Hope Now Alliance: Not to be confused with Apocalypse Now Mortgages.

· Reaching out to struggling borrowers to find more affordable mortgages for their home.

· Sending out letters to sub-prime borrowers’ homes much in advance, 120 days or so encouraging them to contact their lenders.

· Ability to refinance out of high priced sub prime loans into more affordable mortgages.

· Broadening state power temporarily to include home mortgage refinancing into tax-exempt bond programs.

· Not explicitly stated but a potential rate freeze for those that are current on their payment and can demonstrate financial hardship should a rate increase occur.

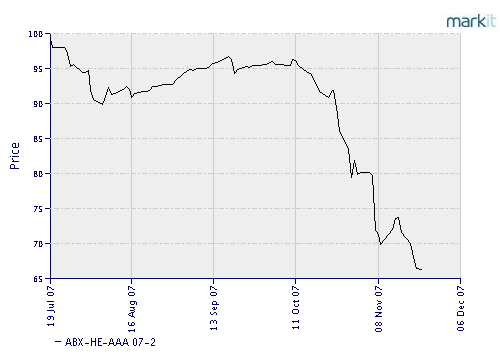

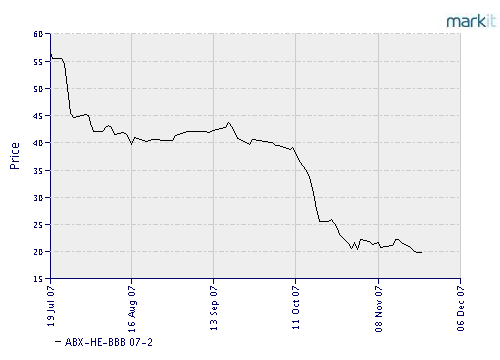

This sounds all good and heart warming but will do very little in terms of saving peoples’ homes. Here’s why. I will address each of these points and the flaw inherent in each one later in this article. But first let us take a look at a few asset backed securities indexes:

Beyond Sub prime

It is becoming more apparent as each day goes by that the media thinks this housing downturn has a large part to do with sub prime. Take a look at this headline from CNN:

Simply by looking at headlines like this, we can understand the nature of the false housing rally last week. Even by Paulson’s own admission, half of delinquent borrowers do not contact their lenders in order to save their homes. With the advent of sites like Zillow.com and the housing obsession of this nation, do you really think an underwater owner with a $500,000 mortgage on a home that is now $400,000 is going to try to save it? Owners have access to this quick information and realize that even if they freeze their rate for 5 years, they will be paying on a depreciating asset that will fully amortize eventually and they may never recoup any equity; lender wins you lose. But this is more than a sub prime issue. We have prime borrowers who took out adjustable rate mortgages and what will happen to them? In

Dear Santa Mortgage Letters

Certainly it is admirable to send out letter to those facing a major rate reset. Yet we already know that 50 percent of delinquent borrowers will not contact their lenders. Unless the lender does an automatic rate freeze without the knowledge of the buyer, I’m certain many people will continue to ignore any letters. Keep in mind these are sub prime borrowers. Many are used to getting late letters from other creditors, that is why they are sub prime to begin with so this will only be another letter to ignore unless they have a major compelling reason to stay in their home. In addition, I wonder what the mortgage investors have to say about this? Do you think they will be pleased to change the terms on their notes? In addition, all this slicing and dicing has made it hard to determine who actually owns the mortgage. I wonder if sub prime mortgage investors got a notice about their investments returns resetting?

Two of the major lenders in the talks are Washington Mutual and Countrywide Financial. Their stocks soared last week because of this plan. There is a reason that these companies are rubbing elbows with government officials. Where Fannie Mae and Freddie Mac have only about 15 percent exposure to

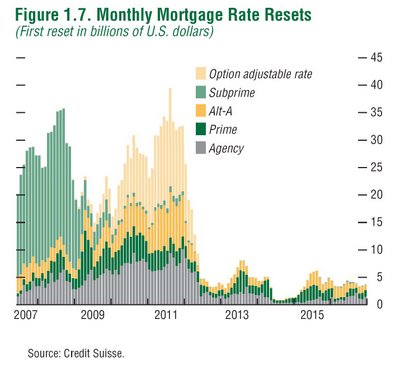

We are certainly in for a prolonged housing bear market. But thinking that sub prime is the main reason is naïve and flat out wrong. Take a look at the amount of Alt A and prime loans resetting next year:

Certainly with the chances of a recession increasing, many of these prime and Alt A borrowers will have a hard time making their payments. Will we allow these folks to freeze their rates? Why can’t we have the government step in and freeze rates for credit cards after their initial APR promotion is due? This is an apt comparison. We all know that 3.9 percent cannot last forever and expect 18 to 24 percent in the future. You can see how this reeks of a moral hazard but this is shortsighted and won’t do much. If anything, it gave the lenders involved a much needed jump in stock value and now the market is teetering between a .25 and .5 rate cut. More liquidity please.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

24 Responses to “Hope Now Alliance: Not to be confused with Apocalypse Now Mortgages.”

I love how Paulson says they’re going to help financially responsible people who are having trouble with bad loans. If they were financially reponsible they wouldn’t be in this mess in the first place!!! Gotta love election year bs.

Question: Say Paulsen’s plan gets approved and all these sub-prime homeowners and others involved get the bail-out they are hoping for. How will that affect the market correction that is in progress? More specifically how will it affect the correction that’s going on in Southern California? Will the bail help keep home prices bouyed or will they fall anyway?

I just don’t see how this bail out will be good for anyone besides big business… if home prices remain at there current astronomical price levels and lenders return to traditional lending standards who will be able to afford to buy a home here?

It sounds as if the government would like to keep home prices at there current unstainable highs even though I don’t know anyone who received salary raises that would help support these prices?

Uhh, does this mean that these folks now have a fixed rate of 5.25% for the duration of the loan? From the San Diego Tribune article:

“The couple would be able to continue paying on an interest-only loan for the next three to five years at a slightly higher, but manageable, rate of 5.25 percent. Once the interest-only period is up, the Hornbeeks would begin paying off the principal as well as interest for the remaining 22 to 24 years left on the loan. The interest rate would remain at 5.25 percent during this time.

“This is really great news for the Hornbeeks,†Barrett said. “Their mortgage would only go up about $1,000 a year based on the new interest rate, but it’s something we all agree that they’ll be able to manage in the short term. And, as we’d hoped, it will give them some time for the market to recover and for Mike’s salary to increase.â€

And now, they’re expecting the second holder to take a hit? What is the end result of value on those loans, since the negotiated interest rate is now going to go down?

Certainly, like any bond, the decrease in yield is going to drastically decrease the face value of the note. Multiply this by 1000’s of loans. Am I missing something, or someone going to take an massive beating?

MASSIVE CLASS ACTION Lawsuits are coming!!!!

This is as morally-bankrupt as it gets people. The only thing this does is protect the Wall Street Theives and of course, Paulson’s buddies at Goldman.

It effectively penalizes everyone with half a brain in this country who made prudent, responsible financial decisions and is thus, COMPLETELY ILLEGAL!!

The only thing that will clean this up, is a massive forest fire, Malibu style…prices must crash and crash HARD!!! Pain is an essential part of a correction, but the govt. wants to skip that part, and illegally keep that from happening!! If you can’t afford your house payments, you need to move out and RENT!! How can you expect American citizens to make solid finanacial decisions, when all you do is show us that we will be SCREWED by our Govt for doing so??

If this plan goes through, every American with a mortgage needs to drop off the keyes at the bank and STOP paying.

Here’s another couple. I couldn’t read the whole thing because my head was spinning too much, but here are a few gems…

Examining the subprime-lending crisis

“I had 27 credit cards at one time. I can’t get one now,” Phyllis said.

Donald is 70, and Phyllis is 68. Their income is fixed at $4,439 a month. Their mortgage payments, insurance and property taxes exceeded $3,300 a month.

AND

The offer, which they accepted Wednesday, allows them to postpone payment on $150,000 of the principal until 2034 and lowers their monthly mortgage payment to a fixed $1,664.

WTF!!! They’ll be dead soon!!

We go from Dumb to Dumber. We now have Senator Clinton talking about a 90 day moratorium on foreclosures. Bwahaha! This feels like a Monty Python sketch. This is what was said according to Reuters:

“Clinton said the freeze would give the housing market time to stabilize and homeowners time to build equity. She also called on the mortgage industry to provide regular reports on the number of mortgages they have modified.”

I agree that the industry needs to have better reporting standards. But freezing rates so owners can build equity? Oh boy.

Homework assignment. Here is a preview of things to come. Here is a couple that had to renegotiate their loan with Countrywide:

Mortgage Renegotiate

After reading the article, can you answer the following?

1. How much did they put down when they bought the condo?

2. How much will the payment be once it fully amortizes in 3 to 5 years (use either one as your base point).

3. Who pays for this?

@eddie,

It is a Catch-22. The circular pandering and logic is beyond me. In fact, I wouldn’t be surprised if the Fed drop rates by .5 anymore. It is apparent they care not if the dollar declines into the layers of hell.

@soyperdido,

You are not lost my friend. Prices will still fall in California. The government would love to perpetually inflate this bubble but we are now in a Ponzi scheme. Any money thrown at this problem is like throwing hundred dollar bills into a campfire. What needs to be pushed is cram down legislation forcing these lenders to face up to their reality and work with buyers by reassessing property at current market values and excess debt is cast off as unsecured debt. This way lenders will get the message that they do in fact have skin in this game instead of running to mommy and daddy government. The sad thing is that this is in no way is in the financial benefit of current owners.

GO GO PAULSON!!! An “agreement” to freeze rates is perfect.

The banks are out of money.. Investors walked away. Lines of credit are drying up real fast for the remaining brokers / lenders.

The banks desperately need cash to meet their reserve requirements and investors need cash flow to keep the scam running so the SIVs and Conduits don’t implode any faster. This is perfect.

The real losers here are yet again the people that get the “benefit” of still paying much more than if they rented.

I actually think this penalizes the home debtors even more by sticking them with more and more payments on a worthless pile of crap. Plus it helps the banks because they get the house maintained for free.

A rate freeze will impair the expected cash flow of many CDOs that are loaded with subprime debt. This will likely force the senior note holder’s hand to execute a liquidation to protect their capital (wipe out lower tranches) and invest elsewhere.

Result of freeze: even lower investor interest in mortgage backed securities and further declines in the value of real estate.

Many homeowners in bubble markets like California are actually better off sending the keys to the bank after getting approval for a rental at less than half the cost of homeownership. I don’t know about you, but saving over $2,000 per month in living expenses sounds like a much better solution to me. Much better than spending most of your disposable income on a bloated mortgage for a depreciating home you can’t afford.

I made a chart of Fannie’s CPI-adjusted conforming limit since 1980:

Fannie Mae Conforming Limit: Then and Now

It’s clear to me that the GSEs still have some suffering ahead of them. They were an integral part of the early stages of bubble formation (’till ~2004), and their MBS issues will be effected as house prices erode into the sub 2002 price range. We’re already starting to see some 2002 pricing in Sacramento, although the bulk of the market is still priced at mid-2004 levels.

Next year will be quite interesting.

YIKES!!!

Losses Stack Up

Local Officials in Florida Try to Assess Damage To Investments Linked to Soured Subprime Loans

By Tomoeh Murakami Tse

Washington Post Staff Writer

Tuesday, December 4, 2007; Page D01

NEW YORK, Dec. 3 — Local governments and school districts in Florida scrambled Monday to assess the damage to their investment portfolios from subprime mortgage loans, as the credit crisis reached into pockets of the investment world previously thought to be out of harm’s way.

Florida last Thursday froze withdrawals from its Local Government Investment Pool, a sort of money-market fund for the state’s public agencies, after nervous investors pulled out $10 billion in 15 days.

Buy This Photo

( Photo Illustration By Tan Ly And Nathaniel Vaughn Kelso — The Washington Post; Istock Photo)

TOOLBOX

Resize Text

Save/Share + DiggNewsvinedel.icio.usStumble It!RedditFacebook Print This E-mail This

COMMENT

washingtonpost.com readers have posted 10 comments about this item.

View All Comments »

POST A COMMENT

You must be logged in to leave a comment. Log in | Register

Discussion PolicyDiscussion Policy CLOSEComments that include profanity or personal attacks or other inappropriate comments or material will be removed from the site. Additionally, entries that are unsigned or contain “signatures” by someone other than the actual author will be removed. Finally, we will take steps to block users who violate any of our posting standards, terms of use or privacy policies or any other policies governing this site. Please review the full rules governing commentaries and discussions. You are fully responsible for the content that you post.

Who’s Blogging» Links to this article

On Monday evening, public school superintendents, municipal finance directors and county clerks from all over Florida participated in a tense conference call to inquire about the fate of their money — money that was supposed to gain modest interest in a supposedly risk-free, easy-to-access fund.

“We keep the lights on and we keep the buses running and we make payroll with that money,” said Stephen Hegarty, a spokesman for the Hillsborough County School District in Tampa, which has $573 million invested in the frozen fund. “We’re paying very close attention to this thing.”

The run on Florida’s state fund was sparked after local governments discovered it held subprime mortgage assets that had soured.

The Florida fund had invested in about $2 billion in what are known as structured investment vehicles and other debt instruments that have been downgraded by rating agencies and no longer meet the fund’s minimum requirement for investment. Those hard-to-value assets have been roiling financial markets for months as housing values decline and mortgage delinquencies rise.

Florida public agencies are not the only ones having problems. A number of local and state funds have exposure to subprime assets whose values have fallen dramatically. While no other state fund has taken the drastic step of stopping withdrawals, analysts say more pain is on the way.

Moody’s said last week that it had downgraded or put on watch for downgrades more than $100 billion of debt sold by structured investment vehicles. Standard & Poor’s said last month that it could downgrade a $5 billion investment pool in Kings County, Wash., because of its exposure to the vehicles.

“Things like this don’t usually come in ones,” said Ed Rombach, senior derivatives analyst at Thomson Financial. “The Wall Street distribution machine fed this stuff everywhere.”

Susan Mangiero, president of independent research company Pension Governance, added that many public investment plans are run by a small staff juggling other duties and that there is no experience or education requirement for trustees. “Statistically speaking, you know there are going to be some problems,” she said.

In Montana, local governments have pulled $260 million from the state’s $2.4 billion Short Term Investment Pool, said Carroll South, executive director of the Montana Board of Investments.

The fund, records show, has $550 million invested in structured investment vehicles (SIVs), which borrow short-term money by issuing commercial paper and invest in higher-yielding, longer-term assets, including subprime-mortgage backed securities. But the vehicles have been squeezed as mortgage investments shed value and buyers for the commercial paper have all but disappeared.

Of the $550 million, $90 million is invested in Axon Financial, which has been downgraded and is being reorganized. South said the fund started investing in SIVs in April.

He added that Montana’s investment pool would not be at risk of a freeze similar to Florida’s, because 70 percent of the money is from state agencies that “can’t invest anywhere else.”

Officials in Virginia, Maryland and the District said their exposures to SIVs and other mortgage-related assets were either non-existent or negligible.

Overseers of the troubled Florida fund are scheduled to meet Tuesday to consider a proposal from BlackRock, an asset manager hired to help the state reopen the fund.

In the Monday conference call with Florida’s local governments and schools, BlackRock explained that of the $14 billion left in the fund, $12 billion — or 86 percent — was in “high-quality” assets. The rest were either securities in default or under stress because of credit issues. The team proposed breaking the fund into two, with one holding the “clean” assets and the other holding the distressed. If a school district had $100 million invested, $86 million would go into the clean fund under this scenario.

BlackRock officials also proposed redemption fees for the “clean” fund after a certain threshold to prevent massive withdrawals.

ANY “gubmit” intervention in the housing market that will insulate greedy lenders and stupid borrowers from their financial imprudence is a huge mistake. Removing the painful consequences to screwing up is tacit endorsement for more screwing up. As was pointed out in an earlier post, investors must be allowed to both reap the benefits of their mortgage investments or take a loss if they made a bad choice. If CountryWide and other lenders have to go the way of New Century, so be it. Other more sensible lenders will fill the gap. If foreclosures take people’s homes, tough nuggies. Welcome to financial reality 101. Who would not like to own a bigger, newer home and have a portfolio of investment and vacation properties? I know I would, but we must all live within our means.

In 2005 I bought a house (more house than I could afford on a stated income 30 year fixed mortgage) at the peak of the market in an upscale L.A. suberb. I was due for a raise soon and I thought that would enable me to make ends meet. The raise never came, but because I had put down 20% AND because had more than 12 months living expenses saved up so I was able to continue making payments on time without missing any.

This was not an investment property for me but a place I wanted to raise my family in.

In 2006 I listed the home for sale and did not recieve one single offer for about 9 months, even after a price reduction (which came at my own suggestion and not my realtor’s).

I finally got an offer (much lower than my reduced asking price and LOWER than what I paid for the property in 2005), it was the only offer that was made. I took it, I lost money (quite a bit) but I was genuinely thankful to get out of that committment.

It was a painful and expensive lesson for me, but it was also powerfully valuable to me as well. I WOKE UP and I realized that buying more house than you can afford (even in an upscale neighborhood) and struggling to pay that mortgage, property taxes, homeowner’s insurance and the utilities IS NOT LIVING and you don’t even get to enjoy the house or your family that you wanted to grow up in the house.

The guy that bought the house from me is an investor (yes they’re still out there — even now) and after closing the escrow, he immediately relisted the house for more than $1 million. He’s put quite a bit of money into the house (added a new master bedroom suite and a swimming pool and painted inside and out).

I’m currently renting in a nice neighborhood and paying less than half what I was paying for my house. But I still have my savings and I now have better wisdom and will not get caught up in the next home buying frenzy as if houses will never again be sold.

I think we, as Americans, have gotten caught up in the idea that we have to have bigger, newer, better, more expensive stuff and that all this new better “Stuff” will make us feel validated and therefore we will feel better about ourselves.

Home ownership has long been touted as the American Dream, but that dream has turned into a nightmare for many that tried to reach for something they weren’t prepared to pay for.

The government should stay out of this miss. They say they’re worried how this slump will affect other sectors of the market, I say if other sectors benefitted from the inflated prices then they should also suffer whatever natural consequences come as a result of the bubble popping.

Let the market fix the market and let us all learn to be more prudent in assessing how much of something we can actually afford to buy.

Don’t fool yourselves for a second thinking this is really aimed just at, or even primarily at, the subprime borrowers. The obvious intent is that this plan, once it starts rolling, is expanded to the prime and Alt-A borrowers who will start resetting en masse beginning in ’09. To say this is morally bankrupt, corrupt, and done for the benefit of Wall St. campaign contributors and government itself (see: higher property taxes as a percentage of income) rather than the people is an understatement.

The same people who are proposing this nonsense are the ones proposing that illegal immigrants who’ve been working without paying taxes, committing identity theft by working under other people’s SSNs, and other crimes be given amnesty so that wages can be kept trending down and mega-corp profits (and campaign contributions) up.

So perhaps it’s time to start working under a falsified social security number and stop paying taxes? After all, you’re just trying to do the best for your family – our congressional leaders say that for Mexicans to do that is ok, and that deliberately falsifying your mortgage application to buy a house you can’t afford makes you a victim rather than a criminal, so how can not paying taxes on your hard earned wages, so that you can keep more to support your family, possibly be wrong?

“Those people” did it to us again. If it wasn’t for “dose people” none a dis wudda happind. It’s dose liberals dat hate `merica – and hate du troops, dats what du problem is; and dose people!

The solution is simple. A national referendum mandating 20% across the board house price appreciation! Instant equity for everyone! Now all the subprimers can go and refi into fixed rate loans. Its brilliant and surely to be endorsed by Hillary, Paulson, Bair and Bernanke.

@Greg

I’ll do you one better.. Everyone gets an automatic 50% raise!! With all that extra cash, the economy is SAVED!!!

Now of course there is the tricky issue of all the people losing their jobs.. so 1.5 X 0 = hmm lemme see.. hmmm oh crap that’s still zero.. Damnit.. My plan failed…

WE ARE IN AN ELECTION YEAR. Hillary is yelling for a 90 day moratorium. The Republicans don’t want this to be an issue for their candidate. In steps Mr. Paulson. When one realistically looks at this mess, how can we believe a bailout from the government can do anything but make matters worse. All the arguments talking about moral hazard and other dangers very well may be true. At any rate, it will truly piss off the average taxpayer who played by the rules and now gets to bail out their irresponsible and, at times, greedy neighbors. Its the American way.

And so the nitpicking of the proposal begins:

“A large part of that plan, it’s been widely reported, is to broadly rework adjustable rate mortgages (ARMs) for all borrowers who qualify and freeze their interest rates before they jump to unaffordable levels.

But investors in mortgage-backed securities, who buy the loans wholesale from lenders, aren’t exactly jumping on board.

“You have contracts in place guaranteeing investors a fixed rate of returns,” said Jim Carr, Chief Operating Officer of the non-profit advocacy group, National Community Reinvestment Coalition. “They have no immediate incentive to give up those returns.”

Ultimately a mortgage rate freeze would result in higher home prices, according to Peter Schiff, president of retail investment brokerage Euro Pacific Capital.

“The [investor] will say, ‘Wait a minute. The government can come back in a few years and alter contracts based on economic emergencies,'” he said.

Investors will want a higher return from their securities, and charge more for that added risk. “Because of government intervention, people will pay too much for their houses.”

Paulson freeze: Will investors agree?

There are many good points being brought up. It is very clear that this program is specifically geared for primary homeowners who can make their current payment, but will be forced out if rates adjust. This is a tiny subset of subprime borrowers. We already know that nearly half of subprime borrowers default even before any rates reset and many never contact their lenders. The irony in all this is many of these owners and lenders for the first time are dealing with “real world” income and documentation. So how can they adequately forecast how things are going to happen if a vast number of loans are fraudulent to begin with? There was a study at the height of the bubble by the Los Angeles Times showing that those who went stated income, over 60 percent “fudged” their numbers. Of those that fudged, they overstated their income by 50 percent. If we look at the Treasury markets you would think that we are already in a recession. The markets are predicting drastic rate cuts but this won’t do much because we are reaching a critical point that $1 of credit does not produce $1 of change in the economy. We seriously need to start talking about cram down legislation and accepting the fact that housing is overpriced. If we can acknowledge that one piece of reality, then we can come to the table with substantive proposals. Right now lenders, builders, and Wall Street are still hoping that this housing market will bounce back in a few months. Their entire system depends on this going on forever. Housing in the last few years was the asset that allowed Wall Street to speculate and trade as if it were a commodity. Take a look at the CDS markets and you’ll realize that this is much larger and structural. Only radical change will allow us to have any semblance of future progress. Otherwise it is a slow bleed for many years. When I used to bring up Japan and how they dropped rates to get this 0, many people pushed this off by saying “the US isn’t Japan” or “our system is more complex” and their market was in the dumps for over a decade and is only starting to slowly recover. Debt is debt folks. Economics has global fundamental rules. If you drop rates, more credit flows in the economy. We can argue the minutia of land or other global circumstances but we can learn some lessons by examining what they did wrong. Is this the path we want to take? Seems like the Fed is going this way. Or do we want to face up to those responsible and correct the problem with some hard but reforming agendas?

Jim at Law. The first thing about this program that came to my mind was that it was not aimed at the subprime borrower. The subprime borrower is toast. This proposal is clearly meant for the Alt A resets. It will be painfully interesting to see how this plays out.

Is Paulson’s plan limited to properties that are owner occupied, and which have equity? Are the investors on board?

These are unanswered questions.

Debt Relief Act to avoid the 1099 IRS for small real state investors.

With all respect;

As a millions of ordinary people of this country, during the boom of real state market I had acquired few real state properties, investing all my savings and credits, with the hope to make some profit. Now I am trap with these properties because the prices have fall down drastically. I can give my part to re start moving the economy of this country, how? I can put these properties in the market for shore sale and some one is going to buy it right away, but to do that it would be very good to extent the Mortgage Forgiveness Debt Relief Act to avoid the 1099 IRS form for investing properties too. This IRS 1099 is holding back to millions of ordinary people, small real state investor people to sell their few properties and therefore moving the economy forward in this real state market, which is the important sector in the recovery of our economy. Extending or adopting another law as the Mortgage Forgiveness Debt Relief Act for small real state investors, also can avoid many bankruptcies and foreclosures in the country. If there is not another chance many of them will go for chapter 7 or 13 anyway, in order to avoid de deficiently judgment or the IRS 1099.

Thank you very much to give us the opportunity to send our concerns to be taking into consideration for policy decisions which will benefit our people and our country.

Ruben

Leave a Reply