Las Vegas looks to California for home sales demand – 1 out of 3 investment property buyers in Las Vegas came from California. A repeat trend from the mania days although home prices are now down 63 percent from the peak reached 5 years ago.

Very few housing markets have been hit as hard as Nevada and in particular the Las Vegas market. Southern Californians share a close kinship with Las Vegas since a large part of the Vegas economy is based on weekend freeway flyers across the desert on Highway 15. A few markets in Southern California like Riverside and San Bernardino counties have been hit nearly as hard although this is out of the mind for most. One fascinating component of the Vegas expansion and bubble had to do with California money flowing into second and investment homes out in Las Vegas. You can say that Californians added additional fuel to the already raging real estate bonfire. Yet as we are well aware the bubble was nationwide with varying degrees across states. Some states had minor bubbles while others went deep into the mania. Las Vegas was unique in the sense that run-off money from the California bubble entered into their market in large numbers. At one point roughly 40 percent of investment homes were being purchased by those with California ties. So it should come as no surprise that we have gone full circle where 1 out of 3 investment purchases again are from California buyers. Only this time, prices are off by 50, 60, and 70 percent.

Californians take another jump into the Las Vegas market

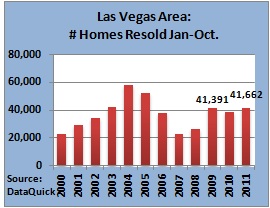

Nearly half of all sales in Las Vegas last month came from investors. This trend has been going on for years and over half of the properties sold were distressed home sales. This is down from the peak of 73 percent distressed sales reached on April 2009. Cash buyers paid a median price of $84,000. That is right, $84,000 for a home out in Las Vegas. Because of the crushing blow to prices we have seen sales increase dramatically:

Source:Â DQNews

Because of these incredibly low prices Californians are rolling the dice once again with Las Vegas:

“(Vegas Inc) Out-of-state buyers — led by Californians — accounted for one-third of Las Vegas home sales in June in a reflection of the demand by investors and vacation-home buyers.

Absentee buyers, including investors who live in-state, purchased 46 percent of all homes sold in June. That figure is down from the record 49.9 percent in March, according to statistics released by San Diego-based DataQuick.â€

I always find these trends fascinating. What this tells us is that Californians are hungry for low priced real estate especially when it comes to investment properties. We have seen some action like this out in the Inland Empire. For years I have been hearing that big money bags from Asian countries would be soaking up this excess real estate. The data doesn’t exactly show us that:

“Of June’s absentee buyers, 34 percent had a mailing address in Nevada, and 30 percent were based in California, DataQuick reported. Most of the remaining out-of-state buyers were based in New York, 5.6 percent; Pennsylvania, 3 percent; New Jersey, 2.4 percent; Utah, 1.9 percent; and Florida, 1.8 percent.

Three 3 percent of all Las Vegas homes sold in June were bought by foreign buyers based on public property records, which can undercount the actual number, DataQuick said. Of those foreign buyers, 78 percent were from Canada, and 11 percent were from Australia. Buyers with addresses in Israel and China were 8 percent of the total.â€

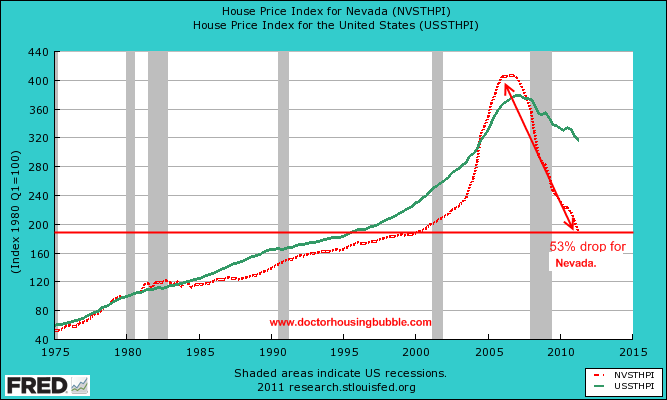

In essence the action is coming from our neighbors to the north and from our friends in Australia. Fascinating when you cut deep into the data. The big draw is definitely coming because prices have absolutely cratered:

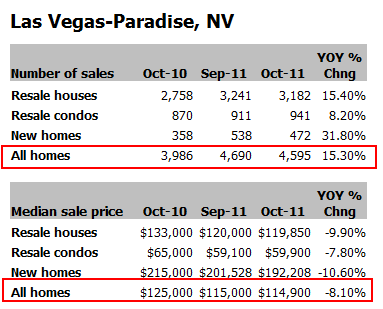

While nationwide home prices are down roughly 30 percent from their peak Nevada home prices are down a stunning 53 to 63 percent depending on what market you examine. The biggest market of course is Las Vegas. In fact, the median price of $114,900 for Las Vegas is down a stunning 63 percent from the peak reached five years ago on November 2006.

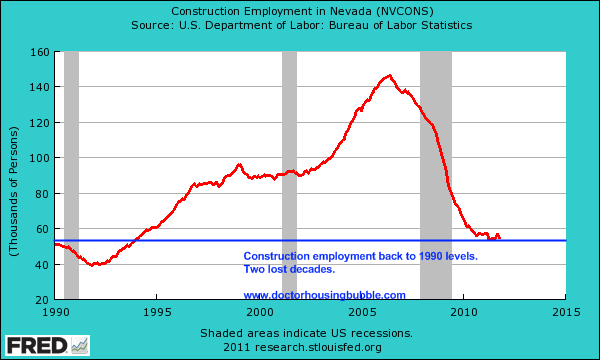

Although good news, this is essentially trading cards between already existing real estate inventory. The shadow inventory is being cleared out quickly in Las Vegas but even at this rate it will take years. This is why the median price fell yet again year-over-year by 8 percent while sales were up by 15 percent. The economy in Las Vegas is still hurting and the once booming construction industry is still clearly in the doldrums:

Until we see a more evenly balanced market, there is little to believe a bottom has set in and even if it has set in, expectations of appreciation may be overstated in the short-term. Las Vegas is showing that even five years into the crisis and 63 percent lower in price, there is still a good amount of momentum for lower prices. As an investor, many are competing with a flood of cheap rentals but for a vacation home prices are looking obviously attractive to snowbirds from Canada. Yet the big buyers are from California once again. 1 out of 3 buyers for investment properties in the Vegas market come from California just like they did during the peak push. To paraphrase Mark Twain, history doesn’t repeat, but it does rhyme especially when it comes to California.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

30 Responses to “Las Vegas looks to California for home sales demand – 1 out of 3 investment property buyers in Las Vegas came from California. A repeat trend from the mania days although home prices are now down 63 percent from the peak reached 5 years ago.”

You have to admit, Nevada is #1 on the list for someone who survived the carnage of ’08 and is trying to find yield for their cash, or is of a certain age (that means you, Mr and Mrs Boomer) who are looking for a cheap, warm place to live. Florida is just too humid hot and flat for my liking, although it is developed well for many to come and die (great geriatric health system). The humidity down there must be quickly destroying the unattended empty foreclosures, while, I’m assuming, the desert dry heat will preserve these homes much longer. You gotta love the no state income tax in both places, though.

Vegas is not to my liking – I consider it a freak show on so many levels, and I’m not into gambling. Reno, on the other hand, is on my radar because of the excellent skiing and other mountain activities just an hour (at most) away up in Tahoe. Any Reno fans or residents here? Do you like it? Lord knows I like the RE prices I see on Zillow. A little bit of shopping through foreclosures and other bank owned properties could get me another 30% off. Nice. And, this isn’t old fix me up garbage. Brand new homes built in the bubble.

I’m from NYC metro, btw. Been to Tahoe twice, skiing.

I live in the Bay Area about 4 hours from Reno. If you are looking for warm and dry, that doesn’t describe Reno. The only thing Reno and Vegas have in common are Nevada and casinos. Reno is on the eastern side of the Sierra Nevada, is high elevation, is very bitterly cold in winter, and gets ice and snow. If I had to pick between Reno and Vegas, I would probably pick Reno as well because of outdoor recreational opportunities as you mentioned, but Vegas has warmer weather and a major airport. Parts of Reno are sketchy and can seem somewhat depressed when all the visitors are gone, so be careful if buying. Reno is to Northern California what Vegas is to Southern California, although on a much smaller scale.

As someone who has lived in Northern NV since 2005 I’ll chime in. Reno does get cold and parts of the town can be windy. 2-3Xs per decade a snowstorm will actually be heavy enough to stick around for 1-2weeks. Expect 300+ days of sunshine. However summers are top out at 85-90 most of the time unlike Vegas.

As with most cities there are good and bad areas. The North Valleys will appear compelling cheap on Zillow but suffer from lots of crime and meth use. A decent house in a ok to good ‘hood will run 140-180k.

As Taz said its sort of the NorCal version of Vegas..but with a much smaller regional catchment area of gamblers. The casinos have also been loosing market share to the Indian operators in CA for the past decade. The economy is significantly more diversified with warehousing and manufacturing playing a much larger role relative to Vegas.

If you’re into skiing, firearms or cars its a great place to live. Within a ~90min drive there are a good dozen ski resorts of various sizes. There is a thriving culture of automotive enthusiasm or all sorts.

Taz:

If you think Reno is “bitterly cold” in the winter, then you haven’t spent time in New England in January. And, as i said, I’m a skier, so, a little ice and snow would be OK. From what I’ve been told, it actually may be a better place to live for skiing, because the mornings aren’t spent shoveling the prodigious amounts of snow that fall in the mountain towns, and I 80 is kept very nicely plowed for the drive.

Mike M:

You’re right, I’ve never spent January in New England and my prospective of bitter cold is likely different than yours. I’ve lived my whole life in California within an hour of the coast. I’ve skiied several times in the Tahoe area. When I’ve skiied in the North Tahoe area I’ve often chosen to drive the hour or so to stay in Reno because there’s very little to do in Truckee. There have been 10′ long icicles hanging from the railroad tracks just outside of Reno when I’ve been there in the wintertime and it’s often below freezing. From my perspective that is bitterly cold. For you, maybe it’s t-shirt weather.

I’ve had extended stays in truckee and have always liked reno, enough to check out real estate there also (but it has been awhile). i love the juxtaposition of driving out the lush sierra nevadas into the rocky high desert. city-data forums mention it can be windy (wind picks up early afternoon, every day) in some neighborhoods–the kind of high winds you get from the santa ana’s here in socal. not a fan of high winds, so I would check out areas that are somewhat protected. also, due to no state tax, the city streets are not plowed/de-iced very well in winter.

I’ve been in Reno about two years and lived in Vegas the 5 years before that. I do like Reno and think it’s better than it usually gets credit for. There’s certainly more of community feel than Vegas, and it’s easier to forget that the Casinos are here if you’re not into that (I’m not). What Taz said about the weather is true, but it you don’t mind driving in snow and ice sometimes, it’s not too bad. Oh, and don’t overlook the airport thing. RNO is tiny; you’ll almost always have at least one layover if going anywhere outside of the west coast, whereas LAS has nonstop flights to everywhere.

I haven’t bought myself, partly because I’m not sure prices are done dropping and partly because I don’t expect to be here much longer. Although they didn’t overbuild nearly as much as Vegas did, there’s still excess inventory, and I expect that to drive prices down just a bit more.

also, though it has been 20 years since i was in the area, there are real live cowboys there, spotted in the coffee shop/breakfast places. as mentioned above, some nabes can be sketchy/meth-y, not unlike other small towns around CA and NV, but they tend to leave you be if you’re not a part of that group.

Beware Property Taxes in no income tax states like NV & FL. Usually higher than their income tax state cousins. Plus no break at >65 yrs old (Cali) when income may dip and you basically get hit with a flat rate tax paying for junior down the street to go to school (which is a good thing, but when do you get done with paying for school?). The most negative thing is they both have a two-tier tax rates meaning if you actually live there your tax is lower by up to 70% nominal. If you just come for skiing or become a part year resident you subsidise the state/counties & neighbors. And don’t get caught cheating on your residency – that means very high penalties, interest, etc. Although the FL statutes say you can be gone for up to 2 years try going before the assessor and proving it after they slap the tax lien on your house. Don’t be employed in a field that regularly checks your credit and have a tax lien on your credit report. Not all paradise but just so you know and plan accordingly.

Carson city is nice. Buddy left here for there about 2 decades ago hasn’t looked back. See story at BME if interested.

BME?

The chart makes clear Las Vegas metro home/condo/townhome prices ares at an all time relative low. Almost no one who has moved there to purchase a home, in the last twelve years can sell their home and have equity left to buy another one in Vegas. The fact is that the losses are spread throughout the property price ranges, and there are pockets of utter disaster both high and low (Lake Las Vegas being a disastrous collapse of the high end). Those investors have all lost money unless they are flippers; everyone who wants to invest and rent has lost money on property price and in many cases, even on cash flow. Investors are still pouring money into a town where jobs are not coming back anytime soon and labor is not getting increased wages; the future also holds more difficult and expensive travel for tourists to get to and stay in Vegas. So much for the idea that thousands of investors can’t be wrong, repeatedly, or learn their lessons. I haven’t seen anything indicating how successful flippers have been lately in the Vegas market. Unemployment there is too high and workers and their families will leave. The Vegas surplus of vacant homes and condos will continue indefinitely, and rents continue to slip. When the investors finally get burned out enough or broke enough, then what will happen to Vegas residence/condo prices?

Every year Vegas gets more competition for gamblers. There’s very little evidence, if any, to indicate that this real estate market will rise in price. Most likely, it will continue to fall.

Last week’s Business Week has a scary article about real estate fraud in Las Vegas: http://www.businessweek.com/magazine/the-king-of-all-vegas-real-estate-scams-12082011.html?chan=magazine+channel_top+stories. Of course, this kind of thing isn’t limited to that area. I am absolutely sure that the townhouse complex in Thousand Oaks where I used to live, and also my mother’s in the San Fernando Valley, suffer from similar corrupt practices. I’d be really interested to hear other readers’ comments on the article, and the doc’s too.

I have to wonder if there’s an additional bigger picture factor pressing downwards on Vegas Real Estate prices. That being…water. So what happens to Vegas when water becomes even more scarce/expensive to buy and transport? Wouldn’t be the first time that a dessert town ends up getting abandoned due to lack of water. Tell me again why Vegas real estate is such a good deal now?

not that there’s money to develop it, but the state is flush (no pun intended) with huge underwater aquafers in the great basin region

1st law of chemisty: Matter can not be created nor destroyed. Lake mead is right there. YOU are mostly water. when you die, where will the water go? Answer: Nowhere, its still here!!

Wrong in two ways. Water is a compound that can be created or destroyed. The elements of that compound (hydrogen and oxygen) are more immutable. More importantly, water in the desert tends to depart for other places – its called evaporation. And Lake Mead is a reservoir storing water than for the most part started out as snow in Colorado. Its folly to claim that Las Vegas (or Los Angeles) is sustainable without importing water. At least the Colorado River flows nearby, but its already over-subscribed. Mining ancient groundwater is not a long-term solution.

@LawsofPhysics- The balance of water on the earth is constant (relatively) over time, that was the point, which is not wrong.

The broader thread was offering a counter argument (right or wrong) that the lack of water will be a driver of home prices in Vegas.

Of course Los Angeles also has that problem.

DHB quotes DataQuick

“Of June’s absentee buyers, 34 percent had a mailing address in Nevada, and 30 percent were based in California, DataQuick reported. Most of the remaining out-of-state buyers were based in New York, 5.6 percent; Pennsylvania, 3 percent; New Jersey, 2.4 percent,

Wikipedia says

Bugsy “Siegel was involved in bootlegging in New York, New Jersey and Philadelphia.”

That is not surprising. Who doesn’t know that Las Vegas exists because of Benjamin Siegelbaum and Meyer Suchowljansky and crime families from those very neighborhoods ?

From this data the one conclusion I am able to make is that crime families comprise some portion of the only folks out there left with any money to buy a home.

What made Las Vegas was a guy named Fidel Castro. Until Havana was locked out, you could never get anybody in that desert.

The real killer for all long distance “resorts” is going to be the price of oil. Flights are already 50% higher and when gasoline hits over five dollars a gallon that will be close to $200 for your weekend jaunt from LA.

Touche’ Jake.

The Crime families make big mula in the Cuban black market. It’s bigger business with Castro in power than without. Ninety miles off the coast of Florida and the USA can’t do anything about it ? Castro is another useful idiot.

Communism isn’t a form of government. Communism is organized crime.

The problem Vegas has is it has gone from being the undisputed global champion of gambling to the #3 spot in the space of 3 years and now sits behind Macau and Singapore , just 4 years ago Singapore decided to allow two casinos to be built, in the space of 3 years the two casinos were designed and built and now together they take in more gambling revenue than the all the casinos combined in vegas, with the high rollers now staying in Asia vegas is going to struggle to replace the easy dollars they represented for so long ….

I am starting to see this craziness out in the East Bay as well where I am sending “PENDING” on almost all homes under $550k. Are these stupid investors back at it again???? When will we get out of this real estate FRENZY? VERY DEPRESSING! I can’t even buy a house at a good price!

There are always buyers out there that will take the route of least resistance to home ownership, even if it’s a foolish route. FHA loans with 3.5% down and sub 4% interest rates are having their intended impact – hook a few more suckers. Under the scenario you mentioned, a buyer qualified under FHA can get into a $550k home for less than $20k down, and with sub 4% interest rates principle and interest payments can be $2k and change. These buyers are strictly looking at the cost to enter and the monthly nut. They aren’t considering what will happen to the property value when interest rates rise. They will be locked into the house for the 30 year term or likely have an ugly exit down the line if they absolutely have to relocate. Keep renting and enjoy the show.

You have at least two things against you. The first is that real estate agents are not selling to the highest bidder rather to “investors†who are really other real estate agents for a price below “market†to then put it back on the market again at $100,000 more. The other issue is that as long as money is free “investors†will continue to make bad investments because they can cash in on any gains and socialize any losses by not paying if the deal doesn’t pan out. The good news is that these Bozos are really saving you from yourself by catching the falling knife for you. We have a very broken financial system at this point. This can be demonstrated by the fact that NAR admitted to fudging the sales numbers by at least 15 percent for the past 5 years and then the stock market goes through the roof today based on new phony NAR numbers…

As you note there are some California buyers who would be responsive to lower prices. In California the non-distressed prices are obviousl way too high and banks are keeping many of the foreclosures (or homes that could be foreclosed upon) off the market in an effort to prop up prices and just slowly feeding them ino the market. At some point the number of homes owned by the banks will get down to the point where it does not make sense to hold them just to prop up prices since they down’y own that many of them. Obviously hte last REO sale by a bank will be done without any regard to the effect on other REO prices since there won’t be any other REO. This suggests a final flushing out at some point where banks just sell at whatever the bid is.

If we had free capital markets I might agree with your prediction that the REOs will at some point be dumped for whatever price they can fetch. But the big banks are run by greedy, connected bastards and their lobbyists are busy in DC angling for a “fix” to the mess the banks created. Look for some kind of B.S. legislation which will claim to help homeowners or stabilize prices, but in reality it will bail out the banks and leave taxpayers holding the bag.

There is already a trial balloon from the Fed with a plan to pump $800B to $1T into the banks next year by offering to accept their trash RE and CRE notes as collateral for “loans” at essentially zero interest. What a deal, borrow from the Fed at under 1%, and loan to J6P on a credit card at 29.9%. Or better yet, lever it up 30:1 and dump it into EU bonds. Is this a great country or what?

The problem with your argument is that REO’s beget REO’s. You would have to assume that feeding the REO’s/Short Sales to the market over an extended time has no effect on the valuation of homes. The slow bleed is causing a slow extended price deflation which is slowly creating more underwater properties. And we all know by now that underwater properties have a higher chance of going into foreclosure than non-underwater properties. The other problem with the slow bleed is that it will change the investment mindset of single family home owners. To change this mindset will take some time as we have seen and the government/banks are insuring that this mindset changes…

Leave a Reply to Jake