News, and lists the time and place of the auction, the address, the NTS amount, and various other legal info. It has to be published for three weeks.

Trustee sale/REO = back to the bank, or someone bought it at the auction. This is the final stage, and it is when the owner loses the house.

You are counting both NTS and REO in Q1 and Q2 together. Besides the fact that NTS can’t be on the market as its stage 2 of the foreclosure process, you’re left with ~90,000 REO available to the MLS. If inventory in Jan was ~115,000 and there were ~112,000 sales to date this year, then we’ve worked through ~98% of the inventory, giving us 6 months to clear all inventory. So what?

I guess I still don’t see how your math is showing that 40,000 homes are shadow inventory. Btw, I’d assume 80+% of those of those NTS you counted ended up REO by Q2.

Congratulations on a Doctor HB reference on Business Insider!

http://www.businessinsider.com/trash-can-photography-all-the-rage-with-california-realtors-2009-8

A sign that people are waking up and starting to smell the coffee? Unlikely, but a boy can always dream.

Well it seems like people are finally getting it. Yes it is true there is a huge backlog – it is also true that they will NEVER release it en masse.

I serve as outside counsel for one such bank. When MTM was in place, I told them to cut their losses, sell as quickly as possible, get back to solvency ASAP.

As soon as we realized the defaults arent stopping anytime soon, we went to Capitol Hill and FASB, asked them to suspend MTM but still be in covenant with GAAP.

That changed everything for us. By our reconing if we get 80% default @ 60% loss rate, our total loss will be 14B. Thats doomsday scenario & would wipe them out at once. Thus their plan now is to spread that loss out over 24 years if necessary. Moreover, thanks to relaxing MTM, they can do it, all the while ekeing out the smallest of gains.

Why not cook the books and get paid for it too?

http://www.usatoday.com/money/economy/housing/2009-08-05-mortgage-foreclosure-help_N.htm

I think there’s some confusion about the nature of this shadow inventory problem, so I’ll try to clear up a few things about it.

The claim that is being made here has two components 1. A Gap Exists, and 2. It Exists By Design: The claims are explained further as the following:

1. There exists a legitimately mysterious (or, at least, presently unexplained) gap between the amount of recent mortgage default activity (that is, people who stopped making timely full payments on their loans within the last two years or so) and the number of bank-owned homes currently available for resale on the market.

In ordinary times (and ignoring the impact of government agencies), a delinquent debtor is contacted very promptly by their bank and is allowed a relatively short period in which to “cure” their delinquency. Depending on the laws of the state – a bank will, in absence of cure, move as quickly as legally possible to foreclose on the property. The rules are different by county – but once the bank gets court approval, a date is set for public auction.

Recently, because debts are tending to exceed current market prices, most “auctions” get no bids above the judgment value and therefore amount to bank repossessions. I recently sat through a lengthy public auction in King County (Seattle) and over 90% of the properties ended up in the hands of the banks as REOs. Typically thereafter, the bank has little interest (and may not even be permitted) to do anything else than hire a real-estate agent to promptly sell the property for whatever the market will allow.

What is being claimed here is that, for whatever reason, this system is not working in its normal way. We can get a good estimate as to how many REOs should be on the market given what we know about the recent default behavior and we observe significantly less listings than the normal process should yield.

We are calling this gap “shadow inventory” in part because there is broad recognition that it’s absence from the market, whatever its cause, is undoubtedly obscuring the true picture of the health of the housing market and warping the estimate of the timing and magnitude of the eventual re-balancing at a new equilibrium of supply, demand, and pricing.

2. The second part of the claim deal with the explanation for this gap. And here, there are many speculative rationales which can be guessed at for why this may have come about. It may be a completely accidental and innocent phenomenon – for instance – if it’s just a matter of the banks being unable to handle the heavy workload, or being constrained by new legal requirements.

But the charge that is being levied here is that at least some, and perhaps a great deal, of the shadow inventory gap has been brought about on purpose as a conscious strategy of the banks to operate as an informal cartel. This accusation depends on a hypothesis that it might be in the banks’ ultimate interests (which means, enhancing the overall long-term profitability of their assets, preserving the short-term solvency of their balance-sheets, and not running afoul of their regulators) to purposefully keep at least some inventory off the market for longer than normal.

I speculate that this hypothesis is correct – that because of the slow-motion nature and inventory sensitivity of the housing market, and because a very small number of very large financial institutions are (or soon will be) essentially in effective control of a substantial fraction of the vacant housing supply – that they have sufficient market power to alter the normal equilibrium and capture larger gains (or endure smaller losses) than they would otherwise experience in this downturn.

At the very least – they have the ability to create a temporary seasonal pause in price decline – a tactic that is probably of low cost if also of relatively short duration. That implies some capability to manipulate estimates and expectations which can also be used to enhance the eventual value of their assets.

So that’s the shadow inventory claim – I have a feeling we’ll all find out fairly soon whether it’s a meaningful theory.

The bank’s losses of cost of money for a deliquent mortgage is essentially buying an option of future government bailout and possible market recovery.

One possiblity is that a house price will recover in nominal terms IF the value of money drops low enough AND incomes also track inflation to some degree.

Another possible future event is further government meddling in the market or financial industry regulation. I see where FDIC called the banks on their phoney valuations then Rahm or Geithner started screaming at “the regulators” for not playing with the team.

It will vary from bank to bank but I’d say a test is what are the profits impacts from holding bad mortgages? Some banks will be heavily exposed, especially if they concentrated in residential real estate, while others are more diversified and can take a hit easily.

I don’t hate banks. They are a vital part of our economic system and we can’t have too much failure and collapse. We do need some more transparency from our government.

I’m curious what the numbers are of non-distressed homes being pulled off the market. I’ve been watching homes around the Sacramento area for over a year now, and I’ve seen so many homes lower their prices, lower them some more, and then disappear from the MLS. I expect to see them show up as sold a month later, but quite a few of them don’t even show up as sold. Also a lot of homes that are priced at or above their 2004 value, while other homes are at 2002 prices. A broad range out there still.

FANNIE MAE suffers massive loss, seeks more aid…

WASHINGTON (AP) — Fannie Mae is seeking an additional $10.7 billion in government aid after posting another massive quarterly loss as the taxpayer bill from the housing market bust keeps growing.

The mortgage finance company, seized by federal regulators last September, posted a second-quarter loss of $15.2 billion, or $2.67 per share, including $411 million in dividend payouts. That compares with a loss of $2.6 billion, or $2.54 per share, in the year-ago period.

The government, which seized control of Fannie Mae and its sibling Freddie Mac last September, has already spent about $85 billion to prop up the two companies. Fannie Mae’s new request from the Treasury Department will bring the total to nearly $96 billion. Freddie Mac is expected to report its quarterly results on Friday.

—

The Obama administration is expected to unveil its plans for Fannie and Freddie early next year. Options being considered include keeping the companies private, winding down their operations, merging them into a federal agency or separating out their bad mortgage assets into a new company backed by the government.

Meanwhile, the head of the federal agency that regulates Fannie and Freddie Mac, James Lockhart, is stepping down at the end of the month.

HUGE NEWS!

Intellichoice ordered to desist and refrain by the CA Dept of Real Estate http://su.pr/1DgqR3 hooray! One more scammer down!

It appears that based on Tallia and Indy’s comments, prices will remain stable and not drop as much as it should under normal market times. Sounds like if the banks get there way and fed continues to back them, DHB’s theory on prices going down will never come to fruition. In other words, prices will remain out of whack for people who want to buy starter homes in W. LA. I guess 150/yr ain’t going to cut it in W LA. Two options: buy in the Valley and commute or continue to work hard and SAVE for a larger down payment.This sucks, but I guess it is life.

Oil and diamonds are non-perishable commodities if you will. Houses fall apart and require constant maintenance. Even five years would cost a huge amount. If the bankers can borrow indefinitely and limitlessly from the Fed (which is currently monetizing the national debt too) then maybe they can pull it off.

http://www.zerohedge.com/article/feds-ust-pomo-pyramid-scheme-exposed

Banks that have now become “too big to fail” are indeed “big enough” to manipulate I am sure they are. That also makes them “big enough” to despise. I am somewhat pessimistic as some are about the alt-A, POA Tsunami producing the flood of fairness that we all want. It seems almost certain that Obama, his congress, and his Banks and the disgusting Fed will have some enormous, jaw-dropping, wholly unfair, market distorting moral hazard for all of us to swallow – right when the big wave of defaults hits. It will be some gimmick that allows the NOD to never need to be issued. Permanent limbo/free mortgages for millions. So I am rooting more for the Silver Tsunami of Baby Boomers. Many of them will need to despeerately cash-out soon, and at the very least, downsize their housing in the coming years. I don’t see how the banks can manipulate that quite as well. Ironically, The baby boomers have to sell their (sometimes multiple) houses to generation x, which is like a third smaller and significantly poorer than their parents. Permanent supply overhang for a generation? I don’t see any “flood” coming, but I do see years and years of gentle price declines. Right now is the predictable knife-catcher rally. It is being fueled by the last foolish cash-heavy “investors” and sadly, by incredibly unethical FHA loans, written completely on our behalf, (but without our permission) that are not only propping the prices up significantly, but will end up on the taxpayer’s balance sheet shortly. This 2009 plateau/propping-up cannot be sustained indefinitely. Remember, all bubbles that burst form a distinct “shoulder” about half the way down. All they can do is extend the shoudler out for a while – maybe years?

I don’t see how Inflation can make prices go up in real terms. With a surplus of willing labor at their disposal, which employers are going to inflate their wages to keep up with the inflation index? None, of course. Most of us will just slowly grow poorer and poorer and poorer as the dollar shrinks, and necessities go up in cost. So, who exactly is going to pay for those “inflated” house prices?

Doc,

I too want to believe in more distressed inventory coming on line over the next 6-18 months and destickifying prices in the $800k+ market in SoCal.

But you’re assumption is that at some point “shadow” inventory becomes real inventory. But all behavior thus far suggests that the lienholders will permit only a trickle of inventory to flow to market, by delaying NODs, continually agreeing to push NTS dates into the future (for up to 1 year), and when they finally do go to auction and become REO, then sitting on them and listing only a fraction.

We need mark to market, and we need to stop trying to stop or slow down this process. Let’s get true price discovery, and we’ll find the bottom faster and thus will also speed up the path to real recovery.

“I don’t see how Inflation can make prices go up in real terms.”

Prices will not go up in “real” terms but the value of the dollar will implode and the posted prices can indeed skyrocket. How did housing prices behave in the Weimar Republic and in Zimbabwe? I don’t know but I guess they tracked bread prices.

Such inflation would make the banks’ balance sheets whole.

Some areas of high labor value, like my Silicon Valley, should see wages “mark-to-market” to some degree during inflation. Real wealth and income will fall as inflation steals from the productive but the asking price for labor will rise.

BTW, I’m bothered by people talking about a bank “cartel.” Certainly, the Fed could be called that but again, we wouldn’t want ALL the banks to fail, now would we? I can see many banks with the same set of incentives acting in the same manner.

The NOD overhang is metastable but the government and the Fed are working to keep it from destroying the banking system. Rational housing markets are of lesser priority.

A house is not a necessity, like bread, because one can always rent, or share a roof. When a greater percentage of your income goes to milk and bread and gas, owning a home will become more like a luxury and the pool of potential buyers will shrink. Oversupply generally results in lower prices, no?

“All” the banks will never fail en masse. The biggest (and most toxic) ones will go first and the next ones down will buy up their assets at a major discount. Eventually the ones in the middle will have “picked up” enough pieces to make themselves able to survive the cascade. I hate the argument that you can’t allow banks to fail. YES YOU CAN, There will be some pain and maybe some chaos, but there will always be another smaller bank willing to quickly mop up and fill the vacuum. Look at WAMU, I didn’t see any problem with the transition.

Maybe the people buying with cash know something we don’t? Like the govn’t and fed won’t allow prices to go down using connections, corruption, bailouts, manipulation and shady accounting? Is something learned from the upper class 3rd world is coming this way?

I think people waiting for another big drop in home prices in the Los Angeles area are going to be sorely disappointed. I’m not going to say we’ll see a precipitous rise, but the free-fall is over. I absolutely understand the “Doctor’s” shadow-inventory theory completely. I just don’t buy it. See, when this decline started, banks were hurrying to dump bad assets off their books and foreclosed immediately. Now, as the Doctor has pointed out, banks are patient. Why? The government is on their side… that’s why. This administration has basically come out and said that there is NOTHING that can possibly happen that will allow any of these banks to fail. So, whatever slight-of-hand accounting they need to partake in to keep things going in the right direction will be done without question.

So, there can be 40K shadow homes in the LA area, and these banks are simply going to sit on these bad assets as long as they need to… and release them slowly. If more foreclose? No problem. We’ve got a template now, and you’re not going to see banks puke out loads of REOs like we saw in 07 and 08.

Short-sales are a normalcy. Some agents specialize almost exclusively in SS’s. The banks know this. The agents know this, so why foreclose? Have a buyer under-water? Write up a short-sale contract and sell it below cost. Sure, banks will take some hits this way… but it keeps the purge going.

Meanwhile, we now have a significant number of price prints that simply won’t be collapsing without significant downward pressure. If someone has been on the sidelines waiting for a home since 05, and they finally see those prices returning to pre-bubble prices, they’re going to buy… particularly if you’ve got price prints showing a floor.

If someone is looking for a 3/2 in Tarzana, and the average price bottomed out at $450K, and then rose to near $500K… there’s only so much room below $500K before buyers snap up what they assume to be deals. And keep in mind, all of this recent price-action has been done with lending being as tight as it’s been in decades. So, as lending begins to loosen, and it will… you’re going to see those support-levels hold, and likely… rise.

Now, is this everywhere? Of course not. Outlying ares that ran up the highest are still going to have a tougher road to recovery. But, if you’re waiting for some sort of big price drop in Studio City on a 3 bedroom house, I think you’re running a fool’s errand. You don’t have to buy now. You don’t have to buy at all. But, I think the Doctor and many others are grossly underestimating the pent up demand for housing in desirable areas in Los Angeles, and the post-bubble conditions that will allow these banks to navigate the land-mines of bad assets.

The government has given the banks get-out-of-jail-free cards, and you can well-expect that they’re going to use them to come out of this just fine. Unemployment is thought to be at or near its peak and yet… we saw a major spike in home buying. As things improve, and they will… I wouldn’t be looking for the next big “pop.”

Bubbles don’t burst twice.

All bubbles have a rise in the middle of the way down due to over-zealous knife catchers who see 40% off as a steal, and jump in. They forget that the run-up was 200%+, so 40% off is not a deal, especially when you cannot be cash-flow positive on hardly any properties right now. There is definitely pent-up demand, but also a shoot-load of pent-up supply, people who are dying to sell, but waiting for the prices to show an uptick. The stalemate cannot last forever. In a word, delusional sellers will capitulate at some point.

@ Cengiz:

I think the problem (and the main difference) in your DeBeers example is that properties, particularly houses, are not stable entities like precious stones. A house that sits vacant and abandoned for years is going to deteriorate and fall apart.

Already, many properties that have been walked away from are showing tremendous signs of decay. The yards have died or gone to seed, often to the detriment of neighboring yards, and the houses themselves fall into disrepair. The values of these houses will continue to fall while they sit idle, and it will do so at an increasing rate over time. The banks cannot sit on a house the way DeBeers can stones. They have to move these properties (sooner than later) or suffer even greater losses or worse, orders from municipalities to maintain the houses or suffer fines.

Out in Victorville, CA, there were a bunch of (way overbuilt for the area) houses that were model homes; they weren’t built to code. The banks took over when the builder defaulted and were ordered to bring them up to code or face fines by the city; instead they tore the homes down. …this is what the real future of this shadow inventory holds. Sale in the near future, or demolition!

“As things improve, and they will… I wouldn’t be looking for the next big “pop.†Not only am I looking for the next big pop, I am counting on it. Its coming.

Bubbles don’t burst twice. 2 bubbles bust, each bubble once. The overflated home bubble and the debt bubble. What about all the debt out there, such as federal unfunded obligations($65 trillion or so), you know, the boomers retiring and taping into medicare and social security. Their 401ks are shot, they will be dumping their homes on the market soon. Banks can’t hide those. Homes do need to be maintained, as a landlord, I know. Personal bankruptcies too. How long do you think it will take to pay this off, assuming it will be paid. Bryan, you are assuming the growth paradigm. This paradigm is dead as we have run up against the limits of nature. Food production( in part due to soil depletion), oil production, coming shortage of many minerals, potable water, etc.

Bingo jimbo! I read through all these comments and was waiting for someone to point out the OBVIOUS, that the old paradigm is dead! Had to wait until I hit your post, the very last one! Geez, I should know better, that if I want to find out how things end I should hit the last chapter first!

This is the trend in the BIG cycle, the ONE cycle that is (growth) capitalism. And that trend is DOWN. Sure, we’ll see some upticks here and there, but the path is down, down until the entire system ruptures (or just decays, like some abandoned property).

I recall over 2 1/2 years ago telling my brother (who dabbles in real estate) that real estate prices were going to drop. No way he said. I just saw a house in my neighborhood sell for $265k; previous sale price? $390k! (and this is in one of the more stable markets in the country!) About 1/2 year ago I stated that property taxes were going to go down. Of course, this really has never happened, so folks felt pretty smug in refuting such a claim. Well, I’ve now seen it!

How could property taxes go down? My argument was that, in addition to the fact that people’s wages were dropping and unemployment was rising, more and more properties were falling back into the hands of the banks. Consider the banks as having a bit of sway; already struggling, banks are going to put pressure on their pals in government (sound familiar?).

And what happens when property taxes go down? MORE unemployment! Followed by yet more foreclosures and on and on downward we go.

People can speculate all they want about how things would work in a functioning system, but this system is broken and cannot be repaired- for why would we want to do that when it was horribly defective to begin with (people now know it!).

I love real estate optimists. It could be the worst economic melt and they would swear by Judas. That they can still do business. I have known guys like that in the past. They faired really well. Of course that was in the boom days. Now some of them are on welfare. Most of those guys the short term. Made more money than any time in my life. Shot their wad because they made some big money fast and now have to collect food stamps. Have to learn the hard way.

The guys with staying power. They don’t blow all of their money on marketing. The fast buck guys try to get you to spend all of your money on marketing and take all of your risk for you.

Fast money is the big lure.

On the other hand the September report of ForeclosureRadar says there is no shadow inventory in California. (https://s3.amazonaws.com/CA_Foreclosure_Report/September+2009+CA+Foreclosure+Report.pdf).

Comments anyone?

Leave a Reply to DG