The resurgence of the low down payment market – The number of FHA insured loans has doubled from Q2 of 2007 to Q2 of 2012.

The dramatic rise in FHA insured loans in a time of historically low rates demonstrates two key aspects of the current American economy. The first point is that many US households have the inability to save for an adequate down payment on housing. Forget about the historical 20 percent down payment but many households cannot scrimp up even a modest 10 percent down payment. The second point is the American economy is still living on leverage. Debt is an elixir best served in moderation but as we are seeing with the low mortgage rates, the country is now setting a threshold where low rates are expected. As a case and point we now see FHA insured loans playing a major role in the housing market. Since Q2 of 2007 the number of FHA insured loans outstanding has more than doubled. This would not be such an issue if they weren’t defaulting in mass.

FHA the nostalgic bridge to easy money loans

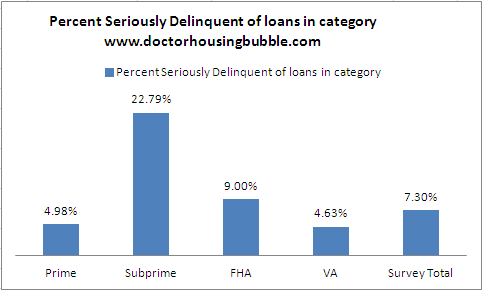

There is little doubt that FHA insured loans are plugging the bottom end of the market. FHA loans were never intended to be a major player in the overall housing market. In a recent MBA survey that covers roughly 88 percent of all outstanding mortgages we find the following:

FHA loans outstanding

Q2 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,030,214

Q2 2012:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6,827, 727Â

In this short period of time, FHA insured loans more than doubled. The benefit? FHA loans require a miniscule 3.5 percent down payment and this is what most typically jump into the market with. Nonsense chatter that people go in with more down payment funds is just not shown in the facts. Most people that use FHA loans use them for the following reasons:

-Lack of down payment funds

-Maximum leverage to squeeze in

-Little risk

FHA insured loans essentially function as a call option on a home. Think about the fact that selling a home will cost a home owner roughly 5 to 6 percent so right off the bat FHA buyers are already in a negative equity situation when selling costs are factored in. However, with such little skin in the game should home prices drop dramatically people have less of their money at risk. Why else would demand for these loans be so high? You can get a conventional mortgage with 20 percent down, fantastic rates, and no mortgage insurance. Mortgage insurance is now getting more expensive because of rising defaults. Don’t think this is true? Let us look at serious delinquency rates across mortgage products:

While prime mortgages have a serious delinquency rate of 4.98 percent FHA loans are up to a stunning 9 percent. This is incredibly high given that this is a loan product that has been booming recently. Subprime loans are a dwindling segment of the mortgage market. In 2007 subprime loans made up 14 percent of all outstanding loans whereas today they are 9 percent and moving lower. However, FHA loans in 2007 made up 6 percent of all loans and are now up to 16 percent of all outstanding loans. We should be concerned about the delinquency rate because we will be on the hook for this. Of course it should come as no surprise that many that can barely save 3.5 percent to buy a home are more likely to encounter financial problems and increase a new category of distressed inventory.

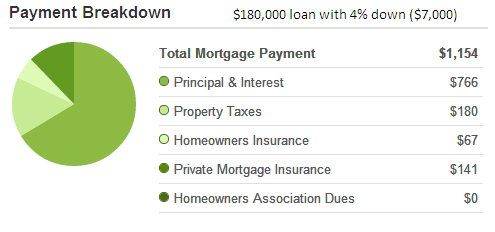

Home prices nationwide are being supported by low interest rates and low down payment products. For example, let us run the monthly payment for your typical nationwide home:

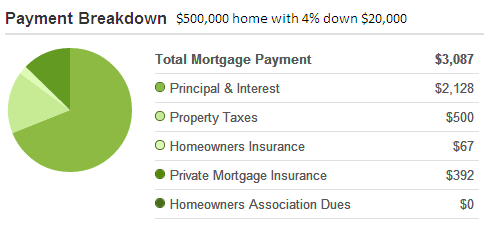

Given the $50,000 typical household income an $180,000 home with a 3.5 percent FHA insured loan doesn’t look like it will stretch the budget too much. Run the figures for a $500,000 home in California:

Notice how high that PMI is? This is how many in SoCal are squeezing into places and creating bidding wars with the low inventory that is being seen on the MLS. The low inventory is not a creation of a booming economy but by number games being pushed by the Federal government and Fed. The fact that over 9 percent of FHA outstanding loans are seriously delinquent (nearly 7,000,000 total FHA loans outstanding) should we simply continue giving out low down payment loans for the sake of getting people into homes? Clearly something is up here because prime conventional loans with higher down payments are performing much better.

As we discussed in a previous article low interest rates are already hurting households in other less obvious ways. How long can this last? Hard to tell but the fact that mortgage insurance rates zoomed up this summer in a hot selling season should tell you that the underlying fundamentals of the economy are still shaky. Also, if FHA insured loans were such a good deal why don’t you see Wall Street banks jumping in to make 3.5 percent down payment loans with their own money to the American public? Currently the entire mortgage market is fueled by government backed products.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

79 Responses to “The resurgence of the low down payment market – The number of FHA insured loans has doubled from Q2 of 2007 to Q2 of 2012.”

$3,087 is the payment. A huge percentage of this is tax deductible. So, if you think you’re income is not going away any time soon, this is what’s attracting many buyers now where rents are up.

Actually, about $1,800-1,900 is tax deductible (interest portion of the loan and the RE taxes). So, we’re looking at ~$16,000 of interest for the year (using the 3.4% rate Dr used), and $6,000 of property taxes. Let’s just say income taxes are $2,500.

So, we have total itemized deductions of ~$26k with the house (I’ll throw in a little for DMV fees and charitable contributions). Since the standard deduction is $11,900, the first $8,000 or so of deductions gained from the home purchase are “lost” on the way to exceeding that amount. $22,000 – 8,000 = $14,000 tax benefit. Multiply that by 30% (Fed 25%, CA/state ~5$), and we have a $4,200 yearly tax benefit, or $350 per month. If your adjusted gross income is much less than $110,000, then that benefit is reduced even further given that you’re only chipping away at the 15% federal bracket.

There are so many factors to consider, but I think it’s important for people to understand that the tax benefits are, in general, a fairly minimal part of the equation given how low interest rates are these days.

I know we’re talking California, but I would bet money that more people don’t even exceed the standard deduction in mid-west states (Texas, especially) that are purchasing today.

Agreed, another example of a nation that can’t do math. I personally wouldn’t spend 1000 to save 200 in taxes, but some people would. Worse, most people treat tax returns like found money and just tinkle it away. Lots of fools parting with lots of money.

thanks for clearing that up Jeff – People hear all the time about the great tax benefits of homebuying but don’t realize it’s overhyped and not as valuable as touted.

Texas is NOT the Midwest.

The Midwest is these twelve states, and only these twelve states:

Michigan

Ohio

Indiana

Illinois

Wisconsin

Minnesota

Iowa

Missouri

North Dakota

South Dakota

Nebraska

Kansas

Whatever you get back from the IRS/Sacramento goes right back out the door to pay property taxes….

Looks like Doctor HB is late to the party. As early as 2003, 80/20 loans (80% first mortgage, 20% second mortgage, zero down payment) was the norm here in sunny southern California.

As late as summer of 2008, 80/20 loans (100% financing/zero down payment) was standard.

Even today, I know numerous couples who have gotten mortgages recently in SoCal, and the banks tried to force them to go the 3.5% FHA route in spite of these people having the 20% cash payment available.

Dr. HB,

Excellent as always. While reading one of your older posts I came across this…. Here is a you tube video posted by Gman in 2009. I really did laugh out loud.

http://www.youtube.com/watch?v=bNmcf4Y3lGM

Lost another one to Ditech!

Wake me when they start the 125% liar loans again. Surely that will mark the bottom.

/sarc

I just got back from my first nightly walk around my neighborhood in Westlake Village since before I left for vacation in June. Right up the street from me, there are two homes that were occupied when I left that are now empty. One of them was a couple who lived in the house for 17 years. The guy was a writer for a popular tv show and with a daughter in college. They used to have an open house every year Thanksgiving weekend. Integrated and solidly upper middle class. The house next to theirs was bought by a divorcee 2 years ago, where she lived with her 3 teenage sons. Tonight, both homes’ lawns are dead. There are tire tracks in the front yard of the writer’s home. Takeout containers are strewn around both homes along with beer bottles.

In talking with the HOA president of our neighborhood before I went on vacation, I learned that 50% of the homes in my neighborhood are now not owner occupied. Most of those homes are now rentals. However, a good portion of these “rentals” are either delinquent on their mortgages, in default or now bank owned, some of which are being rented to tenants by the banks. I would say 15% of the homes in my neighborhood are abandoned.

These homes were $750,000 on the low end to $1,050,000 in 2006/2007. Now, literally, my neighborhood is turning into a low end dumpy neighborhood. This is very difficult for me to digest and frankly unbelievable to me. I used to be very proud to live here. Our town is still a prosperous place, but so many people have bailed that it is no longer the almost Utopian California dream place it was even two years ago.

Sorry that my post is off topic. I don’t see any of the housing recovery that I read about elsewhere happening here.

See my post above about 80/20 loans and 100% financing.

1.) Glass-Stegall was repealed in 1999

2.) The Bush Administration allowed the mortgage industry to self-regulate itself in 2002

3.) Federal Reserve pushed mortgage rates to 5% in 2003

These are the three key events that caused the housing bubble. What you are seeing in Westlake Village is the result of #2 and 100% financing. These would be “strategic defaults”. Since most SoCal mortgages from 2003 to October 2008 were 100% financed, now that those same homes are positively underwater, what you are witnessing is what happened in Texas when the S&L crisis happened: i.e. Jingle Mail

4.) Poor mathskills & herd mentality of the sheeple.

Ernst B.,

Please explain how repeal of Glass-Stegall had anything to do with the mortgage bubble. Lefties always cite the repeal of Glass-Stegall as though it explained every bad thing from the housing bubble to athlete’s foot. I suspect you don’t even know what Glass-Stegall did or why it was repealed or why Obama did not attempt to re-instate it.

And, sorry, but the Bush Administration changed virtually nothing with regard to “mortgage industry” regulation. If you like Clinton’s regulations, you liked Bush’s too. The only thing the Bush Administration tried to was rein in Freddie and Fannie. Unfortunately, Barney Frank shot that idea down. I bet you can’t identify a single regulatory change made during the Bush Administration. What was the big “self-regulation” change I keep hearing about?

It’s true that Fannie and Freddie average mortgage rates dipped to a 5 handle (but NOT to 5%) in June of 2003. But that was only Fannie and Freddie rates. Individual private mortgages may have gotten that low (I don’t know) but not on average. So what conclusions do you draw from this fact? What are you trying to say? The Federal Reserve has pushed mortgage rates to a 3 handle under Obama. Is this good or bad?

ernst and bmc, as far as I can tell, you both missed the main contribution of GW Bush to the housing bubble. Starting in 1968 for Fannie Mae, and 1970 for Freddie Mac (I think), these two GSE’s had only an implied government backing. This implication came from their line of credit with the federal govt. I believe it was rather low as well, only a few billion (not sure about the amount).

However, as they exploded in size in the late 90’s and up until the housing bubble top, there was the assumption that their bonds should be triple A rated, since every one believed that the government would bail out bondholders if a collapse happened. It did and they were bailed out by the American taxpayers on Bush’s watch.

Bush should have stepped in at some point early in his presidency and said that GSE bondholders are on their own and that no taxpayer funds would ever be used to bail them out, if the mortgage market ever went sour. Of course he said nothing, even as these agencies went from the hundreds of billions into the trillions in retained portfolio value.

Since Fannie and Freddie formed the core of the securitized mortgage market, this was one of the key factors in the formation of the housing bubble.

Ernest – let’s not forget a few other MAJOR factors:

1) Favoring of securitization over whole loans coupled with removing leverage limits on the banks. This is so much bigger than Glass-S by many multiples. This lead to massive money availability and velocity in the system (when they talk about the Shadow Bank system this was it). This expanded the “ability to demand” as housing prices are limited by credit when incomes are flat.

2) Heavy push to expand “virtues of homeownership” to everyone including forcing lenders to lend into bad areas and to “iffy” credits. This dramatically increased the population for people who were “able to demand” homes to help galvanize prices while incomes were flat.

3) The blind eye to issues at the agencies which along with banks were functioning on government policy (falls under “ability to demand”).

If you combine your own along with these (and it was very much bi-partisan) you start to see the skelleton of policy in the linkage. Consider flat/declining wages after the 2000 bubble pop. How do you get the economy going again – use housing which traditionally played a part in every post-war recovery. Push all the levers and open up warehouses of capital. People will buy homes, drive prices up, infuse the moveup buyer with cash to buy a bigger home/spend, and galvanize construction to plug the leaky hole until incomes rose again and things settled (increase cost of living via homes and obviously wages need to also increase and the nice thing is that CPI equations for pensions/benefits are all based on rental equivalent so it doesn’t show up and hurt that side either).

One issue with said policy…it didn’t work and instead you had people absorbing massive losses in what is traditionally their largest most levered investment. When personal consumption is 70% of the largest economy on the planet…creates quite a speed bump in the balance sheet of these individuals.

Moral – sometimes it’s better to take a small deserved beating occasionally than try to push it off and avoid any/all pain until finally it crashes down and implodes on you. This is what government and people need to learn (again).

bmcburney

Recovered Republican here. Bush 43 had a lot to do with the housing bubble. He did a speech on the barrier of down payments getting in the way of The American Dream. If you want to see footage of his housing speech, watch the documentary Overdosed, where he fumbles through a really bad speech. Bush started the bailouts. He was the Liar In Chief and is part blame, along with the current Liar In Chief. Free At Last, Political Atheist now.

You missed the biggest contributor of all to the housing bubble….the 1997 Tax Reform Act which allowed married couples to exclude up to $500,000 of Capital Gains if they only stayed in a house for 2 years.How many people do you think would have been bouncing in and out of houses every 2 years if they had to pay the Capital gains on every sale?Before 1997 people only had a 1 time exemption over the age of 55.They should have left it that way….

RTS

Hi neighbor, Thousand Oaks gal here. TO is in transition itself. The criminal invaders have arrived. Having bailed out of the SFV in 1984, the patterns we ran from have caught up with the Conejo Valley. Housing is a mess here. Rentals in areas where homeownership onced made life great, are turning into boarding houses, and the congestion of people, cars, and lifestyles, have turned it not so upper-middle anymore. .

We are house hunting (cash & close) and started looking elsewhere.

I remember WLV in the late 60’s and 70’s. My family moved there to live in paradise. I am sad about your post, but hey, the truth hurts. My family lives in the First Neighborhood.

Do we live in the same town? I’ve been in T.O. for 20+ years and haven’t seen the sort of criminal element you speak of (apart from the crummy areas down by the freeway where they’ve always been). Yes, there are more foreclosures and many neighborhoods (my own fairly cheap one included) have a vacant home or two, but it’s hardly a post apocalyptic scenario with trashed yards, section 8 conversions and thugs moving in – at least I don’t see it, and I drive and cycle around the Conejo all the time.

apolitical scientist

We sold a 4,000 sq ft on a hill w/ a view beautiful home, and are renting in the ghetto of T.O. There is an influx of illegals invading this town. My sister is a teacher and has problems that she didn’t have 6 years ago in the CVUSD. Parts of T.O. are still ok (for now) but I live it daily. You evidently found a sweet spot in T.O. We just wanted cheap rent until we find our cash & close home. The demographics are changing. When did TO have a meth lab blow up in a fairly decent neighborhood? That happened on Arboles a few years back. Our former neighbor worked for the FBI. I have a pretty good understanding what’s up.

I am seeing the same situation. My neighborhood is turning to a slum as described in the Atlantic two years ago. I visited three builders this past weekend. You can still buy a $400,000 to $550,000 house with almost nothing down thru a combination of FHA and other give-aways by the builders company or other sources and “incentives.” It’s even easier if you are a veteran.

I don’t see rents rising. Just the opposite; what’s more, it’s harder then ever to evict and the repair costs and time to repair take that rental off the market for months. For all these reasons and others — joblessness, food stamp usage, sinking retail sales, boarded up store fronts in the mall, etc — I don’t see any turn around in the housing correction. Goldman and Deutsch Bank both said the house prices will continue to fall as long as unemployment stays high. Looks that way to me.

I also live in WV and have for 8 years as a renter. Most houses on my street are rentals and at least one neighbor lost his job. However, local realtors have created the belief that a “recovery” (return to crazy prices of 2006) is underway. I know of folks who are trying to buy and lose out in bidding wars. And I see empty houses everywhere that are not shown as inventory. Major manipulation.

Who knew so many people from WLV read Dr. Housing bubble? Just like Dave we have been in Newbury Park (Conejo Valley) renting for 8 years. We have seen a 200K price deductions from the high. Just fustrated that it is taking so long for the homes to show up on the market. Wasn’t their some talk about housing inventory increasing and price deductions in the fall? Your comments.

HI Valley Girl

We love parts of Newbury Park, but aren’t into PUDs anymore. Wendy Dr has such great lots, but that Casa Conejo tract ‘s sq ft is too small for us. We almost bought a home in Deer Ridge(? ) last purchase.

One thing that Newbury Park and Moorpark have in common is great micro climates. Gotta love it!

A home on Dickenson (backed up to Reino Rd) went out so high at the auction, the MLS might have been a better deal. Two bidders got emotional and up, up, and away. It was insane. Some idiot overpaid by $20K for a fixer. My husband and I were chuckling inside.

Prices are just freakin insane still. I read that when the Texas (oil)housing bubble popped it took 15 years to reach the bottom. We’re not there yet, imho.A few ups along the way to the bottom. Jobs are the driving factor. No jobs with low interest rates still give you no income.Inventory stinks, but no jobs is the origin of the epicenter. Fall will tell all around here.

Thank you for pointing out a real, on the ground, picture of what was once a very high end market with less than 1% vacancy rate. The 2010 Census indicated that the owner occupied level was 85%. Now it is 50% less than two years later. And, to quote the Ca Yellow Pages: “Westlake Village is known for its affluence and secluded character, and is considered one of the wealthiest communities in the Greater Los Angeles Area.”

I did a REDFIN search of westlake village (your area) and found only 6 homes in the entire area under $500k.. (all of them above $450K). All of those were listed as sale pending. Prices are down about 20% from peak 2006 levels in the area. So there may be room for further drops, but what are rents in the area? I wouldn’t give up home just yet… I’m sure the empty lots will be scooped up by an investor shortly and rented out if rental parity is anywhere close to reality.

Maybe a solution would be to gift abandoned properties to neighbors that are financially stable. Allow them to maintain and rent them out and share in the profits. This would be an interesting solution to blighted neighborhoods where every other home is abandoned. Those that have lasted out this depression and paid there mortgages could be rewarded with a gift of their neighbors abandoned lot. They could then finance and fix up the property repairs.. sell or rent it for profit and have an incentive to do a good job and sell for a fair price since there property value will be at risk if they don’t fix it up. By the bank/govt gifting neighbors the property they would have to pay taxes ect on it. but they would have incentive to fix it up quickly and cash in via a renter, new buyer, or expand there own lot to a dual lot.

Fair? not really. but it atleast will quickly bring back to life neighborhoods that need a facelift.

I’m not sophisticated with these things (REDFIN) but I don’t have much faith that these searchable databases capture all the data or the underlying status of various properties. For example, my next door neighbor hadn’t made a mortgage payment for a year and a half as of last November. He told me that there was a foreclosure sale happening on the house that same month and he didn’t know how much longer he would be around for. He and his family are still there. They had a garage sale a couple of weekends back and one of our other neighbors asked if they were moving and they said no. My wife has seen people taking pictures of the house. The neighbor grew up in the house and owned it free and clear, before taking out equity when his business slowed down in 2007.

My point is this property doesn’t show up as for sale in any database.

RTS

Any of the subscription foreclosure websites will show you the data on the property. it will show foreclosures, daily auction information(postponed and canceled status as well).We love Foreclosure Radar, but there are more options.If you know the sq ft, lot size, bdrms, baths, you can look on Zillow and find the foreclosure without its ID.

We are looking in the wholesale and retail markets for a home.

@Utopia?:

That’s ridiculous, how about we flush this shadow inventory into the market so people can buy a house at a decent price instead? We’re being effed by systematic manipulation and that empty house is only empty for that reason.

In uncertain times such as this, it may be the wise move to go 3.5% down and make it easy to walk away if needed. In 1960, America was a powerhouse and ran the world, and 20% down made sense. In 2012, it’s pins and needles all day and risking a lot of money just isnt wise.

Agreed that it may be wiser to put 3.5% down in uncertain economic times, if your out is to walk away should things go bad. Regardless of the feelings toward walking away, this culture of low down payments in uncertain times is horrible policy. It keeps housing unaffordable and sets up the buyers for default. I think it’s far more common though that the average FHA buyer is using it to just barely get themselves into a home, rather than foregoing the 20% down because of future volatility.

Who can possibly save 20% in SoCal? With $400 to $500 per month in fuel commuting, kids, high taxes…there are some hundreds going into long term savings every month, but that’s it.

Doing it “right” in the Midwest is easy. I can save up $25k in a few years, and have that 20% down plus cushion in the bank. Not gonna happen in SoCal unless you are rich.

I agree, “work harder”. But not everyone wants to nor does everyone want to give up their family. I don’t believe in any way that success should be punished, I love rich people, they (usually) earn it. But I also staunchly agree that there should be a level for everybody, and in SoCal the low level is San Bernardino. Umm…that’s flat out dangerous and ghetto. And those people don’t even WORK, I am puzzled as to how it holds up the level it does. So that leaves places like Fontana and Palmdale for the 9-5 crowd, plus sitting in traffic. Not cool.

IMHO, the market valuation in SoCal is whack, and most on this blog agree. I think Northridge and Rancho Cucamonga should top out at $250k but they don’t. They go much higher. Fantasy money? Probably. Cerritos for $500k and using “good schools” to justify it, give me a break. I can throw off 2 dozen interior USA cities off the top of my head with top notch schools and NORMAL house pricing. One has to ask if the delusion will ever end, and if it does then when?

I am currently saving up 20% with my wife. The real problem is that easy money has made that 20% an almost unattainable amount in socal for many families. Without easy access to 3.5% money, saving up 20% would be a lot more feasible for many families.

When I sold my condo here in central Massachusetts in 2010, I was stunned that the buyer was only putting 3.5% down. I think that’s nuts to make it so easy for the buyer to owe more than the value of the home or condo.

Mortgage financing from Banks has pretty much disappeared, so it understandable that the Fed has filled this void to keep the housing market from collapsing. What is not understandable is the contined low-down payment financing, back stopped by the Taxpayer. Has nothing been learned over the lasst 6 years?

What has been learned is how to use the taxpayer to enrich the banks.

With a 3.5% down payment FHA loan, mortgage insurance is required. If the homeowner walk away the insurance will cover the loss, not the taxpayer.

@Matt

Try this on for size. “A November 2011 audit showed the FHA’s capital ratio to be 0.24%, or $0.24 for every $100 in liability.” The premium increases are not going to be enough, even though they are up 300% since 2008. That is why Homeland Security ordered 450 million rounds of hollow points. Outlawed by the Geneva Convention but OK for in-house use.

http://themortgagereports.com/10799/increased-fha-mortgage-insurance-premiums-help-to-self-fund-agency

As expected, no.

What more can be said….?? The interventions of central planning will ultimately cause more pain for an even more extended period of time. Value distortion in the markets is epidemic. Public spending is still way out of whack with revenue reality. What happens when the massive public sector of CA is finally forced into skinny pants ?

“What happens when the massive public sector of CA is finally forced into skinny pants ?”

I’ll bet it never happens in CA with Dems at the wheel…simply threaten “pink slips” for teachers and/or safety personnel; local news lead story will be Mom and Crying Kid picketing school, carrying signs “Please don’t fire My Teacher (frownie face)!” or “I love Mr. Firefighter!” The unions hint at potential anarchy/catastrophe if layoffs occur, the public crumples, either taxes/fees get hiked, or “magically” millions are found in an obscure fund, few/no layoffs happen once dust settles. Also CA is loaded with retired govt employees receiving pensions; a guaranteed govt check arrives and the spending continues, fueling the economy whether boom or bust times. Many have homes bought decades ago; living is cheap, weather is good, they’re not going anywhere.

See Valejo.

Add in Stockton, and San Bernadino. This party is just getting started.

Those retired folks are going to see their pensions and medical benefits pared way back in the next 5 years maximum. Pension busts are coming quick. Calpers owns huge amounts of muni bonds from local Cali governments, many of which themselves are bankrupt. How do you think Calpers is doing (not to mention all pension funds) in the ZIRP environment? Already underfunded and averaging about a 1% return per annum while facing huge losses on muni holdings going forward.

There simply isn’t enough money to meet all the obligations. The collapse is right out there, in many more ways than one. Be prepared.

RTS

“I’ll bet it never happens in CA with Dems at the wheel…”

Nope. It will happen (if its gonna) whoever is at the wheel. States and localities are not fiscally sovereign. Like EU member nations, they can’t just print money. They have to live within their means ultimately. Even if the local powers that be lack the will, it is quite possible that bond vigilantes will force their hand. After all, nobody HAS to buy municipal bonds. If the money isn’t there, it isn’t there.

I was born and raised in Cali and now reside in CO. I’m watching the Cali market with interest and curioisity (still have family out there in South Cal). Here in Denver area the housing bounce is on, low inventory and climbing prices. I wish I knew if this was going to be a sustained move or if we’ll see another correction. I’m trying to decide if I should sell now and rent for a while to see what happens. I’m sitting on a 5.5% 1st and 8% 2nd and could pay it all off and walk away with a small amount of pocket change if I do it now. But rents have been climbing although I could probably get a similar place to rent for what I pay now in mortgage. I love my house and have lots of blood and sweat invested in upgrades I did myself, it’s just the way I want it in a nice location and it would be sad to let it go. But man, if I knew prices would drop in the future and I could pickup something similar for cheaper, that would ideal. Decisions, decisions…..

I noticed you said you love both the way you modded your home and the location. Sell it and you won’t get it back. What you buy later may or may not be less or of the same quality (construction wise, location, layout, et al). Worse yet you will pay the costs of selling, the costs of finding a rental plus two moves and the new purchase prices. In todays market your loans are high but not by historical averages. Here’s what I would explore: a full refi at a lower rate; if not possible a loan pay down via double principal on both loans every month; if not possible a double or more pay down on the 2nd till it’s wiped out and when the time is right in that scenario a refi if rates remain low. Continue the doubled principal payment until you are mortgage free in the home you love. Good luck.

wydeeyed- Great advice.

Take the advice from someone who has been through it. If you LOVE the location and LOVE the house, stay put. Of course, if you can get lower rates, take advantage of that.

It sounds like you have very little equity at the moment anyway. The FED is going to make sure prices rise for the long haul, one way or another. And, even if the FED fails and prices do fall by 40 or 50%, you could always walk away, wait one year then buy that cheaper house.

If the current FED madness doesn’t cure housing, the FED buying out right and then bulldozing them is not out of the question. Bulldozing a crazy notion for sure but suspension of mark to market and the purchase of 2 trillion in treasuries along with 3.5% 30 year rates were all crazy notions 5 years ago. What ever crazy idea you can think of that might cause housing prices to rise could come into play, the imagination of the FED is the limit.

One last thing, if your house is in that area of town everyone wants to live, it simply will not go down unless interest rates were to rise significantly.

Bmcburny

Why do you use the term lefties? We are Americans not communists. Why do you write a phrase like cure everything…. athletes foot? C’mon. That is off putting- insulting actually. I myself am not thoroughly familiar with Glass Stegal, Bushes housing actions. I have always understood it have to do with bank reserves and oversight to avoid deliberate and foolish funding and investing. Sounds like a good thing. If you would cite the events related to Glass Stegal, define the 5 handle, etc… you may come away convincing folks of your argument. You have only muddied water with your post.

I used the term “lefties” and made reference to athlete’s foot because it has been my observation that people who blame the housing bubble on the repeal of Glass-Stegall are: 1) utterly ignorant of what Glass-Stegall actually did; and 2) politically left of center. Your own post confirmed both observations. What do you want me to do about that? You guys read the Huffer Post by choice. I you choose to repeat the moronic things you find there and are not interested enough to investigate further, I don’t see how I can do much about it.

I assume that, by now, you and Ernst B. have googled Glass-Stegall so you now know basically what it was all about. Now, tell me why you think the repeal of Glass-Stegall contributed to the housing bubble. Please note that the prior to the repeal of Glass-Stegall, mortgage originators and investment banks were already selling hundreds of billions worth of RMBS, the decline in underwriting standards was already well underway and Fannie and Freddie were already illegally dealing billions of dollars worth of sub-prime mortgages into their securitizations. So what did the Glass-Stegall repeal have to do with anything?

Lefties point to Glass-Stegall because otherwise they would have to acknowledge that Bush did nothing to cause (and, yes, I agree, also nothing to prevent) the housing bubble. He made one feeble effort to rein in Fannie and Freddie but gave up when Barney Frank claimed Fannie and Freddie would never fail or need a bail-out.

Please stop confusing people with facts. You’re going to ruin the enjoyment I get from reading this blog and always finding someone blaming Bush for (insert problem here).

OK then, I asked you to provide information on things I am not clear on but your reply was to slam me calling me a leftie (a truly unscientific unspecific term that historically defined the difference between fascists and communists) and alleging that I get all my information from the Huffington Post which you claim is nothing but propaganda (sort of like the faux news five and Limbaugh which I would accept as fair if proven to be true). I am at a loss as to why you cannot reach out. You just put me in a box avoiding any real communication and movement toward helpful change.

While writing this I had an odd thought. I am wondering what your take is on global warming. I ask because I put a lot of weight on science and have a good deal of respect for people who base conclusions on science.

@bmcburney

You throw the term ignorant around rather nonchalantly. From my observation, anyone, like yourself, that thinks there is a difference between Bush and Obama is not only ignorant but delusional. If you believe that the President of the United States, regardless of their party, makes the economic decisions in this world you are beyond help. Take a very wild guess of who does make those decisions.

By the way Caliman look for housing to take a down turn this fall winter giving back the bounce and possible a steep bit more. It will not stay puffed and it will not puff up more – too little employment and too many defaults in the pipeline. Keep that in mind as you work on your decision.

We lost a bidding war on a short sale due to all this cheap money, and realturds talking young idiot buyers into paying “whatever it takes”. Being sensible former homeowners paying cash, we run across all these zombies every deal. We don’t want a loan. It feels bubblicious so we’re waiting for the fall. I think the sun has baked brains again. Even if prices don’t correct, and even with tight inventory, the seasonal trance will be over.

Flips seem to be the better deals right now.

Jason E. and Mad as Heck,

I am not here to defend Bush. I basically agree with Jason’s comment that he did nothing to stop the housing disaster. Bush continued all the same Clinton policies which eventually caused the bubble and the disaster. Bush made one feeble effort to stop the disaster and gave up when Barney Frank pushed back. Given Democratic control of the House at the time, Bush probably could not have over-come Frank’s resistance but he should have tried harder. I agree.

My reaction to Ernst B. was not offered in support of the W. Bush Administration policies, it was a response to the idiotic left-wing assertion that “de-regulation” caused the crisis. Anybody with even the slightest understanding of the W. Bush Administration knows that W. did not de-regulate anything meaningful (with the exception of Glass-Stegall) and what he did de-regulate did not have any effect, good or bad, on the financial crisis.

Yes, comments by W., Barney Frank and many, many other politicians regarding the a 20% down payment was a “barrier” to home-ownership and the American Dream were stupid, stupid, stupid. The left likes to quote Bush’s moronic comments regarding these things but they always seem to forget that there own heros said exactly the same things.

bmcburney

I read your explanation and point of view. Thanks for posting it. Well, another Elec-tile Dysfunction year to elect a Liar In Chief for 4 years. Both candidates have their handlers, their lobbyist groups, and both are puppets. I just want a home to grow old in under the red, white, and blue symbolism of this Banana Republic.

Sorry dude, but 100% financing did not occur on conventional mortgages until the Bush administration allowed the mortgage industry to self-regulate itself in 2002.

Get your facts straight.

Ernst B.,

What are you talking about? What do you think Bush changed regarding regulation of the mortgage industry? He did nothing, he changed nothing with respect to mortgage regulations. Bush’s regulation of the mortgage industry was identical to the Clinton Administration’s regulation of the mortgage industry. You are just making stuff up.

To all involved in the Ernst B. generated sub-thread re: Glass-Stegall,

I am not defending W. Bush. W. Bush failed to prevent the bubble and it was his job, at the time, to do something. W. Bush kept in place all the Clinton-era policies that caused it until it was far too late. But the Bush Administration made the ONLY effort (admittedly, only a lame, half-hearted effort) to which anybody made to stop or slow the train before the wreck. Can anybody name a single liberal politician, journalist or economist who attempted to do anything?

“Overdosed” – a documentary (free) on documentaries dot com has a nice history of the housing bubble in it. I watched it treading a few months ago, and actually got something out of it.

PBS FrontLine Show online (free)has some really well done and balanced documentaries on the Financial Crisis. “The Warning”- Brooksey Born against Greenspan was covered as well. That’s just one of many really, really good documentaries.

The “Overdose” documentary is spot on. This is what I have been trying to get across for the past few years and no one is listening. I think the fact that the real cause of this problem was monetary and fiscal policy, scares the average Joes out there because we are threatening to take away their free money. We have no more economic levers to rescue us from this calamity. I think it is really important to watch this documentary and understand the implications. I really hope I am wrong on this one…

http://topdocumentaryfilms.com/overdose-next-financial-crisis/

@

Both Nouriel Roubini and Robert Shiller made calls on the bubble and no one paid attention to them. I think one could safely call them “liberal” economist in the grand scheme of things. Again, this is not a liberal/conservative WWF chain match. Why are you so dogmatic when the evidence is so clear that both sides are mere errand boys for the Big Boys?

I disagree with your assement that Roubini is a liberal. Certainly, Roubini and Krugman give the impression that they hate each other and Roubini opposes stimulus spending and additional deficits. You may be right about Shiller being left of center, hard to tell.

But anyway, I don’t think you can argue that Shiller’s “warning” (such as it was) was made in a way designed to change policy and Roubini’s warning was so late in the process that it would have made no difference to the outcome even if universally believed and acted on. Shiller just said that home prices were going up faster than the long term trend and that prices generally return to the mean. Ok. Shiller was correct and his analysis solid but since he was looking only at prices and not at overall debt/loan underwriting, it just didn’t have any impact on the situation. Roubini’s waring was more complete and a more accurate assessment of the overall situation. If you listen to him you could have made some money shorting bank stocks but I believe his first comments on the situation came long AFTER the Bush administration tried to get control of Fannie and Freddie.

uuuuuh… the previous housing boom, the dot com boom, and the great housing boom all have one thing in common, easy access to artificially cheap money. The blame lands squarely on the Fed’s monetary policy across many administrations. I think quibbling over GSE’s, FHA, deregulation, etc. misses the real cause of the recent bubbles. The concept of using interest rate as a lever versus a market signal has some very unfortunate market consequences. Short term interest rate manipulation to boost economic activity eventually becomes long term policy…

Obama hasn’t forced mark-to-market. The Goldman Sachs Gang also got acquitted of any housing market fraud charges last week.

Man, if he’s re-elected he’s gonna inherit one helluva mess 😉

Although the bubble is back 100% in sub 700K housing along the most temperate Zone of California, prices seem to be weaker than ever further out. The eastern most areas of 92115, but still in San Diego proper, have the best prices I’ve seen, even after the spring frenzy.

Zero rates won’t make a weak economy strong, but it certainly will expand the price differential between the best of areas and the worst of areas and everywhere in between. People with money will pay more to live in a more desirable area and when you can finance twice the amount for the same 5K a month, well, watch out!

I suppose if I had ever imagined sub 4% 30 year rates I would have thought about this before it happened but I never imagined rates like this.

DHB: ” FHA loans were never intended to be a major player in the overall housing market. ”

So? What part of it doesn’t scale?

Haven’t you seen the rising default rates in FHA loans and rising losses at a time when the other GSE’s are improving? It is obvious that they didn’t adequately assess the risk as evidenced by the increase in FHA mortgage insurance. It is one thing to be a small part of the market, it is another thing entirely when they are the market. We saw the same thing in the bubble with subprime and other exotic loan products becoming the market rather than just a small part of the overall market. They don’t scale.

DHB: “How long can this last?”

It will last until banks decide that they can make money servicing this market uninsured or providing inexpensive private insurance themselves. They probably will be more eager to do that when housing prices start to trend upward a little more convincingly than they are now.

“if FHA insured loans were such a good deal why don’t you see Wall Street banks jumping in to make 3.5 percent down payment loans with their own money to the American public?”

The government is performing a public service here. Government probably benefits in the long run by a better tax base from a less ruined economy. The FHA is currently functioning something like the insurer of last resort, and is doing a valuable job. The program is designed to prevent a housing calamity like the Great Depression, wherein housing prices crash and it becomes very difficult to secure funding to buy a house, preventing the problem from fixing itself. Banks would also be in far worse shape, because they would have to bear the losses alone.

Im surprised the Republicans want to win this election… Everyone says we are headed for a 50% drop in home prices so whoever is president during the big drop isnt going to get re-elected for a 2nd term. If republicans were smart they would vote for Obama… Let the economy collapse like its destined too and then a democrat wont get elected for a generation.

The FHA is providing overly risk loans at the taxpayer expense, meanwhile keeping houses unaffordable for many borrowers. This isn’t valuable, it is an inefficient use of capital by the government. Affordable housing is the fix here.

Private insurance was already available.

Banks should have to bear the losses from the risky loans they made during the bubble.

Well said.

@Ian Ollman

“The government is performing a public service here.”

The Fed, which is not the government, is not performing a “public service”. It is bailing out the Wall St. and the big banks. This has been going on for five years, and the Fed has promised two more years at least. There are a lot more public with savings than with mortgages. What is the Zero Interest program doing to them? Why should they subsidize malinvestment for seven years or more? More debt does not save over extended debt. It is one thing to insure bank deposits to the tune of $100,000 but it is quite another to insure wreckless behavior with no moral hazzard for trillions. Your counter point will surely be that if the Fed did not do this the system would crash. Well, it is going to crash anyway but in much worse condition. You must work for GS.

Amen

My 28 year old kid is looking to buy a house. He plans to use FHA financing. If he has problems getting the house he wants with that, I offered to give him $20k for a larger down payment.

@ Jeff B.

Sorry, but in my opinion anybody who claims the repleal of Glass-Stegall caused the housing bubble or financial crisis is ignorant. I am willing to be proven wrong if someone steps forward with an analysis which actually links the two but, at least in my experience, that never happens. Instead, I find out that the people claiming Glass-Stegall repeal as the source of every bad thing that ever happened don’t even know what Glass-Stegall was. The same people also claim that Bush did something which allowed the mortgage industry to “self-regulate” and that caused some very bad thing to happen. Unfortunately, however, these same people are unable to explain what they are refering to. What would you call such people? Informed? Non-delusional?

A few ideas here:

1) with all this near zero interest going on, HOA reserves can’t make any money off interest and in my building, HOA has gone from 280/month in 2005 to 360/month (plus 120/month special assessment x 12 months) for 2012. I don’t particularly like that trajectory.

2) I bought in 2005 (yes, yes, I know, but I didn’t have high speed internet back then to see the insanity unfolding, nor did I watch the economy, and I was moving from an east coast place, where there was no bubble, so I just thought the cost of living was higher in LA, etc..). Anyway, I bought for 255k and currently owe 155k, which is a tiny bit above 2x my yearly salary (though I only work 2 to 3 days per week on average, so i have access to an extra money if i need it, just by working full time, so no sympathy, please (ha, ha!)).

In a normal situation, 255k plus 3% inflation over 7 years, works out to be 313k. So even if they could rig the market to where my place went back to the original price (which they probably can’t because I’m on the low end of the market) I’d still be biting an opportunity cost bullet, keeping me from wanting to sell. When I do decide to move, here in a few years, this place is going to turn into a rental, even if i can’t achieve positive monthly income. Thats the only way to partly recoup my loss. No ‘overwater’ selling here.

Leave a Reply to bmcburney