Millennials shun the housing market: 6 in 10 Millennials would rather rent a home than buy it. First-time home buyers at record low levels.

Millennials have a very different perspective on the housing market compared to their parents. I’m sure many a Millennial has talked with their parents and realizes that being chained to a massive mortgage is not exactly part of the American Dream. Beyond this difference in thought, many younger Americans are simply not in a position to buy especially in high cost states. In California we have 2.3 million adults living at home with parents. And they are living at home because of financial issues. Many in fact cannot afford the high rents in expensive metro areas. So it is no surprise that a recent survey found that 6 out of 10 Millennials would rather rent than buy. Now why is this important? It is important because people don’t just make the biggest purchase of their life on a whim. Even for the pathetic 5 percent down payment, you actually need to put money away given you’ll need those funds at closing. It takes a bit of planning but it appears that most are just not looking to buy. And the market stats reflect this. First-time home buyers now make up a record low percentage of all home sales. Millennials are saying no to buying homes.

Millennials prefer to rent

There was an interesting article discussing the trend of Millennials not favoring the housing market. They call it the $700,000 mistake. The assumptions of course assumes you are buying your regular American home at a cost of $200,000 and rents are comparable. Those are big assumptions. But what if you live in a bubbly area where rents and carrying costs are dramatically different? The only way this difference can change is with a mega down payment that many simply do not have. I’ve joked with people before that you can effectively lower your carrying costs to near zero with a large enough down payment. With a big enough down payment, you can make the numbers say whatever you like.

The article essentially assumes someone rents and doesn’t invest versus someone buying a home and then owning it after 30 years free and clear.

“(MarketWatch)  Most millennials say they’d rather rent than buy a home — a decision that could cost them more than $700,000 over the course of their lives.

Nearly six in 10 millennials (59%) say they’d rather rent a home than buy one, with just one in four saying they are either very or completely likely to purchase a home in the next five years, according to a survey of 1,300 millennials released this week by EliteDaily and Millennial Branding. (This anti-home-buying trend can already be seen: Currently, only about one in four millennials own a home, down from about one in three in the mid-70s and early 80s, according to data from the Demand Institute.) That’s “bad news for the real estate industry,†the report concludes.â€

I actually agree with the article since it is using your standard priced $200,000 American home. But what about buying a $700,000 crap shack that has shoddy construction and is basically a drywall stucco box? This is where the math isn’t so easy since most people don’t stay in homes for 30 years and in California, they are lucky to reach the 10 year mark. With that said, you absolutely are speculating on appreciation building up your equity for your property ladder aspirations. Millennials are having none of it. The survey found that 6 out of 10 would rather rent. And we are seeing this reflected in the number of first-time buyers in the market:

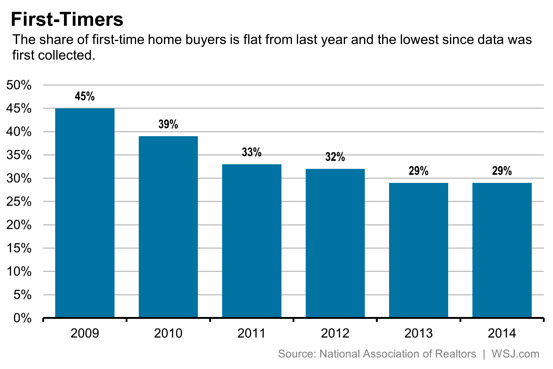

In 2009 49 percent of all home sales went to first-time home buyers before investors dominated the game. This is a healthy balance. Today it is down to a record keeping low of 29 percent. You also have to remember that home sales volume since 2008 has been absurdly low. For the last half decade, investors have been the dominant force in home buying.

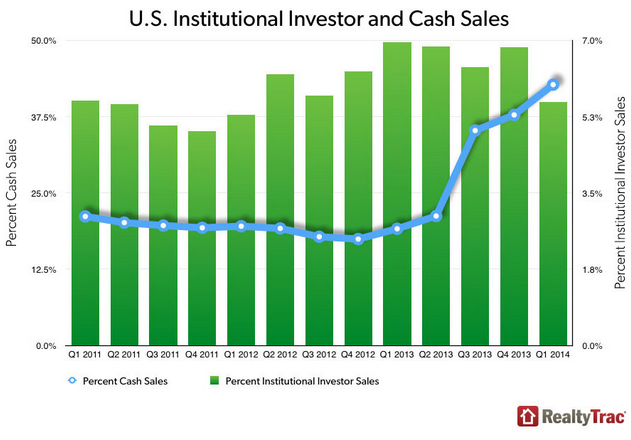

Just look at all cash sales:

How many Millennials have all the cash to buy a $200,000 home let alone a toxic dump $700,000 crap shack? I would venture to say not many and the data backs this up. What is happening right now is you have thin inventory and for those with house lusting urges, they can go with a low rate mortgage and leverage their way into housing heaven.

This idea of pent up demand is largely wrong and has been wrong in expensive areas for younger buyers. Prices are going up because of Wall Street investors, foreign buyers, and those leveraging up from previous purchases on low interest rates. Those that think they missed out are actually outing themselves as speculators because they would need to sell before cashing in on that equity. They also missed out on a 200% jump in the stock market since 2009 but they fail to account for this opportunity cost. You could have bought a $500,000 crap shack that is now worth $700,000. Or you could have bought $500,000 in the S&P 500 and have close to $1.5 million. In life you are faced with opportunity costs. If you want to buy, go for it. However, smart people are running the numbers and seeing the price tag of what they can buy and are scratching their heads. First-time buyers are largely absent and these surveys show that a mindset change would need to happen before it occurs.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

149 Responses to “Millennials shun the housing market: 6 in 10 Millennials would rather rent a home than buy it. First-time home buyers at record low levels.”

I still wonder if home ownership is a plus or minus.

A couple of countries that are considered economically strong (Switzerlnd and Germany) have low home ownership rates. The home ownership rate for the Swiss is 36% and in Germany it is 49% I think.

But, but… I thought “owning” is a pat of the American Dream and the only way to the riches

/s

LISTEN carefully you KIDS,the older generation are nothing but LIEING THIEFTS,If you buy a home,likely as not they have passed a law allowing them to steal it from you,SO are you going to buy a home just to see it taken from you by a pack of old thiefts???

Roger that Arizona, the older generation are a bunch of selfish thieves including realtors and bankers,but I do still think the millenials I know lack some ambition as well,it is a sad formula.

The Millennials seem to me to be a bunch of slackers with no ambition and too much time on their hands. IMO The Millennials make the Gen X’ers look like go-getters.

Hunan, you are too harsh.

The Millennials look to ME like the most disadvantaged generation since that of my grandparents, who hit adulthood at the time of the 1929 crash, and lost a whole decade to the Great Depression. My grandparents lived with my grandfather’s parents in their 10 room house for an entire decade because you were frozen at whatever level career- wise that you were at when the debacle began. He was just grateful to have a career- track job and a nice house to live in, because thousands of people in his line of sight couldn’t even make a living. His generation, too, had been cossetted and spoiled growing up in the go-go teens and twenties, just to face some very rough realities that nothing had prepared them to deal with. But the made it eventually- my granddad became quite successful after the war.

Today’s young seem to have it easier but it is really much worse. At least in the depression, we still had all our nice new factories, our sturdy farms, and nice towns and cities. Those are all gone now. We have no industrial base at all left. And you could become quite successful without even a high school diploma, while our younger people now have to take on crushing debt to have half a chance at a mediocre middle income job. Our young now face a very uncertain future in a country that has burned through its resource base and hollowed out its industrial core. It makes me very glad that I’ve lived most of my life and don’t have that much in front of me.

Because its fun to spend all their time on the internet???

Laura: “Today’s young seem to have it easier but it is really much worse. At least in the depression, we still had all our nice new factories, our sturdy farms, and nice towns and cities.”

No, it’s not worse than during the Depression. Back then there were no government safety nets. No social security, disability, welfare, food stamps, school lunches (and school breakfasts and school dinners), housing vouchers, housing projects, plus free hospital emergency room services.

Sure, no student loan debts. Because there were no student loans.

ALL BULLCR*P!! You don’t know anything about what life was in America in the first half of the last century.

The kids today (including the Baby Boomers which I’m also a member) have never had a hard day in their entire lives.

You are sugar coating history with your ignorance–life was hard back then. And then there is THE WAR. People today have no concept about how hard THE WAR was, and we had it easy here in America!

Also, if you’re under the age of 62 the Vietnam War didn’t affect you at all. And the vast majority of American males of service age during that war DID NOT go there or become a combat casualty. The vast majority of men who fought in the Vietnam War volunteered! So the vast majority of the Baby Boom generation also didn’t have to face war.

Today the kids have grown up with unprecedented affluence–they lived their entire lives in the most affluent, rich and prosperous time in HUMAN HISTORY! Their world is full of milk and honey with gold dust falling from the sky.

And just because they can’t have the same level of affluence that they’ve become accustomed to, they bitch and moan about “How Hard” they have it!

What a bunch of nonsense….

Most of America’s problems today are self-inflicted. We have the largest prison population in the world filled mainly with minorities who come from a permanent underclass.

We have 90,000,000 Americans who are able to work who are unemployed. We have record numbers of people on disability. We have millions of illegal aliens who just mess everything up and burn up government resources.

“Underrepresented minorities” are dragging society down with their lack of job skills, education, intact families, crime and just plain laziness. Since the “Great Society” days we’ve created a Frankenstein monster.

Americans are killing the golden egg laying goose by our self-inflicted wounds. Government spending out of control, a population that can’t act with responsibility and young people who don’t know what work and suffering is.

We’re an “Entitlement Generation” today–everyone has their hands out expecting their fair share.

Sorry, nothing in the world is free or fair. That’s just the way it is.

Wow I agree with zzy for once. But I also love it! I had a phat ride in high school, leathered out and power everything, CD, rims, that was the early 90’s. Now all the kids have Audi’s, BMW’s, if their car is more than a few years old they are made fun of. Well, in the nice areas anyway like north of the 101/134/210 cities, South Bay, and South Orange County.

Thank you for that thoughtful and reasonable reply.

Like I posted last year the boomers are spoiled and their kids and grandkids are paying for it

I agree with Son of a Landlord. Today there are so many safety nets & hand-outs which did not exist years ago. Especially in California. The idea of a principal reduction or debt forgiveness were unheard of years ago. I personally know people who made horrible financial decisions in 06-07 and have since received bail-outs and federal sponsored modifications at taxpayers expense. It’s like America can’t have losers. What about subsidized healthcare, housing, cell phones? Obama even wants to give free community college. Now, who has it easier?

To people saying millennials don’t know what hard life is like, citing social safety net programsand food stamps…

— At least in 30’s when you received food, you knew it was FOOD, rather than inorganic chemicals and nitrites extruded and molded to look like food. SNAP doesn’t mean much when most of your groceries are the latter.

— The regulations put into place by the depression generation and the boomers who followed have rendered the extreme measures used by those previous generations to weather extreme economic hardship. They COULD live in tents or shanties, they COULD live in their cars. Today you will be arrested for such subversive activity.

— In the pre-digital ages, you could dress nicely and pass yourself off as presentable, even if homeless, and schmooze your way into a job. Today, any application not submitted online is not considered, and you better be able to fake it through dozens of automated screenings designed to arbitrarily weed out “undesirable personality traits”.

**The job app process would make Orwell and Huxley cry in one another’s arms!

— When faced with inevitable cuts to safety nets by republicans in the 90’s, the left went full-on bigot: if you’re white and male, those safety nets effectively do not exist in the US anymore.

**Millennials are stuck with unnecessarily onerous required costs of living imposed top-down by government who think they know better than we do what we need, and corporations going along with it because they know mandatory purchases will come from it all.

Boomers and the depression-generation created this dystopia, and now call us “spoiled” for daring to try to live in it.

Blargh is upset because he doesn’t like the food options available to buy with his government stipend. Nor does he like the idea of living in subsidized housing versus living on the street. He is really upset that current employers can easily check references and resumes via the internet.

Are you kidding me? These are your arguments? You must be a Millennial.

“The Millennials seem to me to be a bunch of slackers with no ambition and too much time on their hands”

Ahh, the old people who had it easy when they were young.

Which part of student debt, high unemployment _and_ every day lowering salaries you don’t admit to exist?

The days you could pay tuition with summer job and buy a house with your first salary and had it paid in full in 10 years were somewhere in 70s and the world is quite different now.

I should know, I was there to see it. But I also see what is the reality now.

Well stated

Hey Tom, who’s responsible for the student debt of these lazy bums? Huh? What unemployment? What about housing?

Seems to me that compared to say, 1920, young people today have it pretty easy. Do you know anything about life in the last century? Try reading a book instead of crying in your latte at Starbucks.

No one goes hungry today in America and being impoverished means that you use dial up service for your internet connection. And you use a pay-as-you go cellphone.

And you only eat out 50% of the time. And you drive a used Honda. And you share an apartment with 2 other people.

And you can’t afford to shop at Gelson’s.

Oh the horror. What a bunch freakin bums….

ZZY do everyone a favor and be quiet. Thomas got it right. And do me a favor a retire already so I can take your job.

What is the demographic of the first time home buyers who did buy that’s what I want to know?

I’m in the Gen X boat I guess. I’m not a slacker as Hunan suggests. I have a tech job making six figures as does the wife. We live in SoCal, specifically the SGV, and are looking to buy here but even with the sizable amount of money we’ve saved, I really don’t want to buy right now. Mainly because the world economy looks like $hit and the US economy is about to take a dump too because the US economy has become dependent on high oil prices and those prices being forced down will reveal how weak the US economy really is (and host of other factors too but I think oil will be the “black swan” event that is the catalyst for the economy failing).

You need to remember, the rest of the world has HIV and we only have crabs. 2015 and the next few years are projected to be very good for the US, as the “money printing” and “fake recovery” hit their stride. And the rest of the world being bad is GOOD for the US.

There will be another recession someday, there always is. But sitting around and waiting for it is foolish.

Betting on sustained deflation? Don’t fight the fed.

@sakmann

The FED has created deflationary cycles purposefully on many ocassiuos, most recently 2008. I think you are fighting the FED if you don’t think they don’t want theses crashes from time to time. it’s how they keep control. “First by inflation, then by deflation…”

@Realist

I agree with the other guy, you’re What? for sure 🙂 Funny stuff bro…

~~I was never What? ~~ I was PapaToBe and PapaNow~~

@Sakman – Betting on sustained deflation? Don’t fight the fed.

The FED has screwed it before, why would it be different this time?

Gotto agree, I have a niece 20 still living at home, parents enable them spoiling them thru the years. Most never worked as teens either. Can’t blame them for not buying houses if they’re smart they won’t and will remember the housing bust in 2008 on and many foreclosures and home prices tanked. They’s also be smart not to raise a family since this country is crapped out as politicians are greedy scum bums who have allowed much of this to happen (jobs outsourced) along with the banker scandals, corruption. All politicians care about is getting grant money for their state or local area and nothing else. Young people need to learn a trade since that cannot be outsourced, then get off their butts and get a life.

If only 29% of home buyers are first-timers, versus 45% just five years ago, then we are looking at serious, structural changes in the real estate market for many years to come. Attention all real estate professionals: the market ain’t coming back. This is the new normal.

Numerous market observers keep reminding us that asset prices in general (stocks, real estate, bonds, etc) are quite high based on historical metrics. They are calling for a return to the trend and warning that this time surely isn’t different. When Jim Taylor made his farewell post, the response by the readership on this blog was incredible. There was much sympathy for his call that housing would tank hard.

In hindsight, everything tends to look so obvious. We had a dot com crash and a housing crash in the US that many predicted correctly, but if we apply the same predictive logic to today, what do we conclude? The bubble pattern is quite simple. Central banks ease until inflation gets too high. Then they tighten and a crash happens. If we apply the same historical pattern to today, then we are nowhere close to the top. If Draghi, Yellen, and Kuroda want to achieve their 2% inflation target, they’re gonna have to double down on their QE efforts, because they’re not doing enough right now.

In the past we had frequent crashes because with lower debt levels, it was easier to achieve escape velocity and central banks would err on the side of easing too much, forcing them to tighten too much afterwards to contain inflation. Now it is plausible to speculate that with higher debt levels, the risk is no longer easing too much. The risk is that they will not ease enough. As debts build up, the timing of the central banks has to become more and more impeccable to avoid the next recession.

However, with inflation way below the target right now, I see no reason why central banks won’t continue to surprise markets positively over the next two years. It must be considered a likely scenario that the next big crash or economic downturn will not happen until central banks try to contain inflation, and that could easily take another 5 years or even much longer.

In hindsight, it will then be obvious to everyone that increased debt levels relative to GDP made economies easier to manage, allowing central banks to avoid triggering a recession for an unusually long time.

There is an interesting chart comparison by Zero Hedge that illustrates why we are unlikely to see inflation soon: http://www.zerohedge.com/news/2015-01-24/spot-difference-money-printing-then-and-now. I am not sure how many readers are actually careful enough to really spot the difference in the two charts. The trick employed by Zero Hedge is to compare retail prices in the Weimar Republic with the monetary base in the contemporary United States, and noting the similarities. If you look closely, you will see that in the Weimar Republic, retail prices took off on their own without a sudden surge in the monetary base. In other words, in the Weimar Republic, prices rose first and then the central bank tried to print money afterwards to try to pay the bills. Today’s central banks are printing boatloads of money and retail prices aren’t rising fast enough for them.

“If Draghi, Yellen, and Kuroda want to achieve their 2% inflation target…”

I’ll say they are lying and they know it.

You’ll never get price inflation by dumping boatloads of money to a huge bank as it’s not going anywhere from there (or at least not into consumption): Only people benefitting from it are the bank owners. Who happen to own FED too. What a coincidence.

So they know they are inflating dollar for ultrarich but as wages aren’t rising at all, prices can’t raise either (except for speculators, different mechanism). Again the ultrarich get richer and all others get poorer and that’s the goal of FED: The BS they talk is irrelevant, smoke and mirrors: You have to look at what they do.

At least to me it’s obvious they do nothing at all to raise wages, the trigger for hyperinflation, so people just buy less with their inflated cash: They can’t take more debt as they already have debt up to the ears.

There is zero printing taking place. The money supply in US is not created through printing. A small percentage of the money supply is printed on paper by Treasury for circulation. However, that is not increasing the money supply – it is part of it.

Every single dollar of the money supply is created through borrowing, by the banks or by the FED by lending to the banks. If there is no borrowing taking place, there is no increase in money supply even if they are available. If everyone signs bankruptcy or pays off debt, there would be no dollar in the economy.

The FED and the banks can make funds available for borrowing but if people are afraid to borrow (for loosing their job) or don’t want to borrow, or can’t qualify, the money supply is not increasing – the FED is pushing on a string. That is the reason the US and EU are afraid of deflation not inflation. When all the jobs are outsourced to lower wage countries, people are afraid to borrow or can’t. No borrowing, no increase in money supply. Again, money are not created through printing. That is the reason you see deflation not inflation.

So, if you bet on money supply increase via printing you are going to lose. Guaranteed!

I agree with this. I think they are afraid of deflation because if it happens the economy will take off and they will lose credibility for their deflation is bad mantra all these years.

There is the viewpoint that QE is deflationary because what you are doing is substituting an interest-bearing treasury note with non-interest bearing cash. However, in the aggregate, borrowings must always increase so that there is enough money to pay the interest.

As for betting on a money supply increase via printing, that is something I was seriously considering doing. I’m trying to think ahead and predict the next major surprise we’ll see coming from central banks. At some point, central banks may admit that QE isn’t working, so they’ll try debt reduction, where a scheme is devised to pay down debts with freshly printed money, hoping that lower debts will allow faster economic growth to happen.

Vegas Landlord,

The money for interest is not created. That is the reason for economic crises – all the time. The interest is the wealth transfer from producers to the financial sector which grows every year and suffocates the real economy. That is the reason the financial sector currently reached 40% of the economy. The current economy is no longer creating wealth; it just transfers wealth from producers and middle class to the financial elites.

You need to learn the difference between money supply which has gone through the roof and money velocity, which has collapsed.

Markar,

I know the difference between money supply and velocity. I was talking strictly about money supply. On that you are wrong. From 2007 to present, the credit money supply contracted from about 70 trillion to about 50 trillion. That difference of about 20 trillion pretty much wiped out the middle class and the real economy is on life support, unless you believe the propaganda of central planning.

flyover

dude, they have already printed 4 TRILLION. like theyre going to stop now. the mere thought of the fed simply raising rates has the market taking big losses. the stock market wants printed money and will and has thrown a fit each and every time the fed hasnt tipped its hand about printing more money.

They print and inflate through credit but if you go off Zero hedge you will be broke very soon

Realist,

Did you ever take a course in Finance? Did you ever learned how money appear in the economy?!!!???…The economy can work with no real hard cash (what you call printing). Printing does not increase the money supply with one single dollar.

Credit is a different story. That is exactly what I said – every single dollar is created through debt. However, what can you do when people sign bankruptcy, pay off debt and can’t borrow or are afraid to (for loosing their job)? Then the money supply decreases and you have deflation. That is the truth – does it hurt? Maybe not you personally (I don’t know your financial situation); but it does hurt the economy and the real estate. It doesn’t matter what you or I like to see. What I said is the TRUTH regardless if you accept it or not. It doesn’t matter if I like it or not. The reality it is what it is.

@Vegas Landlord – If Draghi, Yellen, and Kuroda want to achieve their 2% inflation target, they’re gonna have to double down on their QE efforts, because they’re not doing enough right now.

I am not sure on What? planet you live, but on the one I live the inflation (I mean the price inflation, not the increase of money supply) is way way over 2%. The food and energy prices go up every month, even though the oil and gas prices go down. Utilities are up, even though the Nat Gas prices are down. The rent is up, the health insurance premiums are up, just got my car license plates renewal tabs, they are up $5 this year (about 7%)… yup, some TV sets are down, I agree, but you would not measure price inflation by TV sets prices, would you?

Vegas Landlord

you talk like the 2% inflation figure is accurate. please

Vegas Landlord

QE is deflationary?

hahahahahahahahahahahahahahahahahahaha

I am 26 years old with a very secure $100k year job, pension, maxing out 401k, zero debt, excellent credit, and $110k in savings. I’ve been very fortunate to find a great job and kept a low overhead which has allowed me to save quite a bit over the last 4 years. Unfortunately I missed the boat timing wise for purchasing at discounted prices in San Diego as the bulk of my saving has been done in the last 2 years.

I’ve watched single family home prices climb and climb over the last few years as i’ve been saving and am starting to get worried that they will never come back down to what I consider “affordable” levels. I would love even a 10% correction in SD housing, and would ideally purchase a $425k-ish complete fixer upper with 20% down and fix it up from there. The worst house in the nicest neighborhood I can find!

Currently I rent a small but nice 1 bedroom apartment 2 blocks from the ocean with my significant other with a total cost of $900 to me after rent and all utilities/wifi. I love the area we live in and although the apartment is very small I can see myself doing this for a few more years and continuing to save at a slower rate. My only concern is that prices will continue their upward march and all my efforts will be wasted in the long run. Prices seem crazy to me and flipping activity is rampant in the areas I look at. My initial inclination is to keep saving and keep a low overheard and wait for a potential correction.

” My only concern is that prices will continue their upward march and all my efforts will be wasted in the long run”

Big pile of cash is never a waste. Even if you can’t use it to the original purpose (house). As the doctor said houses have appreciated 50% while stock market has risen 200%, better investment than a house even if you pay the rent from the profits.

Housing is already at the peak of the bubble and there’s only one way from top: Down.

I’ll peek to my crystal ball and say it won’t take a decade, but years. How many, I don’t dare to guess: Current ‘no sales’-situation can’t continue for ever as banks aren’t getting new customers and those bring money in.

Of course the big banks get their money directly from FED but the others don’t have it so easy. It will be intereresting to see what they do.

Kristopher,

I’m in the same boat; my wife and I are a mile from the sand in a nice little 2/2 apt, with all utilities paid for $1725 a month. Today I went to an open house in west Costa Mesa and had a good laugh; the place was a dump and needed a $100k overhaul to be liveable – the agent also implied that the area might be a little ‘colorful’ for my family and I. List was $625k for 1400 sq. ft.

I don’t think you and I are missing out on much of anything. I’m happy to keep saving: people will probabky call me naïve, but half a million dollars should at least get you something liveable.

Same here..south OC….250k cash available….but for 700k you can get only some junky house.

I rent 2br, 2bth 1150sqf for 1750$….I’ll keep saving

See my reply to Vegas Landlord to understand why I wouldn’t buy. Then, they are your money, therefore spend them when and whatever way you like. If you buy, at least do it with your eyes wide open and understand what and why you are doing it.

People look at the US history and try to project the same past to the future. That is wrong because the US no longer has the same % of the global GDP and it is no longer in the unique position it found itself after WW II. That position and the cold war allowed a strong middle class. Today we have globalization and that decimates the middle class. Without a strong middle class you can not have major borrowing and increase in money supply. That is a recipe for deflation not inflation.

The FED understands this and that is the reason they orchestrate with EU all kinds of strategies. They try but they will fail for reasons I stated. At least they will say that they tried. You have gravity and you have the consumer psychology. They know that they can not overcome the gravity of the market; at least they try to change the psychology of the people. However, you can not sustain indefinitely the psychology of the people just with smoke screen and no substance.

Stay put. Your patience and frugality will pay off. Trust me, I am more than twice your age and made it with the “get rich SLOWLY plan.” Worth mid 7 figures and never had much at risk.

You are almost like me when I was 26. Let me tell you that I think you are about to make a gigantic mistake. Let me explain. I live in Norway. We had a housing crash in 88-1992. Then prices started going up, and many were scared. What we did not grasp was that when there is a housing crash (like minus 40/50% or more) it is over. You do not get a second crash, its history. I waited for a correction, or another drop, an it never came. House prices increased much faster than I could save, and saveing Money reduced my quality of life at the same time. Not buying something after the crash was tha biggest financial mistake in my life! Do not listen to all those people that only see negative Things going on. It took me 20 years to catch up with those who bought property the first 5 years aften the bottom. It will make you miserable when you find out that not buying because you are careful, actually turns out to be the opposite since you are GAMBLING on lower prices.

Based on my experience and what you Write about youself I would suggest:

Play it safe. Buy something like the place you allready rent. Now you are paying someone elses mortgage. Maybe buy something a little bit bigger. Forget fixer uppers. Buy something that only needs cosmetic work, and easy to sell. Now you will be paying $900 to yourself, you have a foot in the real estate market(you can survive an up or down market). You have to live somewhere anyway, and you can continue putting some Money away for something better later. Like me you are smart, and consider house prices wrong. Stop that kind of thinking! Do not copy my mistake!You will regret it. After a crash house prices og up first. Wages, inflation, etc. follow later, this is what fools everybody. Finally: do not trust inflation numbers when it comes to real estate. They will be wrong. In ten years, if you do as I suggest, you will understand and it will be a lesson that can make you wealthy later in life. Good Luck.

“Do not listen to all those people that only see negative Things going on.”

Yet, here you are on a house price skepticism blog, not living with the realities in this area and citing some event in another country as reason alone that it will work out the same way here.

“What we did not grasp was that when there is a housing crash (like minus 40/50% or more) it is over. You do not get a second crash, its history.”

We’ve had many housing price crashes here in SoCal. You’re either being disingenuous or seriously misguided. Will you be there to indemnify this guy should it not work out as you purport it will? Nope, didn’t think so.

Artic Guy,

“Past performance is no guarantee of future success”

“Never try to catch a falling knife” – it can hurt

Only one crash?! Your kidding me, right. Here in the US we have had multiple real estate crashes, 1981-82, 1990-1991, 2006-2008 and guess what, there will be another coming up sooner or later and I say sooner. Economic trends and demographics do not look promising for the U.S. I say its best to stay liquid, save money, live life frugally. Be diversified in highly liquid assets, gold comes to mind as one choice.

Siggy has some good points. Of course we are talking about two different real estate markets. My point was that reading about Kristopher was like going back in time for me, and I wanted to tell him how it turned out for me. I am not giving advice. I was trying to tell him what I should have done based on similarities with my situation. Kristopher has come here and asked for input. That is how I see it. He has to do what he thinks is best for him. So Siggy is right about me not taking any responsibility. I am just sharing my experience.

About real estate crashes and history. What I meant was that after a crash, it takes many years before there comes another. In my experience the next crash does not bottom under the crash before. The bottom here in Norway was 1992 and many now think we are heading for a new tough period. Well, we are talking over 20 years here of rising house prices. Most apartments in Oslo (the capitol) have risen a lot in that time. If someone said that an apartment would cost 4-5 times more 20 years later, that person would have been looked upon as a nutty dreamer. California is of course different, but I understand they said that real estate in California can only go up. We had the same attitude in Norway before 1988-92.

I am sorry I seem to be on a wrong site, but I am interested in Californian real estate. I will stay away from here from now on. Kristoffer seems to be a very responsible person, so I think he will be allright whatever he chooses to do. Not being tied down

to real estate and having money gives flexibility that can be of great value. So I agree

with many here. That is why I did not buy myself twenty years ago in Norway, and for me it turned out to be a big mistake! I should have bought something, like a tiny apartment that I could live in or rent out. If the market had turned down again I would have survived it since I still would continue to save.

Hopefully my experience has been of interest to somebody. Over and out.

“In my experience the next crash does not bottom under the crash before.”

Bingo. You hit the nail on the head with this yet no one admits it has been the same in California. On the long timeline prices have increased and you can’t argue with that.

When prices were in the toilet a few years ago the same clowns on here were screaming don’t buy, they are going to get much lower, you are an idiot if you buy now, etc.

Arctic Guy, stick around. You don’t have to be in CA to be interested in CA real estate. Your initial comment was thoughtful and your response was both polite and respectful.

“In my experience the next crash does not bottom under the crash before.â€

In nominal terms. USD continues to gain strength and CPI can barely stay off the ground. DHB writes about the wage story for a dammed good reason, much as others try to spin it as irrelevant or attempt to reframe the debate on narrow outliers. Mean reversion is a powerful force beyond the purview of central bankers, flippers, and food truck connoisseurs.

I’m sure your story is of interest to some, but the question remains – how relevant is it when used as a basis for telling some guy he’s making a huge mistake? Nobody said you were on the “wrong” site and shouldn’t voice your perspective, but if you make hyperbolic statements of the sort that tell others they are making a huge mistake for exercising prudence, expect to be called out on it.

All that said, this is one of the best resources out there to learn the truth about SoCal real estate. As far as I can tell, DHB is one of the few putting out articles about the situation not on the dole from the FIRE industry.

Dr. HB, This is one of the Better posts.

I have owned 5 homes in CA, starting in 1972, when I got out of the Army.

Homes were cheap then, there wasn’t a lot of money chasing them.

Now you have a Realtor with 15 offshore clients

Of the 5 homes (mortgages) that I owned, I only made money on 2 of them.

Divorces, job losses, family situations, force you to sell. Only a lucky few stay in one house for any length of time.

After the Realtor (Realturd), termite man, roof man, inspectors, appraisers, Title Company, and County take their cut, you don’t have a lot.

They love it when you move.

I had a Cal Vet loan on one of the homes, when I sold they charged me a $2K penalty for selling too soon.

I rent in the Bay Area because I get more bang for my buck. I cannot afford this neighborhood in Fremont.

It wouldn’t be smart to own a $700 K. crap shack, or a 20-year mortgage at my age.

And don’t forget the $ 7K tax bill every year.

Millennials are smart, you don’t own the house, the house owns you!

I see it from two perspectives:

1) House construction will eventually be automated and commodities used in house construction will continue to become cheaper as time goes on. Eventually, all houses will become worthless, so only the land matters. Buy the best land you can because this will be the scarce commodity of the future.

2) Housing in coastal California is ridiculously overvalued. Jobs will eventually move to wherever people want to live, as working from home and living on welfare become more commonplace. Fundamentally, there is little useful for humans to do anymore in the economy and even those things will be automated in time. Therefore, one should buy where one can get the most house for the money. A bank allows you to take out 4 loans to buy 4 houses. By buying in an area where land is plentiful (e.g. Tucson, Las Vegas), you can use the rent from 4 houses to pay off the mortgages on those houses over time. That way, you can become a property owner, in time, even though you are renting.

So it seems like older home-owners not coming to market to cash in, and investors, seemingly in a frenzy to buy at higher prices – have captured much of mid-to-upper prime. With ever fewer Millennials willing, or able, or stretch to such asking prices or compete.

Others Millennials settling for less, at the lower $200K-$400K end of market – or continuing to rent, or living with family because money is too tight to even rent.

Should be interesting if there is a dark turn in the markets, for those owning at the $500K-$700K+ side of things. If just fractionally more older owners and investors should lose their nerve and seriously look to sell and cash in on that equity. They may find there are far fewer buyers in market. Bit like the Swiss Franc the other day with market participants shocked that ‘liquidity dried up immediately’. Would set things up nicely for the banks by my calculations, and for renter-savers who haven’t overly committed, but continue to look to take position at better value.

_____

For older owners, housing has been a substitute for financial savings. Before these paper windfalls can be converted to cash, however, new buyers must be found.

Most buyers will not have sufficient cash reserves to pay 50 percent down. Therefore mortgage lenders will have to absorb a growing share of the housing market for prices to remain stable. They are unlikely to do this. Losses on real estate loans will be the main cause of increasing losses in the banking system. Creditors normally react to rising losses by curtailing lending, imposing higher qualifications on borrowers, and raising loan rates higher than they would be otherwise.

As this trend becomes apparent, ageing homeowners, who are depending on their homes to provide retirement security, will try to sell. “The predicted trade-up market may nor fully materialise if a growing number of buyers elect to remain in housing they consider merely adequate, rather than risk their equity in expensive luxury homes.”

A combination of demographic and deflationary trends, could make housing perform poorly. This would hit the middle class hard, endangering the savings of millions. It could be just one of several factors contributing to the evaporation of retirement.

GalaxyBrain…Very nice post, condense to make a sensible reason as to why this market is at a impasse.

Aging homeowners who aren’t incapacitated or dying don’t have to sell to live off their home equity. They take out a reverse mortgage.

Homes were the ultimate status of the ‘middle class’ during a time when life was good, i.e., pensions were common, good health insurance was a given from your employer, you could count on raises, and could stick with a company for 40 years! That has mostly been wiped out unless you are a public servant, but then you should be wondering if you are the next Stockton or Detroit, because it will likely happen! It is quite simple to understand why home ownership is on the wane! It is irrelevant if you are wasting money on rent when most can’t even come up with 5% down, can’t put together two consecutive years of stable work history for the mortgage application, and have a dubious credit history. And if you have all that lined up in your favor, then you need to question your sanity if you are considering dropping $500k – $700k on a shack in a questionable neighborhood!

I have a niece who will be turning 30 years old soon. She lives part time at home with her parents and part time with her boyfriend. The boyfriend lives with his Aunt. To look at her facebook page you would think she is loaded with money. Trips to Vegas, Tahoe, Monterey, etc. She is a college grad ( liberal arts) and made less than $ 20,000 last year. We tried to convince her to move out of state. She and her boyfriend could never leave the wonderful Bay Area climate. If her parents don’t leave her a pile of money when they die I don’t see how she will ever afford a house and family in the Bay Area. My first real job in California paid $24,000/yr to start, and that was in 1984. Good luck to all of these kids who don’t have a degree in tech.

One problem with adults still living with their parents — what if the parents decide to cash out the house, downsize, and move to a cheaper state?

I can imagine the family tensions in such a situation. The parents want to move away. The daughter angrily or tearfully protests. The parents feel guilt and resentment. Both parents and daughter feel trapped with each other in the current house.

“She and her boyfriend could never leave the wonderful Bay Area climate.”

Old saying… Bone chilling day spent, is a Aug. day in the Bay area?

You mean the saying that is attributed to Twain and/or Hemmingway (but no proof to either)

“The coldest winter I ever spent was a summer in San Francisco.”

Because its not a starter market. There are “starter homes” but they are not for all.

deep

I graduated from college in 2008 and one of the lazy millennials everyone talks about. Jobs were scarce when k finished school and that was largely due to the housing crash and subsequent recession. Even if I wanted a home right now, I’d still be gun shy about buying. Too many people my age saw firsthand that housing isn’t the golden ticket our parents said it was. Sure we would eventually love to own but we’d like to save enough to make it worth our while. You get nothing for your money in this market. We are waiting to buy until it makes more sense.

Why doesn’t anyone on this board make money? Am I the only one recruited to a Fortune 100 company with a six figure salary? Am I the only one enjoying the hell out of L.A.? I even feel poor compared to Hollywood but I know what I have, in a premier Alpha city. You can do whatever you want in SoCal when you have the money honey. And many, many do.

Like spending time endlessly commenting here?

Exactly

~~I now troll this comment forum as Realist because I’m scared and desperate to have the 25 grand my family loaned us to buy mean something~~

agreed…

You don’t have sh*t and should stop bragging. I’d wipe my ass with your paychecks

Realhoar, you are a fraud. No, you don’t make six figures and work at a Fortune 100 company. If you really did, you wouldn’t be hanging around here talking like a ignorant Real Shill idiot.

You are really a troll because no one could say the dumb things you do about L.A. You talk like an uneducated person trying to sell shoes to a person with no feet.

So try not posting 20 times a day so that it looks like you actually have a job and life elsewhere.

The poverty line for major CA metros like SF metro and LA metro is a staggering 88k a year.

If you’re splurging at 100-120k then you’re a fool who will retire on cat food.

Los Angeles city median household income is $49.5K/year.

Los Angeles county median household income is $56K/year.

U.S. national median household income is $53K/year.

Both LA city and county have per capita incomes ($27,800) that are slightly below the U.S. national per capita income of $28,200.

Los Angeles area incomes when juxtaposed against cost of living are very weak.

http://www.census.gov/quickfacts/table/INC110213/06037,0644000,00

Realist,

I am making a lot of money and don’t live in LA. That means I get to save/invest most of them. If I would have continued to live there, I would hate it and not have any money (all gone to taxes, landlord or banks or a combination of all three).

$Trillions in free reserves mirroring 0% on safe

money interest income, affording the banks an

alternate portfolio, shielding their mortgage

collateral from the market, stops up supply and

artificially props prices.

The millennials are simply shut out due to both

monetary and mortgage market manipulation.

I understand being reluctant to buy property vs.rent. There’s pros and cons to both. As we’ve seen, buying real estate in CA is a rollercoaster game of Russian roulette. Buying definitely ties you down. You can’t just move. If you lose your job you’re screwed – you can’t just move out to a cheaper apartment. You have to fork up substantial amounts of money for property taxes, mello roos, HOA, etc. And let’s pray your roof, HVAC, plumbing doesn’t go out… Renting allows you flexibility.

Cons to renting are: you are at the mercy of your landlord. They could decide to rack up the rent, sell the property or just let it go to foreclosure because they are in financial trouble themselves (it happens a lot on SFH rentals). You can’t decorate to your tastes. You may get a stingy tight-azz landlord who won’t do repairs and maintenance.

I’ve been a homeowner 3 times in the past, and quite frankly, I don’t know if I’d want to buy again. I sort of like the freedom, lack of responsibility knowing I don’t have this huge debt and unknown expensive contingencies (repairs) hanging over my head. On the other hand I miss being able to paint the walls the color I please but that’s about it.

Time will tell.. I may take the plunge if RE in Sacramento dives to rent parity.

I totally agree. Being at the mercy of a landlord can be tough. We found a great landlord who needed long term tenants. No we can’t paint the walls but my husband and I are busy professionals and I personally don’t care to spend every weekend at the Home Depot trying to fix up a place. Aside from the monthly nut, you’ve got repairs and worst of all yard upkeep, which can all be $$$$$.

Even if you buy a home today, and they drop 25%, the 10 year rule still applies. You only need a meager 3% a year appreciation after the bust to regain your loss, plus your 1/3 of the way to paying off your mortgage.

And I don’t even get it anyway. If you buy a Benz, and your neighbor gets one cheaper a month later, you don’t go crying to the dealer about the value or the Gov to bail you out. You buy it, you pay it off, that’s it. Housing should be no different.

~~You are embarrassing us my reincarnated self~~

your comment was somehow making some sense…

Until you compared buying a 50K car with a 500K and up house…then I realize that you’re a (beep) … sorry

I don’t even have to go into details about such nonsense

I think you guys will enjoy this: “Stop Complaining That I, Zathbog of Planet Cibwarv, Am Inflating U.S. Housing Prices” http://www.newyorker.com/humor/daily-shouts/stop-complaining-zathbog-planet-cibwarv-inflating-u-s-housing-prices?mbid=social_tumblr

I have two smart, well educated millennial children. They have no college debt, max out their 401K’s, have money in the bank and very good jobs. The problem is that they feel they’d be crazy to expect to be in their current jobs for any length of time. The job market is very uncertain even for highly trained people. The pressure they’re under at work is immense and not only from the volume of work expected from them. Every now and then there are firings and people are suddenly let go. Even thought things are good for them now they can’t count on things being good for them in five years so stretching themselves for an over priced crap shack would not be a smart thing to do. For now they’re saving and investing and praying their jobs don’t go overseas.

To those making 100K plus a year in secure jobs with fat bank savings, congrats. You’re doing great. However, methinks you’re a small sliver of the population.

Most Millienials in SoCal won’t make $100K/annual in their lifetimes. Many work PT or low wage jobs. Many don’t want promotions if it means dealing with crazy boss/crazy work hours/relocation/job they don’t like. They value lifestyle; that’s why they stay in Socal with beaches, sun, and Disney. Many don’t want marriage, kids. Fat 401Ks or savings accounts? Nope. Many don’t have enough cash on hand or the income to rent a SoCal apartment (unless they have multiple roommates), much less five or six figures for a down payment on a crapshack (unless Mom/Dad bring $ to the table).

Many are happy with their lives just as they are. Living with parents/relatives not bad.

The ones who want marriage, kids, house, etc? Many are bailing to low cost states where they can make it happen. The End.

Great article! This is exactly why when my wife asks me if we should buy a house, I tell her that I will rent our $1300 1 bedroom with no hidden costs in Torrance for as long as I can – or until the housing bubble bursts, all while investing the disposable income which would otherwise go into paying off an overpriced crapshack.

Investing $$$ saved is the key. Joe Average doesn’t have the self-discipline to lay out a vision and stick to it. You will do well.

I am no millennial – I am a 47 yr. old dentist and yet I prefer to rent because I can’t let go and hold $300,000 cash as hostage/down payment in my preferred neighborhood. I just can’t see my house as an investment and I prefer to invest my money at this point in my life. I can get a loan if I really want to but feel priced out, anyway. I don’t succumb to the pressure that to look successful, I need an expensive home. Renting has been so great for me.

What are you going to do when you’re 65 and still have to pay out monthly for rent?

~~your desperate anxiety that you made a bad decision is showing now more than ever~~

It is a good question.

@the realist:

Q: “What are you going to do when you’re 65 and still have to pay out monthly for rent?”

A: “Did you miss the part of his post where he wrote ‘ I prefer to invest my money at this point in my life.’ ?”. He could pay the rent from the income off his investments.

We get it, realist, you’re smarter than everyone else. Go away and troll somewhere else.

I suspect he will withdraw a couple thousand dollars of dividend payments every month and pay the rent.

Crap shacks for under $75K are readily available in non-coastal California. Barstow, Yuba City, Stockton, Lodi, Bakersfield, Modesto, Tulare, all have sub $75K SFR crap shacks, as do many other non-coastal California cities. Here in SoCal, Paramount, Compton, Long Beach, Rancho Dominguez, have sub $75K condos.

For less than a down payment on a crap shack in mid-tier SoCal, one could pay cash in full on a non-coastal SFR. Once you get away from urban Los Angeles, San Diego and the Bay Area, home prices in California are not very different than much of the United States.

Plus there is a ton of undeveloped land in California. This just happens to be in the non-hipster areas. You can buy an acre or several acres of land for less than $75K.

living in Uvita, CR…surfing, diving and living off the money properly invested….which is not today’s housing market…

I used to think like you. I don’t any longer. Simple move to a low cost area and pay cash with all the cash and savings if you are fortunate enough to have been able to save and safely invest. There are still low cost area’s in the US you know always will be. Buying an anchor around your neck for 30 years makes no sense anymore. You can’t count on stability, the economy or the future. Risk is way to high to be anchored to real estate in any one market. Way to many boom bust cycles, which is typical of an economy managed by a Central bank issuing gobs of created fiat currency.

Good for you. It’s interesting that some people try so hard to convince you that you should part with your money and join their congregation. As if they have something at stake with what you do with your money… oh wait, they do.

The only disadvantage the Millennials have, is that they have had it too easy.

If you think those safety nets will still be there when the SHTF, you are sorely mistaken. It will be much worse this time around and will make the Great depression seem like a mild recession.

If you think the Gov isn’t going to raise taxes and increase socialism, then that’s crazy

My two sons have no expectations of owning a home here in California. Their cousins who married into money families have but they are not courting rich girls at the moment.

$60k salaries won’t cut it. They both talk often about working out of country with an eye on making it permanent.

Ok lets disect this a bit. Why don’t your sons increase their value, and/or date rich girls too? And why would they leave the country? I understand a weekend in Vegas but there is no reason to leave SoCal. There is nothing out there that you can’t get here, because this place is a world magnet and it’s all here.

I have a great job. Tons of savings, 2 employer funded, fully vested pensions. No debt whatsoever. Own my 5 yo car, no student loans, no CC – nada debt.

I am reluctant to buy a home because I worry about losing my job. And I’m not getting any younger. Late 40s. I work for a large CA privately held company, and just last week yet another round of layoffs and “restructuring”. Not related to anyone’s job performance, just cuts to make operations more efficient. It could have been me. This is not an isolated incident either. A good chunk of my colleagues were laid off from their professional jobs 4 or so years ago. Some were unemployed for over a year, well qualified individuals to boot. ALL of them took substantial pay cuts to secure their current positions.

If I commit to a mortgage, and I lose my job, I’m screwed. I’m not feeling the bravery right now 🙂 Happy renting my lovely 3 bed house and saving 35% of my net income.

You just gotta jump in and do it. If you lose your job you’ll have that mortgage incentive to find another one faster and stay productive.

Think I’ll pass on your recommendation.

Previous homeowner 3 times, not a fan or being tied to a fluctuating “investment” and surprise repair bills and property tax notices. All I pay is my rent – which is $500 a month UNDER what it would cost me to “buy” the place, and no extra expenses. I’m loving it.

@UnRealist – You just gotta jump in and do it. If you lose your job you’ll have that mortgage incentive to find another one faster and stay productive.

This is the most stupid advice I have ever heard!

Sleepless – it’s called will, drive, and motivation. Something America has clearly lost.

I guess you like the easy way out?

Sometimes as is the case here with the un-realist, out of the mouths of idiots, comes a bit of underlying truth.

It wouldn’t surprise me if some of our government handlers actually believe it’s a “good thing” to noose people with mortgages as sort of a cattle prod for productivity.

dude, you think that hasn’t been the plan all along?

I have very little “will, drive, and motivation” to be in debt hundreds of thousands of dollars.

On the other hand, I have plenty of “will, drive, and motivation” in my career, that’s why I have a great job and make a ton of money.

I like being free of debt, gives you way more choices in life.

“If I commit to a mortgage, and I lose my job, I’m screwed. I’m not feeling the bravery right now 🙂 Happy renting my lovely 3 bed house and saving 35% of my net income.”

Doc often writes about changing demographic profiles and the potential effect on the future housing story. I think what you wrote is equally as important of a bellwether.

Whatever the inputs may be, job mobility and volatility is steadily on the rise. That conflicts with the long-term commitment nature of home buying and the 30 year mortgage.

So what do prudent people such as yourself do? You conserve your resources and plan accordingly for a more volatile environment by making fewer long term commitments. It’s the invisible hand in action.

I’m in the same boat as you – good income, no debt. In this uncertain economical environment, living debt-free is the right way to go, imho. I’ll certainly pick peace of mind over questionable honor of being a homeowner and in the debt to my ears.

Bunch of morons on this blog these days. I’m kind of between Gen X/Y but you boomers who think millennial’s have it so easy are freakin retarded. At what point in your lives did boomers ever have anything difficult. You were given educations for next to nothing and mostly got jobs with great pensions. Need I bring up Social Security and Medicare which are going to be severely watered down for all generations after you because you all took way more than you put in. Talk about a generation that is selfish and had it way too easy. I don’t see most millennial ever able to afford a house because they already have a mortgage in the form of student debt. Yes they took on this debt themselves, but how many 18 years have any sense financially. They are told they have to go to college to ever get a good job which is probably true. The banks are the loansharks in this case giving them these insane amounts of debt knowing that they can’t bankrupt out of it even if the education doesn’t pan out. Society is going down the crapper because the boomers are so selfish that rather than educating their children and grandchildren with the quality affordable education that they themselves received they want to take all the resources for themselves.

Don’t let the kids live at college. There is no reason they cant start at a CC, transfer to a university, and commute. Then work at night. Boo Hoo if they don’t get to live the movie dream of some experience and hazing. This is real deal real world stuff here and anyone with a student loan has zero sympathy from me.

Here’s a suggestion DG, why don’t you try doing something about all of these things instead of just bitchin and moaning about how goofed up the world is and how it’s negatively affecting your life.

Have you not ever faced a challenge in your life? Well, welcome to the real world. It’s a lot bigger and meaner than the population of boomers out there–you do realize that there are 7.2 billion people on the earth, of which only 320 million are Americans.

And consider yourself enormously lucky that you were born here. But of course you are “bitter” and mad because life hasn’t been fair to you and your generation.

This blog has hit rock bottom. There’s no use even discussing this trivial matter called a “housing bubble” with all of these bubble heads here. You guys are clueless….

DG, why don’t you PAY ATTENTION to the conversation?

No one said Boomers had it easy. What I and other Boomers here said was that Millennials do not have it harder than the Depression era folks, which was Laura’s original claim.

As zzy said, EVERY generation since World War 2 has had it WAY EASIER than the generations in the first half of the 20th century.

ANYONE living in the U.S. today has it WAY EASIER than the vast majority in the rest of the world. American Millennials do not have it tough, even if they never buy a house. They don’t know what tough is. Few Americans do.

Ask my late grandfathers about tough, both of whom spent four years in the muddy, rat infested trenches of World War One, and died prematurely because of the illnesses they contracted.

Morons huh?? even the average moron has some awareness of the Vietnam War, the draft, etc. of the ’60’s and ’70’s. Try your schtick out on a Vietnam vet/baby boomer, maybe a draftee that was wounded or disabled, you will likely get a swift (and possibly very painful) education that you sorely need.

Am I the only one that thinks DG is spot on? The boomers will not be satisfied until all that is left of this country is a dry husk. DG didn’t even mention health care. Boomers are going to spend every last dime of their dollars and taxpayer dollars to postpone death even if it means spending a million dollars in the hospital on a feeding tube to get a few extra months. They benefited from the unprecedented rise of the stock market and real estate market. All’s you had to do was drop a little bit of money in either and you would be a millionaire today just by sitting on your ass. Everyone else, on the other hand, has to deal with the inflated prices across all asset classes, stagnant and declining wages and massive government debt. Tell me, pray you, what have boomers actually brought to the table to deserve so much at the expense of so many?

And before you tell me a loser and I’m just whining, I make pretty good money in the financial services industry and none of this really has much of a direct impact on me. But hey, I calls it like I sees it.

I loves me some generational warfare discussion. Anyone bashing Millennials as lazy and entitled is flat out hating. Personally I think Republican Boomers have orchestrated a gigantic mess. And their Elvis Generation enablers are coasting through a comfy retirement earned with an 8th grade education and simply don’t understand that the America they prospered in is gone. Be smug at your own peril. Millennials aren’t going to pay for Baby Boomer retirements. The one thing they don’t know how to do yet is punch a bully in the nose. No problemo. That’s what GenX does best. And if you don’t recognize their pent up anger at their irresponsible lying elders you are in denial. Once GenX/Y make peace and collaborate out of necessity and empathy it’s game over. Only question is whether it’ll be a big meanie or a compassionate equalizer.

Congrats on being the poster child of the spoiled Millennial! Just because the economy is a little unstable and the world is in the midst of a property bubble (THAT’S RIGHT, it’s not just here in America, idiot), and the spoiled children aka “millennials” can’t afford a house just like the one their parent’s had, you feel that you have the right to go Postal!

Can you say, “ME, ME, ME!”

Are you drawing up plans for the concentration camps for all of those old selfish Boomers? You have no idea how dumb you look and at how selfish and completely immature and childish you sound.

There’s a reason why so many people think that you guys are lazy and entitled.

Woo boo. Imma poster child. LOL.

The basic contract is that elders provide a stable environment to grow and thrive in return for being taken care of in their old age. That contract is horribly broken. But hey, bash away.

CoarselyGraded: “The basic contract is that elders provide a stable environment to grow and thrive …”

Where is this contract? You just made that up. You make up an imaginary contract, then complain that it wasn’t fulfilled.

Nobody in the world can “guarantee” a “stable environment.” The world is full of uncontrollable variables.

Do you expect American Boomers to have prevented the Indians and Chinese from developing an industrial base and competing with you? Or to have prevented Third World workers from competing for lower wages?

You think American Millennials have it tough? Put down that iPhone you didn’t invent. Stop using that WiFi and internet you didn’t invent. Then look at the world outside the U.S. and see what tough really is.

American Millennials must now compete with the rest of the world’s labor force. Asians work smarter. Mexicans work cheaper. Too bad for you.

Want to improve the comments on this board? Don’t feed the trolls. Don’t respond to Realist and zzy. They’re just trying to stir you up. Don’t give them what they want. Ignore them.

Thanks to the (UN)Realist, the discussions on this blog have gotten increasingly more idiotic.

While that’s true; the comments regarding Millenials are way off the mark. I think they will have a tough path ahead of them.

Hey… this message is paid for by the National Association of Landlords!! Ha ha ha!

Why rent when you can be GETTING RICH like me!!!

Yup, just Get Retard! 🙂

It’s understandable to say the kids have had it very easy, but you are forgetting one VERY important thing. The life they have, is ALL they know. So to them, yes it is a big deal when you can’t get a house or their phone screen cracks. Isn’t this what the Boomers and everyone wanted anyway? For each generation to be better off than the next? Yes it was and is. So I say people have no right complaining about “the kids” because now they do have it easy, and that was inevitable. How possible hard can life be when you start automating everything? And for the sake of society you better have safety nets.

Nobody’s complaining that American Millennials have it easy.

We’re complaining that Americans Millennials don’t appreciate just how easy they have it. Instead, they whine that they don’t have it easy enough.

But I’m only criticizing American Millennials. Yes, the Millennials in Chad, Haiti, Somalia, Uganda, and dozens of other nations do have it very rough.

Interesting.

I am going a bit obtuse and perhaps that has raised some conflation. Real estate, the economy, etc. are all symptoms. We have a break down of social mechanisms that predate our monetary systems. So while you may think that this social contract is made up it is not. Maybe it’s just the Hume fan in me but our notion of money (“I pulled myself up by my own bootstrapsâ€), all that, is obscuring said ancient arrangements. Adults take care of children. Then when they become adults they reciprocate by taking care of the elderly. Throughout time and culture you can find evidence. It’s simple human compassion.

Even more interesting is pointing out trends is invoking character attacks and assumptions. That only reinforces my perception.

I have probably spent more time outside of the US and “doing as the Romans†than most posters here. And I consider myself fortunate. I do not think branding two generations that have been given the short end of the deal as loser cry babies is productive. And I will not stand by and let the bullying commence. We’re all in this together though the aforementioned makes it difficult to realize.

For the record, I do not blame the Elvis Generation for their apathy. As their poster child most eloquently put it, they were born at the right time.

As a boomer, I can see Darwin’s vision playing out at breakneck speed. The human being is changing, right now as we sit here. There is no going back. The new generation will never know the concept of privacy. And they probably won’t even care. Don’t blame any generation. Greed could have just as easily penetrated the younger generations into something like boomers, if only they had the chance. Adapt or die!

You’re talking about two different things.

Initially you talked about Boomers, Xers, Millennials — about generations. And that older generations had an obligation to provide a “stable environment” to younger generations. Now you’re talking about adults and children.

Yes, parents have a duty to care for their OWN children — by providing food, shelter, etc. Then the children should reciprocate and care for THEIR elderly parents, in like manner.

But there is no “social contract” for older generations to provide a “stable environment” for younger generations. Parents can provide food for their kids. But it’s impossible for any generation to guarantee a “stable environment” for the future.

I’ll be happy to elaborate further on my theme.

I’ll allow that today’s young have it easier than the young people of 1929….. at first blush. Life is materially much easier now than then, and, yes, there are our increasingly frayed and unaffordable social safety nets.

However, these advantages have a lot of negative offsets that the young adults of the 30s didn’t have to deal with. In 1930, we have newly built cities and new, top-grade industrial infrastructure… and most of our prodigious endowment of natural resources were still in the ground. Our cities and towns were still intact, and we had a lot of intact family farms the youngsters could retreat to until things started to mend. And we did not have a crushing load of public and private debt. The debt bubble that burst and crushed our financial markets was mostly corporate debt, and debt owed by formerly high net worth individuals.

The worst economic fallout was the bursting of the farmland bubble of the mid-twenties, that wiped out so many debt encumbered farmers and rural banks. That was actually well underway before the crash of ’29. Then, of course, came the catastrophic dust storms of the early 30s.

But we still had a lot to build on. Now, however, we are burdened with crushing debt both public and private. We have trashed our industrial economy almost completely and will have to rebuild it from scratch- a very scary prospect when you consider that what enabled us to win WW2 was our technology and industry, then the most advanced in the world far and away. And we have RIPPED through our resources- mineral, water, soil. Churchill remarked that “the Allies floated to victory on a sea of American oil”, and now that lavish endowment of sweet, fine, easily extracted oil is almost all gone, and there remains only the shale and sands plays, now unraveling quickly since the prices dropped far under what is necessary for these plays to be economical.

What I find most frightening, especially for the young who will have to endure the next two decades of incredible upheaval and possible WW3 (why do I feel that another world war is setting up as we sit here nattering on this blog), is that the worst lies before us, and when it’s over, there will be nothing to rebuild with.

Yep, I’m glad I have a whole lot more behind me than in front of me. To the young, I am sorry. Really I am.

I’ll give ya that. Currency wars and trade wars lead to World Wars, and this generation of < 30 year olds does not have the stomach to fight a war the way WW2 was won. As for now, it's "MAD" keeping the bombs at bay. Could that change?

Oil prices are plummeting….because we’re running out? Huh? What?

Nathan, Google the term “demand destruction”. We don’t have a glut of oil- we have a glut of people who can no longer afford to buy it, and a country (Saudi Arabia) that desperately needs to raise cash- and desires to maintain its market share.

Enjoy it while it lasts. This is a good time to prepare for steeply higher oil prices in not long. This is what the peak oil people refer to as the ‘bumpy plateau’ at the peak- the price volatility as higher oil prices crush economies and kill demand, thus driving down prices, which causes more productive capacity to be shut in, particularly that like our shale, sands and offshore plays that are very expensive to make productive. Since these plays deplete much more quickly than conventional wells, expect a real supply squeeze in a couple of years, which will send prices ratcheting rapidly north. Then more wrecked economies and demand destruction..

So, from the FED meeting – the FED remains “patient” on the rate hikes… So, here we go, what I have been telling you, guys (& gals 🙂 ) for a while now and you called me a troll. You will not see any rate hikes this year, see MOAR QE coming!

Sleepless,

Give me credit, too. I was saying the same thing for years. It is obvious for anyone who understand finance and how the monetary system works that you can not increase the interest in a deflationary market. Yes, it is a deflationary market for real estate, because it depends on credit money supply which is way lower than 2007 (to the tune of 20 trillion lower).

For those who don’t understand finance, they just repeat whatever the FED is saying, even if the FED knows quite well that they can not raise rates. They say that to manipulate the psychology of the masses. It works on the majority.

Millennials everywhere else will love to have the problems that American millennials have. In many other city centers around the world real estates is not affordable for 70-80% of the population. Yes life is not fair. Why does it have to be fair? Some are born poor/rich, healthy/with conditions, pretty/ugly, smart/stupid etc…We can choose to help those that are less fortunate but in the end our own survival is still the most important. A life without materials doesn’t mean a bad life. They are crying because some of those luxury/amenities might not be available if they don’t have the dough or can’t make enough with the current job and expect socialism to last forever. With our current debt load, I don’t think so. Soldier on millennials. Life may not be fair but you still have your iphone, beemer and faceplant. Well if you show up at the voting booth and vote for the right third party candidate (not current dem or rep) maybe you can tell the last generation to shove it. This message is a non PC message not approved by anyone.

Millennials aren’t asking for handouts. They’re asking for jobs that pay a fair wage in return for hard work.

But what about buying a $700,000 crap shack and then all the central bank manipulation does not work anymore and the market forces return, which will finally bring down this over-leveraged house of cards? If prices are flat for 30 years, you will be very lucky.

@Laura – solid.

Clearly many aren

I could not resist looking up a real estate blog in California. Dr.Housing Bubble and many of ya’ll make some good points. But the reality is your housing market is way out of line with the rest of the country. I don’t know how you stand it. You may have sunny days but so do many states in America. I have lived in South Carolina for 33 years. I moved from Texas. I lived in Charleston, when no one even knew where it was on the map. This was in the 1980s, a great time to live there. Then I moved to Columbia after Hurricane Hugo in 1989. My first home in 1992 was 1535square feet for $66,000. It was a frame house on .49 acres with trees of course. Then my husband and I moved to our present home in 2012. It is 2600 sq ft with a pool and cost us $215,000. I watch all these HGTV/DIY shows on TV which feature your state, as well as Arizona and Nevada-mostly Las Vegas and all I can say, is ya’ll are definitely living in the wrong state! Everyone must make $50/hour to afford to live out there. I really do feel sorry for ya’ll. Good luck. I’d live at home too for those prices and I’m 60.