Predicting the California Housing Bottom and Examining Market Trends from 1992 to 2009: Foreclosures, Inflation Adjusted Prices, and Income. Data Points to a 2011 Bottom for California Housing.

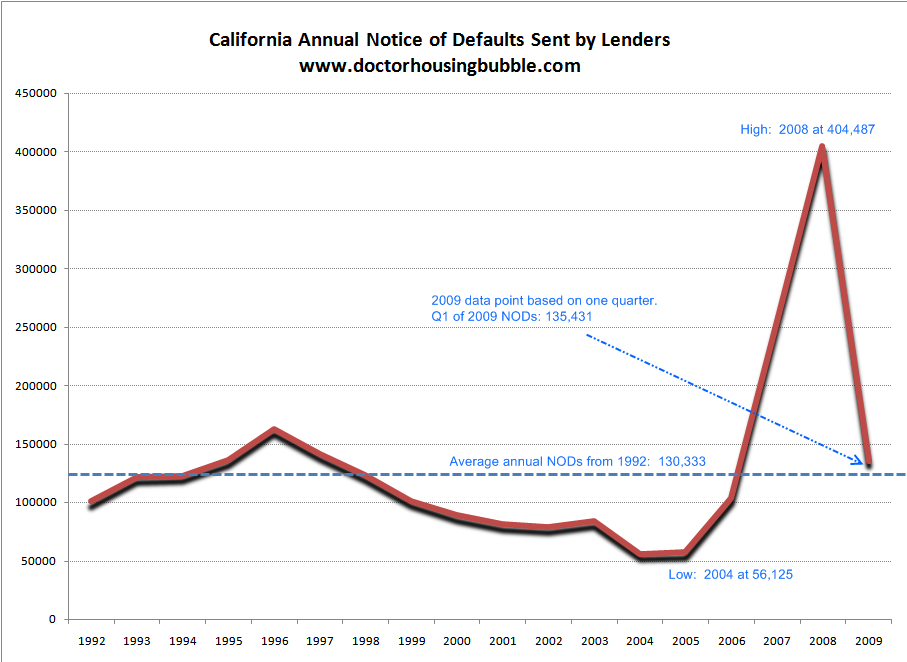

Last quarter California had to deal with the largest amount of Notice of Defaults (NODs) being sent out by lenders in the history of our state. Now without any frame of reference, it is hard to say what an average year of NODs is for California. In today’s article I data mined back to 1992 and gathered information for almost 2 decades for the state NODs. Now why is this crucial in helping us understand the housing situation for the state? First, we have a large amount of toxic mortgages with Pay Option ARMs and Alt-A loans still lingering in our state. Without having a frame of reference, having record NODs in one quarter can mean that we are only X percent above the average annual trend line meaning we would be closer to a bottom. As you will see with the data I gathered, there is nothing further from the truth. I will also examine inflation-adjusted prices to try to analyze the current bottom calling we are seeing.

Foreclosures and Notice of Defaults

*Click for sharper image

I want to spend a few minutes examining this chart. I went back and gathered NOD data for California back to 1992. When you look at the chart, from 1992 to 2006 over 14 years the pattern stayed within a tight range. You see the movement up in NODs for 1992 – 1996 when the last bubble was working its way through the system but the jump was minimal in relation to this current California housing bubble. We hit a trough in 2004 with only 56,125 NODs for the entire year. The average annual NOD over this entire data period is 133,333.

Things became unglued in 2007. The irony of course is that the median price, the main focal point of housing bull pundits was still moving up during this time. Yet the NODs were telling us that a tsunami was quickly approaching. From 2006 to 2007 NODs doubled. And they nearly doubled again for 2008 with a stunning 404,487 NODs filed for the entire year! Keep in mind many of those Q4 2008 NODs are still being worked through the system and will become more inventory in Q2 and Q3 of 2009.

An important point about the chart is the one data point for 2009 is purely based on Q1 of 2009 NODs. I wanted to include this to show that even with one quarter of data, we are already over the annual trend line since 1992. If we continue at this pace, 2009 will see more NODs than the record shattering 2008 data. What does this mean? More foreclosures flooding the market. And with the Pay Option ARMs and Alt-A loans recasting in mass, I would imagine this pattern will continue.

From current data, this is still holding true. In fact, in April of 2009 California had 52,909 NODs filed in one month! With one month of data, we rival the annual NOD number of the entire 2004 year. This shows you how very different the market currently is. In terms of bottom callers, we have never seen such widespread market distress. To assume this is the bottom goes right in the face of all this data. That is why I have given you 10 reasons why I don’t see any housing bottom until at least 2011. And even after that widely anticipated bottom, it doesn’t necessitate a move up. It is very likely that we will move sideways for a decade. That is what astonishes me. I’m reminded of a dog chasing a car. Once the dog catches the car, then what? Once we reach the bottom, then what? Are we going to have another once in a lifetime real estate bubble like we just experienced? No way! We are still in the distress stage here in the state. Until we start seeing the NODs start trending back toward the historical trend line, then we can start talking about a bottom. The last time the market was somewhat “sensible” was probably in 2000. Let us take a look at what was being said back then:

“Two-thirds of the homeowners in default are able to stop the foreclosure process by bringing their mortgage payments current, or by selling their home and paying the mortgage off. Two years ago, only half the distressed homeowners were able to do that.

The effect of foreclosure activity on sales prices is now negligible. While foreclosure homes tugged sales prices down by more than ten percent three years ago, the drag is now less than two percent, and is isolated to just a few local markets, DataQuick reported.”

-January 2000

That was a hidden benefit of the bubble. Homeowners in trouble were able to sell their home into a rising market. That option is now off the table. So two-thirds of California homeowners in trouble in 2000 were able to offload their mortgage either through selling (majority) or bringing the mortgage current. Today, of all those NODs 80 to 90 percent will fall into foreclosure. The data tells us this even though for the last few quarters, the foreclosure and NOD numbers were artificially low because of SB 1137 and other moratoriums. To give you an example, in Q3 of 2008 we had 94,240 NODs and 79,511 actual foreclosures. Now keep in mind, the NOD number dropped because of the laws in California but now, that ratio is ominous. Keep in mind, the NOD tells us that in 6 to 9 months, foreclosure is coming. So with the 135,000 NODs filed in Q1 of 2009 we can expect a surge in actual foreclosures hitting the market in Q3 and Q4 of 2009.

Inflation Adjusted Prices

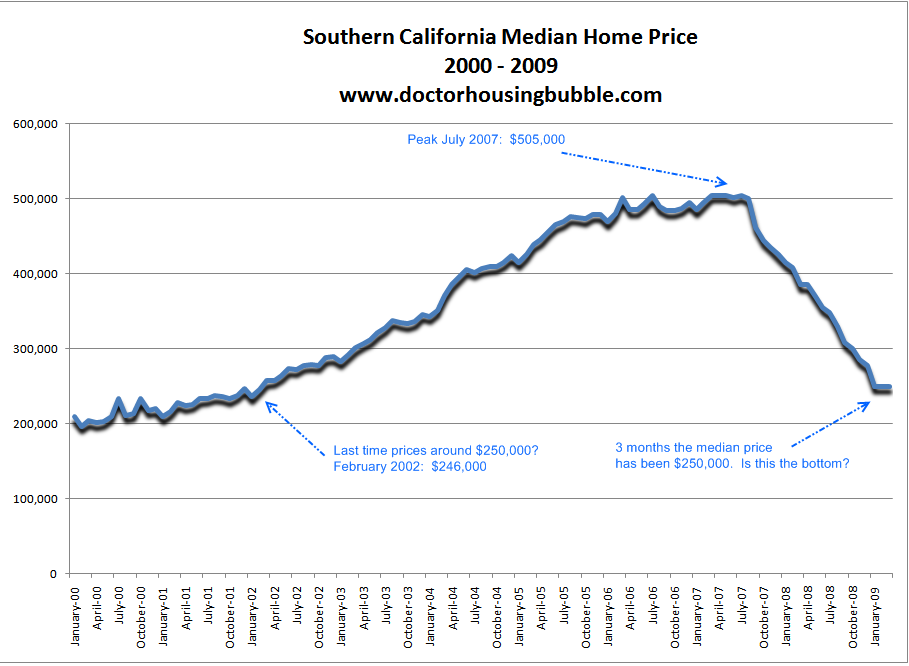

The current median price for a home in Southern California is $250,000. For three months, the median price has been $250,000. Does this mean we are seeing a bottom forming? It depends on how you categorize a bottom. We need to remember that last month 57.4 percent of all home sales were foreclosure resales. A year ago, that number was 35.5 percent. Foreclosure resales are dominating the market and have pushed prices down primarily at the low end. In fact, if we go back to February of 2000, the median price in Southern California was $197,000. I ran the CPI inflation numbers for the decade and we find that the median price should now be $244,522. That is very close to $250,000. So we are near a bottom aren’t we? No way.

What we need to remember is the market is dominated by sales at the lower end. That is, you are seeing fire sale prices of homes in lower priced areas yet many people are looking to buy in mid to upper priced areas. These areas have seen very little price movement. So the data is skewed. When we go back to 2000, the market was more balanced and was dominated by home sellers selling, not foreclosure resales. So when we see the inflation adjusted number argument, it is wrong because we are dealing with two different markets. The one in 2000 was more typical while the one in 2009 now has 57 percent of all homes sold as foreclosure resales. In 2000, two-thirds of those that received NODs (a small number) actually got out of it. Now, with a pace of 400,000+ NODs in one year we can expect 80 to 90 percent to foreclose.

More importantly, the NODs are now expanding into the mid to upper priced markets. Many of the Pay Option ARMs and Alt-A loans are in these areas. The lower end of the market was dominated by subprime mortgages and those have largely hit. As they say, the proof is in the pudding. The average subprime loan still out in the California market is $322,000. The average Alt-A loan is $442,000.

That is why we now see the Inland Empire with the following median prices:

Riverside:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $187,000

San Bernardino:Â Â Â Â Â Â Â Â $150,000

As I showed in a couple of homes in Brentwood and Pacific Palisades, the inflation adjusted prices in those areas are still largely out of line. You have niche markets like Culver City, Irvine, Cerritos, Pasadena, and other cities in Southern California that have seen modest price declines. These are the areas that will be seeing an additional 10 to 15 percent (at least) drops in prices over the next year or two.

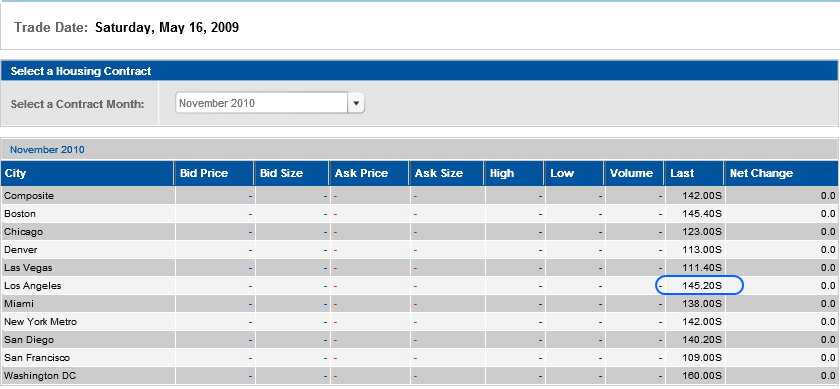

If we look at the Case-Shiller Index Futures, the market is predicting a bottom in late 2010:

The current Case-Shiller Index number for the LA/OC area is 163.16 meaning, the market is betting on an additional 11 percent drop over the next 16 to 18 months. Now if you saved $100,000 for a down payment on a Pasadena home, are you willing to lose your entire down payment because you couldn’t wait 16 to 18 months? The above data tells us there is absolutely no rush to jump into the market right now aside from gut reactions that led to the bubble in the first place. And with the Case-Shiller data we are looking at repeat home sales which gives us a more accurate assessment of the overall market compared to the median price.

In fact, as we start seeing more and more sales in the mid to upper range you will probably see the median price move up. Think of it this way. There is a reluctant seller in Culver City right now. They have their home priced at $600,000 but no offers. They don’t want to drop the price. One year passes and the flood of NODs increases inventory in these areas. The seller, for whatever reason now has to sell (divorce, job relocation, etc). The seller bought the place for $300,000 back in 2000 so he decides to sell it for $500,000. It then sells. The median now has more leverage to go up but the reality is, we just saw a 16 percent price cut. That is what is going to happen to the California market over the next two years.

Income – Jobs Pay Mortgages

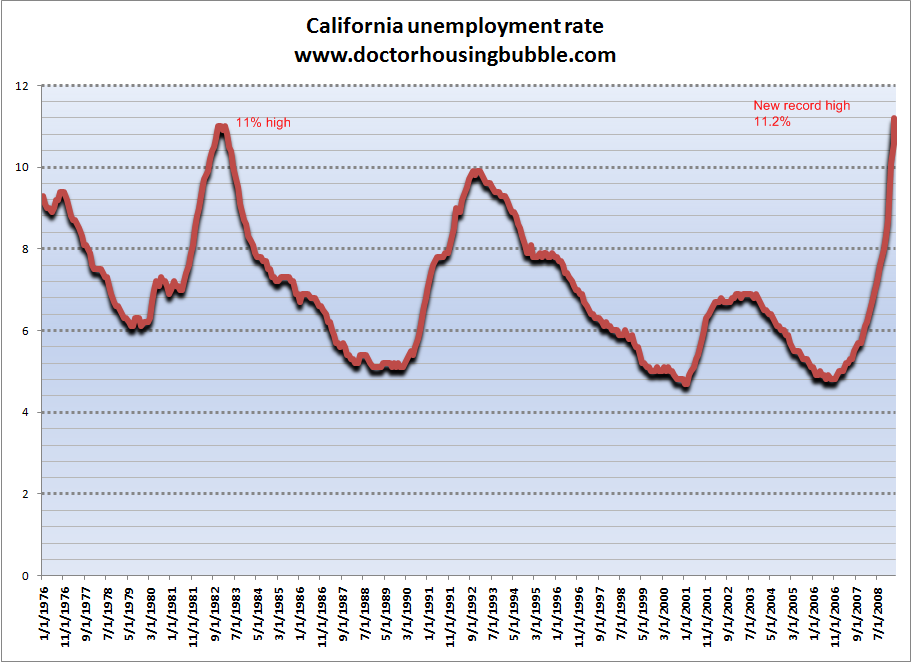

An obvious economic indicator that bottom callers miss is employment. Most people pay their mortgage with income derived from a job. Here in California, the unemployment rate has been skyrocketing and now stands at 11.2 percent, the highest in the post World War II era:

Now what is important if we go back to the data above, in January of 2000 the unemployment rate for California was 5 percent. We now have a rate doubling that. In November of 2006 at the height of the insanity, the unemployment rate hit 4.8 percent. Even in January of 2008, the unemployment rate was at 6.1 percent. Not bad given the average monthly rate since 1992 stands around 6.7 percent. But in one year, the rate has nearly doubled. Why? First, the housing bubble bursting largely exposed that California was unfortunately a one trick pony with housing. A large part of the economy was built on this housing bubble. With the housing bubble bursting, the economy burst as well.

Many bottom callers miss the employment situation. People pay mortgages from their income. Income from jobs. With jobs being lost you will have two things occurring:

(1)Â A reluctance to buy because people with jobs are tightening their belts

(2)Â More people losing their homes because of more job losses

With Chrysler and GM announcing thousands of dealer closings many here in California, we are assured that in the next few months as the dealerships close, the unemployment rate will tick up even higher. The state budget is still in a large mess now facing a monumental $15 billion short-fall or a $21 billion gap if the propositions fail on Tuesday. How anyone can look at this data and say we are at a bottom is beyond me. Until the dust settles, those jumping into the market right now are flying in the face of the above numbers.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “Predicting the California Housing Bottom and Examining Market Trends from 1992 to 2009: Foreclosures, Inflation Adjusted Prices, and Income. Data Points to a 2011 Bottom for California Housing.”

You are absolutely correct that job losses are now becoming the monster that will kill a recovery in it’s tracks. I live in an upper middle class area

. Within a very short radius of my house several people have lost long term jobs with Fortune 500 companies. Another has been demoted, with a 20% pay cut. Several others are “waiting for the other shoe to drop”.

These are people who pay most of the taxes in Calif., the top 15% of all wage earners. (The bottom 40% pay little or no taxes). As this works it’s way through the system, government deficits will swell, leading to widespread job losses of very well paid government jobs.

Despite all the hype and “bottom calling”, you can not sustain prices without a healthy job market. This is the most basic economic fact.

A History of Home Values (graph 1890 to 2006)

http://www.investingintelligently.com/wp-content/uploads/2006/08/a_history_of_home_values.png

The Yale economist Robert J. Shiller created an index of American housing prices going back to 1890. It is based on sales prices of standard existing houses, not new construction, to track the value of housing as an investment over time. It presents housing values in consistent terms over 116 years, factoring out the effects of inflation.

The 1890 benchmark is 100 on the chart. If a standard house sold in 1890 for $100,000 (inflation-adjusted to today’s dollars), an equivalent standard house would have sold for $66,000 in 1920 (66 on the index scale) and $199,000 in 2006 (199 on the index scale, or 99 percent higher than 1890).

You Walk Away Blog

Foreclosure Crisis. Front Row Seats.

http://blog.youwalkaway.com/?p=164&ref=patrick.net

Anytime I start to think I should be able to buy a house in one of the most overpriced markets in California (Beach Cities: Redondo Beach, Hermosa Beach, and Manhattan Beach), I just have to read one of your posts. Those TV ads aimed at teenagaers are working on me: Stop…Think. Thank you for being the lone voice in the wilderness, Dr. H.

Here is a perfect example of one of these prime borrowers who got into trouble buying a house that was too expensive or overpriced. The interesting thing is this guy is an economics reporter for The New York Times. I warn you this is painful to read: http://www.nytimes.com/2009/05/17/magazine/17foreclosure-t.html?_r=1&ref=business

Your link to the “Pay Option ARM-Alt-A loans” is the same rationalizing song and dance my broker tried to explain to me. That the interest rate based on the index with an Option would end up being cheaper than going with a fix. A smarter choice. A market “roller coaster ride” he said, I understand this market index rate now as much as I did in 2006. “I don’t get it?” And when I said the same thing in his office. He said, “I’ve been doing this for twenty years. You’ll be fine.” That’s the fiduciary lending I went with. To think. All he had to say is, “You don’t quailify. Good bye.”

I can’t find fault with anyone who wants to buy a home for their family to live in. When the average price of homes are in the several hundred thousand dollar range and the people’s wages have been repressed for the last 40 years or so, I find fault with our form of “capitalism” that contorts the market so badly that most working people can’t afford to buy home and are excluded from participation in the most cherished facet of the “American Dream.” When the mortgage brokers call these homeowner wannabees every day and tell them they can get them into a home – and they are relentless – and then do get them into a home that they can’t afford, but these buyers want to be homeowners so badly, they will spend everything they have to get into these homes and stay there, we need to look at the big picture here and stop finding fault with these home buyers.

On the other hand, the buyers who bought homes to rent to others, took out the 125% loan to value mortgages, ran off with the excess, didn’t pay their mortgage and caused the renters who had been paying their rent to them all along to be evicted, are the real irresponsible borrowers and much fault can be assigned to them. To refuse to hold the bankers responsible in this fiasco is to ignore the necessity of a “stable banking system.” The most basic requirement of any investor is prudence. “The Prudent Man Rule” has been recognized in our courts since 1830 and has been employed universally since money lending has existed – it is the responsibility of the person lending the money to make sure the borrower is able to repay. Any other arrangement would and does create chaos. Which is where we find ourselves since Congress and the President have chosen to ignore this very basic axiom in the world’s financial industries.

Now we find ourselves in a place where the real estate market has no reliable value because Congress and the President are in such a state of panic over the loss of great sums by their major lobby funders’ investing in oil futures, they stupidly insist on stuffing money up the tail pipe of our economic engine where it can have no effect at all except to deepen the crisis. According to them, this crisis was caused by “irresponsible home buyers” who could not afford the mortgages they took out, yet Congress has further encumbered the taxpayers (the very people who couldn’t afford to buy homes) without (1) our permission to give our money to financiers with little or no hope of them being able to repay it, let alone (2) determining if we could possibly afford to repay Trillions of Dollars of bail out money. Who’s irresponsible?

The just and reasonable way to find the bottom of the housing market is to go back to each of those home buyers who have been or will be foreclosed upon and determine the amount of mortgage they can actually afford, recast their loans, without charge to the homebuyer, in an amount that would be supported by 28% of their income. [The reason all these homes existed or were being built without buyers that could qualify to buy them is a whole other lesson in corrupted capitalism in itself.] We would then have actual comparables that the real estate industry could look to for relative values. The existing homebuyers could resume making their payments because they could actually afford them, the banks would start getting revenue again and we could get our economic engine running again on a very sure footing this time. We are over built in residential and commercial properties. There are no lines of buyers chomping at the bit to buy these homes, only vultures with their vulture funds waiting to pounce on them when the prices get as low as they think they’ll go. This will not give our economy any stability for a very long time. It will only make some very rich only much richer when we need to have the money spread around to a much wider base.

Congress (with Joe Biden leading the pack) has seen to it that the bankers been able to suck our money out of our pockets and now our pockets are empty and we no longer have any purchasing power to feed the economy. It is time to stop blaming us for using credit when they made it so we couldn’t have a decent life unless we did use credit. For example, who can afford health insurance AND a house payment on ordinary wages? Who made health insurance so expensive? Ask Denny Hastert, ex Speaker of the House.

Great Post.

The link that “Just A Reader” left above is a great read. I think we know who the bubble should be blamed on: women!

JK

Thanks once again DR. HBB.

Considering the deeply ingrained fear of “missing the boat” that’s been pushed into everyone’s brain over the last few decades… due to the now-ridiculous bubble mentality….it really does take a weekly slap, I mean reality check, form someone like you to keep some of us from making foolish, gut based decisions – like buying into a down-market that will soon be flooded by foreclosures. Of course I am always worried that Obama and B.F. Frank will “change” the rules again in some massive way to punish those responsible holders-out yet again – let’s not forget, the FHA has now taken over as America’s Sub-prime lender extraordinaire, and that is indeed propping up prices to some degree, as we speak. But in the end I think the problem is too big even for Obama’s hand to fix. Eventually the plane has to hit something big and go down in flames.

Baby boomers have passed their peak earning years and will be steadily bowing out of the RE market….. how can people think there will be a sustained upswing in the next decade with that demographic shift going on?

Once the delusional upper-and-mid sellers wake up and experience true “price discovery” the lower end is going to take such a downward hit that I believe most of the “urban” areas of Los Angeles will have entire swaths where 100k will give someone willing to buy their pick of the litter.

And as for all these “early investors” you see tripping over themselves so as to buy mostly overpriced, barely rent-able ratholes…I say good, they are creating nothing but future inventory…..let them do all the heavy lifting for us, we’ll buy after the new paint and landscaping has been put in.

In response to Stephen F: and let’s not forget the weak men who give-in to them.

Just a Reader and Stephen F:

Painful to read, yes. But Andrews is an adult and could have chosen to rent. With the exception of a few uncontrollable life tragedies, like having to claim bankruptcy due to medical bills for cancer, most people bring on their own financials problems.

And spenders aren’t only women. My ex-husband spent $ like crazy.

BTW, unlike Andrews, the last time most of us got to live anywhere free for eight months was at our parents house before we turned 18.

Who “propelled” Arnold into the governor’s race initially? And which voters “installed him” into his seat of power? Ol’ “Kenny boy” Lay is still playing Californians for the complete, utter, and ignorant fools they have demonstrated themselves to be — even from his grave….. budget and housing problems to be “solved” as a result of tomorrow’s votes? I think NOT!

Decades will not wipe out this catastrophe., May 6, 2005

By Miles D. Moore (documentary review – excerpts)

Alex Gibney’s “Enron: The Smartest Guys in the Room,” based on the book by Bethany McLean and Peter Elkind, is a riveting, masterful documentary about the most appalling catastrophe in American corporate history: the collapse of Enron, brought about by the ruthlessness, greed and treachery of its top executives.

I give one example: of course everyone knows that the California energy crisis brought about largely by the rapacity of Enron energy traders was the main reason for the successful recall effort against California Governor Gray Davis. And most people probably realize, though they don’t think about it much, that the Federal Energy Regulatory Commission chief who refused to help Davis was appointed by George W. Bush on the express recommendation of Ken Lay. But what people almost certainly DON’T know–unless they’ve seen this movie–is that during the crisis Ken Lay called a meeting in Los Angeles of Enron’s Caifornia supporters. No minutes from this meeting have ever come to light, but one of the attendees was Arnold Schwarzenegger. You do the math.

Gman: but what’s your point? The state is still bankrupt and no matter who was governor it would be extremely difficult to balance the budget. You might argue that the state should have saved in good times, but since when has CA ever done that under any governor? And CA tax revenue is very unstable because it’s almost entirely based on income and sales tax. So the usual pattern occurs, spend like crazy in the good et.times, can’t balance the budget in the bad times.

But the basic reality is CA has to man up and get a budget. The responsible thing to do is not to go begging to uncle sam for a state bailout (although we are a net contributor state so it’s not really that objectionable). The responsible thing is not to allow our bond credit rating to collapse. So ….

I think your notice of default chart is unclear because the red line tracks whole year data then shifts to quarterly for the final data point, creating the illusion of a plunge.

It might be clearer if you tracked all four quarters (stacked) over the same time period with pale red lines, then had the yearly figure in the same bold red line terminating with the end of the yearly data. You could even stack the april numbers on top of the first quarter data for an intimation of the catastrophe to come, without actually extending the bold red line. The floating data points ought to be enough.

Thanks for this blog. Been following from the beginning.

With the baby boomers slowly dying off, how will this affect the still overpriced housing market? What about when inflation takes over, how will that affect the housing maket? What if H1N1 kills 10% or 20% of the population this fall/winter? What if a drought persists? I could think of 100 more topics to write about.

Remember our post a few days ago? Low end selling fast, while higher priced properties sit? Well the data just confirms that:

“(DataQuick) At the same time, the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy inland markets. They included Palmdale, Lancaster, Moreno Valley, Perris, Indio, San Jacinto, Lake Elsinore and Victorville.

The sales picture was dramatically different in many older, high-end communities closer to the coast, where foreclosures and deep discounts are less common. Sales of existing houses remained at or near record lows for an April in markets such as Beverly Hills, Malibu, Palos Verdes Peninsula, Manhattan Beach and Pacific Palisades.”

http://tinyurl.com/ovw36x

Oh, and the SoCal median price fell to $247,000. Bottom time!

@Ashby

The point was that even with just one quarter in, NOD’s are already above the calculated norm for an entire year. In all likelihood it will be worse than 2008 and the mortgages defaulting will be larger denominations. So instead of green shoots, the gangrene-span will spread to amputate still more parts of Uncle Sam’s body until there will be nothing left butt Wall Street. Better get him a colonoscopy because that will be the only part remaining.

js said: “although we are a net contributor state so it’s not really that objectionable”…js, the caring and sensitive to do for a liberal kalifornian is to help the poorer states out. California, as a rich state needs to learn how to share. Can’t you guys raise the taxes way up on the holywood rich and others of greed who “make more than I do”? Our furhrer the annointed one will show us the way. kum-bai-yah! Can’t we all just get along?

Comment by Mike M. ……. “With the baby boomers slowly dying off, ….”

>>>

Considering that the age group described by that annoying title are between 46 – 63, it is not surprising that they are “slowly dying off.” In fact it will take at least another 54 years before that generation is gone. The rate o death for those in their late 40 snad 50s is not exactly that of those in their 70s, 80s and up.

>>

Or are you somehow trying to refer to those who are older than 63 ?

>>

In that case you are talking about the WWII generation ( at minimum 82 and up) and the Korean War & 50s-mid-1960s generations who were born typically between 1928 and 1943/44 (at minimum 65 and up.)

Just a Reader’s link to the NY Times Mag’s “Woe Is Me: Boy, Am I An Idiot” article by Edmund L. Andrews hinges on one line: “My answer to any money squeeze was to stop spending.” Andrews’ problem? He didn’t stop spending.

Andrews’ gut was right: in a money squeeze, stop spending.

But dollars to donuts, he voted (like all good NYT employees) for Obama, who, like California legislators, doesn’t know the meaning of “stop spending.”

Somehow, I’m supposed to feel sorry for these idiots. “But it felt so right!” is no excuse for spending beyond your means.

Job Losses Push Safer Mortgages to Foreclosure

Under a program announced in February by the Obama administration, the government is to spend $75 billion on incentives for mortgage servicing companies that reduce payments for troubled homeowners. The Treasury Department says the program will spare as many as four million homeowners from foreclosure.

But three months after the program was announced, a Treasury spokeswoman, Jenni Engebretsen, estimated the number of loans that have been modified at “more than 10,000 but fewer than 55,000.â€

In the first two months of the year alone, another 313,000 mortgages landed in foreclosure or became delinquent at least 90 days, according to First American CoreLogic.

—

Among prime borrowers, foreclosure rates have been growing fastest in states with particularly high unemployment. In California, for example, the unemployment rate rose to 11.2 percent from 6.4 percent for the year that ended in March, while the foreclosure rate for prime mortgages nearly tripled, reaching 1.81 percent.

Even states seemingly removed from the real estate bubble are seeing foreclosures accelerate as the recession grinds on.

More fyi:

Schwarzenegger follows Brown’s route

“There’s only one thing he can do and if he does it his legacy will be restored,” says Steve Merksamer, who runs a big political law firm and was Gov. George Deukmejian’s chief of staff. “He needs to follow through with what he said he’d do. There will be a lot of screaming and demonstrations, but he has to show bold, tough leadership. And, frankly, that is what the public expects.”

I asked Davis.

“This is the closest we have come to a Prop. 13 revolt,” the former governor said. “This was a smack-down. Now is the time you take to heart what the public is saying. What it’s saying is, ‘Look, you’ve already taxed us. We don’t have any more money budgeted for Sacramento.’ ”

Schwarzenegger must become a born-again slasher.

Leave a Reply to Dee Miller