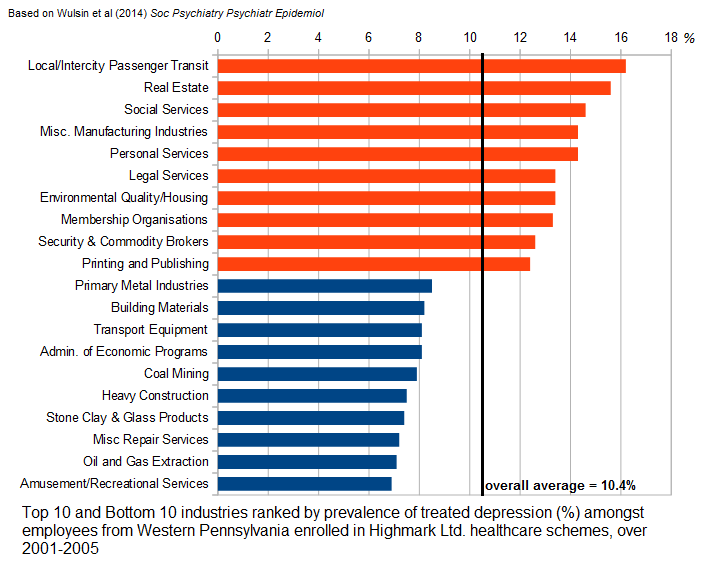

Industry with highest level of depression treatment? Real estate and intercity passenger transit. SoCal home sales continue to lag as spring and summer season fail to take off.

The recent sales figures continue to show a slow start to the spring and summer SoCal selling season. While sellers in many areas are now asking for peak prices, the number of debt slaves buyers continues to shrink as many homes languish on the market. Of course in some markets the number of house lusting buyers continues to provide enough fodder to keep the game going, at least when it comes to prices. As we’ve noted, housing inflection points take a few years to hit and turn. After a few solid years, it does appear that things are softening. You want to see rising home values as an ancillary result of a rising economy, not an investor led rush or a controlled market via banks leaking inventory out at a molasses like pace. On another note, a study called “Prevalence rates for depression by industry: a claims database analysis†found that those in the real estate industry have the highest rates of seeking out treatment for depression. I’ve always had the impression that those in the real estate industry had a higher level of happiness based on all those real estate agent and mortgage broker cards I receive. As it turns out though, the study found that those dealing with the public in high stress activities (i.e., dealing with house lusting buyers and delusional sellers) can be detrimental to your mental health. Given the craziness in California housing and the social behavior I see, I can actually understand why this study found that those in real estate had the highest level of seeking out treatment for depression, only second to local/intercity passenger transit which I’m sure is a thrilling job of interacting with the bright and sunny public.

Working with people is tough!

What I will say is this, there are good agents that actually battle it out for their clients. For those representing buyers, they will get their commission once the deal closes. However, in a tight market like this you might have some that have beer budgets and champagne tastes. In a seller’s market like we’ve had over the last few years, good luck trying to figure out what makes a seller take one bid over another all other things being equal. This of course is softening but many drink their own Kool-Aid and somehow think their crap shack is worth $700,000 even with one small bathroom.

As I mentioned earlier, with a study looking at America’s most depressing jobs, it was interesting to see real estate hitting near the top of the list:

Source: Discover Magazine

I think the conclusion is insightful:

“Industries with the highest rates tended to be those which, on the national level, require frequent or difficult interactions with the public or clients, and have high levels of stress, and low levels of physical activity.â€

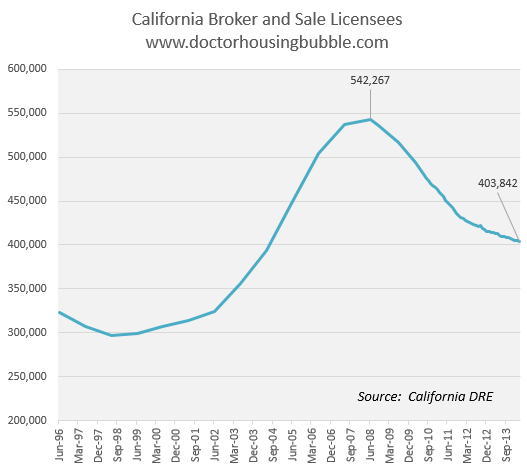

So dealing with the public is bad for your health! Just watch all those house horny shows and you’ll see a wonderful display of aggression, anxiety, narcissism, and delusion all wrapped into one. And just imagine dealing with this on a daily basis in a market where prices are out of this world. Beyond the industry taking a hit, we can be thankful that many agents are protecting their mental health by leaving the industry:

In any industry, you will have good and bad players. When you are dealing with lemming like behavior in housing good luck trying to maintain your sanity. I’ve gotten tear stained e-mails from potential buyers where people say “but we made an offer $50,000 above asking and included a story on our family. Why didn’t they accept our offer?†Like a dejected Romeo asking for Juliet’s hand, some people can’t step back and realize how irrational they sound. Plus, they are buying a structurally beat up place but they have to somehow keep up with all the other lemmings around them. Peer pressure is still a wonderfully powerful force.

SoCal sales weak yet again

It should be no surprise that housing sales are very weak in SoCal:

“A total of 19,556 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 2.3 percent from 20,008 sales in April, and down 15.1 percent from 23,034 sales in May last year, according to San Diego-based DataQuick.â€

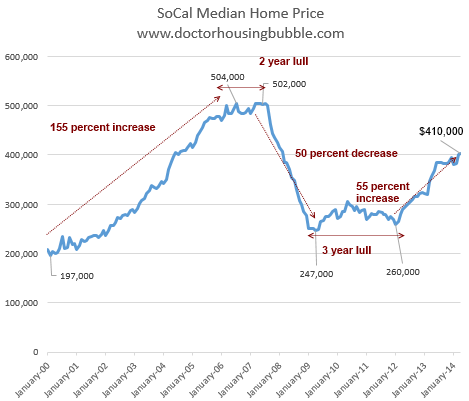

Keep in mind this is a time when sales are usually picking up steam. But take a look at price history here:

Prices are up over 55 percent in a few short years and there really isn’t any corresponding growth in wages here. You have artificially low rates, constrained supply, and investor buying crowding out regular buyers. While all of these are pulling back slightly, you still have these players in the market.

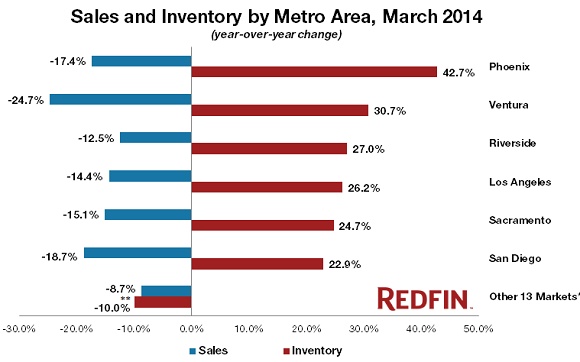

Inventory across the region is picking up:

Outside of California, take a look at what is happening in Arizona. As investors pullback, inventory is piling up. The previous charts should highlight that prices usually peak while sales start the move lower. We would have to see robust economic growth or investor demand surge again to keep this momentum going.

Sales in SoCal fell by 15 percent year-over-year. Prices are holding steady which aligns with our data that shows home sales crater first, and then slowly, prices adjust.

I think the media does a great job showing housing as the happiest of all things. You need to buy a home to be happy! All those in the industry are happy! Financial independence can only be had by buying real estate! Yet, the facts show something else. Don’t believe the hype and use your noggin. When you are paying $700,000 for a home built over 100 years ago and you have one crapper, you don’t need to be a psychiatrist for this advice but you probably should get your head checked.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

99 Responses to “Industry with highest level of depression treatment? Real estate and intercity passenger transit. SoCal home sales continue to lag as spring and summer season fail to take off.”

First!

Maybe you should change your name to Worthless McWorthlesson, because you aren’t contributing anything to the discussion.

OK, not related to this article, but liberals vs conservatives wrt houses:

http://blogs.marketwatch.com/capitolreport/2014/06/12/liberals-want-to-walk-and-conservatives-want-big-houses-survey/

Not sure I buy this one. Most of my liberal friends seem just as into the McMansion syndrome as the conservative ones. Maybe it’s more of an age related thing (as political liberalism is more prevalent among the young) since more youngsters want to be within staggering distance of the clubs while we old farts are happy to hide away in our remote Unabomber fortresses.

Great Analogy, A

More staging techniques I’ve noticed:

* Stained glass closeups. In a house with stained glass windows or chandeliers, there’ll be a photo of the room itself — then a closeup photo of the stained glass. Looking very bright and colorful. Stained glass closeups are often used in older craftsmen houses, as you’ll find in Pasadena or Eagle Rock. This $50 chandelier I can get at Lamps Plus is supposed to make the house look classy and even Victorian.

* Slick, freshly washed driveways and sidewalks. Wet pavement gleaming in the sunlight. Makes your crapbox look clean and pristine.

* Daytime photos with day-glo green grass. Nightime photos with warm yellow light glowing from a window, in contrast to a violet night sky.

To ‘son of a landlord’ – you’re switched on about staging techniques. I admire marketers / sales-people so have no issue against them making a house look sweet on listings. I made a note of one of your comments from a few weeks ago – after a link to a house was posted up in the comments – just to help harden my cynicism to dreamy looking listings. However I’d probably still have sticker-shock even after a substantial house price crash.

_______

son of a landlord: “One trick I’ve noticed is to photograph the house at night, with the lights on. Then photo-shop the image to transform the night into beautiful hues of dark blue and violet, with some deep greens, contrasted with the warmly golden-glowing windows. The houses invariably look less impressive when you see them for real.”

What I find most interesting about staging techniques is their repetitiveness. I’d assume most long-term buyers would grow cynical after seeing the same gimmicks appear repeatedly; that they’d learn to see past the staging and grow callous about musical instruments and citrus fruits.

i’m imagining the really good stages in socal are done by a professional staging company. when you see repetition, it’s because it’s probably the same staging company. i could be totally wrong, just my guess. also, of course, humans have a tendency to mimic what they think works.

Plus, they now Photoshop the water damage and stray cockroaches out too. Pretty handy!

Hello Doc. I read this on BI today, what they call ‘the greatest wealth transfer in history of US’. This article relates to the amount of boomers who will be bequeathing their money to their kids. I wonder if this will factor in to less softening of home prices in the coming years.

“…Nahal and Ma point out that “a second and even larger wealth transfer from the Boomers to their heirs is starting now and will continue over the next 30 to 40 years…”

…The great transfer will see a handover of about $12 trillion from those born in 1920s and 30s to the boomers. But the boomers are expected to transfer some $30 trillion in assets to their heirs over the next 30-40 years in just the U.S., they write…

http://www.businessinsider.com/biggest-transfer-of-wealth-in-history-2014-6

Yes, except all that wealth is now in the hands of the 10% So that big number of 30 trillion? Only 3 are for the bottom 90% (back of napkin sketch) roughly.

Estate taxes will eat 50% of that figure. inflation in things you need vs what you desire is here. A blow up of oil to 140 will eat into any recovery. We are about to fall over the cliff…while inflation rockets….not a good scenario….

“Estate taxes will eat 50% of that figure”

The estate tax applies only after $5m+, and then is only 40%. What percentage of Americans do you suppose end up paying the estate tax?

Answer: .14%

If the inheritance is in a trust, you can pass along assets once you’re dead because the owners of the assets have already paid tax on them. If you pass a home to descendents via trust, property tax stays at the original level. If done through a will, property tax gets refigured to the current rate.

” In 2010 the median net worth of those 65 and older was $ 170,128, down from $ 195,890 five years earlier. ”

http://www.fa-mag.com/news/seniors–household-median-net-worth-drops-13-percent-14059.html

The real cause of the now global off the charts societal depression is Xtrevilism. Its pandemic! A major symptom of this sociopathic disease is its suppression.

Excerpt;

“There are a number of reasons that the sociopathic disease of Xtrevilism will not make it into the Diagnostic and Statistical Manual of Mental Disorders (DSM) published by the American Psychiatric Association. A few have already been mentioned…

1. Those in power write the manuals. They are not going to bite the Crumbunist hand that feeds them, nor are they going to admit to their own Xtrevilist leanings and failings. Therefore they will never create a causative hierarchy of mental disorders with Xtrevilism at the top as most harmful to society.

2. There is an ignorance of the reality of the present day evolutionary environmental dynamics as explained above. Very few understand the explosive role of technology and its exponential effect on evolution.

3. Because of the ignorance noted in 2. above, Psychiatric Associations remain constrained to a predominantly subjective approach.

4. Preexisting cultural, religious, and political biases of the principle authors are reflected throughout the DSM manual. Non illnesses, or illnesses of unknown origin, are labeled so as to stigmatize and control. These biases work to prevent consideration of positive change.

5. There are conflicts of interest that encourage predatory disease mongering betwixt and between psychiatrists and Big Pharma.

6. Developing a just system of measurable environmental ‘biomarkers’ (the environmental ‘biomarkers’ of; yearly income, assets owned, hierarchal social cost benefit ratios (including deaths of others) for products produced and actions taken, diet, family history, local living conditions, etc.), would require that the effects of past Xtrevilist AGC (Aggregate Generational Corruption) be fairly addressed. Few have the integrity and courage necessary to do so.

7. The societal divisiveness and conflict created by all of the above plays into the current top down Xtrevilist global orchestration of eliminating the high resource consuming middle class and creating a two tier global society of ruler and ruled where the ruled will be controlled and herd thinned by a less costly robotic law enforcement overseer class.http://www.boxthefox.com/

In summary; we have a situation where, for a great variety of reasons, the ‘good guys’ who write the DSM are the ‘bad guys’ in reality and they are holding us all back in the psychological middle ages. This is a reflection of the effects of the disease of Xtrevilism itself and gives credibility to the fact that it is a root causative disease that should be number one, top of the list, in the DSM.”

More here…

http://www.boxthefox.com/articles/Xtrevilism.%20Why%20It%20Is%20not%20a%20recognized%20disease.html

Deception is the strongest political force on the planet.

I’m glad I sold in May

yes ben you should…. Buyers and sellers are in a titanic battle of wits. Many sellers have reduced by 10% and buyers still say not enough. Sellers are pulling houses off market at record pace once the listing expires.

Where will this lead to, I believe the fed wants to intervene in the worse way to clear more inventory and make everybody think all is well.

Sellers who are buried in underwater mortgages are in serious trouble for the future. Folks who have their house paid but want to move are mad again. They are being punished by the losers who overpaid in 06′ , and now want to be bailed out by buyers at their very asking high prices.

Real estate agents continue to lie thru their teeth, telling sellers their house is the only one sitting so they must give it away, they want that commission at all cost to?

So again trust nobody, buyers want the steal of a lifetime, sellers went thru this the last several years, they will not budge, RE agents just want their usual 6% and do very little for it.

Looks like there is going to be a play at home plate, the outfielder has a weak arm, the runner is slow, the umpire has a history of making bad calls, you guess is as good as mind, safe or out?

robert: “So again trust nobody, buyers want the steal of a lifetime, sellers went thru this the last several years, they will not budge, RE agents just want their usual 6% and do very little for it.”

_____

My bet is some will owners sell at lower prices, and will budge down on price. If you’re going to panic, panic first. 🙂

And it’s very difficult, almost impossible for owners to understand, that values are set at the margin. They have to learn the hard way. Then remember it, instead of forgetting – one of the reason we’re in this stupid depressing bubble (or wonderful new reality for the VI).

Why did some sellers budge and reduce their asking prices, again and again and again, selling for ever lower prices from 1989/90-1995? (I know this link has been posted up a few times in the past)

_____

A chronological listing of selected Los Angeles Times articles originally published between the years of 1985 and 1997 (inclusive) culled from their archives.

http://www.rntl.net/history_of_a_housing_bubble.htm

there is an ass for every seat… let the sheeple get flocked..no way they will be rescued this time…The recovery is all about the 1% and when the fed hopium wears off, look out…keep believing, keep dreaming….the red pill is on the nightstand

“…I believe the fed wants to intervene in the worse way to clear more inventory and make everybody think all is well.”

It is too bad little “r” does not speak English because this is the real question in my mind. How will the fed “entice” the “market” to hide future excessive inventory. The scary thing is that all my silly shill predictions seem to actually materialize. Like have Fannie and Freddie buy up “surplus” inventory. That seems absolutely bonkers to me but hey, “shill What?” has been correct before…

“there is an ass for every seat…”

True but is there a seat for every ass?

By “the steal of a lifetime” I take it you mean “a house to live in, at a sane price in line with historic levels of appreciation”?

“The scary thing is that all my silly shill predictions seem to actually materialize” – What?

And yet here we are, with a market at a stand still. The FED is shooting blanks and I sincerely hope they keep reloading. The more muppets they can get in to this cycle of leverage will make for that much cleaner a market after the adjustment. Get the last of the greater fools on board to be ruined and only TRUE strong hands will be left to make the market when the easy credit reverses. If it means another year or so of this illusionary “bull” market, so be it.

And on a selfish note, lower prices for those of us with patience and foresight 😉

“And yet here we are, with a market at a stand still.”

Yes we are. Kinda like a Mexican stand off. Hopeful Harry homeowner (the Good), Banks/RE agents (the Bad) and the inventory (the Ugly)…

I thought they were doing God’s work…

https://www.youtube.com/watch?v=DrsZn2fud4c

http://www.redfin.com/CA/Long-Beach/640-W-4th-St-90802/unit-414/home/7619854

real homes of genius

“[B]ut is there a seat for every ass?”

Yes, but many of them are locked in the supply closet and only certain asses are allowed to buy them.

(…why I posted that as a reply to ben, I do not know.)

“Yes, but many of them are locked in the supply closet and only certain asses are allowed to buy them.”

Actually I think that there are some asses that are soooooo big that they have to have many chairs to sit, the rest of us simply go chairless…

Here’s the fundamental problem with realtors. They (both buy side and sell side) profit off of a SALE, and therefore, a buyer’s agent will never ever have your 100% best interest. Here’s an example. If you, the buyer, love a home, and you want to buy it at the asking price of $500k. If the agent knows that he can get it for $450k, he will never ever tell you that, because his profit is based off of SALE price, and not how much he saves YOU.

I am a real estate agent and I tell customers all the time., bid low we can always go back and bid higher. Right now in this market it is tough to do because in the last year all of my sales have gone to highest and best except one. Central Indiana! Now if they are in love with the house then we go all in and offer what we think will get the house.

Okay now you can through the daggers

Sorry, throw the daggers.

You got it mistaken. They’re all sell side. There are a few realtors who are genuine people and will tell you when a house is over priced. They’re not the top of their industry.

You’re buy side. Your “buy” side agent doesn’t really care about you more than closing the transaction. He/she iust brokarage. They’re the Fidelity, etrade, schwab, etc… except they don’t take $8 a trade, they take 3%.

This is correct. Although, an Agent can also sandbag the seller as well. How mud commission do they lose if you drop the selling price by 10% under marker to move the house faster? They lose little and the seller loses a lot. Volume will make more money than highest sale price in the long run.

Can’t trust ’em either way.

You are not correct, Jason

I have been a realtor for over 22 years and the life’s blood of my business is my referral base. I always work in my clients best interests and I will not short change my long term business to make a few extra pennies of commission.

To be focused on how much you can make on one deal over the long term value of a loyal client is a dumb way to do business

Right on Bill,

I have bought and sold over 25 homes in my life, at present I own 4 and are looking to buy more. Good realtors like you are hard to find as the market became full of quick buck artist, money like rotting meat attracts flies.

I have worked both in the buying and selling end with some great real estate professionals. And they get referrals from me all the time. I was a builder for over 40 years and know the industry. Good realtors are upfront honest people that realize by making friends and doing people right will bring them more in the long run.

Sorry bill, Jason is correct. Every realtor says they are one of the “good ones.” You might be one of those and 22 years in the biz gives some credibility. I never heard of ANY sales person admit they are scum.

I’m sure there are some awesome Realtors out there, but this is one tree where the bad apples far outnumber the good ones.

(I was in sales for many years and my father has been a RE broker for almost 25 years)

I feel like this guy’s point is being missed. It doesn’t matter if there are some good guys in the game. A lot of us are willing to sell and buy without the middleman. RE agents are information brokers in the FIRE cartel. Of course they’ll respond by stating how important and needed they are in the transaction chain. It’s to their benefit for the whole process to be perceived as seemingly complicated, wrought with danger, and overly time consuming. We experience this with other industries such as auto sales (shout out to little r).

I say if the MLS information monopoly is broken, that the technology is already here to disrupt the real estate agent game as we know it. Those who want additional hand-holding can pay for it on the side without having it sunk into the cost shared by the market.

Tired of the BS…I totally agree, this practice of pay 6% because we know what is good for you is nonsense, kind of like the guys with white suits and big brim hats, pay me protection money?

Looks like the tanking has started.

Tanking is only meaningful to buyers if inventory remains high (i.e., if sellers don’t withdraw the house from the market).

If the values tank, then this hits property tax revenue a few years down the road as well. Also, don’t forget the people underwater that walk away from their homes.

NOT!

Speaking of tanking, where is Jim Taylor?

Message for What?

Re our discussion about the fringe/margin. My view being where the weakness is, your counter-view being it’s also where powerful VI and power can manipulate things/prices (and seemingly have)… have you read this June 2014 article by a guy at PIMCO ? The multi-multi-billion, or multi-trillion bond group. He gives this example, then says its put into practise on an economy wide basis.

It all seems very stagnant and stale and anti-capitalistic to me. Young independent people save a bit whilst renting, only have limited exposure to stocks as they’ve not really got the capital/savings together, and taking fewer risks whilst saving for a deposit anyway. Also hit by inflation in fuel/medical.

Whilst the VI at the upper end of the market get the value of their homes, bid up during the boom (by people outbidding me time and again – and I was defeated many years ago), then they say the solution is to help the very people who outbid us at silly high prices.

Just two ways to fix it….. no wonder older owners keep regaling me with how much their homes have gone up in value since 1950/60/70/80/90s, against the pittance they paid vs today’s market prices. Can only hope in this reflated market, some of his winners at the top, decide to sell out at lower prices (still fortunes) on their other protected winners.

_____

June 2014

(from mid article) Yes, I hear some of you retorting: But what about asset price inflation? Answer: That’s a good thing!

The decisive dynamic behind the Fed’s story of success has, in my view, actually been soaring equity prices and valuations, both publicly traded and private. How so? Equity capital gains are the only asset that does not have a corresponding liability. Thus, soaring equity prices and valuations endogenously heal private sector balance sheets that have too much debt and too little equity.

Simple example: If a homeowner has negative equity on his house, there are two ways to fix it. The bank can haircut the mortgage to “restore†equity, or the market value of the house can go up – “recover†would be the polite word – above the value of the mortgage.

Moralists would argue for the former; enlightened macro policymakers try to engineer the latter.

http://www.pimco.com/EN/Insights/Pages/Just-Give-Me-a-Framework.aspx

You are assuming that the “system” is broken. Actually it appears to be working rather well for TPTB. The question is how long can a system designed to transfer wealth versus create wealth last.

Interesting profile of one EXTREMELY house-horny buyer: http://www.greaterfool.ca/2014/06/11/cranky-town/

Should we use data collected in Western Pennsylvania as a benchmark to compare the the workplace happiness of the entire USA?

Sorry doctor, I sometimes struggle to stay on message… What was this post about again? Something about depression and not the 1929 kind of depression…

“On another note, a study called “Prevalence rates for depression by industry: a claims database analysis†found that those in the real estate industry have the highest rates of seeking out treatment for depression.”

Be careful doctor with that whole correlation versus causation thingy! I think I saw a news report many years ago about how a high percentage of adult film workers commit suicide suggesting that the industry itself “caused” the suicide. Eventually someone stated that the industry “attracts” troubled people and that is likely why it has a higher rate of suicides. This is the problem with “theories” based on correlation like my money supply / economic activity discussion in the prior post. It might just be possible that mentally ill folks are more attracted to the real estate industry…

I tend to have a threshold on studies. If the study didn’t study 50% +1 of the group it is prone to be BS on some level.

This study is on my BS meter because it fails the obvious test. If other professions have less flexibility in going to medical appointments then of course Realtors have a higher incidence rate. If Realtor health plans offer more benefits that Realtors can use compared to others then of course they might do just that.

Supply and demand.

A family friend told me that 1 year his district got funding for AP classes and his kid was considered a genius later on they getting money for special needs and somehow the AP wiz kid magically transforms into a short bus candidate.

So… are you telling be that the majority of real estate agents are not mentally ill?

Check out “Youtube, VictoryIndependence – US Housing Market

to tank.”

Jim the Realtor says it’s a good time for move-up buyers to purchase premium properties. I generally like Jim, who operates San Diego way, but he seems a little too upbeat, considering the circumstances.

http://www.youtube.com/watch?v=n_FurL0RvBQ&list=UUr5LE6rAA-0M0vY9Y3XHe_w

“I generally like Jim, who operates San Diego way, but he seems a little too upbeat, considering the circumstances.”

We really don’t need your negativity right now. I believe everything is going to be awesome if we can get everyone to simply think positive. You need to support Jim’s positive energy. Now get to work on that vision board…

Wow, that is really disappointing to see. During the depths of the post bubble crash Jim the Realtor seemed one of the few RE professionals willing to give objective information to the masses on the internet. Now he just sounds like another slimy shill. “Feel like buying a house today!!?” His so called “good advice” for move up buyers has nothing to do with getting a better value, but only about how to structure your financing to MAKE SURE YOU GET THAT HOUSE!! Same old realtor bullshit. I guess you throw money at them for long enough and even the good ones turn to crap.

That video is tripping my out. “The frenzy has constricted just way down to just the very best of the best properties… and everything else is kinda sitting.”

Yes; just upsize to better properties, without selling first home… even after being told everything else is kinda sitting around.

Reminds me of a story of friend’s parents in 1991-92. They had 4 kids, including newborn. Upsized to a larger home 50 miles away, thinking the other house would eventually sell. “Couldn’t sell it” excuse (err asking price). Left it empty, on the market. They took an expensive (%) bridging loan to finance the upsize. Market then tanks harder. Meanwhile the Realtor (Estate Agent) marketing the first home, somehow loses the keys to a local tough-guy, and he moves in, claiming a tenancy. He does eventually buy the place but only after a lot of worry and playing them on the eventual selling price. Nearly broke them, and only the father hanging onto his job whilst so many in his company were losing theirs meant they survived it.

The true colors eventually come out.

Jim banned me from commenting on his blog after I commented that a million dollar home he sold looked dilapidated and it actually looked like something the neighborhood homeless guy (who he passed in his vehicle in his video) would be living in.

Jimtherealtor is right. They are not building any more land. Prices will only go higher and higher and higher!!!!!!

Local incomes do not matter. Economics do not matter. Debt service loads do not matter. Taxes do not matter. It’s all about location, location, locations and the hundreds of millions of megamillionaire Chinese nationals waiting to buy in SoCal/San Diego/SF Bay area. Forget fundamentals, history or things that matter like the U-3 unemployment rate or the U-6 underemployment rate. This time is different. Buy now or be priced out of the market forever!!!!!!!!!!!

Don’t forget “everyone wants to live here.”

What?!! Is that you?

No, but he does play a great shill! I find that bears are brighter than bulls so they play much better bulls than bulls themselves…

I love your spirit but peaks are made for retail do jump in and not understand about the other side of the bet…With PE in the game it’s now written in stone….

China is going into it’s own spiral and your comment reminds me of the Japanese real estate invasion…that didn’t work out so well…retail comes from all continents…

Land is highly prized in most other countries as a tangible store of wealth. Financial markets in most other countries are not well-regulated and you can’t reliably put your retirement fund in stocks and bonds. Most other countries have a distributive way of thinking about money – only so many pieces of the pie to go around. They become rent-seekers. Here in the US, we prize innovation – growing the pie – and we have many ways to invest and grow our money due to pretty well-regulated markets.

It is sad, however, that many Americans have chosen to go backwards economically speaking. Selling land back and forth, instead of investing in productive, innovative ideas. The laziness of just wanting to flip a few houses for higher and higher prices instead of creating a new product category or business.

Another reason it’s depressing is probably because they get all fired up thinking a deal is in the bag and at the last minute it falls through. Bam! Excitement to falling off an emotional cliff in one phone call.

Commissioned sales is pretty similar to being a drug addict.

OC judge just sentenced a realtor to death. He killed two people to get their Lexus so he would have a nicer car for showings. Killed them execution style. One realtor down, a crap more to go.

http://www.ocregister.com/articles/thomas-618203-froeberg-lexus.html

By a show of hands, how many commenters on this site are real estate agents, real estate brokers, mortgage brokers, real estate investors, flippers, floppers, landlords, members of NAR/CAR, real estate appraisers, builders, inspectors, insurers, affiliated with CNBC/MSM, etc.? I am just trying to get an understand on how many “opinions” here are influence by the fact that your income is dependent on the housing “market”.

http://www.zerohedge.com/news/2014-06-14/generational-short-banks-wall-street-housing-and-luxury-retail-are-doomed that’s it. game over

In the north San Diego county area I’m looking, there has been a very sudden halving of houses available on the market. Very similar to what happened at the beginning of the last big downturn when the banks pulled half of the homes off the market in a week. Don’t know what’s going on this time. Put in an offer on a place finally, it was accepted and going into escrow now, but the wife decided she doesn’t want to sell and asked me if I would cancel. I said no, so have to perform perfectly or lose the place. 1-1/2 acres, 3/2 1950 sf built 1981 with mature fruit trees, hilltop privacy. $500K, $100K down, 4.625 for 30 years. That’s the facts folks.

So does this mean that you are going to start posting links to unicorn and rainbow blogs stating why hosing can never go down? If so, you will have to wait until QEAbyss tires and moves on to greener pastures to meet up with his old buddy Lord Blankfein. We can only handle one convert at a time…

Har! No, I won’t be doing that. But I’ll be watching to see which way things go you may be sure, and report back here. Very very few houses coming on the market in that area, very strange, and some pulled off the market as I said. I may have overpaid, but by how much is the question. The lender evaluation went through without a problem, comps in the area very good, but usually larger homes. 1950sf was smaller for the area. I’m at that house until I drop dead, and will be pre-paying the loan, get it off my back in 15 years god willing. If housing IS going to tank, I’ll moan a bit I guess, but I had to move now, high rent in West Los Angeles was killing me and my money. Payment on this new place will be half the rental paying here.

@ what

it’s me QE Abyss. I dont recall ever saying housing ‘will never go down’. I have posted articles that are bearish as well as bullish on housing. For people who bought a home they can afford between 2010-2012, they are probably happy with their decision. As of now, in 2014, I think it is a terrible time to buy due to the runup in prices but like many others have said, the stagnant wages are a telltale sign that housing will be in trouble.

” This article relates to the amount of boomers who will be bequeathing their money to their kids. I wonder if this will factor in to less softening of home prices in the coming years.”

The prosecution rests your honor…

Please don’t make me go back and cut a past from every post you have made since you purchased…

Have you considered agreeing to walk away from the purchase in exchange for a $10,000 fee, or whatever, for “your troubles.”

Or you might use the Zillow estimated increase over the next year, and demand that as a fee to walk away.

It’d be funny if a buyer walked away with the flip value of a house, without even having to buy the house. Especially funny if the house instead tanks in value.

Interesting ideas, Son of, but too much trouble for me, who just wants a home.

“…what happened at the beginning of the last big downturn when the banks pulled half of the homes off the market in a week. Don’t know what’s going on this time.”

Not even some idea about what’s going on this time? Good grief, it’s clear as day that the shadow inventory is still an issue. People still not foreclosed after years, even in SoCal. Some will spin that it’s pent-up supply waiting for pent-up demand. The establishment has thrown everything and the kitchen sink at the cratering demand problem and this is the best they can do. And still, some don’t understand why hardly anyone wants to play in this sandbox full of cat turds.

@Tired of the BS, you are correct. It is an inventory issue. Banks, at least in the 310/323/213 area codes, are engaged in a “controlled burn” mode as far as releasing inventory goes.

I work in financial services and what we see the banks doing is that they are allowing deadbeats to live in their foreclosed units on the condition they do not trash or wreck the property. This controlled inventory leakage allows banks to recover close to note value. So the next time you see a “do not disturb the occupants” on a property listed for sale, there is a very good chance that is not a rental but a foreclosure where the deadbeats have been allowed to stay until the property is sold by the bank.

Due to ZIRP, it is less expensive for a bank to lose $1500 a month in unpaid mortgage payments than it is to go the short sale route or normal foreclosure process and lose several hundred thousand dollars in one transaction.

Yes, I haven’t looked around for any specific thing that would make this happen right now, probably should do that. I think it might be something unusual, since the shadow inventory has been with us for some time. Anybody (Doctor!) have any other ideas to add?

Here’s something…http://realtormag.realtor.org/daily-news/2014/06/16/foreclosures-jump-in-northeast-west

Here’s a new real estate meme that I first head in the comments here in relation to the house on Wilson in Pasadena. (I didn’t comment on that house, but by the way–what a dump!!) “You’re buying the land value, not the house.” Here’s an example from Arcadia:

http://www.redfin.com/CA/Arcadia/29-E-Orange-Grove-Ave-91006/home/7230135

Never mind that the local median price per square foot is around $500. When you’re selling the land only it’s $1233 per square foot. You’re buying potential. So much opportunity.

Yes, you are buying the land. This price rivals anything Santa Monica can offer. Whew – too rich for my blood, but lots of film industry people who might be able to afford it, tear that old place down and sink another half million into a mcMansion

It does indeed rival Santa Monica. A few months ago I saw a tear-down listed in Santa Monica, a shoddy crapbox, North of Montana, selling for $2.6 million. The listing emphasized that it was for the land value.

The North of Montana lot was smaller than this Pasadena lot, but still, North of Montana is a lot more valuable, I think, than anywhere in Pasadena.

Or if you look a little bit you can get this place (100k more) just a mile or two away in San Marino, which is an even nicer area, barely smaller lot and a very nice home compared to the tear down in Arcadia.

http://www.redfin.com/CA/San-Marino/1885-Robin-Rd-91108/home/7015640

Hollywood money doesn’t really buy in Arcadia, Pasadena, San Marino or LaCanada maybe.

Mainland ChiCom tax dodgers and embezzlers from state owned enterprises live in Arcadia now days.

That saying has been around for decades. It’s too simplistic. When folks started focusing more on monthly payments, they started pricing in the home to a greater degree. Therefore, the structure has more weight in the equation than it used to. RE agents love to tell clients about buying the land as one of many tactics to manipulate buyer perception.

I love this blog.

Bottom Line is this, The California Market will always be expensive PERIOD. It’s all about SUPPLY and DEMAND.

New York and California will always be pricey, just accept it and keep it moving. If you can buy, when the market pulls back jump in with both feet in. The only thing that will kill the California Market is an massive earthquake, that causes massive destruction, destroying entire neighborhoods. Until that happens, nothing will change.

Could someone on this blog, please show me a period, when The California Market crashed and stayed flat/affordable for ten straight years? Yes, this market will pull back 10-50%, but when it does, you will have buyers on the sideline, waiting to scoop up the premier areas of town.

Bottom Line California is the most coveted place to live in America.

Please all comments welcome #HAPPYFATHERSDAY

FOREVER!!! PERIOD!!!

#always

#supplyanddemand

@GOLDIE

People realize it’s more expensive to live here, but nobody sincerely believes that everyone here can afford a $500K median house or that a 200% increase in 10 years is a rational price.

Yeah, most of the ’90s.

Hahaha,

Good one.

I stopped in a few open houses in Laguna Niguel today. I made a comment to one of the realtors that all 3 houses I stopped in, the owners were moving out of CA. She told me EVERY house in Laguna Niguel she has sold this year, the owners moved out of state! I know people are getting sick of this liberal overpriced overtaxed state (me included) but it still surprised me.

Where are most moving to?

was just in Seattle and Portland OR last week and saw a ton of Cali plates there as well. Nice cars and crappy cars too.

Heard from a friend who used to live in LA, now lives in Arkansas (bought a pecan farm/plantation) and sees CA plates all over Texas when he goes into Dallas and Houston.

On a related note:

Wonder what will happen to the South Bay when Toyota finishes the move and moves all the jobs and the trickle down economic impact, supplies, coffee shops, restaurants, etc.. A lot of homes in PV are owned by Toyota to house execs from Japan…..

J-Dub…CA plates abound in AZ and NEV.

Goldie…”most coveted place” Folks want to live in:

Nice weather

Excellent schools

no crime

Little traffic

Modest home prices

Parks

No HOA fees

Low property taxes

Great paying jobs

Where is this place Utopia, sorry CA doesn’t make the coveted list, matter of fact neither does anywhere USA, just be happy Detroit is still standing, only 5 people were killed in Chicago over the weekend, most of the mid-west hasn’t been destroyed by mother nature yet, the East doesn’t have another polar vortex this winter, RE agents snap out of a deep depression?

“Where is this place Utopia[?]”

It is in Willoughby! I am not sure where Willoughby is exactly but there may be some hints in the video below…

https://www.youtube.com/watch?v=_R7GAx_w7-4

Goldie,

You forgot something more in your face than an earthquake…a drought….

people will leave without water, so let it be written. I live and own in the City, nice neighborhood, gentrified and expensive homes-condos..

my assessment, I wouldn’t buy my place for what it will appraise for and I find housing has been aided greatly by the bernanke put, let’s see how this dr. moreau of moral hazard experiment play’s out. On one hand inflation will help prop assets, while dollar declines, on the other hand the middle class and poor will be wiped out on cost push, purchasing power of gen y-z will be less and housing will be least of worries..

I’m thinking more about selling and heading to northwest, theirs water up there still. Anaszi’s once thought their home was shrangi la…

Leave a Reply to Polo