Case study in controlled inventory for Pasadena real estate – The legacy of poorly designed mortgage lending and creating a surreal real estate market in selective cities.

There are limited examples of how banks are limiting the actual supply of homes on the market. We know that this is rampant yet it is hard to track down specific examples. Some tend to think that this leakage of inventory is only happening in lower priced areas. We will give you a very specific snapshot of a decent neighborhood in Pasadena where this is very obvious. It will become very obvious to anyone paying close attention how banks are manipulating the market to limit supply to push prices higher. Yet this is only a temporary trend since many of those buying today are really rushing in thinking there will be a jump in prices and deep down many do not want to miss another housing mania in Southern California. What is certain is behind the scenes many people are struggling to pay their mortgages even in more affluent neighborhoods where the outside façade is that household income is holding up strongly. Recent data strongly refutes this assertion but don’t let the facts get in the way.

How to go from modest home purchase to maximum home leverage

Today we examine this home in Pasadena:

1225 Leonard Ave Pasadena, CA 91107

5 bedrooms, 2 baths, 2,249 square feet

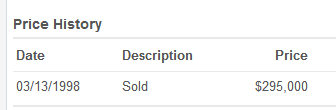

The above home was purchased back in 1998 for $295,000:

Looking at the foreclosure note data, it appears a loan was placed on the home for $236,000. In other words, someone purchased this home with a 20 percent down payment. Remember those? That was the last modest mortgage on the property. Lenders on the note then included:

-Rapid Equity Funding

-AAMES Home Loan

-Ameriquest Mortgage

-Countrywide Home Loans

Suffice it to say that this property had some diverse lenders. What is interesting is the owner already ran into issues back in 2006 when the first Notice of Default was filed. Since prices were going up refinances provided cover for a few more years. By the time this home went REO in April it had this as the loan amount:

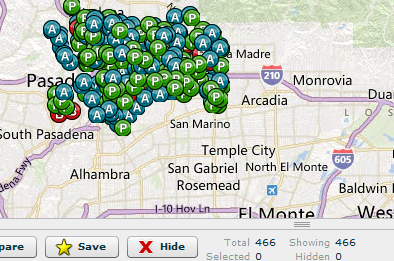

This home isn’t even listed for sale on the market even though it went REO back in April and as we are constantly reminded, the market is now hot! What is interesting is that if you look at Pasadena foreclosures, you will find a large number of properties:

Yet many of the REOs do not show up on the MLS even in areas where there is clearly demand. Just take a look at the area where this home is located:

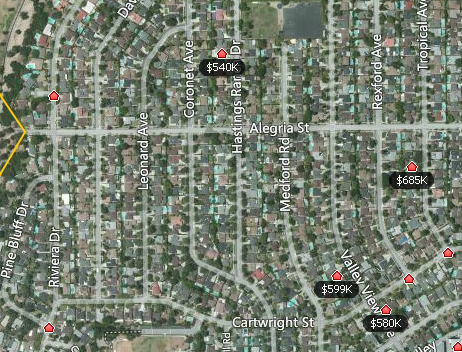

Homes where no price is listed and with a red house icon are in some stage of foreclosure. These are homes that will be coming online. Banks are moving on some of these properties as long as they get a certain price point:

Do you think having more variety would aid home buyers? Who really benefits by keeping prices high here? The bank now owns the home. Hopefully after half a decade of bailouts people realize the main beneficiaries were the big financial institutions and not the public. All this press about home prices rebounding makes sense in the context of the above controlling nature of the market but also manipulated low rates. Supply is being massively controlled even in areas where demand is healthy.

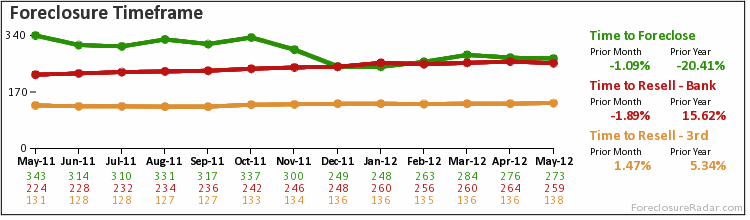

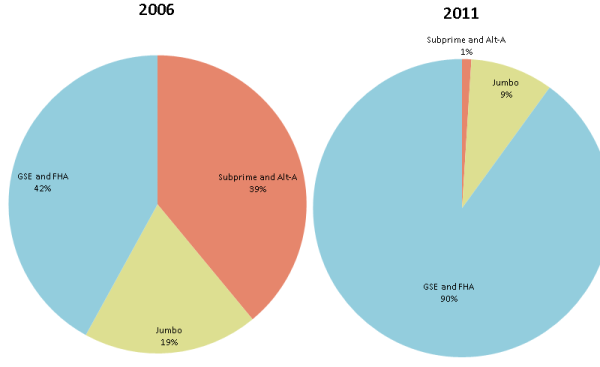

Pasadena has many desirable locations but there are a large number of homes where bad mortgages will become REOs. And many of the distressed properties are fresh with over 160 having an NOD filed recently. The pipeline isn’t a fixed figure where we go from 100 to 0 in a straight line. For each two REOs sold, you might have one (or more) enter the pipeline. Many buyers are unlikely to dig deep into an area analysis like the above but if the press gave greater detail to what is behind the machinery, it is likely that buyers would exercise more caution when buying. Then again, some simply want to believe that this is the beginning of another mania and don’t want to miss out. The big difference this time is the government is on the hook for nearly 100 percent of the mortgage originations:

Source:Â Â Sober Look

With FHA insured loans defaults rising to historic levels, I’m sure this will turn out well. It now seems we are in a perpetual bailout cycle. So yes, if we only look at the controlled figures inventory appears to be constrained and what a stunner that prices are rising in combination with low interest rates. The big question of course will be the staying power of this trend deep into the fall and winter.

What are your thoughts on the controlled release of housing inventory into the market by banks?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “Case study in controlled inventory for Pasadena real estate – The legacy of poorly designed mortgage lending and creating a surreal real estate market in selective cities.”

Substitution affect. We were looking in Pasadena and were seeing ridiculous prices. My wife works in Pasadena, I work in Fullerton, so she was the main driving force. I wanted to be somewhere in the middle and that’s where we are now (Whittier). The loan we bought would’ve been two or three times what we owe now if it we bought the same house Pasadena. Now, we both have similar commutes and she’s closer to her parents and we’re both very happy. I’ll admit, the area isn’t as prestigious as Pasadena, but god forbid one of us looses our jobs, we can still survive. Will our house go down in value? Probably, do I care, I’ll admit I do a little…however I don’t ever plan to buy another house in the next 30 years.

Thanks for focusing on my home town. I just walked past this one the other night. I love this place, ever since childhood. I wonder what it will ultimately sell for…

http://www.redfin.com/CA/Pasadena/537-California-Ter-91105/home/7186073

Wow, they want $400k or 60% more than what they paid during the height of the bubble in Dec’04? Just because they put in $100k in remodeling? CRAZY!

Yes, crazy is an understatement. It’s just a cute little house – – nothing spectacular.

And now you live in Murietta. Nice upgrade from Pasadena – livin the dream!

Uh no, I live in South Pasadena, even better upgrade.

I guess there are always a few suckers willing to buy in at absurd prices. So you can keep prices up and move very little inventory for a long time. But let’s consider all the people who don’t buy. Will they stay in California as rents climb? What about all the people who are going to lose their homes, especially those who have been living rent free in top or medium tier areas? Are they in financial shape to become renters in those areas? Where will they go to?

Most people are focused just on housing inventory and what they can buy. But if you think of housing as a system, controlled inventory, high rents and outrageous prices are going to take us to collapse. Yes, they can keep prices high for a long time, but when the supply of buyers/renters collapses we’re going to see the whole system of housing collapse in this state. People won’t see it coming either, because the press will keep up the NAR propaganda until the very last.

@Teresa, regarding your question about whether people will stay in the state, a mover recently told me that of the 20 people he was involved in moving during a particular week, 18 of them were moving out of California.

I’m not surprised. Many in my peer group are considering leaving the state.

Now that I think about it, this is happening because of what Dr. Housing Bubble has been talking about all along–local incomes don’t support prices. Things are so far along now that not only do local incomes not support home prices, they don’t support the overall cost of living either.

Less traffic and more jobs for those that stay here! I say it’s a win win.. Then we have less competition for jobs and our salaries can rise! Another win!

I’m leaving Cali at after Labor Day especially because of the outrageous housing and rent costs…

This “typical” 1970’s house in FL in a nice neighborhood… http://www.realtor.com/realestateandhomes-detail/9679-Sw-3rd-St_Boca-Raton_FL_33428_M52460-69103

This “typical” 1920’s house in CA in a nice neighborhood…. http://www.redfin.com/CA/San-Diego/3424-Richmond-St-92103/home/5374562

Taz, try out Texas. You would like Austin. In Austin, there is not the stress that you find in the L.A. metro area.

No — please don’t move here. Austin is already the poor mans California and we don’t need to enhance that dubious distinction. Thx!

I’m not leaving but I am currently trapped in the Inland Empire. Help! On your subject I was talking to my Mom recently about my real estate woes (she is beyond them in life) and pointed out that she and my Dad could not afford to retire to San Diego as they did in the 70s. They would have to be out here in oven land.

An aside on the Calif house you posted. If median income is $62,000 that house is at about 12 times and the realtard takes bad photos with a faux DSLR to market a 3/4 million dollar sale. Yike!

What are my thoughts on the controlled release of housing inventory into the market by banks? You said it best when you called it the “command control of US housingâ€. Though I have to say, the blueprint penciled out by the ring masters back in 08 appears to be working exactly as planned. The question becomes, is the controlled ascent the smartest guys in the room are so masterfully orchestrating the right call long term? I’ve always thought the quick collapse and rebuild was the right way to go, but I’m now starting to question that. Look at the numbers; it looks like housing as a whole has bottomed in the US. Prices are up slightly, even in over priced areas like the Conejo Valley. Home builders stocks have ticked up in the last month. Rental rates are expected to increase in LA county 10% in 2012. When homes come on the market, most of them seem to immediately be tagged as “pendingâ€. Has sentiment changed? Are all of us loyal followers at DHB now speaking only to one another? Tell us Doc, and please be honest, have you seen weekly unique visitors to your site shrink in the last few months? Are people tuning out? Are people tired of obsessing about over priced homes in desirable areas of Southern California while seemingly nothing changes? Are people giving in and accepting the new paradigm of a “command†housing economy? It seems to me, the worm has turned.

My family bought our place in 1963 and we’ve held on to it all of this time. I’ll probably be carried out on a stretcher, lol. I wonder how common it is nowadays to buy a place and stay in it over 50 yrs?

probably not very common but it should be. Just like the bankers that are manipulating our so called free market should be in jail!~

Did you see Matt Taibi and Yves Smith on Bill Moyers’ show this past weekend? It’s up on YouTube now, must-see.

Labor markets don’t benefit from a immobile work force. Staying in once place is a fine strategy for farming. Otherwise, staying in one place for 50 years isn’t realistic. It’s a long time and regional fortunates climb and fade. Compare Detroit in 1962 to now.

DHB,

I have one genuine question. I buy your hypothesis that banks are slow are releasing inventory. However, let us look at it from their perspective. I do not follow how they manage this and when are they going to feel the pain of doing this.

1. Say local taxes on a REO or pre-foreclosure are in the 1% to 3% range. That

is an expense to hold onto to the property.

2. Add basic utilities and cost of maintenance about 1%.

Where can they make this kind of money per year to be able to hold these properties. The only incentive I see is mark to model. If they can delay booking the losses on these sales then they can shore up their reserves. Then they can hope

to get out of insolvency over a decade or so time frame.

Right now it makes no sense to me that banks can afford to hold their inventory.

So something is missing in this story, which I do not seem to comprehend. Is the Fed secretly monetizing banks to pay local taxes and do property maintenance? How is this being done? How come there is no reporting on this? Maybe you can help us understand this from a bank’s perspective by running some numbers on a typical house. Will price appreciation be adequate to compensate for the cost

of delaying putting the house on the market?

Thanks.

Always reading the good Dr.’s post updates, but it gets tiring commenting huh? because, well, it’s still the same ol’ tune out there, right people ?

In short, the “little saver” was never intended to have his David vs. Goliath moment with the banks and their real estate assets. And that’s really the frustrating realization for us, hence all the pissed, sarcastic, & comedic comments on the good Dr.’s articles…

Then we all battle the mainstream media and industry gauntlet of buy now – lowest rates ever, the bottom is here, etc… add to that our, well, let’s call them “uninformed” friends who only parrot the same BS. Hey, many of them are stretched, so they have to believe in fairytales at this point, right?

Even in other areas of the economy aside from real estate there is belief or notion ( I call it a dream) that somehow, a wrong turn was made and we’ll be doubling back soon to get back on the path. In reality, the system tacked in a different direction. Especially with regards to banking and real estate.

It all dovetails with the idea that well, “there ain’t gonna be any middle anymore” ..middle class of savers that is, it’s debt for everyone… even those that paid credit cards off and made their mortgage payments were ‘baptized’ into this when their housing value went way south and they were suckered into the house equity roulette game.

Interesting, banks don’t extend interest on our deposits anymore, not even CDs… hmmm.. no stories on that. I remember earning 3-4%… Seniors are being PUNISHED right now, my Grandma depended on those guaranteed CD rates that are now poof, gone, never to return… down the memory hole really, because the younger generation doesn’t remember. They just know they can pay bills and check their bank balance on their iPhones… Chase spends millions advertising and reminding them of these types of KEY services they provide to their customers…at no additional charge! 🙂

Real Estate pricing, job loss, and the overall economic picture eliminate completely eliminate the idea of things “getting back to normal”. More people will be getting escorted out of homes instead of into homes.

If you’re buying right now:

A) you’re pooping cash and have to stick it somewhere – or it’s your “business” – ie: you’re an investor or in the industry. (heck, maybe you’re even renting one of the rooms or apt units!)

B) You’re SETTLING. You’re a saver, and damn it! you will own a home now! So you pick the “best of your options” and shackle up to nice 30 yr sentence, fully realizing, like commenters here that: my house value will drop further, there will be no appreciation on this “asset” I bought, I will pay mucho interest on the money I borrowed, and finally, this house has many “extra expenses” that over the years I will find out about… least of all any time of aesthetic remodeling as those home magazines suck you in because you don’t have this or that upgrade/style yet. You’re doing this because..well, I don’t know why are we? We’re so conditioned, we just go with the flow – I guess 16 you get a car, and then in your 30’s you go get a house. Your friends and neighbors are doing it I guess…

the B option sure doesn’t make any sense to me… well aside from any ego stroking of “I own a home” …but again, in this strange land, what does that even mean now? Back in the day, housing at least used to trudge along at 3-4% and keep pace w/ inflation… Again, these metrics are all gone, they’re not coming back.

The new horizon ahead for California real estate and homeownership I believe will be only further reduced to infinity and beyond! Psychologically, it seems the idea to “buy” a home only has to do with this romantic nostalgic idea that we “own our home now honey” — I prefer the term “loanowners”. Let’s be accurate right ?

And with those buying, they’re basically “settling” so that they can “buy” this home. They admittedly say they would prefer another area (malibu on the cliff, yeah I know, but really now) – by another area I mean just zipcode or two over, but they don’t rent in that area do they? – which they could – they buy in the area they can afford – even though, again, out on that horizon we only have: more housing price drops, more troubled/distressed inventory as people throw in the towel for whatever their reason, no true job creation of defined income levels rising either…

So basically all this just points to the percentage of renters in California severely increasing beyond what it is now. I believe Cali has always been a 50/50 rent/own state – and many renters don’t care because the real estate mantra of “location location” rings truer nowhere else than in this state… Lovely tropical climate, really only 1 of 7 on the planet, and plus, there just ain’t no beaches in Arizona or Nevada 🙂

So to sum up, more renters are coming.. investors for the most part will be gobbling up the now vacant homes and future vacant homes, ie: people who are financially screwed but the system hasn’t kicked them out yet.

If you think about it, this idea of renting/leasing is ONLY growing. Look at car leases now too! wow! I think that’s where housing is heading, at least in this state.

It’s this new twist where you never truly stop paying for anything – roof over your head, automobile, and all those other endless revolving monthly debits.

So many whiners.. We are reaching a bottom in average middle class neighborhoods because we have reached or are dipping below rental parity.

Sure, we aren’t at rental parity in some nice parts of Santa Monica, Beach Cities, or South Pasadena… or other desire-able locals where the top 1% live.

But Rhiannon should know.. who are your neighbors in South pasadena? I’m betting LOTS of lawyers, doctors and well-paid entertainment industry people.

South Pasadena has all the good schools so they all crowd into the 3 mile by 3 mile area to live. It’s simple supply and demand.

They can hold onto their homes longer than we think because the banks can borrow from the FED at nearly 0%-0.25%. Who in the right mind would turn that down? Borrow from the FED at 0%, speculate for a 30-40% profit and if my speculation does not work, ask for a bailout. We live in a privatized gains, social losses country.

Rental parity is out the window as a realistic metric since rents are decoupling from fundamentals. The same stupid money that drove up RRE is finding its way temporarily back into rental market where newly minted landlords are enjoying something like a captive audience. This won’t last, obviously. Let’s look at where rents are in five years time.

It makes no sense for banks to withhold inventory to simply run up prices; the selling season is too short and next year’s too far off. Furthermore, that requires a business conspiracy of all banks with Pasadena foreclosures, by way of example. But suppose there is a valid, other reason? So, suppose the reason is to a) stop selling very much b) assemble all reo inventory in one or two bid packages while prices jump jump jump and c) sell the packages to the highest bidders with no brokers, to hedge/investment funds in bulk, as they have been promising to do? I think this makes the most sense of what is going on and why it is perfectly sensible, the banks “goose” the market prices up during…the summer selling season when demand is highest, and if that works then moving the properties to bulk buyers. No, I have no proof or inside information except for the banks having said they want to do this and are tired out of selling (and short selling) individual homes. Time will tell, maybe there’s a better theory? If so, then look for the homes to hit the market by next year’s spring season.

<>

Bingo.

Hmm – that didn’t quote well. Comment was in response to Indylew’s statement – So, suppose the reason is to a) stop selling very much b) assemble all reo inventory in one or two bid packages while prices jump jump jump and c) sell the packages to the highest bidders with no brokers, to hedge/investment funds in bulk, as they have been promising to do?

the feds guarantee the loans.bank have nothing to lose by waiting.

“Are people tuning out? Are people tired of obsessing about over priced homes in desirable areas of Southern California while seemingly nothing changes?”

For now it seems like a good number of people are diving in and buying. I don’t think that is refutable. Yet the foreclosure figures show people struggling and new owners also having issues. Has the tide turn? Maybe for now but look at the bounce we had with the tax credit. I tend to feel that incomes will ultimately determine whether this sticks or simply fizzles out and slowly drags prices down and possibly sideways.

You mention a new paradigm but what is that? That Americans are falling behind on wages and are now simply going all in with low interest rates and the feeling that home prices will go up again? I would feel better about buying if the economy was healthy with incomes moving up. One thing I have learned however is you need to run your own numbers before following the herd.

In the bubble years people were buying because they were worried about getting priced out and expected their purchase to appreciate. Obviously this wasn’t sustainable.

With prices falling substantially, interest rates at record low, AND rents trending upwards the new paradigm for buyers is to buy if it’s cheaper than renting.

In many areas even 3.5% down can get you to rental parity. If your PITI is less than rent, you care less if you’re underwater or abovewater and just happy if you’re saving $$$ every month + principal.

Of course investors see the opportunities to which is why you have record all-cash purchases. In short, the rental-parity line is setting support for a bottom.

I am a former Realtor that has voluntarily inactivated my license because I can not look a buyer in the eye and try to sell them a bank manipulated overpriced house. All of us the follow Dr HB know there are not enough underlying assets or money to ever pay the QUADRILLION dollars in currently outstanding derivatives. It’s all just air on air and guarantees world debt slaves forever. Once the rule of law is ignored you get societal collapse. When the State becomes too big to fail, the people become the slaves. That is what has happened. I suggest everyone watch this, part 1 and part 2 of George Carlin in his last HBO special before he died (or was he killed for saying this?) http://www.youtube.com/watch?v=HJr_ggTeq64 and http://www.youtube.com/watch?v=31M7bXRwrjg The Part 2 goes into the reason we are all experiencing the collapse of the western world right before our eyes.

May I also suggest reading Matt Taibi’s “Griftopia,” and his RS blog. He is the only journalist I know of who is really getting into the thick of it. I’ve long followed Carlin and have heeded his advice. Congrats on your departure of the RE biz 🙂

People are buying because it’s cheaper to OWN than RENT in most of these areas. Not because they expect a huge boom in prices… At the very least.. people are paying down their mortgage balance at historically the highest levels in history. With interest rates this low… in another 5 years… those that buy now will at worst case be paying down their mortgage at the rate home prices fall.. so they effectively will never be underwater due to low interest rates. If home prices keep falling 2% a year… but your building equity of about 2% a year.. and put down say 10-20%… You won’t ever be underwater.

And if they are close to rental parity.. they are going to be no worse off then a renter.

Sure they might miss out of that future bargain home… But you can say that about anything in life. I didn’t marry my wife because i thought maybe someone better might come along…. I didn’t buy the 2012 model car because the 2013 model car might be cooler…

Prices may now be low enough in many areas of the country to support the cheaper-to-buy-than-rent assertion. But in the more desirable communities in the SF Bay Area, that’s definitely not the case. I live in Berkeley. Here, 2-BR 1-bath houses that last year would have sold for $525K are now being fought over by multiple bidders and ultimately selling for $675-$700K. This appears to be mostly the result of a combination of drastically-reduced inventory and record low mortgage rates. There’s no way these prices are supported either by local incomes or rents.

In Berkeley, like most of the SF Bay Area, there’s been a 50% reduction in MLS listings year-over-year. That’s truly staggering.

Really? I can get a home for 1500 a month in 90048? O wait no. You’re high.

90048 eh? Let’s be fair.. a semi-decent, non-roach infested 2 bedroom apartment is going to run you ATLEAST $2000 a month.

Let’s compare apples to apples here.. NOT A SINGLE HOME is available to for RENT in 90048. Well, one that allows a dog anyway.

Here’s an example:

Asking Rent : $3600 a month

8446 W 4th St

Los Angeles, CA 90048

Zillow PRICE = $645K

$645K at 3.5% 30 year fixed with 10% down payment = $3557 PITI a month est.

VOILA .. rental parity bottom!

http://www.zillow.com/homedetails/8446-W-4th-St-Los-Angeles-CA-90048/2119150721_zpid/

Zillow prices have reached rental parity… about 90% of the time zillow is pricing homes at rental parity now.. and owners are listing at Zillow prices if they want to sell.

90048 not at rental parity? really?

http://www.zillow.com/homedetails/8446-W-4th-St-Los-Angeles-CA-90048/2119150721_zpid/

Rent = $3600

Zillow Price = $645K – (30 year fixed at 3.5% and 10% down = $3555 PITI)

VOILA rental parity.

(also there aren’t any homes for rent in all of 90048 that allow dogs as pets.. kinda limits your ability to rent if you are like half of americans with a dog)

@Rental Parity: That “house” you link to is a duplex. And I can guarantee they’re not going to get $3,600 in rent for a duplex, even a 3-bedroom. That would be more in the $3k max range (they’re asking crazy high rent for a duplex in that area). Plus the Zestimate in your link is just for half the duplex. The Zestimate for the entire building is over $1 million. My point is, $3,600 rent should get you a nice SFH in that neighborhood, but the Zestimate for that house would be much higher than rental parity, and the owners’ asking prices are generally above Zestimate. So rental parity? Not so much.

@Pwned: Do not point out the facts to Rental Parity since it is likely he recently bought and can’t even tell a duplex from a SFR apart.

Had to add one more awesome George Carlin clip talking about your owners http://www.youtube.com/watch?v=hYIC0eZYEtI

And he’s exactly right: the owners want obedient workers, not an educated populace that can think critically. Wonder why the right is so down on education?

@ Rhiannon – oh puh-leeeze. take the Right vs Left yammering to some other blog.

Sorry, but it is a big part of the equation…

Rhiannon, did you see the fraudulent budget your lefties passed in Sacramento yesterday?

If we don’t vote for higher taxes in November, triggers kick in that cut education automatically.

SO WHO IS DOWN ON EDUCATION AGAIN?

The ENTIRE global financial system is collapsing. The US and Europe will pull down China, further pulling down Chinese natural resource for manufacturing supplier countries like Brazil, Chile, Bolivia, Australia, Canada, etc…

Look for a distraction in the form of war in the Middle East, hopefully not leading to a WW3.

Just a matter of time for the Euro, me thinks…

Yeah just what we need another World War now that humans are armed with nuclear weapons. Hope that doesn’t happen!

I have an even longer 🙂 stream of thought post up higher in the comments section…. but the Carlin link has me chiming in again 🙂

George put it so eloquently with: “It’s a big club, and you’re not in it”

I use that line ALL the time w/ folks, because it really conveys, in the most simple way, the new financial paradigm people find themselves in, and frankly, need to wise up to.

It goes hand in glove with this Average Joe vs. Banks / Real Estate relationship. And many are still in denial about it due to mass marketing, media bombardment, and uninformed family/friends parroting BS.

But, I will add a footnote to my rent / buy rant (above in comments) though too: YES, you can probably buy a home and on paper pay the same or less in “monthly payment” than renting, BUT we must agree this COMPLETELY casts aside any discussion about LOCATION. Anyone buying, is really most obsessed w/ that above ‘monthly nut’ comparison, and that’s why they bought a home where they never thought they would, and in most cases adjust to commuting, school system quality, overall community quality, and most important: geographic quality.

The renters out there put HUGE value and weight to GEOGRAPHY. We want to LOVE where we live. We’re obviously talking coastal here, or perhaps a NICE hip/chic area in LA… but bottom line, we want to walk out our doors and LOVE what surrounds us. And thus we’re much more apathetic to any romantic or nostalgic view about ‘owning’ something in an area we don’t love.

Many of us even have family or friends who are “owners” and we see what a shell game of liquidation they’ll need to play when they want to quit the “owners game” and get free and clear.

But I would buy… I would buy if I had the capital. But I would buy only for investment purposes at this point. Maybe some senior condos where they won’t suffer as much wear/tear. I would buy because there’s no where else to put your money these days is there? You can buy some silver & gold, but you certainly can’t make any money in the market right now — okay, daytrader rockstars aside (eh, but they’re like those people who go to Vegas and lie that they’re up or broke even on every visit 🙂

So real estate – in terms of rental income and cash flow is really the only thing on paper that works.

And since we’re making 0% interest on our saved money, and banks are borrowing from the Fed at 0% interest, the opportunity for rental income at least gets us headed into some type of future asset class w/ positive cash flow opportunities. That’s why the investor vultures are circling and diving down, there’s no where else for them to put their money either…

Not having capital to get started is tough, but even tougher is the average joe not being able to penny in with the big dogs on these continuing 15-20% hedge fund returns..

And parting advice, take the conspiratorial view of history and economics, if for only to grasp the idea that individuals of means continue to conspire together for their own perpetual benefit. And no matter how much they try and tell us it’s about political affiliation, race, geographical divides, or personal interests, — we live in a class system. period. Rich, less poor, and poor. And we’ve all seen the graphs on how the rich have been adjusting to this new financial paradigm over the last few years… very well indeed.

Oh Ma Gawd, The Night of The Booty snatchers is back! IT”S HERE RIGHT IN PASADENA!

‘Oh mommy, can we go see that new movie starring flipper the frantic and gretta greedy?”

I think that calling a bottom is a little odd when the support for this “bottom†is manufactured by the “Soviet style command economyâ€. I find it very interesting how quickly sentiment changes. I have looked at other collapses and it is very rare that it is a straight line down.

We need to be careful when we make statements about “banks†slowly leaking inventory. Remember that banks are not holders of the debt/mortgage rather servicers of the debt/mortgage. The bank makes a fee on their service regardless if the value goes up or down or if the house is foreclosed on in the same way that a fund manager makes a service fee on a mutual fund regardless if it goes up down. I would guess that the federal government is the holder of the majority of the debt/mortgages through the GSE’s and the trillions of dollars of MBS holdings on the Fed balance sheet and the Treasuries balance sheet. So, I will hypothesize that it is our “Soviet style command economy†leaders are the ones slowly leaking out inventory. How can our “Soviet style command economy†leaders afford to pay the taxes on the holdings? The “Soviet style command economy†leaders can easily print money to pay the state property taxes. And guess what! It is a way to help bail out the bankrupt zombie states. Win, win!

So the banks collect a fee for servicing loans; sold their “toxic†assets to the Fed/Treasury; and borrow money from the Fed at zero percent interest, buy treasuries with the borrowed money and make a percent or two. I could be very wealthy if I could have that business model…

Any evidence for this massive government-REIT conspiracy?

Here’s some-

https://www.pinellas.realforeclose.com/index.cfm?zaction=USER&zmethod=CALENDAR

Peruse the judgement/assessed value ratios. These liens are typically in excess of 200-300% of fair value. Who’s holding the MBS represented by these stunningly out of whack numbers? This is fascism in action.

Wow! I thought this was common knowledge… What do you think the Fed is buying in QE1, QE2, and QE3 (aka Operation Twist)? They are buying treasuries and MBS’s.

Here is just a small example…

http://www.calculatedriskblog.com/2011/10/fed-officials-discuss-buying-more-mbs.html

http://www.bloomberg.com/news/2012-06-27/fed-to-boost-operation-twist-with-qe3-jolt-bank-of-america-says.html

http://www.newyorkfed.org/markets/mbs_faq.html

http://www.federalreserve.gov/newsevents/reform_mbs.htm

The last two are from the horse’s mouth…

Did you not see the graph in this very article showing that the GSE’s and FHA hold 90% of the mortgages originated in 2011? There is no other show in town my friend. I am at a complete loss how someone can read this site and do a little homework on their own and ask a question like “Any evidence for this massive government-REIT conspiracyâ€.

Let me ask you a question. Who do you think “owns†the majority of the mortgages in the US at this point if it is not the federal government through the GSE’s, FHA, MBS on the Fed and treasuries balance sheets? Do you really believe we are back in the olden days when banks took deposits from savers and held mortgages for borrowers?

Apple just raised wages 25% for all it’s store employees… I know it’s lower waged employees.. But this is the trend that needs to happen everywhere. Companies are HOARDING cash and complaining there is no demand for their products.

How bought you pay your employees a wage that keeps up with inflation and housing costs… Then those people will spend money on your products.

We’ve had more than enough deflation.. It’s time for WAGE INFLATION… Apple, is once again ahead of the curve on this idea. More companies need to follow suit… like they did copying the IPHONE and IPAD.

Now all those $12.50 an hour clerks can go out and buy California real estate. Apple really is generous, 35% margins on Coolies’ backs.

On another point, once and for all, interest rates are rock bottom because it is the only way the US can pay and rollover its debt. It has nothing to do with real estate directly. The carry trade to bail out the banks losses is done on the backs of prudent savers, mostly retired people who need the interest income. It is all a ponzi to feed the big boys. Why is this so difficult to understand? Both Obama and Romey are sock puppets for these guys. If a local government tries to raise taxes a single mill, the idiots go nuts. But, the fed wholesale robbery of savers goes by with no comment. All, centrally planned just like the USSR. Actually, China, where Apple is really located, is more market driven than the Silicon Valley.

I found the exact same thing in two zip codes I checked, one in Palm Springs and one in Huntington Beach. In the HB zip I checked there were about 40% more hidden homes than were listed on the MLS.

I have been on the Redfin forums and the consensus seems to be that some of this low inventory is due to the fact that people underwater, yet current, on their mortgage simply cannot sell even if they want to. This has created the short inventory and frothy behavior of the market. I am ready to buy finally but it means too much to me to get sucked into this when I’ve waited this long. I’m going to wait until winter, until all this mania dies down and everyone realizes this is an upswing before a double dip. I’ve been right about everything thus far, back in 06 when I said this was unsustainable and going to blow up in everyone’s face. Keep the faith fellow educated bubble followers!

Stockton Chapter 9.

They have no choice because pensions are largely ‘funded’ with real estate valued at bubble prices. If prices fall back to supply and demand, the financial implosion will accellerate into chain-reaction mode. Better for us to slowly burn into poverty than explode into chaos. It’s a little too late to do the right thing now, as Tanya Tucker once sang…

This lack of inventory is an artifact of the year-long foreclosure moratorium. It’s funny tome how many people forgot about that – servicers effectively couldn’t foreclose for a year. Of course inventories are down.

But that should change in 6 months or so. I track the servicer reports for private label RMBS and in the past few months, since the robosigning settlement, there has been a pronounced uptick in liquidations (along with a reduction in modifications). We will see inventory rising real soon.

I have heard that the banks have set up corporations that buy most of the REO’s on their books instead of listing them or letting the public submit offers like they did in the 1990’s. They rent them out or flip them. I wonder if this is the so called shadow inventory I have heard about for 4 years now. And I have friends who just sold their house for $100,000 more than they paid 1/09 with very little improvements done and with deferred upkeep necessary. On the market 2 weeks, offer $10k less than asking, accepted and closed escrow within 30 days. And with a new bank loan.

Great analysis on Pasadena. It will be very interesting to look at the market in say December, after the election and right smack in the winter real estate doldrums. We should have a better picture of how the banks worldwide really look as well. JP Morgan just admitted this morning about a $9,000,000,000 loss on a bad trade. My guess is the !”#$% hits the fan.

I know you have written on Culver City in the past Dr. HB, but I am curious at how the shadow inventory and lack of listed inventory might play out there. Many seem to think that Culver City is the new and upcoming Santa Monica on the Westside. I doubt it. Never has and never will be in my opinion.

http://www.westsideremeltdown.blogspot.com

During late 2008-mid 2011 we bid on so many foreclosed multis in the Phoenix area we lost count. I recall days viewing twenty bank owned apartment buildings; the supply seemed endless…went into escrow on several, ultimately bought only three. In retrospect, I was far too picky, but who could have predicted this?

Check out the number of multis available in the Phoenix area today, it’s like a spigot got turned off…appears to me the average investor has been eliminated from the equation.

The REO’s that come to market end up there based upon a metric, algorithm , or formula, not some conspiracy theory wizard scheming in some bank vault. Laymen Example: Riverside house $1M outstanding loan/value on our books, but today can only sell for $200K = 80% loss. Pasadena house $1M outstanding loan/value on our books, but can sell for $500K = 50% loss. If the threshold is set for 49% loss or less, neither one ends up on the banker’s list for sale. I bet about once a month mangers adjust the threshold, it might be 20% right now. As they extend and pretend, fully backed by our tax-dollar/future wages of our children.

There was never a house in riverside worth $1 million now worth $200k. Nice try.

Contrary to what the haters want to think, Riverside has some very very nice property and there are many million + $$ homes. Wood Streets, Hawarden Hills, Alessandro Heights….to name a few.

I like Riverside, it’s a cheap Pasadena. (Save your negative comments, especially you Rhiannon.)

My example was purely hypothetical, BUT I DO have anecdotal evidence: My Good friend LIVES in a house in NoCorona that sold for $900K 18 mos before he bought it at $300K. That is 1/3 hit. This is a tract place…yeah it has 10 foot ceilings, etc, but it aint the $M house on the Hill that the owners of Monster Energy reside in…which DOES in fact exist…

this condo sold last month (5/23) REO $242,500 and now back to the market at $299,900

http://www.realtor.com/realestateandhomes-detail/23678-Wellesley-Ct-21_Laguna-Niguel_CA_92677_M18535-36706

Should we care? Yes, of course we should. It is very frustrating for buyers who know this time should be there’s. I watched and actively looked for a home in Pasadena, Sierra Madre, Monrovia, Santa Barbara, San Diego, Marin County, and Hawaii. There has been a clear trend in all these areas of low, poor quality inventory for two to three years. Even brokers have been complaining about it. More recently, those inventory levels have taken a nose dive, and as Zillow recently pointed out, the share of REO’s has diminished disproportionately with it. http://www.zillow.com/blog/research/2012/06/22/zillow-forecast-april-case-shiller-composite-20-expected-to-show-1-9-decline-from-one-year-ago/

The question is really to what extent have lenders colluded to buoy prices, and how much are attributable to other factors such are the robo-signing moratorium, court processing, government interference etc.

With so little choice, demand should shrink to some degree, and with getting a loan still a challenge for many, I don’t see a spike in prices any time soon. The move up market will be stifled, and when interest rates increase, it will be interesting to see what happens to prices.

The long term prognosis looks unfavorable, and I took the difficult decision to leave family, and move to where my wife and I eventually bought a home. It was Plan C, and was not what we wanted, but we have a roof over our heads, didn’t pay a stupid price, and will be looking for a second, but more substantial home in distant lands later this year. So everything is back to front, and we feel bitter about what we consider to be stupidity and greed of others dictating the road map of our lives.

Regrettably, the ruminants of that stupidity and greed remain, so it’s perhaps as well that we are out of it, but can watch from a distance with vindication as the market continues to fool itself with palliatives imposed from above.

Leave a Reply to peoplearebuying