Renterville USA: Top 10 metros for renters and surprise, 6 of them are in California. Will Millennials show up to create another new home construction boom?

The New American Dream is renting. At least that is what it looks like if we track the homeownership rate over the last decade. Millennials are moving into their prime house lusting age yet somehow, a flood of buying is simply not happening. Renting continues to dominate the recent trend of household formation. It was interesting to see that out of the top 10 metro areas for renters, 6 of them reside here in California. It is becoming increasingly difficult for Millennials to purchase homes in high priced areas. This is simply an observation and the facts back this up. Also, Millennials are unlikely to be in any position to purchase high priced crap shacks. In high priced markets, new home construction is simply a tiny blip on the radar. There are now new products out in the market like the PoppyLoan that try to capitalize on the low down payment crowd. What has become clear is that California is now trending towards renterville.

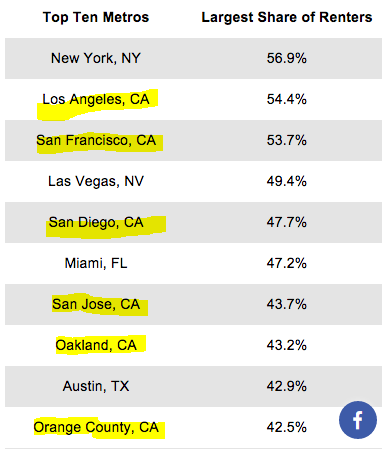

Top 10 metro areas for renters

The latest data shows that we have some really high rental rates in some of the most expensive markets in the nation. Take a look at the chart below:

New York, Los Angeles, and San Francisco all have clear renting majorities. What this means is that there are more households that rent than actually own their property. What is somewhat surprising is that Las Vegas is high up on the list but this might just reflect the nature of the local economy. We also find San Diego, San Jose, Oakland, and Orange County making a showing on this list.

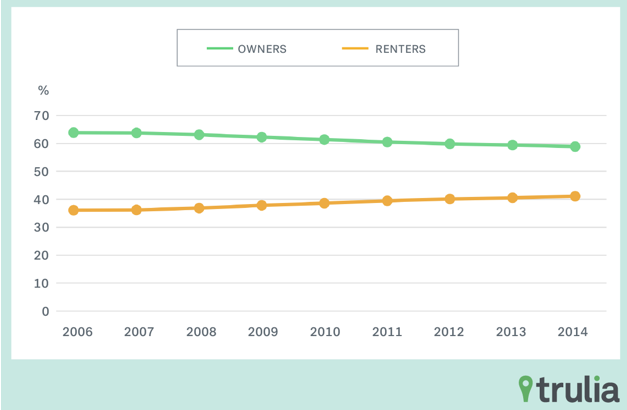

This trend increased over the last decade. Also, there are many Millennials living at home with their parents because they are unable to pay the skyhigh rent in many places like San Francisco. It feels extremely frothy at the moment. You have no down payment loans hitting the market and also new products like that offered through Bank of America that only require a 3 percent down payment (not FHA insured products). The only reason to launch these products is because people simply don’t have the down payment to buy a home. And they don’t have the down payment in many cases because they can’t save it up. Which should cause people to pause but instead it gives incentive to banks to juice the system up with more debt once again. We’ve played this game before.

Of course this renting trend isn’t new:

What this means is a net increase of 10,000,000 renter households over the last decade while the number of new net homeowners has remained virtually flat. I think an example might give this trend some flavor in terms of what is available to buy in some markets:

3873 Spad Pl,Culver City, CA 90232

2 beds, 1 bath 672 square feet

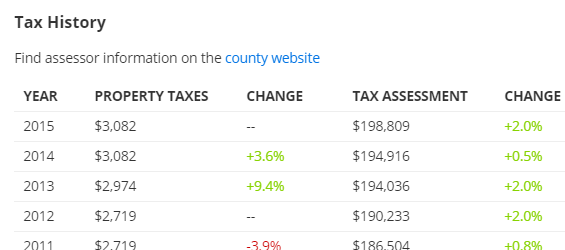

This place is tiny. The list price is $740,000. The new buyer will pay taxes at that new price. What are the current owners paying taxes on?

The property is currently assessed at $198,809. God bless you Prop 13. The new buyers are going to pay 3 times the taxes for the exact same services. Instead of being nearly paid off at this point, the property still has debt but those sins will be washed away when the new buyer of this tiny shack takes it over. No wonder why California loves the housing bubble.

What is interesting is the place right next to it (3869 Spad Pl,Culver City, CA 90232) sold in 1993 for $732,272 and the current Zestimate is $768,745. Thanks to cashing out, the place still has mortgage debt of roughly $250,000 some 23 years late on a home that is smaller than 1,000 square feet.

So you have to wonder, who will pay $740,000 for a 672 square foot crap shack? Are you buying at the top or will this place get to $1 million in the next couple of years? And buy the way, you are paying $740,000 to live in 672 square feet!

When these are your options to buy, it is pretty clear why California has become renterville USA.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

155 Responses to “Renterville USA: Top 10 metros for renters and surprise, 6 of them are in California. Will Millennials show up to create another new home construction boom?”

My condo has 690 sq ft — bigger than that house. They shouldn’t call it a house. It’s a condo alternative.

It’s not a house, it’s a shed with a shower.

But at least you don’t have to deal with HOA fees and the micromanaging assholes who roam around looking for rule violations.

Just a thought.

VicB3

Carpshack art: http://www.freep.com/story/entertainment/2016/02/24/detroit-art-ruin-porn/80754212/

That’s right, a new market for crapshacks!

Crapshacks are no longer just a place to live in, or rent, or flip. They are a new medium for innovative artists.

I think this art is for the sake of the “frisson” of horror people over there will experience, as it shows how the US is becoming Mexico or the Philippines, a place where there a few rich and the rest live in shantytowns or decaying 1920s houses.

I’de like to buy but why would I overpay for some sub par crap shack in the San Fernando Valley, Santa Clarita, Ventura County, inland empire, or inland OC when I can rent in Santa Monica and be smiling ear to ear on evenings and weekends with a 10 minute commute to work? Until the pink slips start flowing and correct the market in prime areas of LA I will continue to rent and save in a neighborhood I like with a high quality of life then move to some bedroom desert community an hour or more from everything. But to be clear I will buy when the prices come down….but not until then.

Agreed, a home is useless if it is somewhere you DONT want to live. Sure you got the “home owner” boy scout badge but at what cost? Also I have a number in my head that I’m willing to pay for the area I want to live. Once the market meets my number then we are golden and ill buy! I’m not going to make huge sacrifices in my life just for a box and a driveway.

I would also add that regardless of any marketing slogan, a house is always an investment – meaning, you should get some sort of value commensurate with the amount you pay. Most of these insanely priced crap shacks in Cali and other “hot” markets lack value – the structures are old, energy inefficient, and probably mirror the infrastructure – roads, pipes, schools, you name it. That means when the bills come due to repair all that, the crap shack owner is going to get taxed and fee’d to death.

I rent a newer, much nicer place of similar size to the one in this article in a MUCH nicer area and state for 1K/mo. and thats been my rent since 2010. Before that I rented different places that were even cheaper. Get out of Cali while you can!

I disagree. In 2012 I bought a short sale in a questionable neighborhood of LA. The property was a steal even at 2012 values. The catch was that it has to be owner occupied for two years. I had no intention of living there, but the bank put this stipulation on right before closing. I ended up buying the place, a couple of handguns, and moved in. I lived there for three years and sold it in 2015 for almost double. It wasn’t easy living in this hood, and there were many difficulties on a almost daily basis, but in the end the payday was well worth it.

@Hunan – I am curious what ‘questionable neighborhood’ did you live in???

Mid Cities?

In reply to QE Abyss, Yes that was the area. Parts of Mid-City LA are rampant with gangs, crime, and drugs.

Why would you put your life, mental health and general well-being in jeopardy just to make a few $$? Additionally, there was absolutely no guarantee that you would double your money. It seems to have worked out ok for you, but that can probably be chalked up to good fortune and not necessarily a shrewd business decision. In 2012, for all anyone knew, prices might have sunk right back down to 2011 levels instead of ascending like they did.

Different strokes for different folks, I guess. But there is no way I would torture myself (or my family) by living in a dangerous neighborhood for any amount of money.

Lastly, how would the bank have any idea whether you were living there or not? Did they send someone once a month to check on you? It seems like you could have easily rented it out and the bank would have been none the wiser. What do they care anyway, as long as the mortgage is being paid…

In reply to Responder, often when you buy a short-sale property the bank will make you sign a legally binding contract that the home will be owner-occupied for a specific amount of time. I always thought this was silly too, I mean why do they care as long as they are getting paid? My guess is that since they are talking a loss on the property they don’t want someone else to flip it or rent it out for profit. I do not know if they check after close, but it is a legally binding contract and I adhere to my agreements,

I did not know RE in LA would almost double in three years, but I do know a good deal when I see it. I took a risk and made a sacrifice and the reward was well worth it. I have moved principal residences 3 times in the past 10 years, each time for the better. I understand that many people do not have that ability due to jobs, family, etc.

i find it interesting that Hunan survived and talks about doubling his money.

the interesting part is that we now have the most manipulated real estate market in the history of the country…can that last forever? For every Hunan out there i will predict 10 that don’t get out doubling their money and some not surviving……..unless the manipulation CAN go on forever and if it can then the house in the missives will be $2,500,000 by 2025…..which makes total sense in an area full of $12 an hour jobs.

facepalm

Rent in Santa Monica has been skyrocketing and it doesn’t look like it’s stopping, hopefully you are in a rent controlled unit, otherwise, you’ll be having to deal with the same kinds of challenges.

Rents will fall when prices fall. Both are products of the same cheap debt bubble. The buy to rent investors bought properties high to keep the value of their existing properties high. Consequently, they raised rent prices to cover their costs.

I was a renter in Santa Monica (10th and Wilshire) for about 10 years before buying a home in 2012.

I moved into a 1 bedroom apt (no upgrades) in 2002 in SM for $950 per month. That was slightly below market rate in 2002 and then I paid approx 3% increase each year – (whatever rent control board allowed). By the time I moved out I was paying around $1250 per month and market rate was about $1400, not a big difference but helpful to have rent control. When I moved out in 2012 the landlord refurbished the tiny bathroom and kitchen and rented it out for $1600.

Now, my PI is $1950 for a 4bd 2ba home on 7,000 sqft of land adjacent to Culver City, paid $470K. Taxes and insurance another $550 per month.

[the real story about rent control is about my neighbors who had been in their 2bd 1 bath apartment next to me, they had been there 25 years and were paying $650 per month!!!!! market was about $2K per month. The landlord offered them $10K to move out, they told him ‘no’ then the landlord offered them $15K to move out and they still told him ‘no’ :)]

I’m with you, millenial buyer. I’m GenXer and currently renting a nice house in a great neighborhood. Less than 20 mins from work.

If I were to buy this exact same house that I’m currently renting, it would cost me $1,000 extra per month! For the same house!

So, I rent instead and put that $1,000+ into savings. No rent increase in the past 2 years (knock on virtual wood), so that’s not an issue right now.

The problem is not having enough for a down payment, we have the 20% for what we can afford. The problem is that the prices are too damn high and we don’t want to get stuck paying the high mortgage/taxes for 30 years!

If it were me I’d put that extra $1000 a month into silver dimes, guns, ammo and bury ’em in the backyard but I guess that’s just me…

I am not originally from CA nor am I a homeowner. Prop 13, I know that limits the max property tax % but does it have any effect on Assessed Value? In Wisconsin they would come by every so often are re-assess homes and your taxes would go up. Does assessment in CA only change when ownership changes?

Subsequently, real property is reappraised for tax purposes only when:

A change in ownership occurs

New construction is completed

New construction is unfinished on the lien date (January 1)

Market value declines below Proposition 13 factored value on the lien date. (ref. Art XIIIA of the State Constitution, R&T 51)

If none of these things occurs, the assessed value of a property should increase by no more than 2% per year.

http://www.assessor.saccounty.net/TopicsAtoZ/Pages/Prop13andRealPropertyAssessment.aspx

Prop 13 allows linked the rise in assessed value to inflation, with a maximum of 2% rise.

Also, if you refinance your mortgage the assessed value does not change, no matter the reappraised vlaue of your house.

Here is the problem with the thesis that a massive young workforce coming on line soon which is very true. If we look at the Census data chart we have a massive workforce ages 19-29 coming on line which do need shelter for sure.

However, the push for bigger and bigger homes at the start of the century has created a housing inflation nightmare for new construction due to the need for higher profit margins.

As you can imagine California has by far the highest net housing inflation story ( Near Water) out of anywhere in America.

New homes and even the luxury apartment build outs are too expensive for young buyers

Existing homes are much cheaper than new homes (Important) homes have a longer life span than humans, so the question is do we really need to build as much homes as we did in previous cycles.

Since new homes ( Start of this century) have deviated from 1967-2000 inflation trends, you have see the worst demand curve for new homes in this cycle even with the lowest interest rates post WWII

Renting demand is booming, even for dual renters in one household. As prices blow up higher, this makes it more and more difficult for even couples to buy in CA.

Cheaper existing homes is the way to go, but it’s harder and harder for first time owners to sell their homes and then move up to a bigger up. Thus the supply of cheaper starter homes is off the market place as well.

Hence why renting nation has been so large in this cycle and in California. Immigration out of CA since 2013 for ages 30-39 has been positive due to the housing shelter cost

However, outside CA, you see the difference in the demand curve from existing homes vs new homes in 2016.

Why? because existing homes are so much cheaper, the builders are in a bind now more than ever in terms of how they create growth and even bring out lower priced homes for renter nation

http://loganmohtashami.com/2016/02/24/existing-home-sales-vs-new-home-sales-2016/

ZZZZZZZZZZZZZZZZzzzzzzzzzzzzzzzzzzzzzz……………………..

Your posts always seem so out-of-context. So unrelated both to the original article, or to any of the conversations on the thread.

You upload these semi-coherent screeds, perhaps because you have no readers for your own blog.

In other words, you’re spamming.

You’ll get more blog traffic when there aren’t serious grammatical errors in your opening lines.

That’s just Inglish.

I just had a co-worker wake me up when my computer started beeping after falling asleep on my keyboard

I had quesadillas for breakfast this morning which is kind of unusual because I usually make some deviled eggs or have an avocado. But, I had an avocado later anyway.

Rentalgedon is in full force here in Sacramento county. Agents are rent humping the prices to peaks not seen in my lifetime. Tons of money being dumped into old apartments and revamping them into apartment homes and townhomes while jacking the prices by 40 percent. The days of a 2 bed 2 bath rentals below 1000 dollars is over unless you want to live in crime ridden areas with a nice few of security bars. Good luck living on minimum wage (10 bucks an hour now) and renting, let alone buying. The buying market for homes in this area is cold as ice which is putting heat on the rental market as well. But this is not a bubble……..Pop!!

Sacramento is a big government town with no big corporations where high taxes from around the state find their way into the pockets of politicians, government officials, government workers, lobbyists, and welfare recipients. All that tax money inflates the housing and rental markets. Sacramento has to have become the welfare and Section 8 capital of California. People who can no longer afford to live in the coastal cities are flocking inland to cities like Sacramento.

This. I use a credit union, and one day was looking up branches – there’s like one in Gilroy (where I joined ’em) one in San Jose, one in Fremont (I think) and TONS in “sackatomatoes” because it mainly caters to gov’t employees.

The magic words are government and unionized. I doubt I could get a job with the DMV etc. in my early 50s now but I wish I’d had the smarts to try *try* to get such a job in my 30s.

That’s the spirit millenial.

Pay attention class, notice how the taxes increases every year, and rose $300 in 4 years. Prop 13 doesnt FREEZE tax it limits the annual amount they can jack it up.

That is correct. Pop 13 allows annual increases of no more then 2% of the assessed value. Since most state services rely on revenue from property taxes, the powers that be had to come up with imaginative ways to tack on additional fees to property tax bills to pay for Ipads for inner city kids.

It’s a lot better then some other states which assess every year based on current market value.

It’s not objectively better than other states’ systems. It distorts market price discovery mechanisms and disproportionally distributes the cost of government services.

It amazes me that the Prop. 13 whiners think that somehow anyone would pay less in property taxes if Prop. 13 went away.

Dan, it’s easy to whine about “whining”, but critically thinking about this issue requires more effort.

Your argument about paying less is a straw man. Nobody is claiming property tax assessments will be lower after Prop 13 is dismantled.

What should happen is a rebalancing of the tax burden so that property taxes overall provide a greater share of state revenue relative to all other sources. This means the end to long-time landowner welfare subsidies from everyone else. The gravy train eventually comes to an end, plan on it.

So Hotel, you would trust County Tax Asseors to value and tax your property? Every time some interest group wants more services you want to pay for them? Will Prop 13 everyone knows there future tax burden going in, if the predictable costs of owning property make sense for an individual they can make the purchase if they costs are too high don’t make the purchase. If you were around back in the day you may remember that the biggest opponents of Prop 13 were public employee unions.

Dan, Prop 13 has not stopped the special interest money grab machine. Everybody still has their hand out (including Prop 13 beneficiaries) and everyone else is paying the price.

I tell ya what, how about also having a 2% yearly cap on property price increases? While we’re at it, let’s also cap yearly at 2% all taxes and fees levied by the state, including consumption, use, and income taxes.

The problem with an artificial cap is that it doesn’t account for real world change in the marketplace. You essentially want today’s pricing on the services and benefits to the land you’ll consume well into the future. That cannot be provided for without someone else making up for the difference in increased cost over time. A cost which has well exceeded 2% per annum since Prop 13’s inception.

We’re probably on a very similar page in regard to unchecked spending, it’s just that you’re in favor of an approach which I contend creates more problems than it solves and is ultimately a failure.

Proposition 13 is a sacred homeowner protection. California, in response to Proposition 13 budget shortfall, created the CA Lottery to balance the budget. The California Lottery hasbecome a voluntary tax on the poor and as long as people continue to PLAY, proposition 13 is safe.

As a disportionate level of income continues to flow to rental housing, the minimum wage increase to $15 an hour will pass inflation and debt onto the consumer. In the grander scheme of things politicians are adding to this problem because it suits them to have a large dependant voter base in the sanctuary city capital of the world, Los Angeles, CA.

Unless a massive earthquake hits Los Angeles, or Freddie and Fannie pull out and stop buying mortages, unless Mexico is annexed into the United States or unless technology decentrilizes populations beyond the urban clusterfuck known as Los Angeles I see no end to the bubble formation in Los Angeles, CA.

The rents will go down and so will housing… it’s just a matter of time. Just like the Titanic comment… nobody wants to be first on the lifeboats, but once the sink is imminent people will stampede to the boats

San Fran, San Jo, and Oaktown are in the top 10 of high rents…

http://www.bizjournals.com/sanjose/news/2016/02/17/netapp-plans-to-slash-1-500-jobs-in-400m-cost.html?ana=twt

Network App 1500 people

http://blogs.wsj.com/venturecapital/2016/02/23/the-daily-startup-billion-dollar-startup-kabam-has-layoffs/

start up

http://techcrunch.com/2016/02/26/zenefits-is-laying-off-250-employees/?ncid=rss&utm_source=dlvr.it&utm_medium=twitter

start up

http://venturebeat.com/2016/02/03/autodesk-announces-929-layoffs-10-of-its-workforce-as-part-of-restructuring-plan/

IT

http://techcrunch.com/2016/01/26/vmware-confirms-layoffs-in-earnings-statement-as-it-prepares-for-dell-acquisition/

A lot of unicorn will go poof… In my line of work we have seen the budget and cash flow problems of some of these companies.

These a few SF bay area and Silicon valley. No all jobs a located in this area but still.

Also remember that IT support and Software sales worth or billions to all the Oil and Gas companies in the bloodbaths in Alberta, Calgary and Texas, North Dakota, Oklahoma…. and rest of the world.

Rent will go down and so will housing…This is the beginning.

To tell you the truth, I do NOT care if I lose my job. I’d be happy to lose my job if we get a good correction that will set things right. I’ll pack my staff and store it a my uncles farm barn in the Salinas central coast area and backpack the world with the wife for a year, finally will use the 600K AA miles, 250K United miles, 500K Hilton points… that are burning my pocket…

I’m a millennial, no student loans, no debt, and tired of pay high rents and seeing loony house prices… fvcck my Job… I want a recession

Same here. Millennial, no debt, have a downpayment and great credit. No way I am going to buy unless we see a crash.

As recently as 2011-2012 you could buy a place in Gilroy or Morgan Hill for $250k, a house on a few acres of land, which is big enough to grow most of your own food or a cash crop. I’m fairly certain a house or a decent commercial building could have been bought for the same in the valley, even in San Jose (although maybe not Palo Alto).

Everyone has such short memories.

“fvcck my Job… I want a recession”

..and for your sins, you will be granted one.

…clap, clap, clap

Housing TO TANK HARD SOON!

I don’t think so. Inventory continues to be low, very low. Home buyers continue to be horny, very horny.

Agreed – I thought things were nutty last spring, boy was I wrong.

All I see here are Millennials whining about how they want their dream home, in their dream neighborhood, at their dream price. That is just absurd, and unlikely to happen. You don’t even know what your dream home is until you’ve actually experienced home ownership. What you think you want and what you actually want may change drastically after you actually buy and have to maintain a primary residence. You have to start somewhere. Find a starter home that needs work in a up and coming neighborhood and get on the property ladder. Build some sweat equity fixing it the over time and live there until it appreciates then move on to a bigger better home. That’s how my grandparents, my parents, and most everyone I know did it.

Sweat equity sucks, and it’s important to keep in mind that you will never get that time back that you spent painting, fixing, landscaping, etc. I would much rather pay a few $$ more and have a turn-key house than spend my very short life doing all that crap that I hate doing. This is coming from someone who has quite a bit of sweat equity invested in a rental unit (which I never intend to do again). But that’s just me; I suppose if you actually enjoy home improvement stuff, it might be a different story.

This is where getting a good/smart education and a good job comes into play (or running your own business). That way, you can pay people to do stuff you don’t want to do, and you can spend more of your short life enjoying yourself.

Seriously? Is this the mentality these days? Sweat equity is for people who can pay someone to do it? How about the smart thing to do when you dont have enough money for a down payment on a “turnkey” house. My first house was a fixer upper and I loved it. Did a lot of the work but paid the professionals to do the hard stuff. Still saved a lot of money and ended up selling it and dumping it into a “turnkey” house which ended up being a show and no dough. Roof leaked, fancy ceramic tile and wood floors were cold and dusty. The garage flooded every year and the neighborhood was crappier (thought it was better seeing how price was higher). Ended up shorting that house for a big loss. Ill take a sweat equity home any time. Lease I know who did the work.

I keep reading about how these “flip” houses are really crappily re-done.

By the way, “least” != “lease” the more you know…

Alex, if you’re going to be picky, try not to screw up within your own post. There should be no hyphen in redone.

Jeff you are right. I always thought it was re-done, and always thought “redone” looks ugly. But apparently “redone” is correct. I probably learned “re-done” from some book that was British, or ‘way out of date, or something.

Guess we aren’t all lucky enough to have the genes for tool use and a desire to make one’s environment reflect one’s genome.

Really, I have to laugh at how Californian-minded people frame these matters.

When we bought our place in 2001 just before the big runup, I looked for the most vanilla cottage I could find, and we looked forward to working together on it. Best marriage therapy a couple could have, and a real test of the character of both the individuals and the marriage itself. Today we say, we like our house, it’s home, but the real investment was in each other and the partnership.

I’ve also learned a lot of skills that I can barter with friends for other things. Did a friend’s bathroom floor for a multi-year pasture-grazed beef share. Didn’t know how to lay tile before doing it out our place. Know how now. The beef rancher runs close to the bone and as a single lady wasn’t happy about having strangers in her home, also didn’t feel confident going through all the back and forth with a contractor. She knows me, the floor’s done, we have years of excellent steaks. What’s not to like?

The fundamental issue is about lack of value relative to cost. Who knows how many commenters here are Millennials anyway?

“That’s how my grandparents, my parents, and most everyone I know did it.”

Yes, 80 years and 50 years ago. Which part of that you missed?

50 years ago (that’s 1966) I could buy a nice house in nice area in a city with a single bluecollar worker pay and pay the mortgage back in 10 years.While having spouse and couple of kids and new, moderate car every 5 years. And some surplus to put kids at least in to college, possibly to university too if I skip some rounds of swapping the car to a new one.

How many people like that you know now, when houses cost half a million and bluecollar workers earn $60 000 per year? If they are lucky.

No, I don’t buy this story at all.

Yes, and in 1966 college was effectively free in California. Even the UC system was cheap, and there were plenty of scholarships to places like Stanford if your kids were either smart or good at football.

Houses in Huntington Beach were under 10 grand, so if you made $7 grand a year you could buy one.

Thomas,

I’ve given up explaining reality to people who think that because that’s the way it worked that’s the way it’s always going to work…..normalcy bias much!!!

take all the charts of the last 30 years, rotate them 180 degrees and that’s the future of the next 30 years……IT’S JUST BASIC MATH!!!

one last reality check, i ask all my homeowners friends “which one of your kids could afford to buy the house you live in now” and i always get the same answer.

“I COULDN’T AFFORD THE HOUSE I LIVE IN NOW ON MY CURRENT INCOME IF I HAD TO BUY IT TODAY”

#FEELTHEBERN

Our nation’s leaders chose to put trillions of dollars into dysgenics, rather than the prosperity of its best and brightest.

Wow another comment on how “my patents or grapas did it” lame comment. Flash news genius… Different times.

Starter homes for 500k and that’s commuting to jobs for like 1 hour.

I got the downpayment a job and no debt. Yet I gotta listen to you calling me whinner. Let me tell you I’m the only one of my circle of friends that has no debt and a downpayment. If you knew the sacrifices I’ve made to save money and be debt free…. While most people I know hit Vegas, New York Hawaii. I don’t even go to football games because $100 tix are insane… $12 dollar beers … No thanx… A you my Friend can suck it. How dare you.

Tequilalili – Yep, even as kids on Welfare in the 1970s, I remember we saw a lot of movies. Sure a lot of them were 2nd run stuff and cheap, but that’s the point. These days, seeing a movie is a big deal because it’s $10+ and I’ve gone to the theater for ONE movie in the last 4 years. (I’ll admit I do find DVD sets for $5 or so at Fry’s and The Glenn Miller story is pretty good.)

Even in min. wage I could always find a rooming house room that I could afford in the 1980s, up until 1986 anyway, then I moved to the expensive Mainland. It used to be possible to survive on min. wage; now if all you’re making is min. wage you’d better have parents to move back in with, lots of room-mates, or become one of the many working homeless. If you made 2X min. wage you could buy a house; maybe not a great house but a house.

This is not 40 years ago. Something akin to “enclosure” which drove the English peasants off of their land, driving them into the cities to become homeless proletarians, is happening now. A roof over your head used to be part of the social contract. Work, and you’ll sleep under a roof. That contract has been broken now.

Union busting, tinkle down economics, tax breaks for the rich and globalization have screw everyone except the rich. It is axiomatic that as the standard of living goes up in China and the rest of the developing world the lifestyle of the average American will go down. After WW2 the U.S. had something like 1/2 the worlds GDP how what is it, 25 percent? 1967 was the peak of U.S. prosperity on an inflation adjusted basis. Welcome to the new 3rd World. And we don’t need any new housing in California, we have 38,000,000 people. Go somewhere else!

Dan,

Peak America is in the rear view mirror. Very sad. I see lots of great kids, young adults but feel the odds are tougher now than ever for young families, our youth and the planet.

Dan: And we don’t need any new housing in California, we have 38,000,000 people. Go somewhere else!

Dan, California is not that over-populated. The L.A. and S.F. hubs are crowded, but most of California is empty.

Is 38 million people all that much? If you check the map, you’ll see that California is as long as much of America’s Eastern seaboard. California extends from around the top of Pennsylvania down to most of Georgia. As much land mass as quite a few states combined, so there’s plenty of room for people.

Landlord,

There is not enough WATER! The Central Valley is sinking as the aquifer is being pumped dry, it will take hundreds of years to recharge it.

Dan, where do you get that it will take “hundreds of years” to refill the aquifers? You just make that up?

Besides, farmers who use the great majority of water from aquifers. They use 40% of the water in the state.

The environment uses 50% of the water. This includes dumping fresh water into the sea to save the “endangered” delta smelt fish.

People (residential and business) use the remaining 10% of water.

If you’re saying we should stop dumping fresh water to save some damn fish, and that California should cease agriculture, okay. But there’s plenty of water for PEOPLE.

You can all flame me and you can all continue to rent and pay someone else’s mortgage every month instead of building equity in your own home. As you wait prices go higher every month. Maybe there will be a correction in 2018 which will correct to 2016 (current prices). Or maybe a 50% correction is around the corner. Who knows? Let’s keep the dream alive.

“rent and pay someone else’s mortgage every month”

Not all landlords are leveraged.

“instead of building equity in your own home”

Can always build equity in other assets.

“As you wait prices go higher every month.”

In other words, buy now or be priced out forever, even though “I did not know RE in LA would almost double in three years”.

Hunan actually the way to make it work these days is to do what you did: Buy a crapshack cheap in the ‘hood, get a couple of guns and an well trained pit or rotty, and hope said ‘hood gentrifies.

It’d be interesting to see a movement to re-colonize the wastlands of Detroit. It would take a fair number of people, not just a family or a few families, it would take a large enough group to put up a good defense, raise a decent militia, and be a large enough customer base for UPS, FedEX etc to risk sending (perhaps armored, 2nd driver literally riding shotgun) supplies the settlers can’t make on their own, in.

Who would want to live in such a god-awful place?

A million for a 50K condo in a collapsed and violent economy with endless traffic jams because we do not invest in the future…?

@Alex. Robocop was a documentary sent back in time to warn us about the future

Robocop was a cool movie. The original full-length version has fake “commercials” done by Spumco, AKA the Ren & Stimpy guy.

I guess you don’t subscribe to the existence of a RE bubble thanks to the sheer amount of cheap debt and over-speculation — the likes of which your grand parents and parents most likely never had to deal with.

Don’t forget how our parents and grandparents made out so well speculating in the ghetto, with handguns at the ready.

Hotel – go back a few more generations and a lot of them actually did that. Settlers in Indian land, and the Indians were generally *not* friendly. In fact, one of the chiefs in the Midwest actually got a campaign together to racially cleanse the whites, and wiped out quite a few families. This land was free for the settlers because it was 19th century ghetto – no one wanted it. The settlers were willing to take the risks, because it was their only way to acquire land.

@HC

It’s simply hilarious to see those “Real estate investor seeking apprentice” homemade signs posted on light or telephone poles. How about those “cash for houses” websites? Retail investors getting into the speculation game 5 years too late — last in and first to lose.

Alex, those are good historical examples of people investing in an area, but we’re pointing out speculative behavior.

Hotel – Going out and settling the prairie was pretty speculative too. Chances were fairly high of being killed – down to the littlest baby – by the Indians. There was bad weather, diseases (human and livestock) and all manner of things that could happen. The Little House On The Prairie books are a pretty good read on this, if you pay attention to how they moved around and took their chances – almost starved once – and the childhood of Abraham Lincoln is another good read on this subject.

Alex, you’re pointing out risk, which is inherent to both investment and speculation. The settlers weren’t planning on tending the land, arbitraging time and whatever else to sell for profit, and then moving on up to the East Side. They were settling, as in to stay put and live off of their investment of time and labor. It’s quite something else to buy something based on the premise that enough other people are going to also want to buy it.

Really Hunan? Did you not just say you lived in a crime ridden area that required you to buy multiple guns in order to be safe, for 3 FREAKING YEARS on the pure speculation that you would turn a profit on a run down property? A person with priorities so out of whack should not be condescending to people who simply wish to have decent, affordable housing options in an area that is safe and well maintained.

I would have done the same. You always buy cheap and wait it out on housing. Especially if you do your homework and see the history of home prices. If I had the cash three years ago I would have bought up several rental homes. You would be making a killing right now as the market is hot. Eventually the home prices will go up , this is cali man.

My biggie is house + arable land. If I had $250k back in 2010 I’d have bought a place in Gilroy or Morgan Hill and become largely food self-sufficient or grown a cash crop like roses, have the land pay for itself and pay me too.

lets not forget that all this happened in the most manipulated market in the history of the country.

sadly, as I’ve seen first hand, if Hunan losses the rest of us will pay for it with another bailout….all though this time it’ll be a bailin.

Hunan, you are correct. I am well into my 40s, and fortunately I purchased fixer beach homes in my 20s, lived in one, and rented the rest out. I do spend my weekends fixing the, which has turned into a hobby. They have appreciated massively, and I can retire.

However, I noticed that the prices of middle class homes in decent areas rose since the 90s, and incomes of college educated workers also rose. Factoring in the drop of interest rates and, except for the beach cities, affordability is the same.

In 20 years from now, it will happen again. Homes will double again and wages will rise in tandem.

How did that strategy work out for people that bought 2 houses in Detroit when the GM plant was still there?

What job did you have in your 20s? You must have been a CEO because the is the ONLY job of which wages rose “in tandem” with living expenses.

I must be so stupid. All I had to do is buy MULTIPLE Laguna Beach fixers for 1.5 million. Live in one and rent the others out. How did I not think of this earlier? Oh wait… Maybe its because I have a much better job than you did in your 20s but nowdays that only allows me to buy a fixer in Santa Ana next door to section 8 apartments.

Sounds like another “I got mine, so screw the next generation”. Never mind that your retirement equity has been built on the backs of taxpayers who have been forced to endure massive amounts of debt and wealth inequity in a desperate attempt to prop up a bubble-dependent economy.

Polish Paul,

Twenty years ago, the small beach fixers cost around $350,000. And, a small home in Irvine was around $275,000. Now the small beach fixer is around $1,500,000 while the same home in Irvine is around $700,000.

Back then, software engineering jobs were paying about $55,000. Now, easy to get $130,000 as a software engineer. And, interest rates are lower. So, Irvine is just as affordable now as 20 years ago. Except for the high price beach cities, affordability is the same.

The only way to win the housing game is buy the most you can borrow on in a good location, then wait 20 years. The earlier you put this plan in action, the better off you will be.

Jim Taylor, you are also correct. Possible to lose your shirt in the real estate game. There are many cities like Detroit where real estate sucks. You have to treat it like the stock market. You should win, but you might lose.

“and wages will rise in tandem”

LOL, LOL, LOL, oh my f’ing god man!!!! don’t say that shit when i’m taking a drink of water…..i literally laughed out loud and almost fell off my chair…..LOL, i’m still laughing on that one.

wages haven’t increased for 90% of Americans since 1974……MEGA facepalm

Interesting – I’m making the same amount – in absolute, not adjusted, dollars – as I did right out of high school in the early 1980s.

For at least 90% of us, we’ve become half as wealthy each decade. It’s just been down, down, down.

Hunan, I love your strategy. Buy now/buy high and enjoy that sweat equity. It would be bad for us first time home buyers if wise people like you and your family wait for the crash as well. So, please don’t waste time with us waiting (eh whining) millennials and go get that next fixer upper.

Yup, no one here is stopping any of these people from buying, not sure why they would waste time here if they felt confident enough that the formula for future gains in housing is so simple and obvious.

It’s like those pesky religion solicitors always knocking on the door, if getting to the promised land involves having to convince others to come along, maybe it’s not such a great destination after all.

Hotel California, you are correct. I would guess that buying a decent home will result in big appreciation in 20 years. But, that is not a sure thing.

As with any investment, you could lose money. There is a chance the home might go down a lot in 20 years if a depression hits. It is also possible the home is the same price in 20 years. However, thanks to the money printers at the Fed, it is likely the home price rises.

The only sure thing in life is happiness. Just find a beautiful girl and marry her. That is the only sure thing that makes life worth it.

Again with the “long-term” mantra. It’s no longer 1990 or earlier. Mobility is more important than ever before. The statistics have long suggested that most people don’t keep a house for more than ten years. Just because people chime in with their personal story of an exception doesn’t change the rule.

Its unfathomable to me as to why anyone would want to pay 1000/sq. ft for anything that is not 50 stories high with breathtaking views or a guest cottage on a grand mansions grounds. Move or buy a boat. For $500,000 you can get a sea going yacht that will take you anywhere. Comes furnished too!

We sold in Valencia in 2005 and then rented for 10 years moving around. One of the places we lived for two years was a pool house in Hope Ranch, Santa Barbara. My wife knew the owner and she needed help with the grounds. I could work off $750/ month with some yard work, so we ended up paying $750/month. It was great, Hope Ranch is beautiful, we had the pool and access to the private beach. We acted liked we belonged there….ha

Would love to live in Hope Ranch! Nice job 🙂

If housing tanks hard I’ll be there@!

A couple of years ago I worked with a guy who rose up in the ranks at a Big Four accounting firm. He always seemed to have a boatload of cash, so one day when we were out at a company party – I asked him his secret. He said, never buy a house and don’t rent from large bloodsucking companies. He used online classifieds to find rooms for rent, house sitter arraignments, and so forth.

I found an elderly woman who needed help with managing a large property after her kids moved away and her husband died. Have my own room and have access to the kitchen and laundry room. Haven’t paid rent in more than 5 years.

Anna Mouse you are doing it right.

I work for a guy, electronics so naturally $15 an hour part-time and no prospect of making more than $10k a year because Silicon Valley, but it comes with a free place to live. And enough free time to work on things of my own.

Silicon Valley average income 2015: $116,033.

Source: http://blogs.wsj.com/digits/2015/02/03/silicon-valley-not-a-bubble-not-about-to-burst-report-says/

Alex, do you have anything non-anecdotal to support your (continuous) claims of low wages in Silicon Valley?

Jeff – not really. I know there are official figures galore showing how it’s just one big party here but all I see is poor people, abjectly poor people, and homeless people. I see a hell of a lot of people who make less than I do. I actually feel I’m getting off light in this poverty-fest.

Intellectually, I know, because of the official figures, that there must be a lot of people here doing well. They’ve got to be around here somewhere. But I never cross paths with them, never talk with them, meet them, etc. IF … there are people making what the official figures say they’re making, they’re keeping to themselves very well.

Renting rooms is not the secret to success, especially in places like coastal CA. Housing appreciation in coastal CA for the last few decades has been astronomical, not to mention it is a highly leveraged investment.

Ask resident blogger jt if it would have been better to rent rooms the last 20 years compared to buying beach close property. I remember when one of Pimco’s top guys sold his home and rented during the downturn. That only lasted for a few years and he repurchased and got back into the housing market.

This is how Ralph Nader always lived. Rented rooms or cheap apartment, lived WAYYY below his means. I remember one anecdote about how he bought a ton of military surplus dress shoes (low quarters) and had shoes for life.

Rent, live cheap, and save save save.

Years ago we used to do courtesy work for people with gas lights and fireplaces. I met an elderly woman who began crying as I serviced her fireplace. She was being packed off to a nursing home after a mild stroke. She could still walk but not do laundry, dishes, cook etc. I tried to console her and asked if she could find no ‘au pair’ or the like to help her? She didn’t know anyone and had no family. She blurted out that she would gladly give her house to anyone who would help her stay there for her remaining years. I was tempted but suggested she contact the Medical College of Virginia student housing office and see if she couldn’t offer room and board for a nursing or medical student in exchange for home care.

This is all too common a situation in the US – everyone is atomized, families essentially do not exist in the sense that “family” is understood in healthy cultures. She certainly has people who are related to her, and they don’t give a shit, they’re too busy “getting theirs”.

I keep receiving these phone calls from who knows what realtors. Once a week regularly someone would call me and ask if I am selling my condo. At first I was very irritated and would tell them that my home is not for sale and F off. After few weeks I’ve changed my strategy…I am telling them to find a buyer for $650K and I will sell it. I bought my property for $430 in 2014, it was a dump. We invested 100K to make place nice. I am not even sure if I want to sell, because we have no place where to move and will not be able to buy and upgrade even if we get a hold of $650K….but what a funny thing….they really do have buyers for $650. Most likely Chinese sitting in China and mailing $ bills to USA. What a bunch of CRAP!!!

Escape, if you have a buyer that pays 650 increase to 750. Wait until spring and raise to 850. There are enough dumb cash buyers out there. And no doubt the bubble pops. It’s all about boom and bust. Just have some patience.

Tell ’em to fuck off unless they can show you a mil cash.

@Escape: I wouldn’t be too eager to sell unless you really dislike living there. Let’s say you get $650K for your place. Subtract 6% in realtor’s fees plus closing costs and other miscellaneous expenses, and you will probably only net about $600K. That’s a $70K profit if you paid $430K + $100K in renovations. $70K just doesn’t sound worthwhile for the hassle. Although I think the market will crash at some point, no one knows when that will be, and you could be waiting 5+ years for a crash. That’s 5 years of paying rent, which will probably be as expensive as your mortgage payment but without the long term benefit. You would effectively be frittering away that $70K profit on rent and then some if a crash didn’t happen soon. Conversely, if a crash happened in a year or two, you’d be in very good shape. Decisions, decisions.

Are we sure this bubble is going to pop? I start having second thoughts….what if it is a new norm?

Then we are all F-ed. Food will rise sharply and people that have proudly sunk everything into their home thinking they will be fine will go hungry. While those losers holding gold living in crappy apartments now will be feasting 🙂

I can see this. The guy I work for, and his family, are what I call “orthodox suburbians”. They have a big McMansion that’s constantly falling apart, tons of deferred maintenance, they insist on growing lawns instead of having a nice little garden or at least some fruit/nut trees, all food is from factories (they eat a lot of “Lean Cuisine”) and they simply MUST have their time-share, their vacations, etc. They’re in constant money trouble, have absolutely no savings, and the guy has to work not only his main job but generally two side jobs at all times. The work I do for him is in one of the side jobs.

It’s really a way of life. You never walk farther than out to the mailbox. You eat “white” foods – white bread, pasta, chicken breast, ham and hot dogs and baloney, with mayo of course. You have to have a lot of things because things, along with a well-maintained lawn, show how moral you are. You have to have lots of cars – one for each person or more.

The place is so jammed full of stuff that when I’m there, when I want to eat I typically have to shut my laptop and then put my plate on top of it. The guy’s wife would love to do artwork, but can’t because there’s no place to set it up. The place is that choked with stuff. “He who dies with the most toys wins” and all.

It’s really as distinct a culture and worldview as that of the Uzbeks or the !Kung. I feel like a visiting anthropologist when I’m there once a week. They’re very nice people, but they do have the standard orthodox suburbian culture down to a tee.

Definitely, this time is different :-))))…..

@Escape, you mean, “this time is different”? Nope. Home prices in the bubble areas of California (Los Angeles, Orange County, San Diego, the Bay Area) always skyrocket when the economy is expanding and home prices in those same areas collapse during recessions.

Not a pop, just a long erosion. There is no future or growth in sustaining these prices, there nothing normal about it!

Global markets grew artificially with debt, speculation and currency manipulation. At this point it is best for our governments to monitor deceleration let it happen gracefully if possible. We can’t sustain values that wants to fall. If you hold it you will have a crisis.

The ride up is over. Why would go up what is creating growth? You can’t force it anymore…

Tech is dying. Apps have already jumped the shark; there are only so many things your smart phone can do for you that your Mom did. And you won’t need ’em when you move back in with Mom and have to settle for a bicycle messenger job (cheaper than a drone!) or have to move into an ad-hoc commune to survive.

Tech is not dying. It is evolving and growing even as creative destruction shifts the focal point over time.

Right now tech == apps. Well, this reminds me of the early days of the internet, where there were a million little mom and pop ISPs and then it became just a few large ISPs.

There’s just *so* much demand for an app that fetches a proletarian to your house to clean your cat box.

Alex: “this reminds me of the early days of the internet, where there were a million little mom and pop ISPs and then it became just a few large ISPs.”

As I remember it, in the very early days — and for several years — there were only four ISPs. CompuServe, Delta, GEnie, and AOL.

Those are the only ones I can recall. Were there any others?

I’m talking about ISPs for the common consumer. Not the ones used by universities or the military.

Alex is right, depending on which “early days” are being referenced, the early days of the commercial Internet in the 90’s did have a ton of local, regional, and national ISPs providing dial-up service.

Not really, the next thing is mining the asteroids. Seriously, Europe wants to do this. Space X or Blue Orion worth more than Apple in 15 years.

http://www.kcrw.com/news-culture/shows/press-play-with-madeleine-brand/l-a-s-chinese-investment-boom-new-visa-policy-and-the-great-mayo-war

I don’t see prices in Southern California decreasing anytime soon.. You don’t have to worry about your competition being American born and raised. If you live in Southern California you are dealing with foreign competition. It is fierce and real.. The hood is no longerLos Angeles. Los Angeles is a model of what is to come.. Good or bad.. It’s here…

Nothing new under the sun!!!… The so called Chinese “investments” will have the same fate as those Japanese “investments” in the eighties. History repeats itself – different actors, same script.

you guess are killing me today!!! some of these posts read almost word for word from 2006-07.

FYI my X bought in 2005, i begged her not to but she listened to all you shills. She paid $415K just sold it for $385K so it’s not all win win in socal real estate…..and yes it was not coastal…….personally i hate the damp cold coast anyway.

AND what’s most shocking, most talk as if earthquakes are a thing of the past as well. Once this dormant period is over we could be having 4.0’s every couple months and then 5.0’s, 6.0’s once a year and maybe even a 7.0 thrown in for good measure……like from 1987-1994 it got to the point where earthquakes didn’t raise an eyebrow BUT most here have never been thru a good shaker yet, make no mistake it’s coming and people will flee.

I grew up witnessing first-hand how “investing” is real estate is as bad or worse than lottery tickets. The idea that you can buy a house, let it appreciate, then buy a bigger house, etc. is the most idiotic one ever. My dad fell for that idiotic idea and the end result was, I got very acquainted with Kraft mac and cheese, and fishing and foraging as a kid.

IF … you have bags of money, and want to buy a place, great. AS A PLACE TO LIVE. And only if it’s competitive with renting.

People buy houses then they “have” to fill them with furniture etc. Oh, and why not buy a new car too? Can’t have a beat-up Toyota Corolla sitting in front of my nice new house, can I?

When I rented in Sunnyvale, I observed that my rent took care of my living space meanwhile people I knew who owned houses were spending the same amount just to keep their lights on and water running.

1986 – 1994 was a wild ride. Quakes all the time.

I moved to L.A. in 1987. I don’t recall a “wild ride” of quakes from 1987 to 1994. I only recall three.

A moderate quake in the late 1980s. A big one up in San Francisco in the late 1980s. And the Northridge Quake, which was the only scary one.

The only reason why Chinese buyers are purchasing real estate here is because of their run up in the stock market and economy over the last few years. It is a safe haven for their money especially now that the Chinese markets are tanking. Obviously, the Chinese failed economics 101 in that they are now resorting to the same measures the US has used since the Great Recession to artificially inflate their markets. No one is buying cheap crap from China anymore and as a result they are tanking. What goes up will eventually come down. Hard. Same goes for the US economy when the music stops. And it will stop sooner than later based on all of the historical measures I have seen. And all the people that have bought in the last 2-3 years will be left holding the bag. I cant say I’m not waiting for it to happen- because I am.

“It is a safe haven for their money especially now that the Chinese markets are tanking.”

How many Chinese buyers have you talked to who have confirmed that it’s purely a lock box play?

I think it’s equally a safe assumption that these are purely speculative plays.

The greedy price our next generation out of every square inch, charging 1.5 million for a 50K condo. And way back, Indians. Remember them. We stole their land, and through systematic genocide, “Kill them all,” to quote our Fuhrer to be.

No European “earned” their wealth in america.

Share with your kids, charge them 150K for the house you paid 30K for.

Start there…

Geez…

k in sf

Keith – I think the US will do down in history as having one of the most poisonous cultures ever. Dog-eat-dog, Social Darwinism, etc. I think it started with Calvinism, a particularly evil sect of a generally evil religion, Christianity. And yes, the Christians pulled out their bible and came up with justifications for killing off the Indians, enslaving blacks, and so on. Notice the KKK are christian. Notice the Nazi groups tend to call themselves Christian – from Christian Identity to Church Of The Creator etc.

Families do not stick together because everyone’s supposed to be an atomized individual, and if you make it, great, and if you don’t, well, you can just be homeless and maybe lit on fire with gasoline by some of the ones who made it – ideally in American terms it would be your own relatives out “raiding” homeless people who kill you. Served you right! You didn’t make your million!

No, Alex. The U.S. does not have one of the “most” poisonous cultures ever. Nor are self-described Christians especially evil.

To say such shows an ignorance of history. War and genocide, and all manner of other evils, have been a big part of human history, of every culture, for millennia.

Yeah, a lot of whining on this forum. It’s bad, and could get a lot worse, but it’s not THAT bad. If I had to start over at 20 in this day and age, I would eventually be doing just as well as I am now. I’d go to community college, finish my BA at a cheap no-name college in a subject that pays, live under my means, invest the rest, diversify, job hop for raises (but not too often) or get a gov job, wait until a downturn to buy (or just keep renting and investing), move out of state if it becomes necessary. Not that hard. The world’s smallest violin is playing for the poor 20-30-somethings who can’t afford to buy in SF or LA – it’s stupid to even consider that and it’s no big loss anyway. Like being born in Manhattan or London and anguishing over not being able to buy an apartment there.

The biggest problem I see is millennials not carefully observing their elders and repeating the same mistakes. The renter next door to me used his previous house as an ATM, bought a $30k boat, lost the house, still has the boat. Stupid. Don’t be stupid.

But you won’t be starting over at 20, so you’ve got no risk at stake in any of your assumptions.

The hypocrisy in whining about whining is deafening. If you don’t want to read about “whining”, then why come here and whine about it?

Did I say anything about not wanting to read it? Maybe I’m bored with watching my stocks go up. Why come here and whine about whining about whining? And for that matter, why get so upset when someone disagrees with you? If you tried logical, friendly debating instead of pure venom, you might find a little more peace. Or maybe just cut back on the coffee.

The first 30 years of my life were really shitty. Not just poverty, but tragedy piled upon tragedy. A life you might read about but never know someone who actually experienced it. Because of that, I’m in a position to recognize that the problems of too-high real estate prices and high student loan debt are not problems AT ALL. Hence the whining about whining.

Would that be the same “logical, friendly” debating which belies a label of “whiner†to others? It’s too bad you have such a terrible story, but it doesn’t set your reality as the universal standard for others’.

If I see many people expressing thoughts that I view as illogical or stupid, I’ll happily point it out, because I’m opinionated – just like you. It’s a normal part of conversation. What I don’t do is single someone out with a personal insult. Unless someone else takes the first swing, of course. I’m not a turn-the-other-cheek kind of guy, as I’m sure you can relate to.

“Maybe I’m bored with watching my stocks go up. Why come here and whine about whining about whining?”

Yes, very objective John. Thank you for coming in here with a “balanced” viewpoint and telling us how to spend our time. What people call discourse you label whining. How about putting out a counterpoint with some data? Sounds more like you are a hypocrite instead of a “turn the other cheek” kind of person.

I somewhat I agree and disagree with John. It is hard, but with some smart moves young people can push through and buy a house. Not in the best neighborhood, not near work – but it is possible to buy a house. Off course everyone wants convenience and the best house. People prefer renting in the expensive area instead of owning in cheaper areas. But on another side – I am a parent and I would not sleep if my kids would go to school rated 2 or 3. Why would I want my kids to grow up stupid? Plus chanced to get killed or rubbed….the difference between your times and ours are simple: you worked hard and could afford to buy in good town, near good schools. Our turn – we can buy, but will walking with guns every day. Seriously, having a job at Google will maximum buy you a house of $700K. That will be enough to buy in East Palo Alto (may be). This is with Google salary! What about people having simpler and less complex jobs? No, our time is different! And believe me we do work very hard and not overspending.

You don’t have to buy, and it wouldn’t be smart to do that now anyway. You’re not missing out on anything and your time will come. You should be focusing on something else.

Escape, your point about the differential in variables gets blithely dismissed and the response is to keep waiting because others know better than you what you should be focusing your life on. Easy for someone without the accountability for your life to do.

Point these things out and you’re essentially labeled a “whiner”. Call that out as the bullshit it is and the labeler diverts the discussion to personal insinuations.

I dismissed nothing. My God you’re an expert at putting words in other people’s keyboards. But while you’re at it, yes, sometimes others DO know better. I wouldn’t set my kids loose in the world without a lot of advice.

I don’t see anyone complaining about not being able to afford a Ferrari, so why complain about not being able to afford a property in the ghetto? That’s energy which could be put to much better use. I’m sure some part of you agrees with that, but apparently the all-consuming need to “win” on the internet overpowers it.

“the difference between your times and ours are simple: you worked hard and could afford to buy in good town, near good schools. Our turn – we can buy, but will walking with guns every day.”

The point about the cost differential in the standard of living, not addressed, therefore dismissed.

“My God you’re an expert at putting words in other people’s keyboards.”

Personal attacks only serve to distract from the issues.

“But while you’re at it, yes, sometimes others DO know better.”

Agree, although there’s no way for us to vet out responder’s credentials in a comment forum much less have a comprehensive understanding of someone’s circumstances of which to issue judgements that they “should be focusing on something else.” There’s a very fine line which gets crossed into condescension.

“I don’t see anyone complaining about not being able to afford a Ferrari, so why complain about not being able to afford a property in the ghetto?”

Shelter is a basic human need, a Ferrari is not, it’s a false equivalence. Regardless, the complaints are very relevant to the blog’s perspective and this article.

“I’m sure some part of you agrees with that, but apparently the all-consuming need to “win†on the internet overpowers it.”

What I care about most is seeking the truth and finding answers – sometimes through vigorous debate – you may not like my approach but I’m not the one trying to make this personal.

Yep Great-Aunt Mary told me to stay the hell away from college and just work for the animal hospital, a job I utterly hated, but the veterinarian kept nagging me to take accounting classes and I think wanted to put me at the front desk, and I could have rolled my vet knowledge plus accounting skills into a better job. Maybe gotten an Associate’s at most.

I agree with you John. A lot of whining. The way I see it is there is always opportunities. You just need to look for them. Succeeding requires taking risk, sacrificing, and doing tons and tons of research. There are still good RE deals out there with lots of upside, you just have to find them. No they may not be in your ideal neighborhood or school district,but that’s where the sacrifice comes in.

I would never sacrifice my kids safety and education. Are you out of your mind?

This “whining” rhetoric conveniently sidesteps the issues by framing the problems as being simply the setting of unrealistic expectations and a lack of resolve, which are unproven to be true. Failure can also accompany “taking risk, sacrificing, and doing tons and tons of research.”

JohnD,

I suspect I’m in the same age range as you and like you I’ve taken advantage of the benefits of that generational timing. That said I recognize that some of those advantages are no longer there to the same degree for the current generation.

I took out student loans to pay for my education, but even for a “name” school the total ended up being around half my starting income when I began my career. I believe that multiple is many times this for the current generation.

Similarly I bought my first home in a decent part of Southern California for about 3 times my income and, despite occasional hiccups, watched it triple in value by the time I paid it off 20 years later. While I do believe that housing will continue to be a decent investment over the long haul, again the multiple of income required to buy a decent homein a decent location has increased considerably.

Finally, you allude to making money in the stock market. I have too, but pretty much anyone not brain dead could have done so over the last 20-30 years. While, I believe there will be money to be made there in the future – which is why, even in retirement, I keep nearly 50% of my assets there – I am in no way confident that we will continue to see the sort of performance from which we Boomers benefited so consistently. Then again, as the great sage Yogi Berra said “It’s tough to make predictions – especially about the future”.

In short, while I do agree with you that patience and self-discipline will reward Millennials as it did us, I think it is fair to say that they experience significant headwinds that we luckily avoided. And if they want to complain and try to change the game in their favor as the world passes over to their control I certainly don’t blame them.

I’m not quite a boomer, so I didn’t have much of the same headwind, unfortunately. Due to minor financial mistakes and laziness of my youth, I didn’t gain traction until 2004ish, by which time housing was out of my price range. Patience paid off, though. Seen one bubble, seen ’em all.

Leave a Reply to Surfaddict