California and the middle class illusion: California and a state of two extremes.

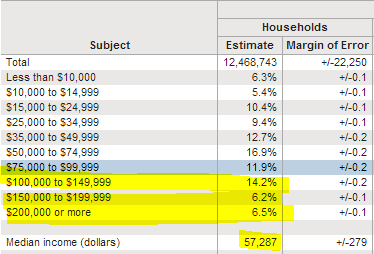

Middle class families in California have faced many challenges over the last few decades. One of those challenges has been the rollercoaster movement of the housing market. What is clear from many readers of this blog is that many are seeking to buy or rent in mid-tier to upper-tier markets. Yet in these markets, even a $100,000 household income is going to put a pinch to a bottom line once housing is factored in. It is also the case that people keep redefining metrics. For example, the middle class by definition is the split between one half of society and the other based on income. The median household income in California is $57,287. By this definition, your typical family simply cannot afford to buy a home in many markets. Yet this isn’t a problem when one out of every three homes is being bought with all cash money from investors, many not even from the state. It should also be no surprise that the homeownership rate in the state continues to decline. Is the middle class dream an illusion in California?

California and household incomes

As we mentioned, the typical California family takes in $57,000:

Source:Â ACS, Census

In other words, half of all households make $57,000 or less. In many areas where people are looking to buy, $100,000 is barely going to get your foot in the door. Roughly 27 percent of households make this much in California. Yet these households are the few that are competing with all cash investor money flooding into the market. Very tight inventory is creating feeding frenzies in many markets. These households would have a solid middle class lifestyle outside of the state in virtually all other parts of the country. Many people are getting a quick reality check on cost of living but also what it is to be at the center of global investor demand. Canada knows this all too well in certain areas.

A $100,000 household income puts you in the top 20 percent of all US households. So this is a solid household income. Yet people in California have illusions of what it means to live a middle class lifestyle. Most people are leveraged to the neck in debt simply to keep up. Seeing people use FHA insured loans for $500,000+ or $600,000+ purchases is out of this world. Remember the above income figures next time you crawl along the freeway and wonder why there are so many new cars on the road.

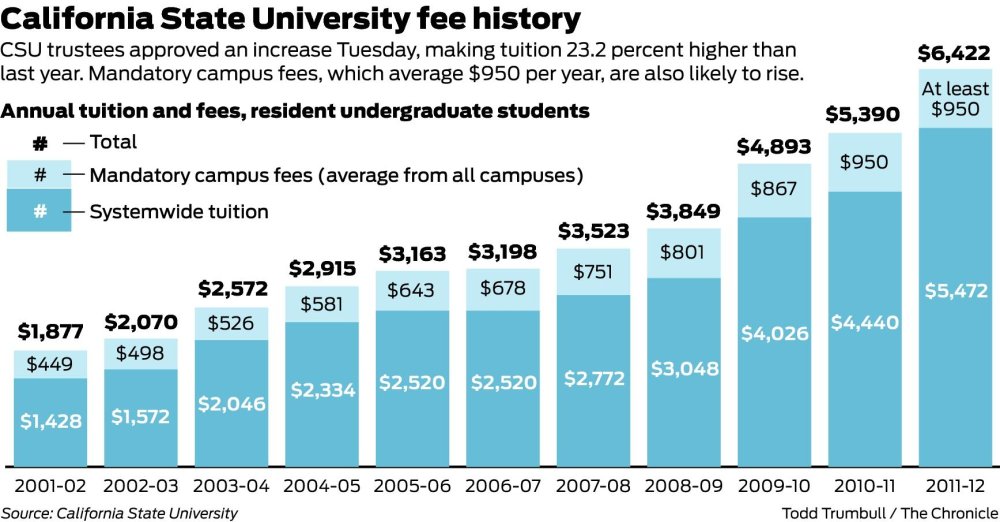

If you do not think there is a squeeze on costs, just look at our California State University system to see how quickly things are changing:

Keep in mind it was $1,400 a year back in 2000. This is also assuming a young student is able to get their required classes. The demand is off the charts:

“(CalState) Through Nov. 30, potential freshmen, transfer, credential and graduate students submitted 763,517 applications for fall 2013 – an increase of 12 percent from last year. Potential students typically submit applications to multiple CSU campuses. The total fall 2013 submissions came from 294,926 individual applicants – an increase of 10 percent from fall 2012.â€

Applications shot up by 10 percent while the population barely moved up. More demand is being placed on the system from those looking for affordable alternatives. This is why even in housing, we are seeing essentially a market driven by FHA insured borrowers and all cash investors.  Your typical move-up middle class buyer is a tiny fraction of this new market. In fact, many of those are the people that lost their homes via foreclosures to investors over the last few years.

What we are seeing in California is much larger than just what is going on in the state. California is a global hotspot. Money is flowing in not only from large New York hedge funds but also, from overseas. Since many of the target locations are not building new housing, more hot money is competing for limited supply. Add into this mix the entire supply crush and you can understand why things are in a mania in many markets.

I’ve heard some say that supply is fine. Really? Take a look at this for example:

Inventory has absolutely collapsed in the last few years. This is the case across many locations including the US, but more dramatic in these California locations. The difference with other parts of the US is that prices there are being driven more by local economics versus global economics (i.e., hedge funds aren’t flooding into Ohio or Nebraska).

Is it possible to live a middle class lifestyle in California? That really depends by what you mean by middle class. By definition $57,000 is mathematically enough for a middle class household income. Yet how far will that get you in certain cities? California is becoming a land of deeper extremes and that is why the homeownership rate is still falling even in the midst of housing mania. What would you consider to be middle class in California?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “California and the middle class illusion: California and a state of two extremes.”

I consider the middle class in CA to be the toughest position to be in, always striving, working 2 and 3 jobs just to be able to eat Frosted Flakes with milk and afford an apartment shared with two roommates. Good luck if you buy a house, the roommates will never end. I sold my CA duplex in ’06 and moved to Las Vegas. No roommates, plenty of cereal, but the terrain is brutal, three changes of clothes every day in the summer, the Mercedes is getting beat up, my knees are killing me – everyplace has stairs, and I’m glad I kept a condo in Long Beach, paid off, it is the Saving Grace…..there is no place like CA and I’ll eat cereal without milk if that’s what it takes!

And that is EXACTLY the reason why I, as a former Expat, dropped a $100K+ job offer from a great company after living in SoCal for four years and returned with my family to our home country. I’d love to be able to afford a living there but this is insane…

Head of the Alameda County is retiring with an annual stipend of over $400,000. per year.

Average worker can’t afford to buy here.

Any clud as to why?

So what OS middle class? That depends on where in CA you live. If it is in the more rural parts then real estate can be more in line with the rest of the country. Average sized homes in Modesto, CA range from $100k – $350k. I expect a median income to be able to afford that without too much trouble.

If you live in the Santa Clara Valley, then they can range from $700k – $2M depending on locality, and your income had better more resemble Bay Area tech median than California median if you want to live there. Even then, the notion of median income is probably a bit muddied because a lot of the housing market may be buoyed by one time stock windfalls rather than year over year salaries. That $750k house starts to look much more affordable if you sink your $500k IPO windfall into a balloon down payment. Other areas like Cupertino seem that they must be in part financed by family money from offshore. Many of our neighbors enjoyed a Nanny and expensive cars on top of the 1.2M house. It was hard to imagine how a single Bay Area salary could afford all that, but there they were! C-suite types live in Los Altos / Saratoga, not Cupertino.

I spent much of the ’80s in grad school in the Palo Alto Area and it was expensive even then. Even though SoCal has its own bubble pricing it’s nothing like the monstrous distortions tech money has wrought in the Bay Area. God help you if you don’t make well into the 6 figure range and have a healthy options/bonus package. I figure I got out just in time – though, in fairness, some of my classmates who stayed cashed in on the tech boom and are living the dream…

This old town’s filled with sin

It will swallow you in

If you’ve got some money to burn

Take it home right away

You’ve got three years to pay

But Satan is waiting his turn

The scientists say

It will all wash away

But we don’t believe any more

‘Cause we’ve got our recruits

And our green mohair suits

So please show your I.D. at the door

This old earthquake’s gonna leave me in the poor house

It seems like this whole town’s insane

On the thirty first floor a gold plated door

Won’t keep out the Lord’s burning rain

“Don’t hate the player, hate the gameâ€

A while back the good Doc HB posted how a buyer in OC submitted a power point presentation with offer to a seller in hopes of influencing the seller to accept their offer and how ridiculous it was. Well, after submitting my offer on a home here in LA, my broker was able to find out that the seller was a 90 year old woman who lived in the custom built house since 1955 and wanted to sell her home to someone she could make a connection with, (she did not want to sell to a profit-oriented flipper). Therefore, my personal letter to the seller definitely helped get our offer accepted even though it was not the highest offer by $5K. [She was free and clear of any debt for many decades and took keen interest in potential buyers, not just dollars]. It helped that my letter indicated that my wife and I intend to live in the house for the rest of our lives, which is the truth.

My imperatives for a first time home owner was to be under $500K in a relatively safe neighborhood, on a quiet street and 15 minutes from the beach on a Saturday morning. And I much preferred an ‘organic sale’ rather than home-depot-flipper. Doc HB suggested to me a while back that if I planned to live in a house for at least 10 years, that it could make sense to buy now. Our kids are off at college, so quality of local schools was not critical. We looked at 13 homes before making our first offer which led to the purchase. The most difficult part of the transaction was not the seller or the listing agent or the buyer agent who represented me, it was the issues between the lender, escrow and appraiser with their miscommunications and paperwork mistakes with each other. And of course the lender hounding me for more and more tax docs, continual salary verifications, and bank statements during the entire process. I guess that is good to weed out unqualified buyers but was exhausting . My advice to first time homebuyers is have 3 years of taxes, bank statements and all financial documents ready before the pre-approval process and don’t make any large purchases of anything until escrow closes.

I am not saying it is a good time to buy for the average joe but I bought a home in Baldwin Vista and there is rent similarity here also: a 3 bedroom, 2 bath home in Baldwin Vista rents for $2200 – $2400 per month. Our Principal + Interest + taxes and home insurance is $2,400 per month. Further my reduction in federal withholding is approximately $700 per month. And the den and bathroom with its own entrance means my wife wont need to rent an office, saving her $300/month. So, our effective payment is less than renting but with homeownership expenses we will probably end up a little higher than renting. It is hard for me to see how purchasing a home helps the ekonomy (except for the bankers and brokers) as we have spent under $10K to make it ready to move in. More on Baldwin Vista area of LA in my next post.

In 2010 many on this blog posited ‘just wait until 2012 when prices really drop’… then in 2011 just wait until 2013 then prices will really crash….etc’ Well, many on this blog now “hope†prices will drop by 20% by 2015. If prices increase 7% per year and I have burned through 2 or 3 years of rent, then not much to gain by waiting until a speculative drop of 15%-20%.

I too fall into the “lucky” camp of middle classes who managed to buy after years of thinking I wouldn’t be able to. We also wanted a “relatively” safe neighborhood near the coast and we settled in San Pedro which has a totally unfounded sketchy reputation. Sure there are bad areas but its more like a little city, not a neighborhood. Regardless we have a MIL suite and share the mortgage burden with my mother so I can stay home with the kids. Our house was $176/sq ft it’s huge and it was 550K. I wanted to say that I really do believe that homeownership helps the economy more than just lenders and brokers. Since purchasing we have paid a contractor to install a separate entrance for my mother, we have replaced our facia because it was leaking behind the stucco and we have replaced 3 of 13 windows. All of that money went to a contractor and to supplies and his workers. Also we purchase paint and I’m even thinking of getting a housekeeper in here every couple of weeks. All the years I rented I didn’t give a crap about the house, I didn’t have pride of ownership and I actually resented the property because of my disdain for the authority of landlords. I think this is the saddest part about all this overseas investment nonsense. Loss of pride of ownership will impact every neighborhood. People of all classes deserve to have a chance to have a home they can invest their blood, sweat and tears in. I love CA and I will never leave but this is just an unfortunate reality these days.

You’re joking right? San Pedro is completely sketchy for very FOUNDED reasons. I lived in RPV for 5 years so I know about the area. I know sketchy too , I went to college at Cal State Dominguez riding public bus in and out of it. San Pedro is a sketchy city and I’m sorry to be realistic with you. FWIW I’m glad you’re happy there.

Unfounded because we all got together and voted on a bad reputation for San Pedro in a plot against the area. That’s sarcasm by the way.

This is a good example of how people in SoCal lower their standards in order to feel comfortable with the set of crummy choices the region offers.

pedro is a fine town. you can live in Torrance or lomita or even hermosa beach,what ever you can afford. me personally i choose rpv for the schools,kids are all grown up, wish i can more back to south shores but can’t find a home i like… as we say around here “if you didn’t buy a home 13 years ago,you missed the boat”

In case anyone in the audience is looking for a house in the $500K range and near the Westside, I offer this info. The home I purchased is 1,700 sqft on 7,000 sqft land for $264/sqft in ‘Baldwin Vista’ (between LaCienega to LaBrea, from Exposition Blvd down to the edge of Kenneth Hahn Park in 90016 zip). I drove the neighborhood at rush hour and late at night and as a life long Santa Monica renter, it met my needs for low traffic, safety and access to the Westside. Baldwin Vista also enjoys a Homeowners Association ($150/yr) with 450 homes that has no tolerance for inoperable vehicles, un-permitted remodels, loitering, homeless or unkempt homes. I think there is good value for the money in Baldwin Vista ($500K range for a 3bd 2 ba) which is about half the price of Culver City, Beverlywood or WLA and 1/3 the price of Venice or SM. An important factor for Baldwin Vista is ‘pride of ownership’ which is obvious in the area. Doc HB has also talked about gentrification in LA. It is easy to find gentrification on the westside, such as the Santa Monica ‘Pico corridor’ area, in Venice, ‘Oakwood’ area, Mar Vista, the ‘Mar Vista Gardens’ area and now and it is happening in 90016 ‘Baldwin Vista’ as well. The last 4 escrows to close in this area were younger, yuppie type buyers.

More info on homes in Baldwin Vista, and Village Green (in case you are looking at condos)

http://losangelesrealestatevoice.com/blog/2011/04/22/baldwin-vista-neighborhood-youve-heard/

http://www.jonamordecor.com/midcentury-motifs/

http://bigorangelandmarks.blogspot.com/2008/08/no-174-village-green.html

Here are examples of homes in Baldwin Vista from $450K-$530K (all sold recently)

http://www.zillow.com/homedetails/5600-Sunlight-Pl-Los-Angeles-CA-90016/20587700_zpid/

http://www.redfin.com/CA/Los-Angeles/5615-Wenlock-St-90016/home/6877352

http://www.zillow.com/homedetails/3424-Alsace-Ave-Los-Angeles-CA-90016/20587408_zpid/

http://www.zillow.com/homedetails/5608-Coliseum-St-Los-Angeles-CA-90016/20577832_zpid/

I also looked at homes in the area of Baldwin View (between LaBrea and Crenshaw, between Exposition and MLK Blvd) and Park Hills Heights but the area did not appeal to me and crime is higher east of LaBrea than West of LaBrea and less ‘pride of ownership’. I also looked at homes in the West Adams area between LaCienega and LaBrea between the 10Fwy and Exposition Blvd but this is clearly a quasi barrio area. And the same strip of homes east of LaBrea towards Crenshaw gets even worse. Lastly, I looked at some areas North of the 10Fwy between LaCienega and LaBrea and there are some streets that were OK but many within earshot of the 10Fwy. But prices climb into the $700K+ range not too far North of Venice Blvd in the 90016. Needless to say I invested a tank of gas or two and many evening hours driving entire grids of 90019 and 90016. As Doc’s post today says, inventory is terrible, due to lack of move up buyers and market manipulation. Good luck to all!

What we need in Calif is called the great equalizier: The Earthquake. It is coming and it will separate the men from the boys when it comes to those that truly want the Calif lifestyle. Some of those LA Condos will be on the ground.

I’m not going to lie, that same thought has crossed my mind numerous times (in terms of an economic and psychological fallout). It’s been too calm for too long.

I too can’t wait for the “Big One” to hit as many CA homeowners do not carry any earthquake insurance (something like 8 out of 10). So there will be many red-tagged fire-sale properties to be bulldozed. Hopefully savvy RE developers will build beautiful newly-improved “in-fill” projects along the coastal “liquefaction zones”. The 1933 Newport/Inglewood Quake shook the hell out Newport/Huntington Beach up past Long Beach destroying many newly built buildings, so anything pre ’72 is probably not going to withstand another “Big One”.

Classy. How about hoping for a recurrence of the black plague or Spanish Flu? or a killer-asteroid. Yeah, that should separate “men from boys.”

For what it’s worth, home prices and rents rebounded higher after Hurricane’s Andrew and Katrina.

Re-entry homeowner here. We paid cash and gutted our adorable and modest one-story forever home. We pray the big one doesn’t hit until our pool gets filled in. We have CEA earthquake insurance $1,000/yr and the first page disclosure states if they run out of money it’s to bad, we’re sol. We’re going private EQ insurance when we can afford it.

Hey uncle veto we dont need any disasters do we? BTW if you notice the damage from earthquakes you will find that most damage is brick buildings and soft-story apartment buildings (buildings where the subterranean or ground floor is a parking lot). It is quite rare for Wood Frame Structures (single family homes) to get much damage other than cracks in walls. I think there have only been 2 quakes in LA that were noteworthy. The Symar quake in 1971 and the Northridge quake in 1991 and neither one caused much damage to single family homes. Most of the damage in both quakes was apartment buildings in the epicenter.

think big! buy in nevada and wait for some beachfront property

And he saith unto me, The waters which thou sawest, where the whore sitteth , are peoples , and multitudes, and nations , and tongues .

California has already fallen into the sea.

I certainly don’t wish for anything like that to happen here in my city, but since the discovery of the Cascadia Subduction Zone (located about 50 miles offshore), the very real possibility exists of a massive earthquake and tsunami to cause major havoc. Even worse, the region has next to no building standards for anything above a mild tremor, so Portland and Seattle will really be in bad shape when it hits.

It’s a different kind of middle class. One that involves either $200k household income, or a long commute. Not much in between.

There is something like 1 million millionaires in CA, so having money is not uncommon here. They get all those prime hillside LA and SF locations. Plus, these days a millionaire really takes about $5 million.

And of course there are the broke arses. Much of CA flatland is filled with struggle. Too many people, not enough sq. ft.

I’m just blessed with a decent job. I’m not one of those “go-getters”, nor am I a Zuckerburg/Jobs/Gates kinda guy. I’ll ride the train til it stops and wont hesitate to leave CA if need be. By no means am I a CA fanboy!

PapaNow

How’s fatherhood? Baby must be a couple months by now. Getting some shut eye or are you going to work in a zombie state?

CA is a huge place. Trying to reduce it down to a “median” or “average” is kind of pointless. Especially when you refer to real estate. Real estate is all local. There are suburbs around Detroit that have very expensive real estate, yet there are many sections of the Detroit that resemble a bombed-out war zone.

Most people must work at an office, so proximity to work is critical and the areas that have higher paying jobs also have more expensive real estate.

The trick to this whole game is to have a secure job/income that is higher than the median for where you can live.

“The trick to this whole game is to have a secure job/income that is higher than the median for where you can live.” And we all know how easy that is and how secure things feel!

I don’t believe using Detroit as an analogy is a particularly apt one – I have friends who live in Grosse Point and Bloomfield Hills, and both areas are going through major agonies regarding RE. The Detroit economy’s collapsed, and the incomes have gone right down the tubes along with it. No amount of gov’t bailout money’s going to fix what’s wrong with the automotive industry there, and that’s the only industry left in the entire region.

Sometimes reading this blog gets me down, but it also comforts me knowing I am not alone in this middle class struggle thing.

Buying a home is something I feel is integral to fully becoming a member of the middle class. I’m not sure why, it may simply be a cultural norm taught to us in decades of television programs. Renting just seems so non-committal and financially foolish. Middle class people are more stable and smart with their money. Having command over one’s own tiny bit of the earth gives us a small measure of control in a world that beats us up every day and gives us little control. There’s a sense of pride and a symbol of self-reliance there. It’s an accomplishment – something that makes the struggle worth it. Poor people live on the scraps others grudgingly give or leave for them. They live where they can, have limited options, lack stability and suffer every day for it. That isn’t how middle class people are supposed to live, but that is where we seem to be heading these days. Grovelling and suffering for work, fighting for admission to college, and competing fiercely with one another to buy scarce real estate.

Interesting article about the coming end of hedge funds buying houses to rent: http://www.zerohedge.com/news/2013-04-03/guest-post-crowded-trade-buy-rent-housing

I’ve seen that the hedgies have been buying in GA, FL, AZ, NV and CA. And they’ve just about scooped up everything that was available at the cash-flow-as-rental market.

Now, I’ve heard the president saying that the govt is going to provide very “reasonable” loans for the poor. So here it is, the purchase has happened, the pump is underway and now all that’s left is the dump. And it looks like the mechanism the enable the dump is just about in place. Love’em or hate’em, you gotta admire their ability to herd the sheeple.

This should no longer be called the housing bubble blog. It’s the new homeownership reality check blog. Read my posts from years ago, I feel vindicated. Everyone spends to much time thinking the average person will get an average home in an average area. Well CA is an above average state as is Hawaii and New York to name a few. And it turns out all of that money from China wasn’t fake after all, people really are sending hordes of cash here to buy homes.

So if you are reading this blog looking for comfort that some day you will be able to afford a great home in CA on your average America income, think again. You are and you forever will be priced out. Once you become above average and make 150K+++ then you can think about joining the average home club in CA.

As for the earthquake comment above, that’s distasteful. It will result in the death of many people and I don’t want blood to be the reason anyone can afford a home. Plus, when they rebuild it will be even more costly to buy. The only reason CA still has affordable housing to rent is because it’s old and most people won’t pay top dollar to rent a dump.

It’s a bit difficult to trust the words from anyone whom predicts never or forever. That’s time tested.

never and forever are realitive to my life. Not from the beginning of time until we get sucked into the sun.

You sound like Robert Toll in 2005. Sooner or later Ben will have to stop injecting $85 billion a month in to the system (buying junk MBS from banks’ balance sheets) trying to keep the market afloat. Prices will then come back to reality and be based on market fundamentals, not Fed manipulations designed to help banks offload houses onto naive buyers.

The median income argument again. Median income means little when LA County has 10m residents and only 5k homes that sold in Feb.

Instead of taking median incomes and comparing it to current home prices, how about we take median incomes of homeowners and compare it to the price that people paid for their home WHEN they actually bought them and see how affordability ratio works out then?

That data is a little hard to source so we can do something similar with rent control which has readily available data. Similar to fixing a long-term housing payment with a mortgage, rent control fixes housing costs long-term.

In NYC (not just Manhattan) median income is about 50k while average rent if you’re looking is about $1375. Unaffordable right? How do people even afford to live there you might ask?

Well, if you live in a rent-controlled apartment the average rent is only $800 a month. A rent-stabilized apartment would cost you $1050.

Same thing happens with housing, especially in areas where LAND (which does not depreciate) makes up the majority the price of a SFH.

I agree that the statewide median income is a completely useless statistic, even though it is a good talking point. What you really need to look at is income of current buyers and then break this down by area. The income of anybody buying in the premium areas won’t anything close to 57K, it will likely be multiples of this. Like somebody else mentioned below, 57K for a family in Socal probably qualifies them for every government assistance program known to man…these people should NOT be buying a house.

The meme of “it’s all about local median incomes” has been the Achilles Heal of the story-lines coming from DHB over the past few years, which has resulted in a serious misreading of the data in the tea leaves. There was also a nonplussed attitude about the influence and impact of wealthy cash buyers, hedge fund investors, foreign buyers, and Prop 65 lottery winners. His focus on California debt (not that big compared to GDP) was an overreach as well, while not recognizing the dynamism of the California economy and the amount of growing wealthy class (1% ers). There were clarion calls regarding “outrageously low” interest rates, which has now been transformed into admission of “incredible” rates. There was no REO/sub-prime/Tsunami.

Turns out the best opportunity for me to “buy the bottom” was when I was ignorant of the market and dating a realtor back in 2009 and she was the listing agent on a 3/1 short-sale Redondo Beach for $375k. Sure, nobody knew what they were doing at the time re: short sales, but my personal relationship put me in the driver’s seat. I wasn’t reading the blog and had no idea where the market was going. Ignorance could have been blissful.

P.S., This blog has been one of my best resource on the economy, finance, demographics, etc. A great, great resource. Just not very predictive, unfortunately.

I don’t see how anyone but the uber-rich chooses to live in California. And I don’t see how the rich can put up with the taxes, save that they are pretty good about sheltering.

Meanwhile, out in flyover America my wife and I just bought a 4,100-square-foot home in a large-lot subdivision (1.5 ac. minimum). We paid $310,000. Our monthly payment, including taxes, insurance and mortgage insurance is less than $1,800. Our subdivision is outside the city, so I do have to drive four miles to work. The local public school is reasonably good; 10 percent of the white students earn National Merit semi-finalist status most years.

How far do you need to drive to have the choice of 50 sushi restaurants? How far for a choice of 10 dim sum restaurants? How far for Chinese bakeries? How for to go skiing? How far to go to the beach? How many days of sunshine a year do you get? Etc….

I have lived in the miserable Midwest. After living in CA never never never again will I live there. I will do what it takes to find the extra 200k for a home in CA. I would gladly move to another place as nice as CA, it just doesn’t exist. At least in the USA.

How many Sushi restaurants do you need? We live in the Hollywood Hills, but we’re considering a move to Indianapolis. I like seasons, and, since we have kids, we can probably only go to one restaurant a week. Plus, Indy has great museums, art walks, good schools, close to Chicago and several other cities, nice people, etc.

I’m not talking about moving to the suburbs outside of Indy. I’m talking about living in town in some of the nicest neighborhoods in the city, and $400K gets you what would be a million and a half plus in our current neighborhood. Heck, I haven’t been to the beach in a year or two, and I like cooler weather, so we’re paying for a lot of perks that we don’t need.

You have go to be kidding me. I’ve lived in the Midwest, and it’s far from miserable.

For a Joe Sixpack like me, the cost of living, schools, people’s attitudes and general entertainment blow everything away out here. Shorter commutes, lower taxes, more jobs available and more peace and quiet are also high on the list.

We all got our reasons, but CA isn’t my “forever home”. It may be Phoenix as I really appreciate the redness of Arizona politics, but other than that it’s Midwest like St. Louis all the way.

GH is spot on. How many sushi joints do you need? Even the most modest of Midwest cities have at least one good place of most food types. And other than that, if it’s not there, it’s the price to pay (well worth it) for lower cost of living.

Snotty pretence such as that is part of what gives SoCal a bad name and feel. Regular people have more to be concerned about when buying a home than how many Asian cuisine dining opportunities are around.

And please, let’s have a reality check. Westside beaches are dirty, crowded, and a pain in the ass to get to. Getting to the limited ski facilities that are within a day trip requires careful planning lest ye want to sit in bumper to bumper traffic. Does a day of sunshine count when it’s covered by a marine layer, fire smoke, or eye watering smog?

SoCal has positives although there’s way too much hubris and not enough honest perspective around the negatives that come with the package.

Maybe it’s not just the Asian cuisine but the Asian people that are appealing…?

It’s all a matter of opinion. I find mid-west types uptight and insufferable. I’ve lived it. That’s why CA is the only place I’ll live in this country. More importantly I like to live in a place where people are from all over and have a broader outlook than just America. You’ve just given up if you move out of the major centres :p

Watched my kids laughing as they ran around on the beach today. Magical memories. My opinion today: CA, worth it.

Tapis, I’m calling BS on your response.

On one hand you narrowly categorize people in a region and in the other you claim to prefer people with a “broader” view.

“Watched my kids laughing as they ran around on the beach today. Magical memories. My opinion today: CA, worth it.”

The suggestion here is: Unless your kids can run around on a beach in CA, the memories have less value.

Tapis, you want to “have a broader outlook than just America”? You are the very virus that is invading this country. Maybe if we had more patriots than tree huggers, the American economy wouldn’t be such a toilet right now.

USA #1

“How far do you need to drive to have the choice of 50 sushi restaurants? How far for a choice of 10 dim sum restaurants? How far for Chinese bakeries? How for to go skiing? How far to go to the beach? How many days of sunshine a year do you get? Etc….”

I don’t have my choice of 50 sushi restaurants, but I can get sushi if I want it, at three or four of the 50 or so restaurants in my town. I don’t ski. I travel a good bit, and am able to afford to because of our lower cost of living. When doing so, I eat at lots of nice restaurants. But we enjoy eating at home. It’s more fun to be at home when you have lots of living space and a big yard. And it costs less.

The California weather beats mine hands down. But there is a limit on how much I’m willing to pay for that. Do you Californians worry about crime? We don’t, really, except for a little property crime from time to time. I allow my 12- and 13-year-old children free rein to go into town on their own whenever they wish. In some places people can’t do that.

Holy shit it’s like talking to neanderthals here sometimes. Call bullshit all you want Joe, the insinuations with that comment was that there are no sushi restaurants in some places because they have no Japanese communities. Asian is actually a pretty broad term. My kid goes to school with kids who are from or whose parents are from Korea, China, Vietnam, Japan and India. They all actually have their own cultures and history so saying ‘Asia’ is not a narrow term. If it pleases you there are also kids from the middle east and south America, England and (this one’s for you Papa) America. From experience I can tell you it is difficult to move to this country and live in a monocultural town.

Jesus, Joe, your answer is in what you quoted. I made sure to say “my opinion” so you girls didn’t get your nickers in a knot. I even added “today” because I know that those kind of days don’t happen everyday here in god’s land (*sarcasm* for those who don’t get it). Having lived land-locked for seven years I really appreciate the beach. Read into it all what you will. I don’t care.

I can only assume Papa is taking the piss. Otherwise he would have moved from CA by now. Us foreigners have been trying to run you Joe Six-packs out for a while now *rolls eyes*

LOL!

What’s the draw of SoCal? Diversity and the Choices it affords SoCal’s residents.

People commonly cite the weather probably because it affects everybody from the ultra-poor homeless to the uber-wealthy living on Broad Beach, but ironically the weather is probably the least diverse part about SoCal.

It’s not necessarily having “50 sushi restaurants” it’s the fact that so many sushi restaurants means there are going to be a lot of good ones. It’s having the choice to eat Dim Sum for breakfast, Ethiopian for lunch and Basque for dinner.

It’s demographic (ethnic/cultural/religious) diversity and the associated neighborhoods. Asian, Armenian, Mexican, Russian, Jewish, Ethiopian etc enclaves all exist in LA. In some neighborhoods it’s like visiting another country where you can’t read any of the street signs. You have the 2nd largest Mormon temple in the world and the largest Buddhist temple in the Western Hemisphere. You can fit in here no matter what race, gender, religion or sexual preference.

It’s geographic diversity. Sure you don’t have the four seasons, but you find the mountains, desert, wetlands, beaches all within a few hours drive. You’ve heard about surfing and skiing on the same day, but you can also go deep-sea fishing and deer hunting in the same day too. (Yeah, it’d be a long day)

It’s economic diversity. It’s not just Hollywood. If a country, LA County would be a within the 25th largest economy. Entertainment, aerospace, engineering, tech, agriculture, finance, manufacturing, tourism, international trade to name a few. I’m sure tourists to LA would be shocked to see the number of oil rigs pumping away. I’m not saying anybody can find a job in LA, but no matter what your occupation or interest it’s probably being done here. Your kids will have the option of thousands of occupations to chose from; this isn’t the case in many areas where the COL is very low.

And finally, to relate it to this blog, there’s diversity in SoCal housing too. You can live in a urban loft in downtown LA, a beach shack in Hermosa, a subdivision in Woodland Hills, a desert trailer near Joshua Tree, or a mountain cabin in Wrightwood. Sure, if you want to be in LA City it’s expensive, but plenty of people live AND work in Hemet for under 40k/year.

If you’re biggest concern is a giant house and you’re satisfied eating in and watching TV all evening for entertainment, I’ll concede, living in LA isn’t a good way to spend your money.

If you’re interested in diversity, I’ll put SoCal up with any other area in the world.

spot on. thanks for the reminder on why i love la. great post.

Listed are many positives with hardly an appropriate reference to the very real negatives that come along with it all.

Albeit the petulant ode to people who want to “sit at home”, only the spin is offered.

Livable wage in SF Bay Area is $250K. Houses under 700K are $700 per sq ft. Houses over $2 million are $450 per sq ft. So the affordable houses are expensive and the expensive houses are selling at a relative discount.

The price per square foot is commonly misunderstood, especially with regard to California home prices. Basically, you have to calculate the lot cost and the house cost separately for it to make sense.

In reasonably nice areas of LA (SF is similar), the lot cost is around $90/sq. ft. The home cost is about $250/sq. ft. This gives you a 2000 sq. ft. home on an 8000 sq. ft. lot for $1.2M and a 4000 sq. ft. home on the same lot for $1.7M. If you used your calculation, the former would be $610/sq. ft. and the latter $430/sq. ft.

livable wage is $250k? Seriously? You need $20k per month to live? What the heck are you doing? A nice rental anywhere but downtown SF is $3k per month. So even if you’re losing half of your check to taxes, you still have 10k per month to live on. I work right next to Google HQ and I do fine on much, much, much less than 250k.

Holy cow. Maybe I am missing something.

I don’t get it either. I know people who make way more than 250k/yr, handle two full-time (nice, desirable) homes, horses, colleges, etc and they’d shit a brick if their monthly expenses went that high on a regular basis.

Of course, these people also drive paid-off Chevy’s and drink cheap Chardonnay. I’ve come to appreciate their selective frugality over the years (but I do prefer a decent Cab).

If a couple’s income is only 58k, 29k a piece, they are big time losers. If each makes 50k(total of 100k), the only difference is that that they are not big time, but still losers(central valley folk, read Fresno or Stockton) The term “middle class” is probably not appropriate. Those 57K and under are the people that Romney was talking about. They don’t pay income tax. They are renters, with a renter’s mentality. Not smart enough to have the responsibility and the self discipline and sacrifice of home ownership. The banks know this, that is why they don’t lend to them.

Let’s face it, to live in a good neighborhood(not great), like Burbank’s average 500k(small old homes) you need a good studio job, 80k a piece. If you work at the studio, commuting east on the 210 to San Bernardino, Rancho to get a cheaper house, it takes hours round trip and eats up the vehicles fast.

But who wants to buy anyway. According to David Stockman’s recent article in the NYTimes we are all going to hell anyway.

Are you being facetious in your first paragraph?

sorry to hear that the “tonight show” is shutting down.maybe now is time to see who is selling.

Not if you are in an employer subsudized vanpool. Closer to $125 a month and the only miles put on the car are to the park n ride lot.

That’s a straw-man response. How many of the vehicles on the freeway during commuting times are vanpools? Hardly any relative to the whole. Obviously it’s not an option that many have or want.

Don’t be a hater Joe. You must be one of the thousands that I pass, that are sitting in the right 3 lanes of the 210 everyday. It’s ok, I’d be mad too. Maybe if you went to college and “got that good job” your employer would pay for your gas too?

Joe’s not a hater. He’s realistic. I’d wager that 90% of the employees in CA do not have a company car/van pool option available to them.

Your assumptions are incorrect but if improperly categorizing and marginalizing someone you don’t know helps you in some way, so be it.

Take it to the personal level all you want, but it would be more useful if you were able to refute the point that I made.

Sorry, it’s not the whole, and I guess I’m blessed. And I make it personal, not to you, but to myself in the fact that if I didn’t have my job (or better) there is no way I’d want to live here.

Papa, understood and your honesty is appreciated.

As with most things in Los Angeles, wealth is an illusion. Anyways before the current market has gone and destroyed any sense of equilibrium, I bet that median income bought a lot more than people are thinking not too far back in history. Aside from Roger Rabbit’s snark, I don’t remember anyone wanting to live in the Valley pre-2000. Those “big time losers” went and bought affordable homes all over the Valley, Hollywood and east, Koreatown, Mid-city, Mar Vista, Highland Park, Atwater, even probably Venice before it became Hipster cool. Those “big time losers” are laughing all the way to the bank as they sell their tiny starter homes to 150k/yr income couples in these areas. There is definitely something to be said if people can’t afford to buy their own house if they had to buy it at current prices.

Income is definitely an illusion in LA. Family wealth is a little more real in many areas, unfotunately. The potential problem with the folks in your example that bought a while ago is that they often don’t sell/cash-in anyway because of replacement costs (do they really want to move even further out?), the fact that they’ve taken out equity from the home during the boom and/or they have kids/grandkids who can’t afford to live elsewhere and are waiting to move into that house.

I’m in Texas and we’re flooded with California transplants. Our housing is much mroe affordable and the COL is much lower. Move to Texas and come get some Barbecue.

Is Texas the worse place on earth? Sounds and looks like it.

Christine’s point still stands – Texas must not be so horrible to a lot of people whom have chosen to leave California in order to relocate there.

Tapis, your responses are becoming increasingly desperate – if a few negative comments about your home state upset you so much it may be because you’re harboring a few doubts of your own.

Right on Dmac. Dude, so when someone dares to defend CA on here and like everyone else in this whole thread, expresses an opinion it means they’re desperate? I’m just annoyed by that whole ‘watch out CA, everyone with half a brain is moving to Texas’ crowd on here with their stupid insinuations about CA taxes and all that dog whistle racist shit that goes on with those people. If I’m desperate it is that those kind of people DO pack up and go to Texas. I don’t get why those people stay here.

If my FRUSTRATIONS appear desperate that would probably because I really don’t have much time to compose well thought out posts because I have two minutes a day to read and post on most days, because, you know, I am busy.

Tapis – fair enough, but perhaps it wouldn’t be such a bad idea to take a few minutes before responding to those posters suggesting a move to their own environs may be a better deal in the long run. I used to have friends in NYC and traveled frequently there for business, and I was always amused when they got so defensive about any comments concerning the paltry size of their apartments (this was in Manhattan). You never heard such vociferous defenses about how awesome the restaurants were, how you didn’t need a car, etc. It’s a funny thing, though – once they got married and started having families they all wound up moving to the suburbs.

Will do Dmac. Sorry for offending y’all with my defensive comments.

Once again, sarcasm in place of anything coherent or factual. Never mind, continue ranting.

Yes, Texas is the “Promised land”. But in all fairness, We do have to mention that the electric bill is high for the AC 24/7 during summer. Property taxes largely offset the absence of income tax. But the people are great. There are fat people in Texas because during summer they have to stay in their AC house, because they claim that it is too hot to go out walking. In the early morning those mosquitoes are also Texas size. Obviously, life is full of trade offs when you are not in the top 1%. That Rick Perry is great for Texas, he came to California and shook up Gov. Moonbeam.

From Harry Dent:

All the financial news stations are saying it. And they’re all idiots.

It goes something like this: “Housing is now driving a more sustainable recovery.â€

Oh really!

My response to these “experts†is: are you aware that only 30% of home sales are coming from first-time buyers?

This is the crowd that should dominate home sales, especially now that the echo boom generation is starting to ascend into this sector. And they’re accounting for only one-third of the sales? That’s nothing to crow about.

Most of the home sales the “experts†have latched all of their foolish hopes on are from institutional investors, hedge funds or private investors looking to cash in on low home prices by buying to flip or rent them out for positive cash flow.

This does NOT a recovery make…

In every conversation I have with realtors in Tampa, Miami, and other parts of the country, I inevitably hear that most of the sales they see are for cash. And in many of the most booming cities, like Miami, New York, San Francisco, Vancouver, London or Sydney, most of these sales are to foreign buyers.

Does that sound sustainable to you?

It certainly doesn’t sound sustainable to me.

Then there’s another thing…

To qualify for an FHA or government-sponsored loan, which comprises most of the loans these days, you have to bring a foreclosed home up to code. This costs $15,000 on average.

The typical young family, most likely burdened with recently acquired student loan debt, can’t afford to buy a home for cash, put $15,000 into it to repair it, and then get a loan for it. Speculators can though. And that’s exactly what they’re doing.

The thing is, new investors to this game – those who’ve come late to this insane party – are going to be very disappointed, very soon.

The rebound in home prices everyone is talking about is minor – like pathetically minor – compared to prices before the greatest crash of our lifetimes.

And let’s not forget that nearly 25% of home mortgages are still underwater, even though we’ve had this so-called rebound. We have gone from 30%, at worst, to near 25%. That’s no progress to be proud of.

Things are much worse in states like Nevada, which has the highest rate of mortgages underwater at 52%. In Florida, 40% of mortgages are underwater. In Arizona that number is 35%. Georgia 34%. Michigan 32%. Illinois 28%.

The most underwater major cities include my home town of Tampa at 44%. Miami’s at 41%. Atlanta 38%. Phoenix 37%. Riverside 36%. Detroit 35%. Chicago 33%.

And if that’s not bad enough, 92 million baby boomers will die between 2012 and 2042, creating a massive supply of homes on the market. This will overwhelm the demand for homes from the rising echo boomers for decades to come.

All of which is why I think that 2013 will be the last time home prices grow for many years to come.

So, think twice about buying a home or an office building. And don’t let your kids buy a house for at least another few years, and when they do, make sure it’s only after we see another substantial decline in home prices.

If you are looking to buy, use my rule of thumb. Find out what the house was selling for at the beginning of the bubble in January 2000. If it is at that level or lower, you can feel better about buying. If not, wait to buy!

You’re right on most accounts, but the shotgun approach can be a little much on this site (considering most of us have already gathered for a specific purpose).

Let’s face it, we already saw the bottom of the housing market. It is going up now. It is too late to get a house on the “Westside”, so be happy being a renter.

Main street is finally catching on. That means the big boys are/have cashed out.

http://finance.fortune.cnn.com/2013/04/05/housing-rentals-investors/

THIS!

The big boys are/have cashed out. There’s only so far you can push housing prices when everything else about the economy from wages to jobs all say things are poo poo.

The smart money has already turned a 20-30% profit on their investment in a short amount of time and any investor on any deal will take that and run.

Back when Joe Kennedy was manipulating the stock market (right before the crash), he said something worth remembering – “only a fool sells at the top.”

Haven’t been to the site for a while. Regarding SUPPLY:

I thought up until recently you indicated that REAL supply (including bank-owned and probable foreclosures) was much greater than MLS indications. Is that strictly on a national basis?

If Cal prices are being driven by spec and Rent securitizations, do you see this slowing down if/when rents drop?

And the sellers have a middle class delusion. Reduced from $810k to $450k. Bargain!:

http://www.redfin.com/CA/Costa-Mesa/890-Joann-St-92627/home/4562531

To get back on Dr Bubble’s topical question, being middle class in California is situational and somewhat of a state of mind. I’m middle class, but I live in a neighborhood that might not cut it with a lot of the posters here. I’m in a low crime area in Orange County with a lot of 1500-1800 sq ft tract houses from the ’60s. All kinds of people live here. There was a guy who lived with his folks that got busted by the FBI for a stupid, dangerous stunt that is also a Federal crime, and there’s a deputy sheriff here too. It doesn’t matter where you live; you can have a nutty neighbor.

Having street gangs warring over your street is another story altogether. Even if you are living on the edge of a gentrifying hip neighborhood, you cannot live on a block with street gangs and live a middle class lifestyle.

We paid this place off a couple of years ago, and now I always seem to have money for hobbies. I take my dog for a nice safe walk in the sunshine on the weekend, and we go out a couple of times a week. I commute 22 miles to work on a freeway that only seems to get congested at the LA County line. I could take the train and get a free ride to work from the station, but it would take more of my time than driving and make it more difficult to get voluntary overtime(time-and-a-half).

We have some inheritance money as all of our Parents are now dead. Our Grandkids live 5 miles away, and soon they will be a 10 minute walk away. We didn’t do the HELOC nonsense, but we do go on driving vacations all around the West. I’m planning on working for another 8 or 9 years which will take me past the “normal” retirement age for a Boomer (66).

My Daughter and her Husband seem to be on track to live a middle class life here in Orange County also. He has a job with even better overtime than I can get (for LA City). Right now, she’s home with the two babies. They are amazing savers, and we have contributed only a small fraction of the down payments they have made on the first place and the new place. A lot of Boomers we know out here in Orange County are helping their kids get houses here. These are mostly middle class people, too.

Being middle class in Beverly Hills is probably not in the cards for you unless you inherit there. But you could probably get a place in my neighborhood for under $500K now, maybe a fixer for $425K (there were more houses available last year when prices were lower, ironically!). The area with bigger houses just west of us is in the $600 Ks. Prices could drop again, so I’d be more inclined to recommend buying an upgrade if you already have a place as opposed to a first place. But if you don’t overextend yourself, you’ll be able to ride out the drop and move up to a bigger place in the next up cycle. The market will never completely price out the middle class here in Orange County. But buying with a 40% of income loan payment on a 3% down is crazy, so just don’t do it!

A very level response.

Question is, are middle class people in SoCal overextending more than before in order to get in the market? If so, would said overextending be happening if it weren’t for the market manipulation?

One can also rent while enjoying a middle class lifestyle.

Leave a Reply