Real estate is not local: Housing markets across the US are overheating outpacing household income gains.

2017 starts with US housing markets in full mania. This recovery is largely disconnected from household wage gains and with the election results, mortgage interest rates surged making housing even more unaffordable. Now while this blog is largely focused on California and many see things through the Hollywood only lens, a large number of metro areas across the nation saw wicked price increases. This price jump has come in an environment with tight inventory, investors, and low interest rates (until the end of 2016). The fastest growing markets in terms of price gains are not in California. In fact, the top 10 metro areas with more than 1 million people are all outside of California. Will this trend continue into 2017?

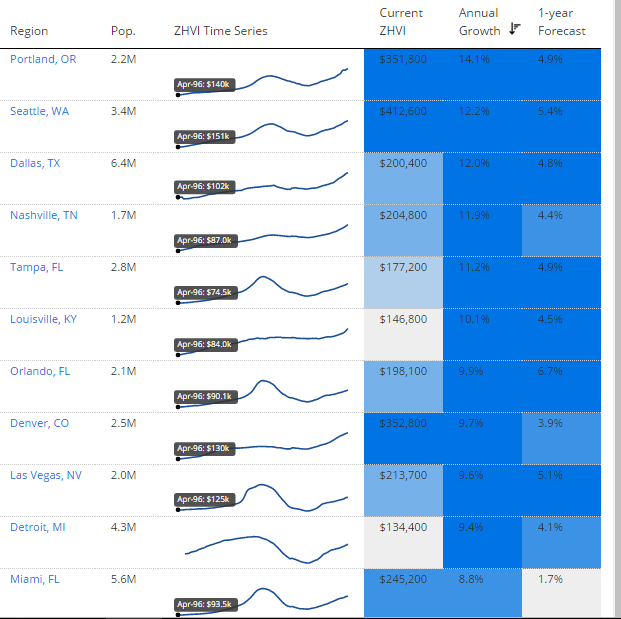

The top 10 fastest growing real estate markets

In California we have insane markets like San Francisco where $1.2 million is the entry point for a crap shack. In many ways, the capitulation talk is dominant as the Dow Jones Industrial Average nears 20,000. People are itching to get a piece of the crap shack mania and don’t want to miss out on homes going from $1.2 million to $2 million. Forget about incomes, logic, quality of life, other investments, or the reality that you are buying what is an inflated poorly built property. The delusion now runs very deep.

This real estate lusting is not confined simply to California. Take a look at the top 10 fastest growing metro areas based on home price gains:

Portland was the hottest market in 2016. It saw prices jump by a stunning 14 percent year-over-year. Coming in a close second was Seattle seeing prices going up by 12 percent. You do have to wonder how much California cash has flowed up to the Pacific Northwest. These are already relatively expensive markets yet prices still went up.

You then have lower priced markets like Dallas, Nashville, Tampa, and Louisville all seeing double-digit gains as well. Finally you have Orlando, Denver, Las Vegas, and Detroit rounding out the list all with 9 percent price gains. From coast to coast prices are surging.

You have Taco Tuesday baby boomers that like to pretend that their California HGTV drywall sarcophagus is the only real estate that is great.  “All real estate is local and they’re not making any more beach front property!â€Â Well according to the data above, house horny mania is sweeping the nation and is even more aggressive in other areas. I didn’t know beach front property was prominent in Denver or Detroit.

Something bigger is going on here. You have a couple of things going on:

-Low interest rates still fueling buying

–Investors are buying in many of these lower priced markets

-Low inventory

-Buying into a trend

You would think that there would be a broad base gain in homeownership but the percentage of homeowners remains near a generational low. Millennials are living at home deep into adulthood and many are priced out of the rental market, let alone buying a home.

Housing markets have turned into a speculative asset class. The difference however is that unlike stocks, prices go up and down in longer periods. We’re in a stage where the public feels like it doesn’t want to miss out which is very reminiscent of 2006 and 2007. We don’t have toxic mortgages floating around but any mortgage is toxic when you can’t pay it (by the way, most of the 7 million foreclosures from the last crisis came from vanilla 30-year fixed rate mortgages). And in places like California where a dump can cost $1 million ($200,000 down and an $800,000 mortgage) the carrying costs can be a big burden if a recession hits and one person in the family loses an income.

So get to your bank and buy any house you can get your hands on. Real estate isn’t local. This is a countrywide mania so you can’t go wrong buying anywhere.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

107 Responses to “Real estate is not local: Housing markets across the US are overheating outpacing household income gains.”

Assuming the last stanza was hyperbolic, I would question whether our tools of analysis are any longer able to provide us an operable hypothesis by which to make decisions about the future of the market. We are in uncharted territory.

I question that validity of the entire FIRE economy, (Wells Fargo creating fake accounts, Zillow’s accuracy, etc…) but more over, other than some of the more obvious potential conflicts of interest with home valuation firms, A lot of the major real estate market forces are headquartered in Orange County-

First American Corporation (HQ – Santa Ana)

CoreLogic (HQ – Irvine)

Case-Schiller the producers of the Case-Shiller home price index (CoreLogic bought in April 2013)

Experian (US HQ – Costa Mesa)

Trulia (HQ – San Francisco)

Zillow (Offices near SNA?)

Auction.com (HQ – Irvine)

+

ATTOM Data Solutions (HQ Irvine)

RealtyTrac (HQ Irvine)

I am sure I am missing some.

I was gonna say good old Ditech, remember them? But they moved from Costa Mesa to PA.

Good point. It’s highly unlikely though as competitors, that they collude on general trends except for their mutual interest in increasing prices. I’ve always wondered why so many corporations were attracted to the OC, especially why Irvine?

You can call me old fashioned for seeing the inflation. Real estate prices are surging. Rents are surging. This can only happen if incomes are also increasing.

Don’t fall for government statistics showing no increase in wages. Those statistics have a political agenda.

And, beware of the income numbers which are “inflation adjusted”. The biggest trick in the book is to inflation adjust income numbers downward, then compare them to home prices which are not inflation adjusted.

Clearly, this will be a very strong spring. Listings are scarce. Many owners locked in super low mortgage rates, so they will be staying put for a long time. This makes listings even more scarce.

This price surge will continue until the economy enters recession. That could happen this year, next year, or not for five years. Who knows.

jt,

I agree that low inventory will likely be here for some time to come. People will not sell for various reasons:

1. The move up buyer ladder is broken, people are “stuck” in their house.

2. Low interest rates make the monthly nut cheaper than renting…why sell?

3. Even if you are forced to move (job relocation), it likely makes sense to rent out your house.

It once again comes down to supply and demand. There is limited supply and much demand and prices will reflect that.

I agree and that is why I made a move. Opportunity is what you make of it. I just closed on a low-maintenance house two-miles from my current one. I spend 1/2 the year at a second home in another state, so the lifestyle convenience was my deciding factor. I made the move because my existing home is considered at the sweet-spot for demand and should sell quickly at asking or above! I was able to acquire the newer residence at under asking and got the seller to pay for a number of maintenance items. The difference is that I am in a position to pay cash and did. I didn’t have to worry about make the purchase conditional on the sale of my existing house, or worry about all the financing.

Hell…I’m stuck in a rental. And know many many Gen X.Y and Millenials in that same situation. Started renting a place in the Bay, Socal, Seattle (went to college there, so I have friends up there) and that 3 years ago…and now you can’t move into a nicer rental let alone move up into a condo or house.

The bond market is three times the stock market. Yellen promised 3-4 more increases in interest rates this year. What is that going to do to the bond and the stock market? Could it blow out the system? Who is going to buy the bonds anymore? What is the strong dollar doing to the US corporate profits?

The higher interest on the mountain of debt could cause not only a recession but a depression, too. Therefore, go ahead and buy any listing you find; you know there are not too many ….:-)))

Pardon the question, but sensing sarcasm can sometimes be difficult when reading on the internet. This is an honest question- we’re you saying to buy any listing sarcastically or seriously? Thanks in advance!

Faintail, based on my rhetorical and obvious questions plus the smiley sign (:-))) it was sarc. The post was addressed to the housing cheerleaders who encourage everyone to buy at the top of the biggest bubble in the history of RE. To those comments (i.e. from Jt) I answered like the Housing Doc, the author – go ahead and buy any listing in sight. What else can you answer to the housing cheerleaders???!!!!

For these housing cheerleaders like JT, all economic fundamentals ceased to be important long time ago.

Disclaimer: I am not a permanent bear on RE. I turned into a bear in 2014. I made my millions in RE exclusively, therefore I am a big bull on RE in general and a bear at this stage in the cycle. I always buy close to the bottom and sell close to the top. I never could figure the absolute bottom and the absolute top. However, getting the direction right is good enough for me. The ROI is important, but equally important to me is the level of risk associated with that ROI. Right now, I feel a very high risk level for very low ROI or potential loss.

For a very in depth analysis of CA real estate, here is a very good article I found recently. I made few of these points many times on this blog in a very short format. Nobody pays me to write at this level of detail. It is a long article but worth reading.

http://www.nationalreview.com/article/443466/california-madness-hypocritical-coastal-elites-soak-middle-class

The future of CA is like the third world countries of South America – few billionaires and the rest EQUALY poor. That is caused by two major factors:

1. Middle class exodus due to high cost and high taxes – vote with their feet agains the liberal insanity from San Francisco and Sacramento. If you don’t believe this, check with the moving company. It cost more to rent a truck to leave CA than the same truck to move into CA. It’s the supply and demand.

2. Whatever left of middle class taxed to poverty to support millions of poor and enrich the very rich politicians even more.

If someone sees this or not makes no difference. All will be affected anyway. Yes, the population can stay the same, but the number of taxpayers increases by 150,000 for 10 millions moving in. Today CA is not the same CA from 3-4 decades ago, therefore you can not extrapolate what happened in CA in the last 3 decades to next 3 decades like JT does all the time.

@Fantail

It’s sarcasm. You wouldn’t pay sticker price for a car like you wouldn’t buy a house near or at its peak price. Especially not when higher financing costs will drive demand, and eventually prices, down.

“Don’t fall for government statistics showing no increase in wages. Those statistics have a political agenda.”

Everything has a political agenda. But the truth is somewhere in the middle. Employers are complaining that they cannot find employees. But those same employers are statistically not willing to increase wages. They are still stuck in the 2009 mentality that all workers should be satisfied with having a job at all. Which they then can continue to keep wages the same but continue to take a larger profit. Where is the incentive to supply more towards an employee budget? Isnt supply and demand supposed to force employers to increase salary to attract talent? Instead they bypass hiring full time and look at temp workers and hb1 visas. Then the only people that can afford housing now are the ones not paying for increase wages.

I work in the industry where the jobs pay at least $125K/year. I work in HiTech Industry and the jobs are getting obliterated because of two reasons mainly: 1) Obliteration because of Automation, AI and Machine Learning 2) Outsourcing where you can hire 3 person in a foreign country for the cost of 1 person in USA.

I am not sure how this can be prevented or what Trump can do.

The above two factors would vaporize Middle class in USA and thus would bring down the real estate prices big time.

It’s a matter of time not If.

@John

That’s something that real estate bulls can’t understand about the real economy. They look at positive media headlines and cheer high housing costs that impoverish the vast majority. They can’t understand RE price growth have exponentially outstripped real wage growth in great part because of the very reasons you outlined.

Trump won because of general economic discontent that the establishment candidate, Clinton, refused to acknowledge.

I was on H1B visa for 10 years and I understand this hi-tech visa quite well.

This visa was created to fill in hi-tech jobs but its no longer the truth.

H1B visas are now synonymous with cheap labor as person with h1B visa is like indentured servants.

Any company would gladly hire a US citizen instead of H1B because of cost. IN that way, you can say americans are entitled and lazy

PrinceOfHeck, of course real wages fall short of home prices, which are nominal. Real wages are reduced by inflation, while home prices are not. The gap is inflation.

Any honest broker would compare nominal wages to nominal home prices, or compare real wages to real home prices. A dishonest player will compare real wages to nominal home prices, then jump up and down.

@jt

The point is that RE price growth in overpriced markets have far outstripped income growth, based on real and nominal standards. Compare the down payment and debt required now compared to 20 years ago. Or price to income ratio. Traditionally, RE prices has been subjected to mostly only wage inflation. But during the era of central bank intervention, speculative inflation has become a bigger component of RE prices.

I believe wages are increasing in some occupations but remember that not everyone has a college degree. For most people that steel mill or paper plant is still CLOSED.

As someone who does not live in a bubble I can see other’s are struggling. 10 years before retirement and you get laid off, unemployed for a few years makes no one want to hire you and it is an endless cycle. The people buying houses are dual income no kids. If I had a wife to split a mortgage with $650,000 would not be so bad.

“Don’t fall for government statistics showing no increase in wages”

I have no clue what the F you are talking about but Obingo has been crowing about wage growth all year. Most people i know don’t even have jobs and those that do haven’t had raises in years, some in decades and that includes more than just socal.

And i just read that 94% of the 10 million new jobs created between 2005 and 2015 were temporary (AKA part time) or contract based jobs not 9-5 traditional jobs according to a study by Princeton and Harvard economists.

According to David Stockman “bread winner” jobs are still below the level of 2000 and inflation adjusted income is down as well

Once again the “fundamentals” make ZERO sense hence, bubble 2.0

Wrong it’s not different this time…….

How much money has been dumped into the system since the last crisis? Where do they expect that money to go? Inflation comes in two forms, we forget that asset price inflation is actually inflation, but it makes us feel rich, so we don’t mind.

The big question is, are human beings so stupid that they would walk into the same buzz saw that they walked into 12 years ago? Absolutely. People are that stupid. Look at the stock market. Another detached market. No basis for valuations, other than mania.

It’s so sad what the Fed has done to us over the last 100 years. Not that the pre-Fed era was great, it wasn’t. But the gold standard for all its flaws, always nipped manias in the bud, with short, steep recessions and swift recoveries. We should never return to the gold standard, but the dollar should be tied to a basket of commodities and left alone. This will never happen, so the only alternative is making money on stupid people until the end of time. Will stupid people get angrier and angrier as they fall into these traps? And will they eventually vote for a Hugo Chavez like candidate by 2024? Likely. They’re that stupid.

The old outage, bread (welfare for the select few) and circuses (media to brainwash the impoverished majority), is alive and well.

One of the investors I follow predicts the stock market will rise on ‘trump delirium’ through Q2 or Q3 of 2017 before the stock market begins its descent. That being said, I dont see how home prices can fall with any significance UNTIL there is a job-loss recession.

I guess no one can predict when the job-loss recession will happen but with Trump in office I am sure he will do everything in his narcissistic power to prevent that from happening (since it is his main campaign promise aside from building a wall even though most of the Mexican border is either walled or fenced.

California raised minimum wage and low skill jobs are leaving or being automated (American Apparel has sent 3500 CA workers layoff notices, for instance). Minimum wage earners aren’t buying 700k crap shacks but they are helping to prop up rental prices. Large school districts will be having layoffs soon. LAUSD and SDUSD have deficits that are 100s of millions of dollars for 17-18. Unfunded pension liabilities mean less money goes to workers. Venture capital is drying up in Silicon Valley. CA global warming policies have forced farms, especially cow farms, out of state. There will be less jobs at the ports if trade wars start. There are a number of ways that CA could have major job losses without a US recession and Trump doesn’t owe CA any favors.

If venture capital really does dry up, be prepared for a mass exodus of H1B types, and personally, I don’t care if the screen door *does* slap ’em in the ass on the way out. The dot-scam game is different this go-around. Last time, if you put “.com” in your company name, people threw money at you. These days investors are a big cagier, they do a physical walk-around, and they want to see asses in seats. Lots of asses in seats. So if you’re gonna scam ’em into losing tons of money on your new fart app company, you show ’em a huge room full of engineers sitting at workstations – cheap H1B engineers who can’t engineer their way out of a wet paper bag, naturally.

Companies are also regularly caught bringing Indians in and paying them what they’d make in India. They get a bunk bed to sleep in and free food, but they only get $2-something an hour. Occasionally someone forgets to pay the bribes so oops! – they get caught and it makes the news.

Now, and this is a very, very, remote possibility, if Trump does what he said he would and make things better for the American working class, you can expect lots of Indians and Chinese to go home. I’m pretty sure the Chattering Cheeto will only look out for himself though.

I agree that just looking at the real estate/housing market in California is foolish! There is a whole lot more going on under the surface that should scare anyone planning on making California their long term home! The State and local government entities will have to steadily and continuously raise taxes or face bankruptcy. My understanding is that accounting law changes may force the State to fully report it’s 1/2 trillion in liabilities in debt, in the future, which will likely affect it’s ability to borrow as well! The sad catch 22, those government entities love that property values are going through the roof also … without doing a thing, more property tax revenue has been coming in! But, still, in a State where building a high-speed train from Bakersfield to the Bay are deemed a higher priority than solving the too-many to mention unfunded water main, street repair, pension problems, etc., the writing is already on the wall for those who take off their rose-colored glasses … California will continue to slide into 3rd world!

That may coincide with the potential interest rate hikes by the Fed this year if there is correction?

Rents are not surging. Perhaps the asking prices for what you see on the internet are, but the reality is they are falling. I am a longtime renter and just made a move. Better neighborhood, 300 more square feet, better schools and $400 less than what I paid for my last single family rental, which I signed a lease for in 2014.

It took some patience and had to wait for them to sit through their two months at the higher asking price, but reality set in and my offer was accepted. Be prudent and stay patient. Surging rates is only the narrative.

It’s geographically based. Rents in LA are seeing manic levels of increases. In my neighborhood I’m hearing and seeing 9% annual raises in rents every time the unit is vacant. This amounts ton15-30% in a couple years. Take some inventory away for airbnb and the problem gets magnified.

Most people in LA would be hard pressed to find a better home, schools and commute for a lower payment.

Just my local experience in the Southbay and west LA

I am in the valley. South of the Ventura Blvd too. I saw the same increases online and just watched properties that sat for a long time. There are more and more sitting. Rent has certainly topped out, even with large management companies and realtors doing their best to control it. Every house I looked at had a realtor showing it. It wasn’t that way in 2014. If something popped up that was under priced and not under contract with a realtor, it disappeared and came back more expensive with a realtor in a couple of days.

Properties that rented quickly at top dollar also often reappear a few months later as if they never rented or the renters quickly moved on. The internet makes price collusion easy, but it also makes tracking this stuff and spotting the BS easy as well. The market radically changed since 2014 and nothing about it feels organic.

Yes, hurry, get your beach front property in Oxnard, the Newport Beach. The properties are going fast, hurry, hurry. It is Taco Tuesday here everyday if you want.

That’s because if you go 1/2 mile in from the beach it’s 1980s Santa Ana every day.

1980’s Santa Ana was great to live in. Not nice to live now, according to some. Corona Del Mar is just down the road from Santa Ana and on the weekends, the locos love to party at the pits. Ventura County Sheriffs and police don’t allow the Santa Ana locos type up here.

1980’s Santa Ana was everything normal* people said about “Mexicans”** writ large. Shootings, stabbings, drugs… I understand “Santy Anny” has gentrified now and it’s not bad, but back in the day….

*straight white Protestant males, of course!

**If you are Hispanic, in the US, you are “Mexican” so just get used to it.

Detroit and its metro area have a great deal of beachfront property! There’s the Grosse Pointes on Lake St Clair and dozens of swimming and boating lakes in Oakland County, all natural and many of them private. On my lake, Lower Long Lake, our house had an acre on the water with our own dock and lawn watering pump, and enjoyed swimming, windsurfing, skating and cross country skiing. These properties held their value much better than others.

There’s a town called Clear Lake that’s north of the Bay Area and houses with docks etc are amazingly cheap compared to the Bay Area (or Orange County for that matter). This is because the commute to where jobs are is just a bit too long, so a worker would still need a place where there are jobs and see their family on weekends. The main industry in Lake County is meth, the flyover industry of choice(tm).

But if you can start a small business (not meth) that’s location-independent, it’s one example of a place that’s near water and nice and inexpensive. Just don’t leave valuables in sight in your car…

Yeah, I’d say;

https://en.wikipedia.org/wiki/Clearlake,_California

The median income for a household in the city is $19,863, and the median income for a family is $25,504. Males have a median income of $24,694 versus $18,207 for females. The per capita income for the city is $12,538. 28.6% of the population and 23.5% of families are below the poverty line. Out of the total population—-

39.8% of those under the age of 18 and 8.4% of those 65 and older are living below the poverty line.

Rents are still so bad in the West side of LA….Apartment stock is crappy and the rents go up every year. I have been looking for my freshly returned from college son, helping him target in on areas to live in close to his job. Its $1250-1500 to share an apartment if you are lucky enough to find one. He”ll be living in his old bedroom until he gets a raise or finds a unicorn rental deal…it makes no sense for him to spend 50% of his income on renting.

The whole reason that apartment rents are high on the west side is restrictions on building

http://www.apartmentguide.com/blog/top-50-most-expensive-places-to-rent-an-apartment/

What’s the long term plan for people staying out of the local housing market?

Are you investing the down payment & monthly savings to finance housing at retirement? Or are you planning to leave SoCal in the next few years and buy elsewhere?

I’m stuck trying to make a decision. I don’t want to overpay or leave my future self stuck paying high housing costs on retirement income.

Good question Maybe some people have some creative hedging ideas

http://www.cmegroup.com/trading/real-estate.html

The problem is that the rents are high enough to make saving very difficult. I suspect that most people renting here save very little at all. So I guess your post is directed towards people who could afford a mortgage, etc. but save money every month by renting.

I just closed on a new primary yesterday, but that was a case of everything falling into place perfectly for a 20-year stay (in our case it was a far smarter decision than renting). If I was single without clingy inlaws and/or didn’t have kids, I would rent, deal with a long commute to save money, live below my means, and stay nearly all in cash until I saw the stock market dropping consistently. Re-evaluate from there. I have a gut feeling/wild guess that we’ll see the stock market drop first this time (the housing market went first last time, but this bubble is different). I wouldn’t consider leaving CA until retirement – it’s only unaffordable for those unwilling to commute. A single person on a software engineer or nurse’s salary in San Diego or Riverside counties can still rent and live VERY well by themselves with a 30-45 minute commute. Hence my disdain of millennials who live in shipping containers and industrial “artist communes” in the bay area, while complaining that they can’t afford to buy – so MOVE! Plenty of engineering jobs elsewhere, in MUCH nicer places than LA and SF.

Did a virus enter the room? Ah AHH… BULLSHIT!!

Engineering jobs are hard as hen’s teeth to find and you pretty much have to know someone to get one. A modicum of engineering skill is helpful but not necessary, what IS necessary is knowing, or being related to, someone. We’ve got CS grads stocking shelves in the Bay Area and I know more homeless than non-homeless engineers.

A 600K loan at 4% for 30 years has a monthly payment of $2864. A salary of 103K is needed to safely qualify for a loan(ie 1/3 income). I am not counting prop taxes (1%) or interest tax write-offs which mostly balance. The median middle class yearly salary is 52K. If you are just an average dual income, no kids household, then you can buy a house/shack somewhere. 600K will buy a very nice house in Denver and an even nicer house in Detroit. IMHO, even average people can still buy very nice houses in most of the US. IMHF(urther)O, I think they are still crazy and pushing the limits because I’m an old guy who can’t let go that in the 80’s, that same house was 200K. Of course back then, the median income was 24K.

Most of the people that post on this forum really ‘get it.’ It is definitely a more savvy group than the general public. That being said, there will be upward price and rent pressure so long as the employment market remains intact. And I standby my projection for a spring boom (at least in my Nor Cal RE markets.)

I honestly feel for renters…my rents are at astronomical levels. As an example, 10 years ago I was getting $525 for semi-ghetto units that are now $850 and probably could be much higher if I was into gauging. That is a yuge percentage big increase. If you don’t think rents have boomed (like someone said above,) you are not plugged in. I honestly feel that the rent crash is going to be much larger percentage wise than SFR detached valuations. Rents are that bubblicious.

Watch for major multifamily distress, interest rates on are not fixed on commercial. Us landlords have 5-7 year debt for the most part and then there’s a bullet or your rate floats. Operators who have done cash out refi’s and bought on pro-forma caps will get rogered sans lube when rents walk back.

Trump will be squarely blamed for this meltdown as it will happen on his watch. There is nothing he can do about it. Of course he didn’t cause it but most low information folks will attach blame to the Orange Stallion.

Rents in San Diego increased 1% in 2016. This news came out yesterday.

I wanted to buy condo in SD to rent out but didn’t as I was barely cash positive.

“I wanted to buy condo in SD to rent out”

you and everyone else and it’s this issue that i think is going to collapse the market this time. There’s too many mom an pop “investors” trying to do this and many have borrowed from the primary residence (or 401K) to pay “cash” for the rental. Once the market turns and these “investors” can’t cover the nut on the 2nd OR see their “imaginary wealth” evaporating due to falling “values” they will all rush to the exits.

AND if the FED/government/banks (fat chance i know) stay out of manipulating the market I’d bet the true “value” of housing based on income is far lower than anyone will believe.

From KPBS in California. “San Diego rent prices continued to go up last month, but the speed of that climb has slowed significantly. ‘San Diego saw really large rent increases in 2015 and early 2016 — in the order of 6 to 8 percent over a year ago,’ Woo said. ‘But starting in the middle of 2016 and continuing through this past month, those actually dropped quite a bit.’â€

San Diego has 3000 new rental units coming in 2017. Have you noticed lots of single family homes in SD are sold and immediately put up for rent? I don’t understand how those buyers make money when they are competing with landlords that owned or inherited property purchased before the bubble.

Funny enough this article popped up on ZeroHedge today. It references a Wall Street Journal article (subscribers only) but lists data points for a few of the cities with the biggest growth listed above (Nashville/Dallas). These cities along with LA, NY and SF have some of the largest year over year increases in new apartments coming online.

Basically the big and smart money started this process 18-24 months ago all with the same idea.

http://www.zerohedge.com/news/2017-01-03/luxury-apartments

or http://www.wsj.com/articles/luxury-apartment-boom-looks-set-to-fizzle-in-2017-1483358401 if you are a subscriber

As I mentioned in the last thread, up here in the Bay Area they’re building apartments *everywhere*. Hundreds of units going in on every piece of vacant land available, and there are lots of those here. Got a favorite field to fly your drone around on your lunch hour? Now you don’t, it’s 1000 apartments!

Plus some rich do-gooder (the best kind; they have money) is going to start a shipping-container village for homeless people on some gov’t land next to Lawrence Expressway, and if that’s shown to be workable, I’d expect to see more. What this means is, more total units of housing coming online. A lot of homeless people here have disability checks or just make a decent income flying that sign, but can’t rent a place with no papers or credit. So they pay what a housed person would pay for a small apartment, on seedy no-questions-asked motel rooms part of the week.

So while we can’t predict the actual time of downturn, we do know one’s due, and right in time for it there may be what will amount to a glut of housing.

Government workers are doing very nicely, in terms of wages. El Monte’s retired mayor gets over $216,000 in pension, plus COL increases, plus free healthcare: http://www.cctoaks.com/2016/12/when-city-retirement-pays-better-than.html

The retired city manager of El Monte collects more than $216,000 a year, plus cost-of-living increases and fully paid health insurance.

“It’s giving me an opportunity to do a number of things I didn’t get to do when I was younger, like travel to Europe, take some things off my bucket list,” Mussenden, 66, said recently. He even flew to Scotland to play the famed Old Course at St. Andrews, a mecca for golf enthusiasts….

Actually, Mussenden has two pensions. He’s part of a coterie of former El Monte civil servants who receive one taxpayer-funded pension through the California Public Employees’ Retirement System (CalPERS) — and a second through a “supplemental” plan approved by the city council in 2000.

Back when I was a kid in the 1970s, we were told that government jobs were for losers. Smart people worked for the private sector. Boy, was I misinformed!

Indeed we were all misinformed. I remember a time around 1990 or so that city? county? something like that, employees in Orange County had to take a pay cut, but I doubt it was catastrophic.

There are tons and tons of jobs that are not “sexy” like doctor, lawyer, engineer, rocket scientist, that pay really well.

Landlord,

Please don’t take this personally as it most definitely is not. But I get really irritated when public pensions get pointed out as some sort of problem. (I don’t even think you’re criticizing it, so I’m just on a tangent.)

All of these low salary people represent a drop in the bucket against exec compensation that is off-the-charts, guillotine levels at this time. And I mean both corporate America and Wall St.

Pensions and Social Security are excellent ideas for a healthy society. I will never condone poverty of the aged. And let people live a little once they’re truly long in the tooth. They weren’t the ones galavanting across the globe for 2-3 months per year in their prime.

“All of these low salary people”

I’m assuming you mean us in the private sector because public employee compensation is off the fucking charts. I have a friend that works for the city and she gets a raise every six mother fucking months…….while i get a raise every sixth fucking decade.

and the golden parachute retirement package these workers get is going to bankrupt the nation.

Mike: All of these low salary people represent a drop in the bucket against exec compensation …

Private sector execs might not deserve their pensions, but paying for it is not my problem. Paying for overly lucrative govt employee pensions is my problem. Big time.

Mike: And let people live a little once they’re truly long in the tooth.

1. Retired govt workers are not “truly” long in the tooth. They retire early. They can put in 20 years and retire with 90% of their salary for life. Over 90% if they put in a lot of overtime in their final two years. They can retire in middle-age and earn six-figure pensions — plus free healthcare — for another 40 years, paid for by me and other taxpayers.

2. They’re not “living a little” on their fat pensions. They’re living large, for decades, on six-figure pensions. Paid for by us, the taxpayer.

Reported on KFI-AM a few days ago: 20% of Los Angeles’s budget goes to retired employee pensions and benefits. That percentage keeps growing. Ever more taxes for retired workers means ever less money for current services. Never mind planning for the future (e.g., fixing crumbling roads, sewers, water pipes, earthquake retrofitting).

mumbo_jumbo,

No, I wasn’t comparing public vs. private. In some areas, public salaries are better. But more often, at higher levels, private is better.

In general, I was comparing people who make $40K-$100K to people who make $250K and up. If you’re not rich, you shouldn’t be concerning yourself with public pensions. You should be applauding them. If you need something to complain about, then do so about private companies having gotten rid of pensions in favor of 401k’s. That’s a big loss for the non-ownership class.

KFI-AM is of course the Rush Limbaugh mouthpiece station for the Los Angeles area ….

Alex: KFI-AM is of course the Rush Limbaugh mouthpiece station for the Los Angeles area

KFI no longer carries Rush Limbaugh, but if it did … so what? Does it mean that if KFI reports that it’s raining, then it’s really not raining?

KFI reported that 20% of Los Angeles’s budget goes to retired employees. How about you address that report with facts — pro or con — instead of telling us about KFI’s lineup of hosts?

Think you can do that?

Since you can’t, here’s a source:

http://www.latimes.com/projects/la-me-pension-squeeze/

Which seems to back up the allegation broadcast on KFI. I don’t consider KFI to be a legitimate source, but in this case the numbers they spouted are correct.

If they don’t run Limburger any more, who have they put in his place? “The G Man” G. Gordon Liddy?

Alex, you can always go to KFI’s website to check out their lineup of hosts.

Since you haven’t, I’ll tell you that they’ve gone all local talent in the key time slots. No nationally syndicated hosts, expect at late nights and weekends.

Monday through Friday they begin mornings with Bill Handel. Then Gary & Shannon, then John & Ken, then Tim Conway. At 10 p.m. they switch to the nationally syndicated George Noori’s Coast to Coast show.

KFI’s gotten so successful, they prefer to run local talent and keep all the ad revenue for themselves.

Son of a landlord, I’d love to see how much “you’re paying” for the la pensions. Look at your 2016 W-2, which should arrive shortly. I’d love to see how much your indignation is worth.

Non-issue. Please put actual numbers to this.

Alex, KSFO has Michael Savage , you probably listen to him 12-3pm.

Bill Handel’s always great. Hell, he’s who I heard about 9/11 from. You tell me they’ve got Tim Conway from McHale’s Navy? Who they really ought to put on late night is Phil Hendrie, go check his Wikipedia page, the guy’s a radio genius.

Alex,

Based on the amount of lies and propaganda coming out from CNN, MSNBC, etc. (MSM) in the last year I don’t consider those sources of information legitimate. They are just purveyors of “fake news”.

Absent these legitimate “fake news” sources, everyone is getting their information from whatever source they perceive as more reliable. LA Times does not fall in a “reliable news” category. They can be correct only by accident like the weather channel.

Mike, pensions are not a non-issue. It doesn’t matter that I — or other middle class taxpayers — only pay a small portion into the pensions. Our small portions add up to a big pile, which is needed to fix the roads and water pipes, for earthquake retro-fitting and news damns to deal with this drought, plus police and fire, plus special ed teachers for Meri’s kid.

Can I assume, Mike, that you’re pulling in, or expect to pull in, a huge pile in govt pensions?

Alex, I should have said Tim Conway Jr., the son of that actor on the Carol Burnett Show (and I guess McHale’s Navy, which I never saw). Although the son sometimes has his father on as a guest.

While opponents of homeownership claim it’s “the American nightmare,†self-made millionaire David Bach is doubling down on his faith in real estate.

He thinks that not prioritizing homeownership is “the single biggest mistake millennials are making.â€

Buying a home is “an escalator to wealth,†he tells CNBC.

Young adults in particular aren’t hopping on this escalator, and it’s a costly mistake, Bach warns: “If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.â€

The self-made millionaire is quick to say that the smartest investments he’s ever made have been the three homes he’s purchased. He tells CNBC: “I first bought a home in San Francisco. It skyrocketed in price. I moved to New York and bought another home. It skyrocketed in price. My net worth has gone up millions and millions of dollars, simply because I’ve lived.â€

Bach argues that you have to live somewhere for the rest of your life, so you might as well invest in a home that you could own permanently.

As he writes in ‘The Automatic Millionaire’, “As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!â€

If you want to get in the game of homeownership, start by crunching the numbers, Bach says: “Actually do the math. Look and see what things costs, starting with the smallest options. This way, you’re really clear on your goals and you won’t just say to yourself, ‘I’ll never afford this.’â€

A good rule of thumb is to make sure your total monthly housing payment doesn’t consume more than 30 percent of your take-home pay. He also recommends having a down payment of at least 10 percent, though more is always better. Finally, recognize that “oftentimes, buying your first home means you’re not buying your dream home,†Bach tells CNBC. “You’re just getting into the market.â€

A lucrative market, that is. “The fact is, you aren’t really in the game of building wealth until you own some real estate,†Bach writes.

Link:

http://www.cnbc.com/2016/12/30/self-made-millionaire-buy-a-home.html

“A good rule of thumb is to make sure your total monthly housing payment doesn’t consume more than 30 percent of your take-home pay. He also recommends having a down payment of at least 10 percent, though more is always better”

No wonder the home ownership rate is at decades low considering current prices and stagnant wage growth. Either prices have to fall in line with local incomes or incomes have to catch up with prices. Which is more likely to happen?

I wonder when he purchased said homes.

This mentality, along with the leverage that enables it, has created the danger in housing prices.

At some point, a majority of people will realize that prosperity is not tied to the price of their home. They have been misguided by all the vested interests for nearly a generation. As soon as it is widely recognized that their residence is not the path to wealth, the market will change dramatically.

Who knows what will spark that change, but its just a spark that will turn everything upside down…or back to normal…depending on how you see it.

Owning a home IS the path to freedom; without a home you are either homeless or someone’s bitch. There are plenty of places in this country where you can own a decent place for CHEAP. Actually owning your home (no mortgage) in a low tax area changes your life in ways that you can’t appreciate until you’ve experienced it. My advice to anyone in CA who feels trapped is to spend all of your spare time researching other states and pick one. Then find an area you like that has a surplus of foreclosures and low ball them like crazy until one says yes. Pay cash! Spend a couple years fixing it up and then enjoy your freedom.

Anyone who says real estate is not the path to wealth really doesn’t understand the game. All business is ultimately a derivative of real estate. Countries only exist for real estate. In medieval times you were nothing without real estate. The new world was always about the promise of real estate and property rights are the basis of what made this country great.

If you are being denied entrance by the status quo THEN MOVE. You only have yourself to blame if you accept serfdom. Essentially it always winds up boiling down to a choice between violent revolution to unseat the entrenched status quo or striking out in search of a new frontier where there aren’t as many gate keepers. There is no shortage of land available in the USA for the peacefully inclined to move to. (yes, you could argue for a 3rd option to work to change things but you have a snowballs chance in hell of changing the 3rd world direction of CA in any reasonable time frame.)

It amazes me how much b.s. people will put up with. We are like the frogs in the proverbial boiling water. I wish I had taken my own advice as soon as I was legally entitled to, I would be so much further ahead right now! I’m so glad I left that stupid state.

I hoped on the “escalator to wealth” in 2007. Didn’t work out to well.

It works just until it doesn’t.

F*CK YOU DAVID BACH!

Look at the math…

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!â€

YES! YOU ARE CORRECT!

A half decent crap shack in my neck of the woods will cost you at least 600k…

So all I need is $120,000 for a down payment! EASY!!! LOLOLOLOL

My Grandpa paid $40,000 for a comparable house in 1963.

I now need 4x his entire mortgage just for the down payment.

Totally. I love talking to those who bought a house in the 90s or prior, and they claim they had to “stretch” too. Yeah, they had to “stretch when homes in LA were 4x income. Now they’re well over double that.

Or you can buy a house and lose your shirt, you can get foreclosed out of it, etc. Sorry but idea of real estate being some kind of an “escalator to wealth” is horse-shit of the strongest variety. I’d much rather my parents hadn’t gotten suckered in by the scam and had buried jars of pennies here and there or something.

The best course in life is get some boring but necessary job, like wastewater management, then make sure that job is Government and Unionized. And live as cheaply at you can, assume the economy might crash at any time and live accordingly.

JY says: “A good rule of thumb is to make sure your total monthly housing payment doesn’t consume more than 30 percent of your take-home pay. He also recommends having a down payment of at least 10 percent, though more is always better. ”

That is the most important advise; you can forget the rest. The biggest mistake you can make in life is to lie to yourself. Therefore, make sure that in that 30% you include:

PMI

Property taxes

Melo Roos

Homeowner dues

Maintenance at 2%/yr. If the house is older, use a higher %.

Mortgage insurance you have to pay if less than 20% down is used.

For the calculation, use the net income because the interest deduction for all practical purposes will become irrelevant when the standard deduction for a couple goes to $30,000 under Trump proposal.

If you use all of the above, then I agree you are safe as long as you never get an accident or get seriously ill, none of the husband and wife lose the job, the economy never gets into a recession or depression and you never go into a divorce. If any happen, you hand the key to the bank and lose the 20% like millions did in 2008-2010.

Good luck finding a house in SoCal with the above healthy advise, which is exactly the point of most of the bloggers here. Make sure the neighborhood is safe especially if you have a wife, daughters and you don’t have a garage for every car. Where you buy, I hope your children will get a true education and not just be in a gang infested school!!!!

Please let me know know many listings you can find meeting the above criteria. I hope they are not in thousands because I don’t have time to look at all of them :-)))

Flyover that’s a solid-gold post right there.

All of you regular posters argue the same old stuff. It is all vaguely theoretical to you, all having made your money or bought your home(s) in the past. All the comments are just the same old casual political and RE debate, with only Alex thrown in for his cliche racist socialist rants. Congrats for you. But even though I’m just another talking head on the internet, I’m a regular person with no political angle and this is a real, slow, painful fucking nightmare for us.

Some people just want to buy a permanent place to live. They aren’t whining for beach front property in San Diego. They aren’t whining for a McMansion on a McDonalds income. Some people just want a home and will find that despite doing all the “right things,” are unable to do anything in the midst of the most absurd housing market. And you can twist this around and try to argue that everything is as the “market”/Fed/Demand/weasel word dictates but at the end of the day, your average hard working middle class person has the right to stop and say, “What the serious fuck?”

In a few months, my special-needs child will start school and per law, will derive some of his therapeutic needs from the local public school and the rest from various therapists in the area. Therapy is also contingent on local state laws and protections so, most families tend to point to the same handful of states. Within those states, we need to live in an appropriate school district that has the funding to supply these services. Good services also tend to center where there are large populations and vibrant collaborative professional networks — in major metropolitan areas. And we’d like to buy because with rent jumping up each year, we cannot handle being suddenly priced out of our neighborhood and completely up-ending our kid’s life.

Living in a suburb of a major city, in a school district with good special education services, and in a state like California as a small, young family of grad-school educated, white collar professionals in our mid-30s? THAT SHOULD NOT BE AN IMPOSSIBILITY. And yet, it is. There are literally 3 condos that fit our budget and needs and they are not really places I’d want to raise a disabled kid.

And no, I am not some stupid millennial on the internet upon which you can project your theories that explain why we don’t “deserve” to own a permanent home. I’m not any example of personal irresponsibility for you to use to inflate your own misguided sense of personal brilliance, insight, responsibility, and success. We’ve just been dealt a shit hand.

If Trump wasn’t out to completely dismantle social protections, like those for my kid, I would be on the BURN IT ALL DOWN TRUMP TRAIN. As it is, we are just feeling more and more vulnerable and depressed. Why is America like this?

Oh what a cry baby you are, I was with you until you started crying and whining. My wife and I make a decent income for LA and we are probably more educated than you guys unless you can beat Palo Alto and Cambridge, but we don’t feel like we deserve a “home”. Our son is growing up just fine in our rental, life is what it is. Our parents didn’t give us squat for money as down payment or paid for our education, but they provided food, shelter, and love. You are right many of these posters bought a long time ago and were in a better position to buy because they may be older than us which means they had their careers in order while we were starting ours, but it doesn’t mean they had it any easier.

My wife and I can buy right now but at what costs? 800-1 mill for a home that just seems insane to me. I rather keep paying more taxes in lieu of mortgage deduction. At the end of the day, you just have to deal with it and not “expect” anything. If you want to be on the Trump train go for it, I don’t think he is out to destroy anything intentionally that will hurt your kid. We plan on private school for our kid, maybe look into that.

America is like this because anyone with money from anywhere in the world is allowed to buy the RE here, no questions asked. Just wire the money. They eat up all the RE that is leftover for middle class families. Mexico, Brazil, Spain, these are countries that have massive restrictions on foreign nationals buying RE, probably hundreds of others too. This country needs a reset and it will hurt, but I don’t see how young middle class families will have a chance otherwise.

Yep buy a half-mil house or commercial building and you get instant citizenship here in the US. Such a deal, eh?

“Why is America like this?”

Meri, the answer to your question is that America is not the only country were the middle class feels this way. The middle class feels this way in any country with a central bank – FED in the case of US. We live in a debt based economic system where the borrower is a slave to the lender. This system is by the FED and for the FED. Hint – none of the FED employees are government employees. The FED is owned and led by a private banking cabal who can print money out thin air while the inflation is pushed on the middle class. With their money printing they can buy any politician.

If it is Obama or Trump, it does not make any difference. As long as you have the FED, your lot in life is not going to change significantly. During the Obama years, the amount of national debt increased more than under all previous US presidents combined. By the time he leaves in 2 weeks it will surpass 20 Trillion dollars. It was under 6 Trillion in December 2008. How much of that did you see???? How much of that did the middle class see? If they would have divided that amount equally among all citizens, how much would you see of that? What would be the effect on the economy?

Now, especially with constantly increasing interest, most of the taxes go to service that debt with real money for which the middle class worked hard. These borrowed money were from the FED created out of thin air. Taxes are a wealth transfer mechanism from the middle class producers to the bankers from the FED. The IRS was created by the FED. There was no IRS prior to 1913 when the FED was created.

While the US jobs are shipped overseas by globalists and NWO advocates, the US is getting filled with illegal immigration to depress wages even more. The financial sector in US used to be under 20% of GDP just few decades ago. Today it is getting closer to 50%. Trump might be wired in some respects, but in many of the things he is saying he is right. If he is doing at least 50% of what he is saying I would be happy. However, he has a very strong enemy in the FED. The FED and the globalists/NWO do not like populists like Trump. What they want are more wars for control of more global resources. The current blaming of Putin and escalating tensions with Russia is part of the same agenda for more wars. All wars are created by the bankers and are paid by the middle class in taxes and inflation (stealth taxation).

I hope that you can now understand why you can not buy a house.

14 Trillion split evenly between 200 million adult / US citizens would be 70k each FWIW.

@Meri,

It is unfortunate to hear about your situation, but I have a few questions for you.

I assume you have your financial house in order (no debt, savings, a downpayment if you are thinking about buying).

You did not mention if both spouses are working. If you are on one “middle class” income supporting a family in this city, things will be brutal.

What part of the city are you looking in where you can only afford a condo? Have you thought about looking in different areas of the city that are still safe, have good schools, and treatment for your child. The tradeoff will likely mean commuting; however, this is something you are doing for the benefit of your family.

How aggressive are you in determining housing affordability. Some people are stuck on old rules that simply don’t apply anymore (house price = 3 x annual income). You are competing with people who will lever themselves to the max and lose out every time in this city.

There are too many forces at play keeping CA RE prices elevated in decent, desirable areas (exactly what you are looking for). Supply, demand, no more buildable land, NIMBYism, environmentalism to the extreme, Prop 13, wealthy foreigners, trust fund babies, etc, etc, etc. Answering some of my questions will shed some light onto things. Good luck.

Meri’s saying he hates socialism, but wants it for his kid. You can’t have it both ways, Socialism for everyone, or go free-market and put your kid in a private school. In other words, the RINOs are restless tonight.

Meri, it took one year from the stock market crash and the start of the Great Depression under the Republican policies of Hoover before shantytown Hoovervilles popped up on the White House lawn from people forced out of their houses and rentals This started the 16 year presidency of the most socialist president in US history. So far, people are managing by stacking up in rentals or stretching their life savings for a house. The pain isn’t there yet for modern Hoovervilles. We’ll see under Trump if he cuts the social safety net and repeats history.

Good points. I’ve been saying we need another FDR but I didn’t think we’d have to have Hoover II to get to him. While we have shantytowns a’plenty, you have a point it’s not bad enough yet but if Trump and the cronies he’s appointing get their way, it will indeed get bad enough.

After 8 years of Obama, there are plenty of Obama shantytowns, a record number of people are on welfare and EBT, the US has the lowest labor participation rates in decades, and the US has almost $20 trillion in debt with nothing to show for it.

FDR? The US definitely doesn’t need another FDR.

FDR issued executive orders that not only interned Japanese but also Italian and Germans too.

FDR issued an executive order that basically stole people’s private gold and it wasn’t until 1974 when president Gerald Ford finally signed a bill that would “permit United States citizens to purchase, hold, sell, or otherwise deal with gold in the United States or abroad.â€

FDR’s New Deal programs were financed by tripling federal taxes from $1.6 billion in 1933 to $5.3 billion in 1940. Excise taxes, personal income taxes, inheritance taxes, corporate income taxes, holding company taxes and so-called “excess profits†taxes all went up. The money spent on New Deal projects came from taxpayers who consequently had less money to spend on food, coats, cars, books and other things that would have stimulated the economy.

FDR created the modern corporatist state that liberals (claim to) hate, by encouraging businesses to form cartels in order to squash their competition. The passage of the National Recovery Act compelled industries to form “code authorities,†and gave them the ability to regulate things such as quality, wages, prices and distribution channels. They were modeled after fascist Italy’s “cooperatives,†which engaged in the same type of anti-competitive business practices.

http://newsroom.ucla.edu/releases/FDR-s-Policies-Prolonged-Depression-5409

@Samantha, There wasn’t EBT or welfare during the Hoover presidency. No safety net. Just breadlines that ran out of food and starving homeless people who took scrapwood to build shacks by the river. FDR’s New Deal gave them jobs at the expense of higher taxes which improved infrastructure.

If we remove the safety net today, where will we be?

Several factors contribute to “Why is America like this?” A big one is massive Third World immigration.

Sorry if that offends, but facts and numbers are stubborn things.

Wealthy, homogeneous societies — Japan, Sweden — can afford generous social services for every special needs kid, in every city and neighborhood. The national money pot is big. The needy are few. Everyone shares the same culture and speaks the same language.

But when you open the floodgates to millions of impoverished Third World kids, financial deficits follow. California’s schools are over-burdened with massive numbers of poor, illiterate Latin (and other) immigrant kids. There’s barely money for the basics — which now include education in multiple languages — much less money for gifted or special needs kids.

Taxpayers are already over-burdened. Much of our money goes to lucrative govt pensions. Infrastructure is crumbling and not being repaired. Govt borrowing and deficits are huge. And poor immigrants keep flooding in.

Los Angeles is diverting money (which could go to special needs kids) to provide legal services for illegal immigrants that Trump might want to deport.

You flood a nation with tens of millions of poor people, all of whom have a “right” to free education, entitlement benefits, healthcare (via hospital emergency rooms), etc., and you’re surprised there’s no money for your special needs kid?

Things will get worse, not better. Demand for tax money is increasing, but the spigot is running dry. We’re all tapped out. How much more can they tax us?

SOL: “Wealthy, homogeneous societies — Japan, Sweden”

That is true for the past. Today, Sweden is overwhelmed by millions of muslim refugees and very soon the whites will be a minority in their own country – Swedistan. The population of Sweden is small.

Here we still have the right to discuss about the REAL problem of massive ILLEGAL immigration and the impact on the economy and society. In today’s Sweden they will put you in jail for that. The socialists and liberals in the position of power in Sweden do not “tolerate” anyone who dare to cross them – they act like muslims.

Trump was labeled from the beginning “racist” for daring to have a national discourse on ILLEGAL immigration and break the PC. The label came from the purveyors of “fake news” from MSM. You know that a site delivers fake news when they don’t have a comment section (they are afraid of being exposed for all the lies they deliver). CNN used to have one till they changed in the “US PRAVDA” and they eliminated the comment section.

It is interesting that people like Meri can not connect the dots between cause and effect and they wonder why are they affected by their own actions – typical liberal who lives in LaLa land with no connection to the REAL world. On one hand she supports the Democrats (who all support massive illegal immigration, from Moonbeam to Obama) and on the other hand she is blaming Trump for no money in CA for her handicapped son.

First, Trump is not in power yet, therefore he can not be blamed. Second, CA was transformed into a third world country by the Democrat policies for over half a century. The liberals in Sacramento do not realize that taxing people to death will cause a state to be filled by tens of millions of equally poor people. Adding millions from third world countries is just going to make the situation worst and faster.

Something bigger is going on here. You have a couple of things going on:

“Low inventory”

In Denver, I do not believe there is low inventory. My company is pulling my site out of California (THANK YOU!!!) and moving to Denver. I see a lot of houses on the Denver market and a large amount of foreclosures. But I’m seeing a lot for sale that were purchased a year or two ago for $100K less. It looks like some sort of game is in play. I can just hear the responses to my cash offers… “Well, we’re not just going to give it away.” Whatever.

We are seeing the EXACT same thing over here in Portland. It seems that an unusual percentage of the houses for sale were purchased a year or two prior for $100K+ less.

Some predictions for home prices in 2017 From Logan M. https://loganmohtashami.com/

Home prices still have legs to go higher in 2017. This is due more to supply then demand.This cycle has demonstrated that you don’t need strong demand for home prices to rise. Millions of people buy homes every year and this cycle has had the weakest demand with the lowest interest rates ever. But home prices continue to rise due to low inventory. For many years I have been stressing that the U.S.housing market doesn’t “naturally†support 6 months of inventory. This has been true of the market since post- 1996 outside the housing bust years of 2006-2011. With this in mind, home prices should continue to rise until a job loss recession. I predict growth of 1%-4% in home prices for 2017.

Remember, inventory fell in 2016 and home sales still hit a cycle high. Higher home prices did not bring more inventory into the market, a lot owners still did not have enough equity to move up. We also have millions of rental housing and booming rental demand still keeping those homes in a rental status. Don’t look for inventory to move too much either way because housing affordability issues are keeping both would-be buyers and sellers where they are. The tenure of living in the same home hit another all time high in 2016.

Other good links as well on his post if you scroll down.

https://www.advisorperspectives.com/dshort/updates/2016/12/21/existing-home-sales-continue-to-climb

I recently spoke at the 2016 Americataylst conference in Austin Texas about the prices of housing and the one thing that I stressed there is that adjusting to inflation we are no where close to the peak of the 2006. That is a key thing to remember and also without the extra % cash buyer in this cycle Existing Home Sales wouldn’t have to many prints above 4.5 million

For what it’s worth

2017 Housing and Economic Predictions

https://loganmohtashami.com/2016/12/31/2017-housing-economic-predictions/

Be mind sales levels are still very low and there is plenty of inventory to buy but not enough to bring down prices yet ..

>>>Real estate isn’t local. This is a countrywide mania so you can’t go wrong buying anywhere.<<<

Global mania, for many countries too.

I am here in London England ~ United Kingdom.

Seen a few commercials on UK television during the past few weeks for 'Visit California'. Paid for by some authority like California Tourist Board. Some TV stars in it – I only recognized a couple of them.

The British Pound Sterling has really weakened against the US Dollar.

Currently £1 gets you $1.24 (best best rate – without commission)

In August 2008 £1 got you $1.90.

In all the following years the £ has traded in band around $1.49 to $1.70 (my memory), but since Brexit vote (Brexit not actually occurred yet) £ taken a beating.

So many housing Vested Interests believe 'rich people investors' and $ big guys going to be buying up all the prime property here, which has been in a runaway local price inflation for last few years. I think it is set for London HPC, but just a thought… perhaps fewer UK tourists to US because £ weakness exchange to US. And VI's claim stronger $ going to be buying up London. (I doubt it – other policy moves especially against property investors are sharply in play in UK.)

Of course the flipside is that London now is starting to look almost affordable to Californians. Wife and I spent the holidays in London (hateful entitled Boomers that we are) and I idly looked at some real estate ads while there. Still more expensive than our Ventura County suburbs, but prices (in dollars) are starting to look like West LA. Not a bargain by any means yet, but it looks $1M can buy a decent place in either LA or London now.

Hell NYC is looking affordable. Especially considering there are probably these things called “jobs” there.

If London is so highly priced, how is it that it’s becoming a Muslim majority city?

Are Muslims the Mexicans of London, living in low-rent “barrios.” Is London becoming like L.A., with some rich white pockets, amid a sea of poor brown people?

Under the UK’s welfare system, men with more than one wife qualify for extra benefits.

http://www.dailymail.co.uk/news/article-3414264/Want-higher-benefits-marry-one-wife-New-welfare-rules-hand-extra-taxpayer-cash-polygamists.html

Have you guys seen the Playa Vista developments? I hadn’t been down Jefferson in years. Hundreds of apartments. $5k/mo 2 bedrooms. Unbelievable.

Meanwhile, Howard Hughes is about to have all of its units for “lease”, (cough), rent.

Are the tech kids this stupid? They’re going to earn these high wages and piss them straight back to developers?

I wonder if Google and Facebook are stakeholders in the residential developments. That would make me laugh. Pay the high wage, get it back in rent.

The best way to observe the techie/techbro in its native environment is to take a walk down Castro Street in Mountain View. It’s become “restaurant row” because techies don’t cook at home. How are you gonna cook when you’re living in either an overpriced so-so apartment you’re working 80 hours a week to support, or Bunk 3A in a room with 5 other guys? So they eat out. Now, you can eat pretty well on $10 there, which is only about 20% more expensive than McDonald’s here, but it’s also really easy to spend $50 on a meal there. And the techbros think that $100k when they’re 25 means $200K when they’re 35, and $300k when they’re 45 and some shit. More like, it goes $100k – $125K – $15k because when they’re 45 they’re too old and they’re stocking shelves at the big Wal-Mart on San Antonio or if they’re really lucky, driving a VTA bus.

So yeah, they’re getting it socked to ’em, by both the landlord and the cook, and they have no idea that almost all of them will not be able to “grow out of” the no-savings regime they’re in now.

im a nurse, just got laid of!! wife makes slightly above minimum wage, thankfully we live in the ghetto in a trailer so we can afford rent on min wage. having a hard time finding another job that pays well, 30k in student loan debt and getting offerd $15 hr jobs. Beginning to think like a capitalist, if you cant win them join them. Going to try and open my own business and just pay some teenagers or illegals min wage to run it for me. One thing no one has mentioned is that marijuana will be legal in california….maybe that will help like it did for colorado?

FtheUSG – Ouch. You are smart to live so that one person, on min. wage, can pretty much make it work.

Leave a Reply to Jon