Real Homes of Genius: $770,000 in Mortgages on a 900 Square Foot Culver City Home. Housing Short Sales and the Hidden Mortgage Equity Withdrawal Machine.

Some people would like to believe that the outstretching tentacles of green shoots will all of a sudden resurrect the California housing market. You have people focused on the Westside of Los Angeles with eagle eyes waiting for their moment to pounce on their prized 900 square foot piece of property. Something over the last few months has shifted and people are jumping back into the housing game. That something was a pause in the financial Armageddon that was leading us to Mad Max territory. They all of sudden dismiss the Alt-A and option ARM catastrophe heading down the tracks and suddenly feel that they will miss housing bubble 2.0. Many think that if they don’t buy now, they will miss the next manic phase of the market where a 500 square foot shack will cost $1 million. A little bit of housing bubble perfume is back in the mix in Southern California.

To give you a true sense of what is happening, we uncovered some 40,000 homes being hidden by banks here in the region. Consider it the bank keeping a few homes in their back pocket for another rainy day. Today we are going to shed our light once again on Culver City. Why are we heading back to this spot? Because this is the perfect landscape where the Alt-A and option ARM problems will take place in 2010 and 2011. Out of the 5,559 homes sold in June in Los Angeles County only 19 took place in Culver City. This is considered a prime location by many, (certainly not on the level of Bel Air or Santa Monica but still a good location). You have many fence sitters wondering whether it is time to jump back into the game. Ideally, after looking at another on the ground example, you will sober up. Today we salute you Culver City with our Real Homes of Genius Award.

Culver City – Prime Time

Whenever I think about half million-dollar homes, I think about steel bars over my window. Some people have forgotten what insanity looks like in the housing market because they assume that prices for the most part have come down to reflect reality. In many areas, they are still over priced. Take the above home for example. The home has 2 bedrooms and 1 bath on a palatial 901 square feet. The home was built in 1941 so you can rest assured everything is up to date.

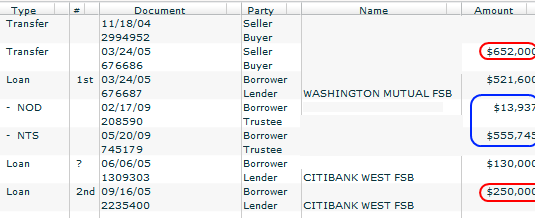

Let us take a look at some sales history here:

Sales History:

03/24/2005: $652,000

11/18/2004: $530,000

Good times in Southern California. Where else are you going to pay over $500,000 for a 900 square foot home? We probably want to get a better angle look if we are going to drop half a million on a home:

Keep in mind these are the kind of homes people are obsessing about in the Westside of L.A. But this home has more of a story than meets the eye. This home also demonstrates the wonderful lending habits of Washington Mutual and Citibank, two big crony banks. WaMu is no longer with us but many of you are probably sick of seeing all those ex-WaMu buildings telling you that “Chase is finally here” and Citibank is pretty much one of the ultimate taxpayer banking bailout stories. This home is currently listed as a short-sale:

What happened here probably flies in the face of what many people think would be a typical foreclosure. The first sale in March of 2005 looked conservative in terms from the banks standpoint. Of course to WaMu anything that moved and didn’t smell like old socks was a good bet for underwriting. So let us walk through that last sale in 2005:

03/24/2005: $652,000

Down payment 20%:Â Â Â Â Â Â Â Â Â Â Â Â Â $130,400

Loan #1:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $521,600

Holy crap! I think we may have found one of the few loans that Washington Mutual did with a 20 percent down payment. Even a 20 percent down on this place isn’t enough to keep you safe if you start using your home like a mortgage equity withdrawal machine. Only 3 months after purchase, Citibank thought it wise to allow that 20 percent to be yanked out from the home in the form of a second to the tune of $130,000. Well at least the home had equity of $400 at that point. So much for that 20 percent buffer.

But this is 2005 baby. Time for another trip to the mortgage ATM. Like an addicted gambler in Vegas, the ATM is not your friend. Another 3 months go by and Citibank sees it fit to allow for a loan of $250,000 as a second. So apparently, the home increased in value by $120,000 in the matter of three months. Maybe it had to do with that spectacular lawn? So let us now run the notes:

Loan #1:Â Â Â Â Â Â Â Â Â $521,600 (WaMu)

Loan #2:Â Â Â Â Â Â Â Â Â $250,000 (CitiBank)

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â $771,600

Now this is looking more and more like a Real Home of Genius. In the span of six months we took what was a conservative 20 percent down payment and turned the house into a zero equity mortgage equity withdrawal machine. Some may think this is something from the bubble bursting days but this is something happening right now if you look at the NOD and NTS. When the first notice of default was sent in February of this year, the borrowers were already behind by $13,937. They obviously have not caught up with their payment and the NTS was filed in May. The current list price is $550,000 and is in the more expensive zip code in Culver City if you believe the data.

And some will probably chalk this up to one example. But since the Real Homes of Genius series has over 100+ homes that are ridiculous examples of Southern California real estate, I have a feeling this is the tip of surface. And here is more savory details.

MLS Single family homes in this zip code:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12

Distress property notices:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 35

So you have nearly a 3 to 1 ratio of distress homes to MLS listed homes. Of those 35 homes only 3 show up on the MLS. Hello shadow inventory! And how do those other 2 short-sales look like?

Oh yes, this is certainly the bottom!

Today we salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

18 Responses to “Real Homes of Genius: $770,000 in Mortgages on a 900 Square Foot Culver City Home. Housing Short Sales and the Hidden Mortgage Equity Withdrawal Machine.”

I wonder if this RHG comes with trash cans? I don’t see them in the picture. Maybe someone stole them.

I think that since so many of these people are not stupid, MBA’s and the like, they either see the reality and ignore it, or they realize it’s just a shell game and they want to play for a while. And you are right about the game’s not over–this was just a test to see how the government would react. Nobody goes to jail, nobody has their ill-gained assets taken away, the only people that are punished are the ones that play the game the old-fashioned way: earning, saving, buying what they can afford. The mob is in complete control and if you don’t play the game, you lose. Why the hell would they stop? In fact all the players are being told to fire it back up again and don’t chicken out this time. Goldman Sam has got your back.

Sabin Figaro, well said.

Here’s a very interesting post I found at http://www.creditinfocenter.com, under their new forum on Mortgages:

From: “Stop_foreclosure”:

>>I would like to share an insight as to a second mortgage holder’s options in CA when there is not enough equity to secure the loan. True are those posts in reference to their ability to foreclose; however selling the note and right to collect on the original balance is more and more common. It comes down to the core concept of “a bird in the hand is worth 2 in the bush” for the lender. Selling it off to a collection company enables the original lender to get their “bird,” though it is most likely a Finch as opposed to the original falcon that they gave to the homeowner. Beware because that Finch may grow into a vulture.

Once the second mortgage (Finch) is sold (for 2.5-5% of the initial second mortgage), the collection company will contact the borrower (after some time) and inform them of a new entity (vulture) trying to collect the debt. People who are looking into a short sale option need to be very careful of this! When the second is sold, it literally disappears from the Customer Service computer screen, and as far as they know you only have a first mortgage. Though when the final numbers are worked up, there will be a few extra thousand dollars (i.e. 2K for a 70K loan), and this is the amount that your initial lender sold to a collection agency. So the danger in this is that even if you close on the short sale, you may be contacted by this collection agency in a few months, and they will be trying to collect the full amount (of the second) even after your short sale is done and done.

Therefore, the collection agency now has the ability to collect on the debt as a secured debt or as an unsecured debt.

Key thing to remember: A home owner who goes a short sale route, needs to have his realtor / negotiator determine if the second will be part of the deal… this means they will need to track down who bought the 2nd loan, and make an offer on a settlement and present this to the 1st mortgage lender who also need to put their stamp of approval on it (because the more money that the new second holder gets, the less the first gets). They (the collection company) usually want 10%, and negotiation with the new second mortgage holder may take time, but this is time well spent.

What a great deal for the company who bought the debt, they pay 2.5-5% and either get 10% at the short sale, or attempt to get a heck of a lot more from the home owner going after as much as they can through unsecured collection efforts.

======================================================

Join Date: Jan 2005

Location: USA

Posts: 3,552

Wait a second- how can you do a short sale if all lienholders don’t agree? That second mortgage is subordinated but still valid. How can any title transfer without the second mortgage holders blessing? That subverts the entire point of holding a lien in the first place.

__________________

At 20% down, this would be a loan of $450,000, which at 5.5% 30 yr loan is $2500/month. The 3x rule says you should make $150,000/yr. I agree this price seems too high for someone in that salary range. The street is Huron, just south of Venice Blvd. Check out Google Street View to see the street. I know the area well; it’s pretty average–not bad, not great. It seems more like the area for a couple making $80K/yr, which means it should be more like $350,000 in my opinion. Not sure if that’s a good way to judge these houses, but I always compare it to myself, then compare it to my rich friends/average friends/poor friends. That helps me to judge who would fit into the neighborhood the best. When I see a mediocre area with 1970’s era cars like this one, I just don’t see my friends making 150K/yr and up being happy there (we make about $90K together and we’d be happy there).

at this prices, a culver starter house is really for a household who makes at least 200k. If only 150k, best have 30% down. payment. 150k is the new 80k.

It appears that Culver City could be the first one to really drop, due to loans crashing. A decent starter area on the Westside, probably with many who couldn´t really afford it. All of the Westsidere areas are connected due to the move-up buyer. Take this rung out of the real estate ladder and add in the top rungs crashing, and we´ll see a quick run for the exits.The carnage from lenders like WaMu, Citi and Countrywide has yet to play out.

Caveat Emptor (Buyer Beware)

http://www.westsideremeltdown.blogspot.com

I must have missed something. How did the Dr. discover that there were 35 notices in this area, when only 2 are listed?

The prices regarding those houses will drop, but not as much as one would think. As our middle class in California is rapidly shrinking, there is a burgeoning middle class from other countries ready and willing to purchase key properties here in So Cal. It won’t be like the nineties where you could wait and buy something nice. We are currently experiencing an internal recession/depression( the Dr. is so right), where as people with money outside of the U.S. are buying properties in desirable areas. There will be great deals here and there, but most of the affordable properties will be located marginal areas or in those “corporate packaged development areas.” The danger in buying in these” no-money-down crowd” or FHA areas, exposes one to an area that is a high risk for a forclosure neighborhood, keeping prices down. Additionally, our destroyed, cheap dollars, won’t buy quality. Corporate package foods (Mc Donalds, etc.), autos (Kia, Focus, etc.), or a new house in Palmdale will be readily available. From now on, quality will be difficult to buy with our cheap dollars. Bottom line: What we are experiencing is a rapid decline in life style with a tiny middle class, leaving a have or have not world.

OK I understand that location thing but REALLY:

http://www.thefirearmblog.com/blog/2009/07/24/john-moses-brownings-utah-mansion-for-sale/

But are foreign buyers really buying up all these properties to live in? And if they plan for them to be investments and to rent them out: how can they possibly rent them out and be cash flow positive? Who will they rent them to? To the new poorer American’s? But you can’t even make a rental in So Cal cash flow positive right now, how will they be able to do it if people are anticipated to get even poorer? Or is the plan for them to just rent to other foreigners?

In addition if America is getting so much poorer what will happen to infrastructure and jobs and so on? But the real worth of a property depends on infrastructure and jobs and all that. Go ask Detroit! Lots of very nice houses there, selling for less than cars. The real value of a property is not a nice house. And even if America as a whole somehow does ok, California is still bankrupt!

JS, I live in one of those areas where most foreigners just rent or sell to their own people exclusively. Just drive around Temple City and you will know what I mean. Most of the realtors involved in certain areas deal with just their own too. The only time I have seen a asian realtor deal with a local is when they have a customer that wants to buy. Remember, these folks are somewhat disconnected with the American way of life and exist on their own economy. The garages at there homes are actually used for cars and not expensive junk. When I lived Valencia, I observed that it was rare that people had room in their garages for a car. They were usually filled with nearly new boats, pool tables, motorcycles, skis, extra TVs, etc. Neighbors were always talking about the next party to attend, the new BMW, the time share in Cabo, etc. I used to go to soccer games and watch the mothers spend all their time on a cell phone, totally unaware what their kids were doing. It was always about me and instant gratification. I have talked my new “foreign neighbors” at length and they view most local Californians or Americans as foolish asses for having so much for so long and just piss it away like unruly children on material crap and giving money away to the rest of the world just to be loved. I blame both our government and corporations for a lot of our problems too. They think it’s crazy that adults around here just live to be constantly entertained like children. I have to somewhat agree with them. If you want to get a credit card in China with 5K worth of credit, you better have more than 5k in the bank. Houses there are bought with cash or at least half down. The CEO’s for Goldman Sachs would probably tried and shot for criminal acts in China. These folks already know what it was like to live in tyranny and save for the future in their own way. The sad thing is, we will probably have to to suffer for a long time until things get better. Much of California will be struggling for a long time, while a few who have discipline to save and learn won’t have it so bad.

To D1,

Thanks for telling it like it is. Foolish asses describes too many of us exactly. We could learn alot from those that are “somewhat disconnected from the American way of life” but will we?

Going back to the rather stirring debate on shadow inventory, I offer this quote:

Karl Denninger explains this latest hoax in a recent entry on his site Market Ticker: “So what’s going on here? Simple: An enormous number of banks are holding loans at or close to “par” that really aren’t. They’re holding mortgages at massively-inflated values, even on defaulted properties, and this is why you are not seeing more foreclosure sales – that is, why inventory is being held back. If they sell it the accountants will force recognition of the loss, which will render them instantly insolvent, but so long as they “extend and pretend” they are marking these loans way, way above recovery value. The upshot of this is that these firms’ balance sheet claims on asset values are massively inflated, regulators know it, and they’re intentionally ignoring it.”

Hey Dr. Housing Bubble, where do you get all of the loan information on these houses? It would be a real advantage in negotiations with a seller if I could understand heir true cost basis.

@D1

Sounds like you’re at ground zero and know the score. One thing people don’t realize is that China as a nation has been around for thousands of years, relatively intact. They are not ignorant. They are a brilliant people and they are probably going to foreclose on CA when Goldman Sam can’t get anyone to show up at his debt refunding auctions–like this week, ‘cept Benny Hill Bernanke? Better get all that crap outta the garage cuz everybody’s wang-chung tonight…two men and a truck will show up with the repo man.

The Chinese can’t be that smart. They have spent years loaning us money to buy their stuff. Now that the music is over we still have their stuff but they just have tons of worthless fannie mae notes. They have tons of our treasury notes but if they dump them on the market it hurts them just as bad as it hurts us. Whats even more hilarious is since they tie their currency to the USD to keep export prices to the US cheap we are dragging the yuan into the crapper with us and they basically just have to take it. Their other option is to let the peg go and cause prices at walmart to double. So when the Fed is firing up that printing press they making oil, food and steel more expensive for Chinese just like they are making it here. How exactly was that smart?

Nice article!

Redondo Beach is just as bad. Dr. Housing Bubble I’d like to hear what your take is on this home in Redondo Beach. $475 K for a gutted house. It’s unbelievable that someone would even try to sell this piece of junk.

Keep up the great work!

http://www.ziprealty.com/buy_a_home/logged_in/search/home_detail.jsp?index=0&source=CARETS&cKey=dh3xxmz4&page=1&listing_num=P641032&numResults=44

what do i think? well, i think i made a good move getting out of ca in ’89. moved to oregon on the coast. work is steady in the building trades but no one is getting rich. anyway, for 6 hun k you can buy one year old, master contractor built, 2500+ sf (real custom) house ,3 car gar, on a CLEAN lake, breath CLEAN air, drive on good roads/w min traffic, good schools ,low crime, the list goes on. could never go back to that cesspool, lifes too short to put up with all that crap and have to pay off someone and some shyster mort.companys greed. oh! and everythings green here and the highway medians dont look like it just snowed with everyones garbage fliting around. and as long as it rains everyother week, it keeps broke and de-evolving sucker caleeforyans away.

Leave a Reply to segfault