The latest Bay Area housing gimmick: Having investors pay for half of the standard 20 percent down payment and sharing on the upside or downside.

One of the biggest pitches about buying real estate is the inevitable buildup of equity overtime. Of course the data usually used shows people staying put for 30 years instead of the real world figure of an average of 13 years. Lives change. People move. Jobs come and go. Millennials are largely staying with parents and there must be a way to get them out. In the Bay Area, you always hear politicians saying something like “it is hard for a teacher or fire fighter to buy a home†but rarely mentions that the typical crap shack will cost you $1.2 million. Since when did “middle class†jobs demand living like a millionaire? But never fear. The wonderful ideas of a mania are now popping up left and right like incredibly low down payment loans and a new one, crowd funding your down payment.

Investors can replace mom and dad

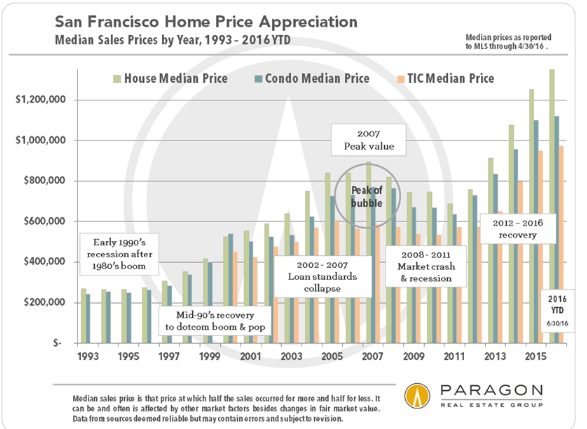

One of the easiest house humping marketing ploys is when the numbers are crunched with a 20 percent down payment. “Sure, look how great things are when you put 20 percent down.â€Â However, for a Bay Area crap shack costing $1.2 million that means $240,000. A small caveat. They provide fantastic numbers on the purchase of the house but fail to crunch the numbers of how one is going to get that $240,000 without a generous gift from the bank of mom and dad. Well God bless tech startups because there is now a company looking to help educators purchase that tiny Bay Area home which costs something like this:

The typical home is now over $1.2 million.

“(Mercury News) Their solution: Get investors to pay for half of a standard 20 percent down payment in exchange for some of the house’s future appreciation — or depreciation — in value when eventually the house is sold or refinanced. In the case of the Bay Area, investors’ share is 25 percent. For example, investors would collectively get $250,000 if a house that originally cost $1 million doubled in value by the time it changed hands. If homeowners aren’t ready to sell or refinance within seven to 10 years, Landed helps them enter a similar agreement with a new set of investors who can pay back the old ones.â€

Now this is an interesting position. We all know with everyone horny on HGTV shows that buying is largely emotional for most. Just watch a couple of hours of that station and you realize people ignore budgets on virtually every other segment. “Sure, our budget can only afford this rat infested dump but this gorgeously redone home with Ikea furniture is $100,000 over budget but what the heck, we are on TV!â€Â I’m sure that budget took longer to come up with than that spur of the moment decision.

So this new startup, Landed seeks to help people like teachers purchase a home by crowd funding the down payment. One tiny caveat: you know that big pitch about equity? Unlike mom and dad, they want a piece of that upside. So that is a big deal. But given how much house lust there is out there and the crash of 2007 is now a distant memory of financial history, people are ready to dive in assuming they can use OPM (other people’s money).

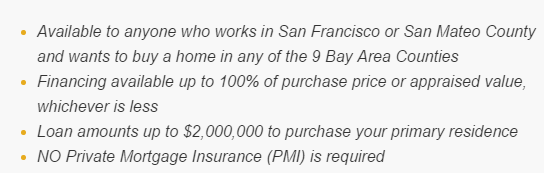

Well we don’t have no money down loans right?

The Poppy Loan takes care of that! And of course this is all happening in the tech crazy Bay Area where of course valuations on tech companies are reasonable. After all, the NASDAQ has never faced a correction right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

119 Responses to “The latest Bay Area housing gimmick: Having investors pay for half of the standard 20 percent down payment and sharing on the upside or downside.”

Housing To Tank Hard Soon!

It is coming Jim. I fear for the worst this time around. I am the alone. See Gary Keller’s warning here.

Beware, warns Gary Keller, foreshadowing ‘shift’ in housing market

http://www.inman.com/2016/08/11/beware-warns-gary-keller-foreshadowing-shift-in-housing-market/

I meant to write “I am not alone on this.”

You also spelled “shit” wrong 😉

First time heard here a home is shared by other investors.

Scams like this area ll over the radio up here in the Bay Area.

“You don’t qualify for the loan, the house does!” and various “buy here pay here” schemes just like with crappy used cars.

The “Rich Uncles” REIT is another scam.

In all of these cases, the idea is to vacuum up any spare money anyone who has any, might have lying around. “Invest” in “Rich Uncles” and watch your money go Poof! Buy a house with one of these scams and watch the value of the house not go up as much as expected, or any of a number of weird conditions written into those papers you didn’t read, and watch your half of the down payment disappear into the pockets of the scammers, who foreclose on the house … guess what? They’re the bank too!

too scary to put 80% of all the savings into one property.

Housing prices NEVER go down!!!

Well… errrr… except for the last time they went down.

But this time, they NEVER go down!!!

Has anyone on this site really stated that ‘housing never goes down’ not that I recall.

Folks here have implied that a good buying time frame has been lost (2010-2012), esp. for the owner/occupier who plans to stay in the home for 10 yrs or more.

Of course, if we follow the history of housing crashes there will be another crash, ie good time to buy.

.

With low unemployment (even if the numbers dont reflect the truly all unemployed) and mortgage delinquency down, and builder confidence is ok, Perhaps we will see a major decrease of 20%… you will just have to wait for it. 2018? 2020?

It will be tied to a job-loss recession, don’t you think?

From this website, there is a lot of decent or positive news in the economy

(vehicle sales, REO inventory, private investment in commercial RE, etc)

http://www.calculatedriskblog.com/

housing will go down, but I dont think to the extent that prices on the Westside will ever return to something reasonable. HOW I LEARNED TO LOVE SOCAL AND FORGET THE HOUSING BUBBLE.

“Has anyone on this site really stated that ‘housing never goes down”

no but i have read.

permanent plateau…implying a floor under how far it can fall

and at most 15% drop “if” prices fall…..even though, on average, during the last 3 busts it was far more than 15%

also, young people not being able to buy homes is a “silly argument” but in reality they are the ones who will HAVE TO step up to the plate evetually

Fannie and Freddie will need a $126 Billion bailout when the economy craters and housing tanks hard. Why does the government screw up everything it touches…?

http://www.zerohedge.com/news/2016-08-11/brace-yourselves-america-next-huge-housing-bailout-could-be-coming

@zigzag

Lobbyists + apathetic uninformed public who keep voting for the incumbent (even while giving Congress terrible ratings) = govt. shitshow.

When people start ‘punishing’ the politicians by voting out those responsible for the mess and actually put people in power who will actually improve and/or enforce the rules and go after the banks and limit Fannie/Freddie to only helping those who really need it with sanely priced homes you’ll see the nonsense stop.

As long as housing in the US is the preferred cash-stash and money-laundering scheme for crooks the world over (and expect Trump to only increase this, after suitable kickbacks to him, of course) housing will not go down in price enough to matter.

Ownership for US citizens only, with no foreign ties, and have a bounty system where anyone cheating can be turned in for a cut of the sale of the impounded property, to be sold to US citizens with no foreign ties.

Alex,

I’d say that there is zero reason to believe that Trump would encourage illigitimate offshore home purchases. If you’ve got something specific, please share.

I’m not sure that he’s going to actively pursue it (i.e. make it illegal), but that makes him the same as every other president. But his pro-America stance as compared to Hillary means IMO that he’s more likely to do something about it than she is. One only has to look at who supports TPP and who doesn’t. Hillary is for it and Trump is against it.

Why is Trump the bogeyman to you? I just don’t get it. You seem to be someone who is very directly adversely impacted by the offshoring of manufacturing and jobs, yet you don’t rail against the globalists…

Jeff – what about my continual declarations that Nationalist, Protectionist, Isolationist is the only way for the US to go, is pro-globalist?

Trump is not pro-American. He is pro-Trump.

He will happily sell our industries, our secrets, hell our health and our rights out to the highest bidder.

He reminds me of no one so much as Hitler, without the ethics. Yes, compared to Trump Hitler was a really ethical guy.

Hillary and a good number of Democrats winning is far preferable. No I don’t think Hillary is the next FDR (which is what we really need) but the Democrats number among them the last few who understand what this country was founded to be.

I’m all for the old 1930s Unionism, which surprise, surprise, surprise, could be summed up by the phrase Nationalist, Protectionist, Isolationist.

Clinton’s record has proven she stands for nothing (other than the Clinton Foundation) and lies about everything. Alex, you are hopelessly drunk on the DNC/MSM kool aid

OK Alex, I give up. If you can’t see past the media’s fearmongering of Trump and you won’t listen to multiple people on this board trying to point out to you the difference between Hillary and Trump, I’m just going to assume that you’re mind is made up. Good luck.

@Jeff

Trump has been involved in so many RE scams most banks won’t even deal with him. To trust anything he says on the matter is beyond laughable at this point.

Its quite possible to ignore what the media says on Trump and still come to the conclusion he is a self serving fraud by only looking at his past business dealings. The man is scum.

We are going to be RICH.

My Dad used to say most people don’t or can’t think beyond the ends of their noses! The older I get, the more I realize he was absolutely right. So, now you take out a 30 year mortgage in a sky-high market, keeping your fingers crossed that real estate doesn’t tank, that you don’t lose your job, that there won’t be another major recession, plus you trade a percentage of your equity for part of the down payment?

“that there won’t be another major recession”

the USA has been in recession since Q3 2014 and the corporate earnings misses for (i think) 4 quarters in a row proves that. It’s being papered over until the election is over.

i know i have been in recession since then.

This. This is why Nationalist, Protectionist, Isolationist, is the only way to go.

“This is why Nationalist, Protectionist, Isolationist, is the only way to go”

Alex, you can not go that route with Hilary. She is the biggest globalist (NWO) you can find and the best woman the big bankers (globalists) can buy. You want something from a woman who wants exactly the opposite. Pick and choose! One or the other.

Flyover – Trump will make Hillary’s globalism look like a walk in the park. He’ll put a huge “FOR SALE” sign on this nation and on our lives.

Alex,

You say he (Trump) “WILL”. Maybe yes, maybe not (there is no track record of him doing that). What I know for sure is that Hilary already sold this nation to the highest donors on her foundation. That is a fact. On top of that, he sold all of us to the Goldman Sacks. Again, that is a fact – just look at her donors.

Thank you, Flyover. One of the most perplexing features of the anti Trump crowd is how sure they are about what this guy is going to do. Reminds me of the crystal ball crowd around here. Most of what we have to assume about this guy (Trump) is his rhetoric, which is cheap. Who the hell knows for sure what he’s going to do, could end up pulling a fast one and being the ultimate establishmentarian, a total disaster or whatever. The other mainstream candidate on the other hand, does have a well established track record as a politician, so the history is a bit more reliable as a guide. I find it to be so odd how one of the points often promoted for Clinton’s candidacy is how experienced she is, although it’s that very experience which informs her greatest weaknesses.

Trump’s already called for Clinton and any Supreme Court justices he and his crowd don’t like to be assassinated, just like Hitler told people to kill Communists “your bullet is my bullet, don’t worry”. What more do you want to see from this psychopath?

Alex,

You put YOUR words (or Pravda media MSM) in his mouth. He NEVER used the word kill or assassinate. On the other hand, her top democrat called publicly for the assassination of Assange. You don’t hear that in our “OBJECTIVE” media. Mafia doesn’t like competition.

The 2nd amendment crowd (NRA) which you are part of, can stop Hitlery (the most corrupt politician in US history) from winning by voting the least of 2 evils, Trump. They don’t have to use guns and bullets.

It just shows how easy the MSM brainwashes you with their spin and indoctrination. See, you like guns and Hillary doesn’t – that means she likes to be the only one with guns, not you.

Don’t worry, she doesn’t campaign for you or the minorities or for the good of this country. She is just a puppet for the globalists and Goldman Sacks and if their interests require, she will throw you and the whole nation “under the bus”. Why you support a PROVEN globalist and LIAR like her is beyond me. They are the globalists who want NAFTA, TPP, etc. along with all wars – in other words everything you detest and speak against on this forum.

@flyover

“He NEVER used the word kill or assassinate.”

He insinuated publicly her and others he disagreed with should be assassinated. He doesn’t have to use the actual word at all. And his attempts to play it off as a joke would perhaps only fool a gullible child at this point.

“On the other hand, her top democrat called publicly for the assassination of Assange.”

Beckel isn’t anyone’s ‘top democrat’. Hasn’t been for years. He also isn’t running for President or any other public office. He is a political commentator now who works at CNN but has also worked at Fox News of all places. So of course him saying something like that isn’t nearly as big of a deal as Trump insinuating political rivals should be killed. The story of him saying so has also been covered by various media outlets so even though it hasn’t gotten much play its factually incorrect to say the media is ignoring it at this point.

“The 2nd amendment crowd (NRA) which you are part of, can stop Hitlery (the most corrupt politician in US history) from winning by voting the least of 2 evils, Trump. They don’t have to use guns and bullets.”

LOL no. The NRA is only about lobbying for anti gun regs. They can’t do a thing about stopping her from becoming President nor from appointing judges or officials if the Democratic Party gets control of the Senate, which at this point looks likely to happen. Attempting to retcon Trump’s call for her killing by saying he reeeaaalllly was talking about the NRA lobbying efforts and not the common euphemism for killing corrupt politicians makes so little sense its astounding anyone would try.

And Clinton as the most corrupt politician in US history?! Do you know nothing of the Reagan/Iran Contra scandal? Nixon’s treasonous sabotage of the 1968 Vietnam Peace talks to get the Presidency? Fall and the Teapot Dome Scandal?? Watergate???

Clinton is no angel, she does lie a fair amount, but other than Obama she is probably the most honest politician we’ve had in a long time as a Presidential candidate. If you want to hate her for lying then fine but make sure to hate all the politicians, including Trump, because at one time or another they all lie.

https://www.washingtonpost.com/graphics/politics/2016-election/trump-lies/

@Hotel California

Trump has a history of being a loud mouth fraud who talks big but delivers little. There is no reason to believe anything good will come of him as President. Especially given what little he as publicly revealed as his plans for the future which experts, both Democratic and Republican in political leanings, have already critiqued as being disastrous.

TTS,

While I agree and said that Trump is evil, he is the least of the 2 evils. Your political bias is obvious to see in the praises you sing to Obama and Hilary.

I agree that Trump is there only to satisfy his ego not to represent you and me. On the other hand Hilary and Obama represent the establishment and a long term evil agenda of globalism and international banking cartel and wars (same like Bush, McCain and Romney). I am more afraid of those behind her than Hilary per se. These are people who care less not only about people but care less about this nation. If the interests of the banking cabal require so, they will throw the whole nation under the bus and say bye to the dollar as reserve currency. They will do that for a one world currency and a world central bank with them in charge; that would be the pinnacle of power centralization, worse than communism.

I don’t trust any man/woman. For that reason I am very afraid of globalization and centralization of power. For decades I witnessed this process progressing faster and faster unabated (regardless of democrats or republicans). The end result is lost of freedom, wealth and civil rights – I don’t want these 3 to be up to few psychopaths to decide. With too much centralization of power you can say bye to true democracy and true representation.

The establishment is not afraid of Trump for his big mouth or what he says. They are afraid for their lives because of the crimes they organized for so long. He would be a wrentch thrown by the people in an evil machine. They don’t want the apple cart disturbed.

That is the difference I see between the 2 evil characters – one to satisfy his ego and one to satisfy her ego plus implement a long evil agenda of the likes like Goldman Sacks and Soros. There is no statesman/woman to chose from – one a scum and the other a bugger and more dangerous scum.

@flyover

‘Your political bias is obvious to see in the praises you sing to Obama and Hilary.’

Praises? What praises?? The closest I came to praising them was by saying they’re the most truthful presidential candidates we’ve had in a long time. If you think that is praise I don’t think you really understand what the word means. Or truly appreciate what I meant by ‘in a long time’. Its a relative statement. One that has to be taken in full context of me also saying she is a liar.

And bias isn’t bad so long as its based in fact and not emotion or hearsay. I have to say your posts seem full of emotion to me but very short on facts.

This might actually be a really good idea. You think housing is going to tank and tank hard? Here is your chance to securitize the losses and pass off a lot of deficit and losses to Poppy Loans instead of your family. If you’re a housing bear this makes perfect sense. Well, if you’re only a bear until you hurriedly pick up a house or two in the 2009 redux that’s coming next year – then maybe not.

Looks like no Tanking…If you had the money back in 2012 and didn;t buy… you must be kicking yourself… waiting for your imaginary crash.

The economy is booming.. there are jobs… and in California people are making big money and investors buying…

sorry folks…

P.S. I am not a homeowner… But I have lost all hope to buy in California…

By what measures is the economy booming? The 2% GDP growth? The lowest home ownership rate rate in decades? Wages that are relatively stagnant? Record debt accumulation that contributes to little or no long term economic growth? Low labor participation rate? Oil industry bust?

This “all is well” attitude is reminiscent of 2006/2007 when headlines ignored the cracks along the economic facade of rampant cheap and easy credit.

i’d bet dollars for donuts you are responding to a troll. Not sure if you remember but back in 2006-07-08 they were flooding the comments section with this same bullshit.

2% GDP growth? Who cares about those stats. You obviously Live nowhere close to money generation areas: Bay Area and Silicon Valley, L.A. and OC., seattle, Portland, DC, Dallas, Boston…. all these areas are booming with lots of Jobs… high rents by the Lords and Hedge funds, No Housing inventory…. buildings going up everywhere…

I get what your saying… But thats not what I am seeing..

No one other than criminals or several-sigma outliers can buy in California any more.

It’s still possible to buy in flyover country, if you don’t mind living in … flyover country. That would be possible if you can get a business going that’s location-independent. Mail-order sales, phone sex line, something like that.

@Tequilini

Who cares about GDP growth? Only public and corporate economists. Not only is employment is a lagging indicator, but job growth has been mediocre throughout this cycle — barely above population growth.

Didn’t you get the memo? Bay area property prices and rents have already hit a wall. This is in part to the collapse in Silicon Valley investments. Increasing inventory is also to blame. One of the biggest real estate hedge funds, Equity Residential, just delivered their 3rd straight revenue forecast cut due to deteriorating rental markets in Manhattan and S.F.

The world can party to its heart content, buying new cars and vacations — up until the credit card bill comes due.

Tequilini, I think you get it. The argument of stagnant wages, 2% GDP growth, record low homeownership means squat in coastal CA. The people buying the limited supply have PLENTY of money and are doing just fine. The money is concentrated in the top 15 or 20% of the population, but that’s all it takes to keep prices of highly desirable elevated.

If things correct, your apartment rent may go from $2200/month to $2000/month. What then? The price of a crap box may fall from 800K to 650K. You’ll likely have a nasty job loss recession, stock market crash or interest rate high (or all the above). Most people barely hanging on won’t have the courage to buy in this circumstance. As I mentioned before, prices in coastal CA have likely become unaffordable to the masses from here on out. People in your position need to think very carefully on what to do next. Time waits for nobody, most people simply can’t outlast the Fed and wait for the next “opportunity.”

I’ll second the fact that coastal CA does not play by the same rules as the rest of the state. Friend of mine put an offer in on a $2 million house in Newport Beach and lost to an all cash offer with no contingencies.

Not making this up… there are some serious money players out there right now. It’s not enough to be able to afford the house, you need to be able to plunk down a suitcase full of cash at closing.

Not going to be affordable. Ever.

Holy cow how the discussion been distorted. We weren’t talking about coastal CA real estate, but CA real estate in general. Cracks in several major real estate markets have undeniably developed. Yet, the bulls will point out how the Buffet or Gates won’t be affected by an Economic downturn — as if they’re suitable representatives of the general market.

For those who still subscribe to the myth of cash suitcases: read up about how investors are really relying on hard loans.

@ Prince Of Heck – I do get all those things you list. numbers are manipulated by FED. GDP, Unemployment, statistics…that have a bigger effect in the middle of the country. But on the coasts things are different. I mean not too long ago, people for cheering the Linkedin stock crash that the collapse of these start ups… then months later, and buyout for like 10B or something like that. Yahoo, same story you know… twitter…

by same account, commercial RE peak last year… If the major recession hits, housing must go down.. but a lot of people will lose their jobs, at that points you must question buying because you might be next.

@ Lord… I won’t leave Cali because my family is here… friends are here… No new house in another area will fill the emptiness of missing the get-together and BBQs with them, deprive parents from seeing grand kids at least semi-monthly while they’re still alive. I could move to Arizona, Texas… or whatever other mid-west state… only to be locked up in the house… I know a lot of people do it… but I’d rather live in a small 1960s house (If could ever find one) than a big nice house away from family and friends.

I know #firstworldproblems…still is Fv.cked

@Tequilini

A recession is inevitable and most likely will rival the last one. No amount of money printing can change that due to the horrible economic fundamentals guiding this and the global economy over the past 20+ years. I’m confident in my ongoing preparedness to buy if and when prices return close to fundamentals.

I do object to the incessant cheerleading of the RE market while ignoring the reality of its rotting core.

@Tequilini

Takeovers and mergers usually lead to headcount reductions. And these takeovers are very rare unless the target acquisition has a viable business model. Just like many 90s .com companies, most of today’s tech start ups won’t survive.

Tech and Media industries are BOOMING in CA. They’re doing very well right now and everyone I know working in these industries are paid a very generous base salary plus excellent bonuses.

Are you new here? The Doc wrote many times that the housing market is like a cruise ship. It does not change direction that quickly. 2012 was a great time to buy but is only 4 years ago. A recession in the US occurs every 7-10 years. Instead of losing hope, how about some patience? Wait a few more years for the crash and try to avoid the California drive-thru mentality (the urge to have things now)

No I am NOT new here. I do understand the cycles in the economy. By the way the recession was in 2009… NOT 2012(this was just the reasonable buying point)… by your count we already passed the 7 years…

“how about some patience?” It’s hard to have it when paying $2200 rent for 1Bed in the ghetto…It hard to have patience when you have to pick between 2 evils… either high rent or high buying prices… those are the 2 soups… and no I can’t have roomies, I have a wife and a baby. If I was single I’d sleep in tent or in my car… u know?

I’m a millennial, so I didn’t have money 5 years ago, but now I have saved a Down payment and only debt is a car note.

Stupid programs like the one presented on this post goes to show you how they’d do and allow anything before a correction… This should’nt be legal..

The problem was not the turning slow, but the iceberg. The news of the iceberg ahead was never communicated in time to turn. Same goes for housing. Information is important. Some say that we already hit the iceberg in housing and the band plays on(Federal Reserve with the low interest money). As for me, I told Francesco Schettino to get the life boat ready(and this time don’t fall into it), I also have my .45 so I can get a seat.

Clearly the economy is booming. Remember years ago all that talk about things like QE, ZIRP and even NIRP? Thank goodness that’s in the past! Finally I can sit back and start earning interest on my traditional investments again.

Tequilini, you misunderstood what I said. A great buying opportunity does not come around that quickly. The US is due for a recession within the next few years. Prices will come down of course. Obviously, you are doing the right thing by renting and saving for a downpayment until the next crash. Keep it up. Live frugal and save as much as you can. If you pay 2k for a one bedroom you must be making a decent amt of money. If you can’t wait it out you have the option to move somewhere else and pay/make less accordingly.

I know man… but when you see all the shenanigans the Fed, gov, banksters pull to have asset inflation… you see not end in sight.

When people at work ask about my housing situation… I sort say that I’d wait till the downturn or decline in prices and they just roll their eyes and semi-laugh at me… suggesting that is no going to happen.

The economy is booming? Wow! You can say that with a straight face? You qualify to be the Press Secretary for the White House.

huh… I don’t know if you live in Kansas or somewhere over there. But with a straight face I can tell you that in the California Bay Area the economy is in full employment. I don’t know anybody without a job… to the contrary I see dumb people with jobs of 70K plus for doing nothing productive. I see packed restaurants, and sporting events… not cheap my friend…

The scam of share ownership is just a indication of the availability of money floating around.

Tequilini hasn’t burned through his “small loan” from parents yet.

San Jose is half occupied by people who wish they were doing as well as I am, and I make about $1000 a month and live in a warehouse with no running water.

Half of this area is borderline third-world. 2nd world maybe.

Yes the restaurants on Castro Street in Mountain View are packed, hello, Google is right down the street, and the 20-somethings eating in them don’t realize that by age 40 they’re going to be lucky to get a job stocking shelves in the Wal-Mart in Palo Alto on the graveyard shift.

San Jose median household income 2014 = $96,481. Santa Clara county (San Jose is part of it) has the highest median household income in the nation.

sources:

http://www.deptofnumbers.com/income/california/san-jose/

and

http://www.mercurynews.com/business/ci_26312024/santa-clara-county-has-highest-median-household-income

Alex, please read the above twice and consider that your perspective on incomes might just be off a bit.

Also note that the above sources are for the median, not the mean. Ergo, San Jose is “half occupied by people” where the household makes more than $96k and “half occupied” with households making less than $96k, not $1k/mo.

@ Alex in San jose…. >>> You must be deluded. “Tequilini hasn’t burned through his “small loan†from parents yet.” It’s called working hard and saving budddy.. my parents are not in a position to loan me any money. I Give THEM money. They live in the central valley.

>>>San Jose is half occupied by people who wish they were doing as well as I am, and I make about $1000 a month and live in a warehouse with no running water. <<<

Well I am sorry you are doing very lousy… If you're not making more than that… then you have no skills or are over 62 and should be at lease semi-retired…other than that you did drugs in the 70s and 80s… COME ON man. !!! even the illegals pull more money than you, and they don't even speak English.

<<>> there’s not need to exaggerate… just head down to

1.**East San Jose** corner of Story/ King … all restaurants PACKED… hardly Googlers there…

2. Tully / Monterey at the Plant. hardly facebookers there.. go there since you live close by.

Go to Salinas… Strawberry picker are pulling 1K a week during summer mothns, and 700 the other months for 7 mo. per year… then collect unemployment at 900/mo. for 5 months while they relax…

I heard they’re looking for people, they are short… plenty of jobs and money to make for the people that “WANT TO WORK” stop crying a river about 1K in SJ…on every post..

I don’t care how you guys are cooking the books, the vast majority of people in SJ are making Mexico City wages.

Why do you think haircuts are $7 here? It’s all people can afford. Why do you think the VTA is growing? People can’t afford to keep cars.

Yes, a tiny portion of the population is doing well, and they’re paying for $45 haircuts at Bedlam downtown, but the vast majority are out collecting cans on the family bicycle.

I’m not necessarily sad about making $1k a month, as mentioned I’m doing better than a hell of a lot of people here. And I have free time, which is even harder to obtain than money here.

But the people making up around $100k are a tiny part of the population, like in any banana republic.

Tequilini, of course, most people don’t like the fact that your are saving money and waiting for the crash. why? Because they wish they would have done the same but already bought and realize/fear that they overpaid or they have the same plan as you but want you to buy now so that they have less competition when the next buying opportunity comes around. Or they are happy home owners and love thinking they are getting rich by increased book value of their homes. So they want millennials to step up and keep the bubble going. Or they are from an older generation and think it’s always a good time to buy. It’s worth it in the long run. There are many reasons why people suggest housing will keep going up. But I can’t think of reasons why people would encourage you to wait and save. So don’t be surprised input be prepared. Maybe, instead if talking about a downturn: tell them you love seeing your downpayment grow and you are just waiting for the right home but you are in no hurry. You can only win here….the worst thing you can do is buy at the wrong time and overpay for these crap shacks.

“I don’t know anybody without a job”

most people i know don’t work or work part time, those who do work can’t get anything more than $12 an hour. Yes i hang out with losers.

No, you hang out with 90% of the population. $12 an hour is CS degree wages, just look at the Help Wanted ads on Craig’s List. For higher pay, you have to do physical work, like working in a warehouse.

Buyers that need a “poppy loan” probably cannot afford the house. These schemes (equities and real estate) usually surface near the peak.

Stories of even Chinese investors heavily relying on financing in overpriced foreign markets are creeping up as the veneer of this seemingly infallible real estate cycle is slowly being peeled off.

Only 18% of homes in China carry mortgages. Most people pay cash. The mortgage people are at the margins. They should probably not be buying, because they really can’t afford to own.

@rody6667

As I said, stories of Chinese investors heavily relying on financing in overpriced FOREIGN – not domestic- markets are being exposed.

I don’t doubt that cash purchases is big in China. However, it is undeniable that the influence of lowered rates by the government played a big hand in revitalizing prices there.

Bingo. I could probably eat for free on the stale sandwiches being served at all the flipper seminars being offered where I am.

Just like the “fog a mirror” loans.

Apparently even fogging a mirror doesn’t matter now, according to the ads on the radio, “you don’t qualify for the loan, the house does!”.

I could almost see buying a place with several bedrooms that way, and doing a total airBNB thing to pay for it. But, it means you’re housekeeper, cook, bookkeeper, all-around handyperson, and you’d better have a good accountant. Plus you have to play “congenial host” 24/7 so if you want to feel like you’re trapped on the set of Fawlty Towers, this is how you end up feeling like you’re trapped on the set of Fawlty Towers. And, live frugally yourself so hopefully you’re making a good amount to set aside in savings for the down times.

Mercury News:

“… If homeowners aren’t ready to sell or refinance within seven to 10 years, Landed helps them enter a similar agreement with a new set of investors who can pay back the old ones.  ”

Isn’t that definition of a Ponzi Scheme – sounds like one to me.

And just how do these crowd sourced ‘investments’ differ from the old fashioned 2nd mortgage with a balloon payment? If the home equity is all that is being shared then if the house doesn’t cover the 1st mortgage and its a non recourse loan then the investor is wiped out. Jingle mail sounds like a likely outcome if home prices stagnate or fall.

It’s outrageous to even suggest that exotic financing exists during the current real estate cycle. Furthermore, you are committing blasphemy to even entertain the possibility of a downturn. Big brother is watching — ignorance is doubleplusgood.

There are no cash buyers. The Chinese get short term loans with very high interest rates from their shady lender. Then they present it as cash when purchasing home outbidding everyone else, refinance as soon as they get the home they wanted, pay back the shady cash lender. Quick $$ for the shady lender and the Chinese got the home they wanted.

Until we run ’em out at the point of a bayonet, yes.

That’s BS. The money comes from 3 generations. The grandparents, the parents, and the son. I see you have spent Zero time in China.

But there is no proof. One person’s guess is about as good as any other. That’s one of the problems with Chinese activity, lack of reliable hard data.

It’s also worth mentioning that one glaring feature of the previous bubble was the degree of obfuscated facts in a system regarded as far more transparent than China’s. It was only after the dust settled that certain schemes become obvious to everyone. Although there were voices of doubt leading up to the crash, they were casually dismissed due to a dearth of evidence which ran contrary to commonly accepted notions. The system essentially had to fail spectacularly in order for most people to accept the truth of what had been going on.

I am a retired American who has been living in China for a few years. My wife and I own property here. She is active in the management of our community, which has 640 units in 8 buildings. We have extensive here family here. Most of them own more than one home. The savings rate in China is 36%. It is not hard for people to buy a home cash, It is tradition for the family to buy the son a home when he gets married. These are often bought years in advance. Young people get married at about age 30. With a 36% savings rate and 30 years to save, it is easy to buy cash.

Roddy,

Do you know folks there that are buying homes in the USA? If so, I’d be interested to hear how it’s done since I’ve heard there is a $50k limit imposed on Chinese citizens when they want to move money out of the country.

HousingTrouble, that’s interesting. could you share any backup/website link regarding your statement? We always read/hear about cash buyers so I would like to learn more about what you are describing.

I believe Roddy. China had huge famines as recently as the mid-1980s. They’ve been through tons of turmoil, and they realize that for a person to do well, they need at least two generations before them to work their asses off, and they also know that banks are to be avoided if at all possible. In other words, they think like me, only if anything, more so.

Brian, let me help you, he cannot provide that data because it does not exist. They don’t think there are cash buyers in play because they don’t have any cash themselves and Alex in San Jose lives in his van at eats Costco samples to survive. These perma bears have gone too far and are getting sugar giddy thinking that the sky will fall soon so they can afford to move out of mama’s basement. They are simply projecting because they don’t have any cash.

Is there reliable direct evidence which proves that the “cash” is not ultimately coming from borrowed sources?

HousingTrouble – Yes, if they can’t draw on family resourced they’ll do that, but only as a last resort. But, if they can make that plan work they will.

I don’t think this is feasible.

A refinance for a foreigner taking cash out would probably be max 50% of the value (ltv) of said property.

Where did the other 50% cash come from?

I invested everything I had in the Espenschied Wagon Co. in the mid 19th century, and I made a killing. I suggest you do the same. Wagons are hot investments.

Just read a study about how the biggest millionaire growth is occurring in small towns. Mount Airy, NC, aka Mayberry from Andy Griffith experienced the largest increase in millionaires. I can only presume that many of these millionaires are Boomers, who have bailed on large cities, sold their homes for small fortunes, and are buying comparable homes for much less and getting out of over-crowded cities. One also wonders if a number of these millionaires still own businesses or have rental properties in the big cities, but have left the declining quality of life in these large urban places to the peons!

Loving all the hopium….

but hopium fades away…..we are close to the turn….

2016 late fall begins the journey down, it will not be quick, it will not be advertised, it will come silently at night when were a sleep in out hopium dreams….

Housing goes up and down, the fed and the govt. will not give in easy but when the masses finally pull back the curtains to the price fixing of the housing market it will get ugly

Realtor alleged to scam clients in $15 million Malibu flip: http://www.hollywoodreporter.com/features/malibus-star-realtor-15m-flip-918177

You know, you just can’t make this stuff up.

So Hollywood, the beautiful, the rich screwing each other.

Funniest thing since Bernie Madoff made off with a bunch of other rich folks’ money.

Hi everyone need your advice. Theres alot of talk on here about the crash and when will happen but need some basic advice about buying a house. What kind of deposit should you have for a house and how much mortgage should you borrow? In terms of your yearly wage(for example five times your yearly wage?). Sorry but new to this and there seems so many products.

Cromwelluk – the typical mortgage is probably 20% down. Best to buy a home that is not more than 3X your annual gross salary. However, for people who are eager to buy a home, are often times purchasing a home that is 5x or 6x annual salary.

Just as important is how long you estimate you can live in the home, to ‘ride out’ any crashes in prices which would wipe out your equity if at the same time you lose a job or need to relocate. Prices now are very high and may decrease so buying now may not be good.

The longer you plan to stay in a home as an owner/occupier the better.

As far as 15yr mortgage or 30yr mortage, there are plenty of Mortgage calculators online and also Rent Versus Own calculators.

And it is better to buy a mediocre house in a nice area, rather than a nice house in a mediocre area.

you have not said anything about where you want to live, but since this is a SoCal website, maybe you wish to be in LA?

the last bastions of affordable homes near the beach in WLA area (INO) are: Pico Robertson district and Baldwin Vista. Check the crime maps.

Good luck

Hello, welcome to the best forum on the housing market on the web. I can answer a few of your questions based on my standpoint. I will disclose that I am a conservative investor so a lot of my advice doesn’t seems feasible in today’s real estate market (at least in most parts of California).

In terms of how much cold hard cash you will need, 20% is recommended as a home user; 25% as an investor (buy and rent out). You could find loans that would allow a much smaller down payment (5% or so) but you WILL pay an additional fee for having less than 20% down until you build up 20% in equity. If you’re an investor, tough luck. You are going to need to pay about 25% (no less than 20% IF you can find it) to be able to borrow against your investment property. In terms of how much money you should borrow, I believe 2.5x your income is where you should be buying. However, seeing how the interest rate is low you could go up to 4x your income (the average is about 9x the income right now if I remember from the article the Doc posted about a weeks ago).

Plug my number into just about any home in CA and you’ll reach right thru your screen and slap me in the face. It’s just not possible in the current market conditions. Like I said I’m a patient, conservative investor and if I have to wait 10 years to make one business move, so be it. But that’s an individual preference. Depending on how much confidence you have in the market, you may have a different opinion.

Patience as an investor is a lost art….

As a former buyer of paper, I can tell you that all the housing bulls on this blog are a sure sign that the dip is near. I own a home in San Francisco, have tons of equity in one of the most desired place to buy by all foreigners and believe gloating about your home buys is a sure sign of insecurity. I hope prices go down so young people have a chance against the pigmen of wall street and the growing retail pigmen of the fixed housing market. They talk a big game but I have seen players in the big game lose in many markets.

Anyone whom thinks this market is real needs there head examined. 18 trillion in currencies from around the world have been thrown at this depression, laws have been scuttled, regulations ignored, ugly MBS bought by the fed. Bankers have fixed everything they put their hands on from currencies, rates and finally housing.

I look forward to a lot of crow eating in the not to distant future by the bulls…

it will be fun to listen to…..

Thanks qeabyss and new age for the advice.

Im actually based in the uk. I feel like I have more of an affinity with people here than the uk when it comes to property.

I could probably have a 50/40 percent deposit. As i have just moved back to the uk from south east asia. Would that affect how much you borrowed?

Thanks

Cromwelluk – A 40-50% down payment is plenty. The larger your down payment the less you borrow. Ex: If you want to buy a house for $500K and you have 40% or $200K to put down, then you’ll be borrowing the difference which is $300K. Compare this to the traditional 20% down or $100K and you’re borrowing less money which means your monthly payment will be lower. However, it’s not always great to put that much money down in my opinion. If interest rates are low and home prices are reasonable, then I’d put down 20% and do something else with the rest of the money. Also if you’re going to be an investor, why put 40% down on a rental and have a low cash flow with a high profit margin and be taxed for all that profit? It’s better to put down 20% on two rentals to have a higher monthly cash flow plus you could hide all your taxable income between the two properties with a thinner profit margin than you can on one property with a bigger profit margin. Real estate is truely an art and the more you know about laws, taxes, macro and micro economics the better you stand to gain.

“Mapping the money”

Santa Monica, Venice, Culver City, Del Rey are top areas by zip code for investment capital.

http://www.builtinla.com/2016/08/08/highest-funded-startup-neighborhoods-la

Any wonder why home prices are so high in those areas?

No, but there certainly is wonder as to why rent concessions are starting to come out of the woodwork against the backdrop of “investment capital” in hot nabes such as CC and Silicon Beach, much less during the prime summer demand months.

Of course there will be attempts to try to frame this as run of the mill promotions, but the reality is that these concessions weren’t there the past several years, so something has changed.

The demand isn’t catching up with the investment.

A return to feudalism dead-ahead

What $549,000 buys in Pasadena: https://www.redfin.com/CA/Pasadena/462-Raymond-Dr-91107/home/7041762/crmls-WS16176438

An 816 sq ft, 1 bath, “fixer upper.”

Flippers, don’t miss this golden investment opportunity!

Where did they even get their comps from? Almost $700 a sq ft? I’d like to tell Paul to shove it, in his face.

RE agents need to start getting called out on this crap, it is a joke.

Does it come with the skateboard?

Does anybody know what it costs to build a house yourself these days in terms of $/sq ft excluding the land? I feel that the prices of homes these days are in the zone that makes it much more cost efficient to just build a home than buy one.

New age,

If you are talking about the expensive coastal properties, most of what you pay is in the land.

In the flyover country, most of the time is cheaper to buy an existing house than a brand new one. The input costs these days is way higher than 15 years ago for everything:

land values (higher cost to develop land), permits and hook up fees (soft cost), materials and skilled labor. It is the same like when you buy a car – a new one cost more than an old used one (also the cost to build a car today is higher than 15-20 years ago).

Take this from someone who is doing this for a living.

Oh believe me…I’m taking what you’re saying and runnin’ with it. It makes perfect sense. What I’m trying to do is determine at what cost would it make sense to build rather than buy and vice versa. There are constants in the equation and variables. The constant is the price to build a home itself including permits, material, labor. A house built in Barstow, CA and the same exact house built in Newport using the same design, same supplier, same laborers will cost the same. What varies is the land value. So let’s take a 3000 sq ft home with no particular special features…a “standard” home. What would you say it costs to build one of those?

New Age,

It doesn’t work quite like that. The cost to build is different from one place to another.

If the skilled labor/contractor live in the expensive area, they charge way more than in Barstow for 2 reasons:

1. What they get has less purchasing power in the expensive area

2. They have less competition in the expensive area because the highly skilled workers want a better standard of living and they move out

Based on these 2 reasons alone they charge way more than in flyover country (i.e. Barstow).

If they have to travel, they charge more for reasons:

1. Additional cost to travel

2. They have to pay accommodations

3. They have lots of dead time when a skilled tradesman can earn a lot (they are always in high demand regardless of where they live).

Materials cost more, because the supplier have a higher cost of doing business in OC or LA than in Barstow (the workers have to be paid more to eat and for higher cost of housing).

These are just few considerations, but the picture is far more complex. It just starts to give you some food for thought.

I bought my house in Silicon Valley over 14 years ago, right before the RE madness began. People in the South Bay are struggling, I see it on my block and its an upper middle class area. They are surviving with 2 or 3 families under one roof. Across the street from my house both of the family sons have gotten married, have a child and still live with mommy and daddy. 3 families under one roof!! Three houses down from them, the same exact scenario, kids family living with mommy and daddy. Its quite sad knowing these youngsters have no real chance.

Well that’s nice for them. For teh rest of us millennials that don’t have a comfortable middle-class mommy and daddy with big house that allow us to live there with our respective families RENT FREE… is a fkking hell to live in a small apartment for over 2K a month… good luck to us saving a DP after all our living expenses.

Don’t call them poor kids…. there are some of us who don’t have the luxury of living my mommy and daddy RENT FREE… I know a bunch of them too… and they all complain while driving 40K cars and taking tours in Europe and lavish Hawaiian vacations… They are LUCKY compared to rest of us…

To summarize:

-the investor pays 10% in exchange for 25% equity

-they target teachers who will have saved $100k for a home, plus have extra cash for closing costs and reserves

-an sf teacher makes enough to pay for PITI on an $800k mortgage

What else is wrong with this deal? Too insane!

Bought a house for $230,000 in October and its worth 300k now. My house as much as me last year nuts. I have become convinced that if Trump wins prices houses will stabilize or fall perhaps. If Hillary wins we will go the way of Japan with interest rates under for 30 uear loans 2% and crazy housing prices. If you think Hillary will win buy because that is the only trick the Fed knows to combat our trade imbalance if our government won’t do it. How low can interest rates go? Who knows… Interesting times we live in

Don’t get too comfy. I also own property in IE which has recently went up in value. But in the back of my mind I always remember that unlike other parts of S. Cali the property values in the IE have still not recovered to what they were prior to the last crash. The IE tends to get hid harder and faster than surrounding counties when the tide turns. There are still plenty of shortsales in parts of the IE.

Japan’s real estate prices never recovered to their highs despite record years of cheap and easy money policies. If there was so much confidence in infinite price increases, insiders would be accumulating rather than selling their portfolios.

Hi Homeowner,

That’s my biggest concern. Just how long does this last? Government never stimulated properly so the Fed does all that it can. Liquidity trap, QE, etc.

And as much as I think the Keynesians have it right overall… the world has never seen ZIRP go on for decades. Even Keynes himself may not have foreseen an entire planet of central bankers going this far.

It feels wrong to me. I wish we just stimulated with real jobs/infrastructure improvements. I think that could only happen with Hillary. But to what degree, who knows.

Also, if a ZIRP environment pops, what does that look like?

I also don’t understand the politics of rewarding borrowers so much at the expense of savers. I have a bit of both and am somewhat hedged. But the part of me that’s disciplined in saving is pretty pissed off at this point.

Look at the North Park neighborhood in San Diego, just east of Balboa Park. It’s mostly “crap shaks”, but $700k would be an incredible bargain. Prices for a shack have gone from $300k to $850k in 4 years. Plus, the kicker is that it’s all millennials buying these 950 sq ft houses with schools rated 4 out of 10.

When the next recession hits in 2017, all of these marketing execs, accountants, for profit law school grads and non-profit directors are going to get sacked–then how will they pay the mortgage when they need two incomes just to pay the monthly bills?

I still do not see a major slowdown yet. I see a cooling off period to start as weather cools down in cali. I see more housing projects starting, especially here in sacramento. Once those get completed and sold you will start to see the glut in housing and prices softening. Its gradual but will happen. Rentals are already cooling but have not gone down yet. I guess the new flippers still want to keep jacking those rents up. I dont see the economy slowing down anytime soon unless something catastrophic happens.

I am seeing exactly the same. If anything the greater Sacramento area is heating up even more. As a landlord though I am not seeing any rent slowdown whatsoever although I agree it is badly needed (we are not all heartless.) Rents are too damn high. Period. The housing market will not slow down soon, barring any catastrophic events. Jim Taylor will have to keep spinning the broken record. The prices are insane but not reversing any time soon.

Expect Hilllary to continue the present policies and stoke up stock and housing market.

Hillary’s access is already bought by rich people via donations to clinton foundation

Donald trump is no good all the establishment people are shit scared of him

Hillary would have been behind the bars if the law has taken proper course.

More signs of a rent slowdown.

“GET UP TO ONE MONTH FREE WHEN YOU MOVE IN BY AUGUST 31ST!”

http://www.avaloncommunities.com/california/huntington-beach-apartments/avalon-huntington-beach

A quick perusal of online inventory shows plenty of units available.

One would think in everyone wants to live here coastal international, perfect weather, this place is different Orange County, that a sure feature of soaring and skyrocketing rents would not be rent concessions.

No slowdown at all.

Halving 10% plus rent growth per years does not constitute a slowdown.

There is no slowdown. There is a massive asset bubble that is inflating rapidly. Real estate rents and prices have a long way to run. Jim Taylor’s babble might be true in 6 months, if there was no such thing as a Fed or a liberal Keynesian.

Leave a Reply to Hotel California