Irvine real estate and a case study of tightening inventory: A deep analysis on an Orange County city trafficked by foreign money, flippers, and families getting outbid even with PowerPoint presentations.

The housing market is continuing the trend from 2012 with home sales picking up and inventory disappearing into the sunset. Today I wanted to dig deep into a high in demand area in Orange County, Irvine. What is useful about this market is that it has a little bit of everything including flippers, foreign money buyers, big money investors, and families looking to buy. What is incredible is how deep inventory has declined in this and many other similar markets. A big city like Irvine also gives us solid Census data to dig into to examine incomes and housing demographics. What is interesting is that the low inventory is adding a tremendous amount of pressure creating a sense that we are back to the early 2000s. Looking at sales figures shows another interesting side to the current housing market.

Irvine case study of disappearing inventory

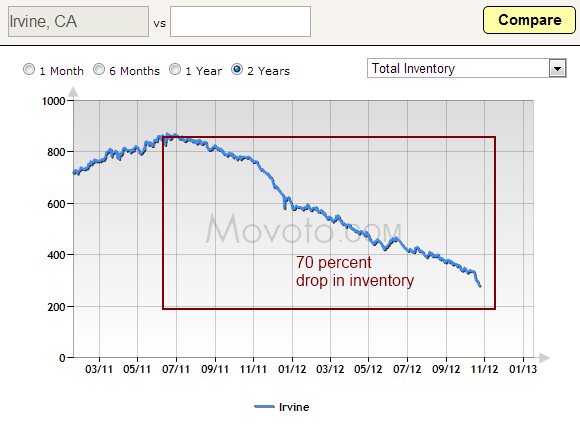

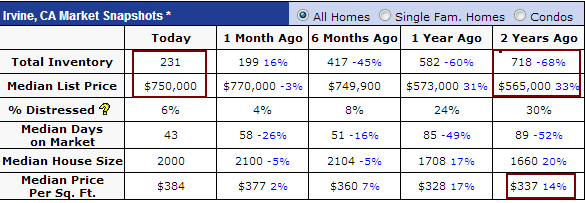

The first chart I wanted to examine is total inventory over the last two years:

Inventory available for sale in Irvine has fallen by a stunning 70 percent. This big decline in inventory coupled with low rates and investor demand has pushed prices back up:

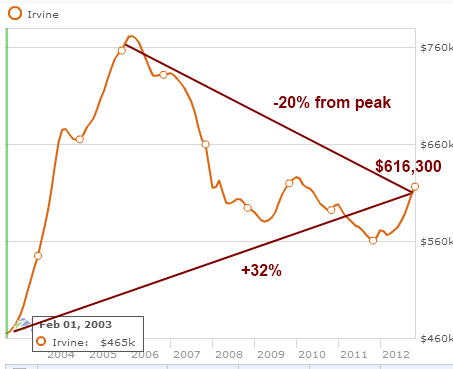

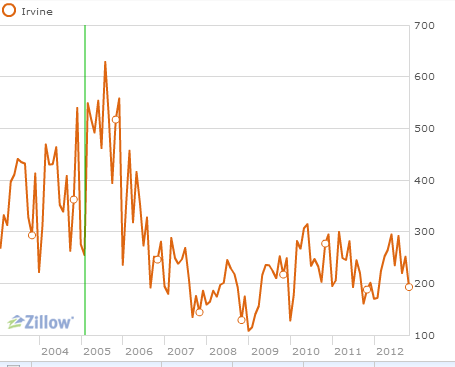

Down by 20 percent from the peak but up 32 percent from 2003. What is more pronounced here is the lack of housing coming onto the market for sale. When we look at sales volume, we see a jump from the bottom but in context, we realize that most of the pressure is coming from the supply side:

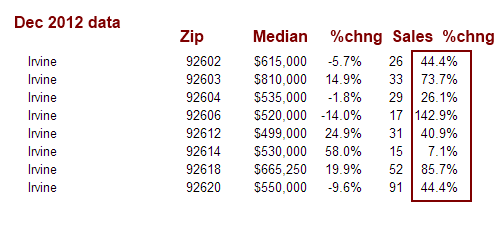

In 2005 there was a month with over 600 sales. Today we are at roughly 290. Of course when compared to the last few years you will see a massive jump upwards in Irvine:

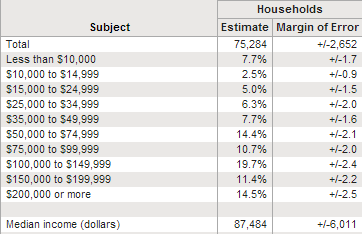

The dynamic is interesting when Zillow puts the estimated Irvine home price at around $616,000. Let us look at the latest household income data:

The median household income in Irvine is $87,484. This would put the ratio of household income to home price at over 7 versus the 3.5 nationwide figures. The cost of living in California has been very high for many years. This is nothing new. But what you have in an area like Irvine is big investor demand.  Many are from outside of the United States. That income does not even show up in Census data but it certainly adds to the pressure on those few homes that are on the market.

Irvine has 39,015 owner occupied housing units. The latest data shows that 231 homes are for sale with a median list price of $750,000:

At least inventory jumped a bit in the last month from a low of 191. Two years ago it was closer to 800. The number of distressed properties in Irvine is up to 320. Now given that only 231 homes are on the market, this does make a difference.

But why would banks alter their current behavior? The current setup is working well to inflate prices back up without having to worry much about weak income growth. What I find interesting however is that even with sales higher, they are still relatively weak. Why? For one, lending standards are still tighter and believe it or not, you still have to qualify for loans in the market today. This is why you see sales volume being weak. Another possibility is the number of those qualified to buy is still fairly low. This ties into the following trend in the United States:

The middle class has gotten much smaller in the last 40 years. More have been thrown into lower income brackets but also, those in upper-income brackets have increased. In places like California this is much more pronounced. Think of Irvine, a city where the current median list price is above $700,000 yet the typical family pulls in $87,000. Seeing current selling volume at these levels signifies that more of the frenzied action with bidding wars and multiple offer situations is coming from: qualified buyers, foreign money, and cash investors. You think this is a normal market? I’ll leave you with this:

“(OC Register) When Tanya and Patrick Courchaine recently made an offer for $615,000 on a house in Anaheim Hills, they were up against 18 other buyers.

The couple figured they’d have it in the bag. In addition to offering $40,000 over the asking price and a healthy down payment, they went the extra mile to promote themselves – with a PowerPoint slideshow.

They lost to a cash buyer.

“We were very disappointed,” said Tanya Courchaine, 42, an IT operations supervisor. “I convinced myself that with $40,000 over and 20 percent down we were going to get it for sure.”

Bidding wars are raging in Orange County and elsewhere, making home shopping especially frustrating for those seeking properties under $750,000. Low inventory is driving the competition. And homebuyers are going head-to-head against investors, who typically pay cash.

The California Association of Realtors said last month a dramatic shortage of homes for sale in California has created an especially tough market for first-time buyers, with nearly 6 in 10 homes selling with multiple offers.â€

For those seeking properties under $750,000? $40,000 over asking plus a PowerPoint presentation. Welcome to Orange County home buying!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “Irvine real estate and a case study of tightening inventory: A deep analysis on an Orange County city trafficked by foreign money, flippers, and families getting outbid even with PowerPoint presentations.”

LOL

Powerpoint presentation!!

Very darkly funny!

Disturbing really.

It’s like a story at The Onion.

Are you financially responsible? Or are you a young family starting out in life? If the answer to either question is “yes,” get out of California.

There was another interesting article in the OC Register that discussed how some Irvine RE agents escort their Chinese “all cash” clients from LAX to preview their listings for their “American college” bound children. These Asian “investor families” typically buy larger houses as long term “safe” investments, and the family can come stay for… “Me love you long time” visit.

BTW, UCI has been appropriately coined the “University of Chinese Immigrants” by the young OC crowd since the early 1990’s when it was also known as the “University of Customized Integras!”

“Me Love You Long Time?” Really?

Not so good about being subtle with your racism, eh?

I bet the PowerPoint didn’t mention a commitment to feed the squirrels.

Their bad…

Thank you for a thought provoking writing.is it possible that we will look back at the current situation and realize that what we were observing was the beginning of the Great Inflation ?

Any thoughts ?

The easiest markets to effect or manipulate are the ones with very small inventory.

Until prices rise to a level where all the underwater homes would be able to sell without a loss or short sale, inventory will probably stay very low.

Let’s look at the truth and not call it racial or prejudice! This is a very sad and an awful situation for our home buyers who are trying to purchase a home to live in for their families. Added to this , I think we should also look at this…our manufacturing has gone to China. The Chinese are accumulating great wealth and are arrivine in Orange County with fist fulls of cash and are not only driving up prices, making it difficult for our home buyers, but are buying out our country and we just say “come on take it” Too bad our country allows this..we are really ignorant and our government is not protecting us. This is what the elected officials are assigned to do. This is very very very sad and

This is part of the bill coming due for the past couple of decades’ worth of economic liberalization that we were feasting on.

The bill is being paid for with our standard of living. This is a simple explanation but in reality the mechanisms that led to the current reality are extremely complex. Racial and cultural components do exist although special interests tend to spin these things beyond honest assessments.

I agree that it’s sad. Capable, driven, intelligent, and hard working young people are getting the shaft on this deal.

Lotsa cheap beanie baby for you. Now I buy your house 🙂

Reminds me of the late 1980’s when the Japanese were buying American real estate at over inflated prices. Well look what happen to them 20 some years later…The MOTHER of all bubbles has not happen yet.

It is always disappointing when “outsiders” come from a more affluent background and come to one’s community and immediately start out at the top of the food chain so to speak. I have lived in many communities where the Californians sold their average $700k house and moved into that community where the average house price was $100k – and built some $700k monstrosity. It is frustrating for those who have been there their whole lives – but that’s just the way it is. Likewise, with the Chinese, we have exploited their labor markets and lack of environmental and labor regulations for decades – in fact they have largely propped up our entire economy for as long as anyone can remember. It is then a bit repugnant to complain about the Chinese who have become more successful than you or I. This iPad I am typing on, and my ability to afford to purchase it, is largely due to our manufacturing relationship to China. Don’t complain when the golden goose craps on your lawn.

Agreed – and two of my friends have close relatives who have lived for over three decades in China, and both are coming home shortly, due to unease over that country’s near – term future. There are widespread riots in the countryside which no one hears about because of the Communist party’s effective news censorship; there are also newly – built cities that are virtual ghost towns due to their entire existence based on state – run oligopolies, and the one – party corruption’s bill is finally coming due. Their looming economic crisis will be bad news indeed for the rest of the world.

Exactly what I was thinking. How often have Americans waltzed into a poor country and snapped up a mansion? Considering that we have consumed on the backs of foreign peasants for all this time it was bound to bite us in the ass eventually. I’m part of the 30-something generation, no wage growth, two kids. Unfortunately for me my husbands parents died and left us a house, we then sold it and bought in CA last year. But we are an exception. I would trade it back for his parents though.

I have to live in Orange County as its my place of employment ….half of my co-workers have purchased homes in the Inland Empire they leave for work at 5:00 a.m to be to work at 8:00 do not get to see their children in the morning ….they leave the office at 5:00 p.m get ho

e at 8:00 just in time to tuck their young ones into bed….what kind of life is that? I would rather be strapped for cash and broke having dinner and watching a movie with my family after burning one….LOL…I guess my family will live and die in the county of dreams Orange County California baby.

I know people who live a good amount of their day on the 91 freeway due to what you commented on.

To what degree does the physical, emotional, and mental cost of these commutes factor?

It seems that one would be better off living closer to work, which would cut the gas expense, and getting a second part-time job, than to live a 3 hour commute away.

HaHaHa…..Seriously. “The couple figured they’d have it in the bag. In addition to offering $40,000 over the asking price and a healthy down payment, they went the extra mile to promote themselves – with a PowerPoint slideshow.”

Sounds as rational as a presentation of your wunderkind’s abilities for the director of a $15k a year pre-kinder. BUY! BUY! BUY! and instant gratify.

Tragic.

Yes, I rather thought it sounded like they thought they were adopting a baby rather than buying a house.

I think the author of the article’s hope was to convey the sense that there are still people out there seeing buying a home as something more than a ruthless financial transaction.

But I think all the article accomplished was to showcase naivety & a pretentious attitude of entitlement.

Either way, it’s a sad commentary on our times.

Now that the Fed’s 2007 FOMC minutes are available for consumption, I wonder how many of these leveraged buyers would feel about the idea which has been commented here that if you can’t beat the Fed, then join them.

Straight from the horse’s mouth – http://www.federalreserve.gov/monetarypolicy/fomchistorical2007.htm

I read about this on Beat the Press where it was mentioned that it’s likely over 1,000 pages.

I’ve read maybe 100 books on this general topic over the past 4 years, but I have to draw the line somewhere.

LOL

Somebody do let me know if there’s anything in particular entertaining (include page #s). ha ha

I try really hard to understand why the inventory is so remarkably low, and I am not sure I know the answer. The epicenter of the crisis is the bank, and I think it is still the bank. But Fed buys all kinds of MBS, and Fannie and Freddie buy all kinds of mortgages. When I get a mortgage to buy a house, my mortgage goes into a pool to be packed as MBS, which will be bought by the Fed Reserve. The banks are being paid for the mortgage and I think the banks have service right to collect the monthly payment. Since the bank has been paid, and if i stop payment, and the house got foreclosed, the loss is at the Fed Reserve, not local bank. Fed Reserve cannot go broke, and loss or gain doesn’t matter. So if I stop my payment, the house can sit there without getting foreclosed for long long time. If this is true, the bank doesn’t have any incentive to foreclose anyone anymore.

Is this making any sense? I don’t understand how a trillion MBS on Fed balance sheet works. Where is the note, if Fed owns the MBS? I just feel this is complicated, and all we see is bidding war on a house, but we don’t have any idea how the system works. Sorry for the PowerPoint couple. Any individual buying a house is against invisible powerful forces that are trying to keep price higher.

If someone knows better can provide some insight, it will be much appreciated.

You’re not far off Pete. Here’s my understanding. A lot depends on the value of the loan. If the loan is a conventional Fannie Mae loan (which most are) Fannie Mae will hold the note and issue the MBS which will be sold to the market. The Federal Reserve is the largest purchaser of MBS from Fannie Mae.

You’re local bank makes a fee for issuing the loan. They may or may not service the loan. There are a lot of mortgage servicing companies that are independent.

If you choose to default, they will definitely foreclose on you and you most likely won’t be offered the bail out programs that were offered to people over the past five years. Those programs like Hamp etc. are going to wind down over the next year or so.

As for Fannie and Freddie, they will most likely change their role in the housing market since the FHA (which insures their loans) has been losing billions of dollars on bad loans.

Currently, it a complicated process. In time that may change.

All I know is that I bought some Bank of America stock when it was cheap a little over a year ago, and it’s my best performing stock of 2012.

There’s a new guy where I work. He is Chinese. He moved here from Irvine. I asked him why he moved from such nice weather, good schools, etc. He said, “There’s too many Chinese there.”

It’s a strange world.

I can kind of understand that. If I went to stay in another country with say the purpose of learning to speak the language fluently, and then my neighborhood filled up with English speaking people…

Or if the person had come to the U.S. with a dream of American culture & speaking English, and then their neighborhood becomes just like back home, it might defeat the purpose they had.

I don’t know if that’s what your co-worker’s motivation is, of course. I’m just saying I could see this as a likely possibility for some.

It’s a race to the greatest fools holding the bag!

People in the inland empire are dumb. By the time they spend money in gas car maintenence, and toll roads, it’s cheaper to buy or rent in orange county. The best thing you can do finance and lifestyle wise is to live the closest you can to your work. That means renting.

I read this blog religiously… And all I’m really getting from it is that middle class families (i.e my family) are getting pushed out by big money from domestic and abroad. They should re-title this blog to “Don’t Hate the Player, Hate the Game..” I get it, it sucks… We’ve lost out on 2 houses ourselves to higher offers…

But you know what doesn’t suck… Waking up to 78Ëš weather on Jan. 18th.

Amen Robin!

Just like Greenspan, who kept low interest rates very low for a extended period of time after 9-11, worrying that the blow to our economy dictated keeping them low. the Feds form they have unintended consequences.

It would not surprised me if the Fed and regulators are working hard to push the too big to fail banks to bring new REO’s market…. and FAST other wise lack of volume will not do the trick that Bernanke wants…VELOCITY of money to pick up(house, furniture, construction improvements etc.) and a true recovery can work its course..

The reason the inventory does not reflect reality is that the banks are bust. Under any normal accounting standards they would be closed down because their reserves are wiped out. This is being forestalled by ponzi accounting, allowing banks to carry loans at phony values for years that do not match market values. The Fed is desperately attempting to reflate the real estate market and has found some success in California for a variety of reasons previously discussed on this forum. However, the vast majority of US real estate has not and will not be reflated for a very long time. In short, California is Madoff real estate. You better hope you are not the last one holding the bag when the inevitable collapse comes. By the way, most people do not know that Madoff was CHAIRMAN OF THE NASDAQ at one time. He was Wall St., not some yahoo, snake oil salesman. If you think it is still not going on, please Google “Geithner Leak” and Libor fraud. The only way to protect yourself is to not become a debt slave. But, go ahead and take on a $600,000 mortgage, no problema. You will be very sorry you did.

I think if you check the Case-Shiller index you will see that well over half the real estate markets in the US are now in an up trend. Certainly the South west is up.

I think one thing everyone must keep in mind is that as the mortgage interest rate moves towards ZIRP, there’s no where else to go. If employment does not pick-up from this house price rise, which I don’t think it will, then the ZIRP mortgage rate policy will run out of gas rather quickly as those that can buy do so and then there’s no one else left to buy more houses.

Of course Irvine is corporate headquarters for many corporations so that skews everything about it. NOT a normal city in any way.

Banking today is a continuing criminal enterprise as we all should know. THAT is why it is hard to figure out….we are too honest to understand the criminal banking system. Look at HSBC…”too big to jail” for aiding and abetting the drug cartels and the terrorists! WF, BofA, Citi …..all corrupt to the core, don’t kid yourself.

The consumer will once again be left holding the bag, as soon as the banks clear the inventory, the rates will rise, driving down the value of real estate. Secondly, we are now in a cycle of less of everything, (food, water, resources) this makes an unstable and unpredictable future. How soon before the next large boot drops?

People want a bigger and backyard tha’s why they moved to the inland empire. There are smaller houses or condos in South OC that are not bad areas.

Well, Irvine face some white flight or slower growth among whties because it is more expensive than many south county towns. Its different than the North County which changed because of a lot of Hispanics. The foreign asians in the case of Irvine have the bucks different from Westminster.

Well, Irvine in the 2000’s grew more in total number than in the 1990’s. I believe in 2000 it was only a little over 140,000 to maybe 212,000 to 220,000 depending upon whether you are using the US census whch undestimated its growth by giving it the county average or California Finance Department which usually give the city a higher populaiton. A look of people from Taiwan and Mainland China which are the foreign cash buyers and the many from Taiwan had came out of LA county looking for a new city than the La county asian cities.

The more middle class asian in Irvine has other family members live in the same house in order to addord the house different from the wealthy foreign cash buyers.

Lastly, the Sac Bee had an article on how legal immirgantion to California swtiched from being more Hispanic in 2001 to more Asian by 2011. Irvine’s growth rate parellals this it grew more as mention above in total numbers during the 2000’s. In the 1980’s Santa Ana grew about 90,000 while losing its white population. In the 1990’s Anaheim grew about 60,000. In the 2000’s Irvine grows over 60,000. This shows the changed of the immirgant trend that Sac Bee is talking about. In the earlier period a lot more Hispanic immirgants in the current period starting by 2008 a shift to Asian immirgants.

Legal vs illegal makes sense because: Asians come from communist countries, and used to filling out tons of paperwork, oppression & red tape, vs the Latin Americas are fine flying under the radar.

What’s wrong with foreign money coming into the United States? From an Economics point of view, this is a net positive for the country. The foreigners consume products in the United States which create jobs. They bring in capital from another country which increases the wealth of the nation.

Yes, there are losers in the economic scenario, namely the people competing for the economic good that the foreign money spends on (in this case, housing). However, if history is any guide, if one overpays for an asset, they get burned later on (Japanese investment in office buildings in the 80’s and 90’s as well as the mid 2000 American mania in housing). The people who plan properly can buy up the asset for cheap after the crash.

Of course, that assumes they are overpaying for the asset. In my personal opinion, the purchase prices for the homes are reasonable due to the low interest rates. Specifically, the investors can make positive cash flow by renting out the asset. For people waiting for a crash, I suggest you don’t hold your breath. If you really want to buy a home, look at some other nearby community.

So, foreign money coming into America is good for the economy overall, unless you’re talking about prospective So Cal home buyers who happen to be in the way of (possibly) decades of boatloads of Chinese Walmart bucks flooding the RE market? I feel so much better, thanks!

And, the assumption is that most of the hot Chinese money is paying cash, where your argument about the asset not being overpriced due to low interest rates, falls rather flat.

@ DFresh and Joe,

Also, don’t discount the owner opening a line of credit after purchasing the home. That effectively works out the same as leveraging (slightly higher interest).

But just the same, I’m waiting for your take as to whether home prices in Irvine are reasonable or not, and specifically why, with some basic conceptual analysis. What will make the Irvine home prices drop to the levels you think it will drop to, and when.

Does it also bother you that the typical Italian and German cannot afford the Ferrari and Mercedes Benz they build and send over here and to the mid-Eastern customer?

“the purchase prices for the homes are reasonable due to the low interest rates”

Really? There are no other factors to consider?

@ DFresh and Joe,

How about you offer your insight instead of throwing peanuts from the peanut gallery. I’m listening.

Is that all you got – peanut gallery? In case you weren’t aware, that’s what comment forums are. You could be putting your efforts toward a blog of your own with comments turned off. Be sure to let us know what the URL is.

By the way, you never answered the question.

@ Dmac,

Nice … the confessed liar (supposed 9 million shadow inventory) and self appointed President of the group think club makes a childish accusation.

Good job. You represent your title well.

@ Sarah,

By the way, if you want proof, I am willing to provide. If you live in LA, we should have coffee some time. I’ll give you my name, driver’s license, properties I owned, sold, and purchased over time. The information can be cross referenced against the Los Angeles County Assessor’s website (For fact checking). In return, I expect the same information from you (verifiable identification). With the information exchange, it should be understood the respect for mutual privacy (no publishing in the web or anywhere else).

One last condition … please leave your hate behind.

This is rich. A few articles ago pugtv said:

“Let’s see … I have a Masters in Finance from a top 10 Finance institution in this country, and I’ve been right with respect to my call on the home market over the last 10 yrs … what are your credentials?â€

Then you criticize people for not providing data that can be verified. You talk about your call from 10 years ago. Please provide proof of your call or your credentials even though none of these have anything to do with predicting future trends. If we are claiming credentials and using past predictions as some form of credibility, I rather listen to Dr. Robert Shiller:

Housing Malaise Could Resemble Japan’s Lost Decade

http://www.cnbc.com/id/100388661

Your MO is clear. Whenever someone calls you out, you ask them to do your homework. Obviously with your elite finance degree you can educate us.

“In my personal opinion, the purchase prices for the homes are reasonable due to the low interest rates.â€

That is right, a personal opinion. Care to share some economic evidence suggesting home prices are reasonable in upscale neighborhoods? How about using Irvine as an example with incomes and current home prices.

To Joe, DFresh and Sarah – please don’t feed the troll.

@ Sarah.

I answered your previous comments, and asked you a follow up question. You declined to answer. Now you selectively hit and run because you are afraid of a full conversation.

So what should I do now? Answer your question, and have you hide until the next time it’s good for you to hit and run again?

It’s a comment forum. Get over it.

I would never live in Irvine. So sterile. No character at all. Gotta be Newport Beach.

just to clue you in: all of OC is wonder bread central

Irvine is one big housing bubble that will burst again. A housing market full of investors is NOT stable. Investors will flee faster than Carl Lewis when the housing market turns. Once the bond market bursts, we will see rates clobber homeowners and then the 2nd housing collapse will ensure.

Recent video on Bloomberg. The surprising part of this is not the entry level buyers or moveup or movedown buyers, but he claims that the ‘boomerang buyers’ (the people who purchased a home 6 or 7 years ago and defaulted) are now qualifying for loans again???? didnt think it would be possible for a defaulter to qualify for a loan again after 4 or 5 years.

http://www.bloomberg.com/video/five-types-of-buyers-rushing-into-housing-market-qqyoKW3LTxuOSI~x24un~A.html

Check out the myfico mortgage forum. A lot of people commenting on how they are doing that very thing.

http://ficoforums.myfico.com/t5/Mortgage-Loans/bd-p/loans

That sucks. If i had not put 20% down in 2005, then proceeded to aggressively pay down my mortgage, and just had put very little down instead, then defaulted, and lived free for a few years, I’d be doing quite well for myself.

Leave a Reply