Building for a future of American renting serfs: Private housing starts for structures with at least 5 units hits a post recession high. More than 11 million Americans spend more than 50 percent of income on rent

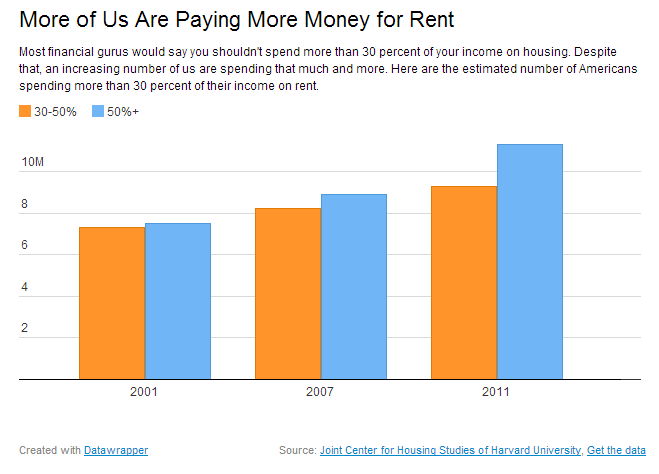

There was much celebration regarding the jump in private housing starts. However, once you begin to look beyond the headlines you realize that the big jump came largely because of multi-family starts. In other words, building more rentals in the form of apartments for a growing population that rents. Private starts for places with 5 units or more has now hit a post recession high. This makes sense given the fall in rental vacancy rates and the rise in rental prices. Yet what we find is that more income is being siphoned off into a less productive sector of our economy. Real estate tends to be a big plus for an economy when it happens organically with rising incomes, good overall employment prospects, and first time buyers leading the charge. Today it is more of a shifting of assets into fewer hands while extracting more income from the productive sectors of the economy. Not everyone can have their flipping show on cable television. For example, over 11 million Americans now pay 50 percent or more of their income to rent. Many of those people are here in California. The trend to building rentals aligns with the underlying reality that many future Americans will be less affluent compared to their parents.

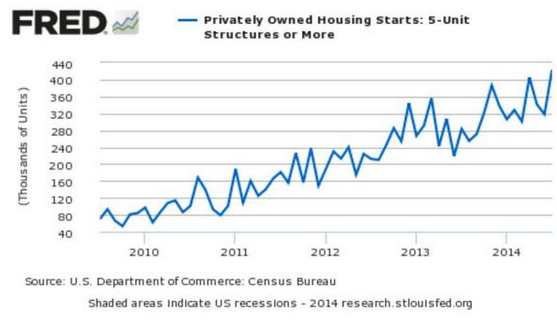

Multi-unit starts

Builders realize there is pent up demand but not for expensive new homes. New demand is in the form of rentals where little savings are required and incomes are less scrutinized. Although I will say in many tight rental markets like San Francisco getting a rental is even more stringent than purchasing a home. The charge for private housing starts is being pushed by rental housing. In some way more supply of this kind of housing should alleviate some of the short-term pressure we are seeing on rental prices.

Take a look at private starts for structures with 5 units or more:

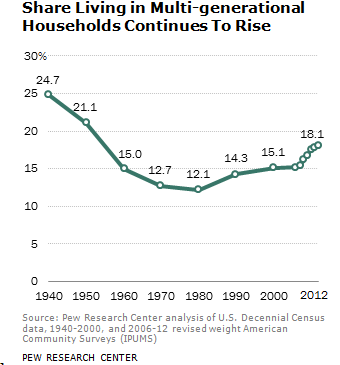

A large part of the blockbuster numbers reported on housing starts were being driven by this multi-family trend. And there is a clear argument to be made that there is pent up rental demand. Multi-generation households being brought on by adults moving home is something that is very real:

The data is clear and most of these adults are living at home because they are financial strapped. These people are not in the market for purchasing a Barbie sized pizza box, let alone venturing out to land a rental. However, should things improve and their incomes stabilize the first step out will be into a rental. That is usually the normal trajectory. Or, as is the case in California many are simply waiting until their Taco Tuesday baby boomer parents go down with their golden sarcophagus so they can haggle over who gets the stucco box next.

It is an interesting case to see so many young adults living at home. All the data points to financial struggles. These people aren’t planning some creative backdoor arbitrage to leverage into an overpriced home. No, most have no money for a rental let alone a home purchase. This is a nationwide trend. Yet builders are now realizing people need to live somewhere and living with mom and dad forever is not going to be a viable option for most (especially if you are still in dating mode). Building more rentals likely makes sense given the movement towards a permanent serfdom for many.

If you think rising rental prices are coming because of big surges in income, think again:

Americans are simply spending more of their disposable income on rent and this likely has the consequence of hitting other areas of consumer spending (which we are seeing). You are seeing companies trying to offer more generous credit offers to get people to spend money they don’t have. Not exactly a wise strategy but in this system, it seems like boatloads of debt is the answer to every problem.

The one thing with housing is that at any given point, only a margin of units are available for rent or purchase. This causes distortions in prices given the current availability of demand and supply. Think of the booms and busts we have lived through. Unlike a stock, there is less liquidity and a more constrained market. If you are looking to buy Google stock you are likely to find a buyer in London, New York, Tokyo, or anywhere around the world for the right price. Housing doesn’t work that way. Prices are made at the margin by a small group of people. The big buyers of the last few years were in the form of investors and those leveraging to the max out with low interest rates. Investors are pulling back and with rates at near record lows, it is hard to juice the system more on this end. That is why sales have fallen strongly in the last year and prices are stalling out. Housing booms and busts in a typically slow and methodical fashion.

One thing I will say with rents is that these units usually get hit the hardest when recessions hit. No sitting around missing mortgage payment after mortgage payment in a unit as banks figure out strategies to constrain supply. If you can’t pay the rent, the landlord is usually forced to evict. Some states are friendly to landlords but others like California can make the process a long drawn out saga. Should be interesting with many single family units now converted into rentals. What is clear is that the nation continues down this road of housing feudalism and rentals are becoming an option for more Americans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

170 Responses to “Building for a future of American renting serfs: Private housing starts for structures with at least 5 units hits a post recession high. More than 11 million Americans spend more than 50 percent of income on rent”

Last week we had news that LA/OC is the most expensive housing market in the country. It’s hard to see how this can continue. The Fed is debating when interest rates will rise. Not if, but when. Can you imagine what will happen when rates get back to 6%? House prices are already cracking at 4% interest rates. Why would anyone buy a house at this point in the cycle?

True, crack start to appear not only in housing market, but also in the equity markets. Look at the last decline in stocks. We start seeing the cracks in the ponzy scheme and you are right, it cannot go on forever. But I don’t believe we are at the turning point either, not just yet. Give it a couple moar years for the crack to develop (interests rates to go up, etc) and then we would start to see something interesting. Meanwhile, have you pop corn ready, I have already reserved my seats in the front row.

Here’s what will contribute to the demise of the SoCal real estate market:

Chinese government policy change kills Coastal California housing market

Source: http://ochousingnews.com/blog/chinese-government-policy-change-kills-coastal-california-housing-market/#ixzz3BQ2E0VtQ

The Red Chinese anti-fraud crackdown ramped up in 2012. This is nothing new. The red hot Chinese money that Irvine, Vancouver and the Bay Area has seen probably came before 2012.

The Red Chinese have also started the process of repatriating government families. They are starting to force Chinese government officials to relocate their families living overseas back to Red China.

By 2016/17/18, that crashing sound in Irvine and the Bay Area will be the sound of home prices falling through the floor.

The prices in LA/OC have increased unbelievably and “breath takingly “,

and unsustainably.

A steady DECLINE in Home Pricing will be HEALTHY and better for our long term

prospects. We want to encourage viable, solid buyers to own properties and

stay there – meet their mortgages and accept that MODEST GAINS in property

values are the NORM … NOT 30% IN ONE YEAR.

THE R.E. Industry wants “Listings” and they have TRAINED SELLERS TO EXPECT

“TOP DOLLAR” ….. even for JUNK homes.

This tactic is dangerous and will backfire in a very serious way.

Prices will drop as a matter of necessity and reality,

BUYERS CAN ONLY BUY …. WHAT THEIR AVAILABLE INCOME DICTATES.

Sorry — THE LIAR LOAN DAYS ARE OVER …..

>>>> If you don’t have the MONEY … THEN YOU CAN’T BUY THIS HOUSE.<<<<

“Why would anyone buy a house at this point in the cycle?”

Well, for one, most Americans aren’t that good at finance, and may be tempted by the hype that ‘It’s a great time to buy!’

For two, while I’m in the camp that sees prices dropping as rates rise, there’s no guarantee that the drop in prices will be proportional – ultimately the trend will come down to whether sellers or buyers are more desperate.

And the tightness of the rental markets in many metros, at least for now, still works in the sellers’ favor.

Housing IS Tanking Hard in 2014!

Nope, it is not. The housing to stay flat for the next couple of years…

Mortgage rates to 5% plus within 6 months and specuvestors running for the exits does not portend a flat market. Once again I’d like to point out the chief shill of the CAR Leslie Appleton Young predicts 6.5% mortgages buy 2016. Once YOY prices drops get to 10% the damn will break. I’m not predicting Armageddon and never have but suburb areas of SoCal are going to take a beating. Prime not so much but it will adjust relative to the cost of money. Even the “Elite” buy there homes with borrowed cheddar. That cheese is about to get significantly more expensive.

@Jim Taylor, keep up the optimism.

However, since 1945 (end of WW2), home prices in SoCal have only declined in the aftermath of recessions. Recessions happen about every 5 years. The last recession ended in 2009 so the timing is right for a recession in 2014.

Interest Rates to stay low Forever!

Show of hands – who here believes the following?

“…your average socal house price will revert to flyover country home prices.”

“…prime coastal socal will…turn into Detroit.”

And if you do agree with either of these statements, please explain.

The prime areas won’t be hit as hard by the crisis, it doesn’t mean they are immune. They would not just decline as low as the other, “less prime” areas, but still, when the STHF, it would affect everybody and everything. I really believe there is a chance the whole country will go “Detroit” if thing get really nasty…

So…People fled Detroit. The massive decrease in population resulted in thousands of abandoned houses and falling housing prices. The poorest people that couldn’t afford to move stayed. This left an increasing concentration of the poor and criminals. Now Detroits boarders have been shrunk to reduce the areas their utilities have to service.

So what you’re saying is that people will flee the US to go get jobs in Mexico. That leaves behind poor people and criminals. This lowered tax base will get the Congress to decrease the boarders of the country and give American land to Mexico and Canada. I can SO see that happening…

I don’t think people will flee the US, if the US economy goes belly up, so will do the rest of the world, unless they “dedollarize” in advance. There will be no place to hide, so we all will end up living in Detroit with no other place to go.

you make a very valid point. If the derivatives market where to start to go south depositors are last in line to get paid behind bondholders and shareholders and we all know there isn’t enough money on the planet to pay back the now nearly two quadrillion dollars in outstanding derivatives debt backed by these so called assets that are overvalued to say the least. Even with FDIC insurance they only have 47 billion dollars to backup a catastrophic economic failure. I did predict this housing serfdom coming though back in 2009 when I wrote about this great transfer of wealth. It was all planned after all. In 2008 when everyone was crying and in pain from the crash, there were a few people toasting champagne at their good fortune. Money does not disappear, it only transfers.

Some reasons why SoCal home prices MIGHT drop, even in prime areas, over the next decade or two:

* DROUGHT. How bad is it, really? I’ve driven through Santa Monica, Pasadena, Woodland Hills, other parts. Everywhere … trees, lawns, greenery. All of it thirsty. All of it thriving in an irrigated desert. What if the water dries up and the desert reclaims SoCal?

* GOVT FINANCIAL CRISIS. The state, counties, cities are obligated to pay huge pension and health benefits over the years. Meanwhile, the tax base is eroding. Wages down. Benefits recipients up. As the middle class and wealthy shoulder higher taxes, some will flee, the remnants will be taxed even higher, still more will flee, taxes rise still higher… How much higher can taxes go? What happens to mid-tier cities as services are cut?

* THE BIG ONE. How bad will the quake be? If it happens in a dry, drought-stricken summer/fall, will fire spread from the Hollywood Hills clear through to Topanga and Malibu? What if many of SoCal’s eroding water pipes break, and the fire trucks have no water to fight the blazes? And rioting and looting break out? What will SoCal look like after such a perfect storm of earthquake, drought, fire, rioting?

Dont forget that of which (almost) no one dare speak: The billions of gallons of radioactive water being dumped in the the Pacific from Fukushima and heading to the CA coast.

The Big one. That may not be enough to get people to move but probably cause a huge re-building boom. People flocked back to Mt Vesuvius after it erupted killing everybody within 3 miles.

Example: Mount Vesuvius. It is best known for its eruption in AD 79 that led to the burying and destruction of the Roman cities of Pompeii and Herculaneum. Vesuvius has erupted many times since and is the only volcano on the European mainland to have erupted within the last hundred years. Today, it is regarded as one of the most dangerous volcanoes in the world because of the population of 3,000,000 people living nearby and its tendency towards explosive (Plinian) eruptions. It is the most densely populated volcanic region in the world.

Yes, both hands up.

Here is the disclaimer, CA will need an event that will tear up the entire infrastructure that would take 20 years to repair. No water, no fire protection, slow police, roads a mess, etc. This could be a hurricane, earthquake, or act of war.

Other than that, prices are always going to be very high. There is a long line of buyers at the next lower tier.

Sharknado.

Home prices will not decline (significantly) in prime coastal SoCal.

Most of the good paying jobs in SoCal are either in DTLA or near the 405 corridor (Sherman Oaks down to Torrance/Carson). The remaining jobs in SoCal are service sector/retail dead-end McJobs.

The proliferation of decent jobs along the 405 freeway creates an inherent inbalance between supply and demand of housing in the area.

So unless Riverside, Ontario, Apple Valley, Yucca Valley or Bastow suddenly become job creation magnets, nothing changes.

Hold it right there Ernst. In case you forgot, this is a housing bubble blog.

Concepts such as supply and demand, and insinuating that certain areas are different or “special” won’t go over well here.

Housing to tank super mega HARD in 2016! 🙂

@Lord Blankfein, I’m all for supply and demand, and normal price discovery in an unmanipulated market…in other words, I support something we haven’t seen since the year 2002.

I see no problem with hosing trend shifting towards renting. I have been renting for many years and see no problem with that. What? I have problem with is the renal cost. The rents are too damn high. We need to build moar rentals to increase the supply, so the rent prices can decline to a reasonable level. If rents decline, it would pull some would be buyers from the housing market as well and ease on the demand, so the housing market can adjust accordingly.

Current rental rate increases appear to be a symptom of greed over common sense. Even if some places have been paid off of for many years or decades just shows this to be the case with some owners. Realistically following the Trend with inflation a lot of these made up rent values need to be taken with a grain of salt.

You can add supply all day and it won’t matter without a return of some semblance of price discovery to our economy. There is a ton of SFH inventory RIGHT NOW being held back which would allow lower income renters to become buyers there by increasing rental supply and lowering rents. We saw this in 2009/10 when foreclosures+.gov incentives juiced the market on the transactions side. Rents got hammered. As the FED takes there step back for this cycle (QE is over rate rise by summer 2015) things will adjust VERY quickly.

Nihilist,

QE is not doing anything for the 30 yr FIXED interest. That interest is a function of the bond market. Number of applications for mortgages plummeted (that is a fact not personal opinion) while capital is flowing into US treasuries to fly from global uncertainty. QE or no QE does not make any difference on 30 yr fixed interest which is the most widely used.

As long as current conditions continue, interest stays the same or goes lower.

Do you see a rush of new applications (and also approvals) for mortgages in the near future? I don’t.

Do you see lots of economic and political stability throughout the world in the near future ?

I don’t.

Conclusion – no change regardless of what the FED is saying. Absent of new real tools, the FED as well as ECB just TALK. Talk is the ONLY tool employed at present and near future. The FED knows that QE is not helping in any way whatever the purpose they say it is. It was never intended to help you an me but the largest banks with their reserves. They no longer need that now, therefore they taper. The tapering does not have ANYTHING to do with the so called “recovery”. There is no recovery for middle class. Pretty soon the middle class will be the new poor.

I don’t believe a single word that cones out of Felon Yellon’s mouth. QE had never ended and the Fed has never tapered. They might have had taper talk or even have tapered on the paper, but as long as “Belgiums” keep buying, there is no taper. Remember, fed cannot just order the rates to stay low. It is not possible. The fed can only do it by injecting excessive liquidity into the market, aka printing. As I said before, it is a BS taper, without any taper whatsoever. If they indeed started to taper, we would’ve seen the rates spike already.

RE:FED

“QE is not doing anything for the 30 yr FIXED interest”

So buying up MBS (part of QE) has no impact on the rates of said securities? Please…

Nihilist,

The taper started almost a year ago. If it helps with the fixed 30 yr rate, you would expect to see an increase in rates. Actually you see the exact opposite. Since the beginning of the year rates came down about 0.5%. Why is that? In few months it will be over completely and I don’t see the rates going up. Actually they are going to stay the same or lower.

If you buy less MBS every month (10 bil. less every month), why is that happening? I think you listen to much to Yellen and actually believe what she says.

I am still in agreement with the guy from Seattle that what you have to watch for is the bond market.

RE: FED

I agree that you have to watch the bond market. But that is not the sole determinant of mortgage rates and MBS. Safety is a factor. And to assume that the current flight to treasuries, with the USA seen as the “least dirty shirt”, means another 5 years of ultra low mortgage rates is bold. The FED is in uncharted waters, but it is still all so familiar. No period of macro monetary expansion has not been followed by a tightening. The cyclical nature of FED policy is what makes the so called “economy” work for the Oligarchy. So when the FED rate raise comes next year mortgages will rise disproportionately to account for risk. It’ll be at least a 4 point spread in m y opinion. Rates hit 1.5%, mortgages hit 5.5%. I agree Yellen is an empty pantsuit. I’m watching the bond market as well and I sense a short term trend with treasuries being pushed down. Just as they popped the last bubble they will pop this one. First by inflation then by deflation…

The bond market is currently flooded with Baby Boomer retirement funds, and Chinese Central Bank money printing (by way of Belgium).

The U.S. mutual fund market is roughly $15 trillion, of which about $6 trillion are bonds. The Social Security trust fund is about $3 trillion in bonds. The Fed’s QE was about $4 trillion. That leads us to Red China. The Chinese central bank expanded their money supply by $16 trillion over the last couple of years, which completely dwarfs every one else. Much of that went into real estate around the world. However….

With all the Federal Reserve money printing the dollar should have collapsed against the yuan. Since the renminbi to dollar peg has largely not budged, we can conclude that the Chinese are the secret Belgium U.S. bond buyers not the Federal Reserve.

If I had high renal costs I might have a hosing trend as well…

“If I had high renal costs I might have a hosing trend as well…”

Going to be hard to top that one.

That is what is happening look at the graph provided by Dr.B above. Once those buildings are complete you will have a glut of rentals 🙂

But this is good, isn’t it? Everybody will benefit from lower rents. All those multigen households and pent up demand will be dispersed…

@Jim Taylor, this being SoCal, the rentals are either:

1.) being built in areas that no one wants to live in. So yes those will be affordable if you like driving 90 minutes to work.

2.) being built in desirable areas but will be priced so that only the top 5% can afford them.

Seattle Guy, you keep spelling “more” as “moar.” I thought it was a typo, but your misspelling is consistent. Is it intentional and is there a reason for it?

Seek and ye shall find.

http://www.urbandictionary.com/define.php?term=moar

I have recently read two other posters, on differing websites spell more (moar) that same way also. I am beginning to think it is an evolving, covert internet spelling, and everyone but me is in on the joke, much like the way “loser” is constantly spelled “looser,” even by educated people. ‘Moar’ is just another attempt to dumb us down.

More than you really need to know about moar:

http://www.urbandictionary.com/define.php?term=moar

“Another word for more.

Used if you wan’t more of a thing very badly.

You wan’t more of it!”

Also:

An internet fad of a f’d up looking Mr. Krabs saying a “MOAR” in the spongebob squarepants episode “Jellyfish Hunter”.

https://www.youtube.com/watch?v=ABzWafwY20o

“Moar” isn’t a word.

It’s the taint between Missouri and Arkansas.

“Hosing trend” is actually exactly what this is.

Lol!

SoCal surfing culture supplanted by serfing culture.

The Mediterranean and Latin culture: One big, happy family

Mediterranean and Latin cultures place a priority on the family. In both cultures, it’s commonplace for multiple generations to live under one roof, (Ã la My Big Fat Greek Wedding) sharing a home and all the duties that come with maintaining one. In the contemporary iteration of this living arrangement, the oldest generation often is relied on to assist with caring for the youngest, while the breadwinners labor outside the home. As such, the aged remain thoroughly integrated well into their last days.

same in asian cultures

“This causes distortions in prices given the current availability of demand and supply.”

Doc, the time tested economic principle of supply and demand has already been roundly dispelled on this board.

“Doc, the time tested economic principle of supply and demand has already been roundly dispelled on this board.”

Because it is a myth…

Don’t expect housing prices to crash just yet folks. Here is an interesting take on the market. Full article here with excerpts below:

http://www.marketoracle.co.uk/Article43843.html

“US House Prices Forecast Conclusion – As you read this, the embryonic nominal bull market of 2012 is morphing into a real terms bull market of 2013, with each subsequent year expected to result in an accelerating multi-year trend that will likely see average prices rise by over 30% by early 2016, which translates into a precise house prices forecast based on the most recent Case-Shiller House Price Index (CSXR) of 158.8 (Oct 2012 – released 26th Dec 2012) targeting a rise to 207 by early 2016 (+30.4%).”

“By mid 2014 the sharp slowdown in price rises will prompt many commentators in the mainstream press to proclaim that the bull market has ended, when in reality it would just represent the market laying the ground work for the next leg higher during 2015 as prices oscillate around the forecast trend.”

“In my opinion the raging housing bull market of 2013 is merely phase 1 of an engineered feed back loop that will next manifest itself in strong U.S. economic growth during 2014 that is far beyond that which any academic analysts can perceive of today as they obsess over the likes of QE tapering, despite the fact that tapering STILL MEANS continuing money printing and somewhere along these academics seem to have forgotten all about what CHEAP fracking energy means for the U.S. economy. So whilst the foot may have been taken off the accelerator for U.S. house prices during 2014, the gas has already been amply applied towards uplifting the U.S. economy that will make itself manifest during 2014 and which will feed back into the U.S. housing market during 2015.

In terms of GDP this translates into typically adding 1.5% to 2% to the academic economic forecasts for 2014. For instance as of writing the IMF is forecasting that the U.S. economy will grow by 2.5% for 2014 whereas actual growth will likely turn out to be a far stronger at a rate of 4% to 4.25%.”

Handing out more tokens to a few at the top will NEVER create economic growth. It creates wealth transfer not NEW wealth. Hell, handing out new tokens to the masses will not create economic growth. In the Short term it may appear that there is growth but more monopoly money does not create wealth especially if there is a glut of money in the system. Why is this so difficult to understand?

30% rise? What?’s the freaking oracle to the prescient!

Come on Dfresh. We all know from blert that economist around the world come to the comment section of DHB to get economic insight…

well that article while interesting was off base. The prediction of the growth of 2.5 GDP was actually a – 1.5 so the following quarter would have had to be over 4.0% just to average the dismal but optimistic 2.5 GDP growth. so much for the optimisim. as for the prediction of housing to increase by 30!% by 2015 that already occurred in 2013 alone. As it standss it is now starting to go the other way because houses are now sitting if priced too high. The only people with access to loans are people that don’t need them. My prediction as soon as the houses do go down in price the investor class will be right there ready and waiting and making it impossible for the average Joe to get a loan or compete in any way. And it will continue to transfer the wealth to the hands of the few at the expense of the many. As long as our government allows banks to securitize and derivatized and insure with “swaptions” the debt on underlying so called assets of whatever bank created securitized derivatized hedge your bet against the equity BS, the little guy won’t stand a chance this is a planned and created transfer to a world of serfdom not just in the United States, and certainly not just California. Unfortunately since our money is just fiat currency and created from debt,  until they start loaning money to the average Joe again, there will be no money on main street. Money is debt. Without debt there is no money. That is how our monetary system works. Until that’s fixed nothing else matters! It is the heart of the fraud perpetrated on the masses right before their eyes and 90% have no clue how it’s done. If they did there would be riots in the streets today.

Hogwash. The fundamentals for home buying couldn’t be worse-no wage growth, little household formation, scant inventory, high prices, excessive debt, artificially supressed interest rates. Not that fundamentals have mattered the last few years, but at this point, they will.

@Markar, you are correct. Wage growth has been in the 1% range for those with existing jobs for the last 5 years. For new jobs, the average starting salary is about 23% less than in 2006, $47K in 2014 vs $62K in 2006. (source: http://www.forbes.com/sites/erincarlyle/2014/08/11/american-mayors-address-pledge-to-fight-income-inequality-low-wages/ )

“…will next manifest itself in strong U.S. economic growth during 2014 that is far beyond that which any academic analysts can perceive of today…”

Is this guy serious?

I read that article and I think it’s hogwash. The analyst is overlooking all kinds of things.

I read this article and I think it’s hogwash. The analyst missed any number of factors in their analysis (starting with interest rates).

Clear out of CA, you rental deadbeats! Ivanka wants to replace them with people with real style.

“I have full confidence that prime coastal socal will NOT turn into Detroit”

It doesn’t have to turn into Detroit. What about if the adjacent ares turn into Detroit?!?…

How would you like your house to be next to a Detroit???!!!….Actually it is already changing into a Detroit. Look at the iron bars in windows, drive through east LA and you’ll see that nothing is special about LA. What about when state of CA and local cities can no longer provide shelter and welfare to the tens of millions of poor? You know that what the state is promising the poor is totally unsustainable. It is a mathematical impossibility to continue like this indefinitely. Detroit was going on the wrong course of action for half a century till they couldn’t. Socialism works ONLY till you run out of other people’s money.

Look at the masses of poor (millions of them) in SoCal who are getting poorer everyday. Look at the ever increasing number of poor. In one decade, the population increased 10 mil. and the taxpayers by 150,000. What is that telling you about the sustainability of this course? The middle class is still moving out and the poor are still moving in; for how long????…

welcome to escape from LA. snake eyes. turd world nation

It’s a multi-decade process. I bet the people living in the mansions in Detroit were saying the exact same things the clowns in CA say. Hubris comes before the fall. Most of them will die off before they see the worst of it. It’s their kids that they’ve sold out. 50 years from now only the tatted up skull pierced mutants will be left. Nice legacy.

“What about if the adjacent ares turn into Detroit?!?…”

There are tens of thousands of houses adjacent to Detroit – they’re called the suburbs, and they’ve been pretty stable over the last half century even as the city neighborhoods slowly decayed. Even when the city is just across the street (i.e. Eight Mile Road). Unlike LA suburbs, Detroit suburbs are all pretty safe, and there’s lots of shopping and recreational options. I rent an apartment in a very nice area for $625 a month. It’s a 70’s era building, but it’s well maintained. New two bedroom apartments can be had pretty much anywhere except for a few ritzy areas for around $1,000. I don’t feel like a serf. In fact, compared to SoCal folks, I think I have it pretty good.

@Flyover Great observation.

@Flyover to Lord B wrote: “… Look at the iron bars in windows, drive through east LA and you’ll see that nothing is special about LA…”

East LA? iron bars in windows stretches all the way west to Culver City, Mar Vista, Palms, Hawthorne, Gardena and portions of Westchester, in other words, up to the 405 freeway.

25 % living at home at the end of the Great Depression in 1940, seems to be normal. We are on our way towards that goal. Living at home, means more money to spend on that BMW or Mercedes and other toys of the young. Also, the single mother lives with her mother. Fewer people are getting married. 40% of babies are now born to free mothers who don’t have a man telling them what to do. Our culture is evolving. The new normal. I know some people look fondly at the economic security of the 50’s, but those were times when women were in slavery and Blacks were just emerging. There is no going back. Just accept the way it is and stop the whining. It takes a village, as the next President said.

Hillary misspoke. She really meant “It takes a Pillage”. That’s what our pols on both sides of the aisle have in store for us.

“Our culture is evolving”

Is it evolving or de-volving? Eckhart Tolle said, “Things are simultaneously getting better and worse.”

Ms Steinem, so it is your position that women in the ’50s were in slavery? Can you please give us your definition of “slavery”. Is is the same as the definition of marriage?

Any you think that all these kids now being raised by just one parent is “evolution”? Do you realize all of the evidence that shows that children brought up by two parents are better off than those brought up by just one?

I’m thinking you’re a moderately-experienced troll, but please prove me wrong.

“Since marriage constitutes slavery for women, it is clear that the Women’s Movement must concentrate on attacking this institution. Freedom for women cannot be won without the abolition of marriage.†(Sheila Cronan, in Radical Feminism – “Marriage” (1970), Koedt, Levine, and Rapone, eds., HarperCollins, 1973, p. 219)

“The simple fact is that every woman must be willing to be identified as a lesbian to be fully feminist.†(National Organization for Women Times, Jan.1988)

“It became increasingly clear to us that the institution of marriage `protects’ women in the same way that the institution of slavery was said to `protect’ blacks–that is, that the word `protection’ in this case is simply a euphemism for oppression.†(Sheila Cronan, in Radical Feminism – “Marriage” (1970), Koedt, Levine, and Rapone, eds., HarperCollins, 1973, p. 214)

“Marriage is a form of slavery.†(Sheila Cronan, in Radical Feminism – “Marriage” (1970), Koedt, Levine, and Rapone, eds., HarperCollins, 1973, p. 216)

Gloria , some of my friends make 6 figures but they are trapped in jobs they hate because they have kids and mortgages. Who is the real slave. A man child like me has all these disposable fun coupons in my wallet because I don’t have a wife like Susanne nagging me to buy a bigger nicer nest in a better school district.

(Ben) Some men do not do well with commitment and obligation and it’s best to know thyself. You have free will to choose the life and lifestyle that suits you best. Cheers to you for staying single!

To say that “women were in slavery” in the 1950s is not even a gross exaggeration. Such a statement is flat out false.

My parents escaped from Communist Europe in the 1950s. My mother never felt that, in coming to the U.S., she had escaped INTO slavery.

I think your mom suffered from Stockholm Syndrome…Master by a different name as a Mister does not mean she was not enslaved. Thank the Lord we don’t have to wear an apron, cook and clean a home under the pretense that it was our life’s work to make the “Mister” of the house happy. Back then women worked in the home for room and board and a place in the master’s bed…that’s pretty much what colonial slaves did.

Wow I’m late to the battle of the sexes. been married for over 40 years, like to think as a man I’m in control, well I can think all I want, my wife lets me strut around and as a former athlete she laughs at what I can’t do anymore, but I think I can.

That’s what great about God in making a woman, they prop up their partner, in reality they know a man’s limitations and take a backseat only because they don’t want to hurt our very big ego’s.

Woemen were never in slavery. They just had their place. Now they are out of place, out of equilibrium, and need to get back into their place. Black folk have arrived, who would have ever thought that the son of a Kenyan economist would be in the White House. But the poor man is abused by Michael, who said at the African leaders conference in the White House, that woemen were smarter than men. We all know that she lies.

(Tyrone lll ) Women are “out of place” and running wild! We have jobs and buy homes all by ourselves! We found our place and it’s not with the likes of you. You should not post on this blog if you want to appear smarter than women…

Christie s

August 26, 2014 at 7:49 pm

It’s the investors who have total ‘Stock-home’ Syndrome, and I hope they pay a terrible price for it via HPC. When investor money dries up, or looks to bail out, the renters and the young people have them held hostage! Their homes are worth what we’re willing/able to pay.

In the US, ‘The Pistol Gives Women the Vote’

>The movement towards the enfranchisement of women, which was a late nineteenth-century phenomenon, coincided with further refinement of small arms technology. Small, dependable pistols allowed disgruntled females practially as much military potential as males. It is probably no coincidence the first place where women got the vote was on the American frontier, in Wyoming, where women were well armed with pistols and knew how to use them.<

IF you think you are a real women I think i’m going to throw up, women were not slaves, in fact there were some single women in the 50’s that had jobs. Thank God all women aren’t like you and christie s.

PD- The women who had jobs in the 50’s were mostly secretaries, teachers, nurses. Now women can enter many different levels and kinds of careers. I’m not sure what you mean by real women? The kind who stay home and take care of the kids, house and their man? I think whatever women chose they are “real women.” Decide to work in the home or out or a combination of both…they are all real women to me. We have choices to what we want to do in life and I think that’s great. Stay at home raising kids or run a Fortune 500 company are all within the realm of possibility. Choice is good. Choose the life that works for you.

Doc: “Americans are simply spending more of their disposable income on rent and this likely has the consequence of hitting other areas of consumer spending (which we are seeing).”

_____

Yes, deflation in other sectors, companies having to discount, tighter margins… which doesn’t bode well for the “let’s solve overvalued house prices with big wage inflation” champions. And why I don’t understand anyone who is expecting their debts to be inflated away and their nominal asset prices to hold up.

I hope all my US friends who want/need better value housing, are okay – it’s not a lot to ask. The position seems so severe between Vested Interests in high property prices, and younger independent people trying to just get the most basic of positions against these house prices.

“I don’t understand anyone who is expecting their debts to be inflated away and their nominal asset prices to hold up.”

“For in this hope we were saved. But hope that is seen is no hope at all. Who hopes for what they already have?”

What? posted: “For in this hope we were saved. But hope that is seen is no hope at all. Who hopes for what they already have?â€

_____

Ah, that reminds me of a scene from Red vs Blue. (Interet series – I think you might enjoy it What?)

Season2, Episode 22. …Standoff with Blue Team penned in against rocks, and Red team 50 metres away, bluffing because they are out of ammunution.

[Blue team] Church: Okay – we’re going to send over our medic. Now what do we get?

[Red team] Simmons: You? You’re surrendering. You don’t get anything but humiliation and ridicule.

[Blue team] Tucker: We’ve already got that. What else do you have?

Being a renter now is a sign of fiscal responsibility. House prices are way out of whack compared to household income, household debt, and a lot of other historical factors. Buying now is just acting like a financial lemming, not understanding what is going on.

So said the renter who’s resigned to his status…..

I owned three homes in the US. No more. I bought another 3 years ago and it has doubled in price. It’s not in America.

I wonder where I’ll get categorized then, owning two rental properties and just about to break ground on a new SFR.

(roddy 6667) Not figuring out the right time to buy in the last 15 years makes you an incompetent fool…you’re right no one has written a book on “Market Timing for Idiots” many renters on this blog would be included in the footnotes.

The return of little s. I am getting the feeling that you really are a shill. I don’t hate you for it. Actually, I am a little jealous if you get paid…

Yet, here you are, commenting on a housing bubble blog. Did the Lord call you here?

I know when to buy and sell. Most people don’t. They buy at the top, not on the way up. It’s easy to see when a market is overpriced. Most people buy on emotion, and often regret it later when reality steps in.

So, I’m curious to hear people’s thoughts on this. DHB’s thesis used to be that So. Cal. housing is too expensive–it’s a bubble that has to pop! Right, gotcha.

Recently, it has turned into more of a conversation about rental serfs and feudalism. So, I agree with the analysis and the implications–that So. Cal. renters are working hard to give an increasing part of their paycheck to their (land)lord. OK, got that, too.

My concern is that with the second point, it perhaps suggests that those silly, serf-ish renters should go out and buy in order to break the cycle. And, as most readers would agree, that’s probably the worst thing to do since it sets them up as victims of the next bubble pop. Wouldn’t it be “smarter” to be the rental sucker until the next pop and then buy?

I moved to FL because I think So. Cal housing is a loser to everyone invested in any form of residence at the moment. (And don’t get me started on my own prognostications with CalPERS issues, CalSTRS, et al…) I’d be curious to hear what DHB would recommend–the only solution that seemed economically sound to me was to move.

You can be damned if you do and if you don’t. There’s not always a silver lining IRL.

You have to weigh your own personal circumstances and your market. If you have a stable job and are likely to be in the same place for 10+ years, it might be worth buying despite the high prices, even if the market is 20% overpriced.

Now, for me, I’m likely to have to relocate for work in 5-7 years, and I think the market is overpriced >0. So it really doesn’t make sense to buy – even if I could save a bit month-month on PITI vs. rent that wouldn’t include cost of transaction fees, risk of loss, or the risk of losing career mobility if I need to move for work when the market is especially sour. The 36% take-home that goes to rent is a major strain against paying off other debt, investing/saving/spending, etc. but it’s manageable on my time horizon.

Unfortunately there’s not a single easy answer – the belief that there is one is a big part of what fuels market bubbles.

“he only solution that seemed economically sound to me was to move.”

KR, that is the smartest thing to do for every middle class CA. Unless you are a true millionaire (assets not debt), life in CA for all poor and soon to become poor middle class is not worth living. Smog, traffic and astronomical prices (for any nice, safe house). Pay all the taxes which benefit both the super rich and the poor and you are true serf the way the Doc is saying all the time.

There are so many stupid people in CA pretending they are anything more that serves! The live a true life of slavery. US offers so many beautiful places for those smart enough to take advantage of them and live a life like on vacation; and having the money, time and freedom to travel anywhere they like.

I am happy anytime I see smart CA who takes advantage of that, who think outside the box and jump out of the matrix.

I saw a nature show today where a snake was eating a rat. Then a bigger snake wanted the rat so it grabbed the other end and started to swallow the rat and continued on to eat the other snake as it swallowed the rat.

Hey BEAVIS (a guy from Seattle) and BUTT HEAD (WHAT?)… Dr. housing Bubble Blog dude just called you both renting SERFS?! HEH-HEH, HEH-HEH, HEH-HEH!

So little s, do you get paid by the word or by the post? What kind of income can a stay at home mom make as a housing shill?

What? I am a day trader and work from home ( nice big house ). Yes, I am a single mom and an owner of several rentals…no shill though. I get paid with ticks not words. 🙂

Little “s”, little”r”, guess you are not big on using the Caps Lock?

🙂

I take you to mean that it’s a myth as it applies to the RE market because the interloping of the government and central banks distort both supply and demand?

Nope…

Sales of new homes reach troubling 4-month low:

http://www.marketwatch.com/story/another-worrying-sign-as-sales-of-new-homes-slow-2014-08-25

And then Redfin sends me this gem (now pending!):

http://www.redfin.com/CA/Thousand-Oaks/221-Houston-Dr-91360/home/4664784

I’m getting emails daily from Redfin about price reductions of about $10-$15K on $500-$600K homes. Panic seems to be setting in as sellers chase the market down.

“But why are housing prices in New York or California so high? Population density and geography are part of the answer. For example, Los Angeles, which pioneered the kind of sprawl now epitomized by Atlanta, has run out of room and become a surprisingly dense metropolis. However, as Harvard’s Edward Glaeser and others have emphasized, high housing prices in slow-growing states also owe a lot to policies that sharply limit construction. Limits on building height in the cities, zoning that blocks denser development in the suburbs and other policies constrict housing on both coasts; meanwhile, looser regulation in the South has kept the supply of housing elastic and the cost of living low.”

http://www.nytimes.com/2014/08/25/opinion/paul-krugman-wrong-way-nation.html?hp&action=click&pgtype=Homepage&module=c-column-top-span-region®ion=c-column-top-span-region&WT.nav=c-column-top-span-region&_r=1

Reads like a treatise on constrained supply of homes (net units), and especially SFR’s, having a profound impact on price. More supply/demand mythology!

Yup…

The economy seems to be doing better. Why isn’t the housing market improving? I wonder if it is because of articles like this.

Because the the economy is not improving. Stop buying the MSM party line and bogus gov.t statistics. Real inflation (as it used to be counted) is running about 6+%. That means you can deduct 4% from the phony GDP numbers that came out for second qtr. putting us clearly in recession territory. In fact, since 2008 we never came out. Then consider the BLS numbers showing UE dropping. Who believes this crap when the labor participation rate is at generational lows?

” Why isn’t the housing market improving? ”

————————————————————

The housing market “is” doing better, but it has hit a wall.

Housing is not meant to go up 20% to 30% per year, no one can afford that.

The 30% increases were from a very depressed home pricing level,

a “one-time shot in the arm”.

The Gov’t and Media are NOT reporting the REAL DATA

surrounding INCOME , JOBS and Poverty levels.

If the truth got out – we would see people stop spending

and this would trigger DEFLATION and another Recession.

It’s about promoting ‘confidence’ – In other words this is a phony recovery.

There is simply not sufficient Income in the hands of average

people to pay for these sky-high Real Estate prices.

Hiring more people is great news – BUT what are they being paid$$ ??

Is it enough to afford these inflated home prices ??

….. Sorry … NO, not possible.

“The economy seems to be doing better.”

Cathy, the key word in your sentence is “seems”, like in illusion. That word gives you all the answers you need. Just because the official unemployment is 6.2%, it just “seems” low. For an accurate number try high 20s.

Just because the official inflation is under 2%, when you buy food and gas and pay rent it “seems” like 30%. It is a very HUGE gap between “seems” and reality.

“The economy seems to be doing better. Why isn’t the housing market improving? I wonder if it is because of articles like this.”

Note that improvement is relative. For those planning to buy, improvement is a decline in prices. For those holding property, improvement is an increase in prices. And amongst other players, governments benefit more (higher ‘take’) from higher prices, and realtors try to make money every real estate transaction. Improve? Indeed!

@Cathy, adjusted for inflation, real income is down about 8% since 2005. (source: http://www.deptofnumbers.com/income/us/ )

So maybe you should provide a definition of “improving”, and for whom…

During such times as ours, expect that a huge number of SFHs are being converted to ‘multi-family’ rentals — by the back door.

These re-purposings are happening under the radar to avoid the meddling tax and zoning man.

%%%

In this digital era, econometricians and statists are enthralled with themselves — and their statistics.

One could call this McNamera’s disease, for the man who ran the Vietnam strategy — by the numbers — off the charts — and into the ground.

Deming’s numbers and control philosophy are magnificently applicable to machine-based mass production.

But econometrics — indeed its entire fabric — linearity — collapses during such times as ours.

By fulsomely corrupting ALL ‘government’ stats — for agitation propaganda and somnolent propaganda purposes — everyone’s rationality steering compass is pulled astray.

While agitation propaganda has been concatenated down to agitprop — it’s more pervasive brother: somnolent propaganda gets no acknowledgment.

But it reigns supreme across the financial airwaves: CNBC and Fox Business… et. al. spend just about 99.9% of their time calming the proles down.

$$$

No ‘serious’ economic broadcaster can bear to tell the public/proles that the maladministration is running the economy backwards.

Rather like shuttling death trains to Siberia, the conductor figures that the end game is best kept a surprise. It was not for nothing that the NKVD let all of the proles wear their Moscow’s finest — right up until they debarked into the snow.

What did happen to millions upon millions of middle class Russians can easily happen to millions upon millions of Western investment portfolios.

$$$

One ought to be put off by the fantastic shrinkage in the hedge fund community. This was , and is, a community that plotted investments based upon linearity and correlations.

It’s died the death of a thousand scalpings.

At some point you reach the end of the road. As Mosul could tell you, the transition to a new normal can come out of the blue.

The agitprop of Ferguson is, in this regard, most disturbing.

The media circus is exposing the total dysfunction which is the modern American mass media. It’s all tabloid — all the time.

The national psyche has a tabloid addiction.

Is it any wonder the economy is strung out?

“By fulsomely corrupting ALL ‘government’ stats — for agitation propaganda and somnolent propaganda purposes — everyone’s rationality steering compass is pulled astray.”

One of my first econ class’s instructor started his definition of GDP with the following discussion:

Why does a king go down to the village to see how his subjects are doing? He wants to know if his people are happy. Why does the king care? Because unhappy subjects tend to rise up against indifferent monarchs. How do we know if the people are happy in a free market system? We measure happiness by the amount of goods and services they consume. Hence, GDP.

Like so many signals, GDP is now considered a lever. The problem with “altering” GDP to give the impression that all is well is the same as changing the gas gauge on a car that is running out of gas to make the driver believe he/she is fine. We all know how that ends…

Don’t forget the fact that there are some not so young adults living with their parents to help support their parents. The baby boomers I know spent all the money they could have made by buying in cheap in So. Cal in the 70’s and selling during one of the booms, instead used their homes as ATM machines and now owe more than they bought the place for.

Everyone rents, period.

You may own your home, but you rent your land from the government. It’s called property tax. At 2% you buy your home over every 50 years. Everyone complains about the interest rate, but what about the lifetime of taxes you can never escape?

That new 1MM home in OC is about $20,000 year in property tax. That is $1667 month and will continue to grow slowly every year.

We are all on borrowed time. If we lived forever then many of these arguments hold true, but we don’t, and if you want to live your life you need to make decisions and concessions. At this point in history we need to make concessions on how much money we spend on rent. Future generations may have cheap rent and pay $20 gallon for drinkable water.

“I’m not a realtor, I’m a realist.”

If you’re going to refer to property taxes as rent, at least get the numbers right. It’s typically 1.25% per year for resale homes unless you are dumb enough to purchase where there is mello roos or some other scam. Based on $1MM PP, that’s $12500 per year or $1042 per month.

I was talking about the effective tax rate which includes Mello-Roos. Yes, it’s often around 1.75%. And don’t forget about he $200-300 HOA on homes. It’s VERY easy to get to 2%.

2%???? No. The base is 1% and the adds on might be another 0.25%. You must not be living in CA so nice for telling us about our own state. If you work you can deduct a portion of this tax so the effective rate maybe less than 1%. The growth is capped at 2% max thanks to Prop 13. Who knows about the future but right now property tax seems to be a small factor to me. Yeah if you rent, you will still not run away from that tax!!! Do you think the landlord is going to eat it all? Nice try.

As a landlord, I’ll tell you that we cannot simply raise rents based on our costs rising, it is more complex than that. If the competition has a comparative vacancy at a lower price, renters have a choice. Rents can move in two directions.

Deduction of mortgage interest depends on income

In OC for example all the new properties do have Mello Roos….overall is like 1.65%.

and you need to add the cost to repair and fix the house….given the quality of the houses I would say 2% is not that far off.

might go down to 1.5 if you can deduct your property taxes and you do not hve the Mello roos but I have the feeling that more and more CA counties are going to use the Mello Tax to fatten gov leeches.

And there is the infamous HOA…in a lot of OC 200$/month HOA is the norm except in very old neighborhood from the 60s

Good point regarding the MI deduction. It’s not a given. Some people will do better taking the standard deduction and with lower interest rates comes less interest payments that can be itemized in a given tax year. We all want to give and hear simple answers but things are not always simple.

Duh. I’m just responding to the tax statement. It has nothing to do with maintenance. BTW mello roos Yes you can’t raise rent to what ever but many long term tenants do enjoy slightly below market rent and they will pay more rent if taxes or maintenance go up they can still leave but that would probably be a downgrade. Still yet landlord can raise rent if the demand is there, income is one thing but demand is another. 10+ living in a house might be the new norms for many places in CA. You don’t like it you can leave, we already have enough people in CA.

I live in CA. I know the real cost. I was talking about the effective tax rate which includes Mello-Roos. Which is NOT a tax deduction if you play fair.

Most rentals don’t have he high mello-roos; the utilities are different as they are part of the new builds. Or they rentals are built in the past when the tax rate was lower.

Good luck avoiding Mello-Roos and HOA fees on any new build in OC.

“You don’t like it you can leave”

Or if one doesn’t like it, they can stay and continue to call attention to it.

The property tax is really a service charge for services like roads and sewage connections which increase the value of your home. You can live in unincorporated areas and not have to pay property tax if that’s your thing, but the value of your “investment” will not grow as much as it would in urbanized areas.

LAer: “The property tax is really a service charge for services like roads and sewage connections which increase the value of your home.”

In theory that’s true. In reality, much of the money that’s collected is not spent on services but on political cronies and union fatcats.

Despite all the property tax it collects, L.A.’s old roads are cratered, its ancient water pipes are breaking, and its dangerous schools graduate illiterates.

“Despite all the property tax it collects, L.A.’s old roads are cratered, its ancient water pipes are breaking, and its dangerous schools graduate illiterates.”

L.A. is not unique in this regard but these are some of the “costs” that people don’t necessarily connect back to their “savings” with things like Prop 13. No free rides.

Tired BS, are you saying that L.A. doesn’t collect ENOUGH property taxes?

I’d say the problem is that the money collected is misspent (i.e., it’s not spent on roads, pipes, and infrastructure).

First let’s spend the money properly. Then we can talk about raising property taxes.

Son of miscomprehension, where did I claim property taxes should be raised? That’s right, I didn’t. You get what you pay for.

Tired BS, NO, we do NOT get what we pay for.

The taxpayers of L.A. pay a lot in taxes (property taxes included), and get very few services in return.

It’s easy to blame high taxes on cronism. It’s true that the state pensions bloated. However, there was a time when not two many people want government job for whatever reasons so the pension was partially there to compensate. However, many pensions are underfunded by 30-40% so cuts is in inevitable. The road/sewer/water etc… system was built when labor and material was cheap (due to cheap cost of living and lower standards of living) plus the building standards is must lower so money to replace everything today is just not there. We don’t live in a perfect world there is cronism everywhere but it’s not the main or only reason for the mediocre infrastructures. It probably caused more by trying to sustain the US urban crawl/low density way of living.

“It probably caused more by trying to sustain the US urban crawl/low density way of living.”

Something like that, but dense cities points east do have similar infrastructure issues. The biggest difference is that they’ve had a longer history of maintenance and fixes to learn from.

What doesn’t always seem to be getting across is that the rising expense of living here cannot be avoided even by those who “won” the Prop 13 lottery. If the value of the dollar deflates by a rate which is faster than the nominal dollar-denominated tax increases, who is going to pay for the difference? New entrants purchasing homes at current assessment? How long before inherent feedback mechanisms inform said new entrants that better value can be found elsewhere, leaving behind the “winners” to pay? Although I agree with the premise on which Prop 13 is based, its intended effect is backfiring.

Again, how would a future L.A. of majority poor, minority rich, and shrinking middle class be beneficial for all users of its infrastructure?

Son of miscomprehension, this is the government and environment we’ve paid for so far.

@ BenShalomBernan, when I think of cronyism, I don’t think simply money being “siphoned” into thin air and into someone’s pocket. I see it more where a “legitimate” deal is not so legitimate. Look at how much we spend on military, same with prisons, ditto education. There is a reason corporations love to deal with government, cost plus contracts means the more you waste/spend, the more money you make (once the budget is approved there is no incentive to underspend since every $ that isn’t spent, is lost profit). Unfortunately I don’t have any data to support my suspicion but I would bet a years salary that if we tallied up all the profits that government pays to corporations, these moneys would far dwarf any pension underfunding. Now, of course companies should make a profit when they make things for our government, but where is the oversight to make sure that government contracts are not handing out taxpayer money through the front door only to see campaign contributions brought in through the backdoor? There really is a reason our prisons, military contractors, and education lobby is so big in this country. Its not because we’re just so special and unique that we spend more in these areas than others, there is much more to this, people just have to be willing to question the status quo. Lets not forget medicine. So, in my opinion, cronyism most certainly plays a huge role in the deficits we run each year and this problem will never end as long as politicians can win political points by using taxpayer money.

One more, lest we forget why Wall St. loves governments (at all levels) running deficits. Every bond floated (be it by the federal, state, county, city, school district, etc) results in fees $$$ for bankers – so you better believe they love to see school districts raising funds for renovating classrooms, or “beautification projects” undertaken by cities, etc.

Well it seems that REITS are selling off like rotten potatoes. Some of them are down as much as 25%. What could possibly go wrong?

Given the article below, how could the nominal house price drop? I think it will go higher in across the board inflation. The savers will be punished again.

http://www.zerohedge.com/news/2014-08-26/it-begins-council-foreign-relations-proposes-central-banks-should-hand-consumers-cas

I’ve no idea what will happen in the future, but the suggestion of such actions seems to be the defenders of the status quo admitting how real the threat of deflation is. I’m not sure I’d put that much faith in their abilities to head it off.

Read Gloom and Doom at your own risk…

Multi generational housing is the future. It is very Mexican. 10 people at one house, with the pickup trucks and mini vans parked in front and the kids playing on the street. Gov Brown said the other day that all Mexicans are welcomed, even the undocumented. You offer good government benefits, and they will come. Gov Brown has made California a sanctuary state. Gov Brown has our vote. Now if you don’t like the idea of us moving in next door, you come on over to Oxnard, the Newport Beach. Get a sea view for cheap. Oxnard by the beach has class, unlike the inland areas that put up with the new arrivals with 10 people to a house.

I see where Hispanics that fled Phoenix who ( the last few years have taken a very hard stand on them), is now affecting construction and related jobs.

Phoenix now lags well behind other major US cities in construction projects and skilled labor.

Many superintendent’s tell you the Hispanics flight out of Phoenix metro is having huge effects on labor. Whites and blacks out of work now have a golden opportunity for steady work are not interested. Many new developments are only open 3 days since they don’t have the work force or many who do work ie the whites, don’t show up and quick the job early on. Blacks have a astounding .09% who apply for work.

What does this say, let illegals remain so projects get completed, no what is should tell us Hispanics who are offered a work program would stay and the whites and blacks can go ahead and live off the 26 week unemployment’s checks and welfare, what a sad statement on not only Phoenix but America in general.

These employers who hire undocumented workers do not pay the applicable payroll taxes and withholding taxes. These employers are criminals because they are embezzlers. The solution is for employers to pay a competitive wage, e.g. union rates, and abide by the law. We live in a civilized society. If you know of any of these embezzlers, please report them here. http://www.edd.ca.gov/payroll_taxes/Underground_Economy_Operations.htm

Heh, I’d say the insane asking process are about to come back down to reality.

Check this listing in Torrance out: That’s a 125k drop in less than 10 days. I think they floated the crazy price thinking it’s just like the TV shows, then reality hit.

http://www.redfin.com/CA/Torrance/1617-W-221st-St-90501/home/7646484?utm_medium=email&utm_content=address&utm_campaign=instant_listings_update&utm_source=myredfin

I suppose it’s possible the listing agent fat fingered the original price but it sure took a bit to fix if that’s the case.

That said, this is not actually Torrance, it’s the Harbor Gateway neighborhood of L.A. city, which is a crime infested slum that shares the Torrance ZIP code because it’s serviced by the same post office. I don’t care if that sounds “racist” or whatever, it’s the truth and it’s ridiculous to put $635K on the line, much less >$400K for a house that “needs minor TLC” in that ghetto.

By the way, I think they got their cable networks mixed up, it should be “needs minor HGTV.”

Wow, $500K for that rathole? Incredible.

Sorry to get on a racism tangent but Sunday while vising a new development a agent ask me the usual questions of a middle age white like myself who drove up in a BMW.

After viewing the three models, a mix couple was asking questions while the agent did little response back to them. When the couple stop asking the agent says “this will be gated community with dues increasing as the development continues to grow?

At no time did the agent remotely suggest to me of gates and dues. The couple proceeded to the model, I ask the agent, looks like gates are being installed she said oh yes and maybe even a guard house in the future to protect the residents and your privacy.

Notice how carful she was with me yet frank and to the point with the mix couple.

I live in a guarded gated area, so I can’t pretend now I’m concerned about the way certain folks who look different in color are viewed or even accepted at high end luxury properties, but yes I did go home and reflect on the incident.

Maybe these gated area’s with HOA dues and bylaws are really unconstitutional since they advertise and are open to the general public and not private.

Of course they are and people like me who bought in such a place knows it but can’t admit it until now. If you follow the HOA rules, enter behind these gates and guards, then you are part of America’s racial problem, I just thought we were insulated from it because it looks so cool to be in a gated area, now I fell ashamed.

Here’s an even better one in Culver City! Look at the price history, 285k reduction since June. WTF! But it fully “up to code, with energy saving features!”

http://www.redfin.com/CA/Culver-City/5021-Purdue-Ave-90230/home/8136377?utm_source=myredfin&utm_medium=email&utm_campaign=instant_listings_update&utm_content=address&reinfo=ZXhwSWQ9MjE2NjA4MyZleHBJbnN0YW5jZUlkPTE5NTY5NTIzMzM0ODkmY2F0ZWdvcnk9ZW1haWwubGlzdGluZ2FsZXJ0cyZjb2hvcnRJZD1CeV9TYXZlZF9TZWFyY2gmdGFyZ2V0PWhvbWUuYWRkcmVzcyZsb2dpbklkPTIzMzM0ODk=

Aug 27, 2014

Price Changed

$500,000 —

CRMLS #CV14118369

Aug 25, 2014

Price Changed

$565,000 —

CRMLS #CV14118369

Jul 30, 2014

Price Changed

$599,000 —

CRMLS #CV14118369

Jul 30, 2014

Price Changed

$625,000 —

CRMLS #CV14118369

Jul 11, 2014

Price Changed

$650,000 —

CRMLS #CV14118369

Jun 26, 2014

Price Changed

$724,950 —

CRMLS #CV14118369

Jun 19, 2014

Price Changed

$749,950 —

CRMLS #CV14118369

Jun 13, 2014

Price Changed

$795,000 —

CRMLS #CV14118369

Jun 06, 2014

Listed (Active)

$895,250 —

CRMLS #CV14118369

We’ve been discussing this property in the comments. The gist from some is that it’s not really Culver City and the proximity to the freeway is what’s hurting it most. It’s an outlier, blah, blah… I guess the new Starbucks and Chipotle around the corner isn’t enough to get the 3% down FHA loan apps flowing on this one.

The flippers are greedy and it’s wonderful to see this piece-o-crap falling off the price cliff. A 45% reduction in less than 90 days is a sign of something afoot.

Brian don’t get to excited investor paid 159k stands to make excellent money, even at 500k this is ridiculous price but will sell. In other words, a house like that should go for 200k at the most isn’t going to happen. Prices in especially CA. at locked in out of sight, unless a catastrophic mother nature event happens, either pay these outlandish prices rent (also to high) move to border sates?

The sales history makes no sense though. It sold a year prior for 380k (which is probably a reasonable price for the neighborhood. Whats up with that 117k sale price a year later, which is WAY under market even acting as an off-ramp to the 405…

Jan 09, 2013

Sold (Public Records)

$117,000 -100.0%/yr

Public Records

Dec 21, 2012

Sold (Public Records)

$380,000 —

Public Records

Dec 21, 2012 Sold (MLS) (Closed)

$380,000 —

TheMLS #12-637265

Started at $900k and now down to $500k….that’s about the craziest one I’ve seen yet. WTF is going on?!?!

That house is in the “Del Rey” neighborhood of Los Angeles but is serviced by the Culver City Post Office. Alot of people in that area put “Culver City” as their address when it is really “Los Angeles 90230”.

Del Rey is the only barrio/ghetto/slum west of the 405 freeway in the L.A. metro area.

It’s almost like being in Inglewood or Crenshaw or the nicer parts of Compton.

Most caucasian professional people stay clear of Del Rey since White people are normally not welcomed in that area, which is why you see the price plunge on that SFR.

Just lost out to a cash buyer on a house owned by my best friend’s step-mom(Chicago Suburbs). We came in with the same offer, but since less paperwork was involved, she chose the easier option…because she’s a selfish b%^$#

homes are generally too expensive, and not worth it unless banking on the continued $$ printing of governments, corporations and investments around the world

Unfortunately, all of the current news does point to more printing, and the Fed can always push rates lower if needed

This coupled with the mentioned desire for renters to break the cycle

Probably more upside to housing for the near future

we may be in the ‘2004 period of the last crash, no major scare till ’18-’19?

good enough for real estate flippers and gamblers

My friend’s house is pending….

https://www.redfin.com/CA/Los-Angeles/1727-N-Avenue-45-90041/home/7079706

Hey andy…Photos look good, don’t know what it will close at but as you see 2bed 1 bath for near 600k, the comps for that area are set, this tells all of you prices are not heading down.

Conversely, the outlook for the housing market has deteriorated as housing activity appeared to have lost momentum at the end of the second quarter and near-term indicators suggest only minor improvement in the second half of the year. Although residential investment still is expected to be a contributor to growth in 2014 and 2015, it does not appear likely to be a growing driver of growth going forward, as expected in the prior forecast.

“The August outlook supports our expectation that the economy will grow in the second half of the year at slightly above trend and push full-year growth into positive territory, albeit still weak by historical standards,” said Fannie Mae Chief Economist Doug Duncan.

CBO says 2014 GDP down to stall speed of 1.5%

“The Housing Echo-Bubble Is Popping”

http://www.oftwominds.com/blogaug14/housing8-14.html

“How do we know when an asset class is in a bubble? When everyone who stands to benefit from the continuation of the expansion declares it can’t be a bubble.”

For instance, current homeowners who “threw in the towel” and comment on housing bubble blogs with hyperbole that suggest all of us who question the market are claiming extreme reversion scenarios such as L.A. prices becoming like Detroit.

But what do I know? I’m just a current homeowner and landlord who has been in the game for long enough to have been through this before.

Compelling article with some interesting metrics, like:

“Current levels of mortgage debt are double historic levels, and 35% above the level of 2001, when the primary housing bubble lifted off.”

Tired old BS. I see you are directing your little insult my way. If you truly are a homeowner and landlord, what the EFF are you doing frequenting this blog? Inquiring minds all want to know here, please do share. I still frequent this blog because there is so much BS prevalent that somebody (like myself) will call it out. RE was on sale a few years ago…who was there to give the buy signal? Was it you or me? Yes, there are always risks in buying RE, but when it sells for rental parity or less in desirable parts of socal you better put your doom and gloom hat away and go BUY.

Just like everybody else here, I do not agree with what is going on in the financial world. I would love to have a financial utopia where savers are rewarded and people who make foolish decisions are punished. How has that been working out? For those who haven’t figured it out yet, what we are seeing now is the new normal. Rates HAVE to stay low for a LOOOOOOOOONG time or the whole system collapses (keep reading that sentence until it sinks in). That means savers get virtually nothing, renters get screwed and money chases other asset classes such as stocks and RE. What is going to cause this to change anytime soon? Let me guess…the Fed loses control, world war, evil black swan event, rich Chinese quit buying, mad max scenario coming soon, etc?

I’m rooting for Jim Taylor all the way. Housing to tank HARD soon. I’m only saying this because I want to buy another property and the numbers don’t pencil out today. Don’t hate the player, hate the game!

Housing is tanking hard! http://www.reuters.com/article/2014/08/28/us-usa-economy-housing-idUSKBN0GS1P120140828

Hey Hackman; “Pending Home Sales up 3.3%”. Guess what, it doesn’t matter so much about the number of transactions. You could have a lot in one month, and very few in another. If the buyers pay lower prices, it also brings other houses down in value. It can tank on low or high buyer volume.

Here’s an alternative link to your story, which suggests a bit less of a frenzy and fewer house-horny buyers pushing and falling over each other to put in ridiculous offers. Also.. July big wow. http://www.cnbc.com/id/101954175

_____

“Interest rates are lower than they were a year ago, price growth continues to moderate and total housing inventory is at its highest level since August 2012,” said Lawrence Yun, NAR’s chief economist. “The increase in the number of new and existing homes for sale is creating less competition and is giving prospective buyers more time to review their options before submitting an offer.”

“Americans signed more contracts in July to buy previously-owned homes than in any month in almost a year, suggesting the housing market was pulling out of its slump more quickly than expected.”

My head is spinning.

“BUBBLE-LICIOUS ”

http://www.reuters.com/article/2014/08/28/us-usa-economy-housing-idUSKBN0GS1P120140828

…… More Real Estate propaganda, let’s promote “optimism”. “BUBBLE-LICIOUS ”

This next COLLAPSE will be breath taking. I’m a Buyer at 40% Discount on property.

Being a spectator is more Fun…. than swimming with the piranhas.

Pending homes increase from last year? I’m a hawk on real estate as you know, I also search out as much as I can to find out the real sorry out there.

I don’t see a sharp upturn pending sales in the vast majority of markets I look at. I don’t research small to mid size towns, I look at the top 50 markets and of course factor in CA. Guess some folks in JULY went on a spending spree in housing, what I found doesn’t support such euphoria at the present time.

Leave a Reply