Jumbo loans, all cash investors, and slow population growth: The gentrification of Southern California.

Only in Southern California will you have someone moan about making six-figures while driving their European financed car and not being able to “live well†while the weather is near perfect all year round. There is one thing you can’t complain about and that is the weather. Ironically though, some of the cheaper SoCal counties like the Inland Empire have weather on par with Arizona or Nevada. So the groaning comes from people looking to buy cheap beach front property for example. Newsflash, beachfront property will be expensive in boom and bust. Yet let us focus on bigger markets since SoCal is vast. Last month sales reached a five year high for April but guess what? So did the use of jumbo loans. Jumbo loans accounted for 26 percent of originated loans, the highest since September of 2007. Another 33 percent of purchases were made by all cash buyers. FHA insured loans still accounted for 21 percent of mortgages and this will be an interesting figure to watch as FHA insured loans become incredibly expensive in June. Little by little certain areas of SoCal are being gentrified as those unable to buy are pushed further inland or are forced to move out of state (or rent which isn’t such a bad deal).

Population growth

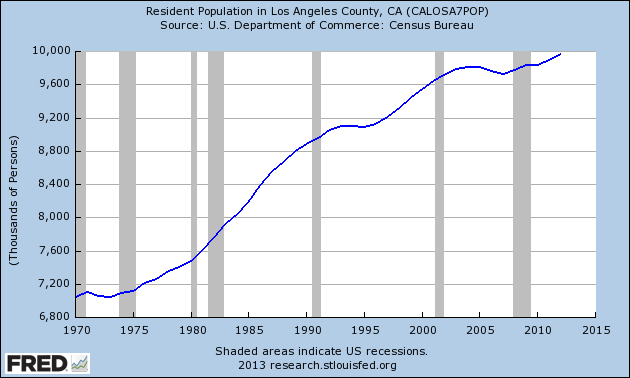

First, let us look at population growth for Los Angeles County:

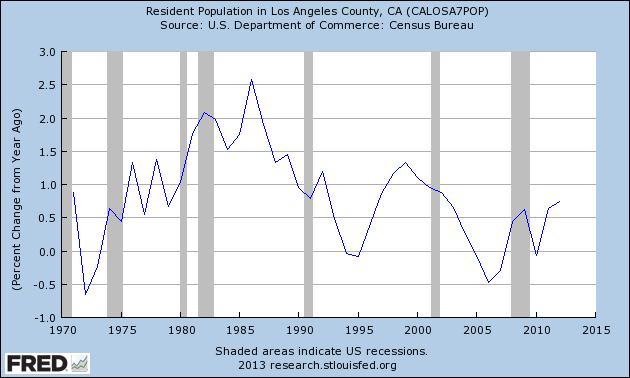

Population growth for L.A. County has remained steady for most of the 2000s and interestingly enough, started going down prior to the official start of the recession. It has now picked back up but the year-over-year growth rate has definitely slowed down over past decades:

For the first time since the 1970s, L.A. actually saw annual population growth decline in 2006 and 2007. That has now reversed but the growth rate is slow.

SoCal home prices are on a tear. The median priced L.A. County home is now up to $395,000 (up from $310,000 last year). This is a 27 percent year-over-year gain. Regardless of market mix, this pace is fully unsustainable. Good luck trying to time this rollercoaster ride!

Foreclosure resales are now a tiny part of the market making up 12 percent of sales. Jumbo loans and all cash offers are a big part of the home sale mix and these are going to either investors or higher income households. We see the gentrification of certain hipster neighborhoods in Los Angeles like Silver Lake and Echo Park.

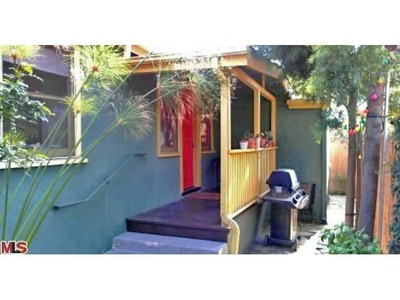

Take a look at this home for sale:

1140 Manzanita St, Los Angeles, CA 90029

Looks nice right? Well this is a 1 bedroom 632 square foot home. Some of you may have offices larger than that. Just look at the sales history:

They actually tried for $399,000! When you see this kind of random pricing, you know you are in full fledged mania. What suddenly changed in a few months to warrant the $40,000 price drop? When you are this off, you are basically trying to sell into momentum. The place was bought for $195,450 back in 2005 which actually is more of a reasonable price for the size of the home. What is funny is that the Zestimate on this place is $419,000.

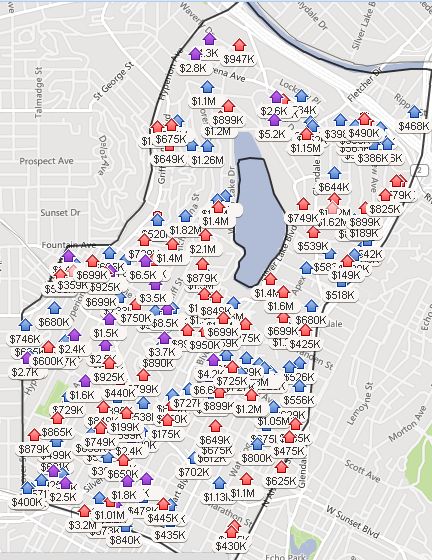

Silver Lake is a very high priced hipster market. Just look at all the homes for sale (in red):

The Hallmark of total gentrification is Whole Foods and Silver Lake now has that:

“(Curbed) It has arrived: Silver Lake’s gentrification singularity. Whole Foods is moving into the Ralphs site at Glendale near Fletcher (in not the prettiest section of SL). There’s been renovation/redevelopment gossip swirling around the site for a while now–Ralphs claimed it was just updating its store as several of the smaller businesses on site have closed (the landlord hasn’t been renewing leases).â€

So what is my take on the low population growth, higher prices in targeted markets, and high jumbo activity? Essentially lower income families are being pushed out of these areas and creating a 1-to-1 exchange where population stays unchanged yet those that can afford or overstretch move in. Speculation is still rampant and flippers are active in these hipster markets. Finally, families are diving in with jumbo loan activity reaching a five year high.

These markets are gentrifying yet prices at current levels go beyond regular gentrification. We are now into a deep seated fever of people feeling they will be left out if they don’t buy today. Go ahead and pull income tax data for all zip codes of Silver Lake or Echo Park. It is an interesting contrast to what is happening in housing. Inventory remains low and we are just starting to enter the summer selling season. If Whole Foods is part of the gentrification singularity, then high usage of jumbo loans is a sign of real estate fever.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “Jumbo loans, all cash investors, and slow population growth: The gentrification of Southern California.”

There is no way this is even remotely long term sustainable. I don’t care what the market says. This is the same feeling I got in early 2k’s when I was working in track homes I. Irvine and San Clemente and watched people line up by the literally hundreds to Bid and pay for houses. I remember people walking by my house approaching me and no joke literally beg me to give them the chance to buy my house. And while we were in the market up to about last month my realtor sounded like a puppet on a string telling me to buy now while the rates are low. I recently told her we are no longer in the market. I think I will wait for the craziness was to die down. Eventually we are gonna run out of money or people are gonna start jumping ship. And if I don’t get a house well the one I have is almost paid off so I’m not freaking out if I “miss my chance “

There is a great documentary on Netflix called “Maxed Out,” which captures the mentality of the last housing bubble. A couple classic lines that still ring true today:

“Well, if I look like I’m making money, I actually should be at some point, right?”

“We just kept going with something bigger and bigger because, well, why not? As long as the interest rates remain low, we are fine. If the rates ever go up, I don’t know what we’ll do.”

On the latter, such folks need to remember that rising rates not only affect their ability to afford their current home but also the ability of buyers to purchase what you are unloading, as well.

what’s a “track” home? Oh, you meant “tract”.

Thank you grammar cop, people need to proofread.

What I’m noticing for the first time, and I don’t remember this during the 2006-2008 runup, is that sellers are RAISING their listing prices after the house has been on the market. Some others are falling out of escrow and put back on the market at a higher price

If no offers come in at $400k, well then it’s gotta be worth $425k!

A couple of years ago, CA passed the law making it hard for banks to foreclose. But the defaults are still there, and will come on the market more slowly.

Is DHB now a cheerleader? Based on the bragging of the first paragraph I’m confused.

My take is that weather actually isn’t as big a deal as one or many would lead on to believe. After all, if it was, why would anyone complain about anything?

I believe SoCal is still a big bowl of transplants. Yes, that is changing as the Post WW2 boom has created families with 2 to 4 generations living here, but the population still boomed until 2006. Many like myself were recruited out of college, only to find the surprises that are the reality of SoCal. Now you would have to be a moron to believe it’s like you see on TV or in the movies, I would hope no one really believed that! But I’m talking about the realities not the “dreams”. Elon Musk publicly shredding the 405 construction, that’s real. The famous E.T. trick or treating scene…not so much.

Being heavily transplanted, of course people are going to revert to what they know. That’s why they complain and many end up leaving. If you’re not born into it, it’s very hard to adapt.

Someone in the L.A. Times made a comment about Aerospace companies and their relocating to Texas and other states. They wondered who would want to work at the ones in L.A. based on the cost of living, and said what’s inevitable: that companies are leaving because it’s cheaper other places. My (more north) Midwest city is booming as well with a 5% unemployment rate and a flurry of new construction for malls, theater, a casino, 2 office buildings and housing. Why? Because in the end it’s cost of living that matters, not weather. This does not apply to the upper crust (Irvine, Westside, et all) as clearly their MBA’s and entrepreneurship has driven them quite high. But for the rest of us…

perhaps a shorter commute and a snow shovel really is worth it.

I grew up in the South Bay part of Los Angeles in the 1980s, and it really was like the “E.T.” trick-or-treat scene–the best place you could ever imagine living. I was so proud of seeing all of the regular sites on Knight Rider, A-Team, et al. The future was bright with plenty of aerospace jobs for all segments of the population, and the civic pride during the 1984 Olympics was remarkable.

I’ve concluded, in the past year, that I want to raise my kids in 1980s L.A. Unfortunately, it doesn’t exist anymore, but there are a number of great places outside of California that replicate it pretty darn well…both culturally and in terms of affordability relative to the time. I picked Naples, FL.

Incidentally, I know that California feels like a state of transplants–primarily from Latin America and Asia nowadays–but I sense it even more here in Florida. The only difference is that most of the transplants here are either European or from the Midwest/East Coast.

I recall the ’90s in LA as more apocalypse than downturn. In the space of 5 years we had the LA riots, the Northridge quake and several large destructive fires – all happening at the same time as major employment flight from the aerospace industry. I bought my house in ’91 and was underwater for a good 6-7 years. Good times…

I remember Orange and San Diego counties in 1990. The weather was great and there were no jobs. I looked at 2/2 condo’s at the beach in Newport and they were asking $100K with not takers. Same thing in San Diego.

The only difference I can see now is that CA has about 15M more people and mortgage interest rates are at record lows with not many homes for sale.

That’s a great housing trough to remember that a lot of folks forget about. That’s when aerospace started leaving, coupled with the general U.S. recession of the time. You then had the ’95-’05 boom and subsequent bust with (as you suggest) not much improving economically. Interesting factoid: San Diego is home to two Fortune 500s, Qualcomm and the electric utility Sempra. Here in SW Florida–not exactly your idea of a jobs hub–you also have two, Health Management Associates and Hertz (just announced, arriving next year).

I always think you have to follow the jobs. “Chief Executive” Magazine just came out with its business climate rankings–you can guess where California placed. This link starts on Page 2 and tells why I think things will be getting worse in the long-term in my old home state: http://chiefexecutive.net/states-more-aggressive-in-competing-with-one-another-2013/2

“The only difference I can see now is that CA has about 15M more people and mortgage interest rates are at record lows with not many homes for sale.”

Don’t forget the lords of Chinese slave labor settling in SoCal with their ill gotten loot 😉

I wouldn’t say DHB has become a cheerleader, but the scent of capitulation is stronger than ever. And, in a sign of frustration that some deep-rooted hypotheses are crumbling (e.g., “it’s all about local incomes,” “sub-prime tsunami is coming,” etc.), he’s unfortunately using straw-man arguments as well in his rationale:

“So the groaning comes from people looking to buy cheap beach front property for example. Newsflash, beachfront property will be expensive in boom and bust.”

Sorry, DHB, NOBODY on this board has been moaning about the cost of Manhattan Beach SFR’s on the strand. Has he forgotten about all the “real house of genius” articles for Culver City? The central point of frustration has been people with upper middle-class incomes not being able to buy in what were formerly upper middle-class neighborhoods from the previous cycle.

I’m not saying that there’s a single astute observer of the Southern California real estate market who could have predicted ANYTHING that has occurred over the past 13 years. Guaranteed he/she does not exist.

Homes on the edge of Silver Lake are definitely not worth the buy, but the area immediately surrounding the reservoir is actually pretty nice. I would say that Silver Lake really isn’t an area for families, but the same type of people who want a cheaper alternative to the Hollywood hills. It’s a nice woody area with jogging trails, parks and a handful of nice restaurants that are growing in numbers.

Silver Lake can still be pretty sketchy. Here’s a mugging reported just few days ago.

http://echopark.patch.com/groups/craig-collinss-blog/p/bp–alert-muggings-on-the-silver-lake-path

If you are hedge fund manager with a name like Geryon (Divine Comedy,Canto xvii), a PO box address in Boca Raton, Florida and good access to the Fed flash cash discount window, you can safely thread the swamp this real estate (whole) market is.Should things don’t pan exactly as promised on your colorful high return/low risk portfolio prospectus…heck with it, just sail away for some more fun some place else.

SoCal housing’s future will be multigenerational across the board; more bodies per house. Wealthy aging boomers adult kids/grandkids live with them or in properties grandparents bought decades ago; adult offspring can’t afford to buy in the communities they grew up in with their real world salaries and emotionally/financially can’t leave/accustomed to Cali lifestyle. Boomer passes on, house goes to kids/grandkids, stay another forty years.

Other end of spectrum one in ten SoCal people undocumented, some areas one in three…low income (17K average annual). Mom, Dad, Sister, Grandma, Aunt Mimi, Uncle Joe, band together to buy house; ten people, four dogs in 1200 sq ft. house, four cars in driveway. Low income low wage population primarily having kids, not “young high earning professionals”. Visit any local mall on the weekend, do your own research.

Middle income people of all races continue exiting SoCal, trading off weather for open space, better schools, quality of life, lower cost of living, job opportunities, etc.

Throw in a few Overseas Cash Buyers, Investors, Hedge Funds, and a couple Trust Fund Babies…a couple of Greedy Bankers, a handful of retired govt types w/ 200K annual pensions, a rock star or celebrity. Maybe they’ll buy some property too.

Everybody else rents. That is all.

So true. I know one trust fund baby who moved from NJ to the Carmel Valley (San Diego) area and probably just spent a third of his money on some new mega-McMansion…five miles from the coast, no less. They always talk about how fortunes won’t last beyond three generations…I am beginning to see why.

Let’s see, the Lost Another One to Ditech guy is back on TV now for CashCall, DHB comment threads are breaking 100, and I just heard a broker on the radio in Phoenix brag about an FHA program that defers the first payment for three months on a new purchase.

Yep, this time it’s different. Just different names for the same games. Anyone who states that fundamentals don’t matter has something to gain in that belief.

Yeah, I noticed that too, isn’t the guy dressed in drag as his mother talking to himself?

Couple that with numerous house flipping shows, house buying shows where Witchy Wife whines about granite countertops, open concept, stainless appliances, room for entertaining, must be close to her Mom and Dad, friends, etc. while hubby shuffles in the background, ready to agree to/sign anything to shut her up…two hour commute? No Problem! Deja vu?

I heard a rumor the Fed to start raising interest rates in 6-9 months. Wonder what will happen then …

Depends on what you mean by interest states. If you mean the federal fund rate…. it won’t happen. If you mean let rates rise as a natural consequence of shutting down QE…then it’s easy. Depending on the amount of loss incurred by banks and investors there may be a re-entry into another lesser round of QE. Rinse and repeat until it don’t work no more

Kingsnake

Watch everyone freak out and push the purchase prices through the roof just so they don’t miss the low interest rate. What most people base buying decisions on is I make x amount therefore I can spend x amount. I will just wait and see how it goes. I have never seen such amount of market manipulation as I see now.

Am I the only one who sees the genius of what the Federal Reserve has done?

The Fed’s REO-to-rental program allows an environment of artificially low volume of homes for sale which causes pricing to move into bubble territory. The Fed’s artificially low interest rates causes investors to leave safe investments and chase after real estate searching for yields. The Federal Reserve and banks then releases housing inventory at a measured pace to keep prices artificially high.

The net result is:

1.) All cash buyers (33%) will be eating huge losses when this housing bubble pops. The banks and the Fed would have eaten these losses had they flooded the market with foreclosures and short-sales but they didn’t. Instead, it will be the all cash buyers who will take the massive losses.

2.) The 21% FHA market means that tax payers are on the hook for these new loans so the banks and the Fed take no losses, again.

3.) Credit remains ultra tight so that means the remaining 46% of mortgages are going (mostly) to people with prime credit, i.e. the average FICO score in 2012 was 750. These people with a FICO of 750 are not going to default if their home value plunges 50%. These prime credit people will pay all the way to the ugly vicious bitter end.

Summary: What the Federal Reserve (and banks) have done is created an environment where much of the risk and losses will be absorbed by all cash buyers, people of excellent credit and John Q. Public (FHA loans), instead of by the banks themselves.

“3.) Credit remains ultra tight so that means the remaining 46% of mortgages are going (mostly) to people with prime credit, i.e. the average FICO score in 2012 was 750. These people with a FICO of 750 are not going to default if their home value plunges 50%. These prime credit people will pay all the way to the ugly vicious bitter end.”

I disagree here, why wouldn’t these people follow the playbook laid out to them previously and just strategically default? I fall into that range and if my house suddenly lost 30% of its value like is going to happen to these fools buying now I would just strategically default. Just save my monthly mortgage payment for a few years, go to no buying jail for a few years and save up enough down payment to rinse and repeat!

I wonder how long the charade can go on, I am guessing in the fall this year the proverbial shit will hit the fan.

If your smart and disciplined enough to have a 750 FICO, you’re smart enough to know when to cut your losses and walk away. Or better yet squat and pocket the rental savings. Only a fool plays the angel when the system is of, for and by devils.

The Federal Reserve made it clear last weekend, and several times this week, that QE3 is going to be scaled back.

What this means is interest rates go up. When interest rates go up, home prices will go down.

Here is what happens when interest rates on mortgages go up:

Example: $800,000 home in a mid-tier area

at 3.5% interest with 20% down payment, the monthly mortgage is about $2875

when interest rates go back to their historic average, what happens?

at 8.9% interest with 20% a down payment, the $800K selling price plunges to $450K. The monthly mortgage payment will remain at about $2870.

Will the buyer @ $800K strategically default when interest rates revert to their historical average and comps in their neighborhood plunge to $450K? No. Because the monthly mortgage isn’t going to change. The reason is that home selling prices are a function of mortgage interest rates and household income for a given locality (real estate is very regional and highly localized, ignore the national averages, they mean nothing).

So these households with FICO scores of 750+ are not going to default when interest rates move up and the selling prices of houses in their neighborhood crater, all because: the monthly mortgage payment isn’t going to change.

FICO scores of 750+ group (or any group) defaulting boils down to how much is one’s credit worth. It’s completely subjective. Factors such as unrealized loss of property value, down payment size, property rental value, marital status could affect that decision but ultimately boils down to how happy and satisfied one is with their home (assuming is one’s primary residence).

One more factor I want to point out that adds stress to strategically defaulting, at least in California, is the recent high volume of refinance’s have essentially turned high percentage of loans from non-recourse to recourse loans. One would definitely think twice about defaulting on recourse debt.

Wall Street is buying into the reo-to-rental business model as well. Banks cannot be landlords, but large institutional investors can. From my perspective, they might as well be one and the same.

The genius isn’t in the idea that the Fed has found a way to offload the losses to the public and ‘outside investors’ but that the Fed has found a way to cover bank losses and provide Wall Street with short term investment opportunities that are inaccessible (as always) to the general public. And as more institutions try to get a piece of the action, the more likely the Fed will continue to manipulate the rates long enough for these big investment entities to either execute their exit strategy with minimal loss, or simply stay in the game while the Fed figures out a way to bail them out with more taxpayer liabilities.

The only hope the rest of us really have is that reo-to-rental programs are targeted to select cities, and they’re still in somewhat of a trial phase. All cash might make up some ~30% of all home purchases in the recent months, but you have to factor in the amount of people who bought all cash simply because they had the money (whether foreign or local).

It’s sad, and there’s nothing that can be done to stop it. The best you can do is observe and learn the game for yourself. Maybe someday you’ll be feasting with them at the winner’s table.

Yep on all cash buyers losing when it bursts. Also, it’s really a double-whammy for the all cash investors. They won’t have the cash to invest in interest bearing accounts, which I imagine will pay much more when lending rates increase.

The “all cash” buyer does not tie up his money in real estate. The all cash buyer (at least the non-institutional ones) uses their cash to get the cash advantage and then akes the cash out of the property and gets to utilize the historically low interest rates. They get the best of both worlds. They use their cash to beat out he owner/occupier bidder. Generally, their bid will be accepted even if lower than an FHA or conventional buyer. As soon as they close they mortgage their property at these low rates and get most of their money back. It’s a great deal for them.

Not so sure about #3. I think those with good FICO scores will keep paying, not to protect their scores or continue with a “responsibility” ethic, but because they probably bought in a range that is affordable to them, i.e. they have prime credit and affordability comes along with it. Job loss, relocation, or opportunity to re-buy their same home for half price would be tempting, especially if this same type is saving and can pay cash for the replacement home.

Though I’m not 100% on-board with your point #3, I agree with your summary. This makes me think the bubble WILL burst, eventually. I guess we’ll know it’s close when at least half of the shadow inventory is gone.

@Sadie,

Read Lord Blankfein’s post below.

What I forgot to mention, and Lord Blankfein alludes to this, is that the average down payment for a successful mortgage in 2012 was 22%. For those in the South Bay beach cities that means $150K to $250K cash down payment. It’s pretty hard to strategically default on a mortgage when you’ve got that much money invested.

Ernst, I agree with your number 3 assertion. The people with excellent credit, 20% plus down buying in the prime/near prime areas are not going to throw in the towel that easily if prices crater. Walking away during housing bubble 1 was a no brainer for most because many put zero down and comparable rents were half the price. The same can’t be said anymore. Most people in this scenario are at or below rental parity, I highly doubt rents will go down by 30, 40 or 50%.

I fit squarely into this third category and I would hold on to my house until the bitter end. The idea of squatting for years, having ruined credit, moving, renting and then re-entering the housing market is NOT an option. That sounds like a major hassle to save a few bucks, no thanks. I bought my house to live in and will enjoy doing so.

What I’m observing in Los Angeles does not jive with your assertion of “at or below rental parity”. This is based on sold properties since last year from the west side to the east and including the valley. Perhaps there is rental parity in the very shittiest parts of the city.

I’m not sure how anyone can be certain about where rents will be in the next few years. Last time around, we had rents going up with home prices as units were being converted from rentals. This time we have home prices going up and units being converted to rentals. So far, I’m not seeing a corresponding increase in rents.

Completely agree with you on the idea of the shrewd default, squat, and repeat methodology that some have acted upon over the past few years. Does anyone have any self respect? That seems like a very stressful approach to take.

Many people have been conditioned to believe that credit scores are also a measure of self worth. Those same people also tend to have beliefs about “owning” a home that have nothing to do with prudent financial sense. These are strong psychological influences that could very well prove Ernst’s theory correct in the next downward slope.

Totally insane market. What is really insane is the all cash buyers. If you have ever bought a home and gone thru the process of booms and busts, then it is crazy to pay top dollar (because rates r low) with all CASH?!! Why tie up your cash when you can borrow at such low rates??? Because Dick and Jane are broke. Living with relatives and unemployed.

Fed has pushed hedge funds and others alike to dip their ink in the R.E. market, in an effort to push price up, well it worked, but now what? Who can afford the rent?? Oh yea that’s right Dick got his job back with a bonus!!! I forgot we are over the crisis, that might explain why the Fed is going to “TAPPER” the QE’s. Hmm, can you say “interest rate” Hope those hedge fund managers know how to swim!!!!!!

Aren’t the all-cash buyers mostly investors rather than primary residence buyers? The math baffles me…go buy some Coca-Cola or Cisco stock and get a 3% dividend yield rather than risking it all on a high-beta residential housing market.

I Love it how this board thinks the all cash investors are suckers who are going to get burned. Did they get the cash in the first place by being suckers? I have not seen one person take into consideration the tax advantages of owning a rental home. A cash owner of a $500,000 home will be able to take roughly $15,000 of depreciation per year as a write-off. Assuming this cash buyer is in the top tax brackets, this will save an extra $8000 or so in taxes per year. That is an additional 1.6% to the yield on one of these properties. This will cover the property taxes and insurance. Depreciation is a better write off than the home mortgage interest deduction for many. Further, these investors are buying all cash to get the deal, and refinancing 60% of their cash out immediately. In this case, they would have 300k back in their pockets within 60 days of closing the deal. I do not think values will go up much more, but I do not see the case for another plunge as most buyers are putting good down payments and have nice credit(other than the 20% who are FHA buyers).

Yes, most cash buyers are investors, but they come in different types. The hedge funds are now getting into the market now, some flip and some rent, but there is still the small time investor who is looking for cash flow. Think of it as an Annuity that pays 6% – 8% on your initial investment, and that will increase payments with inflation. Yes it can be a pain at times, and vacancies will stop payments occasionally, but in the long run its not a bad investment. Who knows what housing are going to be in the future, but it will have some residual value if you chose to cash in your annuity.

Any depreciation is recaptured at a later date. Sure it helps but it is not windfall you imply.

If you pay 500K for a house, depreciate it at a rate of 15K per year, when you go to sell 10 years later, the 500K cost basis is now 350K so if you sell it for exactly what you paid for it your tax liability is the taxes on a 150K gain (25% federal on the depreciated portion along with 5 to 10% state tax depending on where you live) The gains beyond the depreciated recapture (should you sell it for more than 500K)vary but since your example is for a “high income” individual, pretty much the same tax rate as on the depreciated recapture.

“Any depreciation is recaptured at a later date. Sure it helps but it is not windfall you imply.”

Not completely true. You can just 1031 exchange and carry it over to the next property. Recapture is only due when you outright sell without any exchange. I suspect most will do an exchange in to a larger property, rather than sell. People aren’t to excited about giving up passive income, especially as they get closer to retirement age.

It does seem downright stupid to pay all cash when one can get 3.5% loans and offset the interest, since eventually one should be able to get a much better return on that cash in the coming years. Also, more cash means more ability to buy many houses.

So, it makes me think that the “all cash buyer” is a meme. Meaning, everyone thinks you have to be all cash to “win” the house and the real estate industry is pandering to the all cash buyer, ignoring the conventional borrowers. I wouldn’t be surprised if there’s a FED rule that gives kickbacks to people bringing in all cash offers. I’ll bet scrutiny of recently passed rules will uncover such a scheme.

Woe to all who are buying these equities (e.g. Blackstone). And, I still think they’re getting 401(k) fund managers to buy them. I mean who else would buy them?

I guess nobody cares about fundamentals when were in the middle of bubblemania. Sound familiar? How soon some forget.

http://Www.westsideremeltdown.blogspot.com

There are three types of cash buyers

1. Foreign investors holding for rental

2. Investor “flips”

3. Owner occupant (usually parents funding children, or retirees)

I my experience the three segments have always been there… Bubble or not. The difference now, and the reason there is a higher percentage of cash buyers, is because these are the offers most sellers would rather accept. It’s not for the lack of financed buyers.

Forget something?

http://online.wsj.com/article/SB10000872396390443768804578034821658901916.html

Of tho 72 transactions I have done in the last 12 months … None to hedge fund buyers. I will say 30 percent have been cash buyers though, but not for lack of financed offers. My point is, I think there are more cash sales recorded (as a proportion of all sales), simply because When faced with the choice between cash or finance, sellers generally will accepted cash deal even if it means a slightly lower price.

Of tho 72 transactions I have done in the last 12 months … None to hedge fund buyers. I will say 30 percent have been cash buyers though, but not for lack of financed offers. My point is, I think there are more cash sales recorded (as a proportion of all sales), simply because When faced with the choice between cash or finance, sellers generally will accepted cash deal even if it means a slightly lower price.

I will However agree that trustee sales a large portion go to hedge fund buyers.

Bubble 2.0, you don’t say:

http://finance.fortune.cnn.com/2013/05/17/housing-bubble/

Gotta get this thing roll’n up to Vancouver levels. Once ever single property in the area is a Real Homes of Genius property, with crack-shacks going for 1M, then we can all congratulate the masters of mankind…

http://www.crackshackormansion.com

Sometimes I play that game in reality: Is this a 100k starter home or a 800k mansion? Hard to tell.

I have some pdf research pieces that talk about the investors role in single family (i.e. the hedgefunds, corps, and rich people) that have been in the market mid 2012 to present.

They specifically look for homes to buy that are

1* clustered closer to each other, in cities where traffic is not too bad. – to facilitate maintenance.

2* costs 100-300k, with 400k perhaps a kind of ceiling. Reason: rent is not going linearly with home price beyond certain point.

3* from the amounts raised (I am citing 2Harbor IPO for example of $2B) the hedgefunds are just like celebrities in this biz currently: rich -yes, famous – yes, and they’ll make money like any other people, but still on their own I estimate they’re responsible for 10-20% of the sale, no more.

Now those 3 points basically maps out to the buying areas and the areas they seem to be light. The heavy areas they are buying are actually not just phoenix, but cities in NC and SC (east coast) where there are software companies and industrial, and home prices are about right.

The move in prices in the west coast, while have some investors in it, is also to some extent contrary to requirement #1 – 3 above. LA is hard to navigate/congested, expensive price-wise, and was just to big for a portion of several billion $ funds to matter. That and really the supply of homes are tight.

Something to think about – the factors affecting the runs these days aren’t obvious when you look closely at the data. And by data you may have to do things like me, including delving deep into IPO papers and prospectuses of the hedge funds, going to city hall and bribe some people for info, etc.

Do you have links to those pdfs? I’d love to read them.

P.S.: I love your work on meatspin.com.

I am glad you like my work!

Please see page 13 of this SEC document:

http://www.sec.gov/Archives/edgar/data/1557255/000110465913041795/a13-11508_3424b3.htm

Thanks for the link to one of the SEC filings. It certainly confirms that houses are being bought and sold as stock. I wonder how many Silver Lakes there are.

I question I haven’t really seen addressed yet:

If the frenzy stopped tomorrow and prices froze for at least a year, would the current prices still seem bubbleicious?

I feel bad for all you cali guys. I have seen so many examples on this blog, and other online sources, of investors buying properties that have zero or next to nothing cash flow. Rentas are all like mini businesses, if they dont make money why buy them? The sunshine and beaches 24/7 seem nice and all, but how do land lords make a living out there?

Here in Michigan I just picked up a 4-unit for $99k. Gross rents are $2200. Not in the ghetto at all, working class family area. A lot of deals like this in my area. Wish I had more money/financing to acquire more.

Good for you.

Leave a Reply to grammar cop