Rental roulette on the west coast. California foreclosures are up 22 percent from Q4 of 2010 to Q1 of 2011. Santa Monica buy versus rent example. Rent for $5,500 a month or buy at $1,950,000.

The number of homes foreclosed on in the first quarter of 2011 shot up in California by 22 percent from the fourth quarter of 2010. Notice of defaults remained rather steady in California. The reality of the situation is that the market is divided between normal home sales and distressed properties. This divide is virtually down the middle nationwide and in California there are more distressed properties than normal homes for sale. In other words the market is still incredibly flawed from multiple vantage points. The only reason things remain stagnant is because of the Federal Reserve intervening in the mortgage markets and also allowing the suspension of mark-to-market accounting. This is like pushing pause on your favorite sporting event when things are not going your way and expecting the results to remain. However the major issue for the housing market is how do you get actual household incomes up to justify current price levels? The Fed has tried unsuccessfully to boost prices and now inflation is leaking out in energy, medical, and food costs.

California foreclosure picture

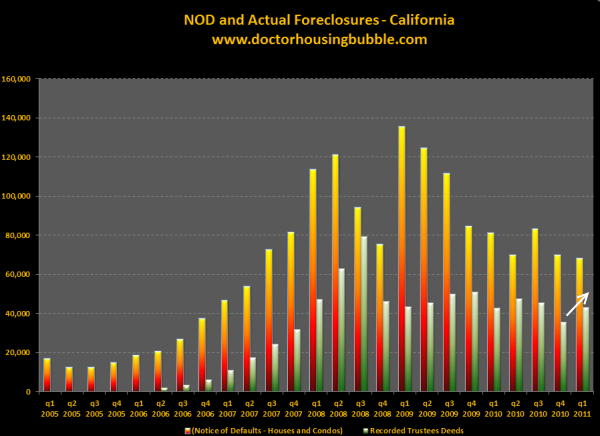

I think it is useful to put the overall market in perspective here. From Q4 2010 to Q1 2011 actual completed foreclosures jumped by 22 percent. Notice of defaults remained steady although how much of this is due to banks simply not moving on the current backlog of shadow inventory? It might be useful to aggregate the data and see how things were during the good days of the market:

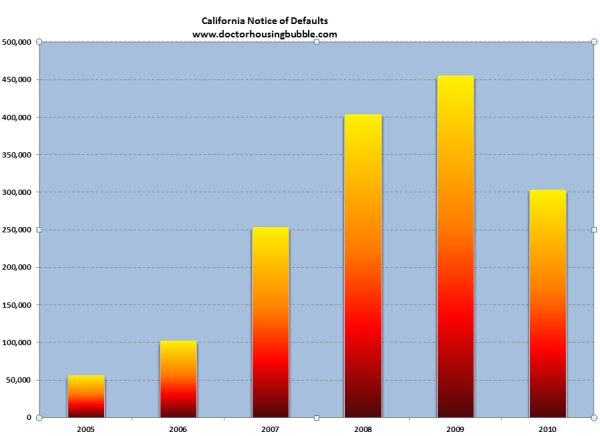

In 2005 notice of defaults for the entire year were slightly above 50,000. Last year even with an artificial market we still had 300,000 NODs filed. What about actual completed foreclosures?

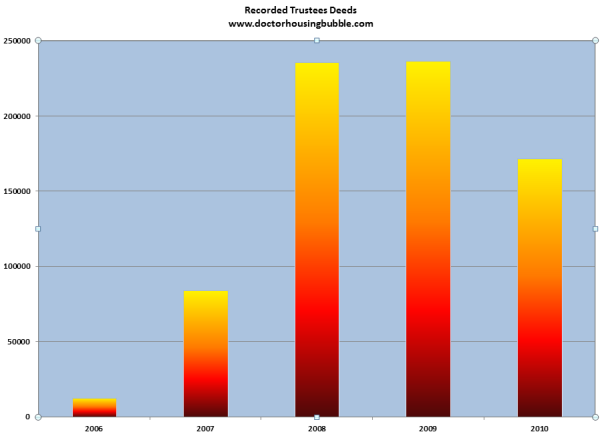

I always marvel at this chart. In 2006 California witnessed roughly 12,000 actual foreclosures for the entire year! In 2010 this number was up to 171,000. Clearly the market is still battling with the aftermath of the bubble bursting. Another item that is rarely brought up is the California budget. Do people simply think that if we don’t talk about it that it will somehow resolve itself? I’m not sure if people really understand the deep changes that are coming down the pipeline.

Should I rent or buy?

This is a common question. The answer of course depends on the home you are looking at and your income. However many people that ask this question are usually looking at areas like Pasadena and Culver City that are simply entering the genesis of their correction. I rarely get asked about buying a home in the Inland Empire to live in (many do ask about this area as an investment property).

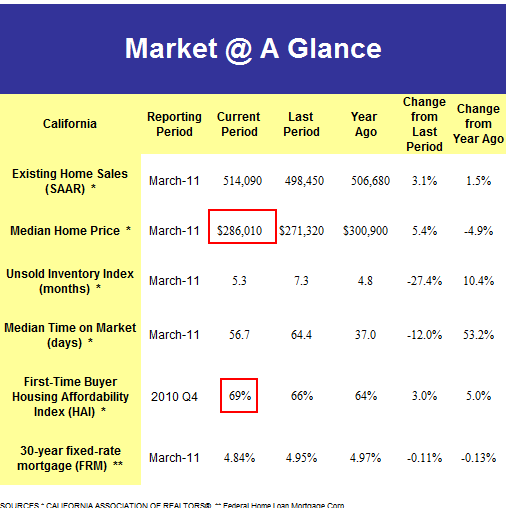

The reason I think we are still years away from any normal market is the fact that there is still a large appetite for housing. The current market is now dominated by investors and first time buyers. These buyers are picking lower priced properties but again, a bulk of these people are speculating even for cash flow purposes. Psychologically assessing the market I believe sentiment is still too strong in some areas. The bottom will come when people look at homes more as a place to live instead of an investment. The California market is facing challenges ahead:

The only things keeping this market together is artificial methods of intervention like the Federal Reserve and accounting gimmicks. These actions have kept the above data stagnant for a year but how long can this game of pretend go on? If incomes are not rising then how are households going to pay for their home? What if mortgage rates start retreating to their more historical average? Ultimately incomes have to go up or home prices have to go down.

We see the same key players as the dominant players in the foreclosure game:

“(DQ News) The most active “beneficiaries” in the formal foreclosure process last quarter were JP Morgan Chase (9,634), Wells Fargo (8,329) and Bank of America (7,158).

The “servicers” (or the Trustees in the formal foreclosure process) that pursued the highest number of defaults last quarter were ReconTrust Co (mostly for Bank of America and MERS), Quality Loan Service Corp (Bank of America), California Reconveyance Co (JP Morgan Chase), NDEx West (Wells Fargo) and Cal-Western Reconveyance Corp (Wells Fargo).â€

Bottom line problems still are deeply embedded in the California housing market. Take a look at this example in prime Santa Monica:

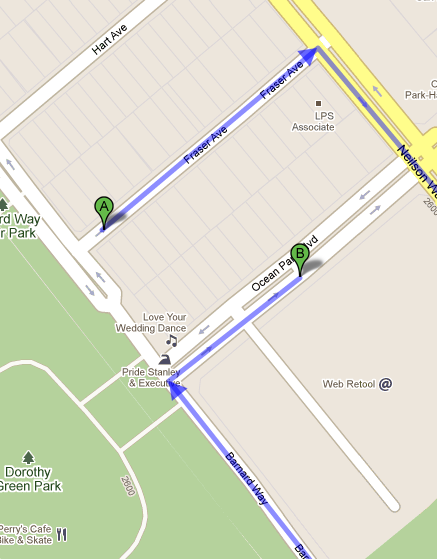

117 FRASER AVE, Santa Monica, CA 90405

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1.5

Square feet:Â Â Â Â Â Â 1,909

This is a nice rental in the prime location of Santa Monica. But look only a few homes away and you find this:

140 Ocean Park Blvd, Santa Monica, CA 90405

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Square feet:Â Â Â Â Â Â 1,502

The rental is going for $5,500 per month while the home is for sale at $1,950,000. How far apart are these homes?

Technically you are a little bit closer to the ocean with the rental. Welcome to California housing folks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

61 Responses to “Rental roulette on the west coast. California foreclosures are up 22 percent from Q4 of 2010 to Q1 of 2011. Santa Monica buy versus rent example. Rent for $5,500 a month or buy at $1,950,000.”

California RE “values”… LOL. Guess The Doc wanted to digest today’s release of more dismal numbers from Case-Shiller… OTOH, that index has a 2-month LAG, so it’s hardly “news” to this forum. ;’)

Holy Skewed Prices, Batman! If I understand the numbers in Doc’s Santa Monica example, that’s a GRM of over 350–INSANE! Owner either got it for MUCH less, or is taking a bath, only slightly cushioned by the (alleged) $5,500/mo.

I just drove through a town on the California coast. I saw quite a few “for sale” signs. One house was cute so I stepped out and got one of the info sheets below the for sale sign. They want $650,000 and guess what…..the paper said “…..this home is a one of a kind fixer! Wanting your attention and loaded with potential.” I didn’s see the inside of the home, but it is obviously need a lot of money to fix it up, or else the paper would not have forwarned any interested buyers like it does. It’s a 4 bed, 2 bath, 2046 sq. ft. home.

Somebody get me a barf bag. This is insanity. As I drove around the neighborhood after seeing that house, I thought “it’s a very slow, painful process coming down off the housing bubble high.” It’s almost like withdrawl from a powerful drug. Who would have ever thought that a person would shell out $650K for a fixer-upper in the United States? For full disclosure: this house isn’t a mansion. It’s an ordinnary, old home!

I hope no poor fool takes the bait. This housing bubble insanity has to have a silver stake driven right though its heart!

http://photos.bravenet.com/272/478/925/3/632EFDD34F.jpg

I agree the rent/buy ratio is a great metric for determining the health of a market but this example may not be the best. The house for sale is a single family house, the rental looks like a condo… People around here pay a premium for a “real” house with a garage, backyard, et.al. That house would probably rent for $6500… But the point is still made as even that yearly rent is far below the 9% of purchase price that patrick.net says is a buy situation…

You brought up psychology and that reminds me of a survey I saw a few days ago that said most Americans (overwhelmingly most – like over 80%) still believe a house is a good long term investment. Though they may be delusional, will this affect the market? Work from some innovative young economists is revealing that the price of stock is affected by perceived value as much as real underlying value… Could the same be true of houses?? Comments, insights Dr. HB? Anyone?

actually it’s the other way around. the house is the rental and the condo is for sale.

And so it is… sorry about the mix up. However, I also see that the condo is a penthouse with major upgrades. I mean its really gorgeous and the house is a bit of a dump inside. Not to justify the discrepancy but they are very different living situations…

Excellent again Dr.

Some of us have been patiently waiting for a place we could afford on our “actual” income, and it’s now years later. I still get the feeling that in 2-3 years there will be some other rabbit the financial industry will pull out of there proverbial hat to continue to crush the middle class with debt for unaffordable housing. I think my parents were the last generation to live the American dream. For the lot of us it’s two incomes and barely getting by. We make well into 6 figures, and watch our spending yet I can’t afford a home in Burbank for Gods sake. I’m not talking luxury, just middle class Burbank. This is a joke. I’m losing hope.

This might well go on for another 2-3 years. The Fed still has tricks up its sleeve. For example, they can keep interest rates down by basically offering insurance contracts on Treasuries. This reduces the risk, and is cheap. They did this once before, during the dot-com bust.

Plus you still have the FHA writing purely speculative loans which require only a few percent down.

If the former reminds you of the AIG blow-up, and the latter reminds you of the subprime blow-up, you would be correct. Only this time, there’s no one to backstop the Fed.

Which is great if you’re saving cash. It may take a while to get there; but we will get there.

I’ve been watching Burbank for about 6 months now. From what I can tell, it’s coming down. We’ve been putting in low ball offers, but we’ve got a lot of competition from investors. I’m finding the best deals in short sales that don’t need upgrades. We’ve got time on our side and I think that is key… especially because now isn’t the best time to buy. The homes we’ve been tracking in Granada Hills, North Hills, Northridge and Sherman Oaks have all been steadily sliding since I’ve been tracking them (all neighborhoods asking price down 2-3.5% since December). Standard Sales also seem to be throwing in the towel. There is a flip in our neighborhood that drops 10K about every 1-2 weeks. I think the flip investors may start looking elsewhere for investment especially if prices keep falling.

Correction is happening. Stick to your guns.

I hear you loud and clear. Maybe Bernanke’s press conference will be relevatory today and Benbo will promise the U.S. he is commited to raising interest rates…

Or the Fed will continue on its path to devaluation and inflation.

Pray for higher interest rates and downward pressure on the CA home prices.

Bummer. Bernanke says interest rates will remain low for an extended time.

http://www.reuters.com/article/2011/04/27/us-usa-fed-bernanke-highlights-idUSTRE73Q6ZU20110427

Dink dink dink… (The sound of a can being kicked down the road)

CC, who cares about losing hope, at least your not losing money.

It’s the quality of life not being able to own your home, fix it up have a real social life that is missing in CA. Losing money is terrible of course but not having a life is worse. As an outsider CA has beautiful weather and that is about it.

CC said: “I still get the feeling that in 2-3 years there will be some other rabbit the financial industry will pull out of there proverbial hat to continue to crush the middle class with debt for unaffordable housing. I think my parents were the last generation to live the American dream. For the lot of us it’s two incomes and barely getting by. We make well into 6 figures, and watch our spending yet I can’t afford a home in Burbank for Gods sake. I’m not talking luxury, just middle class Burbank. This is a joke. I’m losing hope.”

I totally agree with you, and I wish I didn’t.

It’s not just the financial industry. Try being self-employed and paying for your own health insurance. Mine just went up about 30%–again, and they’re raising all the deductibles–again. If my husband and I spent the money on doctors that Blue Cross extorts from us, we’d have the best medical care in the world–for the rest of our lives. I don’t know how we’re ever going to make it to Medicare, even though we’re not that far away. We’ll be bankrupt before that.

Patience!! It might not be what you wish would happen, but it actually took 20-30 years for the housing bubble to be created. The problem, or at least one problem, is the delusional sellers, who still try to sell homes for more than they are worth. Makes the return to normal very slow, and painful.

the market is defined by buyers and sellers. Delusional sellers are only delusional if their asking price is not accepted. Then they either delist and no sale occurs, or, the lower their price to find a buyer, and Define the Market. Homes generally sell, even in this market, at 95-97% of asking. But they do not sell at all if the seller is “delusional”

So, if you’re making well into 6 figures (above 200k at least?), then you should already be able to buy good houses in Burbank, no?

Not saying prices are right but just that I don’t understand the math here…

CC: I feel your pain – we are looking to buy in La Crescenta/Montrose and seeing dumps for $450,000. (Fixer Uppers). I guess things are looking up, as those homes were in the $600K price range before. I’m renting a nice two bedroom house in Montrose with a gigantic front & back yard for only $1750, so I can’t justify buying right now.

Funny thing. You give away money for a decade and nobody wants to leave monopoly game LaLaLand; hence, freeriders galore from the non-paying squatters, bailed-out banks, and every taxpayer who thinks that we can avoid being given the bill for this fiasco.

Is CC’s comment above about the loss of the American Dream of Home Ownership a reality or a commonly held fear? I am questioning if I ever will buy a home given the future of our debt markets and the painfully slow retreat of home prices.

My questions are for the investors buying single family dwellings to rent and flip: Who are your buyers when you are ready to market your “re-postitioned/rehabed” property? And secondly, how is owning a single family dwelling for a rental property in LA, OC or the IE creating a positive cash flow either leveraged or as a cash purchase? I don’t know the market, but it is hard to imagine a decent ROI in such a soft market.

the flippers/investors/speculators are going to get burned–not in all cases, but quite a few. Those who think they will make rental profits are, in some cases, going to be proven wrong. Same for those who think the market will magically turn around in 1-2 years. Homeownership was “the American Dream”, but there will be a new mindset…one of renting is OK, especially when the Asset(house) continues to drop in price over the next several years.

In the IE you can buy a 3+2 SFR for $150k, rent it for $1,000 a month, raise the rents 3% a year, pay taxes, insurance and modest repairs and sell it in 5 years for an ROI of around 9%.

That’s for an all cash investment. Put down 20% and get a 6% interest-only due in 5 and the returns approach 18%.

Hopefully now you see why there are so many all-cash buyers floating around.

Yes. Thanks. As long as the renters pay the rent – it sounds solid.

And all those rented homes are filled with perpetual debt slaves, but that’s ok, because big business, er I mean landlords, get to make money but not doing a damn thing.

I’m tired of the a$$ kissing that goes on to business scammers. Bring the 90% tax rate back to the rich like FDR days…you know, when America made the best roads of any nation and infrastructure that to this day serves us. Wait, nah, on 2nd hand, make millionaires pay ZERO tax so they can create more Taco Bell jobs for the debt slaves YOU can rent too. Make your living off another persons misery, yea, it’s what America is all about. Unrestrained capitalism, every repugnantcan’s wet dream.

Raise the rent 3% every year? Are you kidding me? I’m renting in the San Gabriel area, and I’m looking at a 5% DROP in rent from last summer. Get real.

Are housing prices too high in the economically important areas (close commut to industry) or are rents too low?

The baby boomers in Southern CA are going to start panicking when they realize their homes are going down in value and they have not saved properly for retirement. Ther are a lot of track homes neighborhoods where people have lived for 30-40 years without much turnover. I see that changing. They have always known they can move to Palm Springs or Scottsdale and pay half for their homes if they have not bled the equity.

Since NEVER in recorded history have any except the top 5 -10% been able tor reitre on what they had earned/saved/inherited, pleasse explain the nonsense of “The baby boomers in Southern CA ….have not saved properly for retirement”

NO ONE in the bottom 90 -95% has EVER been able to retire on live on their savings!

And don’t tell me it can be done now by gambling on the stock market and praying that you (a) won’t lose money (b) will make money and (c) market won’t crash jsut when you need to quit …… and oh yeah, that somehoe you are a good enough gambler to make enough money to have an income in the last years of a 25 -30 year retirement that is up 369% more than you need the day you retire. Good luck on that idea!

“Retirement” as a concept really didn’t begin until after WWII with pensions (Pensions -not 401ks) and Social Security. Before then, people tired ot save some money so they when they physically couldn’t work anymore, they would have a little bit to help pay for their food.

Before penisons and SOcial Security, here is what happened to the elderly or injured who could not work until they died:

(1) QUit working and were supported solely by their younger relatives (yep – the reason for having a huge number of kids!)

(2) Quit workiing and went to the poorhouse to die

(3) Lived on the fringes and prayed to die as soon as possible

RE has been in the dumper since 2007. So it’s about 4 years now. I’m thinking this next leg down will change the psychology of people about housing being a decent investment.

I sure hope so. I’m thinking this second leg down will definitely depress this first wave of investor purchasing, and scare them away from this “investment” opportunity. Of course it will probably attract a new wave of investment.

My guess is that this first and second wave of investment will be tired after a few years of slow decline, slow purchasing, and a return to the norm. I’m betting it will take a few years for a shallow long run bottom. Then a slow, upwards normal trend should resume.

Can’t wait for Interest Rates to go up. Praying for laws that require 20% down.

I can only go by the last CA real estate cycle of 1990 to 1996. I still remember that by 1995, no one wanted to buy a house in CA. Then it started to rise in 1996 and people still werent ready to believe it was a good investment. So I think we’re about there from a human psychological aspect. One or two more years and real estate will start to be shunned.

“Can’t wait for Interest Rates to go up. Praying for laws that require 20% down.”

You will be waiting for a LONG time for rates to go up. There will be QE3….QE27 well before the Fed ever allows rates to rise significantly.

Same for the 20% down issue. Ask yourself, will prices drop substantially if the powers-that-be instituted a mandatory 20% down? (which I think it should be instituted by the way)

If the answer is yes, prices would go down, then you know what will happen – 20% will never be the norm, at least for government sponsored entities (cough… FHA… cough). Because we all know what would happen to prices.

Stop using logic and common sense to predict the future, in today’s America you will always be wrong.

@CAE – curious… is the 1995 psychology related to the Northridge quake of 1992?

When I first moved to LA in 2001, I thought it would take an earthquake to enable me to someday buy a home. Then the bubble started to occur, and I thought something was fishy. Had no idea that this bank disaster would be more powerful than an earthquake.

Wow…and as a resident (and renter in Santa Monica) I initially thought the RE Rent vs. Buy comparison might not be fair given the types of property, i.e. one is a SFH and one is a Condo. I was wrong! 1) the sale at $1.95M is the condo and therefore may appreciate less than the SFH that is for rent at $5,500! …2) The $1.95M condo’s last sale was for $1.45M in March 2006 (peak of market anyone?) and now the buyer expects someone to pay $500,000 more, 33%+ more? Ridiculous!!! In all fairness the owner of the SFH on a prime lot probably has an incredibly low mortgage (if any at all) based on the $58,000 taxable value listed on Redfin, but there are plenty of other examples of homes bought post-2000 with reasonable rents that make the prospect of buying in many of these beach communities look like a bad financial decision vs. renting. As always great observations from the Doctor.

Back when I was poorer, I thought it would be nice to have a home on the coast- Pismo Beach, San Luis Obispo, etc. Now I have the means, but no longer the desire.

Prices there are still insane. $1,000,000. condo? In Pismo Beach?? PLEASE!!! This is an old beach town, not La Jolla.

California prices have a LONG way to go down- probably the slow motion collapse will take a decade or so. Either way, I am no longer interested.

I gradudated from Cal Poly and always thought it would be a great place to buy a home and retire in the community of SLO. My brother just bought a home up the road in Paso Robles for a great price. The same home in SLO would easily be double what he paid in Paso. So I agree with you, no desire to be in the areas you mentioned. Over priced and for what? To say you live there? Another leg, or two down is coming for all RE markets in Cali. Look, the State is broke, the Feds are broke and there are no more silver bullets to stave off what most sane people see as a correction. The kind of correction that is line with incomes supporting local home prices. Not the baffoonery we have been living through since 2000.

My fav part of the state, some of the best surf in CA is in that area….

Baffoonery indeed – Greenspan as the stoic ringmaster of the Baffoon circus..

CC, I don’t understand.

Why do you need to purchase a house to feel complete or that you are living the American Dream?

I live in a gorgeous upscale area, pay a rent that is ~ half the cost of what an equivalent purchase would be, drive an upscale luxury sports car, and generally live a happy life that I am very fortunate to be able to afford.

I’m baffled as to why a couple making six figures in LA, like yourself, cannot do the same. I’m also baffled as to why owning vs. renting would change any part of that.

You are so right. The thing is that to feel like renting isn’t the worst thing I rent a $2200.00 house that needs work, and I have procrastinating landlords who live next store. They’re yard looks like a dump, and the front driveway is dirt. This house has breezes blowing through it. I could move to a nicer house (rental) but it would be in the $2700 range. Can’t save much that way. I don’t want to upgrade my landlords house. I don’t even want to buy new furniture because when I move in a couple years it might not fit in a new place, let alone putting any built- ins such as closets. I feel trapped.

CC — there are LOTS of easy answers. Just pack up and get of California. I did years ago and have not looked back since. Sure I missing a few of the outdoor activities, but I look at my tiny mortgage, good check book balance every month, and I realize it was the best thing I ever did. Push the Eject button now!

be patient, keep saving your money. My payment is less than your rent, market is long way from bottom.

You feel trapped????

Try buying a home in 2006 only to see the value of your house drop like a rock. Now try selling that house in this market because you need to move for your job and you are still looking at a $50k to a $100k loss if you do find another sucker willing to buy.

Still feeling trapped in your rental now? Count your blessings.

I was incredibly dumbfounded when I read that same statistics about the majority of Americans still feeling that housing is the best long term investment.

As long as that thought is prevalent, housing will be a screwjob. I’ve given up the idea of ever owning personal residential property in CA. As for the properties my family owns, I will likely liqudate or rent them someday, but knowing this state, whatever ROI was made would get taken by property tax.

*sigh* I was born and raised a democrat…. but I become more and more republican as I age.

For all you real turds and I will do the arithmatic for you, a house purchased in 1998 is now worth half, check this out:

“For some homeowners, prolonged financial trauma has transformed their attitudes toward spending. Tom LeTendre, 47, a food services warehouse operations manager, and his wife Diane, 50, lived well in the years after their 1998 purchase of a $98,000 home on the west side of Phoenix. “We were very comfortable. We went to dinner when we felt like it. We bought the things we needed to enjoy life,†he said in an interview.

Repeated Borrowing

Over the next few years, as home prices rose, the LeTendres repeatedly borrowed against their home. They refinanced into an adjustable-rate mortgage for the final time in 2006, a year that saw Phoenix prices jump more than 40 percent. Today, with an annual household income of about $80,000, they owe about $260,000 and have stopped paying their mortgage. Homes in their neighborhood have sold recently for $45,000 to $65,000, according to Zillow.com.”

http://www.bloomberg.com/news/2011-04-27/phoenix-underwater-mortgages-show-housing-s-threat-to-recovery.html

No pity at all for the LeTurdres, nor the skank-bank that loaned them all that funny money. Had they been able to run a simple spreadsheet, they would’ve taken out a 15-year mortgage–NOT 30–in 1998, paid it every month on time, had STELLAR FICO scores by now, some REAL equity in their PHX homestead, and be just 2 years away from CLEAR TITLE, stay put there, and thus be able to point that monthly payment at a SECOND property, for vacation, rental income, etc.

It’s one thing (though not very mature) to have a baby on the way, etc., and be talked into buying a SFR by a Real-turd, and the year just happens to be 2006, and you’re a “Good Joe”, but not really market-savvy… it’s quite another to have locked in a pre-Bubble (1998) price, have a respectable (apparently stable) family income, AND THEN HIT THE HOUSING ATM for no good reason, other than you’re a boob-tube-brainwashed moron who “needs” a ridiculous Hummer-1, and fiberglass speedboat you never even use anymore!

I think there is quite a bit of private financial pain with many people in the United States that bought into this fiasco. I think everyone involved is going to be scraping by at the end of their lives. I’m glad I can use it as an example of the need to really understand the numbers and plan my future well.

I’ll be happier knowing about the great dinner I’ll eat tomorrow, rather than the one I’m eating today.

I am very appreciative of this site. I am a single man renting in Santa Monica. a 1 bedroom apt 8 blocks from the beach for $1240 per month now. (I moved in, in March 2002 for $950 per month and it has increased under City of SM Rent Control limits). I rent out the garage for $150 = $1100 per month net rent. 1 bedroom units in my bldg now rent for $1500 per month. This blog has helped me see I am not in a bad position AND now that I can afford to buy a small house in mid-cities LA, I am just sitting back and for the first time feel I am in the drivers seat (meaning no longer feel like a loser not being a homeowner). I concur with many on this site, who have somehow been hoodwinked into thinking I am not ‘somebody’ till I own a home.

By the way, one of the homes I looked at was $300K five months ago in the LA 900198 zip code but I decided to wait. It is NOW $259K. That price drop is roughly 10K per month. And I found out it was purchased for $224 by a flipper in Oct. 2010 – seems to me some of these flippers will be taking a loss as the year goes on. Any comments from other LA renters welcome 🙂

People, come on now, renters are not losers!! We’ve all been brainwashed with the American Dream of Home Ownership bullshit for too long now. It’s like the same crap us women are force fed from an early age…” of course you’re going to get married, buy a house, have three kids,” ummm, NO, not necessarily. We have choices in this world: follow the mainstream or do what is best for us as individuals….end of sermon 😉

Prop 13 has ruined any sort of efficient real estate market here in California. It basically carries forward most of the tax burden to the buy side of the equation. Any sucker willing to buy in this environment is duped into taking on the latent tax burden of the seller. I don’t know anyone who would willingly pay someone else’s taxes, but this is basically what happens when you buy a home in California.

Guys, I am leaving you. I am buying a house in South Torrance. I am waiting for this calamity to be over since 2003 and I am throwing the towel. I should have bought before 2 years. Since then prices have gone up now are coming back down but I don’t believe we will see even the bottom of April 2009 in middle class markets. Every house in Torrance/Redondo which is reasonably priced in low 500K is gobbled in 2-3 weeks. What I mean reasonably is according to the rest of the market. Market and prices are crazy, but good area of LA has shown to be very resilient to declines. In Torrance I see max 20% down from peak and at that level there is demand. That is it no matter how crazy is sound it is fact already for 2 tears, how long should I wait… I understand the point of the good doctor, but have to respectfully disagree on what the actual problem is. It is not the high prices but the inflation which is created along the pumping of the bubble before 2006. I am talking for the inflation in rents, which justifies the prices. The house I am buying will have PITI about $3300/mount, but similar rental is $2700. The part of the PITI which thrown to the wind (and is comparable to rent) is the ITI – interest, taxes and insurance, which is about $2500. If you plug in the equation the tax deduction this goes even lower, but even $2500 is already lower than rent of $2700. The back of the napkin calculation of the renter does not work here. It might work in Santa Monica and Beverly Hills and the again work in Riverside, Palmdale and Las Vegas but not here where normal real people actually want o live… Our government is creating inflation and this puts bottom to rents and RE prices. Sad but true, that this government (please, talk to me how different are democrats and republicans) is not working for the interest of the middle class, which is the backbone of this society, not the rich not the poor… I know I sound like a troll, but I just cannot ignore the facts on the ground and that is the prices in the middle hoods are going sideways since spring 2009. In the prime hoods and gangland I see more trouble and long grind, but even there long and shallow…

Well, you can certainly be happy you didn’t buy in 2006! Torrance/Redondo is definitely an awesome area. Wish I could afford there now. Surfaddict, there’s an awesome break in Torrance. If you ever visit, bring a helmet…. The locals throw rocks from the cliffs. 😉

Good Luck with the move.

Inflation in the CPI will create downward pressure on home prices (i.e. less savings, less money for discretionary, more money for gas, food, clothing, etc. – less money for mortgage/rent).

“Our government is creating inflation and this puts bottom to rents and RE prices.”

Someday maybe, but the fat lady is just warming up with a few scales at this point.

Bottom! We don’t need no stinking bottom! Buy. Buy. Buy. BYE.

Not true. The only proven harbor for money and I mean Money, not money for groceries is housing. It happened that in the time of the Great Depression even gold was confiscated from public… Otherwise I understand the pain, I understand that the whole direction in this country is wrong, I see the monster moral hazard that is been created just to preserve the bank capital … I am with you guys. Realistically the price of the house I am buying should be 100K downwards but I doubt we will see even 50K decline from here. And waiting for 50K down from here in period of 3 years is same 50K down the drain, without any trace of it left … What I am saying when I move in I will turn on the TV to what the catastrophe I am sure it will be televised…

Good luck to you. As a good house warming gift, I’d like to leave you with this question:

What, if anything, has changed to prevent the Crash of 2008 from happening again?

From what I see, very little. And the efforts since then have made preventing the next one much weaker, and the results much worse. It’s only a question of “when”, not “if”?

I hope you’re paying all cash, because debt will be a real millstone the next time around.

Torrance and Redondo have great schools, are close to the beach and shopping. Cool afternoon breeze and lots of sunshine & moderate weather. As well as lots of places to work within a 10 mile radius. That creates the demand.

I rented in South Torrance from 10/05 to 3/11 and really enjoyed it. Our rental was put up for sale and there were many people looking at it and some offers made even though it was a duplex and the front unit was a [b]dump.[/b] It sold for a lot more than it should have, $60> Zillow estimate! The front unit built in 1954 & neglected should be scraped and rebuilt; the back unit about 30 years old needs updating, termite repair, etc…. I can only think that a fool and their money are soon separated. The sellers waited and finally got a sucker.

Do what’s right for you, buy if the numbers are right. But that area still has a LONG way to go before household income is on par with home prices. Many people still think they can get bubble prices and the opening price for our rental was above it’s bubble peak price!!!

Foreclosures are now creeping into Santa Monica’s prime areas. Gillette Regent Square in the North Of Montana neighborhood has an excellent house in foreclosure. And they said it could never happen there.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

da-di-da

You are 100% correct. I am in exactly the same boat and kicking my self that I missed the boat (Cerritos) in March 2009. Bankers, Investors and flippers buy these peroperties at trustee sale and bringing back in the market with same high prices. This country always rewards “Loosers” ……

People, people, people…… Don’t get sucked into to buying just yet. Price pressure is not up. Look at the price of everything around you. The things you really need… gas, food, utilities….. and some day in the future …… interest rates. And what is not going up REAL WAGES…. if the house you purchase (rent from the bank) goes down in value by 25% over the next two to three years, then how much per month did it really cost you to live there? And what happens if you really need to sell?

Love this blog. I used to live nearby this recently listed house in Santa Monica. It is small but on a very nice and deep lot. Also, the house is imminently expandable and very cool / well built. Area next to Virginia Park is so so but still very much Santa monica. No way would this thing have been priced at 699,000 three years ago. Price are back to 2004 levels in Santa Monica and dropping . . . If I had to buy a place in today’s market – right now – it would be this place. . .

http://www.redfin.com/CA/Santa-Monica/2034-21st-St-90404/home/6767378

The population of Redondo and Torrance is around 200,000 people. In Los Angeles there are around 120,000 gang members. Kind of funny is it not?

The thing that I find most sickening is that the house that rents for for $5,500 per month, has an assessed value of $57,897 and pays just $1,255 per year in taxes.

Proposition 13 is contemptible.

My neighbors just rented his house for $1,300 plus utilities bills. A year ago, some few houses ago, a similar house was rented for $1200. If you are lucky, you could get a small house under 80k, in the area. Makes better sense to me. It seems that rents are going up around the neighborhood, as houses prices are stabilizing. Fear of a second bubble in real state, people want to rent than to buy. Well that’s what some of my family members are doing, they say they will buy in the end of 2011 or early-mid 2012.

Leave a Reply to Daniel