How to buy a $1 million home in San Francisco for $2,000 a month: Interest only loans and low interest rates provide for maximum leverage.

Some of you may remember San Francisco as it was in the 1970s. It was a place where those with very little income still had the chance to be welcome regardless of earning potential. In fact, much of the city’s vibe went against the machinery of capitalism or old forms of traditionalism. So it is ironic that today, it has become one of the most expensive cities and many that live in the city practice a magnified version of NIMBYism causing housing values to rise to stratospheric levels. It is no surprise then that the typical rent in San Francisco is $3,200 per month for a basic apartment and only 36 percent of households actually own. This in a market where tech workers earn good income. You have many tech workers doubling and tripling up just to cover the rent. Others are living at home with their parents. In California if there is a will there is certainly a way. The interest only loan is making it possible for those on tight budgets to speculate heavily on real estate. What if I told you that you could buy a $1 million home with a $2,000 mortgage payment per month?

The interest only mirage

It is absolutely true that most Californians live by the “monthly nut†version of budgeting. There are many people that I know living in apartments or doubling up with roommates but leasing BMWs, Mercedes SUVs, and even going into deep debt to drive a Tesla. Nothing wrong with that. It is their money after all. Yet many see these folks driving around and somehow assume they are “wealthy†when they are simply living the all hat and no cattle version of the California Dream. Debt makes the world go round.

The interest only loan is still out there and for those wanting to dive into a 30 year commitment and banks are more than willing to make this happen. Take a look at this home in San Francisco:

50 Urbano Dr,San Francisco, CA 94127

2 beds and 1 bath listed at 1,150 square feet

2 beds and 1 bath does not provide a large space for a growing family. If you think the $700,000 crap shacks of SoCal are crazy, San Francisco puts us to shame. The above place is listed for $995,000. One used scooter away from a million dollars. What is interesting with the ad is that it is already assuming you are going to expand this place out. Take a look at the Google Streetview:

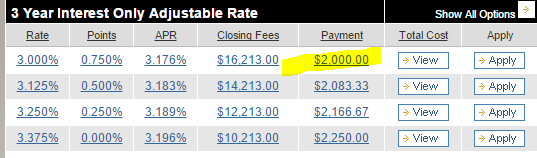

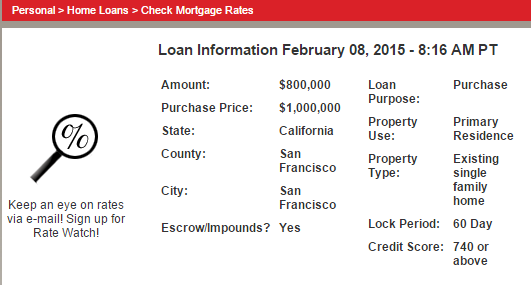

So of course, most of the house lusting budget stretchers are not going to have funds for the massive expansion. Many are going to buy and pretend that they are big “owners†when in reality many are putting every penny to their mortgage payment. Some banks are offering interest only loans again with the caveat that you have a good down payment (which most in California struggle with and that is why sales volume is pathetic). But assume you have the down payment funds. Take a look at the below:

You can go with a 3-year interest only loan on this place and pay $2,000 a month in principal and interest. Of course you still have to pay for insurance and about $10,000+ in annual taxes. If you have $200,000 to burn and itching to live here, feel free to commit $800,000 over 30 years. You are also betting on good things happening to prices over the next 3 years when the interest only portion reverts. It is interesting that people feel that once they have a mortgage that somehow, they own the home outright. Miss one payment and see who truly owns a home. You can ask the 7,000,000+ foreclosed homeowners, many now living in rentals how that works out. You don’t own it fully until it is paid off. You either rent from a landlord or the bank. And even once the home is paid off, you still have taxes, insurance, and maintenance which many Friskies eating baby boomers are realizing as they live in million dollar homes but have weak income streams. It also doesn’t help that many have their adult kids living back home.

The interest only loan is a big speculative bet. After three years, you still owe $800,000 and will need to refinance. You are only paying interest after all. You better make sure you budget for all things. The 10 year adjustable rate mortgage with the same lender is $3,500. That is a big difference from $2,000.

San Francisco has some of the strictest building codes. So the area has basically gentrified to the point that high paid tech workers can’t even purchase homes. Others are pushed out which is the opposite of what the area attracted in the 1970s. Welcome to California housing! You can buy a $1 million shack for $2,000 a month in principal and interest and speculate that housing values will continue to go up. Many in California think they have a diversified portfolio but when it comes down to it, they are heavily vested on one asset class, housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

102 Responses to “How to buy a $1 million home in San Francisco for $2,000 a month: Interest only loans and low interest rates provide for maximum leverage.”

What the Doc failed to mention is that this property is hardly located in a stellar neighborhood. This is another “up and coming neighborhood” that, 10 years ago, was a borderline ghetto with zero charm. A property like this in Noe Valley goes for $1.5m and up.

Why are liberal cities the most expensive? They have all the policies to help everyone…

you probably also think Obama is a liberal. Don’t look at the hype, look at the policy. SF is gentrifying at a record pace, it may attract nominal hipsters but in point of fact almost everyone here out to make a buck.

I bought a condo in a very nice neighborhood of Scottsdale, AZ, in 2005, for $290,000. I put $10,000 into it. If you figure appreciation of say 5% a year, it should be worth about $500,000 today. I should add about 2% for inflation, so at 7% annual appreciation, it should be worth $600,000 today. If it was just based on inflation, it should be worth $400,000 today.

However, my condo is worth about $225,000 in 2015. I have lost 25% of my investment, and then add another 20% for inflation, I have lost 45% of my original investment. Now I made about $100,000 in net rent profit in 10 years.

Was it worth it?

Talk about pulling out some random numbers. So I’ll give you a random answer, “yes, it was totally worth it!”

Yes it was worth it, you are cash flow positive. Where have you been investing your rental profits? How much investment income has your rental profit investment made you? You of course have already re-fied into a very low interest rate mtg. Well done sir, you bought a condo at the very peak of a very overheated bubble and you are plus $100K NET. You have made lemonade out of lemons. I am in a very similar situation with one of my rentals, also purchased in ’05 in San Diego, with the exception that the current value is nearly what I paid for it. Irrelevant, nevertheless, as I am significantly cash flow positive.

As @UnRealist will tell you that your mistake was not buying in SoCal. If you are to buy in SoCal, you would’ve been better of 🙂 because properties never go down in SoCal!

Sounds like a loaded and/or a dumb question. Obviously there are personal factors that none of us could know which would determine “worth” of this endeavor for you.

Strictly looking at it from the money perspective, get back to us after filing your taxes following the sale, then tell us if you thought it was worth it. Don’t forget recapture all of the depreciation you took on the condo while in service. Hope you don’t get hit with any special assessments some day before selling.

You invested $10k into a $290k condo. You say the condo is currently worth $225k. According to your numbers, you have lost only about 20% of your investment excluding inflation (you lost $55k if you were to sell today).

If you netted $100k in rent, as of this moment, you’re up $45k, not including realtor fees, if you were to sell.

So, not accounting for all the work you’ve done, and not including realtor fees, at this moment you’ve turned $10k into $45k in 10 years (450% total ROI, about 16% annualized ROI). Not bad at all.

Problem is, I’m not sure if I believe that. At 5%, a $280k mortgage is $1500/mo. Add in taxes (1.3%? of $225k = ±$250/mo) and HOA ($250?/mo), and you have a monthly expense of $2000. You’re asserting that, after taxes, you profited $833/month in rent per month, meaning you collected somewhere in the neighborhood of $3,000+ per month on a $290k condo? Unless there is some gross deficiency in my math, your claim is not very believable.

Never mind the first part of my post, since I didn’t consider how much you on the place. My numbers for the first part of the post are therefore meaningless.

However, the second part of my post, the part where I noted your claim is not believable, is still relevant. $100k in rent profit in 10 years is an overly optimistic claim (to put in nicely) for a $290k condo where you only put $10k down.

Sorry but it’s certainly possible to have netted $100K in 10 years if the guy did what everyone else in Scottsdale did in ’05 – go with a I/O 3/1 ARM loan. Interest rates plunged and with an I/O his payment would have easily fallen below $1K/mo. With depreciation and other write-offs, taxes would not be much of an issue. $2500/mo. rent on a nice condo in S-dale is about what it would take to get to around $100K over 10 yrs.

No doubt there is some sucker who will take out an interest only loan and buy this place! After all, that would be cheaper than renting … or at least the naive sucker thinks so! Seems futile! We are just recovering from near financial disaster, yet are once again hurling ourselves down that same path. Deja vu! Maybe we’ll get it right this time … and there will be no recovery …

It is not cheaper than renting because renting doesn’t require a $200K deposit.

And the LL foots the bills for repairs. So not cheaper than renting.

Siggy, it IS cheaper after a few years

Take $200K and divide it by 7 years, the average time someone stays in a house. $28.5K a year or $2,375/mo in the aggregate that the renter doesn’t have to outlay.

Most definitely not cheaper than renting. Not even close by a mile. Unless one is define a staying in the place for a “few” years to mean 30 years. Anyone who claims otherwise is only fooling their own self and probably trying to fool everyone else as well.

That’s why you put down 3%, then you don’t have that problem.

An equivalent rental does not require a $30K deposit and then we’re amortizing and accumulating interest on an additional $170K in principal which makes both the pre and post I/O reset payments that much more than an equivalent rent payment, making renting an even wiser financial move. Problem still exists.

It is actually even more expensive after few years since the principle payments will kick in…

Hey sleepless, you should try putting the word “is” in all caps, apparently it has the power to remove reality for scenarios such as principal repayments kicking in down the road.

only memory of 70’s frisco is the five dirty harry movies and the tv show the streets of SF with michael douglas

The McKinsey report from February 2015 has been released and can be downloaded at http://www.mckinsey.com/insights/economic_studies/debt_and_not_much_deleveraging.

Did you know that the Chinese economy alone added over $20 trillion in debt since 2007? Good luck trying to reconcile this report with flyover’s article that credit money supply has decreased by $20 trillion since 2008, assuming such an article even exists. From the report, “Total global debt rose by $57 trillion from the end of 2007 to the second quarter of 2014, reaching $199 trillion, or 286% of global GDP.â€

What are the risks and non-risks for 2015 and beyond?

Government debt growth has seen persistent annual percentage increases. Such increases in debt normally cause financial crises. However, many governments, such as Japan, are not at risk of a currency collapse, despite all the diligent research of hedge fund managers like Kyle Bass. Like the US, Japan has a special technology called the printing press that makes defaulting on government debt impossible.

Unfortunately, for the bears who expect the granddaddy of all bubbles, the government bond bubble, to pop and send US stocks down the cliff for the third time in this century, I think we are far more likely to see smaller crises come up first.

Here are the ones I can think of and my guess as to their probabilities:

1) Traders go all in shorting the Yen to 145 Yen a dollar, and going long the Nikkei to 22,000. As Japan’s money supply is actually growing modestly, the entire depreciation turns out to be a big QE mass delusion and blind faith in Kyle Bass who correctly predicted the US housing bust. An epic and unexpected squeeze sends the Yen roaring to 60 Yen a dollar and the Nikkei crashing to new all-time lows. Estimated probability: 0.5% (the likelihood that some variation of this plays out might be many times higher)

2) How many of your extended relatives would you go jointly and severally liable with? This was the question frequently posed by Kyle Bass around 2012 as the Eurozone seemed to be teetering on the edge of a breakup. Fast-forward to 2015 and traders have come to believe that a breakup is an unlikely possibility. In a huge surprise to the market, Greece is unable to negotiate a deal and decides to Grexit. Grexit fears soon turn into Spanic and the DAX and FTSE hit new all-time lows. Estimated probability: 25%

3) As the housing market in China slows down further, the government panics and decides to double down on their easing efforts. They succeed in inciting another speculative building binge sending commodities soaring and oil surging above $120 a barrel. They save the economy once more, but after 2-3 years, the commodity boom finally runs out of steam as Chinese real estate crashes, sending oil below $30 and copper below $1.50. Global stock markets crater amid a rare contraction in global GDP. Estimated probability: 1%

4) Low commodity prices persist long enough for commodity export economies like Canada and Australia to finally run out of steam. Homeowners watch with bewilderment as prices keep going lower and lower. China fails to go on another printing binge, and the downward spiral in real estate cannot be stopped. The capital flows from emerging economies back to the US accelerates and exceed the expectations and imaginations of most market participants. The risk-off episode sends the S&P to 1600 and the Fed embarks on QE4 to stem the decline. Estimated Probability: 1%

5) Continued economic strength in the US leads the Fed to hike the benchmark interest rate two times in 2015. They do this just as global economic weakness spills over into the US, pushing the US economy into a recession. Home prices decline, led by the fracking states and specuvestor capital Las Vegas. The 10 year US treasury yield goes under 0.8%, causing a refinancing frenzy and a new wave of speculators who buy rental properties using borrowed money rather than cash. Estimated probability: 0.5%

Interesting scenario’s. Based on your probabilities, looks like you think Greece will exit the EuroZone. Didn’t we see a similar issue in 2012 and we know how that played out, right?

Vegas LL,

Those are scarry numbers. Maybe they don’t scare you, but they definitely scare me.

Those percents chance of happening are bogus. Bernake didn’t give a small percent chance of housing colapse in 2007/2008. He said “no chance” – all under controll. That shows how knowledgable are those “experts” or how much truth/ reliability is in what they say.

If you want to trust them, feel free to spend your money. I am not keeping anyone from buying at current prices. I am just saying that I wouldn’t. My gut feeling tells me “danger”.

You also showed the enormous increase in government borrowing everywhere. Can they continue borrowing at the same rate (more than a trillion per year just in US)????!!!!….It is a mathematical imposibility. How are they going to service the debt (I know that they will never pay down anything)??? Where is the interest going to come from (assuming it stays the same – slim chance)???? Are they going to tax a fast decreasing middle class to death?!!!….

How can they continue taxing to death a youth which is mortgaged for life with student loans, who can not find good stable well paying jobs????…..

Maybe you already have all the answers to my questions. All I know is that soon (nobody can tell the exact date) you’ll see “the mother of all bubble” bust – the bond bubble. That will make 2008 like walk in the park (good all days) – just a warm up. The global bond market makes the FED irrelevant – no power to controll it.

If you want to understand the current economics at play in the US and the world right now I recommend the book “The Death of Money.” The author is well known for his previous book Currency Wars. He explains exactly what is unfolding in our economy and other economies (Greece, China, Russia, etc). We have yet to see the worst.

Reality check: the 2014 federal budget deficit was less than half of what you claim. It has been declining very fast over the last few years. Forbes: “the actual 2014 deficit was $483 billion”

Quit lying. Or get better informed.

“It is absolutely true that most Californians live by the “monthly nut†version of budgeting. There are many people that I know living in apartments or doubling up with roommates but leasing BMWs, Mercedes SUVs, and even going into deep debt to drive a Tesla. Nothing wrong with that. It is their money after all. Yet many see these folks driving around and somehow assume they are “wealthy†when they are simply living the all hat and no cattle version of the California Dream.”

I always assume the 20 somethings driving the fancy cars are rich because their parents are rich, so they can blow pay checks on frivolities. They know they’re gonna get a huge windfall somewhere down the road. I read somewhere that Frisco is the rentier capital of our nation. I sure get that trustafarian/privileged vibe whenever I go there.

Wealthy…. You have most to everything you own paid for, you have enough cash on hand to handle most emergencies, you go to the store and buy what you like and don’t ask yourself should I have bought it, you sleep good at night, you are healthy.

PS. don’t count on the parents and windfall’s anymore, most people took a direct hit in the sub-prime disaster, they have very little to leave and may never recover what they lost?

By your definition both my parents and I are wealthy

Thanks to easy credit, anyone can look wealthy. It used to be that when you owned a Cadillac, it meant you actually had the money to buy one. Now any idiot can lease a new $80k Escalade.

All hat, no cattle.

Thanks to the inflated “residual value,” it is often cheaper (monthly payment) to lease a BMW than a main stream car

Come on guys, these are premium prime global vehicles, therefore whatever it takes. Because everyone else.

Asking price: $995,000 and according to MarkinSF, not so good an area, and one which could worsen if the bubble money runs dry I suspect. Looks to me like a real ugly slave-box of a house. That price? I’d rather dress up in camo, climb up one the the tress behind the house, and sleep in the branches.

If the banks are providing the finance, if you have downpayment – then to me they’re just luring in the last of the fool money. The joy of younger buyers will drown out their howls, when market begins to cascade crash.

‘Interest on debt grows without rain’ – Yiddish proverb

Ahhh, that house. Was there ever a better example of “Buy now or be priced out forever” ?

I don’t know if some of you saw the RedFin piece on housing and how it is off to a flying start? It proclaims that a home in Denver got 23 offers and another home had so many people show up they couldn’t park all the cars.

I got to wonder who wrote this article and where is the addresses of these places they couldn’t provide them, started to wonder if Brian Williams got a new job as a beat reporter for RedFin?

Well Redfin’s obviously not writing glowing commentaries about the state of the market in my area! There is a house directly across the street that is listed by Redfin. Been on the market over 3 months now. Owners took another job in another state. Went pending about 8 wks ago, then back on the market 2 wks later and no traffic or bites ever since. They have an open house every weekend and one car turns up, if that. No price reductions in 3 mths. Makes me wonder do they need to sell it? What gets me is current owners bought it as a foreclosure in 2011 for $285k, but they are trying to sell it at $489k.

2 nice rentals on my street sat empty for over 3 months, with multiple rent reductions.

3 other homes for sale in my little neighborhood and all have been on the market for MONTHS. And same thing – no price reductions.

Lots of “for sale” inventory in my zip code, with very, very little movement. All, IMO, overpriced listings by deluded owners and Realtards.

Intel is about 5 miles away and even my deluded landlord stated “all those Intel employees will pay anything to own or rent here” and he was referring to the H1B1 East Indian employee pool which makes up the majority of staff at the Folsom Intel campus. Even they are not biting these days.

Everyone I know is tight on money these days. Basic cost of living and health care/Obamacare is eating away at disposable income. I don’t know a single person who has had a pay raise in YEARS. In fact most make LESS than they did 4 years ago due to their employers cutting back their retirement and health insurance contributions, and making the employees pay more out of their pocket.

Off to a flying start? Not in my zip code.

You are in Folsom. Way inland. Even this skeptic of the rah-rah crowd can say that if you were on the coast, the picture in your neighborhood would be much different.

There are two markets in Cali, within a certain number of miles of the coast (including LA in that), and everything further inland. This blog seems focused on the coastal areas.

Regarding the companies cutting costs…

Our company used to offer free lunches every Friday before the new year. Now, it is every second Friday. I wonder if they end it by the next new year.

We used to have nice health insurance last year. This year the company pushed everyone to the exchanges. Now, I pay 10% more than last year for lower coverage (higher deductibles). Everyone starts to wonder where this is all going… rekovereeee all the way 🙂

The doctor is so right about the bank owning the house. I’ve never understood how people felt they ‘owned’ a house when they owe almost $1,000,000.

The thing about focusing on the monthly payment and stretching yourself to buy in is this – as soon as you move in you’re going to think of things that need to be done. Painting, a new water heater, those pesky leaks in the basement – they all cost more than you think they will. Unless you’re buying a turn key house you’re going to rue the day you left your cozy apartment where everything was taken care of for you.

I agree. I enjoy my gorgeous rental house. What I enjoy even more is saving over 35% of my income every month, and the landlord paying for everything. I never have to worry about paying for repairs, property taxes increasing, etc.

The last house we owned was a money pit. It near bled us dry and I swear I’ll never do it again. And it was only 4 yrs old when we bought it. The only way time I’ll buy again is when its so damn cheap I have even more disposable income left over every month than I do now, being a renter. That way it can’t bleed me dry. I don’t miss being a homeowner except for 2 things: 1. Being able to paint the walls the color I like, and 2. Getting another (large) dog. Rental houses that allow both those are hard to come by, except super expensive ones, which defeats the purpose why I rent!

In the (rare) defense of renting, I’ve never seen a landlord of an SFR disallow painting of the walls. They just say paint them back to white when you leave. And dogs are usually allowed with a small deposit, which is fair. You may want to find a new landlord.

I love your HUMINT (Human Intelligence anecdotal info), your outlook from experience, and your absolute focus on what you want – whilst saving towards it.

Calgirl, I’m going to email my sister with your 2 posts above, to improve her spirits and her focus of mind… especially cost-of-maintaining a house + saving… and hints of rental weakness.

Meh, San Francisco’s stratospheric housing prices will quickly tumble after the next big earthquake or when their drinking water shipped in via canals from the Hetch Hetchy reservoir in Yosemite is turned off.

Been waiting for that scenario for awhile now. Thinking it may never happen. Of course, that would screw So Cal as well.

If they “shut off the water”, you know how many riots there would be? Not gonna happen. And an earthquake will only eliminate more housing, thus driving prices EVEN higher. And then the new regulations for yet STRONGER reinforcements will further drive the price up of new construction.

Realist, “they” won’t shut off the water. But Mother Nature might.

And we can riot all we like when that happens. She won’t give a damn.

@UnRealist, you don’t have to literally “shut off the water”, you can just have a meter on every faucet and raise the prices to, say, $5/gal. See what happens then if you can no longer take a shower. Just the reminder, the Detroit, they did shut off the water to the deadbeats who don’t pay their bills.

@calinomore, SF prices get crushed when Dot Bomb 3.0 implodes.

The Bay Area is supported by other peoples’ month chasing after the next big thing. Most of the Dot Bomb 3.0 companies have no earnings, a massive cash burn rate, and only survive due to investors shoveling money down the gullets of the Bay Area snake oil charlatans.

Do what they do best in liberal cities and just go with it. Go with anything and everything you can. Don’t bother at all to do what you think is right. Don’t be an individual. Just go with the rest of the sheep and be trending. I must get you all to believe change won’t happen so I can feel good about putting all of my eggs in that basket.

$995,000.00 for 1150 square feet in an area considered marginal? Governments are operating with huge deficits. It seems like money isn’t worth much, yet inflation is “low”. With the recent events, I would expect gold and silver to appreciate.

Why is gold even worth $1? Its all based on human perspective. Gold is OLD. People want oil, water, food and shelter.

Gold has intrinsic value because of its history of 3000+ years record of money. Money is something that preserves value over the long haul. In that context, what is a FRN(not going to call it a dollar). What is a Federal Reserve Note worth? Full faith of the US gov’t. Which has over 18Trillion in debt. Or something that cannot be printed out of thin air or generated by a computer. Gold takes labor, hard work to get out of the ground. The Central banks of the world have gold? Why? Are they stupid? Or as Bernanke testified, they keep it as “tradition”. Think and don’t be a sheeple.

Oil is the new gold and that wont change

You can replace oil with other energy sources (wind, solar, nuclear, etc). You cannot replace gold…

…and if the oil is so valuable, why is it so cheap now? Just like with housing, we have only finite supply of oil and constantly growing demand… Can housing lose value, just like oil? Can hosing be over-leveraged, just like oil is now with the junk bonds (aka MBSs)… and don’t tell me it is different with the housing!

Oil is down so they can drive out fracking and then drive it back up. Classic trade wars. (hope they don’t lead to WW’s!)

People will always need transportation and shelter, there will always be value. Hasn’t changed yet. And solar and wind are not viable long term solutions, they are only a piece of the puzzle. Electric cars need to get the electricity from somewhere (fossil fuels) and batteries are awfully messy to mine and make. Lots of energy involved in that, I suppose Musk is going to have a giant solar panel on top of his Gigafactory?

@UnRealist – “People will always need transportation and shelter, there will always be value”

Except the value tomorrow would be 50% lower than it is today. It always comes to supply and demand after all (see oil and other commodities drop 50% over last year). You can never have surplus of housing supply, can you?

@UnRealist – “I suppose Musk is going to have a giant solar panel on top of his Gigafactory?”

Yup, it could be, just like this largest solar plant in CA http://www.usatoday.com/story/tech/2015/02/10/worlds-largest-solar-plant-california-riverside-county/23159235/ . It doesn’t have to be on top, it could just be “next” to it.

I agree that housing and oil, at least in near future until we find a geed alternative, will be in demand. But can demand go down and drive the prices down? Your logic fails with oil as it is the essential commodity in the current economy, but it still can go down significantly in value. Just the same can happen with the housing, it will never be free, but it can lose value significantly!

The reasoning behind this homes price is simple. You have X number of homes in an area, and XX numbers of people. Let’s use 9, and 99.

99 people want a home and there are 9 homes available (sounds typical for San Fran). The 9 richest people are going to win their home. The remaining 90, we know nothing about. They may be dirt poor. So the 9 homes will be surrounded by a Whole Foods, and a bunch of Dollar Tree stores. Sound familiar?

Just looked up income data for that zip code. This is tax year 2011, out of 10136 households, 1934 makes more than $200k/year. So that may explain the craziness. It’s all relative I guess. I remember spending a summer in Oregon. The day I returned back to LA (upper west LA), 75% of the girls were 8+. Weight is a highly weighted factor in my scoring methodology.

Yeah but that zip code includes St. Francis Woods which is pretty damn exclusive; this house isn’t in St Francis Woods.

Realist, get your own blog.

Etherist, would you prefer that everybody on this blog just agree with you?

I’d prefer to see a bit of counter argument rather than a circle jerk. Besides, I’m far from certain that prices are going to fall. Don’t fight the Fed….

Jeff, there’s productive debate and then there’s the type of crop dusting crowds for the fun of it that defines comments from unrealist.

Does your math include the homes with deadbeats who haven’t paid their mortgages in years and keep living for free? Or the homes in the foreclosure limbo?

How about this bump across the street from my office. It has been vacant for at least two years now… Why is it not on the market? It is the prime location with the lakes views…

https://www.google.com/maps/place/Houghton+Beach+Park/@47.659837,-122.204792,3a,75y,81.5h,90t/data=!3m4!1e1!3m2!1saMxKjY0-D7mW1U_Ohb-dOg!2e0!4m2!3m1!1s0x0:0x29aff186bc8eff7a

It annoys me to see such homes, in good areas, left empty, for so long.

That could be a really fine home – or, if it has build-issues, great site for a complete rebuild.

https://www.redfin.com/WA/Kirkland/5808-Lakeview-Dr-98033/home/459552

Last Sold Price: $455,000

Sold On: Sep 7, 2004

Built: 1956

Lot Size: 6,955 Sq.Ft.

Status: Sold Source: Public Records

http://info.kingcounty.gov/Assessor/eRealProperty/Dashboard.aspx?ParcelNbr=2465400181

I thought this was interesting…Millennium Poll 18 -34 year olds. http://fusion.net/story/45003/broke-young-people-remain-convinced-theyll-be-millionaires-one-day/

53% live at home with parents.

28% don’t have jobs

40% receive financial support from parents.

70% expect to be millionaires.

97% expect to buy a home.

So much you can draw from this…Optimism? Delusion? $1M being worthless in a few years?

In any case, it’s clear that there is a lack of basic financial clarity by this cohort.

97% expect to buy a home

In Cali, go with the trending financing. Outside Cali, homes are cheap and ownership is easy. Plenty of $80k homes all over America.

Useless comment. Why don’t you pick a few comments per article instead of just over posting all the time.

with just the down payment amount you could go almost anywhere else outside of cali and pay cash for a house and have change left over………

1 of three things must happen.

1. my income triples.

2. houses devalue by 60%

3. i move out of the state.

it’s only a matter of time.

i digress from the topic in some ways but since I posted my other reply now the landlord has given me 60 days to move; they promised i could stay while they sold but realtors told them to get rid of me.

now Back to question of should I buy or should I rent?

Spoke to a veteran title insurance officer today at the gym and he told me that prices on houses in Southern California will continue to rise into the year 2020 according to his company.

Then on the other hand I watch the video on YouTube by Harry Dent who predicts the bubble will pop again in June 2015 and it will be worse than it was in 2008 a downturn he supposedly predicted.

I think all these guys have axes to grind because it benefits their business and so it’s hard to find someone that is truthful and accurate in their predictions.

There is an exclusive mobile home community near me where I live now in Chino Hills where there is a newer manufactured home and land for sale for $320k. Monthly HOA is $200. Payment of $950 with $120K d.p. plus $375 for taxes and insurance total nut $1525.

Or i could rent hopefully a master bedroom for $700 to 800 a month in someone else’s home in Chino Hills.

Does anybody know for sure when the bubble will pop?

i am very confused I need help and i don’t have too long to figure it out. Maybe I should just rent on a month-to-month basis to see which way the market trends.

@mikebarlow wrote “…when the bubble will pop?”

Answer: no one knows

However, based on history, crashing oil and commodity prices are the canary in the coal mine. Crashing oil and commodity prices generally proceed recessions. Recessions in SoCal results in home price crashes several years after commodity prices crash.

Federal banking laws allow banks to keep foreclosures off of the market for a period of up to 10 years. Most of the garbage loans were issued from 2004 to 2008, and the foreclosures that followed were from 2006 to 2010.

Based on tanking commodity prices and Federal banking laws, I would not expect to see a real estate correction in SoCal until 2016 or later.

ernst, i was thinking after i asked the question that no one really knows; what you said makes sense thank you very much

Nobody even know if there is a bubble, until it bursts.

Of course, some people scream for 10 years “there is a bubble” and eventually they will get it right.

Don’t look at your home as an investment, look at it as an expense.

When you buy you want to calculate your net expense, which is really: interest (minus tax benefit), tax (minus tax benefit), insurance, vs. rent. After that whatever makes sense to YOU.

Don’t forget to add repairs, replacement, maintenance, and transaction costs.

Mik,

You forgot maintenance cost, HOA dues, Melo Roose (most houses these days have that). These are real out of pocket expenses a renter doesn’t pay directly.

Siggy/Flyover, i was not going for a comprehensive list here.. just a sample.

But I do agree that all those things (maintenance, HOA, etc) need to be taken into account.

My main point – because it’s impossible to predict if your house value will go up or down calculation should comparing expenses, not a leveraged investment type computation.

Mike, if you can afford to buy and you plan to be in a place for more than five years, it’s simple — you should buy. Renting sucks. It doesn’t matter what everybody here is trying to tell themselves (I was one of them during the last bubble). Yes, if you squint real hard and convince yourself that you’ll squirrel money away in an awesome investment somewhere… etc.. — you can come up with numbers that make renting look better, but the simple fact is that purchasing a home (if done responsibly) is generally the single best investment the ‘average’ person makes. (I know many here will jump on that as being ‘crazy shill talk’ or something)

Now — the rub — manufactured homes DON’T usually appreciate, so this is something you really should consider.

Play with this calculator… Again, I’m sure the naysayers here will have a field day)

http://michaelbluejay.com/house/rentvsbuy.html

It’s a matter of circumstances and perspective. Renting is a fantastic option for many people just as owning is for many others. The real problem is rhetoric such as yours that tries to frame the debate as an objective given for one over the other. There are better/worse times and situations to buy and there are better/worse times and situations to rent.

Here are a couple of things that suck. Owning a house you can’t sell without taking a big loss. Losing a house in foreclosure. Now that sucks. Renters simply move out and move on quickly.

But hey, some people feel that they need to spread the NAR gospel on the skeptical devil’s playground in order to keep their congregation populated with ever more tithing participants. Reminds me of unrelenting Jehovah’s Witnesses who keep showing up at the door.

Owning can be fine but it ain’t all roses and buttercups that vested interests would like everyone to believe. That’s what blogs such as this one are all about, providing a balance by pointing out the potential pitfalls. There are plenty of mainstream media sources doing a good job of marketing all of the potentially positive aspects.

Renting wins in my case from doing the rent vs. buying house spreadsheet hands down, not even close. And renting wins even with a cheaper manufactured home renting wins but much closer but the assumption of a 3.5% increase in value for the mobile home is probably unrealistic even though I would be buying the home and the land and the homeowners dues is only $200 per month as opposed to $900 to $1000 space rent for mobile home parks in the area.

Headline in the Sacramento Bee today: New Elk Grove construction spurs hope for housing market.

Think they’ve missed the boat somehow.

http://www.sacbee.com/news/local/article9651980.html

Well written article about the currency wars:

http://www.marketwatch.com/story/is-an-accidental-currency-war-breaking-out-2015-02-10

How NOT to sell your house: Hilarious collection of world’s worst estate agent photos (so would YOU want to live here?)

Read more: http://www.dailymail.co.uk/news/article-2947277/Terrible-estate-agent-pictures-homes-dodgy-decor-random-animals-bizarre-furnishings.html#ixzz3RNu5iGsz

Renting is a fantastic long-term strategy in California. It is a strategy that all the wealthy people use. If you talk to any successful person out there, they will all agree that renting is the key to building wealth. Time and time again it has proven true that property ownership in SoCal is for fools who do not know what they are doing. Idiots.

I’m assuming your comment is sarcastic? Assuming that to be the case, you are aware that buying at the peak of the market is every bit as foolish as renting, and probably much more so, correct? At this moment, if someone has to choose between renting a reasonably-priced place versus buying an over-priced crap shack, I think most will select the best option for their short-term and long-term finances. And it’s not buying.

I’m sorry but your blanket statement is simply wrong wrong wrong. Did I say wrong?

In the neighborhood that I currently live in San Diego, homes are selling for more than they did during the ’06 peak. If you bought my home at the peak in ’06, right now you would be plus about $250K in appreciation – beyond it’s ’06 value. We are beyond the ’06 ‘peak’. Plus you would be 9 years into paying the house off.

You could have bought property in any nice coastal area at the market peak and right now you would likely be better than even if not up nicely, and pretty well along into paying off the home. But go ahead and stay on the sidelines, it is where all the smart money is, right? Just follow in the path of financially successful people and be a lifetime renter, yeah, that’s the ticket!

The statement is not wrong at all. It’s an opinion, just like yours, and is therefore not subject to being wrong. You may not agree with it, and it may not apply to every single situation, but it is certainly not wrong.

In very simplistic terms, financially successful people buy low and sell high, generally speaking. Buying high and selling high (breaking even) is better than buying high and selling low (losing), but it’s probably not a great way to make more money than less money.

In your example, you mention that people might have broken even, or maybe profited a bit, if they were to buy in the 2006 peak and sell now. However, a much more savvy approach would have been to wait until the 2009-2011 trough to buy (which I did, in early 2009). Given the multiple booms and busts of So Cal real estate over the past decades, it is probably reasonable to conclude that we are in a boom period not so dissimilar to 2005/2006. I’m comfortable waiting a few years for the bust, given I don’t absolutely need to buy another place, even though I want to. If it doesn’t happen within a few years, oh well, I’ve saved a much larger down payment.

I expect @UnRealist to comment on that 🙂

Yes, all the rich people are renting while all the poor people own. Yes, that is what is happening. Okay.

Yet in one interview, the rock star Meat Loaf said that he’d made more money in real estate than as a singer/recording artist.

Kathleen Robertson, the eye candy from 90210 and Boss, was the highest paid actress in the world last year from…acting? No. From her Real Estate transactions.

Kind of surprised he made any $ as a singer/recording artist.

Wondering if falconator is an old school housing cheerleading congregation member or a born-again of the 2012 vintage. Maybe one of the NAR clergy?

I must say, that was one hell of a straw man he erected.

Thank you Siggy!

Los Angeles Has the Biggest Disconnect in the US Between Wages and Rents

http://la.curbed.com/archives/2015/02/los_angeles_rents_wages_lag.php

Siggy to sleepless:

“…and if the oil is so valuable, why is it so cheap now? Just like with housing, we have only finite supply of oil and constantly growing demand… Can housing lose value, just like oil? Can hosing be over-leveraged, just like oil is now with the junk bonds (aka MBSs)… and don’t tell me it is different with the housing!”

Another way to look at it – USD is more valuable and expensive in terms of its commodity backing, oil. Apparently cash isn’t trash after all – you don’t see that bandied about by the housing cheerleader crowd much these days. Just holding on to cash from six months ago buys > 2x the amount of oil today.

Probably, in couple of years it would buy you twice as much housing… 🙂

Eden: Manufactured housing on it’s own lot doesn’t depreciate. It’s sold and taxed just like other real estate. A manufactured home in a park will depreciate to a certain point. Like site built housing the value is in the land.

Mikebarlow: better choice than an “air estate” where all you “own” is the space between the walls, but a manufactured house is harder to sell. And subject to the same boom and bust pricing as more establishment types of housing.

Should have said “on it’s own land” as opposed to leased in a park.

Thanks for the input i hear what you’re saying

I have a 60 day notice to move so I am under the gun.

I don’t want to do something too fast and make a mistake so I’m leaning towards renting a room now.

I’m going to pay my rent here for a least one more month.

Yesterday I sent out 66 letters to the same mobile home park to owners that have mobile homes that are from 2000 down in age. I got a call tonight from one lady she says thanks for sending me a letter but I’m not selling. I’ll probably just call her back and talk to her about living there. One owner in this park told me he bought last year for $160K. So I could if I find one for that price I can pay cash and have a monthly payment of $200 for homeowners. Tomorrow I’ll do the rent versus buy and plug in these new numbers. So I have to wait a little while to see if I get any bites on my letters and if not then I have about one or two weeks left on my rent and hope to secure a room for rent in an sfr.

I really appreciate this blog because there’s a lot of smart people here advocating all sorts of points of view and giving a lot of insights into Southern Cal housing.

“if you can afford to buy and you plan to be in a place for more than five years, it’s simple — you should buy. Renting sucks. It doesn’t matter what everybody here is trying to tell themselves”

I wonder how “simple” the following sellers feel the decision is? If only they would have consulted Meat Loaf or Kathleen Robertson before buying. Or maybe Carlton Sheets, Than Merrill, or Armando Montelongo.

https://www.redfin.com/CA/Hawthorne/4836-W-134th-St-90250/home/6670940

https://www.redfin.com/CA/Los-Angeles/7101-La-Tijera-Blvd-90045/unit-1102/home/8118945

https://www.redfin.com/CA/Torrance/22338-Harbor-Ridge-Ln-90502/unit-6/home/7645186

These are but a few examples showing how organic sellers in everyone wants to live here Los Angeles are now cracking. No more holding out. They have to move on. Taking a haircut sucks.

Let’s see what a few listings in the actual market are telling us about what’s going on right now, as opposed to what we’re supposedly telling ourselves.

Even super prime coastal global premium international rich clamoring to get in properties can have a hard time staying in escrow.

https://www.redfin.com/CA/Laguna-Beach/969-Skyline-Dr-92651/home/4888586

And some can’t even get a bite after four years of trying.

https://www.redfin.com/CA/Manhattan-Beach/107-N-Aviation-Blvd-90266/home/6701680

Even the banks are taking haircuts in Curbed LA’s neighborhood of the year.

https://www.redfin.com/CA/Inglewood/923-S-Oak-St-90301/home/6455214

But Inglewood is so gentrifyingly up and coming, some flips can’t even get a sale after two years on the market. Not enough Starbucks and Chipotle?

https://www.redfin.com/CA/Inglewood/328-Hargrave-St-90302/home/6431999

While some failed flippers are so desperate to cash-in their 2014 chips, they can’t figure out what price to list at. Seems that they don’t think cash is trash.

https://www.redfin.com/CA/Los-Angeles/1420-W-121st-St-90047/home/7324396

Lots of lucky number sevens. Just like a slot machine at a ghetto casino. What a coincidence.

https://www.redfin.com/CA/Los-Angeles/1822-W-65th-St-90047/home/7280224

It “only” took a 50% price cut for this junkyard to attract a bite.

https://www.redfin.com/CA/Lynwood/11638-Louise-Ave-90262/home/7366071

And “only” a ~25% price cut to attract a bite for a former home of genius in hipsters clamoring to get in Highland Park. Note that this one hasn’t been reeled-in yet.

https://www.redfin.com/CA/Lynwood/11638-Louise-Ave-90262/home/7366071

And you get a million dollar price reduction! And you get a million dollar price reduction! And you get a million dollar price reduction! In super global prime premium international Santa Monica and Palisades.

https://www.redfin.com/CA/Santa-Monica/26-Arcadia-Ter-90401/home/6779875

https://www.redfin.com/CA/Santa-Monica/2131-Virginia-Ave-90404/home/6767284

https://www.redfin.com/CA/Pacific-Palisades/715-Napoli-Dr-90272/home/6839602

https://www.redfin.com/CA/Pacific-Palisades/14170-W-Sunset-Blvd-90272/home/6839953

And what the hell, how about three million off in the hills of Beverly Hills.

https://www.redfin.com/CA/Beverly-Hills/1235-Tower-Rd-90210/home/6823937

Speaking of super global prime premium international mega rich, don’t forget the food truck silicon beach all that and a bag of hand crafted artisan vegan gluten free chips crowd – can’t a Venice flip catch a break?

https://www.redfin.com/CA/Venice/1157-Van-Buren-Ave-90291/home/6741017

https://www.redfin.com/CA/Venice/415-Venice-Way-90291/home/6741600

https://www.redfin.com/CA/Venice/2900-Clune-Ave-90291/home/6734853

https://www.redfin.com/CA/Venice/2325-Cloy-Ave-90291/home/6735099

https://www.redfin.com/CA/Venice/2100-Abbot-Kinney-Blvd-90291/unit-F/home/58662069

https://www.redfin.com/CA/Venice/546-Vernon-Ave-90291/home/6741756

https://www.redfin.com/CA/Venice/33-20th-Pl-90291/home/23073244

https://www.redfin.com/CA/Venice/2007-Dell-Ave-90291/home/6741697

https://www.redfin.com/CA/Venice/585-Grand-Blvd-90291/home/6741558

https://www.redfin.com/CA/Venice/2603-Beach-Ave-90291/home/6735291

Or maybe Manhattan Beach is more your flavor? Apparently price matters, even though we’re told that incomes don’t.

https://www.redfin.com/CA/Manhattan-Beach/3613-Walnut-Ave-90266/home/6707922

https://www.redfin.com/CA/Manhattan-Beach/3005-Maple-Ave-90266/home/6708216

https://www.redfin.com/CA/Manhattan-Beach/640-30th-St-90266/home/6709026

#weather

Buy that million dollar house. If the market goes up 10%, refinance it and take out $100,000. Use that money for minimal down payments on 4 or 5 more houses. When you have milked the 2nd, 3rd, 4rth, and 5th house, walk away from them all. Put $500,000 in your pocket and retire overseas.

Beats working all your life. This is called “How It Was Done In The Eighties”

Leave a Reply to DweezilSFV