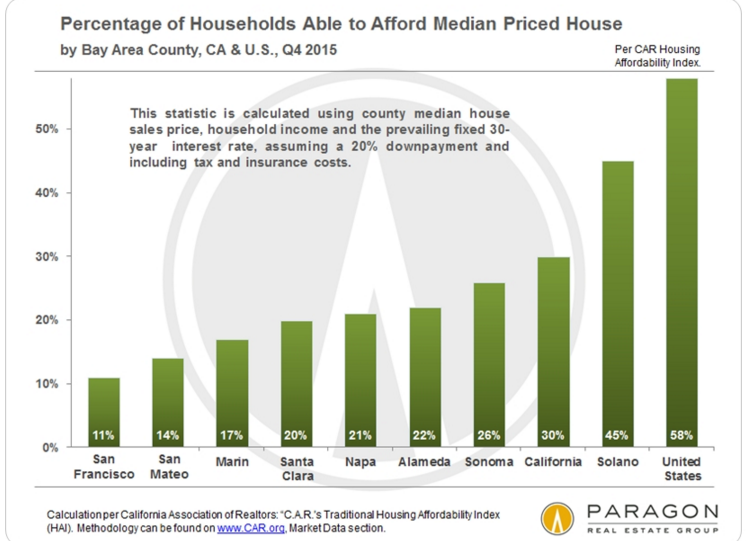

Did San Francisco real estate values hit a peak? Only 11 percent of San Francisco households can actually afford to buy a home at the current median price in the place they live.

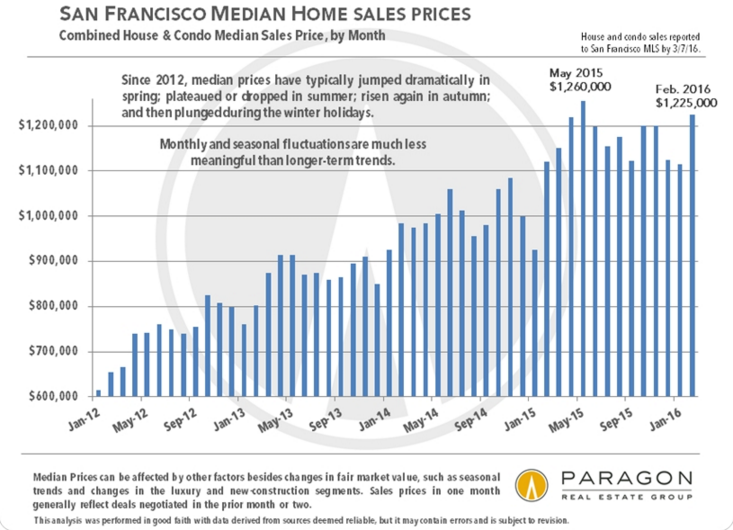

It is hard to believe but home values in San Francisco have doubled in a matter of four years. Since 2012 the typical San Francisco home went from $600,000 to $1,200,000. The Bay Area is under a tech based hypnotic spell and foreign money just can’t get enough of million dollar crap shacks in San Francisco.  As we all know trees do not grow to the sky with unlimited potential and at a certain point the laws of reality have to hit. Only 11 percent of households in San Francisco can actually afford to purchase the typical $1.2 million crap shack. And that is why home prices in San Francisco have been waffling for the past year. It looks like an interim peak has been reached. Of course this also has to do with the stock market moving sideways and people digging deeper into all the venture capital money chasing unicorn tech companies. It seems like people are denying a bubble because we just had a bubble. The bubble was in real estate. The bubble hit California. So of course it can’t happen twice in the same place. But this definitely feels like an echo bubble brought on by foreign money, investors, tech money, and a stock market that has only gone up for 7 years now.

Bay Area delusion

I was up in the Bay Area a few months ago and all people could talk about is “real estate prices are crazy†and “tech values are crazy.â€Â When you hear locals speaking like this you know something is up. But you also realize even smart people get suckered into financial manias.

You also have to use common sense. Just look at what you can buy for one million dollars. It is basically teardown crap shacks. But this “crazy†talk is based in reality because most people can’t afford to buy:

California is already unaffordable with only 1 out of 3 households able to buy homes at current prices. Then again, we have 2.3 million adults living at home and many more millions living the new American Dream in rentals. Who can purchase a $1.2 million crap shack? Not many and inventory is tight. So those playing the game now are foreign buyers and investors. Big money U.S. investors started pulling back in 2014. In San Francisco it is only 11 percent of households that can afford to buy. Therefore, a large part of buying is coming from outside money on the tight inventory in the market (aka China).

Home prices in San Francisco went up in dramatic fashion:

From 2012 to 2015 prices went up in mania like fashion. But you’ll notice over the last 12 months something has been shifting. Call if reality coming into play or cold water being thrown on this house lusting euphoria.Â

From 2012 to 2015 prices went up in mania like fashion. But you’ll notice over the last 12 months something has been shifting. Call if reality coming into play or cold water being thrown on this house lusting euphoria.Â

The market is just nuts in San Francisco. And the real estate market also reflects the valuations that are done with tech companies. Many are still blowing through money with no real profits in sight but investors are willing to make a big bet on the promise. The same goes for San Francisco real estate. If the last four year pace kept up, by 2020 the median home would cost $2.4 million! Yeah, makes total sense.

But let us say you are a real estate horny household looking to buy today. What can we buy in San Francisco today?

57 Martha Ave, San Francisco, CA 94131

3 beds, 2 baths listed at 1,325 square feet

And of course, thanks to housing porn on HGTV people are revved up for this kind of marketing:

“Contractor’s Special! Bring all your tools to rehab this Fixer Upper and make it your pride and joy! This sweat equity potential is the investment opportunity you have been waiting for! This home has 3BED/2BA all in the same level, Living Room, Dining Area & Kitchen plus Huge 2 Car Garage (side by side). This is a Diamond in the rough w/ lots of potential in quaint street and in Great Glen Park neighborhood. Only a few minutes away from BART Station. SOLD AS IS. Opportunity knocks only once! Don’t Miss it!â€

Yes, bring your tools since this “fixer†is only $875,000. I love terms like sweat equity because it implies you are really working hard when you go to Home Depot and buy some overpriced appliances, granite countertops, and hardwood floors and suddenly the home is worth hundreds of thousands of dollars more. It totally makes sense that with one or two weeks of work you can increase the value of a home by what a nurse, teacher, or programmer can make. Welcome to San Francisco real estate. Of course the language here is very much #YoLo focused and as expected, we will get someone coming back in a few weeks/months saying “but it sold†– as if this is confirmation of the price being reasonable.  Sheep usually huddle together as well.

Thanks to Prop 13 the current owner is paying taxes at the assessed value of $67,238. But hey, they are doing you a favor by giving you the chance to own a piece of the Bay Area pie. Buy now or be priced out forever!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

94 Responses to “Did San Francisco real estate values hit a peak? Only 11 percent of San Francisco households can actually afford to buy a home at the current median price in the place they live.”

“Sheep usually huddle together as well”. LOL! Love it!

I was having some fun with the local sheep recently who tried to vilify me for writing about Houston area employment. As is generally the case the truth hurts, and many just don’t want to face reality. These were mostly real estate industry types commenting under pseudonyms on a site that caters to inner-loopers. Of course they can’t understand why I have taken to writing about the state of the economy when I should be out humping up the fabulous housing market we have.

In Layman’s terms…I’m fed up! I’m fed up with the fraud. I’m fed up with the sell-side bullshit. I’m fed up with the lies and obfuscation that have turned this country’s housing market and financial markets into a giant Ponzi scheme.

Amen!

Where were you posting? I live in the Houston area and am interested in this subject.

Always fun to check out a good ‘throw down’ on the Houston area economy.

The site I’m referencing is Swamplot. I used to be a fan, but it now seems to be host to many rather vacuous “news” links that I wouldn’t qualify as news. They now have a host of new “sponsors” which could explain why it seems to be more of an advertising platform now rather than a real estate news portal.

A couple of things. I just noticed a property 3 houses down from one I sold in So. Cal. in 2014, just sold for $150k less than asking price. The one I sold in 2014, went for $150k more than asking price. Roughly the same homes … could it be that prices in So. Cal. are also hitting the proverbial wall? Second point, just read an article that there is an exodus of Europe’s millionaires. Their favorite destinations include Australia and Israel, but San Francisco and Vancouver, are also on the list! Apparently, Europe’s economics and rising racial tensions related to immigration, are the cause!

As I have said many times before the stats regarding median local incomes and median home prices can be quite misleading. The only stat that people need to look at is income of TODAY’S qualified buyer. When you remove renters, long time owners, dead beat adult kids living at home, the income figure goes up significantly. Add to the mix high paying tech jobs, stock options, rich foreigners, trust fund babies and homes still sell quickly at sky high prices. This isn’t only occurring in the Bay Area, go to any of the coastal cities in LA/OC and you will see the same stats. For these areas, today’s buyers are VERY qualified and there seems to be no shortage of them.

Nope, the most important number that one has to look at is the local price vs income ratio. The bubble has and always will be in the price, and qualification takes a distant second. The last RE downturn was caused by failed prime mortgages, not by the subprime type.

Today’s buyers are flippers and retail buyers who usually come in at the tail end of the mania. As mentioned previously, flipper/investors will not want want to be bag holders, and organic buyers who find themselves underwater can and will strategically default.

There will always be a bag holder with these properties. Occupied or not! However, the hot potato can only be passed around for so long while it’s hot. Obviously the last person who gets stuck with this will be the one scrutinized for failing to see what was coming.

Those “deadbeat kids” you are talking about would love a decent job. The reigning oligarchy has destroyed opportunity for the average person. There are more and more people getting left by the wayside. Prepare to feel the Bern (or something like it in 2020). Supply-side/Trickle down has failed and bailing out the banks created a parasitic, extractive investor class. You, Lord Blankenfeld, are part of the problem. “If we remove the renters, deadbeat kids…” Damn, who’s left after that?

Don’t be mad at Lord because he timed the market correctly. If the market kept crashing and you bought now would you be “part of the problem”.

BTW, you are “part of the problem” if you go to work everyday supporting the system you complain about so much.

That’s because the US and European countries try to get grow by keeping interest rates low. The real estate people jack up the price in La/OC at least a 100,000 more if the interest rates were higher. Looked at London, its the low interest rates there that have caused housing to be price out of this world.

With 70% of properties rental properties in the SF bay area…. and only a small percent of homes available to own turning over every year…… it’s true…. the market is set on the margins… a very small number of people.

Your issue is really that such a high percentage of properties in the OC, SF, etc… are available to own in the first place.

Don’t worry PermaBear, less and less of us are part of the problem.

Maybe, but what is hard to reconcile, is the liberal social causes attitudes of California, with the reality that even the middle class are now priced out! I don’t see much empathy or social outpouring or concern! Seems like an every man, women, child, for themselves place, and even the $15/hr gesture isn’t really enough to save all those low-skilled working stiffs, or the middle class who are paying most of their income on a roof over their head! California is sinking into the Pacific, just not due to an earthquake!

It’s not just the cost of housing. Have you seen the price of nuts? I realize that almonds require much water to grow, but a canister of nuts (especially without peanuts) cost a fortune. All kinds of food items are going up at a fast rate. Inflation has been hitting grocery stores very hard these recent years.

I had a plumber (a two-man team, actually) come to my condo a few weeks ago for some deferred maintenance. Replaced three shut-off values, replaced two leaky faucets, replaced that thing in the toilet. Cost about $1,200, tax included.

JNS – speaking as a native born Californian I consider this a “purple” state not a blue one. There’s plenty of right-wingers (California gave us Terrible Tommy Metzger and tons of other neo-Nazi kooks, and Ronald Reagan) and there’s not a terrible lot of empathy.

I like to say that when you lose everything you’d better have 100 friends because 99 of ’em are gonna ice you out.

The one friend who’s helped me out, actually last two, helped me out because I was useful to them. I don’t mind this, really, I like being useful.

I find it hard to believe anyone still thinks today’s qualified buyer in SF/LA/OC/SD is normal: they are anything but normal, except for maybe a realtor or and owner of a real estate company that is trying to keep the hype going. “Buy now or be priced out forever…and a day!”

Yup, don’t forget to include rich, international crooks to your list of qualified buyers. Unless the law is changed or enforced, the housing market will not tank. If the economy is doing as great as you think, why didn’t the Fed raise the rates? I am afraid that the next crash will cause a worldwide depression.

http://miami.cbslocal.com/2016/04/04/panama-based-firm-under-fire-over-alleged-offshore-dealings/

So…. the US becomes like Switzerland … a place for crooks to stash their cash. Only difference is, Switzerland has extensive protections for native Swiss citizens, you don’t see Swiss folks leaving because they can’t afford to live in the country of their birth.

no mention of interest rates………very interesting indeed.

If your 100K investment in the stock market 8 years ago is now worth 300K, you and your spouse are making 300K in high tech, then you are still in the house buying game. Until the market crashes and you are laid off and then you are not. Buy now if you are an optimist and believe in Trump.

Very hard to tell when the bubble is hitting it’s peak. I think San Fran has at least another 2-3 years before the huge crash. Unicorn money is only just starting to dry up, and housing will lag a little.

It’s already hit in SoCa on the West side. 90% of houses are selling for $200K off asking price of around 2-2.5 million (in that segment of houses -Palisades/Santa Monica/Brentwood/etc.)

Housing to tank hard soon!

Thanks my man. I’v been out of town for a week. I’m back now. Housing to Tank Hard Soon!

I think this means it might take another generation to experience the Tank!

It seems that Real Estate is a good place to hide a bubble. What we saw in the last crash is that some areas “tanked hard”, and others only had a reasonable correction (given that wealthy people lost a lot of dough in 2009). I guess if you lose your job (and your neighbors do too) the real estate where you live will”tank hard”. If you lose money on paper, but still own the same assets (ditto neighbors), then you’ll see a correction. So a tech bubble pop will cause a “tank hard”, and an overall bear market will cause a correction in SF?

A tech bubble will indeed cause a “tank hard” because there are a million start-ups all based on making a slightly more amusing rip-off of Angry Birds or a slightly more mercenary way to rent your neighbor’s driveway out while they’re at work. It can’t last. In the early days of the internet there were a million little mom-and-pop ISPs and that narrowed down to comparatively few.

So, in SF, 32-odd food delivery apps that ensure you’ll get your In-N-Out Burger nice and cold with limp fries, will narrow down to probably one and a second-runner, who will each ensure you get your In-N-Out Burger cold with limp fries.

“when you go to Home Depot and buy some overpriced appliances, granite countertops, and hardwood floors and suddenly the home is worth hundreds of thousands of dollars more.”

LOL thanks for reminding me of the jokes about how many thousands of dollars a stick of crappy Pergo flooring were essentially worth just before the last crash!

One thing to remember when housing prices soar beyond the ability of those who own them to buy them is that they will, ultimately, be forced to move. Consider it a type of reverse ‘block busting’. It happened in San Francisco 40 years ago when the FIRE economy took over though then it was the working class who lived in the Mission, Portola, Richmond districts who got forced out. Their homes are today’s ‘crap shacks’ and occupied by lower ranking FIRE economy employees who are being displaced.

Were San Francisco dependent on local buyers for home sales today’s prices are clearly unsustainable but its not. Look at it from the POV of the owner of a small or middling company in China or a senior executives of a larger firm. Rumors of major currency devaluation are louder. The government is tightening your ability to move capital abroad and cracking down on conspicous consumption, corruption and poltical activity. Worse still, if your business goes bankrupt you as a manager or owner can be held personally responsibly for loans made to the business and your personal assets seized. That you can also be shot goes without saying. Under those circumstances paying a million or two for a modest house in San Francisco is not such a bad deal.

Based on your reasoning, today’s prices can not be sustained in the long run by Chinese buyers alone when capital controls and currency devaluation will eventually reduces real estate-related money laundering to a trickle. In the short run, we’re seeing desperate, last minute investors providing the fuel to continue the mania.

Precisely! I find it interesting that China’s central bank is directly buying stocks to prop up their market, and somehow this situation is overlooked by our own government in order to keep the “dream” alive and keep both real estate values and equity values inflated. Seems pretty obvious there are people behind the scenes with a vested interest in keeping the charade going for as long as they can run the tables.

https://confoundedinterest23.wordpress.com/2016/03/31/not-safe-chinas-central-bank-starts-buying-stocks-via-spv-a-new-low-for-manipulation/

If that is true then where were they in 2009 and 2012 before the bubble? Seemed like no talk of China back then until now. Sounds like media and governments trying to keep the party going with the illusion of sustainability from our Far East counterparts.

San Francisco real estate has been ‘overpriced’ relative to the Bay Area for the past 50 years. One reason was the immigration ‘reform’ law of 1965 which opened the door to large scale immigration from Asia ( and Latin America). The Chinese population of San Francisco began to grow beyond Chinatown at this point. At first it was mostly immigrants from Hong Kong, Taiwan and Vietnam but since Deng Xioping, mainland China joined in the emigration to North America. The sheer size of China and its economic growth since then relative to the size of Vancouver, SoCal and SF makes this a different situation.

Consider if you take just the top 1% of China’s population you are talking about 13.5 million people capable of buying a home in these areas. If only 1% of them do per year we are talking about 13,500 homes per year in the $750k and up category and this could continue for 25 years even if only 1 out of 4 decide having a house on the West Coast is ultimately a good idea.

@unit472

China currency’s devaluation is in no small fashion caused by the unwinding of the gigantic bubbles within its economy. Under these circumstances, I don’t see how the elite could continue to freely spend after potentially monstrous meltdowns to their businesses.

In the 1980’s the Japanese lavishly acquired American properties only have to have the whole affair blow up in their faces. Coupled with their ongoing economic problems at home, they haven’t made headlines in the American market since then.

Unit472….I think you are on to something. China’s middle class is now over 300 million people which is roughly the population the entire United States. China has 109 million households who make $50k to $500k and this number is growing. In comparison the U.S. has about 53 million who make between $50k to $500k and this number is growing slower than in China.

Also add in the fact that China and Japan Central Banks are buying stocks, bonds, and ETFs to prop up their markets to make everyone richer is occurring. I wonder how much of those stock market gains are being leveraged into housing.

All you need is about 10% to 15% of those 109 million Chines families to buy housing abroad and they can easily own 10% of all housing in the top 10 U.S. major cities.

One more article:

China added 2 million millionaires in 2014 alone, a nearly 50% increase from 2013.

This makes sense, of course: China has plenty of economic running room, relative to the US, with its mature economy.

The dark side to this trend, however, which Frank points out. Millionaires are on track to “control nearly half” the world’s private wealth by 2016.

That’s a lot of wealth: $164 trillion, according to BCG.

And why do the wealthy control so much wealth? It goes back to the argument put forward by French economist Thomas Piketty last year, in his book “Capital in the 21st Century.”

Piketty’s research, which has been widely debated, suggests that the gains of those who control financial assets is outpacing those who make their money through labor and production, which is represented by economic growth. In developed economies, growth — expressed as GDP — has been anemic during the recovery from the financial crisis. Asset wealth — stocks, bonds, real estate, and so on — has by contrast surged.

Basically, the rich get richer, while wage earners see little or no gains.

It’s always good to re-read JOhn Kenneth Galbraith’s “The Great Crash” once in a while. First thing, when it was evident that finance was in hot water, was a bunch of The Big Rich Guys essentially emptied their pockets into the hole. They thought they could fill it up. Alas, it didn’t have the slightest effect.

Nope, no bubble here…

President Barack Obama on Friday said it’s “not an accident†that the economy is improving under his watch and chided GOP critics for “doom and gloom†predictions that haven’t come true.

Obama said he welcomed the attention Republicans have been giving to the middle class, “but so far at least the rhetoric has not matched the reality.â€

The President says that things are great, it is only Fox news who spreads lies that things are less than great.

Wilbur,

So, we should believe Obama – he is speaking from his own experience – things are great financially when you are the president or connected to the money elite.

Fox is just spreading lies that the middle class is not doing great (sarc.). They never lived better – tuition cost for students during Obama years went down, health care cost went down, the wages for the middle class adjusted for inflation increased for each of the last eight years, good professional jobs are in abundance…..yea, you are right and Obama is right – the middle class has never had it better before.

During his term U.S. household wealth has increased $36 Trillion. That comes to an average of $276k per family. So in just 7 years each family in the U.S. has increased it wealth $276k to a total of $670K.

Unfortunately it did not work out this way as the top 1% and the top 5% experienced most of the wealth gains. The bottom 50% actually saw an average household wealth gains of about $10k and not $276k

ru82,

That is exactly what I was saying – averages don’t mean anything in this crony regime. The 0.0001% of crooks from the top connected to the White House got the vast majority of the gains while the 99% struggle to keep up with the inflation in food, tuition, health care, rent and house prices. Adjusted for inflation for the items stated which mater the most for the average guy, all incomes decreased significantly for 99%. Using the bogus numbers stated by CPI the income for the bottom 95% still decreased.

Wow where’s my $276k? If you all can help me find it, I’ll split for Israel and get out of everybody’s hair.

Don’t jump too quick Alex. Cost of living in Israel has skyrocketed over the past few years and by most accounts is slightly higher then the US average . Also, Israel faces many of the same housing issues as the US with the middle-class being priced out of the more desirable areas.

Hunan – Yes, I know Israel is considered expensive. However, “slightly over US average” == cheap considering my experiences are in places like Hawaii, Orange County, and the Bay Area.

I’ve been watching all the “man in the street” videos I can, Gary Gil-Schuster has some good ones, on YouTube and I’m just really impressed with the place. Everyone seems to be so damned happy! People are fit, veggies are not a luxury but apparently a (cheap) necessity, and Tel Aviv is right on the beach. I see the beach only once every 2-3 years and the water’s too cold to go into.

My preference would be to live in Tel Aviv or Eliat, touristy towns where I can sell touristy shit to tourists hehe.

But I have a lot flow chart to go through first, first it’s 23andme to see if I have what I call the genetic “gimme”, in that I *believe* I qualify to move there and become a citizen but I’ve been told so much malarky about my background that I want to see what’s running in my genes first off lol.

Then if the genes agree with what I suspect, I’d time to work some extra and pay for the services of a good genealogist, since they can do in a week what I’d not be able to do in years. If I’m lucky, I’ll learn enough about my mom’s folks that I’ll learn what I hope for, and may find out about the store they owned when my mom’s dad died, in the mid-late 1940s?

Then that all in order, well, ya can’t function in Israel without knowing Hebrew. It’s got funny sounds and it’s written backwards (yay I’m left handed) but I’ve loved the way the letters looked since I was little so that’s win in my book, but it will take some work to learn a language that’s not Germanic or Romantic.

Then, the subject of bringing an occupation with me, like a snail takes his home with him, when I get there.

Now, Israel is expensive compared to Iowa no doubt. But the infrastructure in the older cities is set up to not require car ownership, so I won’t have to support a petro-beast.

In fact, falafel aside, for someone like me who hates cars and loves guns, what country could be more ideal?

Alex, you dream of moving to Israel, you know nothing of living there. How good of a shot are you? There is a Palestinian problem, that makes America’s terrorist problem look non existent. Alex, you would not last a month.

Alex, I think Israel, and various Jewish groups, have financial aid programs so that poorer Jews can move to Israel. You might qualify for some of them. Do some research.

OTOH, I think Israel prefers young, healthy Jews who can fight wars and bear children. Or if not young, then older Jews who bring money or valuable skills (e.g., doctors, scientists).

I guess they’ll take you. But you’d have a better shot at financial aid if you brought something in addition to your Jewish blood (e.g., youth, strength, money, skills, children).

Yossi – I know, I know. Maybe I might be a part of the solution in that (a) I’d hope to learn Hebrew well enough to write at least one book on precision shooting, and make it entertaining like “PS The Preventative Maintenance Quarterly” put out by the US Army and a hoot to read, and (b) more morbidly. if it comes to that, let some homocidal Pal stab me instead of a sabra.

Yossi – Woops forgot to mention I know one end of a gun from the other.

Alex, sounds like you got it all figured out. Good luck with that. Send us a postcard.

So far homes are still flying…

these 2 are down the street from me and just listed on the market-now are pending…

http://www.realtor.com/realestateandhomes-detail/1423-16th-Ave_San-Francisco_CA_94122_M23589-10304

http://www.realtor.com/realestateandhomes-detail/1430-16th-Ave_San-Francisco_CA_94122_M11098-93602

Both are $1.5mil and are fugly to boot. Our place on Portlock Road was (I think) $40k and it was not fugly, was 5 beds 3 baths and huge yards plus the ocean was across the street.

Wow Alex you have some pretty high standards. Don’t you live in the back of a sign shop?

Hunan – Yeah, I do, but yeah, right now I do in fact live in the finished office in the front half of a building that’s zoned for storage, and right now is storing 1000’s of lbs of old test equipment.

My family’s fortunes fell precipitously, but I still know what’s decent and what’s kitsch, and can pronounce “professional”, “nuclear” and the word “EYE_ther”.

history is great to talk and read about but it’s not relevant to today

Those fugly homes were sold in about 20 days max at big price increase from 2011, probably could have picked up similar lot, not remodeled for 599K back then

plenty of empty homes where I live that were bought over last 3 years….money from overseas is still pouring in…

England is best example of what the fed, govt. treasury are trying to do to Real estate in the US…the greatest heist of middle-mid-upper class wealth in the world was amazing to watch…welcome to Pottersvilles in a suburb near you….

cd – This is why I may be reverting to type in that I’m of the mind of, f*ck the “owning land/house” game and I’m concentrating on portable skills. The more portable the better. I’ll just live where I can do OK and if I can’t, I’m outta there.

In countries with negative interest rates, people are investing money in real estate.

Another undesirable outcome could be economically dangerous asset bubbles.

Sweden’s real estate market is case in point. Instead of boosting inflation, as the central bank had hoped, negative interest rates have driven house prices up as more home buyers take advantage of cheaper-to-service mortgages. Now there are fears of a bubble.

“With the drop in interest rates, we are likely to see an increase in money pouring into real estate,†said Masahiro Mochizuki, a Tokyo-based analyst at Credit Suisse. “Regional banks must make profits somehow and they can’t make money lending, so they need to invest in property funds.â€

I went to a couple open houses in Woodland Hills today. It was the usual rock concert atmosphere. Realtor flags and balloons on street corners. Rows of cars parking along the streets, depositing crowds of house-horny fans. An atmosphere of excitement as people congregate toward the Open House, eagerly anticipating the upcoming show of hardwood floors and granite countertops.

Hehe NE1 else remember all the jokes about stale sandwiches during the last crash?

Looking at this from Sacramento, the influx of bay area home buyers moving to the Sacramento and other super commuter areas is continuing like I thought it would. Same thing happened during the last two boom and bust home cycles. There can only be so many new buyers in the bay area which allow current owners to cash out and move to more affordable areas. Currently this is causing the ripple effect of rising home prices higher than average wages in the local area. It also causes those who cannot afford the new prices to choose to rent and drive up rental prices. Somewhere the money will dry up, once it does the bubble will pop. Not as dramatic as 2008, but a bubble pop non the less. The bay area real estate market will always be high, for a reason, high paying jobs. But when it gets too high too soon and affects other markets, that’s where things get out of wack. And a correction will occur.

Obama administration pushes banks to make home loans to people with weaker credit

https://www.washingtonpost.com/business/economy/obama-administration-pushes-banks-to-make-home-loans-to-people-with-weaker-credit/2013/04/02/a8b4370c-9aef-11e2-a941-a19bce7af755_story.html

I think I heard this tune before…..”Let’s loosen things up and give low down payment loans secured by over-priced crap shacks to low credit individuals, I mean what’s the worst that can happen?”

I remember how this goes …. someone in finance came up with some algorithm that said that if you loaned to enough crackheads with 3 pitbulls that at least *some* of them would pay up, so in essence your junk paper was worth *something*.

That went well.

Does anyone even consider FHA backed offers? I remember being at a packed open house last year and overhearing a buyer ask the selling agent if he would consider a FHA offer. The agent basically just said he was needed in the other room and walked away. I was always under the impression that FHA offers were a pain in the a$$ to deal with and are more difficult to appraise.

In regards to FHA offers. I have several friends who purchased in LA in the recession with FHA offers. The strategy is that in your offer as buyer (you have already qualified for an FHA loan) but in the offer to purchase you write down you will be seeking a “conventional loan with 20% down”; in order to look like you have a good financial position. [The seller does not wait for you to get the loan before accepting your offer]. In some case I think the buyers had a letter from a lender that they were ‘prequalified’ but did give the specifics of source of loan approval. Then when their offer was accepted and they completed their 10 day inspection period, they then also went back to seller and show that they instead got approved for an FHA loan with 5% or 10% or 3.5% down, whatever the case is. Not sure what the stink is about and FHA loan, none of the several friends of mine lost out on a home after opening escrow because it was and FHA loan. And by the way, all of them have been able to re-fi out of the FHA due to strong rise in equity the last few years.

Appears that Obama wants to trash the hotel before he leaves.

Please tank NOW!

I’m in a rage about L.A. prices.

This is about the San Francisco market, very different than L.A.

Looked at the property on Zillow. Total wreck. Strip to the studs and start over. When you’re done it will look like its twin at 53 Martha next door. OK stylish but not fantastic. Very Mid Century. Huge two car garage. gotta’ be worth something in an urban environment.

Sucky Schools. But if you’re single then who cares. Probably wall to wall Mexicans nearby. Ahhh, vibrant diversity and all that.

On the plus side, you get a classic 72 MGB out of the deal. Not thrashed. It’s parked in the garage. and it seems to come with the house.

Just a thought.

VicB3

The market is getting so bad folks are going to the emergency room with great anxiety, this is no joke, sellers ae so distraught because they are told by their lying agents that the market is great and their house is just a problem? Of course take a 40% hit and it will all be okay, they still want 6% because they deserve it???

Folks if you really have to sell I feel for you, but please at all cost stay in your homes and lets see what happens after the election, 2017 is going to be a great comeback or a greater recession, I see soup lines forming and the sale of blow up beds booming.

So its one or the other. Thanks for the clarity.

“I see soup lines forming and the sale of blow up beds booming” do you kind of get it that I feel a recession is more probable (?) thanks for reading between the lines Perma Bear??

I was only 18 at the time of the Great Recession and don’t remember any of the excesses in San Diego when it came to the bubble . But as a prospective buyer in today’s market I can’t help but notice the overwhelming amount of active flippers, shoddily flipped homes listed on the MLS, ads for flipping classes, HELOC advertisements in the mail, billboards for low down payments, online ads for “creative financingâ€, and worst of all a general attitude that the market cannot go down.

Friends that bought in 2012-13 act as if they are financial gurus and chastize me for not jumping into whatever I can get to enjoy the sweet appreciation. I’m completely burned out at this point and absolutely refuse to dump my hard earned savings into a $575,000 starter home. I’ll wait and hope for a 10-15% correction, and if not life goes on.

Watch the big short and it will give you and idea on what was happening. My ex wife worked as an agent/broker in that time. Many startup brokerage houses popped up every were and they took advantage (screw) everyone they could get into their offices. They would jack up points and fees like know other making a profit off every loan, especially the ones that had poor credit. Many of those firms closed or were investigated for fraud and money laundering. Stockton was destroyed by these places. Those homes were never worth the amount they were selling for and still are under water. It still makes me sick thinking about how badly peoples lives were ruined by unregulated greed.

We knew that the cute-as-an-architecturaly-significant-button Berkeley cottage that we wrote about back in mid-February would go fast. But we could not have guessed that it would sell for nearly $600,000 over its $1.15 million asking price,

closing at $1.727 million in mid-March.

http://blog.sfgate.com/ontheblock/2016/04/05/see-the-cute-berkeley-cottage-that-sold-for-nearly-600k-over-asking/#photo-737737

Waiting for the great leveler (8+ on the Richter scale ) will really drop prices and cause a real construction boom. Real price after that,with risk recognized.

the IRS is looking at this foreign money coming in which may discourage some. With negative interest rates, people invest in real estate and will cause a bubble.

There has been a lot written about cities attracting millennials, and they are not L.A. or S.F. One of the problems no one has bothered to discuss, are the long term implications of this younger generation on the future tax base of cities in places like L.A., S.F., and the vibrancy of these cities. Places like Seattle, Portland, Denver, have become major attractors, they have vibrant communities, offer the lifestyle, and by attracting these younger people who will establish roots, are creating a critical mass for their sustainability. In places like L.A., S.F., where the cost of living is quite high, the exact opposite is happening … they risk losing their vibrancy and their future tax base/sustainability, and are quickly becoming some form of middle-ages fiefdom’s, where there is only a privileged rich, and a lowly subservient poor! There seems to be no one looking out 20 to 30 years, only people with their hands held out collecting relentlessly higher rents, uber-rich writing huge checks for crap shacks, and the millions of serf’s scratching dirt to survive!

The L.A. area is a paradise for Latinos. Thank you very much. It is a wonderful place to live. It is true, in the Anglo enclaves, they do not have a vibrant neighborhood like we do. They only have their Taco Tuesday, but we have it every day. Every weekend we have our parties with the Ranchera music.

The auto body repair place that buts up against the back of this property plays ranchera music and man that shit kicks ass. I love the tuba, the melodramatic trumpets, luv luv luv that stuff.

And you guys don’t mess with the abominations that are FLOUR TORTILLAS. You guys eat *real* tacos.

Don’t forget chulos shooting up the hoods every night keeps it lively as well.

I really don’t know what the actual data says, but I will speak to my personal experience. In my line of work I come across 200-300 different millennials (I barely make the cut to be one of them) every month, they seem to be doing ok. Some are as you stated rich but most of them are scrapping by. One thing that most have in common is that they want to live here by all means possible so I tend to disagree with you that LA is not a hot spot for them now and in future years. Many businesses in LA exists based on those demographics. I’m sure most of them have a lot of debt or live via credit cards but that doesn’t change the fact that they consume and spend.

If Hollywood moves out, then I would completely agree with you but that hasn’t happened yet. A lot of cities are gaining a lot of ground or have even surpassed LA in many areas but people still come here and will continue to do so until a dramatic event happens.

Plenty of millennials in L.A. — if you include Central American immigrants.

True, these are not your stereotypical white hipster millennials. They’re not interested in sidewalk bistros, and art galleries, and vinyl record stores, and “sustainability” and “leaving a small carbon footprint.” But they are millennials nonetheless.

And these Central American millennials probably like L.A. just fine. It’s much better than where they came from.

I pretty much disagree JNS, Seattle, Portland, Denver have very high cost of living ,property taxes home, insurance and auto is more due to weather concerns, avg. price of homes well above national avg. Matter of fact a recent survey shows especially in Denver, many millennials have Denver very overrated with traffic, crime, drugs etc. many stated they want to pull up stakes in a few years somewhere else.

I think it’s pretty much a rule that if you’ve heard of a city being “hip” it’s already too late to consider moving there.

To give an example, New Orleans. I follow a “subreddit” on a site called “reddit” about New Orleans, and they’re charging almost California Bay Area rents in a city that vies with a few infamous others for the highest murder rate in the US.

I’m with you.

New Orleans is a fetid, dirty, humid, crime-plagued hole that scarcely has a single safe neighborhood, and given the choice between it and equally violent St. Louis, I’ll take that latter as having more beautiful buildings and fine old houses available at gift prices, and top-tier cultural amenities- The St Louis Symphony Orchestra is considered to be one of the world’s finest orchestras, and I still miss the Missouri Botanical Garden, which is world’s finest, among many other fine cultural and educational institutions,

If I’m going to pay Los Angeles prices, I want to live in Los Angeles. I can see why people pay a huge premium for a huge, beautiful, and altogether fascinating city with a perfect climate, coastal location, nice people, moderate crime (and falling), a lot of beautiful and unusual architecture, and absolutely gorgeous natural scenery.

Laura – True dis. I grew up in Hawaii, hated for being white, and fairly recently considered moving to New Orleans since I can’t even seem to do the “being a white person” think right, as I’m olive-skinned. So I looked into the situation in New Orleans pretty intently, and hell, they’re charging California living expenses for a crime-ridden shithole with, I’m gonna be frank, black people intent on killing whites around every dark alley (or well-lit area, it’s equal-opportunity!).

Fuk that noise.

First I love the word Crap Shack and calling and housing porn showes on HGTV. One would think we learned from 2008 apprently not.

Crap Shack

Craptacular

Crapulescent

Crapatocious

Crapaween

Crapalicious

–

–

You’re welcome

It looks like an interim peak has been reached. It is quite obvious that not everybody can afford to buy such expensive property. It seems like San Fransisco is on its verge to suffer.

“If the last four year pace kept up, by 2020 the median home would cost $2.4 million”

my aunt bought a house in HB in 1969 for $20K and it’s now worth (worth is only what some one is willing to pay) something close to $600K so if that pace continues for the next 47 years that house will be $18,000,000 in 2063…..while min. wage will be $25.

This is why the current housing bubble will crash. Again. Then it will go up. Again. Then it will crash. Again. Repeat because humans are greedy and dumb and markets are always

irrational.

When one person has all the money, the game of Monopoly is over.

The San Francisco bubble is popping now. We I live in the Mission where houses are about 1.2 mil. Down the street someone built something they hope to sell for 3.2. They had one open house 2 weeks ago, not sold.

Hundreds of new apartments are being built thinking they can be rented for $3,000 a month. Not going to happen. Ultimately house prices and rents are a function of incomes. There are people with full-time jobs who are homeless.

Intel laying off 12,000, Yahoo on the block and losing 4 billion in the 1st quarter. Twitter, google, microsoft all down. SecureWorks IPO did nothing. The company will burn through that cash in 18 months or less. $500 billion on the Unicorn list with the IPO pipeline essentially plugged.

I don’t think it will be as bad as the dot com bomb in 2000, but the people who are speculating on sky-high real estate will get burned. I’m planning to shop for property after it’s obvious that we are past some kind of bottom- may be 1-2 years out.

Leave a Reply to Kristopher