The dog days of summer – Americans are losing consumption power because of lower rates at the expense of subsidizing more housing. The psychology of today’s boom.

There seems to be this mentality that low interest rates come with no consequences. While one sector of the economy may benefit from this, primarily the housing and financial system, there are other net losers. This is also coming at a tremendous cost. Our public debt is growing at a fast clip and we are likely to breach another debt limit shortly. While some are narrowly focused on activity in their own markets they fail to answer the broader questions. Will this trend be sustainable? Are we simply seeing the pent up demand rushing in thanks to constrained inventory coupled with historically low rates? Throw in the typical summer seasonal selling heat and it is a recipe for a boom. I want to look at a longer-term perspective since the cheerleading articles are now out in mass (of course they rarely discuss which high paying job sectors are going to boost real wealth for families overall). What is the cost of the low interest rate?

Low interest rate drag

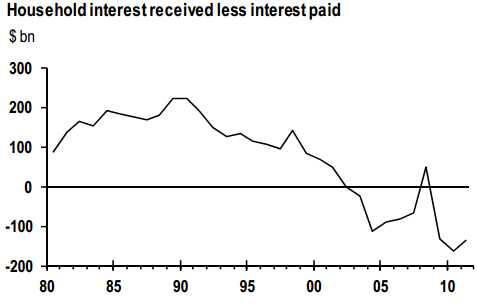

I’m not the only one noticing the downside of low interest rates. The data shows that we are now pushing costs in other areas of the economy:

Source:Â JP Morgan

So net US household interest income is pushing record lows. This is actual money coming out of the pockets of American consumers. One negative aspect being discussed is that this low rate delays retirement for many Americans. Inability to retire with smaller job selection might be a reason for the persistently high unemployment rate for younger Americans (a key future home buying group). Since many older Americans shift to fixed income products as they age, a low rate in effective slashes income (i.e., bonds, CDs, etc). I doubt many retirees are going to be flipping houses as a secondary source of income to Social Security although investments in real estate suggest a chasing of yield.

When we look at savings rates they are abysmally low in the US. So this is a key reason why FHA insured loans have been a big mover of the current housing market. Like many readers, I have heard of many first time buyers getting loans or gifts from family members to subsidize their first home purchase. Yet this isn’t new money being created but equity simply being shifted around. As the chart above demonstrates, the cost of low interest rates has other impacts in the broader economy.

Has housing really recovered?

Nationwide housing prices do look to have reached a bottom and sales are up. Yet this bottom is largely due to low interest rates allowing households with stagnant incomes to purchase more home (higher price) and the slow methodical leaking out of inventory from banks. Yet is this really translating to a better overall economy?

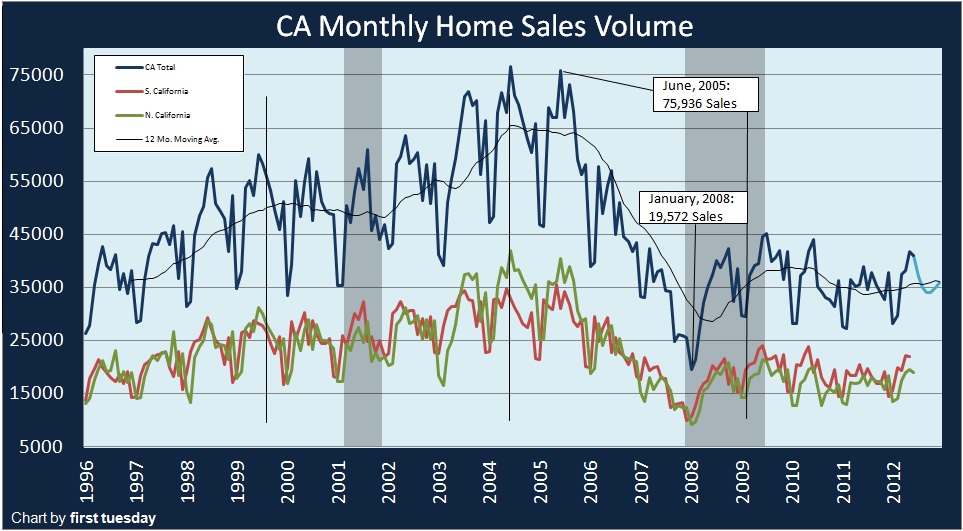

California sales have taken off in 2012. In many markets bidding wars are back. Rarely do we ever see a deep analysis of household incomes and their debt-to-income ratios. Some think just because the government is backing every loan that somehow things are all rosy. FHA insured loans are seeing a growing rate of defaults. Keep in mind this is a due diligence loan with a very low down payment. That is, lenders are examining the total income and debt profile and yet people are still facing problems. Let us not even discuss the 11 million nationwide home owners that are underwater.

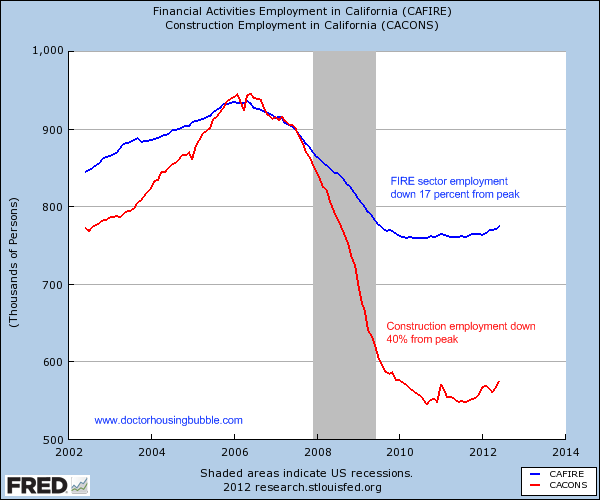

Let us however examine the key metric of the economy with looking at job growth. Since California benefitted the most from the bubble and took one of the largest hits, let us see how the two sectors linked to housing are doing today:

Construction employment is down 40 percent from the peak and FIRE sector employment is down 17 percent. You notice a recent trough but certainly no resurgent boom. These are typically better paying jobs, at least those in the FIRE sector. California still has a headline unemployment rate of 10.8 percent and an underemployment rate of 20 percent. These rates are incredibly high and play into the annual budget deficit issues we face.

The expanding public debt

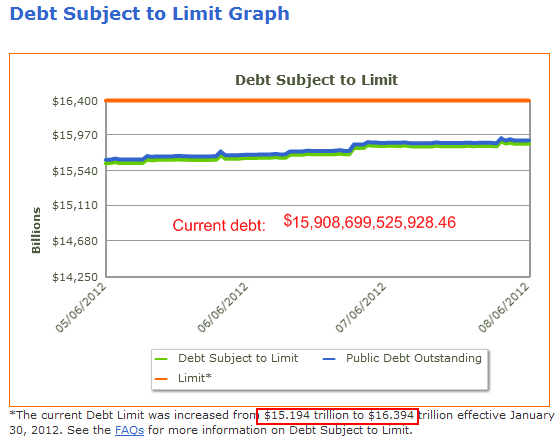

The rate that public debt is increasing is historical:

The debt limit was increased from $15.194 trillion to $16.394 trillion on January 30, 2012. At latest count we already are up to $15.908 trillion (an increase of over $714 billion just this year alone). At the moment as a safety bet, the US can still attract capital at low rates. But for how long?

The psychology behind recent buying involves the following:

-Low rates have pushed leverage up even with stagnant incomes

-Rental parity in many markets exists (in some US places it is cheaper to buy than rent)

-Low inventory. If I’m looking to buy and most do not follow the micro and macro housing trends, they simply ask their real estate agent what is out there. Limited inventory in better markets causing bidding wars.

The problem of course is that this is not being pushed by underlying stronger economic fundamentals. As many readers have pointed out, the issues at hand include:

-Globalization of employment and push for lower wages for competition (i.e., Europe, US, etc).

-Younger less affluent future buyers. How much can they really afford and do they want to buy?

-Bifurcated nature of economy (wealth inequality at record levels)

On the last item, I think this is where we get the many e-mails and stories of “I remember a few decades ago when I was able to buy with my blue collar job.â€Â In many cases, these people live in equity trapped houses but still find themselves living in a high cost area. Many will sell but the new buyers are more likely your high income or dual-income household looking for the California property ladder race in a prime location. Interestingly enough the only stabilizing force was artificially shutting down the inventory pipeline and forcefully lowering interest rates to historical lows.

Based on the bidding war stories you would think that boom times are just around the corner. Sales have picked up but put into perspective we are returning to more normal volume:

The big question is longer term. Here is an interesting psychological twist since some seem so narrowly focused in their own tiny niche market because they bought or somehow have a bias to their area. Back in 2006 in the early days of the blog the California unemployment rate was 4.8 percent. Tax revenues were flush. Home sales and prices were hot. So I completely understood the argument from some bulls at that time regarding their notion that housing would continue to boom (plus, the real global economy was flush with credit, stock markets were soaring, and more importantly unemployment was very low). Even then, it was easy to take the other side of the fence perspective. Today with unemployment in California up to 10.8 percent and with 20 percent underemployment and state budget deficits for years to come, this bidding war mentality that you will be priced out is hard to understand. Rates are so low, that even a further drop will do very little in purchasing power. We are already having spillover costs as you can see from the first interest income chart above. Ultimately some people want to believe that they bought or sold at tipping points in markets. Yet that would presume we somehow have an open market right now.

It’s ironic that we first went from some denying shadow inventory, to then acknowledging it was there but not an issue, to now having banks essentially leaking out this inventory to control price. This is not a market by any standards. I’ve noticed more talk recently of cutting or lowering the mortgage interest deduction by politicians. Do you think that will have an impact on say a market like California?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “The dog days of summer – Americans are losing consumption power because of lower rates at the expense of subsidizing more housing. The psychology of today’s boom.”

People close to retirement can not afford to retire. They tell me that they will work until they die. This means that the new college grads will have to reduce their expectations and flip those burgers. Smart people will not go to college. High School grads that do physical work are okay, since the old people’s body can’t do that, they are forced onto disability for the younger workers to pay for. Heck, that whole generation is leaving us with their bills to pay from the big party they had. How dare they complain about their standard of living falling. They act like spoiled children.

Thats a really broad brush youre painting a whole generation with. I never got invited to the big party and nobody else I know ever did either. The greatest country in the world is going down hill because of the failed liberal policies of the past 50 years.

Yeah. Those college kids now have access to classes which teach a very proper and efficient burger-flipping hand technique, so they’ll be fine. As for the older crowd, why I’m paying one retiree 6 bucks an hour to scoop up dog turds off my yard. Unfortunately my Doberman eats a lot but oh well the old guy needs the money.

All very true and stunned more people that can buy real estate are not. However, if we look at the functions from an economic sense, it seems to me that America’s have been on a decades long delusion that sitting there and receiving checks is “productive”. We have become accustomed to a “money” economy. Housing at least has productive components.

Getting rid of mortgage deduction will do a few things… Firstly, if they lower the mortgage deduction on the middle class.. then they will also lower the tax rates. Which will make take home pay a wash.

So homeowners will basically still have the same take-home pay before and after the MID removal. Renters will suddenly have an extra $3000 or so in take home pay.

What do you think will happen then? Landlords will raise rents.. (Landlord now can’t deduct MID.. he KNOWS his tenants tax rates were just lowered… He can then raise rents comfortably knowing the tenant can afford it).

Meanwhile… mortgage holders will probably see some decline in their home price since buyers won’t have the MID carrot dangling in front of them.. But home price drops will be limited by rise in rents.

The more people that continue to wait on the sidelines.. willingly or otherwise.. the more pressure is put on rental rates. Shadow inventory will become bulldozed inventory before it’s released at a rate that will drop home prices dramatically.

The market is totally manipulated.. the free fall from 2007-2009 is over. Now it’s a see-saw of rental parity determining prices.

I do not think the mortgage intrest deduction will ever happen. It’s been talked about for a long time, with no action taken to elimintate it. What you really have to view is the stockmarket. It is easily over valued by at least 20% right now. We are headed for another downturn (whether it’s another crash or just another slight correction is debateable) and it is long over due. The real problem is lack of jobs. With unemployment in California at 10.2% (real unemployment is around 20%) this little run up in prices will be short lived. Without jobs……….we will never have any susutainable recovery.

“Getting rid of mortgage deduction will do a few things… Firstly, if they lower the mortgage deduction on the middle class.. then they will also lower the tax rates.”

Why? If the MID goes away it could go towards paying down the National Debt. Or it could go towards a tax cut for the wealthy.

“Landlords will raise rents.. (Landlord now can’t deduct MID.. he KNOWS his tenants tax rates were just lowered… He can then raise rents comfortably knowing the tenant can afford it”

Rents aren’t based on affordability. They’re based on supply and demand. More take-home pay from renters don’t equal a rent increase and falling wages don’t point to rents decreasing.

Mostly I expect that a few things would happen:

1) Some people bought their houses relying on the mortgage interest deduction to help pay for the house. If they aren’t grandfathered, they’d either sell or turn the keys over to the bank, though no doubt in the latter case they would first exhaust all their cash and then (unnecessarily and foolishly) exhaust their 401k to keep the sinking ship afloat a little longer.

2) Housing prices would come down to compensate. This alone is why such things probably wont pass.

3) Government deficits would shrink a little.

Falling wages do result in falling rental rates. You can’t pay more than you’ve got (unless you’re the government.) Rents have to fall if wages fall. Either that, or leave the unit vacant.

It would be one thing to end the MIDeduction for a residences but to do it for renal properties is something else. For all practical purposes, when you are talking rental property, interest expense is a business expense.

I haven’t read the proposed legislation but if anyone tried to do away with a business expense like interest deduction I think so much money would fly into congress so that it would never happen. Where would you draw the line between Hilton hotels renting for one day, or other chains that tend to rent by the week and company that rents by the month?

I really don’t know much about the subject but I don’t think the rental part of the mortgage dedcution will ever change.

Not sure from whom you’re receiving tax advice, but you can deduct mortgage interest on a rental property (and pretty much everything else other than principal).

I totally agree with you on the “banks will bulldoze properties before they let the prices drop” to what they should be if we had mark to market in a free market system like we pretend we have. However it escapes me how you draw the conclusion that tax rates will be lowered if the MID is eliminated. My guess is the deduction will be eliminated but tax rates will also increase. Money printing will continue to De- value our buying power and we will be debt slaves for our bankster owners. How do you figure renters will somehow get an extra 3k a month???

Somewhat related as it is a future tax liability:

Borrowing $105 million, Pay Back $1 Billion Using Capital Appreciation Bonds

“There seems to be this mentality that low interest rates come with no consequences.”

10x leverage. Oh my.

“School administrators appear to have looked around at the sluggish economy and property tax revenues and figured, ‘Heck, why not defer now and pay nothing at all for decades? We’ll be dead by then.'”

Does anyone here know if the bulk reo sales to investment groups have began? Would love to get details on the progression of that.

I hear rumblings, but if you buy “bulk” or a “tape” of homes as some call it the homes are all over the country, so if you are looking for So. Cal you will have to buy Michigan, Kansas, Kentucky, i.e. crap so I dont hear much bulk buying going on. A friend of mine bid on 50 homes in So. Cal from some Gov’t agency but it has been over 9 months and they still have not countered or given him any indication if they will sell the homes. http://www.debtx.com sells multi million or even billion dollar pools of performing and non performing notes/loans but they are a total mish mash of office, industrial, SFR, apartments, Hotels, Vacant Land, etc. I think because the SFR loans were all sliced and diced via CDOs, etc, it’s hard for banks to get and sell a group of REO homes in the same part of the country. My advice, find a good REO agent, get your hands on as much money as you can, get a good contractor or two, and offer cash on every short sale/REO/standard Sale you can and buy one house at a time. Make sure the houses are in good areas, below rental parity, you can fix them inexpensively and rent them out for positive cash flow, or fix them nicely and flip them. If you can buy, rent and manage you can get crazy cashflow and great return on investment. If you flip you can net 10-30% return on investment in 3-6 months, if you flip 2 houses a year and make 20-60% return, in addition to saving into your 401K or Roth IRA, it doesnt take that long to see the bank account grow. But you need a few hundred grand to start. After you buy, fix and rent, you can approach hard money or local banks to see if you can get a HELOC/loan against the home so you can get some of your dough back out of the house, the rent will still probably cover the monthly payment so you are still cashflowing and you got some of your cash back just in case of emergency. Treat your tenants right and they will stay put forever. I have one tenant who has been in the house for 16 years.

I am kind of surprised that someone hasn’t put up a mom and pop investor network online consortium to slice and dice the big REO pools so we can attack Blackstone’s bid like hungry leaf eater ants.

Yes, the big funds have started to acquire pools of rental properties this year. This is the first year this is really happening and it’s a VERY convenient way for the market to look like it has “less” inventory while giving the funds an easy way to make money compared to the average person or average investor. A fund that is located within walking distance of my home just closed on 10,000 homes from the government within the past month. I know this for a fact because a friend of mine works there. The problem is that’s only 1/4 of their target 40,000 homes for acquisition in 2012 so they are still in need of a LOT more inventory (they are tryingt to buy $1B (yes B) worth of rental home this year alone. And they’re one of several high profile funds that are all trying to take down $250M+ of rental homes this year alone.

Isn’t it an amazing coincidence that the bulk transactions started in an election year and now the media is all over “low” inventory? It’s amazing what happens when you get out of the weeds of the media and figure out what is really going on…

Meanwhile small pool transactions continue to take place and some don’t require that you take homes nationwide. I know of one source that just cleared 200 homes on behalf of about 8 buyers direct from B of A. The buyers stipulated an area and the bank delivered. These deals are VERY FEW and far between but are still happening.

Good Luck To Everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Is the fund you are referring to a subsidiary of a large private equity firm, and the SFR unit is headquartered in Scottsdale, AZ?

Yes they have and you can find info and application forms on the Federal Reserve ‘s ( a private banking cartel) website.

Eliminating the interest deduction would be the right thing to do, so I wouldn’t bet on our representatives making it happen. If it did happen (or even if it was lowered to a conforming loan limit) it would be painful to many, and force prices to quickly align with incomes across California.

You forgot all the mal-investment that long-term artificially low interest rates causes. I would say that we currently have too much housing as a result of the artificial price of money since 2001. It appears that we will continue on this path for some time…

In order to save the banking system, it has to sacrifice the savers and financial prudents. It is a purely a transfer of money from the savers to the bankers. The interest income actually will be spent in the economy, whereas if the interest is kept to the bankers by zero rate, that money will be either in fed reserve or treasury to earn interest for bankers. Being a saver or financial prudent is a naturally born trait which is the character of most people. Current system is working for the few, and screwing the majority.

Boycot the system. Don’t borrow.

Hold onto your hats. There’s talk of the mortgage and refinancing interest rates to be dropped to 2%!! This may happen before the end of 2012.

I plan to refinance next year when rates drop into the 2% range… I also like that starting in January 2013… all mortgage refinances where no money is withdrawn, counts as if it was a purchase money mortgage. So all refinancing in Jan 2013 will be NON-RECOURSE in CA… Prepare for ultra low rates and mass refinancing in 2013. Refinancing in 2013 will be like an insurance policy to walk away and only lose your downpayment.

The “recovery” in the housing market is based on the same solid economic principles as the “rally” in the stock market. All rigged by the Fed to benefit the banks. There are still trillions of debt out there that has to be recovered. Buy that house, you are getting free money, but it is still debt and it will come back to haunt you. There are no retail investors in the markets, lowest volume in years but lots of robot trading and crazy algos that can go beserk at anytime, just ask Knight. We are living in the most corrupt, inequitable time in the history of mankind. But, just wait for the bill to come after the election. Do you really thing it is an accident that these moves and false statistics in the job market are happening right before the election? Obama is an errand boy for the big boys. Mitt, well he is just a very, very small footnote in the history of losers. If you want to see where the election is going, follow the money. Obama is a TWO to ONE favorite on the betting line, where people put up real money and know the true story. I have noting against either candidate one way or another because they are too ignorant to see how they are being used.

Right on Manny, you’ve hit that nail on head, just a dog and pony show for the suckers. I’m a real estate buyer, looking at long term and i see this market as crooked as a dogs hind leg. Super deals do come down, just not to us.

We saw a place we wanted, got a hold of the agent, sorry sold, got the listing broker and it was unsold, what gives? They keep all the commission if they sell, several houses we have looked at we around 250k we think well still to high, well within weeks they are sold for about half the price we looked at them. It’s insider trading all over again.

Thank you. This blog and intelligent comments such as these restore my faith in the intelligence of the American people!

I was thinking about the canadian housing bubble? I was baffled by how they could have a bubble when they don’t even have a Mortgage Interest Deduction…

I guess they save a lot of money not having to pay for healthcare… and plow the extra savings into housing.

Wouldn’t higher interest rates boost housing? If I was making 5% or 10% interest on my money, I could afford to spend more on a house…

Take a listen to this latest interview with SoCal RE investors and agents that do a lot of business in the area. The big boys are coming.

http://www.tngacademy.com/mp3s/norris-radio-show.html

CAE,

The big boys are already here! See my post higher up for more details. I’m glad that Bruce Norris and friends are letting everyone know, as they’re clearly helping smaller investors to get out of the weeds of the media and learn what is really going on.

Thanks for posting the link, as hopefully it will help some people who are reading this. Tony Alvarez will actually be at a couple of the local real estate club meetings discussing this exact topic over the next couple of weeks in Aug. If you’re reading this, you’re an investor, and you haven’t heard of Bruce Norris or Tony Alvarez then you might want to check them out, especially Tony’s upcoming presentations (

(FYI – I am NOT affiliated with Bruce or Tony but, as an independent investor, I do think they’re a very good source for investor education).

Good Luck To Everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

These are both one trick ponies. I would say that these are “real estate investors” not “investors”… Smart investors do not put all their eggs in one basket.

I think there is a fundamental economic problem with the buy up properties to rent out investment strategy.

My first question would be do we have a housing shortage? I believe we have just been through the largest housing building boom in history. The fact that the government/banks are slowly leaking distressed properties on the market is masking the true inventory. Let’s say that we had all the current available inventory converted to rentals and made available to the public, do you think we would have a surplus of rentals?

My second question would be do you believe this is a guaranteed investment? Let’s assume the following senario where the real values of housing continues to fall which means your principal is losing value. Let’s also say that more and more rentals come on the market causing an inventory surplus. This will leed to vacancies/decreased rents which will have an impact the your ROI.

Other things to think about are possible tax law changes, repairs, legal expenses, earthquakes, non paying tenants (it can take up to a year in California to evict), etc.

Just because the best case numbers seem to work does not mean that rental real estate is a good investment. True investors would conduct a SWOT analysis and run at least three scenarios (best, most likely and worst). I have not seen anyone of these “investors” run the numbers through each senario. I believe this would discourage most from this kind of investment…

The city of Newburgh, in upstate New York, recently became the state’s first independent municipal “land bank”. Essentially, the municipality sells off its’ vacant properties to a newly developed private entity. This entity, comprised of mainly non-profits such as the local hospital and private colleges, that can purchase the properties at a minimum cost of $1, demolish or refurbish a structure, hold the asset for an unlimited amount of time (land “bank”) and not pay property taxes until such property is sold or leased (in the case of the later, the entity receives a 50% tax credit). The municipality claims the land bank designation will “clean-up” the city and put the properties into the possession of more responsible owners relative to less responsible independent “speculators”. They use the term “streamline”, IMHO it’s simply a transfer of wealth.

One question I have is the availability of loans. Even though the interest rates are low, the tight lending standards couple with all the people who lost their houses (and along with that, their credit ratings) means that only investors are buying in the market segment that cratered. It is worth noting that in these communities, the people who own and subsequently lost their homes are the uppidy segment of the population. Their still are. If anyone is buying, it would be them. It has been about 4 years since the beginning of the housing crash. I expect in a year or two, more an more people in this segment will start to re-gain their ability to buy a home again. If banks start to lend to these people again, it would be the start of a housing recovery in the worst hit areas.

Leave a Reply