Westside Los Angeles: Even Prime Real Estate not Immune from California Housing Crash. Examining the Westside Luxury Community with Brentwood and Pacific Palisades.

The Westside of Los Angeles is a coveted niche market that is home to a large portion of the entertainment industry. Century City is a big draw for production and Culver City has a few film studios and special effects companies. Then we have Santa Monica and Beverly Hills that are crucial to the entertainment industry. Talking to some people, you would think that the Westside is the only place to live in Los Angeles. However, in the month of March approximately 170 homes sold in the entire Westside. How many homes sold in Los Angeles County? Try 5,971. Even the Westside is seeing prices dropping and in some areas, significantly. There are many reasons why SoCal real estate is a couple of years away from the bottom but one big one, is in these niche markets you have mediocre property that is leveraged and cannot keep up with more quality product which is moving. What does this mean? A Santa Monica home with a beach front view is going to sell for a lot more than a home that is somewhere on a congested road and is termite infested even if it has the Santa Monica name.

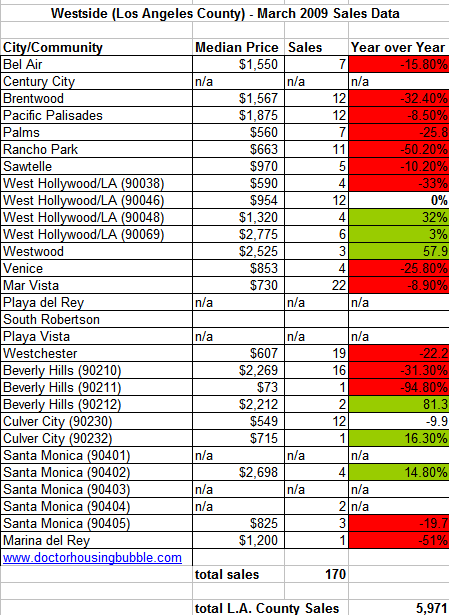

First, we should take a look at the latest data for this area of L.A. I’ve gathered community and city information data:

What you’ll notice is that the vast majority of Westside properties are down on a year over year basis. But you’ll also notice that sales volume is extremely low in certain areas. For example, only one home sold in Marina del Rey for the entire month and only three homes sold in Westwood. So it is hard to use one or two homes as a good reference point. Yet if we look at say Brentwood and Pacific Palisades, we get a better data set. Each of these areas had 12 homes sell for the month. Brentwood is down by 32 percent year over year and Pacific Palisades is down 8.5 percent.

When I talked about the second phase of the housing bust in California, these are the areas where you will start seeing more inventory and also, more price drops. As you can see from the list above, some areas are actually up but the volume is very low. These areas will always have a tiny base to draw from (i.e., high paid entertainers or professional athletes). But these buyers are looking for great homes in these areas, not just any home.

To get a better sense of this, let us do some house hunting in Pacific Palisades and Brentwood since we had a decent amount of sales in March. Is this data a fluke or can we actually find a 32 percent price off home in Brentwood? Let us see what we can dig up.

First Test – Brentwood

Our first home is a short sale. It is a 2,152 square foot home with 3 bedrooms and 2 baths. It has only been on the market for 17 days so it is a recent addition. What is the current asking price? $1,059,000. I know folks, this kind of price is still going for these homes in Los Angeles. But the question is, will it move at this price point?

It always helps to look at previous sales history:

Sale History

03/22/2006: $1,250,000

The current list price is 15% off the peak price of 2006. And here again is the reason why I am telling people looking to buy in the mid to upper price ranges to sit tight for one or two years and have given you 10 reasons for this; a 15% decline might not seem like much given that Southern California as a whole is down 50% in price, but a 15% price drop in this price range translates to a loss of $191,000. Would you wait one or two years for $191,000?

It only took me a few minutes to find a home in Brentwood that verifies the actual data we are seeing. Prices are dropping and dropping significantly in prime Westside communities. As you can see from this home, it might not conjure up visions of a million dollar home but that’s the Westside for you. Let us see what we can find in Pacific Palisades.

Second Test – Pacific Palisades

Our next home is a Pacific Palisades foreclosure. Even a year or two ago, you would have never seen short sales, REOs, or even foreclosures next to Brentwood or Pacific Palisades. Now, we are starting to see a handful. This home is a 2 bedrooms 2 baths home. It is listed at 2,271 square feet and has been on the market for 233 days. This home has gone through the price drop cycle:

Price Reduced: 11/08/08 — $1,499,000 to $1,425,900

Price Reduced: 12/11/08 — $1,425,900 to $1,399,000

Price Reduced: 12/19/08 — $1,399,000 to $1,375,000

Price Reduced: 01/15/09 — $1,375,000 to $1,339,000

Price Reduced: 02/11/09 — $1,339,000 to $1,289,000

Price Reduced: 02/28/09 — $1,289,000 to $1,249,000

Price Reduced: 03/28/09 — $1,249,000 to $1,149,000

The current asking price is $1,099,000. Let us dig into the previous sales history to see what we can find:

08/15/2005: $1,485,000

09/16/1988: $522,000 *

If you recall from the 12 homes that sold in Pacific Palisades back in March, the median year over year price drop is 8.5%. What would be the price drop from the peak for this home? Try $386,000 or a 25% drop from the peak. In my book that is a very significant price drop. Again, this is an REO meaning a bank took this home back. You can tell that when they took this place back in 2008, they wanted to basically unload the place for the loan amount. That did not happen. Ever since, it has been a price drop virtually every month but no luck. And here is another issue with these areas. Pacific Palisades currently has 260 homes on the market. Remember those 12 home sales in March? At that rate we have 21 months of inventory! Almost 2 full years of homes.

The problem with these higher priced areas is you have such a small group of potential buyers. As things get more selective, they will opt for the more prime of the prime of those 260 homes. This leaves homes like this competing to sell on a more basic level including massive price drops.

Can we find another home? Let us try:

This home is a 946 square foot 2 bedrooms 1 bath home. I love how they market this place as an “affordable house” but if you are looking to buy in Pacific Palisades, you might be looking in the wrong place for affordability. This home has also seen pricing action:

Price Reduced: 03/20/09 — $925,000 to $895,000

Price Reduced: 04/09/09 — $895,000 to $849,000

Price Reduced: 05/06/09 — $849,000 to $825,000

The current asking price of $825,000 is a drop from the peak price:

Sale History

03/31/2006: $995,000

07/23/1997: $355,000

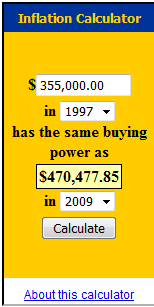

Here is a home with a 17% price decline or a $170,000 discount from the peak price. Take a look at that 1997 price. As we are now painfully realizing, housing typically tracks with inflation. So I went over to the BLS website and put in that 1997 price:

Now if you recall, 1997 is a good year to reference because the bubble was still a good few years from expanding in California. Either way, these examples and the above data should make anyone pause from buying in the mid to upper priced areas. We will be seeing more inventory hitting the market and those claiming the Alt-A and Pay Option ARM issues have been resolved, are looking at the wrong data set. First, even though refinancing is up it is up for people that never needed help in the first place. You cannot refinance a loan that is 20, 30, or 40 percent underwater. Heck, the banking lobby fought so hard to keep out cram-down legislation. Do you think they are actually going to be giving borrowers $100,000 or $200,000 concessions? Not on this planet. Also, many are looking at resets and forgetting all about recasts on these loans. Sure, since interest rates are now artificially low the adjustable part of these loans won’t be a big problem. But the recast will be a big deal even with record low rates.

The Westside of L.A. is prime of the prime and it is being hit by this housing crisis. To think any area is immune from this crisis is naïve. Just wait until we hit Q3 and Q4 of 2009.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

17 Responses to “Westside Los Angeles: Even Prime Real Estate not Immune from California Housing Crash. Examining the Westside Luxury Community with Brentwood and Pacific Palisades.”

I’ve been noticing a lot of “for sale” signs popping up all over Brentwood over the past month or two. And by a lot, I mean maybe 2-4 houses on a small block. The rental market seems to be falling apart in this area too, especially down near Wilshire, where almost every apartment building has a “for rent” sign up. Given double-digit inflation locally, it makes sense that rents will plummet even more than they did in the mid-90’s. People forget how cheap it was to rent back then and how easy it was to find a vacancy. In my experience as a landlord back then, it was actually a challenge to fill quite nice two bedroom apartments for $900 in the 90046. The same places went for well over $2000 by 2006.

With rents seemingly poised for further drops (after a 4% drop last year), there is bound to be a spillover effect on the real estate market. In fact, it seems increasingly likely that housing might overshoot the trend level within the next two years, just to reach a state of rental equivalency.

I’m sure that 2 bed/1 bath house above will probably go for half the current $825,000 asking price when all is said and done. Another unoccupied house near me, which sold for $1.35 million in 2006, has been on the market for half a year and isn’t moving at $759,000. Looks like even a 44% drop from peak isn’t enough for buyers.

You make a good point that top-tier buyers want top-quality homes, not 2 bedroom bungalows NEAR top-quality homes. There will always be a premium for Westside homes, but that premium was already priced in before the bubble. The rest above that trend level is, in Greenspan speak, froth.

And one last thought on those actors and sports superstars – they are almost all taking huge pay cuts lately. Even Jim Carrey apparently will get paid nothing for his last two films (he was forced to agree to only a cut of the net profits, of which there was none). Many other actors have been forced to take equally large pay cuts, especially those just off the A-list. We could well see many more desperate sellers hitting the market just as the latest wave of NODs convert to foreclosures and the Alt-A recasts hit. Doesn’t look like a very soft landing ahead.

Actually, many buyers of these types of homes are government workers.The state of Calif. alone has thousands of employees making $100,000.to $400,000.

(One actually makes over $1,000,000.)

Since retirement benefits are very generous (several thousand State of Calif.retirees make over $100,000. in retirement benefits, (NOT including lifetime medical coverage for the entire family), they can easily afford this.

One of our local firefighters makes $150,000. in salary and overtime, and he has traded up houses 3 times in the last 10 years. He now lives in a house worth about $1.5MM.

Further info at

http://www.pensiontsunami.com

Great post!

My brother in law sold their place in Venice last year, and while it was down from the peak of a few years ago they still netted 500K (and it was literally a termite infested little box). We did not understand their sense of urgency at the time but they look like geniuses now.

Much of the country appears to be considerably later in the housing decline cycle than CA. Here in the midwest we didn’t get the huge run-up in prices that they got on the coasts, so people think there won’t be the crash either. Do you think this is true? My sense is that the high end marketplace is only halfway through its crash–more or less in line with what you observe in today’s piece. Are high end homes everywhere essentially in sync (owing more to jumbo loan problems, sagging economy)?

I read your current thread with great interest. I used to live on the west side until I lost a home there during the last recession. I over levereged and paid the price.

Your BLS calc. is interesting (I like the ref to the bls website), however, in my judgement one more component is needed. It is my experience that on the long pull, 70-80 years, L.A. area real estate has increased at a rate of 1.5 to 2.5 points over inflation on a smoothed basis. What accounts for this premium, I suppose is the long term benefits of the area, eg, weather, jobs, etc.

The west side is a very beautiful area. Wish I could afford that Pacific Palisades house it looks gorgeous from the outside!

It has taken some time, but the Westside is finally starting to feel it. Overall, the declines are about 25% with another 25% to go. It is very true about SOME Westside properties being highly desirable and most not. The majority of houses are from the 20s, 30s and 40s and worth very little. It has always been the land that they sit on that has most of the value. That being said, there is not enough buyers to qualify for the amount of inventory that is sill “bubble priced” on the Westside. Throw in the job loss situation, credit problems etc.. etc.. and many of these homes popping up for sale will have to slash prices or end up in foreclosure. This summer will show a greater sense of urgency on the part of sellers as inventory mushrooms everywhere. You might see a few bidding wars for homes priced $100,000- $200,000 below the most recent comp or due to bank foreclosure. Other than that, everything will just sit, adding to the glut of inventory. As pointed out by Dr, HB, the real issue is LOW SALES VOLUME and BULGING INVENTORY. Prices have to come down in order to clear excess homes for sale.

Even the super high end is struggling now, with a 17 milliion dollar Santa Monica home selling for under 11 milliion. Buyers are finally in the driver seat on the Westside.

http://www.westsideremeltdown.blogspot.com

Hi, you entered 335K on the inflation calculator.

I believe you meant to enter 355K.

Great blog.

How and when do you think the Option ARM resets are going to impact the westside? I’d one day like to buy a place in, say, Culver City, but there’s no way I’m going to even think about it until after the Option ARM tsunami has past, as it could drive prices into the dirt.

One thing to keep in mind is that a lot of the housing stock near the beach is unimpressive — 929 sq. ft. houses of 50 to 80 years old are not uncommon. Santa Monica was not considered a particularly desirable location until the 1970s or so, hence much of it was built out with nondescript homes. The same for Manhattan Beach, Santa Monica’s Republican twin.

That’s because for a long time before the spread of antibiotics after WWII, a sizable fraction of the more affluent people who moved to Southern California were coming for a dry climate because of the perceived link between dampness and respiratory tract illnesses such as tuberculosis. That’s why the Pasadena-San Marino area has so many magnificent homes from before the Depression: it’s far enough inland to be dry, so that’s where well-to-do people first settled in Southern California. My grandfather looked at Palos Verdes in 1929 but decided it was too damp being near the ocean, so he bought in Altadena above Pasadena.

So, a lot of the original housing stock (i.e., that hasn’t been replaced by lavish teardowns) within a few miles of the beach is undistinguished little stuff put up for lower middle class people. It can be hard to tell at first glance because the gardening these days is so spectacular (you can grow anything in the mild climate near the beach).

Someone or a couple has to make a $250,000 a year salary, have a down payment of $100,000, and a FICO score over 780 to afford a $750,000 house on the westside. Basically, $250,000 x 3 = $750,000. This is standard procedure for getting a loan nowadays and the way it was before the loose lending standards that began in late 90’s. So if you want to buy a house on the westside, and you are making $100,000, you can afford a $300,000 house. I see many homes going below $300,000 on westside in 2011-2012.

THE WALL STREET JOURNAL (MAY 8, 2009, 2:35 A.M. ET)

http://online.wsj.com/article/SB124173325883698041.html

Kelsey Grammer Sells, Leases in Los Angeles

“Frasier” star Kelsey Grammer has sold a Los Angeles house for $3.3 million, 19% less than he paid for it in 2007, and leased a seven-bedroom English-style manor after it failed to sell for $18.9 million………(more)

SPECIAL REPORT Road to Rescue

By Les Christie, CNNMoney.com staff writer

Last Updated: May 12, 2009: 10:27 AM ET

Home prices slide 14%

National median home price falls to $169,000 in first quarter, due to market flooded with lower-priced foreclosures and short sales.NEW YORK

(CNNMoney.com) — The steep slide in home price accelerated at a record pace during the first three months of 2009, according to an industry report issued Tuesday………….

http://money.cnn.com/2009/05/12/real_estate/first_quarter_home_prices/index.htm?postversion=2009051210

Hi all,

I know that this site is mostly concentrated on the Westside but I’m hoping to pick some brains here about the SFV. I know that the good areas are still in line to get hit with the Tsunami even though prices there have dropped – obviously some areas (bars on windows) more than others but it would stand to reason that if the Westside drops to $300-$500 for their lower end that mid-upper Valley should go down to at least $200?

any thoughts out there?

thansk,

Totally agree with your article but I think you overstate the bubble effect using the BLM inflation calculator with 1997 as a base point. To wit the last time we had a housing bubble occurred during the the 1986 – 1989 mania. It was also a time of houses doubling in value in a year or two and the first time we saw bidding wars. When the So Cal market crashed in 1990 – recession plus end of the cold war and loss of aerospace jobs – it did not bottom until 1995 and home prices did not recover to the 1990 level until 1999.

I would prefer to use 1999 as a starting point which still yields a number – $578,000 – 32% below the current sales price!

What if everything you thought you knew was wrong? Almost everything is a spin and meant to put yourself in the usury bondage? Did you know that the bankers started both world wars? Do you realize yet that it was a war against the bankers and we helped the bankers win? Do you realize we have lost this war to the bankers? They have pillaged our treasury and are about to do it again. Just as they secured their counterparty CDS positions with AIG ‘bailout’ money, they are doing the same with Chrysler–forcing them into bankruptcy so the taxpayers can pay their credit default swaps at 100% instead of maybe 35% in a reasonable cram-down. You people are missing the point–we’re worried about whether some house in a crowded desert is worth 500,000 or $600,000 while the treasury is looted by Lynch-America and Gold-Mine Sack-Sam. We are spiraling out of control while many of you are still wondering if you can get a granite counter-top with renaissance garbage cans at the next auction. These aren’t green shoots, they’re Charybdis’ green tentacles.

This is a great article, and spot on.

But I fear that it is all going to be a moot point – no one will be able to buy anything because once the EU starts printing money, who knows how bad the inflation will be. We are already poised to have super-inflation as soon as the economy “recovers”. Its going to be a world-wide epidemic of crashing currencies.

If I were to buy a house now – and thank God I’m not in the market having already done the deed by buying a farm before the crash of ’07…I’d be looking for a 10K shell, fix it up minimally so I could live in it, and pay for it in cash.

I’d even go for land over a house if I could find it. Land can feed you.

Ohio is fast following California, and now they are talking about nationally taxing soda pop and HSA benefits to offset the rising tax delinquencies. The average Joe can stop drinking pop & smoking but can’t stop taking their meds.

At some point, the People of America are going to have to stand up and make their voices heard against this continued tyranny which not only affects the value of the US greenback, but our homes, retirement investments, savings and yes, our standard of living.

Congress needs to be wiped clean and we need to start again. I doubt wether that will happen though, as the sheeple of this country have gone complacent and they don’t even know who they are voting for.

most of the real estate “agents” are basically fraudulent, and do very little to “earn” their ill-earned 5-6% commissions-except to ensure another sucker buys someone else’s mistake, with re-fi, hi-fi, we-fi, re-fry; nothing more than gimmicks to sucker the unsophisticated into buying someone’s mistake. “they’re not making any more land anymore, now”, RE always goes up, great investment, etc…..ALL LIES, TO TRICK PEOPLE===$$$$$$ motive.

Many of those RE “agents” should give back a portion of those artificially-ill earned “commissions” during the 2004-2006 “booming” fake estate years as many agents were pressuring those buyers with bloated, puffed, falsely elevated home prices thanks to a myriad of con-men–appraisers in bed with banks, RE agents in bed with developers, conflicts of interest, shysters galore, fake “experts”, giving 700K mortgage to minimum wage illegal mexican, etc…. You even have condos in the overpriced palisades sinking into the mountains/ravines b/c of poor construction, slapped up condos, poorly designed to sucker the naive/ignorant trustfunders into buying into the non-employable lifestyle of the palisades, etc… and the RE agents do NOT care, only they care about their ill-earned commissions.

Leave a Reply