A glimpse at the Irvine housing market and global gentrification: Investor demand, foreign purchases, and financial characteristics of Irvine homeowners.

One of the more challenging pieces of data to come by is financial characteristics of those who own their home. Most data aggregates renters and homeowners together and in California, where nearly half of families rent, this data does not give a good perspective as to what financial characteristics drive homeownership. The homeownership rate in the state continues to fall as outside money pushes out local families with stagnant incomes. Call it global gentrification. In the depths of Census data I was actually able to dig deep and find data on actual homeowners which is very telling and helpful in getting a glimpse behind current owners. It might also help to put things into perspective for those planning on buying in the current market. I was able to get data on a desirable location, Irvine where a large amount of investors, foreign money, and family purchases are taking place. What is the data behind homeownership in these markets?

Irvine and housing data

The city of Irvine has a population of 215,000 people according to the 2011 Census. The number of owner-occupied housing units with a mortgage in the city is 31,037. According to this dataset, the median home value in 2011 was $656,100.

Here is some interesting data on HELOCs and second mortgages:

Homes with a second mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 6.3%

Homes with a home equity loan:Â Â Â Â Â Â Â Â Â Â Â Â Â 18.9%

Homes with both a second and a home equity loan:Â Â Â Â Â Â Â 1.7%

This is typical in California where many people tapped into their homes to extract equity. The one interesting piece of data was the actual financial figures of homeowners in Irvine. The underlying notion is that homeowners are much better off financially, but by how much? In Irvine the median household income of those that actually own a property is $123,786. Over 64 percent of homeowners have household incomes above $100,000.

The median monthly housing cost is $2,905.

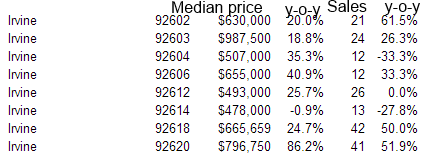

Contrast this information with the median household income in Irvine at $87,484. Irvine has a large number of rentals so this is an area where having this Census data is very useful. Irvine home prices have soared in the last year:

The median price and sales are both up strongly year over year. The one piece of data I would love to see is the amount of investors purchasing in this area. The latest data that I could find was from the NAR and it stated that 11 percent of sales were to foreigners for California.

“(OC Register) The California Association of Realtors, however, pegged foreign sales at 5.8 percent of the state’s transactions. Of those, 39 percent of the buyers come from China, followed by buyers from Canada (13 percent), and from India and Mexico (8.7 percent each), CAR reported.

The state group doesn’t break down statistics for Orange County. But local agents estimated that the proportion of Orange County and Southern California sales to overseas buyers is higher than the statewide average.

About 20 percent of the buyers at Irvine’s Lambert Ranch development – which caters to Asian buyers with wok kitchens and floor plans for extended families – are from abroad, said Joan Marcus-Colvin, senior vice president at the New Home Co.

Local agents specialized in working with foreign buyers say they see strong interest among affluent shoppers in China, Taiwan, India and other Asian countries.â€

We already know that 35 percent of SoCal purchases are coming from the all cash side. Yet all of the all cash purchases are piled into one bucket in terms of statistics. The bulk of course is coming from domestic investors. However, in some markets, a large amount is coming from foreign demand.

One useful way of analyzing current purchasing behavior is looking at what has recently sold:

8 Grant, Irvine, CA 92620

Bedrooms:3 beds

Bathrooms:2 baths

Single Family:1,900 sq ft

Lot:4,800 sq ft

Year Built:1979

The above place was listed for sale on 2/18/2013 for $738,000 and it sold on 3/27/2013 for $739,000 ($1,000 above asking price). Let us look at another example:

30 Long Fellow, Irvine, CA 92620

Bedrooms:4 beds

Bathrooms:3 baths

Single Family:1,964 sq ft

Year Built:2006

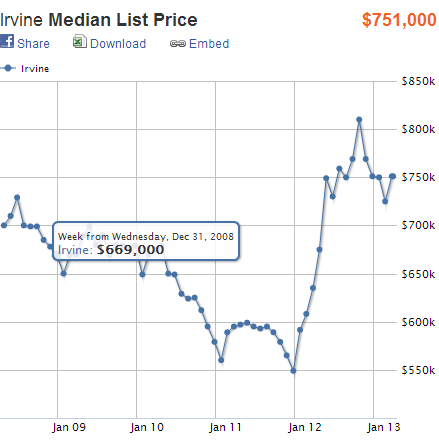

This place sold in 2006 for $908,500. It was listed for sale on 1/26/2013 at $749,900 and sold for $751,000 on 3/25/2013. Listing prices have shot up strongly since 2012:

This should give you some perspective in terms of those that actually finance their homes. However, hot money from outside the state is hard to track and it is definitely flooding in impacting a market with low inventory. In a market like this you can expect fierce demand and competition. No longer are you simply competing with those in the local economy, but those around the world.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

32 Responses to “A glimpse at the Irvine housing market and global gentrification: Investor demand, foreign purchases, and financial characteristics of Irvine homeowners.”

The market is going bonkers! The bottom was 2011Summer. The top will be about 2017 to 2019. If you don’t own now, your late, but able to join the “cow herd going nuts”.

Why take my words? I bought & sold over 23,000 acres=1167% profit per acre. Been doing real estate market timing since 1970’s. California is on a 7-12 year cycle up & down. So if you take 2011 as the bottom, ad 7=2018 is the top! Start selling in 2016-2017!!!!

And who will be buying these houses for the next 5 years?

As long as they can securities the rent rolls, the Wall Street gang will keep demand for housing, at leastuntil they can’t anymore. Fed program requires hedge Funds to hold houses and rent them for mjn. 5 years and they can extend for additional 5 years. If prices go too high they will not make a profit bc rent will be too high. Or to many rentals on the market, or demand did securitized rent rolls doesn’t pan out, I don’t think the bubble will inflate to pre 2007 height, I think it will correct and go up, correct, and go up, repeatedly over the next decade.

“And who will be buying these houses for the next 5 years?”

The Chinese.

The Chinese are patient. The Chinese have built and bought a few dozen empty cities in China. They don’t need an immediate payoff. They may need to escape China relatively quickly.

Judging by the dollars we send their way, I expect they could buy up all the foreclosed real estate in LA and wait a decade or two for their children to grow up, move to America and go to UCLA.

The Vancouver RE bubble is doing fine due to the massive and continuing Chinese demand.

Why would you not expect that same buying frenzy not to spread to LA as things get shakier in China?

Can’t tell if you’re being sarcastic or not, Big Bill. I agree the chinese currently influence and will continue to influence the US and Canadian real estate markets and we now live in a world of global real estate to some degree. That being said, as the good Doctor has mentioned time and time again, you need the US or Canadian citizens/workers in that area to be able to afford to live there too so home prices can’t just keep going up forever (unless wages do too).

In regards to Vancouver, things may be changing as this came out a few weeks ago/mid-March:

“Vancouver homes are overpriced by about 26 per cent, says a report released by a major U.S. credit ratings agency.

Fitch Ratings released a report Monday stating that Greater Vancouver’s housing values could drop by as much as 15 per cent over the “next several years,” News1130 reported.

But home values could drop even further if interest rates go up in the next few years, especially for houses more than condos, UBC real estate expert Tsur Somerville told the radio station.

Fitch reported similar trends across the country, with overall Canadian prices overvalued by about 20 per cent, the Globe and Mail reported.

The news comes the same week that the Real Estate Board of Greater Vancouver reported February home sales were down 29.4 per cent from the previous year, and 30.4 per cent below the 10-year average.

Point Grey realtor Ken Wyder said that Vancouver’s housing market is stable, but he agreed with Somerville that things could change if interest rates were to go up, the Vancouver Observer reported.”

Hey, at least the realtor said the market is stable, right? Now I don’t know enough about Vancouver real estate to pretend to predict the outcome, but the interesting thing about (artificial) stability these days with today’s heard mentality/information access is how quickly things can move to unstable.

Big Bill,

i think Bill’s comments may be a top signal, the classic way to lose big money is take a trend and project it out forever into the future…..as bill is doing

Madness! Enjoy the plunge over the cliff, lemmings.

While I don’t disagree with you about cyclic nature, with much faster flow of info and money (Internet, globalization) the cycles will go up and down much faster, with shorter ups, and longer downs, because people will react a lot quicker. Just look at any speculative assets (stocks, commodities, metals, etc.), the cycles are coming way faster, and spiking upward much quicker, and descending over a longer period of time.

…and don’t discount oil price spikes. There is a cycle here too: price spikes –> economic downturn (stock market downturn) –> oil price comes down on reduced demand –> economy starts up again –> price spikes

We’ve reached the end of cheap energy. But our whole system is built on the idea that cheap energy is infinite. So until our system changes and becomes more resilient to this….

Hello JohnJasonChun. Every now and then you post a sound bite on your view of the market. You only mention your results in buying and selling land, it sounds like and your website gives no worthwhile information. Can you send some links to your boom and bust cycle comments for the California market. And is that land or SFH market?

I used to think it was so easy, cyclical calculation. Since the 70’s I would count on an 11 year up and down cycle, there a bouts. The game either changed or was most likely never what I thought in the first place.

If the market was bonkers the Fed wouldn’t be injecting 85 billion a month to gas the bond market. The interest rate wouldn’t be so low. My home wouldn’t be worth twice what it’s really worth just so my township/municipality could collect twice the property taxes to insure those bonds are payed off. It appears bankers are willing give up interest earned on loans and 85 billion a month to insure the bond market doesn’t collapse. Today I notice if a town isn’t filling bankruptcy then they are voting for more bonds that these banks are still issuing .

Today people listen to Paul Krugman and Stimulus , bailouts , Qe’s . We haven’t seen the bottom. Our chickenshit leaders believe they can edge over it because they talked us out of your and my money, i.e. “Too big to fail”.More like “Too chicken to find out”. Edging over the bottom in my opinion is the bridge to nowhere.

Notice of defaults on home loans became a caution in the wind I noticed in the summer 2006. That is 5 years before 2011. Where would a bottom calculation rest without Bailouts, Stimulus, Qe’s ? My guess would of been a bottom in the winter of 2008/2009 + 11 equals 2019. So my next bottom is your next top ? As well you ignore 5 of your 7/ 12 years. I’ll add your overlooked 5 years . Your top now rests at 2023. All you cows begin selling in 2021/2022 ?

You’re applying 50 years of past performance calculations where we had no Bailouts, Stimulus, or Qe’s. My old cyclical number ( which never had a bass in reality in the first place) is out the window. Good luck my friend with your cyclical calculation.

At Ronnie:

You summed up everything in one sentence: “If the market was bonkers the Fed wouldn’t be injecting 85 billion a month to gas the bond market. The interest rate wouldn’t be so low.” If everything was great, the govt wouldn’t care about the market or the interest rates.

The market is rising on extremely low volume. A danger sign. It’s a bounce. It probably has another year or so in it. But the “tell” will be to get out as the market prices get within about 10% to 20% of the high. Shadow inventory could be lurking to dump as soon as they can.

But thats where we are right now, if prices rise another 10-20% in socal, prices will be at or above the height of the bubble.

What happens when mortgage rates go up 2 % known as 200 basis points? Then what happens when they go up 300, then 400 basis points? Where are the buyers for the 65 % of the financed market, and to whom does one sell at this higher cost of money? CA timing is great, but as a trader you know that the cost of money influences prospective sales prices. You are ready to fold ’em when rates go up. Many buyers are not so aware. They are the ones who get slaughtered either in the housing or stock markets. Example: fed rates on 10 year paper go up 300 basis points; what happens to the pice of a 10 fed bond? It drops like a stone. What happens to the price of an IBM corporate bond? Drops like a rock. What happens to a stock like Walmart that pays a big dividend? It drops. What happens to CA real estate in the same scenario? It drops. No financed buyers will buy at the same prices as today. Traders, flippers, know this. Their discipline is to hold as short as possible. I applaud traders, but, longer term, CA is doomed by taxes and defaults. Even higher taxes are coming. The feds are going to tax retirement accounts, so is CA. CA is going to implode even more as schools close, etc. Suburban communities will not be immune because of education and pension liabilities. So, longer term, CA’s real estate will go the route of Greece. Malibu and Irvine will be surrounded by implosion and they will be forced to pay for the rest of the area schools, etc. Here comes Greece. The only people buying real estrate in Greece are foreign investors. They use cash. Sound familiar? Keep trading. But explain that a trader never holds a position except for the shortest time possible.

Totally disagree! This housing bubble will bust much sooner! The reason being that these foreign investors and local cash buyers will soon dry up leaving a flood of inventory that is being created right now to play catch-up. Don’t forget these foreign investors are being given incentives such as getting their “Green Card” if they invest a certain amount in the U.S. The local middle class population cannot compete with that. If you do a little research you will see that most of the purchases are for mid-range homes, because investors (whether foreign or local cash buyers) are in it for the beef. The either flip these homes or use them as rentals to generate income. Not many of the upper-scale homes are being sold right now because investors cannot flip or rent these. Once the more expensive homes bring their prices down in order to sell, what do you think is going to happen to the regular home sales? BOOM – all over again. No way will this last even till 2015! This bubble is going to bust much much sooner – mark my words!

I’m noticing a ton of houses hitting the market in Laguna Niguel. I guess everyone is trying to take advantage of the spike up in prices over the last year. I think I am already seeing sale prices start to come down again and by early next year, they will be quite a bit lower than they are today. This was that last hoorah for home pices.

One thing that pissed me off though is that the news is reporting that Obama is pushing the banks to start giving more loans to high risk borrowers…… and the kicker…… he is assuring the banks that the banks will not be held accountable when those loans go belly up.

I would be careful about the “owner occupied” status of homes because I know that many people lie and say they are getting the mortgage as “owner occupied” in order to get a better deal on the loan. So that number is probably higher than the reality.

This summer will be interesting. As the prices climb many people may want to sell their homes that have been underwater for the last 5 years. Same reason stock prices meet upper limit resistance. Too many people got in at the top and now they see a chance to get out.

I fail to see what’s so great about Irvine, it’s just another generic planned community but for some reason people think it’s such a great place, to each his own I guess.

This is simple supply and demand. The supply is so tight it is forcing the higher prices. Once supply returns to the market the prices will fall. Also, foreign buyers and institutions are not as price conscious as the person buying the home is not price conscious as a future owner occupied homeowner would be.

However, Irvine is a great place to live. It’s a planned community and they do a good job of keeping the demand and prices high to keep out the unwanted members of the community. Just a few blocks away with the same weather and easy commute is Santa Ana, I don’t see that area getting out of control.

I personally think Irvine is protected unless out entire economy goes bad, and that’s not happening.

Irvine is known as the “move up” city for many Asian-Americans. typically Asian families started out in the early 70’s in Garden Grove/Westminster (e.g. poorer refugees, aka, “Boat People”) then their emerging “middle-class” w/ many small-business owners “moved up” to buy new homes in Fountain Valley/Huntington Beach in late 70’s-90’s. So currently, many of these “Successful” children of these earlier Asian-American immigrant, upper middle-class families now desire to buy brand new (no evil spirits) “upscale homes” in Borvine mostly during the early 00’s up to the present b/c Irvine currently offers the most top-scoring public elementary, middle, and high schools & a world-famous university (i.e. UCI) in all of the OC.

Their educationally “Gifted” children or grand-children will be subsequently surrounded by other high-achieving, academically motivated peers which indirectly creates a healthy competition among the various Irvine neighborhoods. The plethora of “new homes” along w/ the outstanding school district is very enticing to the Asian-American community which explains why many of the current RE developers cater to this large demographic. Even the local businesses such as the newly built hospital utilized Asian “Feng Shui” Consultants to respect & meet ALL of their Asian patient’s needs.

Also, many foreign student’s families from China & other prominent Asian countries buy in Irvine to capitalize on their children’s education, as well as, to park their money in a “safe investment” that can house the entire extended-family when they come for visits. It’s viewed as a “safe investment” b/c they can easily sell their “investment home” to other wealthy foreign Asian families for THEIR children’s future education.

Also, UCI makes bank on all these foreign student’s “Out of State” tuition fees compared to the “In-State” & OC “local” students (which btw. pay much, MUCH, less tuition & whom coined UCI as the “University of Chinese Immigrants” waaaay back in the early 90’s. So, UCI has, and always will cater to this lucrative “foreign student” demographic to fund their highly-paid University Administration Staff & Phd. Research Professors.

PS. If you’re thinking of buying a home, or just driving through “Borvine”, be extremely cautious of the many older Asian women whom should never have even passed the “CA Driver’s Exam”. I guess the DMV needs to pass anyone with a pulse to fund their jobs as well…

Your funny but quasi-racist depiction of Asians in the OC sounds like the American Dream come to life, with the perfect play of “educational upward mobility,” “melting pot excellence,” “bootstrap capitalism,” and “family values.” Why the resentment?

Yes, beware of the white Camry’s driven by white-gloved, mask-wearing elderly Asian ladies AND the TRD-inspired pocket-rockets driven by their grandsons.

Camry? That’s too cheap. Just went on a run in a very nice neighborhood where houses rarely go on sale. Mainly because this particular area is old money. Most of the people living in this area have done so for decades. A house that had been for sale for maybe two months finally sold for 925k. I saw a young asian couple (I doubt much older than 30) moving in. Both were driving new Mercedes SUV’s. Will this end? Of cours it will. But the timing is the hard part if you are trying to make any money on the downturn. Get that timing right and you will retire much sooner rather than later.

“Old money” and “925K”…umm, no. A tract house in Irvine?

In the last eight months the Japanese Yen has gone from 75 to 100 to the dollar. The Venezuelan Bolivar is “worth” 6.5 to dollar but you cannot get a dollar for under 23 to one unless you are connected. The Argentine peso is “officially” worth 5.6 to the dollar but the black market, the only dollars available, is 8.4. There is a worldwide race to debase currencies. Now that interest rates of zero have not worked, this is all that is left other than dropping money out of the sky. Should this be an red flag that just maybe things are really falling apart? And, to see real desperation, in Venezuela you can go to jail for seven years for merely mentioning the term black market dollars. And, Obama is talking about putting a cap on retirement income of $200,00 funded through an IRA. No, there is no crisis of solvency or debt, just swim happily up that stream.

And, this obviously has had an effect on the West Coast real estate and South Florida. However, if the dollar remains relatively strong, this will weaken the market for foreign buyers using devalued home currency. However, if you were Japanese, you already made 25% right out of the box.

It has occurred to me that some very wealthy people may see owning investment real estate as a way to diversify out of currency and avoid capital controls, confiscation, inflation, etc…hard assets that are owned by the majority may be a safer play for them.

Definitely and its not just wealthy investors. Its clear that the fed and obama at the core are really just devaluing our currency to increase domestic and foreign purchases of US (and now Japanese), so non-wealthy ‘idiots’ holding US dollars in their bank accounts that dont own a primary residence need to think similarly. I’m one of those ‘idiot” renters and one of my biggest reasons for wanting to buy is because my US dollars in my bank are only becoming more worthless by the day so locking in fixed mortgage payments is enticing, esp with wages not rising, and other asset classes experiencing bubbles/being risky. Big Ben is putting the squeeze on HARD to those who have saved and played by the rules and causing complete misallocations of capital into risky investments.

That being said, there is just nothing to buy in studio city or LA proper worth buying. Check redfin for the past few weeks. Its crazy how few homes have come out for a city this large. Miami And florida In general is frothy already. I’m from NJ and tha state is high income and property taxes as hurricane issues linger, plus houses are now back to pre-recession levels in many areas (northern/closer to NYC), so that’s less tha ideal. Is Texas the answer? Other cool cities in CA? Where to live if you work from home with your wife and dog and make good/not richie rich type money and in an ideal world you can avoid the cold?

Partially true but too many people view these things as an “all in” or safe play. Housing is not a safe play to put all your eggs in and protect them. Risks include increased taxation, interest rates rising, and increased carrying costs with potentially flat rent eating away yield. That said there are scenarios that do make this attractive and can work out.

If there is one thing everyone can agree on (or most everyone) it is that the probability distribution of future outcomes is as wide or wider than any of us has seen it. A huge all in bet is a bad idea as there is no safe asset (never was either but much less so now) but a diversified portfolio can certainly increasing your chances of protecting your wealth, maybe earning a decent return (home runs require outsized bets so settle for singles and doubles), and stacking your odds against a horrendous outcome (which is key for someone with substantial wealth).

What do people think about the Gov dipping into our 401k’s during the next market crash?

http://market-ticker.org/akcs-www?post=219536

Watchout fellow Bubblers. Looks like HUD is up to shenanigans again. It seems HUD is afraid to report claim losses anymore.

What is HUD Hiding Now!

Those who frequent HUD’s Reading Room may be noticing as I have that HUD is no longer delivering claim and delinquency reports.

http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/hsgrroom

I review the monthly reports (Outlook and Monthly Report) to check on delinquency and claim data. It seems HUD has stopped providing these reports and instead has posted the following message:

Note: Readers of the FHA Outlook Reports and the Monthly Reports to the FHA Commissioner should be aware that HUD will be updating data and formats in the coming months. These changes are intended to improve delivery and presentation of FHA business trend information. The existing reports will continue to be posted here while the new reports are under development. Thank you for your patience during this time of transition. (emphasis added)

But not only has HUD stopped those two reports but HUD, the bank-captured U.S. agency, is late delivering the Quarterly MMIF Insurance Fund Reports to Congress. The 2012 Q4 report is more than TWO months overdue and now the 2013 Q1 report is two weeks overdue.

What is HUD Hiding Now?

Quarterly Report to Congress on FHA Single-Family Mutual Mortgage Insurance Fund Programs

This report is in fulfillment of the requirement under section 2118 of the Housing and Economic Recovery Act of 2008 (12 USC 1708(a)(5)) that HUD report to the Congress on a quarterly basis respecting mortgages that are an obligation of the Mutual Mortgage Insurance Fund. HUD uses this report to provide public information on new endorsement activity, delinquency, claim and prepayment rate trends, and financial information on core insurance operations.

2013 – Quarter 1, not available 14 days past last years’ delivery date of Q1 report

2012 – Quarter 4, not available 68 days past last years’ delivery date of Q4 report

2012 – Quarter 3, delivered 09-07-12

2012 – Quarter 2, delivered 05-21-12

2012 – Quarter 1, delivered 03-26-12

2011 – Quarter 4, delivered 01-31-12

2011 – Quarter 3, delivered 09-30-11

2011 – Quarter 2, delivered 06-27-11

2011 – Quarter 1, delivered 03-17-11

2010 – Quarter 4, delivered 11-04-10

2010 – Quarter 3, delivered 08-02-10

2010 – Quarter 2, delivered – not shown – pdf file dated 05-13-10

2010 – Quarter 1, delivered – not shown – pdf file dated 02-26-10

The future is uncertain. Anybody for a Vegas trip?

I visited several new Irvine developments over the weekend, and the large majority of people interested in buying were Chinese. I live in Irvine, and there is a strong sentiment that Chinese have certainly inflated home prices because of their desire to own homes in an area having stellar schools. Question I have is what happens when the Chinese economy goes bust in 8 to 14 months, as many economists predict. I would not be surprised to see homes prices come crashing back to reality. This happened in the early 1980’s when Japan was buying Hawaii, and then things took a turn for the worse with Japan’s economy. Now may not be the time to buy in Irvine. I would wait it out; however, interest rates by then will certainly have gone up as well.

Leave a Reply to QE abyss