A mirror in the real estate sun – Japan posts record trade deficit while real estate values go deep into the 1980s. US has decade long collapse in real estate values in spite of record low mortgage rates. The path of two lost decades in US real estate values is looking very similar to Japan.

The case of having a Japan like correction in our real estate market grows stronger as each year goes by. The entire notion of zombie banks derives from the crisis in Japan. Shadow inventory and the suspension of mark-to-market accounting are part of the life support that is keeping many US banks operating. Two decades later, with low interest rates and no signs of real estate values going up, the Japanese housing market is virtually stuck in a holding pattern. One thing is now different however as Japan is now starting to run trade deficits. Japan recently posted a record trade deficit because of a strong yen and rising imports on fuel. Yet the real estate market has yet to recover and is back to 1980s values. Can you imagine housing values in the US going lower or sideways well into the 2020s? Hard to believe but let us examine a few areas where the pattern is playing out on a similar note with new data.

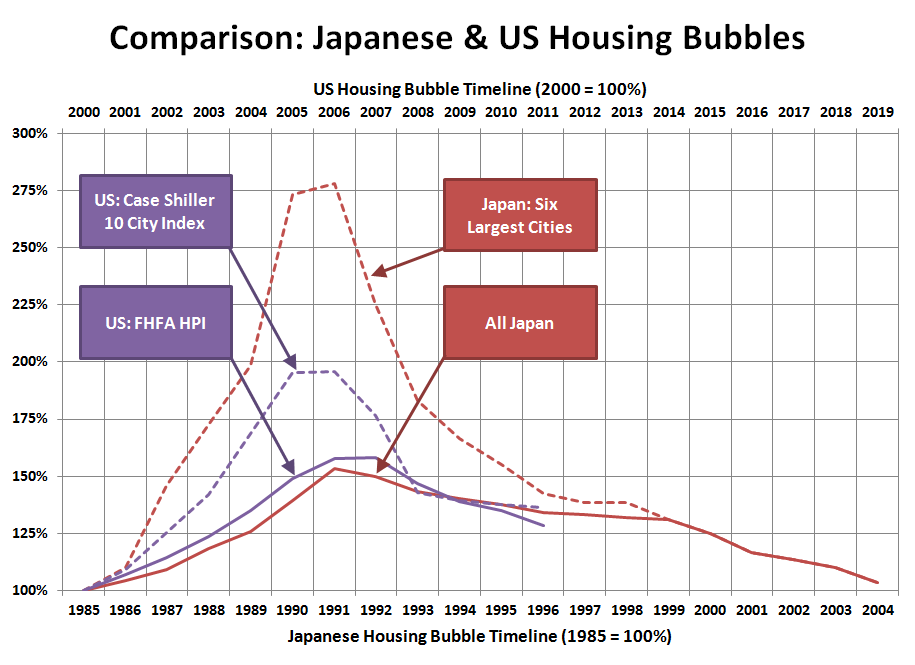

US versus Japan housing values

If we examine the US housing bubble and Japan housing bubble we see a similar bubble bursting format:

Source: Seattle Bubble     Â

Since the chart was produced US home values have moved even lower. Japanese real estate values are going back to levels last seen in 1985. Two lost decades are baked in the cake. The US has already reached one lost decade. When you examine items like the above you have to ask what will be the impetus for increasing US home values. Are we seeing household wages go up? If you listen to talks of the great car recovery story, part of it had to with rising car sales but a large part of it had to do with slashing wages. How is that good for increasing home values?

Low interest rates a panacea for home buying?

Some seem to think that low interest rates are a cure all for everything ailing the real estate market. Certainly the Federal Reserve believes this. Japan has mastered the low interest rate world:

Source:Â Global Property GuideÂ

The Bank of Japan has kept interest rates below 2 percent for nearly 20 years. In fact, the Bank of Japan has had a zero percent target interest rate policy in place since 1999. As you can see this has kept mortgage rates at incredibly low levels. Surely with such low rates home building has taken off?

Source:Â Global Property GuideÂ

Okay, well maybe home values have increased:

Home prices have retraced two full decades even in the face of decade long zero interest rate policies by a central bank. For those that think Japan’s housing market is tiny think again:

Source: Ministry of Land, Infrastructure and Transport  Â

Japan has one of the most valuable real estate markets in the world even after their housing bubble completely collapsed. Over the long-term housing values are driven by local demand. Bubbles of hot money can emerge like what is being experienced in Canada at the moment. But these are unsustainable and by definition will burst at some point.

The case for rising rents

The next argument we hear is that somehow low interest rates and zombie like banks will somehow push rental rates higher. Rents are mainly driven by what people can afford with their paychecks. And so far, there is no indication rents are soaring in Japan:

I find this argument fascinating in the US as well. Of course, once the bubble burst a premium was placed on renting as credit markets seized up and people switched to renting and were unable to obtain a mortgage. Yet once that short-term premium is exhausted rental values begin to find a natural equilibrium. Take a look at the Las Vegas market and you can see a tipping point in rents emerge.

When we hear about the issue with youth employment in the US we need only look at issues being faced in Japan as well:

“(CBC) It’s hard to fault Ueda for his lack of enthusiasm. This was supposed to be the year he followed Japan’s decades-long, springtime tradition that sees hundreds of thousands of students bloom into full-time workers.

“I couldn’t find a job, so I’m staying on in school for another year,” he admits with a shrug.

That makes him one of the more than 100,000 new university graduates — 20 per cent of the total — who hadn’t secured full-time employment as of May 1, according to a survey by the Japanese Education Ministry. Their ranks have been growing each year.â€

Even with real estate values back to 1980s levels in Japan it is hard to purchase a home with no secure employment. People always point to the low unemployment rate in Japan but this is somewhat misleading. Japan has a giant part-time work force, nearly one third of their entire labor force. These workers operate largely like contractors and surely that cannot be a boost of confidence to take on 40 year mortgage.

Our part-time work-force has also increased in the US:

Source:Â Calculated Risk

There are many similarities in how the US and Japanese real estate bubbles burst:

-Massive central bank intervention to save too big to fail banks

-Ignoring bad performing loans thus drawing out shadow inventory or zombie banks

-Artificially low interest rates courtesy of quantitative easing by central banks

-Continuing price declines in the face of record low mortgage rates

-A rising part-time labor force

-Those who argued Japan only carried trade surpluses now see a record trade deficit (see rule on Black Swans)

-Decade long depression on housing starts

-Fast decline in home prices after bubble burst followed by slow and continued decline in real estate values

There are obviously many differences as well but the above is what is playing out. The US has never had a real estate bubble of this magnitude so it is hard to predict how things will play out. Yet we can analyze the data and hopefully arrive at some macro-economic conclusions. We can look at similar situations and ask why our pattern is looking very similar to the bust in Japan.

What are other similarities and differences between the two markets?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “A mirror in the real estate sun – Japan posts record trade deficit while real estate values go deep into the 1980s. US has decade long collapse in real estate values in spite of record low mortgage rates. The path of two lost decades in US real estate values is looking very similar to Japan.”

And yet, in our new “on the other side of the looking glass” world, I have read more than once recently that Japan is either being asked or is volunteering a few hundred billion dollars to funds that will “rescue” and/or “ring fence” Greece and, therefore, Spain and Italy. This coming from a country that has a debt that is now 200% of GDP. How is this possible? What happy drugs are some of these people taking? Can I have some?

Two lost decades? As if the only thing that makes a successful decade is appreciating real estate prices? Let’s get our nose out of the sheaves of dollar bills and look up at the blue sky and the expanding universe for a few moments and be grateful that we are alive after two decades, and perhaps a little wiser.

You’re right, but are you on the right website? The blog you are posting on is specifically dedicated to housing.

One big difference between the USA and Japan is the rate of in-migration. However, for the USA the immigrants are predominantly low skill, low pay workers. One similarity is the aging population, with 10,000 USA citizens turning 65 every day.

I’ve read many economists use the immigration argument as a reason why Japan’s 20 years of rolling recessions will not lead to a similar fate for the USA. But I’m not convinced. Underemployment and low savings rates are bad news for the USA…..not to mention the Trillion dollars in student loan debt outstanding.

well u are just looking at one side of immigrants…what about Asians….they are coming here for engineering jobs….look at the Chinese and Indian queue for GC….all those jobs are high paying jobs…

Exactly, look at the queue, that’s why fewer and fewer of them will be staying to contribute to a country that doesn’t welcome talents simply because they are born in China or India. Currently it takes a Chinese or Indian engineer 5-6 years to get a GC SIMPLY because they are born in China or India, and add 5 years on top of that for citizenship. I know because I’m one of them. This is my second year out of grad school, and I’m making close to 200k and paying a lot of taxes. I absolutely love this country but I don’t feel the country wants people like me to stay. So I won’t be buying any property or settling down. Chances are I will go back to my home country in a few years with global pay because the GC queue is horrendous. Many people have already done just that. When the majority of American-educated Chinese and Indian engineers/IT workers/other professionals like myself decide it’s time to go home because they don’t feel welcome here, it will be a sad day for America. Although if one believes that these immigrant workers are “stealing” American jobs, then perhaps it would be great for America when that day comes. We’ll find out.

That’s a totally empty threat, Sarah. You won’t go home if you can avoid it and you know it. You wouldn’t make nearly the same kind of wages, and you’d be stuck in a Confucian system where you’re supposed to know your place, and the chances of good advancement at a young age are much smaller.

For that matter, as long as you get a good job here, you’ll be able to stay. Of course it’s a pain, but any immigration is. You’ll only be going back home in the end if you can’t hack it here — if you’re not the best. In which case, hey, don’t let the door slam too loudly behind you.

Carl, the fact is that in my field (I realize that it may not be true for many other people), it’s global pay anywhere and if I go back, I get housing allowance/cola on top of that. So you’re right, I wouldn’t be paid the same, because I would get paid more. But you’re also right about the system and way of life there, that’s the only thing keeping me here. Times are changing, wage gaps around the world are shrinking, America may no longer be the top destination for talents, just accept it.

And it’s really not a threat. Why would I make a threat about immigration reform on a RE blog? I pointed out the fact that smart immigrants might be moving back home to provide some perspectives on RE prices. I, for one, will not buy property here unless I know I can stay here. If it takes too long for me a get a GC, I may just go home and never buy property here. That’s what I was trying to get at. Yes there might be a lot of immigrants with high paying jobs, but many of them will not buy property because of the uncertainty of their GC path.

To: Sarah

You sound like the typical foreign person complaining about the GC system. We all know it sucks but you for you to complain about it while making $200K year shows a lack of respect for this country. I welcome you to leave if you are unhappy about your situation. But my guess is you just want to complain and you aren’t going anywhere.

Go home and don’t let the door hit you in the bum on the way out. Engineers aren’t brought here because they’re more talented than Americans. They’re brought here to work as indentured servants at lower pay. Engineers in China aren’t the same as engineers in America. Auto mechanics are considered engineers in China. In India a Bachelors degree is earned in 3 years. In the Philippines there is no middle school. You go directly from 6th grade to 4 years of high school. At best, a bachelors degree in the Philippines is equivalent to a trade high school degree. Yes, this is all related to the price of housing. The result of all this labor dumping is an unstable employment market and a reduction in wages here is the USA. If you want to fix the housing problem you need to fix the employment problem. If you want to fix the employment problem you need to stop dumping cheap foreign labor onto the local labor market. This is Economics 101.

http://www.youtube.com/programmersguild

Sarah,

For my part, you are absolutely welcome in this country. I appreciate your perspective and experience. Please do not take the criticism and offense of some as the mind and heart of us all. Where ever your life leads, good wishes to you.

“Engineers aren’t brought here because they’re more talented than Americans” DUH…yes they are. America is way behind in math and science – out of 34 industrialized countries, American student’s rank 17th in science and 25th in math. Sarah is smart and will get paid well anywhere she goes. American companies will gladly pay her since there aren’t enough smart US employees to fill the positions.

Great article as ever.

“What are other similarities and differences between the two markets?”

The biggest difference is obviously the demographics. Japan has a rapidly ageing population, and has a higher proportion of over 65s than anywhere elsle in the world. Everyone knows that. But why should that lead to a 20 year propery slump?

And why should a slightly more favourable demographic rate in the US ( and also here in the UK) somehow outweigh all the other similarities DR HB has pointed out to Japan? I guess i’m trying to anticipate the argument that Japan’s different because its so ageing, THEREFORE its’ example can be ignored.

There are reasons Japans ’80s bubble was worse than the recent western one. IMO mostly because it was a pro-corporate, semi-planned economy, where every key financial decision maker was in everyone else’s pocket, which led to an even more bloated type of crony capitalism than we’ve suffered.

But alongside the demographic argument theres also the GEOGRAPHIC argument. Japans population is concentrated along the coastlines in massive cities, with much of the rest of the country being mountains and forests. Unlike in the States, you can’t just build a whole new bunch of suburbs on the outskirts of some city some place. This fact ought to make house prices in Japan recover faster than they would otherwise do.

Japan’s property story doesn’t bode well for western housing prospects. I’m happy to keep renting for a while.

“There are reasons Japans ’80s bubble was worse than the recent western one. IMO mostly because it was a pro-corporate, semi-planned economy, where every key financial decision maker was in everyone else’s pocket, which led to an even more bloated type of crony capitalism than we’ve sufferedâ€

The US had deregulation (our version of pro-corporate), Allen Greenspan (our version of semi-planned economy), Congress (our version of every key financial decision maker in everyone else’s pocket) which led to… oh yea, the most bloated type of crony capitalism the world has ever seen. The US even exported our version of said crony capitalism…

I wonder if we include this export in our trade deficit calculation?

Yeah fair enough.

But the point i’m making is that Japan had this web of interconnected banks and coprporations, each owing each others shares, which were partly directed by the government, which didn’t really compete with each other, and who’s success came largelly from gaming export makets. (Sound much modern like China to you?)

This particular form of crony capitalism led to an ever more obscene property bubble than the current western model of crony capitalism. I suppose it took it even longer to get found out.

Well said. You obviously read Contagion by John Talbott. Wall Street and politicians from both parties are robbing us blind. To them, there is no earning anything. They’re all just looking for the big score.

The idea of deregulation being “pro-corporate†is one of the biggest lies in history.

Is this the “anti-corporate†regulation you speak of? This is what it takes to open a lemonade stand in NYC.

-Register as sole proprietor with the County Clerk’s Office (in person).

-Apply to the IRS for an Employer Identification Number.

-Complete 15-hr Food Protection Course! After the course, register for an exam that takes 1 hour. You must score 70 percent to pass. If you pass, allow three to five weeks for delivery of Food Protection Certificate.

-Register for sales tax Certificate of Authority.

-Apply for a Temporary Food Service Establishment Permit. Must bring copies of the previous documents and completed forms to the Consumer Affairs Licensing Center.

-Then, at least 21 days before opening your establishment, you must arrange for an inspection with the Health Department’s Bureau of Food Safety and Community Sanitation. It takes about three weeks to get your appointment. If you pass, you can set up a business once you:

-Buy a portable fire extinguisher from a company certified by the New York Fire Department and set up a contract for waste disposal.

90% of regulations are designed by corporations, marketed by lobbyists and put in place by politicians in order to stifle competition, block new entrants into a market, and line some administrative pockets along the way.

@Joe Average

I would argue “deregulation†even with your example is pro-corporate. Regulations that create barriers to entry are definitely pro-corporate in my mind. Then corporate lawyers write legislation that changes laws/regulations/tax/etc. to their advantage. Senators then tag theses to a bill that is up for a vote at the last minute (i.e. riders)…

” slightly more favorable demographic rate..” SLIGHTLY, I don’t think so, the US has a hugely more favorable demographic rate. Japan has 7.3 births per 1000 while the US has 13.8 births. With current Japanese reproduction rates, the total population is projected to decline by 20% by 2050.

Besides thedemographic time bomb, Japan also has the huge deficit problem as noted by other posters. I think the US – Japan housing comparison is a bit of a stretch and is irrational negativity.

As someone who has lived in Japan, Tokyo specifically, and my wife (Japanese native ) agrees there are simply too many people on that island slightly smaller then the state of California to support. A smaller population might do Japan good.

Have any of you ridden on a subway in central Japan (besides as a tourist) or tried to navigate Ginza, Shinjuku, Tokyo, Ikebukuro station? You never quite get used to the crowds, even though you think you do.

In the UK, almost exclusively London, you have hundreds of billions of capital flight from all over the world, mainly Middle East and Africa, buying up property. Without this stolen money, London would have all the economic power of Budapest. In Japan you have a limited amount of space in Tokyo and an unwelcome mat. In the US you have unlimited space and little capital flight because of banking and tax laws and visa problems. NYC will soon discover that they are not London or Tokyo.

Good point about rent costs. I remember back when the housing crash started….some “investor” groups were crowing about getting into the rental market because all these previous home owners were now going to flood the rental market with demand. Turns out people just stayed in their homes and quit paying the mortgage. But rentals are one area of the economy that the govt impacts only at the Section 8 level. So if incomes are still slowly going down, especially against inflation, where’s the money for rising rents?

I agree CAE – where is the money for rising rents? I certainly can’t stop paying my rent and live for free as long as some have been able to stay “mortgage free”. My landlord doesn’t come and ask how much our annual income is and then decide to charge us rent at 25% or 35% of our monthly gross income. We are sort of stuck in our “maintenance deferred” rental cause we can’t afford surrounding rents and moving further away isn’t an option. We lived that life for a few years! Figure the cost of driving 140 miles a day round trip for a year – not just gas but all the maintenance as well. Run the numbers of our ever upward gas prices – $4/gallon/15 gallon tank x 3 times a week – our car ate better than we did for a while there.

Real estate isn’t the only thing that’s been going sideways in Japan for decades. When comparing the two markets (US vs. Japan), you’ve overlooked a critical component.

http://www.google.com/publicdata/explore?ds=d5bncppjof8f9_&met_y=sp_pop_totl&idim=country:JPN&dl=en&hl=en&q=japan+population#!ctype=l&strail=false&bcs=d&nselm=h&met_y=sp_pop_totl&scale_y=lin&ind_y=false&rdim=region&idim=country:JPN:USA&ifdim=region&hl=en&dl=en

CaliGirl14

Your post just zapped my dream job re-entry. I appreciated your candor about the cost of commuting. THANK YOU. I picked a few jobs field (Shopping Ctr Mgmt). Started out in Accounting but wanted something more diverse and “no day the same”. I guess I’ll look local, and just be happy with what I find.

The MLS was popping for a while with regular sales at fair prices, but our home wasn’t in that pop. Now it’s in a stalemate of nothing new, and everything we had to pick from is sold (yet closing is taking its time). When we get settled, finding a job will be easier. Less projects is more time to devote to job hunting.

Paying cash for a home has its yin-yang. Prices are still high, and multiple rents are killing us. No silver spoon in our lives for the forseeable future. This is Japan. We’ve thought that for a whie. As I call it “a controlled collapse” of housing prices.

After moving to SoCal in late ’04 and becoming disgusted with our relocation realtor’s

“buy now” talk, I asked “has anyone here ever heard of Japan?”. Blank stares all around…dodged a bullet (thanks, in part to a 6-figure cash loss on the move)….we’re actually back in the market…

A big contributor to Japan’s trade deficit was (and is) the earthquake and tsunami. It hasn’t recovered yet.

Whenever a country has a huge demographic bulge, like the baby boomer generation, it is almost impossible to avoid the sort of bubble and bust dynamic that has occurred. Obviously, when you have a fiat money system the potential for a much bigger bubble exists.

It is very wishful thinking to assume that the large immigration into the USA will make a difference. The majority of it, until very recently, was illegal, and no money is being set aside for these workers’ retirements/health care costs. That is somewhat of a moot point, since even the money being set aside for legal workers is rapidly being inflated into a state of worthlessness.

Don’t let falling housing prices fool you into thinking there is any chance of deflation. Rather, low house prices are a function of two things. One is a simple supply/demand function: they built too many houses. The other is a sign of extreme inflation. Namely, that the cost of everything is going up so fast, the people can’t afford to buy houses, even with low interest rates, after paying other expenses.

I feel I should make an informed comment, since I have lived in Japan for twenty years and own (about half and half with the government mortgage company) a house there. Yes, I’ve seen it depreciate in value, although the old location, location, location rule applies, and a 40% depreciation in the dollar puts its value close to purchase (in dollars).

That leads me to another point–the appreciation of the yen is a factor in the long slide in property values. First, because weaker foreign currencies mean lower profits to be repatriated. The property boom in Japan was spurred by a huge volume of foreign exchange pouring into the country, and Japanese banks and corporations had no place to invest other than land. Second, deflation has its own drivers. Salaried employees (I was a college professor) took 20-50% pay cuts (I estimate that my lifetime loss of earnings to retirement topped $500,000), and cash-starved companies were forced to divest of property at fire-sale prices just to raise money. Zombie banks had no money to lend. Any free central bank money that came their way went straight back into government bonds. Sound familiar?

The US property boom had a similar but slightly (and more ominous) driver–loose money policy drew capital from all over the world into the country. I might add that trade surplus countries had excess dollars on their hands and found it easier to spend or save them (treasuries) in the US. Result? Excess capital.

Now Japan must retrench to pay off its massive debt at the same time that it faces a demographic squeeze (more pensions and health care, fewer revenues from workers) and enormous clean up costs in the wake of the tsunami and ongoing nuclear crisis.

But the US problem may be even greater, for the great credit expansion that fueled the US property bubble (and the Spanish bubble, and the…) is over, and it has been replaced by a severe contraction that all the king’s horses, I mean, all the central bank QE in the world will be helpless to reverse. I think the doctor has it right–no recovery in sight.

Comparing the Case Shiller Ten Cities to the Top Six Japanese Cities indices is comparing apples to orangutangs. The Shiller does not include the top ten MSA’s in the US, omitting Dallas, Phila, Houston and Atlanta MSA’s; substituting Denver, San Diego, San Francisco and Las Vegas. In other words, the 4th, 5th, 6th, and 9th largest MSA’s were omitted; instead substituting the 21st, 17th, 11th and the 30th.

I don’t disagree with your ultimate conclusion–however the CSXR is heavily weighted towards Cali. Dallas is down 15% from the top, Houston down 2% from the top, Atlanta 26% from the top, and Phila. down 20%. These would have flattened the curve considerably.

In a Cali RE Blog, the CSXR is a great tool, just understand that it is not the same as the Japanese Index.

Again…I’d say 1985 R.E. prices in California will be near the “bottom” of this downturn. Or, rather, the popping of the bubble.

This is what MUST happen before any “real change” and a healthy economy re-emerge:

1. Tariffs.

2. “Free Trade” agreements amended so the labor wages are balanced by tariffs.

3. Bankers are imprisoned for their Fraud.

4. Politicians bought and paid by bankers join them.

5. Regulators that don’t regulate, join them too.

6. Direct voting by the entire citizenry by paper ballots instead of “(non) representative” government.

7. The USSC is limiited to one term of 6 years, and the (non) justices voted in by direct vote.

8 Presidential elections are a direct vote, no more “electoral college” hoodoo….with paper ballots. Counted in public.

9. People start to realize that Walmart is not good for their communities, and start shopping and purchasing locally grown produce, and locally made goods.

10. They turn off their tv’s, and pick up a book.

Get a grip: The housing bubble burst 5 years ago…and still people debate about R.E. pricing…..look at 1985 prices for the answer.

You speak of “the great car recovery story” but fail to mention one of the reasons for GM’s record profits is that Obama has allowed GM not to pay corporate income tax.

My bottom line would look a whole lot better if I didn’t have to pay income taxes too.

Ask the GM bond holders about that recovery. Also, most of the car loans are subprime and will shortly blow up like the FHA loans. It is the same old bubble, just like student loans. Take away massive debt (the Fed printing), and you have an even bigger contraction. The big boys are just buying time until Obama is re-elected and then the hammer will fall right on your forehead.

Don’t forget all the leasing deals out there with unrealistically high residual values, allowing for very low lease payments. The car companies got hammered on this a few years ago but apparently they have very short memories.

Except Japan doesn’t have things like this:

http://www.statesman.com/business/ask-an-agent-is-flipping-a-home-worth-2169365.html

One similarity we have is the aging population. Japan had a much higher saving rate and held most of its own debt during that time. Now the aging population is beginning to draw down on its retirement savings and leaving a gap, as pointed out, full time employment has not materialized and therefore neither has the savings.

What do we have here? A retiring boomer population beginning to draw on its 401K’s, no new household formation, lower wages, higher debt so if they ever do want to sell and move to “Florida” the older generation will have to sacrifice its equity.

Three differences in my mind between Japan and the USA.

1. The top 6 Japanese cities have 16% of the total population and the top 10 in the USA have 7.8%

2. Population growth. The USA has added 60M people since 1990 while Japan has added 4M.

3. Immigration. Japan is approximately zero/year and the legal USA number is 1M.

In a message to “Sarah”, I can tell you that USA would be MUCH better off if you and other GCers like you would PACK YOUR CRAP AND LEAVE NOW!! We have PLENTY of highly trained underemployed people here who can do your job better than you can, including myself, and WE DO NOT NEED YOU AT ALL. Your job here is nothing but an artifact of illegal professional favoritism, and nothing more.

Let me make it perfectly clear: if you are a GCer, YOU ARE NOT WELCOME IN THE USA. Instead, you GCers are nothing but worthless, harmful, corporate globalist pigs.

GO HOME TODAY!!

You just proved my point earlier. People like you is one more reason I would hesitate to buy property and settle down in this country. But guess what, you don’t get to tell me what to do. In the mean time, you can enjoy sliding home prices and your underemployment, Mr. “Highly Trained”.

Bed.

Wrong side this morning.

Immigrants are what made this country great.

My ancestors were immigrants to the colonies in 1752.

I want more immigrants to come here every year.

I agree, immigration is good for our country.

All of the working people in a country have to support the non working people that are either retired or to young to work. When an immigrant comes here to attend college then stays and enters the work force, we take advantage of the fact that the host country basically subsidized this person for most of their early non working lives.

It is a winning situation for us, plus my grand parents both immigrated from Europe.

Stay classy Tom!

Careful there, your xenophobia is showing…..

The only thing propping up the US housing market from collapsing further is underpriced government lending. But tonight we saw yet another move away from that, with the FHA raising premiums once again. Next I suspect we will see further gfee increases from the GSEs. then the FHA again, etc.

This move to more realistic credit pricing will keep a lid on housing prices in the US.

Not to mention we have several years worth of shadow inventory to work through…

Another great article, doctor. I send these to others from time to time. A very straightforward, easy to understand article with solid graphs to drive home the conclusion.

I am quite familiar with Sarah’s concerns above and have long said that immigration in the US excessively penalizes strongly-educated individuals–basically anybody trying to get in and stay here legitimately. If you’re well educated, proven employment history and no crimes on your record a green card should be given to you quickly. I went through this path myself–cost me a lot of money, a lot of time. And, yes, I had considered moving back out of the US because of this and have cautioned others about the extreme effort and time required to stay here during the non-GC duration.

Those expressing no sympathy to Sarah’s plight probably do not actually know at all what is involved in legally immigrating to the US. This country benefits from people like her unequivocally. Do you want a high degree of productivity being applied within country or without?

Sorry to bring this off topic, it is an RE blog but I cannot withhold opinion on something that was a stressor for several years and needs to be completely overhauled.

Leave a Reply