Million dollar California foreclosures – 35 examples of massive upper-tier foreclosures including one home that is underwater by $2.2 million. Santa Monica housing still in a bubble.

I know some people have this notion that somehow California real estate prices are going to miraculously recover simply by sheer determination and the belief in late night infomercial catch phrases. Instead of focusing on larger macro economic trends they will use limited data that doesn’t capture the larger emerging trend. We’ve all seen those TV ads yet data is going in a very different direction. Inventory is increasing in California. Prices are dropping. Problem loans are still filling the pipeline. These are facts and as stubborn as they are, they tell us a more provocative story about real estate in the state. That story revolves around the fact that a large shadow inventory is lingering and the artificial dams of government intervention are having a tougher time holding back the flood. Today, I wanted to focus on the higher end markets of Los Angeles County to show that contrary to a handful of anecdotal cases, overall there is a bigger trend emerging. The mid-tier market is now entering its correction.

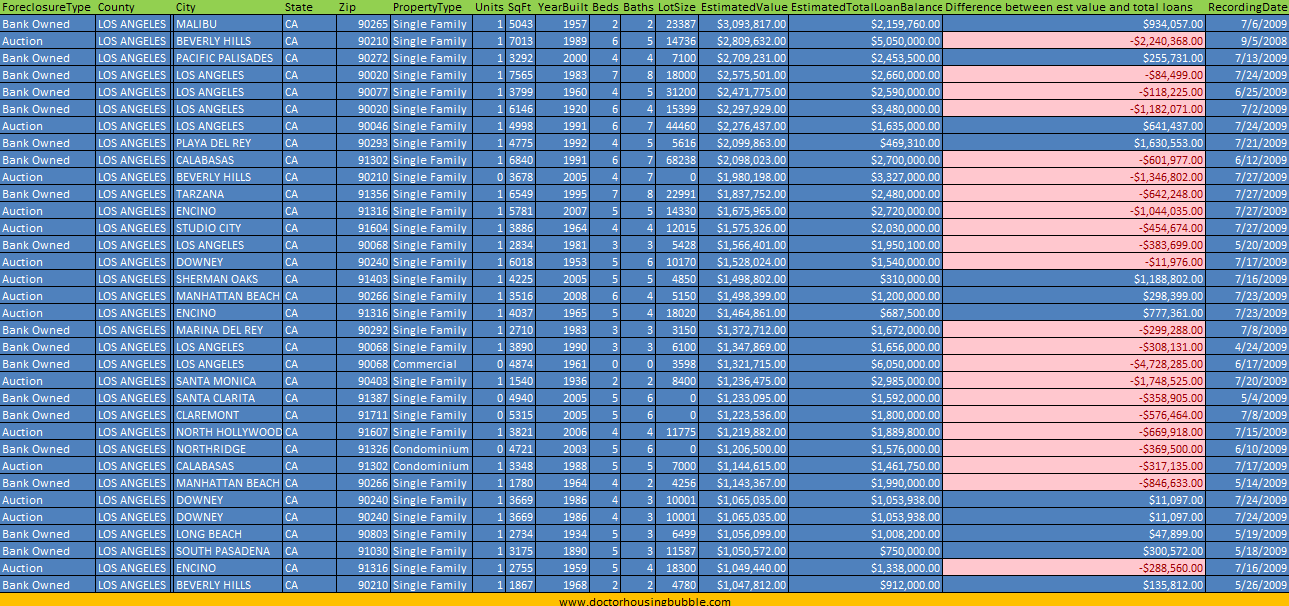

Before we look at Santa Monica our targeted city today, I wanted to provide you with 35 specific examples of million dollar prime location foreclosures in Southern California. These are all in Los Angeles County:

Keep in mind that the estimated value is optimistic and is merely a stab in the dark at what the home would sell for in today’s market. Take a look at the pink highlighted cells. This shows the difference between the estimated value and the amount of outstanding loans. One place in Beverly Hills is underwater by a stunning $2.2 million. It is also interesting to note in some high priced areas people do at times buy with all cash. It is not uncommon for a wealthy individual to purchase a million dollar home with all cash. This happens many times over in places like Beverly Hills. When we talk about the mid-tier this is not the area we are looking at. We are talking about areas like Culver City or Pasadena. The above data is to highlight that even he luxury housing market is getting hammered in this market as well.

So that brings up the question about the health of the overall housing market. These luxury homes are swimming underwater yet many don’t show up on the MLS. Looking at the list we see famous names like JP Morgan Chase, WaMu, Bank of New York, and Wells Fargo to just throw out a few. What will this do to their balance sheet? Hard to say but the strategy right now is to pretend these loans are not underwater. In the high priced luxury market, good luck trying to find some of these homes listed. I was driving down one of these neighborhoods with a couple of foreclosures and life was going on as usual. What is your neighbor not telling you? The driveway was loaded with your typical European foreign cars but the place is underwater by over $1 million and hasn’t had a payment for over a year. The place did have a nice view of the Hollywood sign. Good times in California!

So you want to see a specific example of the bubble bursting in Santa Monica. Let us take a look:

1931 22ND ST, Santa Monica, CA 90404

Beds: 3

Baths: 2

Square feet: 1,282

Built: 1953

Status: Foreclosure

Listing price: $636,000

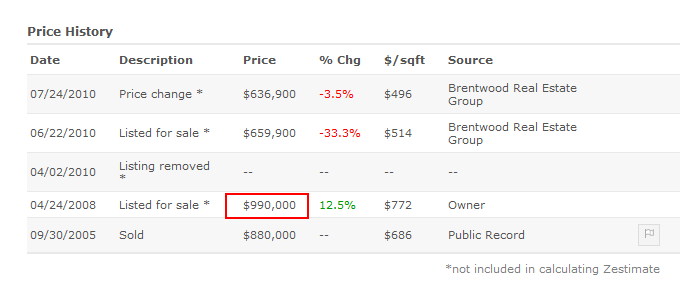

Does the above home look like it is worth $636,000? To some it will because it is in Santa Monica. Contrary to the belief that any place is moving in these markets including the Westside here is some details on the listing action:

Price Reduced: 04/12/10 — $722,900 to $708,900

Price Reduced: 05/04/10 — $708,900 to $689,900

Price Reduced: 05/27/10 — $689,900 to $675,900

Price Reduced: 06/21/10 — $675,900 to $659,900

Price Reduced: 07/23/10 — $659,900 to $636,900

Sure doesn’t seem like things are moving for this place. The price has been dropped by close to $100,000 since April. I pulled up some older data and it looks like someone even attempted to sell this place for $1 million!

Missed the insanity of the bubble by one year or so. You can even see that it last officially sold for $880,000 back in 2005 which is pure madness. Even at the current price this place is incredibly overpriced. Let us run the numbers to see what a typical housing payment on this place would run:

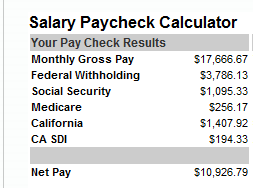

Down payment: $63,600

Mortgage amount: $572,400

Monthly payment (PITI): $4,002

Someone will be shelling out $4,000 net each month to live in this place. Some make the tax savings argument but keep in mind you need to still come up with $4,000 each month because this includes the principal, interest, insurance, and taxes. So how much income is necessary to purchase this place? Assuming our 3 times annual income rule, a household would need $212,000 in annual income to buy this home. Now run the numbers for this:

Only in a state like California will $200,000 not seem like a lot of money. Yet the above is to drive home the point that many homes in “prime†areas are in bubbles but you can see that the market is taking its corrective action. These places would be a Real Home of Genius anywhere else but merely carry the favor of being in a “desired†location. But now, the caveat has shifted to a desired home in a desired location with the right amenities. These places still have a market, (at least today they do). You notice that there are now fewer places to hide from this correction?

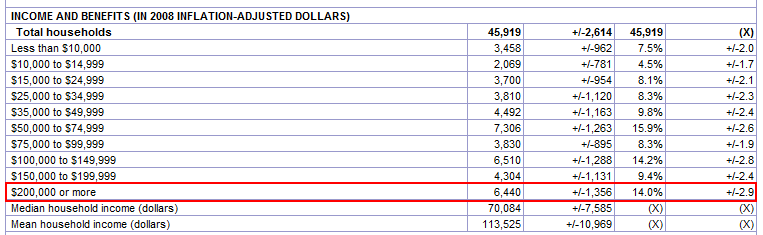

Let us run the numbers for Santa Monica even further. As of the 2008 Census there were 45,919 total households in the city. The income breaks down as follows:

Keep in mind this data is for a very well off area. Only 14 percent of all current households in the city can even afford this place to begin with. No wonder why the shadow inventory is so large. Without a doubt, these areas will be correcting in the next 1 to 2 years. Some say “well we’ve been looking at X home/city and prices haven’t come down in one, two, or even more years.†To that I say broaden your horizon. We’re in a new world folks especially when it comes to real estate. Using old formulas and metrics is not going to work this time. State representatives are already bringing up the idea of new taxes as we have hinted to. If you buy, be prepared to stay put for many years. The buy and hold for 5 to 7 years and sell to another bigger home was simply a widget in the bigger scheme of things. It was a long term bubble. People mistake success in the housing market with actual skill. I’m sure Bernard Madoff’s investors for the 15 year haul thought they were all experts with 15+ percent annual returns until the fund blew up and they lost everything.

Real estate has distracted our economy for too long and the government has artificially supported this market. Those that claim real estate is in a “free market†are delusional and have drunk their own Kool-Aid. Mark to market suspensions, bailing out banks, the Fed buying up trillions of dollars in mortgage backed securities, $8,000 home buyer tax credits, and generous tax write-offs for owning a property. Sure sounds like a free market to me. Even with all that, the overall health of the economy is still suffering but someone is clearly getting the taxpayer bailout funds. Real estate is in for a long haul going forward and we know that other countries have had decades of stagnant real estate prices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “Million dollar California foreclosures – 35 examples of massive upper-tier foreclosures including one home that is underwater by $2.2 million. Santa Monica housing still in a bubble.”

I wonder if anyone has seen the data at;

http://www.businessinsider.com/banks-cant-hold-back-highend-mortgage-repos-for-long-2010-7

If you go there you’ll see a lot of data on just how much of the shadow inventory is being held by the banks.

They cover several counties and metroplexes around the country and in Calif.’s Orange country the banks have reposessed and taken possession of 6,270 homes and only put 227 on the market!

We live in the San Francisco area. Some of the homes here have spectacular views of the bay, and the city of San Francisco. The ones near the water seem to start with asking prices of $1.7 million, eventually drop to 1.4 million, and finally sell at around $1.3 million. These were homes that sold for around $700,000. 10 years ago. So, A) still buyers in that price range , and B) still a profit, if you bough early enough. About 3/4 of the buyers are asian, usually Chinese.

I don’t think anyone seriously plans to live in that house. That house is a tear down in an area clearly zoned for multifamily. The 636k is the asking PRICE OF LAND (doesn’t mean they will get it).

JRS is spot on. The house is located in the ghetto of SM in between I-10 and Pico Blvd. (if you can still call that a ghetto) and is zoned for Multi-family construction. Santa Monica being a Bolshevik run government would love low income apartments in that location but every developer in SM would built townhomes to avoid SM’s over reaching style of government. And if the location were two blocks in either direction, it would have sold. so it has two strikes against it that will reflect in the pricing. Not to say the article is wrong, because generally it is correct, but a better example could have been picked, say from North of Montana Ave. to back up its premise.

There is a whole lot more price decline ahead. What is a house on a parcel? A big box on dirt. How could a box and some dirt be worth hundreds of thousands of dollars, one’s biggest lifetime expense, by any sane reasoning? Was dirt so expensive to make? If you think dirt and a box is worth so much, I can sell you some sky for $3 million to go with it…

In pioneer times, a bunch of folks got together, erected a house in two weeks and voila – that was it. Now a house is what, 10 years of work? (In monthly income.) This is progress? Finally, this collective lunacy is coming to an end.

Ya, that’s right and if you go back further we used to be cave men and living in some bat infested cave was really cool and walking was the most sophisticated form of transportation and stuff and ya, that’s the ticket! 😉

George, the elements of value are subjective period! As long as it’s your cash you’re spending well… anything goes. A box and some dirt? I suppose that’s a spiritual trip your own, right? 😉 Get with the program George, you living in the back woods like the Unibomber? Honestly, I have never understood the value people place in Gold, but some people will kill or die for it. But I sure value a good pizza.

George,

Man that is the truth.

I agree George. It’s not rocket science.

JRS…..

Are you familiar with the area? If you were to drive down residential streets full of single family you would see a of multi family sitting right next to single family.. You can have a residential street, all single family with one giant multi family building plopped down in the middle. You see this block after block. All the other lots on the same street are zoned for single family.

I don’t know if you made your comment based upon the picture but many areas of S. Cal are weird in this way.

@George

In California, they have happy dirt, particularly where happy cows have pooped.

@George: Amen!

Folks have confused the credit expansion over the past 20 years which has blown up RE prices with real value as the bubble deflates most will be bitter bag holders.

I think I realized why the gov’t props up housing. If housing falters further, states and pension plans will fail faster and Sam is on the hook for those too. The whole house of cards will all come down if anything major goes wrong. If the dam breaks too quickly it will be too much. FIRE is the devil’s only friend.

There is something to the supply/demand argument. There are 10 million people in LA County. That’s huge. Say that represents, conservatively, 2 million households. And, among these, 5% are truly rich (i.e., they have millions). That makes 100,000 households that can pay “whatever” for a home. Plus you’ve got all the foreign money that’s been discussed on this blog. So, there will be certain areas, Santa Monica among them (due to location to beach, schools, “hip factor,”), where there is a dearth of supply and tons of demand. Speaking of supply, thanks to prop 13, you’ve got people in Santa Monica who will NEVER leave due to insanely low property taxes.

Look at NYC. That’s the direction we’re headed in certain areas of So. Cal. Conan O’Brien just sold some rooms in the “air” (no land) for $25 mil!!! If I were to guess, I’d say that tear down in Santa Monica will only get down to $600k at the lowest.

Lets net this out .. Yes I am a Realtor…. All this = Downward pressure on price. I am going to send this to all my sellers who are in denial. Yes they now are raising prices after the gov inflating the market with the tax credit.. We have 3 years left of this about – its really not that hard to figure out…. Run the numbers for the last 60 days – sales are down – number of mortgage applications are down “off by 30%”. Sellers are raising their prices….rates are in the 3% range on a 5/1 Arm – Buyers are not buying because they cant afford it and know they can get the same product next year at 10% off. I dont blame them..

@george true. During the boom years, many couples I know bought 4-5 bedroom houses for prices ranging from 500-800k. Granite countertops, chandliers-but tract homes. Now many of these were just the couple and no kids. I grew up sharing a room with my brother and if my uncle came to town-my cousins would be squeezed in too !!!

A short sale is where you come to an agreement with the bank for them to take whatever you can get for the house to pay off the debts. This is a better option than a foreclosure for a couple of reasons: First, it’s less of a negative hit on your credit report. It shows that you took some responsibility to work out a solution rather than just walking away (foreclosure). Second, a bank can go after other assets with a foreclosure to get their money back. This may include hiring a collections agency, who will hound and pester you forever. With a short sale, the debt is just forgiven.

YOu have that backwards. With a SHORT SALE, the lender is only agreeing to release the lien on the property and take the amount of the sale for releasing the lien. It is NOT cancelling the entire debt. And that is when the lender can then go after the borrower for the difference as unsecured debt. (Of course if you can get the lender to agree to accept the short sale price as full satisfaction and accord then you will be off the hook but they have to agree IN WRITING.

In a non-judicial foreclosure aka trustee sale, 99 times out of 100 the lender buys the property itself nearly always for the amount owed on the loan. Since the property sold at auction for the full amount owed (even if the lender ‘bought’ it), the debt is paid in full. If the lender just lets it go for whatever at auction and does not bid it in itself, then it gets interesting. The lender would then have to sue the borrower and prove that the auction price was the absolute best it could do even if it had listed it with a realtor and put it on the MLS for months on end.

Statistically lenders do NOT bother to go after borrowers if the foreclosure was non-judicial trustee sale unless they (a) don’t mind spending $50000 -100000 in attorney fees to litigate the deficency -fees which they will usually NOT get back and (b) the borrower is known to be highly collectible since collecting can cost another $25000 or more in fees.

Now if it is judicial foreclosure where the lender has to sue in court to foreclose and the court orders the foreclosure auction, then that is a different story. There a deficiency jdugement is automatic.

So actually a foreclosure by nnon-judicial trustee sale is better for the borrower than a short sale (absent the lender agreeing to settle the entire debt for just the amount from the short sale.)

Please, please, please STOP that is my comment to all those who think their purchases are worth so very much in re-sale. IMHO those days are long gone and people of intelligence are thankful.

I don’t think the 22nd street listing is overpriced at all. Look at that rug fashionably draped over the unpainted wooden fence. See the windows from the two story structure next door that loom over the property. Listen to the gentle whine of the decades old air conditioner that hangs out of the window. This is clearly a steal at any price. I wonder if they will take my offer if I offer them 100k over list? One can only dream

That house is in the worst neighborhood in Santa Monica. It is so bad that a realtor once refused to show me properties there. Buyers have been so traumatized that a lot of sales are driven by emotion. Any price drop is seen as an opportunity and the so-called incentives are overblown. Unless you are fabulously wealthy or already own, finding decent housing in Southern CA is a problem with no solution. Foreign buyers should have to pay dramatically higher property taxes.

Did you ever hear of the Antelope Valley ?- It’s in Southern California- Even the homeless can afford it.;-)

It’s interesting to compare this property with the property in Detroit on yesterday’s post. The Detroit property was listed at around 2k. It was dilapidated, and in one of those areas in the city that is rapidly running out of people. The area is a great candidate for some kind of eminent domain purchase (if Michigan hadn’t abolished it some years ago, but that’s a different story – it will probably have to be brought back to deal with just this kind of property). The Santa Monica site is not devoid of people. If anything, it looks like this property has way too many neighbors. The lot is small and claustrophobic. There is a much better chance that a factory will someday be built on the lot in Detroit than someone ever wanting to rebuild anything in the Santa Monica lot. Yet someone thinks that lot is more than 300,000 time more valuable? Isanity.

Santa Monica is beginning the big decline now. All zip codes, 90402,90403, 90404 & 90405 are seeing 2004′ prices and below. People who bought the last 3 years of the bubble are now underwater, if you consider maintenance, taxes and selling costs. Even the sacred cow 90402 ,is showing 25% discounts, no matter what the realtors say. This is the start of the next big leg down and banks have started moving properties, because they know the market isn’t coming back.

Be patient, save your cash and be ready to strike, when others have thrown in the towel.

http://www.santamonicameltdownthe90402.blogspot.com

Thanks latesummer…you, like Dr H.B., are doing the Lord’s work, LOL. Preach on!

It’s so frustrating because all of the properties (in middle class reach) have something seriously wrong with them – busy street, bad neighborhood, poorly built condo, derelict house with bad add-on, in flight path of jets from the airport, no parking, etc.

Anyone serious about understanding the RE market in LA might want to invest $10/month for a subscription to Property Shark, which provides access to the original financial documents for individual properties. The amount of leverage and toxic financial products – especially in the highest priced areas – clearly drove the market to these insane levels.

It’s also interesting to see how more recent purchases are being financed. The vast majority of jumbo loans still seem to be what local realtors refer to as “affordability products”, i.e. interest-only or adjustable-rate 40-year loans. Most seem to have put 20% down, but there are very few 30-year fixed jumbos taken out. Can anyone guess why?!

@Darner

“Look at that rug fashionably draped over the unpainted wooden fence. See the windows from the two story structure next door that loom over the property.”

.

.

lolol…exactly! and you forgot to mention it’s only 1 block away from Virginia Park where a couple of people were just shot and killed a few months back! Just think of all of the excitement that could add to you and your children’s lives! Even in a nicer neighborhood of Santa Monica this place wouldn’t be worth $600k in my opinion, but to live in this neighborhood…forget it! No on in their right mind making $200k/year is going to want to live in this ram-shackle dump with a crappy apartment building with bars on the windows looming over them. How are they going to impress their friends and associates with this place? And no investor in his right mind would buy this either. How would are they going to rent it out for $4500/month?…I will say however after reading the above article that there seems to be no shortage of people who are not in their right mind. I guess the question is whether they can get a loan to finance their madness.

Not much leaves me unable to say anything other than “holy crap,” but it happens multiple times a week here at DHB.

~

Gotta wonder how many “deals” like this are lurking in the shadow inventory of the banks.

~

They really mean to bring everything down–every last iota of the middle class, every hope of anything other than serfdom.

~

“In the end they will lay their freedom at our feed and say, “Make us your slaves, but feed us!'” Doestoevsky’s Grand Inquisitor, talking to Christ.

~

rose

A relative with a house purchased in the Inland “Empire?” for $440K just went through foreclosure. Had a neg-am first with Lehman/Aurora at $420k balance and a 2nd at 45k. Owed a total of over $460k. After getting nowhere with a loan mod request, he defaulted on the first in 11/09 with an auction occuring in 05/10. The bank under-bid the property at auction for $178K – no bidders – property reverted to the lender. I just checked title; 3 months later and it still isn’t listed. He’s now renting at $1,900 mo.

That generation of thirty-somethings that took the brunt of the hit were savaged by the FIRE economy. Used and abused and tossed aside. “real estate always goes up” “real estate doubles every 10 years” “you better get in now before you get priced out forever” and such other realtor touts. Pardon my french; but that was a truly phucked up thing to do to that generation.

Any advice? We bought a 4-unit back in 2002 for $245,000 in 90813. We want a single family house in 90815, we waited and waited and really want a house. How much more time should we wait? We have maybe about 20% down for the area and could afford the 15-year payments should we start looking? Or, should we save more and buy another reo? Or, should we wait some more?

help,

chanthy

The “estimated value” of these homes should be correctly labeled “fantasy value.” Absolute insanity, I say. As far as the ugly home in Santa Monica selling for $636K, a person buying it at that price should be committed to the insane asylum.

What profession pays $200,000? And why would they want to live there? I just got back from visiting an old friend across town in my old West Pasadena neighborhood by the Arroyo, right around California Blvd./S. Arroyo Blvd. Cute little house a couple doors down from her on the market–2 bed, 2 bath, 1681 sq. ft….. only $1,048,000.00! I used to dream about moving back into that area, alas, it is just a dream.

Mortgage rates keep sinking and yet applications are at a 14 year low. I would not be surprised if the FED’s resume buying 10 year treasuries to further lower 30 year mortgage rates to 3% range, to stop the downturn. Yet, will there be buyers? Unemployment is high, and people are tapped out, due to high gas prices and higher taxes.

Excellent analysis.

The REAL way to price properties ALWAYS ( and why i told everyone the market would collpase 3 years before it did)

is to compare the price of owning to the price or renting a similiar property.

Right now you can rent one bedrooms at $600-2000 a month and 2 bedrooms at $1200 to 3000 in Santa monica area.

People lost sight of this.

It was cheaper to rent.

It still is. that means there is more collapse left.

The artificial expectation of speculator feulded Equity increases in the house prices are gone now and we are back to the fundamentals – “where does it cost me to live the cheapest”

The expectation of rising equity by owning is gone for a long time.

So houses on the market will now directly compete in price against rentals – period.

Though I know the Inland Empire has returned into sand

Vanished from my hand

Left me blindly here to stand but still not sleeping

My weariness amazes me, I’m branded on my feet

I have no one to meet

And the ancient empty street’s too dead for dreamin …..

The subject property is under contract, FYI, at a last listed price of $625K – one price drop from where Dr Bubble discusses it. I would not be surprised if the buyer demos the house to build an apartment building, since much if not most of the housing stock in the area is apartment buildings.

Leave a Reply to Margaret