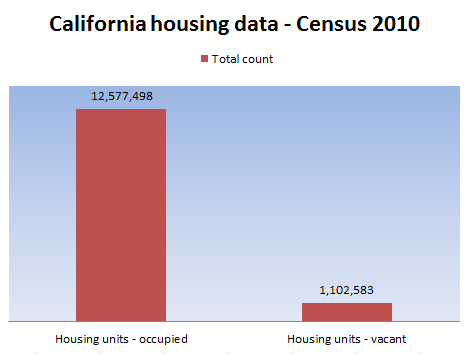

Vacant California – California has over 1 million vacant housing units increasing 54 percent in one decade while actual housing units only increased by 11 percent. Solid financial reasons why California home prices are destined to fall in the coming years.

In 2000 roughly 5.8 percent of all California housing units were listed as vacant. With the latest 2010 Census figures California is now listed as having 8 percent of all housing units vacant. Keep in mind this figure doesn’t include the occupied shadow inventory. When I hear rumblings about a sudden home price recovery in California the arguments usually lack any substantive data showing how home prices will move up in the coming years. Part of the reason why home prices will remain muted revolves around the removal of high leverage loans from the market. As we all know, in any given year only a tiny portion of a city’s inventory is moved via sales. These sales make up the new “market†that most other surrounding homes base their future price. Take Culver City for example. Culver City has approximately 10,000 owner occupied housing units but in February only 8 homes were sold. If more home sales are composed of lower priced distressed homes it is likely to depress overall prices moving forward. The reverse was in order when the bubble took off. Looking deeper into the future home sales will depend more heavily on household incomes. This seems rather obvious but this self evident reality was lacking for all of the last decade. In some niche markets you see all cash buyers moving in but they make up a specific portion of the market. You have investors in lower priced areas dominating and investors picking up lower priced quality homes in solid markets. This trend only has so much lasting power. This is the current cycle of the California housing market.

Large number of vacant homes

Source:Â Census

It might come as a surprise to many that California has 1.1 million vacant housing units. Back in 2000 California had 712,000 vacant units so over the decade we have increased the number of vacant units by 54 percent. At the same time total housing units have increased by 11 percent. The market has a potentially enormous number of homes that should fall into the sales pool. Keep in mind this figure does not include currently occupied homes where borrowers have stopped making payments. In California this is a large number. We are seeing home sales move on lower priced homes and you are seeing this pattern play out in mid-tier markets as well. The realization is coming slowly but as more and more homes are sold on the margins, future comparable home sales will be based on lower priced transactions (even if this means chopping $50,000 from a $500,000 home). This is what we are seeing in the median price coming down in many California cities.

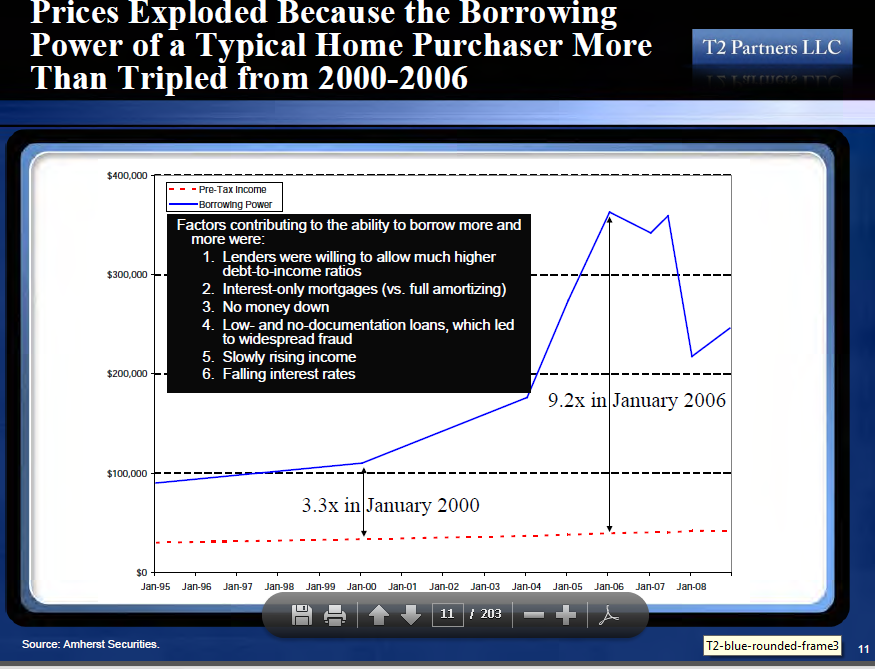

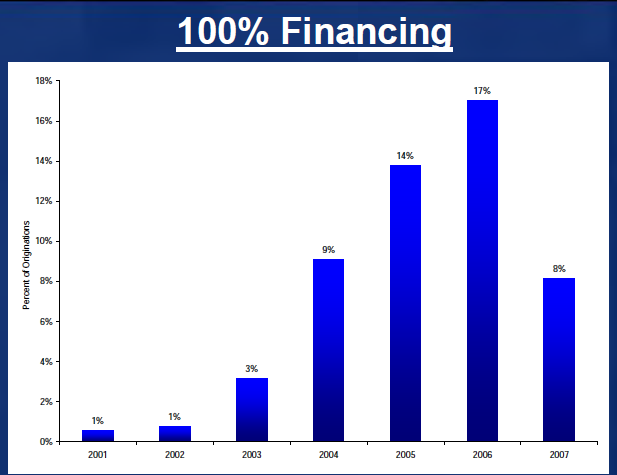

There are a couple of key factors as to why home prices have little chance of going up in these markets and in fact, will likely move lower. First, many of these desirable cities were leveraged up through exotic mortgage financing. We all know about the problems caused by these loans but what is usually ignored in the media is the ability of these loans to exacerbate a mania like we had in the housing bubble. Desirable areas didn’t suddenly become places of interest in 1997 or 2000. But what did happen here is with the repeal of Glass-Steagall investment banks were able to flood the market with demand for junk mortgage backed securities and the desire to live in these markets was suddenly pushed to another level. All people needed to buy was a pen with ink and a willing attitude to sign on a dotted line. It might help to visualize how much leverage was in the market during this time:

Source:Â T2 Partners

This is one of the most important charts especially in forecasting future California home prices. Nationwide the median home price is approximately $160,000 while the nationwide household income is $50,000. Home prices nationally are 3.2 times the annual household income. This is getting more into a sustainable range but I would argue it is still inflated because of economic conditions.  In California prices are still out of balance with household incomes. The high leverage loans have been pulled from these markets allowing people to borrow 9 times their annual household income (or even higher in many cases). Take Culver City as an example and use the pre-bubble figure of 3 versus that of 9 at the peak:

Median household income (2009):Â Â Â Â Â Â Â Â Â $72,000

With pre-bubble mortgages:                    $72,000     x      3    = $216,000

With bubble mortgages:        $72,000 x             9        =      $648,000

This is why you still see nonsense pricing in many mid-tier cities. Current home prices reflect an era with high leverage loans but those are now gone. Since so few cities sell in these markets at any given time the market takes time to adjust lower. Lower priced counties like San Bernardino and Riverside are quickly approaching the pre-bubble price range but sales are also high in these areas:

Riverside median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $190,000

San Bernardino median home price:Â Â Â Â Â Â $150,000

Los Angeles and Orange County have fallen dramatically from their peaks as well but some markets are only waking up to the new reality today. Keep in mind many of these cities still price homes in the jumbo loan category even though households barely scrape in $100,000. This leads us to our next important reason why large home price movements are unlikely to reappear, income.

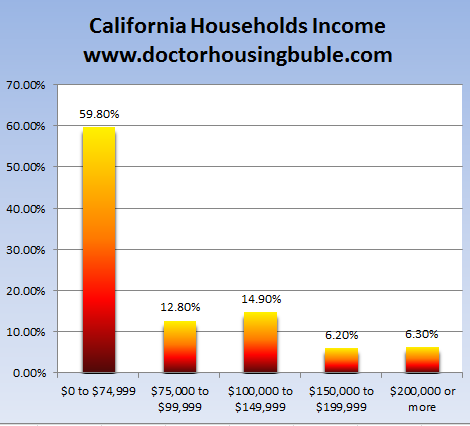

Household income does not justify high prices

Without leverage you now depend on household income. This is how the household income makeup for the state of California looks:

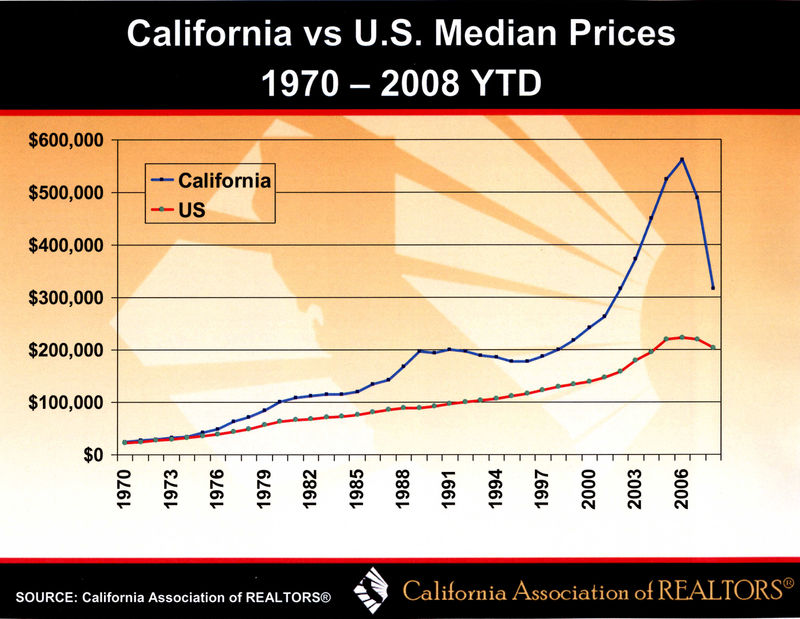

The median California home price is $244,000 at last count. I would argue that a household would need $75,000 a year (at least) to purchase this home. Well right there you eliminate 60 percent of all households. The state is still over priced even though home prices have done this:

Source: Anne’s Land

Home prices have imploded for very valid reasons. This was a mania. In mania’s irrational psychology takes over markets and economics takes a secondary position. As the market awakens from its speculative fever reality starts sinking in. This reality has hit some areas quicker but doesn’t mean it won’t eventually catch up to all areas. People forget how much of the U.S. market ended up being 100 percent financed during the mania:

We are now in a new world. A big reason for showing many examples of homes is to highlight the reality that many cities are still in bubbles. The mania is still going on. When people look back at $500,000 homes in Huntington Park they now realize how crazy that was. Yet during those days in 2005 and 2006 it didn’t seem like a bubble to the majority. That will happen in many of the mid-tier areas. These numbers are unsustainable and by definition will correct. The only way prices remain is if household incomes suddenly bounce up to justify those home prices. I don’t see that happening.

California took punishment during the Great Depression:

The above is a picture of a Hooverville in Sacramento (not real estate San Francisco style) to show that even though things change, we are still impacted by national and global events. Things radically change and the market dynamics have now shifted. Banks are moving on shadow inventory in mid-tier markets because they now realize there may be lost decades in these areas. The bailouts and profits since the massive taxpayer cash infusions have made their balance sheets healthy enough to move on and to speculate on the next new-new thing. You think an institution that is willing to nickel and dime you on ATM fees is going to let folks stay in homes longer simply on charity? The only reason they allowed this squatting to go on for this long is because they thought the bubble pop was merely a temporary downturn. They now realize and I’m sure their internal economists realize the same thing by looking at the above data. Prices have virtually no chance of bouncing back up. Right now may be a great time to unload since there are a good number of cash buyers on the margins ready to pounce on decent properties. Yet this will require banks to move on more desirable homes. You don’t see top paying cash buyers picking up fixer uppers even in solid zip codes.

I think you have many people that bought in 2009 and 2010 now regretting their mistake as they bought into a falling market. This isn’t the bottom so don’t get caught up in the frenzy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “Vacant California – California has over 1 million vacant housing units increasing 54 percent in one decade while actual housing units only increased by 11 percent. Solid financial reasons why California home prices are destined to fall in the coming years.”

Dr. HB, As always a superb blog. I have extended discussions with my sibs about their properties. Two are in the california denial. The other got out of her real estate profession at exactly the right time, so her dream house outside california is paid off.

I wonder about directly comparing median income to house prices. Clearly if you don’t make the magic 3times income ratio, you are doomed. I get that. But, if you look at the median income for a community, that number will be skewed lower as many will not be in the housing market. That is, they are renters. So, a healthy real estate market might use a higher number rather than the straight median.

Before my co blog readers throw the sockpuppet epithet my way, let me say the market in California is so clearly out of whack that the prices have to fall. I believe the fall will be larger than most numbers quoted here in this blog.

The homes and condos that renters rent are part of the market. Are you saying that nobody owns the crack houses that are rented out either?

Although I can’t speak for Glisten, what I have thought and it seems like he is saying is:

It costs less to rent a similar home in LA, so that person does not need to make as much money and are probably more young people earning less money. Questions is, Does that skew the number?

Also, I noticed in my neighborhood, Atwater village, we have a large percentage, maybe 40% that are people who have lived here for a long time and seem like that don’t earn much money. Then a large % are overpriced small homes, mostly with 2 professional workers. Also, does this skew the numbers, when it comes to “can the people living in the hood afford to”.

EconE, I really like your postings here in the blog. You clearly have a great grasp on this topic. My only question relates to applying a 3 to 3.5 multiple to the median for income within a geographical area and then coming up with a sane median house value.

It is obvious to me that this multiple makes sense to any individual. If the multiple is greater than 3.5, the individual probably cannot make the payments over a long term. That individual should not be given a loan. Period.

It is just that in a given community there will be both renters and homeowners. The renters will typically make less than the homeowners. Therefore the pool of buyers will have a greater income than a straight median of everyone in the community. As such I can see a healthy real estate market in a given are where the median house price is greater then 3X median income. Mind you not much greater, maybe 4X.

I can also flaws in my own argument here. For instance why shouldn’t renter be counted as potential home buyers. Only because people tend to stick with what they know.

3-4X income is pushing it.

2.5X income was the norm 50 years ago….and that was when healthcare and education were more affordable.

I know that realtors and mortgage brokers are all for debt slavery as they are paid on commission. Why on earth would anybody else support such high multiples. Is it just that people that want to “own” homes are greedy fools that never watched the movie ‘Fight Club’?

“The things you own end up owning you”

-Tyler Durden

Although the housing problem has caused some pain, it has been a buying opportunity for us. My husband and I are teachers in a very upscale So. Cal. suburb. Although we are tenured teachers, making over $80,000. a year, there are virtually no decent homes in our area under $1,000,000. Prices in our area have dropped just enough that we are now able to sell our condo, and buy a house.

So there is some good news out there.!!

What neighborhood and how much did you pay under 1 million? Also, how much did you make selling your condo?

Lets say you both make $85k = $170k x 3 = $510k for a home

More like…Mike what year were you and your husband married? Congradulations on being in that small window in CA when gay marraige was legal. Why on earth are you and husband thinking of selling your condo and buying a house? Planning to adopt some kids? If it’s just you and your husband, a nice sized condo should suite you well in your area since the houses are $1 mil.

If your speculation on the income is correct you still have left out the profit from the sale of the condo. One scenario, and a likely one given the level of income, would have them purchasing the condo well before the bubble. Imagine they bought in ’96 and used the double principal payment option on that loan. Now they sell the condo which they have paid off the loan on and net $360,000.00. Now they can buy a bank owned home in this ‘hood for around $840,000.00. What they save on the tax deduction for interest will help pay the property taxes.

Another scenario is that this post is actually a straw man for Randy who is one of the posters from the prior blog who bashes teachers (note the $80,000.00 salary) who is also a homophobe.

You can buy my place for $999,999.

Why? is there always a ‘teacher’ commenting in here about their earnings, be it true or false and usually excessive.

It’s probably an anti public education astroturfing by some group with big bucks and an anti middle class agenda. They’ve been hiring these shills from India to astroturf forums for years. Started out spouting pro-H1B nonsense, of how bringing in guest workers was good for everyone.

This was wildly successful; so much so that nearly all the unemployment in IT could be eliminated today just by shipping these clowns back to India. Now it looks like they are outsourcing the propaganda machine from other areas in order to divide the middle class. This too will probably be effective if people let it.

Also what about the teachers who have already taken 5% paycuts and a hit to there benefits, and now may face a lay off or another 15% reduction. Many of them cannot make there payments anymore, and many more wont be able to soon. After the next round of cuts I would expect many many more foreclosures.

Great post, as usual, Dr. H. As far as the number of vacant units, the folks squatting in shadow inventory will eventually move and occupy another house. But it will probably be a smaller house, so the amount of vacant square footage should rise, if not the number of actual vacant properties.

It will be interesting to see where interest rates go. With today’s (4-1-2011) moderately bullish jobs number 10-yr treasury yields are trading up from 3.454% to 3.491%, which is a modest rise. It is amazing that in the third year of this cycle of $1.5 trillion annual budget deficits that interest rates are so low.

What I expect to see is some sort of announcement from the Federal Reserve that QE-3 will only be implemented if interest rates rise above a certain threshold. I then expect this threshold to be reached within a few weeks (or maybe days?) from the end of QE-2 in June. This will give Bernanke the cover to crank up the printing presses and create new dollar units and cap interest rates. So I’m expecting a hyper inflationary outcome where everything rises in price, except wages and houses. Ugly, it will be.

How can there be hyper-inflation if wages aren’t rising and un-employment remains high?

“How can there be hyper-inflation if wages aren’t rising and un-employment remains high?”

Because we import nearly all of our basic goods – oil, clothing, steel, etc. Also, basic food items produced in the US (grain, corn, etc) will be exported (because it is more profitable to the growers) rather than sold domestically since the dollar is getting trashed by the Fed, and any food inputs from foreign countries will cost more.

As Bernanke put it: If you inject $600 billion into the economy by the Federal Reserve buying US treasury bonds and the Fed, as we know, only lends money to it’s member banks, then real people don’t actually get anymore money. And, if the the real people in America don’t actually have more money, then there can be no inflation.

So you see, you are only imagining paying $4 a gallon at the gas pump because your wages really haven’t gone up and there is no inflation. And, food magically appears in grocery stores through the magic of the Lucky Charms Leprecuan and has nothing to do with those trucks that use gas. Again, it is only your iimagination that food prices are rising.

It’s more like selective inflation. Let’s make the people who live pay check to pay check pay more for basic necessities while we let banks gamble with new money “created” by the Fed by buying US Treasury bonds. You see if they gamble right, they clean up their balance sheets and don’t have to ask for more taxpayer money, and then maybe they will throw real, working people a few crumbs.

Rising gas prices don’t effect me. I always put in 20 bucks at a time.

Jason, I’m seconding your views. These days, the FED published a ton of documents. Now let’s see how Bernanke’s public claim of the FED not printing money stands up to its creation of $ 3.3 trillion in a few months out of thin air. You all do know who owns the Federal Reserve Banks? It isn’t the government…

The Census data on vacant housing units includes vacation homes and other 2nd and 3rd homes which are unoccupied most of the time. The real ‘vacant’ number is undoubtedly significantly smaller.

Cheers,

Fast Eddie

Why yes, Eddy, you are referring to my summer vacation home in the Hampton’s. I also have a winter home in Hawaii. I use my home in Florida for obvious tax purposes even though during the week I am at my condo in the City.

Oh… You’re the guy from Gilligan’s Island, arent’t you? Glad you finally made it back to civilization.

On Springdale in Westminster N of 405 there are 7 or so vacant houses (tall weeds no lights at night) in that short stretch. Overspeculation. Busy street.

One of the reasons banks are starting to move on higher tier homes is likely because of the proposals the current administration is making reguarding housing policies. There is a lot of talk about raising down payment minimums and letting the FHA & Fannie/Freddie caps on maximum loan values drop back down when the temporary increases expire in October. If that happens I think it will be a big hit to California’s $400k+ neighborhoods where a lot of the activity now comes from households barely pulling 100k taking those low down payment government backed loans.

ANY decent neighborhood in CA. is $400,000. plus, if you are talking about areas of San Diego,San Francisco, or L.A.

In the inland valleys there may be decent neighborhoods for under $400k, but I am too afraid to drive into those areas to find out.

I know, my wife and I live in San Diego and would be interested in buying a home if it weren’t for that fact. Right now we aren’t buying a home because we’re not willing to take out the amount of financing we see our friends and co-workers jumping into. We’re hoping that the easy gov’t money will go away soon and as actual savers we will be able to turn the tables and be competitive buyers with actual money down. That’s at lower prices, of course.

i live in a decent Inland Empire area where the homes go for about 300k. we all walk around night or day without any fear.

Max, how is it you are not afraid of LA, yet you quiver in your boots about the IE? Come out and check it out for yourself. I have lived in Rancho C for many years…we even have Blue Ribbon Distinquished schools in areas where the avg. home price is $300K.

300k in the inland empire had better be a freakin’ castle.

In the 90’s you could get a home in the Hollywood Hills (Los Feliz or Beechwood Canyon) for $300,000.

Major burnout is the norm. People have no faith in institutions right now. A young person reads constantly about SS insolvency, banking fraud, government spending imaginary dollars like there is no tomorrow. It’s no wonder housing is the new ponzi slang play. Less is more is the kids mantra. I’m waiting until we see no decent sales figures for spring/summer, then the banks will get real on pricing possibly.

Great points Rudy. The Tea Party folks aren’t helping matters. They should come out say if they are gonna try to cut social security payments to retirees. The government needs to define it as a retirement program or as an entitlement and get it over with.

If political expediency forces them to say it is a retirement plan (likely), then they can move on to the obvious next step, which is figuring how many hundreds of billions annually they are gonna cut from Medicare and Defense.

With this do-nothing bunch we have in there now (both parties) I expect no action until after the next election.

Speaking of Sacramento and vacant homes, this was in the Sacramento Bee earlier this week: http://www.sacbee.com/2011/03/28/3507910/housing-bust-leaves-glut-of-vacant.html

“This is the fallout of the housing bust: enough vacant dwellings in the Sacramento region to harbor every El Dorado County resident or to shelter all the state’s homeless on a typical night.” They have a picture of a couple moving out of one of the swanky new lofts because they couldn’t afford it any more. They were paying $1600 a month for an 800 square foot loft. There was an article a day or two later about how the L Street lofts, where were heavily advertized for years, are now up for auction. I used to live in Downtown Sacramento, so I kind of understand the appeal. But rents and home prices have soared since I left in 1999.

The vacant home rate is usually primarily second homes(e.g. Big Bear cabins) and also homes that are looking for renters(investor homes). I would look at the 2000 rate as a base and the additional amount is primarily investor’s homes looking for tenants. I know people who buy these homes in Riverside thinking that they can get good tenants. They find out over time that there are very good tenants in Riverside, especially with the price of gas going up.

Did you mean very “few” good tenants in Riverside? I used to live in Riverside… I used to help a couple of my neighbors when they were renting out their homes. Finding good tenants was very difficult. I don’t think people realize the costs of those great homes out there! In the summer time you could spend $200-$400 on electricity, $80-$100 on gas in the winter time. Keeping that large yard green would cost a couple of hundred dollars. Depending on where this wonderful house is located, you end up driving ten miles or more for most anything you want or need. Stores, restaurants, etc… My husband works in LA county so his daily drive was around 140 so our gas bill was around $400 a month. Just gas, that didn’t include maintenance on the vehicle. Those figures were on a 5 bedroom house – 2350 sq ft. One neighbors tenant stole electricity and water meters to off-set his expenses. The police couldn’t seem to do anything about them. The landlord finally got them out but it wasn’t cheap. One guy that was looking to rent one of the houses was rubbing the walls and commenting on how smooth the walls were. Of course he had an interesting bar code type tattoo on his neck too so that may be all I need to say. Strange mix out there! Not saying all people in Riverside are bad, just that I wouldn’t be an absentee landlord and think I was going to have great tenants that kept my place decent while I raked in $1,500 to $1,900 a month in rent. That is what those houses were going for a year or so ago. By the way, I am a renter, have been and probably will be for some time.

I would be extra cautious being a Riverside area real estate investor now. Why?

http://realestate.yahoo.com/promo/cities-where-things-are-getting-worse.html

Riverside came in first in the US, worse than Detroit.

When someone rents for $1500 a month – as cheap as that is – they expect the landlord to take care of things. I rent at that price, and I send emails noting problems. The tab for repairs on this old house is thousands of dollars a year. That’s just how it is. A newer house, like the one I manage for my mom, is still a couple thousand dollars just in materials and hired labor, not including my own time, fuel, etc.

Nothing is free, and it’s only cheap if you do the work yourself.

You also have taxes, water bills, and you have to sock away money for roof repair and other capital. There’s also that mortgage taking a bite.

Landlording is a business, and it’s not a high profit business – but it’s a very good long-term business for handy folks who like to maintain houses in good condition.

That, or you can be a slumlord and create a ghetto. If there were a Hell, the demons would be constructing a hot little tenement in there for you.

Dr. Bubble. Another great article. In your last few articles you talk a lot about the mid tier segment but what about the high-end? There are $1M+ areas which are just not moving down very much. Will these areas not go down and if so, will this bubble have created a bigger divide between the rich and the poor, the haves and have-nots, those who have access to good schools for their children and those who do not?

These days it’s much more cost prohibitive, relatively speaking, to get into a top school area than 20 years ago.

RIGHT! What do you think will happen in Santa Monica. I am in the market… I drove by a $1.1 dump in Ocean Park on 6th st. but its a big lot (6500SF I think) and it has a curb cut, meaning you have parking off street, not always the case in that area. A similar place, but fixed up and with no parking, sold for almost $900K a month ago.

IN the Palisades, fixers in the alphabet streets are still mostly over $1M for 2B 1600SF. CRAZY! These places have no views, are not walking distance to the beach or anything, just in a ritzy neighborhood… and the “low-rent” part of PP to boot.

Meanwhile, my condo in Marina del Rey, which I am trying to sell short, is getting a few offers! I listed at 630K, dropped to $599, and have 2 offers in. (Bought in 2005 for $790K) So the Marina is “corrected” despite having excellent public elementary, beach and marina access, etc. and yet SaMo really hasn’t come down much… The only SaMo deals are in Sunset park (mid tier SaMo) where a 1600SF 3B is 800K-1.2M.

Are these palces PP and SaMo on the brink.. about to finally correct? Or are there enough Executive VP types and doctors such as myself supporting the $1M + starter home prices there.

I worry about a drop off in prices, but I worry about inflation, rates rising and a stagnant salary for a long time to come just as much… arg!

Have read your posts and think you are a bit of an A** after all I am a teacher, facing default through job loss and you are definately an enemy of teachers but read Brent Whites Underwater Mortgage. It gives you the information you need to make an informed decision about your choice. I cant understand why the bank would let you short sale when you seem to be able to afford your place, but can understand why you would walk.

I live in the Bay area. Similar situation, similar prices. Similar state problems.

The low-end areas have cratered, the mid tier areas are slowly coming down, but the $1M+ are just not staying stagnant. And high-tech seems to be doing ok. Plus – we have a few IPOs around the corner: Facebook, Zynga. Perhaps Twitter and LinkedIn in the future. I also looked up the shadow inventory on foreclosureradar.com – it’s very bad in the low-end areas, somewhat bad in the mid tier, but really not so bad in the $1M areas.

Looking at all this, and I really don’t like this conclusion, the $1M plus areas such as south Palo Alto, west Mountain View, Cupertino, etcetera, may just not come down. Just stay flat and let inflation handle at least part of it. The end result would be a bigger divide between the rich and the poor in terms of access to good schools.

From Doc’s main article: “Current home prices reflect an era with high leverage loans but those are now gone.”

Uh….haven’t you heard of the FHA?!? They regularly allow 3.5% down and 50% back-end DTI’s. If that isn’t a “high leverage loan”, I don’t know what is…..

I predict FHA will rise to 75% (at least) of the loan market in 10 years. The powers-that-be know they can never return to the 20% down, 28/36 DTI model – not without cratering home prices. Also, the loan limits for the “high price” markets won’t be going down anytime soon either – for the same reason.

From Doc’s main article: “You think an institution that is willing to nickel and dime you on ATM fees is going to let folks stay in homes longer simply on charity?”

Uh……they will as long and none of the regulators make them foreclose and/or mark their loans to market – neither of which is gonna happen anytime soon.

Also, in the high-end areas people need to remember that about 60% of the residents are renters (always have been, always will be) so homes are being sold to the 40% that make over $75,000 a year. The $75,000 folks buy the $300,000-$400,000 condos and the higher earners buy the SFR’s.

Finally, Doc you have to get off the 3x income metric for home values. That hasn’t been true in California since the late-1960’s. I have looked at data from the early 1970’s to the present and it has been just above 4x during the bad times (early 80’s, early 90’s and now) and probably averages 5-6x when times are good.

I really just can’t see why many people just “don’t get it.” There is only one direction for housing to go: DOWN, DOWN, DOWN. Image below illustrates the housing bubble and its aftermath, which we are currently experiencing:

http://webpages.math.luc.edu/~ajs/courses/161summer2009/solutions/test3_files/image002.gif

Here is another excellent graph which shows the current state of the houisng market. Note – ignore (Nut) Case-Thriller and the statistics coming from the federal govt. Here is an accurate representation of the houisng market’s situation:

http://www.vectorstock.com/composite/80617/line-graph-growth-and-crash-vector.jpg

I am grateful to Dr. HousingBubble, as a Licensed Real Estate Broker and Civil Engineer when people want me to help them with buying a house I quiz them on the Dr’s Blog. Most of the help I provide for people is showing them where more affordable rental units are here in Santa Barbara as the market continues to tank, and the renter’s paradise continues. The Banks have really hurt the honest hard working people of California and when it will turn around I have no idea. But by knowing what does not make sense allows the individual to focus on investments that do. When growing up I remember my Grandparents always telling me don’t spend more than 20% of your net income on rent, and never spend more than 30% of your gross income if you are buying real estate. Back in the 1980’s My grandparents would say that this time would come, because during the Great Depression the housing took a nose dive in California.

Appraise Real Estate according to the Cost Approach this will save you lots of money and bring the real deals to light. in the year 2000 I bought an Acre of land in Paso Robles Ca for $12,000, made $20,000 worth of improvements (Water, Road, Electrical, Sewer), and build a 3,000 sq. ft. house for $75,000, with 1200 hours of my own labor and a helper for $10 an hour when I needed him. When it was all done and said the bank appraised the property and let me set up an ATM machine(line of credit) on the property with $560,000 in it. The banks really do not have the technical expertise to appraise property and the Appraiser’s are even worse. The individual needs to learn to budget and make wiser and wiser investment decisions. Good luck to all of you who read this site, learn to cost out the improvements on the property you are looking at it will save you in the long run. It pains me to see guys and gals who are making $120k a year putting 80% and more of the income into a mortgage all the while the negative equity continues to grow and the cloths on their back continues to look like the are shopping at the Trash can behind the Thrift store.

Sorry, KSYTMG, you did not build a 3,000 sq.ft. house for $75,000 unless you used adobe bricks made from the clay in your backyard and woven palm fronds for flooring.

Yep still renting as I find home prices in my bay area neighbors too high for my reality and I make over $100K per year. My focus right now similar to many in my generation is to pay off student loans, my other mortgage. When I finally am financially available to buy I will for sure have the 20% down payment and not buy a house that is 2×3 more than my present yearly income. Such house may/may not be in California since on my travels I’m finding a lot of great house for the money and great neighborhoods outside of the Golden State. I was so enamored on one such recent trip I went to a place with a great social scene, almost non existent street and freeway congestion, great neighborhoods, and bars with daily $1.50 happy hour drinks . All of it in a town with 80 degree temperatures in March and within a 20-30 minute drive to the beach and river areas.

Where? Ready to move…..

I lived in Louisiana for four years. Enjoyed my time there. It has it’s charms.

Please don’t forget to pay attention to the fact that a huge bubble of baby boomers (born 1946-1964) are trying to sell and downsize as they are retiring. Additionally, in this generation they were fairly well-educated and thus making the higher incomes necessary, professional resilience during downturns making them attractive customers for over-priced housing (that which exceeds the typical 3 to 4 times annual income). The generation that is immediately and in the near future coming behind is large but not particularly well-educated/large incomes. This means that the buyers in the near future will not be able to afford the properties as they are now priced. This is called demographics. Combined with the shadow inventory, the new 20-25% down requirements (other than owner occupied FHA 3.5%), underwater mortgagees, the market will be declining for some years to come. The go-go years are over for the mortgage industry, flippers, and house ATM’s. The government has census, growths, and projections including education and future workforce information available to the public which you too can analyze. I expect there will be much new creating of changed lending policies and rates as a consequence.

I don’t think I’ll ever comprehend how it is that the real estate market is so decoupled from Wall Street, that Wall Street can thrive, while the R.E. drags. Maybe this month’s employment numbers was just an anomaly, but I’m starting to think this economy can still regrow, although anemic, even with this bad R.E. market.

In the past, California could always draw demand from outside the state, especially during price dips. However, the economic picture of California has changed substantially, and now a good deal of people are more interested in leaving than coming.

So L – please do share with us. Where is your $1.50 happy hour drink town? Where is your 80 degree in March, 20-30 minutes to the beach paradise?

Well, I moved to Thailand. Where one can rent a furnished condo starting at $ 175 and get a good warm meal at a humble eatery for $ 1.15. There is underground parking for your car. At 50 one can get a retirement VISA.

But I’m missing a library and stimulation and a job. Warm weather is not enough! BTW, we rented out out Inland Empire home and are now renting at 1/5 the rent for the paid off home. with a mortgage to pay, we would not even break even. So you got a lovely large home, circular driveway, 0.71 acres and 3387 ft. Who cares when the market rent is around $ 1,200 in Yucca Valley. Trust me, times are bad for landlords!

Where in Thailand?

I’m currently in Mae Sariang.

Re Riverside, let’s talk about DHS Desert Hot Springs. Ghost towns, extreme gang infested neighborhoods. there were Police raids when hundreds of gang members were arrested. Why do you think some nice newish houses can be bought for 1/3 their former price? Come if you want to score drugs or experience a bankrupt city. (Going after some landlord who won the war).

The herd mentality of developers and their greed combined with irrational expectations can be viewed where we rent a condo: http://www.pgp.co.th The main street hasn’t been paved for 40%, a $ 2,000 job. They built a giant 2nd spa complex and abandoned it after 60% completion. They built a huge office building, just missing some 10 windows. No activity in years.

There is no ATM for the residents. The greedy HOA promises “5 banks” will come, but that may be 2019. In the mean time, they won’t let the 7-11 store put in ATMs.

You can find those 80% completed projects where nothing was done in years. I checked out one such project with about 7 almost finished homes. Can someone explain why the banks are not spending another 20% to sell these homes versus letting them go, for future demolition costs coming as certain as Amen in church?

Leave a Reply