The indebted young and shrinking middle class – 6 charts examining fluctuating income changes and the impact on the future housing market.

The sustainability of the housing market is going to come from the potential pool of younger home buyers. The housing market since World War II has followed a very common and steady path up until the 2000s. Each year it was expected that home values would increase but this also came hand and hand with rising household incomes. There is little mention of how big of a hit household income has taken over the last decade. The pattern is broken so to expect that we are now going to be back on a similar path that was very familiar to the baby boomer generation is simply not the case. When we look at the actual income declines taken by the younger groups we realize that something is very different now. Combine this stagnant household income with large levels of student debt and you have headwinds that are likely to keep a lid on the entry level of the market.

The lack of income growth

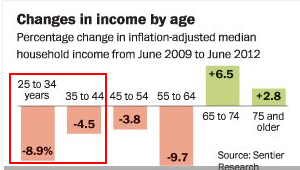

The below chart shows income changes during the recent recovery period:

Source:Â The Washington Post, Sentier Research

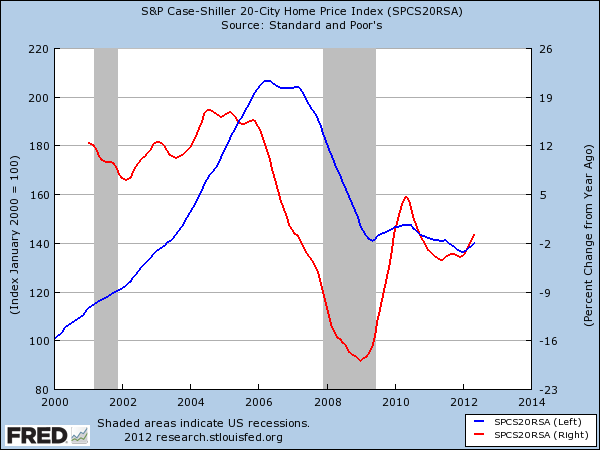

Over this most recent three year period, those in the 25 to 34 age group saw household incomes fall by a stunning 8.9 percent. Those in the 35 to 44 age range saw incomes fall by 4.5 percent. In this same period, the 30-year fixed rate mortgage fell from 6 percent to 3.5 percent (a drop of 41 percent). The additional leverage provided by this falling interest rate covered up the lack of growth in household incomes and also put a floor on falling home prices:

Nationwide there does appear to be a bottom forming in home prices. Yet the above household income data signifies that in order to keep this market going, the government is going to need to keep in place what amounts to negative interest rates while providing programs like FHA insured loans to make up for the lack of growth in household income. Yet the desires of many younger buyers are much more different from older generations. Do they want the suburb life? Many do not. With rising fuel costs and lower incomes, factors that were once not considered are now a big deal.

The above chart shows that it is likely that the Case Shiller Index will finally go positive year-over-year shortly. Yet will this be something that is sustained? The sustainability again will only remain if all of the government and Fed support efforts stay in place. The household income figures seem to be ignored in many cases but truly are the most viable figures for a longer term sustainable housing market. What is more challenging is a big part of the recession is falling on the backs of younger Americans. How so?

-The massive student debt bubble has largely fallen on their balance sheets

-They have witnessed the weakest income growth of any group

-The median net worth of those 35 and younger is $3,500 nationwide

-Nearly half of mortgage holders under 40 are underwater, twice the rate of older borrowers

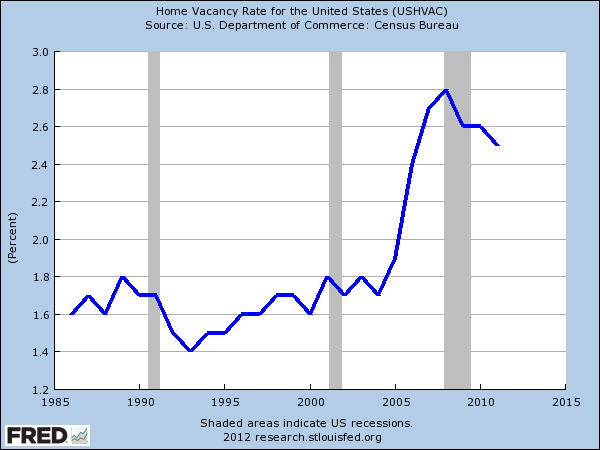

Yet this is the group that is expected to purchase all those houses in the future. Most of the buying in the last few years has been a process of soaking up excess inventory:

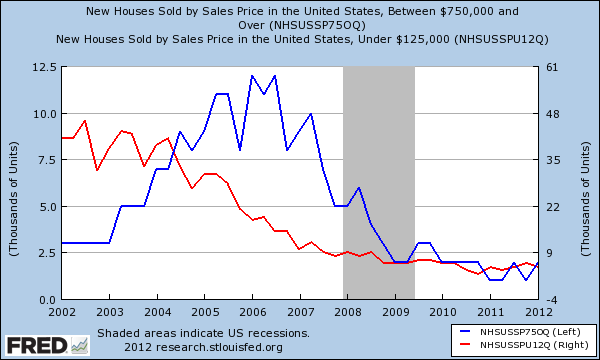

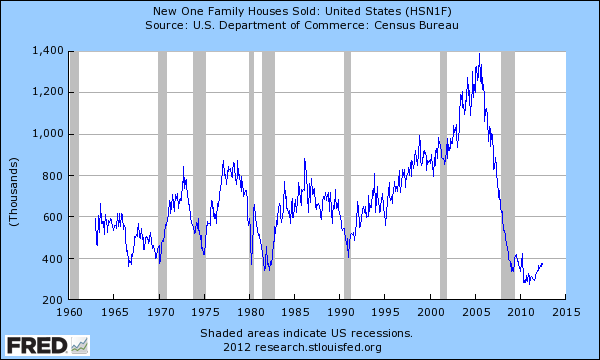

The home vacancy rate is declining as more of the distressed inventory is sold off. If we look at the high-end and low-end of the new home market we see that the appetite for newer homes has largely not come back:

Demand for new homes above $750,000 is a shell of what it was in 2006. At that point, over 12,000 homes on a quarterly basis were being sold. Today it is down to 2,000 (a drop of 83 percent). Even at the lower end, the drop from 2006 to now is substantial. This is largely due to the reality that after 2007, most of the buying activity came from re-sale homes for deeper discounts and a disproportionately large amount of buying from investors; home building largely slowed down to a halt.

Those that claim some kind of GDP booster is going to occur because of a new housing market simply believe that their past history is going to repeat yet again. Will younger buyers go for the suburb model with lower incomes, deep student debt, and a desire to be closer to city centers? Also, families are much smaller today so the need for bigger spaces is not needed. New family home sales have picked up but put this into a bigger context:

The money flowing into the market right now is going to banks that are making good money with closing costs and other associated fees with the refinancing boom. The low rates are being used not to help Americans but to speculate internationally in stocks and other investments since commercial and investment banking are still intertwined. This is why the mortgage market is largely being fueled by government backed debt while banks place no faith in the American household when it comes to making mortgages.

Yet how much lower can rates go? We’ve discussed in a previous article that there are hidden costs now being put on other segments of the economy. The bottom only means that prices nationwide are no longer flying off a cliff but why would home prices rise if incomes are stagnant? The booster shots from low interest rates, low down payment FHA insured loans, and other artificial stimulus is already showing signs of hitting breaking points.

The problem with the last decade was the focus on running fiscal policy through the banking sector. This is why most Americans have seen their bottom line collapse:

Source:Â CNN Money

The middle-class shrank by 10 percent in the last 40 years. Nearly 30 percent of all Americans are now considered low income. The upper-income group went up by 6 percent. Nationwide you need a strong middle class to have a sustained and growing housing market. Household income will be the most important catalyst in sustaining any semblance of a healthy housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The indebted young and shrinking middle class – 6 charts examining fluctuating income changes and the impact on the future housing market.”

Let’s see just how low the govt can get the mortgage interest rate.

Japan went to zero and in reality a bit under it, offering other benefits (deductions etc.) to loaners.

When every change is direct income to banks, I don’t think this mill stops before it hits the bottom, at zero.

Very efficient way of robbing the pension funds empty: The money in them is losing value at inflation rate and income is zero.

Also pumps the prices of commodities up as those are the real casino now.

How about negative interest rate? Gov loans you 300k at -.2%

wouldnt put it past em

While your idea sounds crazy, these idiots may not have any choice but to move rates close to zero for mortgages… maybe they can’t tie them to the ten year note anymore… since internation pressure will drive up that rate via demand. the USA is the best looking girl in a room full of ugly girls…. and in a moments notice International money could flood the USA sending the ten year way up via demand…. stranger things have happened…..

And there will be 40-50 year mortgage packages too. These sticks and bricks have got to keep moving no matter what !

If you make mortgages available at negative interest rates, then everyone will want one. The more you borrow, the more you make. Take a page from banks who borrow from the fed and lend the money back to the government at higher rates. People would mortgage their paid for houses and use the money to buy treasury bonds at a positive interest rate. They make the spread, risk-free and free of state tax.

Exactly why would we want to bankrupt the government in this manner?

I think the Fed has an answer that cannot fail, negative mortgage rates. This way, your house pays off itself over time. If this doesn’t work, and of course the savers will pay for it, then we really know the game is up.

This can easily work in the centrally planned economy of today. Housing that is not only free, but it pays for itself. You live free and then later you get title to the property. With this plan, look at all the money that can be redirected to consumer spending. Simply, a genius of an idea.

Unfortunately this is most likely our future. BTW, a 3.25% 30 year mortgage is already a negative interest rate. Interest rate risk plus loan risk plus anticipated inflation for 30 years in the future is much higher than 3.25%.

Um, no. Come back to reality please.

This blog wrote “The median net worth of those 35 and younger is $3,500 nationwide”. When I read that I was just shocked. I knew I was paying down those student loans, but I didn’t realize so many of my generation were also struggling. Considering I’m above this mean, I suppose I’m doing okay.

presumably this excludes those below a certain age? 16 or 18?

You’re above the median, not the mean. Two different measurements.

Yes. If it includes people under 21 it is a laughably meaningless statistic, since the median value reflects the net worth of one guy in the middle of the pool. Half have more than him, half less. It tells you nothing about how much more or less the others have. It is as if you said “Representing the 0-34 year olds, there is this Junior in High School in Fresno whose net worth is $3500. He has a motorcycle, an iPad, two gold fillings and $1500 in the bank he saved up from a summer job.” This dude is not a potential home buyer, nor should he be. Thus the median net worth among 0-35 year olds is not a useful piece of information.

There is a point to be made here though (but not by this static!) and that is the bottom 40% of the American public by wealth — and there are no doubt a lot of young people here, particularly including freshly indebted college students — own little to nothing and are prone to have negative net worth. In aggregate, they control 0.2% of this nation’s wealth.

http://en.wikipedia.org/wiki/Wealth_inequality_in_the_United_States

Now, Donald Trump not so long ago had a negative net worth, but he didn’t let that stop him. He shows marvelously that you can still buy a lot of real estate on credit. The trick is in finding someone to lend you the money, like say the Federal Government.

I got curious enough to dig around for some numbers. According to some data published by cnn ( http://cgi.money.cnn.com/tools/networth_ageincome/ ), median net worth for at ages 25-34 is a little shy of $8500. It’s interesting to see that this about half of the number reported for “under 35” in the article above, as we’d expect most people below those ages to have very little to their names.

I also found some conflicting statistics for median /household/ net worths, showing figures between 50,000 and 100,000 in different articles published this year, but with all the articles showing that those values have dropped 5-10% in the past few years.

With the most severely affected realizing that homes are likely nothing more than ‘money pits’, the interest rate could got to ZIRP for homes and, this generation of grads would find it hard to rationalize even more taxes.

I work for a very large silicon valley IT company starting with O. We’ve had almost no raises in my group since 2008, and this year, notwithstanding record earnings, bonuses in my entire group were just announced at around 1%, with management adopting the line that they’re preparing for the worst in the EU (and unstated, in the upcoming election). People are demoralized – putting aside obviously faked government figures to the contrary, inflation has been significant (gee, what can we leave out and put in its place to make it look like there’s no inflation… I know, let them eat VCRs!) and our real incomes are falling dramatically over time.

This is beginning to feel like the beginning of the end.

If by “the end” you mean that the world economy may finally start falling to a true bottom, then I’d agree. It would be nice if at least one Presidential candidate this year would get truly serious and propose actual reforms of the entire US Government/Financial sector, but that was an impossible dream. I’d start with re – enacting the Glass – Steagall act, break up the huge banking entities directly after that action, then pass a law forbidding any government employee from taking a lobbying job for at least five years. Then I’d move on shortly to enacting nationwide term limits of not more than two consecutive terms for Senators and four consecutive terms for Reps.

What would you do about monetary policy and deficit spending used as long term stimulants which was the real cause of the financial crisis?

You have my vote!

why not just make lobbying illegal, combine the congress/senator social security program into mainstream SSI (so the reps will take a little “self preservation” mentality to their voting process), and eliminate pensions for representatives until the budget is back in the black….if you are gonna dream, dream big!

@Mark

I hear it only costs 20 million a year to maintain your boss’s yatch, initials LE. Maybe you should have studied seamanship rather than computer science.

Or maybe you can get a job lifeguarding at that Hawaii island he just bought. Think of the chicks in bikinis!

I totally agree with you. I worked in Silicon Valley for a few years at a company that stats with a V. No raises for employees but management took good care of themselves. I finally got tired of watching all the US jobs get outsourced to India and quit. Besides there was no way I would ever make enough money to buy a house up there even on a high end IT salary.

I bet the board of directors, CEO, and shareholders all got their bonuses, stock increases and or dividends though. The people that actually make the products or provide the service or consume the goods are the only losers in the rigged game.

The stockholders are losers in many cases. They get a return after the executives have taken most of the cream of the top or in cases like Gm, the stockholders have lost their shirt yet the executives leave with a golden parachute.

…and THAT, my friend, is the REAL problem of this whole scenario. It permeates government, private, and public sectors. The small businessman and middle class have always been the rock of this country’s economic solidity and potential to stabilize. Pensioins, equity, and value on anything and everything has been pilfered to nothing. The clock is ticking — real decisions will need to be made or cannibalism will ensue.

Instead of the middle class stabalizing, they should be thriving. It should be the carpetbaggers that should be looking for employment.

The generation that passed Glass-Steigal and other important regulation is not the same generation that respects it or adheres to its principles. Lessions will need to be learnt the hard way. History always repeats itself.

Everyone was mesmorized by the promises made by the schemers, crooks, criminals, carpetbaggers, robbers, thieves, and fraudsters every since Reagan. Until this type of personality is recognized for what it is and shunned, things will not return to normalcy.

We have been at the beginning of the end ever since we left the gold standard!.

I think the end is much further away today than it was in 2008. It would appear that the Central Banks are only limited by their imagination. If all else fails, the Government will make your house payment, if you own it, if you rent, you are out of luck. 3K a month stimulous checks for all unemployed could be in the cards.

This ship IS going down, but it is clear the Central Bankers and the Government are going to do their best to bring down the Prudent already safely in life boats, people who foresaw and took prudent action, the FED is going to throw an anchor into each and every life boat if it means this ship stays afloat a second longer.

I think it’s pretty safe to say we’re in the middle of the end, transition to the end of the end. There is a fundamental lack of understanding of the principles of self sovereignty that this nation was built on. It is not respected nor taught in the government’s schools. America was built by wild men, living a dangerous life on the frontier, toiling for bare essentials of sustenance. With the prevalence of city dwelling and the convenience of the neon flooded suburban lifestyle, we’ve forgotten what that means. The notions of scarcity and daily struggle have been absent for at least a few generations. And the result is that we are tame. Domesticated. No longer fit for life as it is outside the the walls of our imagined security. The irony of the democratic process is that when a strong enough plurality recognizes they can legally deprive others of duly earned property, those principles upon which that democracy were founded erode and collapse. And so it goes that we’ve been willfully giving up insane and obscene amounts of value to preserve the perverse. Every time one more person shrieks “fair share” it’s another nail in the coffin of American exceptionalism.

This is why I’m a believer in cooperatives. There’s nothing executives bring to the table that makes them worth their pay.

How very true…. why stock holders can set executive pay is beyond me…. They got a wrap on that effort… Not sure how to break this crazy habit of paying “average people” huge amounts of money just because? Executives do not have any unique qualities? As investors and employees, we’re fed a line of garbage that the CEO is great? Most of them are incompentant…. what makes a person great? Many other average people telling each other this one person is great ( CEO)… it’s all BS. They’re nothing special!!!

“….-They have witnessed the weakest income growth of any group”

If you’re talking about over the period of their lifetimes, this is correct. If you’re talking about over the period of 2009-2012, your own chart shows the 55-64 age group has been even harder hit. Frankly, the older people suffering is of much more concern to me, both privately and in terms of public policy.

A person who starts a career in a time of depressed wages does have lower lifetime prospects overall. But this is a challenge that generation has ~50 years to confront and overcome. Those who are in the older age group have precious few working years left and higher needs in terms of family obligations and health challenges.

Probably the best thing we could do for both groups, IMHO, is to offer full SS benefits to anyone 60 or over for the next 4 years. Reduce competition for jobs, drive up aggregate demand, and route the initial funds people who’ve earned it doing real work.

Great day for once. We are off to get an inspection on a home we opened escrow on Thursday. We weren’t in a massive emotional bidding war, which helped the seller see the transaction clearly. We weren’t the highest in the initial round, but we were a cash & close. We believe we matched the 20% down people and we had to take the house “as is”. By CA Law they had to do the termite stuff.

I am crying for joy. It has been the house hunt from hell, paying multiple rents, years of being locked out of this insane So Ca market. Let’s hope we get notified of nothing horrible (think BK). The house needs everything,but we didn’t overpay into insanity. We are OK with the price.

Everybody cross their fingers and toes. It’s our turn!

Congrats, Mad! I hope it works out for you. We’re thinking of finally trying to do the same soon after years and years of waiting. I’m not optimistic, but your story does provide some comfort.

Enjoy your new home!

Bummer. The inspection report isn’t written yet, but the verbal summary

was a Grims Fairytale.

Pool heater not cleaned in 10 years (impacted leaves. unit shot.

Pool has cracks

HVAC Dangerous fumes-needs replacement

Moisture in slab all over the hse

Aluminum wiring

Roof issues

Chimney Flute cracked ($5K-$10K alone)

Windows leaks-wall moisture issue

Asbestos in original ducts

On & on & on Could run into $100K

We’ll discuss with our broker. Probably walking. Owner has Dementia. Her Trustee bumped us up in price. She looked at the comps, and didn’t take condition into account.

That sucks. I say you have two choices. Either walk or present them with a list of things that absolutely need fixing just to make the place inhabitable. And with that list comes a reduction in price. Your agent needs to tell the seller that this will happen again if it falls out of escrow. Good luck.

Congrats Mad!

I recently had a general inspection done. The inspector said he was not aloud to say the word asbestos.Did the general inspector find all this out? did a specialist come in and send a sample to find out it is asbestos? How about the wiring and dangerous fumes, did the general do that? -Thanks.

If it is a house you like, it must be a huge weight off your shoulders.

I am curious though, I have been in a couple bidding wars myself and in two the seller wanted to drop the termite clearance contignency which made me balk, and as far as I know the “winning” buyers bought without termite clearance. I certainly asked my agent about it and he said most lenders do require it, some don’t and if you have cash, clearance is not a requirement.

Anyway, enjoy your new house!

Yes. Before framing the argument as being about the “generations” (a phony concept), please read the editorial in Utne Reader this month titled “A False War: Beware of those who pit the old against the young.” A few people have gotten rich at the expense of the many in every age category. The editorial urges people to read about this at:

CEPR http://www.cepr.net

http://www.cepr.net/index.php/blogs/beat-the-press/feed/atom/Page-11

This blog, which I admire in most ways, seems to pay no attention to what the FIRE economy did to the boomers’ pensions and savings. Not to mention those of us who never got to buy a house for the same reasons “young” people cannot now buy one.

Most of us have been robbed by a few. And nothing at all has changed since 2008-2009, when it should have been laid bare for all to see.

Say this for Japan, where I lived for 10 years: at least they have intact pensions and health care for all. Think about it.

We are living in a global economy.The main factor in any economy is employment over the level of subsistance and some capacity of saving in real terms(discounting inflation).Any projection to the future must be based this aspect. Transfering employment overseas can depress the housing recovery in US.

After college, many young people in my hood move back with parents to continue pleasant childhood environment they enjoy, but cannot afford on their own. Why struggle elsewhere? Pay little/no rent living in childhood bedroom. Secure $10/hr job, small paycheck funds newer model car, smart phone, etc., can maintain image with no rent/mortgage payment. Adult kid bitter about sucky job, bleak future, but weather and beaches are great in CA, it’s a trade off, plus Mom does the laundry. Ben eases and print forever, financial cliffs papered over into eternity, never a day of reckoning. All is well.

It works until you are 35 and want to start a family.

DHB

What facts/data are you basing the following statement on? “Nationwide there does appear to be a bottom forming in home prices.” When I expand the Case Schiller graph back to 1890, current value is much higher than the “moving average”. I wonder if your definition of bottom is different than mine or Encarta’s (“the lowest or deepest part of somethingâ€). Can you define “bottomâ€?

I believe that the current housing “market†is manufactured by the Fed, the FHA, the GSE’s and other government agencies? Do we all believe that this will go forever? I remember when housing was going to go up forever. Forever is a very long time…

For some level of up, anyway. If you correct for inflation, housing values creep up at something like 0.3% per year. You aren’t going to get rich from that, especially when one considers you are paying something like 1% annually in property taxes as a carrying cost.

http://www.jparsons.net/housingbubble/

Housing prices have reverted to the mean and presumably will resume their ever-so-slow climb.

Why don’t we look at the original Case Shiller chart starting from 1890?

http://www.multpl.com/case-shiller-home-price-index-inflation-adjusted/

I don’t see the same rise that you claim over the long term. I am aware that we left the gold standard in 1971 which still should not have an impact on inflation adjusted.

Pre-1934 C/S takes info from the Grebler HPI, which was basically an estimate based on 1934 values, then extrapolated back as far as 1890. To say it’s imprecise would be kind.

1934-1953 uses a small 5 city advertised price index

1953-1975 uses the CPI index for data

Finally in 1975-1987 you have OFHEO’s repeat sales index

1987+ you have the C/S index.

1987+ is the most accurate measure and 1975+ isn’t bad either since it uses repeating sales.

Trying to determine “moving average” from 4 different subsets of data doesn’t work very well.

You should change your handle to “Landlord” or “Housing Investor”! I am tired of having the same discussion over and over with you. See my prior posts for my response…

You asked “Why don’t we look at the original Case Shiller chart starting from 1890?”

—

I simply answered the question. I made no reference to anything else, and I can’t recall anything you’ve written that pertains to how C/S derives historical data. I’m sure not every reader was aware that C/S uses 4 different subsets of data. Is it smart to pull a moving average from different subsets to data?

Second, it should be obvious to most people that our demographics and economy has changed quite a bit since 1890. Do you also look at the DJIA in the 1900s when trying to determine a moving average or bottom? Why would you do it for C/S?

Well, why don’t we pull up some rent charts while were at it!

Housing may not be a great investment, but what the hell is?! Rents are VERY high for except for a lucky few… Sure, you can live below your means a little easier in a rental. But, some of us have pets and children and want a yard. Every friend I have that is renting a house pays more than my entire PITI with insurance on their rental.

They may not have maintenance costs like I have… But they also aren’t paying down $600 a month to equity and getting $400 a month back each month in Mortgage interest deduction.

My 4 bedroom house with a pool would rent for $2300 easy. … Guess what.. my PITI is $2280 with home insurance included.

Subtract out my $550+ a month in equity .. growing a few bucks each month. And my $380 or so in mortgage interest deductions each month.

And owning doesn’t look like a losing proposition. Sure I could still be living in our 1 bedroom apartment.. 600 sq feet with 1 bath. And be saving some cash.. But when i moved out in 2011.. My rent on that apartment was $1250 a month!

Hey,

If the numbers work for you to buy, then by all means buy. If you believe you will have steady income for the next 30 years in your area and your house will keep up with inflation over the next 30 years than you made the right decision. I think your rental parity argument is missing some expenses but that will be your gain/loss.

My question is why do housing bulls read this site? Doctor Housing Bubble is not really a bullish site. The majority of Americans believe that the best investment is a house. The majority of Americans believe that the housing market will recover to the “pre-recession†values. Even among housing bears, a very small percentage believes that America will follow the Japanese model. I believe that we are pretty much in lock step with the Japanese model at this point.

My theory is that there is no “solution” to truly fix the economy. There are many socio-economic and psychological issues that have to be dealt with, and on a macro basis that is currently impossible. Well, impossible to fix in a short term…the fix is long term.

As much as we want mark-to-market and honest banking, it probably is truly “to big to fail”. Why? Well I always prefer to think down to the lowest common denominator and go up from there. Kinda like sitting at work and wondering if you will get in trouble with your boss for doing something. Consequence is the ultimate end result of any action, and without consequence there is no “wrong” therefore you should look at the worst possible result of any action.

In society, the only thing worse than someone with nothing to lose is someone that is hungry and has nothing to lose. They will do the craziest and most violent things. And here we have an entire society of dependent, uneducated, basically hopeless indivisuals running about. Many have poor credit and criminal records, therefore getting any job with a background check is out of the question. And today most jobs do require this, mainly for liability reasons. And as a former business owner I can see the validity of that. And as a fellow human that has met some twisted people and seen how people are, it’s scary. Ever done business with (or worse dated) someone who is at the bottom? Not pretty. (Although I admit without dating a pile of crap once I wouldn’t know what the queen I have now is!)

But you see where I’m going here. It’s not that honest people (like us) don’t want a fix. And to us, that fix is honesty, integrity, consequence, etc. But what happens if you enact that? You hold millions liable for their crappy lives (that they will blame on others of course) and chaos ensues. Reference Greek riots, et all, for current proof. And that’s even with their can kicking i.e. austerity…

No wonder the US Gov wants to keep kicking the can. And that’s why I could never be POTUS, my Lord what a clusterf–k this situation is to deal with.

Society has advanced over the millennia despite the ever-presence of the bottom quintile, the malthusians and the doubting Thomases. You’ll have to invoke catastrophic volcanic eruptions, nuclear war or cataclysmic asteroid impacts to stop that trajectory. I don’t think that malaise or even malfeasance on Wall St is going to stop us for long.

China money is coming here. Good opportunities. We have lots of dollars to invest from so many years of trade surplus. California will always be the golden state for us.

> The median net worth of those 35 and younger is $3,500 nationwide

I don’t suppose this group excludes people under 21? If it doesn’t, it is a laughably meaningless statistic. The median net worth of ages 0-34 probably comes from a high school or college student and tells us nothing about the 25-35 set who are the actual likely home buyers here.

“Meanwhile 2009 households headed by those 35 and younger had a median net worth of only $3,662, compared with a net worth of $11,521 for their 1984 counterparts.”

http://www.nationaljournal.com/economy/pew-research-older-americans-net-worth-up-younger-americans-net-worth-down-20111107

Do some research before you start trying to drum up the housing market. You come off as a blind housing cheerleader. You also mention that housing prices have reverted back to the mean. Yes, on a nationwide level but not for California. Just look at the ridiculous Bay Area. Funny how you link to articles simply to justify your own perception yet ignore data that does not work with your cause. Open debate is useful and necessary but you probably tend to think you are more unbiased than you really are.

I would think your “average” 25 to 35 year old is worth next to zero. When you factor in all the debt and little savings, what do you have to show for it? I assume a large segment doesn’t have a marketable degree or any higher education whatsoever. Making $10 or $15/hour, it will be a struggle just to survive…forget about saving anything.

The more I think about it, the stat seems realistic.

How is it possible for anyone at the age of 35 (or under) to have a positive net worth, unless their house is paid off? Most people in that age bracket in SoCal have half a million worth of mortgage.

When calculating net worth don’t they take the mortgage as a liability and the house as an asset? Therefore you’d have a positive when you owe less than the house is worth? Or is this not how it’s done??

This assumes a closed system. Like someone else said, lots of foreign money (mostly Asia) is coming in to buy up America.

Scorched Earth, indeed. It indeed seems as though powers have deliberately programmed the demise of the American experiment–the most noble venture in humanity perhaps.

Those knocking the median networth stat have clearly never had a large negative net worth (i.e.-$140K and lower), were so many of my generation are at. So because of that some would think being above the median is meaningless but I’m willing to wager not to everyone.

NEW YORK (CNNMoney) — A sharp boost in home prices during the spring could signal a recovery in the long-suffering U.S. housing market, according to an industry report issued Tuesday.

The S&P/Case-Shiller national home price index, which covers more than 80% of the housing market in the United States, climbed 6.9% in the three months ended June 30 compared to the first three months of 2012.

We have turned the corner. Now party. Everything will be alright with another 4 years of the “Dear Leader”.

All renters need to pay attention to this. This is probably why the rent is high. Someone has to pay.

http://www.nakedcapitalism.com/2012/08/new-real-estate-train-wreck-coming-securitized-rentals.html

I have little sympathy for the soon-to-be extinct “middle class” who have doomed themselves with idiotic financial decisions for decades. Buying more house than they can afford, NINJA loans, new furniture on credit, lease Mr. and Mrs. luxury cars, must have the hardwood floors, can’t possibly live without granite counters, can’t bear to look at an applicance that isn’t stainless steel, need an Iphone/Ipad/Ipod/Laptop/Kindle for every family member, mandatory flat screen tv in every room, a million kitchen gadgets, specialized knives, special cookers for every type of food, etc etc. What a joke. The best thing that can happen for the younger generation is to learn to live without all the excess junk and learn that just because you can afford to make a $50/month credit card payment doesn’t mean you can really afford all the junk. Wake up call time people.

The “middle class” experiment is all but over. Look at all societies around the globe over the span of human existence and you will see that the typical order involves a very small wealthy ruling class and a very large lesser worker class. The middle class we had was an aberration. Say bye-bye to them. They were in a great position to set themselves up with safety and financial security but they could not control their spending and borrowing, and now they are effed. So long people, you are cooked.

And you are a west Texas oil billionaire? You flunked empathy in life.

Leave a Reply to What?