Don’t hold your breath for Millennials to purchase homes: 6 years into a recovery and Millennials are still moving into parental homes at record levels.

I ran into a successful Millennial couple this month and we had a good discussion about housing. They are in their 30s and still do not have any kids. Both are career driven and ultimately would like to buy a home. They have the money to buy but just don’t want to. What they brought up was interesting and they mentioned some of their peers had to resort to moving back in with mom and dad. What they brought up simply reflects a “new normal†for Millennials and that is many are simply not eager to purchase a home. Many are delaying marriage, have smaller families (if any), and a large number are carrying sizable student debt. All of this has caused a low demand for housing and alternative choices to buying a home especially for this cohort of Americans. In California we have a high number of adults living at home largely because of the cost of rents and home prices. Yet this trend encompasses the entire country. Higher home prices and rents have only exacerbated this movement.

The Millennial home buying dilemma

What was interesting about the couple I had a chance to talk to is that they are highly successful and their income put them in the top echelon of earners. But they had little desire to buy a home. I’m sure if we hit the rewind button to the last generation, buying a home would probably be the first item on their financial list. This isn’t happening and it is hard to tell if this trend will reverse as some are forecasting.

Let us first look at the data:

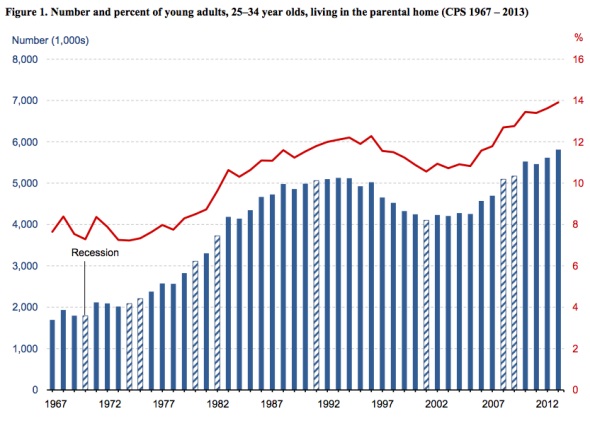

The percent of young adults between the ages of 25 and 34 living with parents remains at historically high levels. The Catch 22 here is that higher home prices and higher rents have made this problem worse. In the past, higher rents and higher home prices came from regular household demand. Today, this function has been stunted by investors, foreign buyers, and local banks stalling on the foreclosure process so you have a small amount of inventory and prices going up largely because of non-family buying. The end result? Tons of adults living at home or renting as the next option.

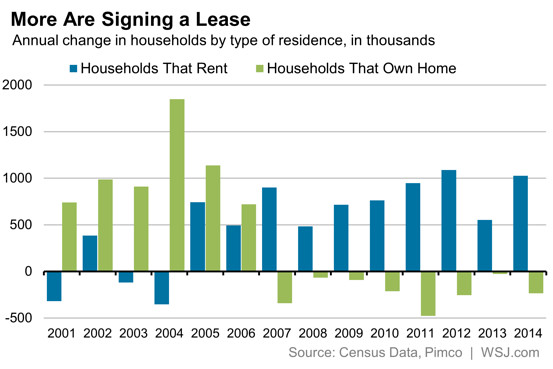

What is dramatic is looking at the number of new rental households versus homeowners:

If you are a young adult, your first venture into the “real world†is renting an apartment, typically. You don’t go from getting a job to buying your dream home right off the bat. Sure, in some states where home prices are cheaper you will have better luck. But in most metro areas where a large portion of people live, this is simply not doable.

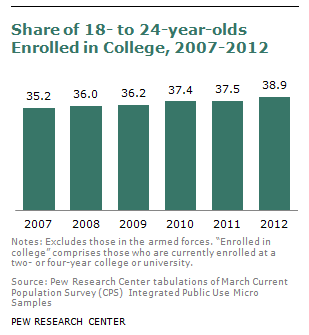

The Fed has interesting data on this. They find that student debt is actually impacting buying rates with Millennials. This makes sense because many more young Americans are going to college:

It is hard to believe but there was a time in California where one blue collar worker was able to buy a home. Many of those Taco Tuesday baby boomers went down this road. That is the expectation that they pass down to their kids. Yet it is drastically different reality in this market. Today, like that dual income no kids couple, even two professionals (with in-demand college degrees) are on the fence about buying a home. Paying $700,000 for a crap shack to smart individuals causes them to pause and rightfully so.

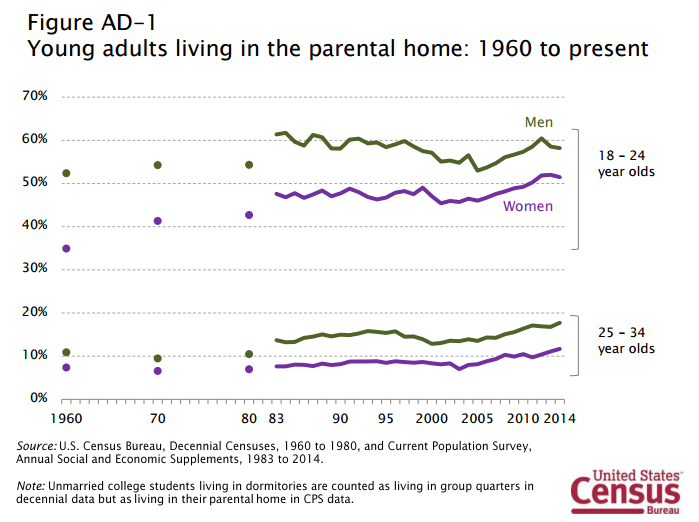

Even if we look at more recent Census data, the trend continues:

You expect the 18 to 24 year old crowd to move out to go to college. But it looks like the 25 to 34 year old crowd is heading back home after getting those degrees. Is this the future buyer of more expensive homes? Builders clearly think not. And that is why building demand for multi-unit housing is booming (aka apartments).

We are living in a housing market with no parallel in history. The fact that so many grown adults are living at home into their 30s and 40s should tell you something.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

106 Responses to “Don’t hold your breath for Millennials to purchase homes: 6 years into a recovery and Millennials are still moving into parental homes at record levels.”

Even the Federal statisticians tell of a contraction in the 1st Quarter of 2015.

The connection with the fantastic expansion of 0-care taxation — and the contraction of the Federal deficit is crime-thought.

The dollar shortage/ tightness should become ever more pronounced as the months pass.

The President has ‘un-FDR’d’ the economy…

Virtually every significant 0bama policy is 180 away from FDR’s.

By so doing, the eighty-year money expansion super-surge has been throttled.

Lest we forget:

The 360 month amortizing mortgage was invented during the FDR era, right along with, de facto, Federal banks that accepted the paper.

Ever since, it’s been the primary source of money and credit growth…. well, until of very late.

FDR kicked Mexicans out of the 48 states — by the thousands — as one of many measures to raise White employment rates. Most modern Americans are entirely unaware that this policy ever existed.

It was the wholesale removal/ eviction of Mexican farm labor that set up the era of “The Grapes of Wrath” for the Mexicans HAD been working California crops prior to the Great Depression.

[When WWII kicked in, this policy was entirely REVERSED: the “Bracero Program.”]

A non-speak cloud has been dropped (Winston Smith style) over the previous round-ups and evictions of Mexican field labor. Your best source for ground-truth on this issue remains Mexican descendants of those evicted on no notice.

Federal stats tell of no employment growth among native born Americans — all races — going back a decade. This is especially true — and ironic — in Texas.

Today’s American real estate market is evidencing every sign of race-replacement policies.

New ghettos to replace old ghettos, if you will.

People are creatures of habit. I believe many young adults (and even 40+ y/o “kids”) who boomerang back home to live with parents/relatives, or perhaps never left in the first place, may never live independently. It’s comfortable, familiar, allows them to live in a better hood/better lifestyle than they could afford on their own, and with housing expenses out of the equation there is more disposable income for status items that make them feel better and appear more successful. The longer they stay, the less likely they will ever leave, though they may repeat “planning on moving out soon!” or “saving up for my own place!” to friends and coworkers…kinda like the cheating spouse who keeps telling the side piece they’ll get a divorce, creating excuse after excuse, but never pulling the trigger. It sometimes works for the parents/relatives too (especially of the helicopter variety); a mutually acceptable “eternal adolescence”.

So much judgement. Who gives a crap what people do as long as they’re happy with it? What’s wrong with “more disposable income,” really? What’s wrong with family looking after each other? There’s a severe 30-year attrition of the middle class going on in America (through no fault of “helicopter” parents or their “eternally adolescent” children). Throughout history when times were tough people moved in back home (or never left), or converted their house into tenement.

You once wrote a family value post supporting a Mother leaving the rat race to stay home to care for a child. So, I know you have it in you, Drinks!

“Who gives a crap what people do as long as they’re happy with it? What’s wrong with “more disposable income,†really? What’s wrong with family looking after each other?”

I agree! However, lending a helping hand can morph into unhealthy enabling. Remember the quote, give a man a fish, he eats today, teach him to fish, he eats for a lifetime? I believe handing out “daily fish” unconditionally to adult “kids” over an extended time can foster unhealthy co-dependency, skewed reality, inflated self worth and lessen ability to deal w/adult responsibilities. Some relationships are symbiotically dysfunctional; a parent can’t “let go” and see offspring as an “eternal child”. Ever see stories about an adult involved in bad decisions and/or criminal activity with terrible outcome where Mother is interviewed and constantly refers to adult offspring as “MY CHILD”, defending him/her unconditionally no matter how extensive a criminal background or what personal responsibility “MY CHILD” may have had of bringing bad situations upon themselves? Often it seems everything is someone else’s fault, societies fault, etc. Extreme example, but true.

“You once wrote a family value post supporting a Mother leaving the rat race to stay home to care for a child”

Yes, or Dad too! When a child is young, they are very dependent upon parents; first three years of life are crucial in brain development, stimulation, trust issues, etc. But when a child can vote, hold a job, or is even a parent themselves, he/she shouldn’t require extensive parental involvement and/or support over a long period of time quite as much, no? 🙂

Absolutely. Especially in Southern California where I lived the previous nine years. As someone that grew up in the midwest, I am/was constantly amazed at the number of people in their 30s, 40’s and even 50s that continue to live as 20 somethings with roommates in cramped apartments or their family homes and live for their weekends going from one party to the next as if they will never grow up. Being an “adult” or “adulting” in their words, is just not very interesting, so the live a perpetual life of self-absorbed activities with little, if any responsibilities. Home ownership is usually the least of their concerns.

Mom!!! Mom!! Meatloaf! F***!!

Livin the dream…

Actually no one in their right mind is buying homes no in areas where there has been rampant price inflation. I am in my 50’s and while could afford to buy that’s not my plan at the moment. For those of us living in California, you can expect local and state taxes to continue to increase, those hoems are going to really going to be a liability.

@Michael, I agree with you on all points. That is why I got rid of my properties in SoCal and became a renter.

The unfunded pension liabilities of Los Angeles, Torrance and Culver City, to name a few, are staggering. They are approaching 20% of the city’s budgets.

Anyone dumb enough to continue buying single family homes deserves what’s coming. The only winners will be 55+ community owners and multifamily. Why? Pensions…nj will continue to raise taxes so all the whining bigots can retire on the brown folk they hate. Check demographics of growth in minority population and lay it over pension size and pending tax hikes. All this is causing a NJ exodus to NC.

See, this is the problem all over America. Ask Meredith Whitney about fraud in the municipal bond market. Ask Gov Christie about the huge pension gap…mind you, these people demand a 8% annual return. What happens when rates rise? If they stay the same, with this labor market, pretty soon 8% becomes unachievable.

All its gonna take is one more ponzi to be exposed. A nice big fat, arrogant, tax dodging, return inflating index fund that targets cheapo investors…tick tock.

Millenials are recent college grads. Not all of them majored in fields such as technology. A lot of them are figuring out what to do with that double major in Communication and History. If they are lucky enough to get a “real job”, what can they afford on $35,000 per year?

Recovery? There are 92 million people in this country unemployed, the economy shrunk by .7 percent last quarter and debt is at astronomical levels both in government and in the average citizen. There is no recovery. This is a depression.

To the moron quoting 92 million people are unemployed QUIT listening to bogus crap from fox news. There aren’t anywhere near 92 million people unemployed. RETIRED people don’t count as being unemployed. 16 year olds and college students don’t count as being unemployed. If 92 million are unemployed now then there were still 75 to 80 million employed under Reagan and Clinton. Quit being a moron and using bogus statistics. As far as millennials not buying homes prices are simply too high. The government did not allow the housing market to correct the way it should have and they are still propping up prices with low rates. Maybe this is the lesser evil, but why wouldn’t anyone want to buy homes at such high prices because when rates do finally go up no one will be able to afford these prices.

It’s not bogus at all you ignorant leftist government cuck. The true statistic that the government doesn’t manipulate, labor participation rate among working age able bodied adults. Is near 40 year lows and only going lower.

Higher rates will most likely steer investments away from risky assets such as RE. Large investment groups will see more of their shareholders cash in and shift their attention to more conservative portfolios. More foreign investors will be enticed to buy U.S. treasuries over RE. Thus, I would expect to see pricing pressure on RE.

Here’s a good way to cut through this: https://research.stlouisfed.org/fred2/series/EMRATIO

Before the great recession roughly 63% of the US civilian population was employed. From 2008-2010 it plummeted to around 58.25% We only recently got above 59%. This chart/stat cuts through all the BS with measurement of the labor force and definitions of unemployment. Enjoy – not pretty by any means and no major recovery. That said, could be a lot worse too.

1) Demographics didn’t change that much in a few years so not everyone retired and if they did Florida housing ex-Miami would be flush with baby boomer money. That’s absolutely not the case, that generation didn’t save and they are stuck in over-sized and over-leveraged houses elsewhere.

2) While the population did age some, this chart is binary with regard to employment. I think it’s accepted at this point that a lot of the new or replacement jobs are not of the same pay or quality as what was lost. The guy making $125K in real estate who now makes $60K is employed and no distinction between the two exists. This conservatism should offset any remaining demographic impact.

Justin, please read Slim’s response, which references actual data and not FOX BS.

Don’t know, siblings get very curious when they find out a brother or sister with spouses moved in with Mom and Dad. The holiday get together takes on a rather foul mood I would think.

I can see and hear it now, why do they get to save money moving in with you, do they cut in on our inheritance . Gee Mom don’t you think Fred and I are also just making it, how could they impose on you like that. When does dad kick them out, he can’t get along with Ray is a know it all right? She cooks in your kitchen, can you eat her food. Know don’t think this is the answer kids to saving money and buying anything, it will be one big disaster.

I agree. There’s a lot of resentment going on with both generations. The children often resent the parents for helping them, almost blaming them for bringing them into a world that only the few survive. And the parents just want their lives back – and some peace and quiet.

ðŸ‘

That’s a dumb generalization. Many siblings are more than happy to have one of them move in to take care of mom and dad.

Sadly, its not. I’ve heard of many situations of an adult child moving home to “help” a parent/relative (often parent/relative doesn’t need “help”, but Junior has to justify moving in). One example…a coworker’s Sister had a baby back in 90’s, moved home to “get on her feet”; never left, her and Baby (now in his 20’s) still live w/Grandma. Sister has declared BK more than once, Baby has trouble holding PT retail jobs. Grandma supposedly has a trust stating when she passes house to be sold, profits split equally among multiple siblings who don’t like each other. Wonder how this will work out?

Let’s see, in some situations it works out and in others it doesn’t. Still a dumb generalization to assume it never works out.

The days when an average intelligent boomer can get wealthy off of SoCal real estate are over …. I once met a millennial who was working retail and his dad was a retired firefighter living in Manhattan beach. The son was not very bright

It’s pretty remarkable how out-of-touch even intelligent boomers are. I overheard a retired boomer neighbor complaining about her water bill being $10 higher last month. That $10 hike was apparently blowing her monthly budget.

My boomer neighbor bought her 1200 sq ft townhome for $80k in the 70s. It would now sell at $800k+. My other boomer neighbor bought hers in the 80s, has refi’d and almost lost it a few times, and has told me she can barely afford her $400/mo mortgage.

My rent for the exact same townhome – all orig from the 70s w only a few updates – is $3k/mo. And that’s under market.

Looking around, EVERY SINGLE neighbor on my culdesac – 20 neighbors, over half are boomers – could neither afford to BUY or even RENT in this neighborhood based on their current income and savings (if the proceeds from selling their current housing was excluded).

I guess it makes me feel a little better than I’m not the only one who can’t afford to buy here in San Diego.

But it’s also remarkable that the people who act like they “belong” here and throw up their noses at their “lowly renter” neighbors wouldn’t have a chance in hell of living here if they lost their current houses.

Something’s gotta give, man. It’s inevitable.

Couldn’t agree more. The disconnect between the generations is quite staggering. Very few folks over the age of 50 or so will concede the obvious: they got (relatively) dirt cheap housing, education, equity and retirement costs in comparison to the youngsters … who they are counting upon to purchase them into paradise.

Are these boomers brain dead? Haven’t they heard of reverse mortgages with that much equity in their homes?

And they want you to continue to subsidize their standard of living in the form of higher taxes and asset prices.

Good data. Millenials don’t like commitment. Many are putting off marriage for that reason. So the 30 year mortage is one hellava commtment they don’t want. Prices need to come down more than 50% before they would entertain them.

…or many are putting off marriage because the average wedding today is 20-30k? If your future wife is also expecting a 6-800k (livable, walk-around-your-neighborhood kind of) house that is an insurmountable task combined with X amount of student debt and limited job prospects.

I’d rather ‘marry’ an XBox too.

This drives me crazy. My wife and I decided to forgo a fancy wedding, and instead used some money from the families to start my business, which is now our only source of income. At 37, I’m a little outside of the millennial age bracket, but I hate seeing so many younger people be saddled with so much school debt, no jobs, and then top it all off with a $20K+ wedding. No wonder they live at home.

Married to X-Box lol. My sister’s small wedding was last Saturday, in Europe. 42 guest during the daytime ceremony, and approx another 25 for the evening. It cost US equivalent of $21,500 and of that I contributed $7,700 and his parents contributed $7,700 and the couple picked up the remainder. They’re really up against it on the housing front. I want him to sell his tiny little city apartment in a rubbish school district, and for them both to move in with our mother.

It’s not that they don’t like commitment. In many cases they are already financially overcommitted to student loans. In other categories such as marriage and settling down, the economic realities of today are making commitment less plausible and desirable.

IMHO, a lot of the men have dramatically reduced interest in marriage because of the way our family laws and courts work now – they know that if they get married and have kids, they’re very likely screwed. First off, the wife is very likely to quit working, whether she tells the truth about that beforehand or not (most women I know told their husbands they’d go back to work after kids, and then 50% or more of them didn’t). Some men are starting to wise up to this.

And to add insult to injury, the wife can #### every guy on the block and still keep custody and get both alimony and “child support” dramatically beyond the cost of the children’s upkeep to live on. Why should she be a good wife? The system rewards the opposite. In the situation, the man effectively becomes her slave: if they get divorced and then *he* quits his job and doesn’t go back, or does other things that cause him to stop paying for her lifestyle, he can go to *prison*.

What sensible man would make such an arrangement, knowing that the odds are at least 50% that he will end up in this situation? (And that doesn’t account for all of miserable marriages that don’t end because the guy doesn’t want to end up living in a trailer park and sending his ex-wife 60% of his take home – something which literally happened to my best friend…)

In modern society, marriage is a terrible, idiotic deal for most men, and if they can get past their hormones and think straight about it, they realize that and get the girlfriend to “wait” indefinitely. One can only hope, for the good of us all, that this trend continues and grows – I am surely advising my son to never, ever even consider getting married or having children.

jim – look up MGTOW or men going their own way on youtube

Makes sense but I wonder how all of that plays out when two guys are married to each other get divorced?

+1 for Mgtow!

Also, a huge fan of Tom leykis 101.

Men, do not get married. If you have to get a well written prenup, and think twice about having children. I’d recommend surrogacy

+2 MGTOW

Oh, and HOUSING TO TANK HARD IN 2015!~

Youre welcome Jim.

They are not getting married not because they fear commitment. That is feminist propaganda to shame single men living ‘free’ from oppressive relationships and common law legality, and going their own way.

Wow.. what’s with this misogynistic talk on a real estate blog? As a married Gen X woman with kids who chooses to work, this is a pretty ridiculous discussion based on broad generalizations and anecdotes.

It depends what kind of person you are. If you’re someone that listens to Tom Leykis and finds yourself agreeing with him quite a bit, there’s a good chance you’re someone who is tough to get along with, and there’s also a good chance that the mate you pick would also be tough to get along with. That’s a recipe for disaster when it comes to marriage, and it’s probably a good idea not to get married. Leykis himself failed at it 4 times.

For me, as a generally agreeable person who’s had few “bad” breakups, my marriage is great, and my wife is my best friend. Despite owning a business and doing pretty well financially, I wouldn’t trade being married to her for anything in the world, and I go out of my way to make sure she and my son are taken care of, should anything bad happen to me.

It’s all a matter of personality and perspective. Tom Leykis is a jerk, albeit an entertaining one, and he likely picked awful women. If you’re good at relationships and compromise, and you pick someone who is similar, being married is pretty easy.

Howard there’s nothing quite like expressing an opposing point of view that can bring out someone writing about being agreeable while espousing generalizations and judgements. Such pious assholism.

Prices in CA need to be half off. This is ridiculous. Foreign buyers purchasing homes and renting them out to Americans. We are paying for their shit. Prices cannot go down if we keep renting their shit.

Not yet and here’s my guess. We need more of those dollars repatriated back home and converted into real assets. Once there is enough, new taxes. Best they’ll be able to do is pay the piper, liquidate for pennies on the dollar as all of the others attempt to sell at the same time or face confiscation. By then, they will either have little recourse for moving the “wealth” back to China or face a new reality there as well. In due time it will become that they paid for our shit. There is no escape and no where to hide.

http://sanfrancisco.cbslocal.com/2015/04/28/realtors-printing-brochures-for-silicon-valley-homes-in-mandarin-to-attract-chinese-buyers/

@Home prices in Cali too high wrote: “Prices in CA need to be half off…”

You mean home prices in the desirable regions of LA, OC, SD and SF are too high.

There are tens of thousands of crap shacks in California selling for less than $100K. However, no one desires to live in Kern County, Madera County, Stanilslaus County, Tulare County, Sutter County, Siskiyou County, Plumas County, Merced County, Fresno County, Imperial County or Madera County. These are areas where median home prices are at or below $200K, and many crap shacks can be had for $75K or less. Granted, many people living in LA, OC, SD or SF would rather commit suicide rather to buy in those areas but there are affordable areas in California.

I have a great down payment to purchase. Will not be buying until this bubble bursts. I don’t have a single (smart) peer thinking about buying. I would be moving out of state before living with my parents. A bigger concern I have is why so many unwise parents allow their adult children to live at home. These kind of parents have created and enabled irresponsible monsters!!! What a sad legacy to leave.

I would encourage you to see the other side… I am 25 and live at home. I make $78,000 a year (not a high earner) but definitely enough to live on my own. My parents aren’t enabling me to be lazy, instead they are helping me to save as much as I can to purchase as much house as possible in the next downturn. I’m not lazy, and my parents are suckers – they are proud parents that believe that there is nothing greater in life than setting up their child for success.

My husband and I are in our 30s, have full time professional jobs, six figure incomes, a bit of student debt, and we live in Denver where prices are going up like crazy. As a result we are not buying a house. Everyone keeps telling us to buy but I really don’t want a house that’s 450k, even though I guess financially we could do it. Seems to be a lot of stress and pressure to keep the same job forever just to swing a mortgage every month for 30 years. What if I want to stay home and raise my child? What if I want to take time off to care for an elderly parent? Having a big mortgage is not conducive to a simple, flexible existence.

So, last year, we looked for a modest home around 200-250 so that we knew we’d always be able to afford it. All of them sold for over asking price or to all cash investors. We did not stand a chance.

The condo we have been renting is being sold, so we are moving into my parents house to save more cash until we decide to either stay put in Denver or move to another state. I’m pretty tired of hearing the media bash millennials for not buying homes. Guess what? We witnessed the last crash and many of our parents’ peers lost their entire LIFE SAVINGS, homes, jobs, etc….and the world is shocked and shaken because we are not buying houses? Get real.

As always, I love this blog and look forward to the great thoughts posted here every week. 🙂

@Imfromcolorado: If you each make a bare minimum of $100k ($200k combined), $450k is not a huge commitment, so it’s a bit perplexing that you would have such reservations about a $450k house, even if it is a bit overpriced. With a $200k+ combined income, you should be able to pay cash for a $200k-$250k house after a couple of years making that much (or pretty close). And moving in with parents when you make $200k+? That’s ridiculous!

I generally agree with the rest of your post, though. We also have a substantial down payment, but we’re not even thinking about buying until the current bubble pops. We have no interest in being the victims of bubble 2.0.

My parents have two houses. One they use as a rental, which we plan to rent from them. They’re currently living in their other house. But they’ve owned them since the 1970s/1990s before everything went bonkers here. We are mostly doing it to avoid signing a lease. When we tried to buy last year, it was close to impossible with bidding wars on literally everything under 400k. This will help us avoid a lease while we continue to look.

It makes perfect sense to me as someone of a similar age. I’ve been through many layoffs over the past 8 years, retrained, started entry-level again, retrained again, and now finding my footing in a 3rd career – all this just to survive! The thought of trying to pay for anything beyond the basics scares the shit out of me. When I was in my 20’s, I worked with people who were in their mid-30’s. They were all pretty settled. Even with psychology degrees they were making over $100K and owned homes. That’s nowhere near the case with 90% of people I know. The economy is just different.

I have only a few friends who have had consistent, high wages their adult lives. Everyone else I know is at low wages, highly paid but also in high cost areas (wash), in volatile fields that go through regular layoffs, or has massive student debt. Even a buddy formerly an officer in the military with a STEM degree went over a year without a job even with the supposed tech talent shortage. The only people doing well financially either had massive parental support or focused so much on career that they aren’t married, engaged or ever really dated.

Life is expensive nowadays, and I’m just talking the basics like food, gas, insurance, and housing. If you have a high monthly payment, EVERYTHING has to go right in your life because you most likely have 0 savings. If you’re laid off, it could mean a very swift change in your life. I’m talking going from having a home to living in your car. That’s why people are scared to make commitments.

Hey Responder, if you read the post, you’d realize that OP mentioned potentially not working if a kid came along. $450k w 20% down is still $2200/month PITI.

A $2200/month PITI on one 6-fig income w other parent staying home to care for infant is still a tight stretch in higher COLA areas like Denver. College savings account? Aggressively saving more than 3% for retirement? Fancy vacations? Forget it.

Responder, the fact that anyone finds it “perplexing” that a young couple in an era of massive unemployment and job losses, and widespread economic instability and economic perversion would not wish to be tied to a long-term debt that is twice their combined incomes, tells me how difficult most Americans are going to find it to adjust to an economy that, going forward as far as anyone can project, will no way resemble the economy of 1950- 2000.

People like ImfromColorado and her husband seem to have an intuitive understanding of the new and hostile economic reality. The fact is that we are in the midst of a global contraction in which more people will fight over the table scraps of the old industrial economy. People are beginning to realize that the prosperity of post WW2 United States was not really in the natural order of things, but was anomalous- a one-off made possible by the huge endowment of natural resources that we have since squandered, a small working-age population, and no foreign competition, and that the wonder is not that it has ended, but that it ever happened at all- and that the exceptional opulence it permitted such a large percentage of our population to enjoy, was a rare gift made possible by a confluence of circumstances such as may never again occur in human history, not a birthright.

I believe that “colorado” and her husband are making extremely wise choices. When you really consider, a $450K mortgage is HUGE for even a couple with a combined income of $200K, especially if they have decided that having large cash reserves is important and staying flexible and able to adjust to the loss of one of their incomes is even more important- she says she would like to stay home with future children, which means they will lose her income.

It is not a excess of prudence to avoid large debts at such a time as this, but necessary to your future survival. I’m glad I bought a modest condo in a non-trendy (though nice) neighborhood here in Chicago for cash, rather than the place for 3X the money that the usual metrics say I ought to be able to “afford”. The result is much more money in the bank, and much less anxiety.

laura – thank you for explaining to the class how spoiled the post WW2 boomers are.

Ben, the Boomers certainly have had it better than the youngsters of today will. However, the generation that was truly spoiled were the Silents, who were able to get high wage jobs just out of high school, and raise their families in the golden period of 1950-1970, with its high-paying jobs, expanding economy, superfluity of native natural resources, and almost non-existent inflation. And the only war they had to worry about being drafted into was the Korean, which was very short-lived and which most Silent Gen men were able to escape.

The Boomers were a little less fortunate. As the protracted Vietnam conflict claimed 40,000 baby boomer lives, it also drove inflation, and the the 70s were a period of economic pain, with the oil embargo, the stock market crash of 72-74, and the oil embargoes of ’73 and ’79, side by side the increasing offshoring of our manufacturing and mass loss of jobs to Japan in the late 70s and early 80s when hundreds of thousands of jobs in the steel and automaking industries, which had been the main support of our middle and lower-middle classes, or 80% of the population, were lost, and the factories and mills shuttered right and left.

In the early 80s, we had what seemed like an economic resurgence, thanks mostly to the development of new oil fields in the rich North Slope of Alaska, and Britain’s north fields, but the bloom was definitely off and the U.S. never recovered anything like the mass prosperity it had in the post-war era. You look at a chart that shows consumer borrowing side-by-side average earnings, and what you see is that wages stagnated from that point forward, while people borrowed to maintain the lifestyles they had come to see as an entitlement. The offshoring and loss of jobs continued and increased, as defense spending was curtailed- ask older Californians what life was like as hundreds of thousands of jobs in aerospace were lost and the shipyards at Long Beach shuttered.

The period 1980-2005 was not a period of “growth” at all, but the period in which our manufacturing, the foundation of any solid economy, died completely, and our country became increasingly financialized, with destructive consumer borrowing making our opulent lifestyles possible. But the boomers “enjoyed” those lifestyles with ever less security and declining wages against rampant inflation in the cost of living, as high paying manufacturing jobs were replaced with low-paying service jobs, and the cost of living ran further ahead of wages and salaries.

In short, the past 30 years of transition and upheaval have not been kind to most of the baby boom cohort who are of ordinary means, though the top 5% have prospered as never before in history as our major industries- finance, health care, education, and agribusiness, have become scams designed to skim the wealth of a captive population while giving people next to nothing in return…. all because the Silents and the Boomers tried to pretend that the post-war party could continue forever. But, then, no one in history has ever voluntarily relinquished a benefit, but extend and pretend until hitting the wall, as we are now.

@Laura

I’ve always found the post WW2 prosperity fake a bit misleading. While the factors you state absolutely were unsustainable, the wealth that was built during the early boomer era was more than enough to keep American’s living standards incredibly high. If not for the looting of our Treasury through the Vietnam War we could have avoided the destruction of the dollar and the inflation of the 70’s. Even then there was a second chance as the first 2 years of Regan’s term destroyed inflation. But the unhappy Boomers had a hissy fit over taking their medicine and the rest of Regan’s term veered toward huge deficit spending. Greenspan’s FED certainty didn’t help matters. Everytime there has been a chance for normalization which would take us right back to the Boomer Golden Era they themselves fight it because they fear losing their faux wealth. If the USA had even a semblance of fair trade and absolutely no bailouts of any industry financial or otherwise the resulting corrections would restore purchasing power to the masses and ignite so much economic activity as to amaze!

We CANNOT let the Oligarchy and their sychophants control the narrative! The era of Working Americans prosperity is not some by gone unattainable memory. If the ruling class can ever be forced to realize even some of their losses along with someone, anyone making a principled stand on trade, we’d be left with a 300 million person economy sitting upon a continent with great natural resources and a liberal society that by it’s nature fosters innovation. The ONLY thing keeping the American economy depressed is those who want infinitely more while the rest of us have infinitely less. It is so far beyond greed. It’s a sociopathic hatred of those not in “The Big Club”. This is why I’m never surprised by political scandals or things like DEA agents having sex parties with underaged prostitutes. These people in power are sick.

NILHILIST………..

I WILL SECOND THAT! GOOD POST!

Uncle Sam thanks people like you. 🙂

Thank you, Colorado.

I’m in the same boat as you, except living in LA and my wife is already staying at home with my son. A 450K mortgage would eat more than half of my post-tax income (with 6 figure pre-tax in aerospace), and daycare would eat at least another 30%. So no way in hell I am buying a home. I’d rather move in with my inlaws who live in a paid off 4bd house and put the saving into IRA/401k. This way I don’t have to worry about job security and the realtors and flippers can kiss their over-inflated ridiculous commission goodbye.

Here’s an interesting case of a Woodland Hills house that lost money: https://www.redfin.com/CA/Woodland-Hills/5011-Balfour-Ln-91364/home/3557248

Bought in 2005 for $670,000.

Sold in 2015 for $670,000.

Of course, $670,000 is worth a lot less today than it was ten years ago. That house failed to appreciate over ten years. It actually lost money due to inflation. Not to mention the cost of selling it.

I toured that house several months ago. It was nice enough. The main problem was that it only had two bedrooms — on different floors. I don’t think mothers like the idea of being on a different floor from their kids. And the elderly don’t like stairs. So that limited its appeal to singles and childless couples.

I considered buying that house, but was worried about its resale value.

Hello Doc

coincidence… recent article in ZH, about reasons Millenials arent buying homes.

http://www.zerohedge.com/news/2015-05-29/most-confusing-reason-why-millennials-arent-buying-houses

…”So while we were certainly not surprised to learn that excessive student loan and credit card debt were responsible for keeping many of America’s youth from buying their first home, we were surprised to discover that for millennials in around one third of US states, the chief impediment is apparently “not knowing how to start ?

The New Nationwide Crime Wave

http://www.wsj.com/articles/the-new-nationwide-crime-wave-1432938425

“Murders in Atlanta were up 32% as of mid-May. Shootings in Chicago had increased 24% and homicides 17%. Shootings and other violent felonies in Los Angeles had spiked by 25%; in New York, murder was up nearly 13%, and gun violence 7%.”

“in a South Central Los Angeles police division, shooting victims are up 100%.”

Gentrifying!

In 2013, Los Angeles reported 246 homicides – which corresponds to a rate of 6.3 per 100,000 population – a notable decrease from 1980, when the all time homicide rate of 34.2 per 100,000 population was reported for the year.

Hello it’s 2015 now, time to wake up.

…off of a low base, sure. Did you miss most of 10th grade stats?

Take a deep breath, your crime wave as relates to gentrification hypothesis just farted. Los Angeles, Atlanta and Chicago among the top 10 cities currently gentrifying in America.

http://www.huffingtonpost.com/2013/11/07/most-gentrified-cities_n_4234239.html

Taking breaths and 10 grade classes? Way to add no value to the discussion with inane and personal antics. Yes off of a low base meaning a potential inflection point has been passed. Good straw man attempt though as we already know and would agree that these cities are gentrifying, the point is that buying into a gentrifying area is risky and crime is on the rise in all of the cities you cited so the next couple of years should be interesting from that perspective.

Demographics

Age 23,24,25 are the biggest in America

Ages 17-29 are very big age group

However, what was missing is the dual income factor model equation which people forgot about

For the Young to Buy

1. Rent

2. Date

3. Mate

4. Marry

3.5-6 years into marriage = babies = dual income factor model = leaving apartments and buying in the Subs

9 reason here why First time home buyers are trending at their worst historic level ever recorded in American history with the lowest rate curve post WWII

http://loganmohtashami.com/2014/11/03/demand-from-first-time-home-buyers-hits-21st-century-low/

My girls moved home after college to save up money, but with prices going back up so much, the buying a home in San Diego idea has been put on the back burner and they now have their own places. Each has a roommate to make ends meet (as I did at their age). As a parent living in a free and clear home, I would love for values to come down 50% so they could buy, but I don’t see how there is going to be the job losses necessary for that to happen. Maybe if Bernie gets elected he will close down the defense industry (as Bill Clinton did) and there will be thousands of hi paying jobs lost in So Cal. That could make a dent in prices, but I don’t know what else will.

Jim, I loved your post about wives not working after having the kids. I have that problem in my household and it has caused a lot of friction. My wife is perfectly capable of working in a good job, maybe $70-$80K, and has a very good resume. We are nine years removed from my youngest being born. She was laid off from a job that was much lower paying, yet she had taken it to stay closer to the kids. The layoff was in September, and she isn’t trying hard enough to find something. A number of my friends, and even my sister and her family, have the same issue, and several are going through a divorce, partially because of the situation. I wish I had the luxury of not working, or choosing my perfect job. With a mortgage and kids, I don’t, although I like what I do.

As for Clinton being the one that caused the layoffs in defense, research this. That was the first Bush, and the layoffs started around 1990, before Clinton was elected. http://en.wikipedia.org/wiki/Early_1990s_recession_in_the_United_States

If Bernie does get elected (he won’t, but I wish), he will trim the defense budget. We can’t afford defense being 25% of the federal budget.

I agree with you — I think this is becoming a problem in our age. The economics of having children and also having them cared for is an interesting topic. For me, as a married woman without kids, I have friends who plan to quit working after having kids…yet, at the same time, they expect their husbands to provide a certain kind of lifestyle (expensive cars, private schools, pricey homes in a good neighborhood) so that they can keep up with their friends/The Joneses. But then they want to stay home with children and not go back to work. I’m not saying that raising kids isn’t a hard job, but no one ever asks men what they want or if they want time at home with children. Men want options too and I think it’s too prevalent in our culture today that men are just expected to “provide” without being asked what their preferences are and how they envision time with their kids, time off, time with aging parents, etc. I plan to work after having kids, and so does my husband. I can work partly from home and so can he, which will be great and we will have some help from our families — they live nearby. I think sharing those responsibilities — both financial and familial — can contribute to a healthier relationship.

I wanted to address your comment because I think it’s really insightful and is often overlooked in the overall scheme of lifestyle expectations and values.

I realize that saying this won’t win me any awards with some people, but the strife some express over this situation should be toward the creation of a ludicrous economy in which a two income household is seen as “necessity” and “normal.” How did such an economy come about? One in which a man feels he can’t provide for his family? Well, we all know the answer to this if we use basic logic. But no one wants to say it out loud. (And I’m no different here. I am sure you all know.)

MANY younger women are now falling back into their traditional gender role as soon as they have the opportunity to do so. Literally every woman I know under age 35 either stays at home with kids or has plans to do so soon. It doesn’t matter if they didn’t graduate high school or they have a graduate degree (as I and some others I know do). This is part of who and what humans are and what they are meant to be, regardless of who wants to admit it or not.

“Millennials” watched their families (or at the very least, many of their friends’ families) torn apart by the stress of the two income household and keeping up with the Jones’… instead of keeping up with one’s own family. Many younger women are thus waking up to the huge scam that was pulled on us and on the prospect of a happy family, all for the sake of a larger work force and lower wages. It’s true, folks. It’s true.

One thing that differentiates these women is that some are able to speak openly with their spouse (or potential spouse) about it, and some aren’t. I do not advocate keeping silent about these feelings, but I can empathize with why some women feel the need to do so. It can be difficult to find men who truly understand that this is for the best, even if it means FAR more modest living. There are some who do understand, including my own husband. He knew my views on this very shortly after we met. But many have been so brainwashed that only being shown will, well, show them.

I live in San Diego, early 30s, make about 90k/yr, single guy. No way will I buy at these prices. I can rent a place that more than meets my needs for 1250-1500 a month and save save save. I can wait as long as it takes because I know that something has to give and that will be prices. Current home owners can’t stay in their homes forever, interest rates can’t stay low forever. I strongly believe that there is going to be a huge crash in housing that makes the previous one look mild in comparison. You can’t create housing demand when the typical household can’t afford asking prices, and you can’t change that the boomer generation, the current owners, are going to start dying off in mass.

Jim, the defense industry began closing at the end of the cold war; 1989-90.

These days the thousands of new high paying jobs are thanks to tech bubble 2.0 spillover mostly from the bay area. We’ll see how long that will be sustained.

So what’s going to happen? Old folks are going to die, leaving their home to their children who will live in it until they die, which in turn they will leave to their children. Or, if they have no children, it will finally be sold outside of the family.

Is it advantageous for banks to stall on the foreclosure process? It seems like they’d want to get bad debt off their books as quickly as possible.

It’s also advantageous for financial institutions to help keep artificially prices high by withholding inventory. As long as mark to market accounting is suspended, they don’t have to write down the value of their RE portfolios. Then they can sell houses at near peak pricing.

As usual, great follow up comments. Thanks for the feedback. We are moving this weekend and the comments here reaffirm my belief that we are making the right decision. It’s not a perfect solution to rent from family, but with market rent in Denver around 1550/mo for a decent place, I don’t really see how we could save for a house or anything else for that matter. We are grateful to have an alternative.

@Imfromcolorado: I never stated that you were making a bad decision by waiting to buy- I think it’s a great decision. It just didn’t make much sense that you were so concerned about paying $450k for a house when you and your partner make a combined $200k+.

And then in your new post you state, “…with market rent in Denver around 1550/mo for a decent place, I don’t really see how we could save for a house or anything else for that matter”. That doesn’t make any sense either!! My wife and I make less than $200k, but we’re saving a bunch of money even while paying rent of more than $1550/mo. We also own a rental, but we just don’t want to live there (we more or less break even on the rental). If you really do make $200k+ combined ($16,666+/mo before taxes), $1550/mo for rent is comparatively cheap and would allow you to save quite a bit of money every month.

Just wanted to point that out. I’ll stop posting for now.

I just got back from a party held at the house of a generation Y couple with three kids. They own it and at the price that houses in their neighborhood are going for, they have about 50% equity (that could drop if another bubble pops, but that’s in the future). There were several other couples of the same age and also some young singe parents with their children and none of them live with their parents. Some own, some rent and some have a deal with their parents on a jointly owned house. They are all out in Orange County or the IE. None of them are Hipsters. LA West Side isn’t the best place to look at to judge what’s gong on in the rest of America.

I think this example illustrates the perceived mistakes many home buyers made 10 years ago and how that has haunted this same demographic since 2006 or before. When you couple the contraction expected, rising interest rates as well as house flippers trying to manipulate the pricing levels, home buyers need to make sure they are getting a good enough value in their purchase that will make it through the market changes that will no doubt occur. Just because a seller in the IE is trying to sell for $200 a square foot, doesn’t mean the value there. It is simple, buy at the lowest price you can.

Blert above – incredible summary.

*Our youngest just graduated from Cal and he is back with us for awhile. As is our 24 year old, who actually contributes towards rent, he’s happy and so are we.

I enjoy having my kids in the house. In time they will make their way and set a course that doesn’t involve mom and dad so this is a great time.

Neither believes they will ever own a home in California. Both are looking overseas.

Made my journey Sat to new housing tract, good amount of Millenial couples were looking. The homes from high 500’s to mid 600’s. The usual questions, lot premiums avg 20k, how much for up grades on avg 50k, window coverings about 15k, landscape with pool about 50k without about 20k.

The most popular seem to be priced at $629 add the above 725k to 755k plus closing cost, moving expenses, and the usual trips to home improvement stores for all the small stuff you have to have another $2000 on the credit card and you could see why nobody while I stayed around was writing a contract and almost all the lots were not built. I talk to a rather tall man about 30 or so we talk about his college basketball days at Loyola Marymount and mine brief play at CA State Northridge

Then I had to ask him, can you and the family swing these houses just asking, and he said no way, no how, don’t have the required down payment, have the job, but with 2 kids and the impound account for taxes, insurance, we don’t qualify to buy here or most homes we see. That is America 2015 in a nut shell, don’t care what the stats and graphs imply, most young people and older (BTW) in this country just can’t buy, to much is thrown at them so they all walk away highly disappointed and confused.

And even the millenials like me who can easily afford to buy do not because we know how is going to end up sonner or later.

Off topic, but I wonder who will buy Michael Jackson’s former Neverland (now Sycamore Valley Ranch)? Wall Street 1%er? Chinese Billionaire? Russian Oligarch as a gift for his teenage daughter? Developer who will subdivide it into tract houses each featuring two kitchens and eight bedrooms?

Maybe Dennis Hastert will buy Neverland. He can entertain his young “friends” there.

I have seen parents work out deals to have their kids rent an apartment while the parents live out of state just so they can attend schools that are better or accessible for them. Makes sense if parents have sold and move on from the state.

I’ve heard of the idea before, but it would be cool for somebody to fire up an anti RE listings site.

Like Zillow, but pointing out how f’d you’re gonna be if you buy that listing at that horrible price, and with a breakdown of exactly each line item and how high and ignorant the price is for any reasonable buyer.

Yes you get graphs of how stupid the price is, how that ocean view is actually a sliver between buildings for 1.5x, and that 2 car garage is really 1+1/3, and that idiotic floor plan will be a shot in the head.

This would at least help educate people and put pressure on the flipper dolphins, plus be really entertaining.

Kudos for the blog.

John – do that! A site like that would be highly entertaining, and the ad revenue from the visitors’ clicks would support it.

mortgagecalculator.org. – Truth is in the numbers.

Just a simple tool, but much more realistic than the Zillow mortgage estimate. Displays how much your taxes will be, how much interest you will pay over the life of the loan. It adds mortgage insurance tax if your down payment isn’t large enough. It even shows how front loaded with interest payments the loans are.

If it was laid out like that on Zillow, people would see just what a poor “investment” a house is.

“…people would see just what a poor “investment†a house is.”

Unfortunately, it’s not that simple. You have to live somewhere, and rent isn’t free. Although you might pay less for rent now than a mortgage, your rent will always increase. Maybe not this year or next, but it will continually increase. Conversely, mortgage costs are static, excluding minimal increases in property taxes (assuming you’re in California). Obviously, you will need to pay to upkeep your house. However, a landlord is going to build the price of upkeep into the rent, so you’re effectively paying for upkeep whether you rent or buy.

I think the trick is to simply do what’s best for you. For me, I want an option that will afford me the best quality of life at a reasonable price, and one that will yield the best future financial benefit. Over 30 years, I’d be very surprised if renting would be a wiser financial choice than buying, unless you’re one of the very few investment wizards, which I am not. That’s why I will definitely be buying at some point; just not now due to outrageous prices.

You also have to keep in mind that, depending on where you live and what you rent, Rent Control may be a factor, where you’re only talking a less than 4% increase per year being allowed.

It doesn’t account for each individual tax scenario which impacts potential government subsidies and it also doesn’t account for insurance, tax, maintenance, and repair expenses which are subject to inflation. That tired saying about having to live somewhere is a useless point and claiming that the rent always increasing is not true. Rent can go up and rent can go down in real terms, ask any landlord who has been in the game long enough. The landlord is not going to build in upkeep price, the landlord is going to set the rent at the level the market can bear, period. Then there’s the also useless platitude of just do what’s best for you. FFS if it was that simple people wouldn’t be here looking for advice on what to do.

@Observations and Responses:

I acknowledged (accounted for) maintenance/repair and tax expenses. Insurance is a nominal expense in most situations, particularly given that any responsible person would have rental insurance anyway.

“That tired saying about having to live somewhere is a useless point and claiming that the rent always increasing is not true.â€

It might be tired (just like topics discussed on forums everywhere), but it’s quite true. Even during one of the worst recessions experienced since the great depression, rents did not decrease by any meaningful amount.

Sources:

https://www.census.gov/hhes/www/housing/census/historic/grossrents.html

http://www.deptofnumbers.com/rent/us/

“The landlord is not going to build in upkeep price, the landlord is going to set the rent at the level the market can bear, period.â€

Fair enough. However, market pricing probably still includes maintenance costs built in- you obviously need to have an understanding of overhead costs, as with any business, in order to set pricing. And actually, a smart landlord may set rent below market in order to secure long term, quality tenants. But what do I know; I’m just a landlord.

“Then there’s the also useless platitude of just do what’s best for you. FFS if it was that simple people wouldn’t be here looking for advice on what to do.â€

Doing what’s best for you isn’t always a useless remark, considering many people have different goals and preferences. For instance, I don’t mind condos. Yeah, you pay a bit more in HOA fees than it would cost you to facilitate the exterior upkeep yourself, but I don’t mind paying for that convenience since I would prefer spending my time and energy doing other things. Others feel differently.

And not everyone here is really looking for advice. I just like to read the articles and comments. Maybe they’ll be useful, maybe not. It’s mildly entertaining either way.

@Responder

The first part wasn’t directed at what you posted but to address your response, using only the past few years as a yardstick for what rents can do is shortsighted.

Advising someone to just do what’s best for them is like advising them to use common sense. Anyone who is going to do what’s best for their self is looking for useful details and anyone who isn’t, won’t. So it’s useless.

You could call it, Silo, or Sighlow, or Sillyow.

However, buyers of recent times are not being misled by the market. Buyers have personal responsibility for the prices they choose to pay for houses in the market. No one is dragging anyone to viewings and forcing them to buy. The buyers can’t be that dumb if they have the money/financing to pay these prices.

_____

I’ve heard of the idea before, but it would be cool for somebody to fire up an anti RE listings site. Like Zillow, but pointing out how f’d you’re gonna be if you buy that listing at that horrible price, and with a breakdown of exactly each line item and how high and ignorant the price is for any reasonable buyer.

Yes you get graphs of how stupid the price is, how that ocean view is actually a sliver between buildings for 1.5x, and that 2 car garage is really 1+1/3, and that idiotic floor plan will be a shot in the head.

Shillow.

As in, exposing the low behind realtor shill. Or perhaps, taking realtor shill to a new low. Your choice.

Got an email from a realtor. Said that if I own property, I could be sitting on a GOLDMINE.

The email used large, colored fonts, of various sizes and colors. The word GOLDMINE was in especially large fonts, and in gold (naturally).

Urged me to contact said realtor for a FREE appraisal of just how much money I could make were I to sell.

Seems realtors are getting desperate with the lack of inventory. Sending out generic emails, trying to drum up new listings.

So a working American solicits you to make you money and you find said realtor desperate. Got it.

I don’t think any condo, even a New York penthouse, is worth over $100 million. But I suppose if you have billions, what does it matter? http://nypost.com/2015/05/30/billionaire-to-buy-95m-sky-high-penthouse/

“a mystery buyer — said to be an American family — bought the $100.5 million penthouse at rival billionaire building ONE57, which was the city’s tallest residential building for a New York minute, until 432 Park Ave. came along.

The building, designed by Rafael Vinoly, is 1,396 feet tall and boasts the city’s highest rooftop.”

It is the employers that hire undocumented workers because they pay them less. The United Farm Workers Union is the solution as well as all unions, to raise the wages, that way the employers will not hire the undocumented. Solidarity forever.

Did you miss the union petitioning to get an exemption from minimum wage last week because it’s “too expensive” and would make it hard on them? The same union that was campaigning to raise minimum wage to $15? What does Arturo Rodriguez take in for a salary?

By the way Oxnard will never be confused with Newport Beach. You can hope for Torrance.

A controversial new plan would put residents on the hook for fixing broken sidewalks across Los Angeles.

http://ktla.com/2015/06/01/new-proposal-would-make-residents-responsible-for-sidewalk-repairs-in-their-neighborhood/

When government bodies get desperate, they get creative with ways to tax, but go ahead and keep believing that Prop 13 is going to protect you.

That’s pretty normal in most big cities.

The first fifteen years of my married life were in Hermosa Beach and then Northridge in the “valley”. After spending all of our time commuting, both working, and trying to have a life we finally left after the uzi shooting at the local junior high. We spent the next twenty years in Northern Virginia. It was a wonderful place to raise a family. We moved back because my wife inherited a crap shack, (free house). All I can say about life in Los Angeles is it is like sex without orgasms; everybody is on top of each other and nobody is having any fun.

Leave a Reply to blert