Loan Modifications Another Taxpayer Bailout to the Housing Industry: Mortgage Modification Default Rates over 50 Percent. Over 4 Percent of Subprime Loans First Payment Defaults.

I’ve gotten a few e-mails asking about loan modifications and their success rates. There is a reason I rarely bring the topic up. The primary reason is that they are, for the most part failures and another handout to the housing industry. Remember the Hope Now program? I actually called this program up when it first started and was connected (amazingly) to a helpful person. Yet they had no power. All they were able to provide was a listening person on the other line. That program of course failed because it had no teeth to dig into the actual mortgage and principal. With loan modifications, the reason they have been such big failures is they fail to strike at the core of the housing problem. Overvalued homes.

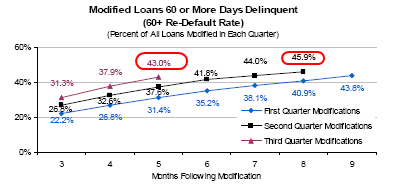

Have you noticed how little the media actually talks about how homes are overvalued? Or how little attention is given to the oncoming Alt-A and option ARM tsunami? Maybe they don’t want to disrupt the fantasy world of those that hold these mortgages. Yet that is not the reality of the situation. I can only shake my head when I hear that servicers are getting “incentives” to modify loans. This is more money down the drain because we already know that many of the modified loans re-default:

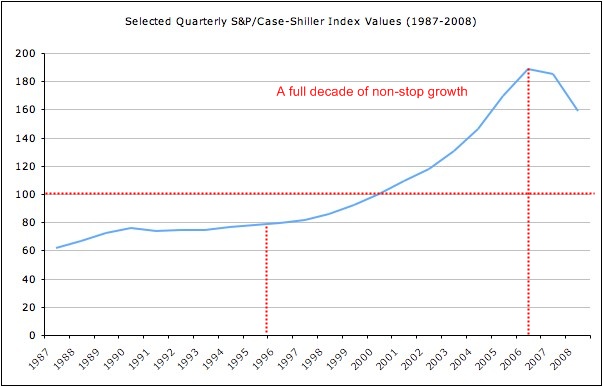

This is absurd. Nearly half the loans after 5 months are back in the default bin because they fail to address the root cause of the problem. Homes are still priced too high in many areas. People conveniently forget that we had an epic housing bubble with unstoppable price gains for a full decade. Now with two years of declines they suddenly expect that home prices are somehow adjusted? They are not. Take a look at the Case-Shiller Index:

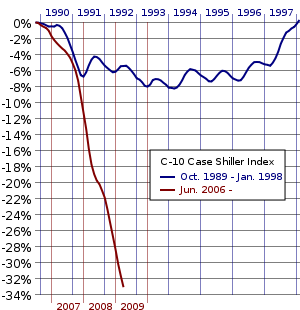

Prices are still too high even after the enormous crash. To highlight this crash, take a look at the current drop which is still going on:

The problem with loan modifications is they fail to address the major reason why people are defaulting. Homes are underwater. And since the housing industry has done such a good job lobbying Congress over and over through various administrations to strip out cram-down legislation, there is rarely any teeth in modifications. For the most part, the servicers are motivated for the incentive they get and that is largely it. Plus, they are unable to work with the actual holders of the note since the actual mortgage has been chopped up in many different areas. The U.S. Treasury and Federal Reserve are trying to figure out every scenario imaginable to offload the toxic mortgage waste onto the taxpayer. At first, the notion of modifying a loan sounds good but most of the cases are token kickbacks to a public that is frustrated with $13 trillion in bailouts and commitments being given to a crony banking system.

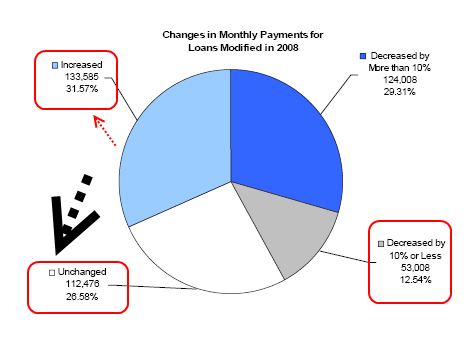

Let us get back to the topic of why loan modifications are failing. Look, I know that the sound of modifying a loan seems good on the surface but the fact of the matter is, over half of the modified loans re-defaulted. This again is a Band-Aid on a broken bone. The data on loan modifications will speak for itself:

To start with an obvious observation, over 58 percent of loan modifications result in a higher monthly payment or a payment that remains the same! So nearly 60 percent of people that had a loan modification are basically running the Red Queen race. What is even more astonishing is 31 percent of modified loans actually had an increase in monthly payment. An absolute joke. 26 percent basically had no change in payments. So what is occurring? Money is flowing once again to the housing industry in the form of incentives to servicers. There literally was no point in these modifications. Is it any surprise that over 50 percent re-default only 5 months later?

Another 12 percent had their payment decrease by less than 10 percent. At least this is better. But many times this was done by extending the term of the mortgage out for a longer period of time or dropping rates. Yet that principal is nice an intact! Thanks cram-down foes! The hypocrisy is incredible. Here we are giving the banking system trillions of dollars in a carte blanche style and they are nit picking loan modifications. The problem is we are once again trusting the same industry that brought this country to the first ever housing led recession. When I used to argue how corrupt the industry was, people would just say, “oh, there’s only a few bad apples in the industry.” That of course turned out to be completely false. Let us look at some criminal activity shall we?

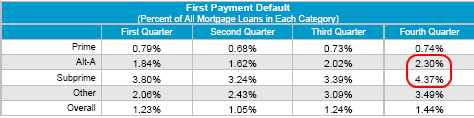

First payment defaults are a warning sign of fraud. What is a first payment default? Oh, you’ll love this.  This is basically where a borrower fails to make the freaking first payment! Absolute fraud. And look at the above rates. The 4.37 percent for subprime loans is incredible. But take a look at the Alt-A products. Yup, those suckers are moving on up following a trend that we are all too familiar with. This isn’t one or two bad apples. This was an industry that operated like a casino giving out loans to anything that moved. And now we are entrusting this same industry to modify the loans of the people it screwed? What a shock that re-default rates are up over 50 percent.

The cram-down is the only option. You make the lender eat it. The taxpayer has already been forced to eat Fannie Mae and Freddie Mac, AIG, and we practically own a piece of every large bank in the country. The cram-down would have had a better success rate because you address the root of the problem that is the actual principal value of the mortgage. That is, you bring down the price of the home to market rates. It is useless to lower rates or extend the term if the price of the home is still underwater. It might sound good to the press or make the servicer happy to get a fee, but in the end the borrower will be back at square one because many homes are still over valued. That is the crux of the problem yet no one can openly admit this. It is the elephant in the room. Home values in many metro areas are still too high!

Some of the data on these loan modifications came out in April of 2009. So it is a little older. But as expected, loan modification redefault rates are expected to go higher:

“(WSJ) Yesterday’s Journal reports that Fitch Ratings looked at mortgages bundled into securities between 2005 and 2007 and managed by some 30 mortgage companies. Fitch found that a conservative projection was that between 65% and 75% of modified subprime loans will fall delinquent by 60 days or more within 12 months of having been modified to keep the borrowers in their homes. This is an even worse result than previous reports by federal regulators. Even loans whose principal was reduced by as much as 20% were still redefaulting in a range of 30% to 40% after 12 months.”

What does this mean? We have been rearranging the deck chairs on the housing Titanic. Do you really think the banking industry cares about homeowners? Of course not. In fact, I would suspect that these weak loan modification programs are designed to buy some time before they can perfect the public-private investment program and do the ultimate loan modification in history by unloading all the toxic waste to the government. At this point, it won’t be the banks kicking people out of their homes but Uncle Sam. Can you envision how well that will politically play out? At that point, the banks will have most of the taxpayer money and we will finally get down to some serious loan modifications much too late. Look at the above projections with a 75 percent re-default rate. It is a joke. What is going to happen with $1 trillion in toxic waste once we enact the PPIP?

Loan modifications for the large part don’t work because they are operating in a bubble world. That is, they still expect housing values to maintain their once appraised price. Yet those prices were largely irrelevant. This is like someone buying a Pinto on a 20 year loan for $20,000 and thinking they got a deal because of the cheap monthly payments. That is, until they realize they have a Pinto and $20,000 was too much to pay for it. So what makes you think that extending the payments to 40 years is going to make it any better? It won’t. Until we have sensible cram-down legislation, any talk of loan modifications is simply a patchwork of distractions to keep us from looking at the trillions being looted from the public. How about having housing prices reflect local area incomes and the notion that people will once again go back to 30 year fixed mortgages and down payments? What we need to modify is how the system currently operates.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Loan Modifications Another Taxpayer Bailout to the Housing Industry: Mortgage Modification Default Rates over 50 Percent. Over 4 Percent of Subprime Loans First Payment Defaults.”

Cram down? no way. reward the homebuyer for a bad decision?

how about foreclose and sell the house to a responsible buyer. Here is a novel idea, let those being foreclosed on rent an apartment/house.

Screw cram-down legislation. The only “cram-downs” should be accelerated foreclosures, and let buyers come back into the market to set the price. If not accelerated foreclosures, then set some limit as to how long a bank can hold a REO from the market.

Why should homeowners get special treatment for over-extending themselves? We have overextended ourselves and are making strides to repair our balance sheet without asking for credit card or student loan cram downs.

I just had to thank you for this post. All of your posts, really! I have learned so much reading your blog.

I realize we here in Chicago are far from the Pacific, but we have our own tsunami a-coming. My upper-tier suburb on the North Shore is abuzz today with talk of the LONG lists of property tax delinquencies published this week in our local weekly–for all the surrounding burbs. Who knows how many foreclosures this foretells? Come fall outright panic will set in. And the school districts and municipalities will have giant holes blown in their budgets. Most people have no idea what is coming, but it is starting to dawn on the smarter ones. UGLY.

Dr. H.B. – do you have access to similar data going back to the early 1950’s if not well before? Another list of data I have seen indicated the “divergence” between median priced homes in the U.S. and California began in the very early 1970’s before becoming quite noticeable by 1975. Again, is there data which goes back well before 1970? I’m still curious as to why folks in California (especially in Orange County) believe they can continue to support median home price to median income ratios far above those of both common financial sense, and relative to much of the rest of the country. Ratios well above three have generally been considered speculative and ultimately risky. When I was growing up, local banks wouldn’t lend much above a ratio of 2.5……..

Orange County, California

Median Median

Year Income Home Price Ratio

1981 29,726 130,125 4.38

1982 30,922 129,641 4.19

1983 32,118 131,456 4.09

1984 31,609 130,668 4.13

1985 33,726 132,758 3.94

1986 36,263 144,441 3.98

1987 37,683 163,218 4.33

1988 37,859 203,860 5.38

1989 41,261 241,708 5.86

1990 41,613 242,358 5.82

1991 42,080 239,680 5.70

1992 43,629 230,860 5.29

1993 42,591 217,210 5.10

1994 44,164 214,540 4.86

1995 46,261 209,400 4.53

1996 48,515 213,370 4.40

1997 49,618 229,840 4.63

1998 51,168 261,700 5.11

1999 54,536 280,900 5.15

2000 57,706 316,240 5.48

2001 57,457 355,620 6.19

2002 57,831 412,650 7.14

2003 60,113 487,020 8.10

2004 64,416 627,270 9.74

2005 65,953 691,940 10.49

2006 67,113 709,000 10.56

2007 71,601 699,590 9.77

This article seems to apply to loan modifications made in 2008. Given that the Obama administration has introduced a new loan mod scenario, is this information useful to predict 2009 modification success and faiilure? Perhaps the 2nd and 3rd Quarter 2009 data will be informative?

Dr. HB, If and when do you expect the bubble to burst for the commerical properties? I have heard some interesting stories on how commercial properties will be next part of the next wave of foreclosures. What is your opinion?

Read this & tell me what flavor of cool aid is this person drinking!

Las Vegas Returns to 2002 Real Estate Prices

Posted by Bruce Hiatt – April 10th, 2009

Categories: High Rise Condo Foreclosures, News

In 2002, Las Vegas was considered one of the best buying opportunities for real estate. Home and some condo prices were in the $100,000 to $200,000 range and affordability was considered to be very good. Then came the recognition of how Las Vegas real estate was undervalued in comparison to California and what happened next is history. Now in 2009, Las Vegas real estate has once again rolled back to 2002 price levels according to John Restrepo of Restrepro Consulting Group. What does that mean for the buyer of Las Vegas real estate, especially Las Vegas luxury real estate? Opportunity knocks once again.

During April 2009, prices for luxury high rise condos, especially Las Vegas luxury high rise condo foreclosures, have attracted buyers all over the world. With a limited number of luxury high rise foreclosures in Las Vegas in the Strip resort corridor area, things have heated up. Buyers are now experiencing multiple offer situations and losing out on opportunities to buy Las Vegas luxury foreclosures in the high rise condos near the Strip. Luxury Strip Resort area high rise foreclosure condos under $500,000 are highly targeted now for purchase by cash buyers.

For example, Luxury Realty Group just sold a two master, two bedroom luxury high rise condo in beautiful Turnberry Place for $192 a square foot at $422,000. High rise developers tell us you cannot build luxury high rise condos for that price anymore. This particular luxury condo was a Turnberry Place high rise condo foreclosure and the buyers was driven to purchase because they believed prices in Las Vegas were near the bottom of the market for such luxury level high rise condos.

Similar buyer perspectives are now occuring in Sky Las Vegas where only a handful of luxury high rise foreclosures are on the market. Our buyers are frustrated as several have recently lost out on buying Sky Las Vegas condo foreclosures due to multiple offer situations.

Contemporary luxury Turnberry Towers high rise condo towers are another very popular community our foreclosure buyers have targeted. Prices have rolled back for Turnberry Towers luxury condo foreclosures in some cases to a 40% to 50% price reduction over the original purchase price. One of our Turnberry Towers luxury condo foreclosure cash buyers just purchased a two bedroom condo under $500,000 that has balconies on either side of the tower.

With multiple offer situations now occuring in some cases for luxury Strip Resort area high rise condo foreclosures, we expect to see an increase in the number of high rise foreclosure condo buyers entering the market for the rest of 2009.

Bruce Hiatt, Broker, CRS can be reached at 702-456-7080 x201.

Learn More About This Author.

All information in this blog is subject to change without notice. Subject matter is not guaranteed and is often considered time-sensitive. See DISCLAIMER.

Copyright © 2008 Luxury Realty Group LLC. All rights reserved.

cram-down, no way! this is just another way to help out people who should have never bought the huge house and all the toys. foreclose on them all quickly, do not let them live there “rent free” they can go rent, move get out. raise interest rates and lower prices to match incomes. you have to have a down payment with a 30 year mortgage. Very easy……

Gman , wha is the source of your data ? I live in Orange county and the census data for my zip code an actual sales price data for my zip code do not support what you are stating.

I’ve been reading your blog for a couple of years now and all I can say is…..YOU ARE ALWAYS RIGHT! Every major (national) news outlet should be putting you out there every week to inform Americans who haven’t found your site yet! The truth would horrify and infuriate people who don’t realize that the full burden of the bailouts is being withheld until it’s too late. We will find out that the losses are ours to pay in full just when Social Security and Medicare begin to be tapped by baby boomers. Our taxes must then go up…WAY up! And where will the execs at all of the bailed out companies be? On a beach somewhere far from the country they looted.

I’ve always wondered how the first payment default fraud went.

Is it that that everyone was paid their fees and commission out of a loan to someone’s pet goat and it was that cut n’ dried? Was the rest of the loan money somehow swindled? It just seems like it would be so easy to bust these people.

You’ve gotta see this video…..economic satire!

http://www.youtube.com/watch?v=rnE5zvosplc

No to cram downs. My wife and I have been patiently renting, and ready to buy our first home, but you would prefer all the irresonsible people to stay in their homes???

Foreclosures need to happen, people need to be kicked out, and home prices need to come down. Then things will turn around.

The bankers that made to loans to the buyers that can’t make payment shouldn’t have any penalty? Maybe we can send them another unaccounted for trillion for their efforts collecting loan origination fees they had no business making in the first place, would that be more to your liking? How times have changed from when I first sought a home loan.

We should reward the crooked bankers by artificially keeping bubble prices propped up? They already are allowed to make/keep fake valuations of these assets on their books. “Stress Tests” my fanny.

Letting it go into foreclosure is the normal process, I agree: this is no normal situation, this was boilerroom origination operations to make fees on folks that should never have been given a loan in the first place, and allowing more foreclosures without end will just continue to drag the rest of the market down. Cram down doesn’t just benefit the borrower, it benefits the neighborhood values AND the mortgages the banks already have on their books.

As it stands now, these bankers plan to unload these artificially high prices on us through Geithner’s obscene PPIP, or haven’t you been paying attention to the details of that scam? Basically, taxpayers loan the private “investors” (most likely entities set up by the very banks selling the toxic, over-priced assets, a double win win for the banks) taxpayer funds to make the purchase of these assets, will guarantee their profit or absorb any loses. Nice.

That we all could get such deals.

The banks sell high to the PPIP (taxpayers) and buy them back low, with loans we give them. And if they lose more value, we eat the loan, if it goes up, they keep the profit. “Capitalism” at its finest.

And you worry we might be helping someone make their payments….and adjust the mortgages to proper levels.

In case you don’t understand:: you can’t “sell the house to a responsible buyer” at the same amount the mortgage is at after a foreclosure!! And with a tanking market, the price drops anyway to sell.

The mortgage goes DOWN either way, except keeping the current mortgage holder in the home now keeps his neighbor’s prices from competing with REO’s on the market. And makes the bank value it at honest levels, which is why bankers fight it tooth and nail: the con would end.

Question: Do you buy foreclosed homes?

@ whiskey

Welcome to the third world.

They were using this strategy to prop up condo prices in Miami too, so there would be a constant record of sales at price X++. Then five residents would be responsible for the entire condo fee because most of the sold units were frauds. Not everyone knew it was a game. The whole system has been gamed. The drunk teenagers have all gone home and the grown-ups have to clean up after the party, not that the criminals have stopped spilling beer on your sofa…it’s still going on. Most reasonable people are not buying these homes and stocks–but somebody is. Who goes to jail? Mozilla? We’ll see. Bailout means crime does pay.

About a month ago, a USDA loan program manager presented a “lunch and learn” to our sales staff. One of the most amazing things he said was about the “payment shock” yardstick used as one of the key tenants of approving folks for USDA mortgages. If the payment the applicant was currently making for housing (either rent or mortgage) was going up by more than 20%, the odds of approval (barring a major pay increase or other mitigating factor) where very slim. Seems to me anyone with paper other than Prime out to be subjected to the same standard. Now USDA loans are not available in any metro areas, and I use this example merely to bear out what you say – the lenders do not care, and never have, about who they’re lending money to.

Navy Chief, Navy Pride

I agree with the above- NO cram-downs!!

Something that all the elected officials seem to be refusing to acknowledge is that ALL the people who signed off on those bad loans were ADULTS wearing their big-boy pants and to treat them as innocent victims is to start a terrifying precedent of refusing to make adult citizens legally responsible for their actions (as long as enough of them are criminally stupid at one time).

If you want to be REALLY compassionate, start a federal subsidy for a small amount to move the families out of their undeserved homes and give them a first/last rental voucher to move into a local apartment complex. THEN boot their fiscally lying asses out of the home, and give the bank 9 months to sell the house or have it seized and sold by the IRS with the proceeds going to pay off the whopping government subsidies.

We are also waiting patiently, prudently, for home prices to drop back to realistic levels. My husband alone makes well above the median price for our area, but we can’t afford to responsibly buy in this inflated market.

I am frustrated that the Banks are being allowed to artificially hold the prices higher by holding onto so many of the REO properties. My dad is a mortgage broker (no, really, a good one- he may have “drunk the cool aid” but none of his clients ever defaulted) and he keeps telling me to buy NOW because “None of the Banks will let an REO go for less than 75% of the defaulted price”.

In short, despite everyone admitting the real estate bubble has burst, we as taxpayers are PAYING Banks to hold on to over priced foreclosed inventory and keep the market from correcting and moving on because they KNOW that once they release all the defaulted properties, the prices will correct and they’ll have to admit the loss on their ledgers. BUT, if they hold on to 80% of the REOs and create a false scarcity, they can keep the prices artificially high and not have to formally admit that their greed allowed their real estate loan portfolio to become overvalued by at least 50%.

If someone as unschooled as I am can see this, why isn’t congress demanding that the banks release all this inventory and sell it off so the market can get moving again??

EXACTLY!!! THIS IS A CRAZY WORLD WE LIVE IN WHERE THE IRRESPONSIBLE GET REWARDED FOR THEIR COMPLETE FINANCIAL NEGLIGENCE. WHY NOT REWARD THOSE OF US WHO HAVE GOOD CREDIT, WILL TAKE A CONVENTIONAL MORTGAGE AND HAVE ALL THE DOCUMENTS TO SHOW WITH HOME PRICES THAT ARE COME BACK DOWN TO REALITY. MANY HOMES WILL CONTINUE TO SIT AND ARE DRASTICALLY OVERPRICED. WHERE IS THE HUMANITY???? THIS IS INSANITY!!!!!

Cram downs aren’t that palatable to responsible folks, but, consider the alternative of putting another house on the market. It’ll only depress it even more. Cram down laws could be written to not reward the residents too much — don’t cram down to less than, say 120% of comparable properties, and bring payments to a reasonable rate. If they can’t afford that, they have to leave. If they can afford it, then, there should also be an add-on fee that brings the monthly payment up to 1/3 of their income for as long as they have the property, and the fee goes toward covering the costs of the bailout. Also, prohibit residents from renting the property out to someone else. You can get really creative with this.

I Love you DR HBB, But get the heck out of here with your cram-downs man!You sound like Mr. Mortgage with this tune. Cram-downs punish the responsible and reward the reckless. Foreclose!

What is it with you pro-cramdown people whining about foreclosures hurting their own property values?

Are these the people who bought from 1999-2003?

Sorry folks, you also bought during a bubble.

The hypothetical equity that you claim to be losing is just fantasy equity.

Want to build equity?

Do it the “old fashioned” way.

Pay down your mortgage!

You think that’s bad, what about all the housing that sits empty on the market? Condos especially but houses as well, sitting empty, not selling at their inflated prices, not released to the rental market, while we compete to be able to buy an overly expensive house or just pay our inflated rent.

@crammy:

Did you say depress the market? Maybe you’ve missed the last ten years… BUBBLE TIME. It’s still bubble time where I live because the crime syndicates known by the euphamism “banks” are deliberately acting in concert with the US Treasury, Federal Reserve and SEC to commit securities fraud. That’s right; all these efforts to keep home prices artificially high are securities fraud tying directly to the fraudulent paper misnamed “toxic assets” they produced known generally as derivatives. All my $150,000 college degree gets me is a crummy $10.00/hr job where basically I’m doing the work of half the department, and with that pay I can only afford to live with my parents. I can’t wait for houses to go back to early 1990’s or even late 80’s prices. Preferably 1880’s or 1890’s prices.

To all those pitching a fit and falling in it over the idea of cram-downs, it appears that you do not understand the concept. And Crammy you too have gotten the concept wrong.

>>>>

(1) The price or loan balance is NOT ‘crammed down’ by the Bankruptcy Court to what the borrower can pay. Not ever, Not once.

>>

The price/loan balance is ‘crammed down’ to the current market value of the property. (And that results in a new ‘price’ for the house just as if it had gone through foreclosure and been sold as an REO. And it is all there in the public records of the Court to act as a comp. The Court has the property appraised to get the new price just as the lender would do if hey got it back in foreclosure.)

>>

(2) The debtor must be able to pay the new payment. And a bankruptcy court would not consider more than 31% of gross income for principal, interest, insurance and taxes – PITI – to be ‘affordable’ and within the borrower’s ability to pay. Also the courts look at total Debt To Income – DTI – for all fixed debts in deterimining ability to pay. If the up-front DTI (house alone) or the back-end DTI (particularly secured loans like cars and non-dischargeable loans like student loans which can not be discharged or even modified 95% of the time) exceed 41% of the debtors income, then the Court would not waste time with doing cram-downs but order the property liquidated and sold.

>>

If the debtor is unemployed or has taken such an income cut that they can not make the new payments after the cram’down, it would not pass muster and they would lose the house.

>>

(3) The only time cram-downs are allowed is in a Chpt 13 reorganization – not a CHpt 7 liquidation. That means the debtor must have an income and have the ability to make payments on some or all of the debts. A Chpt 13 is a long-dranw out process. The Court sets a debt payment plan and the debtor has to fulfill the plan for anywhere from 3-5 years under the Court’s supervision.

>>

Miss payments on anything without a very very very very good reason (say sudden enormous and unexpected medical expenses or being off work from a car accident) and the Court will turn either

(a) dismiss the Chpt 13 and all bets are off and the everything goes back to what it was before the filing; or

(b) convert it to a Chpt 7 liquidatio which means all the ‘cram downs’ are off the table, loans revert to what they were and the only way the debtor can keep the house is to get current on the payments under the original loan.

>>

Only around 60% of all those who file a Chpt 13 make it through the entire process. The other 40% get dismissed and/or end up in a Chpt 7 liquidation.

>>>

(4) Cram downs were done on primary homes for decades. It has only been he past 15 years or so that they were prohibited for primary homes. Cram-downs in bankruptcy reorganization (as opposed to liquidation) have ALWAYS been and are still being done for second homes, vacation homes, commercial real estate, investment real estate, airplanes, care, boats, personal property, business property and everything else The only secured loan which currently can not be crammed down in bankruptcy reorganization is that for a primary home even though the same debtor can cram down their vacation house.

>>>

The comments above seem to reflect a lot of vindicativeness and hatred. It is one thing to want to see property values fall. It is another to still want to see people tossed out of their homes ‘just because’ when they would otherwise be able to afford the house at current value. The first makes sense and is good for all of us. The second resounds with lblanket generalities and assumptions about the debtors, spite, jealousy, hatred and venom – not very attractive at all..

Cramdown is the wrong way to go. The “positive,”, as stated by its proponents, is that to do anything else will only have a negative effect on the value of homes owned by responsible borrowers. That doesn’t make sense.

~

Let’s say I bought a home pre-bubble for $100K and its paper value exploded to $700K due to the bubble (not an uncommon scenario.) Now we have an ocean full of liars who took out their NINJA no-doc Option ARM to buy their $700K McMansion despite their $24K/year income. So what if they lose their house and have to rent? To allow otherwise would, what? Make my house worth “only” $300K? $250K? 200K? I’ve got news for you. My house was never really “worth” $700K. And that McMansion was never really worth $750K either.

~

I agree with others who have commented here that the cramdown is one of the worst “solutions” to this problem. The true solution is to let these overvalued houses default, throw the liars out of them, and force the banks to put them on the market. It’s only then that values will return to their proper level.

Hey AnnS – I know what a cram-down is. The borrower gets to stay only if the new market price is affordable. Maybe I wasn’t being clear, but, I was arguing for cram-down laws that would be less favorable than a standard cram-down to market prices.

Also, I don’t think that landlords or speculators should be given cram-downs. They should be only for owner-occupants. The cram-down is expensive, for us, and what I want from it is to reduce the social instability that foreclosure causes. Furthermore, I think if the market price makes the place cost less than 1/3 of the owner’s income, then, the owner should pay a “tax” back into the cram-down fund, and that tax should be the difference between the PITI and 1/3 of their income.

If they don’t like that deal, then, they are free to foreclose as normal, and move on out.

@SFK – yes, I said depress the market. A good market price for a house is based on the local income. The local income should also be around 3x the price of a similar rental. Right now, at the bottom end of the market, the price to buy a house is slightly less than the rent, but slightly more than what people can afford.

So, speculators are moving in to snap up properties and turn them into rentals.

That is bad, because it decreases the population of owners, and increases the population of renters. That can increase social instability.

In places like Compton, it’s happening. What these communities need is for these middle class and lower middle class newcomers to stay in their homes. They don’t need more rentals. Cram-down legislation could be written to do that, and to discourage speculators.

Also, with regard to McMansions — you could write the cram-down laws to cover only a fixed amount of losses. Say, $150k.

Ok. Do you have an idea of where to keep your money? How about the kids? What do you suppose the reality of the next 20 years will be when considering what has been written here? What I am most sure of is that I do not have the answers as to how to live defensively!

Re: 6/5–Missing in all this vitriol and haste to simplify the issue is Doc’s main point: that loan modifications have been a failure and another taxpayer bailout of a miserable industry.

~

His point about cram-downs as I read it (and have for the past four years) is that it is the LENDER that should be taking a hit, since in so many instances the lender well knew it was writing a bad loan. Now the lenders are permitted to write loan mods based on “lower interest rate” but the house VALUE is STILL too high.

~

What also has been missed is that every time a lender re-originates a loan, the interest curve resets to the FRONT PART, that is the fat part. So for every beleaguered buyer that a lender can get into a house, at a too high value an modestly lower rate, a refi only means resetting the loan for longer (as Doc noted)…and getting six months to a year of fat fat interest payments!

~

Cram-downs could be engineered to empty out the market lard introduced by greedy lenders. I would be the last person to argue borrowers don’t share some of the culpability here. But what DOC is arguing is that the current system is only extending the bubble. DHB, you said there is not other bubble at present, and I’d say, there is: the temporary interest bubble.

~

Run some mortgage amortizations and see what I mean. The first year of a loan is the most profitable for the lender in terms of revenue/intake. To lengthen a loan makes the front end interest curve even steeper. To lower the rate and lengthen the loan in many cases yields the same front-end-loaded interest for the bank as a higher rate, shorter term loan.

AnnS,

That was the best summary of what a cramdown is and is not I have seen on any blog. The general response is as predictable as it is regrettable. Still, thanks you.

Interesting article on Alt A/Pay Option Implosion: http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=987439

Loan modifications are a joke! This program does nothing but reward people for making bad financial decisions. When we purchased our home, we were told that we could easily afford a much larger home in a much better area. We opted for an affordable home with a fixed mortgage just in case something happened to one of our incomes. We live in Michigan and my husband did lose his job. We have had to cut back drastically but we can still make our house payments and don’t have to worry about foreclosure. On the other hand, friends of ours who had an income level similar to ours did purchase a large home in a very nice area and even though they still have both their incomes, were on the verge of foreclosure. Who got the government help? The irresponsible party. Because they fell behind on their mortgage they were able to get a loan modification that cut off approximately 1/3 of their payment. Their house payment is now actually lower than mine. I’m struggling to put food on the table right now but because I made responsible choices, I get no assistance. How does the government expect people to make responsible choices if they keep bailing them out when they don’t? I don’t feel sorry for the people whose ARM’s are going up. They knew that was a possibility. I chose a fixed rate and paid a higher interest rate for years when they were paying a lower rate. How is this fair?

The current Obama Bailout plan is working. The news about the profit of $1.8 billion in interest payments on the first set of bank loans that were repaid is a good indication to it.

The modification program is needed and thankfully it’s working. My problem with the program is why are we paying incentives to the banks. This is what they should be doing. It’s their job and duty. They would have foreclosed on these houses anyway. And we know that foreclosures cost money. This doesn’t help the bank’s bottom line.

Leave a Reply to Kelli in Chicago