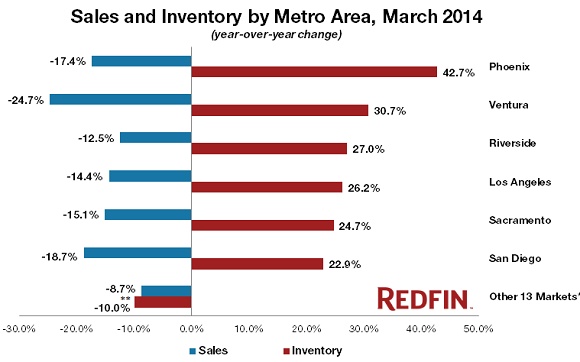

Say hello to rising housing inventory in Southern California: Year-over-year inventory is up 26 percent in Los Angeles and 30 percent in Ventura.

Have you heard the good news? Today is a great time to buy in SoCal! So says the multiple flyers, e-mails, and recent phone messages I have been receiving from local real estate workers. What I find interesting is that in 2013, many were too busy to even pick up their phone let alone put out flyers as if they were searching for a lost and lonely pug. The market is slowing down dramatically because investors are pulling back. Real estate markets turn at a viciously slow pace for our instant gratification society that is hooked on news-o-tainment with multiple tickers and more split screens than NFL Sunday. It is all about entertainment and ironically this showboating has permeated into “staging†homes and putting lipstick on pigs to get house horny folks to commit to massive amounts of debt slavery. Yet budgets are being smashed as reality is now setting in and people are slowly gaining their sanity. You mean that piece of crap is $600,000? Indeed! And in some hot markets you get a juicy middle finger when it comes to upgrades and you will get a nice plate of deferred maintenance with your locked in bid. While the mania slows down, you now hear about steps to lower credit standards and going “non-prime†to goose the market again. Of course this is a great tell on an inflection point. In the mean time we are seeing inventory creeping back up and sales declining.

Inventory and sales make their way back into the SoCal market

The market has dramatically slowed from 2013. While anecdotal, the volume of e-mails and flyers touting “now is the time to buy!†has shot up to a level last seen when sales previously cratered. This says a lot given we now have tens of thousands fewer real estate agents. What isn’t anecdotal is the drop in sales and increase in inventory. Many sellers have bought into the hype that their home is truly worth current prices even though structurally, it is a piece of crap. Sure, you are paying for land but you have to build something on it. Beyond the upper-crust of society, most require sizable levels of debt merely to buy. Of course house horny buyers are unable to control their urges when neighbors jump on the real estate band wagon. After all, you need to spend $600,000 to paint the walls.

So let us take a quick look as to why the market suddenly seems to be so different:

So much for the notion that the market is blistering hot. What you have is a heavily manipulated market where inventory was leaked out, large investors dominated buying, and fringe buyers were convinced that high prices are merely a new paradigm. If everyone that bought a home was a genius we wouldn’t have a graveyard of more than 7,000,000+ foreclosures. Take a look at the growth in inventory:

-Los Angeles (up 27 percent)

-Riverside (up 26 percent)

-Ventura (up 30 percent)

-San Diego (up 22 percent)

Take a look at investor central Phoenix with a whopping 42 percent jump in inventory on a year-over-year basis. If you want to get an idea of a market with a glut of rentals take a look at Arizona. Then again, these investors were planning their exit route via selling to one another similar to a game of musical chairs. Wiser investors are already placing their bets on the other side of the housing trade.

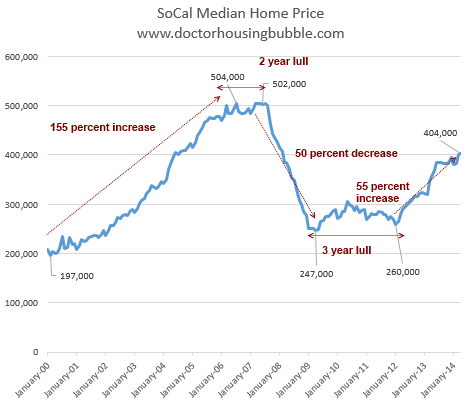

Inventory is picking up because regular households are massively priced out! This is why we are hearing nonsense talk about weakening lending standards and edging back into non-prime goodness. It is worth taking another look at the craziness of SoCal real estate since 2000:

To think we will suddenly have an easy leveling off process is inconsistent with the manic nature of this market. People are psychologically bent on believing real estate appreciation will be built in at very high levels. The median SoCal home went up nearly $100,000 in one year while the typical SoCal family makes around $60,000. So basically, with no additional upgrades or special magic forces, a sitting piece of crap shack went up in one 12 month period by what a regular working family will make in two years (keep in mind net take home pay is much lower than gross). Of course those in the Kool-Aid drinking industry will try to convince you that this is normal but in fact, it is merely a bigger reflection of our rent seeking society. SoCal is the ultimate get something for nothing destination. We are the land where many make millions to pretend that they are something they are not! You have smug people thinking they have the intellect of a say a physicists merely because they were lucky on timing. Many a foreign despot is worth billions but to say they are the brightest among us is missing the bigger picture. To the contrary, the fact that those with such a narrow scope of knowledge can become wealthy is a symptom of our value system. We are a house horny nation. We have mathematicians from M.I.T. opting to go to Wall Street to trade derivates on housing instead of figuring out larger questions on how to make our society better. Selling poorly built crap homes with maximum leverage to sucker buyers is not exactly an added value endeavor for society. We have bigger question to answer in our universe instead of what stainless steel appliance is going to add $15,000 to your flip. Then again, don’t tell that to our local real estate guru since the last flyer said prices are “out of this world!â€

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

128 Responses to “Say hello to rising housing inventory in Southern California: Year-over-year inventory is up 26 percent in Los Angeles and 30 percent in Ventura.”

I’ve noticed another house staging device. Buddha shrines, often in a garden setting. I know there are some Buddhists in SoCal, but I see way more Buddha statues than I think are Buddhists in the population. I think it’s supposed to send a message that “This house is an oasis of peace and tranquility.

So far, I’ve spotted these staging devices, coming up repeatedly:

* Buddha shrines.

* Red front doors.

* Musical instruments, especially string instruments.

* Bowls or jars of citrus fruits: lemons, limes, oranges. I saw a house that was barren, no furniture, yet still had a glass bowl of oranges in the kitchen. Pretty blatant staging.

* Block letters. Not just in children’s rooms. I saw a block letter sign that said BATH in a bathroom. I’ve seen other signs that say HOLLYWOOD or PEACE or LOVE in other rooms.

* Signs with uplifting sayings or poems. I saw a house near the beach with a sign in the kitchen that said: HOUSE RULES, followed by a list of things like “Wake to cool ocean breeze. Enjoy morning walk on the beach. Nap in the afternoon. Tequila at sunset. Chill with friends.” Etc.

* Wrought-iron, Spanish crosses. This is a common staging device in Spanish style homes. Usually, there are several crosses throughout the house, in various sizes, all ornate and antique looking. Makes the house seem like a Spanish nobleman’s hacienda, rather than a stucco crapbox.

* Some staging devices are location specific. I saw several houses near LAX that had prints hanging on walls, all of them photos or drawings of classic airplanes. I guess that’s supposed to make you feel good about living near LAX.

* I saw a house in Studio City that had a desk lamp in the shape of an old movie camera. Many houses in Studio City or Sherman Oaks or Hollywood have classic movie posters on the walls. A subliminal message that the house is close to where Hollywood dreams come true.

Property stager sounds like the next lucrative profession. I wonder how one becomes a property stager…

=…I wonder how one becomes a property stager…=

Drop 600k on a shack, let the market tank hard, and then wait 10 years for manipulators shove their free-market-fantasy wedges under the bottom until your almost ‘breaking even’ (ignoring treasury discounts). Then, and only then, can you achieve oneness with the world, that you have what it takes to select the perfect Buddha statue at the Home Depot garden department.

I would start by learning the fundamentals of Feng Shui. Which is the art of placement. And get rid of ALL CLUTTER.

I am a realtor, and a properly staged home, with professional photos and syndicated on the web is the best way to market a home

where – That really seems like a lot of work and I am really lazy, isn’t there some kind of real estate staging one day seminar in Las Vegas that I could attend?

So a stager is kind of like a fluffer in Chatsworth’s industry of note.

Lipstick on a pig indeed. Not sure how much a stager/fluffer can do for the 1500 square oC crapshacks I have seen. UGGG.

Great article Dr. HB.

Hilarious!!! And true.

Red wine bottle and two glasses. Never forget the wine bottle.

feng Shui, red wine, bowls of fruit, red doors.. but hey guys y’all forgot about those smelly little flasks of essential oils with sticks inside them sitting on the bathroom counter, wafting out the smell of a pay-by-hour motel room 🙂

some of these essential oils are very local:

‘essence of el segundo’

and

‘santa monica, where the smog meets the fog’

🙂

We have lived in Westchester (90045) just north of LAX for over 30 years. My recommendation is to stay north of 77th, or else the plane noise can be annoying.

My other recommendation is to follow our example and buy over 20 years ago. How you do this is your problem.

“My other recommendation is to follow our example and buy over 20 years ago.”

This is hands down the most brilliant advice given on this site ever!!!

Hello Doc.

Some other recent news from CR.

here is a piece of the article

Nationally, asking home prices are rising slower than in previous months, but the real change has been the price slowdown in the hyper-rebounding markets of the West. In May 2014, none of the 100 largest metros had a year-over-year price gain of more than 20%; the steepest increase was 18.8%, in Riverside-San Bernardino. Among the markets with the biggest price gains today, three – Las Vegas, Sacramento, and Oakland – have had significant slowdowns in year-over-year gains, from around 30% in May 2013 to around 15% in May 2014. In contrast, price gains accelerated dramatically in Chicago, up 13.5% year-over-year in May 2014 versus just 3.6% in May 2013. Overall, half of the top 10 markets with the largest price gains are outside the West, another big change from last year when almost all of the biggest price increases were in the West…

http://www.calculatedriskblog.com/2014/06/trulia-asking-house-prices-up-80-year.html#U1J3piXxCeyWz0yv.99

Get to the point Edith…

Things are not as they seem

Skim milk masquerades as cream.

That is all ye know and all ye need to know.

All others pay cash.

say you had a stock worth $0.01 in 2013, and now it is worth $0.02. heck that’s 100%, I’m rich! Crap is crap dear fellow citizens it doesn’t matter its composition.

The avalanche begins.

Haven’t you heard? NIRP is the new ZIRP! We are all saved!!! Thank the Lord!!!

If you think SoCal is bad, come to Toronto, Canada. Housing prices just don’t seem to want to come down. It’s beyond crazy. It’s getting to the point where I am seriously considering starting to take a look at the ‘Rentals’ section of the newspaper. Depending on how much it costs to rent a place with 2 to 3 bedrooms, I might just take the plunge, sell my place, invest the money. My investment earnings (obviously I wouldn’t be investing in fixed income) could then pay for my rental and for that matter, virtually all of my living expenses. The money I currently pay toward property tax, utilities, and other housing costs can then be invested.

On the other hand, when I hear that Bernanke is saying interest rates will stay low for his lifetime and I hear Bill Gross and Jeff Gunlach saying similar sorts of things, I tihnk , maybe I shouldn’t sell my real estate as it will continue to appreciate as people, encouraged by the prospects of interest rates staying low for a long time, continue to bid up real estate prices.

This is why I am continually in a confused state. I have no idea what to do.

Though I’m responding to you, this is a more general comment – your comment was just the impetus for it. I’m a little perplexed at how a number of people on this blog appear to think that “investing” (presumably in stocks?) is a sure-thing, but housing is just a disaster waiting to happen. With the Dow now nearing 17000, is it really a good time to buy in? I suppose if you are an experienced investor and have time to research specific stocks, fine, but if you’re buying a fund – you can lose your shirt in the market too. If housing “tanks,” the resulting instability could wipe away your gains in the market as well (a la 2009); and not to mention the taxes on your gains (especially if you need the funds within a year) can be heavy.

That being said I do sympathize with those of you in Canada. In the US, the tax deduction can make a huge difference – I know you guys don’t have that.

I think it comes down to how easily and quickly one can convert the asset to currency should the given market start to decline quickly assuming cashing out is desired. There’s also the issue of not having to perform maintenance, repairs, and replacements – although that’s more about management than risk.

There’s probably a lot of folks on here who wouldn’t buy into equities any more than they would housing at the moment.

LG-

Herein you have delineated the crux of the problem. Mom and pop investors and savers alike have nowhere to park their cash for even a mediocre return. Next thing you know you’ll have to store it in the mattress to avoid paying the bank interest to hold it for you a la NIRP.

Kudos to the first person that can provide a reasonable alternative (hold the sarcasm for once, what) to real estate or the stock market.

“Kudos to the first person that can provide a reasonable alternative (hold the sarcasm for once, what) to real estate or the stock market.”

I got two words for you CAB… MonaVie I have thousands of bottles in the basement. They lost some value a few years back but I believe they will rebound in value any day now…

The more I think on this stuff, the more depressing it becomes, really. And illustrates that for the most part, average people – including even the upper middle class – are all in this together.

True that you can more easily convert stocks to cash, but they can also drop dramatically in a very short period of time. Timing the stock market and timing the real estate market are both losing battles, really.

If not stocks or real estate, I am curious to hear where people are parking their money at the moment.

Equities keep getting mentioned as if it’s a foregone conclusion that’s the best alternative. As for a better alternative, wouldn’t you like to know! The best options are the ones those in the know won’t want to tell you about – ponzi schemes excepted.

I roll my eyes every time I hear about hwo “risky” the stock market is.

Pick one of two investment strategies:

a) invest in a 5-to-1 leveraged, illiquid investment with carrying costs of at least 2-3% per year.

b) invest in a highly liquid asset structured in such a way as to “guarantee” a nominal return of a few percentage points a year with historically little risk.

In case you haven’t guessed it, a) is housing. b) is a covered call on an S&P 500 ETF. That’s why I invest in the latter.

We’ve parked a lot of money in simple, good old fashioned loans. Alternative asset class, I guess, if you consider loans to people or businesses somehow strange. $42k in LendingClub (yielding 9.5%), $56k in a managed investment fund for business loans (yielding 13%), and going to make a balanced conservative low risk paper play with another $25-50k of our down payment money in Prosper for a roughly 5% yield. The downside is liquidity. Yields have been very stable over two years.

My wife and I have equities through our 403(b)s that we purchase every month. We let those ride (although I have $100k in one that’s in cash waiting for a pullback).

The problem of how to accumulate wealth in a low growth and interest rate era is not new. The focus was to accumulate savings in your lifetime, and build generational wealth for your heirs. How many people today worry about their heirs? Historically, passing the estate on to the oldest son was the way to keep the estate together and run by one family member who doled out allowances to his siblings. The son would collect rents on land and property, and keep his relatives poor so the estate would survive. Where I live in Chester County Pa, the Amish pass the farm onto the favorite son, and the siblings are on their own.

The thing that ruined the old estates was the financially wasteful huge estate homes, like in England. McMansions are a historical phenomenon that accompany the decline in personal wealth. The best investments have been in productive farm land and manufacturing, the means of production.

So one way to handle the wealth problem is to educate your most capable child in financial matters, leave them all your money, and give them the responsibility of managing and growing the estate for the whole family.

Confused – Yes! This is a problem and I am working on a solution.

It is very challenging to correctly interpret the “messaging” our current “economy” is sending now that we are living in an alternate reality where up is down, saving is bad and debt is good. Most would say simply do the opposite of what you think. The problem with this approach is that it is very prone to errors. Studies have shown that it is very difficult for human beings to to react opposite to what they believe is in their best interest.

I am working on the next generation of google glass where you see and hear everything in opposite. This will allow the natural survival instincts to rule human decision making and will solve all confusion. Please like me on facebook and follow me on twitter and we will get this solution to market!

You got me, what. Mona vie. LOL

But I thought you said you were real lazy and that sounds like it might have some work involved.

Bill, Bill, Bill,

You missed the most important sentence. “Please like me on facebook and follow me on twitter and we will get this solution to market!” How hard is it to open a facebook/twitter account?

Money has been pumping up house prices at the margin, all over the place. UK is mental I might add. It’s like a war on the young, in my opinion – with a lot of complacent older VI owners, reckless older investors doubling down with debt to become landlords, cash buyers emptying savings accounts chasing yield, and other buyers just stretching to get on “the ladder” -“buy now (at insane prices) or miss out”. Can only hope crash in one market causes consequences in others. People talk about social unrest if we had a crash – but a lot of younger renters have been enduring the pain.

_______

Knight Frank global house price index % change 2013-14 (The Times, June 3, 2014)

Dubai: +27.%

China: +17.5%

Estonia: +16.2%

Turkey: +13.8%

Taiwan: +12.2%

Brazil: +12.1%

Australia: +10.9%

Colombia: +10.6%

US: +10.3%

Iceland: +9.7%

New Zealand: +9.2%

Great Britain: +9.1%

_______

Sunday Times 25th May 2014 (United Kingdom)

The share of new loans that are for more than 4.5 times income hit a record of nearly

39% in the last quarter of 2013, above the 2007 peak of 32%..

Invest in energy, pipelines and electricity distribution. Not highly traded and not pushed by the web advisers but conservative, steady income with investments. And the Koch Bros won’t let anything happen to their empire.

DHB

I have a couple of “observations”.

First, I believe that it is impossible to have a housing crash in the current unicorn fart rainbow flavored Kool-Aid currency economy. I do not believe we will see a crash until a SFR has a negative cash flow. NIRP is the new ZIRP which means that the houses taxes and maintenance will need to be higher than the rent to even discuss a down turn. Keep in mind that ignores financing. NIRP will continue to push “deposits” into other assets.

Next, I hear daily discussions on NPR about making changes to prop 13 for commercial real estate because the law is not “fair”. I believe this is the first nail in the coffin.

Further, I also heard a discussion about the “thousands” of bank owned property in California that is not being maintained according to the new foreclosure act. The state is NOT collecting fines that are due from the banks for noncompliance. First of all, there are still bank owned property? Second, there is revenue that the state could be collecting that it is not? And finally, this will eventually increase the cost of holding the properties.

All that said, we are still a LONG way from a “crash” in the land of make believe.

Your sardonicism knows no bounds!

I believe that I have now moved into a more satirical state.

Psychological shifts by older, house-culture, buyers may push up the fundamental bottom a bit for now: people giving up on retiring (and saving for retirement) so that they can give all that money to the banks for their box, &c.

‘Course the young ‘uns aren’t into that, and prefer to give all their retirement money to travel planners, airlines, five star hotels, foodie restaurants, designer coffee dispensaries, career colleges, &c. So that particular generational divide may end up steepening a correction over the long term.

This is ridiculous. My parents, who are boomers, spend more frivolously than my husband and I do. If the older generation is so responsible by comparison, then why is the average savings at retirement right *now* so abysmal, despite the much lower cost of living when they were younger?

LG –

I think we’re saying the same thing: less savings for retirement is happening.

My point was there is a difference in home prices between a culture of responsible savers and a culture of spend-every-last-cent-on-a-home-&c.-and-never-retire; everything else being equal.

3000 is thousands, in thousands of bank owned property that is not being maintained. The banks have gotten rid of most of the REOs. Now the prices can go down.

I think you are close. The too big to fail and too big to go to jail banks must have been largely responsible for the sudden low inventory and the ridiculous rise in prices. After all they couldn’t lose money on the illegal foreclosures they assumed, could they? It’s still Heads we win and tails you lose.

Another market not illustrated in the Redfin chart is Orange County, CA, which is up 49% with sales down 14% through June 2nd.

I saw another interesting chart regarding YOY inventory on OCHN this morning (from CR) – http://www.calculatedriskblog.com/2014/06/weekly-update-housing-tracker-existing.html

At the rate we are going, on a national level, we may soon surpass 2012 inventory levels (which was admittedly lower than historical norms).

We live in Silicon Valley. We just sold our home for more than asking. It is in escrow and due to close this month. Real estate here is still extremely hot. We actually had six offers on the first day. I believe DHB is still correct on his view that the southern market is slowing, but this area seems to be heating up. Silicon Valley has jobs. The Real Estate industry has a saying about real estate values here, “If Silicon Valley stubs its toe, outlying areas will break their leg”.

I certainly hope the deal closes as we would like to leave. There’s trade offs for everything. My surrounding area is at least 85% foreign and probably more. We are moving to a quieter cleaner place to experience a different lifestyle. My family has been here for three generations, but the quality of living has deteriorated greatly with the advent of the electronics industry. We really are strangers in our own neighborhood. Yes, there are many people making huge amounts of money, and as DHB says that doesn’t mean they are smarter. There’s something to be said for the actual quality of life. Our friends, in this area, agree and are totally envious. We’ll see…..

Nicely timed!

Curt-

It ain’t done til it funds.

Good luck!

Kurt, You say that your neighborhood turned to 85% foreign and it is no longer clean and quiet, implying that these foreigners are noisy and messy. Who are these foreigners? Are they Turks?

No Turks. The place is very crowded. This was once one of the most beautiful rural valleys in the world. With the advent of the electronics industry, the area has attracted people from all over the world. There’s a very strong job market here and that attracts people from almost everywhere. We have many Asians working in high tech. Our neighborhood is decent, but the local shopping center is rife with homeless. The changing demographics are only one factor in our decision. The associated traffic in this area can be daunting to say the least. Also, this home is much too big for us, on a huge lot and requires much more attention than we want to invest. My wife and I are both retiring and are moving to the Napa Valley for a less industrial lifestyle if you will. We’re closer to San Francisco and other cultural attractions there than we are here. As I said our friends are mostly envious of us leaving this area for many of the state reasons.

Curt,

Well played sir.

I came to the conclusion in 2005 while appraising some very high end development in San Francisco that there is a price on everything and a value to nothing.

Greed has again taken over and it is more true than in 2005 when I said that. I waited for 3 years for the sh*t to hit the fan, and when it did, there was little public outrage about what bankers did to the world’s financial structure.

I recommend you listen to Ted’s Talks called “Liar’s Loans” and he will explain what happened.

Where is the public outrage?

Public outrage?

Sorry, America is too busy for that. Don’t you know there’s a new season of the Kardouchians airing?

Fantastic post, Doc. News before it’s news.

It certainly seems like folks are starting to crowd around the exits.

The line “SoCal is the ultimate get something for nothing destination” is so spot-on and appropriate for this topic. Of course there is no free ride and you pay at the end of the day. Those golden handcuffed seniors are a prime example of how it can play out.

Someone didn’t get the memo:

http://www.redfin.com/CA/Los-Angeles/1545-Kelton-Ave-90024/home/6802524

$2.7mil for a McMansion box that doesn’t belong with any of the other houses in the neighborhood. The interior design looks like a product of the Kardashian’s trashier cousin. The back yard butts onto an apt. building.

The last sale was for $1.72Mil, just after it was built (probably by the builder – it sat on the market for months).

The previous house at this address was a sad early 50’s dump that sold for $995K.

Most of the houses on the street have sold for $1M – $1.5M in the last 5 years.

I don’t see the $1 mil worth of “improvements” other than someone trying to unload an expensive home on a dumb foreigner or someone with more money than brains (or taste). The sad part is that they probably will find an idiot to sell it to – maybe not at this price, but at $2mil or so.

I like the interior doors – they look like the ones you buy right off the shelf at the local big-box store.

The bathroom wallpaper is tripping me out.

(By the way – Horza… I’ve read ‘Consider Phlebas’ many times, along with almost all the other Culture books; just finished reading ‘Matter’ – ok… last 1/3rd quite exciting). When this market turns it’s going to be epic. Even here too many people believe there is no end to people willing and able to pay high/higher prices – no end of cash buyers from xyz – when there surely is a limit.

_____

Manic phase: Properties come to sell at absurd prices on the expectation they will appreciate to still more absurd prices. And they do. They defy gravity, moving from one lofty new high to another, month after month, year after year, long enough to lure otherwise prudent people to mortgaging their gains to reinvest in the inflated assets on margin. Before the market can top, everyone who could conceivably be drawn in must have already become a buyer. And debt levels supporting the asset prices must be many times higher than any that could conceivably be services out of the cash flow yielded by the investments themselves. Then comes the bust. Just as everyone has come to count on the idea that the lofty asset valuations are permanent, there is a crash.

Brain – I’ve read all of the Culture series. “Use of Weapons” is probably the best, “Matter” is probably the weakest.

@Son of a landlord – at least the Westwood part isn’t a lie. You may be thinking of Westwood Village, which would be North of Wilshire.

Westwood, according to the LA Times retcon of Los Angeles cities, extends from SM Blvd. North to Sunset Blvd. and from The L.A. Country Club East to Sepulveda:

http://maps.latimes.com/neighborhoods/neighborhood/westwood/

Westwood used to be considered (at least by the locals) as everything between of Beverley Glenn and the 405 (E-W) and Sunset and Pico (N-S)

The listing claims the house is “in the heart of Westwood.”

This is a LIE. The house is south of Wilshire, so I’m not even sure that it’s IN Westwood, much less “in the heart” of Westwood.

At most, the house is on the fringes of Westwood, though, more accurately, I’d say that it’s in West L.A.

This is a common lie. Many listings claim a house is “in the heart” of whatever area is supposedly hot, even if the house is barely on the fringes of that neighborhood

Disgusting. How insane do you have to be to consider plunking down $2.7M for something that horrid. An ugly s#itbox crammed into a tiny claustrophobic lot, wedged in between towering blocks of concrete! hardly any backyard! absolutely terrible interior design and overall a complete lack of aesthetics. At $3M this must be a misprint.

I wish redfin would take it one step further and add a comments section to all their listings. That would be a thing of beauty.. Then greedy assholes like this guy would get torn to pieces.

Most people in the market for $3M homes can afford to pay cash or at the very least 50% down. If you have that kind of money, unless you came across it by complete luck (lottery/stock market or inheritance) chances are you have worked your ass off for that money and would like something pretty sweet in return. Not a depressing box on a tiny piece of land without views, privacy or a hint of curb appeal (or any kind of rational appeal at all really).

So much of this, “you paid THAT for that POS?!” is going on in SoCal. All I can hope for is how much they lose on it. I can’t understand the idiocy of careless investments.

I have been making soft offers on high end south OC ocean view properties. The inventory is growing in response to the dead cat bounce trend this year. There is hope that cash slingers are gullible and their home has perfect Feng Shui, hense the staged Buddah statues and red front doors. Sellers that I know are downsizing and/or moving out of state. There is no moving up. The long term trend is not there. South OC is get out now, not get in. Uncertainty with Prop 13, excessive income tax increases and the 3.8% medicare tax is affecting the high end market. If you want an ocean view find a desperate seller willing to take less than 20% of an asking price or rent a house held in a trust. An ocean view is like a boat, one is happiest the day they buy it and the day the sell it.

Great points. Please post info on feedback/counters you receive for offers you submit, the more the merrier. Nothing like current data straight from the trenches.

In regards to the soft offers. One actually came back and said the owner wants it sold implying 80% of asking price was in the ball park. A more recent one that just came on the market said the seller would not go for it and said a buyer from Texas made a better offer. I guess buyers need to come from states that do not confiscate 13+% of annual income AND capital gains. Buy the home but stay in Texas most of the year.

I’m a poor man’s version of that story…left a $1 mil house in 2012 for Florida when seeing the writing on the wall regarding taxes, etc. Of course, I kicked myself a bit that I missed the (unpredictable) bounce of 2013, but the long-term trend was clearly going to be that the “rich” need to pay more of their “fair share” to the state. I was fortunate enough to grow up in an ocean view house, and here’s the elephant in the room–you actually get tired of the view! Call it sounding spoiled or whatever, but having the same view, all of the time, actually does get boring after a while.

I live in a condo near the beach. I can see the Pacific from my balcony. Being near the beach has its drawbacks.

Here in Santa Monica, the air is VERY dusty. Doesn’t take long for a thick accumulation of dust to form. And I’ve heard that sea air is not kind to exposed electronics, such as those behind the vents in your TV set. Sea air corrodes electronics.

KR….Nothing in this world like the Real Estate pitch “endless ocean view of blue water” yeah it is endless alright, and it never changes.

My brother who lived in Pacific Beach San Diego said it best, “my ocean view is play it again Sam”, then who moved to the Sedona Arizona, where he really did see endless wild life, cloud formations , and Red rocks that only God could produce.

Then he said, I really want Sam to play it again, Sedona, well this place is pure magic.

No one is mentioning the Fukushima radiation seeping from now until eternity into the Pacific Ocean. Who is going to want to surf with all those dead fish floating around? I personally wouldn’t want to own CA coastal property. I’m also stocking up on pre-FUKU (pre 2011) wines from Napa Valley. And also South American wines….

Actually I’m looking to move up from my fairly modest home in the valley. I just can’t find anything that makes any sense and I am in pretty great financial shape, or so I thought. People are asking crazy money and inventory is mostly junk. The stuff that’s fairly nice in good neighborhoods is listed at around 10 million. Even if I had that kind of money it seems to me it would be an awful investment. I do see a lot of expensive s#itboxes in pacific palisades that are selling like hot cakes though. Makes me worried. Sales are down everywhere except in the prime areas which seem to be thriving as always. Certain areas of l.a are now off limits to everyone but people willing or able to spend $2M+ On “starter homes”.

A wee bit off topic, but today’s non-farm payroll report from the BLS stated 200,000 plus jobs added for May, which is what it says +/- a few thousand every month. Does anyone really believe that this administration, which doesn’t even mention jobs much less have an actual jobs development program, is adding 2.5 million jobs per year, or 10 million jobs over the 2nd term?

The only way to get amazing job creation like that would be to slap a 1,000% tax on all imported manufactured goods (payable at the dock) and a 1,000% export tax on all raw materials (stop sending our food abroad). Thus, an imported Apple gizmo, say an iphone, would go from what, say $500, to $50,000 (1,000 x $500).

That would send them scrambling to build factories in the USofA literally overnight. But, I’ve been thinking, that we won’t invite the Apples and the RCAs etc. back. Those b-stards sold the american people out, so they have to stay out. We could invite say Samsung to set-up shop here and then have new start-ups start from scratch. If it was up to me, I would strip people like Tim Cook and then Nike scum Knight (just to name a couple) of their citizenship. They love China so much, then go live there.

Government lies are supposed to boost the economy by boosting consumer morale. If people think things are getting better, they’ll spend and borrow more, thus creating jobs, which in turn will boost the economy for real.

The idea is to kick-start the economy by fooling people into spending.

I’ve often heard TV and radio pundits talk about the importance of consumer morale and consumer spending.

This may not be the best plan for economic recovery, but it seems to be the one the politicians are implementing.

The problem with this plan is that it forgets balance sheet health. The perception game only works if there is room for more debt on the balance sheet of your target audience. The problem for these central planners is that the “retail consumer’s” balance sheet is tapped out. More debt will actually decrease the ability to increase consumption. So, what has actually happened is that S&P 500 companies are the ones taking on more debt to buy back shares but share buy backs really don’t increase economic activity. It is true that stock holders have increased perceived wealth but remember there are less stocks out standing to be held so in the end it is a net zero sum gain. The perception game may continue forever but I am not sure who is being fooled at this point…

At the rate we’re going a US passport won’t be worth much soon

Wise as F, Tom. I’m with you.

Rents are at all time highs and are equal to what a mortgage would be.

What a pickle.

My advice: move in with the parents, help them out, do your chores, save your money, and give the real estate flippers and landlords the finger.

“equal to what a mortgage would be”

Bullshit. Not everywhere. Especially prime beach.

@Big John wrote: “Rents are at all time highs and are equal to what a mortgage would be.”

Au contraire. In the fly-over states, mortgages can be much cheaper than rents. Here in SoCal, I live walking distance to the beach. My rent is 1/2 to 1/3 what a mortgage (PITI) would be.

I’m sorry, would go to $500,000, left of the last digit there in my haste. Nobody could or would buy the apple gizmo manufactured abroad, that’s the point.

What the BLS says is that the job gains are service industry related, bartenders and such. But, when you see stories like the one I have linked here, the closure of the largest casino in the south, Harrah’s Tunica, with its “950” job losses on June 2, 2014.

http://www.nytimes.com/2014/06/01/us/harrahs-tunica-casino-to-close-hinting-at-gambling-glut.html?_r=0

My lady friend watches the network news every night, so naturally I catch it with her.

Not a word about this Harrah’s story on CBS national news this week. Yet, 200,000 jobs created they say, stawk market now in a manic phase, house flipping shows are back on cable in a big way, etc., etc. Strange is all I can say.

http://wreg.com/2014/06/02/harrahs-casino-tunica-closes-its-doors-for-good/

Anyone who get their news from the networks is very poorly informed. Main Stream news is close to useless and let’s face the rich powers that own the networks are not going to let the public know the truth. It’s not in their interest. One has to dig for the news and that is why Net Neutrality if so important so write to the FCC and beg that sneaky chairman (Obama appointment) to NOT change the internet so we don’t lose our last outlet for the truth.

“During the financial crisis, the central banks of the United States, United Kingdom and Japan created $3.7 trillion in order to buy assets and encourage investors to do the same. Michael Metcalfe offers a shocking idea: could these same central banks print money to ensure they stay on track with their goals for global aid? Without risking inflation?”

http://www.ted.com/talks/michael_metcalfe_we_need_money_for_aid_so_let_s_print_it#t-769503

Sure… Why not…

Somebody really needs to take the keys to the store away from these clowns…

The neighborhood of our rental in Malibu is as hot as ever. 1960’s ranchers with 2300 sq going for 1.6-1.8mm. Renting for 7K per month on year leases.

Seems like there are always monied families ready to move in. I would never pay to rent in Malibu much less buy but the demand seems to come continuously. . .and with a fixed low rate mortgage, we are holding on for the ride. . .

Not monied families but people who got lucky in the entertainment industry. Same as always. But no savings just a sudden large income which usually is gone before you can blink. This has been going on in L. A. since the invention of the movies and pop music.

True, but people in LA also do crazy things with their money. A friend told me about a photographer acquaintance of his who used to rent a house in Silverlake for $10K/month. Rent, not buy. $10K.

Another friend blew all his money on cars to impress rich, foreign women.

Another guy bought a house in Torrance for $350K that needed major structural work and was water-damaged to hell.

Sometimes I think that people in LA don’t think before they do anything especially when it comes to money.

Renting at $10K is not unusual at all. Have a look at rentals from $7K to $10K and see what kind of nasty crap people are renting out. Under $7k and you can forget about a decent area of l.a if you need a fairly big house (3000sqft). My house is rented out at $7K/month, and that’s not even in a prime area. It’s what people were willing to pay so that’s what I’m getting for it.

To a guy making $150K/month , $10k in rent is not that bad. If you’re not sure you want to stay in that area for a big part of your life, then renting makes more sense anyway. The price to pay to be able to get up and go. You pay for the freedom of not being locked in. Currently I’m renting at $4K. It’s a pretty shitty house, but it’s enough for my needs, temporarily. I can write off my my home office, as well as depreciation on my rental, so effectively I am paying more like $3.2K.

Blows my mind that many people have that kind of money. I don’t understand it. Worst job market since the 80’s? No one has money that I know. I don’t understand how more than a handful of folks could swing that kind of rent. Blows my mind.

It blows my mind too. I would also think it’s only a handful who can afford it, but I think some of the problem is that they all seem to want to live in l.a.

People who make this kind of cash are heart surgeons, organ transplant surgeons, B-movie producers, adult entertainment producers, top bankers (the worst! They are just moving money around), entertainment lawyers (a lawyer friend of mine charges his clients up to $60k/m to represent them – and people pay), top real estate agents, athletes, app developers, video game developers, top bands/artists, exotic car rentals, high end hotel managers, small company CEOs, accountant firm CEOs for the stars etc.

Then you have the ultra rich who can afford $300K/month rents without blinking. Movie producers, top artists, movie stars, directors, big company CEOs.

There’s a ton of money out there. A TON. it’s depressing but true, but the reality is, if you want something extraordinary, you have to go out and do something extraordinary.

Wonderful answer, TB. Thanks for enlightening me.

This Culver City house was listed at $830,000 and sold for $915,000: http://www.redfin.com/CA/Culver-City/11113-Barman-Ave-90230/home/6727681

Built in 1947, 1,307 sq ft, and only 2 blocks from the 405. And someone paid $915k for it? WTF?

I know there’s a musical instrument in one photo — a drum — and a bowl with an orange in the kitchen, but still, no Buddha shrine. House seems overpriced.

That house totally sucks. I would love to talk to the person who bought it to see what was going through their mind.

LAer… The RE agent states the “home is bright and charming.”

I can state this, the buyers might be charming, but they certainly not to bright?

@son of a landlord,

In 1990 (one of the many previous housing bubbles in SoCal) in that area of Culver City, homes were selling for +$500K. Adjusted for inflation, that would be equivalent to about $875K today.

Same stuff, different year. Buy now or be priced out of the market forever!!!!!!!!1

P.S. ignore the fact that in that area of Culver City homes would be selling for $200K in 1997.

I forget to mention, there was a surplus of good jobs in CC in 1990 and 1997. In July 1997 when housing prices peaked in SoCal, SFRs were going for +$900K in CC.

Edit: That should read 2007, not 1997.

Thank you Dr. Housing Bubble for pointing out that luck is not the same as intelligence. Being very rich is mostly about being very lucky. Right parents, right schools, making the right friends and connections in those right schools and inheriting from families is a big help. None of these things required intelligence. In fact these days a college degree is no sign of intelligence – all you have to do is play a sport. The university will pay for all plus more while the really smart students struggle with tuition, debts, round down classrooms and equipment. This too tells the sad story of the sinking of American values. At University of CO the academic equipment if falling apart but the sports department accepts students who can barely read at a first grade level but tutors them into barely passing so they get a bogus degree. No wonder our standard of living is in free fall.

it takes luck to be born into the right family instead of a ghetto family of a single drug addicted mom. but it takes a certain amount of intelligence to not lose any of the family wealth.

People rationalize and justify their good luck and privilege with statements like, “Knowing the right people is a skill.”

Well, it is, to an extent. If I’d had better social skills — the ability to schmooze and smooth-talk and make the right connections — then I might have ended up rich rather than middle class.

I’ve seen a lot of slicksters in Los Angeles. People who know how to put of a false front, to talk money out of investors, to convince people of whatever it is they’re selling. It’s a skill.

I can see through them, because I’m a suspicious, untrusting sort. I can’t smooth-talk and don’t trust anyone who can. But I’ve seen other people, including friends, be duped by those with the right people skills.

How do you guys feel about cheap real estate in places like Alabama, the deep South, not the SoCal south.

I’m heading out there for med school this fall, probably to never return to CA, and am thinking of buying. Will the market go up or down in the next year, 2 years, 3 years, 4 years out there? What says the hivemind of trolls, shills, sages, and house horny people?

I know inflation is coming though, so I guess I’m really just trying to time the market in the short term.

I had the “opportunity” to live in northern Alabama for a couple of months on a temporary work assignment a decade or so ago. It was fascinating, but you couldn’t pay me to move back there. Basically it seemed like the Great Depression never ended there.

While there were some nice enclaves in and near the cities, a few miles out and it was a mass of rural poverty. Every property seemed to have a tumbled down shack on it – often as not occupied. In the small towns all the activity was centered around the 99c stores, closed factories were everywhere and unemployment/underemployment was rampant – and this was BEFORE the crunch of 2008-9.

FWIW, the people were friendly, but it was so depressing to be there that I couldn’t imagine moving back permanently.

When I played ball, I got a rude awakening of just how many people in the US live at or below poverty line. Small towns like you said seem frozen in time, very little to do, the folks who came to the games were just happy to get a beer, hot dog, and watch young guys trying to learn a difficult game.

America is a very divese

Fiat…..The American Deep South is not going to be a place to make money in Real Estate. If ever I recommend to rent it would be there, get your degree then head for opportunities other then there. The culture alone is enough for you to worry about, let alone buying a house?

Hey guys, thanks for the advice. I guess I’m just really house horny, with not much blood left for my brain. I’ll rent for the first semester or two, and see if I’d actually like to settle there. It’s southern Alabama, right next to the Florida pan handle. I really like Florida, from what I’ve seen (road tripped from the pan handle all the way down to the keys), and might end up there after I get my degree instead. I like the mobility of renting, but I do want to eventually own (at least cut out one more middle man).

“What says the hivemind of trolls, shills, sages, and house horny people?

1) Buy now or be priced out forever

2) God ain’t making anymore land

3) Housing will only go up

4) I got rich off of real estate and so can you

5) You gotta live somewhere

6) Rich Red Chinese

7) House is a hedge against inflation

8) Rental “parody” bauk…

9) You get to paint your walls any color you want

10) Your kids NEED a back yard to play in

11) House provides stability

12) Blah, blah, blah

“I know inflation is coming though…”

That depends on your what your definition of is is.

I am still curios how you get 1970’s style of inflation without wage inflation. I have no idea how you get wage inflation with the huge slack in the labor force and globalization. We can have price inflation without wage inflation for only so long. Eventually you crowd out everything including food and then you get mass starvation. Ask Marie Antoinette how that worked out. I think there was something about cake but I don’t remember what happened next…

HAHA hilarious.

So I’m curious What? you do with your surplus money? Leave it in a savings account for .01% interest? Or maybe you buy coveted paper shares instead of shelter? lolololol

About inflation, it’s simple. Look at the rest of the world and the way they live. Do you think the common man being able to buy something to eat is even relevant to those in power? Things will just become more expensive/harder to purchase and people will have to make do with less, as the rest of the world does. Perhaps home prices might fall, as people sell their homes to pay for food, but I’m sure there will be an investment banker ready to purchase it no matter the price with 0% credit straight from the spigot of the federal reserve. Buy it all up and rent it out to the slaves, why not? It’s free for the banksters. If I could print money, I would just buy up everything until I own everything, pretty simple.

About a possible french style revolution. I bet you there would be enough willing to work as pinkertons and robocops to smash any protest, rebellion, or *cough* occupation *cough*. Just print out money to pay these cops, or build drones, whatever. Just print out whatever your heart desires. Inflation = more money in circulation. Wage inflation for the common man is irrelevant. If not the common man, it will be a hedge fund instead who has the money and thus demand for real estate. The paper money itself is worthless, it is just a tool to control real resources, along with the military, prisons, etc. Rising prices is definitely possible with constant wages. Most goods are imported to USA anyway, so these goods will increasingly just get shipped to other countries with people who actually have buying power to demand the goods. The common man of the USA will become the new African or something, and the good times will relocate. There is no law in the Universe that says the common American must be able to afford a house.

In the past it was possible for a working man to support his wife and family with just one income, buy a house, etc. Now it takes being a DINK to be able to buy a house. This is inflation without a matched wage inflation. It’s the Red Queen’s race.

“I’m curious What? you do with your surplus money?’

I think you missed a “what†in there somewhere… I have no idea what you mean by “surplus†money. 🙂

“Do you think the common man being able to buy something to eat is even relevant to those in power?â€

They may not care but they are not always able to hold on to their power when the masses are starving. Only time will tell…

“Just print out money to pay these cops, or build drones, whatever. Just print out whatever your heart desires. Inflation = more money in circulation. Wage inflation for the common man is irrelevant. If not the common man, it will be a hedge fund instead who has the money and thus demand for real estate.â€

Interesting view but I think you would need to get the newly “printed†money into circulation for it to have a real impact on inflation. The act of creating money does not in itself create inflation. The idea of paying solders/security forces/privet security/etc. with newly “printed†money does get it into circulation. Building drones not so much. There have been numerous studies on how a few rich spend very little versus a large middle class and lower class. GDP will tumble and economic activity with it as well as “circulation†of the newly “printed†currency. I am not convinced that China/India/Brazil/Russia will have enough consumers to take up the slack. I believe we will head toward a new dark age if this happens. All the things that we discuss on this blog (including your pile of neatly arranged sticks on a pile of sand) will be moot if this is the case…

I’d want to make sure my property wasn’t in the path of an oil pipeline, near a petro chem factory, ect – a lot of no regulation there when it comes to big polluters.

There’s a lot of southern bias here that I would disagree with having lived all over the Southeast and currently in the LA South Bay. SoCal also has plenty of people in poverty. There is nothing wrong with buying in that part of Alabama, there are plenty of nice subdivisions in any decent sized town. Just keep in mind there is little to no ‘investor competition’ therefore make sure whatever you buy is in line with the local incomes. You won’t ‘get rich’ off of real estate in the southeast, but if you are staying long term it makes sense to buy.

But back to southern Alabama, there are nice beach vacation towns there both in AL and FL. It is 45 minutes from Biloxi, MS, which has very nice casino resorts right on the water. If the gulf coast doesn’t have enough entertainment options for you it is 2 hours from New Orleans. I would choose that area of the country every time over say, Riverside CA or anywhere inland. Except for maybe In&Out, the same chain stores and restaurants I visit in the South Bay are available in Mobile, AL!

Sorry didn’t finish, America is a diverse society for sure, especially in the South, for many Ameirica is just a lotto ticket, min wage, and little hope of ever moving up.

http://www.zillow.com/homedetails/7612-Marie-Ave-La-Mesa-CA-91942/17001224_zpid/

What do you all think of this property in La Mesa, CA? I grew up in the area and have been on the hunt for a house for a few years now. It somewhat worries me that the house was potentially shoddily flipped from the details, but at first blush it looks pretty nice. I’ve been of the opinion that the housing market is overvalued, but this particular property suits my needs and doesn’t seem outrageously expensive. Any thoughts?

If you like it and want to live in it. If you can afford it. If you needn’t worry about whether its value goes up or down, because it’s home. Then yeah, it makes sense to buy such a house.

Perhaps not if housing is sure to Tank Hard soon. But I don’t think it will. Maybe a dip.

Looks alright. But make sure you get a good house inspector to check every part of the improvements installed by the flippers.

I check the rent prices, and by that metric it looks like a decent deal

I agree with landlord, this property and price comes down to you liking it and making a commitment to home ownership. I know very little of La Mesa, but if you have a bump up it a few years that is very possiable, the price seems within range.

I notice it has been listed only a few days, this reduces your offer, but if you want it go for it and make your best effort to get your price for it. Good luck

have been making soft offers on high end south OC ocean view properties. The inventory is growing in response to the dead cat bounce trend this year. There is hope that cash slingers are gullible and their home has perfect Feng Shui, hense the staged Buddah statues and red front doors. Sellers that I know are downsizing and/or moving out of state. There is no moving up. The long term trend is not there. South OC is get out now, not get in. Uncertainty with Prop 13, excessive income tax increases and the 3.8% medicare tax is affecting the high end market. If you want an ocean view find a desperate seller willing to take less than 20% of an asking price or rent a house held in a trust. An ocean view is like a boat, one is happiest the day they buy it and the day the sell it.

Well, the white population of South OC which are Republicans think that Texas has a better silver lining. There are the same Hispanic gangs there just like California. The Mexican mafia is there even if you moved into a white area in Texas the Hispanic population has the same problems they do in California.. I predict that South OC will get the Irvine spellover for Asians, Easterners which don’t mine the Taxes will moved in to South Orange if they are transferred for some type of job. In fact La/Orange could redo itself. La has it easier since its not trying to appeal to white suburb types but more whites that don’t mine an urban environment.

We’ll see what happens when Calif has to figure a way to address the State Controller Office’s $31,000,000,000 accounting error discovered just last week through an audit.

More taxes, lower Bond ratings, reduced services and Public Works projects, and a whole host of impactful negative fallout for the Golden State. They already frontloaded Obama Care funding to massage the General Fund numbers, so these two events plus the ever incleasing global deflationary momentum is going to really kickoff the “Perfect Storm” for California.

This is only an echo boom. Just like the Great Depression, the rebound spike from something like the 50% drop in 1929, fooled those who survived and traded that initial plunge, only to lose it all in the almost 85% plunge which followed in 1932.

God bless you and anyone else who understands that they are being lied to on a regular basis !

Yes, there were errors in budget items involving $31 billion dollars. They were in both costs and revenue, and “the office says in part ‘All issues were corrected and identified before the final report was published, and not one cent of taxpayer dollars was affected.'”

So we’re actually still in talks about how to use our budget surplus to undo some of austerity measures we’ve taken over the past decade.

Sooooo…….

Wouldn’t a surplus mean lower prices? I’m not an economist but I do remember from high school econ that a lot of demand is supposed to drive prices while a large supply is to relax costs.

Any opinion on DTLA? Caaaause… holy crap this place is gentrifying faster than I can finish typing this thing!

So many yuppy kids who grew up in the OC and are bored of their vanilla lives are buying property here like it was a rich person’s amusement park. Top that with the a-hole CHinese investors who buy on opening day without negotiating, much less coming to the US to LOOK at the property.

I’ve been here for 5 years and all the mom and pops are packing up and giving way to Banana Republic style stores and frou frou terrible food “foodie” restaurants. But yea, soooo many rich white yuppies and their grown children too. Personally, I rent. Our rent has easily gone up 27% in the last 5 years. We’re getting priced out and the whole area is losing it’s individuality and charisma.

My apartment is actually a rented out condo. It started at $2100 for 1000 square feet in 2009. It’s now on its way to $2700… I can’t do that. I could barely do $2100! But I come from the midwest where rents don’t butt-cut you so, yea. I had a 1200 sq ft apt in a nice high rise there from 2004-2009 for $1800 a month. Our rent never went up. Oh – again, it was a condo, rented.

Some rumors I have heard for this area – the most recent/ominous one comes from a Police Officer, who wouldn’t tell me what exactly he heard, but eluded to… in the next year the job market for L.A. is going to majorly crash. I don’t know what he’s talking about – someone on here know? Another rumor I heard, that has been confirmed by the officer I spoke with and a night club owner, is the housing association here has been intentionally lying about the full capacity of DTLA the last 3 years to generate a more rabid interest? Ooof! So so slimy.

But yea DTLA is a hot spot. The rich want all the mural art and the 40 year old districts removed. They want the homeless erased. And they’re being abated by Jose Huizar, Eric Garcetti, and rich Chinese investors who haven’t even looked at the properties they’re purchasing.

How would a street cop know anything about next year’s job market?

He might know about crime trends in his particular neighborhood, but not about job trends for the entire city.

Well, you know… I try not to discredit anything as I have seen some crazy crap in my life.

“Wouldn’t a surplus mean lower prices? I’m not an economist but I do remember from high school econ that a lot of demand is supposed to drive prices while a large supply is to relax costs.”

I think you answered your own question…

“I spoke with and a night club owner, is the housing association here has been intentionally lying about the full capacity of DTLA the last 3 years to generate a more rabid interest? Ooof! So so slimy.”

Yea! Soooo… what’s the deal with the prices not coinciding, then?

First problem is that you still believe in straight line upward sloping supply curves and straight line downward sloping demand curves. “Supply” and “demand” in isolation do NOT determine price. That is the blinder that you are seeing the world through. There are many other “influences” that “impact” price including collusion as your comment states. Other influences include but are not limited to money, banking, debt, interest, regulation, manias, psychology, perception, etc…

Ah. Yea. Factors. Lame.

Any suggested literature I could pick up that ties all that into a healthy lesson?

I love police officers, but think twice about advice as to trends in Real Estate from anybodyl let alone our men and women who wear blue?

Real estate can come down to a block being better then another street. What happens in Kansas has no bearing on what happens in Vegas for example. Each and every tranaction is based on your income, peace of mind with your choice, and possiable sell in the future, and if this property can at least realize a profit or break even, after all is said and done.

“Each and every tranaction is based on your income, peace of mind with your choice, and possiable sell in the future, and if this property can at least realize a profit or break even, after all is said and done.”

What a quaint belief system. Kinda reminds me of those hot summer days in the town square whiling away the hours eating my five cent ice cream listening to the band play the latest rag time favorite… Yes those where the good ole days…

Oye… >_<

We’ve got the market under siege (rents vs owners). UK, MMR (stress testing borrowers to see if they could afford mortgage rates of 7%) , 2 year and 5 year fixed deals ticking up.

I’ve not verified this myself – comes from a source I believe is accurate though:

Prime London (UK)

– sales volumes 17% down against 2013

– 50% more supply against Jan 2014

– 25% of all listings have been discounted

There’s a word I’m looking for.. ahhh that’s it… ‘contagion’ – I believe many global markets are highly exposed to each other at this point. Too many have been reaping HPI from one place, to take positions in another on margin.

I’m from Los Angeles and am now currently in Las Vegas (by way of Denver for 6 months). Long story, short – I have some funds that I need to put into real estate within a certain time frame.

Unlike many of the commenters, I actually like the Los Angeles market. Namely, due to the entertainment industry and their unions. Having many friends in the industry (I’ve lived there the past 9 years), all of them own their homes and none are having problems with the higher costs. When you make $2,000 a day standing by a truck because you’re a Teamster, or $20,000 an episode if you’re a TV actor, you don’t really scoff at a $4,000/month mortgage. Especially with all of the efforts that California is making to bring back more filming.

Therefore, I don’t think the market there is going to plummet but, that being said, I don’t think there’s much room for inflation either.

I am now currently in Las Vegas and have been researching the market pretty extensively. I think that the speculative buying is receding, but still – average home owners are being out-bidded by cash offers (investors) left and right. Having lived in Vegas during the “big boom”, I’ve seen first-hand how speculation can artificially drive up home prices. Everyone keeps saying that Vegas is a “hot market”, but I’m concerned that it’s going to cool down fast. The primary net migration is construction workers – due to home building – which is again, self-perpetuating and could lead to artificial inflation. Also, there is a huge amount of inventory coming onto the market with home builders jumping into the game. So…can anyone explain to me why Las Vegas is predicted to continue with the upward trend (that was driven by a now-cooling surge of investors)?

Denver really caught my eye while I was out there and I’m wondering if anyone has any thoughts or knowledge on that market. It seems more stable and, with a lot of the energy companies basing their operations out there, a good, healthy inflow of jobs. However, a lot of real estate agents I spoke to out there said that they think the market is over-inflated and is going to go down. Again – opposite of my own personal logic when looking at the facts.

Again, I’m looking to invest. I’m actually *really* looking to flip houses. Consider me crazy, but I genuinely love the process of restoring old homes to their former glory. (Another downside to Las Vegas, if you ask me). However, it would be great to make a chunk of change in the process… Any thoughts or knowledge would be greatly appreciated.

Hi Jennifer,

I hate to tell you but your numbers are way off regarding wages in the Entertainment Industry. Sure, the top producers and actors make the kind of money you are talking about but the average crew member makes around $400-$500 a day. Not the $2000/day you are talking about. Also, a lot of production is still going out of state, especially the features. TV and Commercials is basically all that is left here. Plus, none of us know when our last day of work will be or what our next job will be. It’s still a feast or famine type of industry and not really much of a feast anymore considering inflation and the rising cost of living. Just wanted to give you a perspective from a Union member who has been working in the Industry for the last 20 years on a daily basis. Oh yea, and the $400-$500/ day we make is from working 12+ hours a day.

Leave a Reply