The kids aren’t alright: A record percentage of young adults live with older Americans. The trend continues to renting.

Higher home values for the sake of higher prices is not necessarily a good thing if future generations of Americans are being priced out of the market. There seems to be this movement that simply ignores the glaring plight of many Americans regarding stagnant incomes and the reality that we have gained 7 million renting households while facing a similar number in completed foreclosures since the Great Recession hit. The system in terms of organic supply and demand was artificially stunted as foreclosures lagged and banks auctioned off swaths of properties to large investors. With this trend backing off we are now left with higher prices but most regular families being priced out. In California you have over 2.3 million adults living with other adults because of financial challenges. Housing is an illiquid asset. At any point, you can buy a share of Google or Apple stock and sell it back practically in the same day. Not so for housing. At any given point only a short supply of total housing is on the market. Currently housing is priced for investors and not your typical family. Forget about younger Americans that are saddled with large levels of student debt and have lower incomes. When it comes to housing, the kids aren’t alright.

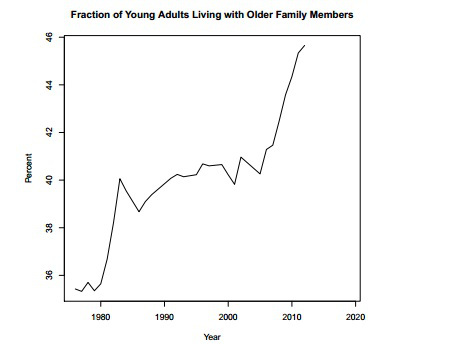

Highest percentage of young adults living at home

We currently have an incredibly high number of young adults living at home. This isn’t some new found appreciation for mom and dad. During the early 2000s the young did have a desire to buy. They bought with toxic mortgages and leveraged every cent they had into real estate. And when the crash hit, much of that reversed. Today, many would like to buy but simply cannot because of household wages. The FHFA is likely going to loosen lending standards but incomes will still be verified.

This trend of adults living with adults is big:

In California I have talked with many parents where their boomerang kids come back home after college because they simply cannot afford to rent even an apartment in their current market. Some of these parents love the million dollar valuation on their granite countertop laden real estate sarcophagus but then pound their fist on the table when their kids making lower wages can’t afford without mom and dad opening up their wallets and kicking some funds down.

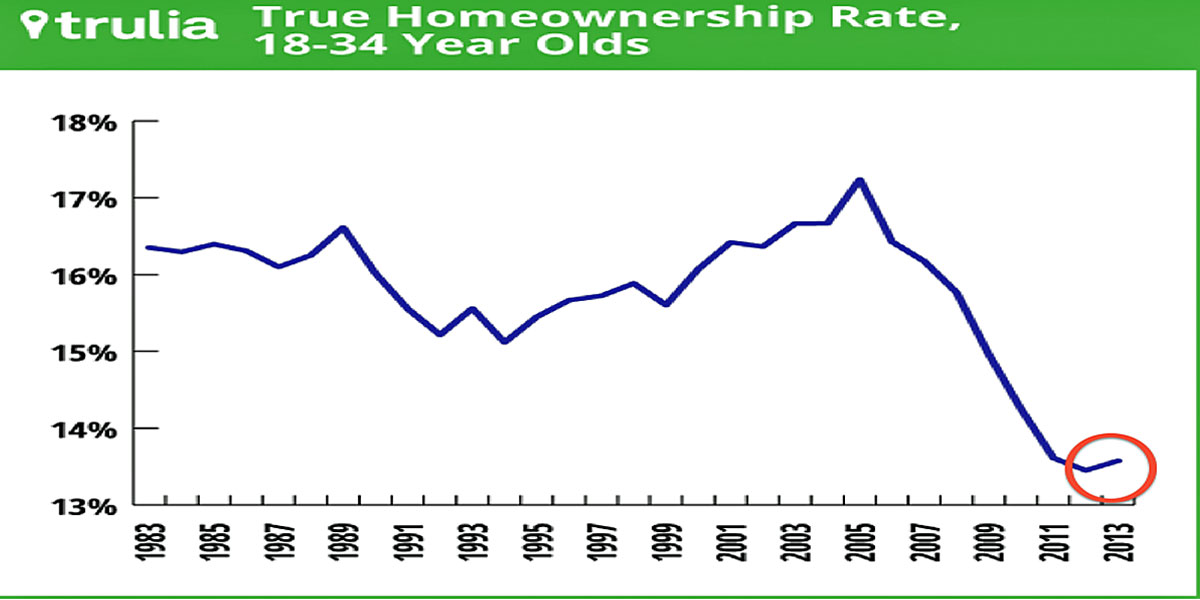

The homeownership rate for younger Americans has gone on a steep decline:

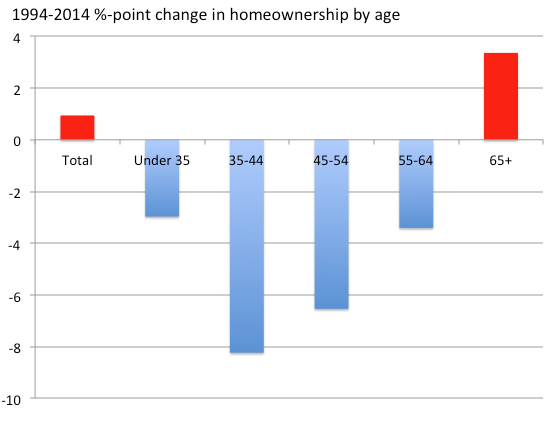

This overall trend has taken a big hit directly on the first time home buyer market. It has pushed many into first time renter status. The only real gains in terms of homeownership have been in the older segment of the market:

So parents in many cases are going to need to offload some housing equity to help kids especially in high priced metro markets. Yet many parents have their portfolio heavily tilted to real estate. We only need to look at retirement savings from multiple surveys and find that many people have most of their wealth in real estate. This is where you have your mythical poor grandma living in Pasadena in a million dollar home but needing to shop at the 99 Cents Store to purchase Friskies for dinner. Yet the solution is simple. Sell and you can unlock those beautiful gains. This is what people don’t realize. Your home is not an investment. Even a paid off home requires insurance, taxes, utilities, and other expenses. You need to cover those expenses with some sort of income. A rental on the other hand throws income your way. Money is either going in or out. Equity does not pay the monthly bills. Many older Americans are realizing this but the young are merely trying to have enough income for a rental.

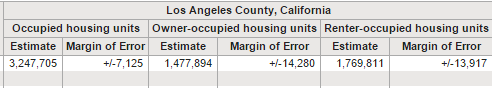

Take Los Angeles County for example. Here is the housing data:

Source: Â Census

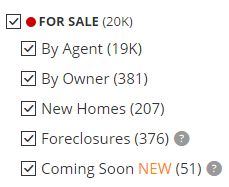

The vast majority of people rent in Los Angeles. In total there are 3.2 million housing units combined between rentals and properties that are owned. Take a look at how many homes are for sale currently:

Source: Â Zillow

Roughly 20,000 homes are on the market right now, or 0.625 percent of the entire housing pool is for sale currently. If you only look at the owner occupied pool 1.3 percent of all owner occupied homes are on the market for sale right now. So real estate prices are completely set at the margins. This is why little changes can causes big booms and busts. Given current inventory, many young buyers are unlikely to find affordable prices in many large metro areas.

Because of all of the above, I see renting to be a big trend with younger Americans. Many are opting to live in city centers and are pushing off the suburbs.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

112 Responses to “The kids aren’t alright: A record percentage of young adults live with older Americans. The trend continues to renting.”

Housing sort of Tanked in 2014!

This will be my last post for a while. First let me say I must admit when I am wrong. I really thought we would see housing drop 20% + this year and then another 20%+ in 2015. With just 1 month of 2014 left this has not happened.

With that said I do want to point out that prices were rising dramatically in 2013. It looked like they were going to never stop rising. I do take satisfaction that in 2014 prices have not increased. In my observations and readings I am seeing price cuts and lower sales prices than last year. In that regard in a way I did call the top for now. I just did not get the downward acceleration I was looking for.

Now since I was wrong I will not continue to post Housing To Tank Hard in 2015 every week. Yet I do believe it. If we go another year with prices staying flat I will be saying in my head Housing To Tank Hard in 2016. These prices do not make sense. Of Course QE 4, 5, 6, 99 could change that, but for now I am confident that prices will come down and come down hard. It is just a matter of time.

I will leave you with one chart: https://giavellireport.files.wordpress.com/2014/11/sf-crash.jpg

Thanks for everyones support and good luck. I will continue to lurk and post from time to time.

Jim “The Tank” Taylor

Hey Tank, don’t stray too far! You may have gotten the timing wrong, but your message is sound. HOUSING TO TANK HARD EVENTUALLY… whether it is through an actual price crash or wage inflation is the question. If wages double but house prices stay the same, it’s still a crash. Let’s hope for wage inflation since that would be the less painful method.

Chris, you can not have wage inflation in a global economy if you are one of the developed nations.

Hey Chris, I just bought a home in LB near Cal State. We’re you born and raised here?

Jim, thanks for posting. Admitting when you are wrong takes character, many people don’t want to swallow their pride. As I have stated time and again, NOBODY can predict what will happen in the future regarding real estate. Only YOU will know when the time is right to buy. California RE has been on a wild ride of epic proportions for the last decade. Many people lost everything and some made a fortune.

Keep your powder dry and be ready to act when the time is right! Good luck!

@Lord Blankfein, @Jim Taylor

Since 1945, California GDP is the best indicator of California housing prices. Home prices did not tank in 2014 because California GDP did not tank in 2014.

ernst – you make sense

Don’t get down on yourself Jim. It will tank eventually…it has to. This is totally unsustainable.

Well done. I was wondering how you’d handle this. There’s really no upside to making predictions. What do you stand to gain even if you’re right?

Jim: I completely agree with your prediction, and it seems just your (and my) timing is a little off. Its going to tank, no doubt about it, its just a matter of when.

I think its started, I’m watching listings get yanked off the market because they just don’t get any bites. I’m even seeing rentals sit empty in my high-end zip code, for months and months on end. One SFH rental 3 doors up from me, ex-model home 2570 sq. ft, started at $2395 in early September. Its still empty, and they’ve now reduced it to $1895. I’ve got 2 gorgeous homes right across the street from me empty. Both owners lost their jobs and took new jobs out of state. Both said they couldn’t sell for what they owe so they are renting them. One’s been empty for 5 weeks, the other 2 weeks. No takers.

The rental I had leased for 3 yrs, that I vacated when the halfwit owners listed it for sale ($75k over appraised value) thinking they were going to “cash out”, didn’t get a single LOOKER let alone buyer/offer, and guess what – its back on the rental market and OFF the for-sale market. Its been empty for 2 months – since I left. They raised the rent $160 a month over what I was paying (greed and stupidity) and I suspect it will sit empty for months. The owners emailed me this past week apologizing for making a mistake trying to sell it and me moving out. I knew this would happen…. but you can’t tell this to people with their head stuck way up their a@@.

Everyone I know, and they are not minimum wage earners by far, are broke or struggling. I’m seeing local apartments advertised for 6 weeks plus sitting empty, then the rent reductions start. Same story all round.

The last of the panic buyers are showing up, then I suspect mid 2015 we’ll see a huge shift in the market and prices will start to go down.

You weren’t wrong, neither was I, we’re just a little ahead of the average sheep 🙂

I don’t think there will be a tank in the Truly Prime areas. Mid-Tier/Faux Prime areas — Pasadena, Culver City — might go down.

But there is a super-rich class of people for whom wages and jobs mean nothing. They’re rich because they own vast amounts of assets. They buy houses all over the world, and spend the year traveling between their houses in London, New York, Bel Air, Shanghai, the Cayman Islands…

The Atlantic Magazine did an article on this super-rich class a year or so ago. Borders and national loyalties mean nothing to them. They all go to the same elite schools, they know each other, they have important contacts in businesses and governments around the world so they have inside information. The world is their oyster.

Certain areas — perhaps San Marino and Santa Monica North of Montana are among them — they colonize. They buy tear-downs and build expensive houses in its place, increasing property values and driving out the middle class. So prices won’t tank in these areas, but will only increase.

Calgirl. I have commented before that I was in the same position as you with landlords wanting to sell. I have just moved out and settled into another rental. $100 increase in what I was paying but a major upgrade of condition of house and its in a much better area.

I look forward to following the sale of their place. Since I told them we would be moving out rather than hosting open houses for them as they were hoping, several other homes in the neighborhood have popped up for sale. These homes are all identical tract homes. These new listings are all more finished and one even had a pool and they are all asking less than what they offered to sell me their place for, as is.

Should be interesting to follow.

SOAL, let’s hope you’re not being too complacent with your view of wealth. They say the same thing for why Prime London can’t crash (too many wealthy buyers/owners). Past few years has been happy times for US wealth, Middle-East wealth (oil), Russia wealth (oil and other commodities), China wealth…. but now things are falling out at the top, and money has become slightly tighter. Markets move at the margin.

Jim, please don’t stop posting! I admire you for admitting you miss timed the market. It’s going to come down at some point. Maybe not this year or next year, but at some point. You rock!!!

Prices continue to rise to insane levels in Truly Prime areas. This North of Montana Santa Monica house was recently listed at just under $2 million. It sold for $2,335,000: https://www.redfin.com/CA/Santa-Monica/633-7th-St-90402/home/6782050

It’s a nice house, but for that kind of money, in other states, you could buy huge mansions with vast tracks of land, smaller guest houses on the estate included.

hello Son of L. tear-downs North of Montana Ave typically sell for over $2Million. My mother’s home on 16th Street, near San Vicente is worth $2.5M as a tear down (1923 3 bed 1 ba) home on 7500 sqft land.

thanks Jim for all the great post housing will TANK soon!!!!

Interesting chart from the St Louis Federal Reserve!! Thanks for sharing Jim.. Lets see if it happens again and how much it pulls back 🙂

haha Jim, I hope you’re right about your comment in 2015…I have been waiting to use the good’ol Nelson from The Simpson “HAHA” to some of the suckers that bought at the peak for a while now.

Hey Jim – you were actually correct. Since housing prices didnt have a that gravy 30% YOY increase in 2014, that is the “TANK HARD” which starts to strike fear in the amateur RE tycoons. In the magical SoCal voodoo economy, the drop starts not from where its at now, but from where people think it SHOULD be right now.

Keep posting Jim!

Jim, I’ve loved your postings! Fresh, Concise, and to the point! I’ll miss you.

Good job Jim, really just about everything in life is speculation, heck the weather folks have the best tools ever and still mother nature fools them.

Housing is a never ending roller coaster of ups and downs, high sipped straight away, curves, slow down to stop. Then the next group gets aboard to experience the highs and lows, good luck in your ventures.

Well put Jim. I think that you are right about tanking, but off by about a year. Part of me thinks (guesses like everyone else?) that 2015 will see major price declines, especially if rates start going up. Another part of me is quite the cynic now and I don’t see how the Fed can raise rates. They have painted themselves into a corner. We shall see…

@ Jim “The Tank” Taylor,

Great comment. 😀

Thanks for the memories.

Best of luck, Jim. Thanks for posting….

Hey Doc, good post. The mainstream continues to ignore the unsustainable social cost of expensive housing. The boomer generation ignores that they need a financially healthy younger generation to support the economy (and Social Security). As long as a high percentage of the population is spending the bulk of their income on housing or student debt, the future will be bleak.

I hate to tell you this but many baby boomers are dying as they aged. I’m in my 50’s. In fact the states with the cheapest housing like West Virginia have lower incomes and support social secuirty less. Remember gen x supports baby boomers more than M since its middle age and has higher incomes. In fact, the biggest problem is probably getting married with living with folks but people use to have grand kids in the same house years ago.

Also, the states with the highest average aged are not high cost of housing states with seniors. Florida, Pa, Oh, Maine, Vermont, West Vrignia, Kentucky. California actually is a percent and a half less 65 and over since its population is a lot more latinos and latinos are younger on average.

Wing nuts will never understand economic booms, because none are the same. We are about to have one of the greatest wealth transfers in history as baby boomers die, leaving estates to the kids.

Yeah, the kids really are alright. Better bonding with parents, etc before RE kicks into high gear, properly now in stronger hands.

Hilarious post.

Most boomers are getting reverse mortgages on their golden sarcophagi, meaning their live-in kids will be in for a rude awakening after the funeral.

If you kids want liberty and to get away from your nagging parents, come to Texas where you can afford a house. If you stay in California, you will get depressed and don’t you get tired of your parents telling you that you are a LOSER?

Hey Tex, I tried Texas and it just wasn’t for me. California is a harsh mistress but I can’t quit her! BTW, why do you lurk on a blog that’s very name and purpose is Southern California? The header up there says “How I learned to love SoCal and forget about the housing bubble.” Could it be you secretly wish to live here?

In the past, I found Thanksgiving weekend traffic — Fridays and Saturdays — to be light. Presumably because everyone was away for the weekend.

I drove those nights this past weekend. Saturday night I drove the 10 east, then the 405 south from Santa Monica. It was stop and go. This insane L.A. traffic never quits. It’s one of the things that makes me consider moving out of state.

My spoiled daughter, Ashley lives in Bel Air Estates, I do have a beach house on Cliffside Dr overlooking Dume Cove. But I prefer Kerrville for the people where I spend most of my time raising non GMO grass fed organic, free range, happy cows(until the air hammer hits). Grass fed cows are low on fat(marbling) and are heart healthy. The Hearst Ranch cattle are not as good as mine.

Chris, my advice to you is to move to Oxnard, Carlos says that they have affordable homes near the harbor. He is an agent and would be happy to find you a home there.

I’ve seen multiple comments suggesting people move to Oxnard (maybe most are from BigTex, I can’t remember). There are some reasonably affordable houses there, but there are many issues with living there. Here are a few:

1. If you have kids (we do, 1), most of the schools there are crap.

2. Oxnard is a pretty isolated area in no-mans land. Your employment prospects are therefore going to be appreciably diminished relative to larger and more populated areas. Obviously this isn’t applicable to people who can work from home full time and have other unique ways of generating income.

3. I generally like living in OC, since there is so much to do in LA, Orange and Riverside counties. Oxnard is so far away from anything, that you’re going to be doing a lot of driving to do anything. Want to hang out in LA? 50 mile drive. Want to hang out in Santa Barbara? 40 mile drive. OC? 80+ mile drive. You get the idea.

Other than being able to live closer to the beach for a bit cheaper than you can in OC/LA, Oxnard seems to be a rather unappealing place to live.

rick would not like me. 🙁

If the shale oil industries cratered than Texas is also in deep doo doo. Nothing against Texas but it seems that OPEC is determined to crush shale oil.

Some bloggers here are very concerned with the life hazards in flyover country but can not determine the hazards of living in SoCal:

1. In case of a major earthquake, the shacking of the land and buildings is not the only danger. What about a nuclear plant accident? What about those located on the shore in case of a tsunami (i.e. nuclear plant on the shore of Oceanside). What is the impact on a very large population living in close proximity? Fukushima 2.0???!!!….

2. There is a higher chance of dying in car accident (or be in a wheelchair for the rest of your life) on a CA freeway in the bumper to bumper traffic than from radiation in flyover country.

3. What about the slow death of inhaling smog everyday while sitting in a car on the SoCal freeways?!!! Did anyone read about all the carcinogenic substances found in that smog which people breath everyday? Even if you live in Malibu or Santa Monica, most likely you don’t have to drive only on Hwy 1.

4. What is the impact on health if living in a crowded place and with a very high cost of living? Think also the stress on the body and the family. Not all costs are measured in dollars, but you pay nevertheless. Is “till DEBT do us part” the new motto in SoCal???

Therefore, if bloggers get paranoic about the hazard of being alive, they should think about all the hazards. Before you do a risk analysis about all kinds of hazards try remember that there a 100% chance that you will die – you just don’t know when. You can not eliminate all hazards in life. In terms of number of hazards I believe that it is fair to say that SoCal is among the top places.

1. You’re aware that CA currently only has 2 nuclear power plants, right? One is in San Lois Obispo County (Diablo Canyon which is 150-200 miles away from LA), and one is near the southern tip of OC (San Onofre). The nearest one, San Onofre, has been shut down since 2013, which likely reduces the potential hazards in the event of an earthquake. Further, the ocean current and wind directions are generally away from OC (with exceptions). Therefore, the potential impact to central/northern OC from San Onofre is probably minimal in the event of a catastrophe at San Onofre.

2. Maybe so; perhaps it’s one of the risks of enjoying more stuff to do and nice weather to do it in.

3. Good point. Put your AC on recirculate and don’t commute far to minimize risk.

4. Another good point. That’s why you save money to sleep more soundly at night with less stress. Admittedly, my neighbors’ dogs sometimes annoy me. Although I’ve been to houses on 2 acres of land where the neighbor’s dogs can still be heard quite well.

I don’t think there are hazards in all parts of flyover country. Just those areas with specific problems, such as the Hanford Site area (discussed in the previous blog post).

I’d love to live in flyover country somewhere and live more cheaply and more stress free. However, as with anything, there are benefits and drawbacks. For me, the drawbacks outweigh the benefits.

Good points Responder,

I understand that people live all over for one reason or another. Nothing wrong with that. Nobody is keeping anyone by force anywhere. I replied to you in the previous post that Hanford, for all practical purposes is a non-issue and I explained to you that the points you raised do not constitute a real hazard; theoretically, in the worst possible scenario you might have a point. The probability is the same as San Bernardino becoming a beach town in case of a catastrophic earthquake – higher than zero but still there.

If you have a good paying job in SoCal, family and friends, like the weather, all are valid points and make sense. But bringing a non-issue like Hanford as reason for people not living in eastern WA is the same as me saying “I left SoCal because a major earthquake along San Andrea fault will make San Bernardino a beach town or I left because the San Onofre nuclear power plant is a big hazard for radioactivity”. I know it sounds silly and that is not the reason I moved.

I can buy in the coastal cities in SoCal with cash and I like the coastal cities. However, in my personal balance of plusses and minuses I prefer Eastern WA (it is personal and I also understand that you have personal preferences). While I like most of the coastal cities, I don’t like the inside (IE) – it looks like a third world country.

I challenged #2 since driving in traffic means you’re driving slower so less chance for fatality especially if you’re in stop n go traffic.

I think they’re talking about bumper to bumper traffic on the highways going 70mph.

This is a reality. And it just has to increase the chances of more cars being involved in any given accident.

My neighbor just sold his two bedroom one bath in Lakewood for full price, 418k, in six days! Place was run down, dead grass out the front, full of termites. Young single guy bought it. Scary!! There are still some people out there with money.mgood for me, I think? Hopefully, he do some work to it.

In 2010 everyone was cheering on a dead-cat bounce in prices and it didn’t come in 2010 …or 2011 or 2012 or 2013 or 2014 all the while unemployment has decreased. The most salient comment I have heard from any of the RE experts was that prices wont crash until there is a job loss recession. Rather than guessing what is sustainable or unsustainable in terms of home prices, shouldn’t we be predicting the next job-loss recession?

Job-loss recession?

1.) The rapid oil price plunge shows that demand is way off. Recessions have usually happened during this type of event since weak oil demand is a sign of weak economic activity.

2.) Black Friday sales off by over 10% year over year.

3.) Recessions usually happen every 5 years. The last one ended in 2009. The timing is right for the next recession.

4.) Consumers are getting clobbered by the combination of stagnant/declining wages and rising prices.

In spite of all this, no recession yet unless the stock markets start tanking.

The “investors” have now moved on to acquiring apartment complexes in the Sacramento area: http://www.sacbee.com/news/business/real-estate-news/article4213968.html

They’ve missed the boat. Vacancy rates are actually rising fast in Sac.

Honestly, I’m looking seriously at moving to Sac. I live in the east bay, and have a girlfriend that is also early 30’s….we are not in Tech, I’m in environmental planning and she is in marketing. So the Tech money isn’t helping us and we don’t have to stay…we just like it.

But as we discuss more and more the unrealistic housing prices of the area we’d want to live…we keep bringing up the Sac area. Yeah, it’s hot in the summer but she is from Florida. But we can get a beautiful condo in downtown or house in the burbs for what we pay for rent now.

Sac doesn’t seem that bad…close to Tahoe, close enough to the Bay for an event, concert, ballgame…and gov’t jobs if you can land one.

East Bay Renter, ever consider living in God’s country, Humboldt county, the Emerald Triangle. Ave home price is $246k, rent $1,400. Good clean air, forests, and no parking lot freeways. Plenty of water here. Humboldt county can compete with any flyover country place, with all the benefits of California. Humboldt is a lot cooler that Cow Town in the summer and no tule fog in the winter.

Sacramento is a cool medium-sized city. They have all the coffee shops and ethnic eateries bigger cities have but with less traffic and cheaper cost of living. Lot of educated people too. People are pretty friendly as well.

Sacramento is a “poor” city. Average rent for 2 bed apartment is $1,315 per month. Average hourly wage $12.32.

* Per capita money income in past 12 months (2012 dollars), 2008-2012 $25,645

* Median household income, 2008-2012 $50,661

* Persons below poverty level, percent, 2008-2012 20.2%

2 bed apartments in the WORST parts of Sac are over $950 a month. And I mean the worst.. and there are some pretty bad parts.

Are “educated” people the kind that like to micro manage the behavior of everyone around them?

If so, NO THANKS!

@Calgirl,

Median household income in the Los Angeles-Glendale-Long Beach region was about $53K last year.

The poverty rate in the LA metro region is pegged at +25% (one of the highest in the U.S. amongst large cities)

So we can debate that the LA metro region is much worse off than Sacramento.

There is a reason why Sacto is called “Cow Town.” There is a reason why Humboldt County is part of the “Emerald Triangle.” Sacto is no place for Vegetarians. Humboldt County has a higher quality of life than Cow Town, in so many ways. Why we even have some property owners and investors from Google here for The City folks.

Let’s face it, real estate prices in LA and those other high priced California locales, are just plain unaffordable, ridiculous, and unsustainable. I recently sold a house in RPV that had belonged to my Mom. We got top dollar for the home with an ocean view, in fact had a bidding war. in hindsight however, what happened? In fact, we sold the house for the amount we likely could have sold it for in 2004-5, and in 1988-89, houses were also bringing similar high prices! Add in inflation/dollar depreciation, and we lost money compared to selling at those prior real estate market peaks! The problem with the boom and bust cycles of California’s real estate … people get so caught up in the feeding frenzy, everyone looses sight of reality! A lot has been made of the ‘lost decade’ in the stock market, wages being no better off than the mid-70’s, etc. Real Estate in California is no different … we’ve been there before!

Good points, JN.

I was trying many times to say the same things and many bloggers are so wrapped up in that mania that they can not think outside the matrix.

I understand perfectly what you say because I used to live in the same matrix till I found out that there is life, a much better quality life, outside SoCal.

I also understand the SoCal mentality that everyone on the face of this globe wants to live there but can’t. They can not understand that people may prefer to live somewhere else even if they can buy with cash in SoCal. They strongly believe that you can’t live in SoCal or you don’t understand the unique culture offered by SoCal, the epicenter of this universe.

It is sad to see that but they believe that religiously. I have family and friends there and that is what I hear al the time. I used to live there and I can move anytime back and buy a house along the coast in cash but I don’t want to – in my humble opinion there are too many minuses for the few pluses.

To your point flyover, my wife and I did the +- columns before we decided to leave the Golden State, to many minus vs plus to justify living there.

Jim Taylor, 2014 could very well be the beginning of “the tank”. Real estate prices don’t change as fast as stock prices because they are less liquid. 2015 doesn’t look good for appreciation. This feels like November-December 2007 to me.

I used to live in the Bay Area – now I live in Central Florida near the Orlando metro. My wife & I had 2 incomes that totalled about $130,000 a year & we were probably barely Middle Class in the Bay Area. After the Big Dip in 2008-9 we moved to Florida. We now live as well or better than we did in the Bay Area, we live near a State Park with Forest land, Wildlife & Natural Springs – 1 hr from Daytona Beach & other beaches – 1.5 hrs to Tampa & the Gulf – 3.5 hrs. to Miami – all the shopping & restaurants, Disney, Universal, SeaWorld, Wet & Wild, etc. – similar demographics to the Bay Area – NO SMOG EVER – great Lightning Showers – Oh did I mention the Public Schools were BETTER? Plenty of Private, Christian, Charter Schools, Etc. & all for LESS THAN $50k a year for a Family of 4 people. Less Stress, Nice People, Southern Hospitality, People Get Along, Drivers are Better but Not perfect. Anyway GOOD LUCK to All of You who can’t break the Much Over-rated California addiction. PS We have Lots & Lots of Water here in Florida. Real Estate prices here are Dirt Cheap Compared to California & you can get get Phenomenal Deals for your money. Gas is Currently $2.62 per Gallon as of 12/1/2014. Happy Days!

Plus When You Move There They give You a Keyboard that Automatically Capitalizes The First Letter of Every Word!

I understand perfectly what you say. Good for you!!! Another one escaped the matrix…

You can’t convince many of the bloggers unless they want to be changed.

I thought Jim Taylor Tank Hard comment was a joke just like the dribble What? Likes to post…no worries.

Real estate is going to keep plugging along and we may get another rally up if credit standards get looser so more people can buy already overinflated real estate.

Rentals in prime areas will still get top dollar…lesser areas are less desirable so you will continue to get a deal over prime areas.

If you pay more than 28% of your take home pay on rent you are DUMB…if you make 100,000 and spend more than 250,000 on a home you are DUMBER.

Stay within smart financial guidelines for renting or buying and you won’t have to worry about the housing market…too many want what they can’t afford and they try to speculate their way to the top.

A rally up? Haha, ok. Loosening of credit now (the only thing left to do is to reintroduce liar loans) will only magnify the crash when it happens later. And a crash almost certainly eminent. And people like me will be waiting with plenty of cash to buy at post-crash prices.

Your continual comments stating that people are dumb if they do this or that are entirely asinine. Some people don’t have a choice, and they have to choose between two unappealing options. Not everyone can afford to spend less than 28% of their post-tax income on rent. Not realizing this seems quite dumb to me…

>> And a crash almost certainly eminent. <<

It's "imminent," not "eminent."

Imminent — forthcoming, soon to happen, pending.

Eminent – distinguished, renowned, widely respected.

The point that I’m trying to get across is because everyone you know shops at Cartier, Christian Dior and Fendi….shopping at Tori Burch is not wise if your budget is really that of the likes of the Dollar Store. The reality is California’s realestate and rental market is too rich for most people and the only thing that they can afford is crap but they want what they can’t afford. More people should move to areas that they can afford, wherever that may be in California or outside of the state. Stop committing financial suicide. Paying Cartier prices on a Dollar Store budget does not make good financial sense. The heart wants what the heart wants, no one likes to think that the place where they belong is the Dollar Store for how hard they work or the fact that they have a good job/profession that in the past would buy a great home. Dollar store reality, settling for Tory Burch is a better move but not wise. Most guys won’t get this analogies, I’m fine with that.

Good catch, thanks for noticing that. I usually type my responses in MS Word (so I can view the post I’m replying to), then copy and paste my response into the message field on this site. Although I do know the difference between the two, I must have misspelled the correct form of the word poorly enough such that Word auto-corrected it to the wrong form. I rarely proofread my posts because, well, I just don’t care that much if something is slightly incorrect.

You are DUMB if you spend more than 28% of your after tax income on rent or a mortgage…hey I’ll cut you some slack, 33% on a mortgage. Most people are not doing so because they are POOR but because they want MORE.

They don’t want that 500,000 crap shack that they can afford, they want the 800,000 house in a neighborhood they like. They belong in the crap shack but want the 800,000 house.

Renters don’t want to live in the 1,600 rental they can afford, they want the 2,200 that they like.

It’s a humbling experience to live within your means.

These numbers such as 28% DTI have been around and was used when rates was 6-7%. We have rates at 3-4% today (depending on 15 or 30 yr). Ok so when rates go up RE prices go down. So what, if you stay long term you will be fine in the end due to inflation (when rates go up). I don’t think you understand the impact of low rates which practically make buying comparable to renting in many areas even today. For long term owners is all about the monthly payment with an average down % of say 25%.

just wanted to mention Black Friday had an 11 percent decrease in sales from last year. Must be due to the great economy they keep reporting huh?

Actually… Yes.

A strengthening economy that changes consumers’ reliance on deep discounts, a highly competitive environment, early promotions and the ability to shop 24/7 online all contributed to the shift witnessed this weekend.

http://bostinno.streetwise.co/2014/12/01/black-friday-numbers-nrf-survey-shows-2014-a-down-year/

keep swallowing that MSM propaganda. The economy sucks and is getting worse by the day.

this surprises me, given that gas is so cheap right now.

Gas prices…..most people I talk know its just a temporary blib on the screen, as soon as the holiday shopping season is over do you think they will still be the same?????

Its all rigged, gas prices give in a little at this time of the year as they always do… just enough to help out the retail season thats all.

Then its back to normal, $4+ a gallon.

Interesting comment above from BenShalomBernanke, Opec might be on a mission to kill our independance on oil,

Lynn Chase…actually LYNN folks showed up for black Friday, what they found was terrible merchandise mostly outdated junk, last years off brands that didn’t sell were brought back. Again retailers trying the old pulling the wool trick and consumers who have access to I pad’s, computers, etc .easily figuring out the game and leaving not buying anything.

There are lot’s of angles to keeping the younger generation frozen out of participating in the economy. Home ownership is a biggie. But an entire generation or two sitting around with nothing to do is the root of it and a much larger problem than rent vs. buy. I don’t think Millennials have any intention of serving the retired class.

Just wait until Goldman Sach’s Lloyd Blankfein wishes the peasants to be hungry. Remember that little incident called the Arab Spring in Egypt? It wasn’t police brutality nor not being able to vote. It was IsRaEli banker Lloyd Blankfein of Goldman Sachs that shorted the wheat futures. Which then caused a massive food shortage. This is why the people took to the streets against the government. But the Israeli owned CNN, CBS, NBC wouldn’t dare let the lowly goy know the truth.

When people are forced into renting or shacking up with relatives because of “housing”. You can lay that problem directly at the feet of two more IsRaEli agents at the private for profit Federal Reserve bank(s)……Janet Yellen and Stanley Fischer.

So stop beating around the bush and admit that America is an IsRaEli occupied nation.

Oh. And look for some kind of war because IsRaEli agent Jamie Dimon of JP Morgan is losing his ass on oil and gas futures.

And remember to sign up for your flag waving classes and pay for that cemetery plot for your White children.

The common cause many of us share is meaningless if we cannot shake off this “stuff” and focus on what matters. Divide the 99% and rule. Hint: you’re helping the bad guys.

I can see real estate trending up a bit longer. Crude, gold are trending down. Stocks and the dollar are trending up. But when these trends reverse we’ll get the epic crash many are lusting after. 2008 was just the warning salvo. I want housing to tank. But I am fearful of what our economy will be like in the aftermath. Enjoy the next 18-24 months.

I agree, we didn’t really hit bottom and flush the excess out of the system in 2008. Really the only people who got it bad were the unlucky and the one’s caught with their pants down. The mild deflation we would have had in 2001-2002 would have been a lot better to deal with than what we will face in the future.

Does everyone who wish hosing to tank also want the knock-on effects of a tanked hosing market…?

loss of jobs, stagnant wages, frenzy of all-cash buyers, further interest rate cuts, etc.

It will be worse for some, better for others. I notice very few are worrying for young productive people, priced out of the market, who are carrying the Ponzi for the smug vested-interest winners. The weight of that is so heavy and unfair, that I fully hope to get the outcomes the ‘be careful what you wish for’ crowd tell me to fear.

2015 (seems crazy 2014 is almost gone) in RE new and resale will probably be determined in the 1st qtr. to early 2nd qtr. of the year.

Loan mortgage lending has been relaxed as of Dec. 1st but the impact won’t be known for about 6 weeks. Short sales owners in 2010-2011 they can now buy homes Jan 2nd going forward.

Yes homeowners are willing to deal and that has to continue in early 2015 especially since they will get mores showings in the 1st qtr. of 2015.

It seems price reduction will probably fall into the 93 to 97% of asking price.

All in all, looks like a tethered recovery in housing with resale’s gaining a little more then new ( land purchase and labor shortages the concern in new housing).

Those adults who have parents who can understand the situation, and allow them to stay (and contribute) are quite fortunate in many low-mid-high prime markets. It’s very far from ideal, but some markets are just impossible for independent adults. Even in replies in this entry, you have certain people slamming rent as ‘dead money’ – vs very high asking prices to buy.

This is what I would be like going back to my mother’s house. (joking)

https://www.youtube.com/watch?v=Y-hhWUywXgU

Robert, is your forecast for California or nationwide? I cannot see it for Coastal California. Nationwide maybe.

Dennis… Real estate as a whole is generally local ,regional, so any such blanket forecast unless a crisis that effects the whole nation has to be viewed with caution.

Coastal California I feel will be good footing going forward in 2015, prices will not increase as much but certainly a crash will only occur if a cataclysmic event happens. I feel strongly overseas money will continue to prop it up.

East… Up slightly

Mid east… Down

Mid West…Flat

South… Down

Southeast…Up

Rockies…Up

Southwest…Up

Far west…up

“The point that I’m trying to get across is because everyone you know shops at Cartier, Christian Dior and Fendi….shopping at Tori Burch is not wise if your budget is really that of the likes of the Dollar Store. The reality is California’s realestate and rental market is too rich for most people and the only thing that they can afford is crap but they want what they can’t afford. More people should move to areas that they can afford, wherever that may be in California or outside of the state. Stop committing financial suicide. Paying Cartier prices on a Dollar Store budget does not make good financial sense. The heart wants what the heart wants, no one likes to think that the place where they belong is the Dollar Store for how hard they work or the fact that they have a good job/profession that in the past would buy a great home. Dollar store reality, settling for Tory Burch is a better move but not wise. Most guys won’t get this analogies, I’m fine with that.”

Good point, Christie!

Since most of those commenting here are guys, the Doc has a different expression using drinks – “champagne taste on beer budget”

I can use one more neutral – “sushi taste on pretzel budget”

The point is the same – most people have a very frustrated life in SoCal. For those who really want to have a good life there, their assets must be at least 5 million. I am saying that because with that amount you can afford something decent in a good area and you don’t have to drive in that miserable traffic everyday of your life – you might afford some investments to get a decent return in relative safety.

For a relative decent life in SoCal a 5 million is a must (minimum) (assets and no debt). This amount is not making you rich by any stretch of imagination; just gives you a decent life, something your parents could have afforded with $500,000 3 decades ago. If you don’t understand this, that means you have blinders. Yes, you can go inland (IE) and live in a third world country, or east LA (another barrio). If you live in your own illusion you will continue wasting your life in a daily frustration. For me, I am a realist.

Flyover, I have to agree with you because I am one of those frustrated with Socal.

Two years ago I was reading this blog and others at the time it seemed like the interest rates should rise and the housing prices should drop further. There were some select bargains during the 2010-2012 time frame but decided against purchasing to save more and was hoping for better selection and prices later. I obviously “waited it out” and kept renting. (Boy was that a big fat mistake.)

Now the areas with excellent school districts have gone up astronomically. Rents have also gone up to chase parity with buying in all areas of Los Angeles. What my current downpayment can buy is pretty pathetic. Either an overpriced remodeled house in a transitional neighborhood, (i.e. Kid goes to private school) a terrible postage-stamp fixer in a blue ribbon school district or moving to the exurbs and seeing commuters more than family.

I am very frustrated that a prudent buyer such as myself is having difficulty finding a good house in a good school district without being a Movie Star or Doctor in Los Angeles. I know this theme has been repeated on a number of occasions by other people on this blog so I know I am not alone in this sentiment.

Alas, I loved growing up in Socal in the 80s and 90s. However,

I think something is terribly wrong with this area if I can not afford a comfortable lifestyle here. I personally know many native Californians of my generation that have moved out of state in search of a better life. I want to stay here and hope there is light at the end of this very long and dark tunnel.

Sleepless and Houseless

FYI: You can still buy in the more affordable trendy “transitional neighborhoods” if you have kids, but you’ll have to use the Federally mandated NCLB Law to transfer your kids out of their “non-performing neighborhood school” to a better school district, so you don’t have to pay for “private school”. A perfect example is buying in hipster/beach close Costa Mesa, and shuttle your kiddos to Southeast Huntington Beach (900+ API Score) schools. At least 1/3 of the HBCSD school students are from inter-district transfers out of NMUSD! Live where you can afford, and just transfer…. Si Se Puede!

I’m in a very similar boat as you. We do own a halfway decent condo (it’s rented out), but it’s a little too small for us and the neighbors annoyed me. Therefore, we rent currently for a net loss every month versus staying at our condo.

Our initial intent was to rent for a year or less (beginning in early 2013) while my wife had our baby and while we looked for a new place. Unfortunately, real estate prices took off right about then (as you know), and we’ve been stuck renting since.

We’re also waiting for prices to tank a bit so we can buy something (hopefully) in Newport or UCI-area Irvine. Our down payment fund is ready to go, so we’re hoping we can remain employed during the next downturn.

Like you, I’m also very frustrated that we can’t buy a two-bedroom condo in the area we want for a reasonable price. Also like you, we stupidly passed up multiple deals in 2011-2012 for frivolous reasons. We make very decent money compared to the national average. However, I just can’t bring myself to pay the current ridiculous prices, especially when we could have paid 30% less just 2-3 years ago. I hope we don’t regret waiting.

My gut feeling (just like many people here) is that if we bought now, the market would tank shortly thereafter and we would be underwater for a very, very long time.

Thanks for people’s responses. I have been looking in the Santa Clarita Valley. I have read a lot of negative comments about new homebuilders. Does anyone have experience with a new homebuilder in that area?

“For a relative decent life in SoCal a 5 million is a must (minimum) (assets and no debt). This amount is not making you rich by any stretch of imagination; just gives you a decent life, something your parents could have afforded with $500,000 3 decades ago.”

Flyover, if anybody is worth minimum 5M today (assets and no debt)…you are filthy rich. I think even the bears will agree to that. Many of you are confusing a decent living with living amongst the movie stars. Are you telling me that if you ONLY have 2M in assets you are forced to live in unsafe, subpar areas in socal? That is 100% incorrect. As usual, my job is calling out the BS when I smell it…and boy does it stink!

Lord B.,

I apologize for doing a poor job in explaining myself better. Let me try again.

I did not mean that you need 5 million to buy a house. You can buy one for way less than that. What I meant is to buy a decent house in cash; lets call it a good quality 3 BR, 2 BA, minimum 2000 SF, double garage, good size lot in a neighborhood I am not afraid to walk at night (at least as a man). For nice surroundings, clean air, to be within 2 miles from ocean. Whatever price you want to put on that, I’ll play along.

To pay the property taxes on that, maintenance, insurance, utilities, vacations, food, nights out, etc. you need an income. I would not want my income to be dependent on a job, especially in this economy, because I may be forced to sell in a depressed market and lose money. Also, I wouldn’t like to spend half of my life in a miserable traffic. For me that is not quality of life. If you like that, I leave that for you.

The rest of the money left from the purchase of the house I would like to have investments for cash flow. Not very high risk, because then you can lose them and I can’t sleep well at night. Whatever you have left from purchasing a house, invested diversified and conservatively, would provide for a decent living.

If I can find some work for my investments or others wherever my interests are, that would be for getting ahead.

Try to find how many have over 10 million in SoCal and then you will realize than 5 mil. is not too much for those prices.

If you want to be in bondage to the bank, I call that slavery (those who borrow are slaves to those who lend). If you are happy in that situation, I will leave that for you. If you have a job that you hate, or a boss you hate, or lose the job and have to sell in a depressing market, I will leave that for you, and I don’t envy you. I know from past experience that life in slavery is no fun. Some apparently enjoy it, but is not my idea of quality living.

For me, I would rather have multiple cash flows for safety, no debt, have freedom to do the work I like, when I want, and travel when and wherever I like. I call that truly living and freedom. But that is just my humble opinion and not everyone likes what I like. I agree with BigTex – many in SoCal have big hats and no cattle.

Lord B.

I forgot to state the assumptions. I am not talking about a single person. I was talking about a family – husband, wife, 2-3 children. I also assumed need for money for school, medical bills/insurance, cars, etc, etc.

Ok 2014 almost over, no tanking yet in sight. I bought my first house in middle class oc last winter with the mortgage payment lower than renting for 15 year. Granted I have to put 30% down but I saved 6% commission fee with no agent so I now have that plus whatever the appreciation is in the last year as extra equity. Buying was the best choice I make in my life so far. For me to be underwater prices has to drop 45% so I can weather a lot of storms. Yes I have to give up some pleasures but it’s only 14 more years before I pay it off. Now I’m protected from rising rents and pesky landlords as well. I’m also a semi DYI guy so maintenance costs will be low. Below the luxury threshold and above the jumbo loan, prices are still ok and supply is more abundant.

I lot of people can say that stock investments might be better but I don’t know many that has the patient or the skill to keep holding through the years or be able to buy and sell at the right time. The essence of investing for me was buy when everyone is fearful and sell [or don’t buy] when everyone is cheering on. I know real estate won’t drop anytime soon since there are still quite a few bears. If you keep doing anything on just [hopefully right] fundamentals than great you probably won’t loose money but you wouldn’t get anywhere. Taking risks is ok as long as you know the odds is in your favor. Life is a gamble anyway.

Well, I’ve been talking about moving to Portland for a while, and we’re finally taking the plunge. We were planning on saving another year or two, while we lived month to month in a rental here, and then buying in Portland. However, our current landlord decided to raise the rent on us after one year, as well as requiring a new 1 year lease, so we’re splitting now and renting in Portland while we wait to buy.

GZ,

I am familiar with Portland and Seattle markets. If you are not tied to Portland by family or a job, Seattle in general offers more and better paid jobs, especially for white collar workers. The RE market has more upward potential because of the jobs and lots of restrictions on building (natural and man made). It offers more natural beauty.

I agree that Portland offers more than SoCal.

If you don’t depend on lots of high paying jobs, Walla Walla offers more in terms of more purchasing power for RE, better climate, slow pace of life.

In general you are right that NW offers more for people without millions.

Porkland, the home of the other white meat. Porkland does not compare with the thin bodies in Malibu or Newport Beach Brewing Co.

Hi flyover,

Thanks for the advice. I’m a former musician and artist who’s fortunate to own a business based out of LA that allows me to live anywhere, so local employment isn’t a current concern. ALL of our family lives in LA, as well as many of our friends, so it took a while to get up the gumption to leave, but we do have some friends in Portland, and we’re looking forward to the move.

Seattle would probably be our second choice, but it’s a little more congested, more expensive to live, and we prefer the city of Portland. We’re going to be living in the city, so we really wanted to end up in a place that we’ll love, and I think Portland is that place. It’s our favorite medium/large city.

In terms of real estate, both cities are bubbly right now, and, while Portland doesn’t have the natural building restrictions of Seattle, it does have the man made expansion boundaries. We’ll rent for a year or two and see what the market does before we buy.

I’ve been following this blog daily for several years, and I’m finally outta here!

Tom L., your comments typify why some of us don’t mind leaving some of the people in LA. I’m sure you’re a real Prince Charming, yourself.

I have not posted for a while. Busy with work…

We bought a house in LA (Westwood) last May, and thought we would be in LA for a long term, but due to a MUCH better job opportunity we moved to Portland. Just moved 2 weeks ago.

We sold our home for about 100k profit (after commissions), not so bad for 18 months. Beats the hell out of wasting $5000/month in rent.

Now that we are in Portland, housing market is much less expensive, but I struggle to find an area that I like. In LA there were some many cool places to live, but here, even with very high budget (for Portland) still can’t find what we want.

I’ve only been to Portland once, and wonder what the nice area are? Someplace safe and quiet, but also walkable with nearby shops.

I’ve heard good things about the Pearl District and the Northwest of Portland.

Why would you leave Westwood and go to Porkland? You are just chasing after money instead of tail. I prefer the tail to the money. That is why I live in Newport. Land of the beautiful people. Porkland has a higher suicide rate than sunny SoCal. What a miserable town in so many ways is Porkland. Life is meant to be enjoyed, not just counting the money.

I found this public radio podcast about how artists are being priced out of Los Angeles. Haven’t listened to it yet: http://www.kcrw.com/news-culture/shows/which-way-la/could-the-creative-class-be-priced-out-of-la

Son of landlord,

There are lots of safe, beautiful neighborhoods in Portland that are walkable and have good schools. Pretty much everywhere west of 82nd is safe, and it really depends on the vibe you’re looking for. The Northwest Hills is a higher end area of Portland. The Southwest is more spread out and less walkable, with bigger wooded lots. The Northeast and Southeast, which I prefer, have great pockets of neighborhoods surrounded by restaurants, shops, etc.

We’re moving in a few weeks, and I’d prefer living there, even if the price was the same as LA, but it depends on what you like. I like weather, redwoods, and the over all artistic feeling of the place. Much of Portland is basically a less expensive Silver Lake or Los Feliz, but with insane amounts of parks, as well as lots of nature things to do outside the city. A home in NE Portland is about a third of the price of an equivalent place in Silverlake. The “hipster” vibe is definitely prevalent there, and it’s pretty white, but everyone seems to commingle nicely.

GZ said about Portland “and it’s pretty white,” have a nice day GZ?

Robert, I’m not sure what you’re getting at. My point was simply that Portland isn’t very diverse, which is one of the few things that we find negative about the city.

Thanks GZ for the clarification, my wife was born in Portland, we also find the town not diverse and not very tolerant of outsiders. Stil is a livable place though, I don’t believe like most places it is for everybody. If people can, I recommend either visit a place a few times at the worse part of the year or stay there for extended periods.

When we bought Denver many years ago we did neither and regretted the decision, spent a lot of money moving to a more desirable climate and tolerance of others.

You are not accepting the reality of their fantasy. You see, they believe they can keep the housing prices artificially high, and while the reality for the working class is they CANNOT afford it, because americans have been brainwashed to believe only banksters and corporate manamgement is worthy of a living wage, the rest should be grateful to breathe, not complain because they cannot live in the nation their forefathers spilled blood for. Plus, we will just market American Visa’s for 700k a pop, not too mention this brings lots and lots of taxes into the coffers.

When I point out common sense facts, the masses do not, and will not accept how they are being treated……so, we deserve it. Eat your sugar, watch your programming, and shut the f up, the majority do it oh so well…remember children, the Bible says obey your masters!

Cognitive Dissonance in America is at such levels I am thinking about moving the hell out of the country.

Massive population makes for massive problems. Ca. as a whole had it all, in the 1930’s visionary’s saw the state as unlimited possibilities in terms of growth, all aspects.

The war of course just solidified CA. standing as a golden opportunity state. Many who went back home just had to make the only hard choice, leave family and friends and journey out 2k to 3k miles West for the ultimate good life.

CA. in the late 40’s to about 1965 was Disneyland for most, great weather, liberal or conservative could coexist, one story homes with a pool, manageable taxes, small business boom. A state where being judge all the time like back home where nowhere to be found, live free and easy, enjoy that you were lucky you made the break.

Many including myself made a lot of money, it seemed so easy buy and sell, everybody is coming it can’t end, the land mas of CA. alone could support maybe 50 million souls?

But in the end the theory of bigger is better caught up, we don’t need to spend writing a novel on this state, it has been well documented by every scholar/economist every which way.

CA. has died because it was Disneyland living, a fantasy of many tomorrow lands, future lands, in the end CA. has become the one land Disneyland never presented, the land to Nowhere?

I guess now that America is not #1, we can go back to rolling up our sleeves, access why we have slip, and what has to be done in our future. Maybe China does it better (no not really) or we let I happen because we couldn’t continue on being first in most everything including world’s policeman.

Whatever, your media runs 24hr non stop on police officer involved deaths that happen everyday, or why Bill Cosby and the likes of him were monsters and nobody knew but the Enquirer?

Our country slipping to #2 is the big story and how and why Americans are so disconnected from Wash DC, why we have over 18 trillion dollar debt, student loans bankrupting folks, women making only 77 cents on the dollar, and the middle class has been pancaked so bad that it all but gone away, with little said on how these people will recover their lives with part time, low paying full time and no pension jobs?

This is a major turning point going forward for the children now and young adults, their was a doubt several years ago, now it turned into a reality of America getting farther behind.

When you are in a horse race in the middle of the pact with no place to make a charge to the finish line, it is a hopeless feeling. America lost this horse race, there will be another one, we better have the best jockey and a plan from start to finish, because our Nation’s standing in the world and our citizens expect us to recover and win, finishing second, third, out of the money is not a option.

America is in second place because China is doing things better. Tens of millions of Americans who are able to work, don’t. Millions of Americans are functionally illiterate and/or have no job skills. Millions of Americans are in jail or prison.

Our common values don’t exist anymore–our youth lag behind the rest of the world in being educated and they don’t want to be educated. They are so dumb that they can’t even figure out that it’s not such a good idea to rack up huge debts going to college and getting a [fill in the blank] degree that has no practical use.

Then they complain that they have huge loan payments that they can’t afford.

Okay, in China most of the population lives in utter poverty by American standards. Even those who attend top Chinese universities live in dormatory quarters that are cramped when compared to American prisons. People with ordinary jobs in big cities toil away in environments that Americans would find absolutely unbearable.

Yet the Chinese keep hammering away and their noses to the grind stone. If you don’t work, you starve. There is no safety net. No free medical care. No free anything.

They are beating us because they are working harder. The same is true all across Asia. Americans have become lazy and fat and no longer lead the world. During the old days of the Space Race to the moon, no one in the world had the technology and people that could compete with the USA.

That’s no longer true today. Computers? Dime a dozen. Leading edge biotechnology hardware and scientists? Everything you need can be fit inside a shipping container and all the PhD’s are Chinese now. Semi-conductor design and manufacturing? Left the USA ages ago.

So what does the USA have that anyone else needs? Not much. The 19th Century was European. The 20th Century was American. The 21st Century is now Asia’s.

“They are beating us because they are working harder”? Maybe they work longer hours but what they produce is very marginal at best. Would you buy a Chinese car or big screen TV, how about washer and dryers?

We put them in this position because we wanted to bankrupt the old Soviet Union with our space program and breakup the love affair between these two communist power houses in exchange for trade with China not the Soviet Union, it worked.

China you are right is not the concern it is America getting back to work, the problem, major corps love a service economy cheaper wages and let the overseas workers break their back for low wages. Unless they get concessions on taxes it will still be a long day in May for the American worker.

Leave a Reply