Will the young buy homes? Student loans holding some young buyers back and household formation remains weak in the face of stagnant incomes.

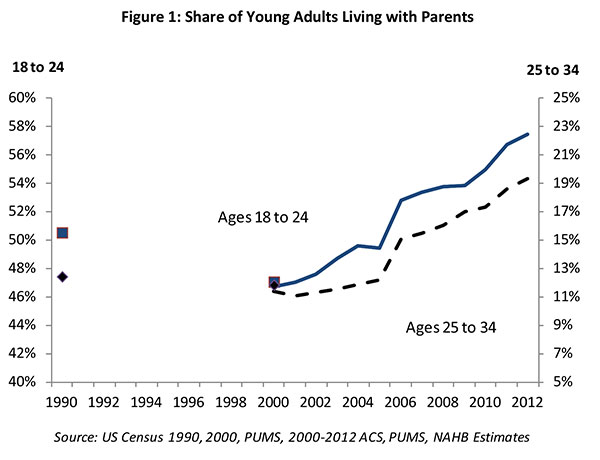

Household formation is an important indicator of future housing demand. One of the big reasons why home builders have been tepid about building homes in the face of a growing population and rising prices is that first time home buyers are a small portion of the housing market. The reality is, you need household formation to justify bigger developments instead of investors looking for deals to flip or rent out. Home builders have been busy building multi-family units but these are clearly slated for rentals (the number of growing renting households would justify this). The odd dynamics in the current market have forced millions to live at home. In California 2.3 million adults live at home because of financial reasons, not because it is the new hip thing to do. In San Francisco, even well paid tech workers double or even triple up in apartments or homes to make the high rent affordable. What is probably more troubling in the data is that this trend is holding steady across the nation. Quality employment growth absolutely matters in the face of household formation. In the past, a boom in employment led to natural demand for housing. Today, you would have some believe that juiced up real estate and investor lust is somehow going to be the drawing force that lures cash strapped young buyers into the market. So far, those figures are not materializing.

Nationwide household formation requires quality employment

One important factor in deciding to start a household is stable income from one or both spouses. This is important on a nationwide basis. When we look at mortgage applications you will see decade lows in spite of the 2013 spike in prices. But low mortgage applications were part of the game going back to the bust in 2007 when the easy money spigot was turned off for regular households. The rise in prices was largely driven by investors. Those investors are now pulling back and sales and prices have stalled out in the usually hot summer selling season.

Even the National Association of Realtors realizes that household formation is critical to a healthy housing market:

“(NAR) More people should mean more housing demand. But that is not always the case. What really matters is household formation. One household can be one person living in a city apartment. One household can also mean a family of six living in a suburban home. Population growth therefore can be accompanied at times by no growth in households if a young adult moves-in with a parent(s). Currently, there are a record number of such cases. Such crowded living arrangements do not create housing demand.â€

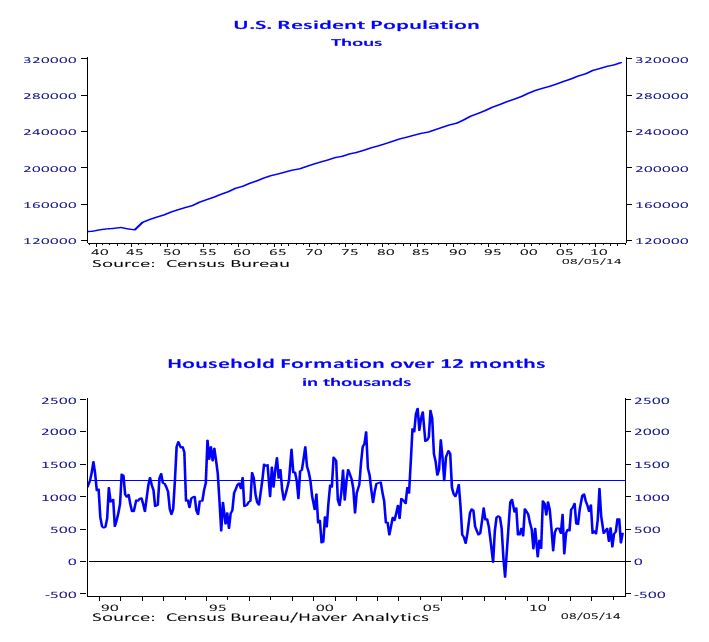

They say this because of these figures:

Source:Â NAR, Census

Sure, the population is growing but look at household formation. Historically 1.2 to 1.4 million households were formed each year. Right now the rate is around 500,000 per year. The population is going up but how does this help if a large part of is coming from lower income workers? Can they afford to purchase crap shacks with high sticker prices?

Household formation is important because it also shows people going off on their own to live in a rental or buying. In California, many of those 2.3 million adults living with older adults can’t even afford rentals at current prices. So they move in with baby boomer parents and have Friday night Purina Dog Chow dinners since they cannot venture out on their own. A new survey by Bankrate found that 36 percent of Americans have zero saved for retirement. That might be an issue when entering retirement age don’t you think? It also makes it clear why so many older home buyers are obsessed with Prop 13 even though they have a home that would sell for close to one million dollars yet would struggle if taxes went up. Why not cut corporate taxes or income taxes in the state and have higher property taxes like many other states around the country? In places like San Francisco and Los Angeles County the vast majority of people rent.

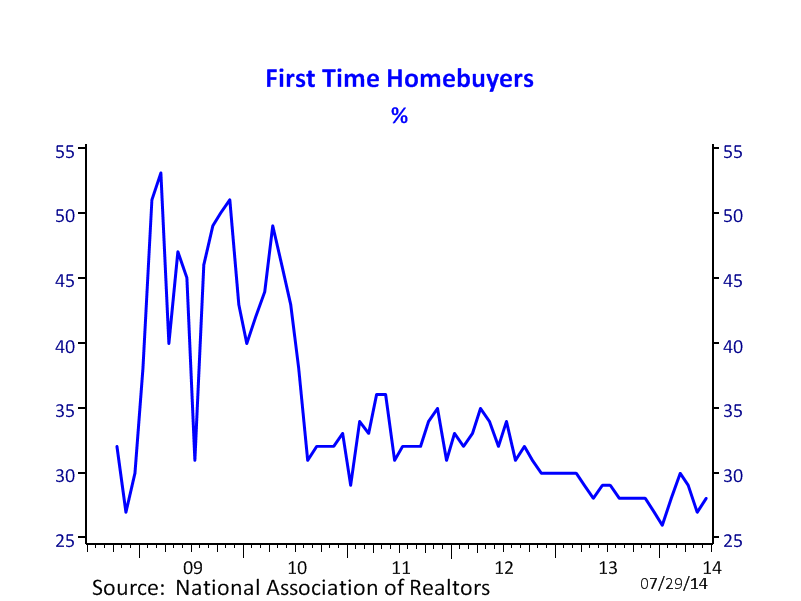

So it should come as no surprise that first time buyers have been pummeled in this market:

This data I find interesting. Back in 2009 first time homebuyers made up close to 50 percent of purchases. So there was a brief period of time after the bust where investors didn’t dominate the game although were already jumping in. Of course we know what happened after that with the next half decade going to investor domination. Yet investors are now pulling back and there is little indication that traditional homebuyers will be out in droves.

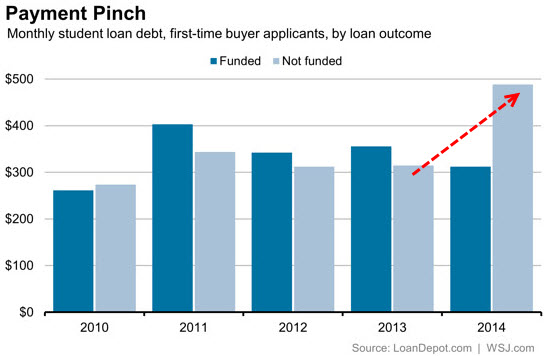

One interesting data point is that many young buyers are saddled with hefty student debt. We are now seeing indications that many first-time buyer home applications are simply not being funded because of debt-to-income ratios being busted out by student debt:

Banks are being even more stringent with funding contrary to the notion that mortgage underwriting is being loosened up. And this is how you end up with 2.3 million adults living at home in California! Will this be your future buyer of the crap shack for $700,000? Cat food eating mom and dad would have to tap out retirement or stick on a HELOC to help little Johnny or Sue to make that down payment on a home purchase. But then they have to pay that monthly nut which many clearly cannot do.

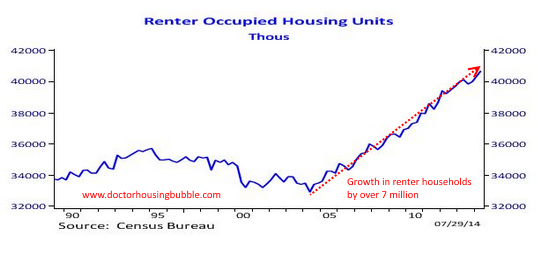

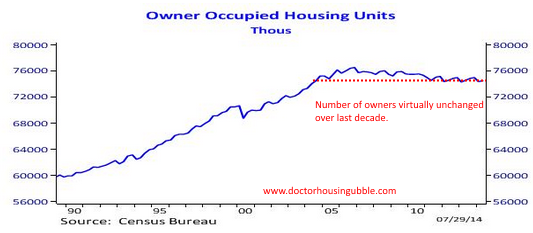

So the unmistakable trend is one where renter status is growing and homeownership is stagnant:

Since 2005, we have added close to 7 million renter households. Homeowner households have been virtually stagnant over this decade (of course you have one-off changes like someone losing their home to foreclosure and someone buying). Yet somehow, people forget that 7 million Americans lost their home to foreclosure since the bubble burst. Many young Americans unlike baby boomers do not have the blind allegiance that home prices only go up. They grew up in a time where the housing bubble was central to the economy caving in and probably witnessed challenges hitting their own household. With their employment being more transitory and with tighter benefits, many are choosing not to lock down in one area.

The trend is unmistakable:

With prices soaring in 2013 not because of first time buyers but because of investors, it is now likely to be a higher percentage that will live at home since many are being priced out of rentals, let alone buying a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “Will the young buy homes? Student loans holding some young buyers back and household formation remains weak in the face of stagnant incomes.”

Family working together is the best way to ride out these tough times. “Starve the Beast” of RE specuvestors should be everyone’s mantra. Voting with your wallet is the surest way to effect change. As the article points out NINJA loans are NOT making a comeback.

The numbers show HOUSING IS TANKING HARD IN 2014 LOL! Sure, certain prime areas benefiting from the continued Hyper Credit Bubble are doing okay (and unless you’re already well off I have no idea why you’d want to live there), but the suburbs and even upper-middle class areas are at a standstill. 5% plus mortgages are a year or less away according the CAR and others. That combined with a lack of household formation squeezing rents on failed flips and other SFH rentals forcing liquidation should lead to the first significant price drops. Without FED MBS purchases and Hot Money inflows will see if this market holds up. My opinion is 2010 prices, which combined with higher mortgage rates gives you a 2012 level monthly nut.

Housing is not YET tanking hard. It’s not even tanking. It’s plateauing. I see some houses slash their asking price, others stalling, and still others being bid up.

Housing might tank. Or it might instead flatline for a while, should sellers simply withdraw houses from the market because they can’t get their high prices.

I hope housing tanks. But I’m a pessimist.

Sales down 12.4% YOY in SoCal for July. I’m pretty comfortable calling a 10% plus YOY drop in volume with strong negative headwinds a tanking market. 20% would be a collapse, and we’ll likely see that within a couple of months. As I’ve said many times, sale prices are the ultimate lagging indicator of market health. The world was going to hell in 2008 yet many properties that did close were less than 15% marked down from peak. And then as well as in hindsight I think we all agree the market was “tanking”.

Have you seen the bond market tank yet, the stock market is heading right back to the all times high… nothing to see here, ok next…

I am sorry, pal, but I haven’t noticed the FED to stop “buying”, unless you believe the BS propaganda. As far as the housing’s concerned, the FED balance sheet keeps expending and the Belgium keeps buying… ok, next…

FLECKENSTEIN: There’s ‘No Chance’ That This Ends Well

Read more: http://www.businessinsider.com/fleckenstein-market-is-crash-prone-2014-8#ixzz3An0CcabP

The Fed will never stop buying, when they do expect bad things to happen

their is no recovery, hot money created a false hope….Social media companies making no money valued at 400 PE will take care of the market at some point. I expect the biggest push up is yet to come. Hot money works that way….They will hit every shorter whom thinks that because of tapering the fed isn’t still buying….ha….enjoy the ride down shorts…This market is meant to decimate anyone whom bets opposite of the fed…

#1 What a silver mane!

#2 What a horrible/amazing name!

#3 What lame!

“But none of that matters until it matters. So you just have to understand what the mosaic is and what the facts are, but you can’t try to act on them until it starts to matter…”

@DFresh – lol But doesn’t that quote sum it all up? He’s basically saying is that we’ll have to exit but seeing where and when will be difficult I think.

Stick to your guns, Jim. Down we go…

July home prices down 2.4%, sales down 3.1%

http://dsnews.com/news/08-15-2014/home-sales-decline-first-time-five-months

July sales down 12.4% Dom. YOY is always the # to watch. Much like the junkie who can’t face reality the bulls don’t understand that the FED made Housing Bubble 2.0 has run it’s course. Just like the first the FED will let it bust and inevitably the member banks will make $$$ on the way down just as they did on the way up.

You’re right of course, NZ. YOY sales numbers have been down for several months.

The only argument a lot of folks had left was “but prices keep going up!”

Well, guess what? Prices just dropped nationally, and in the middle of Summer. Next?

Common, guys (and gals), we’ve been here before. A small correction, nothing to see here. Look at the stock market, it fell for a couple of weeks and now What?, it is heading right back up where it left. Same with the housing, small correction is all you will see, no tank on the horizon, homes still sell (after reductions) at higher price than a year ago. As I said, nothing to see here, next…

Umm – hey Guy? The last time prices fell from June to July, they continued to fall for the next 6 consecutive months. Real estate is not the stock market.

Sorry to burst your bubble (pun not intended) but housing is flat, not in freefall.

http://www.latimes.com/business/la-fi-home-sales-20140814-story.html

Once distressed sales — foreclosures and short sales — are removed from the data, conventional sales fell only 2.8% in July.

A 2.8% decline, while something to watch and look for as a possible trend starter, is by no means the start of a collapse in the market. This means that regular sales from one owner to another owner are down only slightly YoY and cheap foreclosures/short sales that were dragging down prices and going to all cash buyers who flipped them for a quick buck are down 9.6%. Distressed properties are drying up. The housing bubble burst supply glut is almost worked through. Over the next year you’ll see more declines in distressed sales and in 2-3 more years we will have a regular market again. This is GOOD NEWS not bad news.

You know when you’re on a roller coaster and it climbs to the top and the train has that stall point where the front hangs over the cliff and the rear car hasn’t yet made it to the apex yet?

That’s the RE market right now. I wouldn’t call it a plateau.

God why do we keep getting newer and more retarded retards?

Class, who knows what is inside of a bubble? This was a question I remember being asked in Alouettes pre school in Santa Monica in the 60’s. Yes, I have a strange memory to remember this as if it happened yesterday. The answer of course was AIR… Need I explain more? God, I hope not…

“housing is flat, not in freefall”

Nobody said housing was in freefall – try to keep up.

YOY sales volumes, mortgage applications, originations, etc. have been dropping for months. We are finally seeing the declines in sale prices that we’ve heard “can’t happen”.

The last time sell prices dropped in July, we watched prices drop each month thereafter through the New Year. August numbers are already coming in lower than Julys, and “selling season” is over, so it isn’t much of a stretch to expect history to repeat itself.

“This is GOOD NEWS not bad news”

This is exceptionally GOOD NEWS for those of us waiting to buy the dip. It is also right on schedule for the folks that sold the top and are waiting for the bottom (like us :))

God why do we keep getting newer and more retarded retards? – What?

Because we’re near the end game. BLOGs were trolled just like this in 2007. It’s either realtards with nothing to do or professional internet trolls who know they can be even more annoying when the facts are astoundingly against there positions.

They’re worried. Why else seek out a housing bubble blog if you didn’t think something is wrong? We’re supposed to believe they’re here simply for shits and grins? If one is to be content with the idea that there’s nothing to see here, then why be here? It’s why I’ve joked about spreading the good word because that’s the only other legitimate reason I can think of – a sense of calling to “save” the uninitiated.

Nice work by NihilistZerO and Dom-inator!

Housing IS Tanking Hard in 2014!! Look out below!

L.A.-O.C. housing market is least affordable in U.S., Zillow says

http://www.latimes.com/business/realestate/la-fi-unaffordable-homes-20140821-story.html

They expect prices to go up.

Not only are millennials burdened with debt, they also watched their parents get crushed during the last downturn. They like their gadgets, cars, virtual jobs/mobility and responsibility-free lifestyles. They are simply less interested in buying a home than past generations.

If we average 200,000 plus job creation per month during the next 18 months, which is likely, we’re going to have mortgages around 6% by 2016. If this market is gasping under current conditions with credit loosening and flippers trying to get out — look out below.

“millennials … like their gadgets, cars, virtual jobs/mobility and responsibility-free lifestyles. They are simply less interested in buying a home than past generations.”

This “generational theory” contradicts the “female hard-wiring theory,” which states that women have a nest-building instinct, and thus want a nice house.

Hard-wiring is not generational. Hard-wiring is genetic and instinctual, and doesn’t evolve away in one generation.

So if the “female hard-wiring theory” is correct, then there is nothing new, can be nothing new, about the millennial generation’s desire for home ownership.

Men may like their gadgets and mobility and being “responsibility-free.” But their wives will still demand houses in which to raise the kids.

If this is not economically possible, then the millennials will be a generation of unhappy wives. And thus unhappy husbands. Unhappy wife, unhappy life.

The millenial women will just buy their own houses. After all, they’re making bank compared to millenial men.

I don’t have this on hand, but several charts plotting out home ownership by age after the 1990 Japanese housing pop for which we have 20+ years of follow up data. It seems to have, at least for 20+ years, pushed homeownership significantly later in one’s life.

Eceonomy not improving, and military cutting back… Who wil buy the houses? Once again, the prices are artificially inflated. It will keep going down the next few years, Hellooo!

Adult children living at home with their parents are losers and a disgrace to their loser parents. Losers beget losers. Liberalism is a mental disorder and begets losers(e.g. bastard rate is close to 40%). These adult children need a good kick in the butt, so they will get out and learn to be self sufficient. They are weak cry babies and whiners.

Multigenerational household is a new normal, get used to it. Merikans are too poor to buy / rent houses…

Oxnard is the new Newport.

Troll or just “teh stupid”???

i am the biggest loser

mr chill

Such wisdom is blinding. Stick to making rice.

You stick to making the chicken, Polo and Ben the rice, for my Taco Stand. Remember Amigos, Oxnard is by the marina and the ocean. It is like Newport. Buy your beach property now before the prices go to $5million.

You’ve got me confused with Pollo.

I am Marco.

我想æˆç‚ºç¬¬ä¸€å€‹æ¡è¿Žæˆ‘們的新霸主

WÇ’ xiÇŽng chéngwéi dì yÄ« gè huÄnyÃng wÇ’men de xÄ«n bà zhÇ”

Stopped reading after “我…â€

I would cut and paste this into your own post if I was you…

Common, What? I am too lazy to use G translator and I don’t speak Chinese… Just post the translation below… What? the heck ;)…

sleepless, I am trying to convince the Rich Chinese that I am a faithful servant and showing so by using their language. I will only once post a translation for you as it might offend our new overlords…

The translation is: “I want to be the first to welcome our new overlord”

Translates to:

I want to be the first to welcome our new overlord

Stopped reading after “我…”

@Housin’ not to tank HARD at least till 2016

Okay sleepless, where did you purchase your crystal ball? Mine is definitely not working…

I think we both agree that risk is very miss priced in the current market. I believe that there was an attack on the US treasuries that was mopped up by the Fed through our Belgian friends. I am not convinced that we will see a bond crisis rather a default crisis with no where to go other than write down/write offs. So, wouldn’t it make more sense to follow the defaults rather than the US treasuries, if that is what you are talking about when you say “bonds”?

Since the hosing is mostly leveraged, even the “cash” buyers mostly buy with cash borrowed somewhere, I would expect hosing to tank only after the debt market does. As I said on many occasions, hosing is where the bond market is in 1-2 years. If the bonds tank this year, expect the housing to do the same in a year or two. Keep also in mind, this time is indeed different. We have never had FED owning 80% (or whatever the number is) of all the new mortgages. And again, the FED still keeps printing whether they admit it or not. Thus, the hosing will stagnate (remain flat or can even decline a bit) but it won’t tank. As long as the FED has not run out of paper, I see no tank happening. 2016, I pulled this number out of my a… pocket, if you wish. I just don’t see it happening now, in 2014, as Jim Tank claimed, simply because FED is still printing. I just don’t see how this ponzy can continue for much longer either. So, I give it two more years…

sleepless, you are not answering the question. Wouldn’t you agree that defaults precede a bond crisis? Credit dries up if/when defaults start to grow exponentially. The first step to a credit crisis would be the ceasing of issuing new credit. That in itself will cause the crisis. Like all markets today, I believe that the bond market is “disconnected” from the underlying fundamentals (aka risk). The bond market will be one of the last to “know”…

The expression “this time is different” is about the outcome, not the inputs. That’s the whole point, that the outcome is more or less always the same. Some commenters keep co-opting it to suit a point of view about what precipitates. It’s like saying that the more things change the more they really don’t stay the same.

@What?, ok,you got me… let me try my best now…

the current housing market is primarily driven by wall street, where as the previous bubble was the main streets. The reason why the wall street in the housing is because of the miserable yields in binds. Nobody buys bonds at 1-3% returns, it is just stupid. Thanks to the fed. Now, the wall street, which used to higher returns, went after the assets that can generate the returns, aka rents = monthly “dividends”. The bonds are at historically high levels, so, nobody with common sense would buy them. The same pin that pricks the bond bubble (higher interest rates) will move investors to the bonds and makes them to abandon the housing… Same higher interest rates will make already unaffordable housing even more unaffordable, so, even less demand = lower prices because the only buyers will be left are the the Joe Regulars. Now, the fed “estimates” to start raising rates in mid 2015 and to have them at 2% or something by mid 2016. This is why I chose 2016 as a turning point. I believe the rates should rise a couple of hundreds of basics for us to see the deference. I don’t think the bond markets and the housing market are necessarily correlated, I just think they similarly reflect the overall picture.

sleepless, you appear to believe that the “bubble” is different than the prior bubble and that it will not pop for the same reasons as the prior bubble. I think this is the fallacy. The holders of the debt really doesn’t matter, it is the ability of the under lying asset to generate the income necessary to cover the cost of the debt. This is generally where credit crises begin. You are assuming that “all goes as planed” or that TPTB are “telling the truth” to get you to 2016. I am not saying that it is impossible but world finance is so interconnected that any outside factor can have an impact on the best laid plans. I have been surprised many times in the past 5 years and expect to be surprised many times over the next 5 years. This is why I have ceased giving future guidance.

Neither What? Or guy from Seattle are going to be buyers ever so why all the dialogue. Shut up and keep renting you serfs!

What?’up with renting? I do What? makes sense. If renting makes sense, I rent, if buying makes sense, I buy. I would rent for my entire life if I need to and see no problem with that.

Neither What? Or guy from Seattle are going to be buyers ever so why all the dialogue. Shut up and keep renting you serfs! – Christie s

Well Christie if you pay property taxes, income taxes, state fees, etc you are just as much a serf as we 😉

We haven’t heard from you for a few days Christie. Good to see you are still with us. We missed you! 😛

This post is being discussed on Reddit: http://www.reddit.com/r/LosAngeles/comments/2dx0wf/the_drought_of_young_california_home_buyers/

FWIW, to have a monthly student loan nut of $500, by and large you need to have borrowed ~50k which is well above the mean or median borrowing figures. NY Fed data suggests balances of 50k+ applies to 12% of borrowers, and that includes graduate/professionals.

If you’re trying to buy in Cleveland, then sure, $500/mo student loan payment probably is your core financial barrier. Though if you make 40k in Cleveland and want to buy a $120k house in Lakewood, you probably have options for restructuring your student loan payment if you really wanted to make it work, provided you didn’t have significant credit card or other debt on top.

If you’re trying to buy L.A., I’d wager the sheer sticker price of housing is your primary hurdle, and the $500 in student loans is a drop in the bucket. Up until this year we were paying $400/mo on combined student loans in Portland (now down to $250), and I can say quite positively the loans weren’t what held us back from buying.

I wouldn’t say $500 is a drop in the bucket. LA has one of the lowest rental affordability indexes in the nation. Wages there suck too, my friend. $500/month is a killer to young folks even getting to a 3.5% FHA downpayment when rents are so high relative to income.

Most jobs in LA that young people tend to do pay $30-$40K, which is what I made down there 10 years ago. Wages really haven’t gone up, and on that I’d have a bitch of a time paying $500/month on loans. Hell, paying my car insurance was bad enough.

If you only make $35k (single, no kids) you can opt for income based repayment which would reduce your monthly student loan bill to around $200.

My point was two-fold – one most people have options to reduce their loan bill (while extending time to repayment) if they feel that’s what’s keeping them from getting the mortgage.

And two, the big reason they can’t buy a house/condo in LA on $35k salary is that absolutely nothing in the market is priced for someone making that much, even if you took the loan out of the equation completely.

Sure, the loans can make a difference on the margin, no question. But focusing on that obscures the issue that the core affordability problem is still the cost of housing in relation to incomes. And as someone else noted, at least in theory the student loan debt is related to getting a degree which in theory increased your earning potential. Though I know there are significant exceptions.

It might be a drop in the bucket for you but for someone who is leveraging at max DTI with the smallest amount down, it matters. I don’t know the exact figures on how many are in that boat but I know quite a few here in L.A.

Gotta wonder. Is better the degree, better the pay and higher the loan amount? I gotta imagine associate’s degree graduates owe less but make less. To some extent, this must be true. But then again the University of Phoenix is awesome syphoning off tens of thousands from people who get no degree at all.

Hey now, I got my degree from UoP and have done just fine with it… And it was an interesting ride, about 1/3 were true underachievers and another 1/3 or so were quite intelligent and driven. The latter were like me – started their career before getting a degree and were looking for a night-time degree program that at least seemed to have some semblance to my career.

But yeah, the bar is pretty low for getting a degree from UoP. Like most everything, it is what you make of it.

Follow the defaults as they come. Argentina > Ukraine > Greece. That should be enough to get people fleeing to safety. Lets see if Belgium can catch the falling knives before mainstream news picks up the headline. What can the Fed balance sheet grow to? Infinity is a concept not a number. Even QE infinity has a limit.

China’s property market is not doing so well right now. There is not as much money to push up housing in Coastal California, Irvine, and San Gabriel Valley. RE is like the running queen, no price appreciation is a fail not a plateau. How many of the homes owned today would be bought today with the expectation of a plateau? If prices can’t be forced to go up forever then why invest in SoCal housing? Can I write off house maintenance somewhere as a suntax? Why pay double for a place with a mortgage when there is no free money? Why be stuck in one geographic region when the economy is under-performing? I rather go where the jobs are and rent a nice place than stick it out mowing the lawn of my jail cell.

What do people really think the stock market can bear? If the DOW goes all Nikkei style to 20,000 that is what…. a 18% gain from current valuations. I got that last year easy. Why try to do it again with ebola, race riots, WWIII looming, Iraq war 3, and Great Depression Era economic sanctions batted around as if these were common diplomatic tools. People the world is screwy and the easy money is gone. Sorry if you are just entering… you are too late.

Excellent big picture post Leaf. SoCal RE does NOT exist in a vacuum! You also correctly point out that Housing Bubble 2.0, like any ponzi scheme, requires exponential growth. The moment things flatten the decline is inevitable.

I am basically buying my son a place in Colorado Springs. He can’t get hired there from out of state. He can’t move there because he doesn’t have credit or a job to rent a place. So I will buy a place then later on he can buy it from me. I took 6 months and a full price bid on a short sale to finally lock something up. It looks like prices are up there maybe 25% this year.

I’ve added new criteria to my search! Must have cloudy, mold-infested pool: http://www.redfin.com/CA/Altadena/268-E-Poppyfields-Dr-91001/home/7254876

Unfortunately this property has two baths and not the .75 baths I’m looking for.

And it’s on the wrong side of Lake Ave. too – bad area. You need to be east of Lake…

That’s why smart sellers hire professional house stagers and photographers.

No need to actually clean a pool. A professional photographer can Photoshop any moldy-brown, fetid pool into one that’s filled with azure-blue, crystalline, sun-speckled water.

I am not sure that works either if you have at least more than 10 brain cells working.

with my wife we want to see a home which from the pics was perfect (a lot of very recognizable photo shop ). It was initially priced at 1.2M and recently reduced to 1M.

When we entered I thought we were in the wrong house. I did not remove my shes because I was afraid I could get some sickness.

Everything looked old and outdated and I was so annoyed because I would even had spent the time to visit that shed if it wasn’t for the fake pictures.

So i was so annoyed that I said to the agent if the HOA allowed to flatten the whole shed and rebuild it because like that looked like a dirty garage.

she admitted in 167 days they got no offer (the only good thing of the house was a 180 degree view of the ocean) and even after 200k price cut no offer.

she said to me how much I would be willing to offer. I cut 250k from the price and explained to her that the house was in such horrible conditions that it would require 250k to make it decent.

She said that probably the old guys who moved to florida are going to rent it. I said to her good luck 🙂

so I think too much photo-shop might be counter productive

In a sane market that house would be sold bargain basement as a tear down as the lot actually has potential and the pool could be cleaned up. My mortgage calculator spits out a near $4000 monthly nut including PMI on a 3.5% down. Rent would be what, $1800??? The capital misallocation since $2000 has been like an economic mini-Dark Age.

I think Dark Age might be the right term for what we’re going through. Just as the aristocratic Romans hunkered down in their aging villas hoping the marauding barbarians wouldn’t strike or confiscate their property, we have the SoCal wealthy hunkered down in their aging Prop. 13 homes, hoping for the best. Everyone else is on their own.

The pool, if used as a bathtub will get you the extra 0.25 for a full bath 🙂

A question for the smartest guys in the room….

Doesn’t the Fed need Housing prices to stay high? Don’t you think Janet Yellen is just waiting and watching for the perfect time to wave her wand and create mortgage rates back to 3%? Voila! More Air for the deflating bubble!!??

If she does that then I hope you own some GOLD.

Jim, It seems to me that the Feds strategy, (since they really didn’t have one so I use the term loosely), is to kick the can down the road. No matter what the cost. Period. Given what they have done in the past, why wouldn’t she drop rates to try to get things frothy?

Linda you missed my point. If the FED continues and I don’t disagree with you that they won’t try. Try as they might. You will rather have Precious Metals than Real Estate if that happens.

Doesn’t matter what, Jim, don’t buy gold. The government can confiscate it like they did before. You are not going to buy food with gold.

If you have money for gold, it is better to buy food, guns, bullets and farm land (depends how much you have). Gold under current regime is useless – you can’t eat gold.

The best strategy for those with money is to be debt free, have multiple sources of cash flow (diversify) and buy what I said above.

Jim, even those with gold don’t want it. That is the reason they sell it. They prefer the cash and what they can buy with that cash versus gold.

If those with gold don’t trust it, why should I? Those who advertise gold as the solution to everything want to get rid of it. Those who say that cash is toilet paper prefer that toilet paper to gold; that is why they want to exchange it.

“reply” If you believe they can confiscate GOLD then you know they will Hike Property Taxes. If you don’t like GOLD I don’t blame you. But I don’t think there is anything else any better and certainly not Residential Real Estate. Maybe Farmland that you own in your own name and title. Not through a fund or hedge fund. With what is coming Physical will rule.

Of course they do. FED is taper now so they can “un” taper later. With rates crashing even with the tapering, rates can certainly reach new lows (or just a bit lower) if FED QE again. Real estates might not be a good buy for the investors but it’s still an ok buy for anyone who carry a mortage due to the low rates and fixed mortage (hmm rent) and certainly the payment is still at least 20-30% lower than 2006 due to the low rates. No, we’re might be overpriced but certainly not in a RE bubble at least here in the states maybe minus some prime zip codes. However, in the next down turn, people might lost confident in the FED so what ever they do next might not matter if the tide has already turned. Just my 2 cent.

@LindaRN, no the Federal Reserve does not need housing prices to stay high. QE was really a way for the Fed’s member banks to transfer the garbage mortgages from themselves to the Federal Reserve. And since Congress has delegated the money printing responsibility to the Federal Reserve, just as the Fed printed $4 trillion dollars out of thin air, the Fed can make QE disappear. They can do this because the dollar is backed by nothing except the U.S. military (and several thousand nuclear warheads and a couple thousand more cruise missiles and hellfire missile armed drones).

The Fed would monetize QE money printing if they thought they could get away with it. However, only banana republics monetize debts.

They could kick the can down the road but it would further hurt family formation and home buying by younger generations, which would affect prices long-term. In the short-term it feeds into the positive feedback loop of higher and higher prices. Basic economics, workers can’t afford to live in places where jobs are available since sellers won’t sell at prices affordable to them, so they stay out of the labor force further affecting long-term prices.

Home ownership rate is back to 1995 levels!

Millenials are broke and out priced wages are stagnating and jobs are out sourced to H1-B visa holders..

Go make your own assumption!

“Home ownership rate is back to 1995 levels!”

I wonder how they count “stay at home adult kids” in this metric…

We have been in a wrongful (illegal, technically) foreclosure battle for six and a half years. Our (Millennial Generation) children have witnessed what amounts to having been–and continues to be–a traumatizing, if not violent experience this has been for us.

Home ownership is something they have absolutely no desire to enter into. And home ownership is certainly not something that they equate with the American dream–or even, necessarily with status. They feel no stigma attached to “being renters.” And we have two non-boomerang children. They are succeeding out in the world without our help.

Also, just wanted to mention that “back in my day” (I am 50) our middle class parents could often come up with an extra $10,000 to $15,000 to help us with the down payment on our first homes. How many middle class Americans can help their children do that these days?

“We have been in a wrongful (illegal, technically) foreclosure battle for six and a half years.”

Interesting take. You have peaked my interest, please explain.

So 100K a year income with 20% down will qualify you for a loan for a house around 450K. Now if you have lived in Socal for awhile you know the difference between the good and bad areas. The statistics about median price homes means nothing when this is taken into account. There are folks out there that do want to live in the city but most couples that plan on having kids will want the typical upper middle class suburbs. The problem is that unless you make 150K or more with the typical 20% down there is not a lot out there to choose from.

Affordable housing in SoCal is a thing of the past, even if prices drop 20%. If you want inexpensive housing, go to any flyover state. Simple as that.

Middle class is the only group having an issue.

If you are rich, you can afford to buy a few homes, flip some, and line your pockets. This is the best of times for the rich. Party on!

If you are poor, you can rent or live in a home with your 10 cousins. I see many households with 3+++ generations living in them. They use every room as a bedroom. (Except the kitchen.). The garage is often 2-4 bedrooms. The common area is the backyard until 2am. But is allows the poor to make a $5000 mortgage payment. Everyone living there just kicks in $100 week. If you don’t know what I am talking about you have zero clue about the LA market.

Middle Class…you are screwed. You want to act all rich and fancy and have a home to yourself? Good luck. It’s better to be poor with low expectations.

I think you’re right and that’s why we’re seeing so many middle class people leaving the state. They’re tired of the bullshit and voting with their feet. For the middle class folks who are left behind, how is that desirable? How can being a minority middle class person/family squeezed between majority rich and poor be a good position to be in? I’m not even sure how that would be considered the best outcome for the rich or poor, either.

It seems like this is the way we’ve been headed here in SoCal and we have folks blithely dismissive in their remarks that “affordability in SoCal is in the past” so “move to a flyover state” which is essentially taking the position that this is the new order so don’t bother calling it out for change.

Do they not realize everybody will pay a cost for this? I’m not sure what’s worse, the aforementioned complacently aware attitude or refocusing the debate on the weather, ethnic themed restaurants, foreigners with buckets of money, everyone wants to live here, this time is different, and so on.

I argue that it’s not “better to be poor with low expectations.” Folks are leaving and they think that’s the better option. Unfortunately we’ll be losing productive people that we’d be better off with keeping in the state. More poor people doesn’t help us, it only will sow more seeds of discontent for a future that even the rich will be exposed to.

Tired, I for one am not dismissive about it. It deeply troubles me.

But my premise is that the government and thus the country is controlled by the ultra rich. With that being the premise, those folks are getting wealthy at the expense of everybody else. Do the ultra rich care if people that they have never met fall from middle class to lower class? Apparently not.

Worse still, this trend is happening for so many different reasons that smarter minds than my own acknowledge the problem then go on to say that they can’t see a solution. So I’m expecting things to get worse, after all, much of this just comes down to wages versus the cost of living (where the main variable within is housing). Does anybody see any reason to believe that lower class and middle class wages are going to be improving? Outside of jobs in the energy sector, I see absolutely nothing that will cause wages to increase.

I feel fortunate to have escaped the drop in wages over the past few years, but that’s been due to a combination of luck and a willingness to relocate and change employers. And I’ve probably lost a significant amount of possible income as many employers no longer offer the kinds of stock options that they did in the past in my field.

Wallstreet journal yesterday ..”Phoenix gets reality test”..not good numbers…big inventory….prices sliding…Diana olick CNBC yesterday…same story..with worse commentary…..phoenix is the first to go up in housing…and the first to go down…..vegas…same story…bigger inventory up 56%…and those who bought to rent will be running for the exit…as soon as prices go negative…..with 25% of phoenix still underwater…it will get ugly by next spring

Big difference between SoCal and Phoenix or Vegas is that rents are high and rising here and vacancy rates are @ 5-6%. There’s no comparison to PHX or LAS.

People are poor and screwed here and STILL pay more and more of their disposable income on housing. What’s really going to break this trend? A stock or bond market correction? Rising interest rates? Or, oh, what about a scary-ass black swan 2008 type liquidity crisis or some sort crap. Well, then, guess what, the 0.01% go about swooping up even more assets while the rest of us wait for our “fair chance.”

Nobody on this board has a cogent argument for why rents are so high in LA when there’s so much bad about the region.

There were plenty of arguments (as to why the rents are high in SoCal) here on this blog if you read them.

If you like the arguments or not, that is not going to change the fact that rents are high and going higher.

Because corporations have become the landlords, you still think that 1/2 gallon of Hagen Daz is a 1/2 gallon…just the game that is being played…

only sheeple are buying at the top, wall street always crushes retail at the top…

I don’t think anyone here has the market cornered on good ideas or predicting the future. I do believe that many scenarios cited above “can†happen but feel some are more likely than others. The factor that I struggle with is inflation. Putting this question out there to the group. What is the likelihood that inflation will continue to drive housing prices up (or at the least prevent a “crash/tank†for quite a while? After all, it seems that we’re finally going to start forcing some of that QE money out of the hands of the elite (who got first dibs) and into the hands of workers (via minimum wage reform)? At some point I think we have to start seeing those monies flow into the economy afterall, the policies favoring home purchasing haven’t changed (favorable tax policy, rewarding of leverage vs buying what you can afford, etc).

On a different note, many people point to QE ending and the rise of interest rates that will follow. Tapering has been going on for a year now (or so we’re told). Assuming it is true (I’m not familiar enough with their workings to say whether they are actually doing what they say they’re doing – data supporting otherwise would be appreciated), why haven’t we already seen interest rates rise? We’re down to the last 12% of the tapering, i.e., if it is already 87% complete, why should we expect the last 12% to make all the difference that we didn’t see during the first 87% (btw, the increase in rates last year came BEFORE tapering had actually begun).

Lastly while I personally think we’re in for hard times, I never doubt the ability of bankers and those in charge of our money to manipulate things ever more and keep pushing out reality. They’re not dumb people for sure and thus far have shown that they can be as creative as necessary to keep the wool over our heads. Perhaps all the shenanigans only save the big picture complicated numbers (GDP, unemployment, inflation, etc) but mean absolutely nothing to the working class now (i.e., it doesn’t translate into a financially stronger middle class). I thought Bernanke himself had said there were still a few tools available (when at the peak of QE) in the event SHTF – not sure what that would be but I wouldn’t doubt their creativity. Thanks for all the good dialogue, hope to hear some thoughts from all.

Okay, I’ll bite…

“I don’t think anyone here has the market cornered on good ideas or predicting the future. I do believe that many scenarios cited above “can†happen but feel some are more likely than others. The factor that I struggle with is inflation. Putting this question out there to the group. What is the likelihood that inflation will continue to drive housing prices up (or at the least prevent a “crash/tank†for quite a while? After all, it seems that we’re finally going to start forcing some of that QE money out of the hands of the elite (who got first dibs) and into the hands of workers (via minimum wage reform)? At some point I think we have to start seeing those monies flow into the economy afterall, the policies favoring home purchasing haven’t changed (favorable tax policy, rewarding of leverage vs buying what you can afford, etc).”

I would argue that you will NEVER see wage inflation make its way into the US worker’s pockets. First, minimum wage affects a very small minority of workers. Second, there are only so many dollars allocated to wages regardless of the rate that you will probably see less quantity (hours/workers) if rate goes up. Third, globalization (world work force) has impacted the real sweet spot of middle class wage growth. No amount of minimum wage will save us from the deflationary pressure. This is probably the only “prediction” that I am comfortable with.

“On a different note, many people point to QE ending and the rise of interest rates that will follow. Tapering has been going on for a year now (or so we’re told). Assuming it is true (I’m not familiar enough with their workings to say whether they are actually doing what they say they’re doing – data supporting otherwise would be appreciated), why haven’t we already seen interest rates rise? We’re down to the last 12% of the tapering, i.e., if it is already 87% complete, why should we expect the last 12% to make all the difference that we didn’t see during the first 87% (btw, the increase in rates last year came BEFORE tapering had actually begun).”

This at first surprised me as well but the problem is that “taper” does not happen (if it actually is) in a vacuum. In theory the dollar gets stronger if the taper is real. Even the belief of a taper will impact international monetary flows. My understanding of why a “taper” led to lower interest rates was due to the repatriation of funds from foreign banks with better returns back to the US because improved returns were wiped out by currency translation. I am not sure this is true or if it is the whole picture but it shows how it is possible to expect one thing and see the opposite.

“Lastly while I personally think we’re in for hard times, I never doubt the ability of bankers and those in charge of our money to manipulate things ever more and keep pushing out reality. They’re not dumb people for sure and thus far have shown that they can be as creative as necessary to keep the wool over our heads. Perhaps all the shenanigans only save the big picture complicated numbers (GDP, unemployment, inflation, etc) but mean absolutely nothing to the working class now (i.e., it doesn’t translate into a financially stronger middle class). I thought Bernanke himself had said there were still a few tools available (when at the peak of QE) in the event SHTF – not sure what that would be but I wouldn’t doubt their creativity. Thanks for all the good dialogue, hope to hear some thoughts from all.”

I think that you give TPTB too much credit. Yes, they will do all they can to keep the game going as long as possible but they are not all powerful. There are many forces that make each move more costly with diminishing results. Of course Bernanke will say that we have “other tools”. This is really a game of faith. The current asset bubbles require continued exponential growth to be sustained. This is the nature of a bubble. Bubbles are not self sustaining. They need ever growing fuel to keep the fire going. ALL exponential growth ends in a bust. This is a law of nature not an economic theory. There is no such thing as flat bubbles…

I agree, it is hard to predict the future, we are too far from economic fundamentals that make any sense. We know the ponzy will eventually end and it will end badly. Will it take another year or two, I don’t know. I gave my “forecast” based on how I see it, am I wrong? I don’t know, is Jim Tank right and we will see the tank by the end of the year? I don’t know, will we see a hyperinflation? Heck… I don’t either. I just give it two moar years…

they are tapering the MBS-T-bill purchases but still rolling over the t-bills at a 40 billion dollar clip..

the leverage is unreal…they extinguish one fire while blowing on the embers of another to start a new fire up.

I stopped reading at What?

Blah, blah, blah

Christie, do you have a contrary opinion on the matter? Please do tell.

Christie just likes to mock me… It’s kinda cute in a strange way…

Of course there are many factors to consider for an accurate assessment and it is almost impossible for any economist with PhD and years of experience to consider ALL the factors at the same time with an accurate outcome. Part of the reason is the dynamic of these multitudes of factors – they are not static, they change all the time. To be short, I can quote “What?” – nobody has a crystal ball and if they do, it doesn’t work.

You will be supper successful if you get at least the direction of the market right, forget about the amplitude.

Assuming the disclaimer above, like in any economics course I will focus only on 2 variables at the time – any intelligent person knows that in real life you don’t have ONLY 2 variables.

The demand for mortgages collapsed (this is a fact). That lower demand translates in lower mortgage rate – banks want to make some loans to very creditworthy customers.

The REAL (not the bogus CPI numbers published by US propaganda) price increase you see for food and energy is the same or even more pronounced for building materials, good desirable land and very skilled labor (who can produced the high quality homes the people on this blog expect).

These higher construction cost puts a lid on construction and that in turn, long term, puts a floor on prices. You can not continue building one third of hystorical number every year for decades at the same time you have population increases year after year and have prices decreases at the same time. Yes, the prices can drop short term in response to financial crisis but due to the 2 powerful forces I stated above you can not have long term low prices.

I know the Japan argument. In US it doesn’t hold water.

In conclusion, short term you might have a dip in prices in response to a crisis like we had in 2008. However, long term, due to massive inflation, replacement type construction keeping supply the same and constant increase in population will keep at LEAST the NOMINAL prices the same. In the end, the fixed rate mortgage makes the NOMINAL price the ONLY one important because it keeps the payment the same. I agree that quality of life will continue to deteriorate in SoCal for most people and the smart ones in search for quality they will look elsewhere.

Come to Oxnard, I have a view of the ocean. Great food too. This is better than Newport Beach. I have a panga boat at the marina that I rent out every now and then.

As you astutely mentioned there are too many variables. Still price is a complex thing. Mortgage demand and building costs are two simplistic to model SoCal housing prices.

You should consider substitution. ie: moving out of state or living with extended families and friends.

Restrictions to local supply can cause substitution and ultimately kill prices through lowered economic growth. For example if house prices are growing, wage growth must also grow. This might work OK for Silicon Valley, but once the checks don’t come in people with money will move out. Without wage growth, people hunker down and become “cheap”. Good luck starting a business in one of these communities.

Substitution should be really clear by now. Who pays for music these days. Tech has created new efficiencies and wage growth has suffered. Just because SFRs aren’t going up in Palmdale right now, doesn’t mean a few builders can hold the line on price. I can always move to a state willing to house me in exchange for some sweat.

You might think about the power balance differently. Is a house in SoCal a good enough place to exchange most of my adult labor?

Lastly, a builder that doesn’t build is a what?

RE: Carlos

The absence of stuck up WASPs and their parasitical “wealth” makes Oxnard an infinitely better place than Newport Beach. The only thing I can imagine wild be fun in Newport is spending the day in a parking lot keying yuppie’s Mercedes 🙂

These 9 Charts Show America’s Coming Student Loan Apocalypse

http://www.huffingtonpost.com/2014/08/20/student-debt-distress_n_5682736.html

Nuff’ said.

It’s hilarious, some of you are foaming at the mouths calling out RE tanking over July’s ~2.8% price decline?? I guess if you’re so convinced of something, you blind yourself, just like those looters in Ferguson.

LMK when prices are down more than 10% over a reasonable time period before calling a tank. Don’t get my hopes up for nothing.

Yet, some folks are foaming out the other end in believing that home values in SoCal will have double-digit YOY increases from now until the end of time. It’s hard not to understand when you run out of able buyers, the market stalls out and prices plummet. It’s happening.

Common meme here that SoCal RE market is manipulated last 14 years unlike any other period in its history.

Yet, these very same people refuse to admit that “this time it’s different.”

This time it HAS been different.

Simple.

RE: DFresh

Not really. Sure the magnitude of the swing has been greater, but fundamentally this bubble is no different from the late 70’s/Early 80’s bubble or the S&L period bubble. And JUST like those it will be cyclical. The entire ponzi economy is built on booms AND busts. It cannot exist without both! Every speculative market in history, FED induced or otherwise, has a down swing. Show me one historical instance where this has not held true and I’ll give you a cookie.

Some info on interest and home sales

http://money.cnn.com/2014/08/21/real_estate/mortgage-rate-drop/index.html?iid=HP_LN

“Is a house in SoCal a good enough place to exchange most of my adult labor?

Lastly, a builder that doesn’t build is a what?”

Leaf Crusher,

The answer to your first question is – “NO”

The answer to your second question is – “Nothing”; a bankrupt company laying off people. My point is that a builder will not build if he is loosing money. Long term, that will generate major shortage/inventory relative to the population increases year after year through both births and immigration. The fact that people cram more and more in the same housing stock does not point to prices decreases (again, NOMINAL prices not ajusted for purchasing power). It points to lower and lower quality of life in the so much praised SoCal lifestyle with no parallel in the flyover country.

don’t you guys get it: this is the way it’s supposed to be. upward mobility is the brand, not the reality – at least not for most. student debt is just another way to keep the engine running for more generations: mommy and daddy had to pay $x amount for their degrees, and if they work hard enough they can pay for your education so you won’t have to start behind by $y dollars

what i think people fail to understand is that the internet is this huge amplification tool. what we’re seeing today, i’m very confident we’ve seen in the past – but now, everyone has a voice (myself included) and it just appears worse than it really is

would it blow your mind if i told you that this is the way it has always been and will continue to be? adapt to the system or die trying to change it. good luck

A very interesting discussion is taking place here. My five cents are that we are being manipulated by the media up to the point that buying seems as the only option we have. Young people are especially prone to believe movies and stupid series that constantly show people living in big houses. Maybe we should think more about changing the American big house style into more appropriate apartment style. This could alleviate the pressure that was put on the market. How the hell is it even possible that in these not very certain times, people are still willing to enter the bid wars? How much longer can this possibly take?

Leave a Reply