Real Homes of Genius: Shopping in SoCal for the smallest possible properties. 400 square feet and 600 square feet in Pasadena.

Do you enjoy sleeping in your closet? Did you ever dream of living in a box similar to your cat or dog squeezing into those tight spaces? Then we have the right homes for you in Pasadena! It is interesting to see how people will justify prices especially on home flipping shows. “I won’t live there but I can see why it makes sense!†“That floor will add $20,000 immediately!†“That tiny bit of work on the lawn suddenly added $25,000 in visual value.†It all makes sense until it doesn’t. For those of us with some life history in California, we realize this is a boom and bust state. Some of you are aware of the Fancy Feast eating baby boomer neighbors who are sitting on a California goldmine but just can’t quit the state. Virtually every other week I’ll get an e-mail about someone spotting a neighbor with so many cars piling up on the outside that you would think they are starting a dealership right on your street. Or what about those broke Millenials and Generation X “kids†moving back home because they can’t even afford the rent? This is the state of the current California housing market. Today I’m going to show you some sub-$500k homes in Pasadena. Sure, you’ll have to forgive the lack of square footage but at least you will be in a prime area!

House hunting for small homes

Pasadena is a heavily targeted area. For those not in the region they may recognize the city for the Rose Bowl and the annual rose parade. Pasadena is old school SoCal. You have some incredibly high priced areas and some gorgeous homes built when quality mattered. These aren’t your crap shack stucco boxes for the inevitable house lusting shopper. Yet these come with a hefty price tag.

So you are looking for something more up in your price range. Sure. I’m going to show you two homes that are priced to move. Hopefully, you don’t mind tiny spaces.

170 N Holliston Ave APT 1, Pasadena, CA 91106

1 bed, 1 bath, 418 square feet

418 square feet? Sure sounds like a starter home. Let us take a look at the ad:

“Adorable stand alone bungalow located close to PCC and Caltech. It is one of 6 bungalows on the property. Great condo alternative.No HOA fees! Income property potential! Other units have rented for $1,475/mo. Home has an adorable back patio.â€

I’m not sure why this home conjures up memories of the Big Lebowski. Hey, but no HOAs on this baby. The ad is definitely trying to go with the investor viewpoint here. The place is listed at $285,000. Is this a good deal if you can rent it out at $1,475? Assuming you can rent it out at that price, you are looking at a 6 percent annual return (assuming no vacancies, maintenance, taxes, insurance, or other costs associated with being a landlord). Or maybe you want to live here. Let us look at the neighborhood:

All of this for just $285,000 in Pasadena. Incredibly, this place is priced at $681 per square foot which is actually pricey. I love the bathroom photo:

You can go number two and wash your head all at the same time! Awesome. Let us look at another place:

469 Vista Ave, Pasadena, CA 91107

2 beds, 1 bath, 648 square feet

This is a bigger home and you actually get one extra bedroom. At 648 square feet, you are going to need to be flexible with your space needs. Let us look at the ad:

“STANDARD Sale!! Lovely Craftsman on a corner lot in desirable Pasadena. Close to the 210 freeway metro line, shopping, restaurants and entertainment. Completely renovated in 2009 including plumbing, electrical, furnace, A/C, roof, floors, bathroom, kitchen and paver stone driveway. Bright and open format and flow. Walk out to the backyard with deck and newer fence that provides privacy. Drought tolerant, award-winning landscaping. Offers 2 bedrooms, 1 bath. Updated kitchen with apron sink and newer counters. Move-in ready and A MUST SEE!!!â€

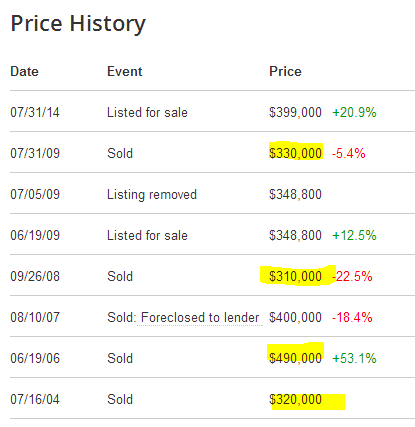

This place is actually a flip that didn’t go so hot (but allowed the seller out with some luck). Take a look here:

The flipper bought it for $310,000 in 2008 as a foreclosure re-sale. They tried to sell it for $348,000 but ended up going for $330,000. Factor in a 6 percent sales cost ($19,800) and the flippers got out with close to zero dollars. So now that we are in housing mania 2.0 the current sellers are looking for close to $70,000 over the last four years just because. Keep in mind it was the 2008 buyers that renovated the place according to the ad.

The upgrades do look nice:

But don’t forget this is 648 square feet. The place is currently listed for $399,000.

Given the lower price range here, I wouldn’t be surprised to see these move especially since they are in Pasadena. The price also will send out a larger net for those with beer budgets trying to squeeze into buying a home at all costs especially in a prime area. Who would have imagined shopping for a house the size of your office would be so much fun?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

91 Responses to “Real Homes of Genius: Shopping in SoCal for the smallest possible properties. 400 square feet and 600 square feet in Pasadena.”

The end is near. Marc Faber says that stocks are in a rebound and he is ALWAYS wrong! ALWAYS!!! I need to sign off and sell everything! TTYL…

http://finance.yahoo.com/news/super-bear-marc-faber-rebound-underway-120011422.html;_ylt=AwrSyCOUJ.lT2BIAtXWTmYlQ

You’re not going to wait for the SPY to plunge through the 200 day MA? I already sold BP in my IRA and started moving a little bit more mid/small cap stuff into treasury heavy funds in my 401k.

As to those shacks above, if the listing guy is reading this, I’ll give you $25k for the 1st house and $32k for the other. Where I’m from, impoverished people live in little shacks like that, but they didn’t get that way in the process of buying/renting their homes.

“Jesus you can’t make a buck in this market, the country’s goin’ to hell faster than when that son of a bitch Roosevelt was in charge. Too much cheap money sloshing around the world. The worst mistake we ever made was letting Nixon get off the gold standard. Stick to the fundamentals. That’s how IBM and Hilton were built. Good things, sometimes, take time.” “Wall Street” (1987) SO TRUE.

“Jesus you can’t make a buck in this market.”

I like to think of Wall Street as among the smarter movies over the past 30 years, but that has to be one of the dumbest lines ever uttered on film.

I wish I knew how to send photos. Because, if I did, I’d send you the photos of the 628sf cottage I built (rented for $650 a month long term, and a movie studio wanted to rent it short term for a Sparks movie it was shooting ), and the 568sf 1920 cottage I recently redid (article on it w/photos in the July issue of Focus On The Coast Magazine). I put in solid wood, character-grade hickory floors, granite counter tops, tumbled marble back splashes, interior glass French doors and paint to die for. It’s a short walk into town and a longer bike ride to the beach. I’ll be asking $60,000, but it’s in Wilmington, NC. and not Pasadena. Pasadena prices are unfathomable to me.

“Sick to the fundamentals” A good practice to preach for sure.

BTW… Worse mistakes, getting into regional wars that escalate to more money being spent then World Wars, let alone human cost?

Believe it or not I thought about buying a home this weekend. I saw a property that was well under market and had some potential but a lot of work. For the current market it was a great find. But as I lay awake at night I kept thinking how could I go through with this when prices are going to get so much better if I just stay patient? How could I not stay true to everyone here?

I think that means I am close to the point of capitulation. This means I just need to hang on strong for a little bit longer and we will see …

Housing to Tank Hard in 2014!!!!

“How could I not stay true to everyone here?’

Well, you could just buy the house and just don’t tell anyone here. Only YOU would know what a hypocrite you are.

2014 is 62% in the past.

Even Jim is getting impatient.

@Jim Tank, how many times should I tell you, no tank will happen in 2014. Wat?ch the bond market (stock, etc), we are getting close, we are not there just yet. Give it 2 moar years. Bond market is what the housing will look like in 1-2 years. No tank in the bonds, no tank in housing. When we see 10 year yields rising to 3.5-4%, then we can start considering tank. At the current rates not happening…

You’re making a huge mistake in thinking all markets must be correlated.

“You’re making a huge mistake in thinking all markets must be correlated.”

They are not necessarily correlated with each other, rather with the debt cycle. The cost of money is what “correlates” all markets. The question is what happens when debt defaults start to happen again. You have two choices refinance and/or write downs.

We have been through a cycle of refinancing with minimal write downs (kicking the can). There really is not a lot of refinancing room left (real rates are negative). Write downs are inevitable. Who bears the cost of these losses? What happens to the cost of money when risk rears its ugly head? The Fed will most likely lose control of the cost of money…

What? – Its true that when debt defaults happen leverage based assets get hit hardest. However, this may not affect interest rates as you and others often imply.

Real estate prices can fall without a simultaneous rise in rates. That would exacerbate it, but its not needed. Constant comments about the bond markets cracking before real estate are misguided. It may, but real estate prices can correct without a corresponding shock in interest rates.

“However, this may not affect interest rates as you and others often imply.”

Do you really believe that defaults do not affect interest rates? The components of interest rate are Cost of money + loan risk + interest rate risk + anticipated inflation. The cost of money is most likely negative and anticipated inflation is pretty low. I agree that real inflation is likely higher than anticipated inflation. The real hidden component is risk. The current belief is that the Fed/Gov are backstops to all default risk. The question is what happens when the next cycle of default occur?

As for interest rates affecting housing, I would argue that the current interest rates are the reason for ALL of the current asset bubbles. The debt may be in different hands this time around but there is no mistaking this as anything other than a debt created asset bubble. There is no sign that any economic growth has been stimulated from the massive monetary experiment and we most likely will revert to the mean.

We’re on the same page regarding the Fed, debts, lack of growth, etc. (although you’re more optimistic than I about reverting to the mean).

Interest rates are a fundamental factor for asset prices, always have been- not arguing that. I’m arguing that “bubbles” have other factors. (Social trends, HGTV, good debt garbage talk, everyone wants to be a landlord, current capital flows- nowhere else to put money, etc.)

Real estate can (and most likely will) fall without the rise in rates. Those of you who imply that rates have to rise as a prerequisite for a correction are wrong. During the housing crash of 2007-2009, when defaults were everywhere, rates fell. Even now in 2014, as housing is dramatically slowing, if not falling, rates have fallen.

The bond market is pricing in something the other markets aren’t.

“During the housing crash of 2007-2009, when defaults were everywhere, rates fell. Even now in 2014, as housing is dramatically slowing, if not falling, rates have fallen.”

I hate to disagree with someone who is actually bringing sound debate to this forum but I disagree. The housing crash was a credit freeze due to non performance of the underlying assets in the MBS/CDO which impacted synthetic derivatives of the manufactured securities. Default was the event that caused the credit “market” freeze. There was no change in rates because there was no credit market. The fed then pumped liquidity into the system but transactions slowed dramatically. I believe this is a typical credit asset bubble cycle. The non performance is usually due to the inability of the under lying asset to cover the cost of debt requiring outside funding to continue financing. Housing just happened to be the under lying asset du jour…

I enjoy the good discussion as well. However, you can’t “disagree” that rates fell- its fact. The data is everywhere. Mortgages were obtained throughout the crises at lower and lower rates.

The derivative securities you reference became illiquid (at book value- they were certainly liquid at the right price), but mortgages were still originated.

My point is simple- don’t mislead people into thinking prices wont fall without a rise in rates (or as some say: “the bond market crashing”). They can, have in the past, and probably will again in the future.

Go to stockcharts.com and type in JNK:TLT

Interjecting a bit, but you’d want to clarify what rate you’re measuring. Comparing time periods a nominal rate can change for various reasons, including perception of risk, but even moreso for inflation.

So the question really is did real interest rates drop over the period you’re considering crucial to your point?

If you look specifically at when the market tanked, for example:

July 2008: Nominal mortgage rate: 6.43; Inflation 5.60; real rate = 0.83.

Jan 2009: Nominal rate: 5.05; Inflation 0.00; real rate = 5.05

So sure, nominal rates generally fell, but that was largely a function of plummeting inflation. What? seems to be correct that the market was demanding higher real rates to account for risk.

Appreciate the thought blert, but… Current rates reflect expectations for inflation (based on historical data), but expectations none the less.

If you expect inflation to be 3% a year for 10 years, you wouldn’t buy a 10-year treasury at 2.4% with your brother in law’s money. But if you expect prices to fall, you’re locking that in with both hands…regardless of what this month’s CPI number is- as you calculated.

Please don’t tell me you (of all people!) also think real estate prices can’t fall unless bond prices do.

To clarify: the bond market is too broad a term. Real estate prices can fall irrespective of mortgage rates.

Sure, I was oversimplifying – and using only two data points is cherry-picking at best.

My point was that looking only at nominal rates isn’t a good reflection of how a lender/financier is weighing risk.

Jim, you’ve already been proven right. Sales volume and price INCREASES are non existent. This is a tanked market to anyone who is looking. The only question is how long after the FED taper is complete does it take us to retrace 2010-11 prices. I suspect not long, though likely not in the 2014 calendar year. There are so many macro economic factors forcing the FED to tighten the drop is inevitable. Even more so than in Bubble 1.0. In the absence of wage inflation (which ain’t coming) EVERY area will decline. Even the “prime” areas will have a noticeable adjustment based on mortgage rates alone. It’s all been an illusion Jim. Don’t start sleepwalking with the sheeple right before morning wake up 🙂

“There are so many macro economic factors forcing the FED to tighten the drop is inevitable.”

I’m all ears…

All that’s happened for me over the past 3 years is I refinanced into a sub 4% rate… then just got rid of PMI. So my mortgage went from a PITI of $2600 a month in 2011… To $2100 a month in 2014. Don’t think i could have negotiated a rent decrease that high in that time without downsizing significantly.

Who said a mortgage is less flexible than renting!

RE: DFresh

1. Food and other COL inflation crushing consumer discretionary spending.

2. Popping of the Hyper Asset/Credit Bubble is worse the longer it’s delayed.

3. BRIC nations negative on the dollar means treasury yields adjust accordingly.

4. QE isn’t working as the FED isn’t getting the wage inflation they want.

And probably most directly to do with our topic of housing…

The banks cannot function without transactions. If they cannot issue new mortgages and charge those lovely fees, they go out of business (at least their mortgage departments). The rentier class must have an economic activity to leech. In the absence of wage increases the only way to bridge the affordability gap is a drop in prices. Now that Wells, Citi, Chase and BofA (The FED’s owners, as we all should know) have moved as much toxic residential RE trash off their books as possible they are all to happy to see the specuvestors burned and make a killing on the next cycle. Same as it ever was.

@ NZ:

RE: DFresh

1. Food and other COL inflation crushing consumer discretionary spending.

* Overstated. Putting Doritos in a 16oz bag instead of a 21 oz bag while keeping the price the same isn’t what I’d call “crushing.” Food is cheaper than ever, dude! That’s a fact. The real cost of a calorie has never been lower in the history of the USA.

2. Popping of the Hyper Asset/Credit Bubble is worse the longer it’s delayed.

* Ooooooo! Black Swan! Sorry, too theoretical and so abstractly time-dependent to be inconsequential in the near-term (say, 5 years) for most house horny on this blog. Plus, do you think the FED, ECB, etc. will allow a “pop” until they’ve exhausted every conceivable tool?

3. BRIC nations negative on the dollar means treasury yields adjust accordingly.

* OK. I doubt the link with BRIC, but, yes, interest rates rise. That will happen. The bigger macro fact (below) puts on a lid on rates, however.

4. QE isn’t working as the FED isn’t getting the wage inflation they want.

* Yes, FED is losing the battle on wage inflation due to it’s impossible war against a more daunting and important macro-economic foe — global disinflation.

And probably most directly to do with our topic of housing…

The banks cannot function without transactions. If they cannot issue new mortgages and charge those lovely fees, they go out of business (at least their mortgage departments). The rentier class must have an economic activity to leech. In the absence of wage increases the only way to bridge the affordability gap is a drop in prices.

* You’re predicting the demise of TBTF banks or banking? Oh, just their mortgage departments. Big deal…these people come and go like the tide.

“In the absence of wage increases the only way to bridge the affordability gap is a drop in prices.”

NZ!

You’re going to absolutes (“only way”)!

There are plenty of ways.

I’ve identified one very important tool…loosening of credit standards. And the “drumbeats” I’ve identified are far more tangible evidence for my case of continued efforts to support “affordability,” IMO.

@ DFresh

* Overstated. Putting Doritos in a 16oz bag instead of a 21 oz bag while keeping the price the same isn’t what I’d call “crushing.†Food is cheaper than ever, dude! That’s a fact. The real cost of a calorie has never been lower in the history of the USA.

– That’s absolute BS. in-N-Out is the one company that doesn’t really screw with their menu and you’re paying more for a DDouble now than 5 years ago. And most of the people buying them are making less money. As for the cost of a calorie, you might have a point their as so much food is just empty calories with no vitamin content (see obesity epedemic)

* Ooooooo! Black Swan! Sorry, too theoretical and so abstractly time-dependent to be inconsequential in the near-term (say, 5 years) for most house horny on this blog. Plus, do you think the FED, ECB, etc. will allow a “pop†until they’ve exhausted every conceivable tool?

– Same Housing Bull bullshit i heard in 2006, the FED is not omnipotent, far from it. And if your Gods of Central Planning are so smart, why did we have the 2007 crash???

* OK. I doubt the link with BRIC, but, yes, interest rates rise. That will happen. The bigger macro fact (below) puts on a lid on rates, however.

– A lid doesn’t matter. Anything above zero now breaks the ponzi as constructed.

4. QE isn’t working as the FED isn’t getting the wage inflation they want.

* Yes, FED is losing the battle on wage inflation due to it’s impossible war against a more daunting and important macro-economic foe — global disinflation.

– Here we agree

* You’re predicting the demise of TBTF banks or banking? Oh, just their mortgage departments. Big deal…these people come and go like the tide.

– You miss the intent of my statement. It’s not about mortgage layoffs or banking demise, it’s about the banks doing what they always do, making money off the cycles. With much of their toxic balances shifted to the FED you don’t think they want to collect fees from mortgage originations at lower prices??? Some work is better than no work.

* NZ! You’re going to absolutes (“only wayâ€)! There are plenty of ways. I’ve identified one very important tool…loosening of credit standards. And the “drumbeats†I’ve identified are far more tangible evidence for my case of continued efforts to support “affordability,†IMO.

– This is the most fantastical of your thesis. Sure loosening standards (which Dodd Frank and a neutered Fannie and Freddie make very difficult) MIGHT get a few house horny twits into the game. But their is no volume there. On the ground, in the real economy, away from LA/SF/Prime people are VERY scared. you think just because they let you claimgrandma’s SS income people are going to jump Multi-generational into a financial death trap???? Please…

All the chickens are coming home to roost and what you call a Black Swan I call “Math”. Math is undefeated in the history of economics and the factors to make your math work are FAR more outlandish than mine.

“All things being equal, the simplest answer tends to be correct”

“There are so many macro economic factors forcing the FED to tighten the drop is inevitable…QE isn’t working as the FED isn’t getting the wage inflation they want.”

NHZERO, you got it backwards. If there is no wage inflation, the Fed will not tighten. “Inflation” (as defined by the Fed) only begins to happen once the money makes it down to the little guy, and that is not happening for the most part. They will keep printing until Joe Blow starts buying collector cars with his HELOC checks.

JamesTinMA and NihilistZerO Thank you for your support. I do believe if I can just hang on a little longer we will see the deals of a lifetime. I think the reason I was thinking of pulling the trigger was because prices have softened and it was the first time in over 6 months I have found anything remotely resembling value. But that just means the tip of the iceberg is showing. Much better deals to come. Cheers!

@NihilistZerO, when full time jobs are being replaced with part time jobs, the Fed will never get the job inflation they are seeking. A big hoorah was made by various entities last month when +200K net jobs were created. What was missed was that 1MM new part time jobs replaced 800K former full time jobs.

Also: http://www.forbes.com/sites/erincarlyle/2014/08/11/american-mayors-address-pledge-to-fight-income-inequality-low-wages/

Median salary for a new job in 2014: $47K year.

Median salary for a new job in 2008: $62K year.

The average new job pays almost 25% less in 2014 than in 2008.

RE: Jim Taylor

“I do believe if I can just hang on a little longer we will see the deals of a lifetime.”

I will disagree with you here. While prices are going down I think It will mostly correlate with mortgages hitting 6% which the perma-bull retards here can’t comprehend, even though this is the head of the CAR’s prediction for 2016. that said I think we over shoot the 2010 trough by dome small percentage in 2016. Now figuring prices in relative dollars ‘Deals of a Lifetime” we had in the 1982-1984 and 1994-1996 downturns. Those lucky bastards came up big! That being said our entire economy is being held together with scotch tape so who knows??? The idea posited by so many dullards here that the FED can just keep manipulating the market and trashing the dollar forever with nary a pull back is laughable. None of these guys have any sense of macroeconomic history and think that post 2000 is a new normal when in reality it’s been one big failure papered over by the FED. Nothing has been solved and they’ve made things worse.

Anyway, change your posts to “Housing is tanking in 2014” because that’s the truth. The lagging indicator of severe price reductions may be a time off, but it’s coming because the “tank” in transaction volume will inevitably force it. And to DFresh’s suprise magical NINJA’s (loans) are not going to appear to prevent that.

NihilistZerO,

In regards to our disagreement “Now figuring prices in relative dollars ‘Deals of a Lifetime†we had in the 1982-1984 and 1994-1996 downturns.”

I wasn’t alive in the 82-84 spell and was still in Middle School during the 1994-1996 opportunity . So I should clarify this will be the opportunity of a lifetime for the millennials, and we can still be in agreement 🙂

Tank Hard 2014 @ Jim revealing he’s close to capitulating!

End of days! Throw-up in mouth a little bit! WTF! I’m speaking Susan-researched-this in CharlesChung tongues!

“The emperor has no clothes!” cry the @Tank disciples!

The obvious, new standard BEARER is the sardonic/sarcastic shill/shrill version of What?!

Fo-EV-ah!

Jim. Read this guy. He’s been all over the story of how the stock of the big publicly traded home builders is already starting to tank:

http://investmentresearchdynamics.com/

Made my usual trek out to home scouting this last weekend, more lookers I must say, but the almost universal statement of buyers, ” just can’t afford these prices on what we make.”

So, the “buyers” season is almost over, What? happens next?

My RE agent tells me he’s seeing a lot of activity. Multiple offers. Can’t understand why I’m not jumping on board. I tell him I have had 45 properties on property watch for as long as 3 months and ONLY 4 HAVE GONE PENDING — the others have been on the market for weeks. Some with price reductions. Some just stay at the same price — forever. He asks me to send him a list of the properties. He sends an email later that starts off with, “Golly, some of these have only been on the market for a few weeks.” I pointed out that Last year, more than once, before I met you, I’d call my agent after seeing a house for the purpose of putting in an offer, and she would call back to tell me they already had an offer and a backup offer. The 1st day of showing. Some houses were on the market only 4 hours before they sold.

Sigh!

You don’t buy at the top, do. The problem as I see it is that 5% of people become successful and 95% are loser. You would ask why… simply because 5% are not doing what the rest of the 95% does. When everybody buys, you sell, when everybody sells, you buy. You always go the opposite direction of the crowd. This is how people become successful.

I’d say you’re spot on. The ancient Greeks envisioned it this way — man is a chariot pulled by 2 horses. A dark horse (emotions) and a white horse (reason). If one horse pulled more than the other the chariot would go in circles. Boom and bust markets trigger a powerful emotional response. I got caught up in it in 2006 and have been able to withstand the pressure to buy emotionally thus far. The way I see it is that those who bought in 2010 through Q1, 2013 made out okay. The rest of us from Q1, 2013 through now missed out and are buying at the top of the boom.

We ALWAYS favor our gut instinct in decision-making over reason.

We only use reason to rationalize our emotionally-based instincts.

Tolucatom,

” I got caught up in it in 2006 and have been able to withstand the pressure to buy emotionally thus far.”

Be honest. You may have side-stepped “greed” in 2006, but isn’t “fear” the real emotion for why you haven’t purchased thus far?

Based on you statement to buy when others don’t buy and sell when others don’t sell, the potential buyers today should buy because other buyers are reluctant to buy. According to some bloggers the numbers of sales dropped and other buyers are reluctant to buy. Based on that rational people should buy today.

If interest is low, if unemployment is low, if the economy is improving and the wages are rising you would expect not to buy because that is exactly the time when ALL buyers want to buy. When there is optimism among buyers, then you get into bidding wars because “all the stars line up” and all of sudden everyone wants to buy.

I would say like you – buy when all the buyers feel pessimistic. That is the ONLY time you don’t get into a bidding war and you have a good selection of properties. You need nerves of “steel” to go against the flow. Most people (95% like you said) can’t do that. They feel depressed/pessimistic when everyone feels the same. Welcome to the real life.

It is one thing to know the theory (everyone knows it) and another to practice it (like you said 5%).

I think you need to drop your agent.

I monitor property sales in a couple different parts of the county, including Los Angeles. Some places have been stuck in reverse and neutral ever since 2008. There has absolutely been no so-called recovery in those parts. As for LA, things heated up in 2012 but ever since last summer it has been stalled. I’ve lost track of how many homes rode a wave a reductions down since last fall and many of the organic sales have been simply pulled off the market. Anyone who is paying attention to what’s happening on the ground can easily see that the market is in the critical care unit without a prognosis. I’ve no idea where prices will go in the next few years in LA but I know for a fact that real demand is abysmal by historical comparison.

“I know for a fact that real demand is abysmal by historical comparison.”

You convinced me!

Oh thank goodness because I’ve been waiting with bated breath for your approval!

DoucheFresh indeed.

@ question marks

you say you follow prices in different parts of LA County and see parts where the prices have been neutral since 2008…. where in LAC is this? Palmdale, Lancaster? I presume you are talking in places that no one who commutes to LA for work would live???. Case in point, Doc has posted that even houses in Compton have seen substantial price increases, let alone everything West of Mid Cities and much of San Gabriel Valley, Pasadena, etc…

qe abyss, I just realized the auto correct on my phone changed country to county in my comment, I was referring to the country, as in the United States. LA area is not where I’m referring to in regard to neutral and reversing activity since 2008. To answer your question, there are a few LA city neighborhoods, parts of South Bay, Long Beach, parts of OC, and Valencia area that I’ve been keeping tabs on for years. I don’t watch anything in Lancaster or Palmdale. My point stands in regard to stalling activity in the LA areas I watch since last autumn.

DFresh Yes, there is a degree of fear but not blind fear. The same fear I would feel before going into any uncertainty. I am poised and prudent. I am not driven by the fear of missing out or the greed of maybe finding a lottery ticket. It’s all about context.

Fair enough. I guarantee you that Mr. Prime Rental Parity himself, Lord B, had far, far less fear as buyer in 2012 than you’ve experienced being concerned with being “right” on the market since 2006. He saw rental parity and jumped in. Done. People here called him stupid, short-sighted, etc. Whatever. Even with a 10% short-term correction he’s golden.

Hey, I get it. I “fear” losing principle, too. So, I rent for far cheaper than I’d pay to buy (my own rental parity comparison) and I put my money in money market, fearing a stock marketing correction. I sleep well at night (as does Lord B). Win/win!

@DFresh I wasn’t in the market in 2012 — I was going through a divorce . 2012 is the year everyone who bought made money. No fear there or then. All of the sign pointed to buying. This is 2014 and if you look to my other posts you’ll see I list just a few of the many properties being discounted. That wasn’t the case in 2012. One month of price reductions — okay no big deal. 2months — pay attention. 3 months — we got a trend. You want to prove a point that I’m afraid? Okay. You win.

It’s a total puzzlement as to why any flipper messes around with a property that sells on the basis of its land value alone.

Just one look tells anyone that the lot is destined to become a multi-unit rental.

&&&

Am I the only one who thinks that Mr. Cocaine made the investment decision?

tolucatom …No rhyme or reason to selling at this time, it is as crazy as I have ever seen. I think you know, I have posted about really poor property selling at above market value while many homes in excellent shape few doors down never get a offer.

Matter of fact, I had asked as tactful (which is not easy for me) to a couple that paid $50k over market that they now are putting another $60k into it, what drew them to there purchase. He knew and I knew 500ft away same home great shape they didn’t offer, what I was driving at. He said his wife wanted to personalize a fixer upper, the other home was already fixed up and she couldn’t do her thing to it???

That’s a buyer for you?

@Robert No rhyme or reason. So true and yet the human mind is geared to find rhyme and reason. If it can’t it goes insane.

Why do you not make proper use of question marks?

Most of the people don’t make rational decisions. Ii is just the fact. Plenty of people buy or sell not based on market fundamentals, but rather on emotions. Like, it will only go up, i need to buy now. Or I don’t have to sell, I am in the long term, even if my asset loses 50% of its value, it will come back some time in future… even if i need to wait next , say, 10-15-20 yeas for it… so, people are just stupid. Most of them will never admit that, it doesn’t change anything whether the one admits he or she is stupid or not…

I have every desirable zip code in LA targeted from Santa Monica (extremely desirable) to West Adams (up and coming). Even SM condos are staying on the market or getting price cuts. I get this in my email most every morning now —

You had 10 price or status changes to your home finder results. View Properties

Building

1241 South BRONSON Avenue

Los Angeles

$519,000 (-$40,000)

Building

950 North KINGS Road

West Hollywood

$478,000 (-$10,000)

Building

4508 West 12TH Street

Los Angeles

$549,000 (-$20,000)

Building

5241 Vantage Avenue

Valley Village

$419,950 (-$14,550)

If I only had a nickel for how many times people claim they’re buying a house for xx years and end up selling just a few years later. Seems like a lot of people are only fooling themselves into justifying the feeding of their emotional desires. I think its the same mechanism that drives people to comment on housing bubble blogs about how crazy we all are for questioning the status quo or how great of a decision their 2-3 year old vintage purchase desicion was. To state that people are stupid comes across as arrogantly dismissive but it’s real hard to shake that thought.

You can’t help stupid.

Women have a large part to play when a couple look at homes for sale. ‘happy wife, happy life’ as the saying goes.

I think any husband would attest to buying a home that pleases the woman is a priority.

A friend of mine is a contractor in WLA/BevHills/SM and he said it is fascinating to watch how this unfolds in the wealthy neighborhoods – as soon as the couple take possession of the new home, the wife wants a new kitchen (and often times a new master bath) – almost as if she wants to rid the home of its former female trademark and give the home a new, better, makeover.

Of course in our recessed ekonomy it is not as common but I remember the pre-2008 days when you could drive through the areas of BelAir, BevHills, PacPalisades, Brentwood and count the contractors trucks up and down every street.

“A friend of mine is a contractor in WLA/BevHills/SM and he said it is fascinating to watch how this unfolds in the wealthy neighborhoods – as soon as the couple take possession of the new home, the wife wants a new kitchen (and often times a new master bath) – almost as if she wants to rid the home of its former female trademark and give the home a new, better, makeover.”

Wow! This is actually pretty good insight! I never thought of it this way but it makes all kinds of sense! Most would state the obvious but you take it one step further and bring it to the primal female marking of her territory…

“(and often times a new master bath) – almost as if she wants to rid the home of its former female trademark and give the home a new, better, makeover.”

It’s so much easier for a man. He just has to ‘pee’ around the perimeter of the territory to mark it. Much cheaper that way…

Perfect example of what would be a tear down in a functional and not hyper-manipulated market. No real value is added by putting lipstick on such a pig. In a non mania housing market it would carry land value only, be torn down and replaced with a 2 story 1500+ square foot (or city permitting 3 story 2000SQFT) befitting a modern family’s needs. Total capital mis-allocation.

“1 bed, 1 bath, 418 square feet?”

In Monterey/Carmel/Pacific Grove that would rent for $1,500 all day long.

Any suggestions on where to find information for assessing property value before you buy? Any good books on buying real estate?

Ouija board…

No need for a book, just ask your local REALTard.

“real estate always goes up”…”you can’t lose”… “great time to buy”… “its a great price”.

This is the funniest, weirdest house staging yet. Flip though the photos of this Woodland Hills house: http://www.redfin.com/CA/Woodland-Hills/22101-Costanso-St-91364/home/4185368

A few weeks ago, the L.A. Weekly ran a cover story on The Karate Kid. Some sort of anniversary. The Karate Kid was apparently filmed in Woodland Hills, and reflected 1980s Valley culture. The critic raved about The Karate Kid.

Well, the above Woodland Hills house has the current family in one photo (normally a no-no) watching a film projected on the house’s outdoor wall. The film is … The Karate Kid.

Is this supposed to make buyers who are Karate Kid fans suddenly feel all warm & fuzzy about Woodland Hills in general, and this house in particular?

Time for a crack hacker to splice in Amityville Horror, or maybe a choice scene from that inane “Susan says” NAR commercial.

Exhibit “b”

Credit standards WILL loosen, people, which will further keep the party going. The forces in favor of loosening (highly organized, cash-rich propaganda masters like NAR and NAH), massively outweigh those against it (chirp, chirp, chirp, chirp).

# # #

The contrast is starker in the new-housing market, where homebuilders are focusing on move-UNp buyers. In May, homebuilders reported that only 16 percent of new-home purchases were made by first-time buyers, the lowest in 15 years of data, according to David Crowe, chief economist for the Washington-based National Association of Homebuilders. That’s further limiting supply as builders shift away from constructing entry-level homes.

Tight credit has made it more difficult for young buyers, who have relatively high unemployment, weak wage growth and lower credit scores, Crowe said.

I think the problem with this belief is that the current cost of housing has already passed these folks by. There really is no financing magic left to get these sub prime folks into housing at the current price points. You would need to start with negative amortizing loans at negative interest. Their incomes could never make the first monthly payment unless… “no payments for the first year” mortgage. That might just work…

Loosen up money/cash flow and watch the brilliant capitalists take advantage.

Condo conversions, anyone?

DStale could be right. 40-45 year amortization schedules wouldn’t surprise me.

RE:What?

DFresh seems to think that since Joe6Pack hasn’t gone full retard like Bubble 1.0 there’s still gas in the tank. He seems willfully oblivious that 80% plus haven’t recovered from the last bust. They’re hesitant and trying to stay whole. Bubble 2.0 was NEVER going to grow past the specuvestors (which I think was the FED plan all along) and they are about to eat losses. The damage of 2008 hit home for to many. And as for his loosening predictions it goes against not only logic but the short term predictions of the CAR and other organizations. If they are reporting what is “bad news” for them, you know it must be REALLY bad as Leslie Appleton Young shits rainbows that glide to stucco shacks every morning!

“Condo conversions, anyone?”

Come on Dfresh you are smarter than that!?!? We don’t need more inventory flooding the market. That would put downward pressure on the market. We need less inventory and more (moar) rich Chinese!!!

heh

https://www.redfin.com/CA/Compton/2409-E-124th-St-90222/home/7347504

no bubble here

Wow it’s a big lot but based on satellite view the whole area looks like a junkyard. Maybe DStale can fill us in on why $410,000 makes sense for this dump.

If only I had a million dollars; I could buy two of those gems.

As has been the case for the last 50 years, there is a lot of demand for appreciating investments, but there is very little demand for cheap and convenient places to live. Try shopping in central Tucson for the smallest possible properties (see http://www.ziprealty.com/property/1458-S-PALO-VERDE-AVE-_UNIT_K212-TUCSON-AZ-85713/84854543/detail). $15k for a 450 square foot studio in what I consider to be the most convenient place to live in Tucson (I lived there for 18 years). There are no rentals allowed and banks won’t lend you money to buy it. There is nothing else wrong with these properties. The low price is entirely due to those two restrictions. Now imagine what would happen to property prices elsewhere if we banned all home mortgages and banned all rentals. That’s all it takes to create affordable housing for all.

$19K marked down to $15K. This is less then I spend a month when I travel for work.

No rentals allowed is likely a good idea otherwise this would be rented out to drunks and crack heads.

Supply and demand determine housing prices.

To get the home prices in line we need more homes. Build 100,000 more homes and that should help.

As for this small home – look at the size of high rise condos downtown. It’s easy to pay 1mm for under 1000 sq ft.

Are you sure? Supply and demand is a small part. Financing is really what determines the prices of houses I think. The bubble due to lax financing and the recent stall after getting everything possible from low mortgage rates demonstrates this.

As for supply and demand, both are really low. Hard to tell which side will win. Note also, that given recent investor involvement, as soon as the annual cost to carry is higher than annual price appreciation, there will suddenly be more supply and less demand. Remember, housing demand is partially elastic and certainly investor demand is close to 100% elastic.

Love the first photo of the teal-blue house with a police cruiser off to the left…

You’ve never heard of the Tiny Houses? Way smaller than these. Good for those of us who are childfree 🙂

Where am I supposed to put all my crap in those tiny houses? I like the pharaohs believe that I will need all this crap in my after life…

You need to watch some George Carlin!

I have no kids and couldn’t fit my yarn stash and archery gear in one of these Hipster Hives. Never mind my kitchen tools, woodworking tools, metalworking tools, landwork tools, and books.

But of course “Tiny Houses” presumes we have no productive or creative lives. Just our iCrap and Kindles. Things are bad! Tools are for imperialists! Look, a new Stieg Larsson/50 Shades/Hunger Games product!

The Pasadena House just made it onto CurbedLA.

If anyone is still wondering what keeps these prices up look no further than the comments section.

After reading about this house on Curbed LA, I saw it mentioned in my Twitter stream and in my Facebook news stream. It appears to be a sensation locally.

You could call these houses the little old ladies of Pasadena.

Leave a Reply to What?