Nearing the First 100 Days of the TARP: Three Major Trends that will Crush the 2009 Marketplace: Bank Hoarding, Resilient States now Being Dragged Down, and Losing Focus.

As 2008 comes to a slow and painful end, we can reflect and see that if we continue on this current road the vast majority of Americans will be in a worse spot come the end of 2009 putting us at the worst economic recession since World War II. Now ask yourself, are you really doing better economically? If you had a large percentage of your net worth in the stock market, your answer is probably no. If you own a home, there is a high likelihood that your equity just shrunk. Or maybe you were trying to be defensive and had some money in commodities. You too faced pain this year. 2008 will go down in the history books as one of the worst performing markets in history.

Today I want to focus our energy on three trends that should they continue, will leave us in a global meltdown come the end of 2009 (as if things aren’t bad already). First, we will examine life after the $700 billion TARP. If you remember, the Troubled Asset Relief Program (TARP) was supposed to help us stay away from a global financial meltdown. It did very little in avoiding this. The only thing it did was provide crony capitalist a window of opportunity to strap on their golden parachutes while they jumped out of the smoldering building leaving everyone else to fend for their own lot in life. The next piece we will examine is the unemployment situation. This past week the BLS released data on individual states and what we are now seeing is once resilient states being sucked down by the weight of the global economic downturn albatross. Finally, we will try to understand the enforcement psychology that has caused the financial world to be a wild west allowing people like Bernie Madoff to swindle investors to possibly $50 billion in a modern day Ponzi scheme.

TARP – The new 4-letter Word

Showing the schizophrenic nature of our politicians, if you remember the initial version of the TARP was smacked down on September 29, 2008 in the House of Representatives. The reason for this was that (a) the bill as it is showing us in practice has done nothing to protect the financial health of average Americans and (b) is simply a get out of jail free card for bankers and Wall Street. The initial vote had it right but politicians freaking out that the markets might free fall, went ahead and passed the bill on October 3, 2008. Let us see how well the markets did after that shall we?

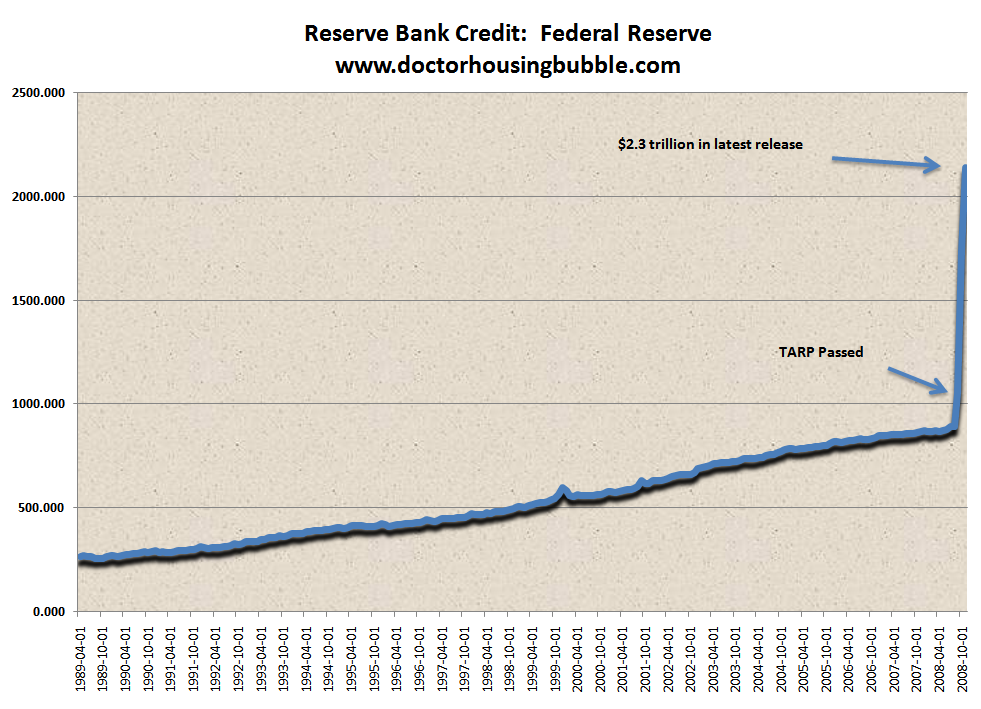

$700 billion well spent! Yet the truth of the matter is the TARP is only one mechanism the U.S. Treasury and Federal Reserve are going to give it to the average American, clandestine style. In reality, the Federal Reserve has extended bank credit to the tune of $2.3 trillion:

If we are to believe Ben Bernanke and Paulson, this unprecedented growth in reserve credit is to give banks the ability to help the folks on Main Street USA go out there and get back on their consumption treadmills. Yet this of course isn’t the case because Americans are already tapped out! Think about this, there solution to a problem caused by too much debt it more debt! Bwahahaha! This is Alice in Wonderland type stuff here. If you want proof this isn’t working just look at what banks are doing with that “extra credit” and you’ll realize who this bailout really helps:

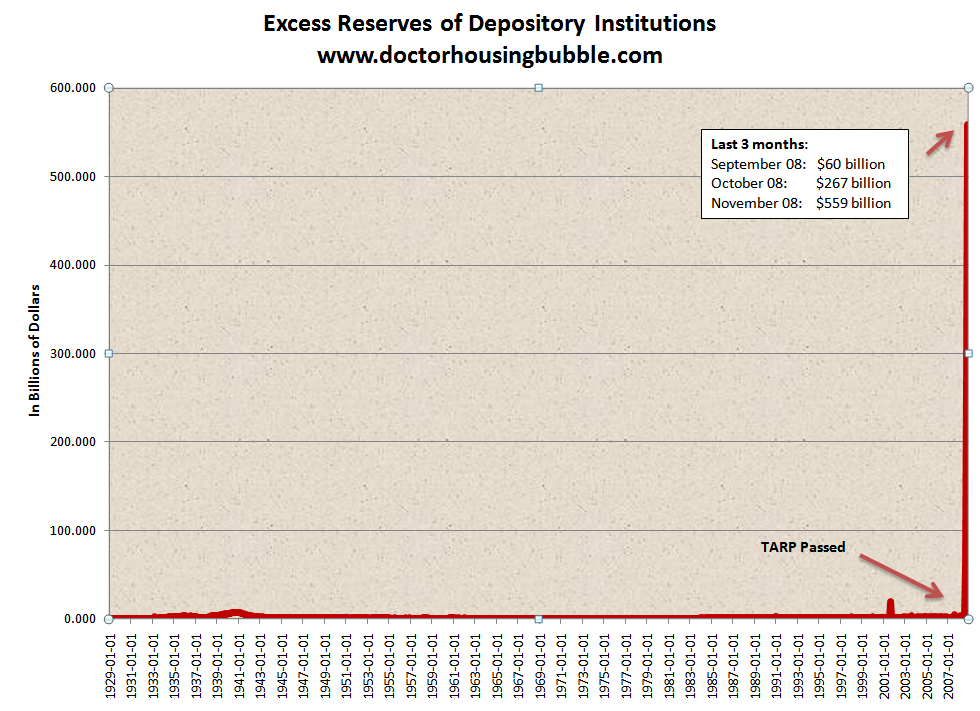

In the last few months, especially since the TARP was passed banks have parked their money most likely in treasuries. Excess reserves have shot up by $500 billion. This is money not finding its way to Joe and Susie America which was the bill of goods Americans were sold. Now imagine if Paulson said this when selling TARP:

“We want to ensure banks have extra funds so the big can eat the small and go bargain basement shopping on the back of the American taxpayer.”

Keep your eye on this. We have to break the system down to really think of the consequences. Banks are still operating in this pseudo-independent role so if that is the case, anyone offered free and cheap money will take it. But once they have it, why in the world will they loan it to the U.S. consumer who is flat broke and overly stretched in debt? By the way, most of that debt was given by these same banks! This is such an incestuous system that should it continue, Americans are going to find themselves in a worse position come the end of 2009. The irony here is that if Americans were given $700 billion flat out, this would have been better for the economy. Not that I’m advocating that but just pointing out the crony system we are currently living in.

Only a Few Strong Remain

This past week the BLS released data on individual states and the employment situation is deteriorating across the board. For example, in California 42,000 jobs were lost in November putting the state unemployment rate at 8.4% and a 14-year high:

“(LA Times)Â I don’t at the moment see any kind of turnaround,” said John Husing, a Redlands private economist who focuses on Southern California and its international ports. “My instinct is 2010. I think 2009 is going to be the worst year we’ve seen in many moons.”

“Even once-strong hiring in healthcare and government is showing signs of weakening next year. A projected $41.2-billion state budget deficit could lead to involuntary furloughs and wholesale firings of workers at state and local government agencies, school districts, community colleges and public universities. For now, one of the economy’s only real bright spots is in motion picture and sound recording, which gained 3,900 jobs in November as studios geared up production for 2009 and 2010.”

“California’s real or “effective” unemployment rate is probably twice the official number, Sohn said, meaning “the pain in the marketplace is much greater than 8.4% would show.”

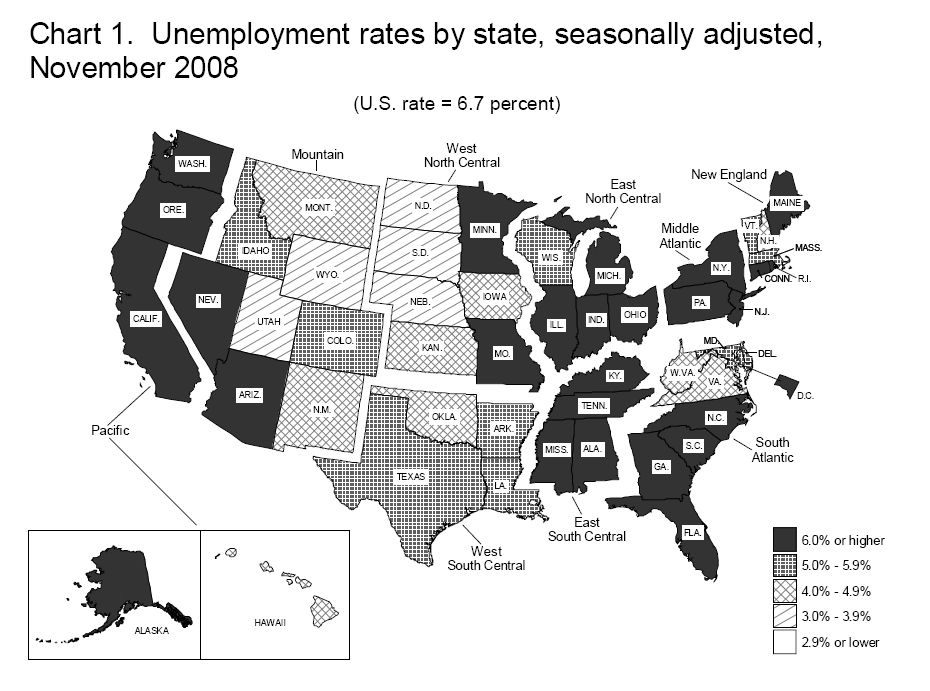

The good news if you can call it that, is the mainstream media is now focusing on the sham of the “official” unemployment rate. Clearly this rate understates the true nature of our current economic landscape. I have talked about this in 10 Significant Signs why this will be the worst Recession since World War II. . Let us first look at the national landscape:

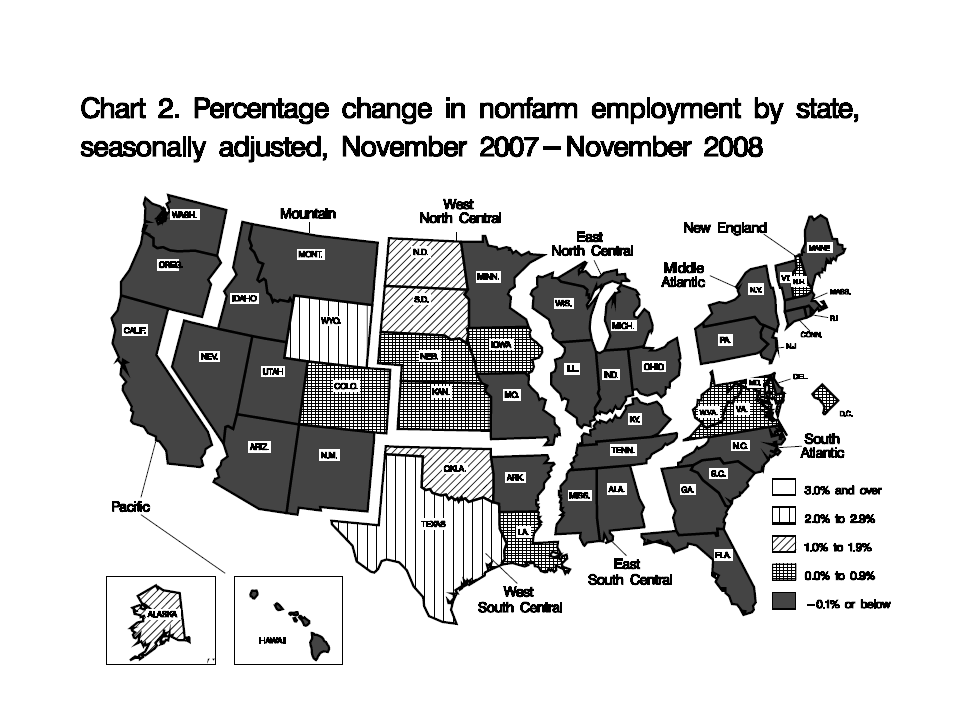

As you can see from the above map, the coastal regions are facing the brunt of the problems. Keep in mind that most of the country’s GDP comes from here so this is problematic should it continue which current data tells us it will. Very few states are left unscathed. But the above picture doesn’t capture the entire story. The trend is heading lower for many more states:

When we look at the percent change in employment from a year ago, the entire country has a sweeping blanket of negative news. Only 13 states show positive gains (and those gains are weak and will probably be gone in a few months). This is probably one of the most disturbing trends. By looking at the above chart we find the vast majority of Americans are living in areas were employment is contracting. In addition, once resilient jobs in government and healthcare are now feeling the pain. There is nowhere to hide.

Keep your eye on the BallÂ

The Bernie Madoff story is big and most everyone now has heard about it. Ponzi schemes are nothing new but the magnitude of what Mr. Madoff did has no parallel in history. The story will remain with us for a very longtime as each piece of the puzzle is unraveled only to reveal more and more shenanigans. The question that this brings up is this; was Mr. Madoff an exceptional case or simply one of many? I would argue that what Mr. Madoff did is simply a reflection of the current market culture. The fact that rating agencies stated that they would even rate a “cow” for fees is troubling. The fact that Wall Street firms knowingly bought toxic mortgages and sold them off to investors without thinking twice is troubling. The countless stories of shady brokers and dubious real estate investors makes our Real Homes of Genius look like safe treasuries. Bernanke and Paulson, representing the United States rewarding these people first is unspeakable.

As it turns out the SEC was asleep at the wheel. Recent reports are revealing our most horrible hunches. We are being run by a bunch of incompetents and those corrupt cronies on Wall Street had free reign for much too long. This is the mission of the SEC:

“protecting investors and maintaining fair, orderly, and efficient markets” Â Â Â Â Â

Yeah right. So how can so many things fall through the cracks? First, the SEC has been under funded and had no possibility to fight with the crony capitalist interest. They weren’t the only agencies in this category. OFHEO which has seen its heyday was basically ran out of the basement with little resources and these were the folks who were suppose to oversee the multi-trillion dollar housing market. We all know how that turned out. Besides the reality that our previous politicians set these agencies up to fail with little resources, these agencies did themselves in with incompetence. Recent reports are only adding fuel to the flame:

“[Investigators] uncovered evidence that an employee who was still in his probationary period had used his SEC laptop computer to attempt to access Internet websites classified as containing pornography, resulting in hundreds of access denials. The OIG investigation also disclosed that this employee successfully bypassed the Commission’s Internet filter by using a flash drive.”

Hundreds of access denials? Amazing that he was able to bypass the internet filter with a flash drive. If this ingenuity was only used in looking at Madoff’s Ponzi scheme. And there is much more:

“An employee repeatedly and flagrantly used Commission resources, including Commission Internet access, e-mail, telephone and printer, in support of his private photography business for several years.”

We don’t need simple reform. We need a complete overhaul of the system. I hear the regulation chatter going sky high but what we need is tough enforcement. If you believe that, you should expect to fund competent agencies to oversee this. Otherwise, we will have another wild west finance bubble like the one we just had. If these trends don’t reverse themselves in 2009 we are going to make 2008 look like a walk in the park.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Nearing the First 100 Days of the TARP: Three Major Trends that will Crush the 2009 Marketplace: Bank Hoarding, Resilient States now Being Dragged Down, and Losing Focus.”

Excellent post as always. Thanks for the work you do.

It would be interesting to see charts that show 1) unemployment changes once government hiring is taken out, and 2) percentage of percentage changes YOY of unemployment (i.e. the national average went from 4.7% to 6.7% YOY, a 43% increase from last year; CA went from 5.7% to 8.4%, a 47% increase).

I do want to thank you Dr for sticking in there!!! Also I see many bad ways the Banks are dealing with todays market ! I do short pay re-fi’s and loan mods that make sense for the consumer (payments they can afford) not what the current lenders think! OR The Back Door Mod Co’s Doing Nothing But Takeing The Customers $$ Again !! Also a note sense tarp ,banks have been proped up and know they will be again I feel . So now they are not working with customes,See The Following EXP___ #1 customer owes 47k on car worth 23k, customer says he will pay 0%intrest at the full ballance . Answer NO WE WANT CAR BACK!! Oh This Was After A Vice Pres Of Chase Was On The Line With Her And He Also Gave Her Verbal HELL !!! #2 mobile card Chase Bank calls customer to pay on late card, they say pay 100. per month for 6 months and we will give you 15%intrest , so customer says how much to bring current they say $200 customer says I will bring current today so now what rate will I Get!! They Say NO RATE BREAK YOU WILL PAY ORINGAL 27% RATE !!! This Customer is My Wife By the Way!! But I do hear and SEE this day in and day out !!!! The Big 4 as I call Them Will Now Take “Hope $ and Do Service retiton and keep all the Loans in house under the new higher limits of hope (They did nothing with the old hope till they forced the % higher value) . Now On To How Cheep Is It To Have A Puppet In You Pocket???? (Sentor or Congress Man) Well let see ask Bof A (Countrywide) ,Do Loan Mod’s get law suite !! Get The Hill To Pass The New BK Judge Bill ( This will happen this time, 3rd Time a charm , NO JUST HAVE Bof A WANT IT DONE !! THIS I Beleave Will MAKE THE LAW SUIT GO AWAY ) Well I Could Like You Go On For EVER!! Thanks JB

What will it take to get people to take to the streets? You provide mucho knowledge but I feel that NOTHING WILL BRING AMERICANS TO THE STREETS! Maybe 10 buck gas but maybe not even that. Nothing is SO personal that it becomes Political. Sad… OH well!

I just picked up a 52′ HD flat screen for under 500 bucks….NICE… Me happy again.

NOT!

Mucho love,

We are in a vortex right now. A vacuum of power is just sitting there waiting for something to happen. After all, what can be done right now? Things are already set in motion. If you want to see how bad lending got, take a look at this chart I uploaded:

Decline in Lending Standards 2001 to 2006

Not a pretty picture.

“Ponzi schemes are nothing new but the magnitude of what Mr. Madoff did has no parallel in history”

Actually you are forgetting the USA Social Security System. It is by far the biggest Ponzi scheme in World History.

Scared Indio,

Where did you get the 52′ HD for $500? I need that deal.

That’s great rhetoric Matt. My 83 year old Mom is blind and suffers from dementia. If it weren’t for Social Security, I wouldn’t be able to care for her in my home. She would have to pledge her check to the nursing facility, and medicaid would pick up the balance. Have you ever priced long term nursing care?

Privatizing Social Security and giving it to Wall Street to “invest”, would be an unmitigated disaster. Means testing, not so much.

Thanks for another good post Doctor.

I can’t blame the banks for not lending. Afterall it was largely their greed and disregard for credit standards that got us into this mess.

Seems if the consumer is becoming responsible, trying to save, and not spend money they don’t have, the government will do it. Either way, the money will be spent.

I cannot imagine what will be like in 2009.

Who are you Doctor? so much of knowledge and so much of dept?

Who are you?

Great blog every time.

Dick,

You should read Peter Schiff’s editorial this week. It’s about how the US govt and its liabilities is no unlike a Ponzi scheme. As a matter of fact, IT IS A BIG PONZI SCHEME. I’m a doctor, I should know. There is no way in hell 2.5 workers can pay for 1 retiree. 1 retiree can blow through 100 grand in one week easily! Thank the lawyers especially. Because of them we order many unnecessary tests and practice defensive medicine.

The “Social Security is a Ponzi Scheme” BS is all over the net and talk radio now. If it’s a ponzi scheme then so are all insurance policies. The only reason SS is having trouble is that congress keeps stealing the SS trust fund money to pay for wars and bridges to nowhere. My uncle was disabled in a farming accident almost 40 years ago and without SS my family would have had to pay for all of his care. It has been a godsend for our family and many families in our position. If you care about yourself, your family, and your neighbors, demand that congress stop spending your SS money on anything except SS payments and the small overhead costs involved in administering the program. Remember Al Gore’s “lockbox?” That’s what he was talking about but unfortunately everyone was too busy making fun of him for “inventing the internet” to pay attention.

Comrade Housing Bubble,

The crony capitalism you describe is crony communism masquerading as capitalism! It’s what Russia has been practicing since the fall of the “real” communism. It’s what China has been practicing since the great reform. (BTW, that money being handed out in TARP is coming from the Bank of China.) Why don’t we just call it what it is? The US version of crony capitalism just happens to be fancier and more sophisticated. Kinda like the difference between a Las Vegas casino and Native American casino. Still meant to take your money and leave you feeling good about it.

~

Perhaps you could recycle the chart of the concentration of wealth in the US over the past few decades. It’s a telling story. Believe me, I’m not saying that the wealthy should be punished if the wealth was obtained in a true free and fair system. In fact, they should be allowed their reward as wealth/profit is the primary motivator in a capitalistic system. But they certainly have gamed the system at the expense of the commonwealth, whether illegally or immorally. Where is the outrage amongst the people? I guess we are too hungover from partying at the casino and haven’t had the Oh, Sh*t moment yet.

~

Be brave Comrades!

Happy holidays?

:o)

Matt -“Ponzi schemes are nothing new but the magnitude of what Mr. Madoff did has no parallel in historyâ€

Actually you are forgetting the USA Social Security System. It is by far the biggest Ponzi scheme in World History.

_____

And obviously Matt you neither understand Ponzi schemes not the setup of SS. Ponzi schemes take in money, the operator drains off the bulk and relies upon incoming money to pay out the “earnings” of so-called investors. Problem is that eventually it runs out of new suckers…..uh…”investors.”

SS will NOT run out of new entrants and contributors to the system – unless people stop breeding. It is an intergenerational contract where the younger generations support the elderly. It is NOT a new concept as that is how societies have functions through out recorded history and even earlier. and that leads us to this nonsense of

“Miamicondo Forum

\. It’s about how the US govt and its liabilities is no unlike a Ponzi scheme. As a matter of fact, IT IS A BIG PONZI SCHEME. I’m a doctor, I should know. There is no way in hell 2.5 workers can pay for 1 retiree. 1 retiree can blow through 100 grand in one week easily!

____

God help us if you really are a doctor. You neither can gather data and facts nor do math. How on earth can 1 retiree spend $100,000 a week? (And do remember the subject is SOCIAL SECURITY.) Unless they are Bill Gates, it is not going to happen.

The average SS Retirement is around $1100 a month. Obviously they are not getting $398,900 a month from SS.

As far as 1 worker supporting x number of retirees here is reality:

(a) Prior to SS, less than 10% of the US could retiree. The others worked until they died which meant they were out there competing for jobs; or

(b) If too old or to ill to work they went to the poohouse and were supported by taxes; or

(c) They were supported by the younger members of their family. And in that scenario, that 1 worker did, and without Soc Sec will again, support their parents, their in-laws, their aunts and uncles who had no children or whose children were too poor, their grandparents………

The real issue isn’t whether Soc Sec is or is not sustainable (and it is because the claims that it isn’t are based on artificial and extremely low estimates of future GDP) but whether retirement will continue to be possible for other than the top 10%. Pensions are gone; 401ks are a sadistic joke played on the bottom 80% by the top 5%; and that only leaves SS.

So either get prepared to support your older relatives by personally writing checks for their bills and having them all live with you, or suck it up and contribute to SS.

PS: Save the whining about med mal. FIrst, it is not the lawyers who make the award of danages – it is a jury of lay people. Blame them. Second, less than 1-2% of annual medical expenditures go to med mal cases. Go whine about the 30% of insurance premiums divereted by insurers to pay their excessive overhead (advertising and denying claims) and their profit which takke up 10-15% of every premium dollar. That is a much bigger target.

Spot on Doc,

Even if housing suddenly bottoms (no evidence of that happening anytime) there certainly is no market-driven reason for a sudden resurgence.

Another point might be as the wars wind down, the unemployment will get worse. The services have been very strong employers this decade. Everyone is tired of these wars and it will be another huge unwinding if peace were to break out.

Most reasonably intelligent folks have felt for most of the last 80 years that the markets are rigged and that only the insiders make consistent profits. Except great traders like Madoff (a regular Nostradamus)…Now we see that the entire capitalist system is loaded with crooks and cronies…Like the Great Depression, we have lost faith in our entire system. And it will be quite some time before that faith is restored, if ever.

The parasitic lawyers will become predators. The televangelist millionaire tax evaders will come to ruin as the foolish finally figure it out. If it isn’t already obvious, the rest of us will finally figure out it wasn’t just Madoff, but the entire financial community that schemed to steal the aggregate wealth of the entire middle class for their opulence. Think the French Revolution was bloody? See how this plays out…250 million Americans couldn’t be wrong.

Doctor I was wondering too.

Where is the outrage? Why haven’t most people woken up to the fact that the people in wallstreet and Government who enacted all of this have basically destroyed the trust that is the most important part of our economy/ along with the rules. Its like the rich are one team vs us the people on another in a sports game and the rich make up the rules as the game goes on. If you are not the rich team you cant win like that. So what you do is stop playing the game. Is this due to the ignorance about wealth ( that it is an agreement and trust that something has value?) or is it more the fact that many people are living in what Martin Luther king Jr. deemed as a false peace and that people would rather live in false comfort then change the status quo?

Thanks Anna.

Lots of good points-one more-when the big bulge of baby boomers gets through the system, it should ease up a little. Just putting in Al Franken’s doughnut hole will take care of anything close to a shortfall:

http://hanlonsrazor.wordpress.com/2008/06/14/barack-obamas-donut-hole-for-social-security/

@Cory

I think the hamster wheel has been spinning so fast we haven’t stopped long enough to be outraged. I hear a lot of complaining, but it’s like cursing the stars–the corruption is coming from so many directions who do you get made at? Madoff? Phil Gramm (mental recession, Enron Wendy, Gramm-Rudman/Glass Steagall)? Mozilo? Jamie Dimon? Where do you start?

Just like Ponzi’s plan, Social Security does not make any real investments — it just takes money from later “investors,” or taxpayers, to pay benefits to earlier, now retired, taxpayers. Like Ponzi, Social Security will not be able to recruit new “investors” fast enough to continue paying promised benefits to previous investors. Because each year there are fewer young workers relative to the number of retirees, Social Security will eventually collapse, just like Ponzi’s scheme.

AnnS, since you defend SS, it is likely you are a bleeding heart liberal democrat and who believes in pro-choice. Therefore, if it wasn’t for the 50 million abortions in this country since 1973, maybe, then maybe, SS can be considered not a ponzi scheme.

Having lived in the Bay area for 13 years and now in Portland, OR I was surprised to read the 81% drop in values in Southern California. Real estate buyers always did bank on the appreciation and because of the steep housing prices and barrier to entry it is no wonder people got into Arms and betting that prices would continue to rise.

This last post is frightening to me in terms of the amount of money our government keeps spending which is driving our economy deeper and deeper into a very difficult situation, one that might take a very long time to get out of.

@Cory

I think the game is chess and we are the dispensable pawns. If senators and reps can be bought for tens of thousands, Madoff probably owns DC. Wonder why he fessed up and just didn’t ask for a bailout like the other cronies? His plan was the same as the mortgage industry, wasn’t it?

Leave a Reply to SickOfTheBS