San Francisco housing market reaches highest levels of unaffordability: The tech led housing bubble where the typical condo now sells for $1.1 million.

There is no doubt that San Francisco is in a deep housing mania. When you take a look at the junk you can buy with $1 million you realize something is amiss. Bubbles are hard to assess when you are in them. You have continuing momentum pushing prices higher and the constant rhetoric that “this time is different†although history tends to serve as a better guide. But San Francisco is in another dimension. The median home price is now $1.25 million and the typical condo is selling for $1.1 million. You have tech professionals earning good money struggling to afford basic rundown rentals. All of this is being spurred by hot money in the tech sector and foreign money flooding the market. In a place like San Francisco even a professional couple with a solid down payment will have a tough time competing with all cash offers over asking price. As we noted, last month we saw a large portion of the market being taken over by all cash offers yet again as regular buyers are priced out. San Francisco is now more unaffordable than at the peak of the last bubble.

The mania in San Francisco housing

Home prices in San Francisco seem to defy gravity. It is an interesting market and that seems to be all people can talk about in The City. It is either conversations of insane rental prices or ridiculous home values. Yet rarely do you hear about people talking about the derived value of real estate in San Francisco like you would of price-to-earnings ratios for a stock. Of course you will have house humping cheerleaders saying “you can’t live in a stock†but then again, you probably should ask a few more questions before paying $1.25 million for a rundown piece of crap box with little to no parking space. And by the way, most can’t afford to pay these prices. That is why families are either being pushed out or struggling to hold on in high priced rentals.

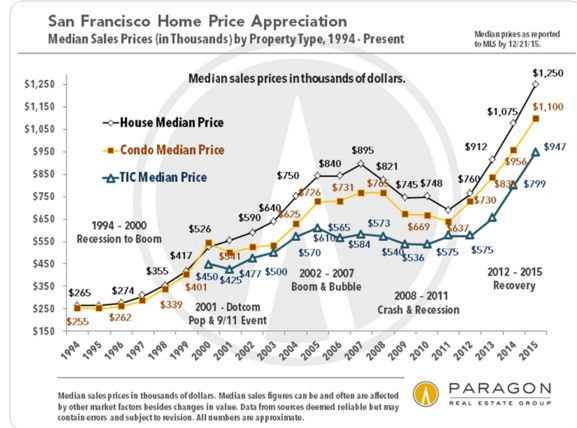

Here is a chart showing home and condo prices in San Francisco:

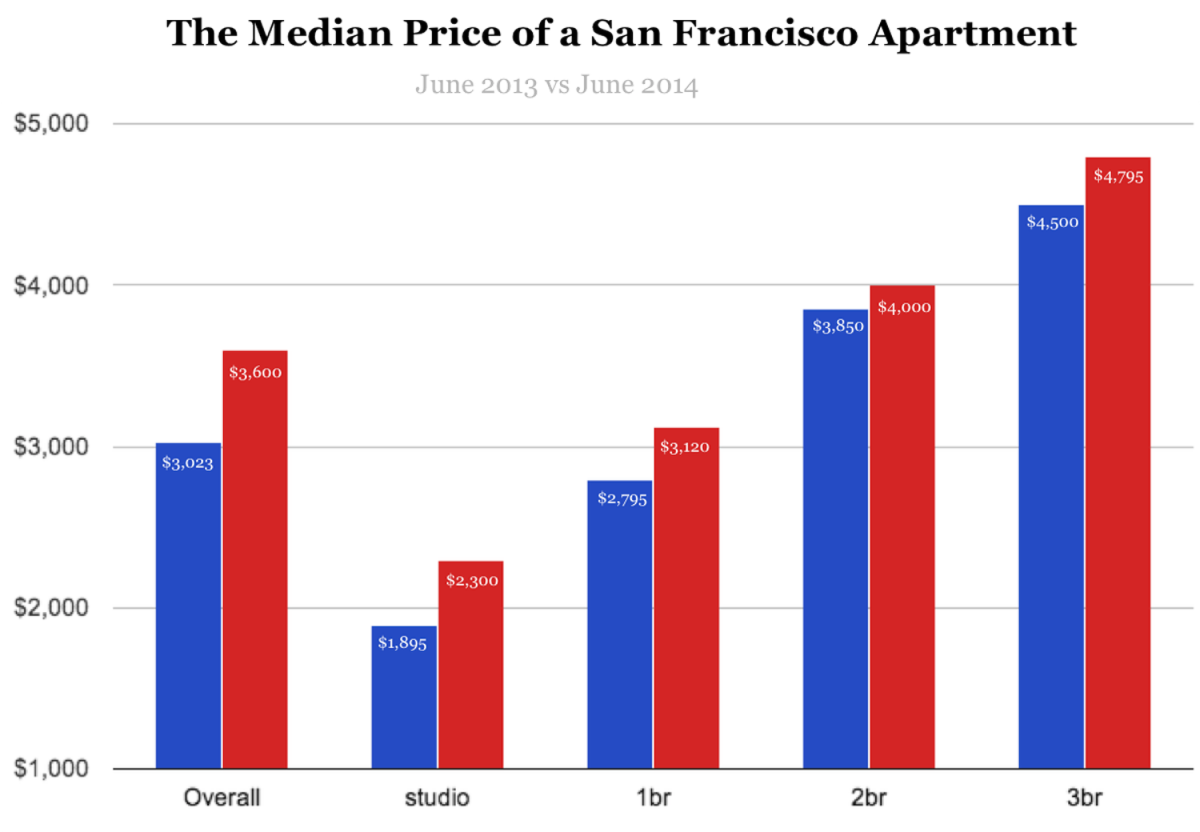

Housing prices are up over 65 percent from 2012 alone. The typical home went from $750,000 to $1,250,000. Reasonable or not, that is an insane jump in prices and this of course has created a crazy rental revolution in San Francisco. Your typical 2 bedroom apartment is now over $4,000 based on last year’s information:

But let us see what we can get today. Here is what you can get for $3,650 per month:

474 Noe St,

San Francisco, CA 94114

1 bed, 1 bath listed at 400 square feet

Part of the ad talks about the AirBnB history of this place:

“The place was set up as a part-time Air BnB rental with 27 outstanding and consistent 5* reviews and a per night rental price of $300-450 and is very well appointed. People LOVE this place – check out the reviews on the link below. The cottage is a small studio (~400 sqft) but is really well laid out with a bedroom, lounge, kitchen and bathroom area.”

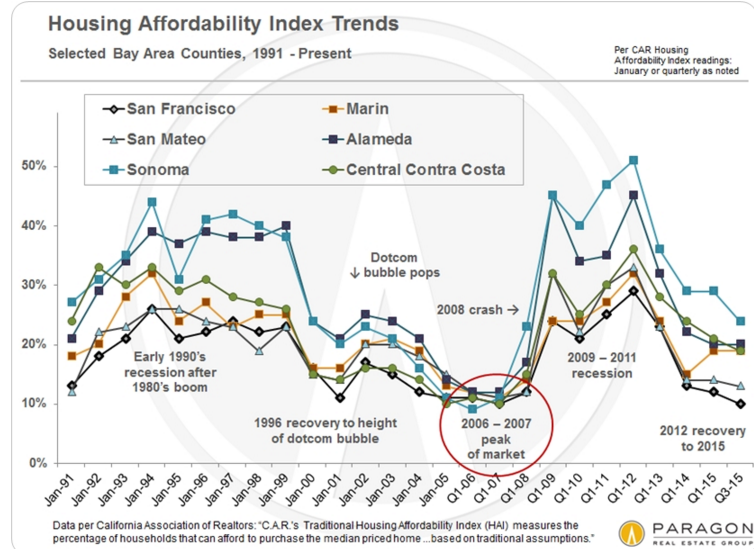

So have at it for a place that is the size of a walk-in closet. Affordability, based on local incomes is at record lows:

Looking back at the 2006 and 2007 peak of the market we realize that San Francisco was in a bubble and it corrected. Yet looking at the above chart, San Francisco is even less affordable today. Yet somehow this isn’t a bubble. Prices are being pushed up again largely by investors and foreign money.

It will be interesting to see what 2016 will bring. At these current prices, even if people wanted to buy it would likely strain their monthly budget to the maximum. People somehow justify that real estate is less risky than stocks yet over 1 million Californians lost their homes to foreclosure since the first bubble burst. Why did they lose their homes? Largely because they spent more than they could afford. Most of the foreclosures happened to boring 30-year fixed rate mortgage bought properties. There is always a new line of converts to the real estate religion. San Francisco seems to be ground zero for this housing worship.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “San Francisco housing market reaches highest levels of unaffordability: The tech led housing bubble where the typical condo now sells for $1.1 million.”

It seems curious that the owner of this property would be willing to leave up to 3x income on the table with the conversion of a reportedly successful AirBnB listing to traditional rental. In addition, traditional rentals in a city such as S.F. seem far less favorable to landlords from a regulatory perspective when compared to a “home sharing” arrangement.

On a related note, asking rents continue to drop in the “hot” west side nabes of Los Angeles from Santa Monica through Culver City to the South Bay. Silicon Beach being the epicenter.

I took a quick look at current rent ask activity in the Castro and Dolores Heights. Guess what? The same scenario is playing out there.

It’s just as non-discriminatory where the reductions are found in every price and property type category.

This wasn’t happening the past few years prior.

There’s a small margin of schizophrenic back and forth pricing action but around half of listings have at least one reduction. An increasing number of failed flip to sales converted to rentals in L.A. are coming on line. It can’t be explained away by seasonal factors as enough examples of rentals with reduced asks going back months, some all the way to last Spring.

This doesn’t square with the ‘rents to the moon’ rhetoric. The data is difficult to gather and parse, so MSM is completely behind the curve on this development.

Something has clearly shifted.

Good reading HC – keep us informed. I also feel rents are worth tracking, looking for market weakness signals. What seems to be reflation load-of-money real estate riches for house prices… well rents may begin to show that the dynamic of contraction works behind the scenes. Muscular attempts to counter dynamic process by inflating, may paradoxically strengthen the deflationary impulse.

I’ve noticed rents in Silicon Valley coming down too. There was a place that was asking $3400 for a 2bd/2ba in August and now it’s a Craislist special at $2800. That’s one example that I know of specifically, but I’ve seen rents on CL for other places dropping as well.

Price drops everywhere in Orange County. Even in Irvine, where everyone thought prices would keep rising and rising, we are seeing price drops everywhere. Even new developments are having significant price drops because new home sales have stalled. More price drops ahead…

I just bought a condo in irvine and i don’t know what data or who else is telling you that prices are dropping in Irvine

@Dream16: Buying a condo in Irvine in 2012, a good move. Buying a condo now in Irvine. Not such a good move. By the way, are you Indian or Chinese? Seems like the only people buying in Irvine right now are people from Asia.

@Dream16, Irvine median home prices for November 2015 sales data is down 2% year over year from November 2014. Factor in inflation at the fake but official rate of 2%, that means the real price change is down about 4% in Irvine.

For most of 2015, home prices in SoCal have been like a yo-yo. Up one month, down the next month, and that is without a recession and with unemployment declining.

Overall, I expect Irvine, and the San Gabriel Valley to slowly slide in prices. The Red Chinese government instituted stronger capital controls, and the Chinese economy has stagnated so most of the red hot Red Chinese money that could have leaked from China has already done so. Much of the run up in prices in Irvine and the San Gabriel Valley happened before 2015.

Don’t shoot the messenger, according to this article OC RE looks pretty healthy for 2016. I would not bet against Irvine. There are plenty of non Red Chinese that wouldn’t mind living there also.

Here is the link:

http://www.ocregister.com/articles/percent-698172-year-orange.html

SF has been cracking down on Airbnb–http://www.nolo.com/legal-encyclopedia/overview-airbnb-law-san-francisco.html

San Francisco has many charming neighborhoods. They’ve always been expensive. It used to have more affordable neighborhoods because not all of the City has views, Victorians or even sunshine. Live out in the ‘Avenues’ and you can go for days without seeing the sun… in mid summer. Even outside the ‘fog belt’ you might only have a few hours of sunshine in the afternoon before the fog rolls in again.

While not cheap, Marin or the East Bay hills offer better value and weather and you can park a car!

I own in Inner Sunset, we see the fog after Avenues..

This year the fog played friendly and made it feel more like Long Beach, Seal Beach weather. In some ways San Francisco has shifted to 1960-70’s weather in Southern Cal..

maybe jet stream shift, whom knows…Homes around here are expensive, not for sale, usually in a trust to avoid tax increase upon sale to family……but then again I can walk to some of the best eateries in the world, the hospital and down to N Judah line…

Parking here is controlled by City mafia whom will pillage as much as they can. I’m beginning to see more boots on tires which is an alarm I use on economic conditions here….

If I could just get my significant other to sell….I would be out of this place in a jiffy…though I will miss GGpark walks and the views…If we put it up for sale it would be snapped up on the views.. The city, Ocean and GGpark laid out across the living room is inspiring…

still a lot of hot money pouring into valid business entities here..

Hey cd, that’s good info to hear. I found this blog after a curious search in Google about a possible SF housing bubble. This read was fascinating for me. I am living in the Inner Sunset and paying 2500 a month for a pretty nice 1BR 1BA in a 4 unit building (signed the contract in early Oct 14). I am thinking of moving because i can’t afford the rent anymore after I finish my Master’s Degree (I attend school on the GI Bill – which pays its Vets the best rate nationally for housing here in SF), but nothing is affordable anywhere now! HOW IS THIS SUSTAINABLE?

Speaking of a housing bubble in SF… http://www.sfchronicle.com/business/networth/article/How-much-will-Bay-Area-homes-cost-a-year-from-now-6422610.php

Looks like there will be a lot of homes for sale next year but the supply of ready buyers won’t increase by the same rate…

I’ve been on the sidelines since 2007, Many bids but no takers.

The Bay area is too rich for my income, drive 55 miles out to Manteca and the prices make sense.

Manteca manteca!! – Dizzy Gillespie.

(Manteca is Spanish for lard)

Alex en San Jose’

Pos Si! and that would make those living there… Mantecosos? Que No?

How did Manteca get the name? Back in the day, it was a new train stop, with the name Monteca, when the first train tickets were printed, they mis-spelled the name Monteca and printed Manteca. and so it stuck. Probably a Mexican ticket printer.

Now a bedroom community for the bay area, you can buy a decent place for 250-350.

Less than half the price of San Hoozits..

HouseOwnsYOu – that’s interesting. I wonder what’s the story behind the name of the lovely town Los Banos?

FWIW, “manteca” is also slang for heroin. I bet Dizzy wasn’t getting so excited about lard…

https://www.youtube.com/watch?v=s2Tt6W-TxXs

the commute will kill you….not worth it….the 205-580 nightmare is 2 hours each way, so 20 hours of your life weekly to live in Manteca?

no way would I have the patience to live there…I would move to foothills maybe Fair Oaks, Sacramento neighborhood

Fair Oaks? It was once a nice quiet suburb of Sacramento back in the day but now has a growing homeless problem and crime problem.

http://sacramento.cbslocal.com/2015/03/03/sacramento-county-deputies-tackling-growing-homeless-problem/

http://www.sacbee.com/news/local/news-columns-blogs/marcos-breton/article31921503.html

Good reading Doc. It’s crazy for me that so few owners are resisting coming to market and trying to sell. Possible fortunes to cash in, should be a selfish market incentive, for many more owners to come to market and try to sell. And so help market be self-balancing. I can only assume it’s total bubble mentality, and complacency.

Good points. I think it is the marker of unrealistic outlook as you say. I think the real issue is what do they do when they sell. See this is what is so funny about Real Estate. We all cheer values going up, but who does that help? If you are about to need to go to assisted living and sell at the top then great. Or you are retiring from an expensive market and sell to move to a cheaper area you win again.

But if you are still in your working years with no intention of moving, then what do you do when you sell? You can rent and ride it out and buy when it is cheaper again, but if you don’t get the timing right you can be renting for much longer than you wish, so that is a gamble.

Believe it or not I know someone who bought at the low and at first cheered his rising home values, but not so much anymore as he has realized he can’t rally unlock the value.

There are people fortuantly I don’t know, or maybe just havn’t told me, that are unlocking this value buy taking out equity loans against their home. That way they don’t have to move and they get the money too. Well we know what will happen when prices start edging down a all. Then poof housing crisis 2.0 and HOUSiNG TO TANK HARD SOON!

I sold a house in So. Cal. in 2014. I don’t have a crystal ball, so there is no way I could have timed the market perfectly, or I would have held on another 6 – 9 months in hindsight! I still had a bidding war, sold well above asking price, and did just fine. I don’t understand why more Boomers aren’t cashing out either. I’m guessing the older generations may have Prop 13 benefits, the kids are taking over, or they simply don’t know where to go … the old if I sell, I’d have to spend that much on another place! There were a few neighbors that sold over the last several years, that took their money and fled … put 1/2 on a home in Arizona and live/retire comfortably! I already had two other homes out of state, so just added the proceeds to my nest egg and am retiring comfortably.

I’ll speak to that. I recently retired (now officially one of those Golden Sarcophagus Boomers so often vilified here – though my little crapshack is maybe Bronze at best). I could cash out and move anywhere, but I’m not in any hurry to do so. Sure I could get a bigger house (or the same size house and a few hundred $K) if I moved to flyover country, but I actually kinda like it here.

Though a bit chilly last week (down in the 50s, brrrr) I’ve still been getting on the bike or hiking in the nearby park pretty much every day. My friends live here and it’ll be a long time till I need to start looking at Taco Tuesdays or eating cat food, so why should I bail? Sad truth is that most of the boomers I know are basically fat and happy. Yes, we ate the seed corn, took advantage of unlikely-to-be-repeated growth in equities and real estate, screwed the upcoming generations and got rich at their expense, but there it is.

Given that situation I don’t think anyone should expect a mass boomer exodus anytime soon.

I think on reason more sellers aren’t coming on the market and selling their homes is that they couldn’t afford to purchase another home in the same or better area. And many probably want to stay in the area, but even if they got asking price, they couldn’t afford it!

Reminds me of 2005-2006 all over again. Sure, I could sell my home in Phoenix for $400K, but then if all the other houses are selling for the same or more, then I couldn’t afford to move!

Stalemate!

And the big shit sandwich about it is, then you have to live in Arizona.

Eddie, ignore Alex in San Jose, he’s always making rude, irrelevant comments like that to people.

@Eddie89, another reason people aren’t selling is they think their $700K crap shack will soon be worth $2MM dollars. Heaven forbid they sell at $700K when if they wait a couple of years it will be crap shack lotto at $2,000,000.00. These people believe that all of SoCal is prime world class real estate, even the areas that border on and include slums, ghettos and barrios.

Brain, there are still a lot of people here who mortgaged in the run up to 2008 and remain underwater or barely have any equity. In other words, they can’t afford to sell!

Even for the non-mortgaged and those with sufficient equity, why sell and have to fight the other mice for expensive crumbs?

Just one of the potential tangibles of ownership, being stuck in place.

Good reading, all above – and I can understand those owners who are happy as they are, and are not tempted by the immense money if they sold. Mainly because they have had very good run with everything else, including career and pensions, so they are ‘sorted’ regardless of a correction in prices.

HC, that much is true (underwater) but it does not cover all owners, including high-value equity rich owners.

I can only hope more of them act upon a selfish incentive to sell, and that the buying side cools into it, including foreign money that ‘never runs out’. Used to enjoy What!? post about that.

There is also the option to STR. In England, that’s the term for ‘Sell To Rent’. It has occurred before. Not sell to buy again, but to sell (cash out toppy price and bank the big big money) and choose to Rent somewhere nice, waiting/as house prices fall.

So HC, it is worth keeping an eye on rental values, for even better value in rents, may tempted out more sellers.

That sounds like someone I know who is trying to sell their house in Fountain Valley as she and her husband want to move into a bigger one.

She bought near the peak of the last housing bubble, roughly $700000 for the SFR. When she got the house appraised, they valued it between $650 – 700K. I was SHOCKED that the value did not go up at all! And this is certainly no ‘ghetto’ neighborhood by any stretch of the imagination (actually looks upper middle-class)…

And on OCHousingNews site, I am already hearing about people saying that sales even in IRVINE (epicenter of wealthy Chinese homebuying activity) slowing down considerably…

I wonder if i we really are in the midst of a housing “correction” or even a dreaded crash??? If that is case, I am definitely going to wait for prices to go down before I even think about buying.

Brain, I think it does apply to those with a lot of equity because the vast majority who sell will be buying a replacement. Of those, many would only consider a like kind or better replacement. The problem is that they would be buying said replacement in the same inflated and limited marketplace that they have to sell into. Therefore, their potential transaction costs are also inflated and the pickings slim. In other words, it’s become expensive to sell.

Have not heard of ‘sell to let’ but it’s certainly the shrewd approach that most Americans aren’t willing to take, unsure if it’s the same story in England.

Lately I meet many different people from different origins. They all are talking about not just leaving California, but leaving US. For example one Italian guy who came to US with his family as a 13 years old boy, lived in San Jose all his life. He is going back to Italy…he looked around 60 yo to me. He said there is no morals or God left in this country. There is no respect from person to person, too many guns, too expensive and he has to always watch his back, because too much crime around. He said his house was all paid off and he is not really looking for money, but rather for spiritual growth that does not exist in this country any longer. Hippy Days Have Ended?

I forget if I read an article from this year or last but it highlighted the fact that Americans are revoking citizenship at an increased pace. Every subsequent year there are more Americans leaving the country and not coming back. Last year was the largest number in history. Yes, this place is really messed up but it is a hell of a lot better than 90% of other countries.

I sold my house in the East Bay for a bundle in 2006 and moved to Central America thinking the grass was greener but returned to a semi rural area in 2013 and I have a paid off house. The grass was greener for awhile but the Turd World got old. It might work to leave the U.S. if you are a national of another country and you return home or if you are married to a national of the country you move to but otherwise it rarely works. I have gained a great deal,of respect for forgniers who come here and stick it out. God bless my grandparents.

We pay, effectively, as much in taxes as the average European, and then pay on top of that for things the Europeans get for laying their taxes. I was awakened to this fact by a rather ticked off European telling me this.

Our social mobility is very low, lower than in Britain and we’re becoming a caste society.

Crime is rather high, and we have what are essentially tribes, gearing up for battle. Black, Mexican, you name it. Scariest to me are the white tribes and I’m white.

I wish when I was 20 or so I’d picked up a very portable skill like sign lettering and wetbacked it to France!

I love this! I would have never thought to consider spiritual and moral climate in evaluating where to live. Thank you for sharing this perspective of a long time immigrant, it is eye opening and refreshing.

Not to mention the rule of law is effectively nullified. IRS/NSA/CIA/EPA and whatever other govt agencies can target you for your political or religious beliefs. Mandatory vaccinations and gmo laden food plus you rot in traffic hours per day to work for the leviathan. The whole system of systems (healthcare, education, housing, finance, labor, regulation, immigration) is untenable and will either collapse under its own weight or be killed.

Junior when I was “successful” running my small business it was the classic “you’re self employed; you get to choose which 60 hours a week to work” and I was spending about 3 hours a day “A.I.S” ass-in-seat, driving my car. It was just a treadmill.

I’m truly disappointed in this Italian-American fellow.

What is wrong with the American religion of greed anyway?

Greed, after all, is the true American religion. I’m sorry to see that he’s such an apostate from it and that, like some sort of an infidel, he refuses to bow down to it and instead subscribes to some quaint, and antiquated notion of “God.”

The one and only true “god” in the U.S. of A. is money!!!! Sorry to see this fellow doesn’t share the faith.

I was just thinking about this today, in fact. We’ve commercialized EVERYTHING in the USA. From childbirth to even beyond the grave, everything is just a money grab. It’s sad really that things such as child care, weddings and funerals are seen as cash cows. It’s sad how greedy Americans have become.

Lately I meet many different people from different origins. They all are talking about not just leaving California, but leaving US. For example one Italian guy who came to US with his family as a 13 years old boy, lived in San Jose all his life. He is going back to Italy…he looked around 60 yo to me. He said there is no morals or God left in this country. There is no respect from person to person, too many guns, too expensive and he has to always watch his back, because too much crime around. He said his house was all paid off and he is not really looking for money, but rather for spiritual growth that does not exist in this country any longer. Hippy Days Have Ended?

You posted this twice? Under two different handles?

How many handles do you post under?

He’s of age where he can move and it wouldn’t affect anyone else. So good for him.

I don’t mind more people leaving back to Europe. Frees up more space for the rest of us who wants to be here.

I live in the Napa Valley area and we go to SF 4 or 5 times per year. On top of what this article states the place is downright dirty. The city streets are trashed and homeless seem to be everywhere downtown. Near Market the smell of urine can be found on many streets. Trash is everywhere. Ascetically San Francisco will always be beautiful due to its locale and setting. Humans have done their best to ruin this once beautiful city. So go for your 1.1 million dollar 400 sq. ft. shack and enjoy….

A condo in Santa Monica or Venice starts at 675k for a beater and 750 for anything decent, 850 for something good, and million something really nice. No wonder tech world is expanding to LA, seems a steal compared to SF.

That’s what a west side techie was explaining to me today. The west side of L.A. is a steal compared to San Francisco prices. This is why so many tech companies are expanding into Southern California. Even though to us people down south, the prices they and their employees pay for real estate seem outrageous, it is a lot less expensive than what they would be paying if they were expanding in the Bay Area.

Are these established tech companies or more of the unicorn kind?

@Prince of Heck, 90% of these Silicone Beach high tech companies are unicorn and/or startups.

I work in a business park where these unicorns and/or startups move in, buy $2000 ergonomic chairs, burn through their cash and then shut down within two years. They are dime a dozen in West LA.

Well, in Playa Vista, on the west side of town, Google just paid $120 million for 12 acres on the old Hughes property. Mind you, they already have a presence up the road in Venice.

http://www.latimes.com/business/realestate/la-fi-playa-property-sale-20141203-story.html

Google is no “unicorn.”

What $1.35M is asked for in Villa Park, CA:

http://www.zillow.com/homedetails/18582-Valley-Dr-Villa-Park-CA-92861/25420990_zpid/?utm_source=Yahoo&utm_medium=referral&utm_campaign=serp

70 days on the market.

$1.2M asking price in Sonoma, 18 days:

http://www.zillow.com/homes/for_sale/house_type/15829272_zpid/500000-_price/1869-_mp/38.379614,-122.421684,37.981281,-122.917442_rect/10_zm/2_p/0_mmm/?3col=true

I’d say a half acre high end suburban home is a better lifestyle buy at $1.35 M than an nice middle class house for $1.2M.

But awful Orange County vs wonderful Sonoma!!

Joe R..As a buyer and seller of properties for many years now the Villa park home at 457 sq. ft. is ridiculous price and here lies the problem. In the world of RE at the most that house should fetch 200 a ft. and that is something a buyer needs to think about.

This is why I see a crash coming forget the cute word of bubble, when houses sink in price and value ratio, it is crash of the markets. Nobody in their right mind should buy that home at $1.3m and think in 5 years they can sell it for $1.8m and make a nice profit won’t happen, especially in Villa park. Insane is even not strong enough as to the prices of homes, houses overvalued by many, hundred’s of thousand dollars will fall away and another major housing depression is born?

Location, location, location … that is still a fundamental for real estate. These people paying a Malibu or Newport Beach per square foot price in all of these lesser locations, are in for rude surprises!

At the bottom of the market, distressed properties on the southwest end of Villa Park (a block from Orange) were ~$600K. VP seems to have fairly low turnover from what I see. If someone handed me $1M and said go buy a house with this or lose it, I’d buy in VP. We know a couple of families who live there. One won a huge lawsuit, and one had a rich Dad.

I would take the Sonoma home but I’m not going to pretend like Villa Park isn’t a nice city if you like the privacy. It is a very rich area and people that live there prefer it because it is more private/exclusive than Anaheim Hills or Orange.

But what jobs are there in Sonoma? Waiter? Dishwasher? Selling smelly candles in a gift shop? That’s the problem, cheaper areas tend to have far less in the way of jobs.

I see where Sara Palin listed her Scottsdale home at $2.5m.they paid $1.7m She says it is to big (?) talk on the street, she can’t get speaking engagements and most of her TV contact’s dried up. Her husband won’t get a job and just wants to swim and fish all day, so back to cold dark Alaska.

The market says it is priced right at 8,00 sq. ft. the problem, her zip code is selling very, very slow, only her name can save the day, but most buyers don’t buy houses with a name recognition on it anymore, ask any Hollywood celebrity they are taking a bath on sale of their mansions.

This is a sign of the times coming in 2016, I believe many sellers who are holding out this spring to sell their house to just break even or lose some equity, just may find few buyers at any price let alone $2m+ houses?

What are you talking about? A decent but older single family in a decent Santa Monica street that is not a major highway costs at least 2 million. North of Montana starts in the 3 million. I am talking teardowns. Same in Manhattan Beach, Pacific Palisades, Malibu, Maria Del Ray, Hermosa Beach, …. If you are white, and you want to live in a save area, you are looking at 2M for starter home. That is as expensive as it gets in California. And, they are going higher. There is almost nothing for sale.

Schools in Sonoma are lower rated. That matters for buyers with kids.

Pasadena is experiencing a spike in crime: http://www.pasadenastarnews.com/general-news/20151230/spate-of-pasadena-shootings-raise-concern-about-gang-violence

If this keeps up, home values should go down.

L.A., too:

“2015 was a violent year in Los Angeles”

http://www.cbsnews.com/news/2015-was-a-violent-year-in-los-angeles/

If indeed this is the beginning of a trend, once it sinks into the public perception there’s going to be a lot of rethinking around the idea of buying an overpriced flip in the ghetto. Let the good times roll.

A friend of mine bought a small commercial building in downtown LA in 2000 for 465K. It was a gamble back then because he was two blocks from skid row. But he needed a place to stash all his video and audio equipment.

Now, 16 years later, he turned down 4.8M. His building is in a hot neighborhood. He says he wants 5.2M and he will sell in the spring then buy a ranch in Austin. I try to warn him about the housing bubble, but I can’t offer any insight into the commercial market. I’m not sure if the same rules exist there.

“Bulls make money, bears make money, pigs get slaughtered.”

Since hot money found its way all around risky assets, it wouldn’t be a surprise if and when commercial real estate gets hit hard. Holding out for another measly 400K after a 10-fold return is piggish.

It is ALWAYS better to have 4.8 mil. cash in your pocket than 5.2 mil. on paper. Greed goes before the fall. Later he will regret it. I heard about similar cases so many times.

I am really surprised to see worldwide stock markets have not tanked yet. All it takes is for some hedge fund managers to pull the plug and we will be in for a rude awakening. I am not that greedy and have pulled my money out of the market for over two years now. I wish that I am wrong but what I am seeing are greedy investors who want to make a quick buck from doing nothing except for gambling and betting. The rich won’t get hurt but what I am pity are for the poor and the working class folks who depend on their retirement savings which will soon get evaporated if these so-called investors are withdrawing their easy earning profits. I hate to be pessimistic but bad time is coming. It has for many of us already. It will take a while for Wall Street to wake up and see the reality as is.

Looks like your new years resolution may come true-

Global Stocks Sink on China, U.S. Growth Concerns – January 4, 2016 — 2:31 PM PST

Stocks were pummeled on the first trading day of the year, sending the Dow Jones Industrial Average down as much as 467 points before recouping some of those losses as a selloff in Chinese equities spread amid anxiety over the outlook for global growth.

While the U.S. blue-chip index had almost halved its decline by the end of Monday trading, the Dow still capped its worst start to a year since 2008. Banks and health care shares led the Standard & Poor’s 500 Index to a 1.5 percent slump, and a gauge of global equities posted its worst inaugural session in at least three decades. Emerging-market shares slid the most since August as evidence of slowing manufacturing in China triggered a selloff that halted trading in Shanghai. As riskier assets were shunned, bonds found favor and the yen rallied. Oil ended lower after rising earlier in the session.

http://bloom.bg/1YZloRu

Leave a Reply