Adding 7+ million renter households over the last decade: Number of homeowners neutral over last 10 years. The shifting purchasing power of American households.

The low turnover in housing is having some organizations changing their tune regarding the current boom in home values. After all, places like the National Association of Realtors (NAR) will be better off with higher sales volume and lower prices versus very low sales volume and higher prices. As we see investors pulling back, the already low volume is dropping even further in what is typically the house lustful months of the summer. In virtually any three month period over the last 60+ years you would typically see the number of homeowners far outpace the growth in renter households. That trend has reversed since the housing bubble popped. For example, over the last 3 months the number of renting households went up by 312,000 while the number of homeowners went up by 54,000. The trend to becoming a renter nation continues. The NAR actually is echoing a similar tune to what we are seeing and that is many young households are income strapped and many are living at home and will first go out and rent before buying a home. So this trend is likely to continue. Rents are heavily dependent on local incomes and jobs. We’ve had a solid run since 2009 in regards to the stock market and things are looking a little bit frothy at this point if we look at price-to-earnings ratios and also overall sentiment. So what changes when we add over 7 million renter households over the last decade?

Renting nation

There is a major push to becoming a renter nation mostly by economic forces. Since 2008 the strongest and most consistent group of buyers has come in the form of investors. Keep in mind that these buyers were going after lower priced foreclosure re-sales. These are not your “mom flippers†now paying high price-tags to squeeze a few bucks out of a flip. Many investors were outbidding regular households looking for deals. Many had access to auction sales that regular buyers never even had a chance at contending with unless they had the liquid cash available. And of course, those millions of households that lived through a foreclosure now need a place to live. Many have opted to rent.

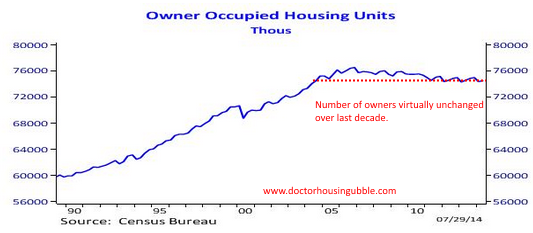

The trend is rather dramatic when we look at the raw numbers of homeowners and renters over the last decade:

Source: Census, NAR

We still have fewer actual homeowners today than we did at our peak one decade ago. This in spite of every effort by the government, a growing population, the Fed, and banks to keep housing afloat. Ultimately the end goal was to assist banks from going under, whatever that entailed. What ended up happening is the biggest group to benefit from the low rate environment were investors and banks with ready access to the low rates being pushed by the Fed. It certainly didn’t boost the number of homeowners as you can see above.

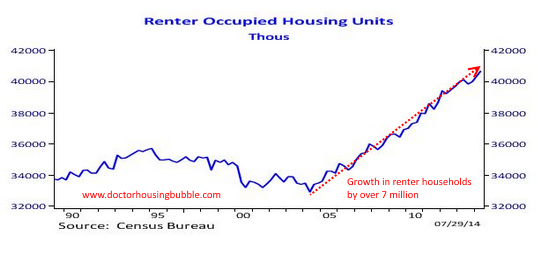

But one group that has been growing in fantastic fashion is renting households:

We have added over 7+ million renter households over the last decade. This is a large group and is more than an anomaly in the data. The NAR realizes that having low sales volume is not helpful in expanding their membership base. Selling one house for $700,000 does not yield as much as selling 3 homes at $500,000. Also, many of the sales that went to investors went off the books via auction sales so the public never really had access to these purchases.

The NAR, not one to be negative on housing is seeing the same data we are:

“(NAR) The falling homeownership in recent years is partly due to the struggles of first-time buyers. Lower wages and larger student debts among recent college graduates have limited the millennial generation from taking advantage of the historically low interest rates.â€

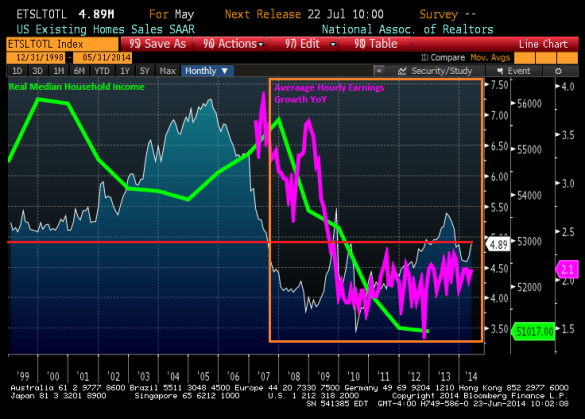

Apparently these things matter when it comes to buying and renting nationwide. And you can see this reflected when you look at income growth and home sales:

You’ll notice that existing home sales have never really recovered their step since the mid-2000s. It is also interesting that this mostly coincides with real household incomes falling at the same time. For most Americans, it appears that renting might be the only option (or for the 2.3 million adults living at home in California, shacking up with parents).

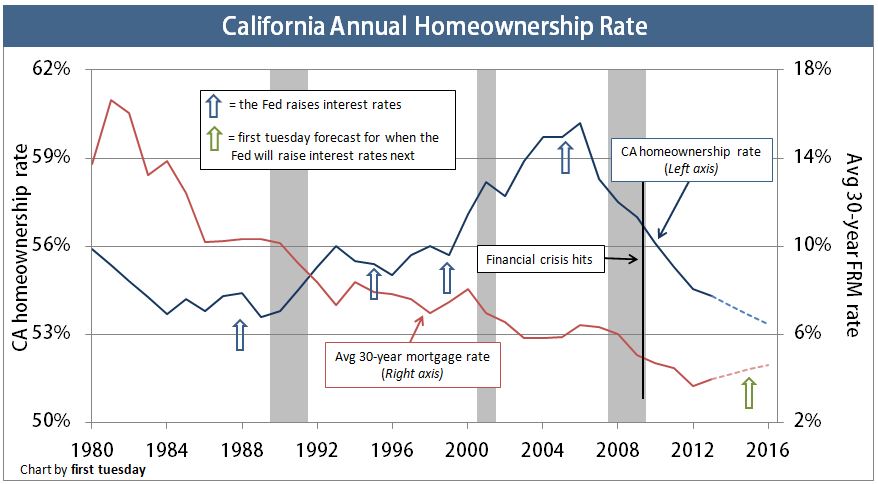

Nationwide, the homeownership rate is at 64.8 percent, a 20 year low. In California, the homeownership rate is quickly inching down to 53 percent:

This has larger implications in terms of voting blocs and the trend is unmistakable. Low sales volume, high investor purchasing, and stagnant household incomes. The 7+ million additional rental households had to come from somewhere.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “Adding 7+ million renter households over the last decade: Number of homeowners neutral over last 10 years. The shifting purchasing power of American households.”

Housing to Tank Hard in 2014!!

Hi Jim

I recall when you first broadcasted that ‘housing to tank hard in 2014’ you quickly developed an evangelical kind of following of people in this site – hoping you could foresee the ‘tank’ they are all waiting for.

Can you spell it out for us:

5%?; 10%?; 15%?;, 20%?; 25%?; 30%?

On what factors: unemployment, wages, GDP, notice of defaults, mortgage apps, housing inventory, months on market, inflation? as you know all the aforementioned are a mix of good and bad news.

I see no tank as long as the stocks and bonds at “all time highs”…

In prime areas of California 30%+ drop. US as a whole is not severily overpriced. I believe we will see drops nationally. But LA, SF and other big markets in Cali will drop considerably.

Baby boomers will need to downsize. Millennials can’t and don’t want to buy homes. Wages are trending lower. Workforce participation rate is at all time lows. Mortgage apps are at 15 year lows. Energy and food costs are rising.

Investment firms are slowing their cash purchases of homes and anyone who wanted to and could bought a home last year. There is not a strong demand left at these prices. They will have to drift lower to the get the next wave of people who are currently priced out to buy. Once true supply of homes hits the market look out below.

Great to see you are still here Lord Blankfien. I am gonna have to go with blert (someone who I almost never agree with) and “guess” that high risk bonds/debt will be the catalyst. Watching the S&P or the “housing market” is really not going to give you any insight until it is too late.

I would like to give a shout out to rental parody!!!

@Jim Tank, the houses still sell at higher price than a year ago regardless to the price reductions. If, say, I bought a house at $1 mil a year ago and now i want to sell it at $1.5 mil (50% markup) and no nobody bites, so even if I drop “30%”, say, $400K and still sell at $1.1 mil, it is 10% increase, even after “30% drop”, right?

I predict systemic fail across the board sometime between labor day and haloween 2014. Maybe after mid-terms? Election did not stop 2008 from happening in September.

Indicators seem to be there. Historically these crashes (1929, 1987, 2008) occur afteer the summer hildays (read into that what you will. Economic indicators (record highs in multiple categories) match previous collapses.

Finally this

http://www.cbsnews.com/news/ceos-selling-stock-sign-of-a-downturn/

CEOs are dumping stock.

I feel as a good a prediction as any. I have 25 years to recover on my retirement, and there is nothing I can do anyway accept have my investements in long term game plan areas.

when calendar specific predictions of when the tank is to begin are made, it’s the surest sign the bull market has a ways to run…

Housing to Tank Hard in 2014 as defined by 30% drop…I’m still sitting pretty as a landlord collecting rents, cash flow…thanking you for renting! Landlords can hold out longer than homeowners…we will buy more rentals if it “Tanks Hard”..we can only wish! Even if I had to drop rents 30% I’m still cash flow positive. We will buy more rentals and you can firmly believe homeownership is for suckers…hey we like your kind! We provide a service for the stupid but renters always think they are so smart anyways so let them rent.

… until renters make up huge percentages of the populace and begin easily winning elections.

“We provide a service for the stupid”

Maybe you can get a job at GS! You already live YOUR life according to their teachings. You would have to eat your young though… Think it over!

You are in the business of buying houses, usually with a small down payment, and making cash flow with rents. This is not the same thing as buying a house for your personal residence. There are times when it is not financially wise to own a home and when it is also possible to make money as a landlord. These times often co-exist. Now is one of these times. The fact that you are making money doesn’t make renters stupid. It is not wise to be a homeowner in most of the US right now, unless you are a leveraged landlord taking advantage of the preferential tax laws.

Hey What? I knew if I wrote stupid in my post you would come running…you are too predictable…you crack me up 🙂

You’re just mad because a simpleton like me may be your landlord one day…lol!

Sorry roddy6667, that comment about renters was meant for What? Not anyone else.

It’s hard to get ahead as a renter, it can be done. Instead of buying a residence for yourself to live in, take some money and buy a much cheaper rental when housing Tanks Hard…if you buy right, it will provide you with cash flow and maybe appreciation.

If you have made money in the market already scale out and save it for a future purchase. I know so many professional couples want to buy but if you start smaller with a couple of rentals that pay you income, its not a bad way to go instead of putting all your money into 1 house. Renting becomes a smart move in this scenario.

So I take it that is a yes! Good! You will receive instructions by courier by this afternoon. Good luck! I hope you make it through boot camp. Yes, they actually call it boot camp…

@ Housing not to tank hard at least till 2016…

Housing to NEVER tank!!! NEVER!!!

What?

Are you part of some cult that chants the same phase over and over all day every day?

Are you repeating your silly quotes as some fulfillment of the book “The Secret”? Do you look in the mirror at yourself a hundred times a day saying the same phrase?

Are you a Zombie?

“What?”

Yes?

“Are you part of some cult that chants the same phase over and over all day every day?”

Yes!

“Are you repeating your silly quotes as some fulfillment of the book “The Secretâ€? Do you look in the mirror at yourself a hundred times a day saying the same phrase?”

Yes!!

“Are you a Zombie?”

YES!!!!

Houzing is going down! Boyeeeee

@Jim Tank, as much as I want to see at least 20% correction in the housing market, I have to admit, it is not going to happen. Look at the stocks, they are going back up to the new “all time highs”. As long as the funny money stream flows, no tank happens (you don’t believe in the fake FED’s taper, do you). Sorry, but the bond and the stock markets should tank first, then we can see some housing tank. The interest rates should also go up. My estimate, I give this ponzy two more years, I don’t think it can last longer. So, my prediction, the housing can start tanking in something around 2016, but again, not earlier than we see 20% correction is stocks and bonds. Remember, in 2008 it was a main street bubble in housing, now it is a wall street bubble. The wall street will have to get hit hard first before the tank occurs, which would come from stocks and bonds. Remember, the regular Joe is renting now, not buying… This time is “different” in the way that it is a wall street bubble all the way… Until the wall street starts to unload their inventory, we will see no tank.

Seattle- Food for thought: Wall street bubbles pop much faster than main street bubbles. Institutional investors will make a sell decision quickly- ma and pa will mull it over for a year watching prices fall.

Not a bad analysis but have to add the last bubble was also a Wall Street bubble with notes were basically presold to investors often before the borrower even closed, 30%of the Notes entire value pulled out before the borrower even closed escrow, credit default swaps, CDO’s, Notes derivatized to infinity, assets re hypothecated multiple times, blah blog blah. The Federal Reserve put together this sweet deal for large investment banks only to buy up large vats of foreclosed homes on pennies of the dollar, hold them for minimum 5 years w option to renew for an additional 5 years then they have to sell. This will be interesting to watch, even if it is painful at times. Rents can only go as high as the market will bare and wages are flat and/or declining. This can’t go on forever. The one thing we can count on is change. Except for greed. That never changes and the bankers are greedy men and women. Eventually they will loosen the loans again and loan to regular people because it will be profitable for them to do so. Until then, the middle class will keep disappearing and we will experience hardship and suffering while those that create nothing but for the thing that represents the real value, i.e. The goods and services, will continue to make all the money. Ironic isn’t it?

I spoke to an LA real estate agent who told me the truth i.e. he said the only properties getting multiple offers are in nice areas and even then it’s only 2 or 3 offers. Houses in all other areas are sitting on the market for days. The house he was showing is owned by a man who owned and sold 4 other house. The house has been on the market 40 days. The man who owns it got one offer 15K below asking. He turned it down and will not sell under asking. Why? He doesn’t need the money and he already has a renter. The agent went on to say he’s been an agent for years and he believes prices will drop in 2015. He also stated that he used to flip but his margins went from 40% to 5% so he stopped. Great guy to talk to.

The historic norm for housing to stay on the market is around 6 month, I don’t see 1 – 2 months as terribly prolonged period. Tell me when houses start to sit for 4+ months with no offers and price reductions, then it will start to be interesting. It is too early just yet…

Last year when I was shopping 40 people were waiting for the open house and there were 10-15 offers by the end of the day and even offers before the showing. 6 months on the market? Where did you get that number? Houses didn’t stay on the market that long in 2010.

tolucatom

The historic level of housing inventory is 6 months. Inventory is the ratio of sales to inventory. In 2012 inventory inventory was at 1 month! In 2007 it hit 15 months. We are at 3 months in San Diego. I am not sure about LA.

@tolucatom, @bb is right, what I meant is inventory supply which, of course, doesn’t always translates one to one to the actual numbers of months a home spends on the market. But what “months” of supply means is that all the current homes inventory (with no new homes coming to the market) at the current sale pace. Which means if we have, say, 60 houses on the market and if we sell 10 houses a month, thus we have 6 months of the inventory, which assumes homes to stay on the market up to 6 months. 6 months supply is believed (by realtors of course) to a “balanced” market, neither buyer’s nor seller’s. This is why I said, when the houses start to sit for 4 + months without offers, then we will start seeing shift towards buyer’s market. 1-2 months isn’t that bad, just yet…

Thanks bb and agfs.

There is a tankishness in the air.

The so called “American Dream” is dying. It used to be thought that each successive generation would be more prosperous than the one before. That trend is reversing. That is why more people are renting than buying.

“It used to be thought that each successive generation would be more prosperous than the one before. That trend is reversing.”

That trend began reversing sometime back in the 70’s.

I blame disco… and Reagan.

Most economics textbooks have sections devoted to the beneficial economic and social benefits of disco. That only leaves on culprit…

Polo: “That trend began reversing sometime back in the 70′s. I blame disco… and Reagan.”

If the trend began in the 1970s, how can you blame Reagan? He didn’t take office until 1981.

Yes, I remember the 1970s. I was in high school during the Carter years. We were already in, what was called at the time, “a malaise.”

So clearly, things began going bad before Reagan. Partially, it was a post-WW 2 Europe and Japan finally becoming competitive. Can’t blame that on Reagan or Carter.

Son of Landlord, you say you rememer the 70s, but apparently you don’t remember the 70s in California. Ronnie was our Governor frrom 67-75. He had a dramatic effect on CA…hence the election to the presidency. If you don’t think so, then you werent paying attention. This blog’s about SoCal, and some of us have been in-state for a while. Reagan took his CA bag of tricks national. But what the nation experienced 1981 and onward under Reagan, was already happening here.

I was living in New York City in the 1970s. So I remember the Son of Sam killings, the ’77 blackout, and the city’s near bankruptcy, but nothing about California.

But Californians must have been pleased with Reagan. The state went to him in both 1980 and 1984 presidential elections. California also voted for Bush in 1988, which some pundits called a referendum on Reagan.

It was the fumes from those highly flammable polyester clothes.

Housing is tanking. The general public won’t realize this til it gets ugly in 2015.

Guys, guys (and gals :)), nobody seems to follow. You shouldn’t watch the housing bubble alone. You should watch the stock and the bond markets, they should fall first. The bond market will fall when the interest rates start to cripple up. And the interest rate will start to grow ONLY after the FED stops printing… Remember, all this “taper” talk is a complete hoax. As long as Belgium keeps buying, the FED can taper as much as they want with no harm to the bubble(s). The bubble(s) start(s) to crack already. Look at the stock market… but we have to wait when the DOW falls to bellow 16K level for panic to be set in place, so the wall street guys will run for exit. As I said, as long as the stock and the bonds at “all time highs”, no housing crash..

I do agree with you. But I also see stocks, bonds, and housing all coming down together. There will be no place to hide. Everything is topping out at the same time. While Bonds and Stocks will likely see larger price drops faster than housing. Housing will start trending lower simultaneously and when stocks and bonds start to level off or bounce a bit housing will continue tanking hard for a much longer period.

I am guessing the market will go higher due to hope that Ninja loans will come back in vogue again. Hopefully not since that will lead us to the same debacle as before.

The market/banks maybe betting on this in order to show things are rock solid. Like you say if another entity is potentially injecting money into MBS and/or bonds then obviously the whole mess is being covered up once again to make the FED not look like the one that failed. If I recall doesn’t the effects of the FED usually take 9 months for the market to react to? That would mean sometime next May or June we see the first wif of this unwinding if it really is happening. I think we may end up marching forward a bit further on the market with occasional dumps. Who knows. Just seems we are seeing another wall-of-worry climb with “uncertainty” leading the way.

All in my opinion.

While a sharp decline in the stock market could help precipitate a crash, it isn’t as “mandatory” as you’ve been implying.

The last housing crash (2006) began a full year before the stock market tanked:

http://investorplace.com/wp-content/uploads/2013/10/Home-Prices-Existing-Homes-Sales-CHART.jpg

http://stockcharts.com/freecharts/historical/djia2000.html

There are rumors that are gaining some steam lately that the Ebola virus has become airborne – which explains how some are contracting the disease without coming into physical contact with a carrier. Now THAT would have an impact on the stock market if confirmed.

“Guys, guys (and gals :)), nobody seems to follow.”

Agreed!

“You shouldn’t watch the housing bubble alone. You should watch the stock and the bond markets, they should fall first. The bond market will fall when the interest rates start to cripple up.”

I agree that we should be watching debt but I would focus on the grossly misspriced high risk debt. When the default start the interest rate on this class of debt will do more than “cripple up”…

“And the interest rate will start to grow ONLY after the FED stops printing… Remember, all this “taper†talk is a complete hoax. As long as Belgium keeps buying, the FED can taper as much as they want with no harm to the bubble(s).”

Your assuming that the Fed can control long term interest rates forever. What happens if they lose control of the bond market?

“The bubble(s) start(s) to crack already. Look at the stock market… but we have to wait when the DOW falls to bellow 16K level for panic to be set in place, so the wall street guys will run for exit. As I said, as long as the stock and the bonds at “all time highsâ€, no housing crash..’

The bond/debt market has to turn over all debt eventually the stock market and housing market trades on the margin which gives manipulators a lot of leverage to manipulate. I would watch for bond/debt defaults for a sign. The stock market is a rigged game and the “corrections” are only to entice the shorts back into the market. Then like the anaconda they are they squeeze the life out of the shorts…

Again, folks, there will be no such thing as housing crash, or stock market crash, when the SHTF, the entire system will implode and there will be no place to hide. If all the bubbles collapse simultaneously, it won’t be the “market” correction, it will be the market collapse. The problem as I see it is not the actual prices decline to a historic norms, who cares what the price of the stock (or a house) is if you don’t have a job and cannot provide food for your family. When the things get nasty, there will be no opportunity to buy, it will be necessity to survive. Remember, the biggest bubble of all is the USD, if it collapses, sorry, WHEN it collapses it will be a financial tsunami, not a correction, remember, in 2008… we haven’t seen nothing yet…

Stock, bond and real estate do not have to be correlated. They may or may not be (or have been), but it is not a hard rule as implied by some here.

Also, there were asset bubbles long before “central banking†and there will be asset bubbles long after. To assess the bubble entirely to Fed policies may be a misdiagnosis.

“Also, there were asset bubbles long before “central banking†and there will be asset bubbles long after. To assess the bubble entirely to Fed policies may be a misdiagnosis.”

This may be true but I have seen studies that show that the cycles are much more exaggerated with intervention than without intervention.

@Seatle…are we about to hear a pitch from you about buying gold?

“@Seatle…are we about to hear a pitch from you about buying gold?”

Tin foil is the new gold. Buy now or be priced out FOREVER!!!

Read this blog and the predictions and likely outcomes to makes changes now.

Not enough FDIC to bail out the big banks…open an account at a credit union today.

Stock market crash likely…start taking a percentage out of the market now. You likely won’t time the crash correctly.

Housing to tank…decide if it makes sense to keep your home if prices fall 30-50% if you have a lot of equity in your home…sell now and save your cash for the crash…

If you have a home and not a lot of equity, keep it…you can always default on your loan and many will again.

Job losses…re educate yourself to where you are your own boss or highly sought after fields.

Bank holiday…have some cash on hand.

Have two to three weeks of supplies to sustain yourself…most will not have enough beyond a few days.

You forgot tin foil!!! Rolls and rolls of tin foil!!! Rookie move…

I agree Christie! I think that’s great advice. One doesn’t need tin foil to analyze what’s going on with the money printing and who gets first cut. Always been that way, always will. Law of physics too. Bubbles burst. People need to understand exponential growth. Derivatives, how money is created to begin with. When those that create money, which is nothing but the thing that represents the real wealth i.e. the goods and services, have all the money, you know something is seriously wrong.

Rolls and rolls of tin foil to make hats.

a guy from Seattle …excellent, the US is the currency of the world any movement let alone collapse of that standard as a economic leader or powerhouse of world influence we as a nation become like a second mortgage, in the financial world we would be done.

All heck breaks loose in the greatest country The World as ever known, it as you said the tsunami that overtakes our country, pray folks, we are all in this one together.

@r, it is good that you find it funny. Tell me this. We are at full swing of money printing (again, no taper her, see the above posts) and ZIRP and we are falling back into recession (4% GDP, common, really?)… When the recession comes, and we all know it will, what the FED is going to do. We are technically not in ZIRP, but in NIRP if you count the inflation and the dollar devaluation. So, this is the first recession in the US history where it will start with ZIRP and money printing, the FED has run out of bullets to prevent the next recession. Of course, then can introduce NIRP and print even more money which, with stagnant wages and hyperinflation would definitely help. Remember, BRICS and the other countries consider dumping the dollar, the reserve status won’t help to save the USD. What happens next? Who needs worthless paper that the FED can print by trillions?

“Tell me this. We are at full swing of money printing (again, no taper her, see the above posts) and ZIRP and we are falling back into recession (4% GDP, common, really?)…”

Agreed, however, I would say that real GDP has been negative for sometime. When we say “recession”, we are talking about the commerce department’s phony numbers and even with the phony numbers, we are most likely already in a “commerce department phony numbers recession. No waiting necessary!

“When the recession comes, and we all know it will, what the FED is going to do. We are technically not in ZIRP, but in NIRP if you count the inflation and the dollar devaluation.”

This might just be the reason for the “taper”. Give the impression that we have tapered and that we will need a “new” Qsomethingorother…

“So, this is the first recession in the US history where it will start with ZIRP and money printing, the FED has run out of bullets to prevent the next recession.”

Pray?

“Of course, then can introduce NIRP and print even more money which, with stagnant wages and hyperinflation would definitely help.”

WTF? Stagnant wages + Hyperinflation = revolution I am not sure how this “helps” unless you like the smell/sound of guillotines in the morning…

“Remember, BRICS and the other countries consider dumping the dollar, the reserve status won’t help to save the USD. What happens next? Who needs worthless paper that the FED can print by trillions?”

I am not convinced that any of these countries will outlast the USD. That does not necessarily mean that I believe that the USD has a long life ahead. Just guessing at this point like the rest of us…

@ a guy from Seattle

Looks like you may be right.

http://www.theburningplatform.com/2014/06/05/nirp-after-zirp/

if you need to unburden yourself of this worthless paper, i know plenty of people who will take it off your hands.

@What? “WTF? Stagnant wages + Hyperinflation = revolution I am not sure how this “helps†unless you like the smell/sound of guillotines in the morning…”

/sarc 🙂 🙂 🙂

I don’t think anyone here has the market cornered on good ideas or predicting the future. I do believe that many scenarios cited above “can” happen but feel some are more likely than others. I personally think we live in too large of a police state, we are too fragmented by other ideologies to see a true revolution of pitchforks and guillotines (i think shaking up the nerves of those at the very top would be really good – i think most of us will just stay home and yell at our TVs or pound on our keyboards. Can we say Apathy?

The other factor that i struggle with is inflation. Putting this question out there to the group. What is the likelihood that inflation will continue to drive housing prices up (or at the least prevent a “crash/tank” for quite a while? After all, it seems that we’re finally going to start forcing some of that QE money out of the hands of the elite (who got first dibs) and into the hands of workers (via minimum wage reform)? At some point i think we have to start seeing those monies flow into the economy, after all the policies favoring home purchasing haven’t changed (favorable tax policy, rewarding of leverage vs buying what you can afford, etc).

Lastly while i personally think we’re in for hard times, i never doubt the ability of bankers and those in charge of our money to manipulate things ever more and keep pushing out reality. They’re not dumb people for sure and thus far have shown that they can be as creative as necessary to keep the wool over our heads. Perhaps all the shenanigans only save the big picture complicated numbers (GDP, unemployment, inflation, etc) but mean absolutely nothing to the working class now (ie, it doesn’t translate into a financially stronger middle class). I thought Bernanke himself had said there were still a few tools available (when at the peak of QE) in the event SHTF – not sure what tha would be but I wouldn’t doubt their creativity. Thanks for all the good dialogue, hope to hear some thoughts from all.

We watch serious world problems from Syria to Israel and everything in-between, but in front of our own noses America has deep, deep set issues. The press (?) can’t be counted on after it happens it is the “how did we know what was happening.”

like sub-prime, were Greenspan and so many others played the, it wasn’t me, I saw and heard no evil.

Americans for the most part are working very hard, some have yes three jobs to keep head above water, so don’t really have the time to know what is happening and of course for us who try to understand it all ,what power do we have, other then expressing it here in this forum.

The days of Vietnam type protest seem to be gone. I believe the Wall Street protests did they have a effect, did the press really care, we are so different in 2014, like zombies waiting to be plucked.

Maybe folks it is so bad that the so called experts like a team down 28 points with 5 minutes left, you have no more plays to call, it is over?

Can you say “NINJA Loan” perhaps not too far away.

From August 3rd LA Times

http://www.latimes.com/business/realestate/la-fi-harney-20140803-story.html

Are mortgage lenders finally loosening up a little on their credit score requirements — opening the door to larger numbers of home buyers this summer and fall?

It depends on what type of loan you’re seeking. If it’s a Federal Housing Administration-insured mortgage, the answer is a resounding yes. The average FICO credit scores for approved applicants for FHA home purchase loans have been dropping steadily this year, according to new data from Ellie Mae, a Pleasanton, Calif., company whose mortgage origination software is used by most large lenders.

lRelated

But if you’re shopping for financing in the much broader conventional market — where most mortgages are bought or guaranteed by giant investors Fannie Mae and Freddie Mac — scores have not budged for months. FICO scores averaged 755 in June, the same as in January, 4 points below their average for all of 2013. FICO scores run from 300 to 850; higher scores indicate lower risk of default.

Though credit scores represent just one factor that lenders use in determining whether to grant an applicant a mortgage, today’s average scores required of borrowers are far above historical norms and represent a high hurdle for many would-be purchasers — especially first-time, minority and moderate-income buyers…. ”

follow link for entire article.

Slow – NIJA is sooo 2005…

What a surprise…

I love everybody discussing the tankage. It’s so much fun. So where will all these trillions in wealth will go if not bonds, stocks or RE? Cash? Baseball cards? What have you? No we will not go up forever but maybe the risk of bank bail ins is as high as RE or stocks dropping so I can see billionaire carting truckload of cash to their private vault for “safe keeping” for better days. That will be the day I guess.

The “wealth” never existed. That is the real nature of a ponzi investment scheme…

“So where will all these trillions in wealth will go if not bonds, stocks or RE? Cash? Baseball cards? What have you?”

To the same place they came from. Virtual money create a virtual reality. In the last few years, the few extra trillions, where did they come from? From Bernake’s computer. Write some zeros on the computer with one in the front and wire them to Geithner at treasury as a loan. Now the taxpayers have to pay interest to the good old banker’s club, the FED; or I should say to shareholders of the FED who are also the owners of the US Plantation and government- Citi, Wells Fargo, Chase and BofA.

In the last recession, all the trillions of dollars, where did they evaporate? Virtual money go to ether.

Money might be virtual but there’s nothing wrong with it. Fine, we can go back to paper if you don’t mind carrying a thick wad or stack of it to pay for your goods. If the country economic activity increases than the money supply should also increase by the same token. Argentina just defaulted last week, did I see any tax payer paying? If we default, than nobody will pay anything but our credit and the dollar is shot and debt [money] will get destroyed. Nothing wrong with that. Just like any other business, if you not successful, you will loose money on your business venture same as depositor loosing money for making bad loans. Lets see, we’re running a deficit of almost a trillion and the debt we serviced is only 17*.025 = 425 trillion or half. No we are still not paying for it. This go back to why they will print away. And if you hold cash you will be at the short end in the long run. All the trillions that you spoke of went to repair the busted bank balance sheets but a lot of them has been paid back. Even though most of the loan is bad in the last recession, this country has been buoyed by venture capitalists willing to risk their money to invest in new ideas, businesses. It could have been a lot worse if the FED didn’t print the money but I did digress that they over did it.

“If the country economic activity increases than the money supply should also increase by the same token. ”

The problem is that we live a debt money system and you can’t increase the money supply if nobody wants to borrow or they can’t qualify to borrow. Every single dollar out there is created through debt. If everyone wants to pay down debt because their income decreased and is hard to service or because it is a high risk environment and they are afraid, then the money supply decreases (the debt portion of the money supply is the largest).

The government can force people to borrow if they want but only shortly. If they can not service the debt, then the house of cards collapses like it did in 2008. Money supply increase is not the same as increase in wealth. If the TRUE rate of inflation is higher than the GDP, that means that the economy is contracting even when the nominal GDP is positive. Just because you publish bogus CPI does not mean that the GDP is growing. People still feel the contraction in decreased standard of living. In eastern bloc countries, at the begining of nineties everyone was a millionaire in their national currency but their standard of living collapsed because of higher prices.

In regard to your explanation of paper money I understand that. That was not the point. I was just taking about money supply increase overnight out of nothing to lend to the government. You can create the illusion of wealth increase, but that is all it is – an ILLUSION. The real economy based on the real inflation (not bogus CPI numbers) was contracting all these years and that is what people are feeling.

Obama can tell you everyday that the economy is better; if you don’t have a job or you can’t put food on the table or you can not fill the tank, all that talk is meaningless.

“If the TRUE rate of inflation is higher than the GDP, that means that the economy is contracting even when the nominal GDP is positive.”

Hmmmmm

I thought that GDP was inflation adjusted so I am not sure there is such a thing as nominal GDP but I could be wrong. I am not convinced that anyone really knows how they make GDP. I guess it is grown in some laboratory in area 51 using alien technology.

Otherwise I completely agree but you would need to define a couple of words like “true”, “economy”, “higher”, “contracting”, “is”, “positive”, et cetera for me to be sure…

Similarly, home ownership rates for those under 35 peaked in 2004…

http://cnsnews.com/news/article/terence-p-jeffrey/homeownership-rate-americans-under-35-peaked-2004

Don’t worry people as of today US assets are at $82 trillion

vs liabilities at $ 89 trillion. “RECOVERY”

We need to up the “Goodwill” balance sheet account 7 trillion and then we are all good!!! I love the nebulous nature of “Goodwill”…

“Stocks will significantly outperform bonds in the years ahead as investors get used to interest rates that will rise more than consensus expectations, according to an analysis from Goldman Sachs.”

Gotta love GS! So, how does this work again? Interest rates go down stock market goes up. Interest rates go up stock market goes up. Got it! So, the stock market can only go up FOREVER!!! It will NEVER go down! NEVER!!!

https://finance.yahoo.com/news/goldman-dramatic-divergence-coming-market-134147501.html

I believe when the bonds interest goes up, the stock will go down as bonds would become more attractive. The only problem is – not gonna happen. I don’t see the interest rates (long term) going up any time soon. The only buyer of bonds at this moment is the FED. Who would ever buy bonds with yield lower than the inflation level?

Not according to GS and I live my life according to their teachings…

I will take economics for $400 Alex…

Question: “The only buyer of bonds at this moment is the FED. Who would ever buy bonds with yield lower than the inflation level?”

Answer: Who are Belgians?

Alex, I’ll take Economics for $700.00

Question: Who is paying negative interest rates to depositors to “hold” their money”?

Answer: Who is Belgian Banks

Any of you house horny ladies and chaps are interested in prime Thousand Oaks are real-estate. Amgen is laying off 2900 people. Recovery!

I lived in Cornhole (Conjeo) Valley for a half decade, in Thousand Oaks and frankly, being a single man at the time, was more than happy to leave TO and return to Santa Monica.

Anywho, the Amgen layoff is bad news, but the 2,900 people who will lose their jobs are made up of locations in Washington, Colorado and Cornhole Valley. According to LAT, many will be under voluntary buyouts. Lets say it is 2,000 at the Cornhole Valley offices. Some will get a voluntary buyout, some early retirement compensation, some live far from Cornhole Valley and some will find local work for other hi tec firms. Some will be stay at home moms or dads till their spouse can find a suitable relocation as well.

Sounds grim at first glance but I dont think it will hurt home prices too much in Thousand Oaks (over 5,000 oak trees actually).

http://www.latimes.com/business/la-fi-amgen-layoffs-20140730-story.html

The whole concept of bubbles are soooo confusing to me. I studied economics in the neo classical age and we NEVER discuss silly superstitious wives tails about the mythical creature called an “asset bubble”. THEY DON’T EXIST!!!

This guy needs to find a comb and a member of the Chicago school of economists before he blows a gasket.

https://www.youtube.com/watch?v=QU5TIQIGzVk

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

There is no such thing as an asset bubble.

etc…

Wives don’t have tails???

My has a tail AND horns!

My WIFE has a tail AND horns!!

Did you forget the sarc. tag?

Interest rates have nowhere to go but up, housing prices have nowhere to go but down. Not even taking into account higher food prices, people losing their jobs, taking pay cuts, etc.

Interest rates go up, housing goes down……period

Take a look at online reviews of the Blackstone Group’s property management company, Invitation Homes. They’re horrendous. Take a look at the large number of BBB complaints. My guess? Blackstone and other institutional investors will sell off everything and be out of the rental business in a year or two. Unless they go bankrupt before they have the chance. These big institutional investors had no idea what they were taking on getting into the rental business. Blackstone bought heavily in Southern California. Maybe when they liquidate, the glut of homes they release onto the market will help bring prices down, but who knows? Wall St. always seems to find a way to screw us common folk.

Leave a Reply to a guy from Seattle